Investor Presentation As of March 31, 2019

2 Important Notices and Disclaimers This presentation contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, including, without limitation, future financial and operating results; costs and revenues; economic conditions generally and in our markets; loan demand; mortgage lending activity; changes in the mix of our earning assets and our deposits and wholesale liabilities; net interest margin; yields on earning assets; interest rates (generally and those applicable to our assets and liabilities); credit quality, including loan performance, nonperforming assets, provisions for loan losses, charge-offs, other-than-temporary impairments and collateral values; market trends; and customer preferences, as well as statements with respect to our objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlook” and other similar words and expressions of the future. Forward-looking statements, including those as to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk Factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2018, our quarterly report on Form 10-Q for the period ended March 31, 2019, and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. In addition, this presentation and certain information management may discuss in connection with this presentation references non-GAAP financial measures (i.e. Adjusted Net Income, Adjusted Net Income Before Income Tax, Adjusted Net Income per Share (Basic and Diluted), Adjusted Noninterest Income, Adjusted Noninterest Expenses, Adjusted Return on Assets (ROA), Adjusted ROATCE, Adjusted Efficiency Ratio). These non-GAAP financial measures exclude certain income, expenses and tax benefits. Reconciliations of non-GAAP financial measures to their corresponding GAAP measures are included herein in Appendix 2. Such non-GAAP financial measures should not be considered in isolation or as a substitute for financial measures presented herein calculated in accordance with GAAP.

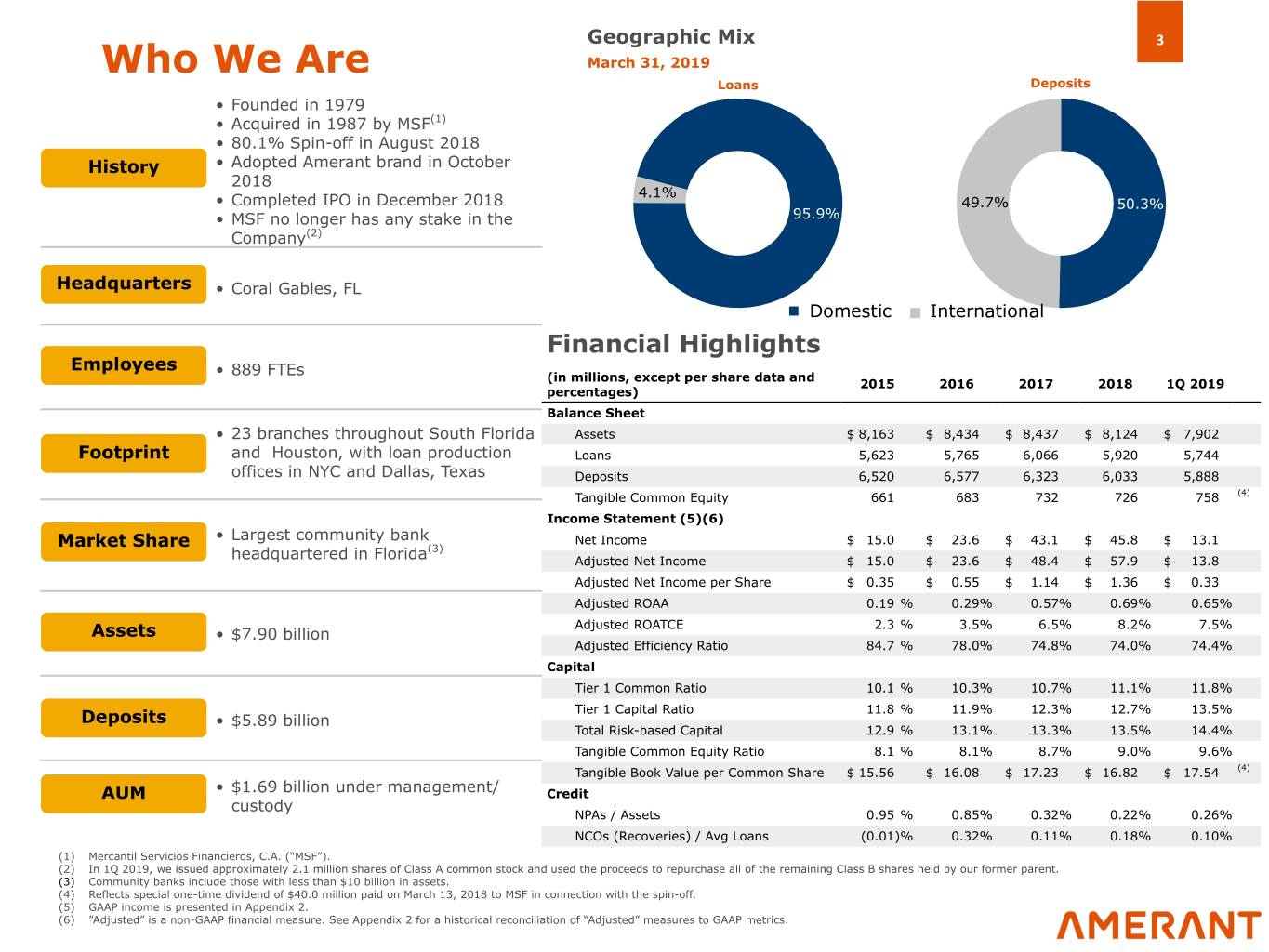

Geographic Mix 3 Who We Are March 31, 2019 Loans Deposits • Founded in 1979 • Acquired in 1987 by MSF(1) • 80.1% Spin-off in August 2018 History • Adopted Amerant brand in October 2018 4.1% • Completed IPO in December 2018 49.7% 50.3% • MSF no longer has any stake in the 95.9% Company(2) Headquarters • Coral Gables, FL § Domestic § International Financial Highlights Employees • 889 FTEs (in millions, except per share data and 2015 2016 2017 2018 1Q 2019 percentages) Balance Sheet • 23 branches throughout South Florida Assets $ 8,163 $ 8,434 $ 8,437 $ 8,124 $ 7,902 Footprint and Houston, with loan production Loans 5,623 5,765 6,066 5,920 5,744 offices in NYC and Dallas, Texas Deposits 6,520 6,577 6,323 6,033 5,888 Tangible Common Equity 661 683 732 726 758 (4) Income Statement (5)(6) • Largest community bank Net Income $ 15.0 $ 23.6 $ 43.1 $ 45.8 $ 13.1 Market Share (3) headquartered in Florida Adjusted Net Income $ 15.0 $ 23.6 $ 48.4 $ 57.9 $ 13.8 Adjusted Net Income per Share $ 0.35 $ 0.55 $ 1.14 $ 1.36 $ 0.33 Adjusted ROAA 0.19 % 0.29% 0.57% 0.69% 0.65% Adjusted ROATCE 2.3 % 3.5% 6.5% 8.2% 7.5% Assets • $7.90 billion Adjusted Efficiency Ratio 84.7 % 78.0% 74.8% 74.0% 74.4% Capital Tier 1 Common Ratio 10.1 % 10.3% 10.7% 11.1% 11.8% Tier 1 Capital Ratio 11.8 % 11.9% 12.3% 12.7% 13.5% Deposits • $5.89 billion Total Risk-based Capital 12.9 % 13.1% 13.3% 13.5% 14.4% Tangible Common Equity Ratio 8.1 % 8.1% 8.7% 9.0% 9.6% Tangible Book Value per Common Share $ 15.56 $ 16.08 $ 17.23 $ 16.82 $ 17.54 (4) AUM • $1.69 billion under management/ Credit custody NPAs / Assets 0.95 % 0.85% 0.32% 0.22% 0.26% NCOs (Recoveries) / Avg Loans (0.01)% 0.32% 0.11% 0.18% 0.10% (1) Mercantil Servicios Financieros, C.A. (“MSF”). (2) In 1Q 2019, we issued approximately 2.1 million shares of Class A common stock and used the proceeds to repurchase all of the remaining Class B shares held by our former parent. (3) Community banks include those with less than $10 billion in assets. (4) Reflects special one-time dividend of $40.0 million paid on March 13, 2018 to MSF in connection with the spin-off. (5) GAAP income is presented in Appendix 2. (6) ”Adjusted” is a non-GAAP financial measure. See Appendix 2 for a historical reconciliation of “Adjusted” measures to GAAP metrics.

Investment Opportunity Highlights 4 Established Strong and Well-Positioned Significant Fee Pathway to Franchise in Diverse Deposit Loan Income Strong Attractive Portfolio Markets Base Platform Profitability • Long history with • Combination of • Loan book well- • Wealth • Recent strong reputation domestic and low- diversified across management and independence allows and deep client cost international various asset brokerage platform for clearer path to relationships deposits provides a classes and markets with accompanying ROA/ROE stable funding source trust and private improvement • Presence in high- • Outstanding credit banking capabilities through efficiency, growth markets of • Domestic deposit performance due to fee income, asset Florida, Texas, and base experiencing disciplined • Approximately 19% sensitivity, and New York significant growth underwriting culture noninterest income/ other levers (approximately 12% total operating • Seasoned CAGR since 2015) • High level of income • Building on management team relationship lending improving financial and board with long • Low cost, loyal performance as part tenure international deposit of a multi-year shift customers (0.37% towards increasing • Largest community average cost in 1Q core domestic bank headquartered 2019) are a strategic growth and in Florida(1) and one advantage profitability of the leading banks serving the Hispanic Community (1) Community banks include those with less than $10 billion in assets.

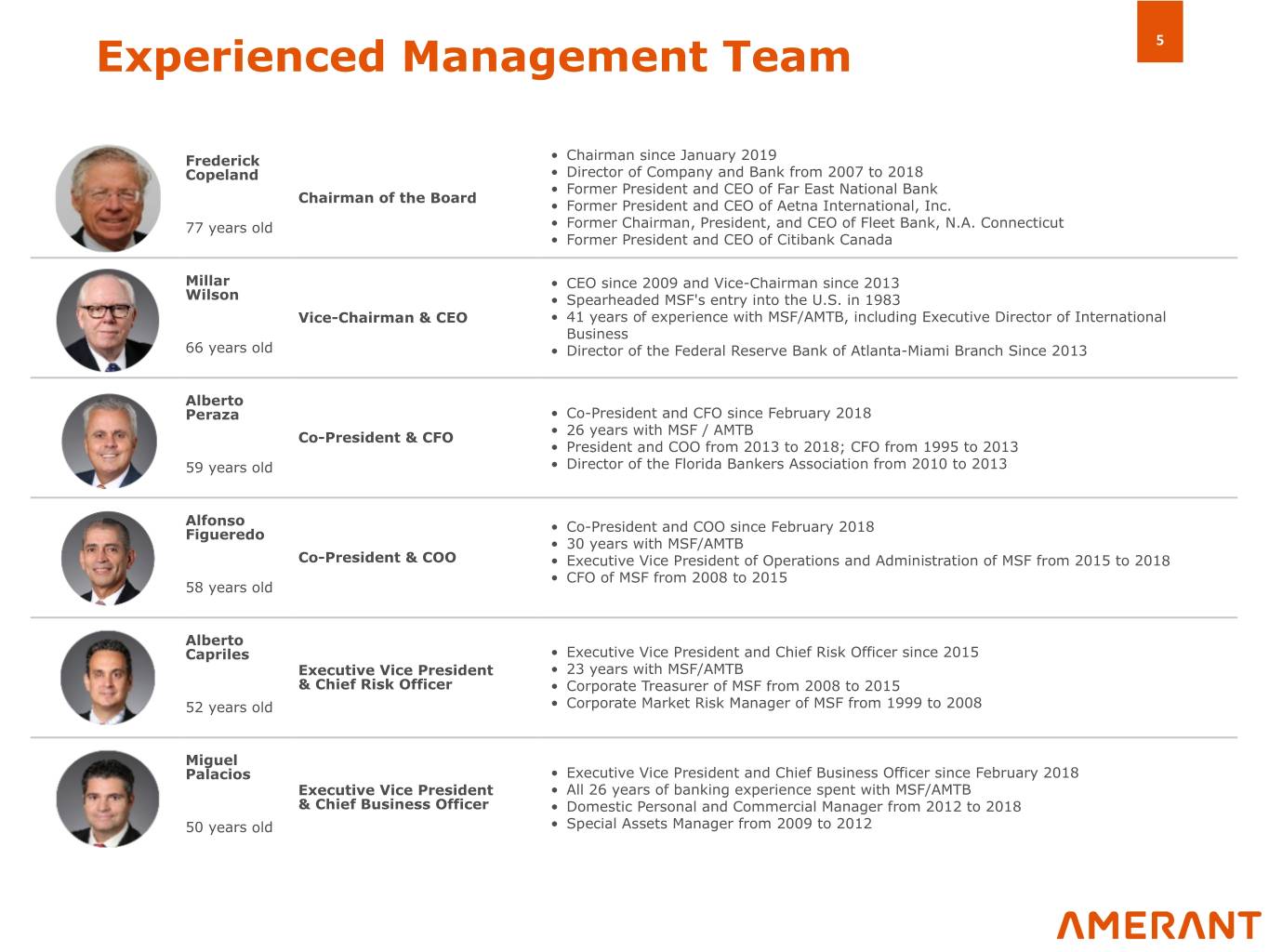

Experienced Management Team 5 Frederick • Chairman since January 2019 Copeland • Director of Company and Bank from 2007 to 2018 • Former President and CEO of Far East National Bank Chairman of the Board • Former President and CEO of Aetna International, Inc. 77 years old • Former Chairman, President, and CEO of Fleet Bank, N.A. Connecticut • Former President and CEO of Citibank Canada Millar • CEO since 2009 and Vice-Chairman since 2013 Wilson • Spearheaded MSF's entry into the U.S. in 1983 Vice-Chairman & CEO • 41 years of experience with MSF/AMTB, including Executive Director of International Business 66 years old • Director of the Federal Reserve Bank of Atlanta-Miami Branch Since 2013 Alberto Peraza • Co-President and CFO since February 2018 • 26 years with MSF / AMTB Co-President & CFO • President and COO from 2013 to 2018; CFO from 1995 to 2013 59 years old • Director of the Florida Bankers Association from 2010 to 2013 Alfonso • Co-President and COO since February 2018 Figueredo • 30 years with MSF/AMTB Co-President & COO • Executive Vice President of Operations and Administration of MSF from 2015 to 2018 • CFO of MSF from 2008 to 2015 58 years old Alberto Capriles • Executive Vice President and Chief Risk Officer since 2015 Executive Vice President • 23 years with MSF/AMTB & Chief Risk Officer • Corporate Treasurer of MSF from 2008 to 2015 52 years old • Corporate Market Risk Manager of MSF from 1999 to 2008 Miguel Palacios • Executive Vice President and Chief Business Officer since February 2018 Executive Vice President • All 26 years of banking experience spent with MSF/AMTB & Chief Business Officer • Domestic Personal and Commercial Manager from 2012 to 2018 50 years old • Special Assets Manager from 2009 to 2012

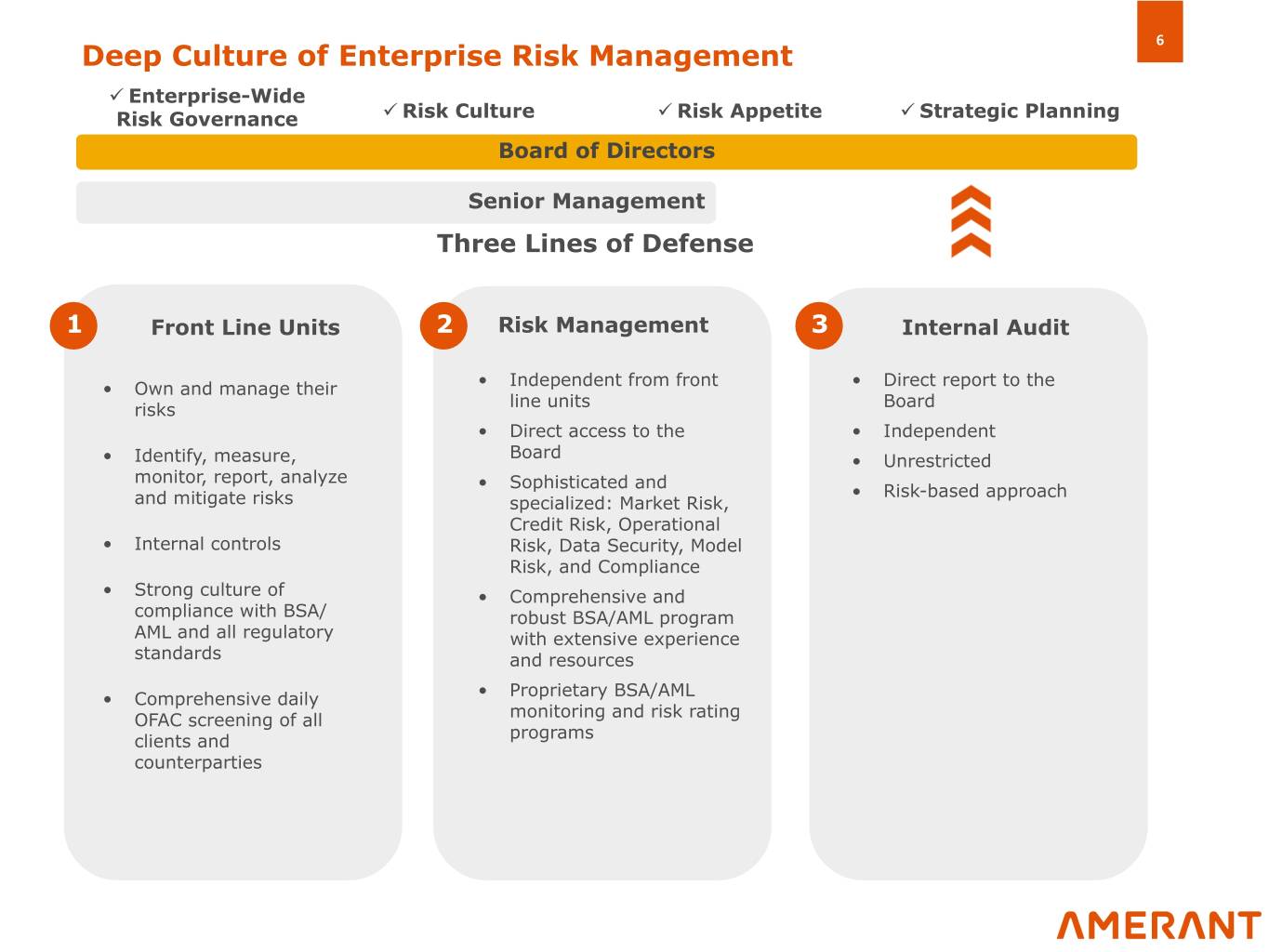

6 Deep Culture of Enterprise Risk Management ü Enterprise-Wide ü ü ü Risk Governance Risk Culture Risk Appetite Strategic Planning Board of Directors Senior Management Three Lines of Defense 1 Front Line Units 2 Risk Management 3 Internal Audit • Own and manage their • Independent from front • Direct report to the risks line units Board • Direct access to the • Independent • Identify, measure, Board • Unrestricted monitor, report, analyze • Sophisticated and • Risk-based approach and mitigate risks specialized: Market Risk, Credit Risk, Operational • Internal controls Risk, Data Security, Model Risk, and Compliance • Strong culture of • Comprehensive and compliance with BSA/ robust BSA/AML program AML and all regulatory with extensive experience standards and resources • Comprehensive daily • Proprietary BSA/AML OFAC screening of all monitoring and risk rating clients and programs counterparties

Our New Brand 7 Meant for You: A Different Kind of Bank Our new purpose We are evolving, just like you All that we do, our attitude and behaviors, aim We are renewing our commitment to you by at our ultimate goal: offering the closest, most aiming to keep growing and making possible a personal and exceptional service to our brighter future for you, our investors, our customers. communities, and our people. We have developed strong relationships for over 40 years and we are excited to create new ones, always adapting to your lives and specific needs, in a dynamic and positive way. Everything we do is designed with our stakeholders in mind

Market Strategy 8 Our strategy is to operate and expand in high-growth, diverse economies where we can build from our heritage serving the Hispanic community Target markets have: Miami-Dade MSA • Major industry sectors of trade, tourism, services, • Substantial domestic deposit manufacturing, education, real estate growth potential • Unemployment rate of 3.3% as of February 2019 • Ranked #1 MSA for startup activity by the 2017 Kauffman Index among the 39 largest MSAs • Diversified industries, requiring high-quality loans Houston MSA • Population growth, and thus a • Major industry sectors of health care, retail, oil/ larger number of potential gas, travel, and services customers • Unemployment rate of 4.2% as of February 2019 • Home to the world’s largest medical complex. Ranks #2 in manufacturing GDP nationwide • Customers that require more than one of our banking services NYC MSA • Existing, significant Hispanic • Major industry sectors of education, health care, communities that value our tourism, financial services, and professional / business services bilingual employees and services • Unemployment rate of 4.3% as of February 2019 • MSA has #1 GDP in the nation Our markets are diverse with growing demographics and industry Sources: S&P Global Market Intelligence. US Bureau of Labor Statistics. Greater Houston Partnership (www.Houston.org). Business Facilities’ 2018 Metro Rankings Report. US Bureau of Economic Analysis. Center for Governmental Research. Company filings.

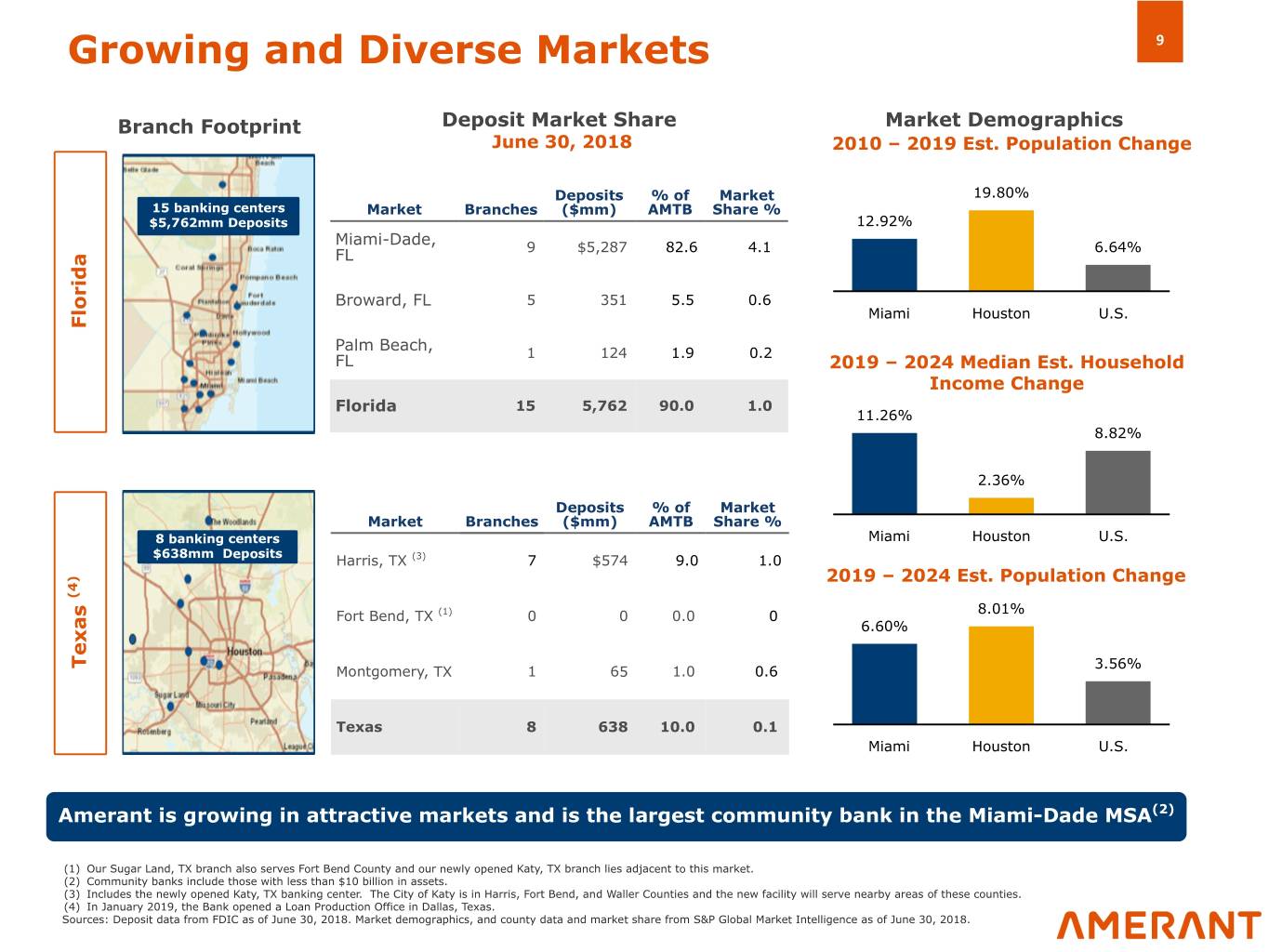

Growing and Diverse Markets 9 Branch Footprint Deposit Market Share Market Demographics June 30, 2018 2010 – 2019 Est. Population Change Deposits % of Market 19.80% 15 banking centers Market Branches ($mm) AMTB Share % $5,762mm Deposits 12.92% Miami-Dade, 9 $5,287 82.6 4.1 6.64% FL Broward, FL 5 351 5.5 0.6 Miami Houston U.S. Florida Palm Beach, 1 124 1.9 0.2 FL 2019 – 2024 Median Est. Household Income Change Florida 15 5,762 90.0 1.0 11.26% 8.82% 2.36% Deposits % of Market Market Branches ($mm) AMTB Share % 8 banking centers Miami Houston U.S. $638mm Deposits Harris, TX (3) 7 $574 9.0 1.0 2019 – 2024 Est. Population Change (4) (1) 8.01% Fort Bend, TX 0 0 0.0 0 6.60% Texas 3.56% Montgomery, TX 1 65 1.0 0.6 Texas 8 638 10.0 0.1 Miami Houston U.S. Amerant is growing in attractive markets and is the largest community bank in the Miami-Dade MSA(2) (1) Our Sugar Land, TX branch also serves Fort Bend County and our newly opened Katy, TX branch lies adjacent to this market. (2) Community banks include those with less than $10 billion in assets. (3) Includes the newly opened Katy, TX banking center. The City of Katy is in Harris, Fort Bend, and Waller Counties and the new facility will serve nearby areas of these counties. (4) In January 2019, the Bank opened a Loan Production Office in Dallas, Texas. Sources: Deposit data from FDIC as of June 30, 2018. Market demographics, and county data and market share from S&P Global Market Intelligence as of June 30, 2018.

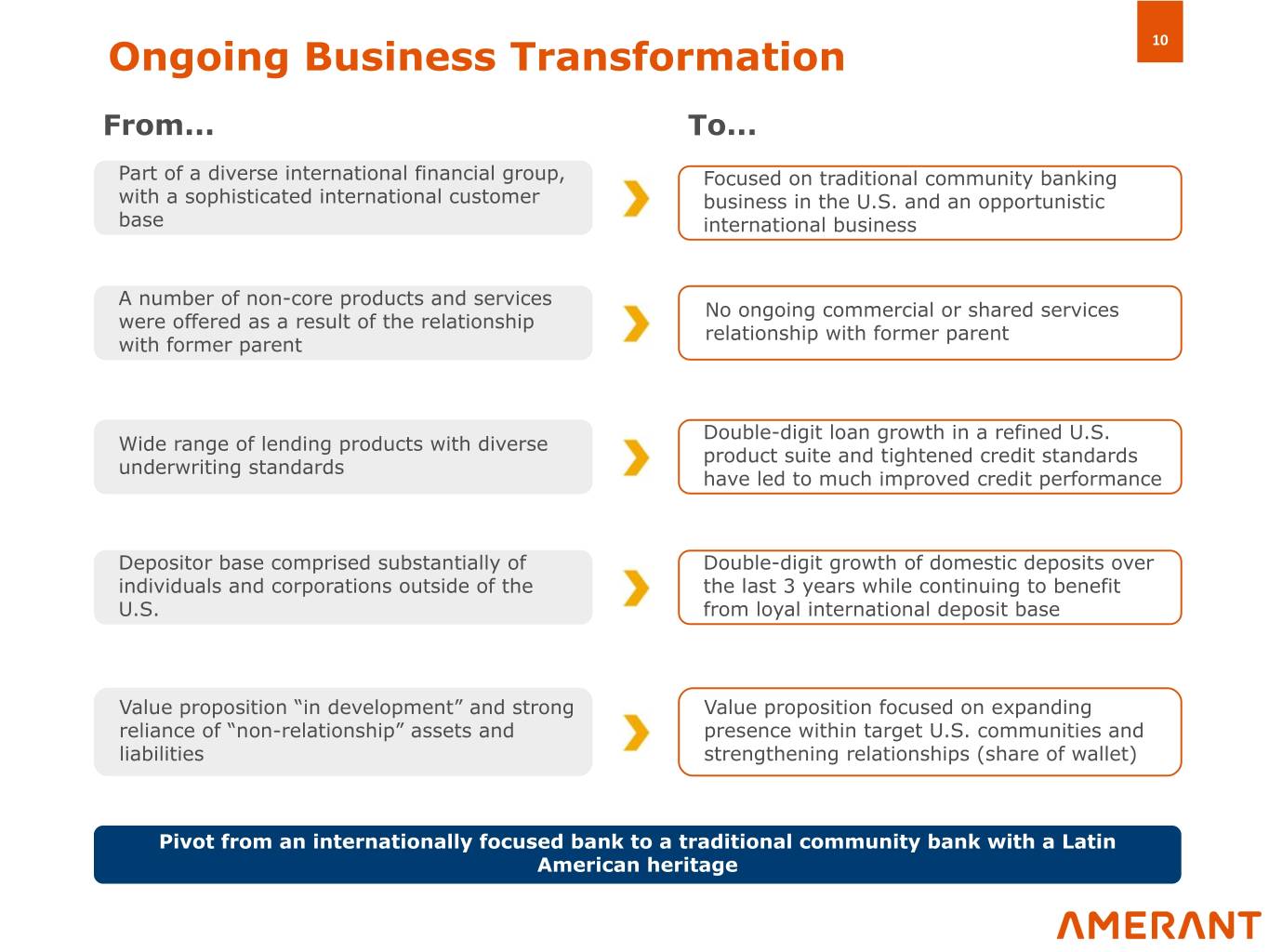

Ongoing Business Transformation 10 From... To... Part of a diverse international financial group, Focused on traditional community banking with a sophisticated international customer business in the U.S. and an opportunistic base international business A number of non-core products and services No ongoing commercial or shared services were offered as a result of the relationship relationship with former parent with former parent Double-digit loan growth in a refined U.S. Wide range of lending products with diverse product suite and tightened credit standards underwriting standards have led to much improved credit performance Depositor base comprised substantially of Double-digit growth of domestic deposits over individuals and corporations outside of the the last 3 years while continuing to benefit U.S. from loyal international deposit base Value proposition “in development” and strong Value proposition focused on expanding reliance of “non-relationship” assets and presence within target U.S. communities and liabilities strengthening relationships (share of wallet) Pivot from an internationally focused bank to a traditional community bank with a Latin American heritage

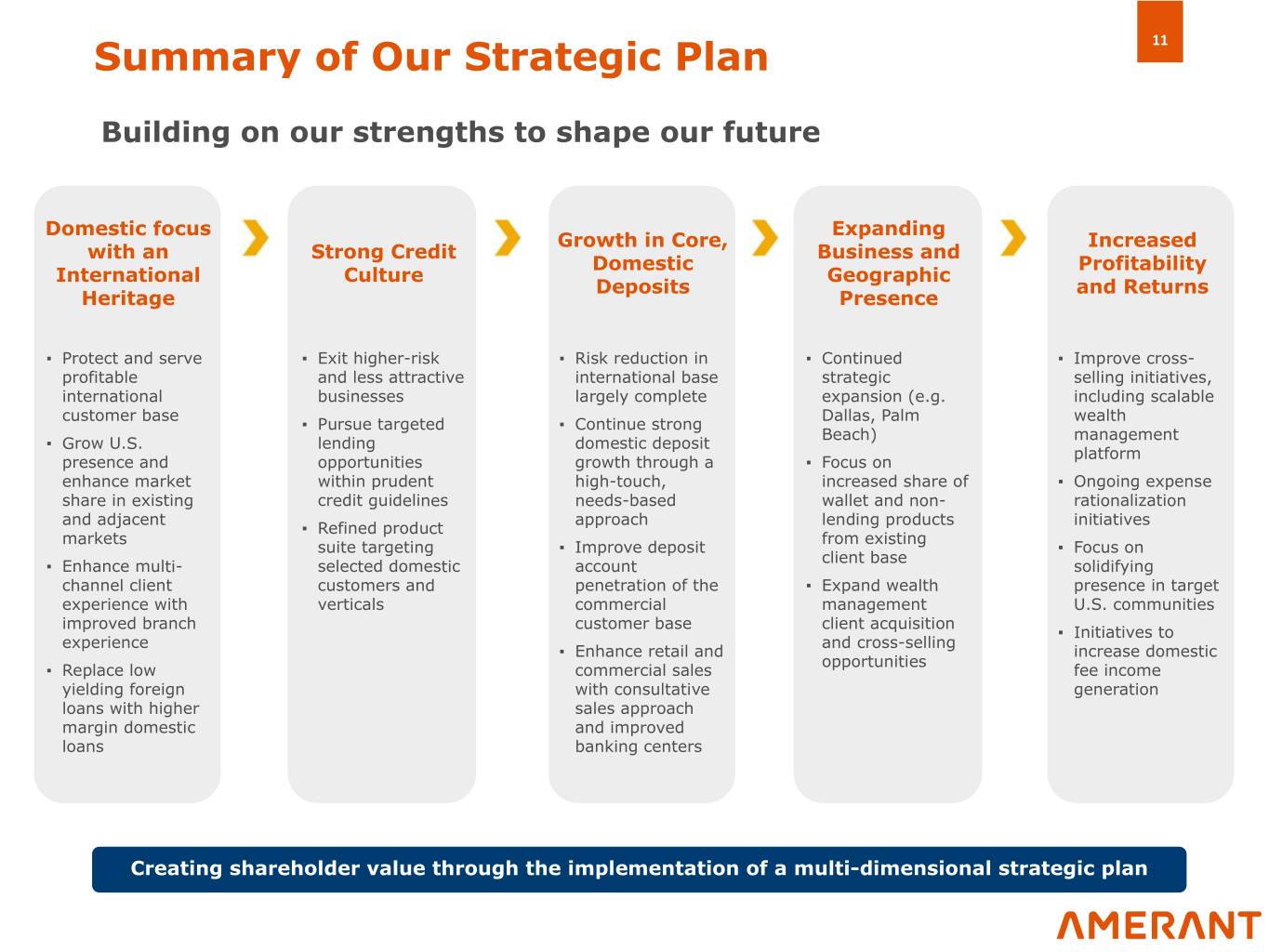

Summary of Our Strategic Plan 11 Building on our strengths to shape our future Domestic focus Expanding Growth in Core, Increased with an Strong Credit Business and Domestic Profitability International Culture Geographic Deposits and Returns Heritage Presence ▪ Protect and serve ▪ Exit higher-risk ▪ Risk reduction in ▪ Continued ▪ Improve cross- profitable and less attractive international base strategic selling initiatives, international businesses largely complete expansion (e.g. including scalable customer base Dallas, Palm wealth ▪ Pursue targeted ▪ Continue strong Beach) management ▪ Grow U.S. lending domestic deposit platform presence and opportunities growth through a ▪ Focus on enhance market within prudent high-touch, increased share of ▪ Ongoing expense share in existing credit guidelines needs-based wallet and non- rationalization and adjacent approach lending products initiatives ▪ Refined product markets from existing suite targeting ▪ Improve deposit ▪ Focus on client base ▪ Enhance multi- selected domestic account solidifying channel client customers and penetration of the ▪ Expand wealth presence in target experience with verticals commercial management U.S. communities improved branch customer base client acquisition ▪ Initiatives to experience and cross-selling ▪ Enhance retail and increase domestic opportunities ▪ Replace low commercial sales fee income yielding foreign with consultative generation loans with higher sales approach margin domestic and improved loans banking centers Creating shareholder value through the implementation of a multi-dimensional strategic plan

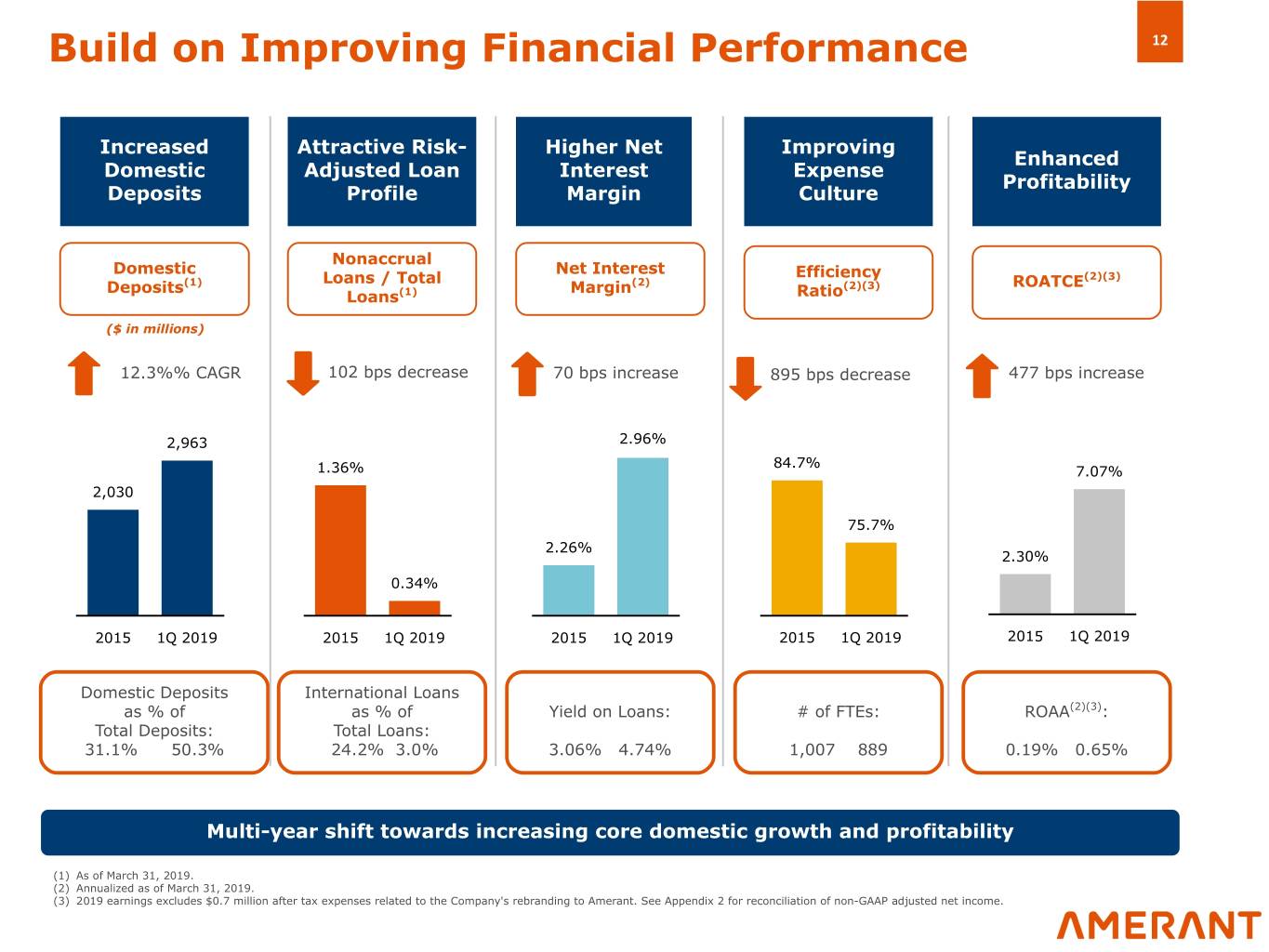

Build on Improving Financial Performance 12 Increased Attractive Risk- Higher Net Improving Enhanced Domestic Adjusted Loan Interest Expense Profitability Deposits Profile Margin Culture Nonaccrual Domestic Net Interest Loans / Total Efficiency (2)(3) Deposits(1) Margin(2) (2)(3) ROATCE Loans(1) Ratio ($ in millions) 12.3%% CAGR 102 bps decrease 70 bps increase 895 bps decrease 477 bps increase 2,963 2.96% 84.7% 1.36% 7.07% 2,030 75.7% 2.26% 2.30% 0.34% 2015 1Q 2019 2015 1Q 2019 2015 1Q 2019 2015 1Q 2019 2015 1Q 2019 Domestic Deposits International Loans as % of as % of Yield on Loans: # of FTEs: ROAA(2)(3): Total Deposits: Total Loans: 31.1% 50.3% 24.2% 3.0% 3.06% 4.74% 1,007 889 0.19% 0.65% Multi-year shift towards increasing core domestic growth and profitability (1) As of March 31, 2019. (2) Annualized as of March 31, 2019. (3) 2019 earnings excludes $0.7 million after tax expenses related to the Company's rebranding to Amerant. See Appendix 2 for reconciliation of non-GAAP adjusted net income.

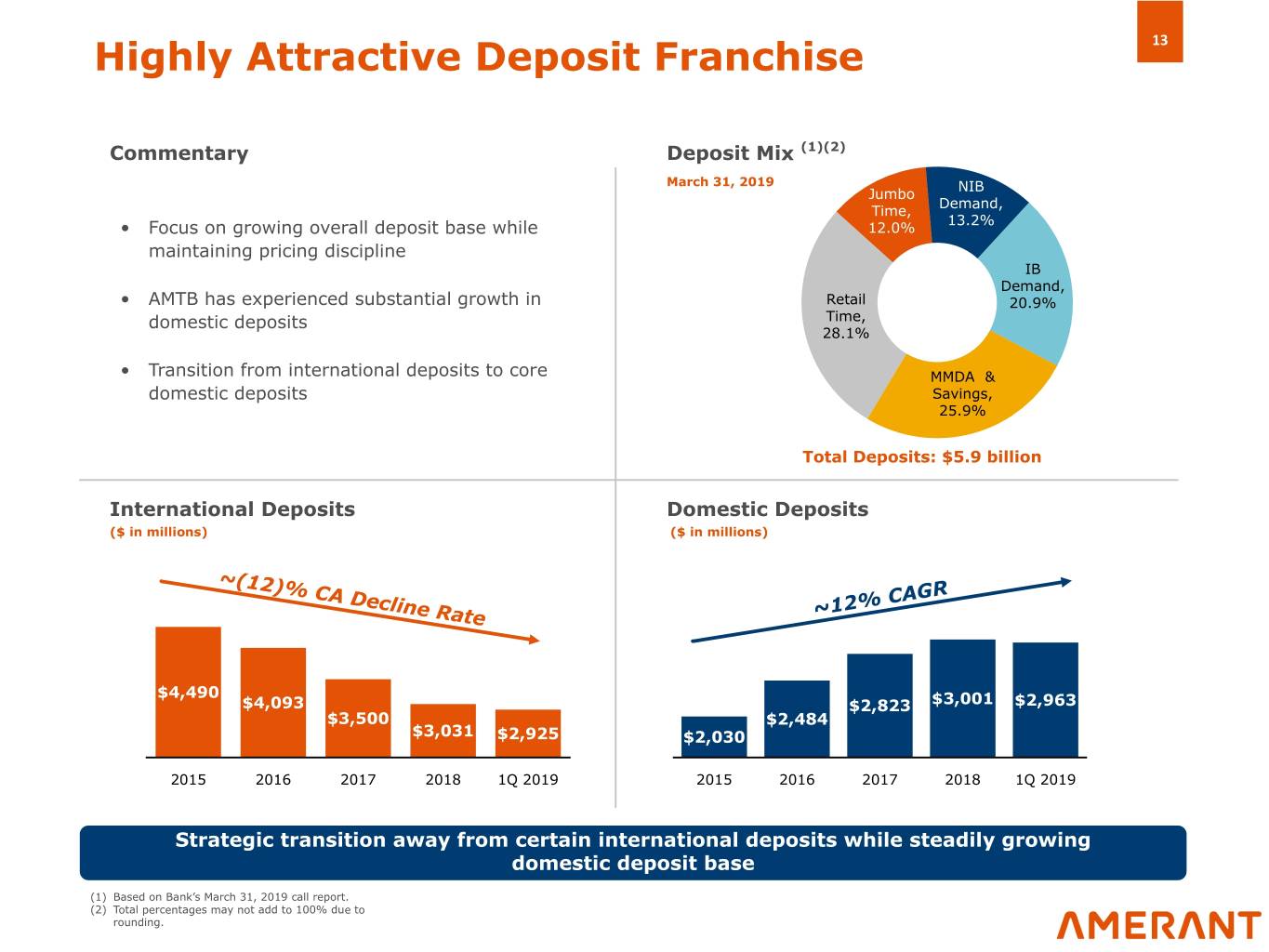

Highly Attractive Deposit Franchise 13 Commentary Deposit Mix (1)(2) March 31, 2019 NIB Jumbo Demand, Time, 13.2% • Focus on growing overall deposit base while 12.0% maintaining pricing discipline IB Demand, • AMTB has experienced substantial growth in Retail 20.9% domestic deposits Time, 28.1% • Transition from international deposits to core MMDA & domestic deposits Savings, 25.9% Total Deposits: $5.9 billion International Deposits Domestic Deposits ($ in millions) ($ in millions) ~(12)% CA Decline Rate CAGR ~12% $4,490 $4,093 $2,823 $3,001 $2,963 $3,500 $2,484 $3,031 $2,925 $2,030 2015 2016 2017 2018 1Q 2019 2015 2016 2017 2018 1Q 2019 Strategic transition away from certain international deposits while steadily growing domestic deposit base (1) Based on Bank’s March 31, 2019 call report. (2) Total percentages may not add to 100% due to rounding.

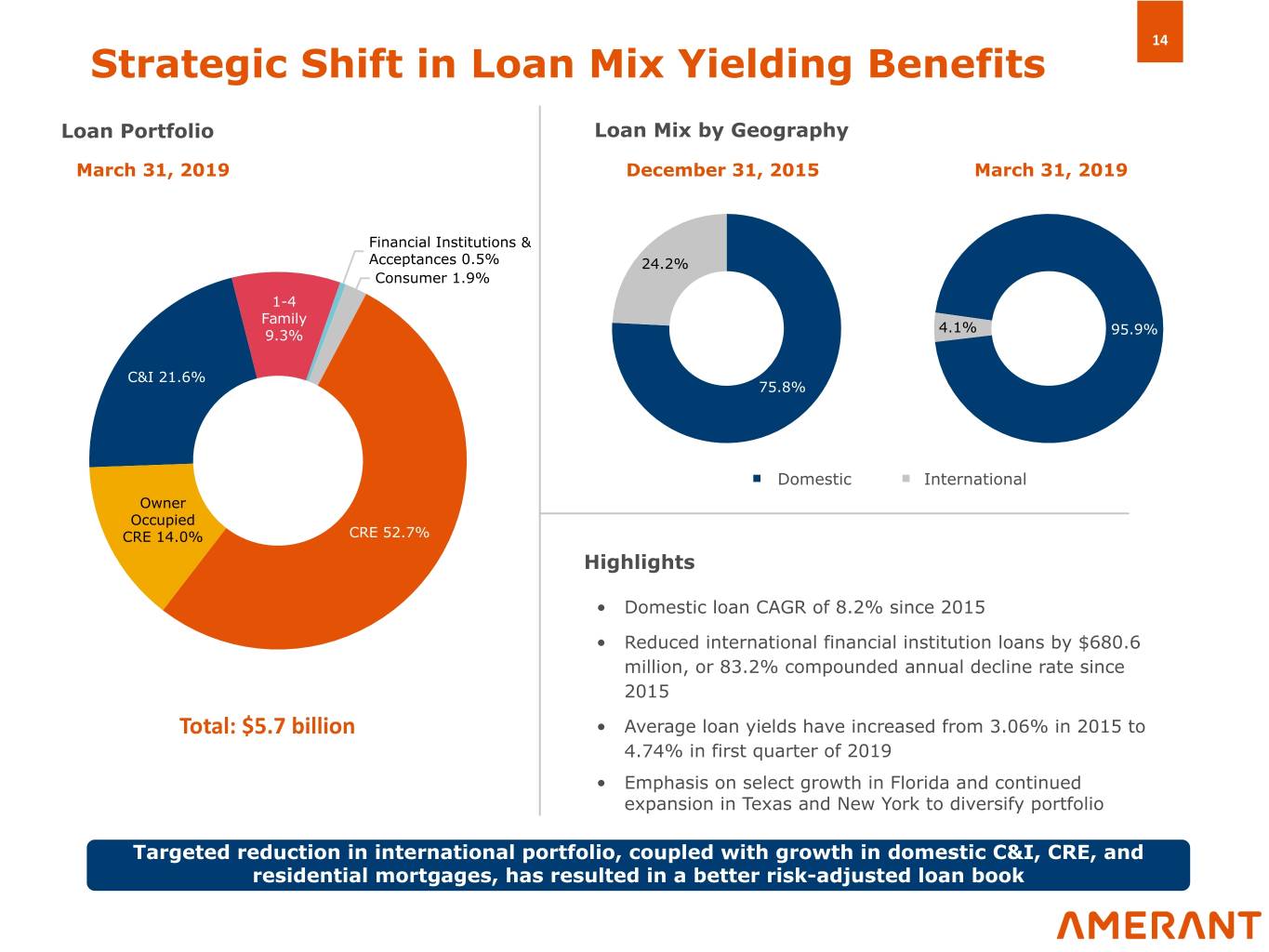

14 Strategic Shift in Loan Mix Yielding Benefits Loan Portfolio Loan Mix by Geography March 31, 2019 December 31, 2015 March 31, 2019 Financial Institutions & Acceptances 0.5% 24.2% Consumer 1.9% 1-4 Family 4.1% 9.3% 95.9% C&I 21.6% 75.8% § Domestic § International Owner Occupied CRE 14.0% CRE 52.7% Highlights • Domestic loan CAGR of 8.2% since 2015 • Reduced international financial institution loans by $680.6 million, or 83.2% compounded annual decline rate since 2015 Total: $5.7 billion • Average loan yields have increased from 3.06% in 2015 to 4.74% in first quarter of 2019 • Emphasis on select growth in Florida and continued expansion in Texas and New York to diversify portfolio Targeted reduction in international portfolio, coupled with growth in domestic C&I, CRE, and residential mortgages, has resulted in a better risk-adjusted loan book

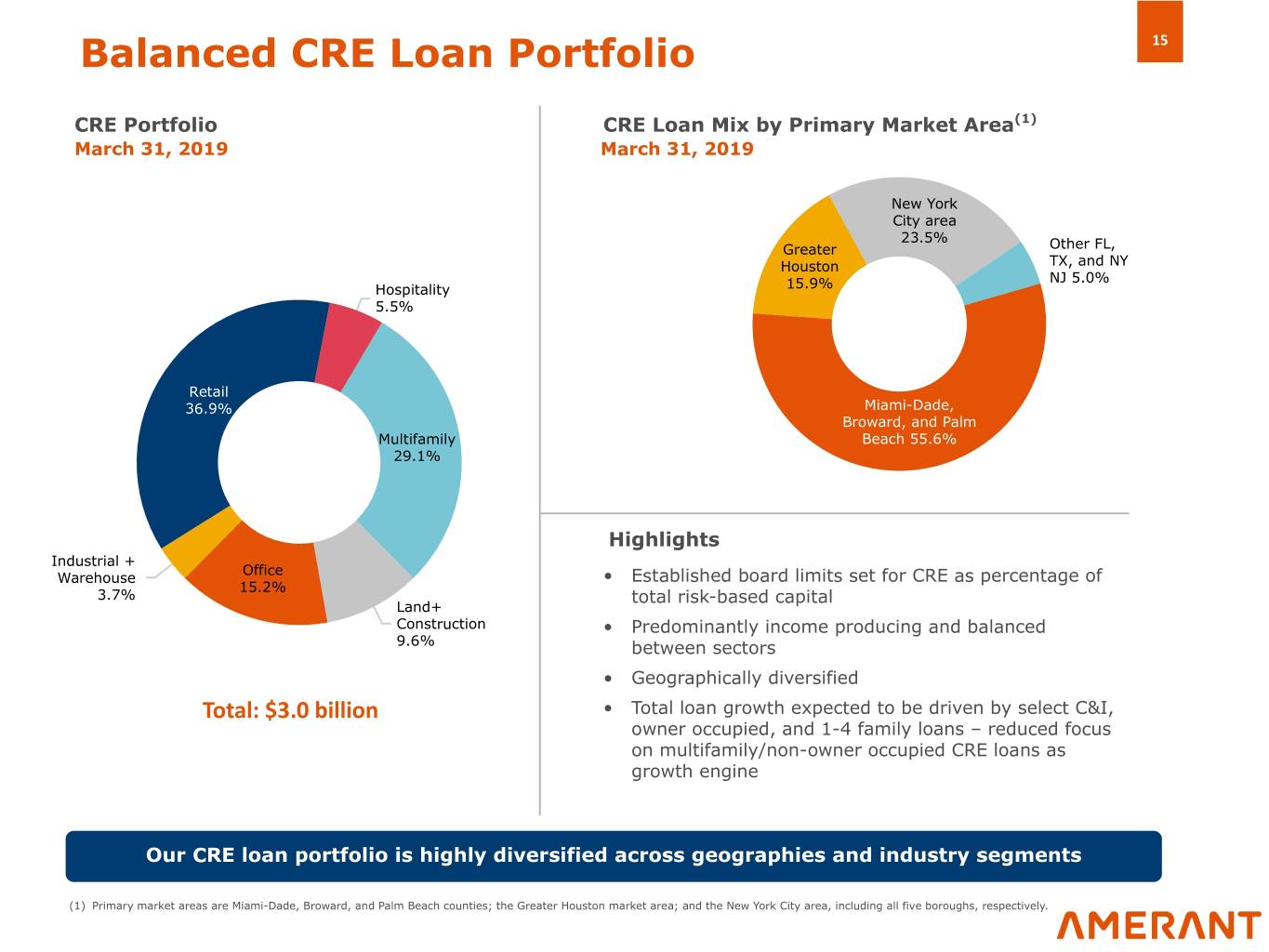

Balanced CRE Loan Portfolio 15 CRE Portfolio CRE Loan Mix by Primary Market Area(1) March 31, 2019 March 31, 2019 New York City area 23.5% Greater Other FL, Houston TX, and NY/ NJ 5.0% Hospitality 15.9% 5.5% Retail 36.9% Miami-Dade, Broward, and Palm Multifamily Beach 55.6% 29.1% Highlights Industrial + Office Warehouse • Established board limits set for CRE as percentage of 15.2% 3.7% total risk-based capital Land+ Construction • Predominantly income producing and balanced 9.6% between sectors • Geographically diversified Total: $3.0 billion • Total loan growth expected to be driven by select C&I, owner occupied, and 1-4 family loans – reduced focus on multifamily/non-owner occupied CRE loans as growth engine Our CRE loan portfolio is highly diversified across geographies and industry segments (1) Primary market areas are Miami-Dade, Broward, and Palm Beach counties; the Greater Houston market area; and the New York City area, including all five boroughs, respectively.

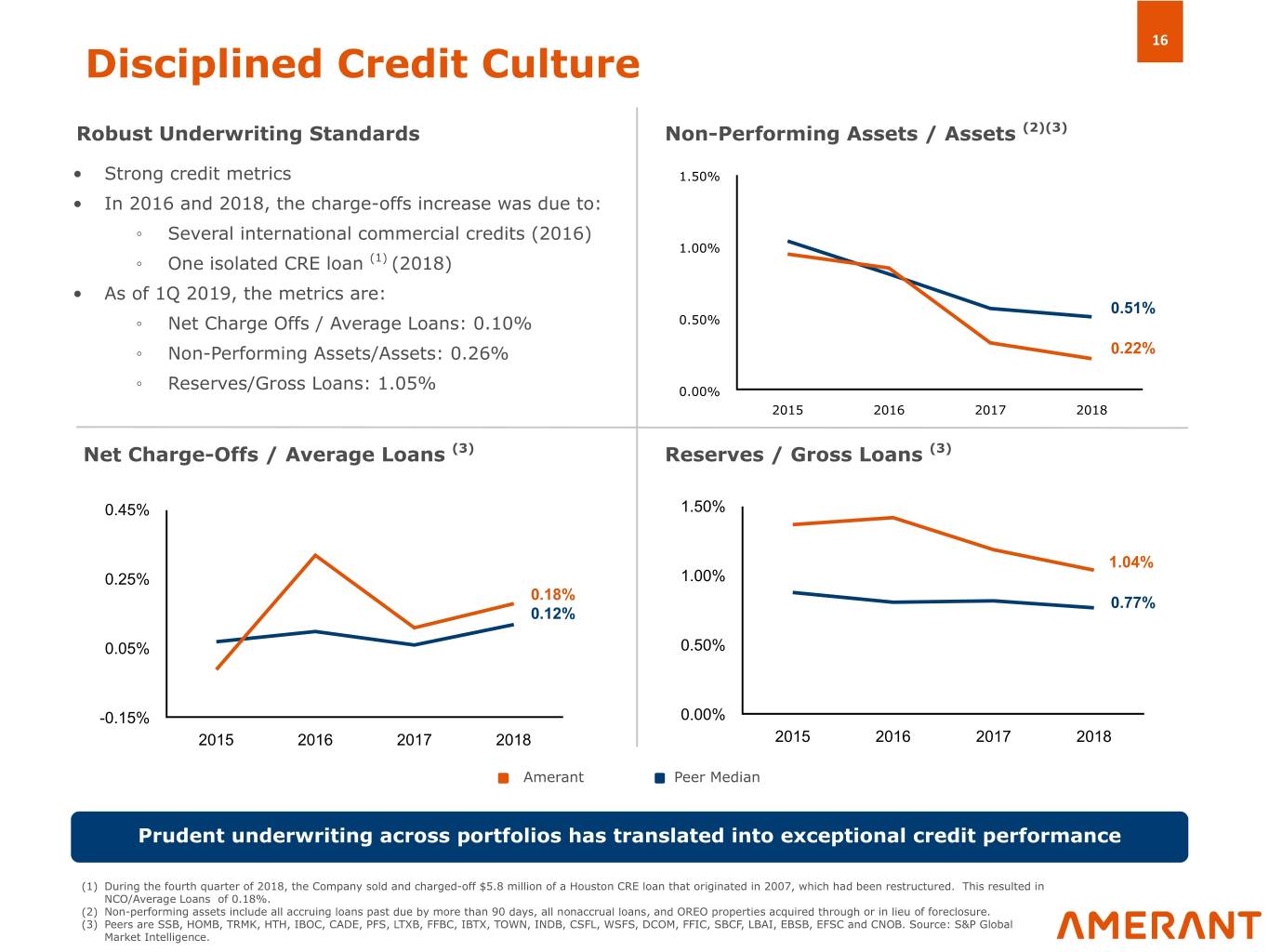

16 Disciplined Credit Culture Robust Underwriting Standards Non-Performing Assets / Assets (2)(3) • Strong credit metrics 1.50% • In 2016 and 2018, the charge-offs increase was due to: ◦ Several international commercial credits (2016) 1.00% ◦ One isolated CRE loan (1) (2018) • As of 1Q 2019, the metrics are: 0.51% 0.50% ◦ Net Charge Offs / Average Loans: 0.10% ◦ Non-Performing Assets/Assets: 0.26% 0.22% ◦ Reserves/Gross Loans: 1.05% 0.00% 2015 2016 2017 2018 Net Charge-Offs / Average Loans (3) Reserves / Gross Loans (3) 0.45% 1.50% 1.04% 0.25% 1.00% 0.18% 0.77% 0.12% 0.05% 0.50% -0.15% 0.00% 2015 2016 2017 2018 2015 2016 2017 2018 Amerant Peer Median Prudent underwriting across portfolios has translated into exceptional credit performance (1) During the fourth quarter of 2018, the Company sold and charged-off $5.8 million of a Houston CRE loan that originated in 2007, which had been restructured. This resulted in NCO/Average Loans of 0.18%. (2) Non-performing assets include all accruing loans past due by more than 90 days, all nonaccrual loans, and OREO properties acquired through or in lieu of foreclosure. (3) Peers are SSB, HOMB, TRMK, HTH, IBOC, CADE, PFS, LTXB, FFBC, IBTX, TOWN, INDB, CSFL, WSFS, DCOM, FFIC, SBCF, LBAI, EBSB, EFSC and CNOB. Source: S&P Global Market Intelligence.

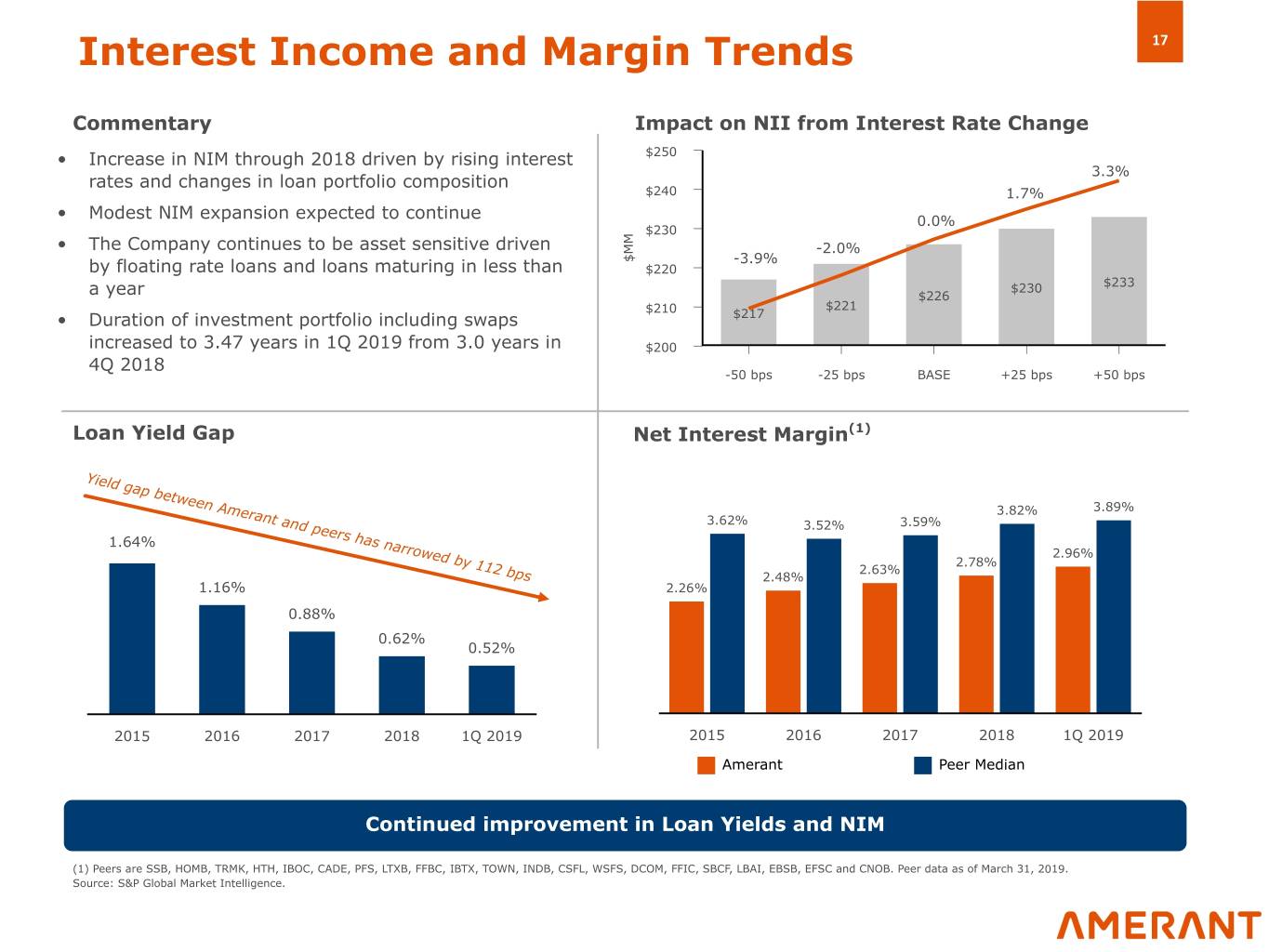

Interest Income and Margin Trends 17 Commentary Impact on NII from Interest Rate Change • Increase in NIM through 2018 driven by rising interest $250 3.3% rates and changes in loan portfolio composition $240 1.7% • Modest NIM expansion expected to continue 0.0% $230 • The Company continues to be asset sensitive driven M M -2.0% $ -3.9% by floating rate loans and loans maturing in less than $220 $230 $233 a year $226 $210 $221 • Duration of investment portfolio including swaps $217 increased to 3.47 years in 1Q 2019 from 3.0 years in $200 4Q 2018 -50 bps -25 bps BASE +25 bps +50 bps Loan Yield Gap Net Interest Margin(1) Yield gap between Amerant and peers has narrowed by 112 bps 3.82% 3.89% 3.62% 3.52% 3.59% 1.64% 2.96% 2.78% 2.63% 2.48% 1.16% 2.26% 0.88% 0.62% 0.52% 2015 2016 2017 2018 1Q 2019 2015 2016 2017 2018 1Q 2019 Amerant Peer Median Continued improvement in Loan Yields and NIM (1) Peers are SSB, HOMB, TRMK, HTH, IBOC, CADE, PFS, LTXB, FFBC, IBTX, TOWN, INDB, CSFL, WSFS, DCOM, FFIC, SBCF, LBAI, EBSB, EFSC and CNOB. Peer data as of March 31, 2019. Source: S&P Global Market Intelligence.

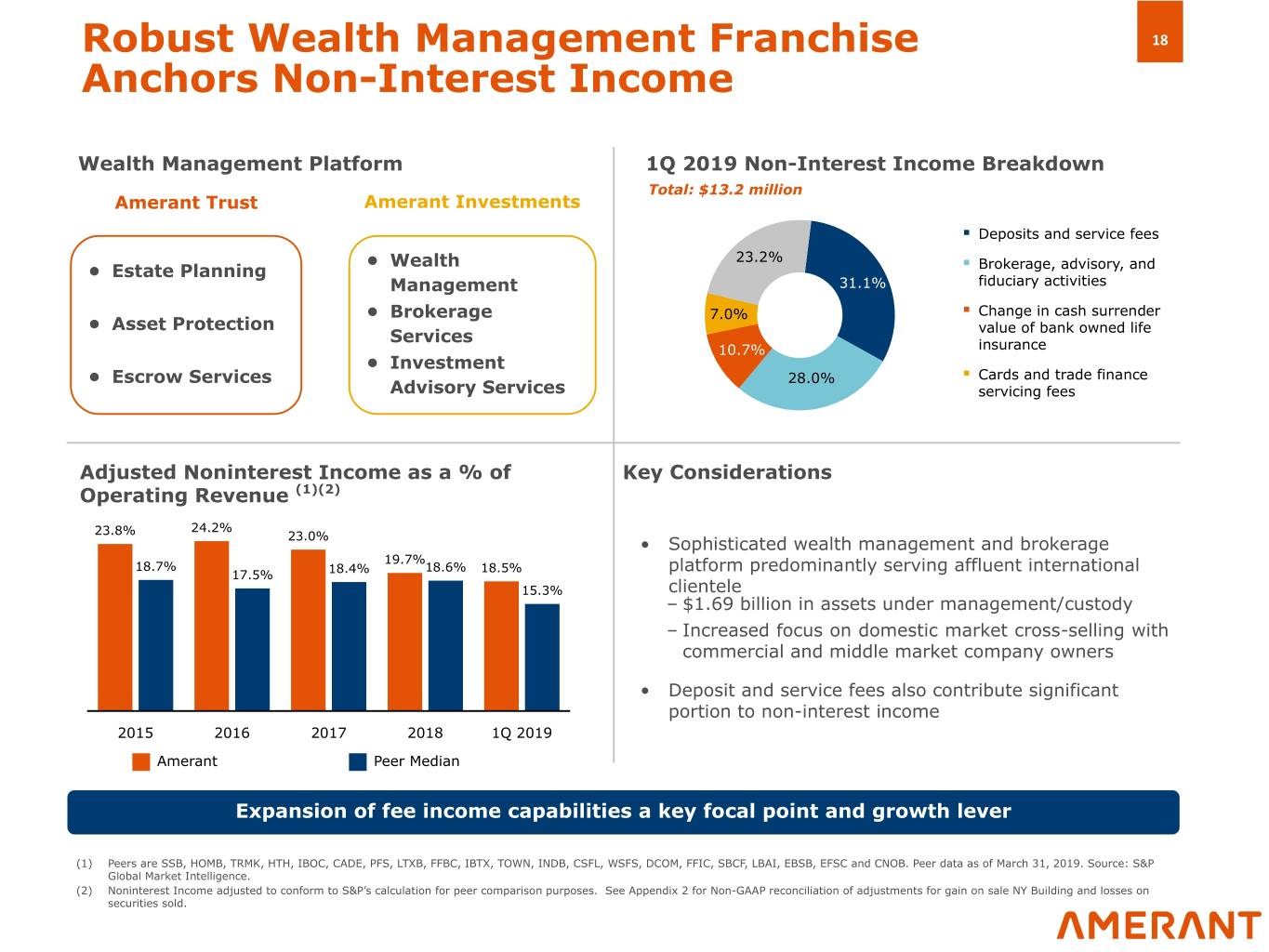

Robust Wealth Management Franchise 18 Anchors Non-Interest Income Wealth Management Platform 1Q 2019 Non-Interest Income Breakdown Total: $13.2 million Amerant Trust Amerant Investments § Deposits and service fees • Wealth 23.2% § • Estate Planning Brokerage, advisory, and Management 31.1% fiduciary activities § • Brokerage 7.0% Change in cash surrender • Asset Protection Services value of bank owned life 10.7% insurance • Investment § • Escrow Services 28.0% Cards and trade finance Advisory Services servicing fees Adjusted Noninterest Income as a % of Key Considerations Operating Revenue (1)(2) 23.8% 24.2% 23.0% • Sophisticated wealth management and brokerage 19.7% 18.7% 18.4% 18.6% 18.5% platform predominantly serving affluent international 17.5% 15.3% clientele – $1.69 billion in assets under management/custody – Increased focus on domestic market cross-selling with commercial and middle market company owners • Deposit and service fees also contribute significant portion to non-interest income 2015 2016 2017 2018 1Q 2019 Amerant Peer Median Expansion of fee income capabilities a key focal point and growth lever (1) Peers are SSB, HOMB, TRMK, HTH, IBOC, CADE, PFS, LTXB, FFBC, IBTX, TOWN, INDB, CSFL, WSFS, DCOM, FFIC, SBCF, LBAI, EBSB, EFSC and CNOB. Peer data as of March 31, 2019. Source: S&P Global Market Intelligence. (2) Noninterest Income adjusted to conform to S&P’s calculation for peer comparison purposes. See Appendix 2 for Non-GAAP reconciliation of adjustments for gain on sale NY Building and losses on securities sold.

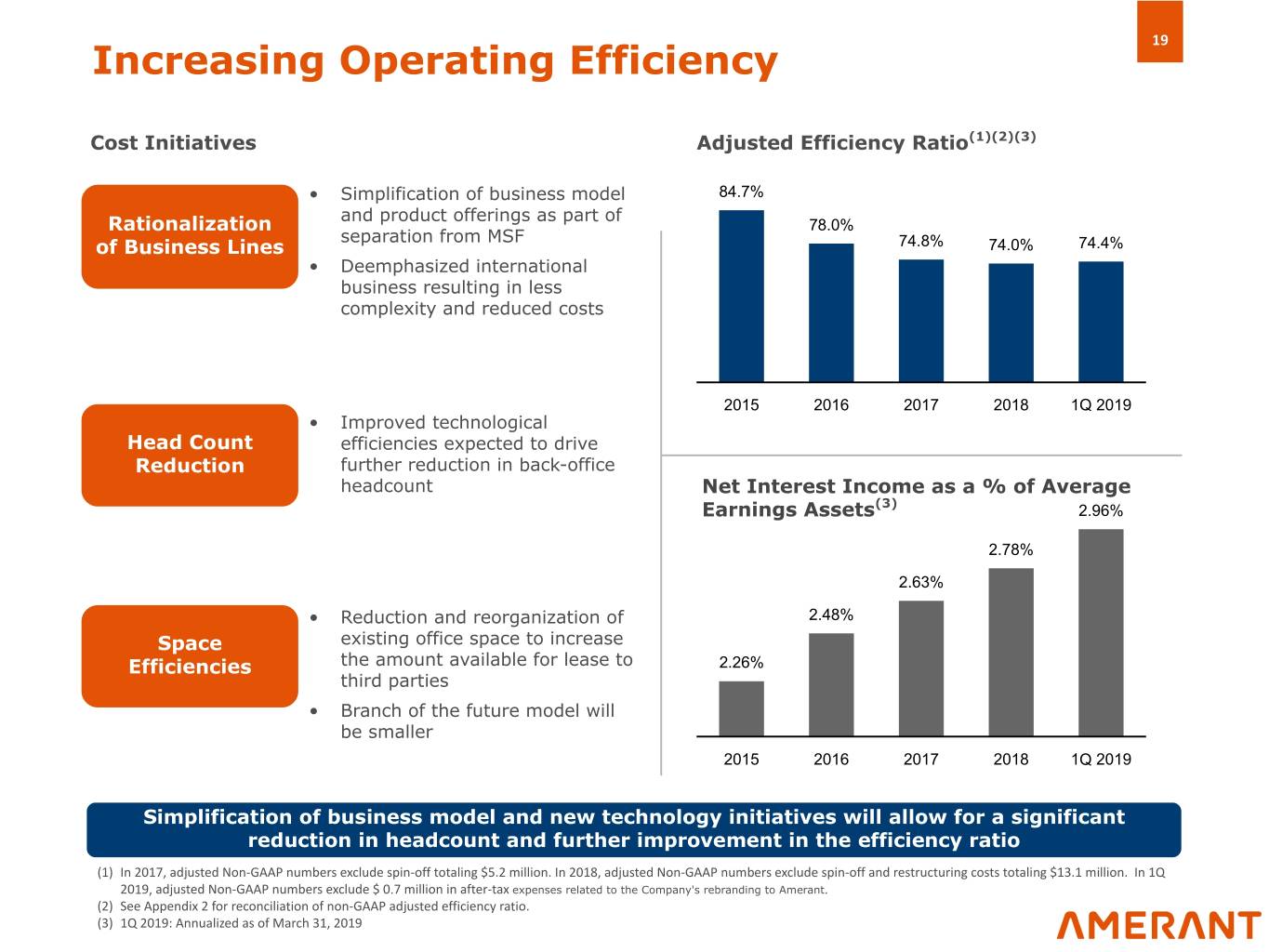

19 Increasing Operating Efficiency Cost Initiatives Adjusted Efficiency Ratio(1)(2)(3) • Simplification of business model 84.7% and product offerings as part of Rationalization 78.0% separation from MSF of Business Lines 74.8% 74.0% 74.4% • Deemphasized international business resulting in less complexity and reduced costs 2015 2016 2017 2018 1Q 2019 • Improved technological Head Count efficiencies expected to drive Reduction further reduction in back-office headcount Net Interest Income as a % of Average Earnings Assets(3) 2.96% 2.78% 2.63% • Reduction and reorganization of 2.48% Space existing office space to increase Efficiencies the amount available for lease to 2.26% third parties • Branch of the future model will be smaller 2015 2016 2017 2018 1Q 2019 Simplification of business model and new technology initiatives will allow for a significant reduction in headcount and further improvement in the efficiency ratio (1) In 2017, adjusted Non-GAAP numbers exclude spin-off totaling $5.2 million. In 2018, adjusted Non-GAAP numbers exclude spin-off and restructuring costs totaling $13.1 million. In 1Q 2019, adjusted Non-GAAP numbers exclude $ 0.7 million in after-tax expenses related to the Company's rebranding to Amerant. (2) See Appendix 2 for reconciliation of non-GAAP adjusted efficiency ratio. (3) 1Q 2019: Annualized as of March 31, 2019

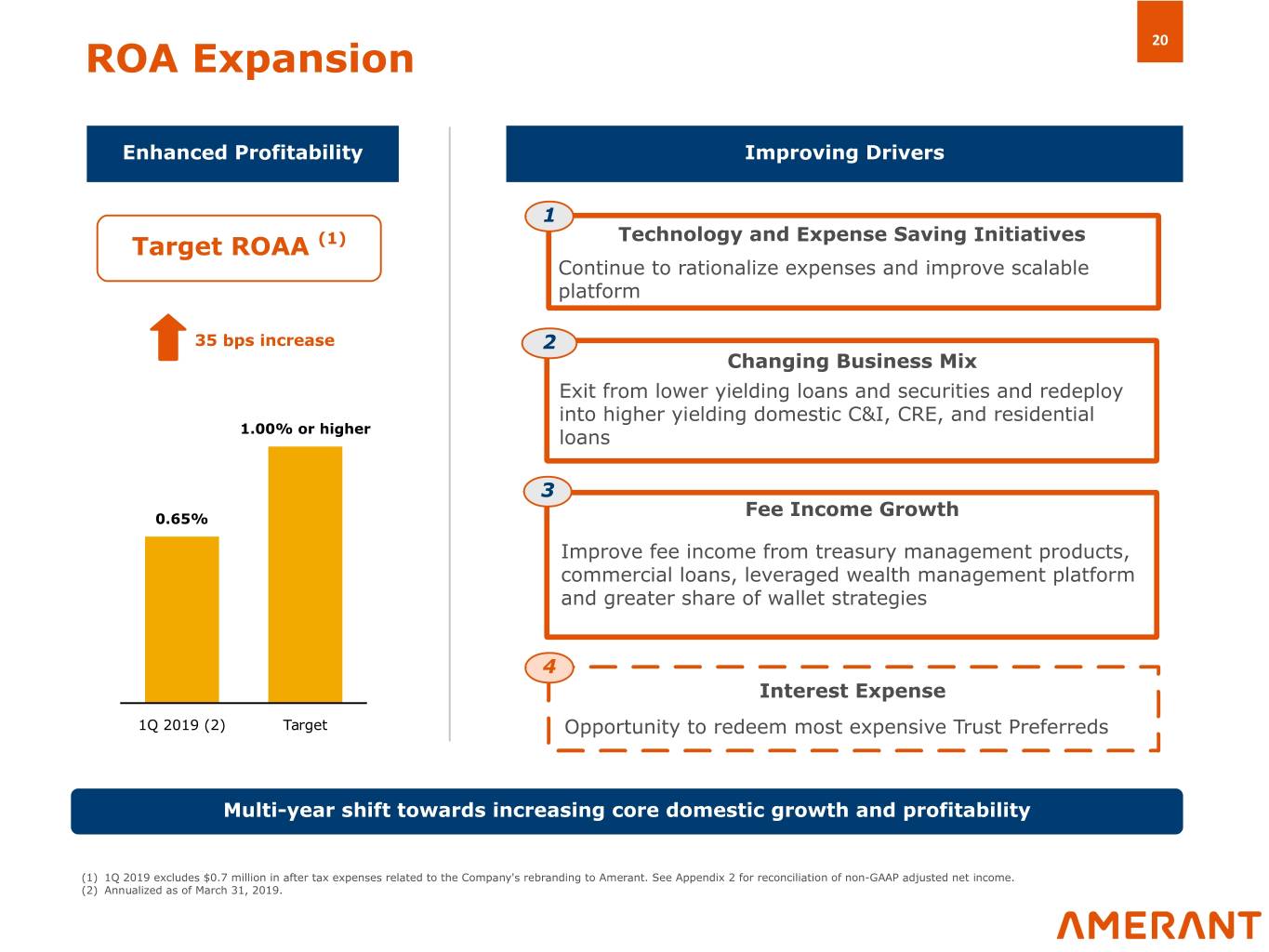

20 ROA Expansion Enhanced Profitability Improving Drivers 1 Technology and Expense Saving Initiatives Target ROAA (1) Continue to rationalize expenses and improve scalable platform 35 bps increase 2 Changing Business Mix Exit from lower yielding loans and securities and redeploy into higher yielding domestic C&I, CRE, and residential 1.00% or higher loans 3 0.65% Fee Income Growth Improve fee income from treasury management products, commercial loans, leveraged wealth management platform and greater share of wallet strategies 4 Interest Expense 1Q 2019 (2) Target Opportunity to redeem most expensive Trust Preferreds Multi-year shift towards increasing core domestic growth and profitability (1) 1Q 2019 excludes $0.7 million in after tax expenses related to the Company's rebranding to Amerant. See Appendix 2 for reconciliation of non-GAAP adjusted net income. (2) Annualized as of March 31, 2019.

21 Investment Highlights Recent shift from preservation of capital to driving profitable growth and shareholder value Substantial and continuing insider ownership, approximately 30% Strong asset quality and domestic loan growth Focus on expanding domestic deposit base throughout our high growth U.S. markets Low cost deposits from loyal international customers who view U.S. as a safe haven for their savings Diversification of revenue from a greater share of wallet strategy and an attractive wealth management platform that is being emphasized and cross-sold to domestic customers Top-shelf risk management culture stemming from being part of large, multi-national organization

Appendices

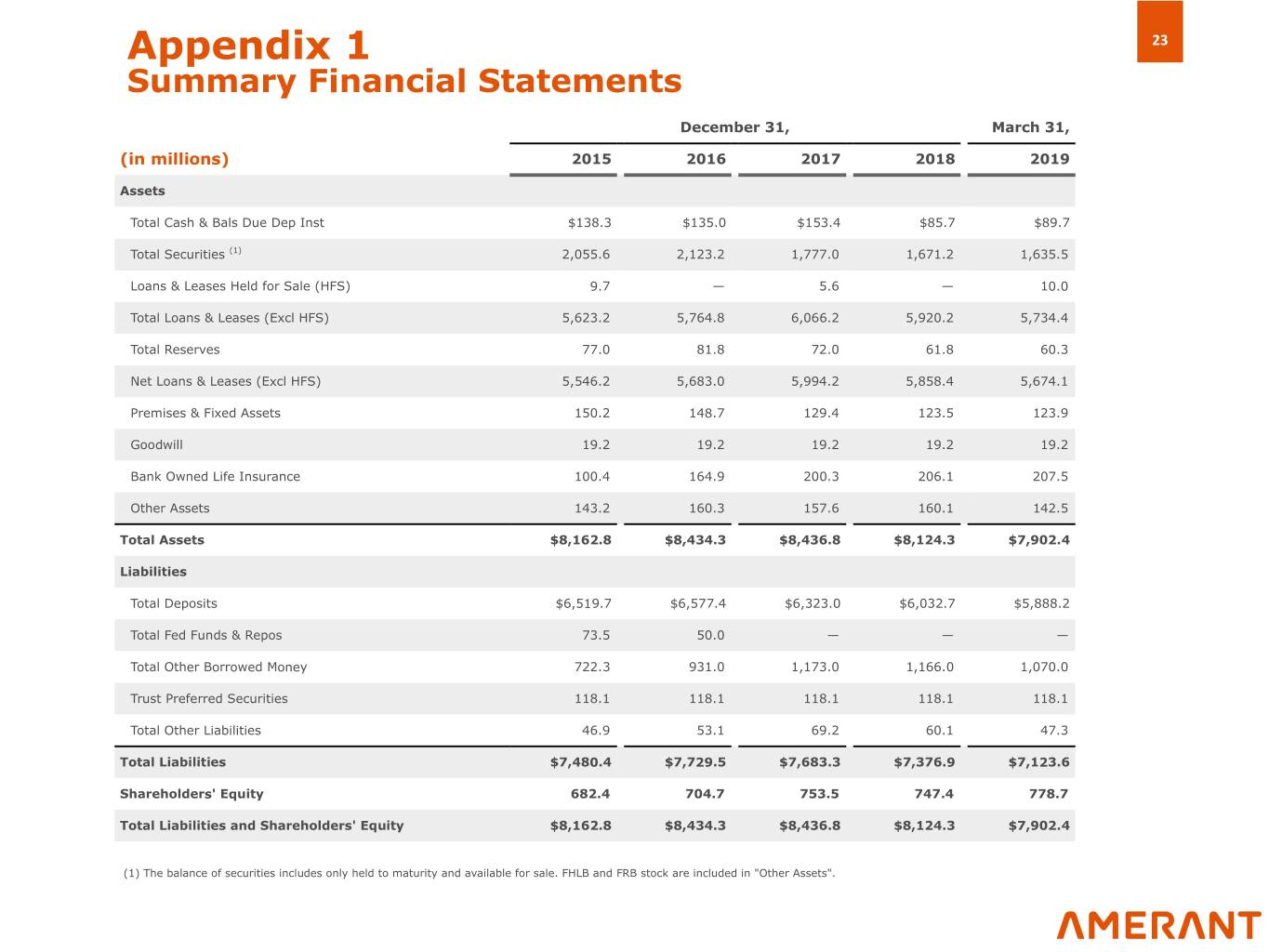

Appendix 1 23 Summary Financial Statements December 31, March 31, (in millions) 2015 2016 2017 2018 2019 Assets Total Cash & Bals Due Dep Inst $138.3 $135.0 $153.4 $85.7 $89.7 Total Securities (1) 2,055.6 2,123.2 1,777.0 1,671.2 1,635.5 Loans & Leases Held for Sale (HFS) 9.7 — 5.6 — 10.0 Total Loans & Leases (Excl HFS) 5,623.2 5,764.8 6,066.2 5,920.2 5,734.4 Total Reserves 77.0 81.8 72.0 61.8 60.3 Net Loans & Leases (Excl HFS) 5,546.2 5,683.0 5,994.2 5,858.4 5,674.1 Premises & Fixed Assets 150.2 148.7 129.4 123.5 123.9 Goodwill 19.2 19.2 19.2 19.2 19.2 Bank Owned Life Insurance 100.4 164.9 200.3 206.1 207.5 Other Assets 143.2 160.3 157.6 160.1 142.5 Total Assets $8,162.8 $8,434.3 $8,436.8 $8,124.3 $7,902.4 Liabilities Total Deposits $6,519.7 $6,577.4 $6,323.0 $6,032.7 $5,888.2 Total Fed Funds & Repos 73.5 50.0 — — — Total Other Borrowed Money 722.3 931.0 1,173.0 1,166.0 1,070.0 Trust Preferred Securities 118.1 118.1 118.1 118.1 118.1 Total Other Liabilities 46.9 53.1 69.2 60.1 47.3 Total Liabilities $7,480.4 $7,729.5 $7,683.3 $7,376.9 $7,123.6 Shareholders' Equity 682.4 704.7 753.5 747.4 778.7 Total Liabilities and Shareholders' Equity $8,162.8 $8,434.3 $8,436.8 $8,124.3 $7,902.4 (1) The balance of securities includes only held to maturity and available for sale. FHLB and FRB stock are included in "Other Assets".

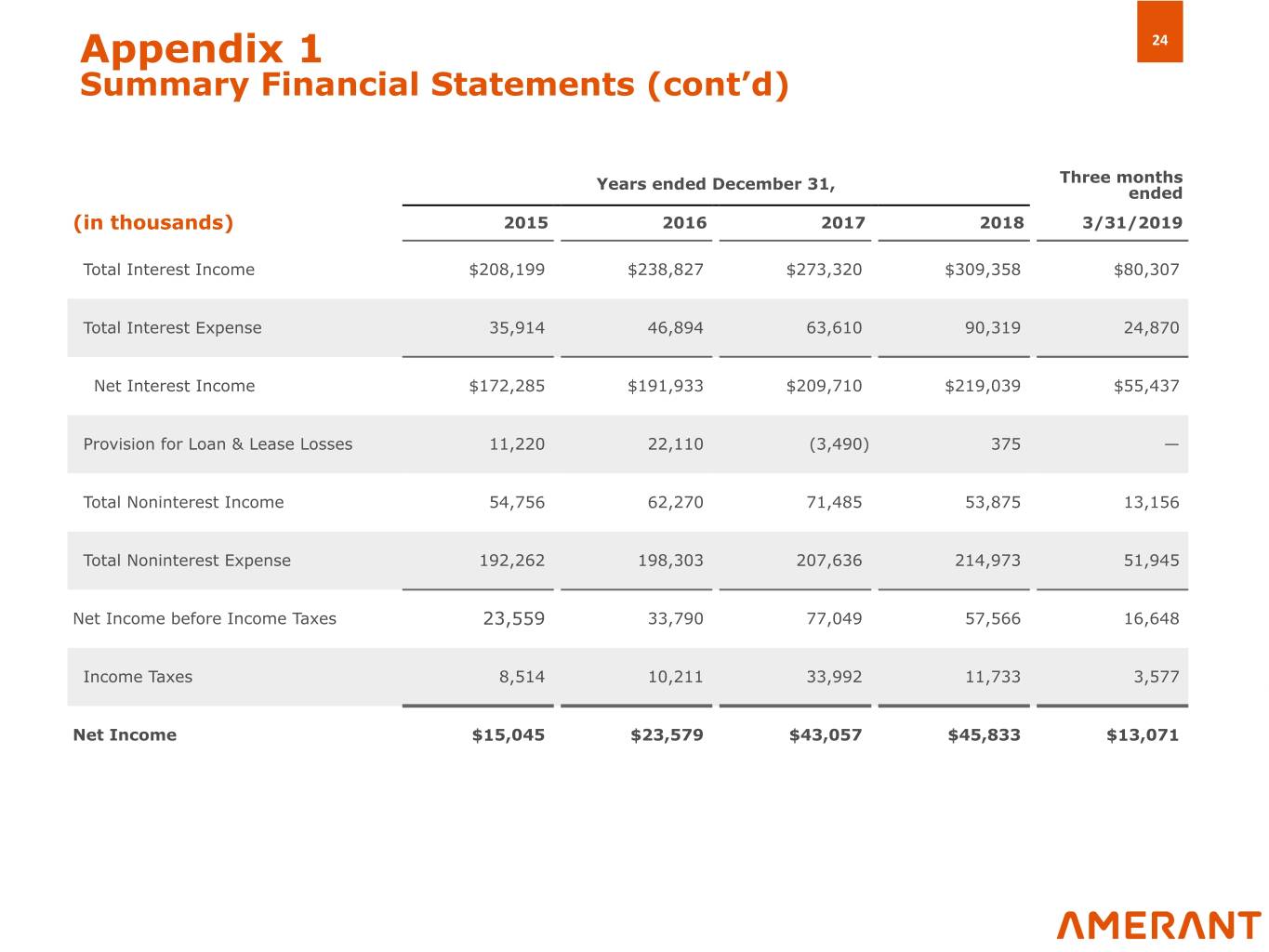

Appendix 1 24 Summary Financial Statements (cont’d) Years ended December 31, Three months ended (in thousands) 2015 2016 2017 2018 3/31/2019 Total Interest Income $208,199 $238,827 $273,320 $309,358 $80,307 Total Interest Expense 35,914 46,894 63,610 90,319 24,870 Net Interest Income $172,285 $191,933 $209,710 $219,039 $55,437 Provision for Loan & Lease Losses 11,220 22,110 (3,490) 375 — Total Noninterest Income 54,756 62,270 71,485 53,875 13,156 Total Noninterest Expense 192,262 198,303 207,636 214,973 51,945 Net Income before Income Taxes 23,559 33,790 77,049 57,566 16,648 Income Taxes 8,514 10,211 33,992 11,733 3,577 Net Income $15,045 $23,579 $43,057 $45,833 $13,071

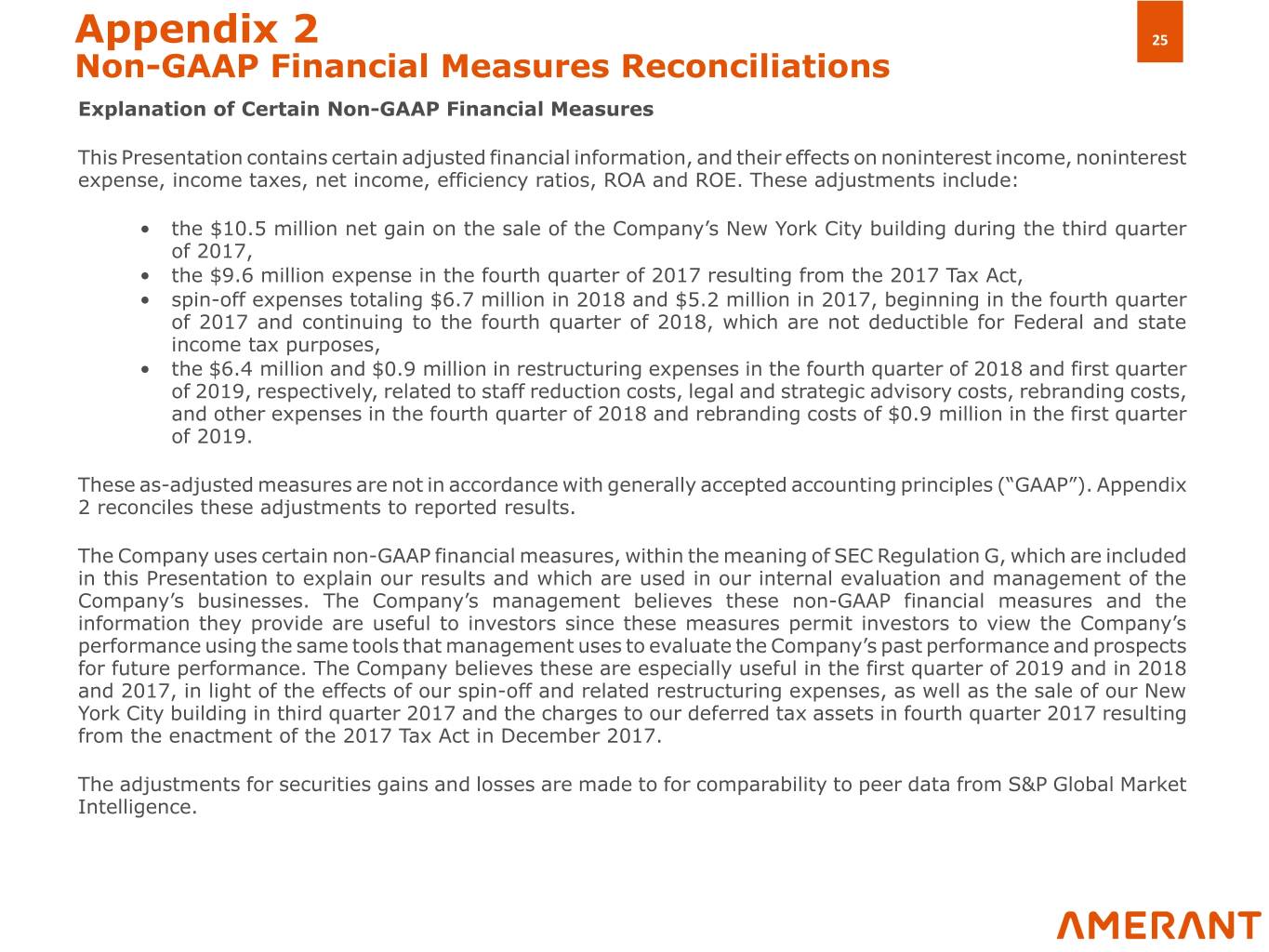

Appendix 2 25 Non-GAAP Financial Measures Reconciliations Explanation of Certain Non-GAAP Financial Measures This Presentation contains certain adjusted financial information, and their effects on noninterest income, noninterest expense, income taxes, net income, efficiency ratios, ROA and ROE. These adjustments include: • the $10.5 million net gain on the sale of the Company’s New York City building during the third quarter of 2017, • the $9.6 million expense in the fourth quarter of 2017 resulting from the 2017 Tax Act, • spin-off expenses totaling $6.7 million in 2018 and $5.2 million in 2017, beginning in the fourth quarter of 2017 and continuing to the fourth quarter of 2018, which are not deductible for Federal and state income tax purposes, • the $6.4 million and $0.9 million in restructuring expenses in the fourth quarter of 2018 and first quarter of 2019, respectively, related to staff reduction costs, legal and strategic advisory costs, rebranding costs, and other expenses in the fourth quarter of 2018 and rebranding costs of $0.9 million in the first quarter of 2019. These as-adjusted measures are not in accordance with generally accepted accounting principles (“GAAP”). Appendix 2 reconciles these adjustments to reported results. The Company uses certain non-GAAP financial measures, within the meaning of SEC Regulation G, which are included in this Presentation to explain our results and which are used in our internal evaluation and management of the Company’s businesses. The Company’s management believes these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view the Company’s performance using the same tools that management uses to evaluate the Company’s past performance and prospects for future performance. The Company believes these are especially useful in the first quarter of 2019 and in 2018 and 2017, in light of the effects of our spin-off and related restructuring expenses, as well as the sale of our New York City building in third quarter 2017 and the charges to our deferred tax assets in fourth quarter 2017 resulting from the enactment of the 2017 Tax Act in December 2017. The adjustments for securities gains and losses are made to for comparability to peer data from S&P Global Market Intelligence.

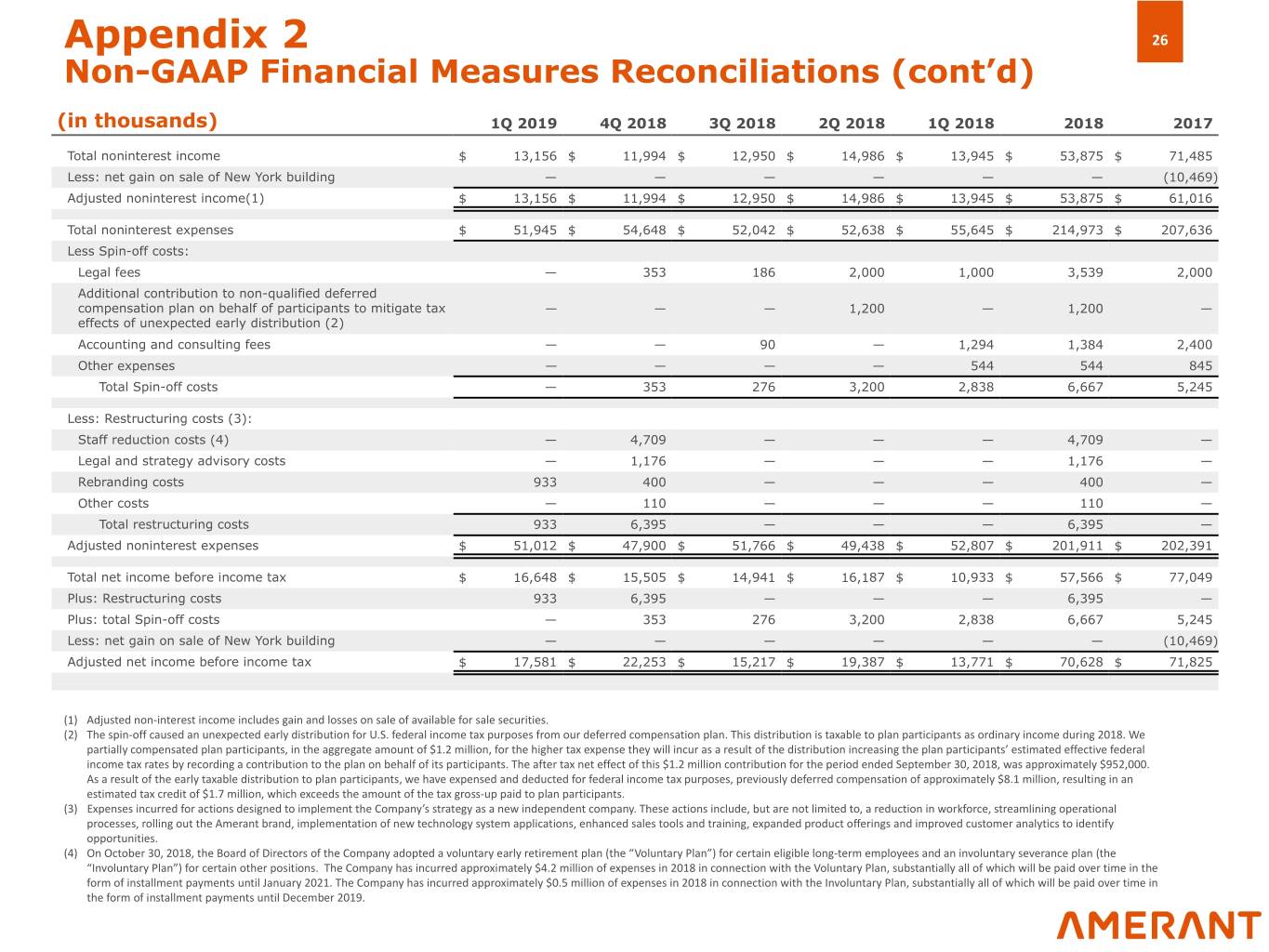

Appendix 2 26 Non-GAAP Financial Measures Reconciliations (cont’d) (in thousands) 1Q 2019 4Q 2018 3Q 2018 2Q 2018 1Q 2018 2018 2017 Total noninterest income $ 13,156 $ 11,994 $ 12,950 $ 14,986 $ 13,945 $ 53,875 $ 71,485 Less: net gain on sale of New York building — — — — — — (10,469) Adjusted noninterest income(1) $ 13,156 $ 11,994 $ 12,950 $ 14,986 $ 13,945 $ 53,875 $ 61,016 Total noninterest expenses $ 51,945 $ 54,648 $ 52,042 $ 52,638 $ 55,645 $ 214,973 $ 207,636 Less Spin-off costs: Legal fees — 353 186 2,000 1,000 3,539 2,000 Additional contribution to non-qualified deferred compensation plan on behalf of participants to mitigate tax — — — 1,200 — 1,200 — effects of unexpected early distribution (2) Accounting and consulting fees — — 90 — 1,294 1,384 2,400 Other expenses — — — — 544 544 845 Total Spin-off costs — 353 276 3,200 2,838 6,667 5,245 Less: Restructuring costs (3): Staff reduction costs (4) — 4,709 — — — 4,709 — Legal and strategy advisory costs — 1,176 — — — 1,176 — Rebranding costs 933 400 — — — 400 — Other costs — 110 — — — 110 — Total restructuring costs 933 6,395 — — — 6,395 — Adjusted noninterest expenses $ 51,012 $ 47,900 $ 51,766 $ 49,438 $ 52,807 $ 201,911 $ 202,391 Total net income before income tax $ 16,648 $ 15,505 $ 14,941 $ 16,187 $ 10,933 $ 57,566 $ 77,049 Plus: Restructuring costs 933 6,395 — — — 6,395 — Plus: total Spin-off costs — 353 276 3,200 2,838 6,667 5,245 Less: net gain on sale of New York building — — — — — — (10,469) Adjusted net income before income tax $ 17,581 $ 22,253 $ 15,217 $ 19,387 $ 13,771 $ 70,628 $ 71,825 (1) Adjusted non-interest income includes gain and losses on sale of available for sale securities. (2) The spin-off caused an unexpected early distribution for U.S. federal income tax purposes from our deferred compensation plan. This distribution is taxable to plan participants as ordinary income during 2018. We partially compensated plan participants, in the aggregate amount of $1.2 million, for the higher tax expense they will incur as a result of the distribution increasing the plan participants’ estimated effective federal income tax rates by recording a contribution to the plan on behalf of its participants. The after tax net effect of this $1.2 million contribution for the period ended September 30, 2018, was approximately $952,000. As a result of the early taxable distribution to plan participants, we have expensed and deducted for federal income tax purposes, previously deferred compensation of approximately $8.1 million, resulting in an estimated tax credit of $1.7 million, which exceeds the amount of the tax gross-up paid to plan participants. (3) Expenses incurred for actions designed to implement the Company’s strategy as a new independent company. These actions include, but are not limited to, a reduction in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (4) On October 30, 2018, the Board of Directors of the Company adopted a voluntary early retirement plan (the “Voluntary Plan”) for certain eligible long-term employees and an involuntary severance plan (the “Involuntary Plan”) for certain other positions. The Company has incurred approximately $4.2 million of expenses in 2018 in connection with the Voluntary Plan, substantially all of which will be paid over time in the form of installment payments until January 2021. The Company has incurred approximately $0.5 million of expenses in 2018 in connection with the Involuntary Plan, substantially all of which will be paid over time in the form of installment payments until December 2019.

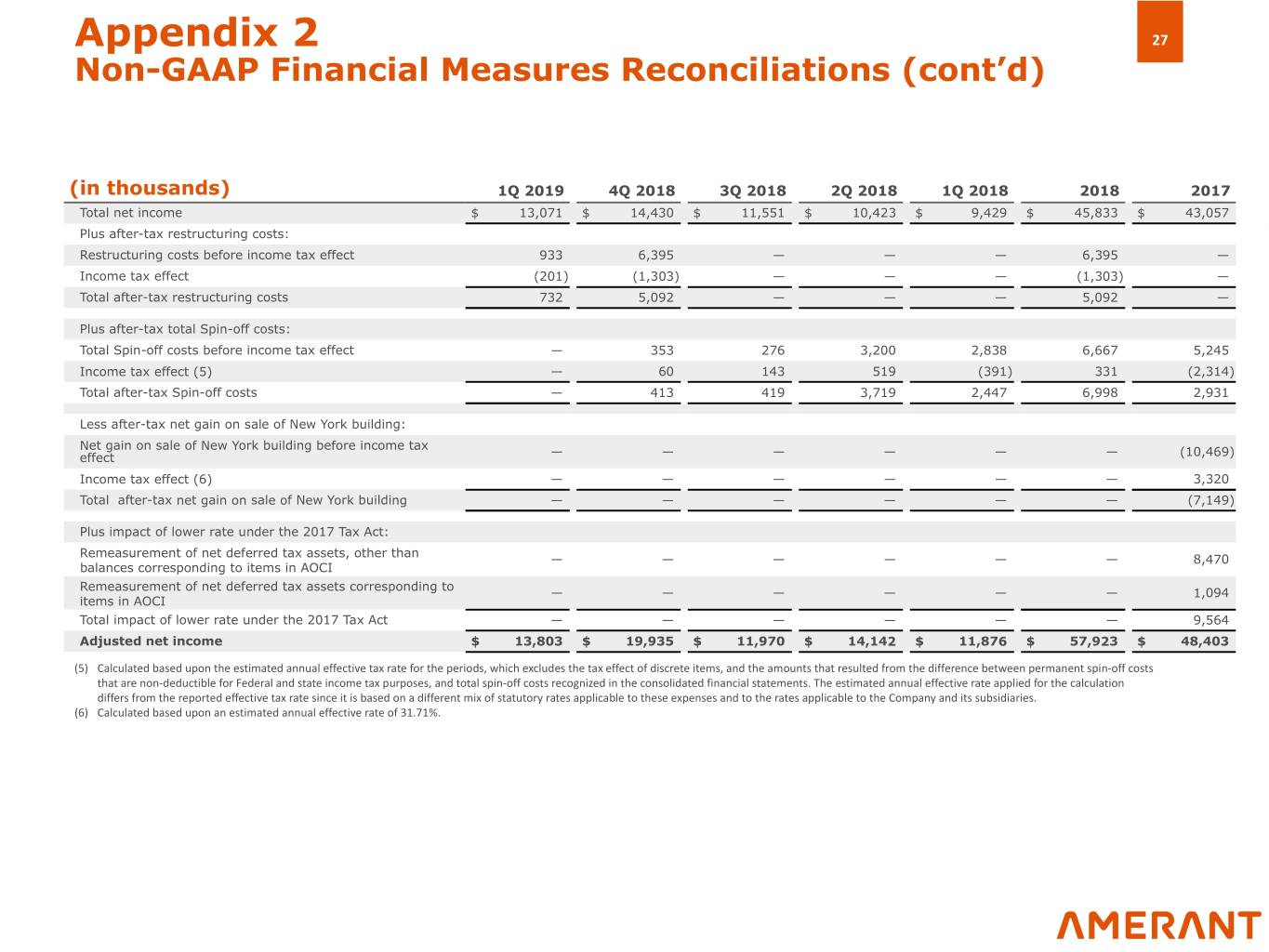

Appendix 2 27 Non-GAAP Financial Measures Reconciliations (cont’d) (in thousands) 1Q 2019 4Q 2018 3Q 2018 2Q 2018 1Q 2018 2018 2017 Total net income $ 13,071 $ 14,430 $ 11,551 $ 10,423 $ 9,429 $ 45,833 $ 43,057 Plus after-tax restructuring costs: Restructuring costs before income tax effect 933 6,395 — — — 6,395 — Income tax effect (201) (1,303) — — — (1,303) — Total after-tax restructuring costs 732 5,092 — — — 5,092 — Plus after-tax total Spin-off costs: Total Spin-off costs before income tax effect — 353 276 3,200 2,838 6,667 5,245 Income tax effect (5) — 60 143 519 (391) 331 (2,314) Total after-tax Spin-off costs — 413 419 3,719 2,447 6,998 2,931 Less after-tax net gain on sale of New York building: Net gain on sale of New York building before income tax effect — — — — — — (10,469) Income tax effect (6) — — — — — — 3,320 Total after-tax net gain on sale of New York building — — — — — — (7,149) Plus impact of lower rate under the 2017 Tax Act: Remeasurement of net deferred tax assets, other than — — — — — — 8,470 balances corresponding to items in AOCI Remeasurement of net deferred tax assets corresponding to — — — — — — 1,094 items in AOCI Total impact of lower rate under the 2017 Tax Act — — — — — — 9,564 Adjusted net income $ 13,803 $ 19,935 $ 11,970 $ 14,142 $ 11,876 $ 57,923 $ 48,403 (5) Calculated based upon the estimated annual effective tax rate for the periods, which excludes the tax effect of discrete items, and the amounts that resulted from the difference between permanent spin-off costs that are non-deductible for Federal and state income tax purposes, and total spin-off costs recognized in the consolidated financial statements. The estimated annual effective rate applied for the calculation differs from the reported effective tax rate since it is based on a different mix of statutory rates applicable to these expenses and to the rates applicable to the Company and its subsidiaries. (6) Calculated based upon an estimated annual effective rate of 31.71%.

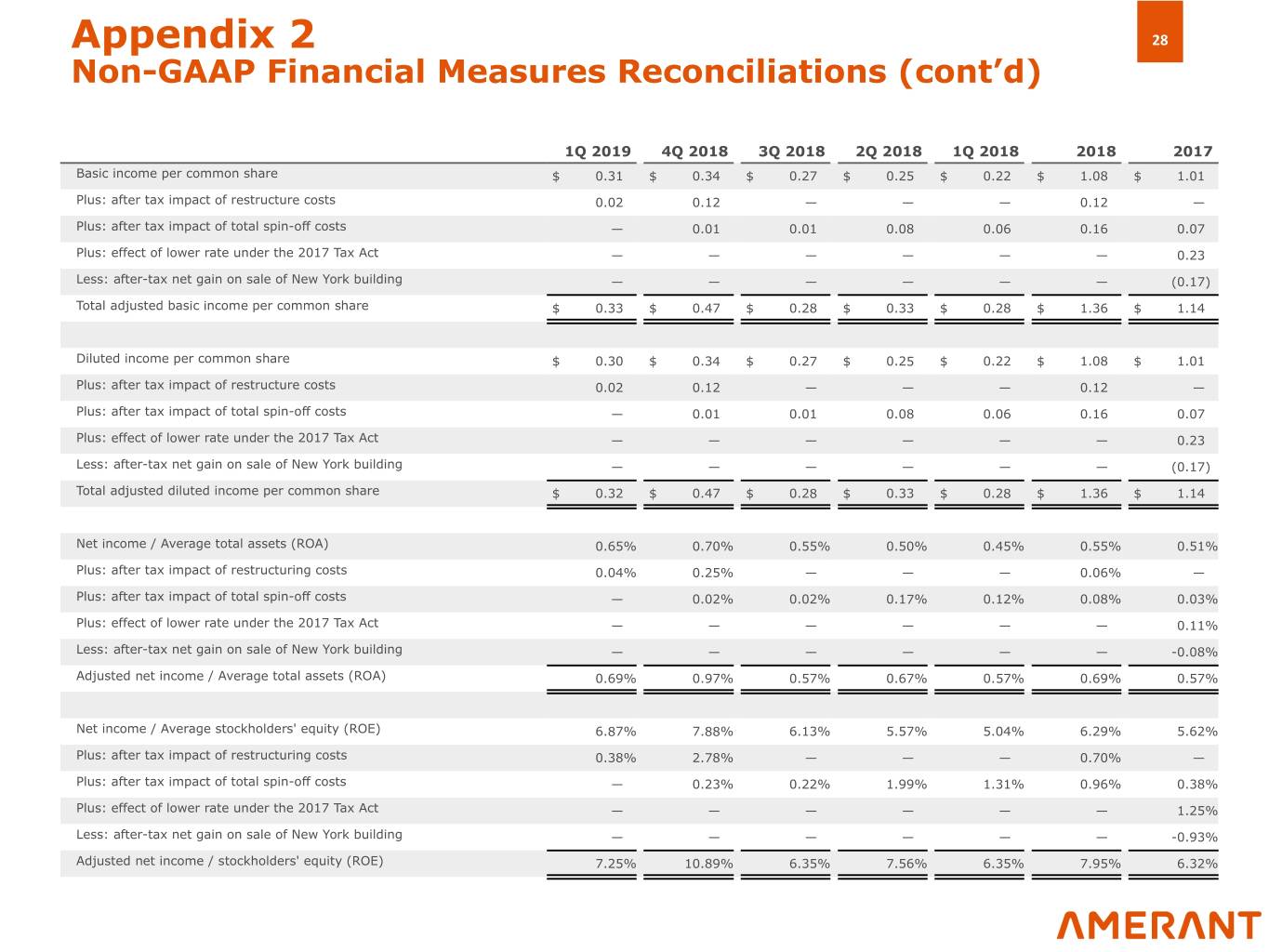

Appendix 2 28 Non-GAAP Financial Measures Reconciliations (cont’d) 1Q 2019 4Q 2018 3Q 2018 2Q 2018 1Q 2018 2018 2017 Basic income per common share $ 0.31 $ 0.34 $ 0.27 $ 0.25 $ 0.22 $ 1.08 $ 1.01 Plus: after tax impact of restructure costs 0.02 0.12 — — — 0.12 — Plus: after tax impact of total spin-off costs — 0.01 0.01 0.08 0.06 0.16 0.07 Plus: effect of lower rate under the 2017 Tax Act — — — — — — 0.23 Less: after-tax net gain on sale of New York building — — — — — — (0.17) Total adjusted basic income per common share $ 0.33 $ 0.47 $ 0.28 $ 0.33 $ 0.28 $ 1.36 $ 1.14 Diluted income per common share $ 0.30 $ 0.34 $ 0.27 $ 0.25 $ 0.22 $ 1.08 $ 1.01 Plus: after tax impact of restructure costs 0.02 0.12 — — — 0.12 — Plus: after tax impact of total spin-off costs — 0.01 0.01 0.08 0.06 0.16 0.07 Plus: effect of lower rate under the 2017 Tax Act — — — — — — 0.23 Less: after-tax net gain on sale of New York building — — — — — — (0.17) Total adjusted diluted income per common share $ 0.32 $ 0.47 $ 0.28 $ 0.33 $ 0.28 $ 1.36 $ 1.14 Net income / Average total assets (ROA) 0.65% 0.70% 0.55% 0.50% 0.45% 0.55% 0.51% Plus: after tax impact of restructuring costs 0.04% 0.25% — — — 0.06% — Plus: after tax impact of total spin-off costs — 0.02% 0.02% 0.17% 0.12% 0.08% 0.03% Plus: effect of lower rate under the 2017 Tax Act — — — — — — 0.11% Less: after-tax net gain on sale of New York building — — — — — — -0.08% Adjusted net income / Average total assets (ROA) 0.69% 0.97% 0.57% 0.67% 0.57% 0.69% 0.57% Net income / Average stockholders' equity (ROE) 6.87% 7.88% 6.13% 5.57% 5.04% 6.29% 5.62% Plus: after tax impact of restructuring costs 0.38% 2.78% — — — 0.70% — Plus: after tax impact of total spin-off costs — 0.23% 0.22% 1.99% 1.31% 0.96% 0.38% Plus: effect of lower rate under the 2017 Tax Act — — — — — — 1.25% Less: after-tax net gain on sale of New York building — — — — — — -0.93% Adjusted net income / stockholders' equity (ROE) 7.25% 10.89% 6.35% 7.56% 6.35% 7.95% 6.32%

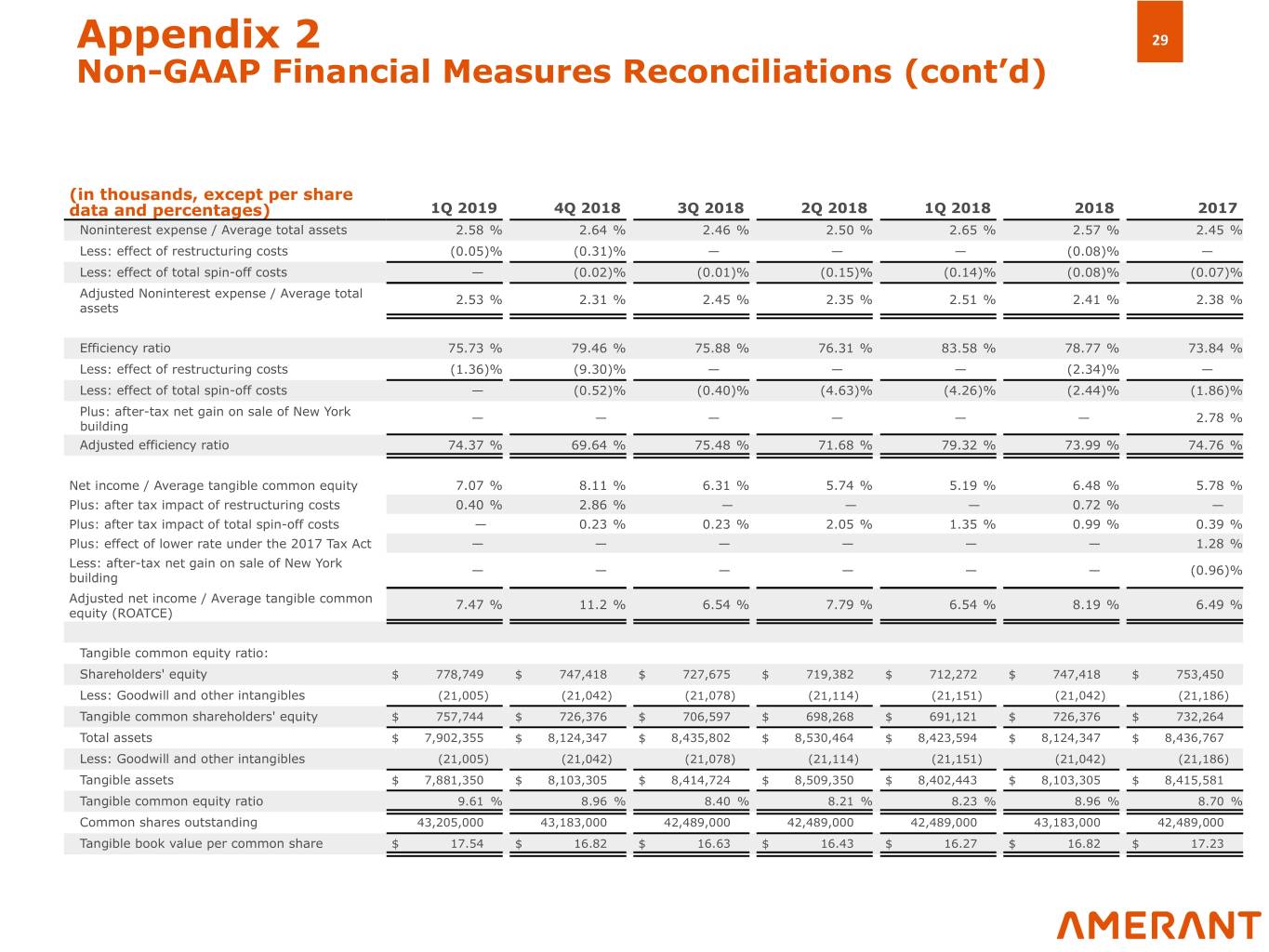

Appendix 2 29 Non-GAAP Financial Measures Reconciliations (cont’d) (in thousands, except per share data and percentages) 1Q 2019 4Q 2018 3Q 2018 2Q 2018 1Q 2018 2018 2017 Noninterest expense / Average total assets 2.58 % 2.64 % 2.46 % 2.50 % 2.65 % 2.57 % 2.45 % Less: effect of restructuring costs (0.05)% (0.31)% — — — (0.08)% — Less: effect of total spin-off costs — (0.02)% (0.01)% (0.15)% (0.14)% (0.08)% (0.07)% Adjusted Noninterest expense / Average total 2.53 % 2.31 % 2.45 % 2.35 % 2.51 % 2.41 % 2.38 % assets Efficiency ratio 75.73 % 79.46 % 75.88 % 76.31 % 83.58 % 78.77 % 73.84 % Less: effect of restructuring costs (1.36)% (9.30)% — — — (2.34)% — Less: effect of total spin-off costs — (0.52)% (0.40)% (4.63)% (4.26)% (2.44)% (1.86)% Plus: after-tax net gain on sale of New York — — — — — — 2.78 % building Adjusted efficiency ratio 74.37 % 69.64 % 75.48 % 71.68 % 79.32 % 73.99 % 74.76 % Net income / Average tangible common equity 7.07 % 8.11 % 6.31 % 5.74 % 5.19 % 6.48 % 5.78 % Plus: after tax impact of restructuring costs 0.40 % 2.86 % — — — 0.72 % — Plus: after tax impact of total spin-off costs — 0.23 % 0.23 % 2.05 % 1.35 % 0.99 % 0.39 % Plus: effect of lower rate under the 2017 Tax Act — — — — — — 1.28 % Less: after-tax net gain on sale of New York — — — — — — (0.96)% building Adjusted net income / Average tangible common 7.47 % 11.2 % 6.54 % 7.79 % 6.54 % 8.19 % 6.49 % equity (ROATCE) Tangible common equity ratio: Shareholders' equity $ 778,749 $ 747,418 $ 727,675 $ 719,382 $ 712,272 $ 747,418 $ 753,450 Less: Goodwill and other intangibles (21,005) (21,042) (21,078) (21,114) (21,151) (21,042) (21,186) Tangible common shareholders' equity $ 757,744 $ 726,376 $ 706,597 $ 698,268 $ 691,121 $ 726,376 $ 732,264 Total assets $ 7,902,355 $ 8,124,347 $ 8,435,802 $ 8,530,464 $ 8,423,594 $ 8,124,347 $ 8,436,767 Less: Goodwill and other intangibles (21,005) (21,042) (21,078) (21,114) (21,151) (21,042) (21,186) Tangible assets $ 7,881,350 $ 8,103,305 $ 8,414,724 $ 8,509,350 $ 8,402,443 $ 8,103,305 $ 8,415,581 Tangible common equity ratio 9.61 % 8.96 % 8.40 % 8.21 % 8.23 % 8.96 % 8.70 % Common shares outstanding 43,205,000 43,183,000 42,489,000 42,489,000 42,489,000 43,183,000 42,489,000 Tangible book value per common share $ 17.54 $ 16.82 $ 16.63 $ 16.43 $ 16.27 $ 16.82 $ 17.23

Thank you