MERCANTIL BANK HOLDING CORPORATION CODE OF CONDUCT AND ETHICS ADOPTED MAY 7, 2018

PURPOSE .......................................................................................................................................................... 1 Individual Responsibility .............................................................................................................................. 2 Amendments and Waivers .......................................................................................................................... 2 FAIR AND HONEST DEALING ............................................................................................................................ 3 COMPLIANCE WITH LAWS, RULES AND REGULATIONS.................................................................................... 3 Banking Laws ............................................................................................................................................... 3 Antitrust Laws and Fair Competition ........................................................................................................... 4 Discrimination and Harassment Laws; Fair Treatment and Respect ........................................................... 4 Insider Trading ............................................................................................................................................. 5 Political Process ........................................................................................................................................... 5 Relations with Government Officials ........................................................................................................... 5 Integrity of Records and Compliance with Accounting Principles ............................................................... 5 CONFLICTS OF INTEREST .................................................................................................................................. 6 Outside Financial Interests .......................................................................................................................... 7 Outside Employment ................................................................................................................................... 7 Gifts and Gratuities...................................................................................................................................... 8 Loans ........................................................................................................................................................... 8 CORPORATE OPPORTUNITIES .......................................................................................................................... 8 PROTECTION AND PROPER USE OF COMPANY ASSETS.................................................................................... 9 Personal Use of Corporate Assets ............................................................................................................... 9 Use of Company Computers, Software and Email....................................................................................... 9 Protecting Corporate Assets ........................................................................................................................ 9 CONFIDENTIAL AND PROPRIETARY INFORMATION / COMMUNICATIONS WITH THE PUBLIC ........................ 9 Confidentiality ............................................................................................................................................. 9 Intellectual Property and Proprietary Information ................................................................................... 10 Communicating with the Media and the Public ........................................................................................ 10 REPORTING VIOLATIONS ................................................................................................................................ 11 INVESTIGATIONS AND ENFORCEMENT .......................................................................................................... 12 SPECIAL PROVISIONS FOR SENIOR FINANCIAL OFFICERS ............................................................................... 13 Honesty and Integrity ................................................................................................................................ 13 Compliance with Laws ............................................................................................................................... 13 Conflicts of Interest ................................................................................................................................... 13 Integrity and Accuracy of Public Disclosures ............................................................................................. 14 Accounting Treatment ............................................................................................................................... 14 DISTRIBUTION oF tHIS cODE ........................................................................................................................... 14

PURPOSE Mercantil Bank Holding Corporation and its subsidiaries (the “Company”) conduct business based on high standards of honesty, integrity and impartiality. These are among our most valuable assets and are directly affected by the conduct of our officers, directors and employees (each an “Associate”). For this reason, the Company encourages all its Associates to conduct themselves every day to maintain our outstanding reputation in the communities we serve. Integrity and high standards of ethical conduct are fundamental to our beliefs. The Company is committed to doing what is right and deterring wrongdoing, and we expect you to uphold these beliefs as well. If you have questions concerning the proper course of action, please consult your division head, immediate supervisor or the Human Resources Department. This Code of Conduct and Ethics (the “Code”) is intended to deter wrongdoing by Company officers, directors and employees and to promote: • Honest and ethical conduct, including the ethical handling of actual or apparent conflicts of interest between personal and professional relationships; • Full, fair, accurate, timely and understandable disclosure in all public communications, including reports and documents that the Company files with the U.S. Securities and Exchange Commission (the “SEC”); • Compliance with all applicable laws, rules and regulations; • The prompt internal reporting of violations of this Code, and the protection of persons who report violations of this Code, violations of any law, rule or regulation, or any questionable accounting practice; and • Accountability on the part of all employees for adherence to this Code. This Code outlines the standards of ethical behavior the Company expects of all its Associates, but is by no means a complete list of your responsibilities under this Code’s principles. You should keep in mind these important considerations when reading this Code: • You should follow this Code in letter and in spirit. This means that you shall avoid any action, whether or not specifically prohibited by this policy, which might create the appearance that, you are (1) using your position at the Company for private gain; (2) giving preferential treatment to any person, whether a customer, supplier or otherwise; (3) impeding the Company’s efficiency or economy; (4) losing your independence or impartiality; (5) making a decision outside the Company’s normal channels, procedures or authorizations; or (6) adversely affecting the confidence investors, customers or the public have in the Company’s integrity. • You should follow this Code along with any applicable laws, regulations and other Company policies and procedures. • This Code does not include all of the policies, procedures and ethical standards applicable to Company Associates. 1

• This Code applies to all of our Associates, regardless of location or position, including the Company’s principal executive officer, financial officer, accounting officer or controller or persons performing similar functions. • You must report any violation of this Code. You should report suspected violations to your division head, immediate supervisor, or the Human Resources Department. You can also report violations of this Code or other Company policies and procedures or other illegal or unethical activities anonymously to the Company’s Internal Audit Department or the Audit Committee of the Company’s Board of Directors. See “Reporting Violations.” • If you do not comply with the provisions of this Code and other Company policies and procedures, you could be disciplined or terminated. You could also face criminal penalties and civil liabilities for violating the standards outlined in this Code. This Code will be posted on the Company’s website and the Company’s annual report shall disclose this website address and that this Code of Ethics is posted to and available on the Company’s website. INDIVIDUAL RESPONSIBILITY The Company expects all employees to abide by this Code and to comply with the Company’s policies. Differences of opinion as to appropriate conduct in a given situation are unavoidable; however, they do not excuse you from observing the stated Company policies. You may voice your concerns or request an exception for special circumstances through appropriate management officials. Our Human Resources Department, and such other person(s) who may be appointed by the Board of Directors, shall be available for counseling and guidance respecting this Code, and the laws, rules and regulations affecting employee responsibility and conduct. Each employee shall be notified of this service at the time he or she receives a copy of this Code. You represent the Company at all times. Therefore, you have a responsibility to act with honesty, integrity and within the parameters of the Company’s policies. As an employee of the Company, you also have a responsibility to voice concerns if you know or suspect fellow employees are acting contrary to existing policies. Please refer to the section “Reporting Violations” for additional procedures that you may use to report possible violations. AMENDMENTS AND WAIVERS Only the Company’s Board of Directors may amend this Code. Only the Board of Directors may waive a part of this Code for any principal executive officer, financial officer, accounting officer or director. The Company will disclose publicly all material amendments and any waivers for its principal executive officer, financial officer, accounting officer or directors, to the extent required by law, by posting such amendments on its internet website at mercantilcb.com. Any amendment to this Code will be recommended by the Executive Management Committee and approved by the Board of Directors of the Company. The Company will issue interpretations, guidelines and relevant materials as appropriate. Waivers and interpretations of this Code with respect to Executive Management may be issued only by the Board of Directors of the Company or the Board Audit Committee. 2

FAIR AND HONEST DEALING You must deal fairly and honestly with the Company’s employees, shareholders, customers, suppliers and competitors. You must behave in an ethical manner and not take unfair advantage of anyone through manipulation, concealment, abuse of privileged information, misrepresentation of material facts, or any other unfair dealing practice. You must respect the integrity of persons and firms with whom the Company deals. You must limit the fees and commissions paid to agents and other representatives to amounts that are consistent with proper business conduct. We have earned our reputation by providing excellent customer service through knowledgeable employees and quality products. You and your co-workers must be aware that every action and interaction you undertake affects that reputation. Our goal is and should always be to provide excellent customer service and quality products. COMPLIANCE WITH LAWS, RULES AND REGULATIONS The Company strives to ensure that all activities conducted on its behalf comply with applicable laws, rules and regulations. You must comply with all applicable laws, rules and regulations, whether or not specifically addressed in this Code. Additional Company policies and rules can be found in the Employment Manual and other Company policies. Please contact your supervisor for additional guidance or if you have questions. While not all inclusive, the following will serve as a guide to the types of laws, rules and regulations that you should consider: BANKING LAWS You must comply with applicable federal and state laws and regulations that govern the activities of banks and bank holding companies. You should familiarize yourself with laws and regulations applicable to the Company and your responsibilities. If you have any questions, consult with the appropriate bank officer before taking any action on behalf of the Company. As an employee, you must not engage in certain activities, and should immediately inform your division head, immediate supervisor or the Human Resources Department if you become aware of any other employee engaging in prohibited activities. The following list is by no means comprehensive, but is a sample of the type of activities you should be aware of and avoid: • violating any provision of the United States Code or Federal regulations applicable to the Company; • violating any “prompt corrective action,” “cease and desist” order or other formal or informal enforcement action or condition imposed by any applicable governmental or regulatory authority. • providing misleading or inaccurate information on any report filed with the Board of Governors of the Federal Reserve system or its delegee (the “Federal Reserve”), the FDIC, the Office of the Comptroller of the Currency (“OCC”) or the SEC, or any other governmental or regulatory authority; 3

• violating the Bank Secrecy Act, Anti-Money Laundering and Office of Foreign Asset Control regulations even if you do not directly participate in it (violations of these laws and regulations which are observed or know about, and not reported, represent grounds for immediate disciplinary action, and could be subject to prosecution to the full extent of the law); • causing the Company to engage in, or acquire an interest in a company that engages in, non-banking activities that the Federal Reserve has not determined to be permissible or which are not permitted by the OCC; • taking any action which would reasonably be expected to adversely affect the Company’s regulatory ratings or credit ratings; • causing the Company to enter into any transaction with its subsidiary or any other affiliate that violates Sections 23A or 23B of the Federal Reserve Act or Federal Reserve Regulation W; • knowingly violating any term of any agreement to which the Company is a party or to which it is subject or bound; • taking actions regarding accounts and services not authorized by customers or which are billed, but where the services are not provided; or • causing the Company to engage in any activity that may reasonably be viewed as an unsafe or unsound practice. ANTITRUST LAWS AND FAIR COMPETITION You must comply with applicable antitrust and similar laws that regulate competition and sales practices. As an employee, you must not engage in the following activities, and should immediately inform your division head, immediate supervisor or the Human Resources Department if you become aware of any other employee engaging in such activities: • Discussing prices, pricing strategies, product or marketing plans or terms of sale with competitors or anyone outside the Company. Should a prohibited subject arise during any meeting, you should immediately leave the meeting and inform the Company Board of Director’s Audit Committee. • Entering into agreements or arrangements with our competitors concerning prices, bids, dealers, customers or sales territories or markets. • Tying the purchase of one product or service to another or requiring suppliers to buy from us to retain our business, except as permitted by applicable law. • Using information obtained illegally or improperly including through misrepresentation, violation of privacy rights or coercion. • Otherwise using unfair trade practices, including bribery, misappropriation of trade secrets, deception, intimidation and similar unfair practices. • Engaging in unfair, deceptive or abusive practices prohibited by law, or the FTC or CFPB. DISCRIMINATION AND HARASSMENT LAWS; FAIR TREATMENT AND RESPECT 4

The Company’s policy is to grant equal opportunity to all qualified persons, at all phases and in all aspects of employment, without regard to race, color, religion, gender, ethnic origin, age, disability or any other classification prohibited by law and to provide all employees freedom from harassment, as set forth in more detail in the Company’s Employment Manual. You must at all times abide by the Employment Manual. The Company will investigate allegations of harassment or discrimination in accordance with applicable laws and the Company’s policies. INSIDER TRADING Federal and state securities laws and the Company’s Insider Trading Policy prohibit you from: • Purchasing or selling Company securities utilizing material nonpublic information about the Company; • Purchasing or selling any other person’s securities utilizing material, nonpublic information about such other person obtained in the course of your employment by, or engagement with the Company; and • Disclosing material, nonpublic information to others who then trade in the Company’s or any other person’s securities. POLITICAL PROCESS You must comply with all laws, rules and regulations governing campaign finance and contributions, and lobbying activities. In addition, various federal and state laws further limit the ability of corporations to make political contributions. You cannot use the Company’s funds and assets for political campaign purposes of any kind. You may participate in the political process by means of personal campaign contributions, expenditures or other activity, but may not do so as representatives of the Company, and may not use the Company’s name or address in connection with any such activities. You may not represent that any benefit to the Company is sought or desired. You must comply with provisions of the Company’s Personnel Policy Manual that address solicitation of employees, distribution of printed materials, and company bulletin boards. In addition, because personal involvement in political activities could reflect upon the Company, employees desiring to engage in political activities should consult their division head, immediate supervisor or the Human Resources Department. RELATIONS WITH GOVERNMENT OFFICIALS You may not make any payments to or for the benefit of any government official or employee or their families or business in order to secure business or to obtain special concessions. Relations with government representatives, even where personal friendships may be involved, must be in good taste and consistent with applicable law and the Company’s policies and such that full public disclosure would in no way damage the Company’s reputation. INTEGRITY OF RECORDS AND COMPLIANCE WITH ACCOUNTING PRINCIPLES The Company and the law require the preparation and maintenance of accurate and reliable business records. You must prepare all reports, books and records of the Company with care and honesty. False or misleading entries in such records are unlawful and are not permitted. The Company maintains a system of internal controls to ensure that transactions are carried out in accordance with management’s authorization and properly recorded. This system includes various policies and procedures and periodic examination by a professional staff of internal auditors, independent outside auditors, bank regulatory 5

agencies, with oversight by our Audit Committee. The Company expects you to adhere to these policies and procedures and to cooperate fully in any examination by any of these persons. The Company’s corporate records are important assets. The Company is required by law to maintain certain types of corporate records, usually for specified periods of time. Failure to retain such documents for such minimum periods could subject the Company to penalties and fines, cause the loss of rights, obstruct justice, place the Company in contempt of court, or place the Company at a serious disadvantage in enforcing its rights or remedies, including in litigation, arbitration or other proceeding, and may expose you to civil and criminal penalties. However, storage of voluminous records over time is costly. Therefore, the Company has established controls to assure retention for required periods and timely destruction of retrievable records, such as paper copies and records on computers, electronic systems, microfiche and microfilm. The Company expects all employees to become familiar with and fully comply with the records retention/destruction schedule for the departments for which they work. If you believe documents should be retained beyond the applicable retention period, consult your division head, immediate supervisor or the Human Resources Department. You are forbidden to use "off-book" record-keeping, unrecorded bank accounts or corporate entities, and falsified books. In addition, if you have any complaints or suspect a violation regarding accounting, internal accounting controls, auditing or financial reporting matters you should report such matters to your supervisor or pursuant to the procedures under “Reporting Violations.” CONFLICTS OF INTEREST The Company requires you to avoid any relationship, activity, or ownership that might create a conflict between your personal interest and the Company’s interest. A “conflict of interest” occurs when your private interest interferes in any way, or even appears to interfere, with the interests of the Company. A conflict of interest can arise when you take actions or have interests that may interfere with your ability to perform your job objectively and effectively. Conflicts of interest also arise when you, or a member of your family, receive improper personal benefits as a result of your position with the Company. You need to disclose any relationships, gifts, compensation or other situations which could be a conflict of interest or that reasonably could create the appearance of a conflict of interest in the following manner: (1) employees shall report to their division head or immediate supervisor; (2) officers shall report to the President and CEO; and (3) the President and CEO and members of the Board of Directors shall report to retained counsel. You owe a duty of loyalty to the Company. You may not use your position or any information gained as a result of your position improperly to profit personally or to assist others in profiting at the Company’s expense. Employees must refrain from any activity or having a financial interest that is inconsistent with the Company’s best interest, and also must refrain from activities, investments, or associations that compete with the Company’s best interest, or exploits one’s position with the Company for personal gain. The Company expects you to avoid situations that might influence your actions or prejudice your judgment in handling the Company’s business. You must not become obligated in any way to representatives of firms with which you deal and must not show any preference to third parties based on personal, family or outside business interests. In addition, you must communicate to your supervisor any material transaction or relationship that could create a conflict of interest. 6

While not all inclusive, the following will serve as a guide to the types of activities that might cause conflicts of interest: OUTSIDE FINANCIAL INTERESTS • Owning a substantial financial interest in any company that is a competitor of the Company or which does or seeks to do business with the Company, unless such interests are disclosed to the Board of Directors and any business with the Company is approved by the Board of Directors in advance, and is conducted on arms’ length terms at least as advantageous as available elsewhere. Generally, owning securities of a publicly owned corporation regularly traded on a national securities exchange, where you are not an “affiliate” of such other entity, would not create a conflict of interest; • Representing the Company in any transaction in which you or a family member or a related business have a substantial personal or financial interest; • Disclosing or using confidential, special or material nonpublic information of or about the Company or a customer for your or a family member’s or other person’s profit or advantage; or • Competing with the Company in the purchase, sale or ownership of property or services or business or investment opportunities. Employees of the Company or its subsidiaries may not act as power of attorney for customers of the Company or its subsidiaries. Limited exceptions are made for employees to hold a power of attorney for a customer’s account if the account holder is the employee’s relative or the employee is the ultimate beneficial owner of the account. Relative is defined as: parents, grandparents, siblings, children, grandchildren or spouse. Should an employee hold a power of attorney on a relative’s account, the employee may not be the officer of the account. For example, employees may have a general or specific power of attorney over their relatives or establish trusts, or accounts for their children under the Uniform Gifts to Minors Act or similar laws. This policy does not apply to accounts used in the ordinary course of business of the Company or its subsidiaries such as operating accounts or trust accounts. Involvement in community and political activities is encouraged, provided participation is accomplished in a legal manner, does not interfere with the discharge of work, duties or responsibilities owed the Company, and is done in a manner clearly indicating the director, officer or staff member does not speak or act for the Company. OUTSIDE EMPLOYMENT As detailed in the Employment Manual, you may not engage in any outside employment that in any way competes with the Company’s business activities, compromises its business interests or interferes with your ability to fulfill all of your responsibilities to the Company, including your duties of loyalty, care, candor and confidentiality. You shall not use Company property or services for your personal benefit, or take advantage of the Company's opportunities, their position, or confidential information for personal gain. The Company's letterhead and stationery are to be used for business related correspondence only. Offers of directorships to any outside organization (excluding non-profit organizations) that has or desires to have a business relationship with the Company, or to any institution within the financial services 7

industry, must be reported to the Human Resources Department and must be approved by the Company’s counsel prior to acceptance. GIFTS AND GRATUITIES It is the Company’s policy to prohibit employees from seeking or accepting gifts or compensation in connection with any business of the Company. Any gifts or offers of entertainment of more than $500.00 must be refused. All such gifts or offers of entertainment in excess of $100.00 and any offers of commissions or fees in connection with the Company business should be reported to your immediate supervisor or the Human Resources Department. Mercantil Investment Services, Inc. has additional policies, which may provide different levels for gifts or entertainment due to FINRA and SEC rules. In such cases, the more restrictive rule shall apply. In the event that the Company does not have the opportunity to refuse or return the gift because such action could harm its reputation or the relationships with the customer, the Executive Management Committee shall take action to dispose of the gift for charitable or community purposes. You and your immediate families shall not ordinarily accept, directly or indirectly, any bequest or legacy from a Company customer, except where such customer is a close relative and the Company is not serving as a fiduciary with respect to the grantor. If a director, officer or staff member learns of such legacy in a customer’s will, or otherwise, such director, officer or staff member shall promptly report all pertinent facts to Senior Management of the Company. LOANS You may not personally lend to, borrow from, or receive the benefits of a guarantee from or guarantee obligations of, any Company customer, supplier, contractor or any person connected with such entities. In addition, you may not make or approve loans to any entity in which you or a member of your immediate family has a direct or indirect interest, or to a business associate. (“Immediate family” includes your grandparents, parents, step-parents, siblings and step-siblings, children, step-children, grandchildren and step-grandchildren, or in-laws (parents, brothers, sisters, sons and daughters-in-law and their spouses and your spouse. You should disclose such interest and refer any request for credit that you feel may create a conflict of interest to another employee who has no affiliation with the borrower, and disclose to the borrowing customer any of the foregoing relationships by blood or marriage you may have with the referral source. Loans to employees of the Company must meet the same requirements and be on the same terms and conditions as loans granted to non-employees, except as provided by policies approved by the Company’s Board of Directors. CORPORATE OPPORTUNITIES You owe a duty to the Company to advance its legitimate interests. You cannot take any business opportunity you learn of as a result of your employment with the Company or use any Company property for your personal benefit or for the benefit of a family member or business associate, or take any action that might create the appearance of such a benefit. For example, you should not acquire any interest in a company when you know that the Company is or may take steps to acquire an interest in that company. If you learn of a business opportunity that is within the Company’s existing or proposed lines of business, you should inform your immediate supervisor. You may not personally pursue that business opportunity until the Company decides not to pursue it. 8

PROTECTION AND PROPER USE OF COMPANY ASSETS You must strive to preserve and protect the Company’s assets and resources and promote their efficient use. PERSONAL USE OF CORPORATE ASSETS You must use the Company’s property for legitimate business purposes and conduct the Company’s business in a way that furthers the Company’s interests rather than your personal interest. You may not use or take the Company’s equipment, supplies, materials or services, except in the normal course of your employment, without approval of your supervisor. USE OF COMPANY COMPUTERS, SOFTWARE AND EMAIL The Company’s computer resources, which include the electronic mail system, website, electronic applications or “apps,” certain software developed internally by employees of the Company or by independent contractors, and software as to which the Company has purchased certain rights or has licenses, belong to the Company and not to you. You shall abide by all software licensing agreements and copyright laws and shall not bring any software or hardware onto the premises for installation or use on the Company’s computer equipment or change any software, apps or websites, except as otherwise permitted by Company policy or special direction incident to your specific job function. Your use of email, software and the internet must comply with the Company’s email/intranet/internet policies and may be monitored by the Company. In no case may you introduce any malware into, or destroy or damage any Company systems, hardware, software, apps or websites. No employee shall delete, destroy or damage any Company data, except as directed by an authorized officer consistent with the Company’s policies and applicable laws and regulations. PROTECTING CORPORATE ASSETS You have an obligation to safeguard the Company’s assets by making certain our assets, including information, is used to further our business interests. When you use a corporate asset, you must consider whether that use is in the best business interest of the Company. This includes the personal use of Company monies, credit, vehicles, equipment, computers, computer programs, apps, e-mail and customer and supplier information. CONFIDENTIAL AND PROPRIETARY INFORMATION / COMMUNICATIONS WITH THE PUBLIC CONFIDENTIALITY Confidential information includes all material non-public information that might be of use to competitors or harmful to the Company or its customers, if disclosed, or which could influence an investor’s decision to buy, hold or sell by security. The Company owns all information, in any form (including electronic information), that is created or used in its business activities. This information is a valuable asset and the Company has various privacy obligations to our customers and suppliers. The Company expects you to protect it from unauthorized disclosure. This information includes Company accountholders’, customers’, suppliers’, business partners’ and employees’ data. Federal and state law may restrict the use or 9

dissemination of this information and may penalize you if you use or disclose it. You should protect information pertaining to the Company’s competitive position, business strategies and information relating to negotiations with employees or third parties and share it only with employees who need to know it in order to perform their job. Financial information regarding the bank is not to be released to any person unless it has been published in reports to shareholders or otherwise made public by filings in compliance with disclosure regulations. You must maintain the confidentiality of information entrusted to you by the Company, its customers, employees, vendors, consultants and other third parties, except when disclosure is authorized or legally required. You must take all reasonable efforts to safeguard confidential information that is in your possession against inadvertent disclosure and must comply with any non-disclosure obligations imposed on the Company. The Company and its bank subsidiary are periodically examined by one or more state and Federal regulatory agencies. The reports that examiners furnish to the Company are the property of the agency, not of the Company, and are strictly confidential. Information contained in these reports must not be communicated to anyone not connected with the Company. Improper disclosure is subject to criminal penalties. This Confidentiality policy shall not be construed so as to apply to concerted activity that is protected by Section 7 of the National Labor Relations Act. INTELLECTUAL PROPERTY AND PROPRIETARY INFORMATION You must maintain the Company’s intellectual property rights, including the Company’s name, logo, trademarks, patents, copyrights, software, apps and programs, licenses and trade secrets, to preserve and protect their value. All innovations or inventions you create in connection with your employment with the Company or relating to any of the Company’s businesses are for the benefit of and belong solely to the Company. You must inform your supervisor thereof so that the Company can take steps to protect its rights and title in and to these valuable assets. Intellectual property that you create during the course of your employment belongs to the Company. In addition, you must respect the intellectual property rights of others. If you violate other person’s intellectual property rights in connection with your employment with the Company, you and the Company could face substantial liability, including criminal penalties. COMMUNICATING WITH THE MEDIA AND THE PUBLIC Public perceptions of the Company are important to our business, and are directly affected by communications with the media and the public. In addition, the unauthorized disclosure of internal information could create serious legal and financial problems for the Company. Therefore, it is important that any communications with the media or the general public are clear, accurate and consistent with the Company’s philosophy, policies and procedures. Employees should not discuss internal business matters, confidential or proprietary information, or business developments with anyone outside the Company. The CEO and the Co-Presidents are responsible for communicating with the media and the public. If you are contacted by a member of the press or the 10

general public, you should immediately contact your division head or immediate supervisor to make certain that one of these officers is notified. REPORTING VIOLATIONS You must report any violation of this Code, the Company policy or a legal requirement of which you become aware. In reporting suspected violations, we encourage you first to contact your division head, immediate supervisor, or the Human Resources Department, or the Human Resources Department. If you are not comfortable doing so, you may instead report any suspected violation to the Internal Audit Department, using the form found at the end of this policy, mailed to P.O. Box 141896, Coral Gables, Florida 33134, Attn: Internal Audit Department. In addition to the reporting procedures described above, you may report any suspected violations directly to the Audit Committee of the Board of Directors or any member thereof, on an open, confidential or anonymous basis. Reports may be mailed to the address above, but with attention to the Audit Committee of the Board of Directors. Any envelope addressed to the Audit Committee and marked "CONFIDENTIAL", will be forwarded directly to the Chairman of the Audit Committee and will not be opened by the Internal Audit Department. Furthermore, you may report any suspected violations by contacting either the CEO or the Internal Audit Manager or designated members of the Audit Committee directly at their private telephone numbers. The private telephone numbers will be posted in the Human Resources section of the Company’s corporate intranet website. Anonymity and confidentiality cannot be guaranteed, but will be maintained to the extent possible consistent with the Company’s investigation of any reported matters. The Company cannot guarantee anonymity or confidentiality in the event that governmental, regulatory or judicial investigations or proceedings ensue. If you report a possible violation, regardless of the method that you use to make the report, it is important that you provide as much detail as possible, including names, dates, times, locations and the specific conduct in question. Only with sufficient specific information can the Company adequately investigate the report. Your submission of information will be treated in a confidential manner to the extent reasonably possible. Please note, however, that if an investigation by the Company or any governmental, regulatory or self- regulatory authority or third party of the activities you have reported takes place, the Company may have its own reporting obligations, and it may be impossible for the Company to maintain the confidentiality of the existence of the report or the information reported. All complaints or suspected violations regarding accounting, internal accounting controls, auditing or financial reporting matters will be forwarded to the Internal Audit Manager and the Chairman of the Audit Committee. The Internal Audit Manager and/or Chairman of the Audit Committee will assess each complaint and will report complaints relating to material amounts or matters to the full Audit Committee for its review. The Internal Audit Manager will maintain a log of all complaints relating to accounting requirements, internal accounting controls, or auditing matters. This log shall include a description of the complaint, the findings of the Audit Committee, the resolution of the complaint, and any corrective or 11

disciplinary action taken by the Company. Copies of complaints and related documents will be retained in accordance with the Company’s document retention and destruction policy. The Company strives to create an environment where employees feel free to call attention to possible legal or policy violations. We will investigate reported concerns impartially. It is also the Company’s policy to comply with all laws that protect employees against unlawful discrimination or retaliation by anyone at the Company as a result of their lawfully, truthfully and good faith reporting information regarding, or their participating in, investigations involving allegations of corporate fraud or other violations of federal or state law by the Company or its agents. In addition, the Company prohibits retaliation or other types of discrimination for refusal to obey directives that constitute fraud or any other violation of law, rule, regulation, accounting requirements or Company policies. If you believe that you have been subjected to any action that violates this policy, or if you believe another employee has been subjected to any action that violates this policy, you may file a complaint with your division head, immediate supervisor, or the Human Resources Department. If it is determined that you experienced any improper employment action in violation of this policy, corrective action will be taken. INVESTIGATIONS AND ENFORCEMENT Where any doubts exist, interpretation and clarification as to the applicability of this Code to a particular situation should be sought from your immediate supervisor, or the Human Resources Department. Reports of possible violations of this Code will be investigated by the Company through the Code of Conduct and Ethics Committee and other applicable communications and management. If a violation of this Code is substantiated, disciplinary action will be taken, where necessary, up to and including termination of employment. Any officer or director believed to have participated in a possible violation shall not be permitted to participate in any investigation or recommendation for disciplinary action or sanctions. Violations of this Code that may also constitute illegal conduct shall be addressed. This may include making a report to civil or criminal authorities, including bank regulatory authorities, whether through a “suspicious activity report” or otherwise, and, in certain circumstances, making public disclosure in SEC filings or otherwise. The Company may also from time to time conduct reviews to assess compliance with this Code. As part of the Company’s commitment to conducting its business ethically and investigating possible violations of this Code, the Human Resources Department and the Internal Audit Department will help administer and implement this Code. The Code of Conduct and Ethics Committee and/or the Human Resources Department have overall responsibility to: • Receive, collect, review, process, investigate and resolve concerns and reports by employees and others on the matters described in this Code; • Work with legal counsel from time to time to review this Code in connection with current federal, state and local laws and recommend to the Board any updates or improvements to this Code; • As necessary, provide guidance on the meaning and application of this Code. 12

SPECIAL PROVISIONS FOR SENIOR FINANCIAL OFFICERS Senior financial officers hold an important role in corporate governance. The Company’s Board of Directors has established certain ethical standards for its principal executive officer and senior financial officers that are in addition to those applicable to employees under this Code of Conduct and Ethics. These officers include the Company’s Chief Executive Officer, Chief Financial Officer and other principal financial and accounting officers, as well as such officers of Mercantil Bank, N.A. While all employees, officers, and directors are required to adhere to the other provisions of this Code, the professional and ethical conduct of senior financial officers is essential to the proper function and success of the Company. Therefore, the Company’s principal executive officer and senior financial officers must also comply with the additional conduct and ethics standards set forth below. HONESTY AND INTEGRITY The Company’s senior financial officers have a responsibility to act with honesty and integrity and within the parameters of the Company’s policies. Senior financial officers must comply with this Code and these Special Provisions, and have a responsibility to voice concerns if you know or suspect directors, officers or employees are acting contrary to this Code, including these Special Provisions, or other Company policies. COMPLIANCE WITH LAWS The Company strives to ensure all activity on its behalf is in compliance with all applicable laws, rules and regulations. Senior financial officers of the Company must comply with all applicable laws, rules and regulations, whether or not specifically addressed in this Code or in these Special Provisions. CONFLICTS OF INTEREST The Company requires its senior financial and accounting officers to avoid any relationship, activity, or ownership that might create a conflict between their personal interest and the Company’s interest. A “conflict of interest” occurs when a senior financial or accounting officer’s private interests interferes in any way, or even appears to interfere, with the interests of the Company. A conflict of interest can arise when a senior financial officer takes actions or has interests that may interfere with his or her ability to perform his or her job objectively and effectively. Conflicts of interest also arise when a senior financial officer, or a member of a senior financial officer’s family, receives improper personal benefits as a result of his or her position with the Company. The Company’s senior financial and accounting officers owe a duty of loyalty to the Company. The Company’s senior financial officers may not use their positions improperly to profit personally or to assist others in profiting at the Company’s expense. The Company expects its senior financial and accounting officers to avoid situations that might influence their actions or prejudice their judgment in handling Company business, or that may undermine public confidence in the Company through the appearance of a conflict of interest. Senior financial and accounting officers must not become obligated in any way to representatives of firms with which they deal and must not show any preference to third parties based their own interests or the interests of their families, business acquaintances, or other individuals. In addition, they must communicate to the Company’s Audit Committee or the Board of Directors any transaction or relationship that could create a conflict of interest. 13

INTEGRITY AND ACCURACY OF PUBLIC DISCLOSURES The Company’s senior financial and accounting officers must take all reasonable steps to ensure that the disclosures in the reports and documents that the Company files with or submits to the U.S. Securities and Exchange Commission and to the Company’s bank regulatory agencies, as well as its public communications are full, fair, accurate, timely and understandable. In the event that the principal executive officer or a senior financial officer learns that any such report, document or communication does not meet this standard and that the deviation is material, then such officer will review and investigate the deviation, advise the Board of Directors or the appropriate Board committee and, where necessary, revise and correct the relevant report, document or communication. ACCOUNTING TREATMENT Although a particular accounting treatment for one or more of the Company’s operations may be permitted under applicable accounting standards, the principal executive officer and senior financial and accounting officers will not authorize or permit the use of such an accounting treatment with the intent of distorting or concealing the Company’s true financial condition. DISTRIBUTION OF THIS CODE The Personnel Department shall distribute this Code electronically to every employee within 60 days after approval by the Board of Directors, to every employee at the time of employment, and to every employee each calendar year thereafter upon amendment, if any, and re-approval by the Board of Directors. A copy of this Code shall be posted on the Company’s website. 14

Certification and Acknowledgement of Receipt of Code of Conduct and Ethics I certify that I have received the Code of Conduct and Ethics of Mercantil Bank Holding Corporation (the “Company”) applicable to the Company, its subsidiaries and all their respective employees. I have read or agree to read the information contained within this Code of Conduct and Ethics. I agree to comply with the Code of Conduct and Ethics and the Company’s other policies and procedures and understand that compliance with these policies is a condition of my continued employment with the Company. I understand that this Code of Conduct and Ethics does not create any contractual employment rights of any kind between the Company and myself. I also understand that violation of this Code of Conduct and Ethics may lead to disciplinary action up to and including termination of my employment with the Company. Signature: ________________________________________ Name (Print): _____________________________________ Department: ______________________________________ Date: ____________________________________________

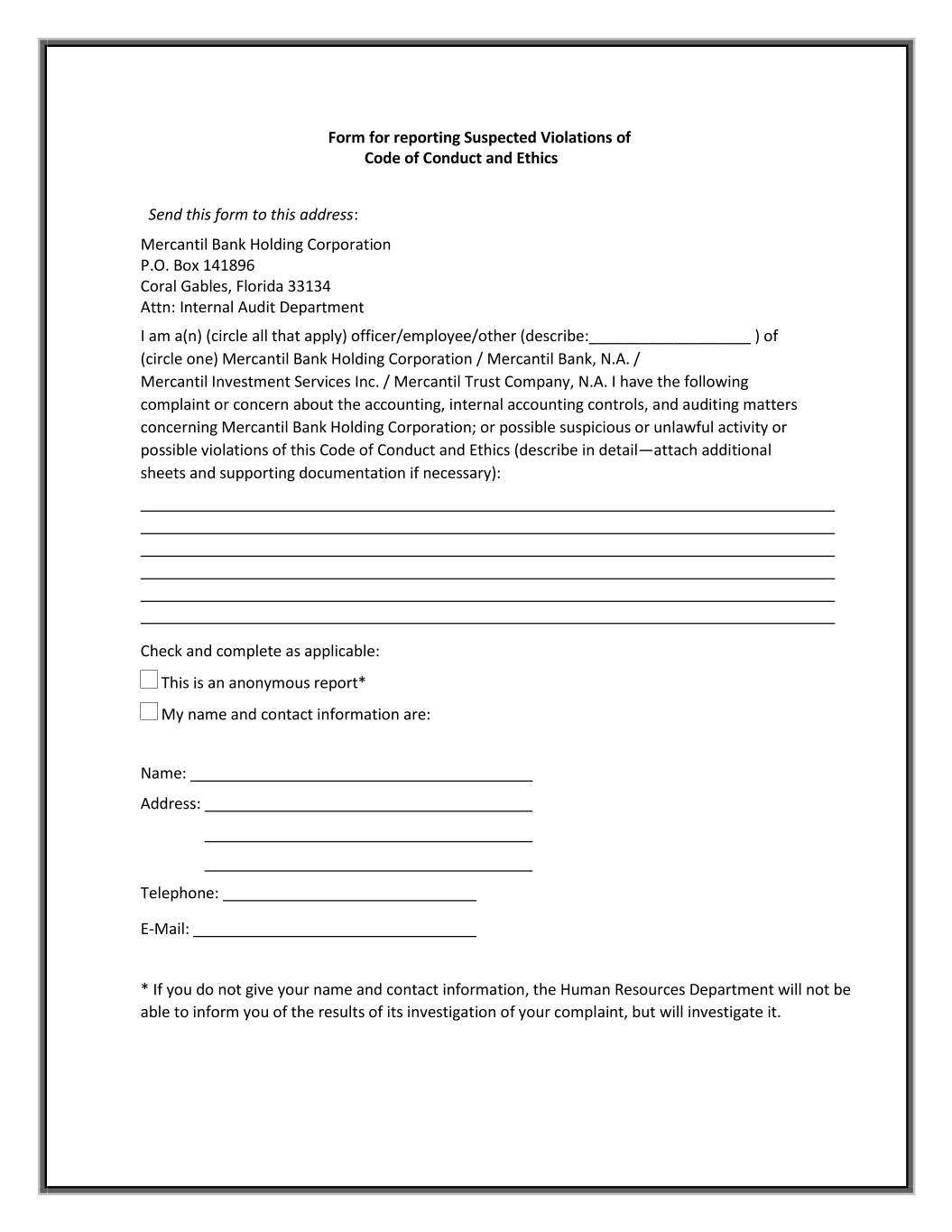

Form for reporting Suspected Violations of Code of Conduct and Ethics Send this form to this address: Mercantil Bank Holding Corporation P.O. Box 141896 Coral Gables, Florida 33134 Attn: Internal Audit Department I am a(n) (circle all that apply) officer/employee/other (describe:___________________ ) of (circle one) Mercantil Bank Holding Corporation / Mercantil Bank, N.A. / Mercantil Investment Services Inc. / Mercantil Trust Company, N.A. I have the following complaint or concern about the accounting, internal accounting controls, and auditing matters concerning Mercantil Bank Holding Corporation; or possible suspicious or unlawful activity or possible violations of this Code of Conduct and Ethics (describe in detail—attach additional sheets and supporting documentation if necessary): Check and complete as applicable: This is an anonymous report* My name and contact information are: Name: Address: Telephone: E-Mail: * If you do not give your name and contact information, the Human Resources Department will not be able to inform you of the results of its investigation of your complaint, but will investigate it.