UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary proxy statement | |

☐ | Confidential, for use of the Commission only (as permitted by Rule 14a-6(e)(2)) | |

☒ | Definitive proxy statement | |

☐ | Definitive additional materials | |

☐ | Soliciting material pursuant to Sec. 240.14a-12 | |

AMERANT BANCORP INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of filing fee (Check the appropriate box):

☒ | No Fee Required | ||||

☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | ||||

(1 | ) | Title of each class of securities to which transaction applies: | |||

(2 | ) | Aggregate number of securities to which transaction applies: | |||

(3 | ) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

(4 | ) | Proposed maximum aggregate value of transaction: | |||

(5 | ) | Total fee paid: | |||

☐ | Fee paid previously with preliminary materials: | ||||

☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||||

(1 | ) | Amount previously paid: | |||

(2 | ) | Form, Schedule or Registration Statement No. | |||

(3 | ) | Filing party: | |||

(4 | ) | Date filed: | |||

AMERANT BANCORP INC.

220 Alhambra Circle

Coral Gables, FL 33134

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 3, 2020

To the Shareholders of Amerant Bancorp Inc.:

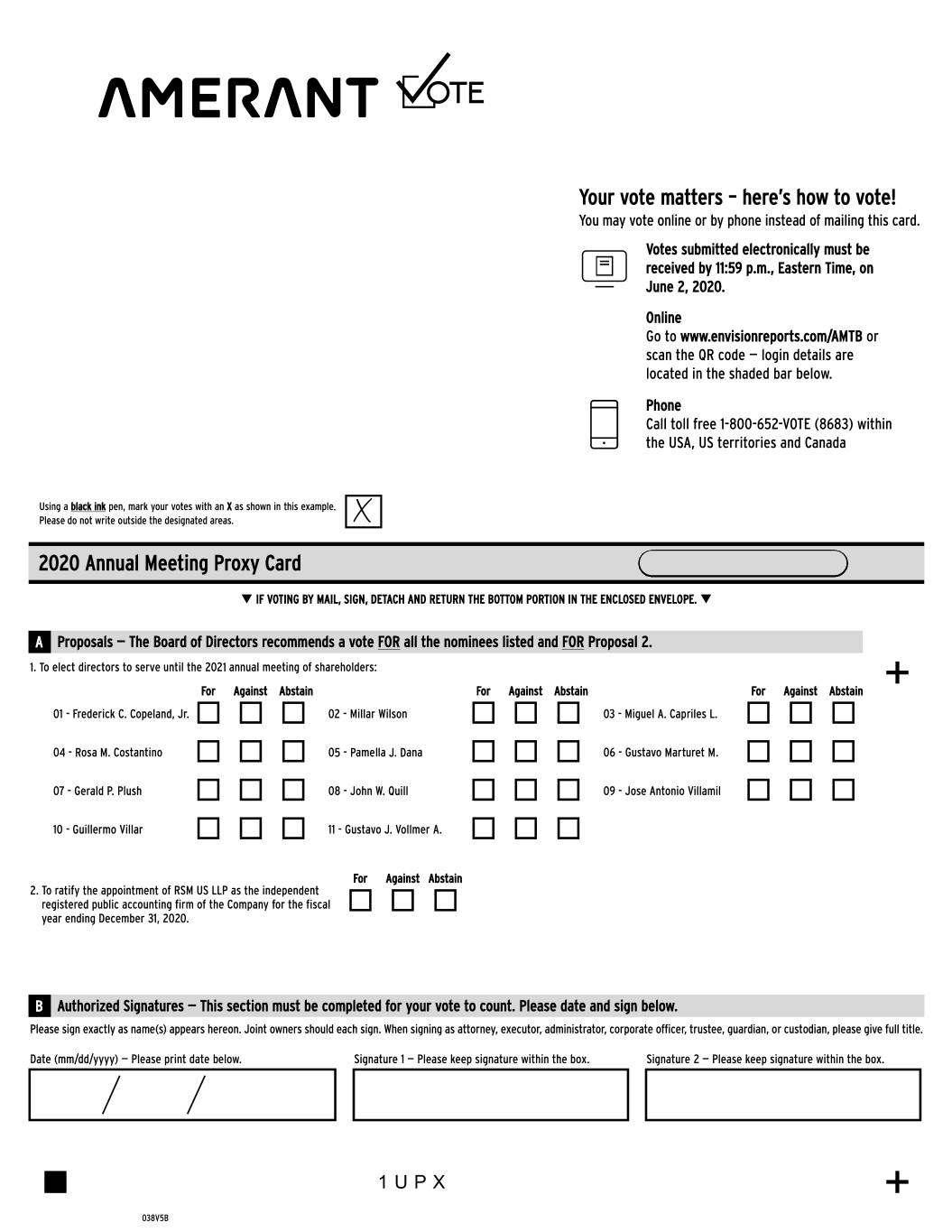

Notice is hereby given that the annual meeting (“Annual Meeting”) of the shareholders of Amerant Bancorp Inc. (the “Company,” “we,” “us” or “our”) will be held at the Hotel Colonnade, 180 Aragon Avenue, Coral Gables, Florida 33134 on June 3, 2020 at 8:00 a.m., Eastern time, for the following purposes:

1. | to elect directors to serve until the 2021 annual meeting of shareholders; |

2. | to ratify the appointment of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2020; and |

3. | to transact such other business as may properly come before the meeting or any adjournments thereof. |

In anticipation of potential orders limiting gatherings of people and closing places of business in connection with the COVID-19 or coronavirus pandemic, we are preparing for the possibility that the Annual Meeting may be held solely or in part by means of remote communication. Although not anticipated at this time, there is also the possibility that we may delay, postpone or adjourn the Annual Meeting, including changing the time, location or date of the Annual Meeting. If we decide to implement any of these actions, we will announce the decision to do so in advance, including details on how to participate in a virtual meeting, in a press release and/or in a current report on Form 8-K.

Shareholders of record at the close of business on April 9, 2020 are entitled to notice of and to vote at the Annual Meeting. We are taking advantage of the U.S. Securities and Exchange Commission rules allowing us to furnish proxy materials to shareholders on the Internet. We believe that these rules provide you with proxy materials more quickly and reduce the environmental impact of our Annual Meeting. Accordingly, we are mailing to shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review our Notice and Proxy Statement and Annual Report to Shareholders for the year ended December 31, 2019, and to vote online or by telephone.

If you would like to receive a paper copy of our proxy materials, please follow the instructions for requesting these materials in the proxy statement.

By Order of the Board of Directors | ||

/s/ Frederick C. Copeland, Jr. | ||

Frederick C. Copeland, Jr. Chairman of the Board of Directors | ||

April 24, 2020

Table of Contents

Page | |

PROXY STATEMENT | |

PROPOSAL 1 | |

Directors and Nominees | |

Corporate Governance | |

Report of the Audit Committee | |

Security Ownership of Certain Beneficial Owners | |

Certain Relationships and Related Party Transactions | |

Executive Compensation | |

Director Compensation | |

Compensation Committee Interlocks and Insider Participation | |

Equity Compensation Plan Information | |

PROPOSAL 2 | |

ADDITIONAL INFORMATION | |

AMERANT BANCORP INC.

220 Alhambra Circle

Coral Gables, FL 33134

PROXY STATEMENT

FOR THE ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON JUNE 3, 2020

This proxy statement is furnished in connection with the solicitation by the Board of Directors (the “Board”) of Amerant Bancorp Inc. (“we,” “us,” or the “Company”) of proxies to be voted at the annual meeting of shareholders of the Company to be held at 8:00 a.m., Eastern time, at the Hotel Colonnade, 180 Aragon Avenue, Coral Gables, Florida 33134, on June 3, 2020, or any postponement or adjournment thereof (the “Annual Meeting”). These proxy solicitation materials and our Annual Report to shareholders for the year ended December 31, 2019, including related financial statements, were first made available to our shareholders entitled to notice of and to vote at the Annual Meeting on or about April 24, 2020.

Important Notice Regarding the Availability of Proxy Materials for the Shareholder Meeting To Be Held on June 3, 2020 - our Annual Report to Shareholders, this proxy statement and the related proxy card are available at www.envisionreports.com/AMTB. The content on any website referred to in this proxy statement is not incorporated by reference into this proxy statement unless expressly noted.

QUESTION AND ANSWERS ABOUT THE PROXY MATERIALS

AND THE ANNUAL MEETING

Why am I receiving these materials?

We are providing these proxy materials to you in connection with the solicitation, by the Board of Directors of Amerant Bancorp Inc., of proxies to be voted at the Company’s Annual Meeting. You are receiving this Proxy Statement because you were an Amerant Bancorp Inc. shareholder as of the close of business on April 9, 2020, the record date of the Annual Meeting. This Proxy Statement provides notice of the Annual Meeting, describes the proposals presented for shareholder action and includes information required to be disclosed to shareholders.

When and where is the Annual Meeting?

The Annual Meeting will be held on Wednesday, June 3, 2020 at the Hotel Colonnade, 180 Aragon Avenue, Coral Gables, Florida 33134 at 8:00 a.m., Eastern time.

In anticipation of potential orders limiting gatherings of people and closing places of business in connection with the COVID-19 or coronavirus pandemic, we are preparing for the possibility that the Annual Meeting may be held solely or in part by means of remote communication. Although not anticipated at this time, there is also the possibility that we may delay, postpone or adjourn the Annual Meeting, including changing the time, location or date of the Annual Meeting. If we decide to implement any of these actions, we will announce the decision to do so in advance, including details on how to participate in a virtual meeting, in a press release and/or in a current report on Form 8-K.

What is the purpose of the Annual Meeting?

At the Annual Meeting, shareholders will act upon the matters described in the Notice of Annual Meeting that accompanies this Proxy Statement, including (1) the election of directors to serve until the 2021 annual meeting of shareholders, and (2) the ratification of the appointment of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2020.

Who Can Vote?

Only shareholders of record at the close of business on April 9, 2020, which we refer to as the record date, are entitled to notice of and to attend and vote at the Annual Meeting. As of the record date, there were 28,879,575 outstanding shares of our Class A Common Stock and 13,286,137 outstanding shares of our Class B Common Stock.

Each share of our Class A Common Stock outstanding on the record date will be entitled to cast one vote on each matter to be voted on at the Annual Meeting.

Each share of our Class B Common Stock outstanding on the record date will be entitled to cast one-tenth (1/10) of a vote, voting together as a single voting group with the Class A Common Stock shareholders, on Proposal 2 (to ratify the

1

appointment of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2020). Pursuant to our articles of incorporation, our Class B Common Stock will not be entitled to vote on Proposal 1 (election of directors).

How You Can Vote?

Shareholders of record (meaning the shares are registered in your name as opposed to the name of a bank or broker) may vote online, by telephone, by mail and at the Annual Meeting. Shareholders of record may vote online at www.envisionreports.com/AMTB, 24 hours a day, seven days a week. Votes online must be received no later than 11:59 p.m., Eastern time, on June 2, 2020. Shareholders of record may vote by telephone by calling 1-800-652-8683, 24 hours a day, seven days a week. Votes by telephone must be received no later than 11:59 p.m., Eastern time, on June 2, 2020. Shareholders of record will need the control number included in their Notice of Internet Availability or proxy card in order to vote online or by telephone. Shareholders of record may also vote by mail by completing, signing and dating each proxy card received and returning it in the prepaid envelope to Proxy Services C/O Computershare Investor Services, PO BOX 505008 Louisville, KY 40233-9814. Shareholders of record submitting their vote by mail should sign their name exactly as it appears on the proxy card. Votes submitted by proxy cards must be received no later than June 2, 2020. Shareholders of record may also vote at the Annual Meeting where votes must be received no later than the closing of the polls.

If you are a beneficial owner (meaning the shares are held in the name of a bank or broker (in “street name”)), you have the right to direct that organization how to vote the shares in your account by following the voting instructions provided by the organization. The availability of online and telephone voting will depend on the voting options of your broker, bank or other nominee. Alternatively, a beneficial owner may vote directly at the Annual Meeting by obtaining a legal proxy from the applicable brokerage firm, bank or other nominee confirming such holder's beneficial ownership of shares of our common stock as of the record date and authority to vote such shares. A beneficial owner attending the Annual Meeting will need to present the legal proxy received from the applicable brokerage firm, bank or other nominee along with photo identification. Votes at the Annual Meeting must be received no later than the closing of the polls.

If you need directions to the Annual Meeting, please call us at (305) 460-8728.

Revocability of Proxies

Shareholders who execute proxies retain the right to revoke them at any time before the shares are voted by proxy at the meeting. A shareholder may revoke a proxy by delivering a signed statement to our Corporate Secretary at or prior to the Annual Meeting or by timely executing and delivering, by Internet, telephone, mail or in person at the Annual Meeting, another proxy dated as of a later date. Furthermore, you may revoke a proxy by attending the Annual Meeting and voting in person, which will automatically cancel any proxy previously given.

Attendance at the Annual Meeting, however, will not automatically revoke any proxy that you have given previously unless you request a ballot and vote in person. If you hold shares through a brokerage firm, bank or other nominee, you must contact the brokerage firm, bank or other nominee to revoke any prior voting instructions.

Quorum Required

In order for business to be conducted, a quorum must be represented at the Annual Meeting. The majority of all votes entitled to be cast by the holders of the outstanding shares of Class A Common Stock and Class B Common Stock, as applicable, represented in person or by proxy, shall constitute a quorum at the Annual Meeting. Shares represented by a proxy in which authority to vote for any matter considered is “withheld,” a proxy marked “abstain” or a proxy as to which there is a “broker non-vote” (described below) will be considered present at the meeting for purposes of determining a quorum.

Required Vote to Elect Directors

Directors will be elected by a plurality of the votes cast by the Class A Common Stock shareholders at the Annual Meeting, meaning the eleven nominees receiving the most votes will be elected. Only votes cast for a nominee will be counted. Unless indicated otherwise by your proxy, the shares will be voted for the eleven nominees named in this proxy statement. Instructions on the accompanying proxy to abstain for one or more of the nominees will result in those nominees receiving fewer votes but will not count as a vote against the nominees.

Required Votes to Pass Proposal 2

Proposal 2 (to ratify the selection of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2020) requires the favorable vote of the majority of votes cast for approval, with each share of our Class A Common Stock entitled to one vote on Proposal 2 and each share of our Class B Common Stock entitled to

2

one-tenth (1/10) of a vote on Proposal 2. Although these votes are advisory in nature and are not binding on the Company, the Board will consider the outcomes of these votes in future deliberations. Abstentions are not treated as votes cast, so abstaining has no effect on this Proposal.

Broker Non-Votes

If your shares are held by a bank, broker or other nominee and you do not provide the bank, broker or other nominee with specific voting instructions, the organization that holds your shares may generally vote on “routine” matters but cannot vote on non-routine matters.

If the bank, broker or other nominee that holds your shares does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will inform our inspector of elections that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.”

When our inspector of elections tabulates the votes for any matter, broker non-votes will be counted for purposes of determining whether a quorum is present.

Proposal 1 (election of directors) is considered “non-routine,” and banks, brokers and certain other nominees that hold your shares in street name will not be able to cast votes on these proposals if you do not provide them with voting instructions. Broker non-votes are not treated as votes cast and will not affect the outcome of Proposal 1 because directors are elected by a plurality of votes cast.

Proposal 2 (ratification of independent auditors) is considered “routine” and we do not expect any broker non-votes on this matter.

Please provide voting instructions to the bank, broker or other nominee that holds your shares by carefully following their instructions.

Abstentions

Abstentions will not be counted as votes cast with regard to any proposal. Therefore, abstentions will have no effect on the outcome of any proposal. As stated above, abstentions will be counted for the purpose of determining whether a quorum is present.

Other Information

If no instructions are indicated on a duly executed and returned proxy, the shares represented by the proxy will be voted FOR the election of the eleven nominees for director proposed by the Board and set forth herein, and FOR the ratification of the appointment of RSM US LLP as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2020.

A list of shareholders entitled to vote at the Annual Meeting will be available for inspection upon request of any shareholder at our principal executive offices at 220 Alhambra Circle, Coral Gables, Florida 33134 during the ten days prior to the meeting, during ordinary business hours, and during the meeting.

3

PROPOSAL 1

ELECTION OF DIRECTORS

Directors and Nominees

The Board currently consists of eleven directors. The Board has determined that eleven directors is an appropriate size for the Board and, accordingly, the Board has nominated, upon the recommendation of the Corporate Governance and Nominating Committee of the Board, the eleven persons identified below, who are currently directors, to serve as directors to hold office until the next annual meeting or until their successors shall be duly elected and qualified.

On July 17, 2019, after the 2019 annual meeting, the Board increased the size of the Board of the Company from ten members to eleven members and appointed Gerald P. Plush as a Company director. As had been previously reported in a free writing prospectus filed by the Company with the Securities and Exchange Commission ("SEC") on December 13, 2018, Patriot Financial Partners, L.P. (“Patriot”), a private equity fund specializing in investments in the financial services sector, which purchased shares of Company Class A Common Stock in the Company’s December 2018 initial public offering, asked the Company to consider an additional independent director for nomination to the Company’s Board, including, among others, a person suggested by Patriot. Following review and consideration by the Company’s Corporate Governance and Nominating Committee and the Company’s and such committee’s criteria for directors, and compliance, to the Company’s satisfaction, with all applicable laws, as well as Nasdaq requirements, the Board appointed Mr. Plush, a Patriot partner, as a director.

The names of, and certain information with respect to, the nominees of the Board for election as directors, are set forth below. If, for any reason, any nominee should become unable or unwilling to serve as a director, the Board may either reduce the number of directors to be elected or select a substitute nominee. If a substitute nominee is selected, the persons named in the proxy card may exercise their discretion to vote your shares for the substitute nominee.

The Board has determined that Messrs. Copeland, Plush, Quill, Villamil, and Villar, and Mmes. Dana and Costantino qualify as independent directors in accordance with the listing requirements of The NASDAQ Stock Market LLC (the “NASDAQ”). The NASDAQ independence definition includes a series of objective tests, including that the director is not an employee of the Company and has not engaged in various types of business dealings with us. In addition, the Board has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The following table shows information as of the record date for each director nominee.

Name | Age | Title | |||

Frederick C. Copeland, Jr. | 78 | Chairman of the Board of Directors | |||

Millar Wilson | 67 | Vice-Chairman and Chief Executive Officer | |||

Miguel A. Capriles L. | 56 | Director | |||

Rosa M. Costantino | 62 | Director | |||

Pamella J. Dana | 57 | Director | |||

Gustavo Marturet M. | 54 | Director | |||

Gerald P. Plush | 61 | Director | |||

John W. Quill | 66 | Director | |||

Jose Antonio Villamil | 73 | Director | |||

Guillermo Villar | 77 | Director | |||

Gustavo J. Vollmer A. | 70 | Director | |||

The Board believes that the directors and director nominees as a whole will provide the diversity of experience and skills necessary for a well-functioning Board. The Board values highly the ability of individual directors to contribute to a constructive Board environment and the Board believes that the current director nominees, collectively, perform in such a manner. Set forth below is a more complete description of each director’s background, professional experience, qualifications and skills.

Frederick C. Copeland, Jr. Mr. Copeland has served as Chairman of the Board since December 31, 2018 and as a director of the Company and Amerant Bank, N.A. (the “Bank”) since 2007. Previously, Mr. Copeland served as the President and Chief Executive Officer of Far East National Bank, Los Angeles, a bank, from May 2009 to December 2009 and as a member of the board of directors of Far East National Bank, Los Angeles from September 2004 to December 2009, the President and Chief

4

Executive Officer of Aetna International, Inc., an insurance company, from 1995 to 2001, the Chairman, President and Chief Executive Officer of Fleet Bank, N.A. Connecticut, a bank, from 1993 to 1995, and the President and Chief Executive Officer of Citibank Canada, a bank, from 1987 to 1993. Additionally, Mr. Copeland is the Chairman of the Board of Connecticut Landmarks and a Trustee of the Wadsworth Atheneum, Hartford, Connecticut. Mr. Copeland received a Bachelor of Arts degree from Bowdoin College and a MBA from Columbia University.

Mr. Copeland brings extensive experience in leading large financial services companies to the Board, which furthers his ability to provide valued oversight and guidance to the Company and its strategies. Mr. Copeland’s substantial corporate management experience also serves to inform the Board’s general decision-making.

Millar Wilson. Mr. Wilson has served as Chief Executive Officer of the Company and the Bank since 2009 and as the Vice-Chairman of the Board and the board of directors of the Bank since 2013 and as a director since 1987. Under his leadership, the Bank has grown to $8 billion in assets, achieved a continuous upward trend in net income, and enhanced both the banking center network and product offerings to steadily increase lending and deposits. Mr. Wilson served in various roles with Mercantil Servicios Financieros (“MSF or our “Former Parent”) for over 40 years, including as Executive Director of International Business of MSF from 2013 until January 2018. Mr. Wilson served as a member of the board of directors of the Federal Reserve Bank of Atlanta, Miami Branch from 2013 to 2018, as a member of the board of directors of Enterprise Florida, Inc. from 2009 to 2013, as chairman of the board of directors of the American Red Cross of Greater Miami and the Keys from 2001 to 2002, and as a director and treasurer of the Miami Dade College Foundation from 1999 to 2004. Mr. Wilson is a graduate of Bradford University, England and the Harvard Business School Management Development Program.

As our Chief Executive Officer, Mr. Wilson has a breadth of knowledge concerning issues affecting us and the banking industry. His prior executive and director experience will assist the Board as we continue to expand our business.

Miguel A. Capriles L. Mr. Capriles has served as a director of the Company since 2003. Previously, Mr. Capriles served as a director of MSF from 1997 to 2018. Mr. Capriles has been the Managing Director of Gran Roque Capital, a real estate development firm focused in Spain and Portugal, since 2014. Previously, Mr. Capriles served as the Chairman and President of Cadena Capriles, a newspaper publisher in Venezuela from 1998 to 2013. He has also served as a director of H.L. Boulton S.A., a Venezuela-based holding company engaged in the import and export of goods and equipment, since 1999 and Corporación Industrial Carabobo, C.A. since 2014, and was a member of the Governing Council of the Instituto de Estudios Superiores de Administracion - IESA in Venezuela. Mr. Capriles has a degree in business administration from the Universidad Metropolitana in Caracas, Venezuela.

As a long-time director and large shareholder of the Company, Mr. Capriles brings extensive experience with the Company and a shareholder perspective to the Board. Mr. Capriles' executive experience and real estate development experience also serves to inform the Board's general decision-making.

Rosa M. Costantino. Mrs. Costantino has served as a director of the Company since January 2018 and of the Bank since November 2018. Mrs. Costantino retired in 2015 after 36 years in the financial services industry. Mrs. Costantino served in various positions with MSF from 1979 to 2015, including as the Global Personal Banking and Wealth Management Manager from 2005 to 2015 and in various roles in treasury, finance and retail banking. Mrs. Costantino graduated with a degree in Economics from the Universidad Central de Venezuela.

Mrs. Costantino brings unique knowledge of the Company and wealth management expertise to the Board.

Pamella J. Dana, Ph.D. Dr. Dana has served as a director of the Company and the Bank since 2007. Dr. Dana has served as Senior Advisor for Strategic Initiatives at the Institute for Human & Machine Cognition, a Florida-based research institute engaged in artificial intelligence, robotics, sensory substitution, data mining, and related technologies, since 2007. Previously, Dr. Dana served as the Executive Director of the Florida Governor’s Office of Tourism, Trade, and Economic Development from 1999 to 2007 and the Florida’s Chief Protocol Officer from 2002 to 2007. Dr. Dana served as Assistant and Deputy Secretary of the California Trade and Commerce Agency from 1995 to 1999. Dr. Dana serves on the board of directors of Triumph Gulf Coast, Inc. since 2013, which is overseeing the distribution of $1.5 billion in BP oil spill settlement payments awarded to Florida, and the Scripps Florida Funding Corporation Board, where she also serves on the Audit Committee, since 2007. She has been a Trustee of the Florida Chamber of Commerce Foundation since 2007, a member of the Florida Sports Foundation Board since 2011, and a member of the International Economic Development Council since 2007. From 2006 to 2009, Dr. Dana was a Trustee of the University of West Florida and was a voting member for Florida on the U.S. Gulf of Mexico Fisheries Management Council from 2011 to 2016. Dr. Dana holds a Ph.D. in International Development and

5

Economics from the University of Southern California, a master’s degree in administration, planning and policy from Harvard University and a bachelor’s degree in sociology and social work from California State University, Chico.

Dr. Dana brings over 30 years of successful senior economic, business, and university leadership, policymaking and public affairs experience to the Board.

Gustavo Marturet M. Mr. Marturet has served as a director of the Company and the Bank since 2015. Previously, Mr. Marturet served as a director of MSF from 2014 to 2018. Mr. Marturet has served as the Portfolio Manager of the Canepa Dividend Select Fund, an investment fund, since 2012. In 2017, he co-founded Unison Asset Management, an affiliate of Canepa U.S., which serves as a financial advisory firm and manages the Canepa Dividend Select Fund. Since 2016, Mr. Marturet has been a Director of Canepa Funds ICAV in Dublin, Ireland, an affiliate of Canepa U.S. Previously, Mr. Marturet served as the Head of Private Banking and Asset Management at the Bank from 2008 to 2012, and as President and Chief Executive Officer of the Bank’s securities broker-dealer subsidiary from 2002 to 2010. Mr. Marturet also served in various roles at Verizon Investment Management, a corporate pension manager, and Bankers Trust Company, a New York-based bank. Mr. Marturet is a graduate of the Universidad Catolica Andres Bello (Venezuela), Yale University, and Hult University.

Mr. Marturet brings extensive wealth management, banking and U.S. capital markets experience to the Board.

Gerald P. Plush. Mr. Plush was appointed as director of the Company in July 2019 and of the Bank in October 2019. Mr. Plush is currently a Partner at Patriot Financial Partners. Mr. Plush also serves on the board of directors of Numerated Growth Technologies in Boston, MA. Mr. Plush’s prominent leadership roles include his tenure with Santander US, a bank, from 2014 to 2017, initially as CFO and Executive Committee member, and subsequently as Chief Administrative Officer. Mr. Plush served on the board of Santander Consumer, a consumer finance company, from 2014 to 2016, and as a director for the Federal Home Loan Bank of Pittsburgh from 2016 to 2017. Mr. Plush previously served as President, COO and Board Member for Webster Bank where he was responsible for turnaround efforts for the institution beginning in 2006 as EVP and Chief Financial Officer. Mr. Plush spent 11 years with MBNA America, a bank, most recently as Senior Executive Vice President & Managing Director for corporate development and prior to that as CFO - North America. Mr. Plush holds a Bachelor of Science degree in Accounting from St. Joseph’s University in Philadelphia. Mr. Plush has been active in several philanthropic organizations, including serving on the board of trustees of the Connecticut Public Broadcasting Network, as chairman of Junior Achievement of Southwest New England, board of Ronald McDonald House of Delaware and most recently on the Board of Overseers for WGBH in Boston.

Mr. Plush brings over 25 years of executive level experience in the banking industry to the Board and his previous prominent business and operations roles in other financial institutions provide the Company with insightful and relevant information as the Company continues to build upon its strategy.

John W. Quill. Mr. Quill was appointed as director of the Company and the Bank in March 2019. Currently, Mr. Quill serves as a consultant to the International Monetary Fund (the “IMF”), an international organization with the aim of promoting international financial and monetary cooperation, where he previously served as a Senior Financial Sector Expert in bank supervision and policy effectiveness from 2013 to 2015. Prior to the IMF, Mr. Quill served in various capacities with the Office of the Comptroller of the Currency (the “OCC”), a U.S. financial regulator, from 1980 to 2011, including Deputy Comptroller from 2004 to 2011 and the chair of the interagency council that advised the United States Treasury as to banks that should receive funds under the United States Treasury’s Troubled Asset Relief Program. Mr. Quill was an independent director of Gibraltar Private Bank & Trust, Coral Gables, Florida from 2015 to 2018.

Mr. Quill brings nearly 40 years of experience in financial services, public and private, to the Board and, in particular, his 31 years of experience working with the OCC, the Bank’s primary regulator, allows him to provide the Company with a valuable regulator-perspective.

Jose Antonio Villamil. Mr. Villamil has served as a director of the Company and the Bank since 2003. Mr. Villamil has over 35 years of successful experience as a senior business economist, university educator and high-level policymaker for both the federal and Florida governments. Mr. Villamil is the Founder and currently a Senior Advisor to The Washington Economics Group, Inc., a Florida-based economic consulting firm established in 1993 upon his return to Florida from his service as Chief Economist and U.S. Undersecretary of Commerce for Economic Affairs from 1989 to 1993. He was selected in 2008 as the founding Dean of the School of Business of St. Thomas University, serving until December 31, 2013. From 1999 to 2000, he directed Florida’s Tourism, Trade and Economic Development activities in the Office of the Governor and is a past Chairman of the Governor’s Council of Economic Advisors of Florida. Mr. Villamil is a Board Member of the Beacon Council, Miami-Dade County’s official economic development organization, and Chairman of its Economic Roundtable. He also serves as Senior

6

Fellow of the James Madison Institute of Tallahassee, Florida. Since June 2004, he has been a member of the board of directors of Spanish Broadcasting System, Inc., and since November 2010 he has been a director of Pan-American Life Insurance Group. Mr. Villamil has both a master’s degree in economics and a bachelor’s degree in economics from Louisiana State University.

Mr. Villamil brings over 30 years of successful experience as a senior business economist, and as a public official of both the federal and Florida governments to the Board.

Guillermo Villar. Mr. Villar has served as a director of the Company and the Bank since 1998. Mr. Villar has served as a Managing Partner of Alcazar Development Group, a real estate development firm, since April 2015. Previously, Mr. Villar served as the President and Chief Executive Officer of the Bank and the Company from 1988 to 2008. Mr. Villar also served in various roles with MSF from 1974 to 2008, including as Chief Financial Officer from 1978 to 1988 and Managing Director of other international banking subsidiaries from 1980 to 2008. Prior to joining MSF, Mr. Villar managed corporate and real estate lending in Puerto Rico for Chase Manhattan Bank (now JPMorgan Chase Bank) from 1972 to 1974. Mr. Villar has served on the boards of various trade, community, and charitable organizations, including Enterprise Florida, Inc., the American Red Cross, the Small Business Credit Initiative, and the Coral Gables Chamber of Commerce. Mr. Villar has a master’s degree in Economics from Vanderbilt University and a bachelor’s degree in Business Administration from the Universidad de Puerto Rico.

As a former executive of MSF and President and Chief Executive Officer of the Bank, Mr. Villar brings extensive banking and executive leadership experience, Company knowledge and continuity to the Board that is essential for maintaining the trust of our employees, customers and communities where we conduct business.

Gustavo J. Vollmer A. Mr. Vollmer served as Chairman of the Board and the board of directors of the Bank from 2012 until December 31, 2018 and has been a member of the Board of the Company and the board of directors of the Bank since 2003 and 2013, respectively. Mr. Vollmer has served as the Chairman and Chief Executive Officer of MSF since 2011 and as a member of the MSF board of directors since 1997. Additionally, Mr. Vollmer served as a member of the Latin America Advisory Committee of the New York Stock Exchange from 1996 to 2004, as a Director of the Instituto de Estudios Superiores de Administración in Venezuela since 2000, and as its Chairman from 2002 to 2008, as a member of the International Young Presidents Organization from 1983 to 1998, and as its President from 1992 to 1993, as a member of The Group of Fifty since 1994, as the Founding President of the Partnership for a Drug-free Venezuela from 1990 to 1991, as a member of the Development Council of the Universidad Católica Andrés Bello in Venezuela since 2015, and as a member of the World President’s Organization since 1998. Mr. Vollmer was also Founding Co-Chairman and a Member of the US-Venezuelan Business Council from 1990 to 2010. Mr. Vollmer is a graduate of Duke University, Cambridge University and the Program for Executive Development at the International Institute for Management Development in Switzerland.

Mr. Vollmer brings extensive experience in leadership positions with global economic development and commerce, as well as business and social/community organizations to the Board.

In order to be elected, a nominee must receive a plurality of the votes cast at the meeting in person or by proxy.

THE BOARD RECOMMENDS A VOTE “FOR” APPROVAL OF THE ELECTION OF THE NOMINEES NAMED HEREIN AS DIRECTORS.

7

Corporate Governance

Except for Mr. Capriles, all of our directors also serve on the board of directors of the Bank and all of our executive officers serve in the same position at the Bank. During the fiscal year ended December 31, 2019, the Board held 9 meetings and acted 7 times by written consent.

The Board’s unwritten policy regarding director attendance at the annual meeting of shareholders is that directors are encouraged to attend. We generally hold a board meeting coincident with our annual meeting to minimize director travel obligations and facilitate their attendance at the annual meeting of shareholders. All members of the Board attended the 2019 annual meeting of shareholders, except for Mr. Vollmer due to family bereavement and Mr. Plush who was not a director at the time.

All directors attended at least 75% of the aggregate of (i) the Board meetings held during their tenure as directors during 2019 and (ii) the meetings of any committees held during their tenure as members of such committees during the fiscal year ended December 31, 2019. The Company’s independent directors have had meetings at which only the independent directors met in executive session and such executive sessions are regularly scheduled each year. The standing committees of the Board consist of the Audit Committee, the Compensation Committee, the Corporate Governance and Nominating Committee and the Risk Committee.

The charters of our Audit, Compensation, Corporate Governance and Nominating and Risk Committees are available on our website at https://investor.amerantbank.com/corporate-governance/documents-charters. You may also request copies of our committee charters free of charge by writing to our investor relations team at investorrelations@amerantbank.com or via mail addressed to “Investor Relations” at 220 Alhambra Circle, Coral Gables, Florida 33134. Below is a summary of our committee structure and membership information.

Audit Committee

The Company has a separately designated Audit Committee, as defined in Section 3(a)(58)(A) of the Securities Exchange Act of 1934 (the “Exchange Act”). The Audit Committee consists of six independent directors: Mr. Villar, as Chair, Mmes. Costantino and Dana, and Messrs. Copeland, Plush and Quill (until March 31, 2020, the members of the Audit Committee were Mr. Villar, as Chair, Mrs. Dana, and Messrs. Copeland, Plush and Quill). Each member of the Audit Committee is financially literate and the Board has determined that each member of the Audit Committee qualifies as an “audit committee financial expert” as defined in applicable SEC rules, except Mrs. Costantino. The Audit Committee held 15 meetings in 2019 and acted 3 times by written consent.

The Audit Committee’s charter details the principal functions of the committee, including:

• | appointing, compensating, retaining, replacing and overseeing the work of the independent registered public accounting firm and any other independent registered public accounting firm engaged by us; |

• | pre-approving all audit and non-audit services to be provided by the independent registered public accounting firm or any other independent registered public accounting firm engaged by us, and establishing pre-approval policies and procedures; |

• | reviewing and discussing with the independent registered public accounting firm all relationships the independent registered public accounting firm has with us in order to evaluate their continued independence; |

• | setting clear hiring policies for employees or former employees of the independent registered public accounting firm; |

• | setting clear policies for audit partner rotation in compliance with applicable laws and regulations; |

• | obtaining and reviewing a report, at least annually, from the independent registered public accounting firm describing (i) the independent registered public accounting firm’s internal quality-control procedures and (ii) any material issues raised by the most recent internal quality-control review, or peer review, of the audit firm, or by any inquiry or investigation by governmental or professional authorities, within the preceding five years, respecting one or more independent audits carried out by the firm and any steps taken to deal with such issues; |

• | reviewing and approving any related party transaction required to be disclosed pursuant to Item 404 of Regulation S-K promulgated by the SEC prior to us entering into such transaction; |

• | reviewing with management, the independent registered public accounting firm and our legal advisors, as appropriate, any legal, regulatory or compliance matters, including any correspondence with regulators or government agencies and any employee complaints or published reports that raise material issues regarding our financial statements or accounting policies and any significant changes in accounting standards or rules promulgated by the Financial Accounting Standards Board, the SEC or other regulatory authorities; and |

8

• | meeting, as it deems appropriate, in separate executive sessions with the independent registered public accounting firm, other directors, internal audit, the Chief Executive Officer or other Company employees, agents, attorneys or representatives. |

Compensation Committee

The Compensation Committee consists of four independent directors: Mrs. Dana, as Chair, Messrs. Copeland and Quill, and Mrs. Costantino (until March 31, 2020, the members of the Compensation Committee were Mrs. Dana, as Chair, Mr. Copeland and Mrs. Costantino). The Compensation Committee held 9 meetings in 2019 and acted 2 times by written consent.

The Compensation Committee’s charter details the principal functions of the committee, including:

• | reviewing and approving on an annual basis the corporate goals and objectives relevant to the compensation of our Chief Executive Officer and our other executive officers, evaluating the performance of our Chief Executive Officer and our other executive officers in light of such goals and objectives and determining and approving the compensation levels of our Chief Executive Officer and other executive officers based on such evaluation; |

• | reviewing our executive compensation policies and plans; |

• | implementing and administering our incentive compensation equity-based plans; |

• | assisting management in complying with our proxy statement and annual report disclosure requirements; |

• | producing a report on executive compensation to be included in our annual proxy statement, when required; |

• | reviewing, evaluating and recommending changes, if appropriate, to the director compensation program; and |

• | periodically conducting a risk assessment of the Company's compensation plans and programs. |

The charter also provides that the Compensation Committee may, in its sole discretion, retain or obtain the advice of a compensation consultant, legal counsel or other adviser and will be directly responsible for the appointment, compensation and oversight of the work of any such adviser. However, before engaging or receiving advice from a compensation consultant, external legal counsel or any other adviser, the Compensation Committee will consider the independence of each such adviser, including the factors required by NASDAQ and the SEC.

The Compensation Committee may, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee of the Compensation Committee and it may also delegate to one or more officers of the Company its authority to approve grants of stock options and other equity-based awards, subject to the terms and conditions of such delegation and applicable plans and law. Except for the delegation to the Company’s Vice-Chairman and CEO of its authority to grant restricted stock under the 2018 Equity and Incentive Compensation Plan or, the 2018 Plan, as described more fully below under Executive Compensation, the Compensation Committee has not delegated any portion of its duties and responsibilities at this time.

Corporate Governance and Nominating Committee

The Corporate Governance and Nominating Committee consists of five independent directors: Mr. Copeland, as Chair, Mrs. Dana and Messrs. Plush, Villamil and Villar (until March 31, 2020, the members of the Corporate Governance and Nominating Committee were Mr. Copeland, as Chair, Mrs. Costantino and Mr. Villamil). The Corporate Governance and Nominating Committee held 8 meetings in 2019 and acted 4 times by written consent.

The Corporate Governance and Nominating Committee’s charter details the principal functions of the committee, including:

• | to identify individuals qualified to become members of the Board; |

• | to make recommendations to the Board regarding Board and committee composition; |

• | to review and evaluate director nominations as well as any recommendations relating to corporate governance issues submitted by the shareholders; |

• | to monitor director independence; |

• | to oversee director training and continuing education programs; |

• | to assist in succession planning; |

• | to review the Code of Ethics and recommend changes to the Board as appropriate; and |

• | to oversee the evaluation of the Board and management. |

9

Risk Committee

The Risk Committee consists of six directors: Mr. Plush, as Chair, and Messrs. Capriles, Marturet, Quill, Villamil and Vollmer (until March 31, 2020, the members of the Risk Committee were Mr. Villamil, as Chair, and Messrs. Capriles, Marturet, Plush and Vollmer). The Risk Committee held 7 meetings in 2019.

The Risk Committee’s charter details the principal functions of the committee, including:

• | to review and approve the Company’s and the Bank’s risk appetite, profile, and aggregate tolerance levels in light of their strategic, operational, and financial objectives; and |

• | to evaluate, monitor and, where appropriate, make recommendations to the Board with respect to |

• | the risks inherent in the businesses of the Company and the Bank, the interrelationships between these risks and the process by which management identifies, assesses and determines appropriate controls; |

• | the enterprise risk management framework and control activities, including the setting of performance measurement goals and key risk indicators; |

• | the integrity, advancement and understanding of the Company’s and the Bank’s systems and processes of operational controls; and |

• | the allocation of risk capital and use of risk adjusted return on capital in decision making. |

Board Leadership Structure and Risk Oversight

The positions of Chairman of the Board and Chief Executive Officer are held by different individuals: Frederick C. Copeland Jr. serves as Chairman and Millar Wilson serves as Vice-Chairman and Chief Executive Officer. Mr. Copeland is an independent director and non-executive Chairman, which allows him to serve on Board committees without interfering with his ability to meet applicable SEC, NASDAQ and corporate independence requirements. Our Board believes that the current separation of the offices of Chief Executive Officer and Chairman takes advantage of these persons’ respective strengths and perspectives. The Chief Executive Officer is responsible for determining how best to execute the Company’s strategy, as approved by the Board, and providing day-to-day leadership to the Company. The Chairman, with the Board, oversees management and determines and approves the Company’s strategy.

The separation of the roles of Chief Executive Officer and nonexecutive Chairman and the independence of a majority of the board members helps ensure independent oversight of management. The Company believes that the current Board structure, policies and practices, when combined with the Company’s other governance policies and procedures, provide appropriate risk oversight.

The ultimate responsibility for risk oversight rests with the full Board and the committees of the Board assist in this oversight in the areas over which they have responsibility.

The Risk Committee has responsibility over the Company’s enterprise risk management framework, which includes oversight over credit, market, operational, information security, and strategic and reputational risks. This framework allows management to understand, manage and report the risks our Company and its subsidiaries face. In addition, the Risk Committee evaluates, monitors and makes recommendation for setting our overall risk appetite and oversees management’s responsibility for maintaining operational controls and procedures designed to ensure that the Company’s various business activities function within the risk appetite and tolerance established by the Board. The Audit Committee monitors risks associated with financial reporting, accounting practices and policies, disclosure controls and procedures and internal control over financial reporting as well as regulatory compliance risk and meets periodically in joint session with the Risk Committee to review the enterprise risk management framework. The Corporate Governance and Nominating Committee is responsible for overseeing risks related to the independence of our Board as well as potential conflicts of interest facing our directors and executive officers. The Compensation Committee is primarily responsible for risks associated with our compensation policies, plans, programs and practices and, particularly, for ensuring that these plans and programs are designed in a manner that do not encourage inappropriate or excessive risk by our employees. In addition, the AML-BSA Committee of the Board of the Bank is responsible for overseeing risks related to Anti-Money Laundering, the Bank Secrecy Act and OFAC sanctions compliance.

The Board’s and management’s proactive approach to risk management has been evidenced with the recent COVID-19 pandemic. Since the outset of the pandemic, our Executive Management Committee has been closely monitoring the impact of the COVID-19 outbreak on our business and operations and has implemented measures for the continuous and safe operation of the Company and its subsidiaries, while also monitoring market developments and implementing measures to manage credit, liquidity and other risks. Management is in regular communication with the Board about the assessment and management of significant risks to the Company and impact on our business resulting from the COVID-19 pandemic.

10

Share Ownership Guidelines

In September of 2018, the Board adopted the following guidelines, which require our directors and officers to own shares of our Class A Common Stock having values equal to the applicable multiple of base salary for executives and annual cash retainer for directors, as set forth in the table below:

Officers and Directors | Ownership Requirement | ||

Chief Executive Officer | 4X | ||

Other Section 16 Executive Officers | 2X | ||

Other Non-Section 16 Officers (those reporting to Executive Management Committee members) | 0.5-1X | ||

Non-Employee Directors | 4X | ||

Shares that count toward meeting the share ownership guidelines include: (i) Shares owned outright, directly or indirectly, including shares held in trust for the benefit of the director or officer; (ii) restricted stock or restricted stock units not subject to attainment of stated performance goals, or performance-based awards that have already met the required performance criteria; (iii) shares or share equivalents beneficially held in any employee stock purchase plan, retirement savings plan, deferred compensation plan, employee stock ownership plan or similar plan; and (iv) deferred shares or deferred stock units.

Shares that do not count towards meeting the share ownership guidelines include: (i) unexercised stock options and stock appreciation rights; (ii) unearned performance-based restricted stock or units; and (iii) Company shares purchased on a short term basis and not held for investment purposes, or which are pledged to secure non-recourse loans.

The officers and directors have 5 years from their appointment or promotion to the position to comply with the share ownership guidelines. The Board may, in its discretion, extend the period of time for attainment of such ownership levels in appropriate circumstances. Until the required ownership level is met, executives are required to retain 50% of the shares received from us under our equity incentive plan net of shares withheld for taxes or payment of the applicable exercise price.

Anti-hedging Policy

The Company’s Insider Trading Policy prohibits officers, directors, employees and all other Covered Person (as that term is defined in the Insider Trading Policy) from engaging in transactions with securities issued by the Company or its subsidiaries, including Company Class A common stock and class B Common Stock, or Company Securities, of a speculative nature at any time. This prohibition includes short-selling Company Securities or engaging in transactions involving Company Derivative Securities (options, warrants, restricted stock units, stock appreciation rights or similar rights whose value is derived from the value of the Company’s Securities). Officers, directors and employees are, however, not prohibited from receiving and exercising options, restricted stock units, stock appreciation rights or other Derivative Securities granted under the Company’s equity incentive plans.

Nomination Process

The Corporate Governance and Nominating Committee is responsible for identifying and recommending to the Board potential directors who possess the skills, knowledge, and understanding necessary to be valued members of the Board in order to assist it in successfully performing its role in corporate oversight and governance. The Corporate Governance and Nominating Committee considers not only an individual director’s or possible nominee’s qualities, performance, and professional responsibilities, but also the then-current composition of the Board and the challenges and needs of the Board as a whole in an effort to ensure that the Board, at any time, is comprised of a diverse group of members who, individually and collectively, best serve the needs of the Company and its shareholders. In general, and in giving due consideration to the composition of the Board at that time, the factors considered of individual directors, including those of any nominees of shareholders, include judgment, skill, diversity, integrity, experience with businesses and other organizations of comparable size, the interplay of the individual director’s or possible nominee’s experience with the experience of the Board and the extent to which the individual director or possible nominee would be a desirable addition to the Board and its committees.

Additionally, the Corporate Governance and Nominating Committee will consider persons nominated by shareholders and recommend to the full Board whether such nominee should be included with the Board’s nominees for election by shareholders. Our Bylaws contain provisions that address the process (including the required information and deadlines) by which a shareholder of our Class A Common Stock may nominate an individual for consideration by the Corporate Governance and Nominating Committee to stand for election at an annual meeting of shareholders. Specifically, our Bylaws provide that, a

11

shareholder may nominate a director nominee, provided that such shareholder is a shareholder of record of our Class A Common Stock at the time notice of the director nomination is provided to the Board, is a shareholder of record of our Class A Common Stock at the time of the annual meeting and is entitled to vote on the election of directors at the annual meeting (a shareholder that meets these provisions and is nominating a director nominee, a “Nominating Shareholder”). Nominating Shareholders should submit the candidate’s name and the other information required by our Bylaws (as described below) to our Corporate Secretary and follow the procedures stated in our Bylaws.

Our Bylaws provide certain requirements as to the form and content of a Nominating Shareholder’s notice. These provisions may preclude shareholders from making nominations for directors at an annual meeting of shareholders. A Nominating Shareholder’s notice must be received by the Company’s Corporate Secretary at 220 Alhambra Circle, Coral Gables, Florida 33134 not less than 90 calendar days nor more than 120 calendar days prior to the first anniversary of the date on which the Corporation held the preceding year’s annual meeting of shareholders. For purposes of the annual meeting of shareholders to be held in 2021, the Nominating Shareholder’s notice must be received no later than March 5, 2021 and no earlier than February 3, 2021. If the date of the next annual meeting of shareholders is scheduled for a date more than 30 calendar days prior to or more than 30 calendar days after the anniversary of the preceding year’s annual meeting, however, notice by the shareholder to be timely must be so delivered not later than the close of business on the later of the 90th calendar day prior to such annual meeting and the 10th calendar day following the day on which public disclosure of the date of such meeting is first made. May 4, 2021 is thirty calendar days prior to the anniversary of the Annual Meeting and July 3, 2021 is 30 calendar days after the anniversary of the Annual Meeting. In no event will a recess or adjournment of an annual meeting (or any announcement of any such recess or adjournment) commence a new time period for the giving of a shareholder’s notice as described above.

Director Qualifications and Diversity

The Corporate Governance and Nominating Committee monitors existing director qualifications and periodically examines the composition of the Board and determines whether the Board would better serve its purposes with the addition of one or more directors. This assessment includes, among other relevant factors, in the context of the perceived needs of the Board at that time, issues of experience, reputation, judgment, diversity and skills.

If the Corporate Governance and Nominating Committee determines that adding a new director is advisable or if a vacancy on the Board arises, the Corporate Governance and Nominating Committee initiates the search, working with other directors, management and, if it deems appropriate or necessary, a search firm retained to assist in the search. The Corporate Governance and Nominating Committee will consider all appropriate candidates proposed by management, directors and shareholders. Information regarding potential candidates is presented to the Corporate Governance and Nominating Committee, which then evaluates the candidates based on the needs of the Board at that time and the criteria listed above. Potential candidates are evaluated according to the same criteria, regardless of whether the candidate was recommended by the Corporate Governance and Nominating Committee, a shareholder, another director, management or another third party. The Corporate Governance and Nominating Committee would then meet to consider the selected candidate(s) and submits the approved candidate(s) to the full Board for approval and recommendation to the shareholders. Although neither the Board nor the Corporate Governance and Nominating Committee has a formal policy with regard to the consideration of diversity in identifying director nominees, the director nomination process is designed to ensure that the Board considers members with diverse backgrounds, including race, ethnicity, gender, education, skills and experience, with a focus on appropriate financial and other expertise relevant to the Company’s business, and also considers issues of judgment, conflicts of interest, integrity, ethics and commitment to the goal of maximizing shareholder value. The goal of this process is to assemble a group of directors with deep, varied experience, sound judgment and commitment to the Company’s success.

Shareholder Communications with Directors

Shareholders who wish to communicate with the Board, or any individual director or group of directors, may do so by sending written communications addressed to:

Amerant Bancorp Inc.

Attention: [Board of Directors] or [Board Member]

c/o Corporate Secretary

Amerant Bancorp Inc.

220 Alhambra Circle

Coral Gables, Florida 33134

12

Each letter should indicate that the author is a shareholder and if shares are not held of record, should include appropriate evidence of stock ownership. All communications will be compiled by the Corporate Secretary of the Company and submitted to the Board or each applicable director at the next regular meeting of the Board. The Corporate Secretary will not forward the communication if it is primarily commercial in nature, relates to an improper or irrelevant topic, or is unduly hostile, threatening, illegal or otherwise inappropriate.

Code of Ethics

We have adopted a Code of Conduct and Ethics that applies to our directors and employees, including our principal executive officer, principal financial officer, principal accounting officer and controller and persons performing similar functions. The Code of Conduct and Ethics is available on our website at https://investor.amerantbank.com/corporate-governance/documents-charters. We will post any amendments to or waivers of our Code of Conduct and Ethics at the same location on our website.

13

Report of the Audit Committee

The Audit Committee has reviewed and discussed the audited financial statements of the Company for the fiscal year ended December 31, 2019 with management and has discussed with PricewaterhouseCoopers LLP (“PwC”), the Company’s independent registered public accounting firm for the fiscal year ended December 31, 2019, those matters required to be discussed by applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”) and the Securities and Exchange Commission.

In addition, the Audit Committee has received the written disclosures and the letter from PwC required by applicable requirements of the PCAOB, regarding PwC’s communications with the Audit Committee concerning independence, and the Audit Committee has discussed PwC’s independence with PwC.

Based on these reviews and discussions, the Audit Committee recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 for filing with the SEC.

Audit Committee

Guillermo Villar, Chair

Frederick C. Copeland, Jr.

Pamella J. Dana

Gerald P. Plush

John W. Quill

14

Security Ownership of Certain Beneficial Owners

The following table sets forth certain information with respect to the beneficial ownership of our Class A Common Stock and Class B Common Stock as of April 15, 2020 (unless otherwise indicated), for:

• | each person whom we know to own beneficially more than 5% of our Class A Common Stock or Class B Common Stock; |

• | each named executive officer and each director; and |

• | all of our executive officers and directors as a group. |

As of the date set forth above, we had 28,879,575 shares of Class A Common Stock outstanding and 13,286,137 shares of Class B Common Stock outstanding.

Beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. Except as otherwise noted in the footnotes below, each holder identified below has sole voting and investment power with respect to such securities. Unless otherwise provided, the address of each holder listed is c/o Amerant Bancorp Inc., 220 Alhambra Circle, Coral Gables, Florida 33134.

Shares of Class A Common Stock Beneficially Owned | Shares of Class B Common Stock Beneficially Owned | |||||||||||

Name of Beneficial Owner | Number | Percentage | Number | Percentage | ||||||||

Named Executive Officers and Directors | ||||||||||||

Millar Wilson | 191,168.00 | * | — | — | ||||||||

Alberto Peraza (1) | 26,514.00 | * | — | — | ||||||||

Miguel Palacios | 39,198.66 | * | 52.00 | * | ||||||||

Frederick C. Copeland, Jr. | 13,615.00 | * | — | — | ||||||||

Miguel A. Capriles L. (2) | 2,161,833.00 | 7.49 | % | 1,772,689.00 | 13.34 | % | ||||||

Rosa M. Costantino | 14,280.33 | * | 3,010.00 | * | ||||||||

Pamella J. Dana, Ph.D. | 10,384.00 | * | — | — | ||||||||

Gustavo Marturet M. (3) | 66,213.66 | * | 7,149.66 | * | ||||||||

Gerald P. Plush (4) | 100.00 | * | — | — | ||||||||

John W. Quill | 3,939.00 | * | — | — | ||||||||

Jose Antonio Villamil | 10,384.00 | * | — | — | ||||||||

Guillermo Villar | 10,384.00 | * | — | — | ||||||||

Gustavo J. Vollmer A. (5) | 2,051,947.66 | 7.11 | % | 482,461.66 | 3.63 | % | ||||||

Executive officers and directors as a group (16 persons): | 4,683,033.33 | 16.22 | % | 2,266,394.66 | 17.06 | % | ||||||

Other Greater than 5% Security Holders | ||||||||||||

Patriot Financial Partners III, L.P. (6) | 2,078,289.00 | 7.20 | % | — | — | |||||||

Diana Medina de Marturet (7) | 1,868,653.66 | 6.47 | % | 215,790.00 | 1.62 | % | ||||||

Perry Creek Capital LP (8) | 1,543,229.00 | 5.34 | % | — | — | |||||||

* | Represents less than 1% of the class. |

(1) | Effective March 16, 2020, Mr. Alberto Peraza resigned as Co-President & CFO of the Company and, in accordance with the Restricted Stock Agreement by and between the Company and Mr. Peraza dated January 7, 2019, Mr. Peraza forfeited 54,462 restricted shares of Class A Common Stock of the Company. |

(2) | As reported in a statement on Schedule 13G filed with the SEC on February 14, 2019 by Miguel A. Capriles L. According to the filing Mr. Capriles has sole voting and dispositive power over 576,696.48 shares of Class A Common Stock and shared voting and dispositive power over 1,585,136.52 shares of Class A Common Stock. We understand that Mr. Capriles has sole voting and dispositive power over 472,767.62 shares of Class B Common Stock and shared voting and dispositive power over 1,299,921.38 shares of Class B Common Stock. |

Mr. Capriles disclaims beneficial ownership over 1,585,136.66 shares of Class A Common Stock and 1,299,921.38 shares of Class B Common Stock included in the table above and held by certain of his sisters of which he has no economic interest therein.

15

(3) | These shares include shares directly held by Mr. Marturet as well as shares held by certain trusts and companies under common control by and/or for the benefit of Mr. Marturet and certain members of his family. |

(4) | Mr. Plush is a partner of Patriot Financial Partners, L.P., a greater than 5% security holder of the Company’s shares of Class A Common Stock, as discussed in note 6 below. |

(5) | As reported in a statement on Schedule 13G/A filed with the SEC on April 14, 2020 by Gustavo J. Vollmer A. According to the filing Mr. Vollmer has sole voting and dispositive power over 749,116.00 shares of Class A Common Stock and shared voting and dispositive power over 1,302,832.00 shares of Class A Common Stock. We understand that Mr. Vollmer has sole voting and dispositive power over 58,853.00 shares of Class B Common Stock and shared voting and dispositive power over 423,609.00 shares of Class B Common Stock. |

These shares include 1,795.66 shares of Class A Common Stock and 217.00 shares of Class B Common Stock held by Mr. Vollmer’s wife, as well as 324,314.33 shares of Class A Common Stock and 68,812.66 shares of Class B Common Stock held by Mr. Vollmer’s mother for herself and her grandchildren, as to which Mr. Vollmer has a power of attorney. Mr. Vollmer disclaims beneficial ownership of 1,302,832.00 shares of Class A Common Stock and 423,609.00 shares of Class B Common Stock included in the table above as to which he has no economic interest therein.

(6) | As reported in a statement on Schedule 13D filed with the SEC on April 4, 2019 by Patriot Financial Partners III, L.P. According to the filing, the Company’s shares of Class A Common Stock are held by the following group of entities and individuals: Patriot Financial Partners III, L.P., Patriot Financial Partners GP III, L.P., Patriot Financial Partners GP III, LLC, W. Kirk Wycoff, James J. Lynch and James F. Deutsch (together, the “Patriot Financial Group III” or “Patriot”). In March 2020, Patriot informed the Company that it had acquired an additional 78,289 shares of Class A Common Stock of the Company. The principal business address of each member of the Patriot Financial Group III is c/o Patriot Financial Partners III, L.P., Four Radnor Center 100 Matsonford Road, Suite #210 Radnor, Pennsylvania 19087. |

The Patriot Financial Group III may be deemed to beneficially own, in the aggregate, 2,078,289 shares of Class A Common Stock, representing approximately 7.20% of the outstanding shares of the Company’s Class A Common Stock as of the date set forth above. We understand that each member of the Patriot Financial Group III has shared voting power and shared dispositive power with regard to such shares of Class A Common Stock.

Each member of the Patriot Financial Group III disclaims beneficial ownership of the shares of Class A Common Stock owned by Patriot Financial Partners III, L.P., except to the extent of its or his pecuniary interest therein.

(7) | As reported in a statement on Schedule 13G filed with the SEC on February 15, 2019 by Diana Medina de Marturet. According to the filing, Mrs. Marturet has sole voting and dispositive power over 1,800,131.66 shares of Class A Common Stock and shared voting and dispositive power over 68,522 shares of Class A Common Stock; this does not include 154,905 shares of Class A Common Stock over which Mrs. Marturet only has an economic interest. We understand that Mrs. Marturet has sole voting and dispositive power over 167,165 shares of Class B Common Stock and shared voting and dispositive power over 48,625 shares of Class B Common Stock. |

Mrs. Marturet disclaims beneficial ownership of 187,331 shares of Class A Common Stock and 24,619 shares of Class B Common Stock included in the table above as to which she has no economic interest therein.

(8) | As reported in a statement on Schedule 13G/A filed with the SEC on February 14, 2020 by Perry Creek Capital LP. According to the filing, the Company’s shares of Class A Common Stock are held by Perry Creek Capital LP (“Perry Creek”) and Perry Creek Capital Fund II LP (the “Fund”). Also, according to the filing, Perry Creek acts as investment manager to the Fund, and accordingly exercises investment discretion with respect to the shares of Class A Common Stock directly owned by the Fund. The principal business address of each of Perry Creek and the Fund is 150 East 58th Street, 17th Floor, New York, NY 10155. Perry Creek and the Fund may be deemed to beneficially own, in the aggregate, 1,543,229 shares of Class A Common Stock, representing approximately 5.34% of the outstanding shares of the Company’s Class A Common Stock as of the date set forth above. Each of Perry Creek and the Fund has shared voting power and shared dispositive power with regard to such shares of Class A Common Stock. |

16

Certain Relationships and Related Party Transactions

Since January 1, 2019, we have not been a party to any transaction or series of similar transactions in which the amount involved exceeded or will exceed $120,000 and in which any then director, executive officer, holder of more than 5% of our common stock, or any member of the immediate family of any of the foregoing, had or will have a direct or indirect material interest, other than in connection with the transactions described below.

Policies and Procedures Regarding Related Party Transactions

Transactions by the Bank or its subsidiaries with related parties are subject to certain regulatory requirements and restrictions, including Sections 23A and 23B of the Federal Reserve Act and Federal Reserve Regulation W. Under applicable SEC and NASDAQ rules, related party transactions are transactions in which we are a participant, the amount involved exceeds $120,000 and a related party has or will have a direct or indirect material interest. Our related parties include directors (including nominees for election as directors), executive officers, 5% shareholders and the immediate family members of these persons.

Various Company and Bank directors, officers, and their affiliates, including corporations and firms of which they are directors or officers or in which they and/or their families have an ownership interest, are customers of the Company and the Bank. These persons and entities have had transactions in the ordinary course of business with the Company and the Bank, including borrowings, all of which, in the opinion of management, were on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with unaffiliated persons and did not involve more than the normal risk of collectability or present other unfavorable features. Such transactions are subject to review and approval as provided in our Audit Committee Charter and our Related Party Transaction Policy. The Company and the Bank expect to have such transactions, under similar conditions, with their directors, officers, and affiliates in the future.

Federal Reserve Regulation O requires loans and other “extensions of credit” made to executive officers, directors and their related interests and to persons beneficially owning with their family 10% or more of the voting securities of a bank or its bank holding company to be made on substantially the same terms, including interest rates and collateral, and following credit-underwriting procedures, that are no less stringent than those prevailing at the time for comparable transactions by the Bank with other persons. Such loans also may not involve more than the normal risk of repayment or present other unfavorable features. The Board would review any loan to a director or his or her related interests that has become criticized in order to determine the impact that such classification has on the director’s independence. In addition, the Audit Committee Charter provides that the Audit Committee will review and approve all related-party transactions. This includes a review of the Company’s compliance with applicable banking laws, including, without limitation, those banking laws and regulations concerning loans to insiders.

We have adopted a Related Party Transaction Policy governing the review and approval of transactions with related parties, including those transactions that are expected to exceed $120,000 in any fiscal year. The policy calls for the related party transactions to be reviewed and, if deemed appropriate, approved or ratified by our Audit Committee. Upon determination that a transaction requires review under the policy, the material facts are required to be presented to the Audit Committee. In determining whether or not to approve a related party transaction, our Audit Committee will take into account, among other relevant factors, whether the related party transaction is in conformity with our Code of Conduct and Ethics and is in our best interest, whether the transaction would be in the ordinary course of our business; whether the related party transaction is on terms comparable to those that would be obtained in arm's length dealings with an unrelated third party or on terms comparable to those provided to employees generally; if the related party transaction is an extension of credit, whether the extension of credit is being made in the ordinary course, on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans to persons who are not related parties, and involves more than the normal risk of collectability or other unfavorable features. In the event that we become aware of a related party transaction that was not approved under the policy (such as before the policy was adopted), our Audit Committee will review such transaction as promptly as reasonably practical and will take such course of action as may be deemed appropriate under the circumstances. In the event a member of our Audit Committee is not disinterested with respect to the related party transaction under review, that member may not participate in the review, approval or ratification of that related party transaction.

Certain transactions are not subject to the related party transaction approval policy, including: (1) decisions on compensation or benefits relating to directors or executive officers or reimbursements for business travel and expenses, (2) credit extensions by us in the ordinary course of business, on substantially the same terms, including interest rate and collateral, as those prevailing at the time for comparable loans with persons not related to us and not presenting more than the normal risk of collectability or other unfavorable features, and approved by the Board or an authorized Board or management committee in accordance with our policies or procedures, and (3) other financial services, including brokerage services, banking

17

services or services as a bank depositary of funds, transfer agent, registrar, trust or similar services provided by the Company provided that the services are on substantially the same terms as those prevailing at the time for comparable services provided to persons that are not related parties.

All related party transactions, including those described below, have been made consistent with our policy and applicable law, including Federal Reserve Regulation W, when applicable.

Mercantil Bank & Trust Ltd. (Cayman acquisition)