Second Quarter 2020 Financial Review Earnings Call July 24, 2020

Important Notices and Disclaimers 2 Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, including, without limitation, future financial and operating results; costs and revenues; economic conditions generally and in our markets and among our customer base; the challenges and uncertainties caused by the COVID-19 pandemic; the measures we have taken in response to the COVID-19 pandemic; our participation in the PPP Loan program; loan demand; changes in the mix of our earning assets and our deposit and wholesale liabilities; net interest margin; yields on earning assets; interest rates and yield curves (generally and those applicable to our assets and liabilities); credit quality, including loan performance, non-performing assets, provisions for loan losses, charge-offs, other-than-temporary impairments and collateral values; market trends; rebranding and staff realignment costs and expected savings; customer preferences; and anticipated closures of banking centers in Florida and Texas, as well as statements with respect to our objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” and other similar words and expressions of the future. Forward-looking statements, including those as to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2019, in our quarterly report on Form 10-Q for the fiscal quarter ended March 31, 2020 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including as of and for the three and six month periods ended June 30, 2020 and 2019, may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2020, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non- GAAP financial measures, such as “adjusted noninterest income”, “adjusted noninterest expense”, “adjusted net income (loss)”, “operating income”, “adjusted net income (loss) per share (basic and diluted)”, “adjusted return on assets (ROA)”, “adjusted return on equity (ROE)”, and other ratios. This supplemental information is not required by, or are not presented in accordance with, U.S. generally accepted accounting principles (“GAAP”). The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued into 2020, the one-time gain on sale of the vacant Beacon land in the fourth quarter of 2019, the Company’s increases of its allowance for loan losses and net gains on sales of securities in the first and second quarters of 2020. While we believe that these non- GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies.

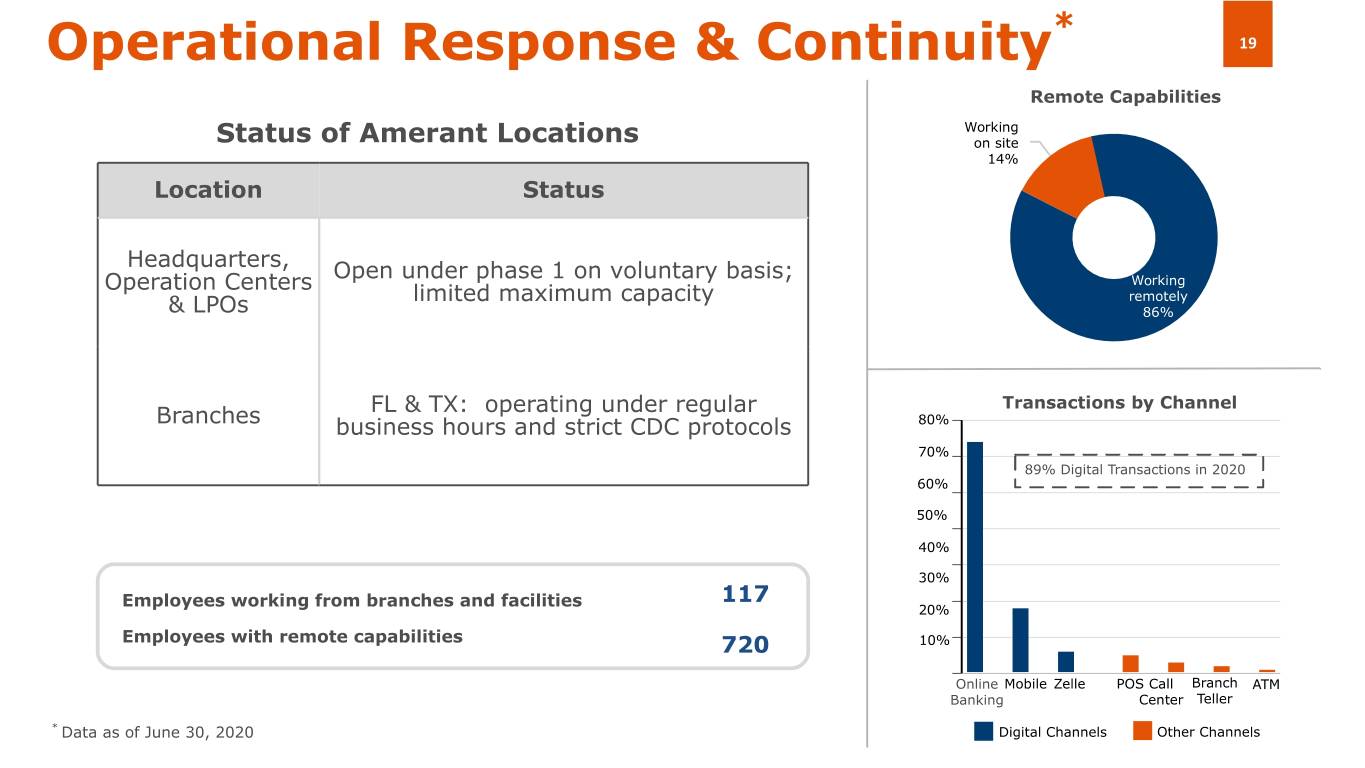

Business Update Related to COVID-19 3 • Amerant’s Business Continuity Plan (“BCP”), activated on March 16, 2020, successfully supports approximately 86% of employees with remote work capabilities Business Continuity • Phased opening approach started June 3rd to re-introduce employees back to the workplace on a voluntary and capped basis 1 based on roles and responsibilities and includes safety protocols per CDC guidelines, placing rotating schedules to minimize risk Plan of contagion. • Banking centers returned to regular business hours, following strict CDC protocols • As of June 30, 2020, loans outstanding, which had been modified, totaled $1,128MM or 19% of total loans. Forbearance period expired on $519.5MM • Modified loans totaling $164.9 million had scheduled payments due. Collected payments due on $136.9 million of these loans. Relief The remaining modified loans totaling $354.6 million have payments due by 7/31/2020. This remaining balance is comprised of: Requests ◦ 64% in Florida, 21% in Texas and 15% in New York 1 Summary ◦ 34% 90-day int. only, 61% 90-day no payments, 4% 180-day int. only ◦ 81% of CRE relief requests tied to hotel and retail loans ◦ 98% of total requests are loans secured with RE collateral ◦ CRE requests as % of their respective portfolio: Hotel 55%, Industrial 20%, Retail 15%, Office 8% and Multifamily 2.2% PPP Requests • Approvals Received: over 2,000 loans totaling $218.6 million Summary • Average loan size: over 90% of these loans were under $350,000 each • Proactive and careful monitoring of credit quality practices, including examining and responding to patterns or trends that may arise across certain industries or regions. Tightening of underwriting standards while continuing to do business, enhancing the Credit Quality monitoring of the entire loan portfolio • Ongoing review of credit exposures by industry and geography to identify loans susceptible to increased credit risk in light of the COVID-19 pandemic Implemented remote-work arrangements across the organization, with 86% of our employees with remote work capabilities 1 As of July 17, 2020 unless specified otherwise

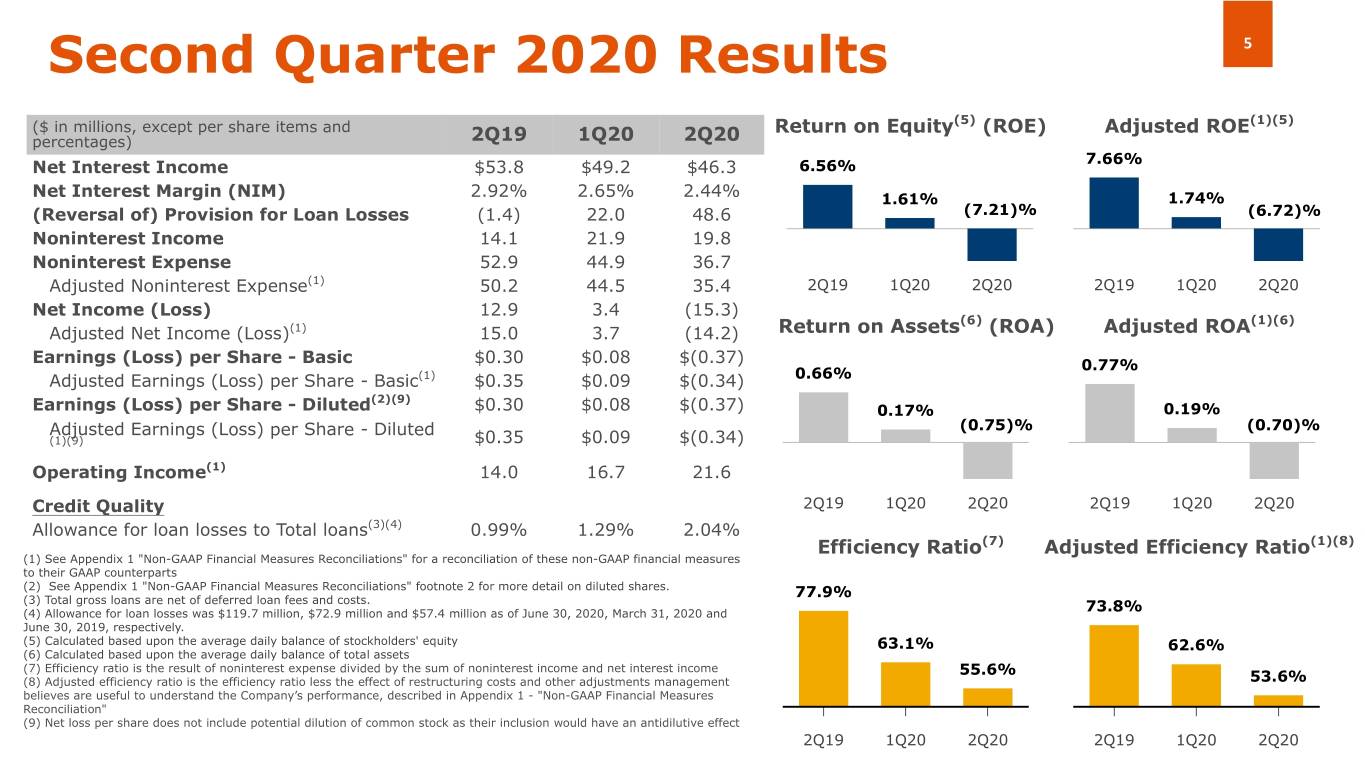

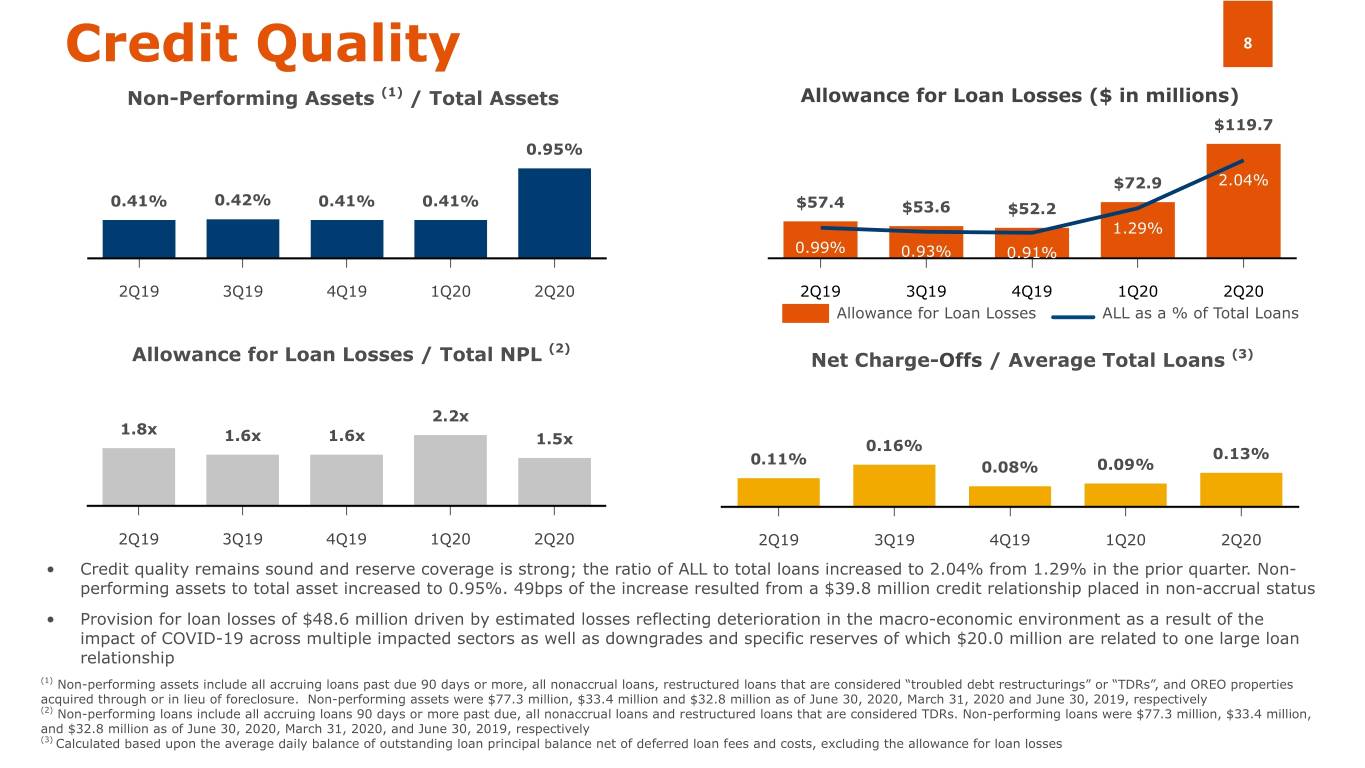

Performance Highlights 2Q20 4 • Net loss of $15.3 million in 2Q20, compared to net income of $3.4 million in 1Q20 and $12.9 million in 2Q19; Operating income(1) was $21.6 million in 2Q20, up 29.7% from $16.7 million in 1Q20, and up 53.8% from $14.0 million in the same period of 2019. • Noninterest income decreased 9.8% over 1Q20 and increased 39.6% compared to same period last year driven Profitability mainly by increased net gain on sale of debt securities as the Company repositioned its portfolio in lower rate environment • Continue active management of investment portfolio and funding sources to mitigate impact of lower rates • Noninterest expense decreased 18.1% and 30.6% over 1Q20 and 2Q19, respectively, largely driven by lower salaries and employee benefits expenses • Total Loans were $5.9 billion, up 3.6% from March 2020, driven by the funding of $218.6 million in SBA's Paycheck Protection Program ("PPP") loans • Total deposits were $6.0 billion, up 3.1% from March 2020, driven by the funding of the PPP loans originated Balance Sheet during 2Q20 into small business customer accounts, which have not been fully utilized, totaling $132.7 million as of June 30, 2020 • Total cash and cash equivalents were $217.3 million as of June 30, 2020 with an additional $1.4 billion available under the FHLB credit line • Provision for loan losses of $48.6 million to account for estimated portfolio deterioration due to COVID-19 as well as downgrades and specific reserves, including $20.0 million for the Miami based coffee trader; will continue to reassess provisions as conditions evolve Credit Quality • Higher ALL coverage this quarter at 2.04%, up from 1.29% in 1Q20 • The ratio of allowance to non-performing loans(2) decreased to 1.5x in second quarter 2020, down from 2.2x in 1Q20 (1) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP counterparts (2) Non-performing loans include all accruing loans 90 days or more past due, all nonaccrual loans and restructured loans that are considered TDRs. Non-performing loans were $77.3 million, as of June 30, 2020, and includes $39.8 million for the Miami based coffee trader

Second Quarter 2020 Results 5 ($ in millions, except per share items and Return on Equity(5) (ROE) Adjusted ROE(1)(5) percentages) 2Q19 1Q20 2Q20 7.66% Net Interest Income $53.8 $49.2 $46.3 6.56% Net Interest Margin (NIM) 2.92% 2.65% 2.44% 1.61% 1.74% (Reversal of) Provision for Loan Losses (1.4) 22.0 48.6 (7.21)% (6.72)% Noninterest Income 14.1 21.9 19.8 Noninterest Expense 52.9 44.9 36.7 Adjusted Noninterest Expense(1) 50.2 44.5 35.4 2Q19 1Q20 2Q20 2Q19 1Q20 2Q20 Net Income (Loss) 12.9 3.4 (15.3) (6) (1)(6) Adjusted Net Income (Loss)(1) 15.0 3.7 (14.2) Return on Assets (ROA) Adjusted ROA Earnings (Loss) per Share - Basic $0.30 $0.08 $(0.37) 0.77% Adjusted Earnings (Loss) per Share - Basic(1) $0.35 $0.09 $(0.34) 0.66% (2)(9) Earnings (Loss) per Share - Diluted $0.30 $0.08 $(0.37) 0.17% 0.19% Adjusted Earnings (Loss) per Share - Diluted (0.75)% (0.70)% (1)(9) $0.35 $0.09 $(0.34) Operating Income(1) 14.0 16.7 21.6 Credit Quality 2Q19 1Q20 2Q20 2Q19 1Q20 2Q20 Allowance for loan losses to Total loans(3)(4) 0.99% 1.29% 2.04% Efficiency Ratio(7) Adjusted Efficiency Ratio(1)(8) (1) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP counterparts (2) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" footnote 2 for more detail on diluted shares. 77.9% (3) Total gross loans are net of deferred loan fees and costs. (4) Allowance for loan losses was $119.7 million, $72.9 million and $57.4 million as of June 30, 2020, March 31, 2020 and 73.8% June 30, 2019, respectively. (5) Calculated based upon the average daily balance of stockholders' equity 63.1% 62.6% (6) Calculated based upon the average daily balance of total assets (7) Efficiency ratio is the result of noninterest expense divided by the sum of noninterest income and net interest income 55.6% (8) Adjusted efficiency ratio is the efficiency ratio less the effect of restructuring costs and other adjustments management 53.6% believes are useful to understand the Company’s performance, described in Appendix 1 - "Non-GAAP Financial Measures Reconciliation" (9) Net loss per share does not include potential dilution of common stock as their inclusion would have an antidilutive effect 2Q19 1Q20 2Q20 2Q19 1Q20 2Q20

Investment Portfolio 6 Investment Securities Balances and Yields (1) Highlights ($ in millions) 1,750 • Effective duration of 2.6 years as expected prepayment $24.2 speeds stabilized in the mortgage securities portfolio $70.3 $24.4 $23.8 $65.6 • Floating portion of the portfolio at 16.9% of the total 1,500 $81.2 portfolio $1,601.3 $1,519.8 $1,477.4 • Continued purchasing higher-yielding corporate debt, 1,250 primarily in the subordinated FI sector, while maintaining 2Q19 1Q20 2Q20 portfolio duration Available for Sale (AFS) Held to Maturity (HTM) Marketable Equity Securities (2) Investments Securities Fixed vs. Floating Available for Sale Securities by Type June 30, 2020 U.S. Gov't agency Jun. 2019 Jun. 2020 15.3% 16.9% 17.9% Municipals 4.4% 3.1 yrs 2.6 yrs U.S. Gov't Effective Effective sponsored Duration Duration enterprises 82.1% 83.1% 54.7% Corporate debt 25.4% Fixed rate Floating rate US treasury 0.2% (1) Excludes Federal Reserve Bank and FHLB stock (2) The Company adopted ASU 2016-01 on December 31, 2019. Marketable Equity Securities shown for prior quarters only for comparative purposes

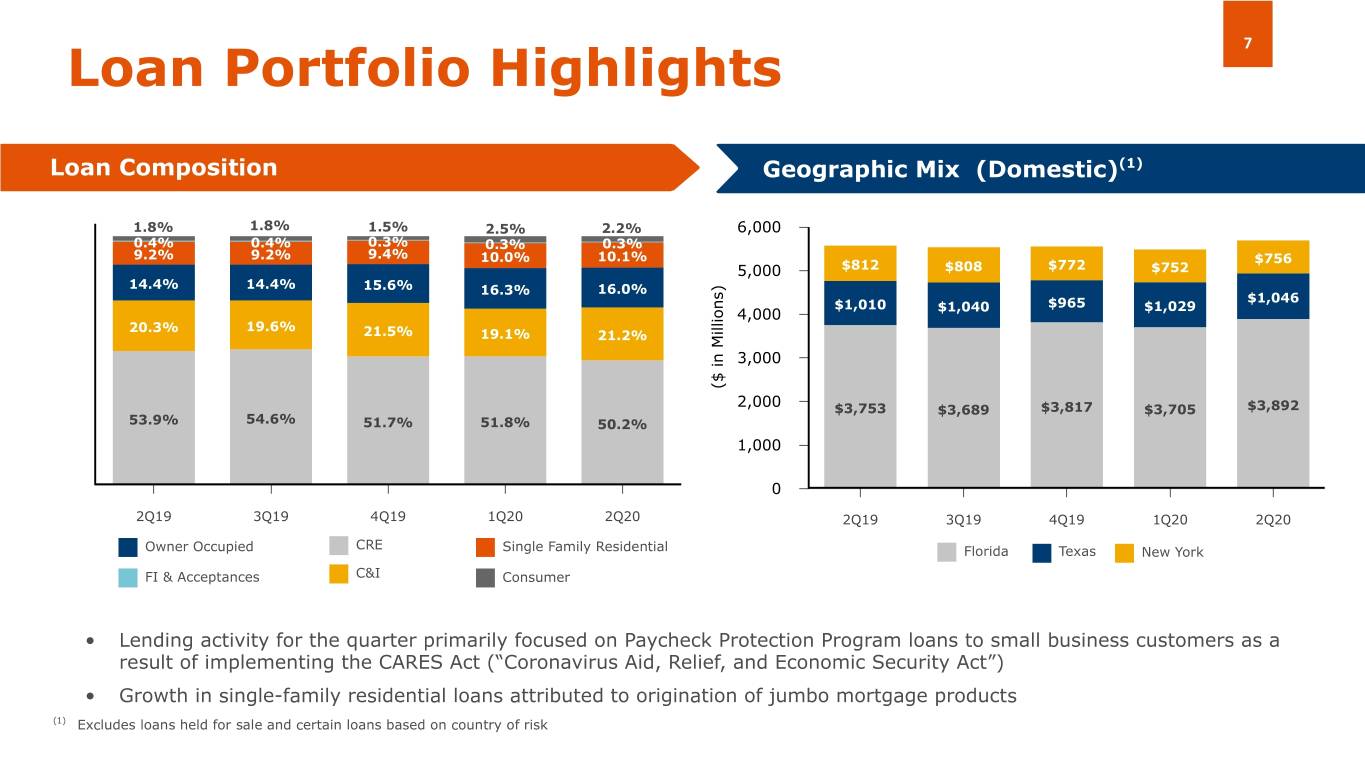

7 Loan Portfolio Highlights Loan Composition Geographic Mix (Domestic) (Domestic)(1) 1.8% 1.8% 1.5% 2.5% 2.2% 6,000 0.4% 0.4% 0.3% 0.3% 0.3% 9.2% 9.2% 9.4% 10.0% 10.1% $756 5,000 $812 $808 $772 $752 14.4% 14.4% 15.6% 16.3% 16.0% $1,046 $1,010 $965 $1,029 4,000 $1,040 20.3% 19.6% 21.5% 19.1% 21.2% 3,000 ($ in Millions) 2,000 $3,753 $3,689 $3,817 $3,705 $3,892 53.9% 54.6% 51.7% 51.8% 50.2% 1,000 0 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 CRE Owner Occupied Single Family Residential Florida Texas New York FI & Acceptances C&I Consumer • Lending activity for the quarter primarily focused on Paycheck Protection Program loans to small business customers as a result of implementing the CARES Act (“Coronavirus Aid, Relief, and Economic Security Act”) • Growth in single-family residential loans attributed to origination of jumbo mortgage products (1) Excludes loans held for sale and certain loans based on country of risk

Credit Quality 8 Non-Performing Assets (1) / Total Assets Allowance for Loan Losses ($ in millions) $119.7 0.95% $72.9 2.04% 0.41% 0.42% 0.41% 0.41% $57.4 $53.6 $52.2 1.29% 0.99% 0.93% 0.91% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 Allowance for Loan Losses ALL as a % of Total Loans (2) Allowance for Loan Losses / Total NPL Net Charge-Offs / Average Total Loans (3) 2.2x 1.8x 1.6x 1.6x 1.5x 0.16% 0.11% 0.13% 0.08% 0.09% 2Q19 3Q19 4Q19 1Q20 2Q20 2Q19 3Q19 4Q19 1Q20 2Q20 • Credit quality remains sound and reserve coverage is strong; the ratio of ALL to total loans increased to 2.04% from 1.29% in the prior quarter. Non- performing assets to total asset increased to 0.95%. 49bps of the increase resulted from a $39.8 million credit relationship placed in non-accrual status • Provision for loan losses of $48.6 million driven by estimated losses reflecting deterioration in the macro-economic environment as a result of the impact of COVID-19 across multiple impacted sectors as well as downgrades and specific reserves of which $20.0 million are related to one large loan relationship (1) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of foreclosure. Non-performing assets were $77.3 million, $33.4 million and $32.8 million as of June 30, 2020, March 31, 2020 and June 30, 2019, respectively (2) Non-performing loans include all accruing loans 90 days or more past due, all nonaccrual loans and restructured loans that are considered TDRs. Non-performing loans were $77.3 million, $33.4 million, and $32.8 million as of June 30, 2020, March 31, 2020, and June 30, 2019, respectively (3) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, excluding the allowance for loan losses

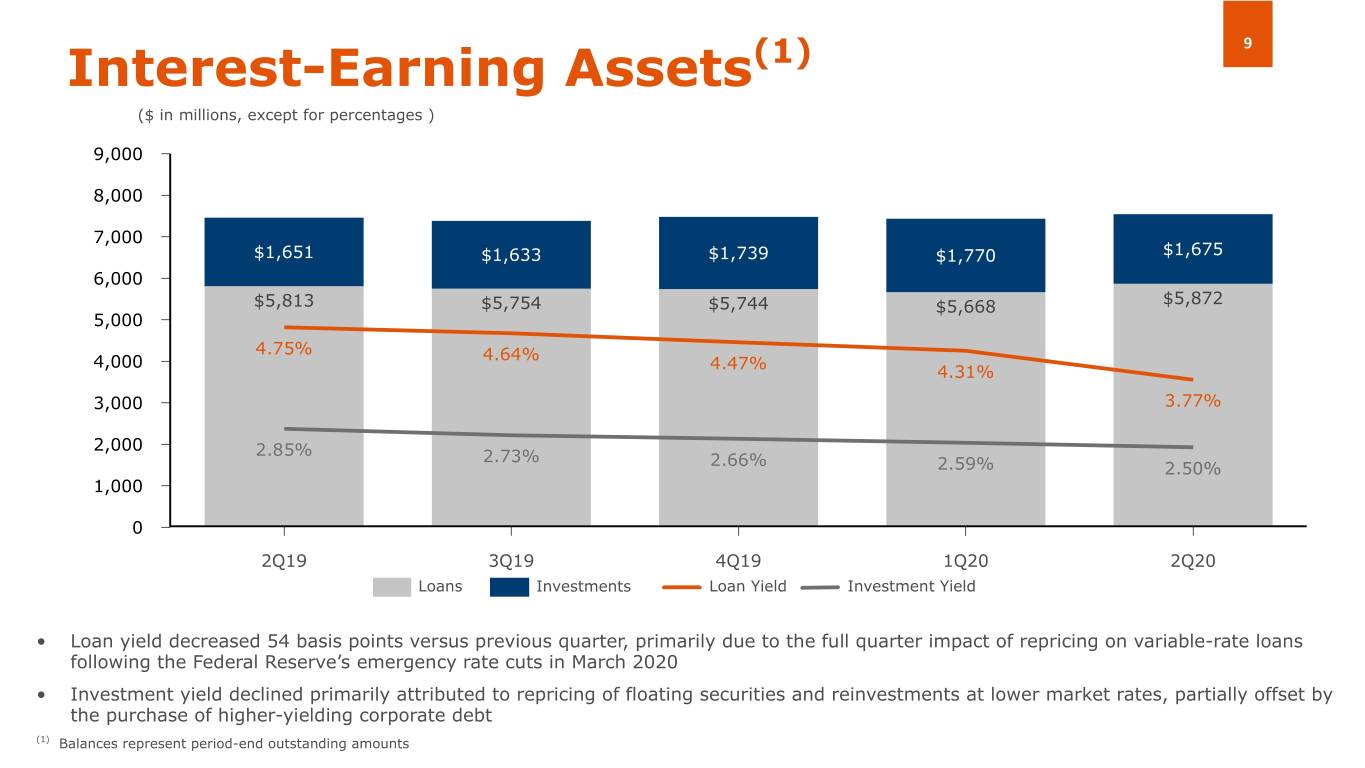

9 Interest-Earning Assets(1) ($ in millions, except for percentages ) 9,000 8,000 7,000 $1,651 $1,633 $1,739 $1,770 $1,675 6,000 $5,813 $5,754 $5,744 $5,668 $5,872 5,000 4.75% 4.64% 4,000 4.47% 4.31% 3,000 3.77% 2,000 2.85% 2.73% 2.66% 2.59% 2.50% 1,000 0 2Q19 3Q19 4Q19 1Q20 2Q20 Loans Investments Loan Yield Investment Yield • Loan yield decreased 54 basis points versus previous quarter, primarily due to the full quarter impact of repricing on variable-rate loans following the Federal Reserve’s emergency rate cuts in March 2020 • Investment yield declined primarily attributed to repricing of floating securities and reinvestments at lower market rates, partially offset by the purchase of higher-yielding corporate debt (1) Balances represent period-end outstanding amounts

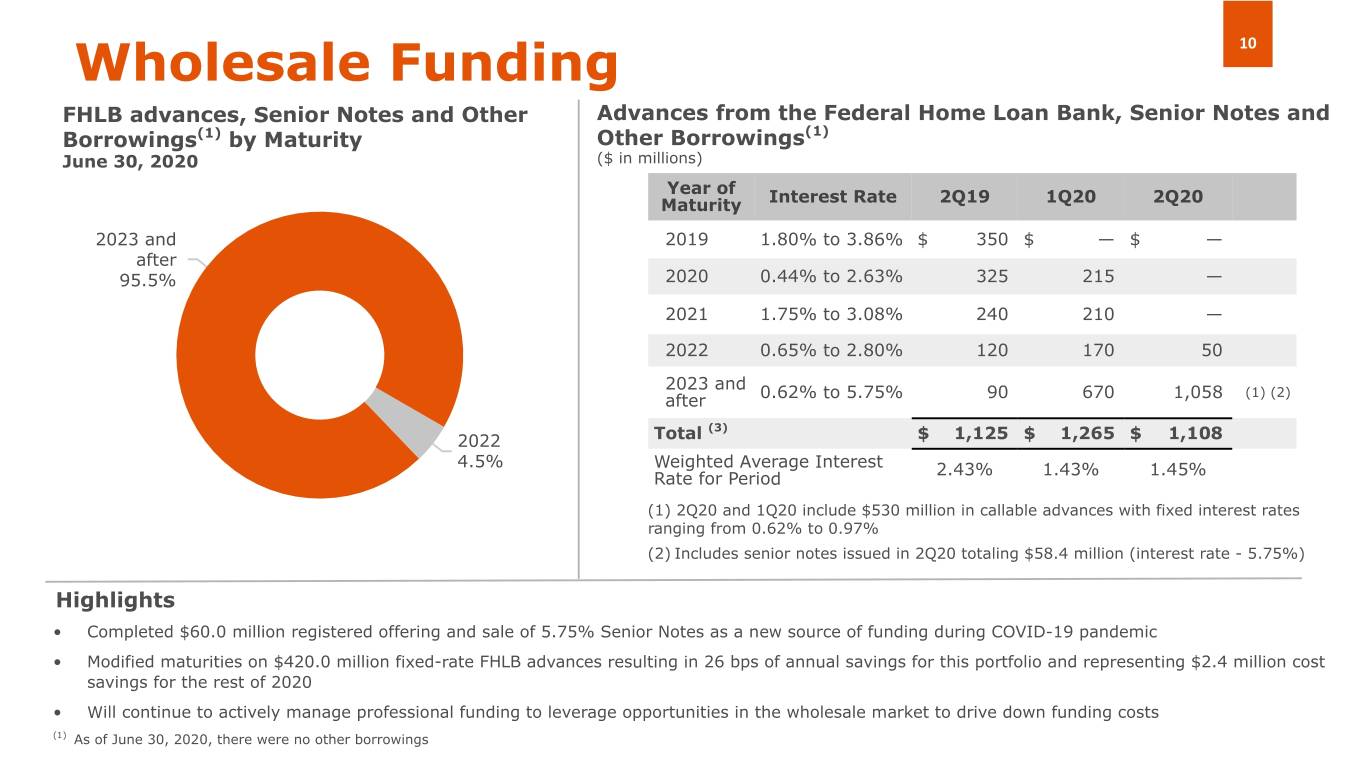

Wholesale Funding 10 FHLB advances, Senior Notes and Other Advances from the Federal Home Loan Bank, Senior Notes and Borrowings(1) by Maturity Other Borrowings(1) June 30, 2020 ($ in millions) Year of Maturity Interest Rate 2Q19 1Q20 2Q20 2023 and 2019 1.80% to 3.86% $ 350 $ — $ — after 95.5% 2020 0.44% to 2.63% 325 215 — 2021 1.75% to 3.08% 240 210 — 2022 0.65% to 2.80% 120 170 50 2023 and after 0.62% to 5.75% 90 670 1,058 (1) (2) (3) 2022 Total $ 1,125 $ 1,265 $ 1,108 4.5% Weighted Average Interest 2.43% 1.43% 1.45% Rate for Period (1) 2Q20 and 1Q20 include $530 million in callable advances with fixed interest rates ranging from 0.62% to 0.97% (2) Includes senior notes issued in 2Q20 totaling $58.4 million (interest rate - 5.75%) Highlights • Completed $60.0 million registered offering and sale of 5.75% Senior Notes as a new source of funding during COVID-19 pandemic • Modified maturities on $420.0 million fixed-rate FHLB advances resulting in 26 bps of annual savings for this portfolio and representing $2.4 million cost savings for the rest of 2020 • Will continue to actively manage professional funding to leverage opportunities in the wholesale market to drive down funding costs (1) As of June 30, 2020, there were no other borrowings

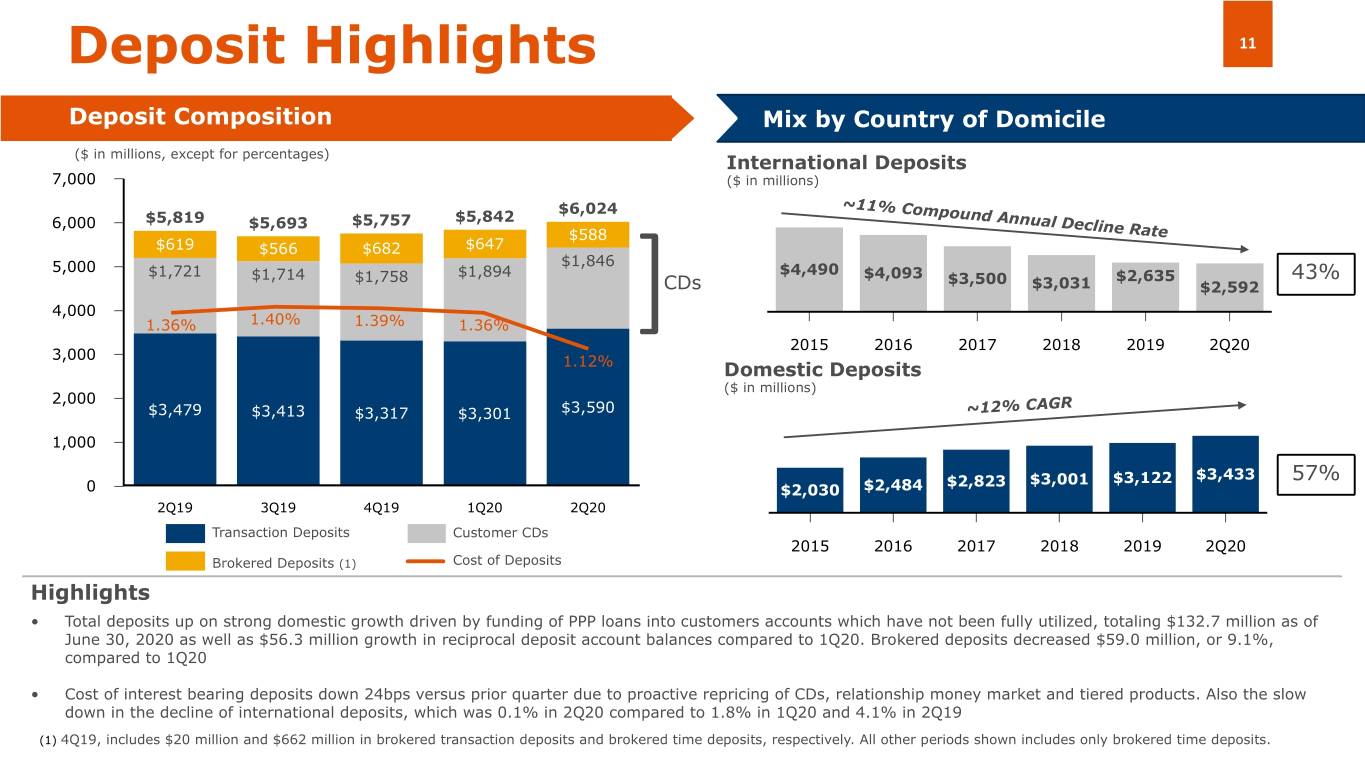

Deposit Highlights 11 Deposit Composition Mix by Country of Domicile ($ in millions, except for percentages) International Deposits 7,000 ($ in millions) $6,024 ~11% Compound Annual Decline Rate 6,000 $5,819 $5,693 $5,757 $5,842 $588 $619 $566 $682 $647 $1,846 5,000 $4,490 $1,721 $1,714 $1,758 $1,894 $4,093 $3,500 $2,635 43% CDs $3,031 $2,592 4,000 1.36% 1.40% 1.39% 1.36% ] 2015 2016 2017 2018 2019 2Q20 3,000 1.12% Domestic Deposits ($ in millions) 2,000 CAGR $3,479 $3,413 $3,317 $3,301 $3,590 ~12% 1,000 $2,823 $3,001 $3,122 $3,433 57% 0 $2,030 $2,484 2Q19 3Q19 4Q19 1Q20 2Q20 Transaction Deposits Customer CDs 2015 2016 2017 2018 2019 2Q20 Brokered Deposits (1) Cost of Deposits Highlights • Total deposits up on strong domestic growth driven by funding of PPP loans into customers accounts which have not been fully utilized, totaling $132.7 million as of June 30, 2020 as well as $56.3 million growth in reciprocal deposit account balances compared to 1Q20. Brokered deposits decreased $59.0 million, or 9.1%, compared to 1Q20 • Cost of interest bearing deposits down 24bps versus prior quarter due to proactive repricing of CDs, relationship money market and tiered products. Also the slow down in the decline of international deposits, which was 0.1% in 2Q20 compared to 1.8% in 1Q20 and 4.1% in 2Q19 (1) 4Q19, includes $20 million and $662 million in brokered transaction deposits and brokered time deposits, respectively. All other periods shown includes only brokered time deposits.

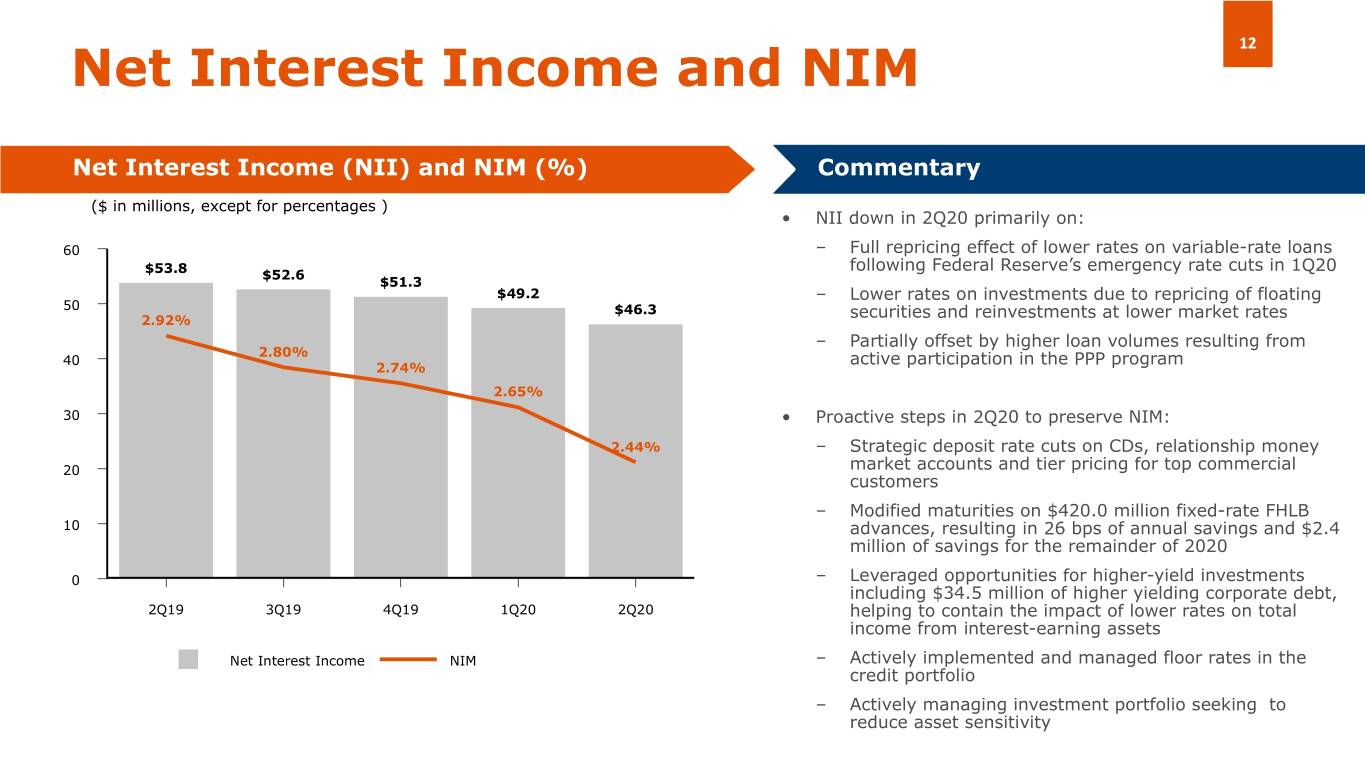

12 Net Interest Income and NIM Net Interest Income (NII) and NIM (%) Commentary ($ in millions, except for percentages ) • NII down in 2Q20 primarily on: 60 – Full repricing effect of lower rates on variable-rate loans following Federal Reserve’s emergency rate cuts in 1Q20 $53.8 $52.6 $51.3 $49.2 – Lower rates on investments due to repricing of floating 50 $46.3 2.92% securities and reinvestments at lower market rates – Partially offset by higher loan volumes resulting from 2.80% 40 active participation in the PPP program 2.74% 2.65% 30 • Proactive steps in 2Q20 to preserve NIM: 2.44% – Strategic deposit rate cuts on CDs, relationship money 20 market accounts and tier pricing for top commercial customers – Modified maturities on $420.0 million fixed-rate FHLB 10 advances, resulting in 26 bps of annual savings and $2.4 million of savings for the remainder of 2020 0 – Leveraged opportunities for higher-yield investments including $34.5 million of higher yielding corporate debt, 2Q19 3Q19 4Q19 1Q20 2Q20 helping to contain the impact of lower rates on total income from interest-earning assets Net Interest Income NIM – Actively implemented and managed floor rates in the credit portfolio – Actively managing investment portfolio seeking to reduce asset sensitivity

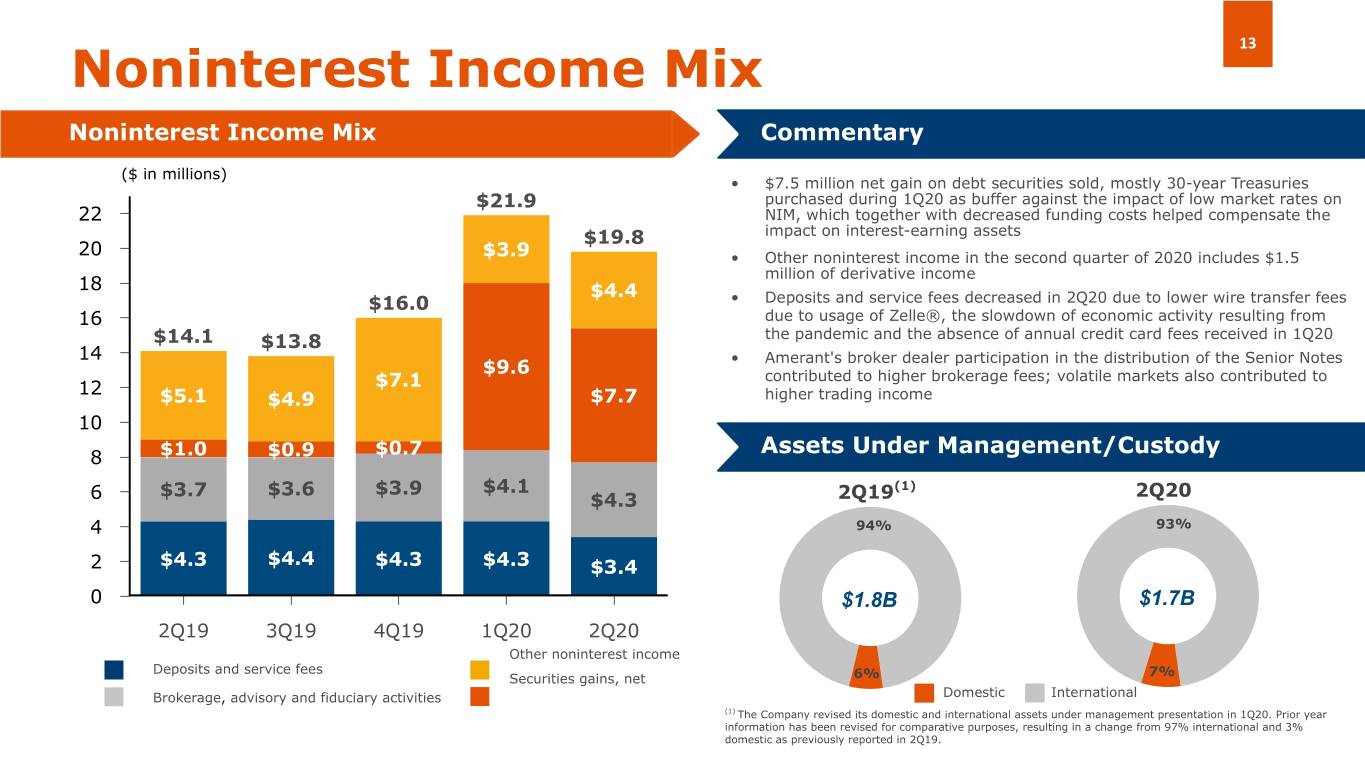

13 Noninterest Income Mix Noninterest Income Mix Commentary ($ in millions) • $7.5 million net gain on debt securities sold, mostly 30-year Treasuries $21.9 purchased during 1Q20 as buffer against the impact of low market rates on 22 NIM, which together with decreased funding costs helped compensate the $19.8 impact on interest-earning assets 20 $3.9 • Other noninterest income in the second quarter of 2020 includes $1.5 million of derivative income 18 $4.4 $16.0 • Deposits and service fees decreased in 2Q20 due to lower wire transfer fees 16 due to usage of Zelle®, the slowdown of economic activity resulting from $14.1 $13.8 the pandemic and the absence of annual credit card fees received in 1Q20 14 • Amerant's broker dealer participation in the distribution of the Senior Notes $9.6 contributed to higher brokerage fees; volatile markets also contributed to 12 $7.1 $5.1 $4.9 $7.7 higher trading income 10 $0.7 Assets Under Management/Custody 8 $1.0 $0.9 $3.7 $3.6 $3.9 $4.1 (1) 2Q20 6 $4.3 2Q19 4 94% 93% 2 $4.3 $4.4 $4.3 $4.3 $3.4 0 $1.8B $1.7B 2Q19 3Q19 4Q19 1Q20 2Q20 Other noninterest income Deposits and service fees 7% Securities gains, net 6% Brokerage, advisory and fiduciary activities Domestic International (1) The Company revised its domestic and international assets under management presentation in 1Q20. Prior year information has been revised for comparative purposes, resulting in a change from 97% international and 3% domestic as previously reported in 2Q19.

Noninterest Expense 14 Noninterest Expense Mix Commentary ($ in millions, except for FTEs) • $8.1 million decline in noninterest expense in 2Q20 mostly reflects a deferral of expenses related to the origination of loans under the PPP program including: 60 – $7.8 million in salaries and benefits expense $52.9 – $0.7 million in other operating expenses $52.8 $51.7 50 • Other operating expense in 2Q20 includes $1.0 million of $44.9 restructuring expenses in connection with digital transformation $18.8 $18.9 $15.7 40 $36.7 $15.6 Noninterest Expenses / Average Total Assets(1) $36.0 $34.1 $33.9 ($ in millions, except for percentages) 30 $15.1 $29.3 10,000 $7,867 $7,917 $7,906 $7,951 $8,148 8,000 20 $21.6 2.70% 6,000 2.64% 2.60% 839 838 2.27% 829 825 825 4,000 1.74% 1.70% 1.81% 1.81% 1.48% 1.06% 10 2,000 0.96% 0.95% 0.79% 0.79% 0.75% 0 0 2Q19 3Q19 4Q19 1Q20 2Q20 Average Total Assets Salaries and employee benefits 2Q19 3Q19 4Q19 1Q20 2Q20 Other operating expenses Total Noninterest Expense Salaries and employee benefits Other operating expenses FTE (1) Calculated based upon the average daily balance of total assets. Noninterest expenses for the three months presented have been annualized.

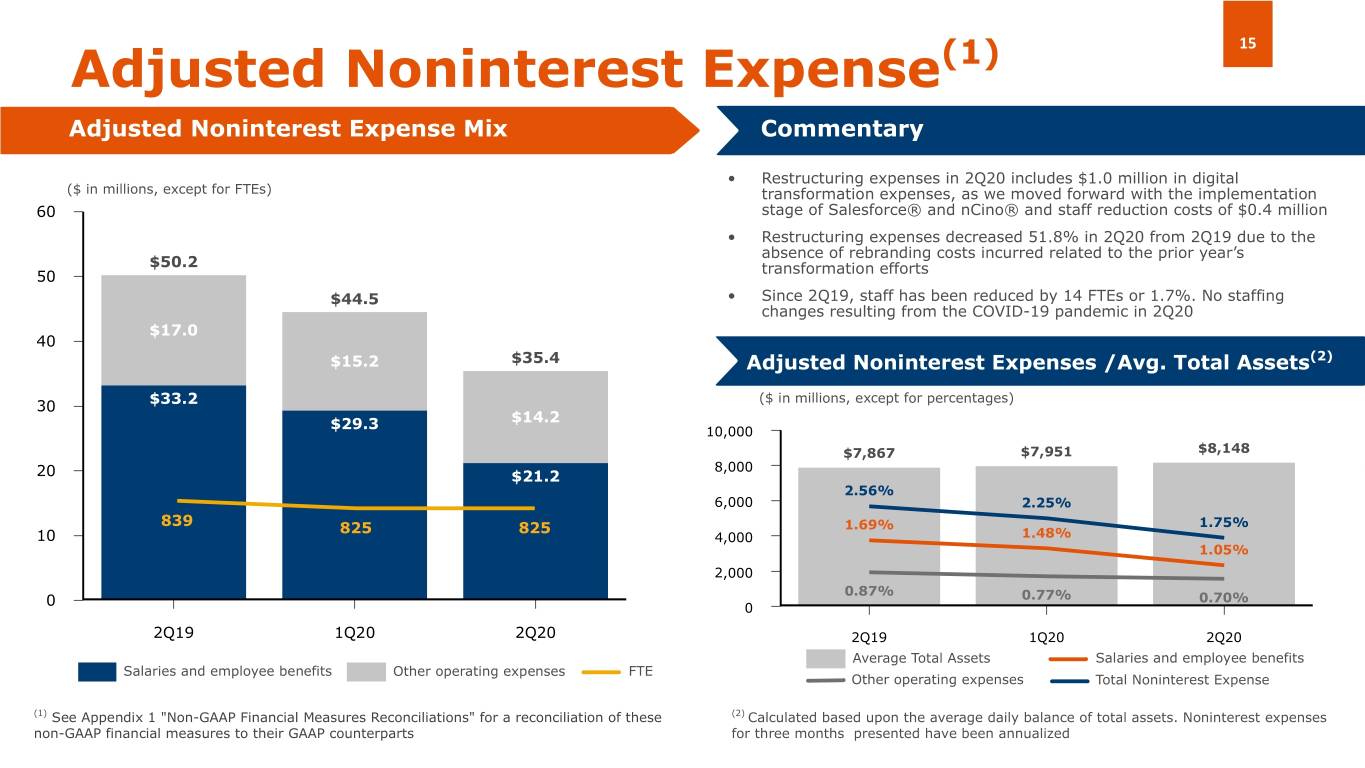

15 Adjusted Noninterest Expense(1) Adjusted Noninterest Expense Mix Commentary • Restructuring expenses in 2Q20 includes $1.0 million in digital ($ in millions, except for FTEs) transformation expenses, as we moved forward with the implementation 60 stage of Salesforce® and nCino® and staff reduction costs of $0.4 million • Restructuring expenses decreased 51.8% in 2Q20 from 2Q19 due to the absence of rebranding costs incurred related to the prior year’s $50.2 transformation efforts 50 $44.5 • Since 2Q19, staff has been reduced by 14 FTEs or 1.7%. No staffing changes resulting from the COVID-19 pandemic in 2Q20 $17.0 40 $15.2 $35.4 Adjusted Noninterest Expenses /Avg. Total Assets(2) ($ in millions, except for percentages) 30 $33.2 $29.3 $14.2 10,000 $7,867 $7,951 $8,148 8,000 20 $21.2 2.56% 6,000 2.25% 839 825 825 1.69% 1.75% 10 4,000 1.48% 1.05% 2,000 0.87% 0.77% 0.70% 0 0 2Q19 1Q20 2Q20 2Q19 1Q20 2Q20 Average Total Assets Salaries and employee benefits Salaries and employee benefits Other operating expenses FTE Other operating expenses Total Noninterest Expense (1) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" for a reconciliation of these (2) Calculated based upon the average daily balance of total assets. Noninterest expenses non-GAAP financial measures to their GAAP counterparts for three months presented have been annualized

Interest Rate Sensitivity 16 Commentary Loan Portfolio & Repricing Detail • The Company continues to be asset sensitive as over half of (As of June 30, 2020) loans have floating rate structures or mature within a year By Rate Type By Interest Type • Actively implementing floor rates in the loan portfolio and managing investment portfolio seeking to reduce asset sensitivity in low interest rate environment and protect the NIM Fixed Swap • Leveraging opportunities for higher-yield securities 4% 49% Fixed Prime 51% 8% Impact on NII from Interest Rate Change(1) (As of June 30, 2020) 4.1% 2.5% Adjustable Libor 51% 35% UST 190 0.0% 2% By Repricing Term -1.9% -2.5% 1-3 years 12% 4-5 170 $185 years ($ in Millions) $182 12% $175 $178 $173 5+ years 24% 150 -50 bps -25 bps BASE +25 bps +50 bps Net Interest Income Change from base <1 year (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat 52% interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve

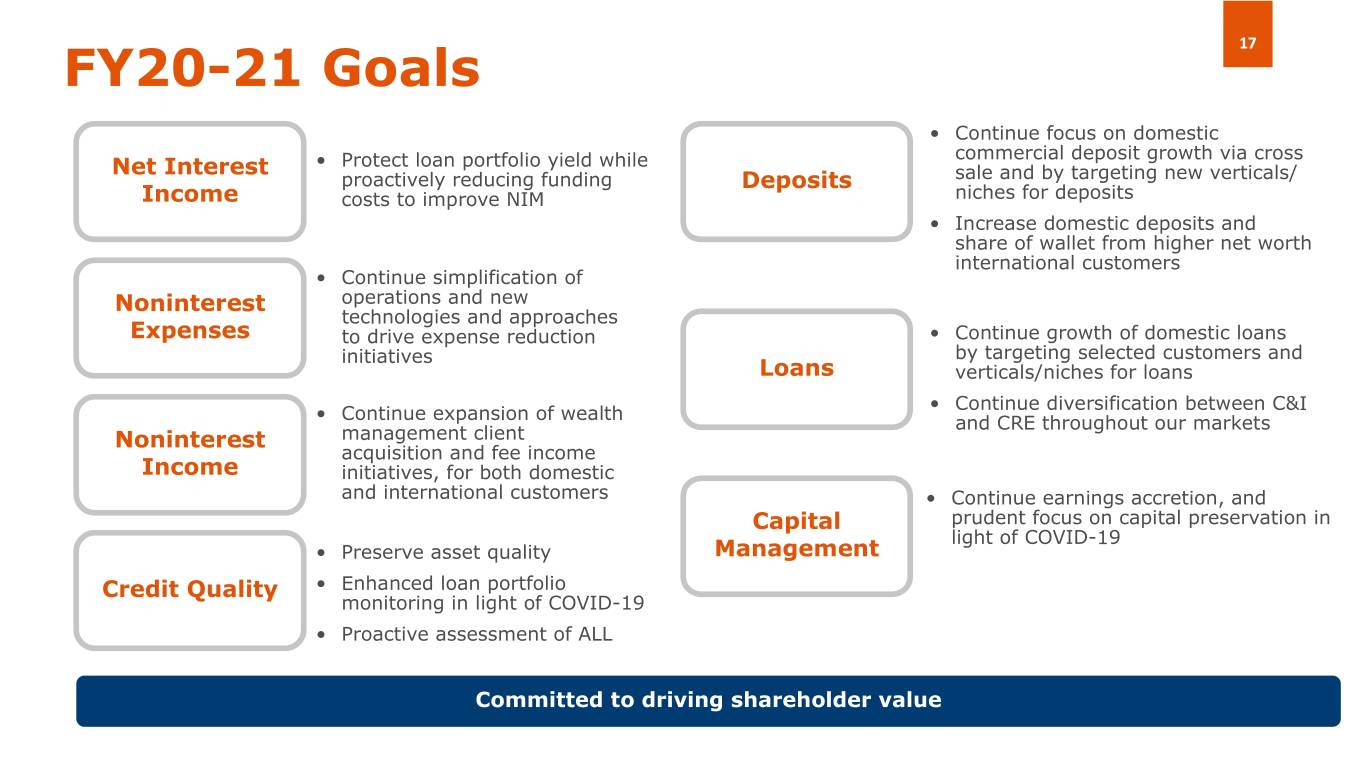

17 FY20-21 Goals • Continue focus on domestic commercial deposit growth via cross Net Interest • Protect loan portfolio yield while proactively reducing funding Deposits sale and by targeting new verticals/ Income costs to improve NIM niches for deposits • Increase domestic deposits and share of wallet from higher net worth international customers • Continue simplification of Noninterest operations and new technologies and approaches Expenses to drive expense reduction • Continue growth of domestic loans initiatives by targeting selected customers and Loans verticals/niches for loans • Continue diversification between C&I • Continue expansion of wealth and CRE throughout our markets Noninterest management client acquisition and fee income Income initiatives, for both domestic and international customers • Continue earnings accretion, and Capital prudent focus on capital preservation in light of COVID-19 • Preserve asset quality Management Credit Quality • Enhanced loan portfolio monitoring in light of COVID-19 • Proactive assessment of ALL Committed to driving shareholder value

Supplemental Loan Portfolio Information

* Operational Response & Continuity 19 Remote Capabilities Working Status of Amerant Locations on site 14% Location Status Headquarters, Open under phase 1 on voluntary basis; Operation Centers Working limited maximum capacity remotely & LPOs 86% FL & TX: operating under regular Transactions by Channel Branches business hours and strict CDC protocols 80% 70% 89% Digital Transactions in 2020 60% 50% 40% 30% Employees working from branches and facilities 117 20% Employees with remote capabilities 720 10% Online Mobile Zelle POS Call Branch ATM Banking Center Teller * Data as of June 30, 2020 Digital Channels Other Channels

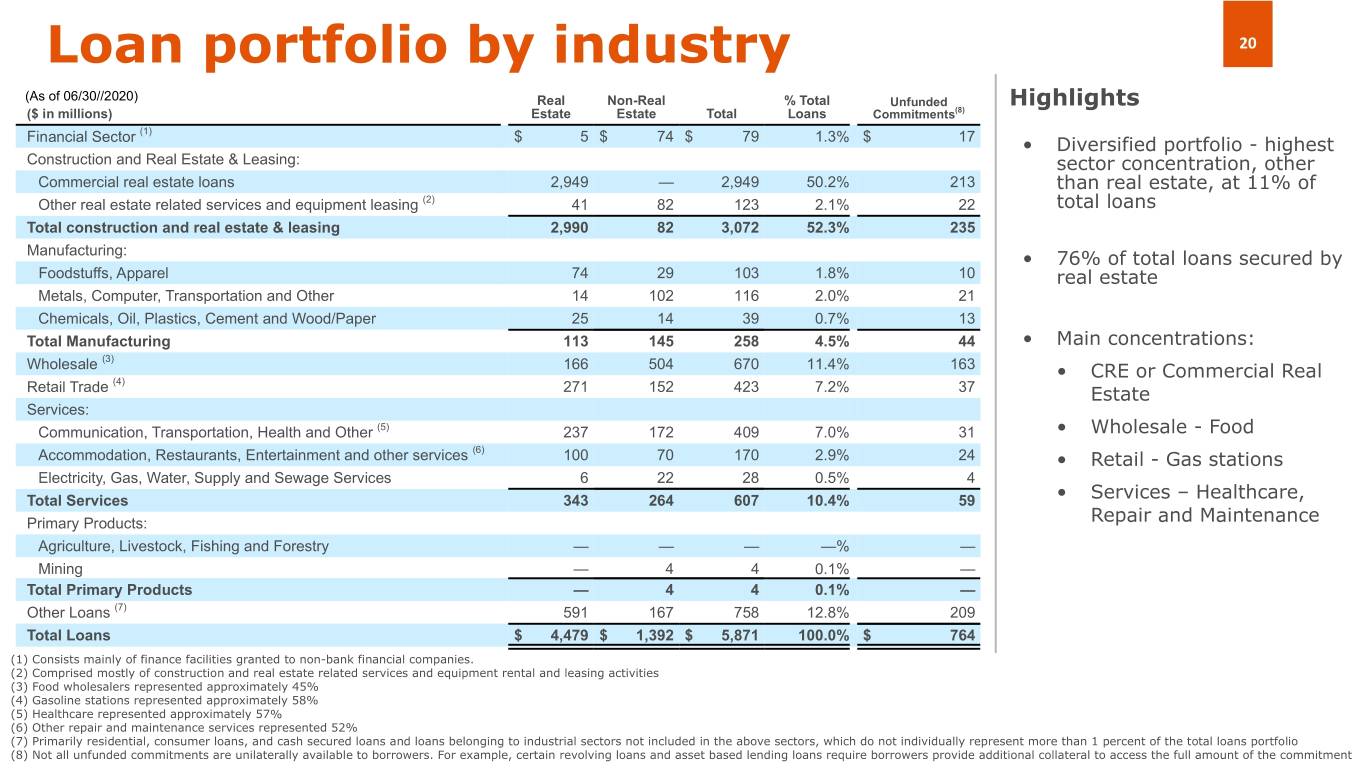

Loan portfolio by industry 20 (As of 06/30//2020) Real Non-Real % Total Unfunded Highlights ($ in millions) Estate Estate Total Loans Commitments(8) (1) Financial Sector $ 5 $ 74 $ 79 1.3% $ 17 • Diversified portfolio - highest Construction and Real Estate & Leasing: sector concentration, other Commercial real estate loans 2,949 — 2,949 50.2% 213 than real estate, at 11% of Other real estate related services and equipment leasing (2) 41 82 123 2.1% 22 total loans Total construction and real estate & leasing 2,990 82 3,072 52.3% 235 Manufacturing: • 76% of total loans secured by Foodstuffs, Apparel 74 29 103 1.8% 10 real estate Metals, Computer, Transportation and Other 14 102 116 2.0% 21 Chemicals, Oil, Plastics, Cement and Wood/Paper 25 14 39 0.7% 13 Total Manufacturing 113 145 258 4.5% 44 • Main concentrations: (3) Wholesale 166 504 670 11.4% 163 • CRE or Commercial Real (4) Retail Trade 271 152 423 7.2% 37 Estate Services: Communication, Transportation, Health and Other (5) 237 172 409 7.0% 31 • Wholesale - Food (6) Accommodation, Restaurants, Entertainment and other services 100 70 170 2.9% 24 • Retail - Gas stations Electricity, Gas, Water, Supply and Sewage Services 6 22 28 0.5% 4 Total Services 343 264 607 10.4% 59 • Services – Healthcare, Primary Products: Repair and Maintenance Agriculture, Livestock, Fishing and Forestry — — — —% — Mining — 4 4 0.1% — Total Primary Products — 4 4 0.1% — Other Loans (7) 591 167 758 12.8% 209 Total Loans $ 4,479 $ 1,392 $ 5,871 100.0% $ 764 (1) Consists mainly of finance facilities granted to non-bank financial companies. (2) Comprised mostly of construction and real estate related services and equipment rental and leasing activities (3) Food wholesalers represented approximately 45% (4) Gasoline stations represented approximately 58% (5) Healthcare represented approximately 57% (6) Other repair and maintenance services represented 52% (7) Primarily residential, consumer loans, and cash secured loans and loans belonging to industrial sectors not included in the above sectors, which do not individually represent more than 1 percent of the total loans portfolio (8) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers provide additional collateral to access the full amount of the commitment

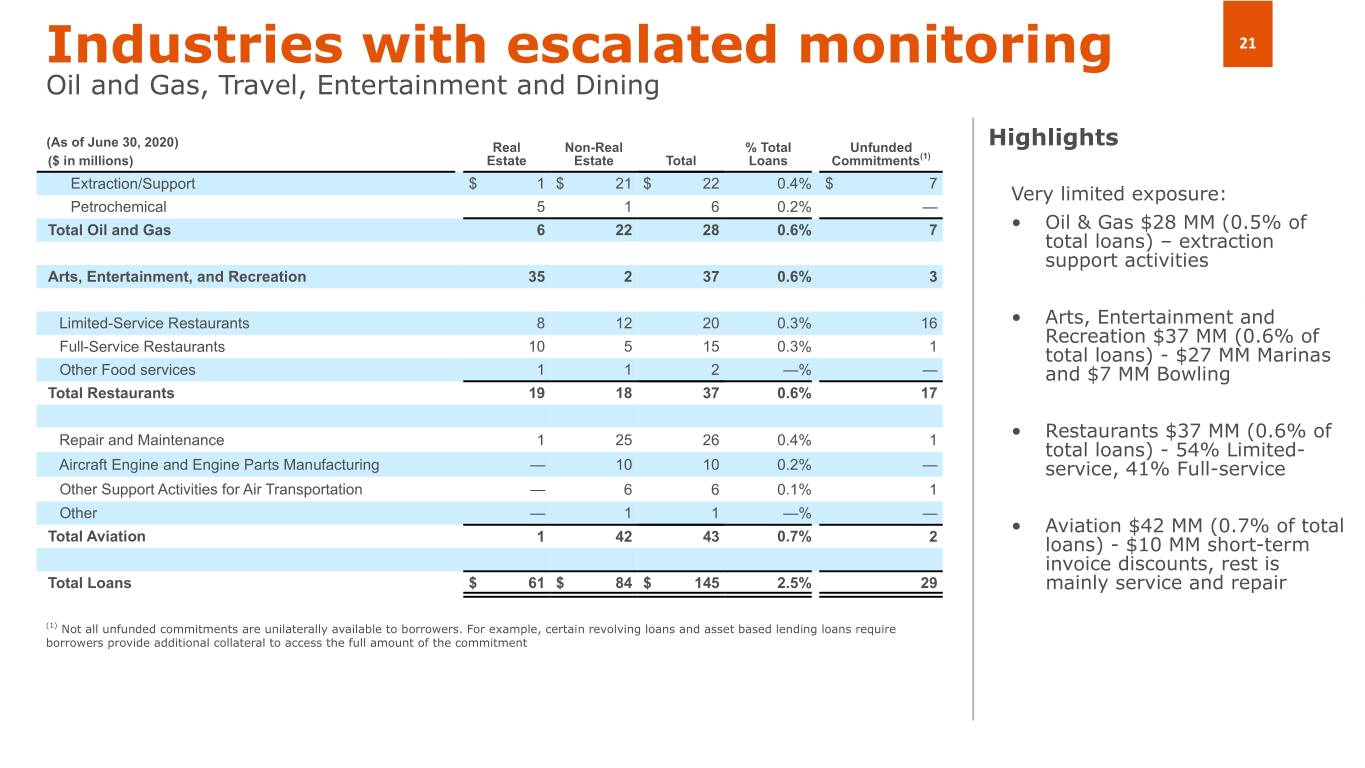

Industries with escalated monitoring 21 Oil and Gas, Travel, Entertainment and Dining (As of June 30, 2020) Real Non-Real % Total Unfunded Highlights ($ in millions) Estate Estate Total Loans Commitments(1) Extraction/Support $ 1 $ 21 $ 22 0.4% $ 7 Very limited exposure: Petrochemical 5 1 6 0.2% — Total Oil and Gas 6 22 28 0.6% 7 • Oil & Gas $28 MM (0.5% of total loans) – extraction support activities Arts, Entertainment, and Recreation 35 2 37 0.6% 3 Limited-Service Restaurants 8 12 20 0.3% 16 • Arts, Entertainment and Recreation $37 MM (0.6% of Full-Service Restaurants 10 5 15 0.3% 1 total loans) - $27 MM Marinas Other Food services 1 1 2 —% — and $7 MM Bowling Total Restaurants 19 18 37 0.6% 17 Repair and Maintenance 1 25 26 0.4% 1 • Restaurants $37 MM (0.6% of total loans) - 54% Limited- Aircraft Engine and Engine Parts Manufacturing — 10 10 0.2% — service, 41% Full-service Other Support Activities for Air Transportation — 6 6 0.1% 1 Other — 1 1 —% — • Aviation $42 MM (0.7% of total Total Aviation 1 42 43 0.7% 2 loans) - $10 MM short-term invoice discounts, rest is Total Loans $ 61 $ 84 $ 145 2.5% 29 mainly service and repair (1) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers provide additional collateral to access the full amount of the commitment

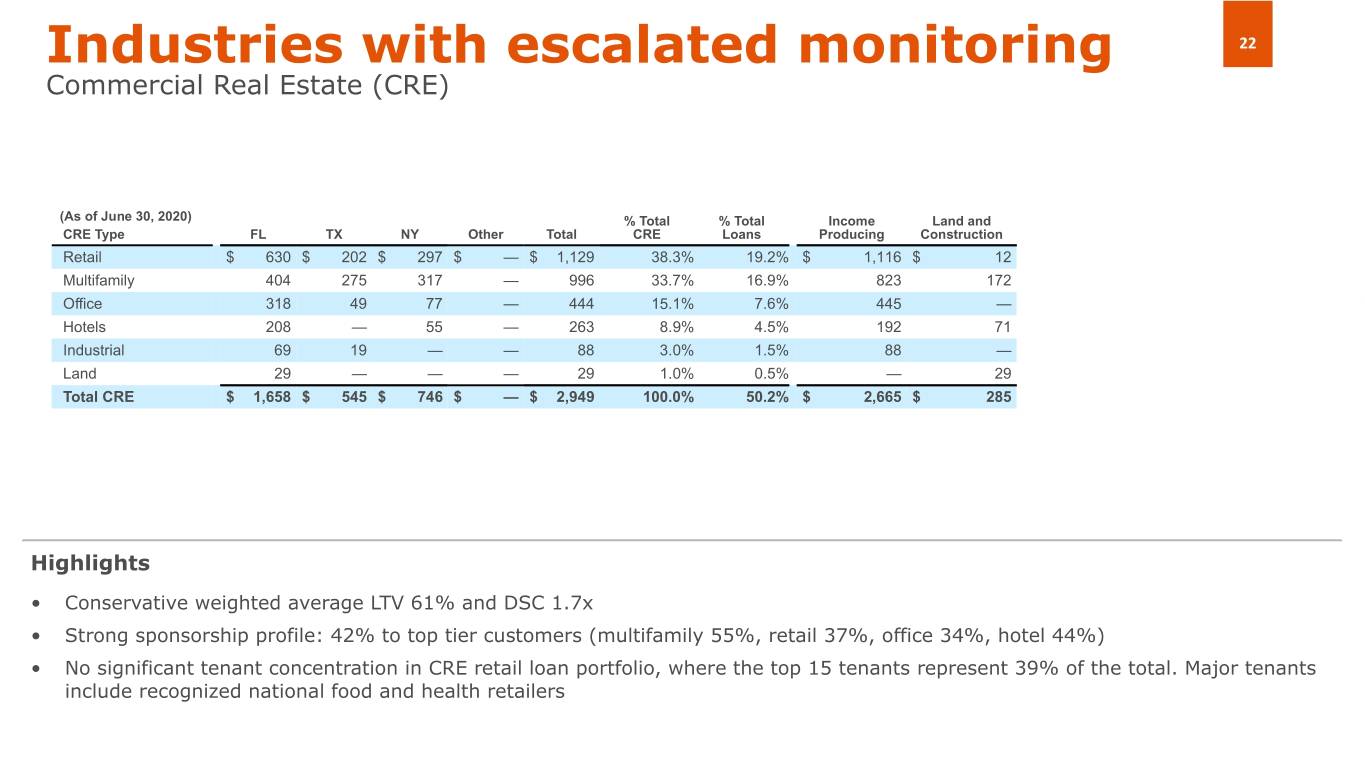

Industries with escalated monitoring 22 Commercial Real Estate (CRE) (As of June 30, 2020) % Total % Total Income Land and CRE Type FL TX NY Other Total CRE Loans Producing Construction Retail $ 630 $ 202 $ 297 $ — $ 1,129 38.3% 19.2% $ 1,116 $ 12 Multifamily 404 275 317 — 996 33.7% 16.9% 823 172 Office 318 49 77 — 444 15.1% 7.6% 445 — Hotels 208 — 55 — 263 8.9% 4.5% 192 71 Industrial 69 19 — — 88 3.0% 1.5% 88 — Land 29 — — — 29 1.0% 0.5% — 29 Total CRE $ 1,658 $ 545 $ 746 $ — $ 2,949 100.0% 50.2% $ 2,665 $ 285 Highlights • Conservative weighted average LTV 61% and DSC 1.7x • Strong sponsorship profile: 42% to top tier customers (multifamily 55%, retail 37%, office 34%, hotel 44%) • No significant tenant concentration in CRE retail loan portfolio, where the top 15 tenants represent 39% of the total. Major tenants include recognized national food and health retailers

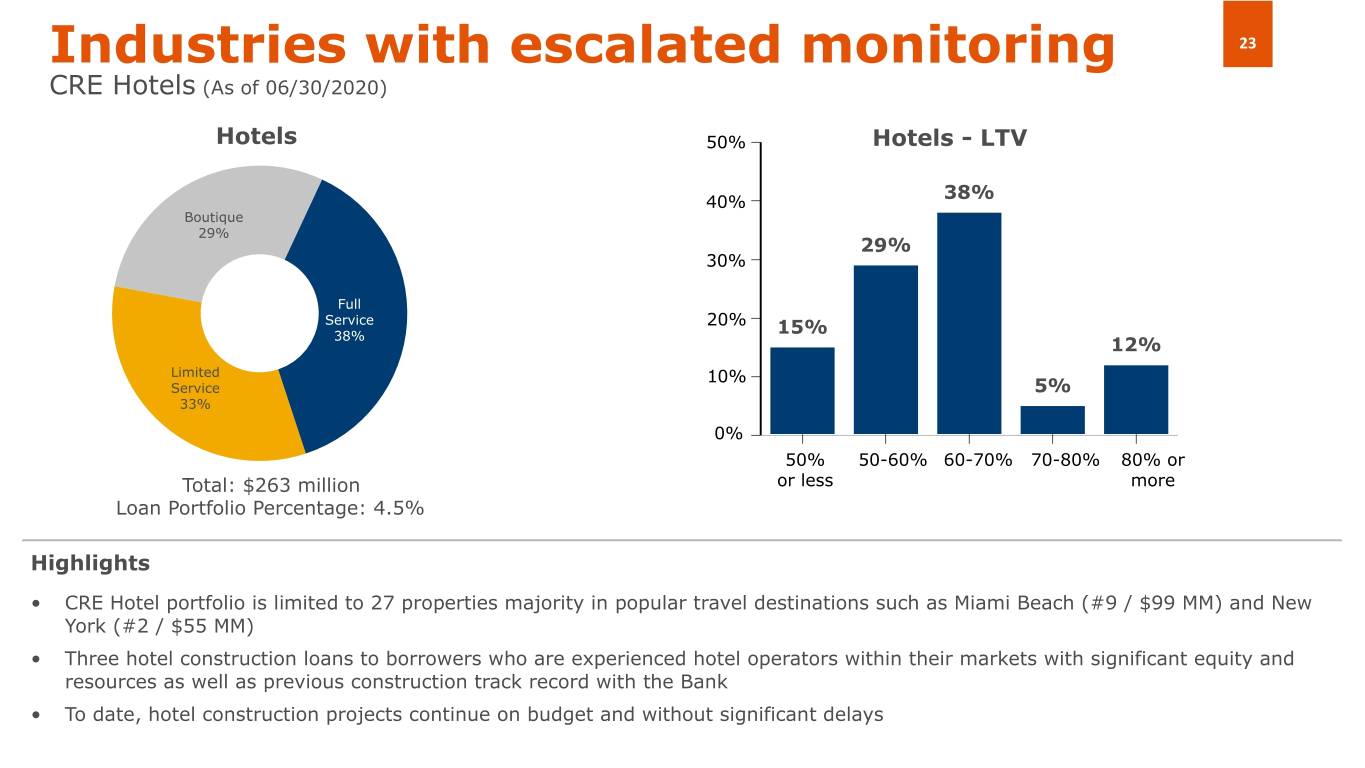

Industries with escalated monitoring 23 CRE Hotels (As of 06/30/2020) Hotels 50% Hotels - LTV 38% 40% Boutique 29% 29% 30% Full Service 20% 15% 38% 12% Limited 10% Service 5% 33% 0% 50% 50-60% 60-70% 70-80% 80% or Total: $263 million or less more Loan Portfolio Percentage: 4.5% Highlights • CRE Hotel portfolio is limited to 27 properties majority in popular travel destinations such as Miami Beach (#9 / $99 MM) and New York (#2 / $55 MM) • Three hotel construction loans to borrowers who are experienced hotel operators within their markets with significant equity and resources as well as previous construction track record with the Bank • To date, hotel construction projects continue on budget and without significant delays

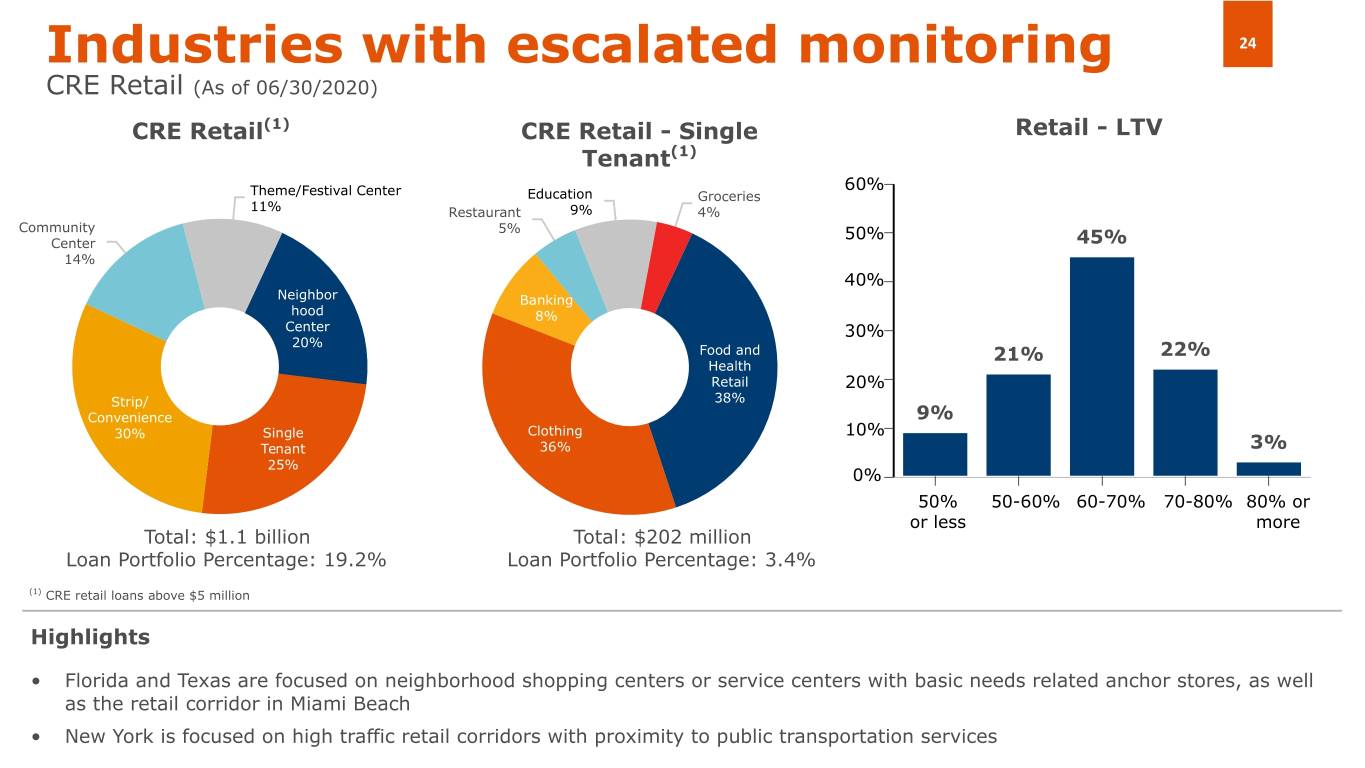

Industries with escalated monitoring 24 CRE Retail (As of 06/30/2020) CRE Retail(1) CRE Retail - Single Retail - LTV Tenant(1) 60% Theme/Festival Center Education Groceries 11% Restaurant 9% 4% Community 5% 50% Center 45% 14% 40% Neighbor Banking hood 8% Center 30% 20% Food and 21% 22% Health Retail 20% Strip/ 38% Convenience 9% 30% Single Clothing 10% Tenant 36% 3% 25% 0% 50% 50-60% 60-70% 70-80% 80% or or less more Total: $1.1 billion Total: $202 million Loan Portfolio Percentage: 19.2% Loan Portfolio Percentage: 3.4% (1) CRE retail loans above $5 million Highlights • Florida and Texas are focused on neighborhood shopping centers or service centers with basic needs related anchor stores, as well as the retail corridor in Miami Beach • New York is focused on high traffic retail corridors with proximity to public transportation services

Appendices

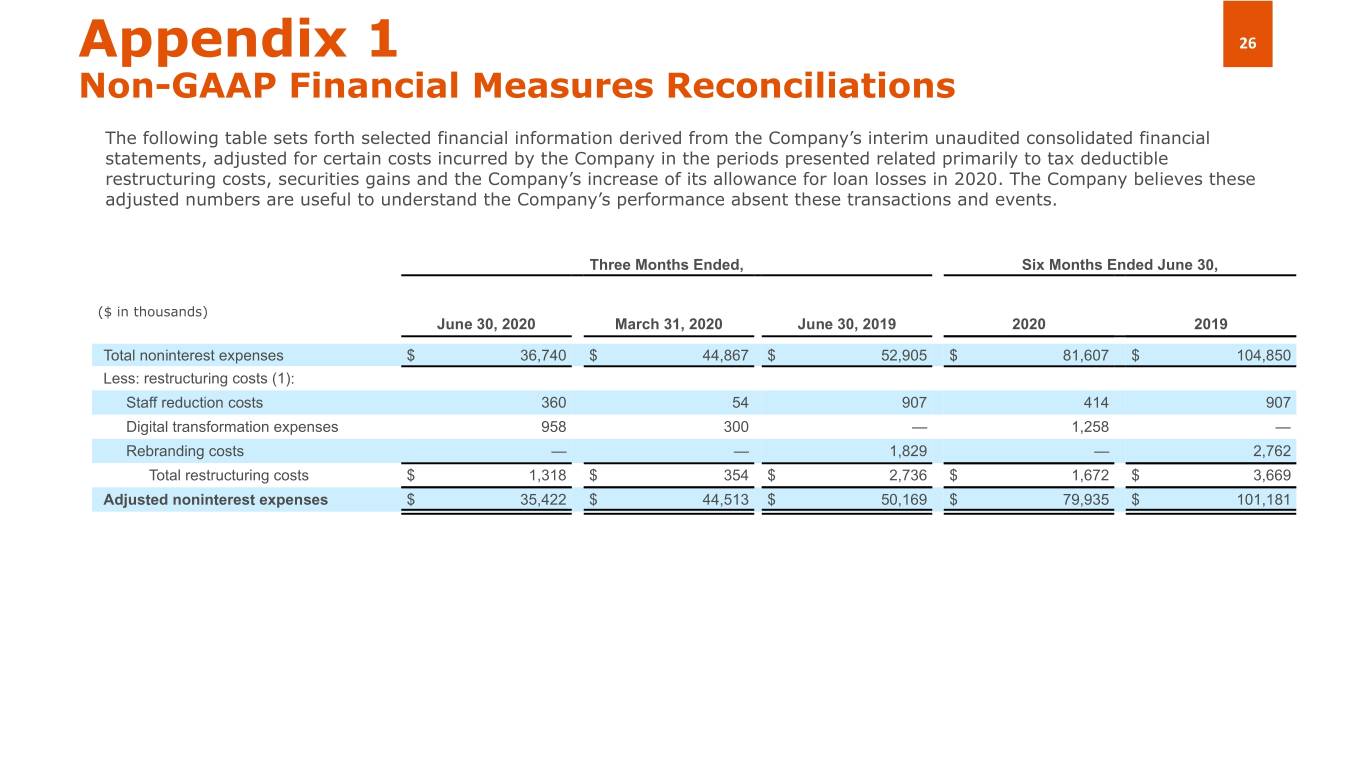

Appendix 1 26 Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related primarily to tax deductible restructuring costs, securities gains and the Company’s increase of its allowance for loan losses in 2020. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events. Three Months Ended, Six Months Ended June 30, ($ in thousands) June 30, 2020 March 31, 2020 June 30, 2019 2020 2019 Total noninterest expenses $ 36,740 $ 44,867 $ 52,905 $ 81,607 $ 104,850 Less: restructuring costs (1): Staff reduction costs 360 54 907 414 907 Digital transformation expenses 958 300 — 1,258 — Rebranding costs — — 1,829 — 2,762 Total restructuring costs $ 1,318 $ 354 $ 2,736 $ 1,672 $ 3,669 Adjusted noninterest expenses $ 35,422 $ 44,513 $ 50,169 $ 79,935 $ 101,181

Appendix 1 27 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Six Months Ended June 30, ($ in thousands, except per share amounts) June 30, 2020 March 31, 2020 June 30, 2019 2020 2019 Net (loss) income $ (15,279) $ 3,382 $ 12,857 $ (11,897) $ 25,928 Plus after-tax restructuring costs: Restructuring costs before income tax effect 1,318 354 2,736 1,672 3,669 Income tax effect (273) (74) (588) (347) (789) Total after-tax restructuring costs 1,045 280 2,148 1,325 2,880 Adjusted net (loss) income $ (14,234) $ 3,662 $ 15,005 $ (10,572) $ 28,808 Net (loss) income $ (15,279) $ 3,382 $ 12,857 $ (11,897) $ 25,928 Plus: provision for income tax (benefit) expense (4,005) 890 3,524 (3,115) 7,101 Plus: provision for (reversal of) loan losses 48,620 22,000 (1,350) 70,620 (1,350) Less: securities gains, net 7,737 9,620 992 17,357 996 Operating income $ 21,599 $ 16,652 $ 14,039 $ 38,251 $ 30,683 Basic (loss) earnings per share $ (0.37) $ 0.08 $ 0.30 $ (0.28) $ 0.61 Plus: after tax impact of restructuring costs 0.03 0.01 0.05 0.03 0.07 Total adjusted basic (loss) earnings per common share $ (0.34) $ 0.09 $ 0.35 $ (0.25) $ 0.68

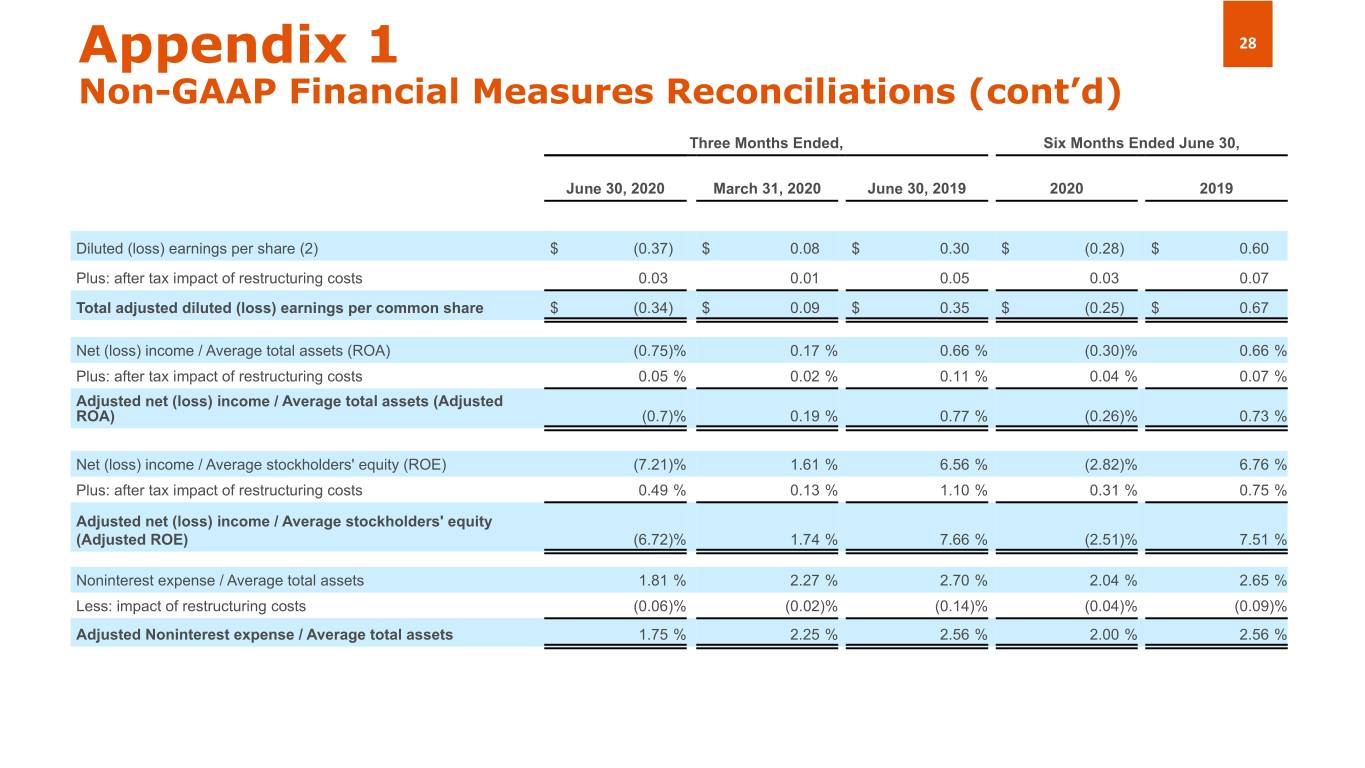

Appendix 1 28 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Six Months Ended June 30, June 30, 2020 March 31, 2020 June 30, 2019 2020 2019 Diluted (loss) earnings per share (2) $ (0.37) $ 0.08 $ 0.30 $ (0.28) $ 0.60 Plus: after tax impact of restructuring costs 0.03 0.01 0.05 0.03 0.07 Total adjusted diluted (loss) earnings per common share $ (0.34) $ 0.09 $ 0.35 $ (0.25) $ 0.67 Net (loss) income / Average total assets (ROA) (0.75)% 0.17 % 0.66 % (0.30)% 0.66 % Plus: after tax impact of restructuring costs 0.05 % 0.02 % 0.11 % 0.04 % 0.07 % Adjusted net (loss) income / Average total assets (Adjusted ROA) (0.7)% 0.19 % 0.77 % (0.26)% 0.73 % Net (loss) income / Average stockholders' equity (ROE) (7.21)% 1.61 % 6.56 % (2.82)% 6.76 % Plus: after tax impact of restructuring costs 0.49 % 0.13 % 1.10 % 0.31 % 0.75 % Adjusted net (loss) income / Average stockholders' equity (Adjusted ROE) (6.72)% 1.74 % 7.66 % (2.51)% 7.51 % Noninterest expense / Average total assets 1.81 % 2.27 % 2.70 % 2.04 % 2.65 % Less: impact of restructuring costs (0.06)% (0.02)% (0.14)% (0.04)% (0.09)% Adjusted Noninterest expense / Average total assets 1.75 % 2.25 % 2.56 % 2.00 % 2.56 %

Appendix 1 29 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Six Months Ended June 30, ($ in thousands, except per share amounts and percentages) June 30, 2020 March 31, 2020 June 30, 2019 2020 2019 Salaries and employee benefits / Average total assets 1.06 % 1.48 % 1.74 % 1.27 % 1.71 % Less: impact of restructuring costs (0.01)% — % (0.05)% (0.01)% (0.02)% Adjusted salaries and employee benefits / Average total assets 1.05 % 1.48 % 1.69 % 1.26 % 1.69 % Other operating expenses / Average total assets 0.75 % 0.79 % 0.96 % 0.77 % 0.95 % Less: impact of restructuring costs (0.05)% (0.02)% (0.09)% (0.03)% (0.07)% Adjusted other operating expenses / Average total assets 0.70 % 0.77 % 0.87 % 0.74 % 0.88 % Efficiency ratio 55.60 % 63.07 % 77.87 % 59.47 % 76.80 % Less: impact of restructuring costs (1.99)% (0.50)% (4.03)% (1.21)% (2.69)% Adjusted efficiency ratio 53.61 % 62.57 % 73.84 % 58.26 % 74.11 % Stockholders' equity $ 830,198 $ 841,117 $ 806,368 $ 830,198 $ 806,368 Less: goodwill and other intangibles (21,653) (21,698) (20,969) (21,653) (20,969) Tangible common stockholders' equity $ 808,545 $ 819,419 $ 785,399 $ 808,545 $ 785,399 Total assets 8,130,723 8,098,810 7,926,826 8,130,723 7,926,826 Less: goodwill and other intangibles (21,653) (21,698) (20,969) (21,653) (20,969) Tangible assets $ 8,109,070 $ 8,077,112 $ 7,905,857 $ 8,109,070 $ 7,905,857 Common shares outstanding 42,159 42,166 43,205 42,159 43,205 Tangible common equity ratio 9.97 % 10.14 % 9.93 % 9.97 % 9.93 % Stockholders' book value per common share $ 19.69 $ 19.95 $ 18.66 $ 19.69 $ 18.66 Tangible stockholders' book value per common share $ 19.18 $ 19.43 $ 18.18 $ 19.18 $ 18.18

Appendix 1 30 Non-GAAP Financial Measures Reconciliations (cont’d) (1) Expenses incurred for actions designed to implement the Company’s strategy as a new independent company. These actions include, but are not limited to reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (2) As of June 30, 2020, March 31, 2020 and June 30, 2020 potential dilutive instruments consisted of unvested shares of restricted stock and restricted stock units mainly related to the Company’s IPO in 2018, totaling 491,360, 482,316 and 789,652, respectively. As of June 30, 2020, potential dilutive instruments were not included in the dilutive earnings per share computation because the Company reported a net loss and their inclusion would have an antidilutive effect. For all other periods presented, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share at those dates, fewer shares would have been purchased than restricted shares assumed issued. Therefore, at those dates, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings.

Thank you Investor Relations InvestorRelations@amerantbank.com