Investor Presentation As of March 31, 2020

2 Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, including, without limitation, future financial and operating results; costs and revenues; economic conditions generally and in our markets and among our customer base; the challenges and uncertainties caused by the COVID-19 pandemic; the measures we have taken in response to the COVID-19 pandemic; our participation in the PPP Loan program; loan demand; changes in the mix of our earning assets and our deposit and wholesale liabilities; net interest margin; yields on earning assets; interest rates and yield curves (generally and those applicable to our assets and liabilities); credit quality, including loan performance, non-performing assets, provisions for loan losses, charge-offs, other-than-temporary impairments and collateral values; market trends; rebranding and staff realignment costs and expected savings; and customer preferences, as well as statements with respect to our objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” and other similar words and expressions of the future. Forward-looking statements, including those as to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2019 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including as of and for the three month periods ended March 31, 2020 and 2019, may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2020, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “adjusted noninterest income”, “adjusted noninterest expense”, “adjusted net income”, “operating revenue”, “operating income”, “adjusted net income per share (basic and diluted)”, “adjusted return on assets (ROA)”, “adjusted return on equity (ROE)”, and other ratios. This supplemental information should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued into 2020, the one-time gain on sale of the vacant Beacon land in the fourth quarter of 2019 and the Company’s increase of its allowance for loan losses in 2020. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies.

3 Who We Are Vision Mission To be recognized as a trusted financial To provide our customers with the advisor dedicated to building stronger financial products and services they and deeper customer relationships in need to achieve their success and life the markets we serve, leading to the goals, with an inspired talented team, company’s success and increase shareholder value Values • Focus on Customer • Innovative and Forward Thinking • Sound Financial Management • Doing What is Right • Collaborative Thinking • Developing Our People • Strengthening Communities Meant for You - Our mission, vision and values define our culture and guide our future

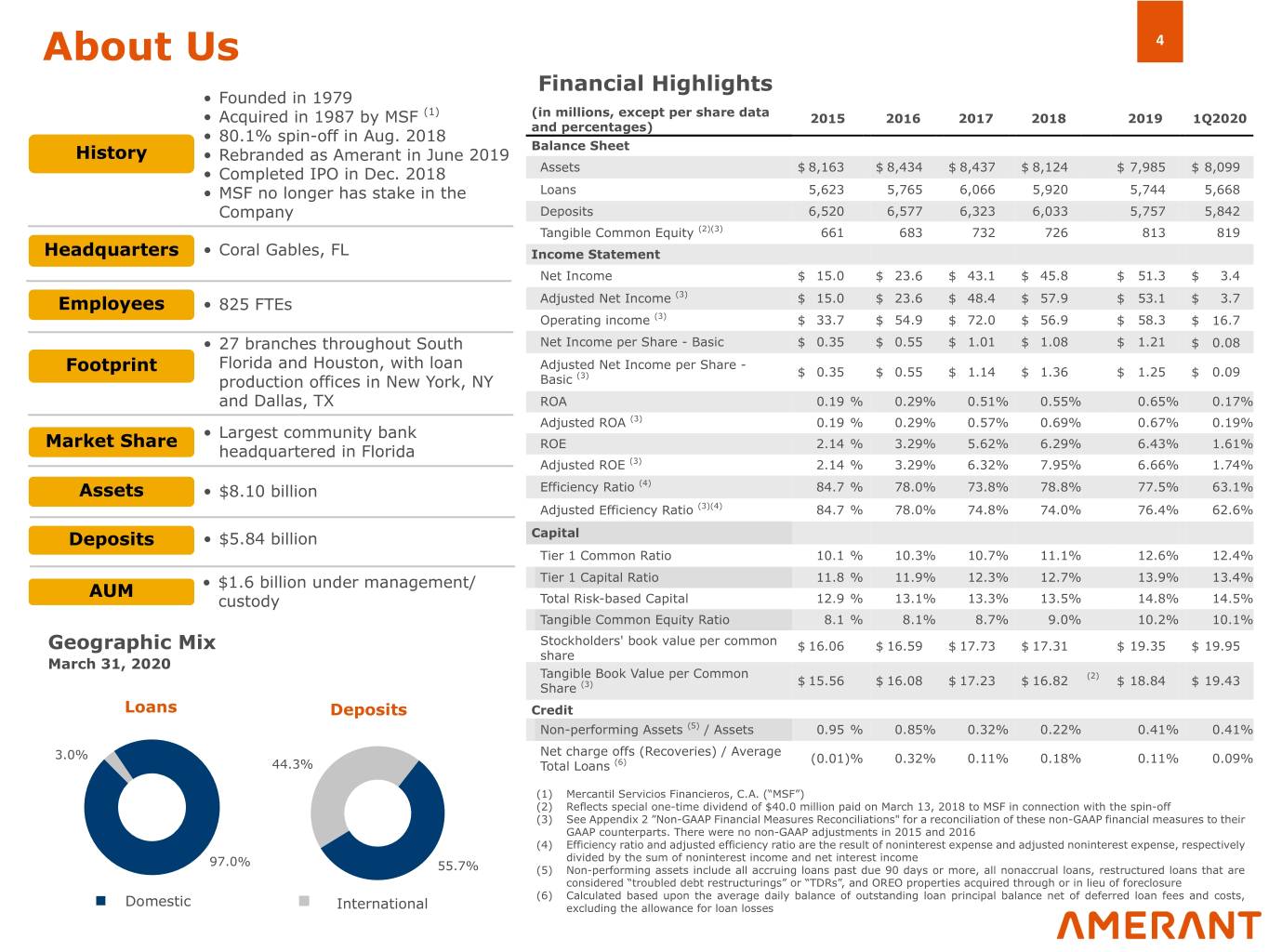

About Us 4 Financial Highlights • Founded in 1979 (1) (in millions, except per share data • Acquired in 1987 by MSF 2015 2016 2017 2018 2019 1Q2020 and percentages) • 80.1% spin-off in Aug. 2018 Balance Sheet History • Rebranded as Amerant in June 2019 • Completed IPO in Dec. 2018 Assets $ 8,163 $ 8,434 $ 8,437 $ 8,124 $ 7,985 $ 8,099 • MSF no longer has stake in the Loans 5,623 5,765 6,066 5,920 5,744 5,668 Company Deposits 6,520 6,577 6,323 6,033 5,757 5,842 Tangible Common Equity (2)(3) 661 683 732 726 813 819 Headquarters • Coral Gables, FL Income Statement Net Income $ 15.0 $ 23.6 $ 43.1 $ 45.8 $ 51.3 $ 3.4 (3) Employees • 825 FTEs Adjusted Net Income $ 15.0 $ 23.6 $ 48.4 $ 57.9 $ 53.1 $ 3.7 Operating income (3) $ 33.7 $ 54.9 $ 72.0 $ 56.9 $ 58.3 $ 16.7 • 27 branches throughout South Net Income per Share - Basic $ 0.35 $ 0.55 $ 1.01 $ 1.08 $ 1.21 $ 0.08 Florida and Houston, with loan Adjusted Net Income per Share - Footprint $ 0.35 $ 0.55 $ 1.14 $ 1.36 $ 1.25 $ 0.09 production offices in New York, NY Basic (3) and Dallas, TX ROA 0.19 % 0.29% 0.51% 0.55% 0.65% 0.17% Adjusted ROA (3) 0.19 % 0.29% 0.57% 0.69% 0.67% 0.19% Market Share • Largest community bank headquartered in Florida ROE 2.14 % 3.29% 5.62% 6.29% 6.43% 1.61% Adjusted ROE (3) 2.14 % 3.29% 6.32% 7.95% 6.66% 1.74% (4) Assets • $8.10 billion Efficiency Ratio 84.7 % 78.0% 73.8% 78.8% 77.5% 63.1% Adjusted Efficiency Ratio (3)(4) 84.7 % 78.0% 74.8% 74.0% 76.4% 62.6% Deposits • $5.84 billion Capital Tier 1 Common Ratio 10.1 % 10.3% 10.7% 11.1% 12.6% 12.4% Tier 1 Capital Ratio 11.8 % 11.9% 12.3% 12.7% 13.9% 13.4% AUM • $1.6 billion under management/ custody Total Risk-based Capital 12.9 % 13.1% 13.3% 13.5% 14.8% 14.5% Tangible Common Equity Ratio 8.1 % 8.1% 8.7% 9.0% 10.2% 10.1% Geographic Mix Stockholders' book value per common $ 16.06 $ 16.59 $ 17.73 $ 17.31 $ 19.35 $ 19.95 share March 31, 2020 Tangible Book Value per Common (2) $ 15.56 $ 16.08 $ 17.23 $ 16.82 $ 18.84 $ 19.43 Share (3) Loans Deposits Credit Non-performing Assets (5) / Assets 0.95 % 0.85% 0.32% 0.22% 0.41% 0.41% Net charge offs (Recoveries) / Average 3.0% (0.01)% 0.32% 0.11% 0.18% 0.11% 0.09% 44.3% Total Loans (6) (1) Mercantil Servicios Financieros, C.A. (“MSF”) (2) Reflects special one-time dividend of $40.0 million paid on March 13, 2018 to MSF in connection with the spin-off (3) See Appendix 2 ”Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP counterparts. There were no non-GAAP adjustments in 2015 and 2016 (4) Efficiency ratio and adjusted efficiency ratio are the result of noninterest expense and adjusted noninterest expense, respectively 97.0% divided by the sum of noninterest income and net interest income 55.7% (5) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of foreclosure § § (6) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, Domestic International excluding the allowance for loan losses

5 Investment Opportunity Highlights Established Strong and Well-Positioned Significant Fee Pathway to Franchise in Diverse Deposit Loan Income Strong Attractive Portfolio (1) Markets Base Platform Profitability • Long history with • Combination of • Loan book well- • Wealth • Dynamic initiatives strong reputation domestic and low- diversified across management and to improve ROA/ and deep client cost international various asset brokerage platform ROE through relationships deposits classes and markets with accompanying efficiency, fee trust and private income, and other • Presence in high- • Domestic deposit • Outstanding credit banking capabilities levers growth markets of base experiencing performance due to Florida, Texas, and significant growth disciplined • Approximately • Proactive strategy New York (approximately 12% underwriting culture 20.0% noninterest to enhance financial CAGR since 2015) income/total performance as part • Seasoned • High level of operating revenue of a multi-year shift management team • Low cost relationship lending in the three months towards increasing and board with long international deposit ended March 31, core domestic • Strong risk tenure customers are a 2020 (2) growth and management to strategic advantage profitability • Largest community (0.43% average cost allow adjustments • Adaptive product bank headquartered in 1Q20) based on market lineup to increase • Embarking on digital (1) in Florida and conditions fee income transformation to one of the leading • Retaining adapt to a new banks serving the international competitive Hispanic community deposits by adding environment new and revamped products bundles and services, and improved customer journey (1) Community banks include those with less than $10 billion in assets. Source: S&P Market Intelligence (2) See "Supplemental Information COVID-19" (3) Operating revenue is the result of net interest income before provision for loan losses plus noninterest income. Noninterest income excludes all securities gains and losses ($9.6 million net gain in 1Q20).

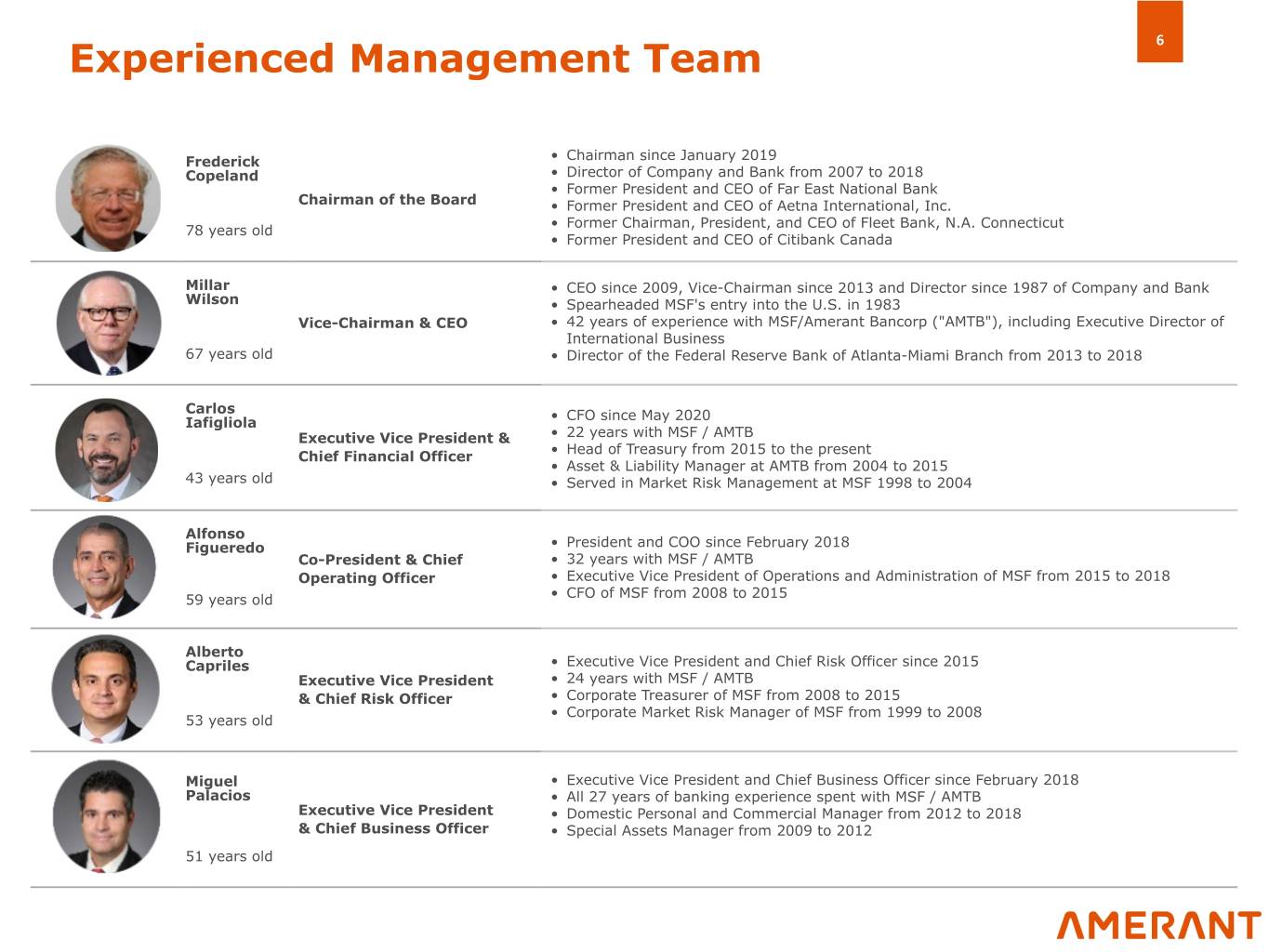

6 Experienced Management Team Frederick • Chairman since January 2019 Copeland • Director of Company and Bank from 2007 to 2018 • Former President and CEO of Far East National Bank Chairman of the Board • Former President and CEO of Aetna International, Inc. • Former Chairman, President, and CEO of Fleet Bank, N.A. Connecticut 78 years old • Former President and CEO of Citibank Canada Millar • CEO since 2009, Vice-Chairman since 2013 and Director since 1987 of Company and Bank Wilson • Spearheaded MSF's entry into the U.S. in 1983 Vice-Chairman & CEO • 42 years of experience with MSF/Amerant Bancorp ("AMTB"), including Executive Director of International Business 67 years old • Director of the Federal Reserve Bank of Atlanta-Miami Branch from 2013 to 2018 Carlos • CFO since May 2020 Iafigliola Executive Vice President & • 22 years with MSF / AMTB • Head of Treasury from 2015 to the present Chief Financial Officer • Asset & Liability Manager at AMTB from 2004 to 2015 43 years old • Served in Market Risk Management at MSF 1998 to 2004 Alfonso Figueredo • President and COO since February 2018 Co-President & Chief • 32 years with MSF / AMTB Operating Officer • Executive Vice President of Operations and Administration of MSF from 2015 to 2018 59 years old • CFO of MSF from 2008 to 2015 Alberto Capriles • Executive Vice President and Chief Risk Officer since 2015 Executive Vice President • 24 years with MSF / AMTB & Chief Risk Officer • Corporate Treasurer of MSF from 2008 to 2015 • Corporate Market Risk Manager of MSF from 1999 to 2008 53 years old Miguel • Executive Vice President and Chief Business Officer since February 2018 Palacios • All 27 years of banking experience spent with MSF / AMTB Executive Vice President • Domestic Personal and Commercial Manager from 2012 to 2018 & Chief Business Officer • Special Assets Manager from 2009 to 2012 51 years old

7 Value Proposition and Brand Attributes High Touch Service • Dynamic • Adaptable Meant for You • Attentive • Diligent • Responsive • Innovative By leveraging our experience and knowledge, we Trustworthy proactively anticipate your financial needs based on where you are and where you plan to go. We appreciate • Dependable • Insightful that everyone’s journey and goals are different, and our • Solid commitment is to inspire you and support you along the • Transparent way. • Reliable We combine traditions and innovations to offer a diverse portfolio of financial solutions to meet your evolving Community Orientation preferences and priorities. • Caring You have choices to create a relationship that is uniquely • Responsible yours and backed by a team of financial partners that • Committed share your sense of community and a vision for what’s • Inspiring • Purposeful ahead. Everything we do is designed with our stakeholders in mind

8 Market Strategy Our strategy is to operate and expand in high-growth, diverse economies where we can build from our heritage serving the Hispanic community Miami-Dade MSA Target markets have: • Major industry sectors are trade, tourism, services, manufacturing, education, and real estate • Substantial domestic deposit • Low unemployment rates, historically growth potential • Ranked #1 MSA for startup activity by the 2017 Kauffman Index among the 39 largest MSAs • Diversified industries, requiring high-quality loans(1) Houston MSA • Major industry sectors of health care, retail, oil/ • Population growth, and thus a gas, travel, and services larger number of potential • Low unemployment rates, historically customers • Home to the world’s largest medical complex. Ranks #2 in manufacturing GDP nationwide • Customers that require more than one of our banking services NYC MSA • Major industry sectors of education, health care, • Existing, significant Hispanic tourism, financial services, and professional / communities that value our business services bilingual employees and services • Low unemployment rates, historically • MSA has #1 GDP in the nation Our markets are diverse with growing demographics and industry (1) See "Supplemental Information COVID-19" Sources: S&P Global Market Intelligence. US Bureau of Labor Statistics. Greater Houston Partnership (www.Houston.org). Business Facilities’ 2018 Metro Rankings Report. US Bureau of Economic Analysis. Center for Governmental Research

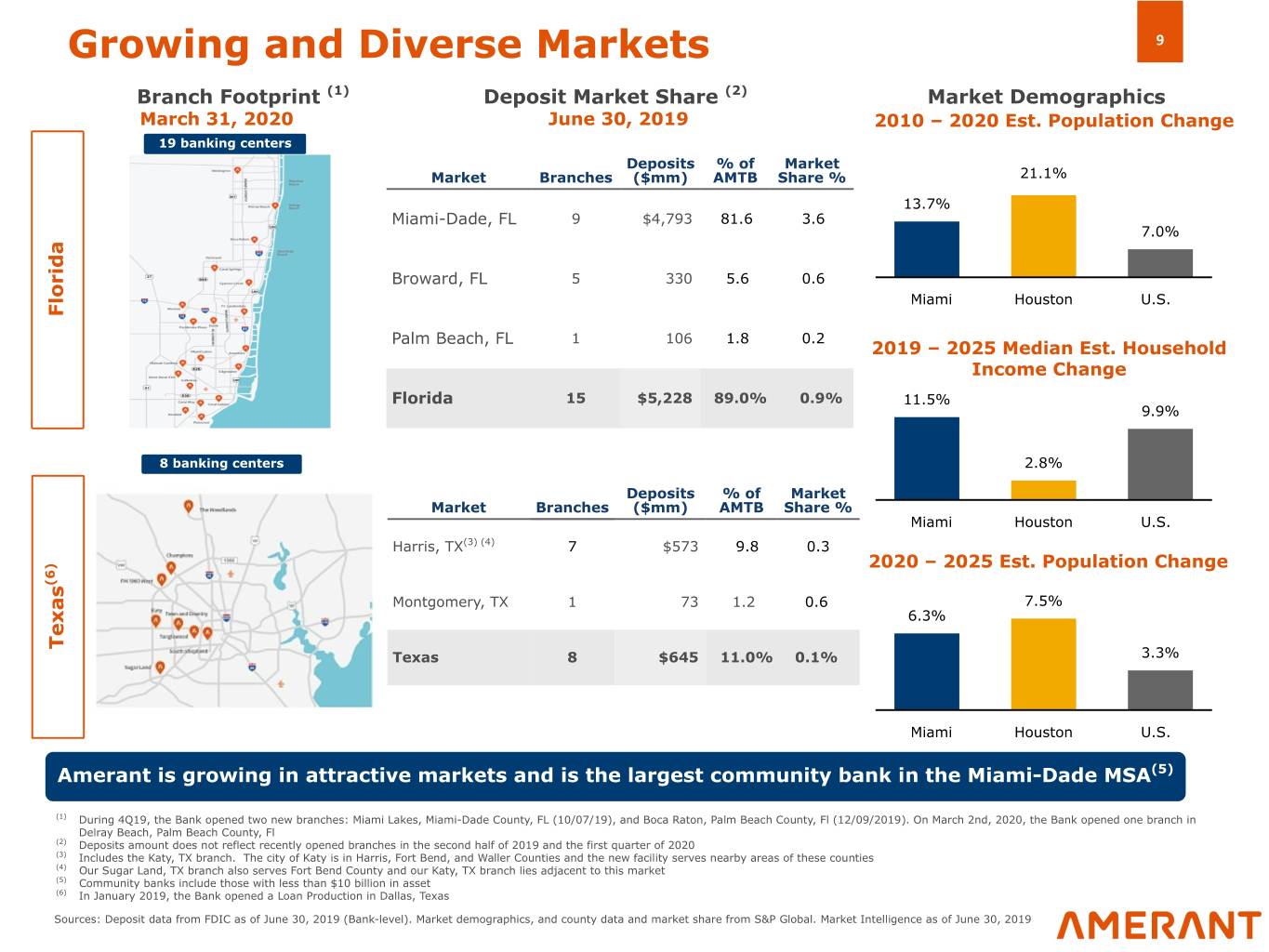

Growing and Diverse Markets 9 Branch Footprint (1) Deposit Market Share (2) Market Demographics March 31, 2020 June 30, 2019 2010 – 2020 Est. Population Change 19 banking centers Deposits % of Market Market Branches ($mm) AMTB Share % 21.1% 13.7% Miami-Dade, FL 9 $4,793 81.6 3.6 7.0% Broward, FL 5 330 5.6 0.6 Miami Houston U.S. Florida Palm Beach, FL 1 106 1.8 0.2 2019 – 2025 Median Est. Household Income Change Florida 15 $5,228 89.0% 0.9% 11.5% 9.9% 8 banking centers 2.8% Deposits % of Market Market Branches ($mm) AMTB Share % Miami Houston U.S. Harris, TX(3) (4) 7 $573 9.8 0.3 2020 – 2025 Est. Population Change (6) Montgomery, TX 1 73 1.2 0.6 7.5% 6.3% Texas Texas 8 $645 11.0% 0.1% 3.3% Miami Houston U.S. Amerant is growing in attractive markets and is the largest community bank in the Miami-Dade MSA(5) (1) During 4Q19, the Bank opened two new branches: Miami Lakes, Miami-Dade County, FL (10/07/19), and Boca Raton, Palm Beach County, Fl (12/09/2019). On March 2nd, 2020, the Bank opened one branch in Delray Beach, Palm Beach County, Fl (2) Deposits amount does not reflect recently opened branches in the second half of 2019 and the first quarter of 2020 (3) Includes the Katy, TX branch. The city of Katy is in Harris, Fort Bend, and Waller Counties and the new facility serves nearby areas of these counties (4) Our Sugar Land, TX branch also serves Fort Bend County and our Katy, TX branch lies adjacent to this market (5) Community banks include those with less than $10 billion in asset (6) In January 2019, the Bank opened a Loan Production in Dallas, Texas Sources: Deposit data from FDIC as of June 30, 2019 (Bank-level). Market demographics, and county data and market share from S&P Global. Market Intelligence as of June 30, 2019

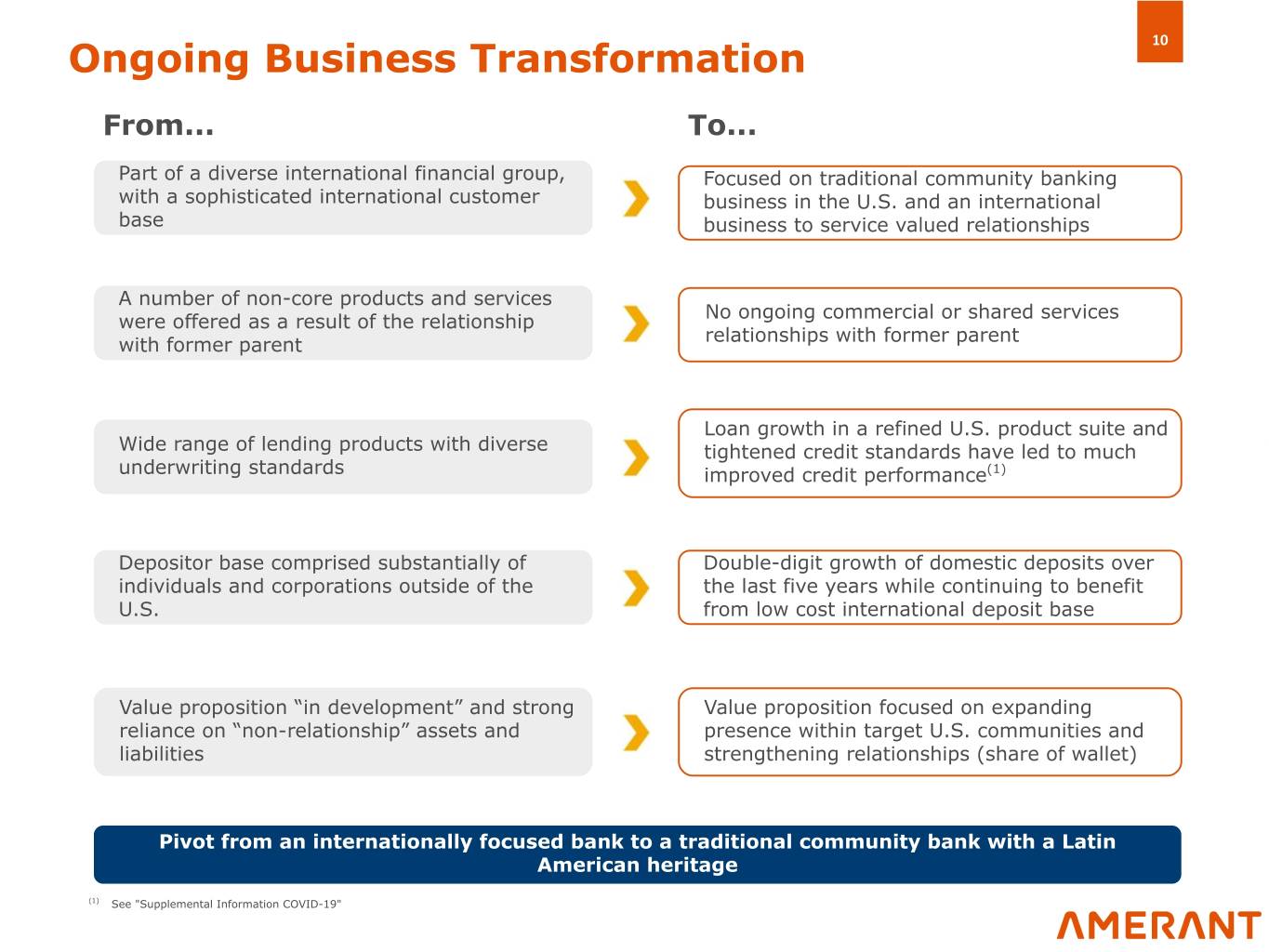

10 Ongoing Business Transformation From... To... Part of a diverse international financial group, Focused on traditional community banking with a sophisticated international customer business in the U.S. and an international base business to service valued relationships A number of non-core products and services No ongoing commercial or shared services were offered as a result of the relationship relationships with former parent with former parent Loan growth in a refined U.S. product suite and Wide range of lending products with diverse tightened credit standards have led to much underwriting standards improved credit performance(1) Depositor base comprised substantially of Double-digit growth of domestic deposits over individuals and corporations outside of the the last five years while continuing to benefit U.S. from low cost international deposit base Value proposition “in development” and strong Value proposition focused on expanding reliance on “non-relationship” assets and presence within target U.S. communities and liabilities strengthening relationships (share of wallet) Pivot from an internationally focused bank to a traditional community bank with a Latin American heritage (1) See "Supplemental Information COVID-19"

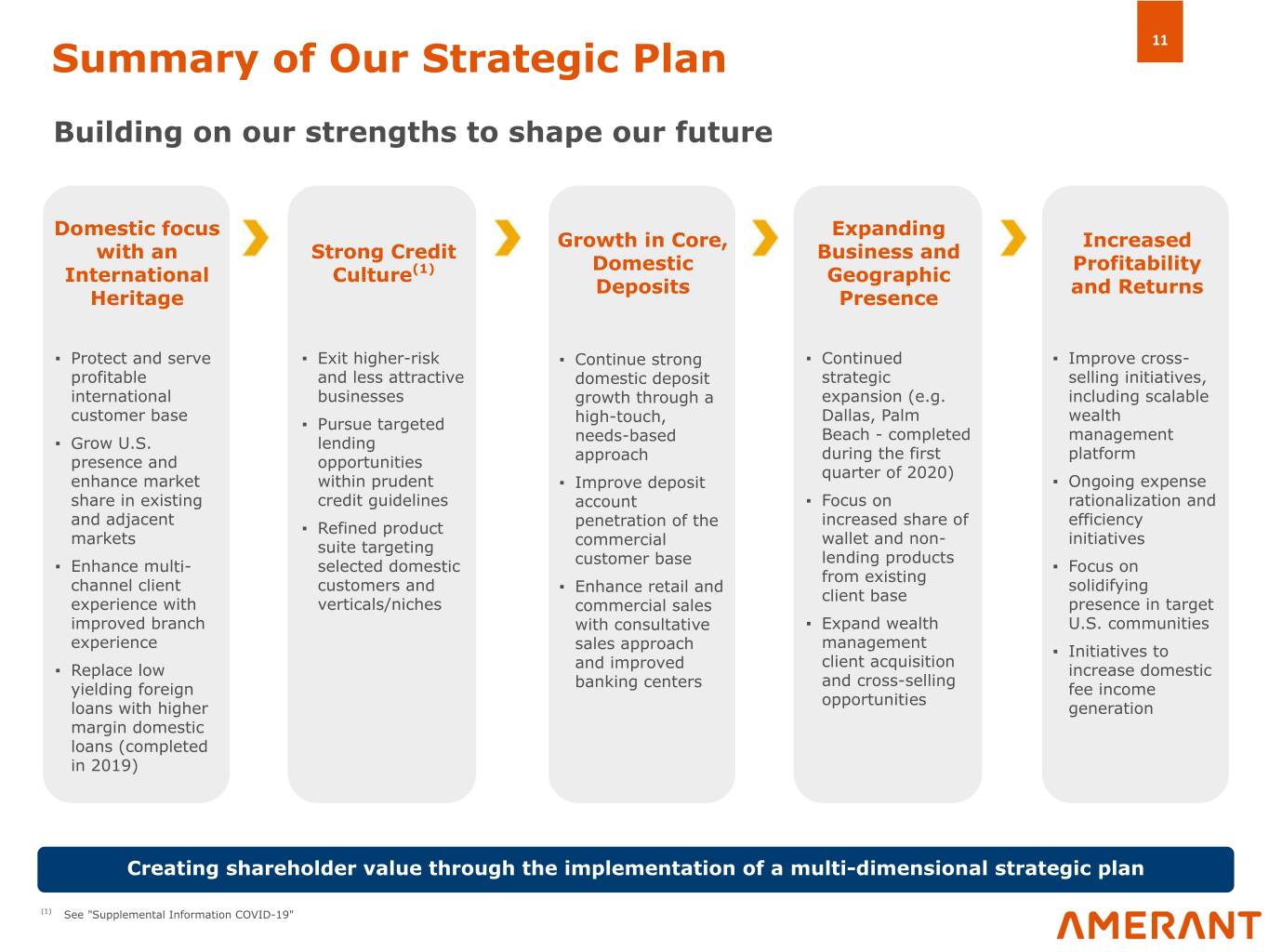

11 Summary of Our Strategic Plan Building on our strengths to shape our future Domestic focus Expanding Growth in Core, Increased with an Strong Credit Business and Domestic Profitability International Culture(1) Geographic Deposits and Returns Heritage Presence ▪ Protect and serve ▪ Exit higher-risk ▪ Continue strong ▪ Continued ▪ Improve cross- profitable and less attractive domestic deposit strategic selling initiatives, international businesses growth through a expansion (e.g. including scalable customer base Dallas, Palm wealth ▪ Pursue targeted high-touch, Beach - completed management ▪ Grow U.S. lending needs-based during the first platform presence and opportunities approach quarter of 2020) enhance market within prudent ▪ Improve deposit ▪ Ongoing expense share in existing credit guidelines account ▪ Focus on rationalization and and adjacent increased share of efficiency ▪ Refined product penetration of the markets wallet and non- initiatives suite targeting commercial lending products ▪ Enhance multi- selected domestic customer base ▪ Focus on from existing channel client customers and ▪ Enhance retail and solidifying client base experience with verticals/niches commercial sales presence in target improved branch with consultative ▪ Expand wealth U.S. communities experience management sales approach ▪ Initiatives to client acquisition ▪ Replace low and improved increase domestic and cross-selling yielding foreign banking centers fee income opportunities loans with higher generation margin domestic loans (completed in 2019) Creating shareholder value through the implementation of a multi-dimensional strategic plan (1) See "Supplemental Information COVID-19"

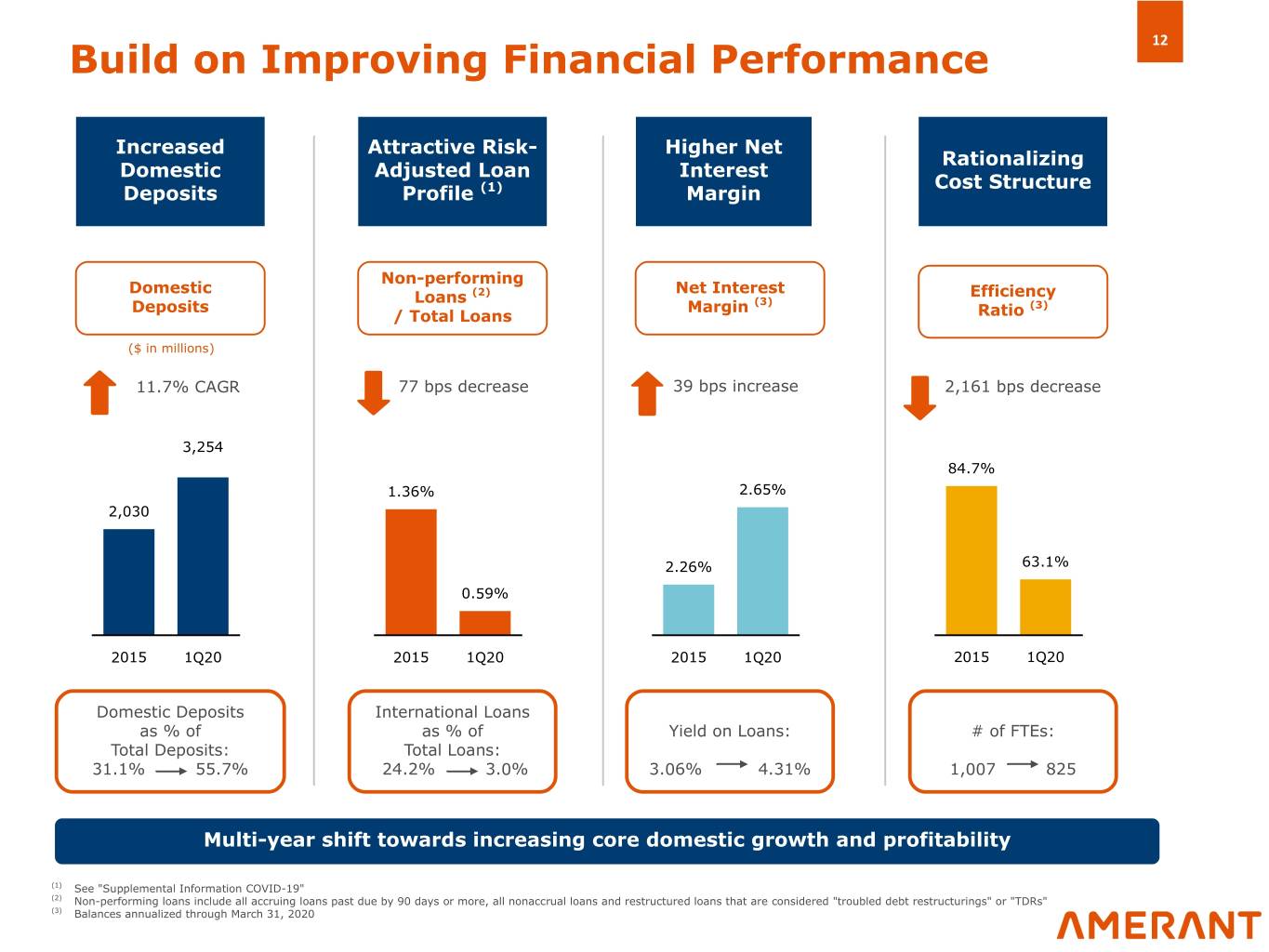

12 Build on Improving Financial Performance Increased Attractive Risk- Higher Net Rationalizing Domestic Adjusted Loan Interest Cost Structure Deposits Profile (1) Margin Non-performing Domestic Net Interest Loans (2) Efficiency Deposits Margin (3) (3) / Total Loans Ratio ($ in millions) 11.7% CAGR 77 bps decrease 39 bps increase 2,161 bps decrease 3,254 84.7% 1.36% 2.65% 2,030 2.26% 63.1% 0.59% 2015 1Q20 2015 1Q20 2015 1Q20 2015 1Q20 Domestic Deposits International Loans as % of as % of Yield on Loans: # of FTEs: Total Deposits: Total Loans: 31.1% 55.7% 24.2% 3.0% 3.06% 4.31% 1,007 825 Multi-year shift towards increasing core domestic growth and profitability (1) See "Supplemental Information COVID-19" (2) Non-performing loans include all accruing loans past due by 90 days or more, all nonaccrual loans and restructured loans that are considered "troubled debt restructurings" or "TDRs" (3) Balances annualized through March 31, 2020

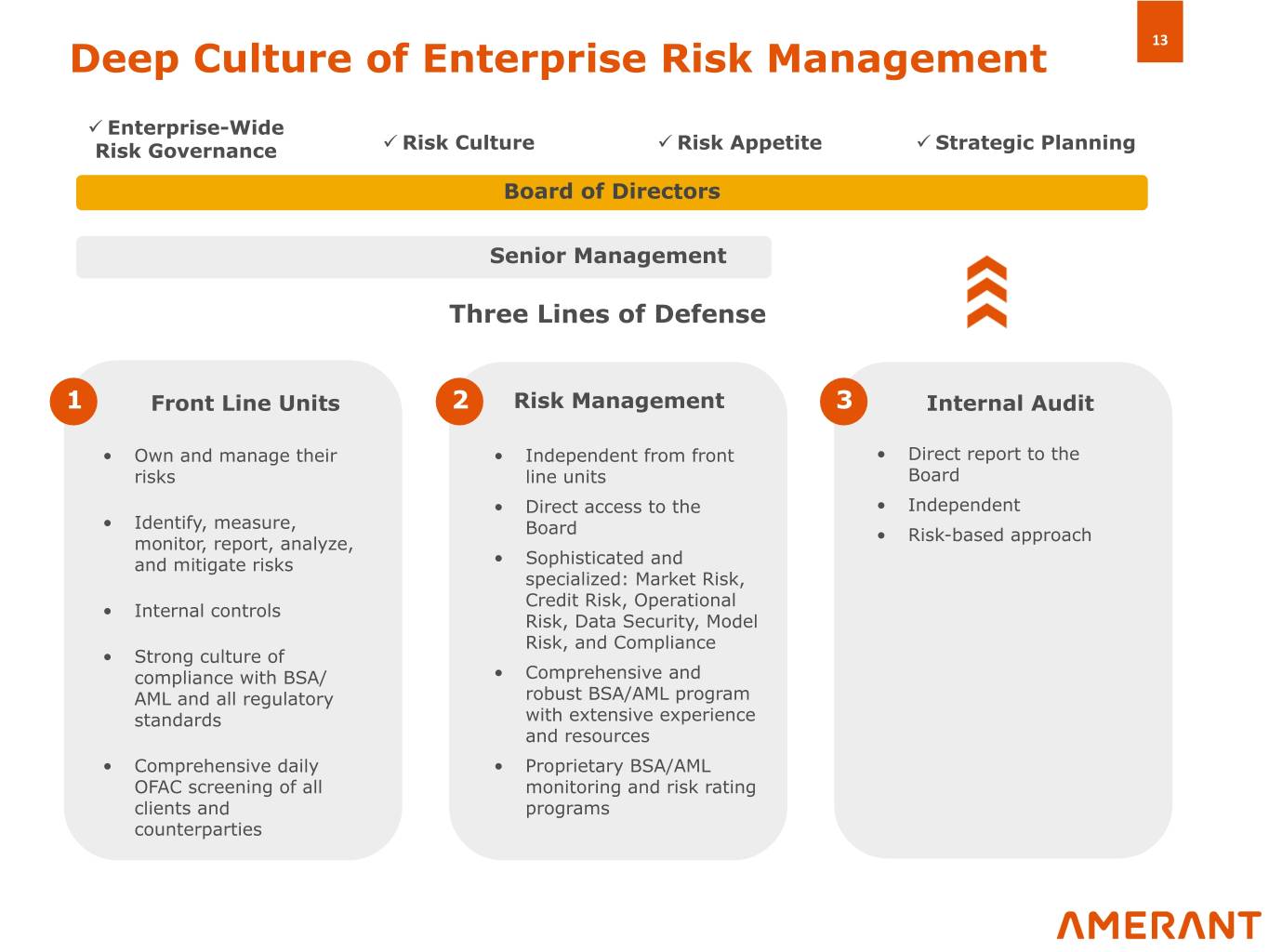

13 Deep Culture of Enterprise Risk Management ü Enterprise-Wide ü ü ü Risk Governance Risk Culture Risk Appetite Strategic Planning Board of Directors Senior Management Three Lines of Defense 1 Front Line Units 2 Risk Management 3 Internal Audit • Own and manage their • Independent from front • Direct report to the risks line units Board • Direct access to the • Independent • Identify, measure, Board monitor, report, analyze, • Risk-based approach and mitigate risks • Sophisticated and specialized: Market Risk, Credit Risk, Operational • Internal controls Risk, Data Security, Model Risk, and Compliance • Strong culture of compliance with BSA/ • Comprehensive and AML and all regulatory robust BSA/AML program standards with extensive experience and resources • Comprehensive daily • Proprietary BSA/AML OFAC screening of all monitoring and risk rating clients and programs counterparties

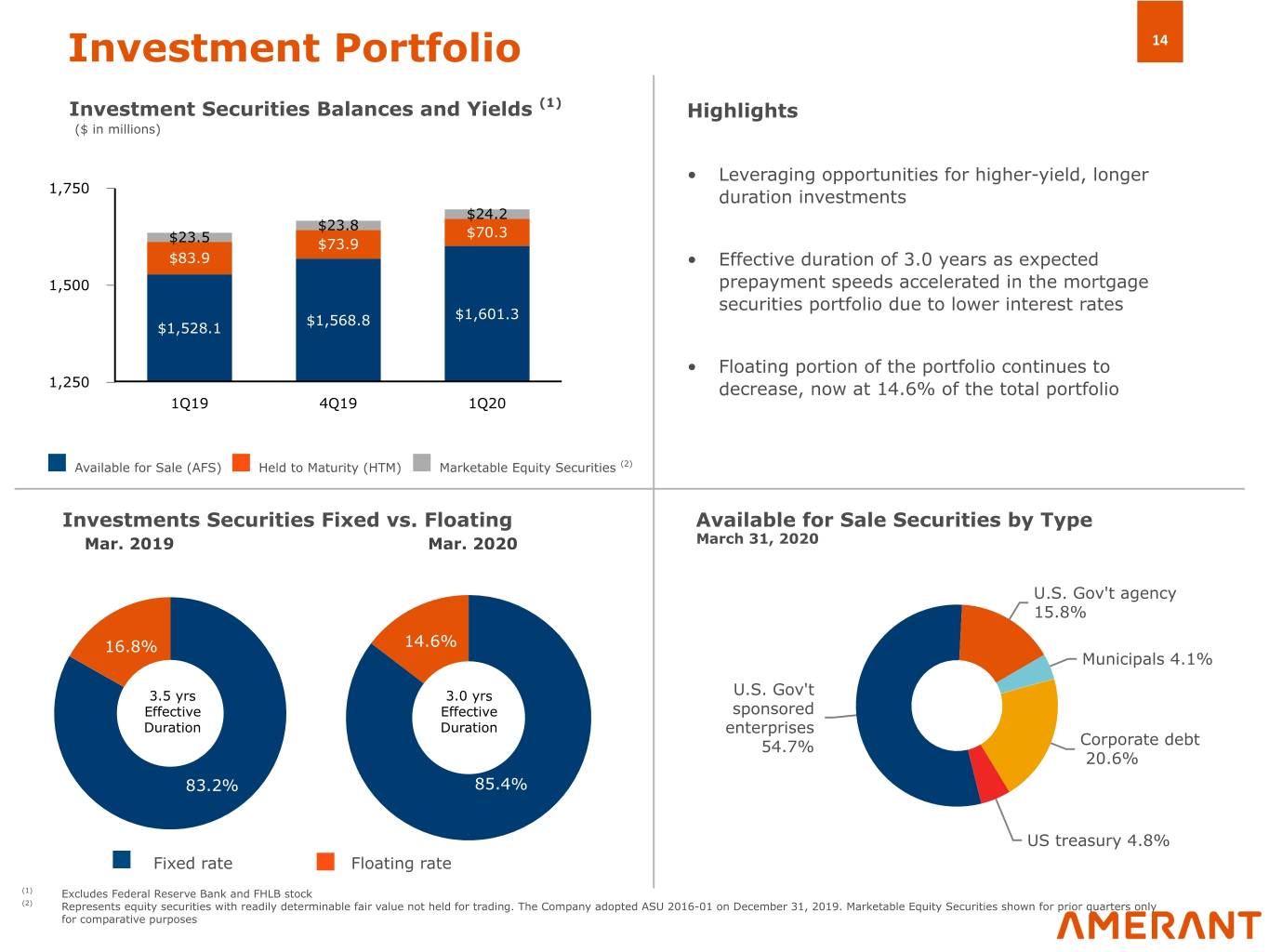

Investment Portfolio 14 Investment Securities Balances and Yields (1) Highlights ($ in millions) • Leveraging opportunities for higher-yield, longer 1,750 duration investments $24.2 $23.8 $70.3 $23.5 $73.9 $83.9 • Effective duration of 3.0 years as expected 1,500 prepayment speeds accelerated in the mortgage securities portfolio due to lower interest rates $1,568.8 $1,601.3 $1,528.1 • Floating portion of the portfolio continues to 1,250 decrease, now at 14.6% of the total portfolio 1Q19 4Q19 1Q20 Available for Sale (AFS) Held to Maturity (HTM) Marketable Equity Securities (2) Investments Securities Fixed vs. Floating Available for Sale Securities by Type Mar. 2019 Mar. 2020 March 31, 2020 U.S. Gov't agency 15.8% 16.8% 14.6% Municipals 4.1% 3.5 yrs 3.0 yrs U.S. Gov't Effective Effective sponsored Duration Duration enterprises 54.7% Corporate debt 20.6% 83.2% 85.4% US treasury 4.8% Fixed rate Floating rate (1) Excludes Federal Reserve Bank and FHLB stock (2) Represents equity securities with readily determinable fair value not held for trading. The Company adopted ASU 2016-01 on December 31, 2019. Marketable Equity Securities shown for prior quarters only for comparative purposes

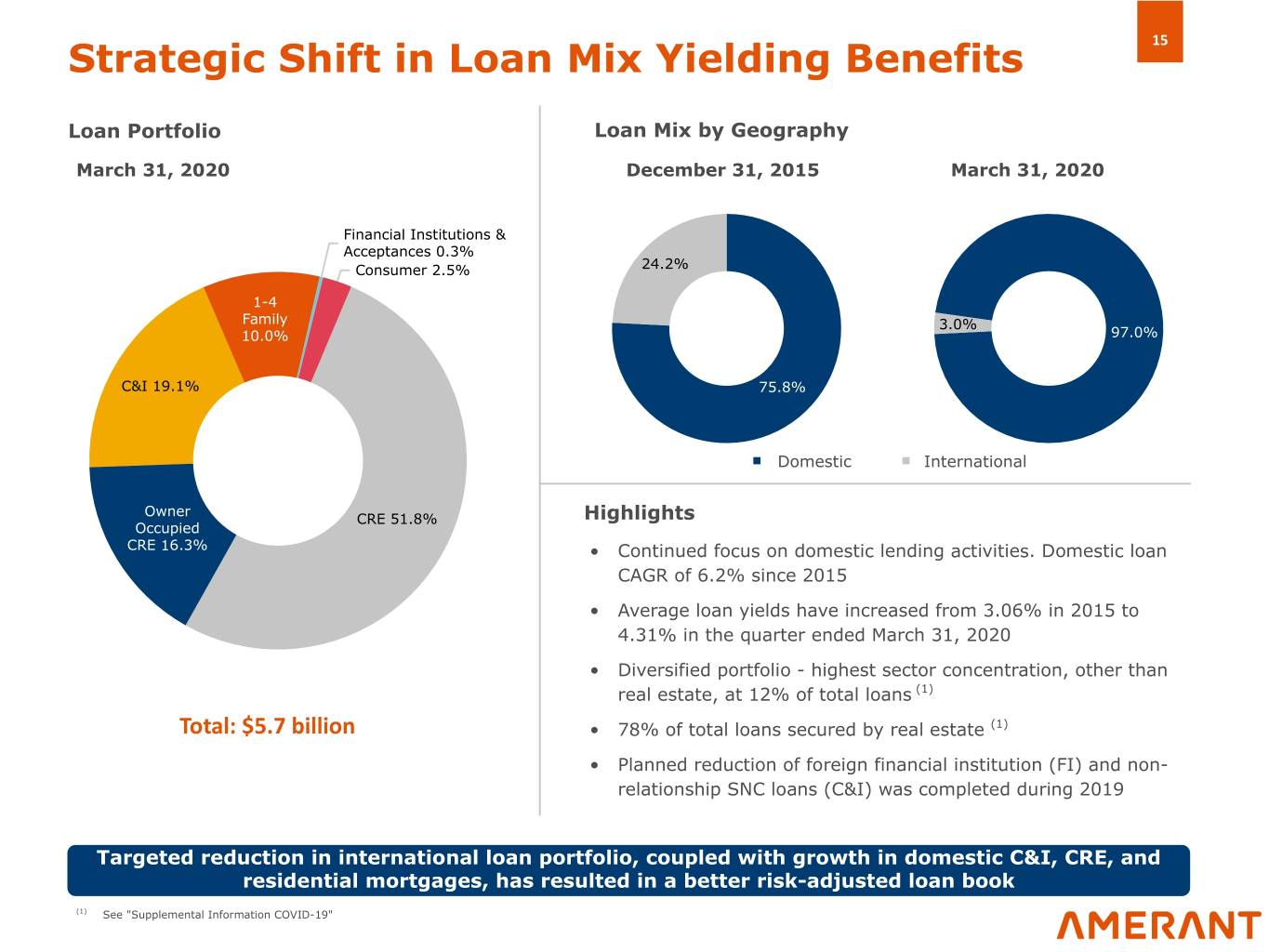

15 Strategic Shift in Loan Mix Yielding Benefits Loan Portfolio Loan Mix by Geography March 31, 2020 December 31, 2015 March 31, 2020 Financial Institutions & Acceptances 0.3% Consumer 2.5% 24.2% 1-4 Family 3.0% 10.0% 97.0% C&I 19.1% 75.8% § Domestic § International Owner CRE 51.8% Highlights Occupied CRE 16.3% • Continued focus on domestic lending activities. Domestic loan CAGR of 6.2% since 2015 • Average loan yields have increased from 3.06% in 2015 to 4.31% in the quarter ended March 31, 2020 • Diversified portfolio - highest sector concentration, other than real estate, at 12% of total loans (1) Total: $5.7 billion • 78% of total loans secured by real estate (1) • Planned reduction of foreign financial institution (FI) and non- relationship SNC loans (C&I) was completed during 2019 Targeted reduction in international loan portfolio, coupled with growth in domestic C&I, CRE, and residential mortgages, has resulted in a better risk-adjusted loan book (1) See "Supplemental Information COVID-19"

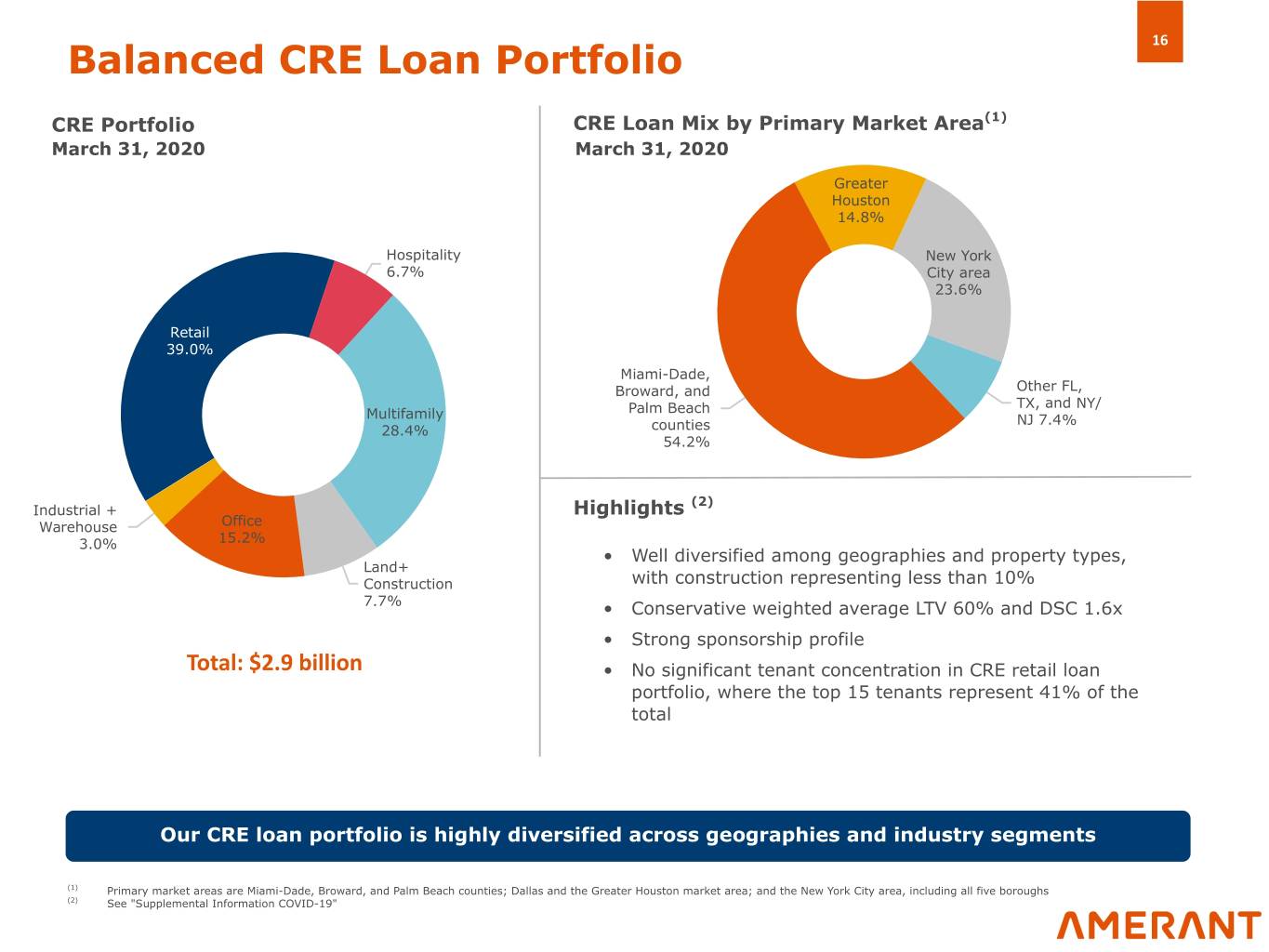

16 Balanced CRE Loan Portfolio CRE Portfolio CRE Loan Mix by Primary Market Area(1) March 31, 2020 March 31, 2020 Greater Houston 14.8% Hospitality New York 6.7% City area 23.6% Retail 39.0% Miami-Dade, Broward, and Other FL, Palm Beach TX, and NY/ Multifamily NJ 7.4% 28.4% counties 54.2% (2) Industrial + Highlights Warehouse Office 3.0% 15.2% • Well diversified among geographies and property types, Land+ Construction with construction representing less than 10% 7.7% • Conservative weighted average LTV 60% and DSC 1.6x • Strong sponsorship profile Total: $2.9 billion • No significant tenant concentration in CRE retail loan portfolio, where the top 15 tenants represent 41% of the total Our CRE loan portfolio is highly diversified across geographies and industry segments (1) Primary market areas are Miami-Dade, Broward, and Palm Beach counties; Dallas and the Greater Houston market area; and the New York City area, including all five boroughs (2) See "Supplemental Information COVID-19"

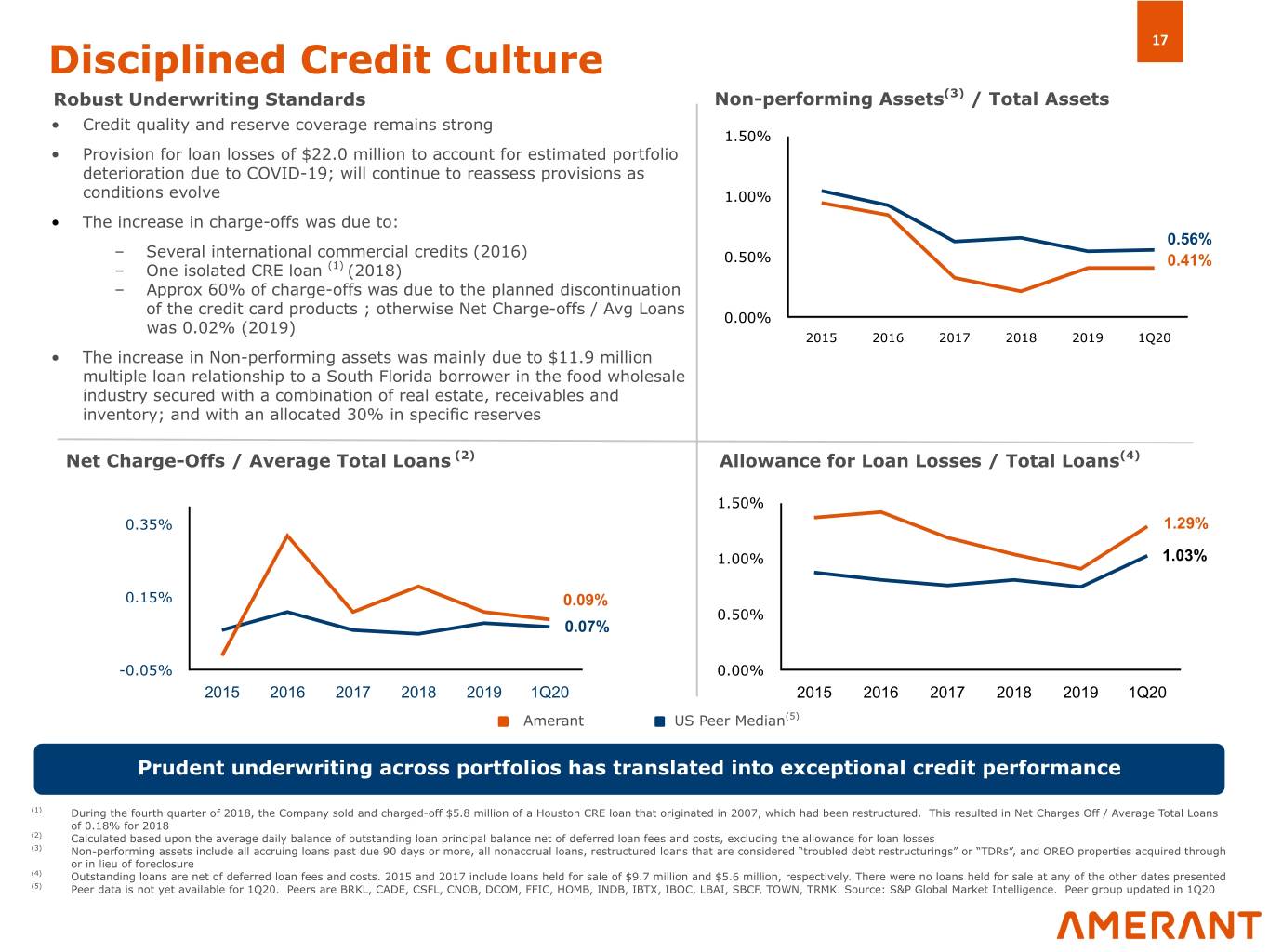

17 Disciplined Credit Culture Robust Underwriting Standards Non-performing Assets(3) / Total Assets • Credit quality and reserve coverage remains strong 1.50% • Provision for loan losses of $22.0 million to account for estimated portfolio deterioration due to COVID-19; will continue to reassess provisions as conditions evolve 1.00% • The increase in charge-offs was due to: 0.56% – Several international commercial credits (2016) 0.50% 0.41% – One isolated CRE loan (1) (2018) – Approx 60% of charge-offs was due to the planned discontinuation of the credit card products ; otherwise Net Charge-offs / Avg Loans 0.00% was 0.02% (2019) 2015 2016 2017 2018 2019 1Q20 • The increase in Non-performing assets was mainly due to $11.9 million multiple loan relationship to a South Florida borrower in the food wholesale industry secured with a combination of real estate, receivables and inventory; and with an allocated 30% in specific reserves Net Charge-Offs / Average Total Loans (2) Allowance for Loan Losses / Total Loans(4) 1.50% 0.35% 1.29% 1.00% 1.03% 0.15% 0.09% 0.50% 0.07% -0.05% 0.00% 2015 2016 2017 2018 2019 1Q20 2015 2016 2017 2018 2019 1Q20 Amerant US Peer Median(5) Prudent underwriting across portfolios has translated into exceptional credit performance (1) During the fourth quarter of 2018, the Company sold and charged-off $5.8 million of a Houston CRE loan that originated in 2007, which had been restructured. This resulted in Net Charges Off / Average Total Loans of 0.18% for 2018 (2) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, excluding the allowance for loan losses (3) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of foreclosure (4) Outstanding loans are net of deferred loan fees and costs. 2015 and 2017 include loans held for sale of $9.7 million and $5.6 million, respectively. There were no loans held for sale at any of the other dates presented (5) Peer data is not yet available for 1Q20. Peers are BRKL, CADE, CSFL, CNOB, DCOM, FFIC, HOMB, INDB, IBTX, IBOC, LBAI, SBCF, TOWN, TRMK. Source: S&P Global Market Intelligence. Peer group updated in 1Q20

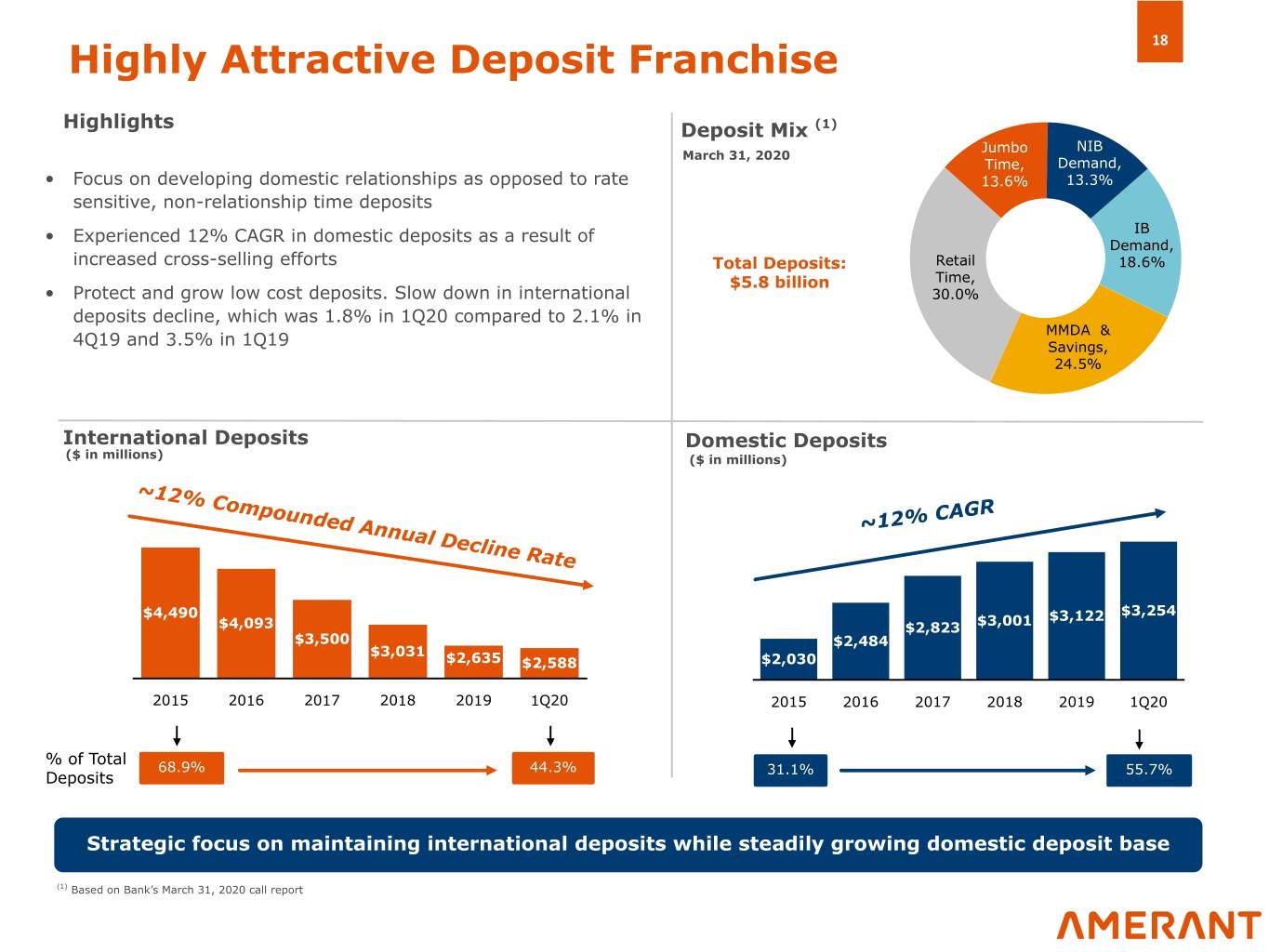

18 Highly Attractive Deposit Franchise Highlights Deposit Mix (1) Jumbo NIB March 31, 2020 Time, Demand, • Focus on developing domestic relationships as opposed to rate 13.6% 13.3% sensitive, non-relationship time deposits • Experienced 12% CAGR in domestic deposits as a result of IB Demand, increased cross-selling efforts Total Deposits: Retail 18.6% $5.8 billion Time, • Protect and grow low cost deposits. Slow down in international 30.0% deposits decline, which was 1.8% in 1Q20 compared to 2.1% in MMDA & 4Q19 and 3.5% in 1Q19 Savings, 24.5% International Deposits Domestic Deposits ($ in millions) ($ in millions) ~ 12% Compounded Annual Decline Rate ~12% CAGR $4,490 $3,254 $3,001 $3,122 $4,093 $2,823 $3,500 $2,484 $3,031 $2,635 $2,588 $2,030 2015 2016 2017 2018 2019 1Q20 2015 2016 2017 2018 2019 1Q20 % of Total 68.9% 44.3% 31.1% 55.7% Deposits Strategic focus on maintaining international deposits while steadily growing domestic deposit base (1) Based on Bank’s March 31, 2020 call report

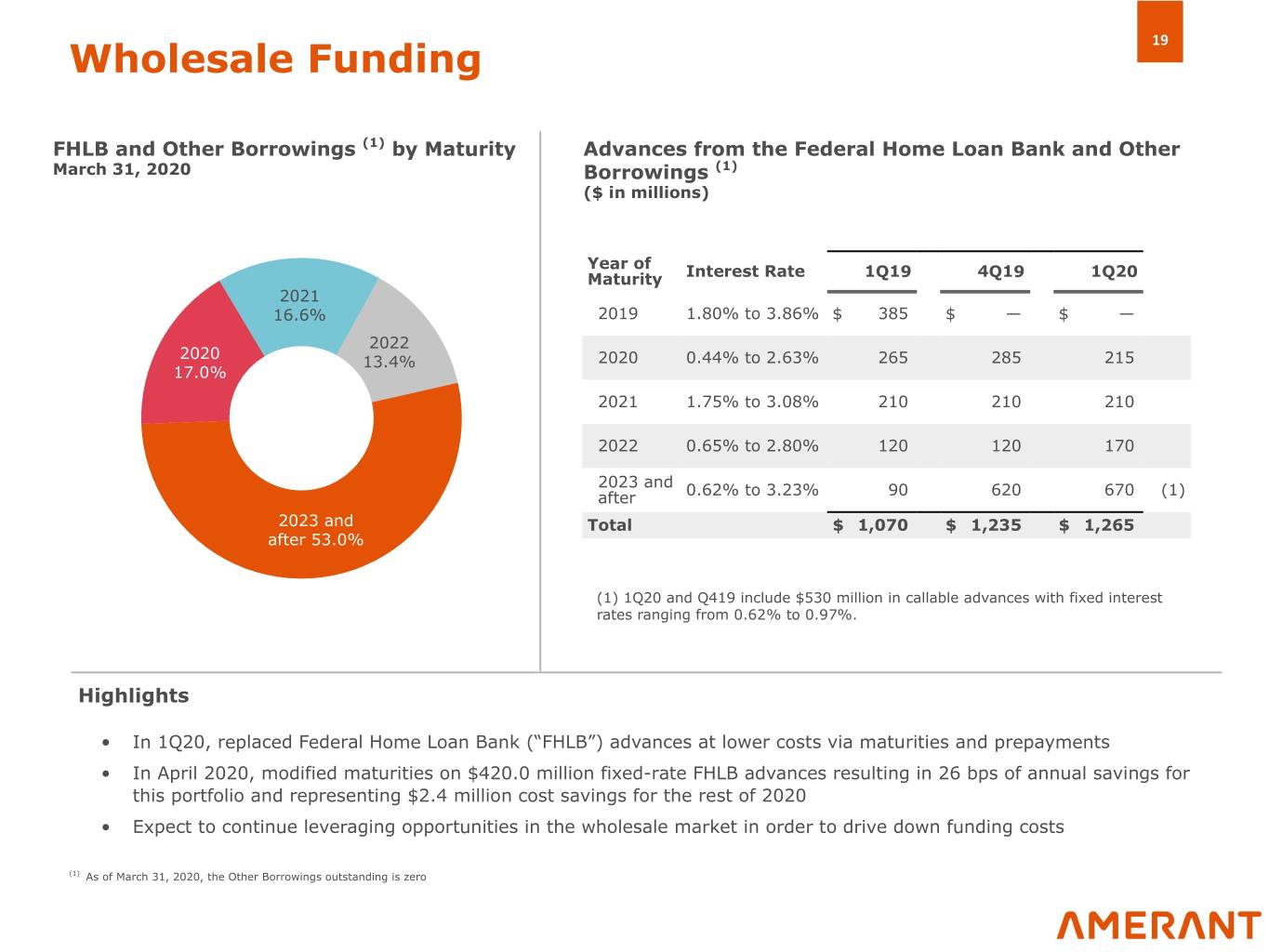

19 Wholesale Funding FHLB and Other Borrowings (1) by Maturity Advances from the Federal Home Loan Bank and Other March 31, 2020 Borrowings (1) ($ in millions) Year of Maturity Interest Rate 1Q19 4Q19 1Q20 2021 16.6% 2019 1.80% to 3.86% $ 385 $ — $ — 2022 2020 13.4% 2020 0.44% to 2.63% 265 285 215 17.0% 2021 1.75% to 3.08% 210 210 210 2022 0.65% to 2.80% 120 120 170 2023 and 0.62% to 3.23% 90 620 670 (1) after 2023 and Total $ 1,070 $ 1,235 $ 1,265 after 53.0% (1) 1Q20 and Q419 include $530 million in callable advances with fixed interest rates ranging from 0.62% to 0.97%. Highlights • In 1Q20, replaced Federal Home Loan Bank (“FHLB”) advances at lower costs via maturities and prepayments • In April 2020, modified maturities on $420.0 million fixed-rate FHLB advances resulting in 26 bps of annual savings for this portfolio and representing $2.4 million cost savings for the rest of 2020 • Expect to continue leveraging opportunities in the wholesale market in order to drive down funding costs (1) As of March 31, 2020, the Other Borrowings outstanding is zero

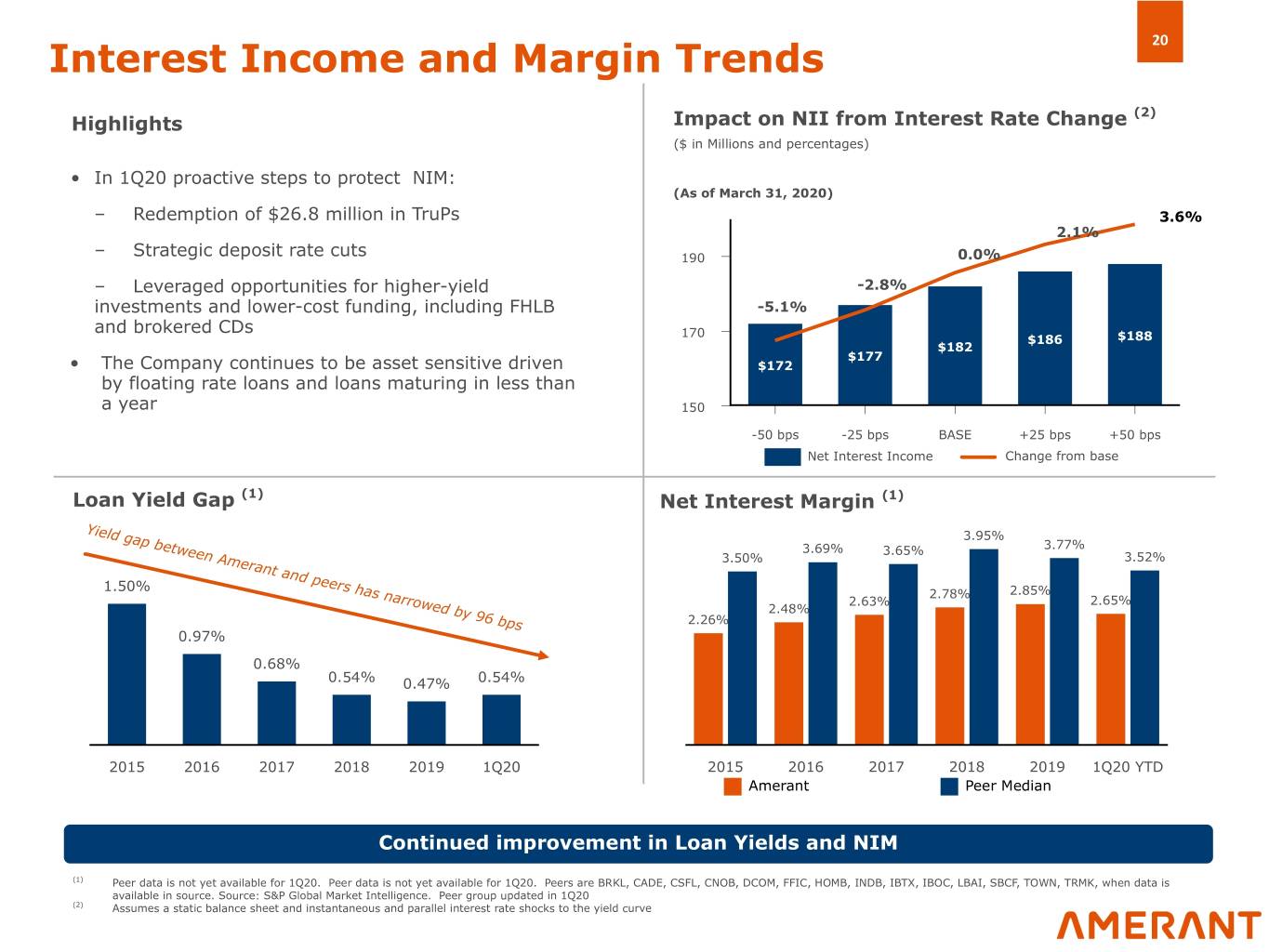

20 Interest Income and Margin Trends (2) Highlights Impact on NII from Interest Rate Change ($ in Millions and percentages) • In 1Q20 proactive steps to protect NIM: (As of March 31, 2020) – Redemption of $26.8 million in TruPs 3.6% 2.1% – Strategic deposit rate cuts 190 0.0% – Leveraged opportunities for higher-yield -2.8% investments and lower-cost funding, including FHLB -5.1% and brokered CDs 170 $186 $188 $182 $177 • The Company continues to be asset sensitive driven $172 by floating rate loans and loans maturing in less than a year 150 -50 bps -25 bps BASE +25 bps +50 bps Net Interest Income Change from base Loan Yield Gap (1) Net Interest Margin (1) Yield gap between Amerant and peers has narrowed by 3.95% 3.69% 3.65% 3.77% 3.50% 3.52% 1.50% 2.78% 2.85% 2.63% 2.65% 2.48% 96 bps 2.26% 0.97% 0.68% 0.54% 0.47% 0.54% 2015 2016 2017 2018 2019 1Q20 2015 2016 2017 2018 2019 1Q20 YTD Amerant Peer Median Continued improvement in Loan Yields and NIM (1) Peer data is not yet available for 1Q20. Peer data is not yet available for 1Q20. Peers are BRKL, CADE, CSFL, CNOB, DCOM, FFIC, HOMB, INDB, IBTX, IBOC, LBAI, SBCF, TOWN, TRMK, when data is available in source. Source: S&P Global Market Intelligence. Peer group updated in 1Q20 (2) Assumes a static balance sheet and instantaneous and parallel interest rate shocks to the yield curve

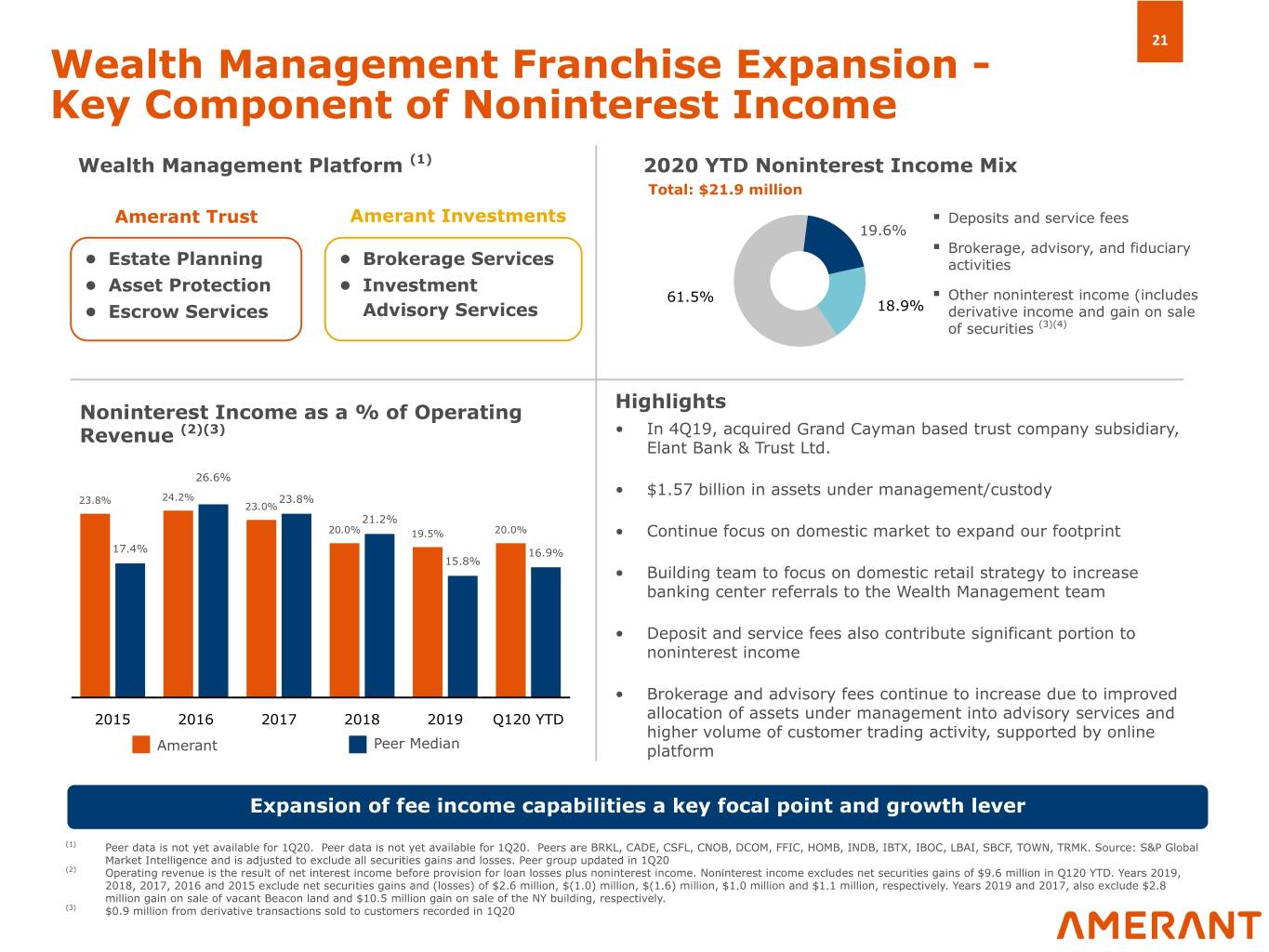

21 Wealth Management Franchise Expansion - Key Component of Noninterest Income Wealth Management Platform (1) 2020 YTD Noninterest Income Mix Total: $21.9 million Amerant Trust Amerant Investments § Deposits and service fees 19.6% § Brokerage, advisory, and fiduciary • Estate Planning • Brokerage Services activities • Asset Protection • Investment § 61.5% Other noninterest income (includes • Escrow Services Advisory Services 18.9% derivative income and gain on sale (3)(4) escrow of securities Highlights Noninterest Income as a % of Operating Revenue (2)(3) • In 4Q19, acquired Grand Cayman based trust company subsidiary, Elant Bank & Trust Ltd. 26.6% • $1.57 billion in assets under management/custody 23.8% 24.2% 23.8% 23.0% 21.2% 20.0% 19.5% 20.0% • Continue focus on domestic market to expand our footprint 17.4% 16.9% 15.8% • Building team to focus on domestic retail strategy to increase banking center referrals to the Wealth Management team • Deposit and service fees also contribute significant portion to noninterest income • Brokerage and advisory fees continue to increase due to improved 2015 2016 2017 2018 2019 Q120 YTD allocation of assets under management into advisory services and higher volume of customer trading activity, supported by online Amerant Peer Median platform Expansion of fee income capabilities a key focal point and growth lever (1) Peer data is not yet available for 1Q20. Peer data is not yet available for 1Q20. Peers are BRKL, CADE, CSFL, CNOB, DCOM, FFIC, HOMB, INDB, IBTX, IBOC, LBAI, SBCF, TOWN, TRMK. Source: S&P Global Market Intelligence and is adjusted to exclude all securities gains and losses. Peer group updated in 1Q20 (2) Operating revenue is the result of net interest income before provision for loan losses plus noninterest income. Noninterest income excludes net securities gains of $9.6 million in Q120 YTD. Years 2019, 2018, 2017, 2016 and 2015 exclude net securities gains and (losses) of $2.6 million, $(1.0) million, $(1.6) million, $1.0 million and $1.1 million, respectively. Years 2019 and 2017, also exclude $2.8 million gain on sale of vacant Beacon land and $10.5 million gain on sale of the NY building, respectively. (3) $0.9 million from derivative transactions sold to customers recorded in 1Q20

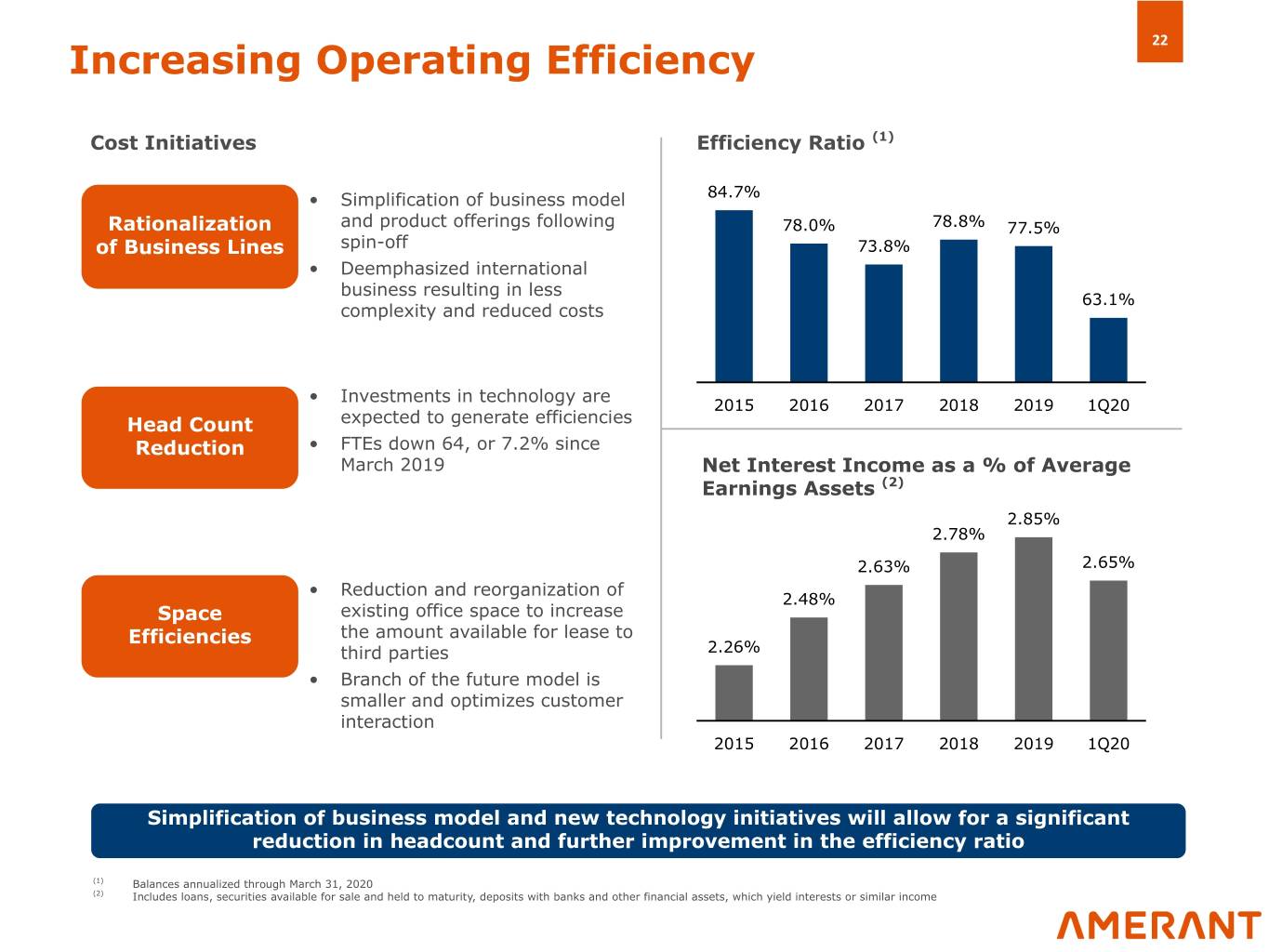

22 Increasing Operating Efficiency Cost Initiatives Efficiency Ratio (1) • Simplification of business model 84.7% Rationalization and product offerings following 78.0% 78.8% 77.5% of Business Lines spin-off 73.8% • Deemphasized international business resulting in less 63.1% complexity and reduced costs • Investments in technology are 2015 2016 2017 2018 2019 1Q20 Head Count expected to generate efficiencies Reduction • FTEs down 64, or 7.2% since March 2019 Net Interest Income as a % of Average Earnings Assets (2) 2.85% 2.78% 2.63% 2.65% • Reduction and reorganization of 2.48% Space existing office space to increase Efficiencies the amount available for lease to third parties 2.26% • Branch of the future model is smaller and optimizes customer interaction 2015 2016 2017 2018 2019 1Q20 Simplification of business model and new technology initiatives will allow for a significant reduction in headcount and further improvement in the efficiency ratio (1) Balances annualized through March 31, 2020 (2) Includes loans, securities available for sale and held to maturity, deposits with banks and other financial assets, which yield interests or similar income

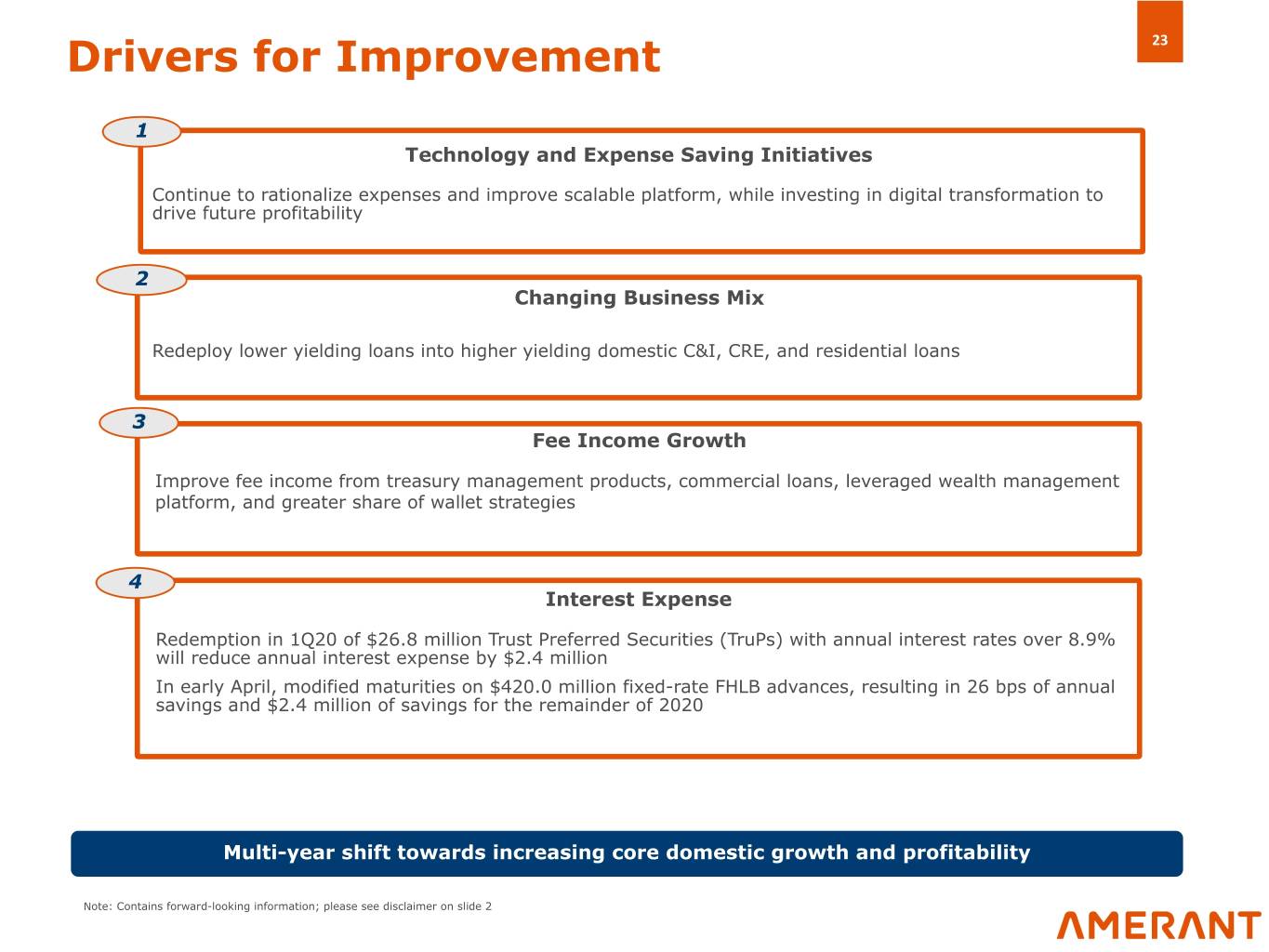

Drivers for Improvement 23 1 Technology and Expense Saving Initiatives Continue to rationalize expenses and improve scalable platform, while investing in digital transformation to drive future profitability 2 Changing Business Mix Redeploy lower yielding loans into higher yielding domestic C&I, CRE, and residential loans 3 Fee Income Growth Improve fee income from treasury management products, commercial loans, leveraged wealth management platform, and greater share of wallet strategies 4 Interest Expense Redemption in 1Q20 of $26.8 million Trust Preferred Securities (TruPs) with annual interest rates over 8.9% will reduce annual interest expense by $2.4 million In early April, modified maturities on $420.0 million fixed-rate FHLB advances, resulting in 26 bps of annual savings and $2.4 million of savings for the remainder of 2020 Multi-year shift towards increasing core domestic growth and profitability Note: Contains forward-looking information; please see disclaimer on slide 2

24 Investment Highlights Focus on driving profitable growth and shareholder value Substantial and continuing insider ownership, approximately 30% Strong asset quality and domestic loan growth Focus on expanding domestic deposit base throughout our high growth U.S. markets Low cost deposits from international customers who view U.S. as a safe haven for their savings Diversification of revenue from a greater share of wallet strategy and an attractive wealth management platform that is being emphasized and cross- sold to domestic customers Top-shelf risk management culture stemming from having been part of large, multi-national organization Embarked on digital transformation to adapt to a new competitive environment and drive future profitability

Supplemental Information COVID-19 Update

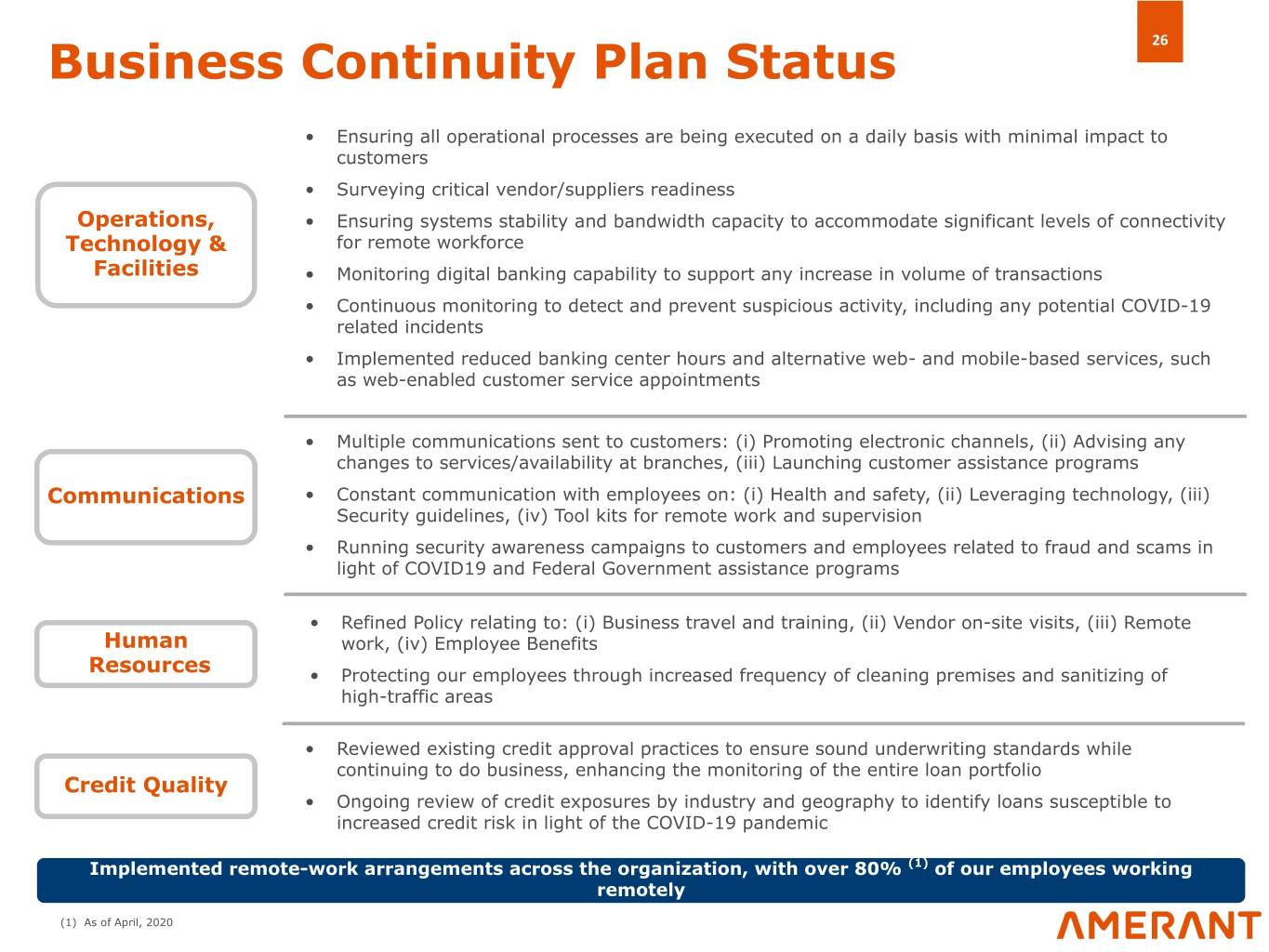

Business Continuity Plan Status 26 • Ensuring all operational processes are being executed on a daily basis with minimal impact to customers • Surveying critical vendor/suppliers readiness Operations, • Ensuring systems stability and bandwidth capacity to accommodate significant levels of connectivity Technology & for remote workforce Facilities • Monitoring digital banking capability to support any increase in volume of transactions • Continuous monitoring to detect and prevent suspicious activity, including any potential COVID-19 related incidents • Implemented reduced banking center hours and alternative web- and mobile-based services, such as web-enabled customer service appointments • Multiple communications sent to customers: (i) Promoting electronic channels, (ii) Advising any changes to services/availability at branches, (iii) Launching customer assistance programs Communications • Constant communication with employees on: (i) Health and safety, (ii) Leveraging technology, (iii) Security guidelines, (iv) Tool kits for remote work and supervision • Running security awareness campaigns to customers and employees related to fraud and scams in light of COVID19 and Federal Government assistance programs • Refined Policy relating to: (i) Business travel and training, (ii) Vendor on-site visits, (iii) Remote Human work, (iv) Employee Benefits Resources • Protecting our employees through increased frequency of cleaning premises and sanitizing of high-traffic areas • Reviewed existing credit approval practices to ensure sound underwriting standards while continuing to do business, enhancing the monitoring of the entire loan portfolio Credit Quality • Ongoing review of credit exposures by industry and geography to identify loans susceptible to increased credit risk in light of the COVID-19 pandemic Implemented remote-work arrangements across the organization, with over 80% (1) of our employees working remotely (1) As of April, 2020

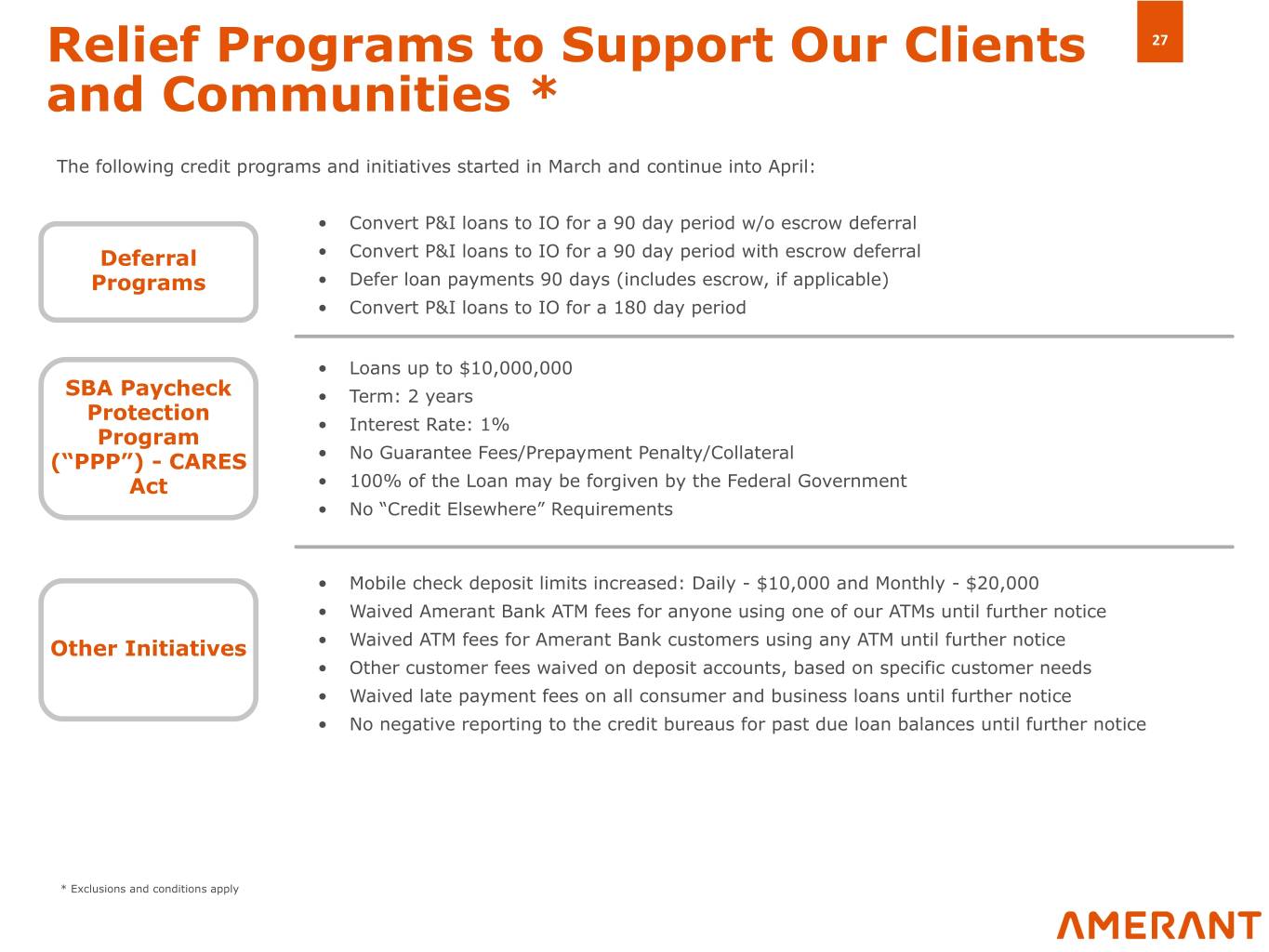

Relief Programs to Support Our Clients 27 and Communities * The following credit programs and initiatives started in March and continue into April: • Convert P&I loans to IO for a 90 day period w/o escrow deferral Deferral • Convert P&I loans to IO for a 90 day period with escrow deferral Programs • Defer loan payments 90 days (includes escrow, if applicable) • Convert P&I loans to IO for a 180 day period • Loans up to $10,000,000 SBA Paycheck • Term: 2 years Protection • Interest Rate: 1% Program (“PPP”) - CARES • No Guarantee Fees/Prepayment Penalty/Collateral Act • 100% of the Loan may be forgiven by the Federal Government • No “Credit Elsewhere” Requirements • Mobile check deposit limits increased: Daily - $10,000 and Monthly - $20,000 • Waived Amerant Bank ATM fees for anyone using one of our ATMs until further notice Other Initiatives • Waived ATM fees for Amerant Bank customers using any ATM until further notice • Other customer fees waived on deposit accounts, based on specific customer needs • Waived late payment fees on all consumer and business loans until further notice • No negative reporting to the credit bureaus for past due loan balances until further notice * Exclusions and conditions apply

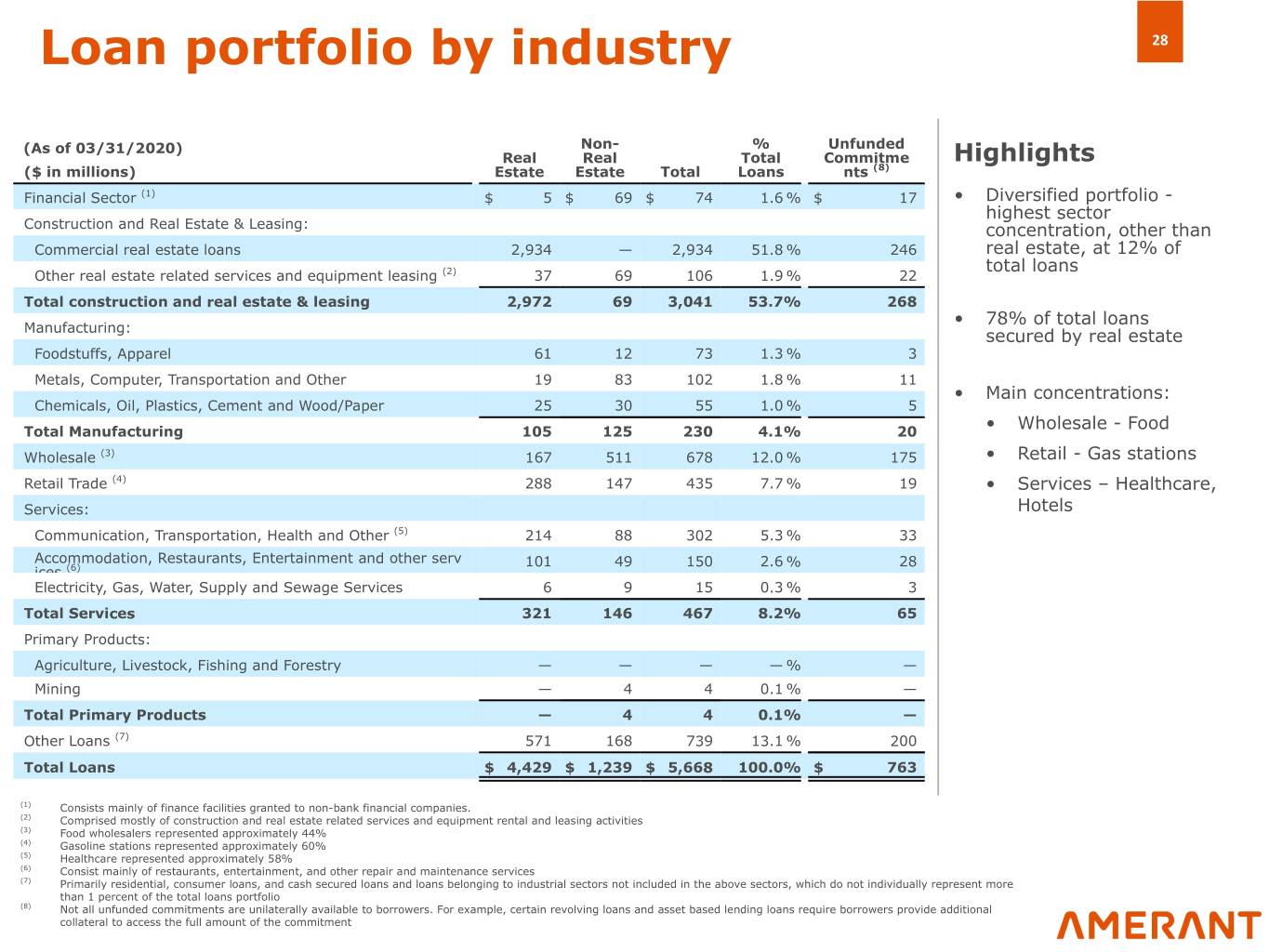

Loan portfolio by industry 28 (As of 03/31/2020) Non- % Unfunded Real Real Total Commitme Highlights ($ in millions) Estate Estate Total Loans nts (8) Financial Sector (1) $ 5 $ 69 $ 74 1.6 % $ 17 • Diversified portfolio - highest sector Construction and Real Estate & Leasing: concentration, other than Commercial real estate loans 2,934 — 2,934 51.8 % 246 real estate, at 12% of total loans Other real estate related services and equipment leasing (2) 37 69 106 1.9 % 22 Total construction and real estate & leasing 2,972 69 3,041 53.7% 268 • 78% of total loans Manufacturing: secured by real estate Foodstuffs, Apparel 61 12 73 1.3 % 3 Metals, Computer, Transportation and Other 19 83 102 1.8 % 11 • Main concentrations: Chemicals, Oil, Plastics, Cement and Wood/Paper 25 30 55 1.0 % 5 Total Manufacturing 105 125 230 4.1% 20 • Wholesale - Food Wholesale (3) 167 511 678 12.0 % 175 • Retail - Gas stations Retail Trade (4) 288 147 435 7.7 % 19 • Services – Healthcare, Services: Hotels Communication, Transportation, Health and Other (5) 214 88 302 5.3 % 33 Accommodation, Restaurants, Entertainment and other serv 101 49 150 2.6 % 28 ices (6) Electricity, Gas, Water, Supply and Sewage Services 6 9 15 0.3 % 3 Total Services 321 146 467 8.2% 65 Primary Products: Agriculture, Livestock, Fishing and Forestry — — — — % — Mining — 4 4 0.1 % — Total Primary Products — 4 4 0.1% — Other Loans (7) 571 168 739 13.1 % 200 Total Loans $ 4,429 $ 1,239 $ 5,668 100.0% $ 763 (1) Consists mainly of finance facilities granted to non-bank financial companies. (2) Comprised mostly of construction and real estate related services and equipment rental and leasing activities (3) Food wholesalers represented approximately 44% (4) Gasoline stations represented approximately 60% (5) Healthcare represented approximately 58% (6) Consist mainly of restaurants, entertainment, and other repair and maintenance services (7) Primarily residential, consumer loans, and cash secured loans and loans belonging to industrial sectors not included in the above sectors, which do not individually represent more than 1 percent of the total loans portfolio (8) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers provide additional collateral to access the full amount of the commitment

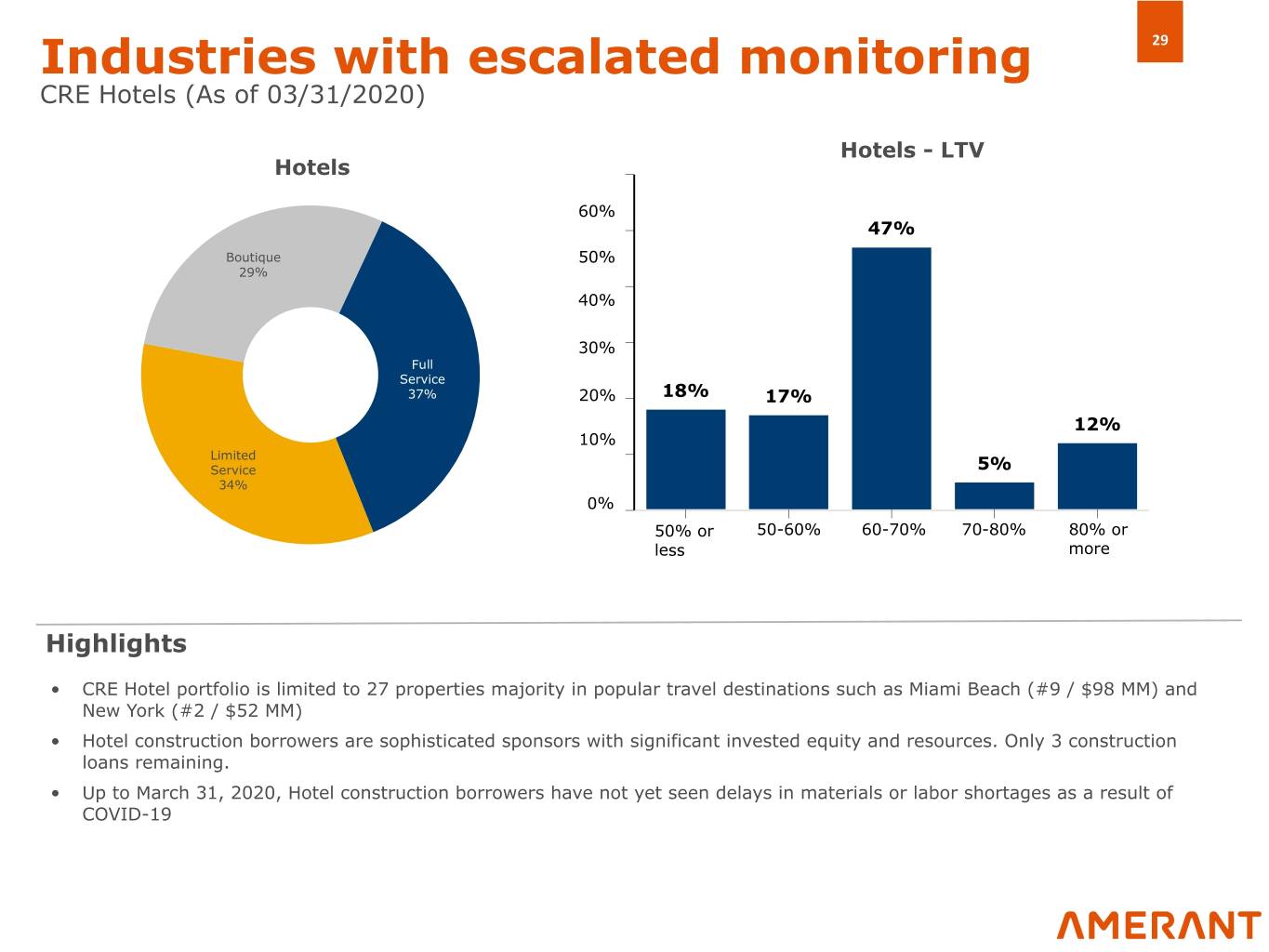

Industries with escalated monitoring 29 CRE Hotels (As of 03/31/2020) Hotels - LTV Hotels 60% 47% Boutique 50% 29% 40% 30% Full Service 37% 20% 18% 17% 12% 10% Limited Service 5% 34% 0% 50% or 50-60% 60-70% 70-80% 80% or less more Highlights • CRE Hotel portfolio is limited to 27 properties majority in popular travel destinations such as Miami Beach (#9 / $98 MM) and New York (#2 / $52 MM) • Hotel construction borrowers are sophisticated sponsors with significant invested equity and resources. Only 3 construction loans remaining. • Up to March 31, 2020, Hotel construction borrowers have not yet seen delays in materials or labor shortages as a result of COVID-19

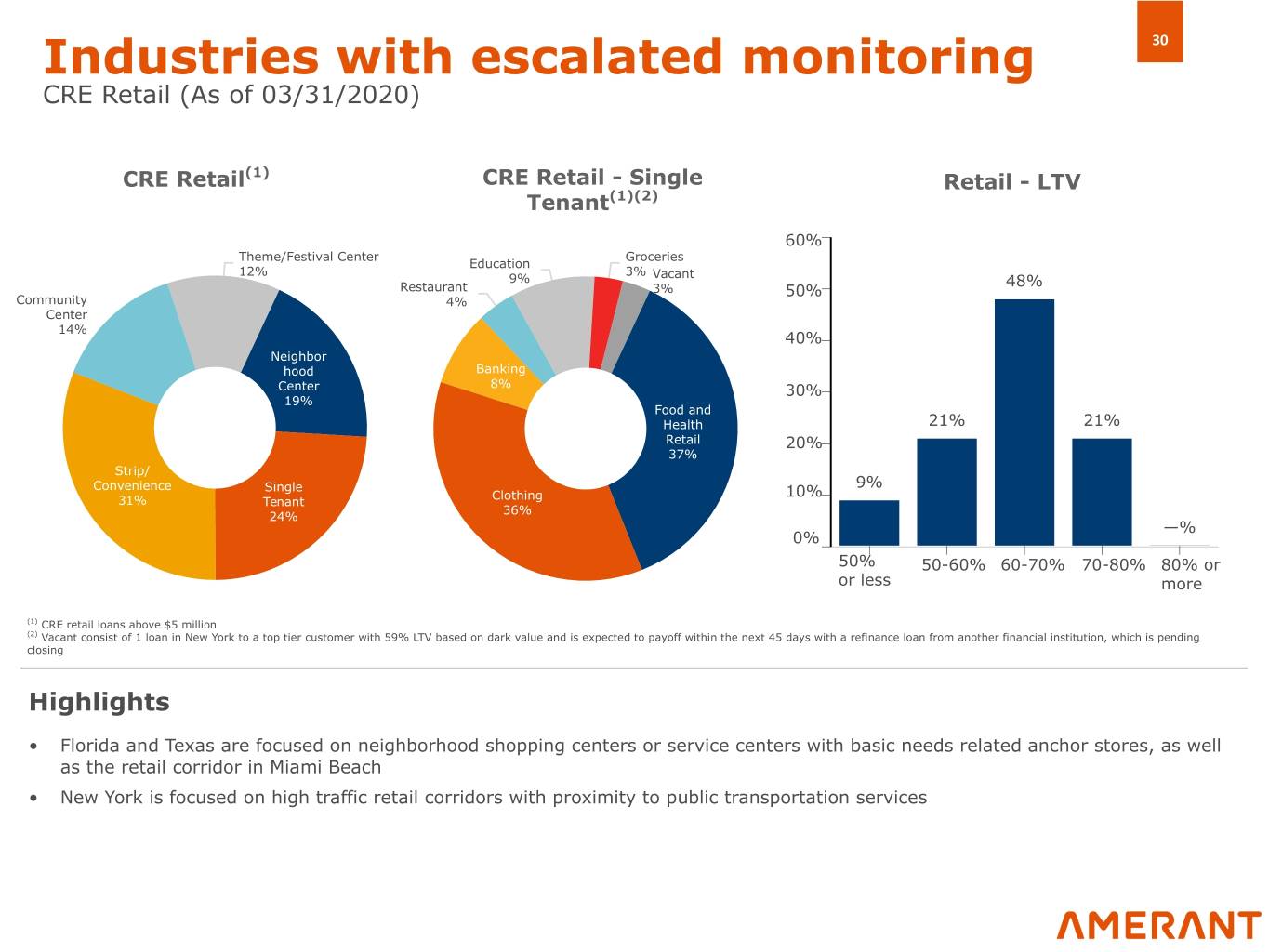

Industries with escalated monitoring 30 CRE Retail (As of 03/31/2020) CRE Retail(1) CRE Retail - Single Retail - LTV Tenant(1)(2) 60% Theme/Festival Center Groceries Education 12% 3% 9% Vacant 48% Restaurant 3% 50% Community 4% Center 14% 40% Neighbor hood Banking Center 8% 30% 19% Food and Health 21% 21% Retail 20% 37% Strip/ Convenience Single 9% Clothing 10% 31% Tenant 36% 24% —% 0% 50% 50-60% 60-70% 70-80% 80% or or less more (1) CRE retail loans above $5 million (2) Vacant consist of 1 loan in New York to a top tier customer with 59% LTV based on dark value and is expected to payoff within the next 45 days with a refinance loan from another financial institution, which is pending closing Highlights • Florida and Texas are focused on neighborhood shopping centers or service centers with basic needs related anchor stores, as well as the retail corridor in Miami Beach • New York is focused on high traffic retail corridors with proximity to public transportation services

Appendices

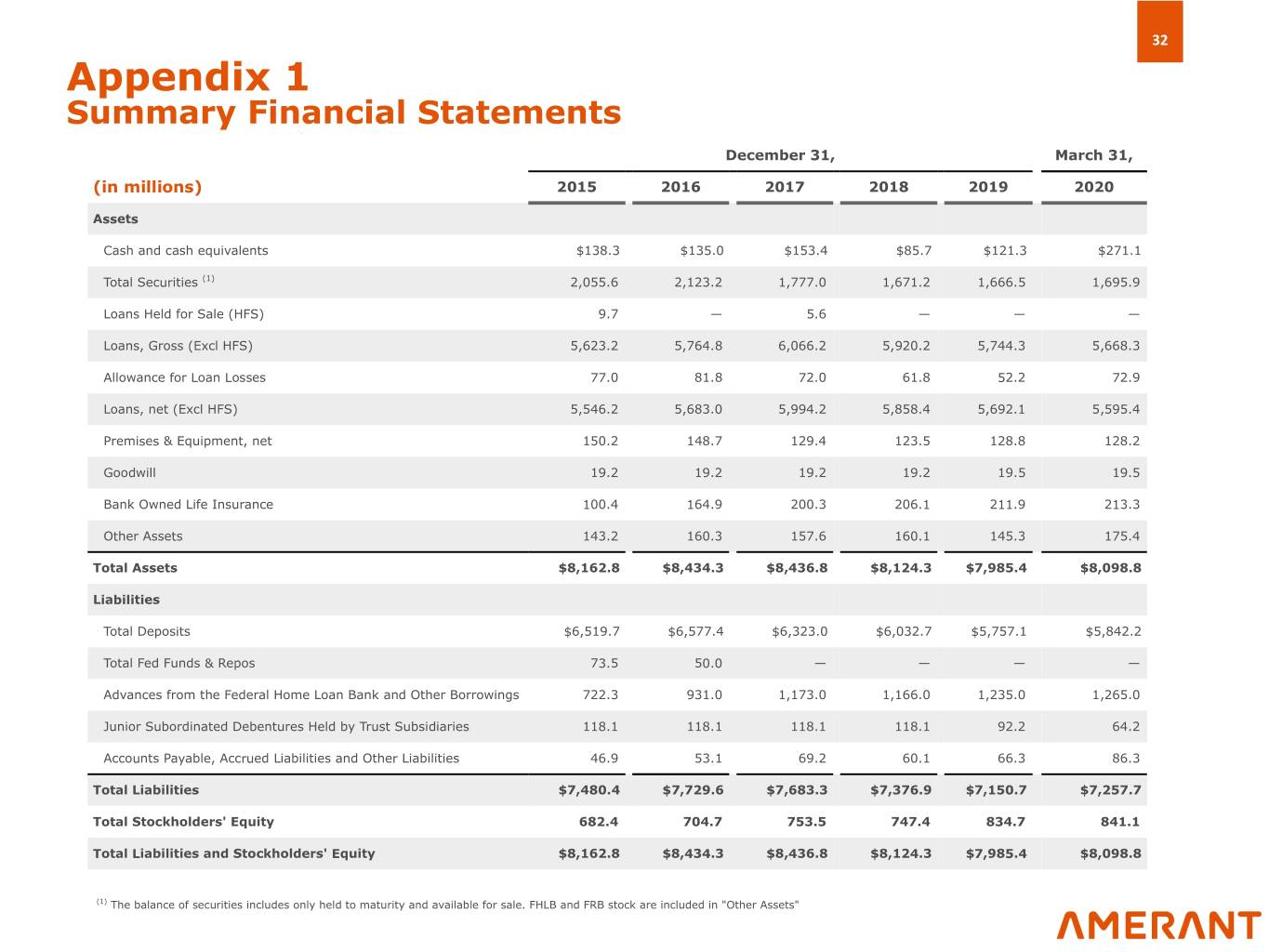

32 Appendix 1 Summary Financial Statements December 31, March 31, (in millions) 2015 2016 2017 2018 2019 2020 Assets Cash and cash equivalents $138.3 $135.0 $153.4 $85.7 $121.3 $271.1 Total Securities (1) 2,055.6 2,123.2 1,777.0 1,671.2 1,666.5 1,695.9 Loans Held for Sale (HFS) 9.7 — 5.6 — — — Loans, Gross (Excl HFS) 5,623.2 5,764.8 6,066.2 5,920.2 5,744.3 5,668.3 Allowance for Loan Losses 77.0 81.8 72.0 61.8 52.2 72.9 Loans, net (Excl HFS) 5,546.2 5,683.0 5,994.2 5,858.4 5,692.1 5,595.4 Premises & Equipment, net 150.2 148.7 129.4 123.5 128.8 128.2 Goodwill 19.2 19.2 19.2 19.2 19.5 19.5 Bank Owned Life Insurance 100.4 164.9 200.3 206.1 211.9 213.3 Other Assets 143.2 160.3 157.6 160.1 145.3 175.4 Total Assets $8,162.8 $8,434.3 $8,436.8 $8,124.3 $7,985.4 $8,098.8 Liabilities Total Deposits $6,519.7 $6,577.4 $6,323.0 $6,032.7 $5,757.1 $5,842.2 Total Fed Funds & Repos 73.5 50.0 — — — — Advances from the Federal Home Loan Bank and Other Borrowings 722.3 931.0 1,173.0 1,166.0 1,235.0 1,265.0 Junior Subordinated Debentures Held by Trust Subsidiaries 118.1 118.1 118.1 118.1 92.2 64.2 Accounts Payable, Accrued Liabilities and Other Liabilities 46.9 53.1 69.2 60.1 66.3 86.3 Total Liabilities $7,480.4 $7,729.6 $7,683.3 $7,376.9 $7,150.7 $7,257.7 Total Stockholders' Equity 682.4 704.7 753.5 747.4 834.7 841.1 Total Liabilities and Stockholders' Equity $8,162.8 $8,434.3 $8,436.8 $8,124.3 $7,985.4 $8,098.8 (1) The balance of securities includes only held to maturity and available for sale. FHLB and FRB stock are included in "Other Assets"

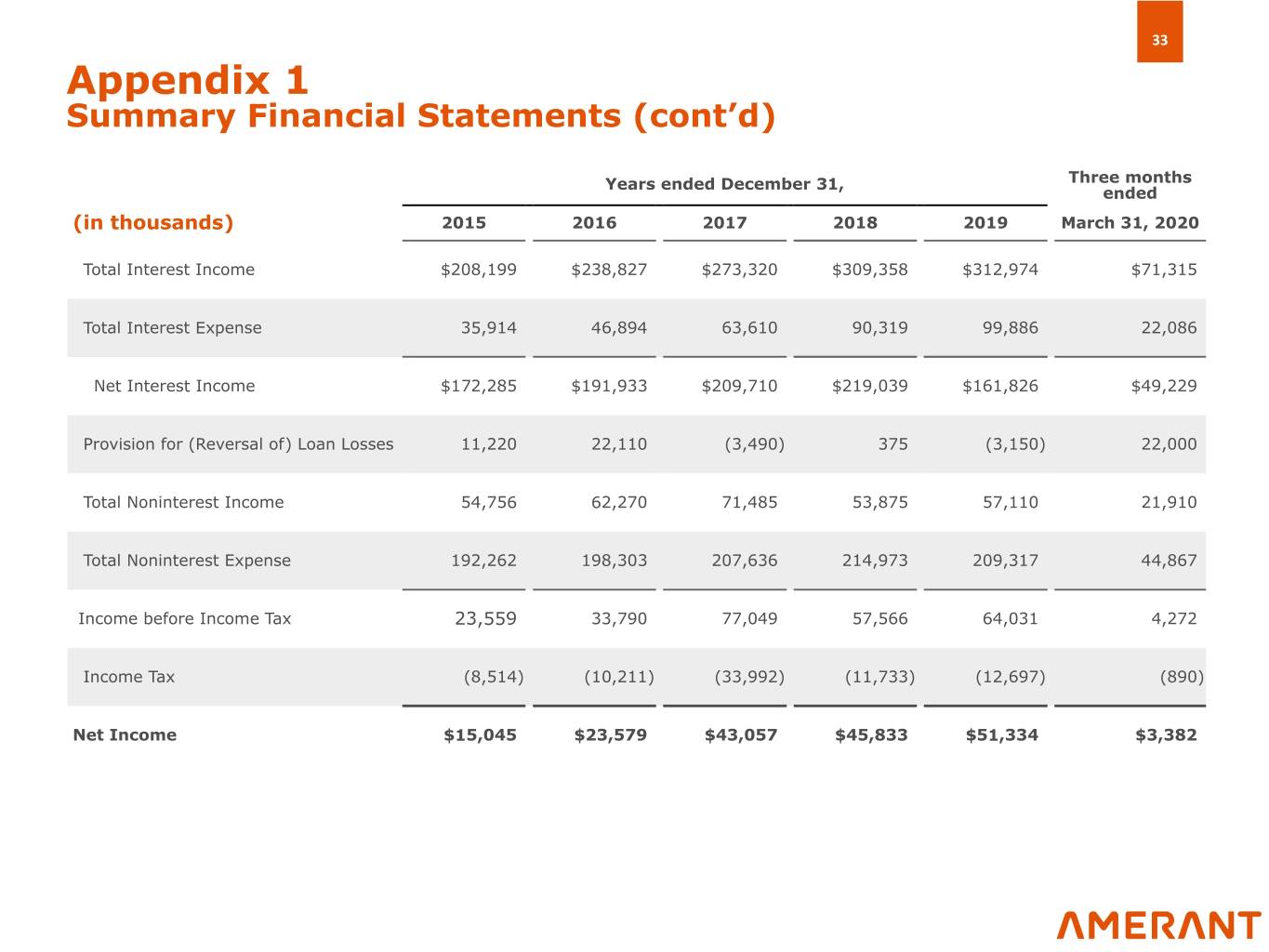

33 Appendix 1 Summary Financial Statements (cont’d) Years ended December 31, Three months ended (in thousands) 2015 2016 2017 2018 2019 March 31, 2020 Total Interest Income $208,199 $238,827 $273,320 $309,358 $312,974 $71,315 Total Interest Expense 35,914 46,894 63,610 90,319 99,886 22,086 Net Interest Income $172,285 $191,933 $209,710 $219,039 $161,826 $49,229 Provision for (Reversal of) Loan Losses 11,220 22,110 (3,490) 375 (3,150) 22,000 Total Noninterest Income 54,756 62,270 71,485 53,875 57,110 21,910 Total Noninterest Expense 192,262 198,303 207,636 214,973 209,317 44,867 Income before Income Tax 23,559 33,790 77,049 57,566 64,031 4,272 Income Tax (8,514) (10,211) (33,992) (11,733) (12,697) (890) Net Income $15,045 $23,579 $43,057 $45,833 $51,334 $3,382

34 Appendix 2 Non-GAAP Financial Measures Reconciliations Explanation of Certain Non-GAAP Financial Measures This Presentation contains certain adjusted financial information, and their effects on noninterest income, noninterest expense, income taxes, net income, operating income, efficiency ratios, ROA and ROE and certain other financial ratios. These adjustments include: • the $2.8 million net gain on the sale of vacant Beacon land during the fourth quarter of 2019, • the $10.5 million net gain on the sale of the Company’s New York City building during the third quarter of 2017, • the $9.6 million expense in the fourth quarter of 2017 resulting from the 2017 Tax Act, • spin-off expenses totaling $6.7 million in 2018, $5.2 million in 2017, beginning in the fourth quarter of 2017 and continuing to the fourth quarter of 2018, • the $6.4 million, $5.0 million and $0.4 million in restructuring expenses in 2018, 2019 and first quarter of 2020, respectively, related to staff reduction costs, legal and strategic advisory costs, rebranding costs and digital transformation costs, • the securities gains of $9.6 million and $2.6 million in the first quarter of 2020 and year ended 2019, respectively, and securities losses of $1.0 million and $1.6 million in the years ended 2018 and 2017, respectively, • the provision for loan losses of $22.0 million and $0.4 million in the first quarter of 2020 and year ended 2018, respectively, and reversal of loan losses of $3.2 million and $3.5 million in the years ended 2019 and 2017, respectively, and • the income tax expense of $0.9 million, $12.7 million, $11.7 million and $34.0 million in the first quarter of 2020, and the years ended 2019, 2018 and 2017, respectively. These as-adjusted measures are not in accordance with generally accepted accounting principles (“GAAP”). This Appendix 2 reconciles these adjustments to reported results. The Company uses certain non-GAAP financial measures, within the meaning of SEC Regulation G, which are included in this Presentation to explain our results and which are used in our internal evaluation and management of the Company’s businesses. The Company’s management believes these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view the Company’s performance using the same tools that management uses to evaluate the Company’s past performance and prospects for future performance. The Company believes these are especially useful in light of the effects of our spin-off and related restructuring expenses, as well as the sale of vacant Beacon land in the fourth quarter of 2019, the sale of our New York City building in third quarter 2017, the charges to our deferred tax assets in fourth quarter 2017 resulting from the enactment of the 2017 Tax Act in December 2017, and other adjustments mentioned above. No adjustments were made to the 2015 and 2016 financial information.

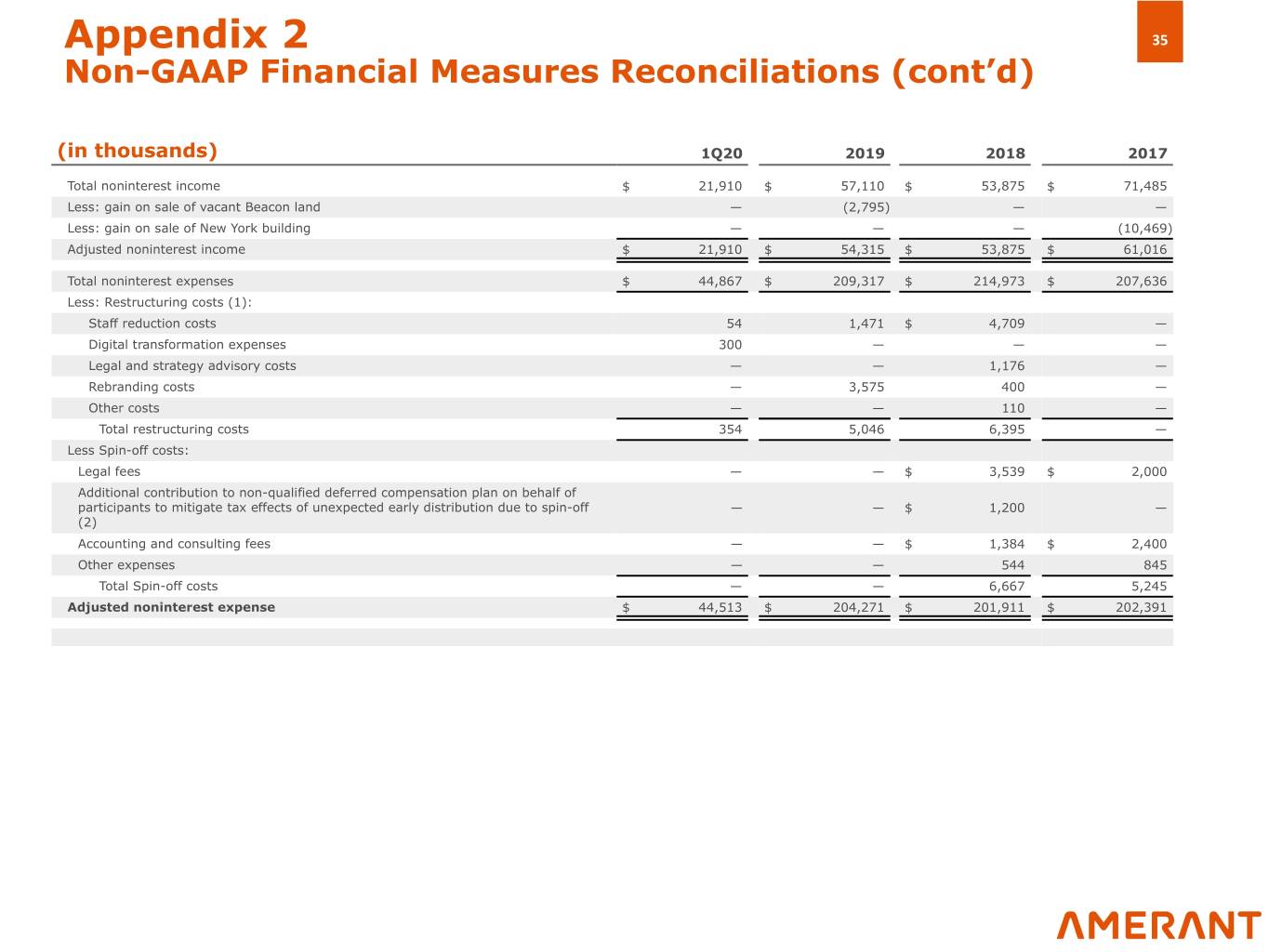

Appendix 2 35 Non-GAAP Financial Measures Reconciliations (cont’d) (in thousands) 1Q20 2019 2018 2017 Total noninterest income $ 21,910 $ 57,110 $ 53,875 $ 71,485 Less: gain on sale of vacant Beacon land — (2,795) — — Less: gain on sale of New York building — — — (10,469) Adjusted noninterest income $ 21,910 $ 54,315 $ 53,875 $ 61,016 Total noninterest expenses $ 44,867 $ 209,317 $ 214,973 $ 207,636 Less: Restructuring costs (1): Staff reduction costs 54 1,471 $ 4,709 — Digital transformation expenses 300 — — — Legal and strategy advisory costs — — 1,176 — Rebranding costs — 3,575 400 — Other costs — — 110 — Total restructuring costs 354 5,046 6,395 — Less Spin-off costs: Legal fees — — $ 3,539 $ 2,000 Additional contribution to non-qualified deferred compensation plan on behalf of participants to mitigate tax effects of unexpected early distribution due to spin-off — — $ 1,200 — (2) Accounting and consulting fees — — $ 1,384 $ 2,400 Other expenses — — 544 845 Total Spin-off costs — — 6,667 5,245 Adjusted noninterest expense $ 44,513 $ 204,271 $ 201,911 $ 202,391

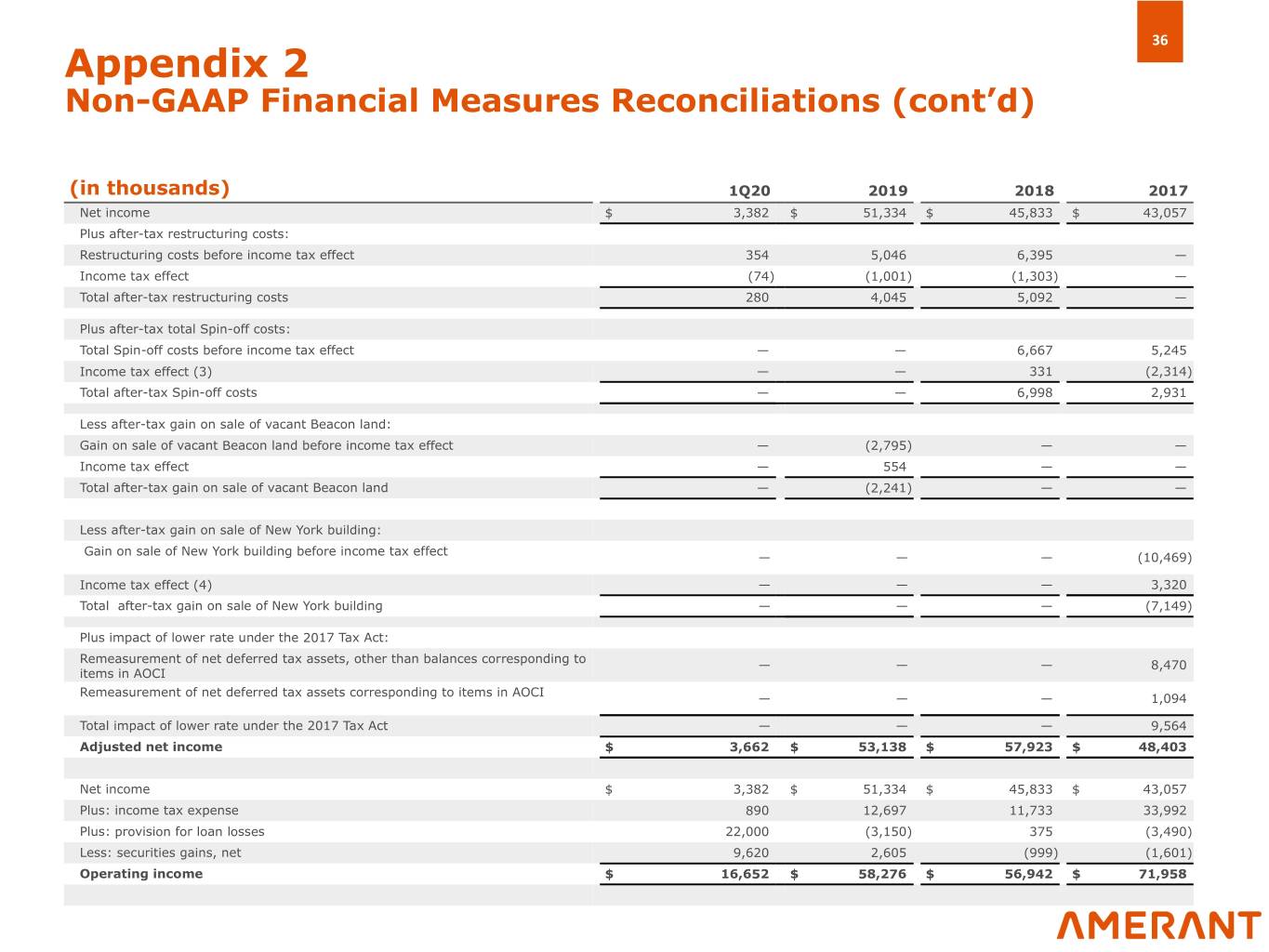

36 Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d) (in thousands) 1Q20 2019 2018 2017 Net income $ 3,382 $ 51,334 $ 45,833 $ 43,057 Plus after-tax restructuring costs: Restructuring costs before income tax effect 354 5,046 6,395 — Income tax effect (74) (1,001) (1,303) — Total after-tax restructuring costs 280 4,045 5,092 — Plus after-tax total Spin-off costs: Total Spin-off costs before income tax effect — — 6,667 5,245 Income tax effect (3) — — 331 (2,314) Total after-tax Spin-off costs — — 6,998 2,931 Less after-tax gain on sale of vacant Beacon land: Gain on sale of vacant Beacon land before income tax effect — (2,795) — — Income tax effect — 554 — — Total after-tax gain on sale of vacant Beacon land — (2,241) — — Less after-tax gain on sale of New York building: Gain on sale of New York building before income tax effect — — — (10,469) Income tax effect (4) — — — 3,320 Total after-tax gain on sale of New York building — — — (7,149) Plus impact of lower rate under the 2017 Tax Act: Remeasurement of net deferred tax assets, other than balances corresponding to — — — 8,470 items in AOCI Remeasurement of net deferred tax assets corresponding to items in AOCI — — — 1,094 Total impact of lower rate under the 2017 Tax Act — — — 9,564 Adjusted net income $ 3,662 $ 53,138 $ 57,923 $ 48,403 Net income $ 3,382 $ 51,334 $ 45,833 $ 43,057 Plus: income tax expense 890 12,697 11,733 33,992 Plus: provision for loan losses 22,000 (3,150) 375 (3,490) Less: securities gains, net 9,620 2,605 (999) (1,601) Operating income $ 16,652 $ 58,276 $ 56,942 $ 71,958

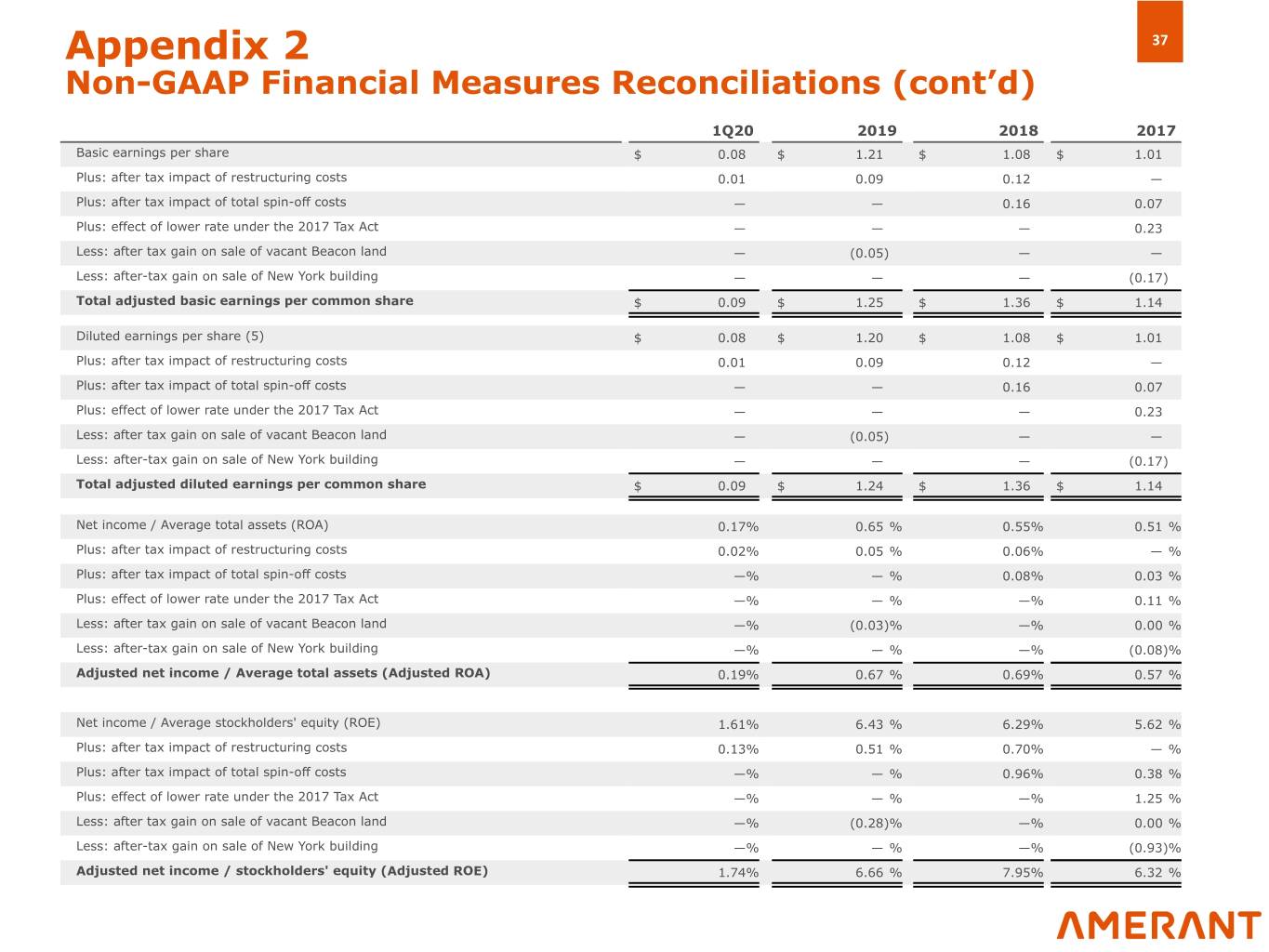

Appendix 2 37 Non-GAAP Financial Measures Reconciliations (cont’d) 1Q20 2019 2018 2017 Basic earnings per share $ 0.08 $ 1.21 $ 1.08 $ 1.01 Plus: after tax impact of restructuring costs 0.01 0.09 0.12 — Plus: after tax impact of total spin-off costs — — 0.16 0.07 Plus: effect of lower rate under the 2017 Tax Act — — — 0.23 Less: after tax gain on sale of vacant Beacon land — (0.05) — — Less: after-tax gain on sale of New York building — — — (0.17) Total adjusted basic earnings per common share $ 0.09 $ 1.25 $ 1.36 $ 1.14 Diluted earnings per share (5) $ 0.08 $ 1.20 $ 1.08 $ 1.01 Plus: after tax impact of restructuring costs 0.01 0.09 0.12 — Plus: after tax impact of total spin-off costs — — 0.16 0.07 Plus: effect of lower rate under the 2017 Tax Act — — — 0.23 Less: after tax gain on sale of vacant Beacon land — (0.05) — — Less: after-tax gain on sale of New York building — — — (0.17) Total adjusted diluted earnings per common share $ 0.09 $ 1.24 $ 1.36 $ 1.14 Net income / Average total assets (ROA) 0.17% 0.65 % 0.55% 0.51 % Plus: after tax impact of restructuring costs 0.02% 0.05 % 0.06% — % Plus: after tax impact of total spin-off costs —% — % 0.08% 0.03 % Plus: effect of lower rate under the 2017 Tax Act —% — % —% 0.11 % Less: after tax gain on sale of vacant Beacon land —% (0.03)% —% 0.00 % Less: after-tax gain on sale of New York building —% — % —% (0.08)% Adjusted net income / Average total assets (Adjusted ROA) 0.19% 0.67 % 0.69% 0.57 % Net income / Average stockholders' equity (ROE) 1.61% 6.43 % 6.29% 5.62 % Plus: after tax impact of restructuring costs 0.13% 0.51 % 0.70% — % Plus: after tax impact of total spin-off costs —% — % 0.96% 0.38 % Plus: effect of lower rate under the 2017 Tax Act —% — % —% 1.25 % Less: after tax gain on sale of vacant Beacon land —% (0.28)% —% 0.00 % Less: after-tax gain on sale of New York building —% — % —% (0.93)% Adjusted net income / stockholders' equity (Adjusted ROE) 1.74% 6.66 % 7.95% 6.32 %

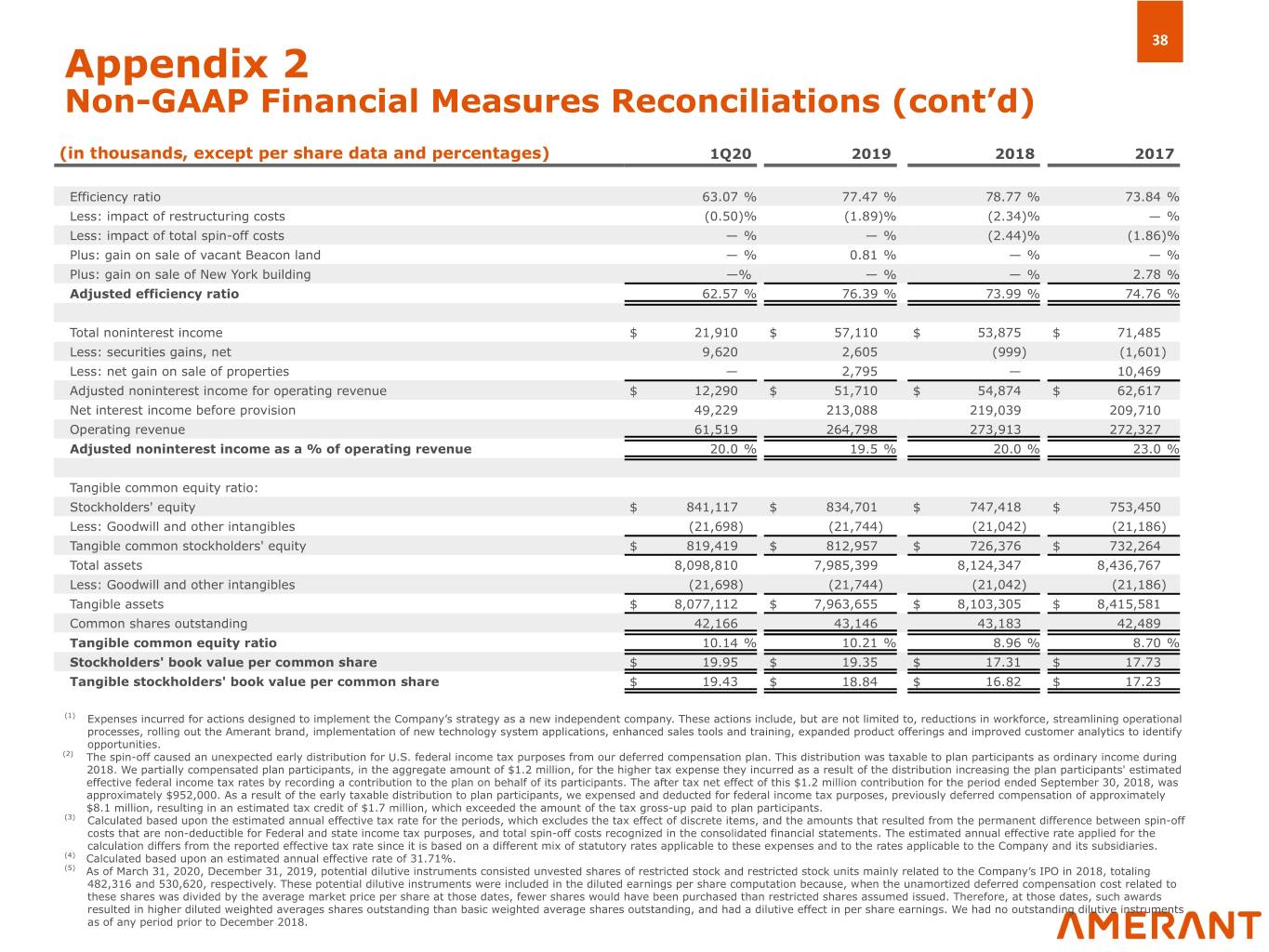

38 Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d) (in thousands, except per share data and percentages) 1Q20 2019 2018 2017 Efficiency ratio 63.07 % 77.47 % 78.77 % 73.84 % Less: impact of restructuring costs (0.50)% (1.89)% (2.34)% — % Less: impact of total spin-off costs — % — % (2.44)% (1.86)% Plus: gain on sale of vacant Beacon land — % 0.81 % — % — % Plus: gain on sale of New York building —% — % — % 2.78 % Adjusted efficiency ratio 62.57 % 76.39 % 73.99 % 74.76 % Total noninterest income $ 21,910 $ 57,110 $ 53,875 $ 71,485 Less: securities gains, net 9,620 2,605 (999) (1,601) Less: net gain on sale of properties — 2,795 — 10,469 Adjusted noninterest income for operating revenue $ 12,290 $ 51,710 $ 54,874 $ 62,617 Net interest income before provision 49,229 213,088 219,039 209,710 Operating revenue 61,519 264,798 273,913 272,327 Adjusted noninterest income as a % of operating revenue 20.0 % 19.5 % 20.0 % 23.0 % Tangible common equity ratio: Stockholders' equity $ 841,117 $ 834,701 $ 747,418 $ 753,450 Less: Goodwill and other intangibles (21,698) (21,744) (21,042) (21,186) Tangible common stockholders' equity $ 819,419 $ 812,957 $ 726,376 $ 732,264 Total assets 8,098,810 7,985,399 8,124,347 8,436,767 Less: Goodwill and other intangibles (21,698) (21,744) (21,042) (21,186) Tangible assets $ 8,077,112 $ 7,963,655 $ 8,103,305 $ 8,415,581 Common shares outstanding 42,166 43,146 43,183 42,489 Tangible common equity ratio 10.14 % 10.21 % 8.96 % 8.70 % Stockholders' book value per common share $ 19.95 $ 19.35 $ 17.31 $ 17.73 Tangible stockholders' book value per common share $ 19.43 $ 18.84 $ 16.82 $ 17.23 (1) Expenses incurred for actions designed to implement the Company’s strategy as a new independent company. These actions include, but are not limited to, reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (2) The spin-off caused an unexpected early distribution for U.S. federal income tax purposes from our deferred compensation plan. This distribution was taxable to plan participants as ordinary income during 2018. We partially compensated plan participants, in the aggregate amount of $1.2 million, for the higher tax expense they incurred as a result of the distribution increasing the plan participants' estimated effective federal income tax rates by recording a contribution to the plan on behalf of its participants. The after tax net effect of this $1.2 million contribution for the period ended September 30, 2018, was approximately $952,000. As a result of the early taxable distribution to plan participants, we expensed and deducted for federal income tax purposes, previously deferred compensation of approximately $8.1 million, resulting in an estimated tax credit of $1.7 million, which exceeded the amount of the tax gross-up paid to plan participants. (3) Calculated based upon the estimated annual effective tax rate for the periods, which excludes the tax effect of discrete items, and the amounts that resulted from the permanent difference between spin-off costs that are non-deductible for Federal and state income tax purposes, and total spin-off costs recognized in the consolidated financial statements. The estimated annual effective rate applied for the calculation differs from the reported effective tax rate since it is based on a different mix of statutory rates applicable to these expenses and to the rates applicable to the Company and its subsidiaries. (4) Calculated based upon an estimated annual effective rate of 31.71%. (5) As of March 31, 2020, December 31, 2019, potential dilutive instruments consisted unvested shares of restricted stock and restricted stock units mainly related to the Company’s IPO in 2018, totaling 482,316 and 530,620, respectively. These potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share at those dates, fewer shares would have been purchased than restricted shares assumed issued. Therefore, at those dates, such awards resulted in higher diluted weighted averages shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings. We had no outstanding dilutive instruments as of any period prior to December 2018.

Thank you