Fourth Quarter 2019 Financial Review Earnings Call January 30, 2020

2 Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, including, without limitation, future financial and operating results; costs and revenues; economic conditions generally and in our markets and among our customer base; loan demand; mortgage lending activity; changes in the mix of our earning assets and our deposit and wholesale liabilities; net interest margin; yields on earning assets; interest rates (generally and those applicable to our assets and liabilities); credit quality, including loan performance, nonperforming assets, provisions for loan losses, charge-offs, rebranding and staff realignment costs and expected savings, other- than-temporary impairments and collateral values; market trends; and customer preferences, as well as statements with respect to our objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward- looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlook”, "modeled" and other similar words and expressions of the future. Forward-looking statements, including those as to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2018 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including the three and twelve month periods ended December 31, 2019 and the three month period ended December 31, 2018, may not reflect our results of operations for our fiscal year ended, or financial condition as of December 31, 2019, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with generally accepted accounting principles in the United States of America (“GAAP”) with non- GAAP financial measures, such as Adjusted Net Income per Share (Basic and Diluted), Adjusted Noninterest Expense, Adjusted Return on Equity (ROE), Adjusted Return on Assets (ROA), and other ratios. This supplemental information should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including these, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our business. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we incurred in 2018 in connection with the Spin-off and related transactions, the rebranding and restructuring expenses which began in 2018 and continued in 2019, and the one-time gain on sale of vacant land in Florida in the fourth quarter of 2019. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. See Appendix 1 “Non-GAAP Financial Measures Reconciliations” for a reconciliation of these non-GAAP financial measures to their GAAP counterparts.

Performance Highlights FYE 2019 and 4Q19 3 Strategy-Driven Achievements • Full-year net income increased 12.0% or $5.5 million; diluted EPS reached $1.20 from $1.08. In 4Q19, net income increased 12.9%, or $1.5 million from 3Q19; diluted EPS reached $0.31 from $0.28 • Noninterest income increased 15.4% over 3Q19 driven by higher income from derivatives sold to Profitability customers as well as a one time gain on the sale of vacant land adjacent to our operations center and a benefit from the adoption of a new accounting standard on financial instruments • Reduction of 82 FTEs from 4Q18, primarily in back-office positions, in line with efficiency improvement strategy • Total loans, excluding non-relationship SNCs and foreign financial institution (FI) loans, increased $137.4 Balance Sheet million, or 2.5% year over year following our domestic relationship driven strategy Optimization • New composition of FHLB advances resulted in savings of $0.7 million during 4Q19 and $3.5 million YTD • Completed $25 million TruPs redemption in 2019 and announced redemption of 8.90% TruPs to take place on January 30, 2020 • Credit quality remained strong in Q4 2019; Allowance for Loan Losses (ALL) release of $0.3 million; Credit Quality recovery of $0.9 million on a C&I loan • ALL coverage continued to be strong in Q4 2019 at 0.91% • Opened three new banking centers in South Florida during 2019 and expect to open a new one during Domestic 1Q20, expanding our retail footprint and continuing our focus on domestic growth Expansion • Embarked on our digital evolution; engaged Salesforce for its Customer Relationship Management ("CRM") system and nCino for its loan origination solution

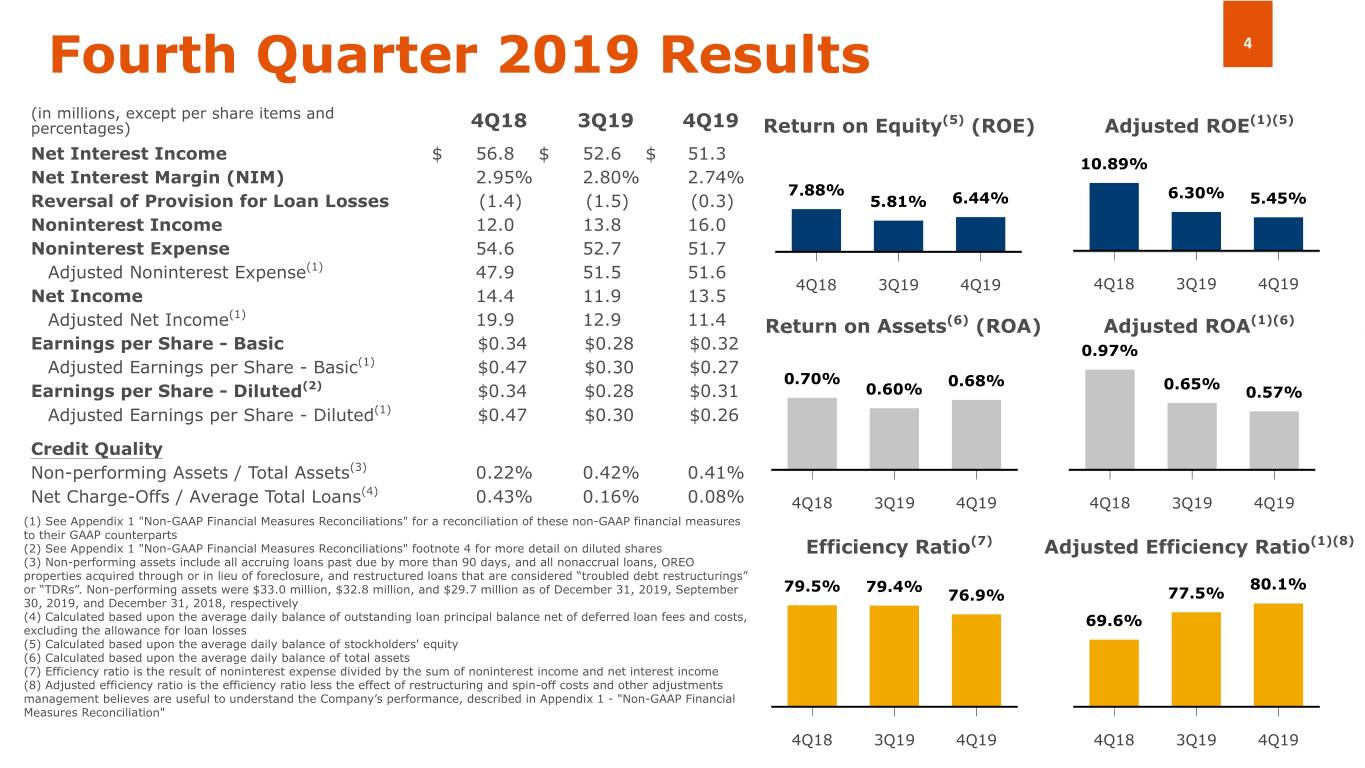

Fourth Quarter 2019 Results 4 (in millions, except per share items and (5) (1)(5) percentages) 4Q18 3Q19 4Q19 Return on Equity (ROE) Adjusted ROE Net Interest Income $ 56.8 $ 52.6 $ 51.3 10.89% Net Interest Margin (NIM) 2.95% 2.80% 2.74% 7.88% 6.30% Reversal of Provision for Loan Losses (1.4) (1.5) (0.3) 5.81% 6.44% 5.45% Noninterest Income 12.0 13.8 16.0 Noninterest Expense 54.6 52.7 51.7 Adjusted Noninterest Expense(1) 47.9 51.5 51.6 4Q18 3Q19 4Q19 4Q18 3Q19 4Q19 Net Income 14.4 11.9 13.5 (1) Adjusted Net Income 19.9 12.9 11.4 Return on Assets(6) (ROA) Adjusted ROA(1)(6) Earnings per Share - Basic $0.34 $0.28 $0.32 0.97% Adjusted Earnings per Share - Basic(1) $0.47 $0.30 $0.27 (2) 0.70% 0.68% 0.65% Earnings per Share - Diluted $0.34 $0.28 $0.31 0.60% 0.57% Adjusted Earnings per Share - Diluted(1) $0.47 $0.30 $0.26 Credit Quality Non-performing Assets / Total Assets(3) 0.22% 0.42% 0.41% (4) Net Charge-Offs / Average Total Loans 0.43% 0.16% 0.08% 4Q18 3Q19 4Q19 4Q18 3Q19 4Q19 (1) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP counterparts (7) (1)(8) (2) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" footnote 4 for more detail on diluted shares Efficiency Ratio Adjusted Efficiency Ratio (3) Non-performing assets include all accruing loans past due by more than 90 days, and all nonaccrual loans, OREO properties acquired through or in lieu of foreclosure, and restructured loans that are considered “troubled debt restructurings” 79.5% 79.4% 80.1% or “TDRs”. Non-performing assets were $33.0 million, $32.8 million, and $29.7 million as of December 31, 2019, September 76.9% 77.5% 30, 2019, and December 31, 2018, respectively (4) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, 69.6% excluding the allowance for loan losses (5) Calculated based upon the average daily balance of stockholders' equity (6) Calculated based upon the average daily balance of total assets (7) Efficiency ratio is the result of noninterest expense divided by the sum of noninterest income and net interest income (8) Adjusted efficiency ratio is the efficiency ratio less the effect of restructuring and spin-off costs and other adjustments management believes are useful to understand the Company’s performance, described in Appendix 1 - "Non-GAAP Financial Measures Reconciliation" 4Q18 3Q19 4Q19 4Q18 3Q19 4Q19

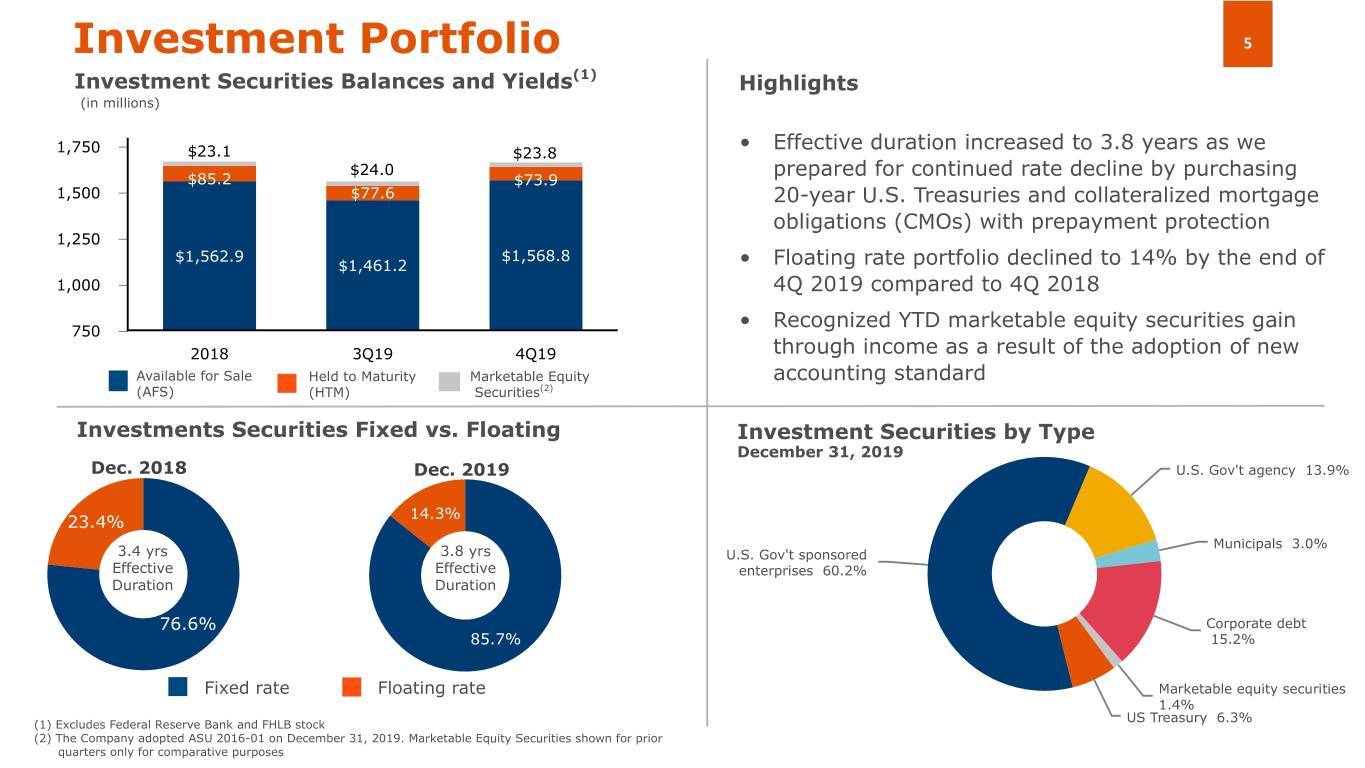

Investment Portfolio 5 Investment Securities Balances and Yields(1) Highlights (in millions) • Effective duration increased to 3.8 years as we 1,750 $23.1 $23.8 $24.0 prepared for continued rate decline by purchasing $85.2 $73.9 1,500 $77.6 20-year U.S. Treasuries and collateralized mortgage obligations (CMOs) with prepayment protection 1,250 $1,562.9 $1,568.8 $1,461.2 • Floating rate portfolio declined to 14% by the end of 1,000 4Q 2019 compared to 4Q 2018 • Recognized YTD marketable equity securities gain 750 2018 3Q19 4Q19 through income as a result of the adoption of new Available for Sale Held to Maturity Marketable Equity accounting standard (AFS) (HTM) Securities(2) Investments Securities Fixed vs. Floating Investment Securities by Type December 31, 2019 Dec. 2018 Dec. 2019 U.S. Gov't agency 13.9% 23.4% 14.3% Municipals 3.0% 3.4 yrs 3.8 yrs U.S. Gov't sponsored Effective Effective enterprises 60.2% Duration Duration 76.6% Corporate debt 85.7% 15.2% Fixed rate Floating rate Marketable equity securities 1.4% US Treasury 6.3% (1) Excludes Federal Reserve Bank and FHLB stock (2) The Company adopted ASU 2016-01 on December 31, 2019. Marketable Equity Securities shown for prior quarters only for comparative purposes

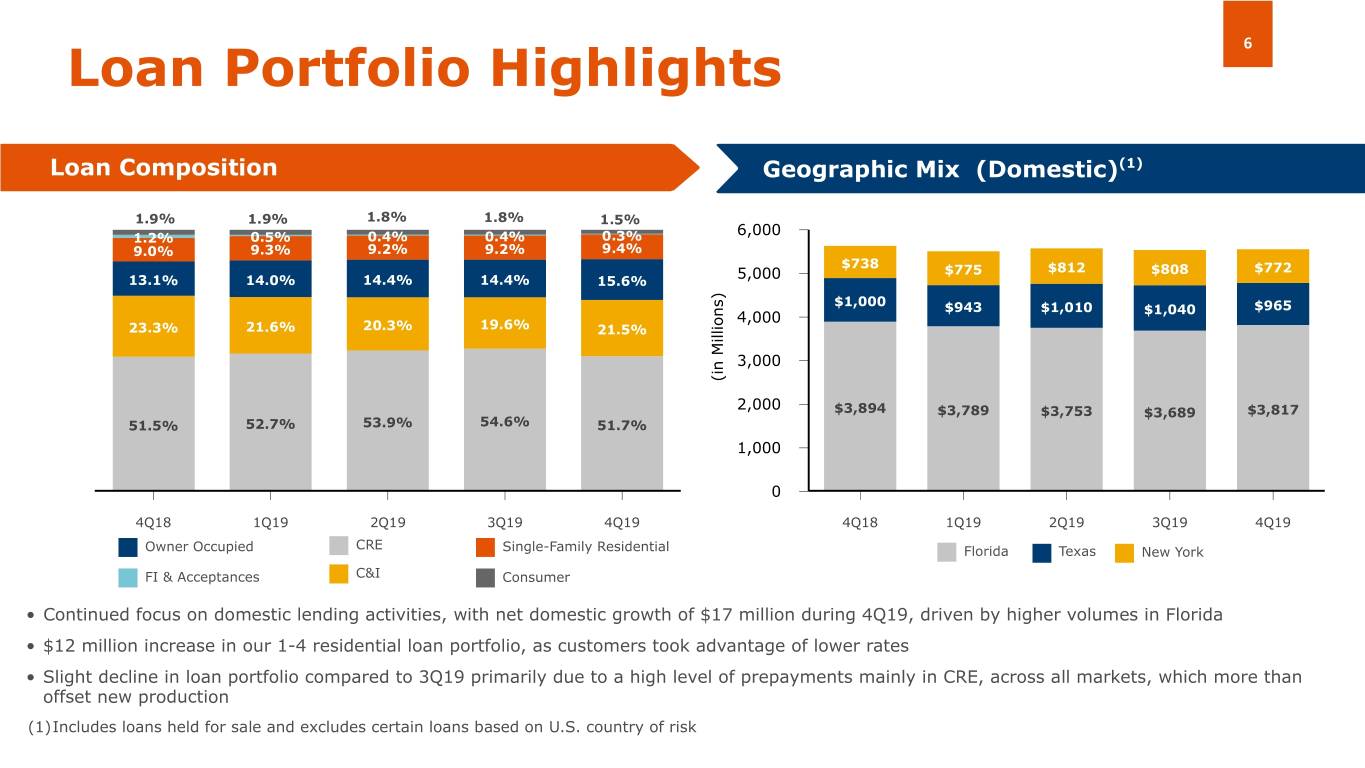

6 Loan Portfolio Highlights Loan Composition Geographic Mix (Domestic) (Domestic)(1) 1.9% 1.9% 1.8% 1.8% 1.5% 6,000 1.2% 0.5% 0.4% 0.4% 0.3% 9.0% 9.3% 9.2% 9.2% 9.4% $738 5,000 $775 $812 $808 $772 13.1% 14.0% 14.4% 14.4% 15.6% $1,000 $943 $1,010 $965 4,000 $1,040 23.3% 21.6% 20.3% 19.6% 21.5% 3,000 (in Millions) 2,000 $3,894 $3,789 $3,753 $3,689 $3,817 51.5% 52.7% 53.9% 54.6% 51.7% 1,000 0 4Q18 1Q19 2Q19 3Q19 4Q19 4Q18 1Q19 2Q19 3Q19 4Q19 CRE Owner Occupied Single-Family Residential Florida Texas New York FI & Acceptances C&I Consumer • Continued focus on domestic lending activities, with net domestic growth of $17 million during 4Q19, driven by higher volumes in Florida • $12 million increase in our 1-4 residential loan portfolio, as customers took advantage of lower rates • Slight decline in loan portfolio compared to 3Q19 primarily due to a high level of prepayments mainly in CRE, across all markets, which more than offset new production (1)Includes loans held for sale and excludes certain loans based on U.S. country of risk

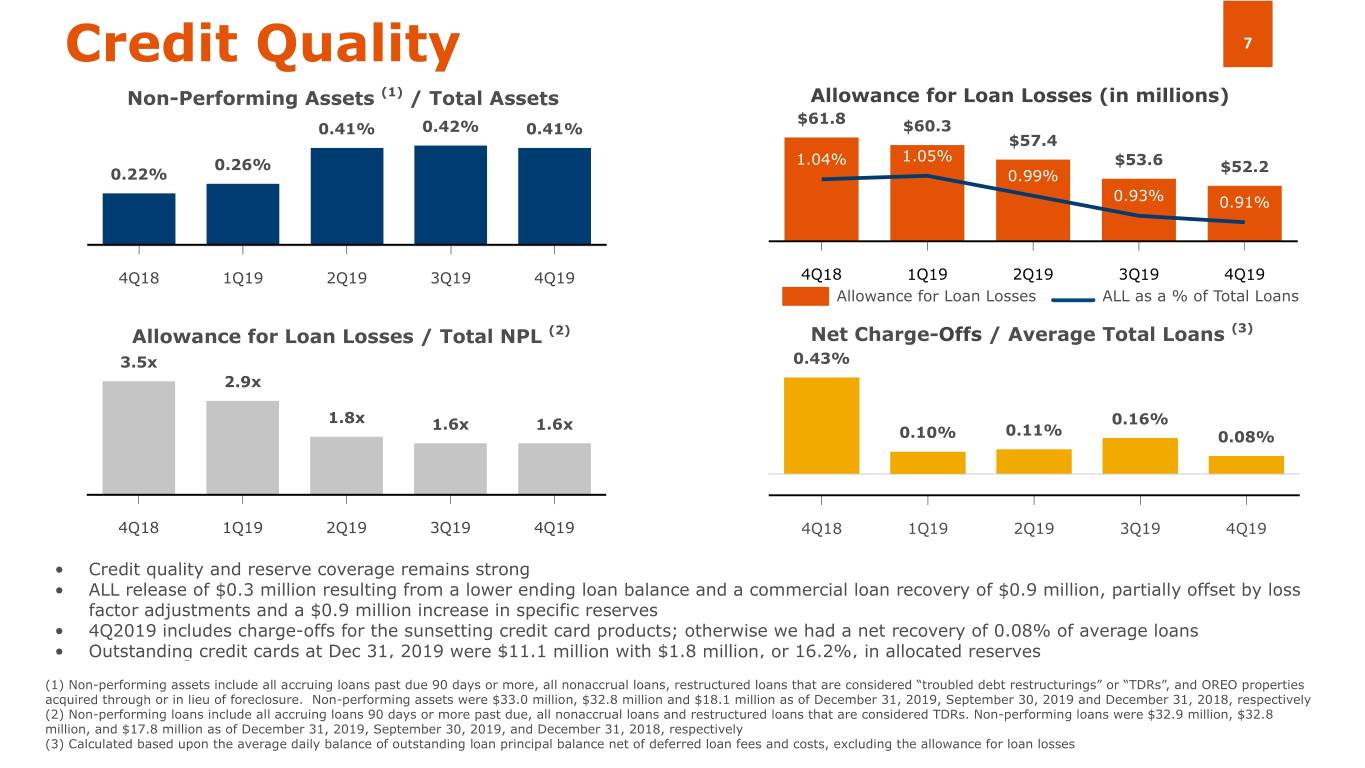

Credit Quality 7 Non-Performing Assets (1) / Total Assets Allowance for Loan Losses (in millions) $61.8 0.41% 0.42% 0.41% $60.3 $57.4 1.05% 0.26% 1.04% $53.6 $52.2 0.22% 0.99% 0.93% 0.91% 4Q18 1Q19 2Q19 3Q19 4Q19 4Q18 1Q19 2Q19 3Q19 4Q19 Allowance for Loan Losses ALL as a % of Total Loans Allowance for Loan Losses / Total NPL (2) Net Charge-Offs / Average Total Loans (3) 3.5x 0.43% 2.9x 1.8x 1.6x 1.6x 0.16% 0.10% 0.11% 0.08% 4Q18 1Q19 2Q19 3Q19 4Q19 4Q18 1Q19 2Q19 3Q19 4Q19 • Credit quality and reserve coverage remains strong • ALL release of $0.3 million resulting from a lower ending loan balance and a commercial loan recovery of $0.9 million, partially offset by loss factor adjustments and a $0.9 million increase in specific reserves • 4Q2019 includes charge-offs for the sunsetting credit card products; otherwise we had a net recovery of 0.08% of average loans • Outstanding credit cards at Dec 31, 2019 were $11.1 million with $1.8 million, or 16.2%, in allocated reserves (1) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of foreclosure. Non-performing assets were $33.0 million, $32.8 million and $18.1 million as of December 31, 2019, September 30, 2019 and December 31, 2018, respectively (2) Non-performing loans include all accruing loans 90 days or more past due, all nonaccrual loans and restructured loans that are considered TDRs. Non-performing loans were $32.9 million, $32.8 million, and $17.8 million as of December 31, 2019, September 30, 2019, and December 31, 2018, respectively (3) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, excluding the allowance for loan losses

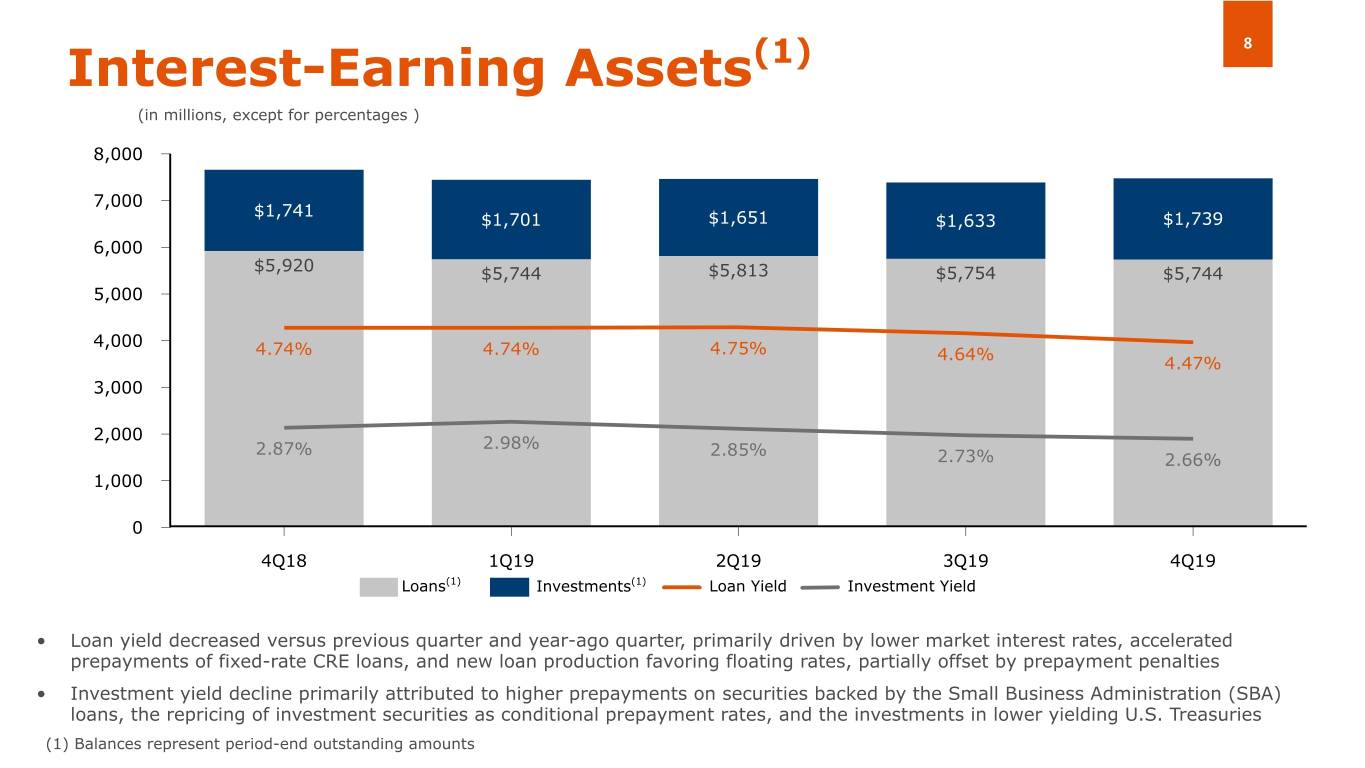

8 Interest-Earning Assets(1) (in millions, except for percentages ) 8,000 7,000 $1,741 $1,701 $1,651 $1,633 $1,739 6,000 $5,920 $5,744 $5,813 $5,754 $5,744 5,000 4,000 4.74% 4.74% 4.75% 4.64% 4.47% 3,000 2,000 2.87% 2.98% 2.85% 2.73% 2.66% 1,000 0 4Q18 1Q19 2Q19 3Q19 4Q19 Loans(1) Investments(1) Loan Yield Investment Yield • Loan yield decreased versus previous quarter and year-ago quarter, primarily driven by lower market interest rates, accelerated prepayments of fixed-rate CRE loans, and new loan production favoring floating rates, partially offset by prepayment penalties • Investment yield decline primarily attributed to higher prepayments on securities backed by the Small Business Administration (SBA) loans, the repricing of investment securities as conditional prepayment rates, and the investments in lower yielding U.S. Treasuries (1) Balances represent period-end outstanding amounts

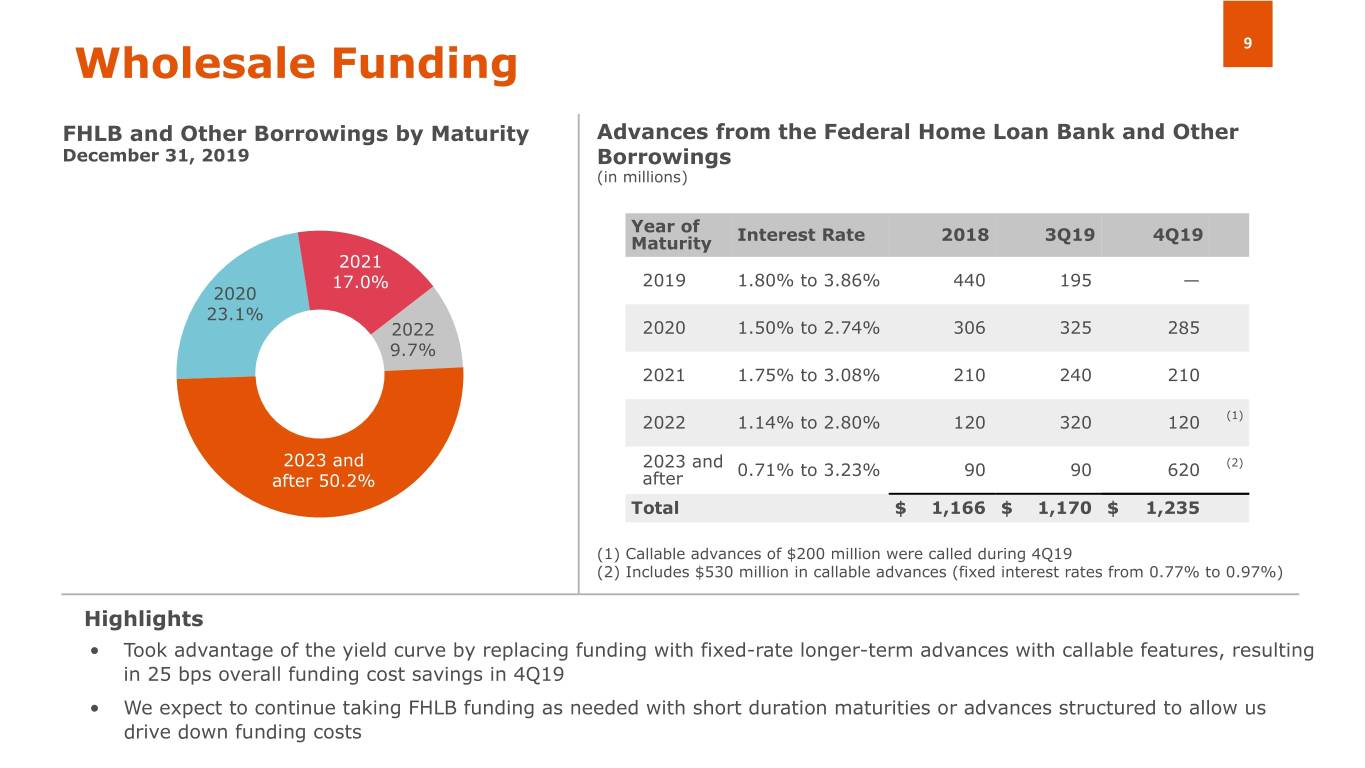

9 Wholesale Funding FHLB and Other Borrowings by Maturity Advances from the Federal Home Loan Bank and Other December 31, 2019 Borrowings (in millions) Year of Maturity Interest Rate 2018 3Q19 4Q19 2021 17.0% 2019 1.80% to 3.86% 440 195 — 2020 23.1% 2022 2020 1.50% to 2.74% 306 325 285 9.7% 2021 1.75% to 3.08% 210 240 210 2022 1.14% to 2.80% 120 320 120 (1) 2023 and (2) 2023 and 0.71% to 3.23% 90 90 620 after 50.2% after Total $ 1,166 $ 1,170 $ 1,235 (1) Callable advances of $200 million were called during 4Q19 (2) Includes $530 million in callable advances (fixed interest rates from 0.77% to 0.97%) Highlights • Took advantage of the yield curve by replacing funding with fixed-rate longer-term advances with callable features, resulting in 25 bps overall funding cost savings in 4Q19 • We expect to continue taking FHLB funding as needed with short duration maturities or advances structured to allow us drive down funding costs

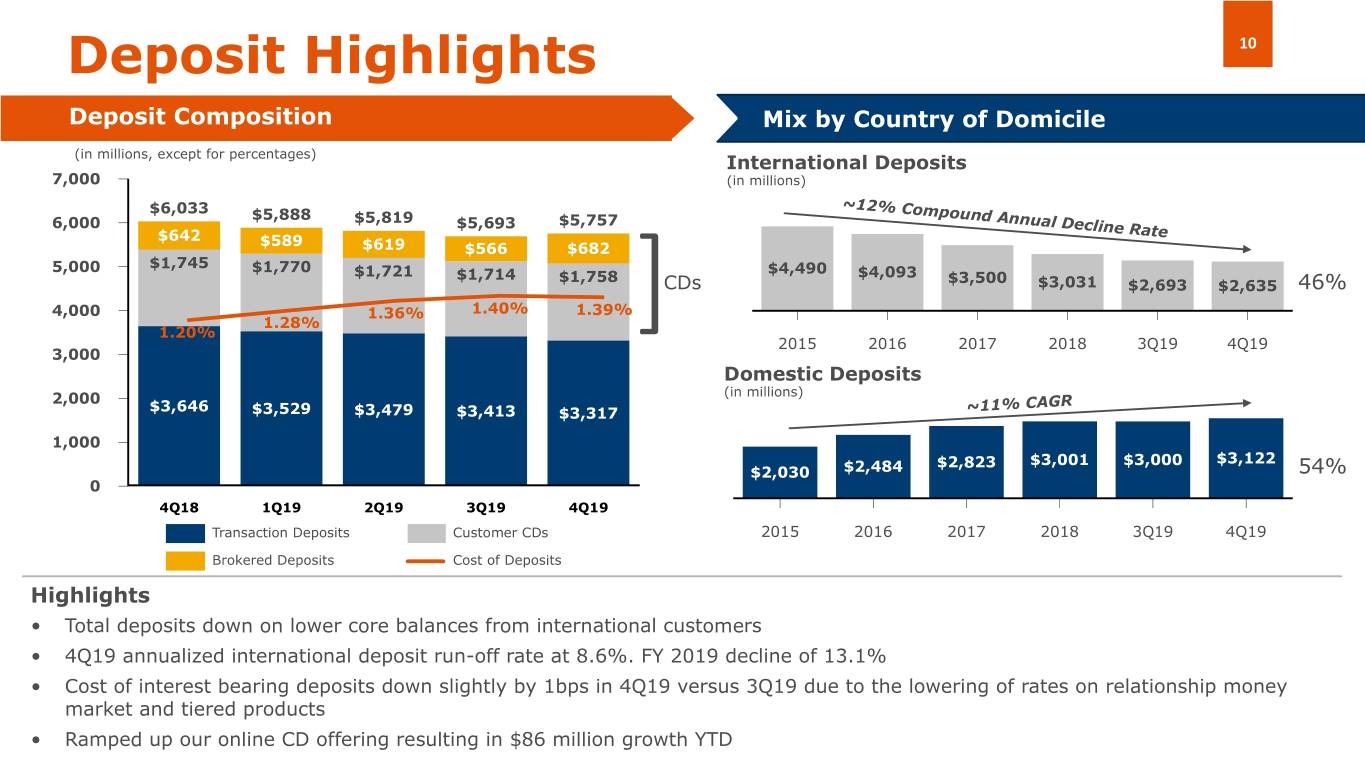

Deposit Highlights 10 Deposit Composition Mix by Country of Domicile (in millions, except for percentages) International Deposits 7,000 (in millions) ~12% Compound Annual Decline Rate $6,033 $5,888 6,000 $5,819 $5,693 $5,757 $642 $589 $619 $566 $682 5,000 $1,745 $1,770 $4,490 $1,721 $1,714 $1,758 $4,093 $3,500 CDs $3,031 $2,693 $2,635 46% 4,000 1.36% 1.40% 1.39% 1.28% 1.20% ] 2015 2016 2017 2018 3Q19 4Q19 3,000 Domestic Deposits 2,000 (in millions) $3,646 $3,529 $3,479 $3,413 $3,317 ~11% CAGR 1,000 $2,823 $3,001 $3,000 $3,122 $2,030 $2,484 54% 0 4Q18 1Q19 2Q19 3Q19 4Q19 Transaction Deposits Customer CDs 2015 2016 2017 2018 3Q19 4Q19 Brokered Deposits Cost of Deposits Highlights • Total deposits down on lower core balances from international customers • 4Q19 annualized international deposit run-off rate at 8.6%. FY 2019 decline of 13.1% • Cost of interest bearing deposits down slightly by 1bps in 4Q19 versus 3Q19 due to the lowering of rates on relationship money market and tiered products • Ramped up our online CD offering resulting in $86 million growth YTD

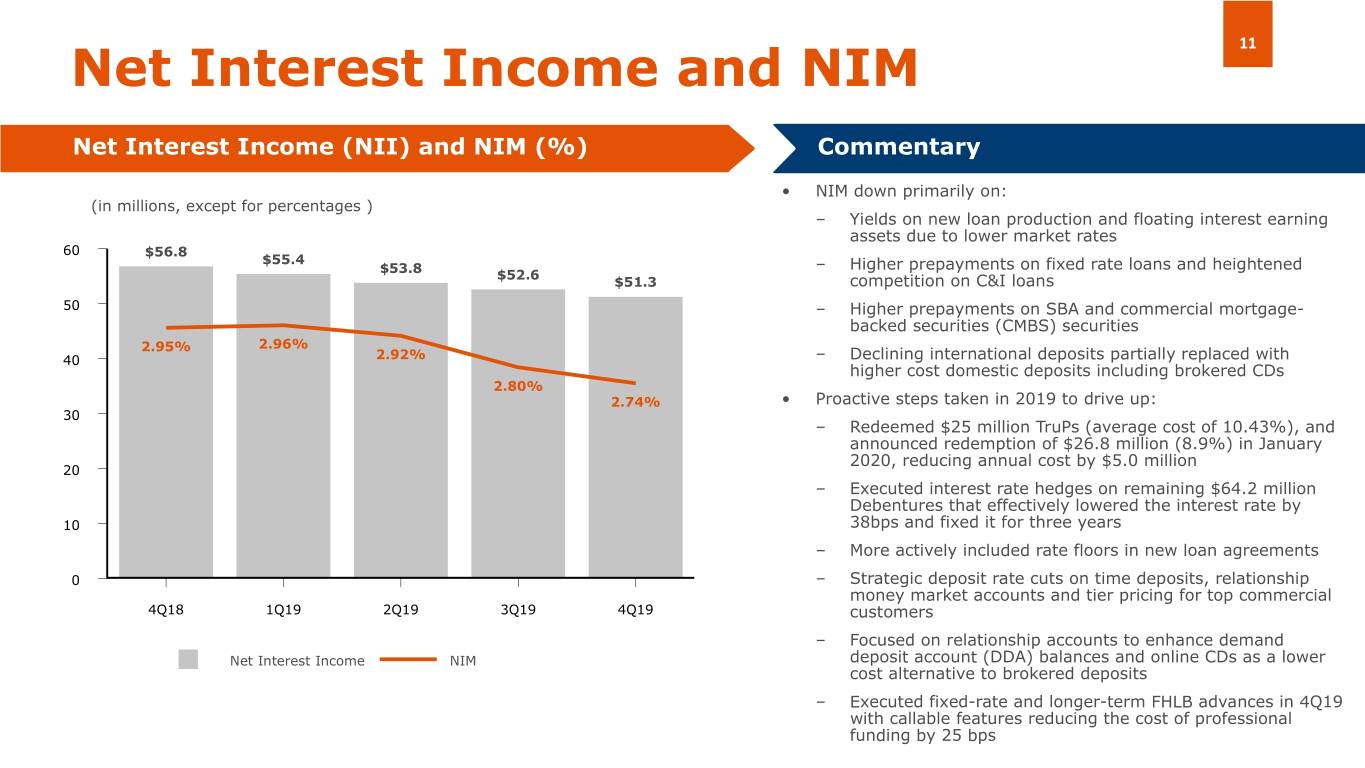

11 Net Interest Income and NIM Net Interest Income (NII) and NIM (%) Commentary • NIM down primarily on: (in millions, except for percentages ) – Yields on new loan production and floating interest earning assets due to lower market rates 60 $56.8 $55.4 – Higher prepayments on fixed rate loans and heightened $53.8 $52.6 $51.3 competition on C&I loans 50 – Higher prepayments on SBA and commercial mortgage- backed securities (CMBS) securities 2.95% 2.96% 40 2.92% – Declining international deposits partially replaced with higher cost domestic deposits including brokered CDs 2.80% 2.74% • Proactive steps taken in 2019 to drive up: 30 – Redeemed $25 million TruPs (average cost of 10.43%), and announced redemption of $26.8 million (8.9%) in January 2020, reducing annual cost by $5.0 million 20 – Executed interest rate hedges on remaining $64.2 million Debentures that effectively lowered the interest rate by 10 38bps and fixed it for three years – More actively included rate floors in new loan agreements 0 – Strategic deposit rate cuts on time deposits, relationship money market accounts and tier pricing for top commercial 4Q18 1Q19 2Q19 3Q19 4Q19 customers – Focused on relationship accounts to enhance demand Net Interest Income NIM deposit account (DDA) balances and online CDs as a lower cost alternative to brokered deposits – Executed fixed-rate and longer-term FHLB advances in 4Q19 with callable features reducing the cost of professional funding by 25 bps

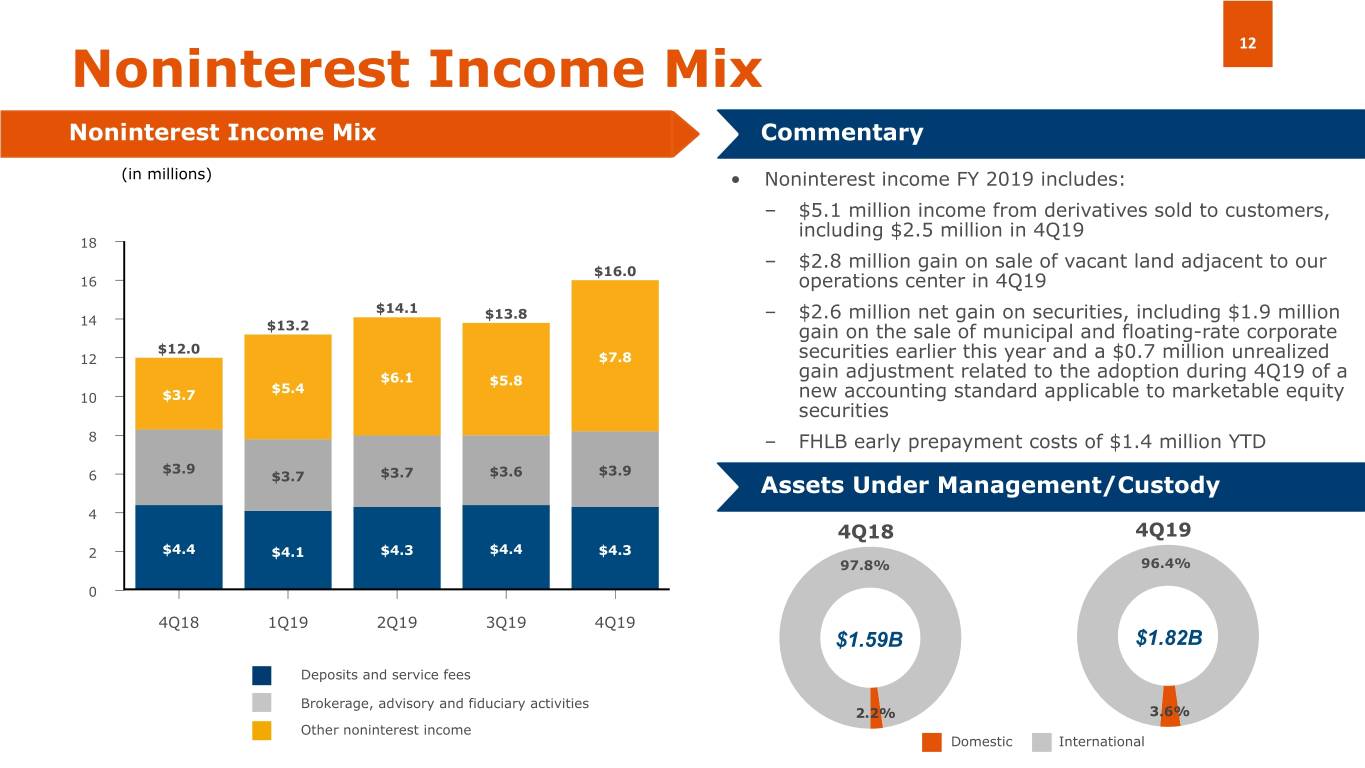

12 Noninterest Income Mix Noninterest Income Mix Commentary (in millions) • Noninterest income FY 2019 includes: – $5.1 million income from derivatives sold to customers, including $2.5 million in 4Q19 18 – $2.8 million gain on sale of vacant land adjacent to our $16.0 16 operations center in 4Q19 $14.1 14 $13.8 – $2.6 million net gain on securities, including $1.9 million $13.2 gain on the sale of municipal and floating-rate corporate $12.0 12 $7.8 securities earlier this year and a $0.7 million unrealized $6.1 $5.8 gain adjustment related to the adoption during 4Q19 of a $5.4 10 $3.7 new accounting standard applicable to marketable equity securities 8 – FHLB early prepayment costs of $1.4 million YTD $3.9 $3.7 $3.6 $3.9 6 $3.7 Assets Under Management/Custody 4 4Q18 4Q19 2 $4.4 $4.1 $4.3 $4.4 $4.3 97.8% 96.4% 0 4Q18 1Q19 2Q19 3Q19 4Q19 $1.59B $1.82B Deposits and service fees Brokerage, advisory and fiduciary activities 2.2% 3.6% Other noninterest income Domestic International

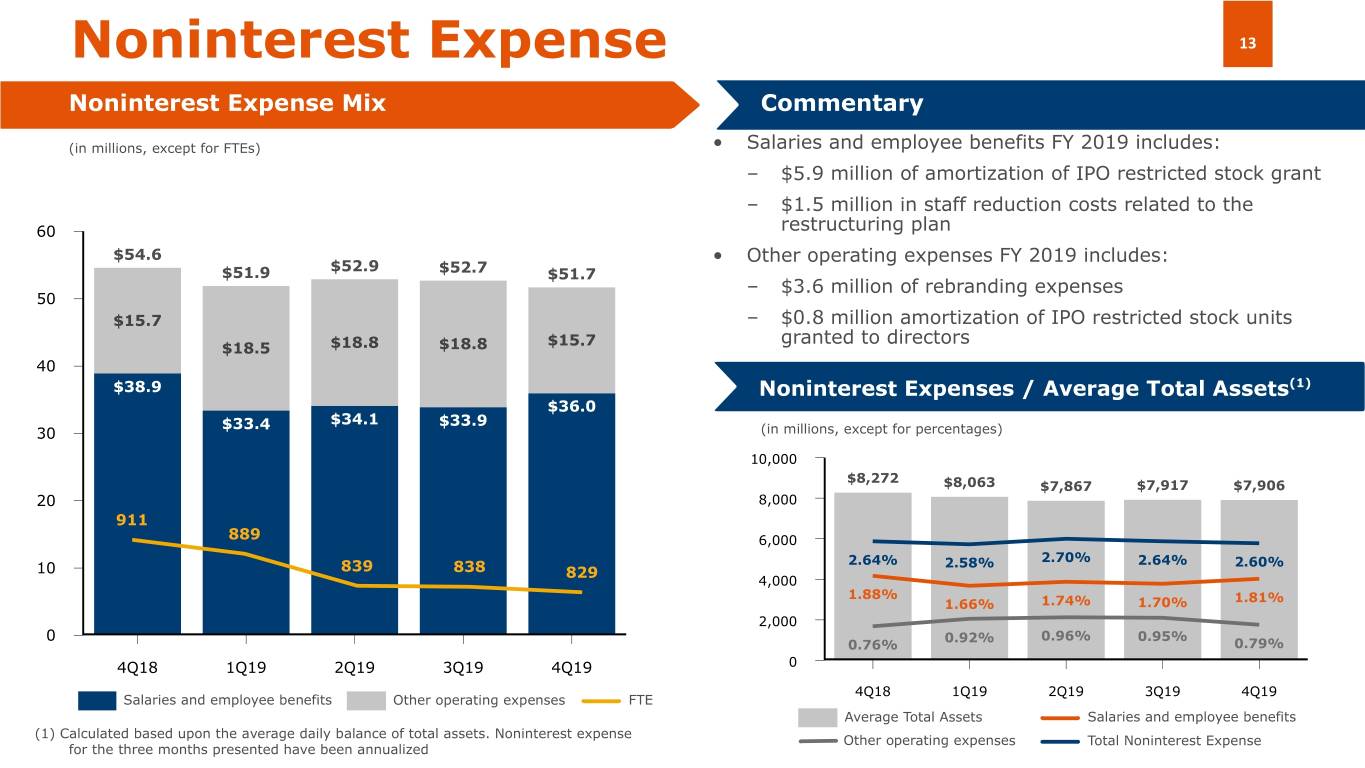

Noninterest Expense 13 Noninterest Expense Mix Commentary (in millions, except for FTEs) • Salaries and employee benefits FY 2019 includes: – $5.9 million of amortization of IPO restricted stock grant – $1.5 million in staff reduction costs related to the 60 restructuring plan $54.6 • Other operating expenses FY 2019 includes: $52.9 $51.9 $52.7 $51.7 – $3.6 million of rebranding expenses 50 $15.7 – $0.8 million amortization of IPO restricted stock units $15.7 granted to directors $18.5 $18.8 $18.8 40 $38.9 Noninterest Expenses / Average Total Assets(1) $36.0 $33.4 $34.1 $33.9 30 (in millions, except for percentages) 10,000 $8,272 $8,063 $7,867 $7,917 $7,906 20 8,000 911 889 6,000 2.64% 2.58% 2.70% 2.64% 2.60% 10 839 838 829 4,000 1.88% 1.81% 1.66% 1.74% 1.70% 2,000 0 0.92% 0.96% 0.95% 0.76% 0.79% 4Q18 1Q19 2Q19 3Q19 4Q19 0 4Q18 1Q19 2Q19 3Q19 4Q19 Salaries and employee benefits Other operating expenses FTE Average Total Assets Salaries and employee benefits (1) Calculated based upon the average daily balance of total assets. Noninterest expense Other operating expenses Total Noninterest Expense for the three months presented have been annualized

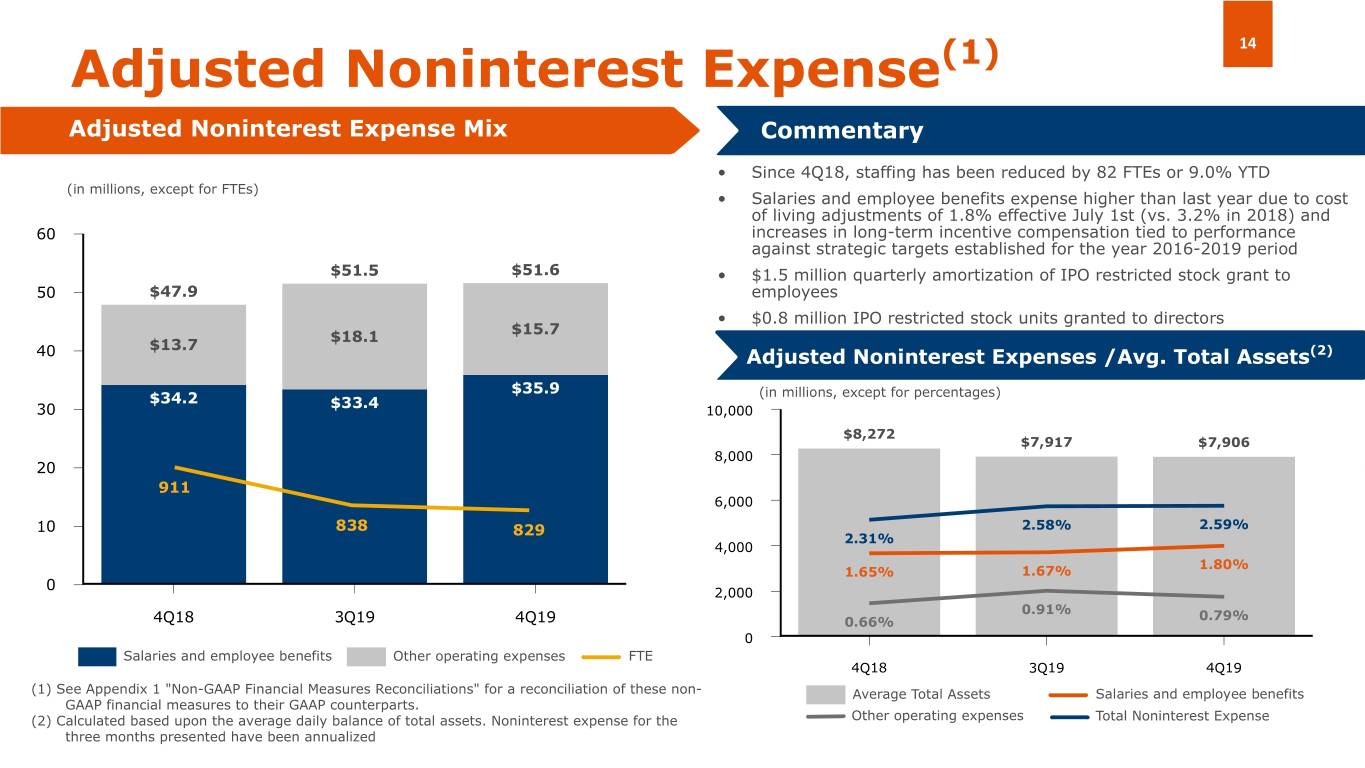

14 Adjusted Noninterest Expense(1) Adjusted Noninterest Expense Mix Commentary • Since 4Q18, staffing has been reduced by 82 FTEs or 9.0% YTD (in millions, except for FTEs) • Salaries and employee benefits expense higher than last year due to cost of living adjustments of 1.8% effective July 1st (vs. 3.2% in 2018) and 60 increases in long-term incentive compensation tied to performance against strategic targets established for the year 2016-2019 period $51.5 $51.6 • $1.5 million quarterly amortization of IPO restricted stock grant to 50 $47.9 employees • $0.8 million IPO restricted stock units granted to directors $15.7 $18.1 $13.7 40 Adjusted Noninterest Expenses /Avg. Total Assets(2) $35.9 (in millions, except for percentages) $34.2 $33.4 30 10,000 $8,272 $7,917 $7,906 8,000 20 911 6,000 10 838 829 2.58% 2.59% 2.31% 4,000 1.80% 1.65% 1.67% 0 2,000 0.91% 4Q18 3Q19 4Q19 0.66% 0.79% 0 Salaries and employee benefits Other operating expenses FTE 4Q18 3Q19 4Q19 (1) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non- Average Total Assets Salaries and employee benefits GAAP financial measures to their GAAP counterparts. (2) Calculated based upon the average daily balance of total assets. Noninterest expense for the Other operating expenses Total Noninterest Expense three months presented have been annualized

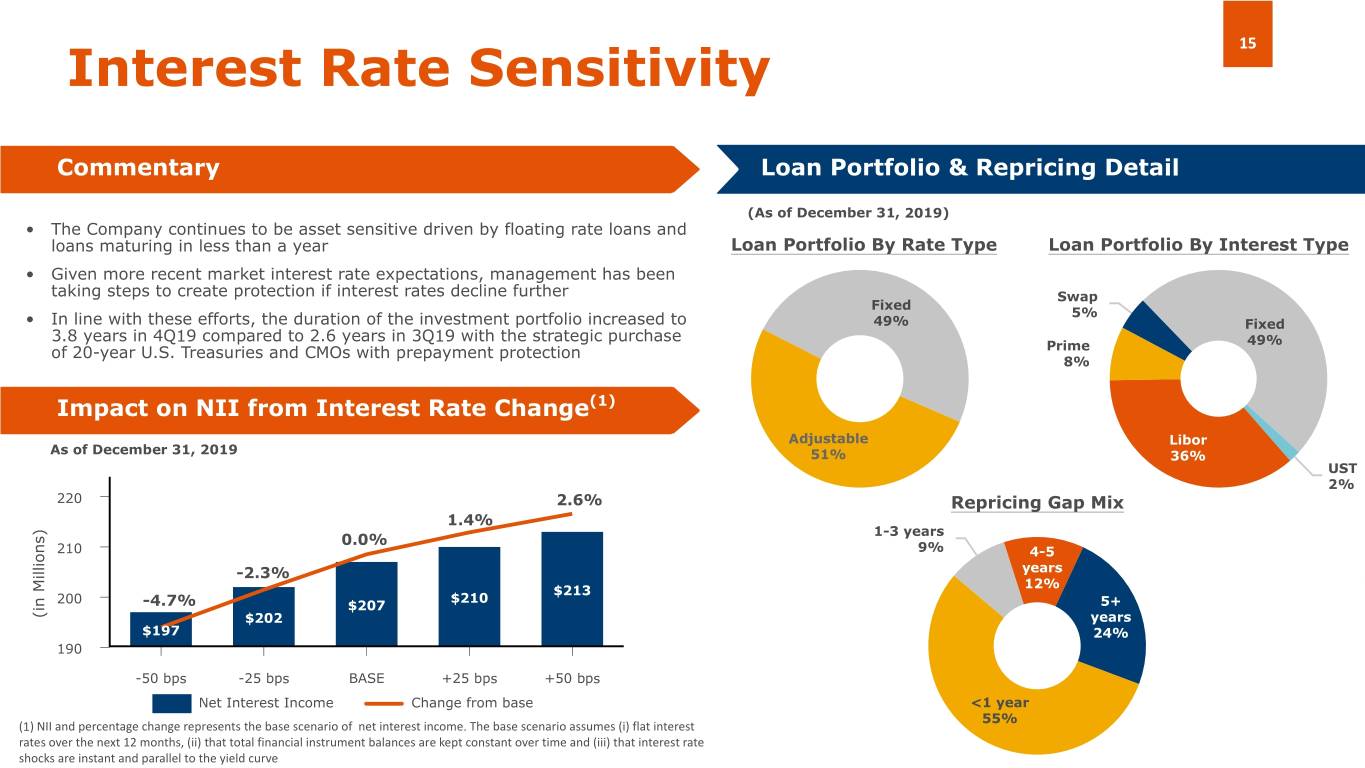

15 Interest Rate Sensitivity Commentary Loan Portfolio & Repricing Detail (As of December 31, 2019) • The Company continues to be asset sensitive driven by floating rate loans and loans maturing in less than a year Loan Portfolio By Rate Type Loan Portfolio By Interest Type • Given more recent market interest rate expectations, management has been taking steps to create protection if interest rates decline further Swap Fixed 5% • In line with these efforts, the duration of the investment portfolio increased to 49% Fixed 3.8 years in 4Q19 compared to 2.6 years in 3Q19 with the strategic purchase 49% of 20-year U.S. Treasuries and CMOs with prepayment protection Prime 8% Impact on NII from Interest Rate Change(1) Adjustable Libor As of December 31, 2019 51% 36% UST 2% 220 2.6% Repricing Gap Mix 1.4% 1-3 years 0.0% 210 9% 4-5 -2.3% years 12% $213 200 $210 -4.7% $207 5+ (in Millions) $202 years $197 24% 190 -50 bps -25 bps BASE +25 bps +50 bps Net Interest Income Change from base <1 year 55% (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve

16 2020 Goals • Continue focus on domestic commercial Net Interest • Improve loan portfolio yield deposit growth by targeting new verticals/ while driving down deposit Deposits niches for deposits Income costs to drive up NIM • Increase domestic deposits and share of wallet from higher net worth international customers • Continue expansion of wealth Noninterest management client acquisition and fee income • Continue growth of domestic loans by Income initiatives, for both domestic targeting selected customers and verticals/ and international customers Loans niches for loans • Continue diversification between C&I and CRE throughout our markets • Continue simplification of Noninterest operations to drive expense reduction initiatives • Continue earnings accretion to support Expenses future activities • Capture full annual savings from rationalization efforts Capital • Complete redemption of remaining high Management cost, fixed rate TruP • Evaluate other capital deployment • Maintain strong asset quality opportunities including share repurchases, Credit Quality dividends and strategic business acquisitions Committed to driving shareholder value

Appendices

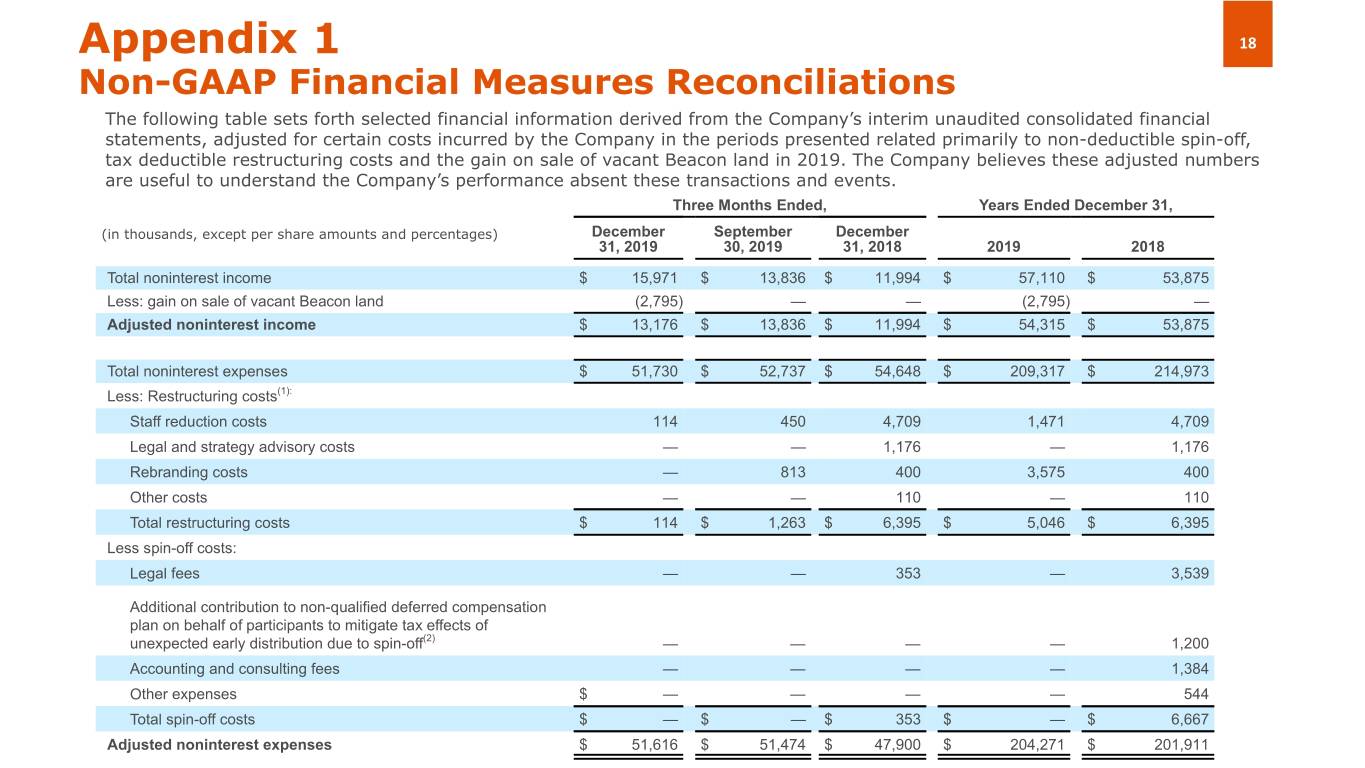

Appendix 1 18 Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related primarily to non-deductible spin-off, tax deductible restructuring costs and the gain on sale of vacant Beacon land in 2019. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events. Three Months Ended, Years Ended December 31, (in thousands, except per share amounts and percentages) December September December 31, 2019 30, 2019 31, 2018 2019 2018 Total noninterest income $ 15,971 $ 13,836 $ 11,994 $ 57,110 $ 53,875 Less: gain on sale of vacant Beacon land (2,795) — — (2,795) — Adjusted noninterest income $ 13,176 $ 13,836 $ 11,994 $ 54,315 $ 53,875 Total noninterest expenses $ 51,730 $ 52,737 $ 54,648 $ 209,317 $ 214,973 Less: Restructuring costs(1): Staff reduction costs 114 450 4,709 1,471 4,709 Legal and strategy advisory costs — — 1,176 — 1,176 Rebranding costs — 813 400 3,575 400 Other costs — — 110 — 110 Total restructuring costs $ 114 $ 1,263 $ 6,395 $ 5,046 $ 6,395 Less spin-off costs: Legal fees — — 353 — 3,539 Additional contribution to non-qualified deferred compensation plan on behalf of participants to mitigate tax effects of unexpected early distribution due to spin-off(2) — — — — 1,200 Accounting and consulting fees — — — — 1,384 Other expenses $ — — — — 544 Total spin-off costs $ — $ — $ 353 $ — $ 6,667 Adjusted noninterest expenses $ 51,616 $ 51,474 $ 47,900 $ 204,271 $ 201,911

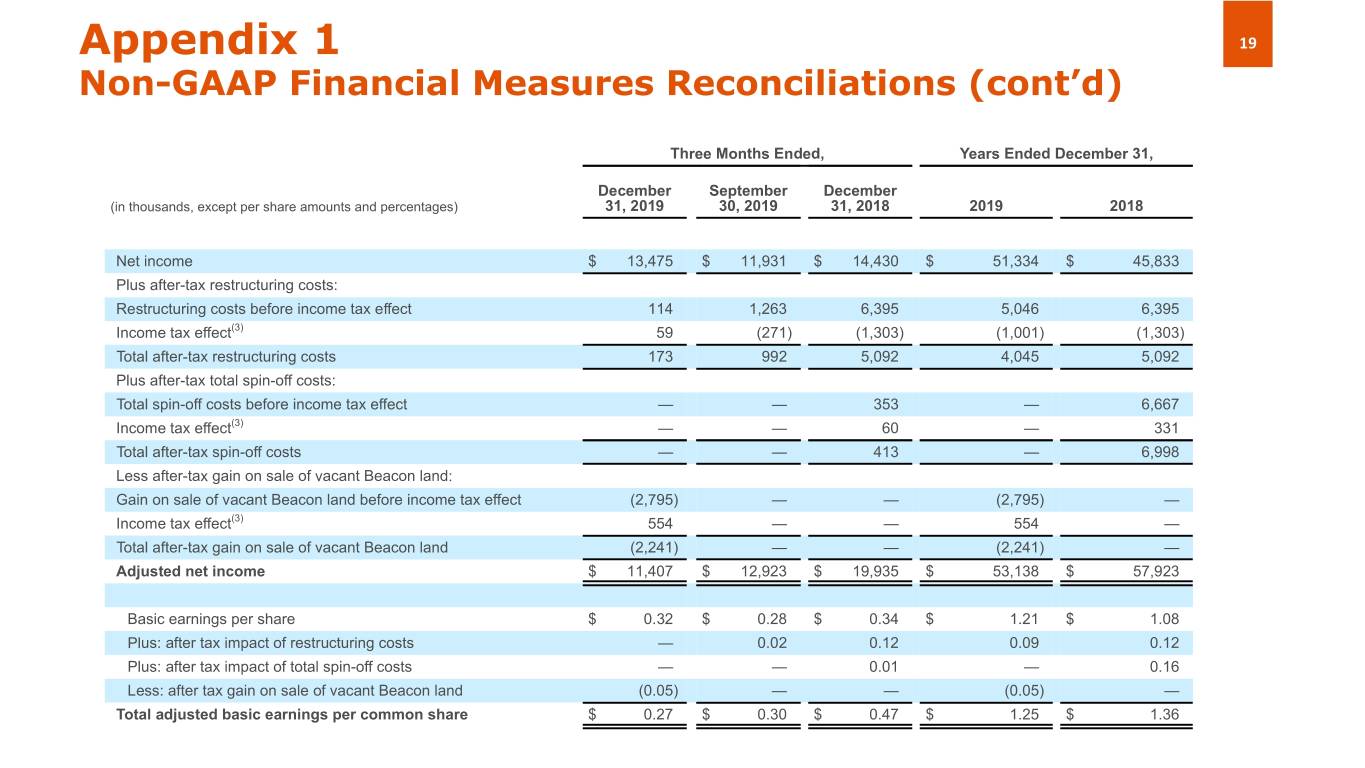

Appendix 1 19 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Years Ended December 31, December September December (in thousands, except per share amounts and percentages) 31, 2019 30, 2019 31, 2018 2019 2018 Net income $ 13,475 $ 11,931 $ 14,430 $ 51,334 $ 45,833 Plus after-tax restructuring costs: Restructuring costs before income tax effect 114 1,263 6,395 5,046 6,395 Income tax effect(3) 59 (271) (1,303) (1,001) (1,303) Total after-tax restructuring costs 173 992 5,092 4,045 5,092 Plus after-tax total spin-off costs: Total spin-off costs before income tax effect — — 353 — 6,667 Income tax effect(3) — — 60 — 331 Total after-tax spin-off costs — — 413 — 6,998 Less after-tax gain on sale of vacant Beacon land: Gain on sale of vacant Beacon land before income tax effect (2,795) — — (2,795) — Income tax effect(3) 554 — — 554 — Total after-tax gain on sale of vacant Beacon land (2,241) — — (2,241) — Adjusted net income $ 11,407 $ 12,923 $ 19,935 $ 53,138 $ 57,923 Basic earnings per share $ 0.32 $ 0.28 $ 0.34 $ 1.21 $ 1.08 Plus: after tax impact of restructuring costs — 0.02 0.12 0.09 0.12 Plus: after tax impact of total spin-off costs — — 0.01 — 0.16 Less: after tax gain on sale of vacant Beacon land (0.05) — — (0.05) — Total adjusted basic earnings per common share $ 0.27 $ 0.30 $ 0.47 $ 1.25 $ 1.36

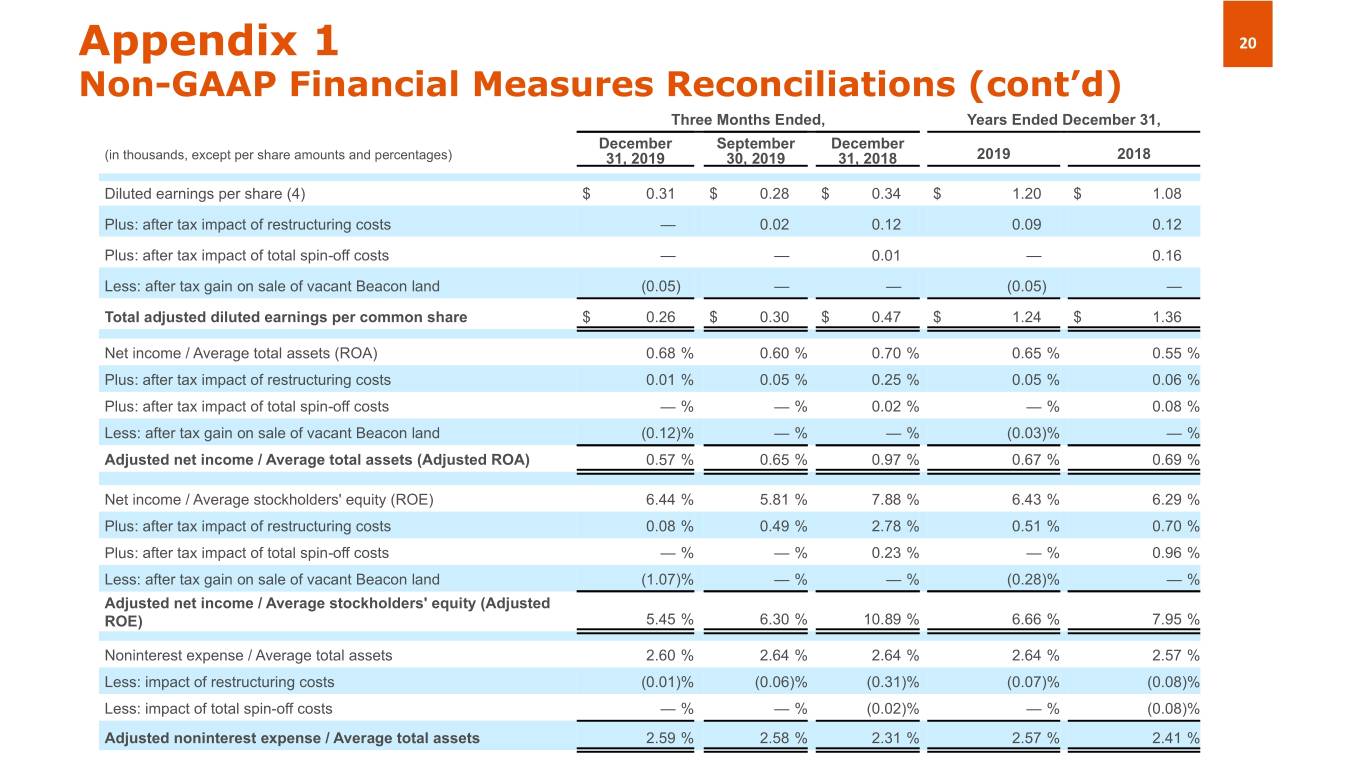

Appendix 1 20 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Years Ended December 31, December September December (in thousands, except per share amounts and percentages) 31, 2019 30, 2019 31, 2018 2019 2018 Diluted earnings per share (4) $ 0.31 $ 0.28 $ 0.34 $ 1.20 $ 1.08 Plus: after tax impact of restructuring costs — 0.02 0.12 0.09 0.12 Plus: after tax impact of total spin-off costs — — 0.01 — 0.16 Less: after tax gain on sale of vacant Beacon land (0.05) — — (0.05) — Total adjusted diluted earnings per common share $ 0.26 $ 0.30 $ 0.47 $ 1.24 $ 1.36 Net income / Average total assets (ROA) 0.68 % 0.60 % 0.70 % 0.65 % 0.55 % Plus: after tax impact of restructuring costs 0.01 % 0.05 % 0.25 % 0.05 % 0.06 % Plus: after tax impact of total spin-off costs — % — % 0.02 % — % 0.08 % Less: after tax gain on sale of vacant Beacon land (0.12)% — % — % (0.03)% — % Adjusted net income / Average total assets (Adjusted ROA) 0.57 % 0.65 % 0.97 % 0.67 % 0.69 % Net income / Average stockholders' equity (ROE) 6.44 % 5.81 % 7.88 % 6.43 % 6.29 % Plus: after tax impact of restructuring costs 0.08 % 0.49 % 2.78 % 0.51 % 0.70 % Plus: after tax impact of total spin-off costs — % — % 0.23 % — % 0.96 % Less: after tax gain on sale of vacant Beacon land (1.07)% — % — % (0.28)% — % Adjusted net income / Average stockholders' equity (Adjusted ROE) 5.45 % 6.30 % 10.89 % 6.66 % 7.95 % Noninterest expense / Average total assets 2.60 % 2.64 % 2.64 % 2.64 % 2.57 % Less: impact of restructuring costs (0.01)% (0.06)% (0.31)% (0.07)% (0.08)% Less: impact of total spin-off costs — % — % (0.02)% — % (0.08)% Adjusted noninterest expense / Average total assets 2.59 % 2.58 % 2.31 % 2.57 % 2.41 %

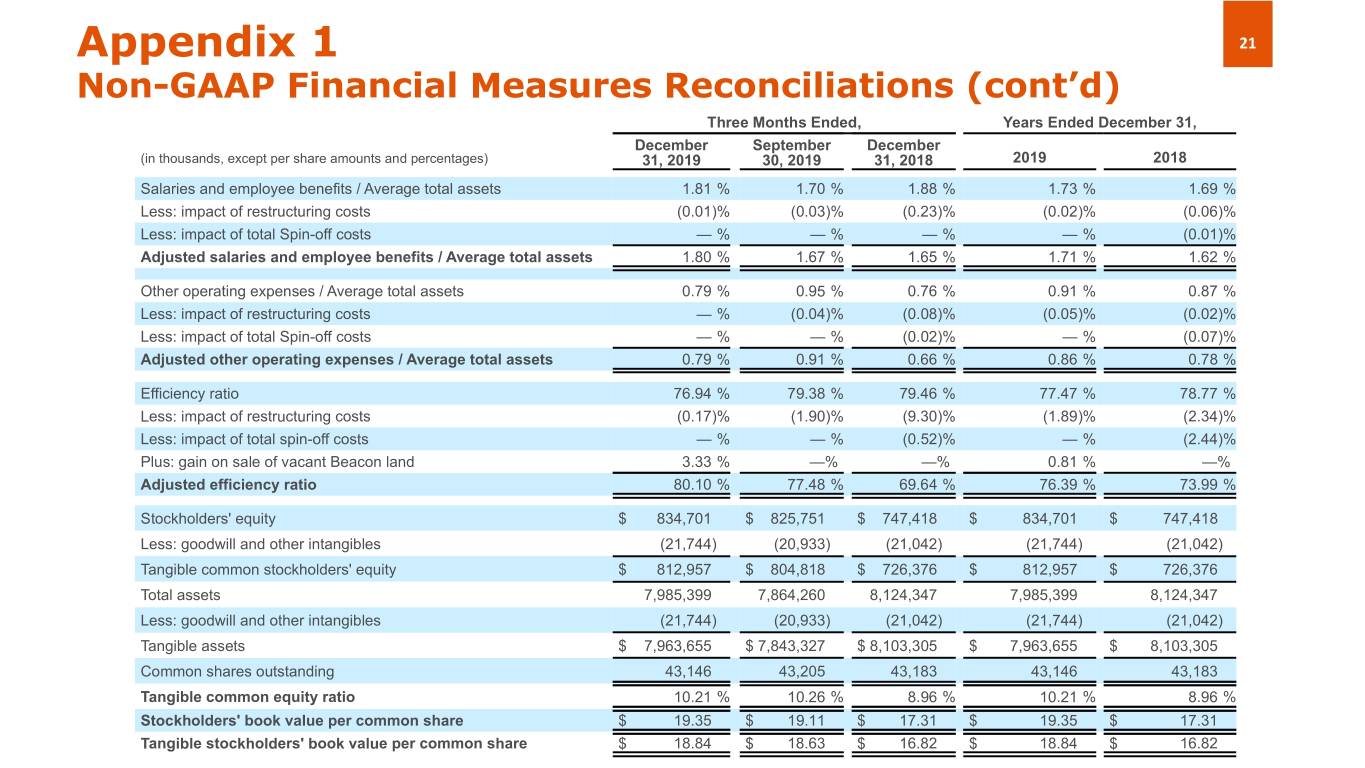

Appendix 1 21 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Years Ended December 31, December September December (in thousands, except per share amounts and percentages) 31, 2019 30, 2019 31, 2018 2019 2018 Salaries and employee benefits / Average total assets 1.81 % 1.70 % 1.88 % 1.73 % 1.69 % Less: impact of restructuring costs (0.01)% (0.03)% (0.23)% (0.02)% (0.06)% Less: impact of total Spin-off costs — % — % — % — % (0.01)% Adjusted salaries and employee benefits / Average total assets 1.80 % 1.67 % 1.65 % 1.71 % 1.62 % Other operating expenses / Average total assets 0.79 % 0.95 % 0.76 % 0.91 % 0.87 % Less: impact of restructuring costs — % (0.04)% (0.08)% (0.05)% (0.02)% Less: impact of total Spin-off costs — % — % (0.02)% — % (0.07)% Adjusted other operating expenses / Average total assets 0.79 % 0.91 % 0.66 % 0.86 % 0.78 % Efficiency ratio 76.94 % 79.38 % 79.46 % 77.47 % 78.77 % Less: impact of restructuring costs (0.17)% (1.90)% (9.30)% (1.89)% (2.34)% Less: impact of total spin-off costs — % — % (0.52)% — % (2.44)% Plus: gain on sale of vacant Beacon land 3.33 % —% —% 0.81 % —% Adjusted efficiency ratio 80.10 % 77.48 % 69.64 % 76.39 % 73.99 % Stockholders' equity $ 834,701 $ 825,751 $ 747,418 $ 834,701 $ 747,418 Less: goodwill and other intangibles (21,744) (20,933) (21,042) (21,744) (21,042) Tangible common stockholders' equity $ 812,957 $ 804,818 $ 726,376 $ 812,957 $ 726,376 Total assets 7,985,399 7,864,260 8,124,347 7,985,399 8,124,347 Less: goodwill and other intangibles (21,744) (20,933) (21,042) (21,744) (21,042) Tangible assets $ 7,963,655 $ 7,843,327 $ 8,103,305 $ 7,963,655 $ 8,103,305 Common shares outstanding 43,146 43,205 43,183 43,146 43,183 Tangible common equity ratio 10.21 % 10.26 % 8.96 % 10.21 % 8.96 % Stockholders' book value per common share $ 19.35 $ 19.11 $ 17.31 $ 19.35 $ 17.31 Tangible stockholders' book value per common share $ 18.84 $ 18.63 $ 16.82 $ 18.84 $ 16.82

Appendix 1 22 Non-GAAP Financial Measures Reconciliations (cont’d) (1) Expenses incurred for actions designed to implement the Company’s strategy as a new independent company. These actions include, but are not limited to reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (2) The spin-off caused an unexpected early distribution for U.S. federal income tax purposes from our deferred compensation plan. This distribution was taxable to plan participants as ordinary income during 2018. We partially compensated plan participants, in the aggregate amount of $1.2 million, for the higher tax expense they incurred as a result of the distribution increasing the plan participants' estimated effective federal income tax rates by recording a contribution to the plan on behalf of its participants. The after tax net effect of this $1.2 million contribution for the twelve months ended 2018, was approximately $952,000. As a result of the early taxable distribution to plan participants, we expensed and deducted for federal income tax purposes, previously deferred compensation of approximately $8.1 million, resulting in an estimated tax credit of $1.7 million, which exceeded the amount of the tax gross-up paid to plan participants. (3) Calculated based upon the estimated annual effective tax rate for the periods, which excludes the tax effect of discrete items, and the amounts that resulted from the permanent difference between spin-off costs that are non-deductible for Federal and state income tax purposes, and total spin-off costs recognized in the consolidated financial statements. The estimated annual effective rate applied for the calculation differs from the reported effective tax rate since it is based on a different mix of statutory rates applicable to these expenses and to the rates applicable to the Company and its subsidiaries. (4) As of December 31, 2019, September 30, 2019, June 30, 2019 and March 31, 2019 potential dilutive instruments consisted of unvested shares of restricted stock and restricted stock units mainly related Company’s IPO in 2018. As of December 31, 2019, and March 31, 2019 unvested shares of restricted stock and restricted stock units totaled 530,620 and 786,213, respectively, and 789,652 as of September 30, 2019 and June 30, 2019. These potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share at those dates, fewer shares would have been purchased than restricted shares assumed issued. Therefore, at those dates, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings for the year ended December 31, 2019. We had no outstanding dilutive instruments as of any period prior to December 2018.

Thank you Investor Relations InvestorRelations@amerantbank.com