First Quarter 2019 Financial Review Earnings Call April 26, 2019 Exhibit 99.2

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, including, without limitation, future financial and operating results; costs and revenues; economic conditions generally and in our markets; loan demand; mortgage lending activity; changes in the mix of our earning assets and our deposit and wholesale liabilities; net interest margin; yields on earning assets; interest rates (generally and those applicable to our assets and liabilities); credit quality, including loan performance, nonperforming assets, provisions for loan losses, charge-offs, other-than-temporary impairments and collateral values; market trends; and customer preferences, as well as statements with respect to our objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlook” and other similar words and expressions of the future. Forward-looking statements, including those as to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2018 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Descriptions for full year 2019 goals are preliminary and are subject to risks and uncertainties, including, among others, changes in connection with quarter-end and year-end adjustments. Any variation between the Company’s actual results and the preliminary descriptions set forth herein may be material. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, including Adjusted Net Income, Adjusted Net Income Before Income Tax, Adjusted Net Income per Share (Basic and Diluted), Adjusted Noninterest Expense, Adjusted Return on Equity (ROE), Adjusted Return on Assets (ROA), Adjusted ROATCE (as defined below), Adjusted Efficiency Ratio and other ratios appearing in the “Non-GAAP Financial Measures Reconciliations” table. This supplemental information should not be considered in isolation or as a substitute for the GAAP measures presented herein. Additional information regarding the non-GAAP financial measures referred to in this presentation is included at the end of this presentation under “Non-GAAP Financial Measures Reconciliations.”

Net Income increased 38.6% over 1Q18, or 16.2% as adjusted Net Income Before Income Tax increased 52.3% over 1Q18 Improved Net Interest Income (NII) versus 1Q18 on higher yields and rebalanced assets mix; Net Interest Margin (NIM) improved 26bps compared to 1Q18 Early termination of FHLB advances resulted in $0.56 million gain Strong asset quality continues Allowance for Loan Losses (ALL) coverage continues to be strong Loan production reflects expected seasonality International loan runoff continues as planned Continued Shared National Credit (SNC) loan portfolio sales, as planned, focusing on relationship loans International deposits lower primarily due to customer spending of U.S. Dollars Execution of relationship-focused strategy, resulting in balance sheet deleveraging Push for enhanced loan mix and fee income growth Focus on operational efficiencies Earnings Business Drivers Performance Highlights 1Q19 Credit Quality Loans & Deposits

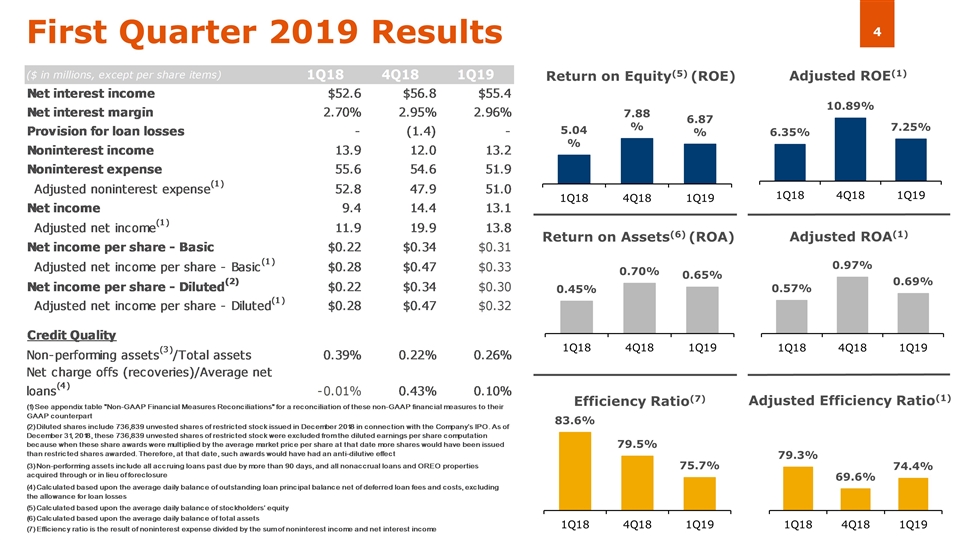

First Quarter 2019 Results Return on Assets(6) (ROA) Return on Equity(5) (ROE) Adjusted ROE(1) Adjusted ROA(1) Adjusted Efficiency Ratio(1) Efficiency Ratio(7) ($ in millions, except per share items) 1Q18 4Q18 1Q19 Net interest income $52.6 $56.8 $55.437178909999965 Net interest margin 2.7E-2 2.9499999999999998E-2 2.9554860025943208E-2 Provision for loan losses 0 -1.4 0 Noninterest income 13.9 12 13.156746979999999 Noninterest expense 55.6 54.6 51.946209109999991 Adjusted noninterest expense(1) 52.8 47.9 51.012 Net income 9.4 14.4 13.070957889999978 Adjusted net income(1) 11.9 19.899999999999999 13.803000000000001 Net income per share - Basic $0.22 $0.34 $0.30571573127495766 Adjusted net income per share - Basic(1) $0.28000000000000003 $0.47 $0.33 Net income per share - Diluted(2) $0.22 $0.34 $0.30458546940994852 Adjusted net income per share - Diluted(1) $0.28000000000000003 $0.47 $0.32 Credit Quality Non-performing assets(3)/Total assets 3.8999999999999998E-3 2.2000000000000001E-3 2.6015724167733818E-3 Net charge offs (recoveries)/Average net loans(4) -1E-4 4.3E-3 1E-3 (1) See appendix table "Non-GAAP Financial Measures Reconciliations" for a reconciliation of this non-GAAP financial measures to its GAAP counterpart (2) Diluted shares include 736,839 unvested shares of restricted stock issued in December 2018 in connection with the Company’s IPO. As of December 31, 2018, these 736,839 unvested shares of restricted stock were excluded from the diluted earnings per share computation because when these share awards were multiplied by the average market price per share at that date more shares would have been issued than restricted shares awarded. Therefore, at that date, such awards would have had an anti-dilutive effect (3) Non-performing assets include all accruing loans past due by more than 90 days, and all nonaccrual loans and OREO properties acquired through or in lieu of foreclosure (4) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, excluding the allowance for loan losses (4) Calculated based upon the average daily balance of stockholders’ equity (5) Calculated based upon the average daily balance of total assets ($ in millions, except per share items) 1Q18 4Q18 1Q19 Net interest income $52.6 $56.8 $55.437178909999965 Net interest margin 2.7E-2 2.9499999999999998E-2 2.9554860025943208E-2 Provision for loan losses 0 -1.4 0 Noninterest income 13.9 12 13.156746979999999 Noninterest expense 55.6 54.6 51.946209109999991 Adjusted noninterest expense(1) 52.8 47.9 51.012 Net income 9.4 14.4 13.070957889999978 Adjusted net income(1) 11.9 19.899999999999999 13.803000000000001 Net income per share - Basic $0.22 $0.34 $0.30571573127495766 Adjusted net income per share - Basic(1) $0.28000000000000003 $0.47 $0.33 Net income per share - Diluted(2) $0.22 $0.34 $0.30458546940994852 Adjusted net income per share - Diluted(1) $0.28000000000000003 $0.47 $0.32 Credit Quality Non-performing assets(3)/Total assets 3.8999999999999998E-3 2.2000000000000001E-3 2.6015724167733818E-3 Net charge offs (recoveries)/Average net loans(4) -1E-4 4.3E-3 1E-3 (1) See appendix table "Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP counterpart (2) Diluted shares include 736,839 unvested shares of restricted stock issued in December 2018 in connection with the Company’s IPO. As of December 31, 2018, these 736,839 unvested shares of restricted stock were excluded from the diluted earnings per share computation because when these share awards were multiplied by the average market price per share at that date more shares would have been issued than restricted shares awarded. Therefore, at that date, such awards would have had an anti-dilutive effect (3) Non-performing assets include all accruing loans past due by more than 90 days, and all nonaccrual loans and OREO properties acquired through or in lieu of foreclosure (4) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, excluding the allowance for loan losses (5) Calculated based upon the average daily balance of stockholders’ equity (6) Calculated based upon the average daily balance of total assets (7) Efficiency ratio is the result of noninterest expense divided by the sum of noninterest income and net interest income

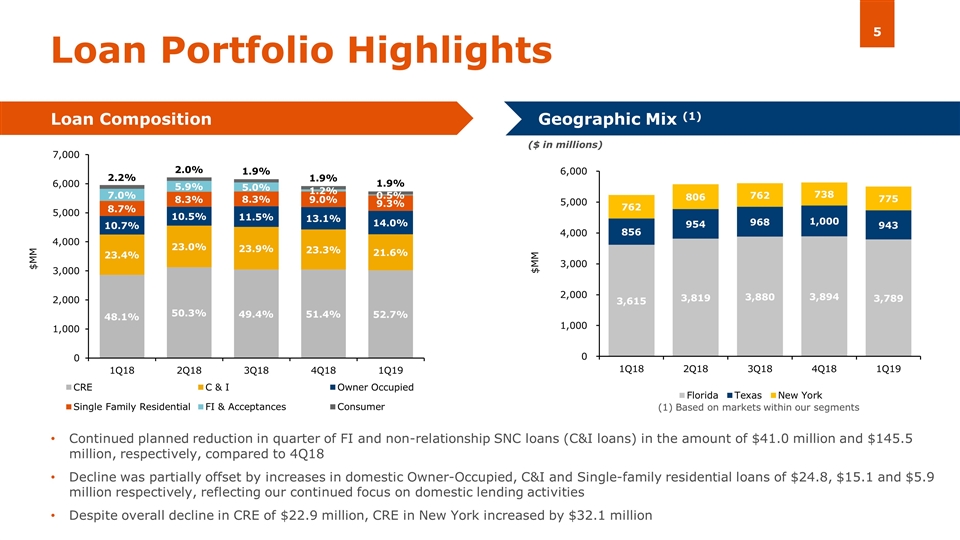

Loan Portfolio Highlights Loan Composition Geographic Mix (1) Continued planned reduction in quarter of FI and non-relationship SNC loans (C&I loans) in the amount of $41.0 million and $145.5 million, respectively, compared to 4Q18 Decline was partially offset by increases in domestic Owner-Occupied, C&I and Single-family residential loans of $24.8, $15.1 and $5.9 million respectively, reflecting our continued focus on domestic lending activities Despite overall decline in CRE of $22.9 million, CRE in New York increased by $32.1 million ($ in millions) (1) Based on markets within our segments

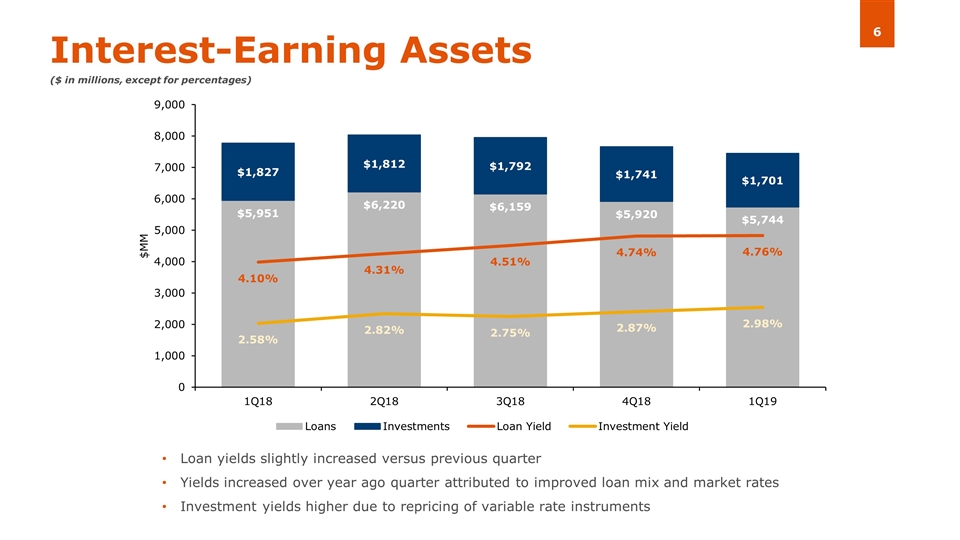

Interest-Earning Assets Loan yields slightly increased versus previous quarter Yields increased over year ago quarter attributed to improved loan mix and market rates Investment yields higher due to repricing of variable rate instruments ($ in millions, except for percentages)

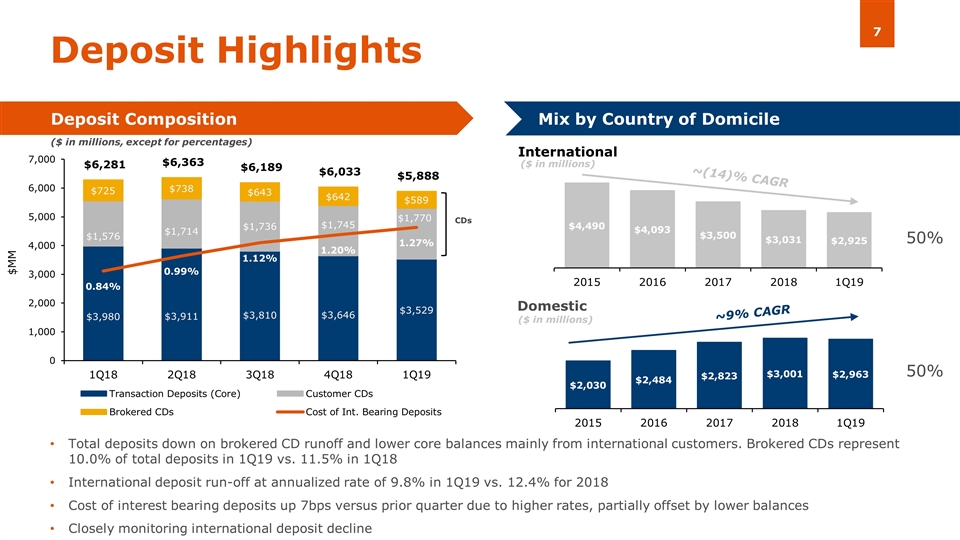

Deposit Highlights Deposit Composition Mix by Country of Domicile Total deposits down on brokered CD runoff and lower core balances mainly from international customers. Brokered CDs represent 10.0% of total deposits in 1Q19 vs. 11.5% in 1Q18 International deposit run-off at annualized rate of 9.8% in 1Q19 vs. 12.4% for 2018 Cost of interest bearing deposits up 7bps versus prior quarter due to higher rates, partially offset by lower balances Closely monitoring international deposit decline 50% 50% ~(14)% CAGR Domestic ~9% CAGR CDs ($ in millions, except for percentages) ($ in millions)

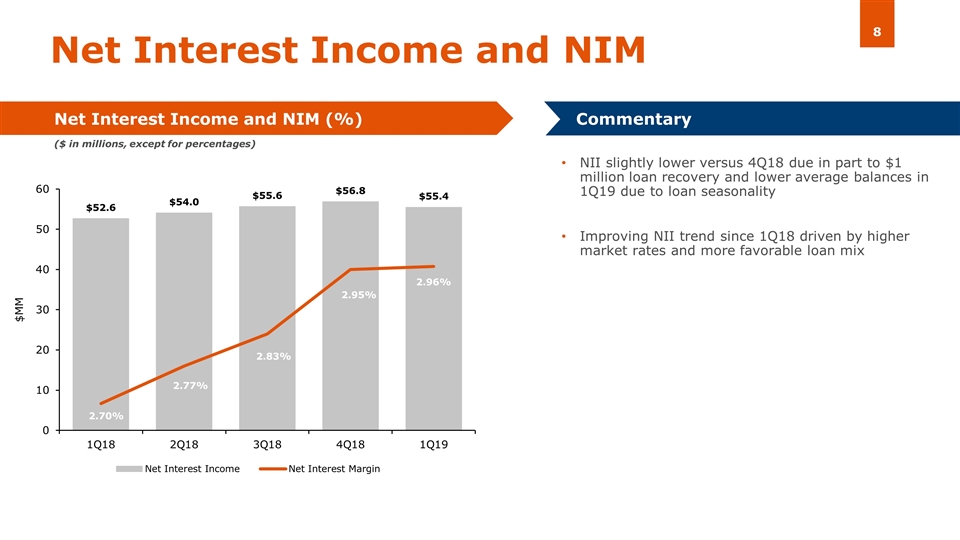

Net Interest Income and NIM Net Interest Income and NIM (%) Commentary NII slightly lower versus 4Q18 due in part to $1 million loan recovery and lower average balances in 1Q19 due to loan seasonality Improving NII trend since 1Q18 driven by higher market rates and more favorable loan mix ($ in millions, except for percentages)

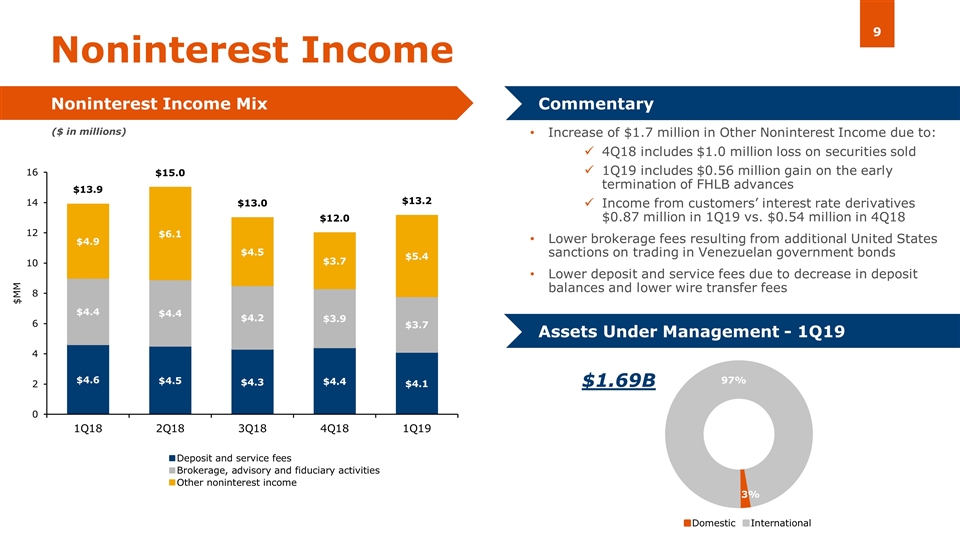

Noninterest Income NON INTEREST INCOME Noninterest Income Mix Commentary Increase of $1.7 million in Other Noninterest Income due to: 4Q18 includes $1.0 million loss on securities sold 1Q19 includes $0.56 million gain on the early termination of FHLB advances Income from customers’ interest rate derivatives $0.87 million in 1Q19 vs. $0.54 million in 4Q18 Lower brokerage fees resulting from additional United States sanctions on trading in Venezuelan government bonds Lower deposit and service fees due to decrease in deposit balances and lower wire transfer fees $1.69B Assets Under Management - 1Q19 ($ in millions)

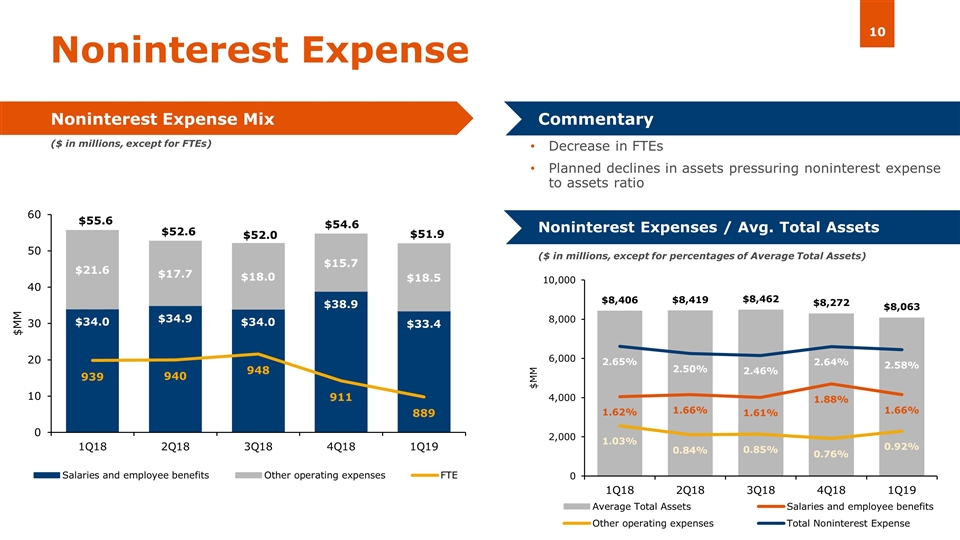

Noninterest Expense Noninterest Expense Mix Commentary Decrease in FTEs Planned declines in assets pressuring noninterest expense to assets ratio Noninterest Expenses / Avg. Total Assets ($ in millions, except for FTEs) ($ in millions, except for percentages of Average Total Assets)

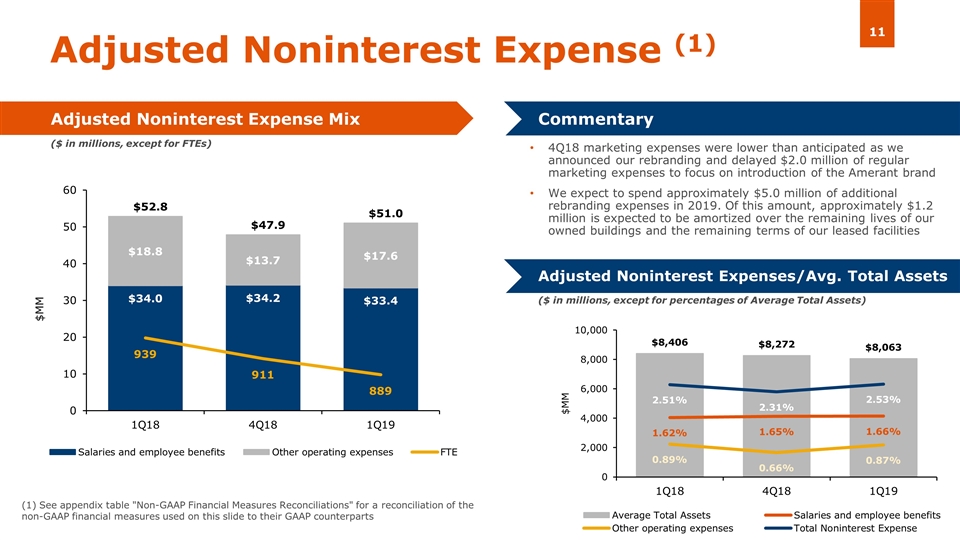

Adjusted Noninterest Expense (1) Adjusted Noninterest Expense Mix Commentary 4Q18 marketing expenses were lower than anticipated as we announced our rebranding and delayed $2.0 million of regular marketing expenses to focus on introduction of the Amerant brand We expect to spend approximately $5.0 million of additional rebranding expenses in 2019. Of this amount, approximately $1.2 million is expected to be amortized over the remaining lives of our owned buildings and the remaining terms of our leased facilities Adjusted Noninterest Expenses/Avg. Total Assets ($ in millions, except for FTEs) ($ in millions, except for percentages of Average Total Assets) (1) See appendix table "Non-GAAP Financial Measures Reconciliations" for a reconciliation of the non-GAAP financial measures used on this slide to their GAAP counterparts

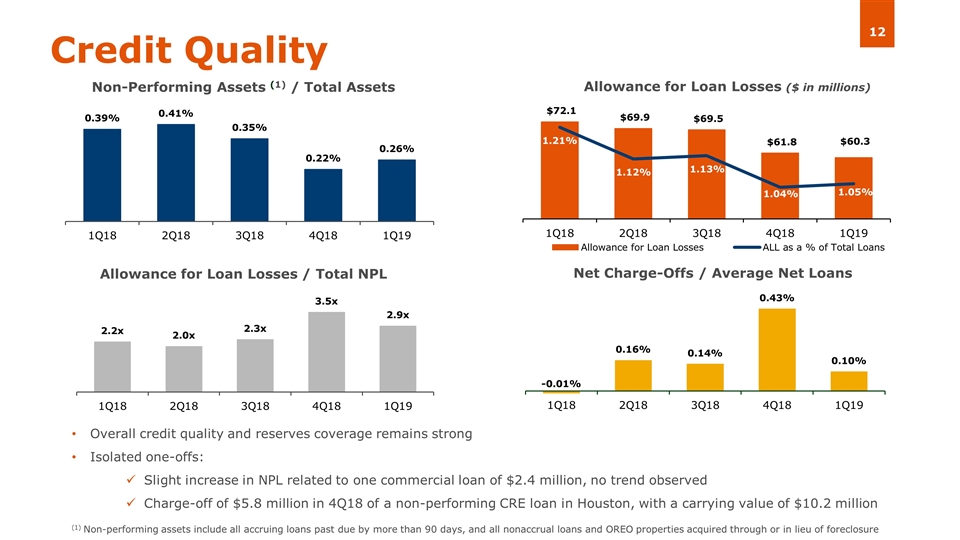

Credit Quality Overall credit quality and reserves coverage remains strong Isolated one-offs: Slight increase in NPL related to one commercial loan of $2.4 million, no trend observed Charge-off of $5.8 million in 4Q18 of a non-performing CRE loan in Houston, with a carrying value of $10.2 million (1) Non-performing assets include all accruing loans past due by more than 90 days, and all nonaccrual loans and OREO properties acquired through or in lieu of foreclosure Non-Performing Assets (1) / Total Assets Allowance for Loan Losses / Total NPL Net Charge-Offs / Average Net Loans Allowance for Loan Losses ($ in millions)

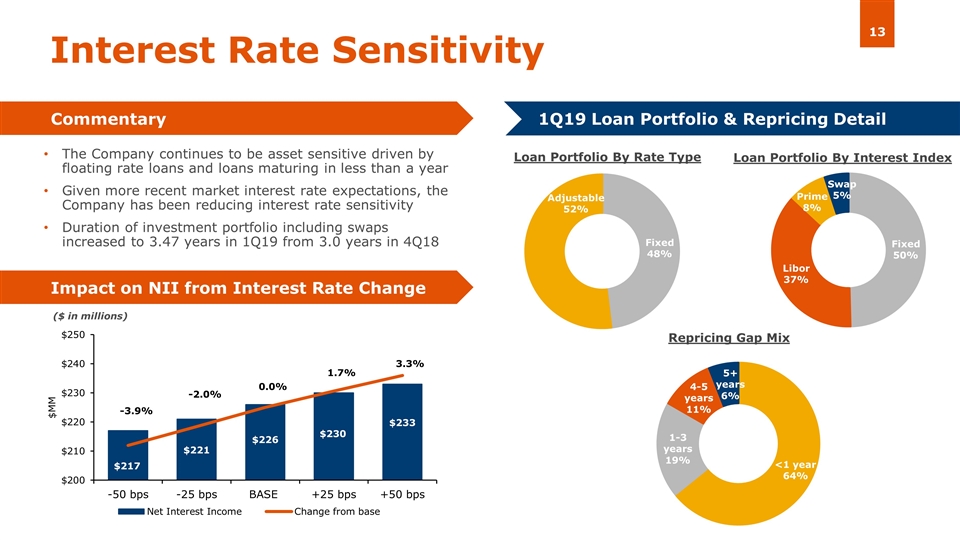

Interest Rate Sensitivity The Company continues to be asset sensitive driven by floating rate loans and loans maturing in less than a year Given more recent market interest rate expectations, the Company has been reducing interest rate sensitivity Duration of investment portfolio including swaps increased to 3.47 years in 1Q19 from 3.0 years in 4Q18 Loan Portfolio By Interest Index Loan Portfolio By Rate Type Repricing Gap Mix Commentary 1Q19 Loan Portfolio & Repricing Detail Impact on NII from Interest Rate Change ($ in millions)

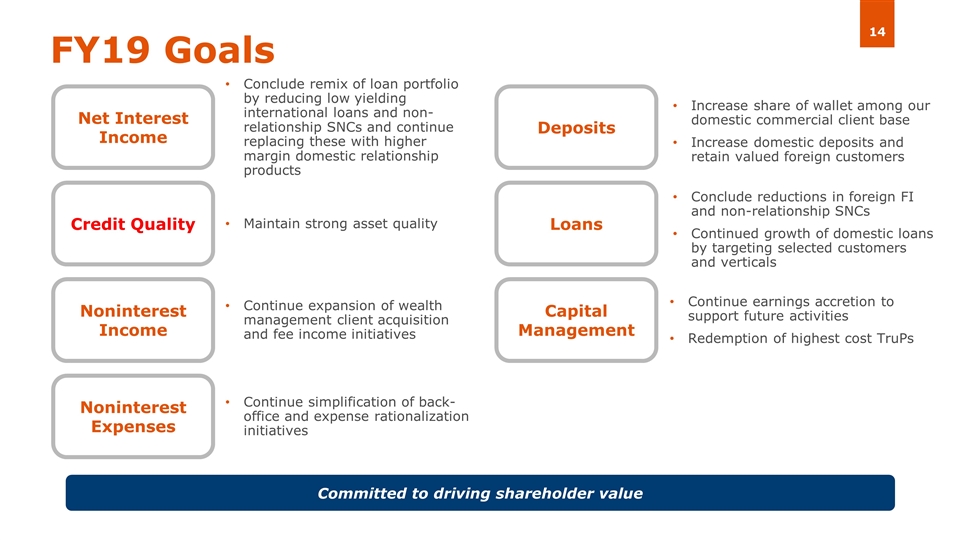

FY19 Goals Net Interest Income Noninterest Income Loans Noninterest Expenses Deposits Capital Management Credit Quality Conclude remix of loan portfolio by reducing low yielding international loans and non-relationship SNCs and continue replacing these with higher margin domestic relationship products Maintain strong asset quality Continue expansion of wealth management client acquisition and fee income initiatives Continue simplification of back-office and expense rationalization initiatives Increase share of wallet among our domestic commercial client base Increase domestic deposits and retain valued foreign customers Continue earnings accretion to support future activities Redemption of highest cost TruPs Committed to driving shareholder value Conclude reductions in foreign FI and non-relationship SNCs Continued growth of domestic loans by targeting selected customers and verticals

Appendices

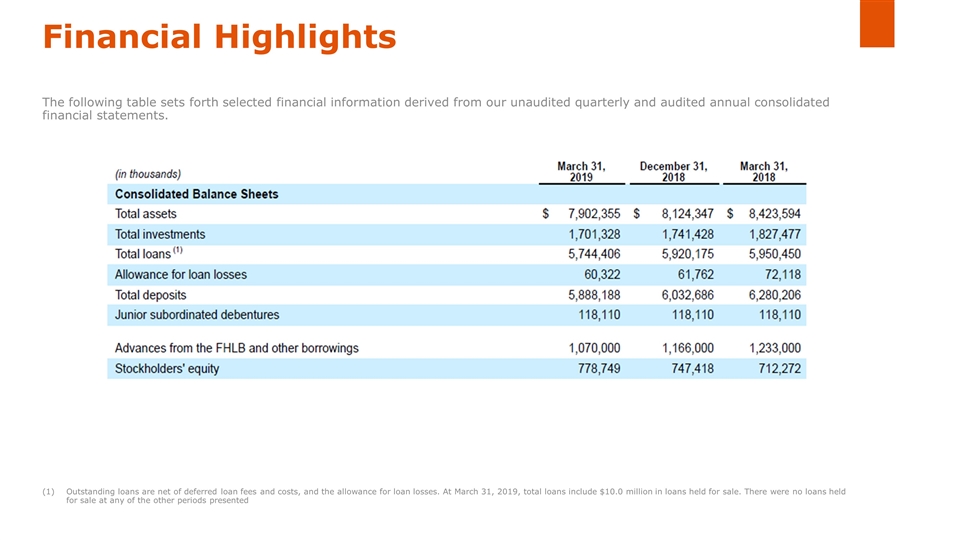

Financial Highlights The following table sets forth selected financial information derived from our unaudited quarterly and audited annual consolidated financial statements. Outstanding loans are net of deferred loan fees and costs, and the allowance for loan losses. At March 31, 2019, total loans include $10.0 million in loans held for sale. There were no loans held for sale at any of the other periods presented

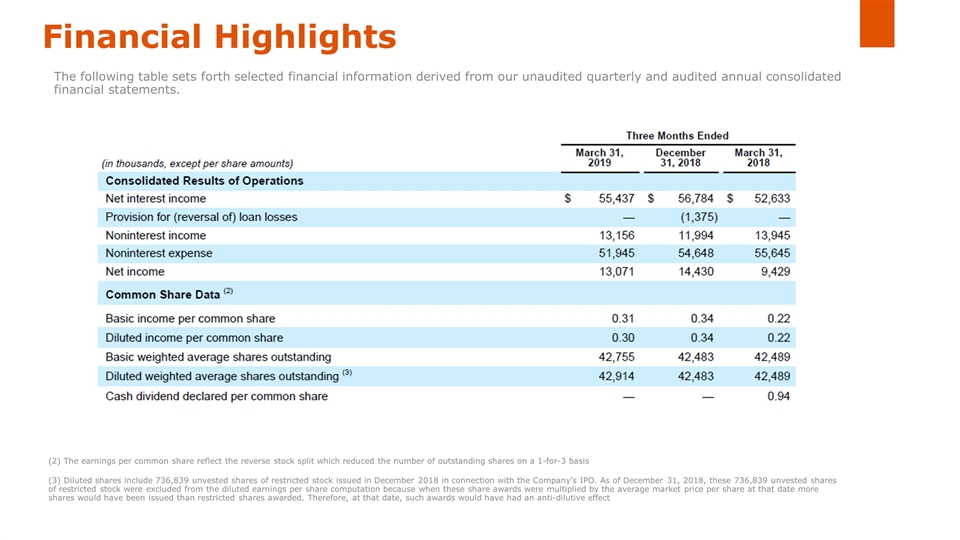

Financial Highlights The following table sets forth selected financial information derived from our unaudited quarterly and audited annual consolidated financial statements. (2) The earnings per common share reflect the reverse stock split which reduced the number of outstanding shares on a 1-for-3 basis (3) Diluted shares include 736,839 unvested shares of restricted stock issued in December 2018 in connection with the Company’s IPO. As of December 31, 2018, these 736,839 unvested shares of restricted stock were excluded from the diluted earnings per share computation because when these share awards were multiplied by the average market price per share at that date more shares would have been issued than restricted shares awarded. Therefore, at that date, such awards would have had an anti-dilutive effect

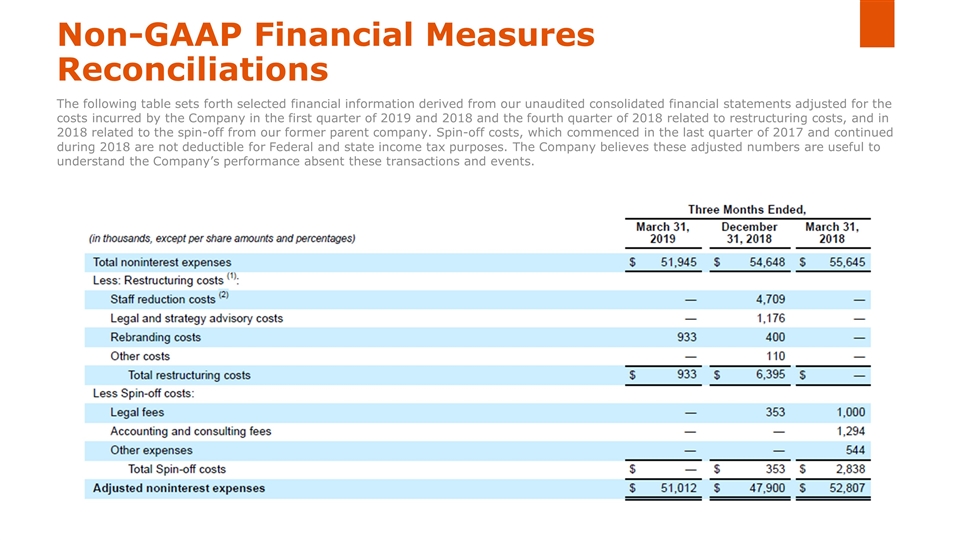

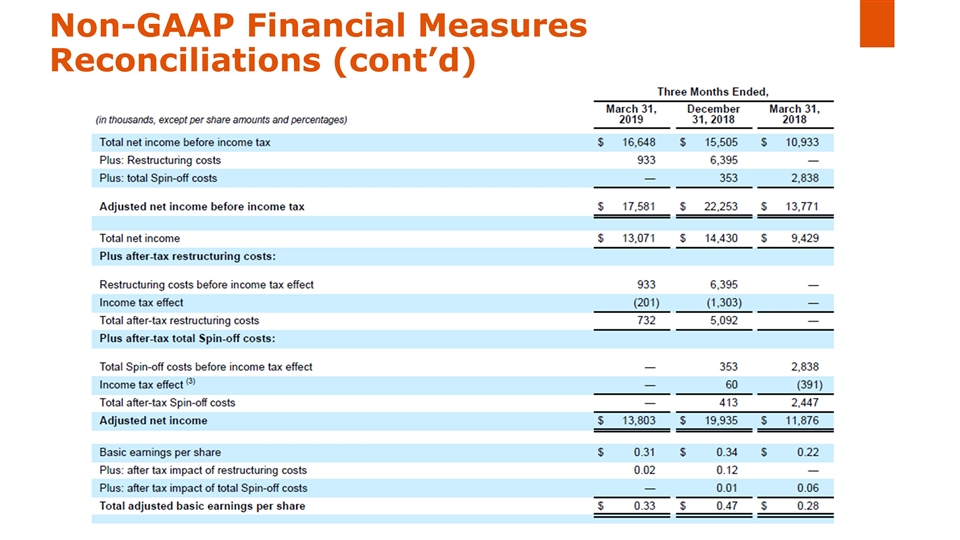

Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from our unaudited consolidated financial statements adjusted for the costs incurred by the Company in the first quarter of 2019 and 2018 and the fourth quarter of 2018 related to restructuring costs, and in 2018 related to the spin-off from our former parent company. Spin-off costs, which commenced in the last quarter of 2017 and continued during 2018 are not deductible for Federal and state income tax purposes. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events.

Non-GAAP Financial Measures Reconciliations (cont’d)

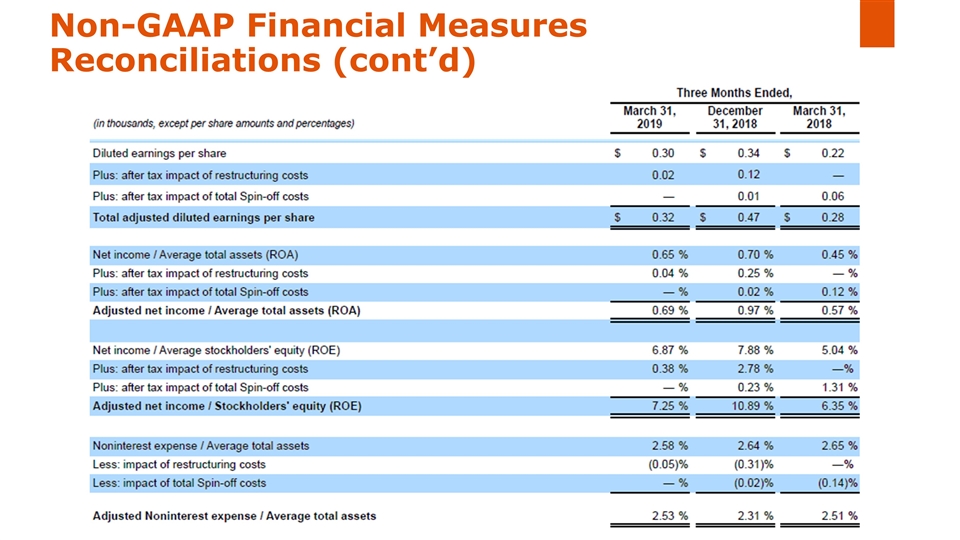

Non-GAAP Financial Measures Reconciliations (cont’d)

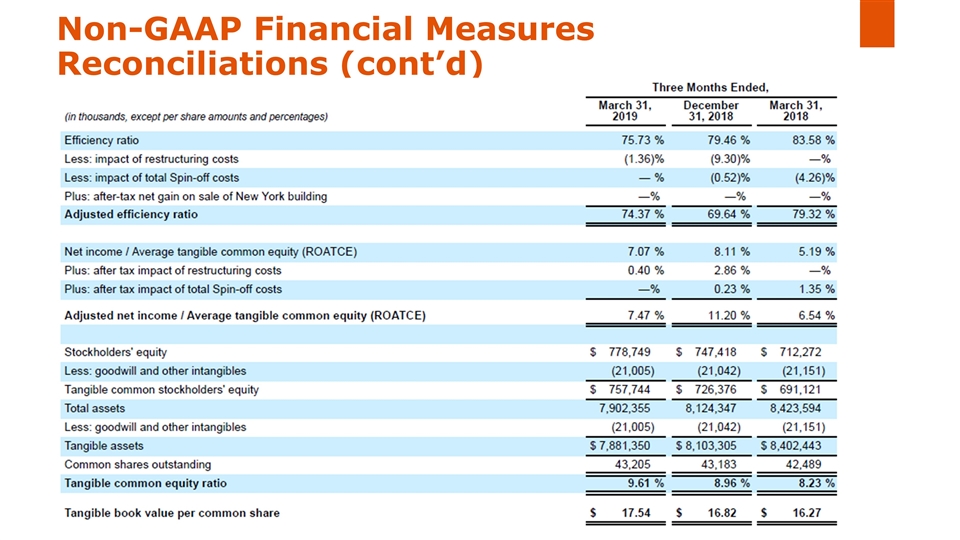

Non-GAAP Financial Measures Reconciliations (cont’d)

Non-GAAP Financial Measures Reconciliations (cont’d)

Thank you Investor Relations InvestorRelations@amerantbank.com