Investor Presentation November 2018 Free Writing Prospectus Filed Pursuant to Rule 433 Registration Statement No. 333-227744 Dated November 26, 2018

Important Notices and Disclaimers The Company has filed a registration statement (File No. 333-227744), including a preliminary prospectus, with the Securities and Exchange Commission (“SEC”) for the offering discussed in this presentation. This registration statement has not yet been declared effective by the SEC. Before you invest, you should read the prospectus and the other documents the issuer has filed with the SEC for more complete information. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or dealer participating in this offering will arrange to send you the prospectus if you request it by contacting: Raymond James & Associates, Inc., 880 Carillon Parkway, St. Petersburg, Florida 33716 or by calling (800)-248-8863 or by emailing prospectus@raymondjames.com; or Keefe, Bruyette & Woods, Inc., 787 Seventh Ave., 4th Floor, New York, New York 10019, Attention: Equity Capital Markets, or by calling (800) 966-1559, or by emailing kbwsyndicatedesk@kbw.com. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This presentation is not an offer to sell or the solicitation of an offer to buy any securities in any jurisdiction in which such offer, solicitation or sale would be unlawful. Any statements in this presentation about our expectations, beliefs, plans, objectives, assumptions or future events or performance, including returns on assets, are not historical facts and are forward-looking statements. These statements are often, but not always, made through the use of words or phrases such as “believe,” “will,” “expect,” “anticipate,” “project,” “seek,” “estimate,” “intend,” “indicate,” “designed,” “contemplate,” “plan,” “future,” “would,” and “should,” “could,” “continue,” “predict,” “target,” “strategies” and similar words and expressions of the future. Forward-looking statements involve known and unknown risks, uncertainties and assumptions, including the risks outlined under “Risk Factors” in the preliminary prospectus and elsewhere in our filings with the SEC, which may cause actual results, levels of activity, financial condition, performance or achievements to differ materially from any results, levels of activity, financial condition, performance or achievements expressed or implied by any forward-looking statement. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we cannot guarantee future results, events, levels of activity, performance or achievement. We are not under any duty to update any of the forward-looking statements after the date of this presentation to conform these statements to actual results, unless required by law. The Company has no obligation to update any forward-looking statement to reflect changes since the date of the forward-looking statement. This presentation contains non-GAAP financial measures not presented in accordance with generally accepted accounting principles in the U.S. (“GAAP”). Appendix 2 includes reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP. We use certain non-GAAP financial measures, certain of which are included in this presentation, both to explain our results to stockholders and the investment community and in the internal evaluation and management of our businesses. The Company believes that these non-GAAP financial measures and the information they provide enable investors to better understand our performance, especially in light of the one-time gain on our New York City building in 2017 and the additional costs we have incurred in 2017 and 2018 in connection with the spin-off from Mercantil Servicios Financieros, C.A. and related transactions, and adjustments for securities gains and losses in the presentation of non-interest income to total revenue. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered supplemental in nature and not as a substitute for or superior to the related information prepared in accordance with GAAP.

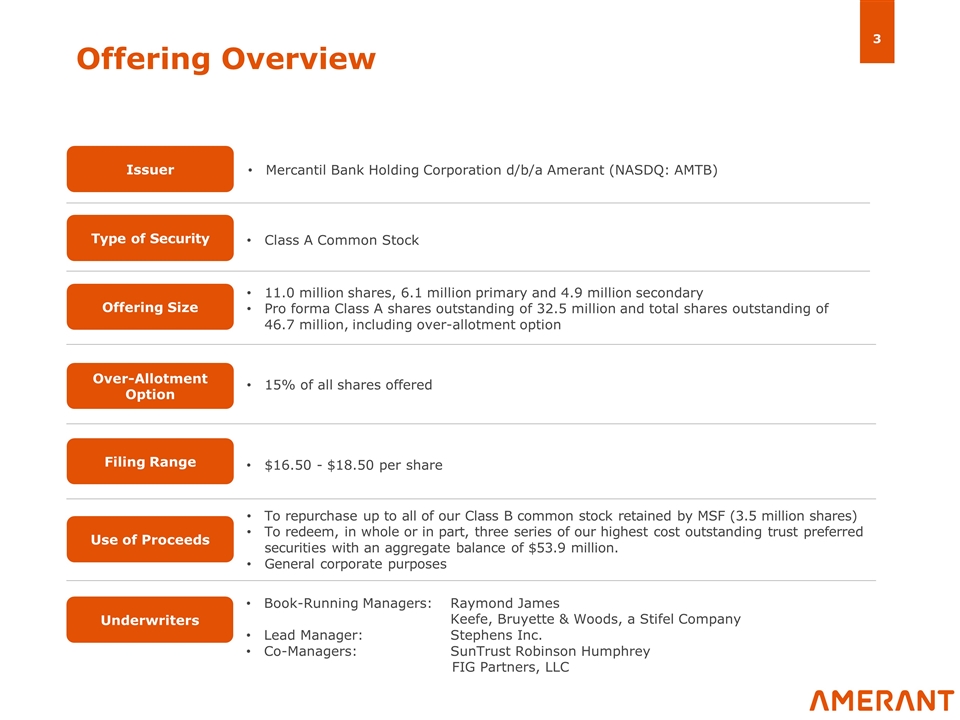

Offering Overview $16.50 - $18.50 per share 15% of all shares offered To repurchase up to all of our Class B common stock retained by MSF (3.5 million shares) To redeem, in whole or in part, three series of our highest cost outstanding trust preferred securities with an aggregate balance of $53.9 million. General corporate purposes Class A Common Stock 11.0 million shares, 6.1 million primary and 4.9 million secondary Pro forma Class A shares outstanding of 32.5 million and total shares outstanding of 46.7 million, including over-allotment option Book-Running Managers:Raymond James Keefe, Bruyette & Woods, a Stifel Company Lead Manager:Stephens Inc. Co-Managers:SunTrust Robinson Humphrey FIG Partners, LLC Issuer Over-Allotment Option Use of Proceeds Filing Range Type of Security Offering Size Underwriters Mercantil Bank Holding Corporation d/b/a Amerant (NASDQ: AMTB)

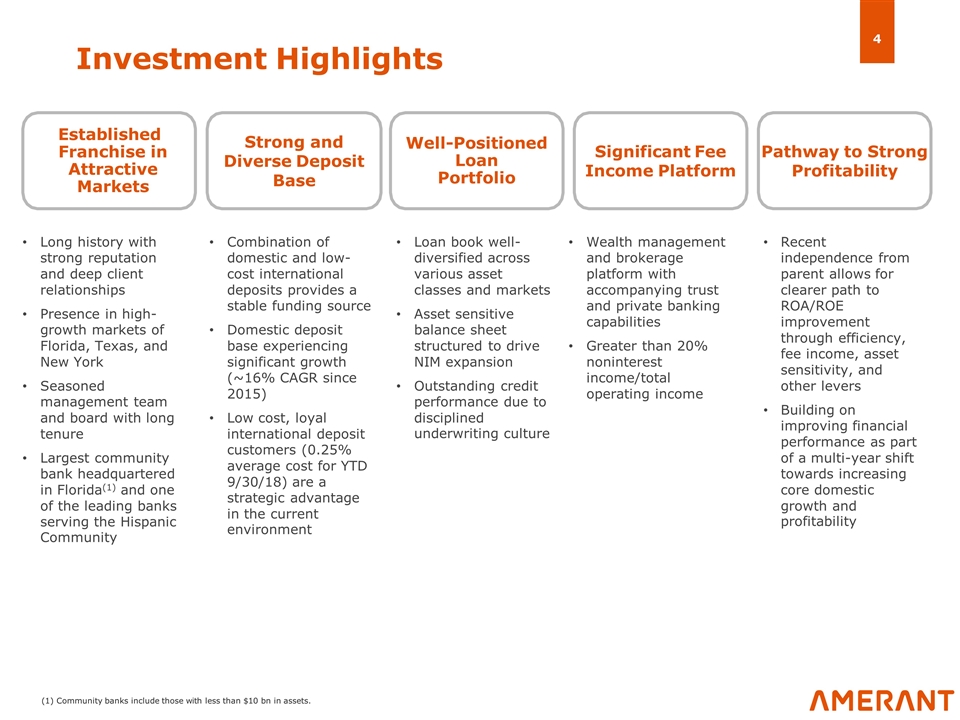

Investment Highlights Established Franchise in Attractive Markets Strong and Diverse Deposit Base Well-Positioned Loan Portfolio Pathway to Strong Profitability Significant Fee Income Platform Long history with strong reputation and deep client relationships Presence in high-growth markets of Florida, Texas, and New York Seasoned management team and board with long tenure Largest community bank headquartered in Florida(1) and one of the leading banks serving the Hispanic Community Combination of domestic and low-cost international deposits provides a stable funding source Domestic deposit base experiencing significant growth (~16% CAGR since 2015) Low cost, loyal international deposit customers (0.25% average cost for YTD 9/30/18) are a strategic advantage in the current environment Loan book well-diversified across various asset classes and markets Asset sensitive balance sheet structured to drive NIM expansion Outstanding credit performance due to disciplined underwriting culture Wealth management and brokerage platform with accompanying trust and private banking capabilities Greater than 20% noninterest income/total operating income Recent independence from parent allows for clearer path to ROA/ROE improvement through efficiency, fee income, asset sensitivity, and other levers Building on improving financial performance as part of a multi-year shift towards increasing core domestic growth and profitability (1) Community banks include those with less than $10 bn in assets.

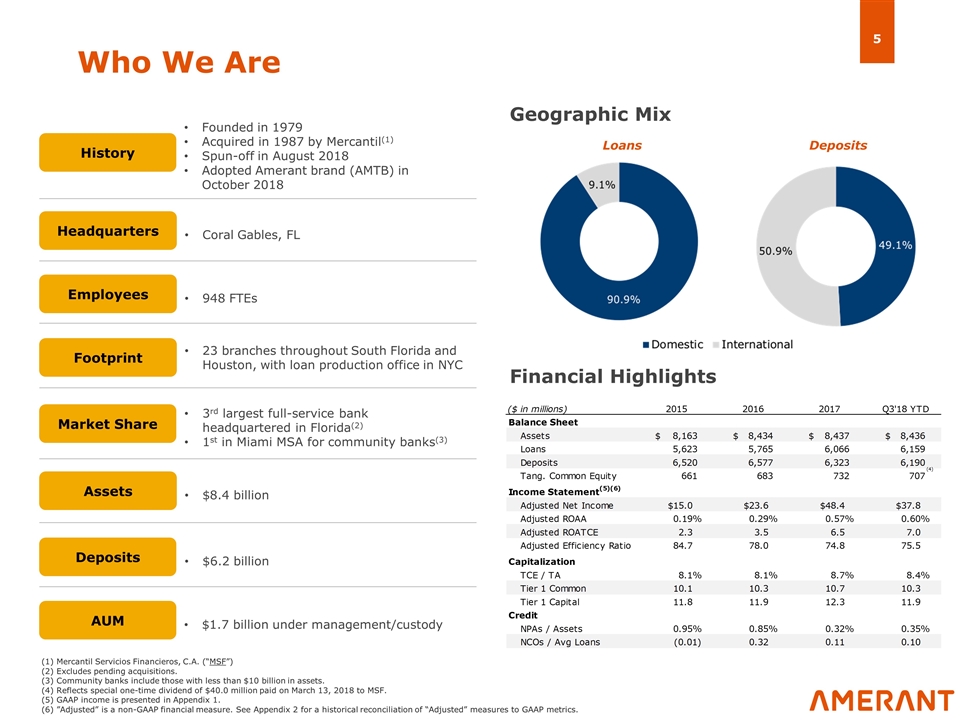

3rd largest full-service bank headquartered in Florida(2) 1st in Miami MSA for community banks(3) Who We Are Market Share 23 branches throughout South Florida and Houston, with loan production office in NYC $6.2 billion $8.4 billion Coral Gables, FL 948 FTEs $1.7 billion under management/custody Founded in 1979 Acquired in 1987 by Mercantil(1) Spun-off in August 2018 Adopted Amerant brand (AMTB) in October 2018 Footprint Assets Headquarters Employees Loans Deposits Geographic Mix Financial Highlights AUM Mercantil Servicios Financieros, C.A. (“MSF”) Excludes pending acquisitions. (3) Community banks include those with less than $10 billion in assets. (4) Reflects special one-time dividend of $40.0 million paid on March 13, 2018 to MSF. (5) GAAP income is presented in Appendix 1. (6) ”Adjusted” is a non-GAAP financial measure. See Appendix 2 for a historical reconciliation of “Adjusted” measures to GAAP metrics. Market Share History Deposits

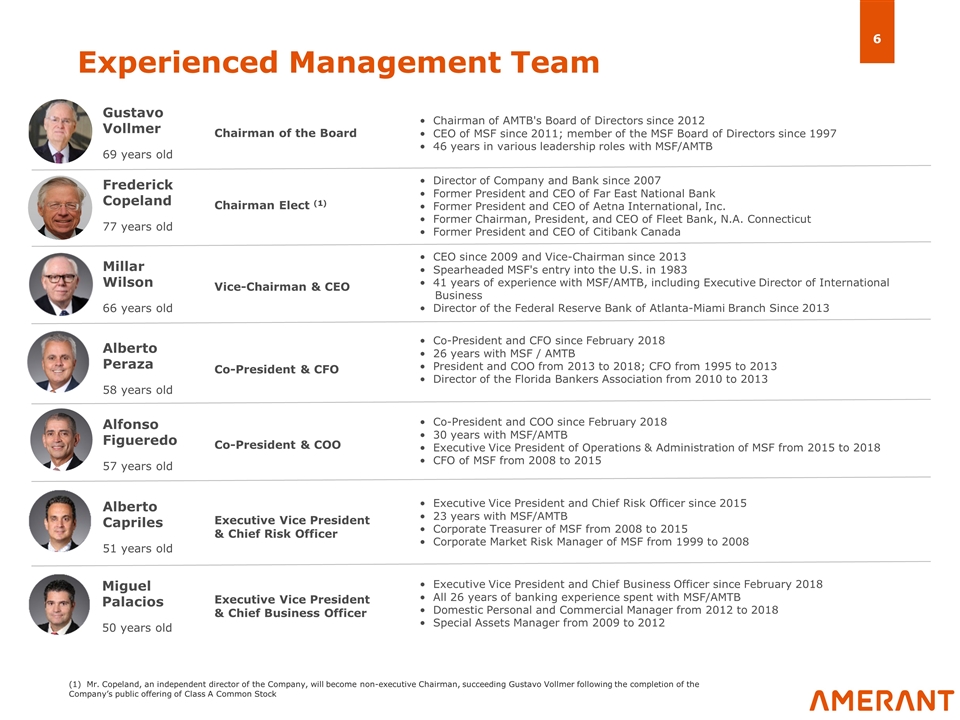

Experienced Management Team • Executive Vice President and Chief Business Officer since February 2018 • All 26 years of banking experience spent with MSF/AMTB • Domestic Personal and Commercial Manager from 2012 to 2018 • Special Assets Manager from 2009 to 2012 Executive Vice President & Chief Business Officer • Executive Vice President and Chief Risk Officer since 2015 • 23 years with MSF/AMTB • Corporate Treasurer of MSF from 2008 to 2015 • Corporate Market Risk Manager of MSF from 1999 to 2008 Executive Vice President & Chief Risk Officer • Co-President and COO since February 2018 • 30 years with MSF/AMTB • Executive Vice President of Operations & Administration of MSF from 2015 to 2018 • CFO of MSF from 2008 to 2015 Co-President & COO Co-President & CFO Miguel Palacios 50 years old Alberto Peraza 58 years old Alfonso Figueredo 57 years old Alberto Capriles 51 years old Vice-Chairman & CEO Millar Wilson 66 years old (1) Mr. Copeland, an independent director of the Company, will become non-executive Chairman, succeeding Gustavo Vollmer following the completion of the Company’s public offering of Class A Common Stock Frederick Copeland 77 years old • Director of Company and Bank since 2007 • Former President and CEO of Far East National Bank • Former President and CEO of Aetna International, Inc. • Former Chairman, President, and CEO of Fleet Bank, N.A. Connecticut • Former President and CEO of Citibank Canada Chairman Elect (1) Gustavo Vollmer 69 years old • Chairman of AMTB's Board of Directors since 2012 • CEO of MSF since 2011; member of the MSF Board of Directors since 1997 • 46 years in various leadership roles with MSF/AMTB Chairman of the Board • CEO since 2009 and Vice-Chairman since 2013 • Spearheaded MSF's entry into the U.S. in 1983 • 41 years of experience with MSF/AMTB, including Executive Director of International Business • Director of the Federal Reserve Bank of Atlanta-Miami Branch Since 2013 • Co-President and CFO since February 2018 • 26 years with MSF / AMTB • President and COO from 2013 to 2018; CFO from 1995 to 2013 • Director of the Florida Bankers Association from 2010 to 2013

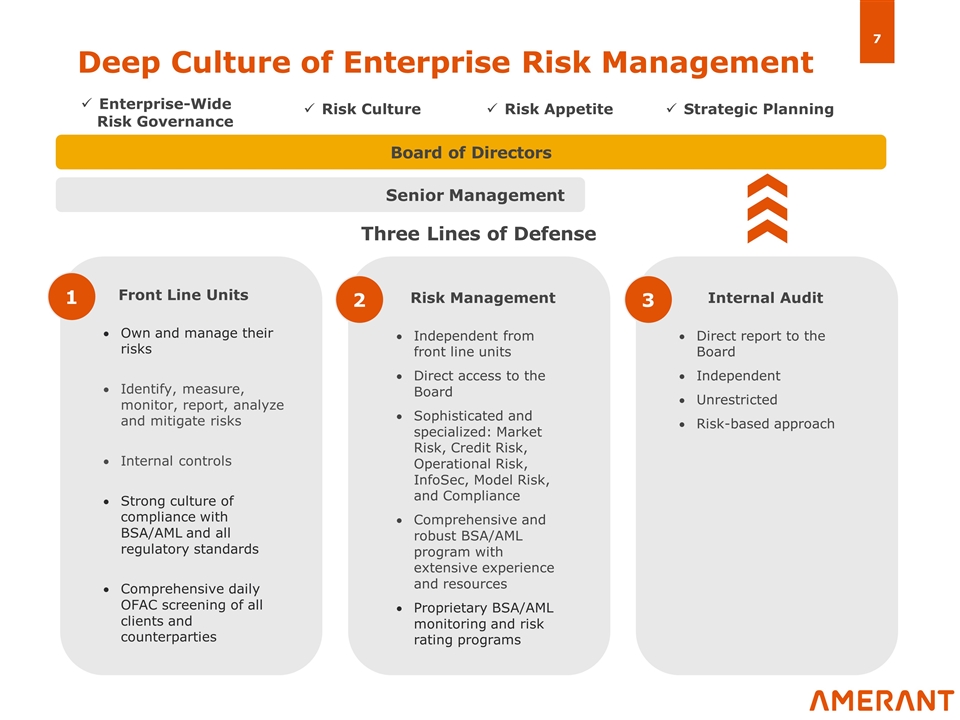

Deep Culture of Enterprise Risk Management Own and manage their risks Identify, measure, monitor, report, analyze and mitigate risks Internal controls Strong culture of compliance with BSA/AML and all regulatory standards Comprehensive daily OFAC screening of all clients and counterparties Front Line Units 1 Three Lines of Defense Independent from front line units Direct access to the Board Sophisticated and specialized: Market Risk, Credit Risk, Operational Risk, InfoSec, Model Risk, and Compliance Comprehensive and robust BSA/AML program with extensive experience and resources Proprietary BSA/AML monitoring and risk rating programs Risk Management 2 Direct report to the Board Independent Unrestricted Risk-based approach Internal Audit 3 Risk Culture Risk Appetite Strategic Planning Enterprise-Wide Risk Governance Board of Directors Senior Management

Meant for You: A Different Kind of Bank All that we do, our attitude and behaviors, aim at our ultimate goal: offering the closest, most personal and exceptional service to our customers. We have developed strong relationships for the past 39 years and we are excited to create new ones, always adapting to your lives and specific needs, in a dynamic and positive way. We are renewing our commitment to you by aiming to keep growing and making possible a brighter future for you, our investors, our communities, and our people. We are evolving, just like you Our new purpose Everything we do is designed with our stakeholders in mind

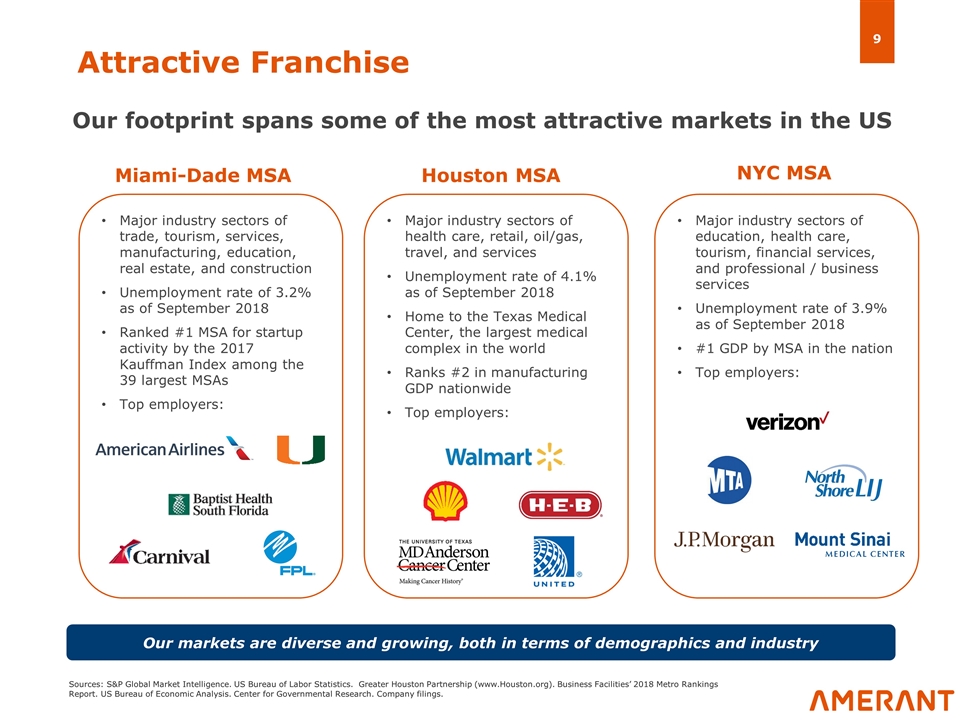

Attractive Franchise Our markets are diverse and growing, both in terms of demographics and industry Our footprint spans some of the most attractive markets in the US Miami-Dade MSA Sources: S&P Global Market Intelligence. US Bureau of Labor Statistics. Greater Houston Partnership (www.Houston.org). Business Facilities’ 2018 Metro Rankings Report. US Bureau of Economic Analysis. Center for Governmental Research. Company filings. Houston MSA NYC MSA Major industry sectors of trade, tourism, services, manufacturing, education, real estate, and construction Unemployment rate of 3.2% as of September 2018 Ranked #1 MSA for startup activity by the 2017 Kauffman Index among the 39 largest MSAs Top employers: Major industry sectors of health care, retail, oil/gas, travel, and services Unemployment rate of 4.1% as of September 2018 Home to the Texas Medical Center, the largest medical complex in the world Ranks #2 in manufacturing GDP nationwide Top employers: Major industry sectors of education, health care, tourism, financial services, and professional / business services Unemployment rate of 3.9% as of September 2018 #1 GDP by MSA in the nation Top employers:

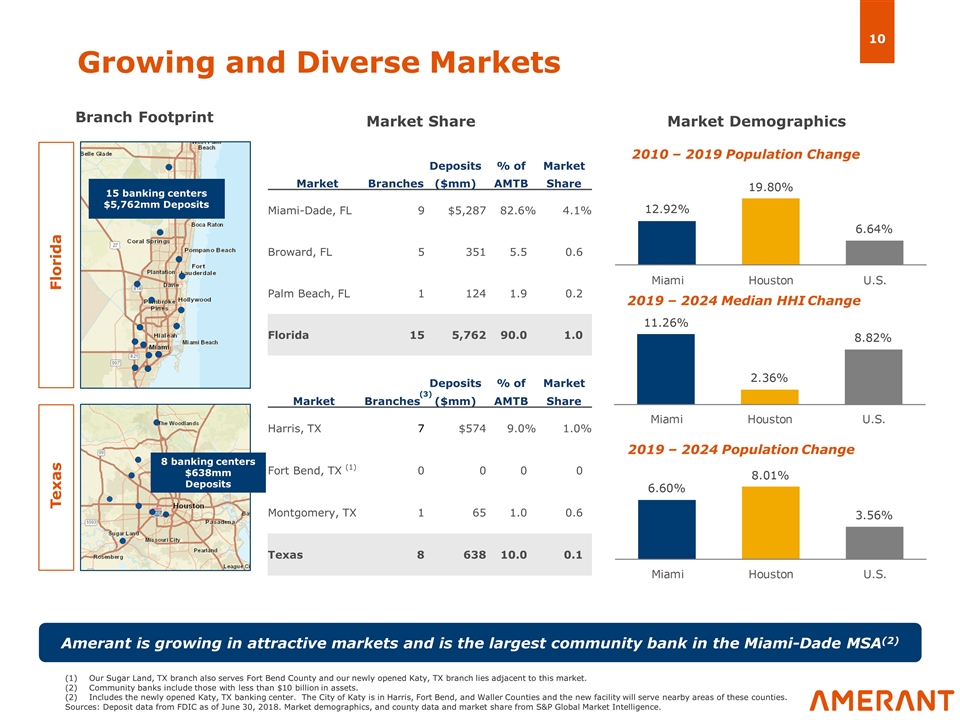

Growing and Diverse Markets Market Share Branch Footprint Florida Texas Market Demographics 2010 – 2019 Population Change 2019 – 2024 Median HHI Change 2019 – 2024 Population Change 15 banking centers $5,762mm Deposits 8 banking centers $638mm Deposits Our Sugar Land, TX branch also serves Fort Bend County and our newly opened Katy, TX branch lies adjacent to this market. Community banks include those with less than $10 billion in assets. Includes the newly opened Katy, TX banking center. The City of Katy is in Harris, Fort Bend, and Waller Counties and the new facility will serve nearby areas of these counties. Sources: Deposit data from FDIC as of June 30, 2018. Market demographics, and county data and market share from S&P Global Market Intelligence. Amerant is growing in attractive markets and is the largest community bank in the Miami-Dade MSA(2) Deposits % of Market Market Branches ($mm) AMTB Share Miami-Dade, FL 9 $5,287 82.6% 4.1% Broward, FL 5 351 5.5 0.6 Palm Beach, FL 1 124 1.9 0.2 Florida 15 5,762 90.0 1.0 Deposits % of Market Market Branches ($mm) AMTB Share Harris, TX 7 $574 9.0% 1.0% Fort Bend, TX (1) 0 0 0 0 Montgomery, TX 1 65 1.0 0.6 Texas 8 638 10.0 0.1 (3)

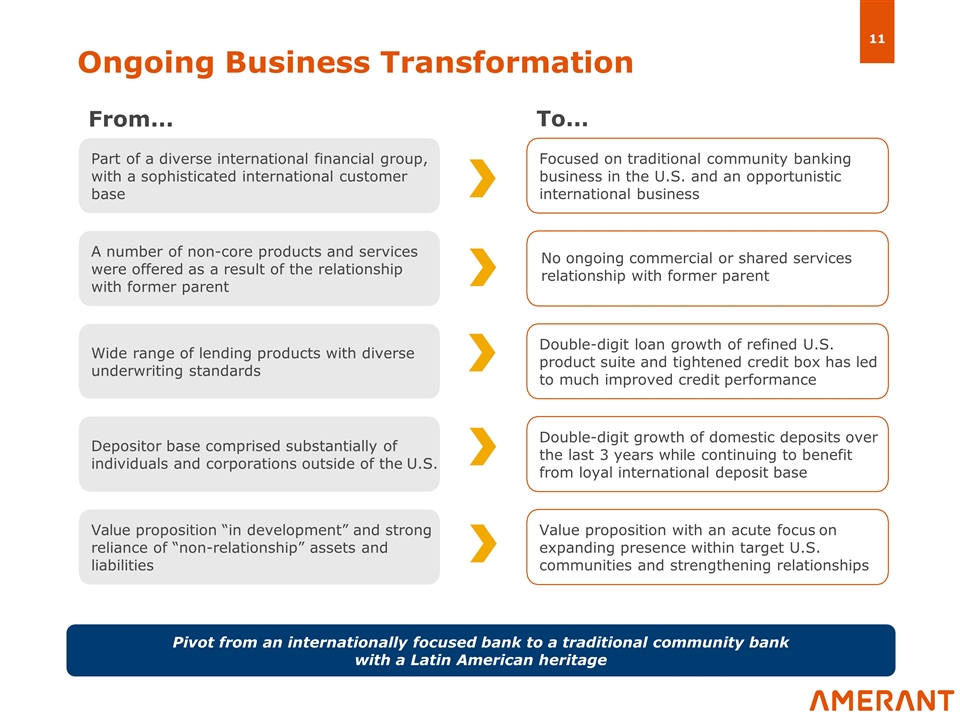

Ongoing Business Transformation Focused on traditional community banking business in the U.S. and an opportunistic international business Depositor base comprised substantially of individuals and corporations outside of the U.S. Value proposition “in development” and strong reliance of “non-relationship” assets and liabilities Double-digit loan growth of refined U.S. product suite and tightened credit box has led to much improved credit performance Double-digit growth of domestic deposits over the last 3 years while continuing to benefit from loyal international deposit base Value proposition with an acute focus on expanding presence within target U.S. communities and strengthening relationships Part of a diverse international financial group, with a sophisticated international customer base Wide range of lending products with diverse underwriting standards No ongoing commercial or shared services relationship with former parent A number of non-core products and services were offered as a result of the relationship with former parent Pivot from an internationally focused bank to a traditional community bank with a Latin American heritage From... To...

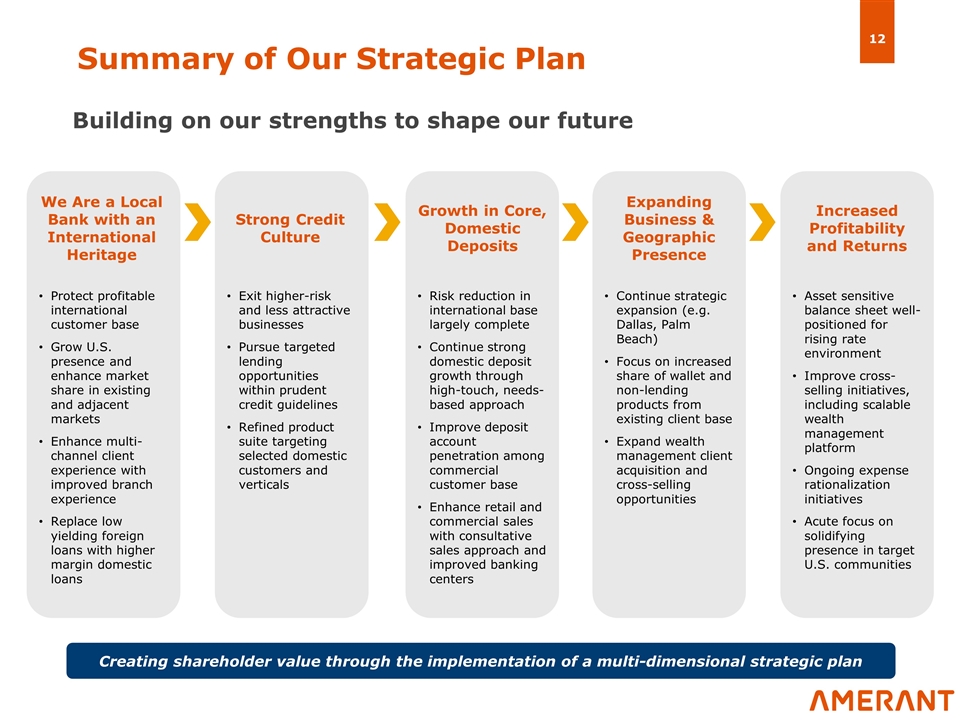

Summary of Our Strategic Plan Building on our strengths to shape our future We Are a Local Bank with an International Heritage Protect profitable international customer base Grow U.S. presence and enhance market share in existing and adjacent markets Enhance multi-channel client experience with improved branch experience Replace low yielding foreign loans with higher margin domestic loans Exit higher-risk and less attractive businesses Pursue targeted lending opportunities within prudent credit guidelines Refined product suite targeting selected domestic customers and verticals Risk reduction in international base largely complete Continue strong domestic deposit growth through high-touch, needs-based approach Improve deposit account penetration among commercial customer base Enhance retail and commercial sales with consultative sales approach and improved banking centers Continue strategic expansion (e.g. Dallas, Palm Beach) Focus on increased share of wallet and non-lending products from existing client base Expand wealth management client acquisition and cross-selling opportunities Asset sensitive balance sheet well-positioned for rising rate environment Improve cross-selling initiatives, including scalable wealth management platform Ongoing expense rationalization initiatives Acute focus on solidifying presence in target U.S. communities Strong Credit Culture Growth in Core, Domestic Deposits Expanding Business & Geographic Presence Increased Profitability and Returns Creating shareholder value through the implementation of a multi-dimensional strategic plan

Build on Improving Financial Performance Domestic Deposits Nonaccrual Loans / Total Loans Net Interest Margin Efficiency Ratio ROATCE(2) Domestic Deposits as % of Total Deposits: 31.1% 49.1% International Loans as % of Total Loans: 24.2% 9.1% Yield on Loans(1): 3.06% 4.26% # of FTEs: 1007 948 ROAA(2): 0.19% 0.60% ($ in millions) 90 bps decrease 57 bps increase 451 bps increase 920 bps decrease (2) (2) 15.8% CAGR Annualized using YTD values. Reflects nine months ended September 30, 2018; normalized earnings exclude $6.4 million in 2018 YTD spin-off costs. See Appendix 2 for reconciliation of non-GAAP adjusted net income. Increased Domestic Deposits Attractive Risk-Adjusted Loan Profile Higher Net Interest Margin Improving Expense Culture Enhanced Profitability Multi-year shift towards increasing core domestic growth and profitability

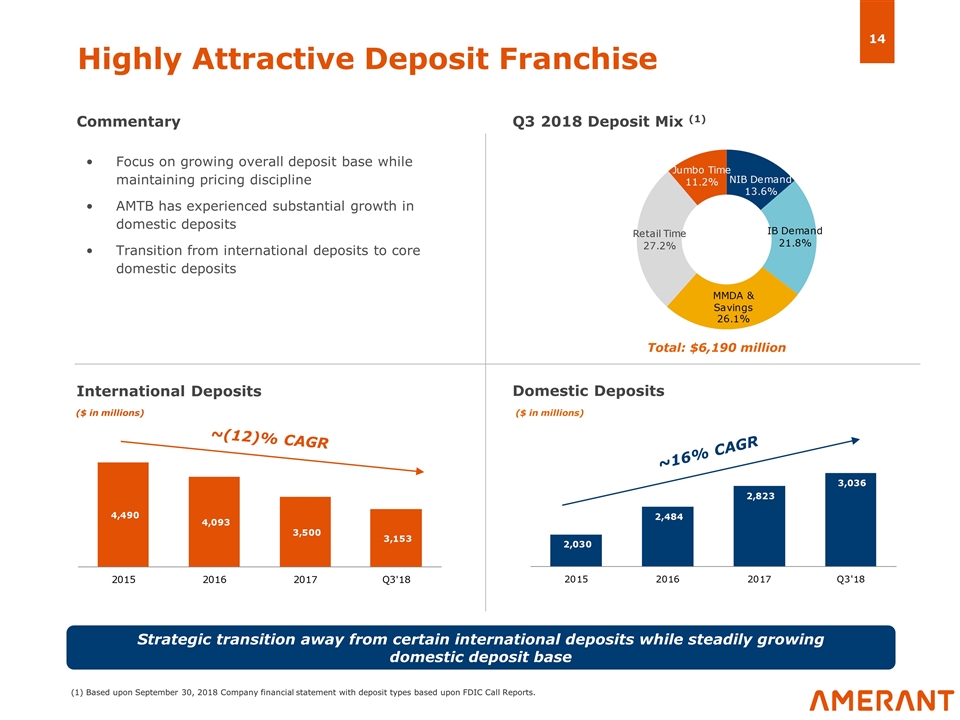

Highly Attractive Deposit Franchise Commentary Q3 2018 Deposit Mix (1) Domestic Deposits International Deposits Focus on growing overall deposit base while maintaining pricing discipline AMTB has experienced substantial growth in domestic deposits Transition from international deposits to core domestic deposits ($ in millions) ($ in millions) ~16% CAGR ~(12)% CAGR Total: $6,190 million Strategic transition away from certain international deposits while steadily growing domestic deposit base (1) Based upon September 30, 2018 Company financial statement with deposit types based upon FDIC Call Reports.

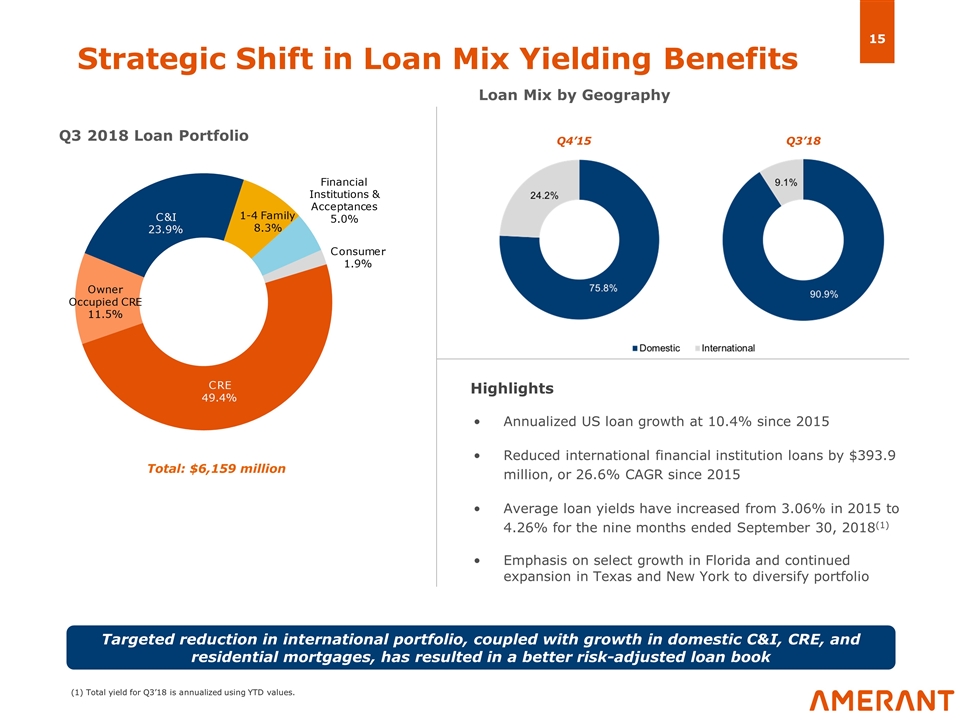

Strategic Shift in Loan Mix Yielding Benefits Highlights Annualized US loan growth at 10.4% since 2015 Reduced international financial institution loans by $393.9 million, or 26.6% CAGR since 2015 Average loan yields have increased from 3.06% in 2015 to 4.26% for the nine months ended September 30, 2018(1) Emphasis on select growth in Florida and continued expansion in Texas and New York to diversify portfolio Q4’15 (1) Total yield for Q3’18 is annualized using YTD values. Total: $6,159 million Targeted reduction in international portfolio, coupled with growth in domestic C&I, CRE, and residential mortgages, has resulted in a better risk-adjusted loan book Q3’18 Q3 2018 Loan Portfolio Loan Mix by Geography

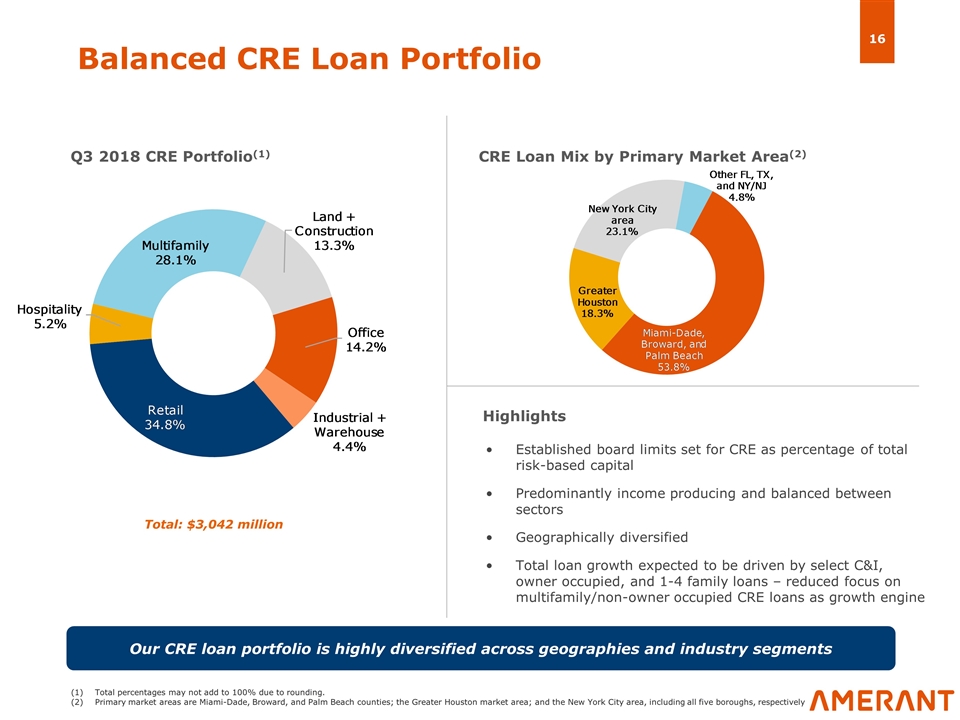

Balanced CRE Loan Portfolio Q3 2018 CRE Portfolio(1) CRE Loan Mix by Primary Market Area(2) Highlights Established board limits set for CRE as percentage of total risk-based capital Predominantly income producing and balanced between sectors Geographically diversified Total loan growth expected to be driven by select C&I, owner occupied, and 1-4 family loans – reduced focus on multifamily/non-owner occupied CRE loans as growth engine Total: $3,042 million Our CRE loan portfolio is highly diversified across geographies and industry segments Total percentages may not add to 100% due to rounding. Primary market areas are Miami-Dade, Broward, and Palm Beach counties; the Greater Houston market area; and the New York City area, including all five boroughs, respectively

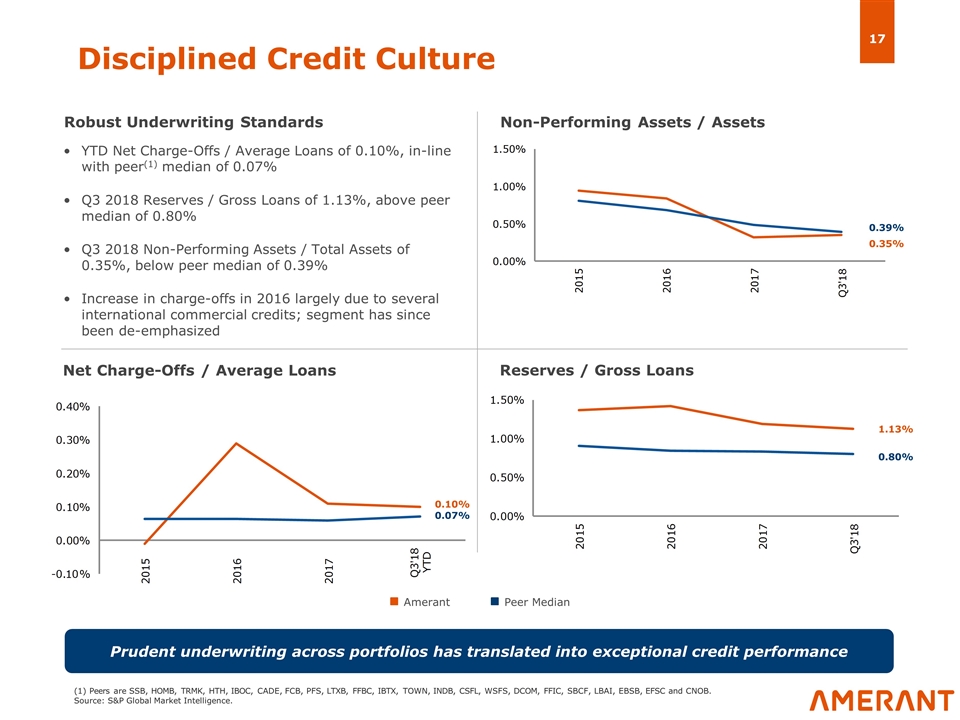

Peer Median Amerant Disciplined Credit Culture Net Charge-Offs / Average Loans Robust Underwriting Standards Non-Performing Assets / Assets Reserves / Gross Loans YTD Net Charge-Offs / Average Loans of 0.10%, in-line with peer(1) median of 0.07% Q3 2018 Reserves / Gross Loans of 1.13%, above peer median of 0.80% Q3 2018 Non-Performing Assets / Total Assets of 0.35%, below peer median of 0.39% Increase in charge-offs in 2016 largely due to several international commercial credits; segment has since been de-emphasized 0.39% 0.35% 0.10% 0.07% 1.13% 0.80% (1) Peers are SSB, HOMB, TRMK, HTH, IBOC, CADE, FCB, PFS, LTXB, FFBC, IBTX, TOWN, INDB, CSFL, WSFS, DCOM, FFIC, SBCF, LBAI, EBSB, EFSC and CNOB. Source: S&P Global Market Intelligence. Prudent underwriting across portfolios has translated into exceptional credit performance

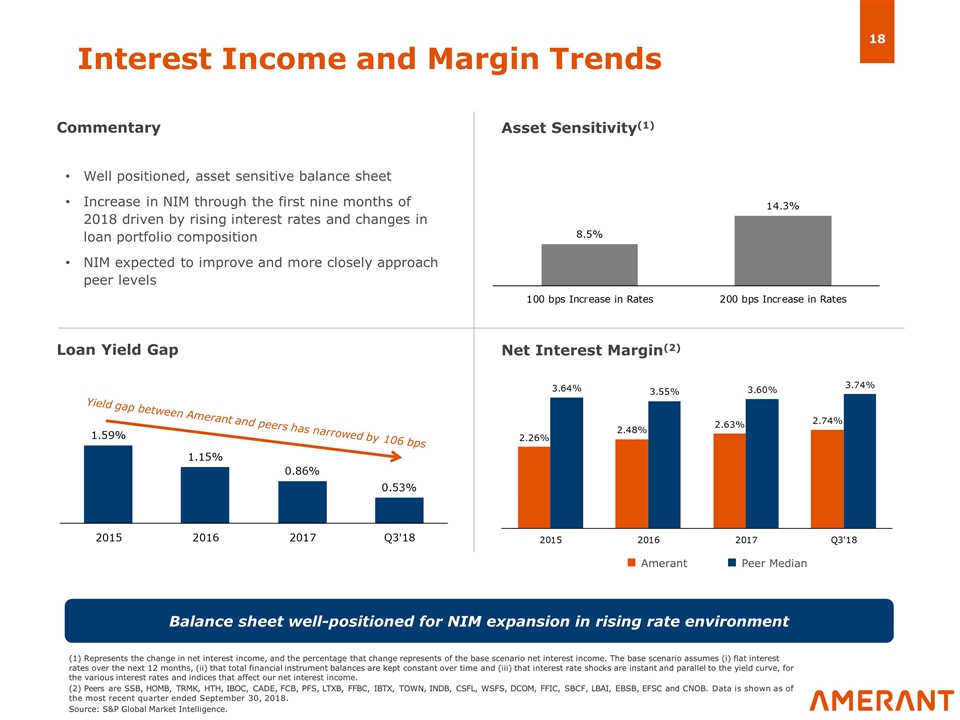

Peer Median Interest Income and Margin Trends Asset Sensitivity(1) Well positioned, asset sensitive balance sheet Increase in NIM through the first nine months of 2018 driven by rising interest rates and changes in loan portfolio composition NIM expected to improve and more closely approach peer levels Commentary Loan Yield Gap Net Interest Margin(2) Yield gap between Amerant and peers has narrowed by 106 bps (1) Represents the change in net interest income, and the percentage that change represents of the base scenario net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve, for the various interest rates and indices that affect our net interest income. (2) Peers are SSB, HOMB, TRMK, HTH, IBOC, CADE, FCB, PFS, LTXB, FFBC, IBTX, TOWN, INDB, CSFL, WSFS, DCOM, FFIC, SBCF, LBAI, EBSB, EFSC and CNOB. Data is shown as of the most recent quarter ended September 30, 2018. Source: S&P Global Market Intelligence. Balance sheet well-positioned for NIM expansion in rising rate environment Amerant

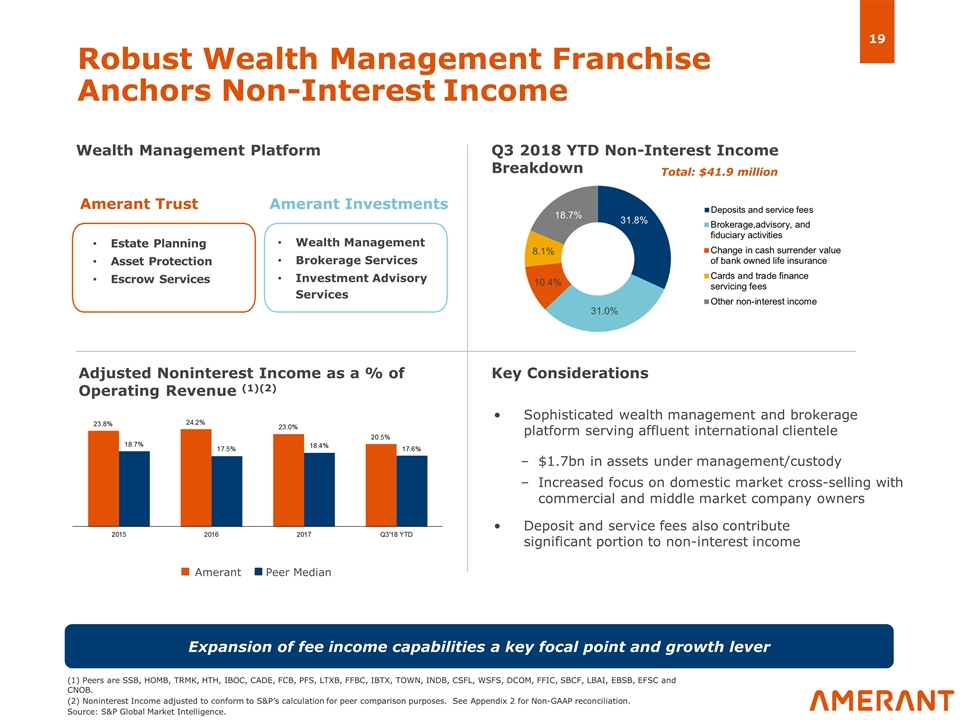

Robust Wealth Management Franchise Anchors Non-Interest Income Key Considerations Sophisticated wealth management and brokerage platform serving affluent international clientele $1.7bn in assets under management/custody Increased focus on domestic market cross-selling with commercial and middle market company owners Deposit and service fees also contribute significant portion to non-interest income Q3 2018 YTD Non-Interest Income Breakdown Wealth Management Platform Adjusted Noninterest Income as a % of Operating Revenue (1)(2) Amerant Investments Total: $41.9 million (1) Peers are SSB, HOMB, TRMK, HTH, IBOC, CADE, FCB, PFS, LTXB, FFBC, IBTX, TOWN, INDB, CSFL, WSFS, DCOM, FFIC, SBCF, LBAI, EBSB, EFSC and CNOB. (2) Noninterest Income adjusted to conform to S&P’s calculation for peer comparison purposes. See Appendix 2 for Non-GAAP reconciliation. Source: S&P Global Market Intelligence. Amerant Trust Estate Planning Asset Protection Escrow Services Wealth Management Brokerage Services Investment Advisory Services Expansion of fee income capabilities a key focal point and growth lever Peer Median Amerant

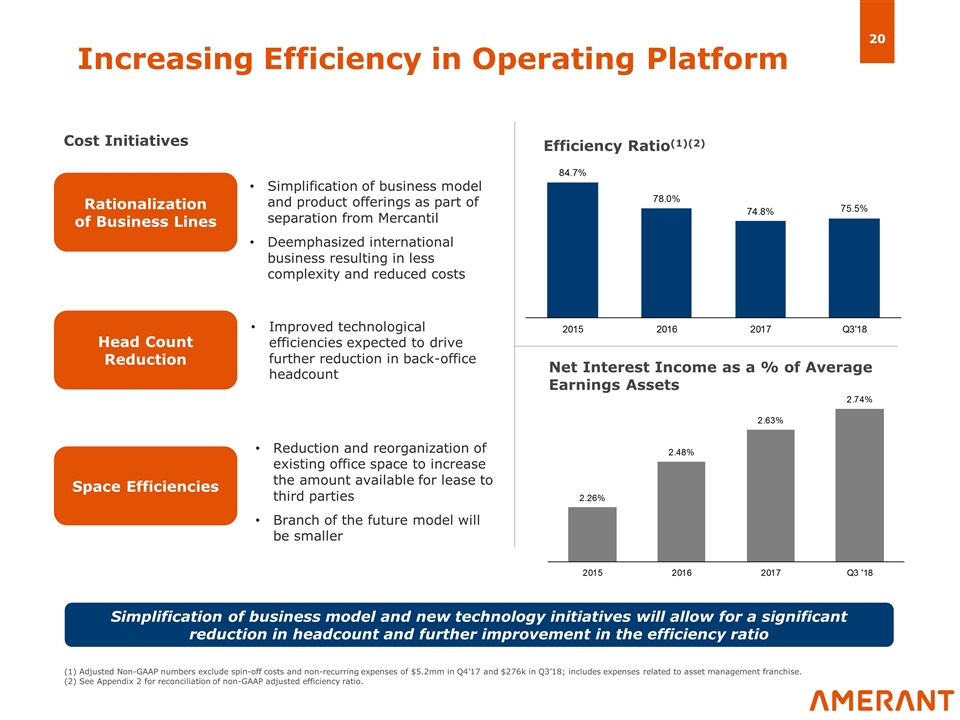

Increasing Efficiency in Operating Platform Reduction and reorganization of existing office space to increase the amount available for lease to third parties Branch of the future model will be smaller Cost Initiatives Simplification of business model and product offerings as part of separation from Mercantil Deemphasized international business resulting in less complexity and reduced costs (1) Adjusted Non-GAAP numbers exclude spin-off costs and non-recurring expenses of $5.2mm in Q4’17 and $276k in Q3’18; includes expenses related to asset management franchise. (2) See Appendix 2 for reconciliation of non-GAAP adjusted efficiency ratio. Efficiency Ratio(1)(2) Rationalization of Business Lines Improved technological efficiencies expected to drive further reduction in back-office headcount Head Count Reduction Space Efficiencies Simplification of business model and new technology initiatives will allow for a significant reduction in headcount and further improvement in the efficiency ratio Net Interest Income as a % of Average Earnings Assets

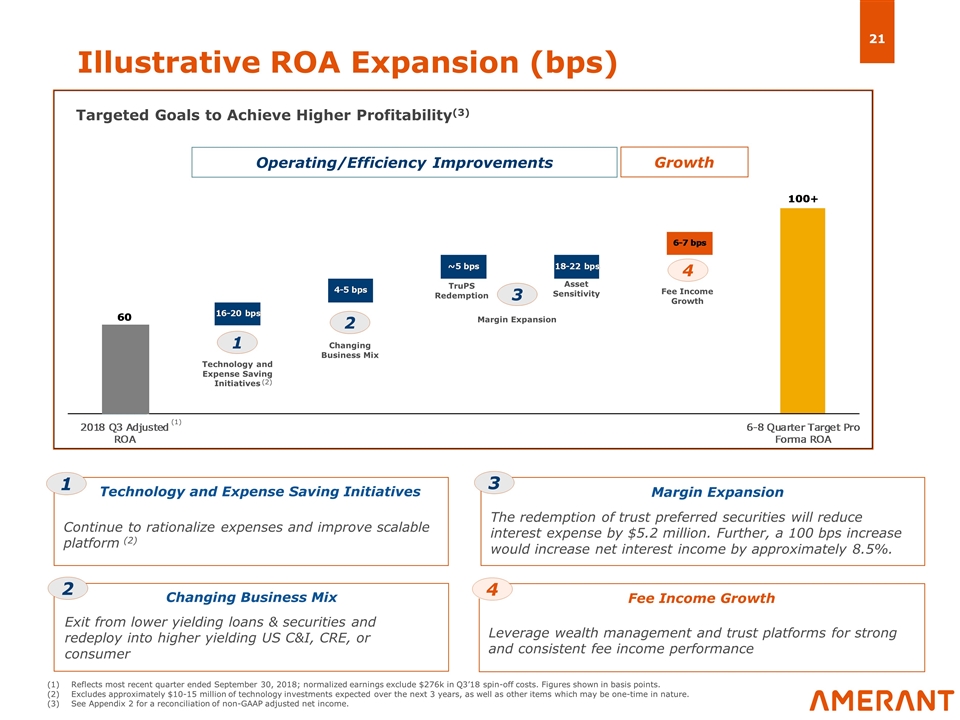

Illustrative ROA Expansion (bps) 1 2 3 4 Operating/Efficiency Improvements Growth Technology and Expense Saving Initiatives Changing Business Mix Margin Expansion Fee Income Growth 1 2 3 4 Technology and Expense Saving Initiatives Changing Business Mix Margin Expansion Fee Income Growth Continue to rationalize expenses and improve scalable platform (2) Exit from lower yielding loans & securities and redeploy into higher yielding US C&I, CRE, or consumer The redemption of trust preferred securities will reduce interest expense by $5.2 million. Further, a 100 bps increase would increase net interest income by approximately 8.5%. Leverage wealth management and trust platforms for strong and consistent fee income performance (1) Reflects most recent quarter ended September 30, 2018; normalized earnings exclude $276k in Q3’18 spin-off costs. Figures shown in basis points. Excludes approximately $10-15 million of technology investments expected over the next 3 years, as well as other items which may be one-time in nature. See Appendix 2 for a reconciliation of non-GAAP adjusted net income. Targeted Goals to Achieve Higher Profitability(3) (2) Asset Sensitivity TruPS Redemption

Investment Highlights Recent shift from preservation of capital to driving and growing shareholder value Substantial and continuing insider ownership, approximately 30% pro forma Strong asset quality and domestic loan growth coupled with an asset sensitive balance sheet Focus on expanding domestic deposit base throughout our high growth U.S. markets Low cost deposits from loyal international customers who view U.S. as safe haven for assets Diversification of revenue from attractive and growing wealth management platform Top shelf risk management culture stemming from being part of large, multi-national organization

Appendices

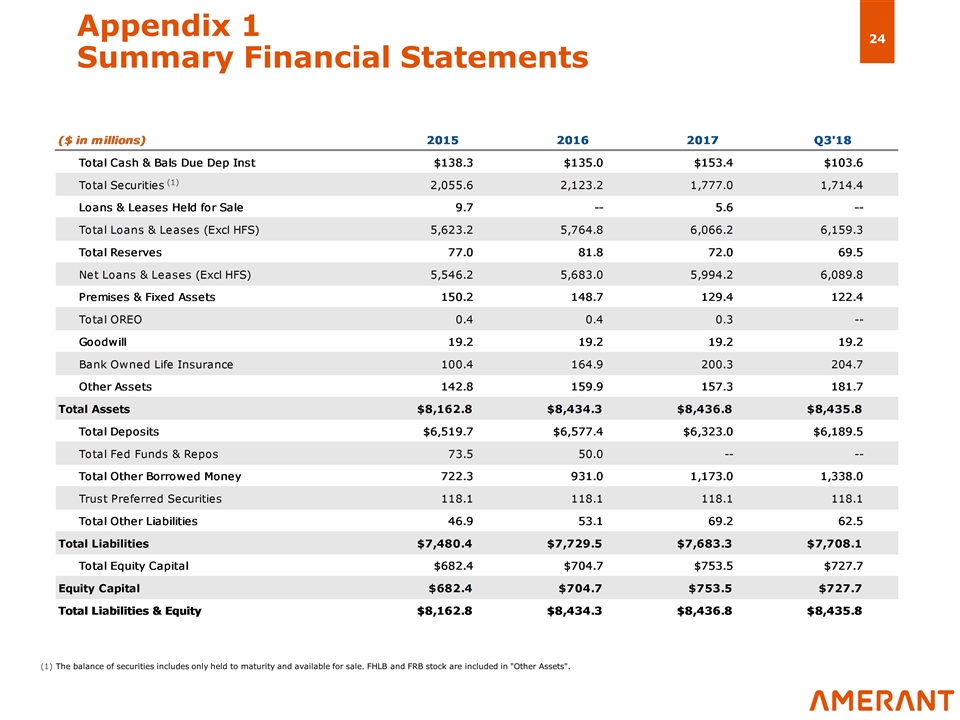

Appendix 1 Summary Financial Statements (1) (1) The balance of securities includes only held to maturity and available for sale. FHLB and FRB stock are included in "Other Assets".

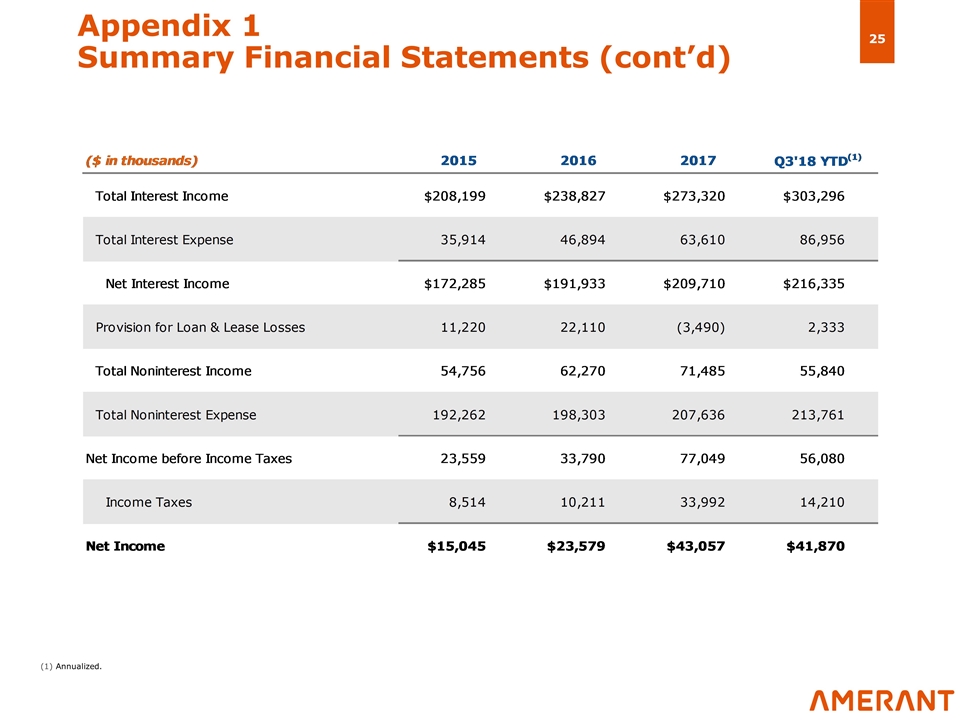

Appendix 1 Summary Financial Statements (cont’d) (1) Annualized.

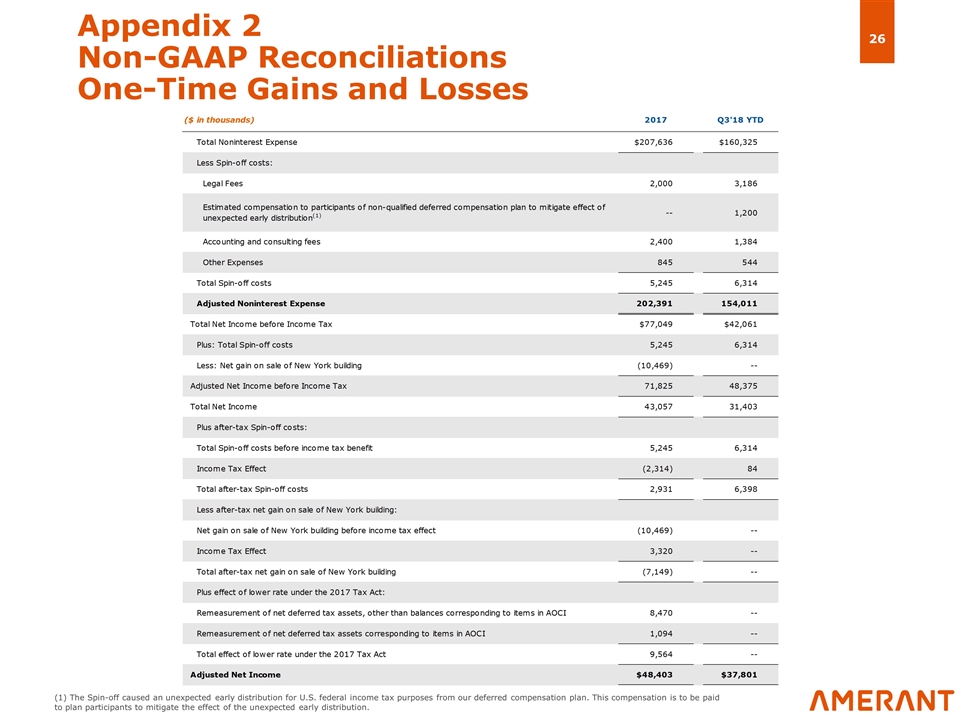

(1) The Spin-off caused an unexpected early distribution for U.S. federal income tax purposes from our deferred compensation plan. This compensation is to be paid to plan participants to mitigate the effect of the unexpected early distribution. Appendix 2 Non-GAAP Reconciliations One-Time Gains and Losses

Appendix 2 Non-GAAP Reconciliations Adjusted Non-Interest Income

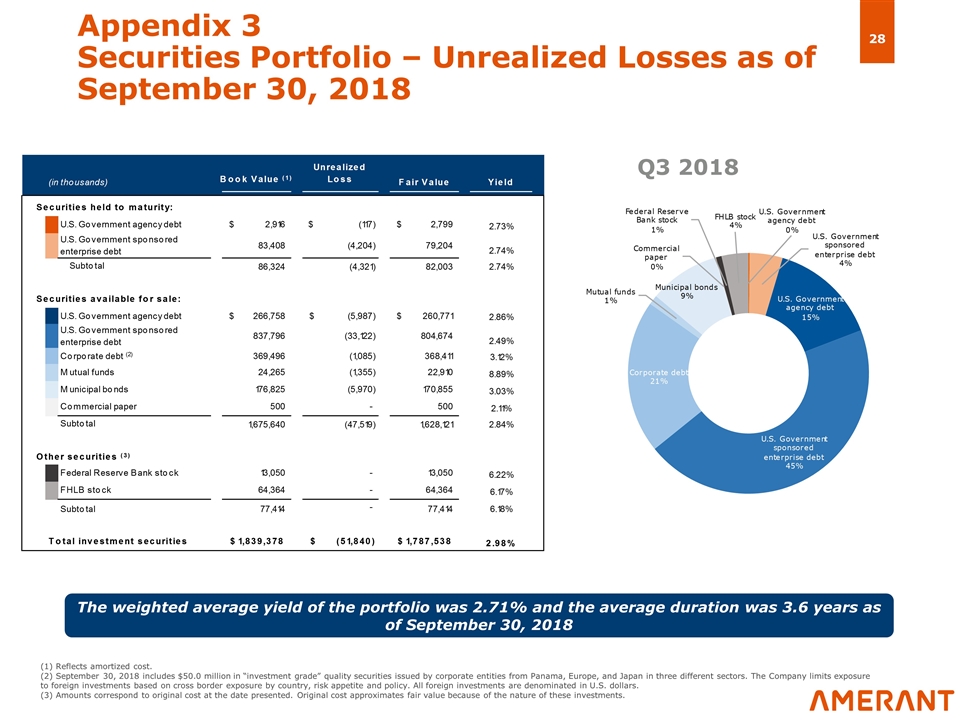

(1) Reflects amortized cost. (2) September 30, 2018 includes $50.0 million in “investment grade” quality securities issued by corporate entities from Panama, Europe, and Japan in three different sectors. The Company limits exposure to foreign investments based on cross border exposure by country, risk appetite and policy. All foreign investments are denominated in U.S. dollars. (3) Amounts correspond to original cost at the date presented. Original cost approximates fair value because of the nature of these investments. Q3 2018 The weighted average yield of the portfolio was 2.71% and the average duration was 3.6 years as of September 30, 2018 Appendix 3 Securities Portfolio – Unrealized Losses as of September 30, 2018

Thank you