Investor Presentation As of September 30, 2019

2 Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, including, without limitation, future financial and operating results; costs and revenues; economic conditions generally and in our markets and among our customer base; loan demand; drivers for improvement; mortgage lending activity; changes in the mix of our earning assets and our deposit and wholesale liabilities; net interest margin; yields on earning assets; interest rates (generally and those applicable to our assets and liabilities); credit quality, including loan performance, non-performing assets, provisions for loan losses, charge-offs, other-than-temporary impairments and collateral values; rebranding and staff realignment costs and expected savings; market trends; and customer preferences, as well as statements with respect to our objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks”, "modeled" and other similar words and expressions of the future. Forward-looking statements, including those as to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2018 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including as of and for the three and nine month periods ended September 30, 2019 and 2018, may not reflect our results of operations for our fiscal year ended, or financial condition as of December 31, 2019, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as Adjusted Net Income, Adjusted Net Income per Share (Basic and Diluted), Adjusted Noninterest Expense, Adjusted Noninterest Income, Adjusted Return on Equity (ROE), Adjusted Return on Assets (ROA), Adjusted Efficiency Ratio, and other ratios. This supplemental information should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including these, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in 2018 in connection with the spin-off and related transactions, and the rebranding and restructuring expenses which began in 2018 and continue in 2019. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. See Appendix 2 “Non-GAAP Financial Measures Reconciliations” for a reconciliation of these non-GAAP financial measures to their GAAP counterparts.

3 Geographic Mix Who We Are September 30, 2019 Loans Deposits • Founded in 1979 • Acquired in 1987 by MSF (1) § Domestic • 80.1% spin-off in Aug. 2018 3.5% History 47.3% • Rebranded as Amerant in June 2019 96.5% 52.7% • Completed IPO in Dec. 2018 § International • MSF no longer has any stake in the Company(2) Headquarters • Coral Gables, FL Financial Highlights (in millions, except per share data and 2015 2016 2017 2018 3Q19 Employees • 838 FTEs percentages) YTD Balance Sheet • 25(9) branches throughout South Florida Assets $8,163 $8,434 $8,437 $8,124 $7,864 Footprint and Houston, with loan production Loans 5,623 5,765 6,066 5,920 5,754 offices in New York, New York and Deposits 6,520 6,577 6,323 6,033 5,693 Dallas, Texas Tangible Common Equity(5) 661 683 732 726 (4) 805 Income Statement Market Share • Largest community bank headquartered in Florida(3) Net Income $ 15.0 $ 23.6 $ 43.1 $ 45.8 $ 37.9 Adjusted Net Income(5) $ 15.0 $ 23.6 $ 48.4 $ 57.9 $ 41.7 Assets • $7.86 billion Net Income per Share - Basic $ 0.35 $ 0.55 $ 1.01 $ 1.08 $ 0.89 Adjusted Net Income per Share - Basic(5) $ 0.35 $ 0.55 $ 1.14 $ 1.36 $ 0.98 Deposits • $5.69 billion ROA 0.19 % 0.29% 0.51% 0.55% 0.64% Adjusted ROA(5) 0.19 % 0.29% 0.57% 0.69% 0.70% AUM • $1.71 billion under management/ ROE 2.14 % 3.29% 5.62% 6.29% 6.43% custody Adjusted ROE(5) 2.14 % 3.29% 6.32% 7.95% 7.09% (1) Mercantil Servicios Financieros, C.A. (“MSF”) Efficiency Ratio(6) 84.7 % 78.0% 73.8% 78.8% 77.6% (2) In 1Q 2019, we issued approximately 2.1 million shares of Class A common Adjusted Efficiency Ratio(5) 84.7 % 78.0% 74.8% 74.0% 75.2% stock and used the proceeds to repurchase all of the remaining Class B shares held by MSF, our former parent Capital (3) Community banks include those with less than $10 billion in assets. Source: Tier 1 Common Ratio 10.1 % 10.3% 10.7% 11.1% 12.6% S&P Market Intelligence (4) Reflects special one-time dividend of $40.0 million paid on March 13, 2018 to Tier 1 Capital Ratio 11.8 % 11.9% 12.3% 12.7% 13.9% MSF in connection with the spin-off Total Risk-based Capital 12.9 % 13.1% 13.3% 13.5% 14.8% (5) See Appendix 2 ”Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP Tangible Common Equity Ratio 8.1 % 8.1% 8.7% 9.0% 10.3% counterparts. There were no non-GAAP adjustments in 2015 and 2016 Stockholders' book value per common share $16.06 $16.59 $17.73 $17.31 $19.11 (6) Efficiency ratio and adjusted efficiency ratio are the result of noninterest (5) (4) expense and adjusted noninterest expense, respectively divided by the sum Tangible Book Value per Common Share $15.56 $16.08 $17.23 $16.82 $18.63 of noninterest income and net interest income Credit (7) Non-performing assets include all accruing loans past due 90 days or more, Non-performing Assets(7) / Assets 0.95 % 0.85% 0.32% 0.22% 0.42% all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of Net charge offs (Recoveries) / Average Total (8) (0.01)% 0.32% 0.11% 0.18% 0.12% foreclosure Loans (8) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, excluding the allowance for loan losses (9) The bank recently opened 2 new branches: On September 30, in Davie, FL, and on October 7, in Miami Lakes, FL

4 Investment Opportunity Highlights Established Strong and Well-Positioned Significant Fee Pathway to Franchise in Diverse Deposit Loan Income Strong Attractive Portfolio Markets Base Platform Profitability • Long history with • Combination of • Loan book well- • Wealth • Independence strong reputation domestic and low- diversified across management and allows for clearer and deep client cost international various asset brokerage platform path to ROA/ROE relationships deposits classes and markets with accompanying improvement trust and private through efficiency, • Presence in high- • Domestic deposit • Outstanding credit banking capabilities fee income, and growth markets of base experiencing performance due to other levers Florida, Texas, and significant growth disciplined • Approximately New York (approximately 11% underwriting culture 20.3% noninterest • Building on CAGR since 2015) income/total preserving financial • Seasoned • High level of operating income in performance as part management team • Low cost relationship lending the first nine of a multi-year shift and board with long international deposit months of 2019 towards increasing tenure customers (0.40% core domestic average cost in the growth and • Largest community first nine months of profitability bank headquartered 2019) are a strategic in Florida and one advantage of the leading banks serving the Hispanic community

5 Experienced Management Team Frederick • Chairman since January 2019 Copeland • Director of Company and Bank from 2007 to 2018 • Former President and CEO of Far East National Bank Chairman of the Board • Former President and CEO of Aetna International, Inc. • Former Chairman, President, and CEO of Fleet Bank, N.A. Connecticut 78 years old • Former President and CEO of Citibank Canada Millar • CEO since 2009, Vice-Chairman since 2013 and Director since 1987 of Company and Bank Wilson • Spearheaded MSF's entry into the U.S. in 1983 Vice-Chairman & CEO • 41 years of experience with MSF/Amerant Bancorp ("AMTB"), including Executive Director of International Business 67 years old • Director of the Federal Reserve Bank of Atlanta-Miami Branch from 2013 to 2018 Alberto • Co-President and CFO since February 2018 Peraza • 26 years with MSF / AMTB Co-President & CFO • President and COO from 2013 to 2018; CFO from 1995 to 2013 • Director of the Florida Bankers Association from 2010 to 2013 59 years old • Co-President and COO since February 2018 Alfonso • 30 years with MSF / AMTB Figueredo • Executive Vice President of Operations and Administration of MSF from 2015 to 2018 Co-President & COO • CFO of MSF from 2008 to 2015 58 years old Alberto • Executive Vice President and Chief Risk Officer since 2015 Capriles • 23 years with MSF / AMTB Executive Vice President • Corporate Treasurer of MSF from 2008 to 2015 & Chief Risk Officer • Corporate Market Risk Manager of MSF from 1999 to 2008 52 years old • Executive Vice President and Chief Business Officer since February 2018 Miguel Palacios • All 26 years of banking experience spent with MSF / AMTB Executive Vice President • Domestic Personal and Commercial Manager from 2012 to 2018 & Chief Business Officer • Special Assets Manager from 2009 to 2012 51 years old

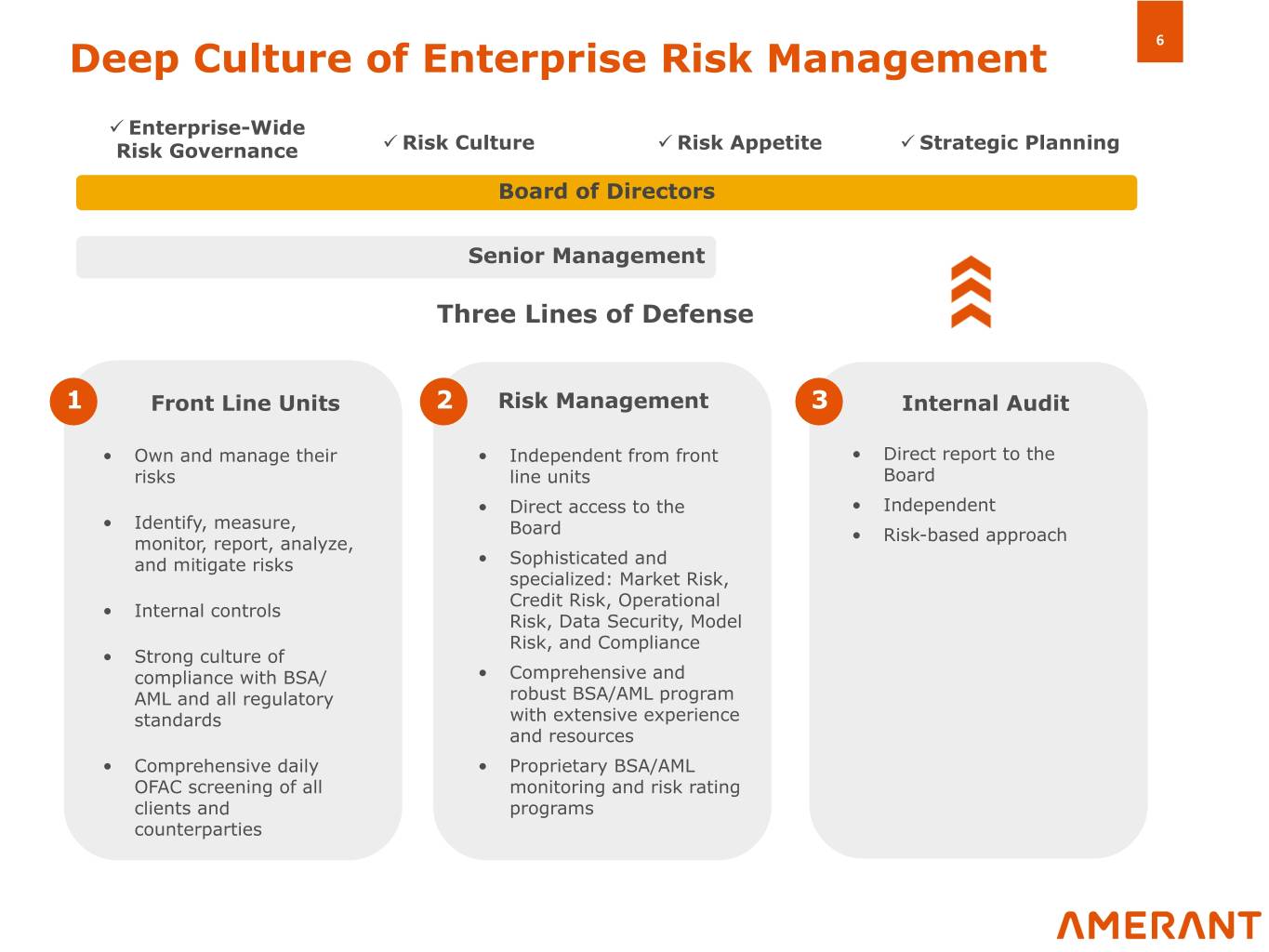

6 Deep Culture of Enterprise Risk Management ü Enterprise-Wide ü ü ü Risk Governance Risk Culture Risk Appetite Strategic Planning Board of Directors Senior Management Three Lines of Defense 1 Front Line Units 2 Risk Management 3 Internal Audit • Own and manage their • Independent from front • Direct report to the risks line units Board • Direct access to the • Independent • Identify, measure, Board monitor, report, analyze, • Risk-based approach and mitigate risks • Sophisticated and specialized: Market Risk, Credit Risk, Operational • Internal controls Risk, Data Security, Model Risk, and Compliance • Strong culture of compliance with BSA/ • Comprehensive and AML and all regulatory robust BSA/AML program standards with extensive experience and resources • Comprehensive daily • Proprietary BSA/AML OFAC screening of all monitoring and risk rating clients and programs counterparties

7 Our New Brand Meant for You: A Different Kind of Bank Our new purpose We are evolving, just like you All that we do, our attitude and behaviors, aim We are renewing our commitment to you by at our ultimate goal: offering the closest, most aiming to keep growing and making possible a personal and exceptional service to our brighter future for you, our investors, our customers communities, and our people We have developed strong relationships for 40 years and we are excited to create new ones, always adapting to your lives and specific needs, in a dynamic and positive way Everything we do is designed with our stakeholders in mind

8 Market Strategy Our strategy is to operate and expand in high-growth, diverse economies where we can build from our heritage serving the Hispanic community Miami-Dade MSA Target markets have: • Major industry sectors are trade, tourism, services, manufacturing, education, and real estate • Substantial domestic deposit • Unemployment rate of 3.5% as of August 2019 growth potential • Ranked #1 MSA for startup activity by the 2017 Kauffman Index among the 39 largest MSAs • Diversified industries, requiring high-quality loans Houston MSA • Major industry sectors of health care, retail, oil/ • Population growth, and thus a gas, travel, and services larger number of potential • Unemployment rate of 3.9% as of August 2019 customers • Home to the world’s largest medical complex. Ranks #2 in manufacturing GDP nationwide • Customers that require more than one of our banking services NYC MSA • Major industry sectors of education, health care, • Existing, significant Hispanic tourism, financial services, and professional / communities that value our business services bilingual employees and services • Unemployment rate of 3.9% as of August 2019 • MSA has #1 GDP in the nation Our markets are diverse with growing demographics and industry Sources: S&P Global Market Intelligence. US Bureau of Labor Statistics. Greater Houston Partnership (www.Houston.org). Business Facilities’ 2018 Metro Rankings Report. US Bureau of Economic Analysis. Center for Governmental Research.

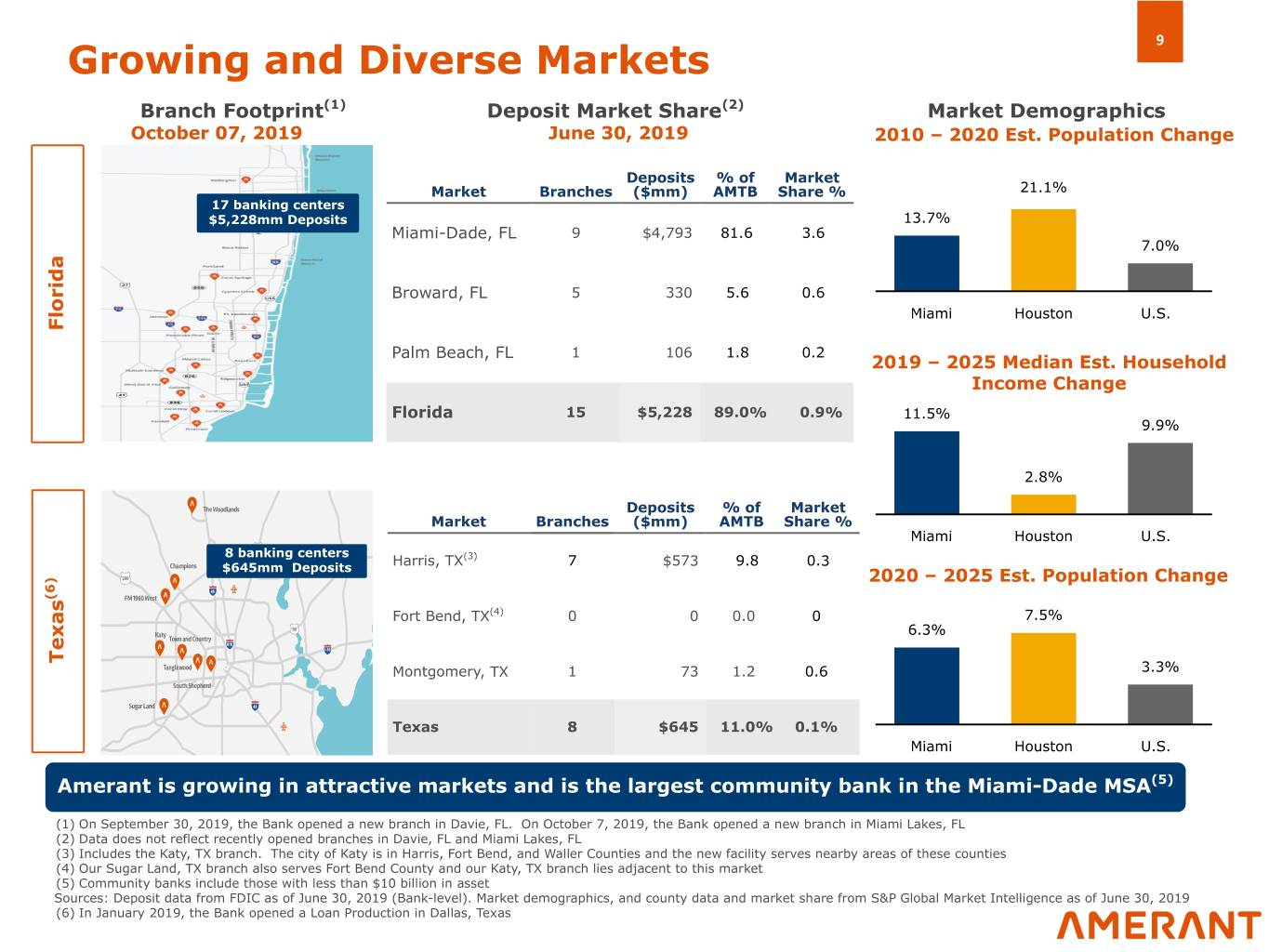

9 Growing and Diverse Markets Branch Footprint(1) Deposit Market Share(2) Market Demographics October 07, 2019 June 30, 2019 2010 – 2020 Est. Population Change Deposits % of Market Market Branches ($mm) AMTB Share % 21.1% 17 banking centers $5,228mm Deposits 13.7% Miami-Dade, FL 9 $4,793 81.6 3.6 7.0% Broward, FL 5 330 5.6 0.6 Miami Houston U.S. Florida Palm Beach, FL 1 106 1.8 0.2 2019 – 2025 Median Est. Household Income Change Florida 15 $5,228 89.0% 0.9% 11.5% 9.9% 2.8% Deposits % of Market Market Branches ($mm) AMTB Share % Miami Houston U.S. 8 banking centers Harris, TX(3) 7 $573 9.8 0.3 $645mm Deposits 2020 – 2025 Est. Population Change (6) Fort Bend, TX(4) 0 0 0.0 0 7.5% 6.3% Texas Montgomery, TX 1 73 1.2 0.6 3.3% Texas 8 $645 11.0% 0.1% Miami Houston U.S. Amerant is growing in attractive markets and is the largest community bank in the Miami-Dade MSA(5) (1) On September 30, 2019, the Bank opened a new branch in Davie, FL. On October 7, 2019, the Bank opened a new branch in Miami Lakes, FL (2) Data does not reflect recently opened branches in Davie, FL and Miami Lakes, FL (3) Includes the Katy, TX branch. The city of Katy is in Harris, Fort Bend, and Waller Counties and the new facility serves nearby areas of these counties (4) Our Sugar Land, TX branch also serves Fort Bend County and our Katy, TX branch lies adjacent to this market (5) Community banks include those with less than $10 billion in asset Sources: Deposit data from FDIC as of June 30, 2019 (Bank-level). Market demographics, and county data and market share from S&P Global Market Intelligence as of June 30, 2019 (6) In January 2019, the Bank opened a Loan Production in Dallas, Texas

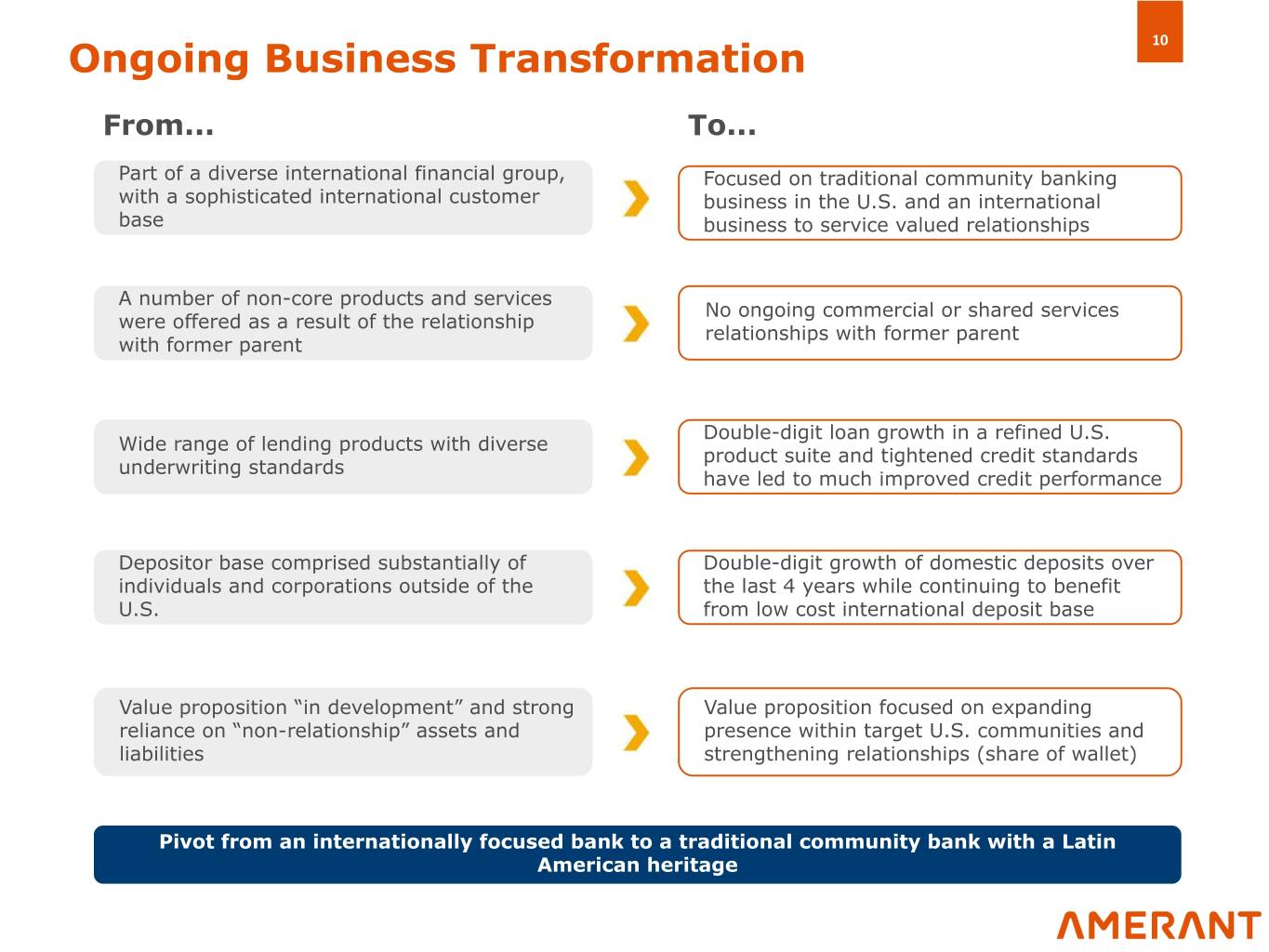

10 Ongoing Business Transformation From... To... Part of a diverse international financial group, Focused on traditional community banking with a sophisticated international customer business in the U.S. and an international base business to service valued relationships A number of non-core products and services No ongoing commercial or shared services were offered as a result of the relationship relationships with former parent with former parent Double-digit loan growth in a refined U.S. Wide range of lending products with diverse product suite and tightened credit standards underwriting standards have led to much improved credit performance Depositor base comprised substantially of Double-digit growth of domestic deposits over individuals and corporations outside of the the last 4 years while continuing to benefit U.S. from low cost international deposit base Value proposition “in development” and strong Value proposition focused on expanding reliance on “non-relationship” assets and presence within target U.S. communities and liabilities strengthening relationships (share of wallet) Pivot from an internationally focused bank to a traditional community bank with a Latin American heritage

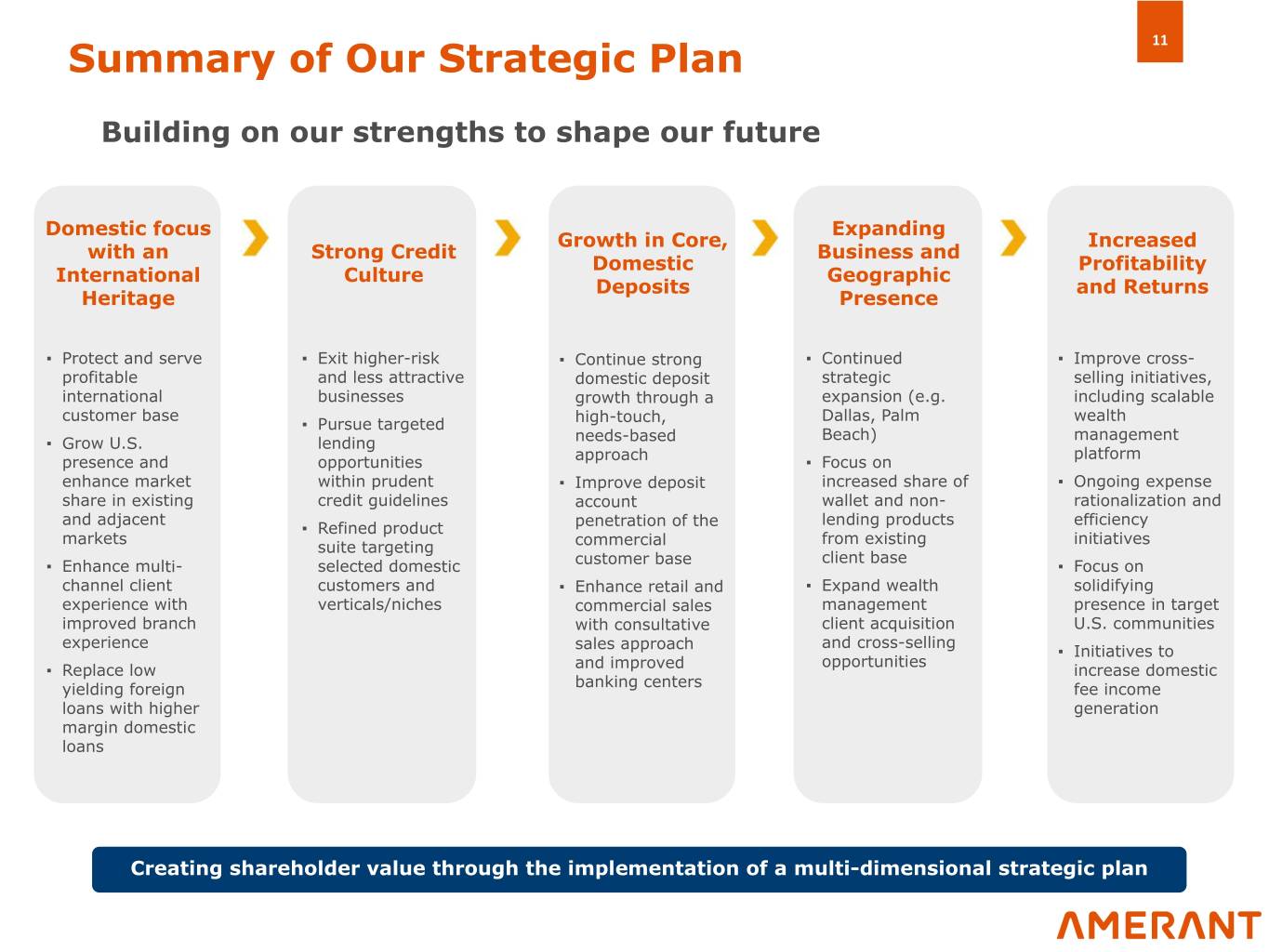

11 Summary of Our Strategic Plan Building on our strengths to shape our future Domestic focus Expanding Growth in Core, Increased with an Strong Credit Business and Domestic Profitability International Culture Geographic Deposits and Returns Heritage Presence ▪ Protect and serve ▪ Exit higher-risk ▪ Continue strong ▪ Continued ▪ Improve cross- profitable and less attractive domestic deposit strategic selling initiatives, international businesses growth through a expansion (e.g. including scalable customer base Dallas, Palm wealth ▪ Pursue targeted high-touch, Beach) management ▪ Grow U.S. lending needs-based platform presence and opportunities approach ▪ Focus on enhance market within prudent ▪ Improve deposit increased share of ▪ Ongoing expense share in existing credit guidelines account wallet and non- rationalization and and adjacent lending products efficiency ▪ Refined product penetration of the markets from existing initiatives suite targeting commercial client base ▪ Enhance multi- selected domestic customer base ▪ Focus on channel client customers and ▪ Enhance retail and ▪ Expand wealth solidifying experience with verticals/niches commercial sales management presence in target improved branch with consultative client acquisition U.S. communities experience and cross-selling sales approach ▪ Initiatives to opportunities ▪ Replace low and improved increase domestic yielding foreign banking centers fee income loans with higher generation margin domestic loans Creating shareholder value through the implementation of a multi-dimensional strategic plan

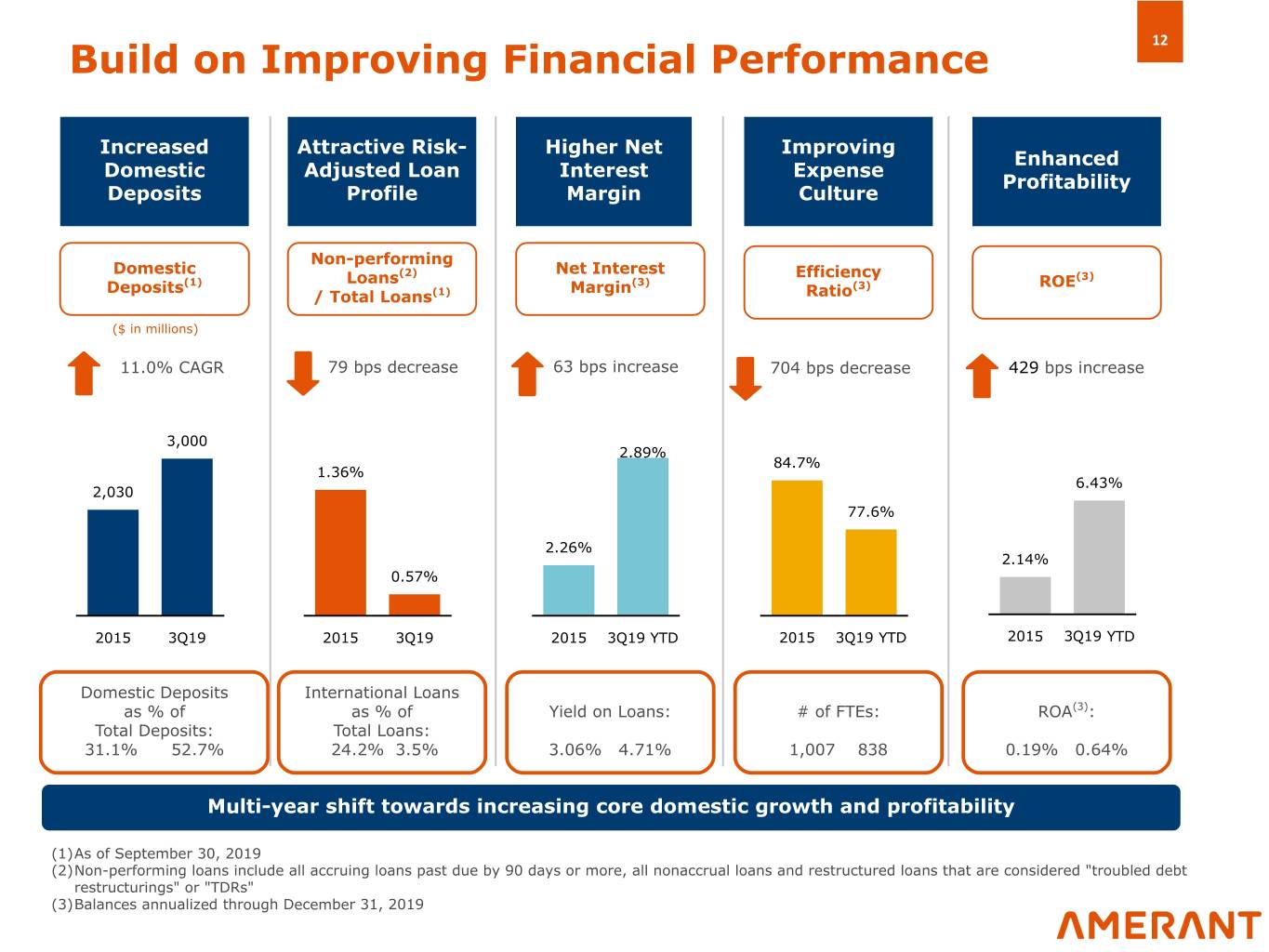

12 Build on Improving Financial Performance Increased Attractive Risk- Higher Net Improving Enhanced Domestic Adjusted Loan Interest Expense Profitability Deposits Profile Margin Culture Non-performing Domestic Net Interest Loans(2) Efficiency (3) Deposits(1) Margin(3) (3) ROE / Total Loans(1) Ratio ($ in millions) 11.0% CAGR 79 bps decrease 63 bps increase 704 bps decrease 429 bps increase 3,000 2.89% 84.7% 1.36% 6.43% 2,030 77.6% 2.26% 2.14% 0.57% 2015 3Q19 2015 3Q19 2015 3Q19 YTD 2015 3Q19 YTD 2015 3Q19 YTD Domestic Deposits International Loans as % of as % of Yield on Loans: # of FTEs: ROA(3): Total Deposits: Total Loans: 31.1% 52.7% 24.2% 3.5% 3.06% 4.71% 1,007 838 0.19% 0.64% Multi-year shift towards increasing core domestic growth and profitability (1)As of September 30, 2019 (2)Non-performing loans include all accruing loans past due by 90 days or more, all nonaccrual loans and restructured loans that are considered "troubled debt restructurings" or "TDRs" (3)Balances annualized through December 31, 2019

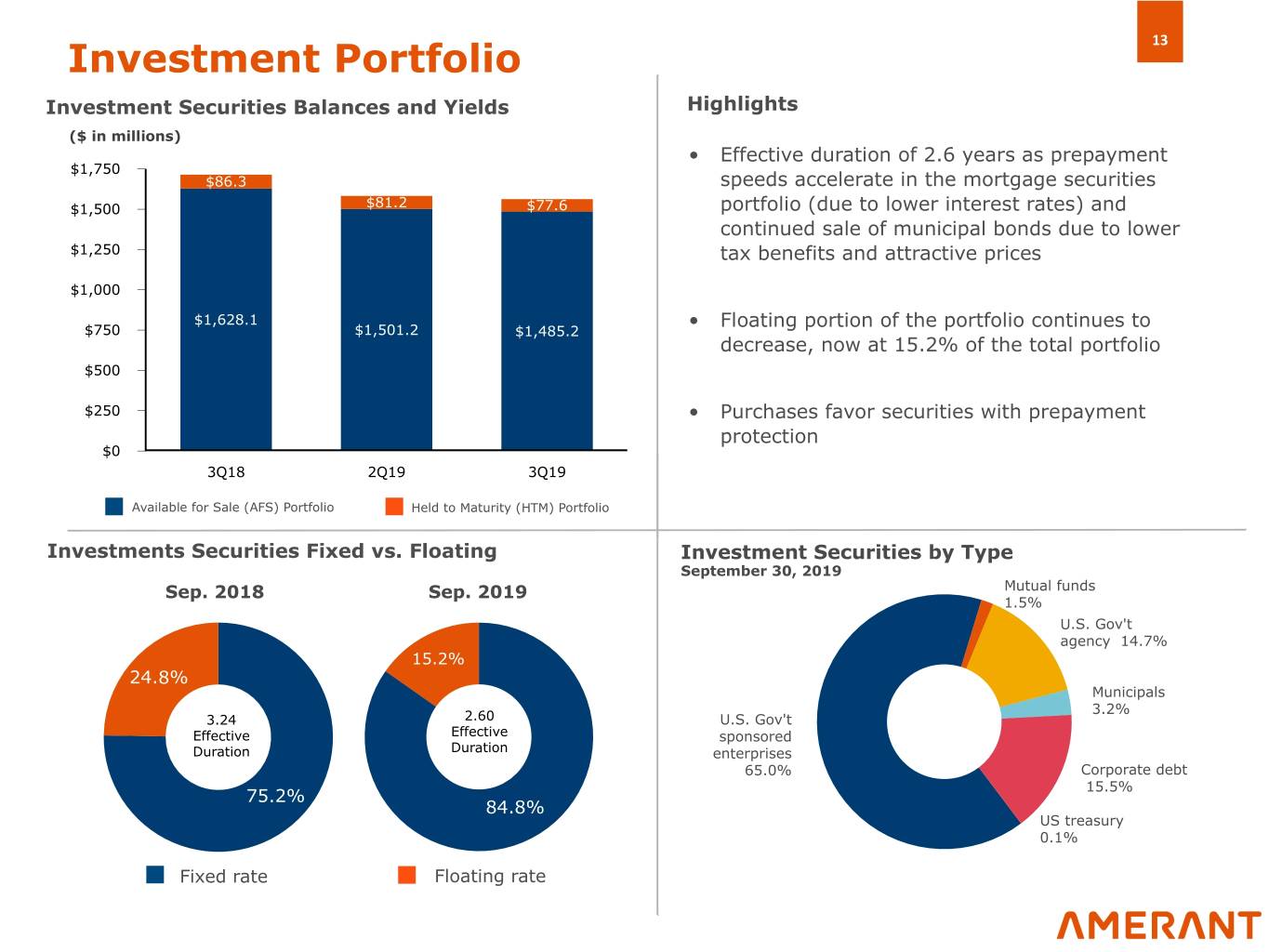

13 Investment Portfolio Investment Securities Balances and Yields Highlights ($ in millions) • Effective duration of 2.6 years as prepayment $1,750 $86.3 speeds accelerate in the mortgage securities $1,500 $81.2 $77.6 portfolio (due to lower interest rates) and continued sale of municipal bonds due to lower $1,250 tax benefits and attractive prices $1,000 $1,628.1 • Floating portion of the portfolio continues to $750 $1,501.2 $1,485.2 decrease, now at 15.2% of the total portfolio $500 $250 • Purchases favor securities with prepayment protection $0 3Q18 2Q19 3Q19 Available for Sale (AFS) Portfolio Held to Maturity (HTM) Portfolio Investments Securities Fixed vs. Floating Investment Securities by Type September 30, 2019 Sep. 2018 Sep. 2019 Mutual funds 1.5% U.S. Gov't agency 14.7% 15.2% 24.8% Municipals 3.2% 3.24 2.60 U.S. Gov't Effective Effective sponsored Duration Duration enterprises 65.0% Corporate debt 15.5% 75.2% 84.8% US treasury 0.1% Fixed rate Floating rate

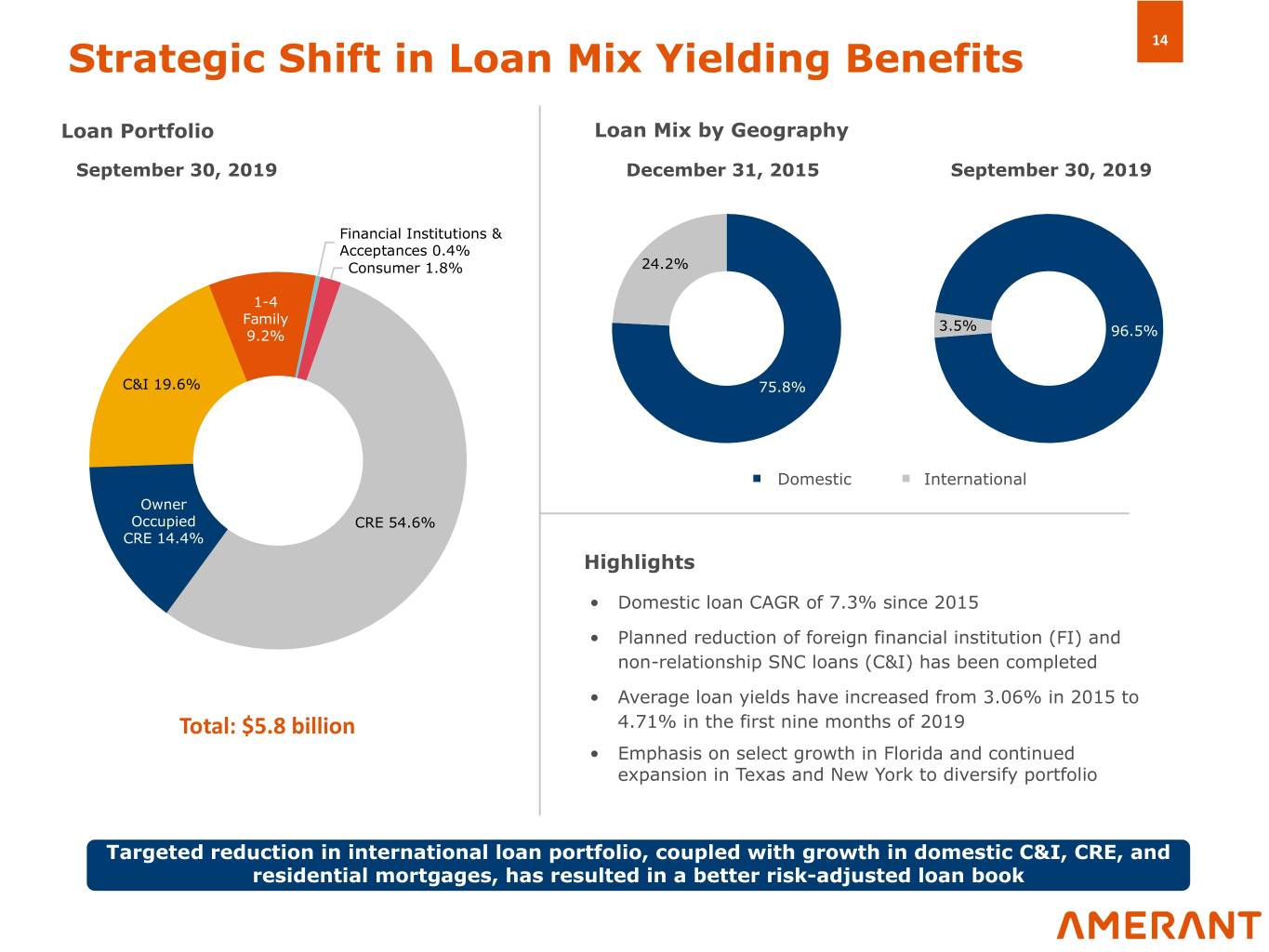

14 Strategic Shift in Loan Mix Yielding Benefits Loan Portfolio Loan Mix by Geography September 30, 2019 December 31, 2015 September 30, 2019 Financial Institutions & Acceptances 0.4% Consumer 1.8% 24.2% 1-4 Family 3.5% 9.2% 96.5% C&I 19.6% 75.8% § Domestic § International Owner Occupied CRE 54.6% CRE 14.4% Highlights • Domestic loan CAGR of 7.3% since 2015 • Planned reduction of foreign financial institution (FI) and non-relationship SNC loans (C&I) has been completed • Average loan yields have increased from 3.06% in 2015 to Total: $5.8 billion 4.71% in the first nine months of 2019 • Emphasis on select growth in Florida and continued expansion in Texas and New York to diversify portfolio Targeted reduction in international loan portfolio, coupled with growth in domestic C&I, CRE, and residential mortgages, has resulted in a better risk-adjusted loan book

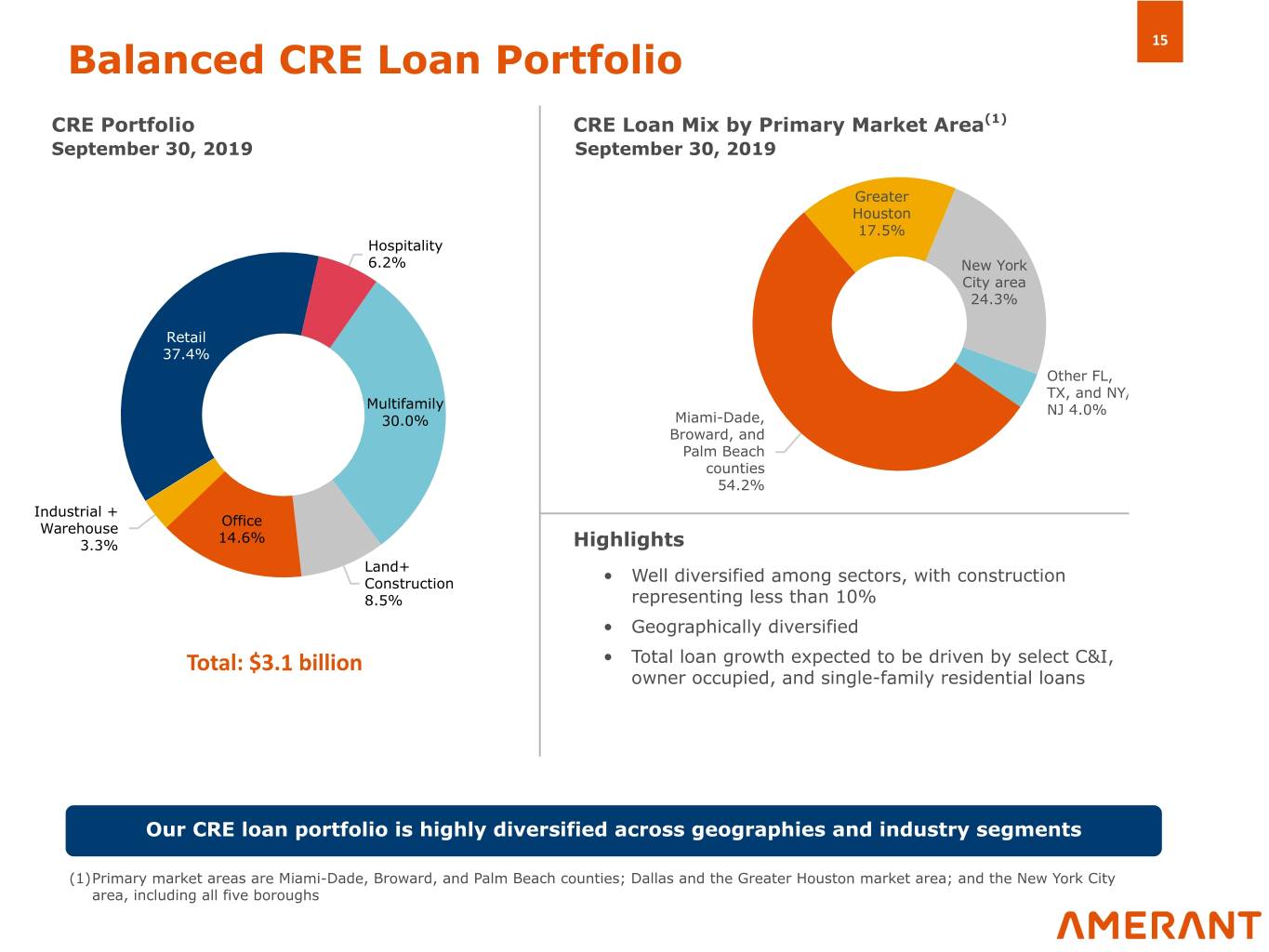

15 Balanced CRE Loan Portfolio CRE Portfolio CRE Loan Mix by Primary Market Area(1) September 30, 2019 September 30, 2019 Greater Houston 17.5% Hospitality 6.2% New York City area 24.3% Retail 37.4% Other FL, TX, and NY/ Multifamily NJ 4.0% 30.0% Miami-Dade, Broward, and Palm Beach counties 54.2% Industrial + Office Warehouse 14.6% 3.3% Highlights Land+ Construction • Well diversified among sectors, with construction 8.5% representing less than 10% • Geographically diversified Total: $3.1 billion • Total loan growth expected to be driven by select C&I, owner occupied, and single-family residential loans Our CRE loan portfolio is highly diversified across geographies and industry segments (1)Primary market areas are Miami-Dade, Broward, and Palm Beach counties; Dallas and the Greater Houston market area; and the New York City area, including all five boroughs

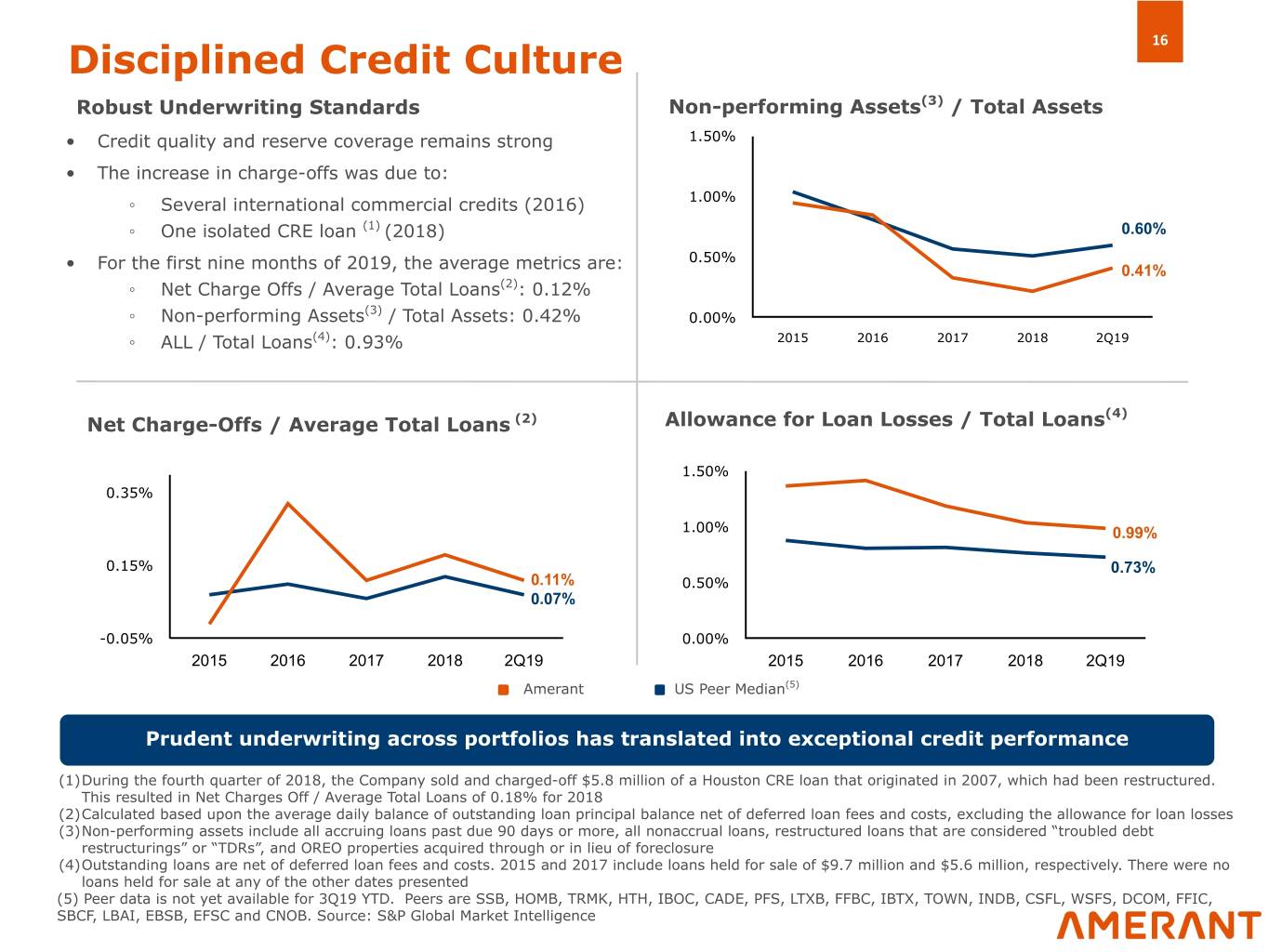

16 Disciplined Credit Culture Robust Underwriting Standards Non-performing Assets(3) / Total Assets • Credit quality and reserve coverage remains strong 1.50% • The increase in charge-offs was due to: ◦ Several international commercial credits (2016) 1.00% ◦ One isolated CRE loan (1) (2018) 0.60% 0.50% • For the first nine months of 2019, the average metrics are: 0.41% ◦ Net Charge Offs / Average Total Loans(2): 0.12% (3) ◦ Non-performing Assets / Total Assets: 0.42% 0.00% ◦ ALL / Total Loans(4): 0.93% 2015 2016 2017 2018 2Q19 (4) Net Charge-Offs / Average Total Loans (2) Allowance for Loan Losses / Total Loans 1.50% 0.35% 1.00% 0.99% 0.15% 0.73% 0.11% 0.50% 0.07% -0.05% 0.00% 2015 2016 2017 2018 2Q19 2015 2016 2017 2018 2Q19 Amerant US Peer Median(5) Prudent underwriting across portfolios has translated into exceptional credit performance (1)During the fourth quarter of 2018, the Company sold and charged-off $5.8 million of a Houston CRE loan that originated in 2007, which had been restructured. This resulted in Net Charges Off / Average Total Loans of 0.18% for 2018 (2)Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, excluding the allowance for loan losses (3)Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of foreclosure (4)Outstanding loans are net of deferred loan fees and costs. 2015 and 2017 include loans held for sale of $9.7 million and $5.6 million, respectively. There were no loans held for sale at any of the other dates presented (5) Peer data is not yet available for 3Q19 YTD. Peers are SSB, HOMB, TRMK, HTH, IBOC, CADE, PFS, LTXB, FFBC, IBTX, TOWN, INDB, CSFL, WSFS, DCOM, FFIC, SBCF, LBAI, EBSB, EFSC and CNOB. Source: S&P Global Market Intelligence

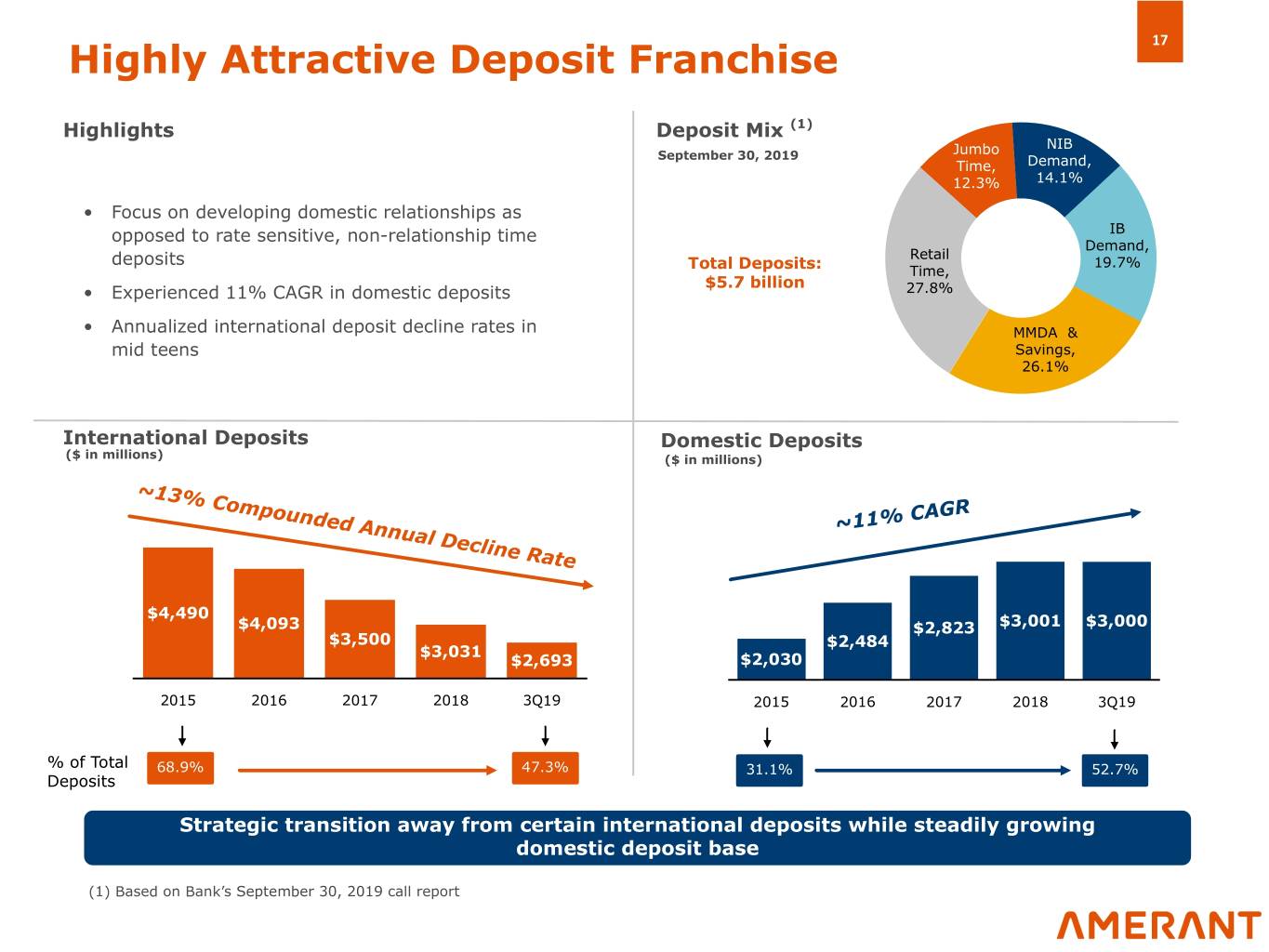

17 Highly Attractive Deposit Franchise Highlights Deposit Mix (1) NIB September 30, 2019 Jumbo Time, Demand, 12.3% 14.1% • Focus on developing domestic relationships as opposed to rate sensitive, non-relationship time IB Demand, Retail deposits 19.7% Total Deposits: Time, $5.7 billion • Experienced 11% CAGR in domestic deposits 27.8% • Annualized international deposit decline rates in MMDA & mid teens Savings, 26.1% International Deposits Domestic Deposits ($ in millions) ($ in millions) ~ 13% Compounded Annual Decline Rate ~11% CAGR $4,490 $4,093 $2,823 $3,001 $3,000 $3,500 $2,484 $3,031 $2,693 $2,030 2015 2016 2017 2018 3Q19 2015 2016 2017 2018 3Q19 % of Total 68.9% 47.3% 31.1% 52.7% Deposits Strategic transition away from certain international deposits while steadily growing domestic deposit base (1) Based on Bank’s September 30, 2019 call report

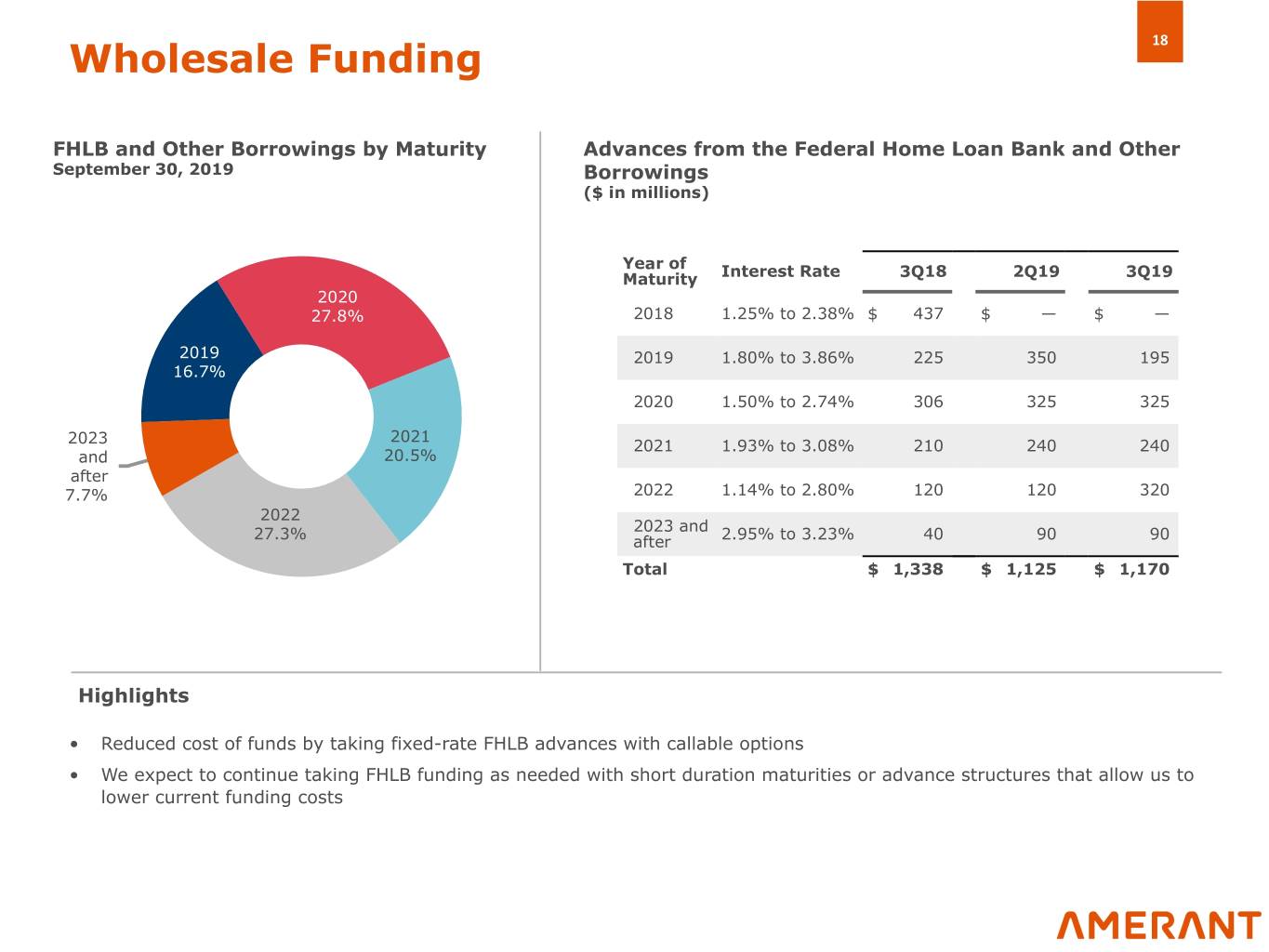

18 Wholesale Funding FHLB and Other Borrowings by Maturity Advances from the Federal Home Loan Bank and Other September 30, 2019 Borrowings ($ in millions) Year of Maturity Interest Rate 3Q18 2Q19 3Q19 2020 27.8% 2018 1.25% to 2.38% $ 437 $ — $ — 2019 2019 1.80% to 3.86% 225 350 195 16.7% 2020 1.50% to 2.74% 306 325 325 2021 2023 2021 1.93% to 3.08% 210 240 240 and 20.5% after 7.7% 2022 1.14% to 2.80% 120 120 320 2022 27.3% 2023 and after 2.95% to 3.23% 40 90 90 Total $ 1,338 $ 1,125 $ 1,170 Highlights • Reduced cost of funds by taking fixed-rate FHLB advances with callable options • We expect to continue taking FHLB funding as needed with short duration maturities or advance structures that allow us to lower current funding costs

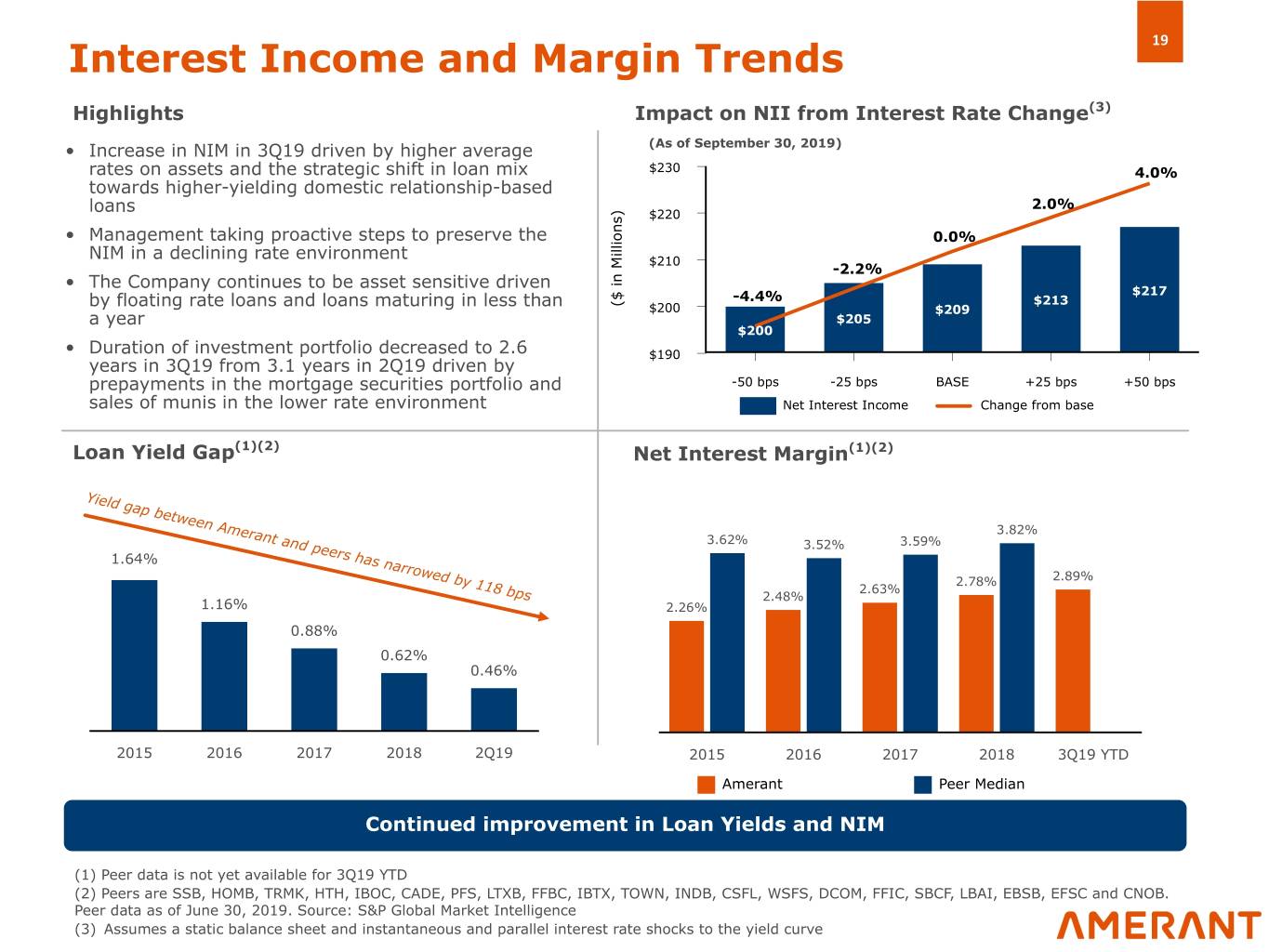

19 Interest Income and Margin Trends Highlights Impact on NII from Interest Rate Change(3) • Increase in NIM in 3Q19 driven by higher average (As of September 30, 2019) rates on assets and the strategic shift in loan mix $230 4.0% towards higher-yielding domestic relationship-based 2.0% loans $220 • Management taking proactive steps to preserve the 0.0% NIM in a declining rate environment $210 -2.2% • The Company continues to be asset sensitive driven -4.4% $217 by floating rate loans and loans maturing in less than ($ in Millions) $213 $200 $209 a year $205 $200 • Duration of investment portfolio decreased to 2.6 $190 years in 3Q19 from 3.1 years in 2Q19 driven by prepayments in the mortgage securities portfolio and -50 bps -25 bps BASE +25 bps +50 bps sales of munis in the lower rate environment Net Interest Income Change from base Loan Yield Gap(1)(2) Net Interest Margin(1)(2) Yield gap between Amerant and peers has narrowed by 118 bps 3.82% 3.62% 3.52% 3.59% 1.64% 2.78% 2.89% 2.63% 2.48% 1.16% 2.26% 0.88% 0.62% 0.46% 2015 2016 2017 2018 2Q19 2015 2016 2017 2018 3Q19 YTD Amerant Peer Median Continued improvement in Loan Yields and NIM (1) Peer data is not yet available for 3Q19 YTD (2) Peers are SSB, HOMB, TRMK, HTH, IBOC, CADE, PFS, LTXB, FFBC, IBTX, TOWN, INDB, CSFL, WSFS, DCOM, FFIC, SBCF, LBAI, EBSB, EFSC and CNOB. Peer data as of June 30, 2019. Source: S&P Global Market Intelligence (3) Assumes a static balance sheet and instantaneous and parallel interest rate shocks to the yield curve

20 Wealth Management Franchise Expansion - Key Component of Noninterest Income Wealth Management Platform 2019 YTD Noninterest Income Mix Total: $41.1 million Amerant Trust Amerant Investments § Deposits and service fees • Estate Planning • Brokerage Services 42.0% 31.1% § Brokerage, advisory, and fiduciary • Asset Protection • Investment Advisory activities • Escrow Services Services § Other noninterest income (includes (4) escrow derivative income ) 26.9% Noninterest Income as a % of Operating Highlights Revenue (1)(2)(3) • Continue focus on strategic increase in the domestic market 25.4% 24.1% 24.5% to expand our footprint 19.7% 20.3% 18.7% 18.4% 18.6% 17.5% • Recent launch of a Domestic Retail Strategy to increase banking center referrals to the Wealth Management team • $1.71 billion in assets under management/custody • Deposit and service fees also contribute significant portion to noninterest income 2015 2016 2017 2018 Q319 YTD Amerant Peer Median Expansion of fee income capabilities a key focal point and growth lever (1) Peer data is not yet available for 3Q19 YTD (2) Peers are SSB, HOMB, TRMK, HTH, IBOC, CADE, PFS, LTXB, FFBC, IBTX, TOWN, INDB, CSFL, WSFS, DCOM, FFIC, SBCF, LBAI, EBSB, EFSC and CNOB. Peer data obtained from S&P Global Market Intelligence and is adjusted to exclude all securities gains and losses (3) Noninterest Income for Amerant includes all securities gains and losses which represent less than 2.5% of noninterest income in all years. Year 2017 includes $10.5 million gain on sale of the NY building (4) $2.7 million from derivative transactions sold to customers, including $1.3 million recorded in 3Q19

21 Increasing Operating Efficiency Cost Initiatives Efficiency Ratio(1) • Simplification of business model 84.7% Rationalization and product offerings as part of 78.0% 78.8% 77.6% of Business Lines spin-off 73.8% • Deemphasized international business resulting in less complexity and reduced costs • Investments in technology are expected to drive further reduction 2015 2016 2017 2018 3Q19 YTD Head Count in back-office headcount, Reduction generating efficiencies • FTEs down 110, or 11.6% since Net Interest Income as a % of Average (2) September 2018 Earnings Assets 2.89% 2.78% 2.63% • Reduction and reorganization of 2.48% Space existing office space to increase Efficiencies the amount available for lease to third parties 2.26% • Branch of the future model will be smaller and optimize customer interaction 2015 2016 2017 2018 3Q19 YTD Simplification of business model and new technology initiatives will allow for a significant reduction in headcount and further improvement in the efficiency ratio (1)Balances annualized through December 31, 2019 (2)Includes loans, securities available for sale and held to maturity, deposits with banks and other financial assets, which yield interests or similar income

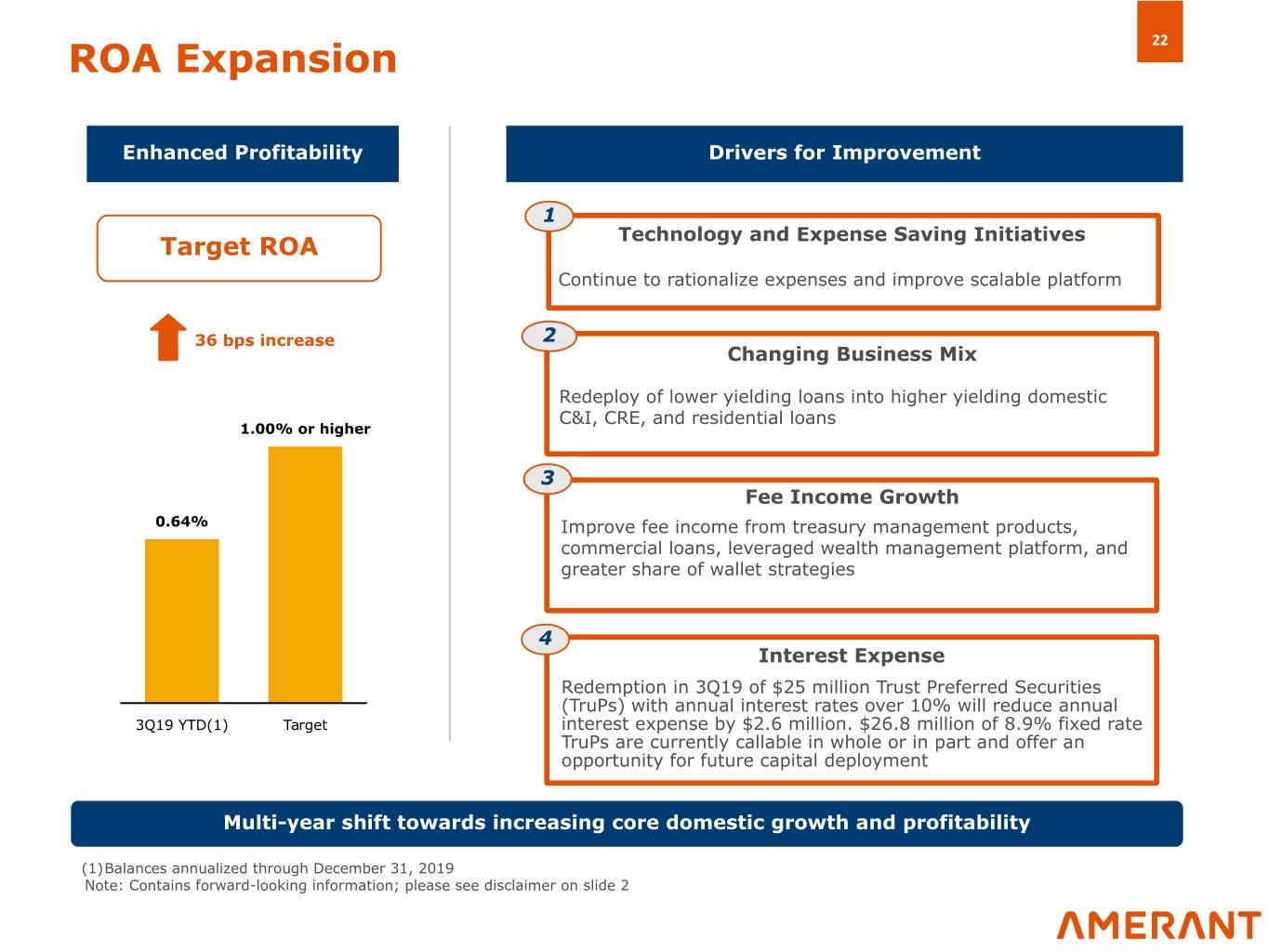

22 ROA Expansion Enhanced Profitability Drivers for Improvement 1 Technology and Expense Saving Initiatives Target ROA Continue to rationalize expenses and improve scalable platform 36 bps increase 2 Changing Business Mix Redeploy of lower yielding loans into higher yielding domestic C&I, CRE, and residential loans 1.00% or higher 3 Fee Income Growth 0.64% Improve fee income from treasury management products, commercial loans, leveraged wealth management platform, and greater share of wallet strategies 4 Interest Expense Redemption in 3Q19 of $25 million Trust Preferred Securities (TruPs) with annual interest rates over 10% will reduce annual 3Q19 YTD(1) Target interest expense by $2.6 million. $26.8 million of 8.9% fixed rate TruPs are currently callable in whole or in part and offer an opportunity for future capital deployment Multi-year shift towards increasing core domestic growth and profitability (1)Balances annualized through December 31, 2019 Note: Contains forward-looking information; please see disclaimer on slide 2

23 Investment Highlights Shift from preservation of capital to driving profitable growth and shareholder value Substantial and continuing insider ownership, approximately 30% Strong asset quality and domestic loan growth Focus on expanding domestic deposit base throughout our high growth U.S. markets Low cost deposits from international customers who view U.S. as a safe haven for their savings Diversification of revenue from a greater share of wallet strategy and an attractive wealth management platform that is being emphasized and cross-sold to domestic customers Top-shelf risk management culture stemming from having been part of large, multi-national organization

Appendices

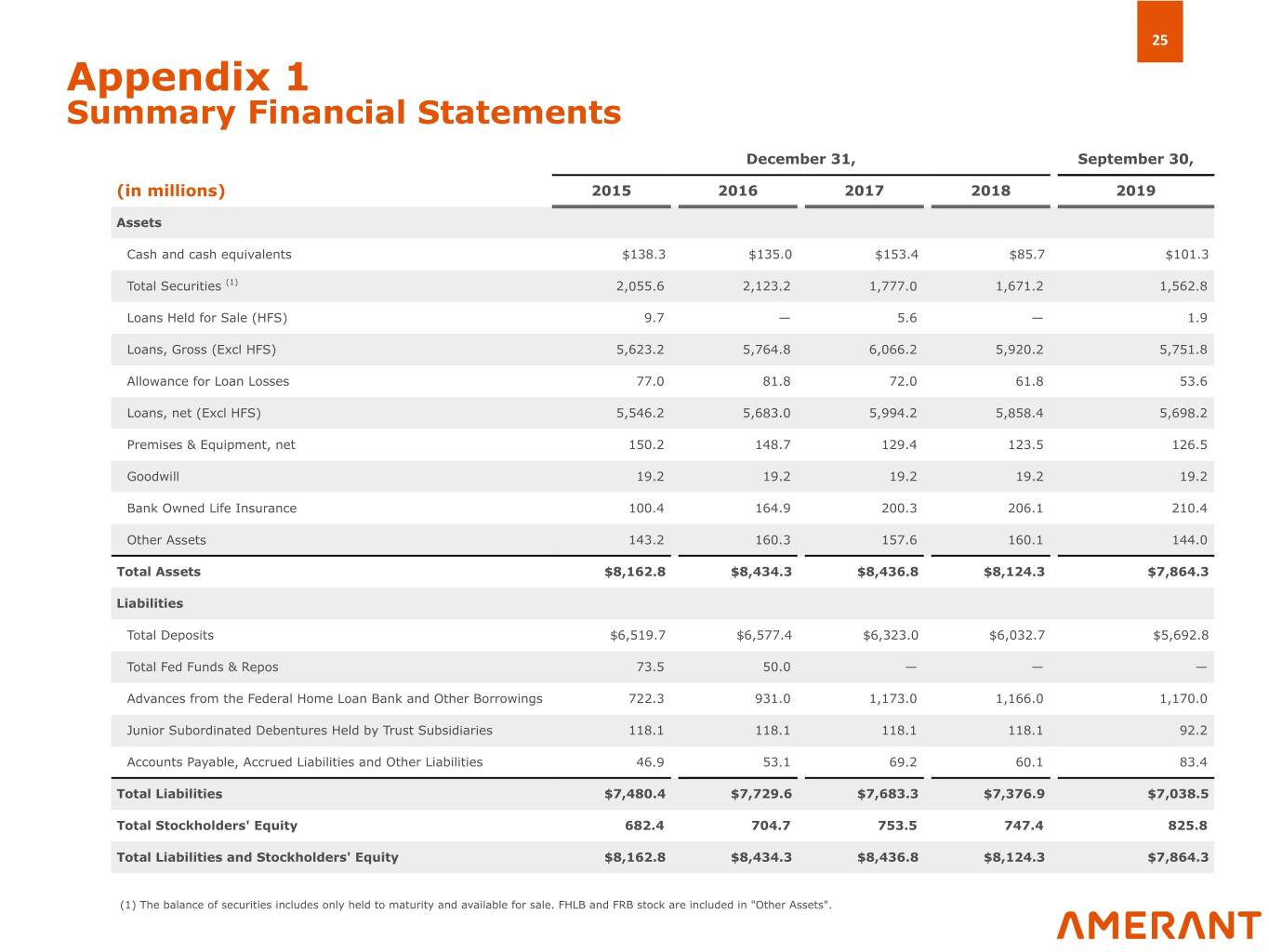

25 Appendix 1 Summary Financial Statements December 31, September 30, (in millions) 2015 2016 2017 2018 2019 Assets Cash and cash equivalents $138.3 $135.0 $153.4 $85.7 $101.3 Total Securities (1) 2,055.6 2,123.2 1,777.0 1,671.2 1,562.8 Loans Held for Sale (HFS) 9.7 — 5.6 — 1.9 Loans, Gross (Excl HFS) 5,623.2 5,764.8 6,066.2 5,920.2 5,751.8 Allowance for Loan Losses 77.0 81.8 72.0 61.8 53.6 Loans, net (Excl HFS) 5,546.2 5,683.0 5,994.2 5,858.4 5,698.2 Premises & Equipment, net 150.2 148.7 129.4 123.5 126.5 Goodwill 19.2 19.2 19.2 19.2 19.2 Bank Owned Life Insurance 100.4 164.9 200.3 206.1 210.4 Other Assets 143.2 160.3 157.6 160.1 144.0 Total Assets $8,162.8 $8,434.3 $8,436.8 $8,124.3 $7,864.3 Liabilities Total Deposits $6,519.7 $6,577.4 $6,323.0 $6,032.7 $5,692.8 Total Fed Funds & Repos 73.5 50.0 — — — Advances from the Federal Home Loan Bank and Other Borrowings 722.3 931.0 1,173.0 1,166.0 1,170.0 Junior Subordinated Debentures Held by Trust Subsidiaries 118.1 118.1 118.1 118.1 92.2 Accounts Payable, Accrued Liabilities and Other Liabilities 46.9 53.1 69.2 60.1 83.4 Total Liabilities $7,480.4 $7,729.6 $7,683.3 $7,376.9 $7,038.5 Total Stockholders' Equity 682.4 704.7 753.5 747.4 825.8 Total Liabilities and Stockholders' Equity $8,162.8 $8,434.3 $8,436.8 $8,124.3 $7,864.3 (1) The balance of securities includes only held to maturity and available for sale. FHLB and FRB stock are included in "Other Assets".

26 Appendix 1 Summary Financial Statements (cont’d) Years ended December 31, Nine months ended (in thousands) 2015 2016 2017 2018 September 30, 2019 Total Interest Income $208,199 $238,827 $273,320 $309,358 $237,737 Total Interest Expense 35,914 46,894 63,610 90,319 75,911 Net Interest Income $172,285 $191,933 $209,710 $219,039 $161,826 (Reversal of) Provision for Loan & ) ) Lease Losses 11,220 22,110 (3,490 375 (2,850 Total Noninterest Income 54,756 62,270 71,485 53,875 41,139 Total Noninterest Expense 192,262 198,303 207,636 214,973 157,587 Net Income before Income Tax 23,559 33,790 77,049 57,566 48,228 Income Tax (8,514) (10,211) (33,992) (11,733) (10,369) Net Income $15,045 $23,579 $43,057 $45,833 $37,859

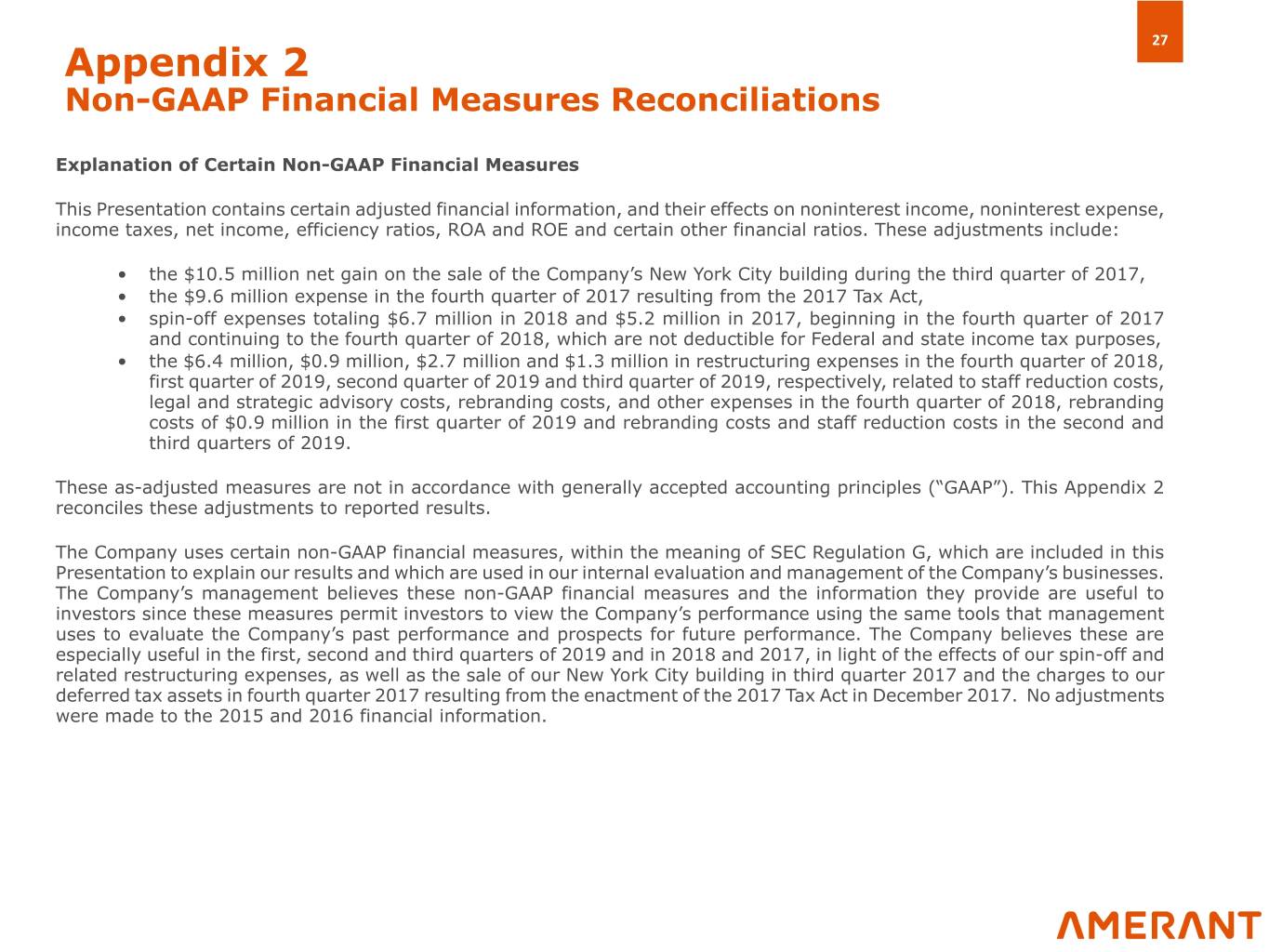

27 Appendix 2 Non-GAAP Financial Measures Reconciliations Explanation of Certain Non-GAAP Financial Measures This Presentation contains certain adjusted financial information, and their effects on noninterest income, noninterest expense, income taxes, net income, efficiency ratios, ROA and ROE and certain other financial ratios. These adjustments include: • the $10.5 million net gain on the sale of the Company’s New York City building during the third quarter of 2017, • the $9.6 million expense in the fourth quarter of 2017 resulting from the 2017 Tax Act, • spin-off expenses totaling $6.7 million in 2018 and $5.2 million in 2017, beginning in the fourth quarter of 2017 and continuing to the fourth quarter of 2018, which are not deductible for Federal and state income tax purposes, • the $6.4 million, $0.9 million, $2.7 million and $1.3 million in restructuring expenses in the fourth quarter of 2018, first quarter of 2019, second quarter of 2019 and third quarter of 2019, respectively, related to staff reduction costs, legal and strategic advisory costs, rebranding costs, and other expenses in the fourth quarter of 2018, rebranding costs of $0.9 million in the first quarter of 2019 and rebranding costs and staff reduction costs in the second and third quarters of 2019. These as-adjusted measures are not in accordance with generally accepted accounting principles (“GAAP”). This Appendix 2 reconciles these adjustments to reported results. The Company uses certain non-GAAP financial measures, within the meaning of SEC Regulation G, which are included in this Presentation to explain our results and which are used in our internal evaluation and management of the Company’s businesses. The Company’s management believes these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view the Company’s performance using the same tools that management uses to evaluate the Company’s past performance and prospects for future performance. The Company believes these are especially useful in the first, second and third quarters of 2019 and in 2018 and 2017, in light of the effects of our spin-off and related restructuring expenses, as well as the sale of our New York City building in third quarter 2017 and the charges to our deferred tax assets in fourth quarter 2017 resulting from the enactment of the 2017 Tax Act in December 2017. No adjustments were made to the 2015 and 2016 financial information.

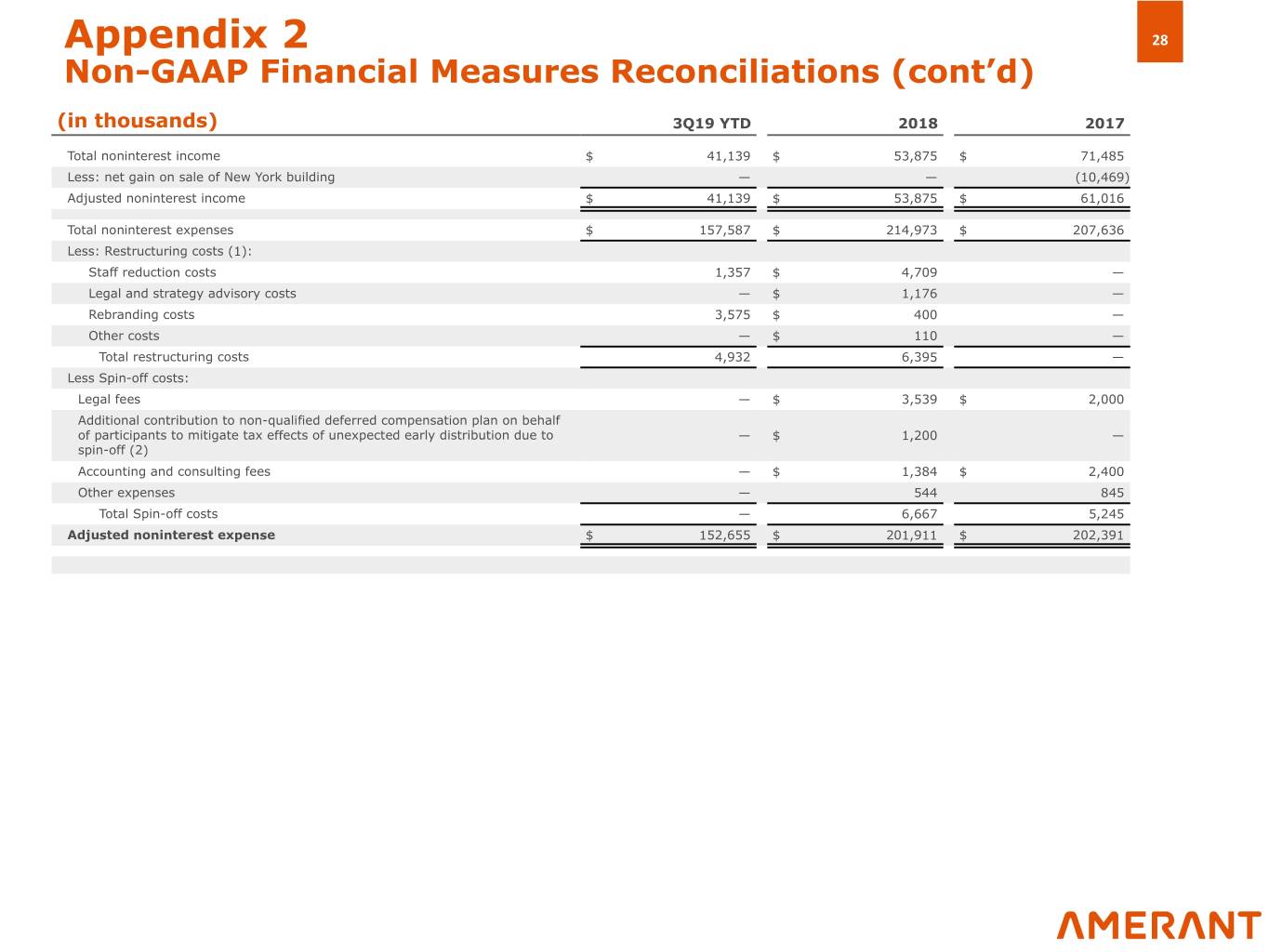

Appendix 2 28 Non-GAAP Financial Measures Reconciliations (cont’d) (in thousands) 3Q19 YTD 2018 2017 Total noninterest income $ 41,139 $ 53,875 $ 71,485 Less: net gain on sale of New York building — — (10,469) Adjusted noninterest income $ 41,139 $ 53,875 $ 61,016 Total noninterest expenses $ 157,587 $ 214,973 $ 207,636 Less: Restructuring costs (1): Staff reduction costs 1,357 $ 4,709 — Legal and strategy advisory costs — $ 1,176 — Rebranding costs 3,575 $ 400 — Other costs — $ 110 — Total restructuring costs 4,932 6,395 — Less Spin-off costs: Legal fees — $ 3,539 $ 2,000 Additional contribution to non-qualified deferred compensation plan on behalf of participants to mitigate tax effects of unexpected early distribution due to — $ 1,200 — spin-off (2) Accounting and consulting fees — $ 1,384 $ 2,400 Other expenses — 544 845 Total Spin-off costs — 6,667 5,245 Adjusted noninterest expense $ 152,655 $ 201,911 $ 202,391

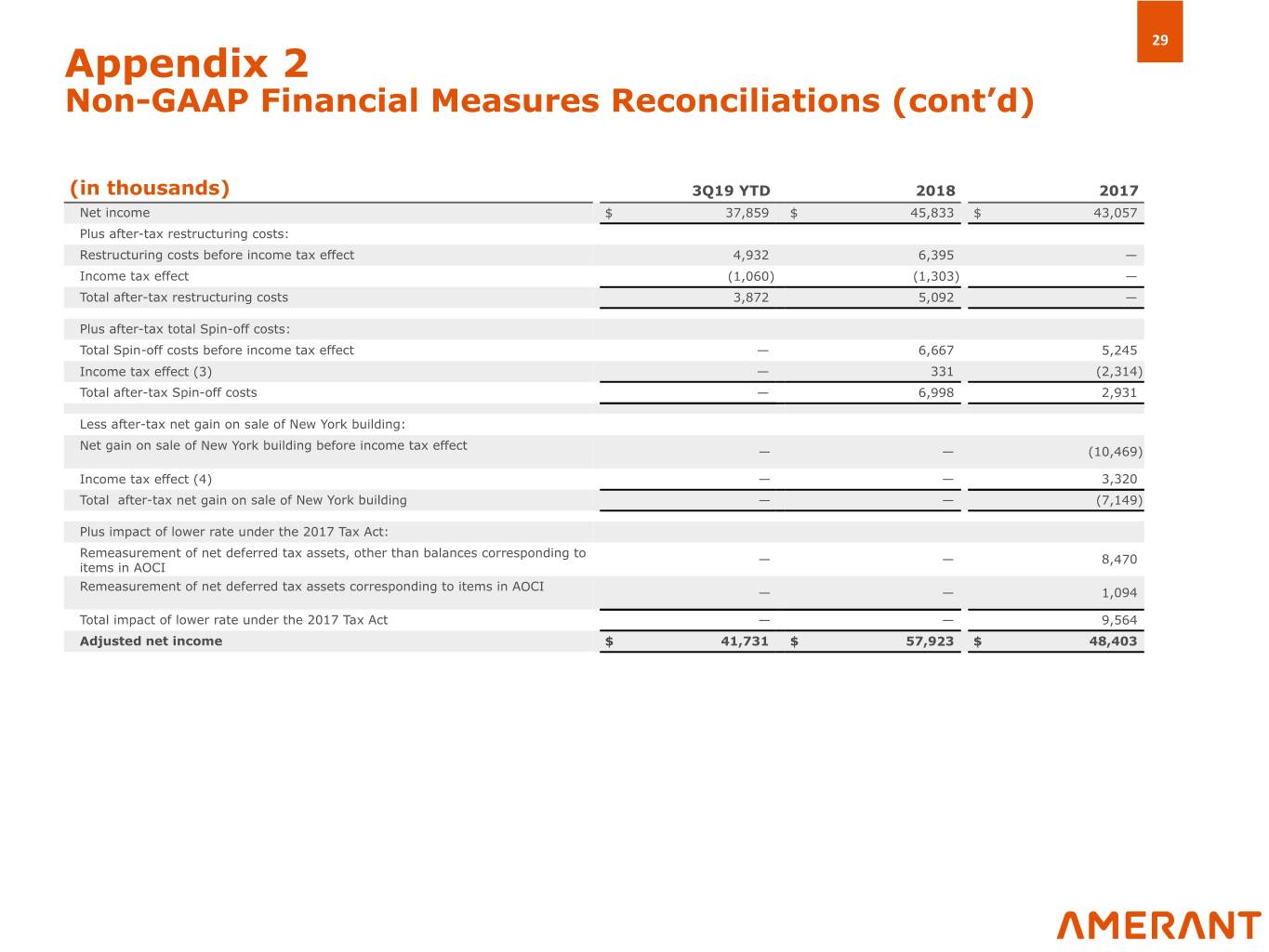

29 Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d) (in thousands) 3Q19 YTD 2018 2017 Net income $ 37,859 $ 45,833 $ 43,057 Plus after-tax restructuring costs: Restructuring costs before income tax effect 4,932 6,395 — Income tax effect (1,060) (1,303) — Total after-tax restructuring costs 3,872 5,092 — Plus after-tax total Spin-off costs: Total Spin-off costs before income tax effect — 6,667 5,245 Income tax effect (3) — 331 (2,314) Total after-tax Spin-off costs — 6,998 2,931 Less after-tax net gain on sale of New York building: Net gain on sale of New York building before income tax effect — — (10,469) Income tax effect (4) — — 3,320 Total after-tax net gain on sale of New York building — — (7,149) Plus impact of lower rate under the 2017 Tax Act: Remeasurement of net deferred tax assets, other than balances corresponding to — — 8,470 items in AOCI Remeasurement of net deferred tax assets corresponding to items in AOCI — — 1,094 Total impact of lower rate under the 2017 Tax Act — — 9,564 Adjusted net income $ 41,731 $ 57,923 $ 48,403

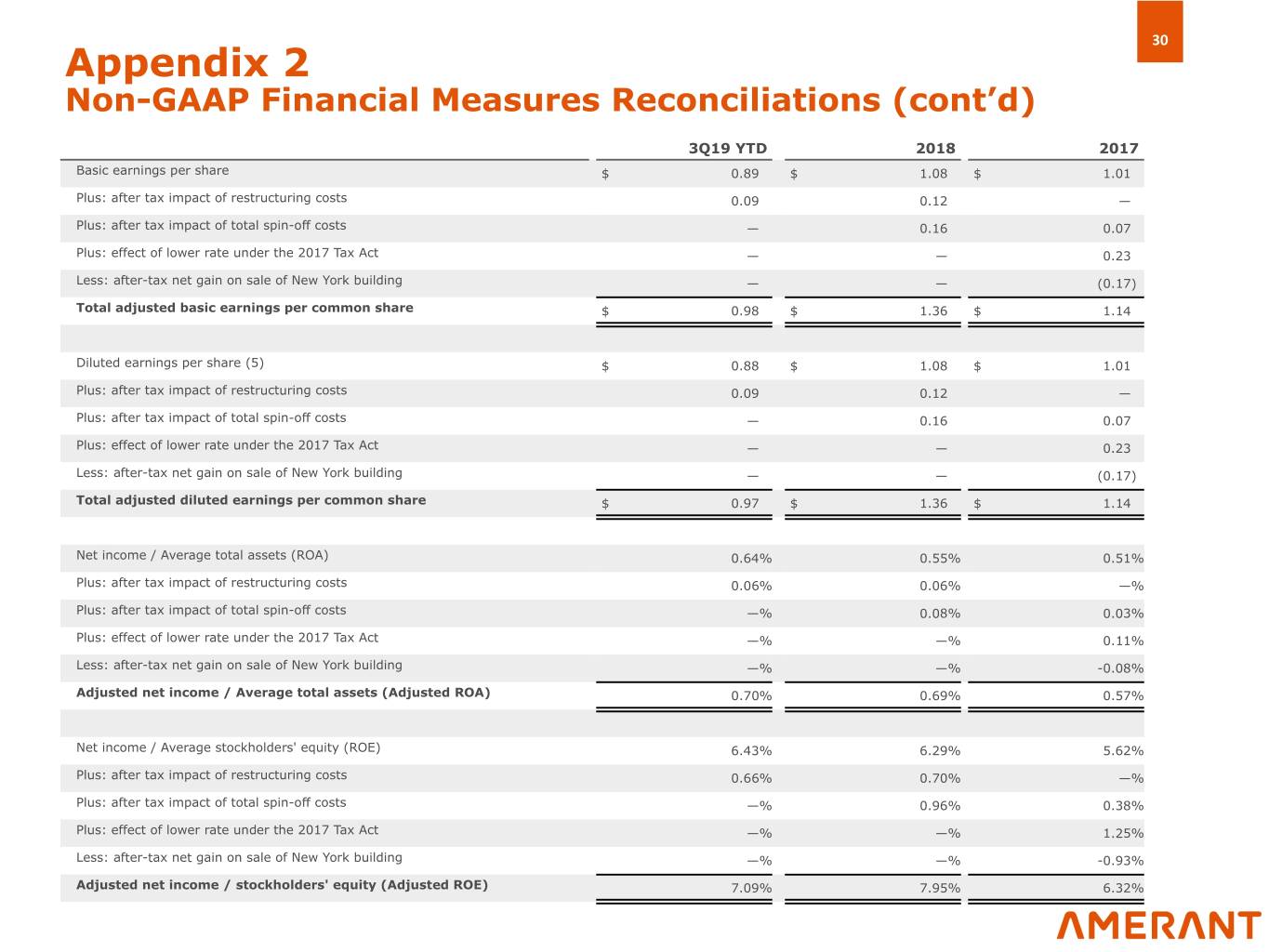

30 Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d) 3Q19 YTD 2018 2017 Basic earnings per share $ 0.89 $ 1.08 $ 1.01 Plus: after tax impact of restructuring costs 0.09 0.12 — Plus: after tax impact of total spin-off costs — 0.16 0.07 Plus: effect of lower rate under the 2017 Tax Act — — 0.23 Less: after-tax net gain on sale of New York building — — (0.17) Total adjusted basic earnings per common share $ 0.98 $ 1.36 $ 1.14 Diluted earnings per share (5) $ 0.88 $ 1.08 $ 1.01 Plus: after tax impact of restructuring costs 0.09 0.12 — Plus: after tax impact of total spin-off costs — 0.16 0.07 Plus: effect of lower rate under the 2017 Tax Act — — 0.23 Less: after-tax net gain on sale of New York building — — (0.17) Total adjusted diluted earnings per common share $ 0.97 $ 1.36 $ 1.14 Net income / Average total assets (ROA) 0.64% 0.55% 0.51% Plus: after tax impact of restructuring costs 0.06% 0.06% —% Plus: after tax impact of total spin-off costs —% 0.08% 0.03% Plus: effect of lower rate under the 2017 Tax Act —% —% 0.11% Less: after-tax net gain on sale of New York building —% —% -0.08% Adjusted net income / Average total assets (Adjusted ROA) 0.70% 0.69% 0.57% Net income / Average stockholders' equity (ROE) 6.43% 6.29% 5.62% Plus: after tax impact of restructuring costs 0.66% 0.70% —% Plus: after tax impact of total spin-off costs —% 0.96% 0.38% Plus: effect of lower rate under the 2017 Tax Act —% —% 1.25% Less: after-tax net gain on sale of New York building —% —% -0.93% Adjusted net income / stockholders' equity (Adjusted ROE) 7.09% 7.95% 6.32%

31 Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d) (in thousands, except per share data and percentages) 3Q19 YTD 2018 2017 Efficiency ratio 77.64 % 78.77 % 73.84 % Less: impact of restructuring costs (2.43)% (2.34)% — % Less: impact of total spin-off costs — % (2.44)% (1.86)% Plus: after-tax net gain on sale of New York building — % — % 2.78 % Adjusted efficiency ratio 75.21 % 73.99 % 74.76 % Tangible common equity ratio: Stockholders' equity $ 825,751 $ 747,418 $ 753,450 Less: Goodwill and other intangibles (20,933) (21,042) (21,186) Tangible common stockholders' equity $ 804,818 $ 726,376 $ 732,264 Total assets 7,864,260 8,124,347 8,436,767 Less: Goodwill and other intangibles (20,933) (21,042) (21,186) Tangible assets $ 7,843,327 $ 8,103,305 $ 8,415,581 Common shares outstanding 43,205 43,183 42,489 Tangible common equity ratio 10.26 % 8.96 % 8.70 % Stockholders' book value per common share $ 19.11 $ 17.31 $ 17.73 Tangible stockholders' book value per common share $ 18.63 $ 16.82 $ 17.23

32 Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d) (1) Expenses incurred for actions designed to implement the Company’s strategy as a new independent company. These actions include, but are not limited to, reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (2) The spin-off caused an unexpected early distribution for U.S. federal income tax purposes from our deferred compensation plan. This distribution was taxable to plan participants as ordinary income during 2018. We partially compensated plan participants, in the aggregate amount of $1.2 million, for the higher tax expense they incurred as a result of the distribution increasing the plan participants' estimated effective federal income tax rates by recording a contribution to the plan on behalf of its participants. The after tax net effect of this $1.2 million contribution for the period ended September 30, 2018, was approximately $952,000. As a result of the early taxable distribution to plan participants, we expensed and deducted for federal income tax purposes, previously deferred compensation of approximately $8.1 million, resulting in an estimated tax credit of $1.7 million, which exceeded the amount of the tax gross-up paid to plan participants. (3) Calculated based upon the estimated annual effective tax rate for the periods, which excludes the tax effect of discrete items, and the amounts that resulted from the permanent difference between spin-off costs that are non-deductible for Federal and state income tax purposes, and total spin-off costs recognized in the consolidated financial statements. The estimated annual effective rate applied for the calculation differs from the reported effective tax rate since it is based on a different mix of statutory rates applicable to these expenses and to the rates applicable to the Company and its subsidiaries. (4) Calculated based upon an estimated annual effective rate of 31.71%. (5) As of September 30, 2019, potential dilutive instruments included 738,138 unvested shares of restricted stock, including 736,839 shares of restricted stock issued in December 2018 in connection with the Company’s IPO and 1,299 additional shares of restricted stock issued in January 2019. As of September 30, 2019, these 738,138 unvested shares of restricted stock were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share at those dates, fewer shares would have been purchased than restricted shares assumed issued. Therefore, at that date, such awards resulted in higher diluted weighted averages shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings in the nine months ended September 30, 2019. We had no outstanding dilutive instruments as of any period prior to December 2018.

Thank you