MERCANTIL BANK HOLDING CORPORATION

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 4, 2019

To the Shareholders of Mercantil Bank Holding Corporation:

Notice is hereby given that the annual meeting (“Annual Meeting”) of the shareholders of Mercantil Bank Holding Corporation (the “Company,” “we,” “us” or “our”) will be held at the Hotel Colonnade, 180 Aragon Avenue, Coral Gables, Florida 33134 on June 4, 2019 at 3:00 p.m., Eastern time, for the following purposes:

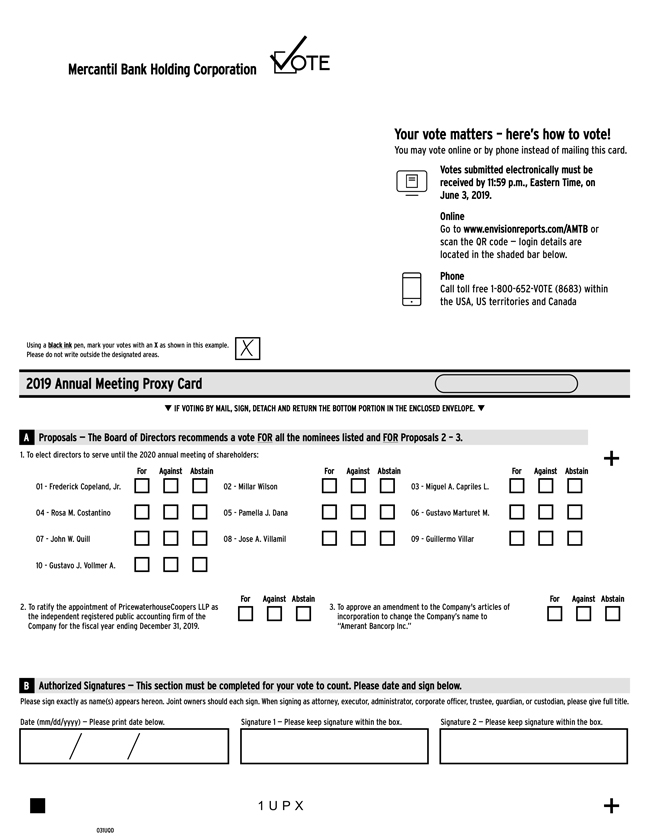

| 1. | to elect directors to serve until the 2020 annual meeting of shareholders; |

| 2. | to ratify the appointment of PricewaterhouseCoopers LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2019; |

| 3. | to approve an amendment to our articles of incorporation to change our name to Amerant Bancorp Inc.; and |

| 4. | to transact such other business as may properly come before the meeting or any adjournments thereof. |

Shareholders of record at the close of business on April 11, 2019 are entitled to notice of and to vote at the Annual Meeting. We are taking advantage of the U.S. Securities and Exchange Commission rules allowing us to furnish proxy materials to shareholders on the internet. We believe that these rules provide you with proxy materials more quickly and reduce the environmental impact of our Annual Meeting. Accordingly, we are mailing to shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review our proxy materials and Annual Report to Shareholders for the year ended December 31, 2018, and to vote online or by telephone.

If you would like to receive a paper copy of our proxy materials, please follow the instructions for requesting these materials in the proxy statement.

| By Order of the Board of Directors | ||

| /s/ Frederick C. Copeland, Jr. | ||

| Frederick C. Copeland, Jr. Chairman of the Board of Directors | ||

April 25, 2019