Amerant Bancorp Inc. 2023 Proxy Statement

☐ |

Preliminary Proxy Statement |

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ |

Definitive Proxy Statement |

☐ |

Definitive Additional Materials |

☐ |

Soliciting Material under § 240.14a-12 |

☒ |

No fee required |

☐ |

Fee paid previously with preliminary materials: |

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Amerant Bancorp Inc. 2023 Proxy Statement

AMERANT BANCORP INC.

220 Alhambra Circle

Coral Gables, FL 33134

Notice of Annual Meeting of Shareholders to be held on June 7, 2023

To the Shareholders of Amerant Bancorp Inc.:

Notice is hereby given that the annual meeting (“Annual Meeting”) of the shareholders of Amerant Bancorp Inc. (“Amerant”, “the “Company,” “we,” “us” or “our”) will be held on June 7, 2023 at 8:00 a.m., Eastern Time in a virtual meeting format only. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the Annual Meeting by visiting: www.meetnow.global/MTMM2KV.

There is no physical location for the Annual Meeting and you will not be able to attend the Annual Meeting physically in- person. The Annual Meeting will begin promptly at 8:00 a.m., Eastern Time. We encourage you to access the Annual Meeting prior to the start time. The platform includes functionality that affords shareholders the same meeting participation rights and opportunities they would have at an in-person meeting, while also allowing our shareholders to participate from any location with internet connectivity that is convenient to them. Participants should allow ample time to log in and ensure that they can hear streaming audio prior to the start of the Annual Meeting.

A recording of the Annual Meeting, including any questions asked and answers given, will be available for a period of 12 months following the Annual Meeting at https://meetnow.global/MTMM2KV. Please refer to the “Questions and Answers about the Proxy Materials and the Annual Meeting” section of this Proxy Statement for more details on how to attend the Annual Meeting.

The Annual Meeting is for the following purposes:

| 1. | to elect directors to serve until the 2024 annual meeting of shareholders; |

| 2. | to approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers—Say-on-Pay; |

| 3. | to vote, on a non-binding, advisory basis, on the frequency of voting on the compensation of the Company’s named executive officers—Frequency on Say-on-Pay; |

| 4. | to ratify the appointment of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2023; and |

| 5. | to transact such other business as may properly come before the meeting or any adjournments thereof. |

Shareholders of record at the close of business on April 13, 2023 are entitled to notice of and to vote at the Annual Meeting. We are taking advantage of the Securities and Exchange Commission rules allowing us to furnish proxy materials to shareholders on the Internet. We believe that these rules provide you with proxy materials more quickly and reduce the environmental impact of our Annual Meeting. Accordingly, we are mailing to shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review our Notice and Proxy Statement and Annual Report to Shareholders for the year ended December 31, 2022.

It is important that your shares be represented and voted at the meeting. You have the following options for voting your shares:

(i) vote via the internet;

(ii) vote via the telephone;

(iii) complete and return the proxy card sent to you; or

(iv) vote electronically during the virtual meeting.

If you would like to receive a paper copy of our proxy materials, please follow the instructions for requesting these materials in the proxy statement.

| By Order of the Board of Directors |

|

|

| Gerald P. Plush Chairman and Chief Executive Officer |

April 26, 2023

i

Table of Contents

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 7, 2023 |

i | |||

| 1 | ||||

| 6 | ||||

| 6 | ||||

| 15 | ||||

| 27 | ||||

| 28 | ||||

| 30 | ||||

| 31 | ||||

| 33 | ||||

| 33 | ||||

| 45 | ||||

| 54 | ||||

| 59 | ||||

| 62 | ||||

| 63 | ||||

| 64 | ||||

| PROPOSAL 4 - RATIFICATION OF THE APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING |

65 | |||

| 67 | ||||

ii

Proxy Statement Summary

This proxy statement summary highlights important information contained elsewhere in the proxy statement. Since it does not contain all the information you should consider before voting your shares, please read the entire proxy statement carefully before voting.

| Annual Meeting Information |

|

|

|

| ||||

| DATE AND TIME:

June 7, 2023 at 8:00 a.m. EDT |

LOCATION:

Online only at www.meetnow.global/ MTMM2KV. |

RECORD DATE:

April 13, 2023 |

PROXY MAIL DATE:

On or about | |||||

| How to Vote

|

BY INTERNET:

Visit the website listed on your proxy card |

BY PHONE:

Call the telephone number on your proxy card |

BY MAIL:

Sign, date and return your proxy card in the enclosed envelope |

AT THE ANNUAL MEETING:

Vote electronically at the virtual Annual Meeting | ||||

Proposals

| Item |

Board Recommendation | |||

| 1. | To elect directors to serve until the 2024 annual meeting of shareholders. |

FOR | ||

| 2. | To approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers—Say-on-Pay. |

FOR | ||

| 3. | To vote, on a non-binding, advisory basis, on the frequency of voting on the compensation of the Company’s named executive officers—Frequency on Say-on-Pay. |

ONE YEAR | ||

| 4. | To ratify the appointment of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2023. |

FOR | ||

| 5. | To transact such other business as may properly come before the meeting or any adjournments thereof. |

— | ||

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Amerant Bancorp Inc. (“Amerant,” the “Company,” “we,” or “us”) of proxies to be voted at the 2023 annual meeting of shareholders of the Company or any postponement or adjournment thereof (the “Annual Meeting”). The Annual Meeting will be held virtually over the Internet on Wednesday, June 7, 2023 at 8:00 a.m. Eastern Time.

These proxy solicitation materials and our Annual Report to shareholders for the year ended December 31, 2022, including related financial statements, were first made available to our shareholders entitled to notice of and to vote at the Annual Meeting on or about April 26, 2023.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on June 7, 2023 — our Annual Report to Shareholders, this proxy statement and the related proxy card are available at www.envisionreports.com/AMTB. The content on any website referred to in this proxy statement is not incorporated by reference into this proxy statement unless expressly noted.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND THE ANNUAL MEETING

Why am I receiving these materials?

We are providing these proxy materials to you in connection with the solicitation, by the Board, of proxies to be voted at the Company’s Annual Meeting. You are receiving this Proxy Statement because you were an Amerant Bancorp Inc. shareholder as of the close of business on April 13, 2023 (the “Record Date”). This Proxy Statement provides notice of the Annual Meeting, describes the proposals presented for shareholder action and includes information required to be disclosed to shareholders.

1

Proxy Statement Summary

When and where is the Annual Meeting and how can I attend with the ability to ask questions and/or vote?

The Annual Meeting will be held on Wednesday, June 7, 2023 at 8:00 a.m., Eastern Time. The Annual Meeting will be a completely virtual meeting of shareholders, which will be conducted exclusively by webcast. No physical meeting will be held. You are entitled to participate in the Annual Meeting only if you were a registered holder of our common stock on the Record Date, or if you were a beneficial owner of shares of our common stock as of the Record Date and you hold a valid legal proxy for the Annual Meeting.

Shareholders of record: If your shares are registered directly in your name with the Company’s transfer agent, Computershare, Inc. (“Computershare”), you are considered, with respect to those shares, the registered holder, and a Notice of Internet Availability of Proxy Materials and the enclosed proxy card were mailed directly to you by the Company. As a registered holder, you will be able to attend the Annual Meeting online, ask a question, and vote by visiting https://meetnow.global/MTMM2KV and following the instructions on the proxy card or on the instructions accompanying the proxy materials.

Beneficial owners: If your shares are held through a broker, bank or other nominee, you are considered the beneficial owner of shares held in “street name”, and a Notice of Internet Availability of Proxy Materials or this proxy statement and the enclosed proxy card were forwarded to you by your broker, bank or other nominee. If you are a beneficial owner and want to attend the Annual Meeting online by webcast, you have two options:

(1) Registration in Advance of the Annual Meeting

You will need to obtain a legal proxy from your bank, broker or other nominee to attend the Annual Meeting. You should contact your bank, broker or other nominee for instructions regarding how to obtain a legal proxy. Once you obtain your legal proxy from your broker or bank reflecting your Amerant Bancorp holdings, you must submit it along with your name and email address to Computershare.

Requests for registration in advance of the Annual Meeting must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on June 2, 2023. You will receive a confirmation of your registration by email after Computershare receives your registration materials.

Requests for registration should be directed to Computershare in the manner provided below:

By email: Forward the email from your broker granting you a Legal Proxy, or attach an image of your Legal Proxy, to legalproxy@computershare.com

By mail: Computershare

| Amerant Bancorp Inc. Legal Proxy P.O. Box 43001 Providence, RI 02940-3001 |

(2) Register at the Annual Meeting

Beneficial owners may register online at the Annual Meeting to attend, ask questions and vote. We expect that the vast majority of beneficial owners will be able to fully participate using the control number received with their voting instruction form. Please note, however, that this option is intended to be provided as a convenience to beneficial owners only, and there is no guarantee this option will be available for every type of beneficial owner’s voting control number. The inability to provide this option to any or all beneficial owners shall in no way impact the validity of the Annual Meeting. Beneficial owners may choose to register in advance of the Annual Meeting as set forth in (1) above.

In any event, please go to https://meetnow.global/MTMM2KV for more information on the available options and registration instructions.

The Annual Meeting will begin promptly at 8:00 a.m., Eastern Time. We encourage you to access the Annual Meeting prior to the start time leaving ample time for check in. Please follow the registration instructions as outlined in this proxy statement.

2

Proxy Statement Summary

What if I have trouble accessing the Annual Meeting virtually?

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Please note that Internet Explorer is no longer supported. Participants should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the Annual Meeting. We encourage you to access the Annual Meeting prior to the 8:00 a.m., Eastern Time, start time. A link on the Annual Meeting page will provide further assistance should you need it, or you may call US & Canada: 1-888-724-2416 or from outside the US & Canada: 1-781-575-2748.

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will act upon the matters described in the Notice of Annual Meeting that accompanies this Proxy Statement, including (1) the election of directors to serve until the 2024 annual meeting of shareholders, (2) to approve, on a non-binding, advisory basis, the compensation of the Company’s named executive officers—Say-on-Pay, (3) to vote, on a non-binding, advisory basis, on the frequency of voting on the compensation of the Company’s named executive officers—Frequency on Say-on-Pay, and (4) the ratification of the appointment of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2023.

Who Can Vote?

Only shareholders of record at the close of business on the Record Date are entitled to notice of and to attend and vote at the Annual Meeting. As of the record date, there were 30,009,231 outstanding shares of our Class A Voting Common Stock. Each share of our Class A Voting Common Stock outstanding on the Record Date will be entitled to cast one vote on each matter to be voted on at the Annual Meeting.

How You Can Vote?

Whether or not you plan to attend the Annual Meeting virtually, we urge you to vote in advance of the Annual Meeting by one of the methods described in the proxy materials for the Annual Meeting. Shareholders who log into the virtual meeting following the instructions above will be able to vote their shares electronically during the Annual Meeting by clicking on the “Cast Your Vote” link on the meeting center site.

Shareholders of record (meaning the shares are registered in your name as opposed to the name of a bank or broker) may vote online, by telephone, by mail and at the Annual Meeting. Shareholders of record may vote online at www.envisionreports.com/AMTB, 24 hours a day, seven days a week. Shareholders of record may vote by telephone by calling 1-800-652-8683, 24 hours a day, seven days a week. Shareholders of record will need the control number included in their Notice of Internet Availability or proxy card in order to vote online or by telephone. Shareholders of record may also vote by mail by completing, signing and dating each proxy card received and returning it in the prepaid envelope to Proxy Services c/o Computershare Investor Services, PO BOX 43101 Providence RI 02940-5067. Shareholders of record submitting their vote by mail should sign their name exactly as it appears on the proxy card. Votes submitted by proxy cards must be received no later than June 6, 2023. Shareholders of record may also vote at the Annual Meeting where votes must be received no later than the closing of the polls.

If you are a beneficial owner (meaning your shares are held through a broker, bank or other nominee), you have the right to direct the broker, bank or other nominee that holds your shares how to vote the shares in your account by following the voting instructions provided by such broker, bank or other nominee. The availability of online and telephone voting will depend on the voting options of your broker, bank or other nominee. Alternatively, a beneficial owner may vote directly at the Annual Meeting by following the process outlined in the answer to the question “When and where is the Annual Meeting and how can I attend with the ability to ask questions and/or vote?” above. Votes at the Annual Meeting must be received no later than the closing of the polls.

How can I change or revoke my proxy?

Shareholders who execute proxies retain the right to revoke them at any time before the shares are voted by proxy at the Annual Meeting. A shareholder may revoke a proxy by delivering a signed statement to our Corporate Secretary at or prior to the Annual Meeting or by timely executing and delivering, by Internet, telephone, or mail, another proxy dated as of a later date. Furthermore, you may revoke a proxy by attending the Annual Meeting and voting online using the “Cast Your Vote” link on the meeting center site, which will automatically cancel any proxy previously given. Attendance

3

Proxy Statement Summary

at the Annual Meeting, however, will not automatically revoke any proxy that you have given previously unless you vote online using the “Cast Your Vote” link on the meeting center site.

If you hold shares through a broker, bank or other nominee, you must contact the broker, bank or other nominee to revoke any prior voting instructions.

What constitutes a quorum?

In order for business to be conducted, a quorum must be represented at the Annual Meeting. The majority of all votes entitled to be cast by the holders of the outstanding shares of Class A Voting Common Stock, as applicable, represented as present in the Annual Meeting or by proxy, shall constitute a quorum at the Annual Meeting. Shares represented by a proxy in which authority to vote for any matter considered is “withheld,” a proxy marked “abstain” or a proxy as to which there is a “broker non-vote” (described below) will be considered present at the meeting for purposes of determining a quorum.

What is the required vote to elect directors?

Directors will be elected by a plurality of the votes cast by the Class A Voting Common Stock shareholders at the Annual Meeting, meaning the eleven nominees receiving the most votes will be elected. With respect to the election of directors, a plurality of the votes cast means that the number of votes cast “for” the election of a director must exceed the number of votes cast “against” that director. Unless indicated otherwise by your proxy, the shares will be voted for the eleven nominees named in this proxy statement. Instructions on the accompanying proxy to abstain for one or more of the nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees.

What is the required vote to approve proposal 2?

Proposal 2 (Say-on-Pay) requires approval by the affirmative vote of the majority of votes cast by the Class A Voting Common Stock shareholders at the Annual Meeting. In voting for this matter, shares may be voted “for”, “against” or “abstain.” These votes are advisory in nature and are not binding on the Company or the Board.

What is the required vote to approve proposal 3?

Proposal 3 (Frequency on Say-on-Pay) requires approval by the affirmative vote of the majority of votes cast by the Class A Voting Common Stock shareholders at the Annual Meeting. In voting for this matter, shares may be voted for a frequency of once every year, once every two years, once every three years or to abstain. These votes are advisory in nature and are not binding on the Company or the Board.

What is the required vote to approve proposal 4?

Proposal 4 (to ratify the selection of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2023) requires approval by the affirmative vote of the majority of votes cast by the Class A Voting Common Stock shareholders at the Annual Meeting. These votes are advisory in nature and are not binding on the Company or the Board.

What will be the effect of broker non-votes and abstentions?

• Broker Non-Votes. If your shares are held by a bank, broker or other nominee and you do not provide the bank, broker or other nominee with specific voting instructions, the organization that holds your shares may generally vote on “routine” matters but cannot vote on non-routine matters. If the bank, broker, or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will inform our inspector of elections that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” When our inspector of elections tabulates the votes for any matter, broker non-votes will be counted for purposes of determining whether a quorum is present.

Proposal 1 (election of directors), Proposal 2 (Say-on-Pay), and Proposal 3 ( Frequency on Say-on-Pay) are considered “non-routine,” and banks, brokers and certain other nominees that hold your shares in street name will not be able to cast votes on these proposals if you do not provide them with voting instructions. Broker non-votes are not treated as votes cast and will not affect the outcome of Proposal 1 because directors are elected by a plurality of votes cast. Broker non-votes are not treated as votes cast and will not affect the outcome of Proposal 2 and Proposal 3 because these proposals require the favorable vote of the majority of votes cast.

4

Proxy Statement Summary

Proposal 4 (ratification of the independent registered public accounting firm) is considered “routine” and we do not expect broker non-votes on this matter.

Please provide voting instructions to the bank, broker or other nominee that holds your shares by carefully following their instructions.

• Abstentions. Abstentions will not be counted as votes cast with regard to any proposal. Therefore, abstentions will have no effect on the outcome of any proposal. Abstentions will be counted for the purpose of determining whether a quorum is present.

Other Information

If no instructions are indicated on a duly executed and returned proxy, the shares represented by the proxy will be voted FOR the election of the eleven nominees for director proposed by the Board and set forth herein, FOR the approval of the compensation of the Company’s named executive officers, FOR ONE YEAR on the frequency of voting on the compensation of the Company’s named executive officers and FOR the ratification of the appointment of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2023.

A list of shareholders entitled to vote at the Annual Meeting will be available for inspection upon request of any shareholder at our principal executive offices at 220 Alhambra Circle, Coral Gables, Florida 33134 during the ten days prior to the meeting, during ordinary business hours. In addition, beginning 15 minutes prior to, and during, the Annual Meeting, a list of shareholders of record will be available for viewing by shareholders admitted to the Annual Meeting for any purpose germane to the meeting at https://meetnow.global/MTMM2KV.

5

Proposal 1 — Election of Directors

Directors and Nominees

As of the Record Date, our Board consisted of twelve members, eleven of whom were non-employee directors. On February 6, 2023, Gustavo J. Vollmer A. notified the Company of his decisions to not stand for re-election to the Board of Directors at the Company’s Annual Meeting and as a result Mr. Vollmer’s term as director of the Company will end on June 7, 2023 (the date of the Annual Meeting).

On April 4, 2023, the Board temporarily authorized increasing the size of the Board from eleven to twelve members, with such increase effective as of April 17, 2023 (the “Effective Date”), and thereafter appointed Ms. Ashaki Rucker, to serve as a member of the Company’s Board, with such appointments becoming effective as of the Effective Date. The appointment of Ms. Rucker was based upon the recommendation of the Corporate Governance, Nominating and Sustainability Committee of the Board, following a detailed review and consideration by that committee of the Company’s and such committee’s criteria for directors, and compliance, to the Company’s satisfaction, with all applicable laws, as well as Nasdaq requirements.

Effective upon the retirement of Mr. Vollmer from the Board, the size of the Board, as temporarily expanded, will be contracted from twelve to eleven members. As of the date of this proxy statement, the Board has determined that eleven directors is an appropriate size for the Board and, accordingly, the Board has nominated, upon the recommendation of the Corporate Governance, Nominating and Sustainability Committee of the Board, the eleven persons identified below, who are currently directors, to serve as directors and to hold office until the next annual meeting or until their successors shall be duly elected and qualified.

The names of, and certain information with respect to, the nominees of the Board for election as directors are set forth below. If, for any reason, any nominee should become unable or unwilling to serve as a director, the Board may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the persons named in the proxy card may exercise their discretion to vote your shares for the substitute nominee.

The Board has determined that Messrs. Capriles L., Marturet M., Quelch, Quill, and Suarez, and Mmes. Dana, Holroyd, Knight and Rucker qualify as independent directors in accordance with the listing requirements of The NASDAQ Stock Market LLC (“Nasdaq”). The Board had also previously determined that Mr. Vollmer also qualified as an independent director in accordance with the NASDAQ listing requirements. The NASDAQ independence definition includes a series of objective tests, including that the director is not an employee of the Company and has not engaged in various types of business dealings with us. In addition, the Board has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

As disclosed in the Related Party Transactions section of this Proxy Statement, Mr. Marturet’s brother-in-law is a salaried employee of ours and his total compensation is in excess of $120,000, however, Mr. Marturet’s brother-in- law is not an executive officer of the Company and therefore, Mr. Marturet’s independence is not affected by the NASDAQ Marketplace rules 5605(2)(B) and 5605(2)(C).

6

Proposal 1 — Election of Directors

The following table shows information as of the Record Date for each director nominee.

| Name |

Age | Director Since |

Independent* | Title | ||||||||||

| Gerald P. Plush |

64 | 2019 | No | Chairman, President and Chief Executive Officer | ||||||||||

| Pamella J. Dana |

60 | 2007 | Yes | Lead Independent Director | ||||||||||

| Miguel A. Capriles L. |

59 | 2003 | Yes | Director | ||||||||||

| Samantha Holroyd |

54 | 2022 | Yes | Director | ||||||||||

| Erin D. Knight |

46 | 2022 | Yes | Director | ||||||||||

| Gustavo Marturet M. |

58 | 2015 | Yes | Director | ||||||||||

| John A. Quelch |

71 | 2022 | Yes | Director | ||||||||||

| John W. Quill |

69 | 2019 | Yes | Director | ||||||||||

| Ashaki Rucker |

51 | 2023 | Yes | Director | ||||||||||

| Oscar Suarez |

62 | 2022 | Yes | Director | ||||||||||

| Millar Wilson |

70 | 1987 | No | ** | Director | |||||||||

| * | In accordance with the listing requirements of Nasdaq and the applicable rules of the Securities and Exchange Commission. |

| ** | Mr. Wilson ceased to be an executive officer of the Company in March 2021 and consequently is not independent under the NASDAQ listing standards. |

The Board believes that the directors and director nominees as a whole will provide the diversity of background, experience, expertise and skills necessary for a well-functioning Board and that there are sufficient independent directors to staff the independent committees of the board and provide independent oversight. The Board values highly the ability of individual directors to contribute to a constructive Board environment and the Board believes that the current director nominees, collectively, perform in such a manner. We have a mix of age and new and longer tenured directors to help ensure fresh perspectives as well as continuity and experience. Set forth below is a more complete description of each director’s background, professional experience, qualifications, and skills.

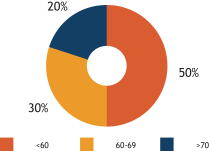

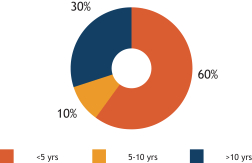

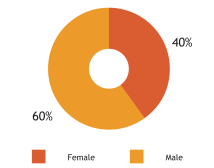

Board Diversity*

| Age | Tenure | |

|

| |

| Gender | Ethnicity | |

|

| |

| * | Based on non-employee nominee directors |

7

Proposal 1 — Election of Directors

| Skills & Experience |

Jerry Plush |

Pamella Dana |

Miguel A. Capriles |

Samantha Holroyd |

Erin Knight |

Gustavo Marturet M. |

John W. Quill |

Ashaki Rucker |

John Quelch |

Oscar Suarez |

Millar Wilson | |||||||||||

| Audit & Accounting |

X | X | X | X | X | X | X | X | X | |||||||||||||

| Risk Management & Oversight |

X | X | X | X | X | X | X | X | ||||||||||||||

| Financial Services & Banking |

X | X | X | X | X | X | X | X | ||||||||||||||

| Capital Markets |

X | X | X | X | X | |||||||||||||||||

| Business Development & Marketing |

X | X | X | X | X | X | X | X | ||||||||||||||

| Human Capital Management |

X | X | X | X | X | X | ||||||||||||||||

| Executive Compensation |

X | X | X | X | X | X | X | |||||||||||||||

| Corporate Governance |

X | X | X | X | X | X | X | X | X | X | ||||||||||||

| ESG |

X | X | X | X | X | X | X | |||||||||||||||

| Technology & Digital Transformation |

X | X | X | X | ||||||||||||||||||

| Cybersecurity |

X |

8

Proposal 1 — Election of Directors

| Gerald P. Plush Chairman, President, and Chief Executive Officer

|

Director since July 2019

Age 64

Key qualifications and expertise: Mr. Plush provides the Board with broad perspective on the Company’s strategies, challenges, and opportunities; Mr. Plush also brings over 35 years of senior executive level leadership experience in the banking industry to the Board and his previous prominent business and operations roles in other financial institutions provide the Company with insightful and relevant information as it continues to build upon its strategy. Mr. Plush has previous experience serving on public company boards including the boards of multiple financial institutions. Mr. Plush also holds a Certificate in Cybersecurity Oversight from the National Association of Corporate Directors (NACD).

Committee assignments:

• None

Other Current Public Company Boards:

• None

| |

|

| ||

| Mr. Plush serves as the Company’s Chairman, President, and CEO since June 8, 2022, having served previously as Vice-Chairman, President & CEO since July 1st, 2021, and previously as Vice-Chairman & CEO since March 20, 2021. Mr. Plush has been a director of the Company’s and Amerant Bank, N.A.’s (the “Bank”) Board of Directors since July and October 2019, respectively, and served as Executive Vice-Chairman from February 2021 until his appointment as Vice-Chairman & CEO in March 2021. Mr. Plush is a highly respected financial services industry professional with over 35 years of senior executive leadership experience. From January 2019 to February 2021, he was a partner at Patriot Financial Partners, or Patriot, a private equity firm where he sourced new investment opportunities and represented Patriot on the board of directors for multiple portfolio banks, finance and fintech companies. In 2018, he served as CEO for Verdigris Holdings, Inc., leading this start- up through the regulatory application, organization, and initial funding processes. Mr. Plush’s other prominent leadership roles include his tenure with Santander US from 2014 to 2017, initially as CFO and Executive Committee member, and subsequently as Chief Administrative Officer. He served on the board of Santander Consumer from 2014 to 2016, and as a director for the FHLB of Pittsburgh from 2016 to 2017. Mr. Plush previously served as President, COO and Board Member for Webster Bank beginning in 2006 as EVP and Chief Financial Officer. He spent over 11 years with MBNA America, most recently as Senior Executive Vice President & Managing Director for corporate development and acquisitions and prior to that as CFO—North America.

Mr. Plush holds a Bachelor of Science degree in Accounting from St. Joseph’s University in Philadelphia, Pennsylvania. He is a CPA and CMA (inactive), and currently serves on several local boards, including the board of directors of the Miami-Dade Beacon Council, the Orange Bowl Committee and the University of Miami Citizen’s Board.

| ||

9

Proposal 1 — Election of Directors

| Pamella J. Dana Lead Independent Director

|

Director since 2007

Age 60

Key Qualifications and Expertise: Dr. Dana brings over 30 years of successful senior governmental, economic, business, and university leadership, organizational management, policymaking and public affairs experience to the Board. This experience coupled with her tenure on the Board and her independence are of great value to the Board.

Committee Assignments:

• Audit Committee

• Compensation and Human Capital Committee (Chair)

• Corporate Governance, Nominating and Sustainability Committee (Chair) | |

|

Dr. Dana has served as Senior Advisor at the Institute for Human & Machine Cognition, a Florida-based research institute engaged in artificial intelligence, robotics, sensory substitution, data mining, and related technologies, since 2007. Previously, Dr. Dana served as the Executive Director of the Florida Governor’s Office of Tourism, Trade, and Economic Development from 1999 to 2007 and Florida’s Chief Protocol Officer from 2002 to 2007. Dr. Dana served as Assistant and Deputy Secretary of the California Trade and Commerce Agency from 1995 to 1999. Dr. Dana served as Vice Chair of the board of directors of Triumph Gulf Coast, Inc. from 2013 until 2021, an organization that oversees the distribution of $1.5 billion in BP oil spill settlement payments awarded to Florida, and was Chair of the Scripps Florida Funding Corporation Board, where she also was a member of the Audit Committee, from 2007 until 2022. She has been a Trustee of the Florida Chamber of Commerce Foundation since 2007, a member of the Florida Sports Foundation Board from 2011 until 2019, and a member of the International Economic Development Council since 2007. From 2006 to 2009, Dr. Dana was a Trustee of the University of West Florida and was a voting member for Florida on the U.S. Gulf of Mexico Fisheries Management Council from 2011 to 2016.

Dr. Dana holds a Ph.D. in International Development and Economics from the University of Southern California, a master’s in administration, planning and policy from Harvard University and a bachelor’s in sociology and social work from California State University, Chico. She was a 1991 Henry R. Luce Scholar (Philippines) and 1994 J. William Fulbright Scholar (Australia).

| ||

|

Other Current Public Company Boards:

• None |

| Miguel A. Capriles L. Director

|

Director since 2003

Age 59

Key qualifications and expertise: As a long-time director and large shareholder of the Company, Mr. Capriles brings extensive experience with the Company and a shareholder perspective to the Board. Mr. Capriles’ executive experience and real estate development experience also serves to inform the Board’s general decision-making.

Committee Assignments:

• Audit Committee

• Corporate Governance, Nominating and Sustainability Committee | |

|

Mr. Capriles serves as the Managing Director of Gran Roque Capital and Chairman of Prime Capital, real estate investment and development firms focused on the redevelopment of residential buildings in Spain and Portugal, since 2014. Since 2017, he also serves as Chairman of Agartha Real Estate a company dedicated to the acquisition, development and management of flexible space office buildings under leading sustainable practices and to providing sustainability and social impact advisory and consulting services in Spain. Previously, Mr. Capriles served as the Chairman and President of Cadena Capriles, a newspaper and magazine publisher in Venezuela from 1998 to 2013, where he initiated and led the digital transformation of this traditional media publishing company. He has also served as a director of H.L. Boulton S.A., a publicly-traded Venezuela-based holding company engaged in the import and export of goods and equipment and maritime services, since 1999 and Corporación Industrial Carabobo, C.A., Venezuela’s main tile producer, since 2014. He is also a director of Mercantil Servicios Financieros Internacional, a Panama based Latin-American financial services holding company. Previously, Mr. Capriles served as a director of Mercantil Servicios Financieros (“MSF”) from 1997 to 2018, as a member of the board of directors Abanca Corporacion Bancaria, a commercial bank based in Spain, from 2014 to 2016, and was a member of the Governing Council of the Instituto de Estudios Superiores de Administracion—IESA in Venezuela.

Mr. Capriles has a degree in business administration from the Universidad Metropolitana in Caracas, Venezuela. | ||

|

Other Current Public Company Boards:

• None |

10

Proposal 1 — Election of Directors

| Samantha Holroyd Director

|

Director since April 2022

Age 54

Key Qualifications and Expertise: Ms. Holroyd brings extensive risk management experience from her professional experience and public board and corporate governance experience from her service as a director. She also holds FINRA Certifications (Series 79 and Series 63) and is also a Certified Corporate Director by the National Association of Corporate Directors (NACD) and is NACD Certified in ESG. Her experience in risk management, ESG matters as well as her knowledge of the Houston marketplace are valued by our Company and Board.

Committee Assignments:

• Compensation and Human Capital Committee

• Corporate Governance, Nominating and Sustainability Committee

Other Current Public Company Boards:

• Chord Energy (NASDAQ – CHRD) | |

|

Ms. Holroyd has been an independent advisor to the oil and gas industry since February 2020 through Golden Advisory Services, a consulting firm she founded, most recently serving as consultant for ZeroSix, a carbon credit generation company serving the US Market with specific focus on carbon credits generated by oil and gas companies. Previously, Ms. Holroyd served as a Managing Director at Lantana Energy Advisors, an advisory firm specializing in energy transactions, which was a division of SunTrust Robinson Humphrey, Inc., the corporate and investment banking arm of Truist Financial Corporation from January 2018 until January 2020. Prior to that, she served as a Managing Director at TPG Sixth Street Partners, a global finance and investment firm, from September 2016 to January 2018, and as Technical Director at Denham Capital Management LP, an energy and resources-focused global private equity firm, from October 2011 to September 2016. Ms. Holroyd previously served as Global Reserves Audit Manager and Business Opportunity Manager at Royal Dutch Shell PLC, as Vice President of EIG Global Energy Partners, a provider of institutional capital to the global energy industry, and Vice President of Ryder Scott Company, a petroleum consulting firm. Ms. Holroyd currently serves in the Board of Directors of Chord Energy, and serves on the Audit Committee and the Environmental, Social and Governance Committee. Previously, Ms. Holroyd served as an independent director for Oasis Petroleum and for Gulfport Energy. At Oasis Petroleum, she served as Lead Independent Director from late 2020 to early 2021.

Ms. Holroyd received a Bachelor of Science degree in Petroleum Engineering from the Colorado School of Mines, holds FINRA Certifications (Series 79 and Series 63) and is also a Certified Corporate Director by the National Association of Corporate Directors (NACD) and is NACD Certified in ESG.

|

| Erin D. Knight Director

|

Director since December 2022

Age 46

Key Qualifications and Expertise: Ms. Knight brings extensive subject matter expertise in corporate governance, BSA compliance, portfolio management, as well as credit and investment evaluation. She is also a Certified Financial Planner™ and holds a NASD Series 7 license. Her experience in banking, real estate management, business operations and portfolio management as well as her knowledge of the communities we serve in Florida bring valuable insights to our Company and Board.

Committee Assignments:

• Audit Committee

• Compensation and Human Capital Committee

Other Current Public Company Boards:

None | |

|

Ms. Knight has served, since January 2019, as President of Monument Capital Management (“Monument”), a fully-integrated real estate management and private equity firm that has acquired and managed over $1 billion of real estate assets across 15 states. In her role she is responsible for operations, growth strategy, and investor relations. Prior to joining Monument, from January 2018 through November 2018, she served as Chief Operating Officer for Alexis, a women’s clothing designer, manufacturer, and distributor, and was responsible for the company’s operations. Previously, from June 2010 until December 2017, Ms. Knight worked at Stonegate Bank, where prior to its successful sale to Centennial Bank, she led Stonegate Bank’s expansion into Miami, opening de novo offices and serving as Market President for the organization, overseeing over $1 billion in loan portfolios comprised of corporate and real estate facilities. Ms. Knight has over 20 years of financial services experience, spanning across risk analysis and management and strategic growth. She began her career with SunTrust Bank as a commercial analyst and subsequently held leadership roles at Regions Bank and SouthTrust (now Wells Fargo).

Ms. Knight received a Bachelor’s degree in Political Science and Business from Florida State University, is a Certified Financial Planner™ and holds a NASD Series 7 license. She serves on the Board of Governors for Citizens Property Insurance Corporation, the Board of Directors at The Miami Foundation and the Baptist Health Foundation and is a member of the International Women’s Forum (IWF).

|

11

Proposal 1 — Election of Directors

| Gustavo Marturet M. Director

|

Director since 2015

Age 58

Key Qualifications and Expertise: Mr. Marturet brings extensive wealth management, banking, and U.S. capital markets experience to the Board.

Committee Assignments:

• Compensation and Human Capital Committee

• Risk Committee

Other Current Public Company Boards:

• None | |

|

Mr. Marturet has served as the owner and CEO of Martuga Corporation, a general consulting services company since December 2021. In 2017, he co-founded Unison Asset Management LLC (an SEC registered US equity fund manager), an affiliate of Canepa for which he served as CEO and Co-Portfolio Manager until the end of 2021. From October 2016 until November 2021, Mr. Marturet was a Director of Canepa Funds ICAV in Dublin, Ireland. From 2012 until 2017 Mr. Marturet served as the Portfolio Manager of the Canepa Equity Select Fund, an investment fund. Previously, Mr. Marturet served as the Head of Private Banking and Asset Management at the Bank from 2008 to 2012, and as President and Chief Executive Officer of the Bank’s securities broker-dealer subsidiary from 2002 to 2010. Mr. Marturet served as a director of MSF from 2014 to 2018. Mr. Marturet also served in various roles at Verizon Investment Management, a corporate pension manager, and Bankers Trust Company, a New York-based bank.

Mr. Marturet is a graduate of the Universidad Catolica Andres Bello (Venezuela), Yale University, and Hult University.

|

| John A. Quelch Director

|

Director since April 2022

Age 71

Key Qualifications and Expertise: Mr. Quelch is a well-recognized and highly qualified financial expert and also has considerable previous public board experience. His significant experience in strategic marketing, knowledge of our Florida market, leadership roles in higher education and numerous directorship positions make him well-qualified to serve on our Board.

Committee Assignments:

• Corporate Governance, Nominating and Sustainability Committee

• Risk Committee

Other Current Public Company Boards:

• Relativity Acquisition Corp. (SPAC) (NASDAQ – RACYU) | |

|

Since January 2023, Mr. Quelch serves as the Leonard M. Miller University Professor at the University of Miami Herbert Business School. Between 2017 and 2022, he also served as Dean of Miami Herbert Business School and as the University’s vice provost for executive education. Prior to joining the Miami Herbert Business School, Mr. Quelch was the Charles Edward Wilson Professor of Business Administration at Harvard Business School from 2013 until 2017. He also held a joint appointment as professor of health policy and management at the Harvard T.H. Chan School of Public Health. Prior to his most recent time at Harvard, Mr. Quelch was dean, vice president and distinguished professor of international management of the China Europe International Business School (CEIBS) from 2011 to 2013, leading the school to realize a significant increase in annual revenues and improving the global ranking of its MBA programs. From 1998 to 2001, Mr. Quelch served as dean of the London Business School, where he helped transform the school into a globally competitive institution and launched seed capital funds to invest in student and alumni start-ups. Mr. Quelch initially joined Harvard Business School in 1979, holding a number of positions over the years, including Sebastian S. Kresge Professor of Marketing, co-chair of the marketing department and Lincoln Filene Professor of Business Administration. He served as senior associate dean of Harvard Business School from 2001 to 2010. Mr. Quelch has served as an independent director of several publicly traded companies in the United States and the United Kingdom as well as in nonprofit and public agency boards, including as chairman of the Massachusetts Port Authority. He is a member of the Trilateral Commission and the Council on Foreign Relations.

Mr. Quelch earned a BA and an MA from Exeter College, Oxford University; an MBA from the Wharton School of the University of Pennsylvania; an MS from the Harvard School of Public Health; and a DBA in business from Harvard Business School.

|

12

Proposal 1 — Election of Directors

| John W. Quill Director |

Director since 2019

Age 69

Key Qualifications and Expertise: Mr. Quill brings nearly 40 years of experience in financial services, public and private, to the Board and, in particular, his 31 years of experience working with the OCC, the Bank’s primary regulator, allows him to provide the Company with a valuable regulatory- perspective.

Committee Assignments:

• Audit Committee

• Risk Committee (Chair)

Other Current Public Company Boards:

• None | |

|

Since June 2015, Mr. Quill has served as a consultant to the International Monetary Fund (the “IMF”), an international organization with the aim of promoting international financial and monetary cooperation, where he previously served as a Senior Financial Sector Expert in bank supervision and policy effectiveness from 2013 to 2015. Prior to the IMF, Mr. Quill served in various capacities with the Office of the Comptroller of the Currency (the “OCC”), a U.S. financial regulator, from 1980 to 2011, including Deputy Comptroller from 2004 to 2011 and the chair of the interagency council that advised the United States Treasury as to banks that should receive funds under the United States Treasury’s Troubled Asset Relief Program. Mr. Quill was an independent director of Gibraltar Private Bank & Trust, Coral Gables, Florida from 2015 to 2018.

Mr. Quill earned a Bachelor of Science in Finance from the University of South Florida.

|

| Ashaki Rucker Director

|

Director since April 2023

Age 51

Key Qualifications and Expertise: Ms. Rucker has significant human capital management experience from a variety of well-known public companies and major organizations, and brings significant expertise in human capital strategy, leadership development, culture, and human capital issues at the C-suite executive level to the Company and the Board.

Committee Assignments: As of the date of this proxy statement the Board has not appointed Ms. Rucker to serve on any committees of the Board.

Other Current Public Company Boards:

• None | |

|

Since February 2019, Ms. Rucker is the Senior Vice President, Human Resources for NBCUniversal Telemundo Enterprises & Latin America where she is responsible for the development and execution of the Human Capital Strategy. From November 2017 through February 2019, she served as Vice President, Human Resources for NBCUniversal Global Distribution and International where she led the development of the Human Capital Strategy for North America while partnering with global Human Resources Counterparts. Ms. Rucker has 30 years of Human Capital experience partnering with C-Suite executives within global Fortune 100 companies. Her industry experience spans across the financial services, professional services and media and entertainment industries. She started her career as a Human Resources Associate at JP Morgan Chase and then held various senior Human Resources leadership positions at UBS, Deutsche Bank, PricewaterhouseCoopers, Warner Media and The Walt Disney Company.

Ms. Rucker graduated from Columbia University’s Teacher’s College with a Master of Arts in Organizational Psychology and also earned a Bachelor of Arts degree from the University at Albany. Ms. Rucker serves on the Board of Directors for Rebuilding Together Miami, and also serves on the Advisory Board of University of Miami Herbert Business School’s Executive Education Program. She is also a member of Girls Inc for Greater Miami’s 150+ Women Strong and was recently recognized on Cablefax’s Diversity list celebrating the most influential multi-ethnic executives in the media industry.

|

13

Proposal 1 — Election of Directors

| Oscar Suarez Director

|

Director since April 2022

Age 62

Key Qualifications and Expertise: Mr. Suarez is a highly qualified financial expert given his considerable experience in public accounting. He is well known and respected in our South Florida market and brings extensive public accounting experience spanning a wide array of industries and sectors to our Board.

Committee Assignments:

• Audit Committee (Chair)

• Compensation and Human Capital Committee

Other Current Public Company Boards:

• None | |

|

Mr. Suarez is a lifelong resident of Miami. He has over 40 years of public accounting experience spanning the consumer/retail, hospitality, transportation and international banking sectors. He was a member of the Ernst & Young (EY) U.S. central region leadership team and prior to that, Mr. Suarez served as EY’s markets leader for Florida and Puerto Rico, overseeing all services provided by EY in these two markets. Mr. Suarez was admitted as an executive member to the Latino Corporate Directors Association, is a board member of Industrial Rail Services, L.P., and was the chair, until 2022, of the Florida Accountants Coalition where he served for over 14 years. Mr. Suarez started his career in 1981 with Arthur Andersen and subsequently spent 15 years with KPMG, finally joining EY in 2004. During his career, he worked with management teams and board of directors across large multinational and SEC registrants and served on the board of Miami United Way and Florida International University (FIU) Foundation. Mr. Suarez was a founding member of corporate advisory boards at FIU and University of Miami.

Mr. Suarez received a Bachelor of Science degree in Accounting from St. Thomas University.

|

| Millar Wilson Director

|

Director since 1987

Age 70

Key Qualifications and Expertise: As our former Chief Executive Officer, Mr. Wilson has a breadth of knowledge concerning issues affecting us and the banking industry. His prior executive and director experience will continue to assist the Board as we expand our business and build upon our strategy.

Committee Assignments:

• Risk Committee

Other Current Public Company Boards:

• None | |

|

Mr. Wilson served as Chief Executive Officer of the Company from 2009 until March 2021, and as Vice-Chairman and Chief Executive Officer of the Bank from 2013 until March 2021. During his tenure as Chief Executive Officer, Mr. Wilson successfully led the Company through one of the most historically difficult times the financial industry has faced. Under his leadership, the Bank grew to $8 billion in assets, achieved a continuous upward trend in net income, and enhanced both the banking center network and product offerings to steadily increase lending and deposits. Previously, Mr. Wilson served, for over 30 years, in various roles with MSF including as Executive Director of International Business of MSF from 2013 until January 2018. Mr. Wilson served as a member of the board of directors of the Federal Reserve Bank of Atlanta Miami Branch from 2013 to 2019 and served as a member of the board of directors of Enterprise Florida, Inc. from 2009 to 2013, as chairman of the board of directors of the American Red Cross of Greater Miami and the Keys from 2001 to 2002 and as a director and treasurer of the Miami Dade College Foundation from 1999 to 2004.

Mr. Wilson is a graduate of Bradford University, England and the Harvard Business School Management Development Program.

|

THE BOARD RECOMMENDS A VOTE “FOR” APPROVAL OF THE ELECTION OF THE NOMINEES NAMED HEREIN AS DIRECTORS.

In order to be elected, a nominee must receive a plurality of the votes cast at the meeting or by proxy.

14

Corporate Governance

Meetings and Attendance

During the fiscal year ended December 31, 2022, the Board held nine meetings and acted once by written consent. In addition, the Board held a two-day special session in the third quarter of 2022 to discuss the strategy for the 2023-25 period.

All directors attended at least 75% of the aggregate of (i) the Board meetings held during their tenure as directors during 2022 and (ii) the meetings of any committees held during their tenure as members of such committees during 2022.

The Board’s unwritten policy regarding director attendance at the annual meeting of shareholders is that directors are encouraged to attend. All but two of the then-incumbent members of the Board participated in the 2022 annual meeting of shareholders.

Executive Sessions

The Company’s independent directors meet separately from the other directors and management in regularly scheduled executive sessions at least twice annually, and at such other times as may be deemed appropriate by the Company’s Lead Independent Director or the other independent directors. Our Board believes this is an important governance practice that enables the Board to discuss matters without management present. Our Lead Independent Director presides over the executive sessions of the independent directors. Any independent director may call an executive session of independent directors at any time. The independent directors met two times in executive session without management in 2022.

Director Education

Our director education program assists Board members in fulfilling their responsibilities. The director education program commences with an orientation session when a new director joins the Board. The director orientation is designed to familiarize new directors with the Company’s strategic plan, business, reporting structure, risk management, key policies and practices. Our directors also have access to learning courses, materials, and other resources.

Ongoing education is provided through presentations from Senior Management, discussions and presentations by external subject matter experts and other learning opportunities. In 2022, directors were provided with education on subjects including the following:

| • | the Company’s products and services; |

| • | cybersecurity and technology; |

| • | diversity, equity and inclusion (“DEI”); |

| • | banking industry trends; |

| • | significant and emerging risks; |

| • | corporate governance, and |

| • | key laws, regulations and supervisory requirements applicable to the Company and its subsidiaries. |

15

Corporate Governance

Board Committees

The standing committees of the Board consist of the Audit Committee, the Compensation and Human Capital Committee (the “Compensation Committee”), the Corporate Governance, Nominating and Sustainability Committee (the “Governance Committee”) and the Risk Committee. The composition of each Board committee as of the date of this proxy statement and the number of meetings held in 2022 by each Committee are set forth below:

| Director name |

Audit | Compensation and Human Capital |

Corporate Governance, Nominating & Sustainability |

Risk | ||||

| Pamella J. Dana (1) |

✓ | ✓ (2) | ✓ (2) | |||||

| Miguel A. Capriles L. (3) |

✓ | ✓ | ||||||

| Samantha Holroyd (3) |

✓ | ✓ | ✓ | |||||

| Erin Knight (3) |

✓ | ✓ | ||||||

| Gustavo Marturet M. (3) |

✓ | ✓ | ||||||

| John A. Quelch (3) |

✓ | ✓ | ||||||

| John W. Quill (3) |

✓ | ✓ (2) | ||||||

| Ashaki Rucker (3) (4) |

||||||||

| Oscar Suarez (3) |

✓ (2) | ✓ | ||||||

| Gustavo J. Vollmer A. (3) (5) |

✓ | ✓ | ||||||

| Millar Wilson |

✓ | |||||||

| Number of Meetings held in 2022 |

11 | 7 | 9 | 6 |

| (1) | Lead Independent Director |

| (2) | Committee Chair |

| (3) | Independent Director |

| (4) | Joined the Board effective April 17, 2023. As of the date of this proxy statement the Board has not appointed Ms. Rucker to serve on any committees of the Board, nor has a decision been made as to which committee(s) of the Board she is expected to be named to. The Company intends to address committee assignments at its annual organizational meeting in June 2023. |

| (5) | On February 6, 2023, Gustavo J. Vollmer A. notified the Company of his decision to not stand for re-election to the Board of Directors at the Company’s Annual Meeting and as a result Mr. Vollmer’s term as a director of the Company and a member of the Board committees listed above will end on June 7, 2023 (the date of the Annual Meeting). |

Each of the standing committees of the Board has a charter specifying such committee’s duties and responsibilities. Each committee charter is reviewed at least annually. The charters of the committees of the Board are available on our website at https://investor.amerantbank.com/corporate-governance/documents-charters. You may also request copies of our committee charters free of charge by writing to our investor relations team at investorrelations@amerantbank.com or via mail addressed to “Investor Relations” at 220 Alhambra Circle, Coral Gables, Florida 33134.

Key Committee Responsibilities

Audit Committee

The Audit Committee has been established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board has determined that all Audit Committee members are independent under Nasdaq and SEC rules and that each member is “financially literate”. The Board has also determined that each of Messrs. Capriles, Quill, and Suarez, and Dr. Dana qualifies as an “audit committee financial expert” as defined in applicable SEC rules.

16

Corporate Governance

The Audit Committee’s key responsibilities include:

| • | appointing, compensating, retaining, replacing and overseeing the work of the independent registered public accounting firm; |

| • | pre-approving all audit and non-audit services to be provided by the independent registered public accounting firm; |

| • | reviewing and discussing with the independent registered public accounting firm all relationships the independent registered public accounting firm has with us in order to evaluate their continued independence; |

| • | considering and discussing the results of each quarter’s review and the annual audit by the independent registered public accounting firm; |

| • | reviewing the Company’s financial statements and related disclosures in the Company’s quarterly and annual reports prior to filing with the SEC; |

| • | reviewing the effectiveness of the Company’s internal control over financial reporting; |

| • | reviewing with management, the independent registered public accounting firm and our legal advisors, as appropriate, any legal, regulatory or compliance matters; |

| • | meeting, as it deems appropriate, in separate executive sessions with the independent registered public accounting firm, other directors, internal audit, the Chief Executive Officer or other Company employees, agents, attorneys or representatives; |

| • | overseeing the performance of the Company’s internal audit function, including the approval of the annual internal audit plan; |

| • | reviewing and approving any related party transaction required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the SEC; and |

| • | reviewing and discussing with management and the Risk Committee policies with respect to risk assessment and risk management. |

Compensation and Human Capital Committee

The Board has determined that all Compensation Committee members are independent under Nasdaq and SEC rules. The Compensation Committee’s key responsibilities include:

| • | reviewing and approving on an annual basis the corporate goals and objectives relevant to the compensation of our Chief Executive Officer and our other executive officers, evaluating the performance of our Chief Executive Officer and our other executive officers in light of such goals and objectives and determining and approving the compensation levels of our Chief Executive Officer and other executive officers based on such evaluation; |

| • | reviewing our executive compensation policies and plans; |

| • | implementing and administering our incentive compensation equity-based plans; |

| • | overseeing the Company’s human capital management strategy and promoting sound HCM policies and a prosperous corporate culture aligned with the Company’s strategy; |

| • | assuring that the Company’s compensation policies and programs are effective in attracting and retaining talent, and reviewing the competitiveness of the Company’s benefits plan, equity plans and wellness initiatives; |

| • | assisting the Board in overseeing the Company’s Diversity, Equity and Inclusion (“DEI”) Program; |

| • | supporting management in complying with our proxy statement and annual report disclosure requirements, including reviewing and discussing with the Company’s management the Compensation Discussion and Analysis (“CD&A”) and other disclosures required by Item 402 of Regulation S-K and recommending to the Board that the CD&A be included in the Company’s Annual Report on Form 10-K or proxy statement, as applicable; |

| • | producing a report on executive compensation to be included in our annual proxy statement; |

| • | reviewing and recommending the Company’s Stock Ownership Guidelines, and amendments thereto, as well as monitor compliance with these guidelines; |

| • | reviewing, evaluating and recommending changes, if appropriate, to the director compensation program; |

17

Corporate Governance

| • | assisting the Board and the Corporate Governance, Nominating and Sustainability Committee in developing the framework for the Succession Plan of the Chief Executive Officer; |

| • | assisting the Chief Executive Officer in annually evaluating the succession plan of the other Executive Officers; |

| • | periodically conducting a risk assessment of the Company’s compensation plans and programs; and |

| • | completing an annual self-assessment. |

The charter also provides that the Compensation Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser, including the factors required by NASDAQ and the SEC.

The Compensation Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee of the Compensation Committee and it may also delegate to one or more officers of the Company its authority to approve grants of stock options and other equity-based awards, subject to the terms and conditions of such delegation and applicable plans and law. Except for the delegation to the Company’s Chairman, President and CEO of its authority to grant restricted stock under the 2018 Equity and Incentive Compensation Plan or, the 2018 Plan, as described more fully below under Executive Compensation, the Compensation Committee has not delegated any portion of its duties and responsibilities at this time.

Compensation Committee Interlocks and Insider Participation

From the month of January 2022 until the end of the month of June 2022, the members of the Compensation Committee were Pamella J. Dana (Chair), Frederick C. Copeland, Jr. (who did not stand for reelection at the 2022 annual meeting), Gustavo Marturet M. and Gustavo J. Vollmer A. From July 1, 2022 until December 8, 2022 the members of the Compensation Committee were Orlando Ashford (Chair), Samantha Holroyd, Gustavo Marturet M., Oscar Suarez and Gustavo J. Vollmer A. In December 2022, Mr. Ashford stepped down from the Board effective December 8 2022, and Ms. Erin D. Knight was elected to serve on the Committee effective December 15, 2022. Except for Mr. Vollmer A. who was Executive Chairman of the Company until July 6, 2018, none of the members of the Compensation Committee in 2022 had any interlocks required to be disclosed under Item 407(e)(4) of Regulation S-K.

Except for Mr. Marturet M., none of the members of the Compensation Committee in 2022 had any relationships requiring disclosure by the Company as a related party transaction under Item 404 of Regulation S-K. Mr. Marturet M.’s brother-in-law is a salaried employee but not an executive officer of the Company and received total compensation of approximately $232,000 in 2022. His compensation was established by us in accordance with our compensation practices, generally, and applicable to employees in similar positions with comparable qualifications, tenure, and responsibilities and without the involvement of Mr. Marturet.

During 2022, none of our executive officers served as a member of the compensation committee or the board of directors of any other company that has one or more executive officers serving on our Board or our Compensation Committee.

Corporate Governance, Nominating and Sustainability Committee

The Board has determined that all Governance Committee members are independent under Nasdaq and SEC rules. The Governance Committee’s key responsibilities include:

| • | identifying individuals qualified to become members of the Board; |

| • | making recommendations to the Board regarding Board and committee composition; |

| • | making recommendations to the Board regarding the appointment of a Lead Independent Director from among its non-executive members; |

| • | reviewing and evaluating director nominations as well as any recommendations relating to corporate governance issues submitted by the shareholders; |

| • | monitoring director independence; |

18

Corporate Governance

| • | overseeing director training and continuing education programs; |

| • | reviewing and assisting in succession planning annually; |

| • | reviewing the Code of Conduct and Ethics and recommending changes to the Board as appropriate; |

| • | overseeing the Company’s Sustainability Program; |

| • | overseeing the evaluation of the Board and Board Committees; and |

| • | completing an annual self-assessment. |

Risk Committee

The Board has determined that all Risk Committee members except for Mr. Wilson are independent under Nasdaq and SEC rules. The Risk Committee’s key responsibilities include:

| • | reviewing and approving the Company’s and the Bank’s risk appetite, profile, and aggregate tolerance levels in light of their strategic, operational, and financial objectives; |

| • | approving and monitoring the Company’s enterprise risk management framework, which includes oversight over credit, market, operational, information security (cybersecurity), and strategic and reputational risks; |

| • | reviewing and approving the Company’s Information Security Program and changes thereto that address emerging cybersecurity and information security matters, at least annually; |

| • | overseeing risks related to Anti-Money Laundering, the Bank Secrecy Act and OFAC sanctions compliance; and |

| • | evaluating, monitoring and, where appropriate, making recommendations to the Board with respect to: |

| • | the risks inherent in the businesses of the Company and the Bank, the interrelationships between these risks and the process by which management identifies, assesses and determines appropriate controls; |

| • | the enterprise risk management framework and control activities, including the setting of performance measurement goals and key risk indicators; |

| • | the integrity, advancement and understanding of the Company’s and the Bank’s systems and processes of operational controls; and |

| • | the allocation of risk capital and use of risk adjusted return on capital in decision making. |

Board Leadership Structure

The Board’s primary responsibility is to provide effective governance over the Company’s affairs and seeing that our business is managed to meet our goals and objectives and that the long-term interests of our shareholders are served. The Corporate Governance Guidelines adopted by the Board do not establish a fixed policy with respect to the separation of the offices of Chairperson and Chief Executive Officer. The Board believes that it should have flexibility to select the Chairperson and decide on the Board leadership structure, from time to time, in the context of the Company’s specific circumstances at the time the determination is made and based on considerations that it deems to be in the best interests of the Company and its shareholders. The Bylaws of the Company and the Corporate Governance Guidelines provide that in the event the positions of Chairperson and Chief Executive Officer are held by the same person, the Board of Directors must appoint a Lead Independent Director from among its non-executive members.

On March 9, 2022, following the recommendation of the Governance Committee, the Board resolved to appoint Gerald P. Plush as Chairman of the Board, effective immediately after the 2022 Annual Meeting. In addition to his role as Chairman, Mr. Plush continues to serve as the Company’s President and Chief Executive Officer. In connection with the appointment of Mr. Plush as Chairman of the Board, the Board also resolved to appoint Pamella J. Dana, Ph.D as Lead Independent Director of the Board, effective immediately after the 2022 Annual Meeting.

The Board considers that Mr. Plush’s knowledge of the Company, its strategy and goals, his deep knowledge and understanding of the financial services industry and the challenges it is facing, coupled with his experience as Chief Executive Officer and President and his demonstrated leadership capabilities, benefits the Company, its employees, and shareholders. The Board determined that leadership by our Chairman and Chief Executive Officer, combined with

19

Corporate Governance

oversight from our Lead Independent Director, and our strong, well-qualified directors (all of whom are independent, with the exception of Mr. Plush and Mr. Wilson), Board Committee members and Board Committee Chairs will best provide an effective, high-functioning Board and allow the Company to implement and execute its business plan and key strategic initiatives at this time while meeting the challenges facing the industry and expectations of our shareholders. The Board will continue to evaluate its leadership structure in the future and make changes at such times as it deems appropriate.

Lead Independent Director

Following the recommendation of the Governance Committee, the Board appointed Pamella J. Dana, Ph.D as Lead Independent Director of the Board, effective immediately after the 2022 Annual Meeting. Dr. Dana brings extensive leadership, policymaking and public affairs experience, and her long-term tenure as an independent director of the Company provides her with significant knowledge of the issues facing the Company and will ensure that those issues be considered by the Board.

The primary responsibilities of the Lead Independent Director include the following:

| • | acts as Chair of the Board in meetings where the Chair & CEO is not present or unable to serve in that capacity; |

| • | acts as a liaison between the independent directors and the Chair & CEO without inhibiting direct communication between them; |

| • | provides input to the Chair & CEO regarding Board meeting schedules and additional agenda items so that matters of concern or interest to the independent directors are appropriately scheduled for discussion; |

| • | presides over and calls executive sessions of the independent directors, which are held at least semi-annually; |

| • | meets one-on-one with the Chair & CEO after executive sessions to review the matters discussed therein; |

| • | engages and consults with major shareholders and other stakeholders, where appropriate; |

| • | coordinates with the independent directors and Compensation Committee Chair regarding the annual performance and compensation review of the Chair & CEO; and |

| • | assists the Board and Governance Committee in overseeing compliance with the Company’s Corporate Governance Guidelines. |

In addition to the Chairman and Chief Executive Officer and the Lead Independent Director, the Board leadership and oversight framework is complemented by talented and experienced independent directors and the standing committees of the Board. The Company believes that the current Board leadership structure, policies, and practices, when combined with the Company’s other governance policies and procedures, is appropriate and serves the best interest of our shareholders.

Board and Board Committee Performance Evaluations

Each year, the Governance Committee leads the Board through a self-evaluation process. Through this, the directors assess performance, identify areas for improvement and provide feedback.

Board Annual Self-Evaluation: annually, each director completes an open-ended questionnaire with key topics such as board composition; information and resources, and effectiveness and oversight. Responses are reviewed by the Chairman and the Lead Independent Director. The Lead Independent Director leads a discussion of the results at the Corporate Governance, Nominating and Sustainability Committee, and then reports the results of such discussion and the action plans to be implemented as a consequence thereof to the full Board. As a result of director feedback, the Company has implemented and enhanced its director education program and management has updated content and formats of some materials provided to the Board, as well as reviewed the Company’s executive session practices and conducted a special off-site strategic session.

Committee Annual Self-Evaluations: also annually, each director completes an open-ended questionnaire for each committee on which he or she serves with key topics such as Committee Charter, structure, composition and effectiveness. Responses are reviewed by each Committee Chair, who then leads a discussion of the results with the respective Committee. The results of the process, along with any improvement actions are then reported to the full Board at the next Board meeting.

20

Corporate Governance

Individual Director Evaluations: beginning in 2022, the Governance Committee leads an annual individual director evaluation process. This process consists of individual questionnaires for each director wherein each evaluates their peers and self-assess their performance. The Governance Committee then reviews the aggregated results of the individual evaluations, and the Lead Independent Director and the Chairman meet privately with each of the directors to discuss the results of their evaluations and provide feedback on behalf of the other directors.

Risk Oversight

Information Security Oversight and Risk Management