Third Quarter 2020 Financial Review Earnings Call October 29, 2020

Important Notices and Disclaimers 2 Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, including, without limitation, future financial and operating results; costs and revenues; economic conditions generally and in our markets and among our customer base; the challenges and uncertainties caused by the COVID-19 pandemic; the measures we have taken in response to the COVID-19 pandemic; our participation in the PPP Loan program; loan demand; changes in the mix of our earning assets and our deposit and wholesale liabilities; net interest margin; yields on earning assets; interest rates and yield curves (generally and those applicable to our assets and liabilities); credit quality, including loan performance, non-performing assets, provisions for loan losses, charge-offs, other-than-temporary impairments and collateral values; market trends; rebranding and staff realignment costs and expected savings; customer preferences; and anticipated closures of banking centers in Florida and Texas, as well as statements with respect to our objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward- looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” "create" and other similar words and expressions of the future. Forward-looking statements, including those as to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2019, in our quarterly reports on Form 10-Q for the fiscal quarters ended March 31, 2020 and June 30, 2020 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including as of and for the three and nine month periods ended September 30, 2020 and 2019, may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2020, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non- GAAP financial measures, such as “adjusted noninterest income”, “adjusted noninterest expense”, “adjusted net income (loss)”, “operating income”, “adjusted net income (loss) per share (basic and diluted)”, “adjusted return on assets (ROA)”, “adjusted return on equity (ROE)”, and other ratios. This supplemental information is not required by, or are not presented in accordance with, U.S. generally accepted accounting principles (“GAAP”). The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued into 2020, the one-time gain on sale of the vacant Beacon land in the fourth quarter of 2019, the Company’s increases of its allowance for loan losses and net gains on sales of securities in the first, second and third quarters of 2020. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies.

1 Business Update Related to COVID-19 3 • Amerant’s Business Continuity Plan (“BCP”) continues to successfully support employees with remote work Business capabilities Continuity • Company moved into a new phase of reintroducing a higher number of employees back into the workplace Plan following safety protocols per CDC guidelines and placing rotating schedules to minimize risk of contagion • Banking centers working regular business hours, following strict CDC protocols • Proactive and careful monitoring of credit quality practices, including examining and responding to patterns or trends that may arise across certain industries or regions. Tightening of underwriting standards while continuing to do business, enhancing the monitoring of the entire loan portfolio • Ongoing review of credit exposures by industry and geography to identify loans susceptible to increased credit risk Loan in light of the COVID-19 pandemic Portfolio • $71.8 million, or 1.2% of total loans, remained under forbearance; a significant decrease compared to prior quarter Monitoring & Relief • This remaining balance is comprised of: Requests ◦ 46% in Florida, 21% in Texas and 33% in New York Summary ◦ 95% of CRE relief requests tied to retail (67%) and multifamily (28%) loans ◦ 94% of total remaining requests are loans secured with RE collateral with 64% Wavg. LTV ◦ CRE requests as % of their respective portfolio: Hotel 0%, Industrial 2.1%, Retail 2.1%, Office 0% and Multifamily 0.9% Continue to monitor credit quality and effectively reduce loans under forbearance 1 As of October 23, 2020

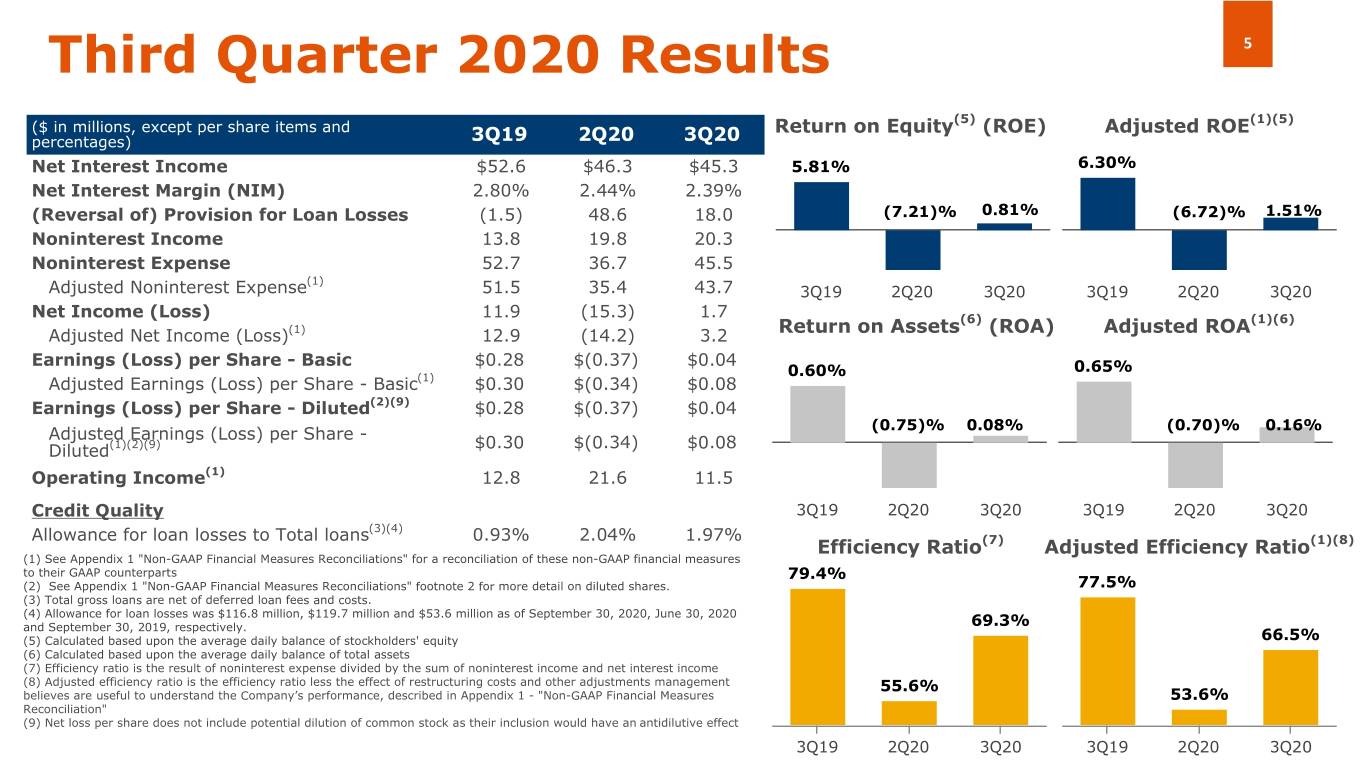

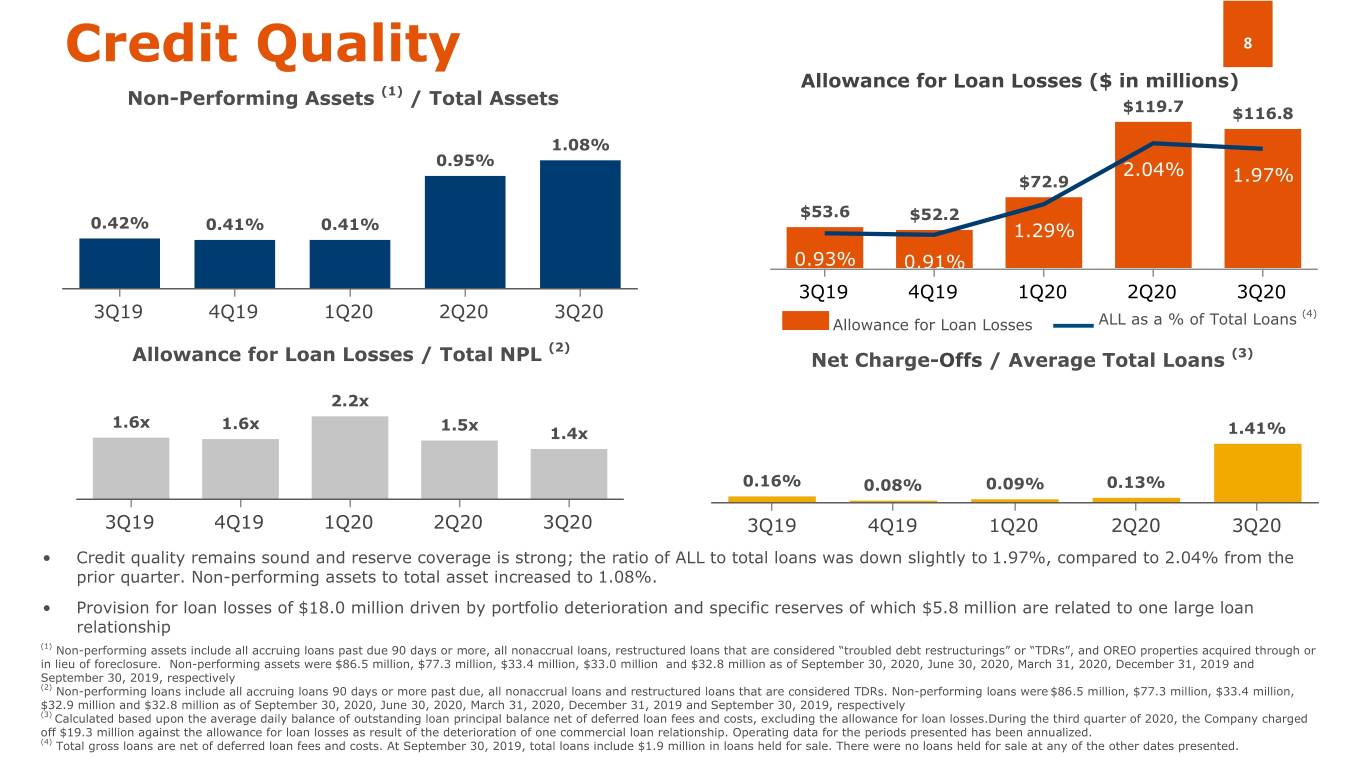

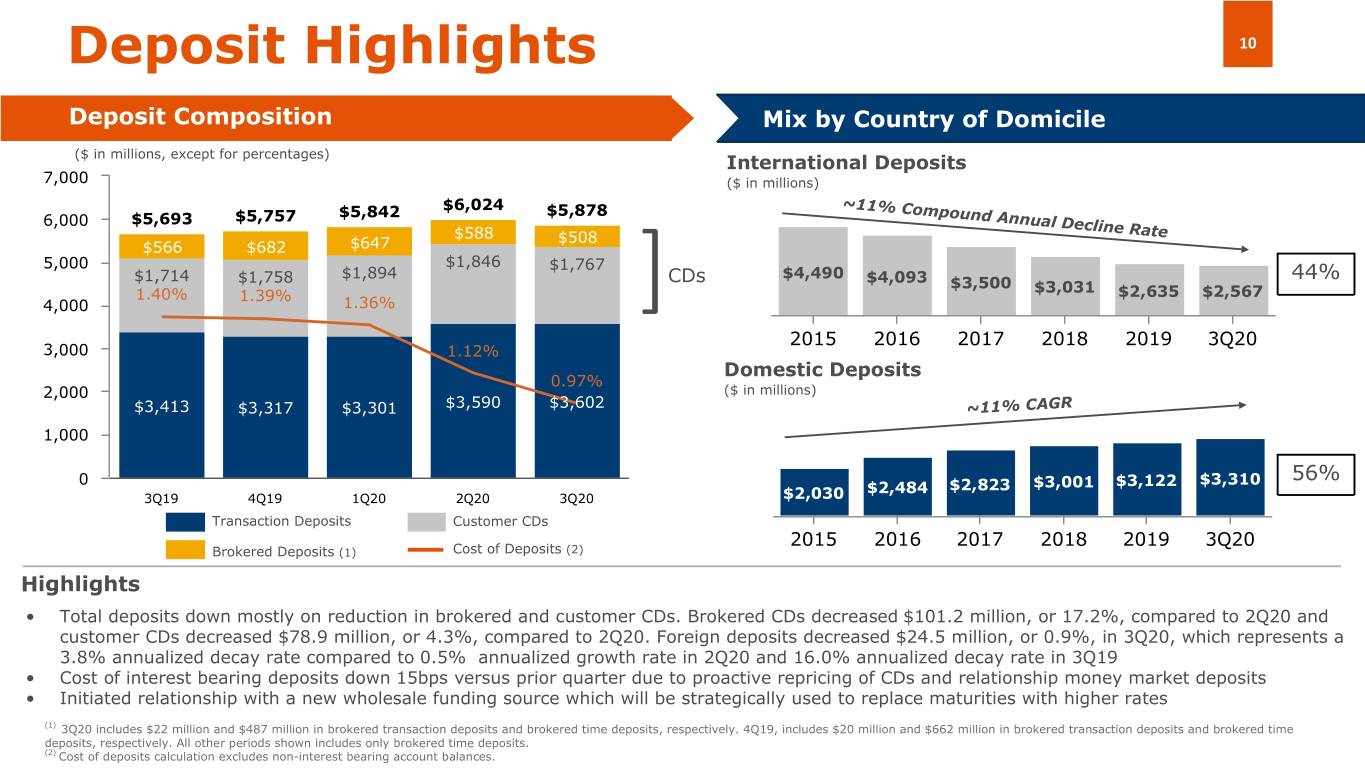

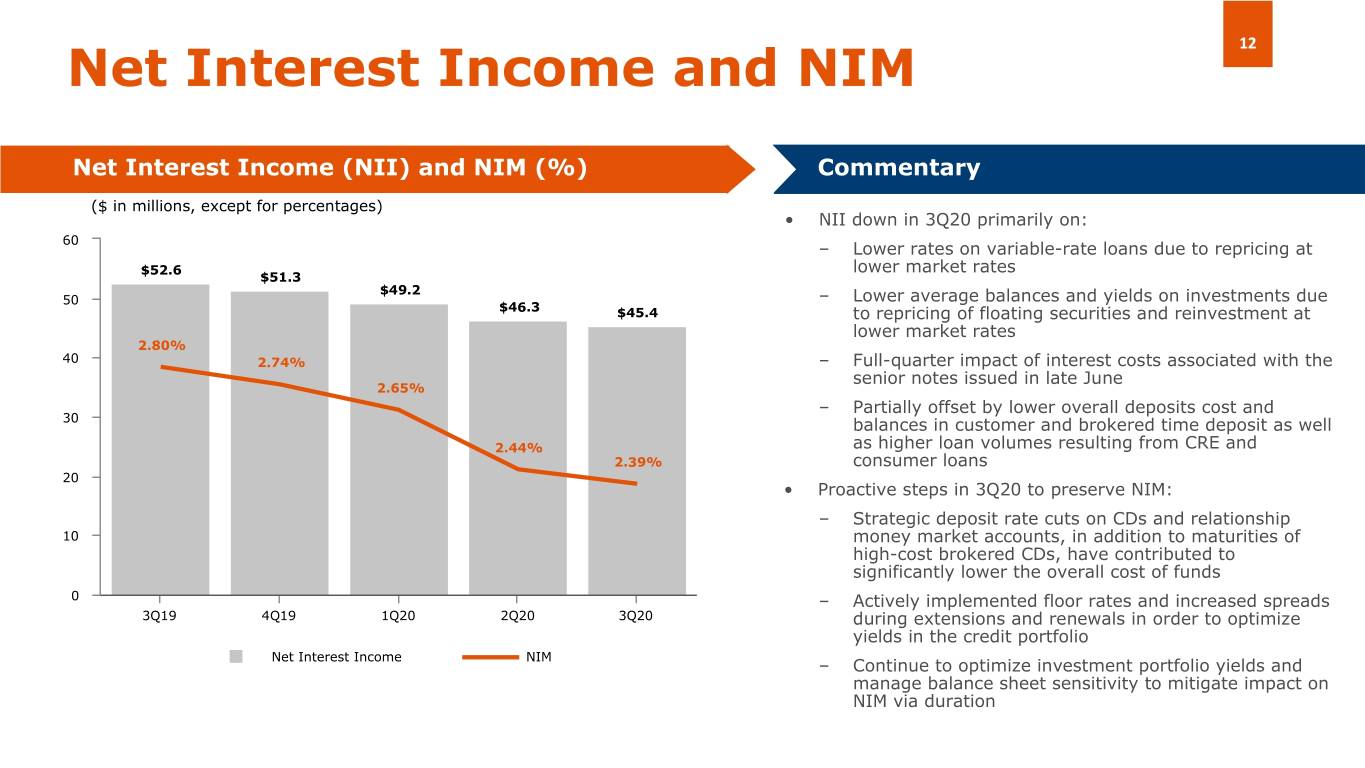

Performance Highlights 3Q20 4 • Net income of $1.7 million in 3Q20, compared to a net loss of $15.3 million in 2Q20 and net income of $11.9 million in 3Q19; Operating income(1) was $11.5 million in 3Q20, down 46.6% from $21.6 million in 2Q20, and down 9.8% from $12.8 million in 3Q19. • Noninterest income increased 2.7% over 2Q20 and 46.7% compared to 3Q19, driven mainly by increased net Profitability gain on sale of debt securities as the Company continues to actively manage its strong Balance Sheet and duration of investment portfolio • Noninterest expense increased 23.8% over 2Q20 largely driven by higher salaries and employee benefits expenses and higher operating expenses due to the absence of $7.8 million in expense deferral related to PPP loan originations in 2Q20. Noninterest expense decreased 13.7% compared to 3Q19, largely driven by lower salaries and employee benefits expenses and other operating expenses (mainly lower marketing costs) • Total loans were $5.9 billion, slightly up 0.9% from 2Q20, driven by an increase in CRE and consumer loans • Total deposits were $5.9 billion, down 2.4% from 2Q20, mainly driven by a reduction of brokered and Balance Sheet customer CDs and a decrease in PPP related deposits • Total cash and cash equivalents were $227.2 million as of September 30, 2020, compared to $217.3 million as of June 30, 2020. The Company has $1.3 billion in investment securities that could be used as collateral for borrowings and $1.4 billion in additional borrowing capacity with the FHLB • Provision for loan losses of $18.0 million to account for $12.2 million related to credit deterioration and $5.8 million from a specific reserve requirement related to the Miami-based U.S. coffee trader ('the Coffee Trader"); Credit Quality will continue to reassess provisions as conditions evolve • ALL coverage ratio this quarter at 1.97%, down from 2.04% in 2Q20 • The ratio of allowance to non-performing loans(2) decreased to 1.4x in 3Q20, down from 1.5x in 2Q20 (1) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP counterparts (2) Non-performing loans include all accruing loans 90 days or more past due, all nonaccrual loans and restructured loans that are considered TDRs. Non-performing loans were $86.5 million, as of September 30, 2020, and includes $19.6 million for the Coffee Trader loan relationship

Third Quarter 2020 Results 5 (5) (1)(5) ($ in millions, except per share items and Return on Equity (ROE) Adjusted ROE percentages) 3Q19 2Q20 3Q20 Net Interest Income $52.6 $46.3 $45.3 5.81% 6.30% Net Interest Margin (NIM) 2.80% 2.44% 2.39% (Reversal of) Provision for Loan Losses (1.5) 48.6 18.0 (7.21)% 0.81% (6.72)% 1.51% Noninterest Income 13.8 19.8 20.3 Noninterest Expense 52.7 36.7 45.5 (1) Adjusted Noninterest Expense 51.5 35.4 43.7 3Q19 2Q20 3Q20 3Q19 2Q20 3Q20 Net Income (Loss) 11.9 (15.3) 1.7 (6) (1)(6) Adjusted Net Income (Loss)(1) 12.9 (14.2) 3.2 Return on Assets (ROA) Adjusted ROA Earnings (Loss) per Share - Basic $0.28 $(0.37) $0.04 0.60% 0.65% Adjusted Earnings (Loss) per Share - Basic(1) $0.30 $(0.34) $0.08 Earnings (Loss) per Share - Diluted(2)(9) $0.28 $(0.37) $0.04 (0.75)% 0.08% (0.70)% 0.16% Adjusted Earnings (Loss) per Share - Diluted(1)(2)(9) $0.30 $(0.34) $0.08 Operating Income(1) 12.8 21.6 11.5 Credit Quality 3Q19 2Q20 3Q20 3Q19 2Q20 3Q20 Allowance for loan losses to Total loans(3)(4) 0.93% 2.04% 1.97% Efficiency Ratio(7) Adjusted Efficiency Ratio(1)(8) (1) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP counterparts 79.4% (2) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" footnote 2 for more detail on diluted shares. 77.5% (3) Total gross loans are net of deferred loan fees and costs. (4) Allowance for loan losses was $116.8 million, $119.7 million and $53.6 million as of September 30, 2020, June 30, 2020 and September 30, 2019, respectively. 69.3% (5) Calculated based upon the average daily balance of stockholders' equity 66.5% (6) Calculated based upon the average daily balance of total assets (7) Efficiency ratio is the result of noninterest expense divided by the sum of noninterest income and net interest income (8) Adjusted efficiency ratio is the efficiency ratio less the effect of restructuring costs and other adjustments management 55.6% believes are useful to understand the Company’s performance, described in Appendix 1 - "Non-GAAP Financial Measures 53.6% Reconciliation" (9) Net loss per share does not include potential dilution of common stock as their inclusion would have an antidilutive effect 3Q19 2Q20 3Q20 3Q19 2Q20 3Q20

Investment Portfolio 6 Balances and Yields (1) Highlights ($ in millions) $24.4 • Effective duration of 2.4 years as mortgage securities' $24.0 prepayment speeds ramped up in the third quarter 1,500 $77.6 $65.6 $24.4 $61.7 • Floating portion of the portfolio at 13.3% of the total portfolio 1,000 $1,461.2 $1,519.8 • Continued purchasing higher-yielding corporate securities, $1,317.7 primarily financial institutions subordinated debt • Corporate debt participation within AFS portfolio has 500 increased to 23.5% in 3Q20 from 16.4% in 3Q19 3Q19 2Q20 3Q20 Available for Sale (AFS) Held to Maturity (HTM) Marketable Equity Securities (2) Fixed vs. Floating Available for Sale Securities by Type (3) Sep. 2019 Sep. 2020 September 30, 2020 U.S. Gov't 13.6% 13.3% Fixed rate agency 16.3% 2.6 yrs 2.4 yrs Effective Effective Duration Duration Floating rate Municipals 4.2% U.S. Gov't 86.4% 86.7% sponsored enterprises (1) Corporate debt Excludes Federal Reserve Bank and FHLB stock 55.8% (2) The Company adopted ASU 2016-01 on December 31, 2019. Marketable Equity Securities shown for prior 23.5% quarters only for comparative purposes (3) The Company revised its classification of securities by rate type in 3Q20. Hybrid investments are classified based on current rate (fixed or float). Prior year information has been revised for comparative purposes, US treasury 0.2% resulting in a change from 15.2% (floating) and 84.8% (fixed) as previously reported in 3Q19

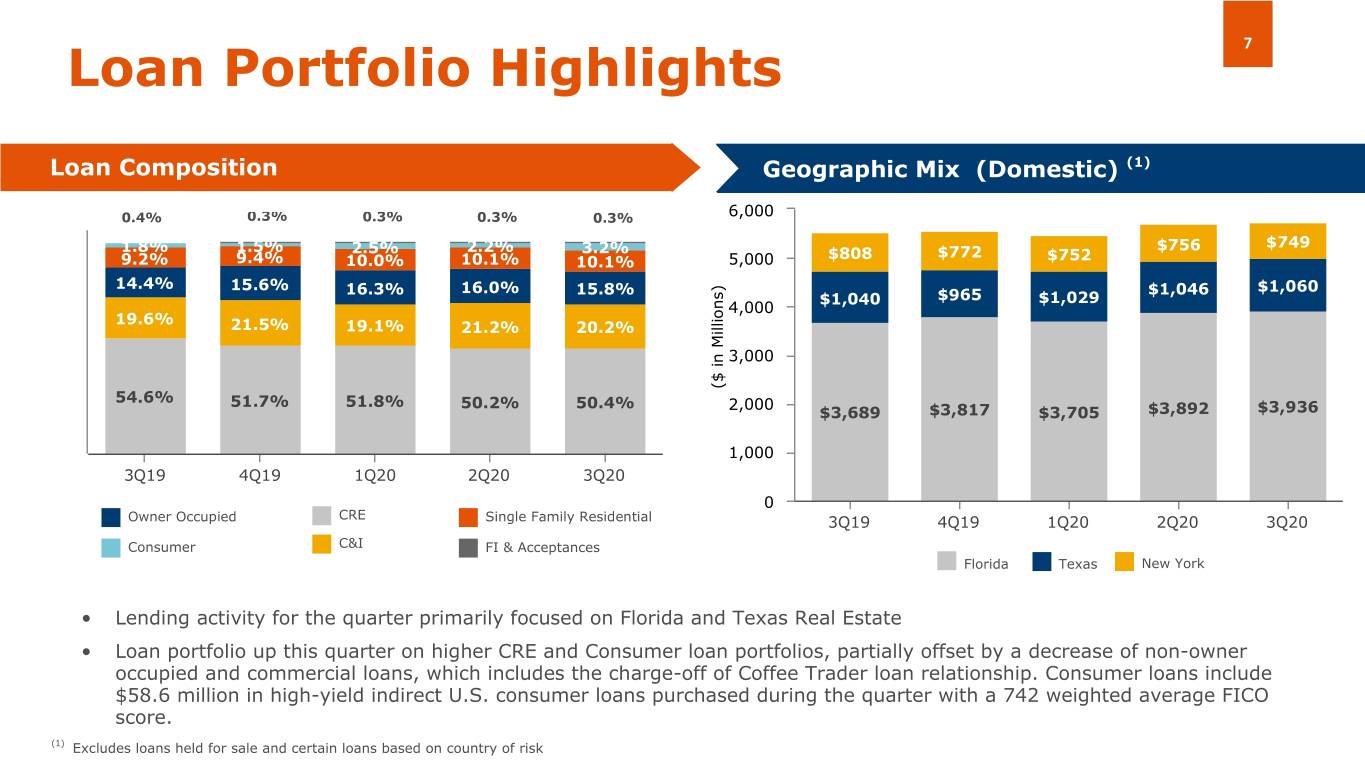

7 Loan Portfolio Highlights Loan Composition Geographic Mix (Domestic) (Domestic) (1) 0.4% 0.3% 0.3% 0.3% 0.3% 6,000 $756 $749 1.8% 1.5% 2.5% 2.2% 3.2% $808 $772 9.2% 9.4% 10.0% 10.1% 10.1% 5,000 $752 14.4% 15.6% 16.3% 16.0% 15.8% $1,046 $1,060 $1,040 $965 $1,029 FFI 4,000 19.6% 21.5% 19.1% 21.2% 20.2% 3,000 ($ in Millions) 54.6% 51.7% 51.8% 50.2% 50.4% 2,000 $3,689 $3,817 $3,705 $3,892 $3,936 1,000 3Q19 4Q19 1Q20 2Q20 3Q20 0 Owner Occupied CRE Single Family Residential 3Q19 4Q19 1Q20 2Q20 3Q20 Consumer C&I FI & Acceptances Florida Texas New York • Lending activity for the quarter primarily focused on Florida and Texas Real Estate • Loan portfolio up this quarter on higher CRE and Consumer loan portfolios, partially offset by a decrease of non-owner occupied and commercial loans, which includes the charge-off of Coffee Trader loan relationship. Consumer loans include $58.6 million in high-yield indirect U.S. consumer loans purchased during the quarter with a 742 weighted average FICO score. (1) Excludes loans held for sale and certain loans based on country of risk

Credit Quality 8 Allowance for Loan Losses ($ in millions) Non-Performing Assets (1) / Total Assets $119.7 $116.8 1.08% 0.95% 2.04% $72.9 1.97% $53.6 $52.2 0.42% 0.41% 0.41% 1.29% 0.93% 0.91% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 (4) Allowance for Loan Losses ALL as a % of Total Loans (2) Allowance for Loan Losses / Total NPL Net Charge-Offs / Average Total Loans (3) 2.2x 1.6x 1.6x 1.5x 1.4x 1.41% 0.16% 0.08% 0.09% 0.13% 3Q19 4Q19 1Q20 2Q20 3Q20 3Q19 4Q19 1Q20 2Q20 3Q20 • Credit quality remains sound and reserve coverage is strong; the ratio of ALL to total loans was down slightly to 1.97%, compared to 2.04% from the prior quarter. Non-performing assets to total asset increased to 1.08%. • Provision for loan losses of $18.0 million driven by portfolio deterioration and specific reserves of which $5.8 million are related to one large loan relationship (1) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of foreclosure. Non-performing assets were $86.5 million, $77.3 million, $33.4 million, $33.0 million and $32.8 million as of September 30, 2020, June 30, 2020, March 31, 2020, December 31, 2019 and September 30, 2019, respectively (2) Non-performing loans include all accruing loans 90 days or more past due, all nonaccrual loans and restructured loans that are considered TDRs. Non-performing loans were $86.5 million, $77.3 million, $33.4 million, $32.9 million and $32.8 million as of September 30, 2020, June 30, 2020, March 31, 2020, December 31, 2019 and September 30, 2019, respectively (3) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, excluding the allowance for loan losses.During the third quarter of 2020, the Company charged off $19.3 million against the allowance for loan losses as result of the deterioration of one commercial loan relationship. Operating data for the periods presented has been annualized. (4) Total gross loans are net of deferred loan fees and costs. At September 30, 2019, total loans include $1.9 million in loans held for sale. There were no loans held for sale at any of the other dates presented.

9 Interest-Earning Assets (1) ($ in millions, except for percentages ) 9,000 8,000 7,000 $1,633 $1,739 $1,770 $1,675 $1,469 6,000 $5,754 $5,744 $5,872 $5,925 5,000 $5,668 4,000 4.64% 4.47% 4.31% 3,000 3.77% 3.64% 2,000 2.73% 2.66% 2.59% 2.50% 1,000 2.32% 0 3Q19 4Q19 1Q20 2Q20 3Q20 Loans Investments Loan Yield Investment Yield • Loan yield decreased 13 basis points versus previous quarter, primarily driven by the increase in non-performing loans and lower market rates on variable-rate loans • Investment yield declined primarily attributed to repricing of floating securities, prepayment acceleration and reinvestment at lower market rates, partially offset by the purchase of higher-yielding corporate securities, primarily financial institutions subordinated debt (1) Balances represent period-end outstanding amounts

Deposit Highlights 10 Deposit Composition Mix by Country of Domicile ($ in millions, except for percentages) International Deposits 7,000 ($ in millions) ~ $5,842 $6,024 $5,878 11% Compound Annual Decline Rate 6,000 $5,693 $5,757 $588 $508 $566 $682 $647 5,000 $1,846 $1,767 $1,714 $1,758 $1,894 CDs $4,490 $4,093 44% $3,500 $3,031 1.40% 1.39% $2,635 $2,567 4,000 1.36% ] 2015 2016 2017 2018 2019 3Q20 3,000 1.12% Domestic Deposits 0.97% 2,000 ($ in millions) $3,413 $3,317 $3,301 $3,590 $3,602 ~11% CAGR 1,000 0 $3,310 56% $2,484 $2,823 $3,001 $3,122 3Q19 4Q19 1Q20 2Q20 3Q20 $2,030 Transaction Deposits Customer CDs 2015 2016 2017 2018 2019 3Q20 Brokered Deposits (1) Cost of Deposits (2) Highlights • Total deposits down mostly on reduction in brokered and customer CDs. Brokered CDs decreased $101.2 million, or 17.2%, compared to 2Q20 and customer CDs decreased $78.9 million, or 4.3%, compared to 2Q20. Foreign deposits decreased $24.5 million, or 0.9%, in 3Q20, which represents a 3.8% annualized decay rate compared to 0.5% annualized growth rate in 2Q20 and 16.0% annualized decay rate in 3Q19 • Cost of interest bearing deposits down 15bps versus prior quarter due to proactive repricing of CDs and relationship money market deposits • Initiated relationship with a new wholesale funding source which will be strategically used to replace maturities with higher rates (1) 3Q20 includes $22 million and $487 million in brokered transaction deposits and brokered time deposits, respectively. 4Q19, includes $20 million and $662 million in brokered transaction deposits and brokered time deposits, respectively. All other periods shown includes only brokered time deposits. (2) Cost of deposits calculation excludes non-interest bearing account balances.

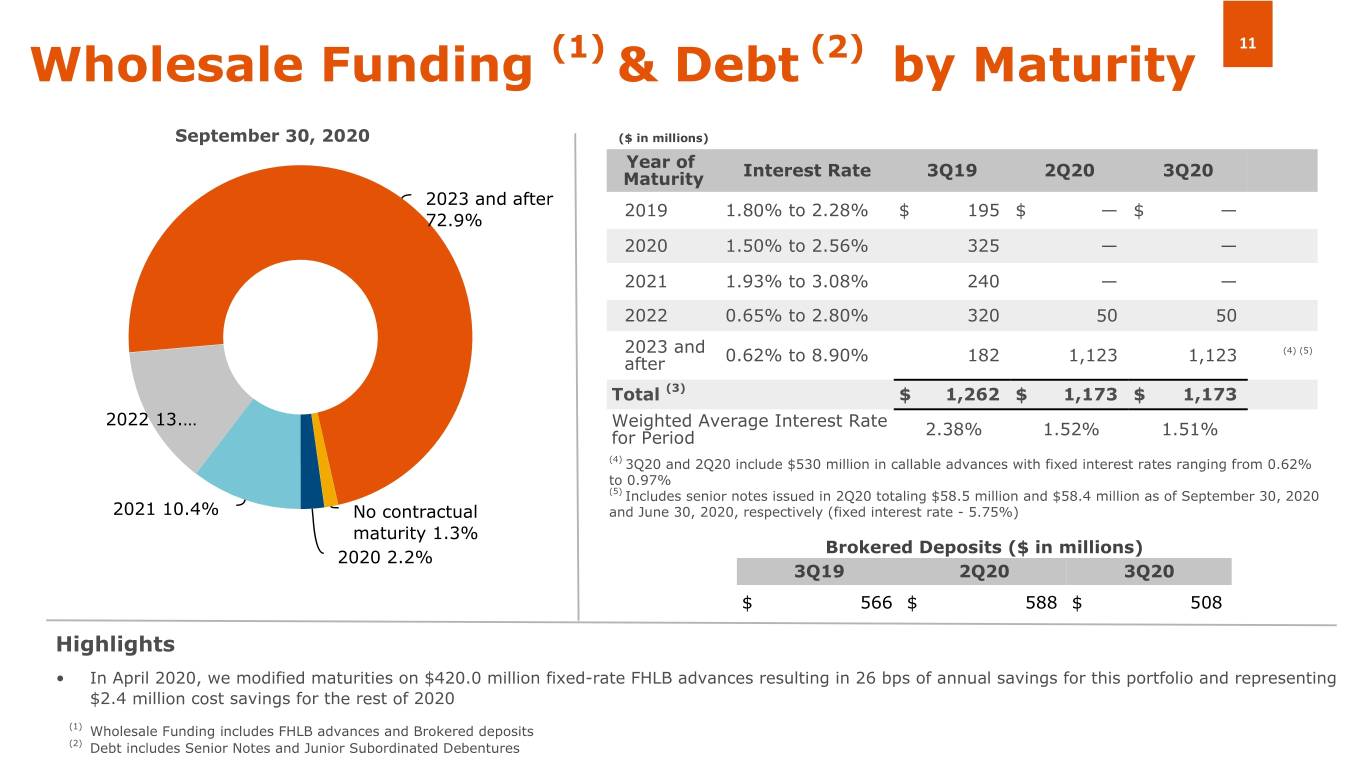

Wholesale Funding (1) & Debt (2) by Maturity 11 September 30, 2020 ($ in millions) Year of Maturity Interest Rate 3Q19 2Q20 3Q20 2023 and after 2019 1.80% to 2.28% $ 195 $ — $ — 72.9% 2020 1.50% to 2.56% 325 — — 2021 1.93% to 3.08% 240 — — 2022 0.65% to 2.80% 320 50 50 2023 and (4) (5) after 0.62% to 8.90% 182 1,123 1,123 Total (3) $ 1,262 $ 1,173 $ 1,173 2022 13.… Weighted Average Interest Rate for Period 2.38% 1.52% 1.51% (4) 3Q20 and 2Q20 include $530 million in callable advances with fixed interest rates ranging from 0.62% to 0.97% (5) Includes senior notes issued in 2Q20 totaling $58.5 million and $58.4 million as of September 30, 2020 2021 10.4% No contractual and June 30, 2020, respectively (fixed interest rate - 5.75%) maturity 1.3% Brokered Deposits ($ in millions) 2020 2.2% 3Q19 2Q20 3Q20 $ 566 $ 588 $ 508 Highlights • In April 2020, we modified maturities on $420.0 million fixed-rate FHLB advances resulting in 26 bps of annual savings for this portfolio and representing $2.4 million cost savings for the rest of 2020 (1) Wholesale Funding includes FHLB advances and Brokered deposits (2) Debt includes Senior Notes and Junior Subordinated Debentures

12 Net Interest Income and NIM Net Interest Income (NII) and NIM (%) Commentary ($ in millions, except for percentages) • NII down in 3Q20 primarily on: 60 – Lower rates on variable-rate loans due to repricing at $52.6 lower market rates $51.3 $49.2 50 – Lower average balances and yields on investments due $46.3 $45.4 to repricing of floating securities and reinvestment at lower market rates 2.80% 40 2.74% – Full-quarter impact of interest costs associated with the senior notes issued in late June 2.65% – Partially offset by lower overall deposits cost and 30 balances in customer and brokered time deposit as well 2.44% as higher loan volumes resulting from CRE and 2.39% consumer loans 20 • Proactive steps in 3Q20 to preserve NIM: – Strategic deposit rate cuts on CDs and relationship 10 money market accounts, in addition to maturities of high-cost brokered CDs, have contributed to significantly lower the overall cost of funds 0 – Actively implemented floor rates and increased spreads 3Q19 4Q19 1Q20 2Q20 3Q20 during extensions and renewals in order to optimize yields in the credit portfolio Net Interest Income NIM – Continue to optimize investment portfolio yields and manage balance sheet sensitivity to mitigate impact on NIM via duration

13 Noninterest Income Mix Noninterest Income Mix Commentary ($ in millions) $21.9 • $8.6 million net gain on debt securities sold buffered the 22 impact of low market rates on NIM $19.8 $20.3 20 $3.9 • Deposits and service fees increased in 3Q20 due to higher $3.5 wire transfer fees attributed to elevated volumes from 18 $4.4 increased economic activity $16.0 16 • Other noninterest income decreased in 3Q20 due to lower $13.8 derivative income 14 $9.6 $7.1 $8.6 • Higher advisory and fiduciary fees though offset by decreased 12 $4.9 $7.7 brokerage fees. Net New Assets increased $25.5 million in 10 3Q20 $0.9 $0.7 8 Assets Under Management/Custody $3.6 $3.9 $4.1 6 $4.3 $4.3 3Q19 (1) 3Q20 4 2 $4.4 $4.3 $4.3 $3.4 $3.9 93% 93% 0 3Q19 4Q19 1Q20 2Q20 3Q20 $1.7B $1.8B 7% 7% Deposits and service fees Other noninterest income Domestic International Brokerage, advisory and fiduciary activities Securities gains, net (1) The Company revised its domestic and international assets under management presentation in 1Q20. Prior year information has been revised for comparative purposes, resulting in a change from 97% international and 3% domestic as previously reported in 3Q19.

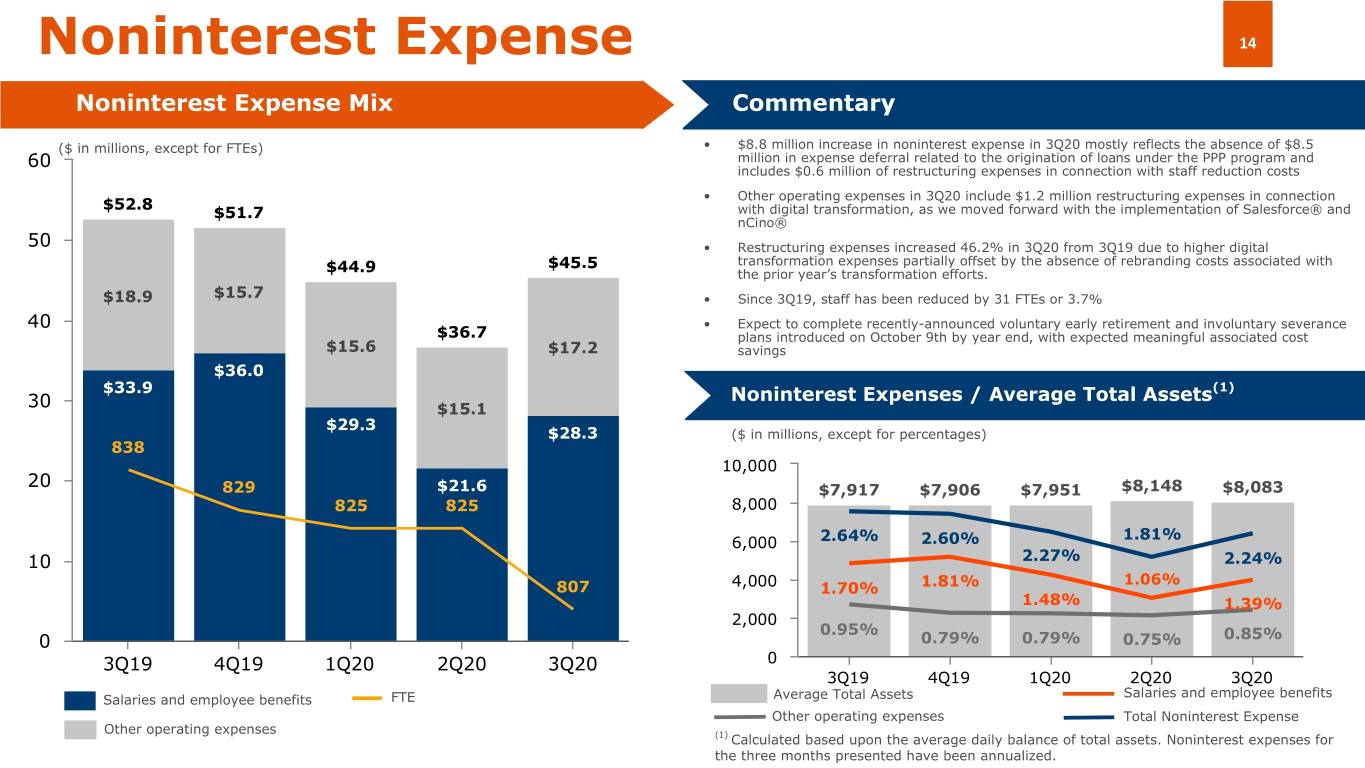

Noninterest Expense 14 Noninterest Expense Mix Commentary ($ in millions, except for FTEs) • $8.8 million increase in noninterest expense in 3Q20 mostly reflects the absence of $8.5 million in expense deferral related to the origination of loans under the PPP program and 60 includes $0.6 million of restructuring expenses in connection with staff reduction costs • Other operating expenses in 3Q20 include $1.2 million restructuring expenses in connection $52.8 $51.7 with digital transformation, as we moved forward with the implementation of Salesforce® and nCino® 50 • Restructuring expenses increased 46.2% in 3Q20 from 3Q19 due to higher digital $45.5 transformation expenses partially offset by the absence of rebranding costs associated with $44.9 the prior year’s transformation efforts. $18.9 $15.7 • Since 3Q19, staff has been reduced by 31 FTEs or 3.7% 40 • Expect to complete recently-announced voluntary early retirement and involuntary severance $36.7 plans introduced on October 9th by year end, with expected meaningful associated cost $15.6 $17.2 savings $36.0 $33.9 Noninterest Expenses / Average Total Assets(1) 30 $15.1 $29.3 $28.3 ($ in millions, except for percentages) 838 10,000 20 829 $21.6 $7,917 $7,906 $7,951 $8,148 $8,083 825 825 8,000 1.81% 6,000 2.64% 2.60% 2.27% 2.24% 10 1.06% 807 4,000 1.70% 1.81% 1.48% 1.39% 2,000 0.95% 0 0.79% 0.79% 0.75% 0.85% 3Q19 4Q19 1Q20 2Q20 3Q20 0 3Q19 4Q19 1Q20 2Q20 3Q20 Salaries and employee benefits Salaries and employee benefits FTE Average Total Assets Other operating expenses Total Noninterest Expense Other operating expenses (1) Calculated based upon the average daily balance of total assets. Noninterest expenses for the three months presented have been annualized.

Interest Rate Sensitivity 15 Commentary Loan Portfolio & Repricing Detail • The Company continues to be asset sensitive as over half of (As of September 30, 2020) loans have floating rate structures or mature within a year By Rate Type By Interest Type • Actively implementing floor rates in the loan portfolio and managing investment portfolio seeking to reduce asset sensitivity in low interest rate environment and protect the NIM • Leveraging opportunities for higher-yield securities with higher Fixed Swap coupon rates and longer duration 48% 4% Fixed 52% Impact on NII from Interest Rate Change (1) Prime 7% (As of September 30, 2020) 3.5% Adjustable Libor 2.1% 52% 35% UST 0.0% 200 2% By Repricing Term -1.7% -2.6% 180 1-3 years 4-5 years 11% ($ in Millions) $193 $196 11% $184 $186 $189 160 5+ years 25% -50 bps -25 bps BASE +25 bps +50 bps Net Interest Income Change from base <1 year (1) 53% NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve

16 FY20-21 Goals • Continue focus on domestic Net Interest • Protect loan portfolio yield while commercial deposit growth via cross proactively reducing funding sale and by targeting new verticals/ Income costs to improve NIM Deposits niches for deposits • Increase domestic deposits and • Continue simplification of share of wallet from higher net worth operations and moving forward international customers with new technologies and Noninterest approaches to drive expense Expenses reduction initiatives • Continue growth of domestic loans • Continue alignment of operating by targeting selected customers and structure and resources with our Loans verticals/niches for loans business activities • Continue diversification between C&I and CRE throughout our markets Noninterest • Continue expansion of wealth management client acquisition • Continue earnings accretion, and Income and fee income initiatives Capital prudent focus on capital preservation Management in light of COVID-19 • Preserve asset quality • Enhanced loan portfolio Credit Quality monitoring in light of COVID-19 • Proactive assessment of ALL Committed to driving shareholder value

Supplemental Loan Portfolio Information

Loan portfolio by industry 18 (September 30, 2020) Real Non-Real % Total Unfunded Highlights ($ in millions) Estate Estate Total Loans Commitments(8) (1) Financial Sector $ 5 $ 70 $ 75 1.3 % $ 18 • Diversified portfolio - highest Construction and Real Estate & Leasing: sector concentration, other Commercial real estate loans 2,986 — 2,986 50.4 % 192 than real estate, at 10.4% of Other real estate related services and equipment leasing (2) 50 87 137 2.3 % 20 total loans Total construction and real estate & leasing 3,036 87 3,123 52.7 % 212 Manufacturing: • 76% of total loans secured by Foodstuffs, Apparel 74 32 106 1.8 % 4 real estate Metals, Computer, Transportation and Other 16 120 136 2.3 % 20 Chemicals, Oil, Plastics, Cement and Wood/Paper 25 12 37 0.6 % 4 Total Manufacturing 115 164 279 4.7 % 28 • Main concentrations: Wholesale (3) 164 426 590 10.0 % 150 • CRE or Commercial Real Retail Trade (4) 257 156 413 7.0 % 41 Estate Services: Communication, Transportation, Health and Other (5) 240 172 412 7.0 % 32 • Wholesale - Food Accommodation, Restaurants, Entertainment and other services (6) 100 72 172 2.9 % 27 • Retail - Gas stations Electricity, Gas, Water, Supply and Sewage Services 6 29 35 0.6 % 3 • Services – Healthcare, Total Services 346 273 619 10.4 % 63 Repair and Maintenance Primary Products: Agriculture, Livestock, Fishing and Forestry — 1 1 — % — Mining — 3 3 0.1 % — Total Primary Products — 4 4 0.1 % — Other Loans (7) 598 224 822 13.9 % 223 Total Loans $ 4,521 $ 1,404 $ 5,925 100.0 % $ 735 (1) Consists mainly of finance facilities granted to non-bank financial companies. (2) Comprised mostly of construction and real estate related services and equipment rental and leasing activities (3) Food wholesalers represented approximately 40% (4) Gasoline stations represented approximately 60% (5) Healthcare represented approximately 57% (6) Other repair and maintenance services represented 53% (7) Primarily residential, consumer loans, and cash secured loans and loans belonging to industrial sectors not included in the above sectors, which do not individually represent more than 1 percent of the total loans portfolio (8) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers provide additional collateral to access the full amount of the commitment

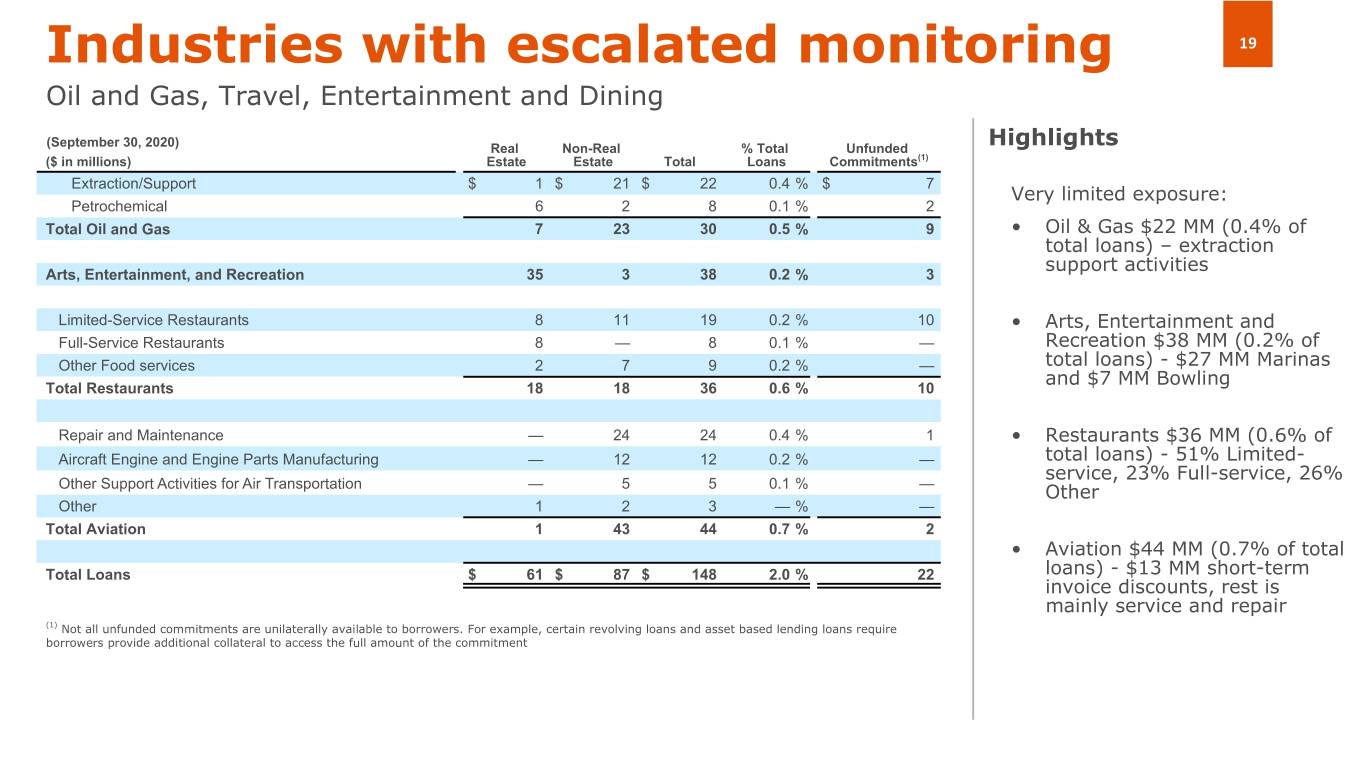

Industries with escalated monitoring 19 Oil and Gas, Travel, Entertainment and Dining (September 30, 2020) Real Non-Real % Total Unfunded Highlights ($ in millions) Estate Estate Total Loans Commitments(1) Extraction/Support $ 1 $ 21 $ 22 0.4 % $ 7 Very limited exposure: Petrochemical 6 2 8 0.1 % 2 Total Oil and Gas 7 23 30 0.5 % 9 • Oil & Gas $22 MM (0.4% of total loans) – extraction support activities Arts, Entertainment, and Recreation 35 3 38 0.2 % 3 Limited-Service Restaurants 8 11 19 0.2 % 10 • Arts, Entertainment and Full-Service Restaurants 8 — 8 0.1 % — Recreation $38 MM (0.2% of Other Food services 2 7 9 0.2 % — total loans) - $27 MM Marinas and $7 MM Bowling Total Restaurants 18 18 36 0.6 % 10 Repair and Maintenance — 24 24 0.4 % 1 • Restaurants $36 MM (0.6% of Aircraft Engine and Engine Parts Manufacturing — 12 12 0.2 % — total loans) - 51% Limited- service, 23% Full-service, 26% Other Support Activities for Air Transportation — 5 5 0.1 % — Other Other 1 2 3 — % — Total Aviation 1 43 44 0.7 % 2 • Aviation $44 MM (0.7% of total Total Loans $ 61 $ 87 $ 148 2.0 % 22 loans) - $13 MM short-term invoice discounts, rest is mainly service and repair (1) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers provide additional collateral to access the full amount of the commitment

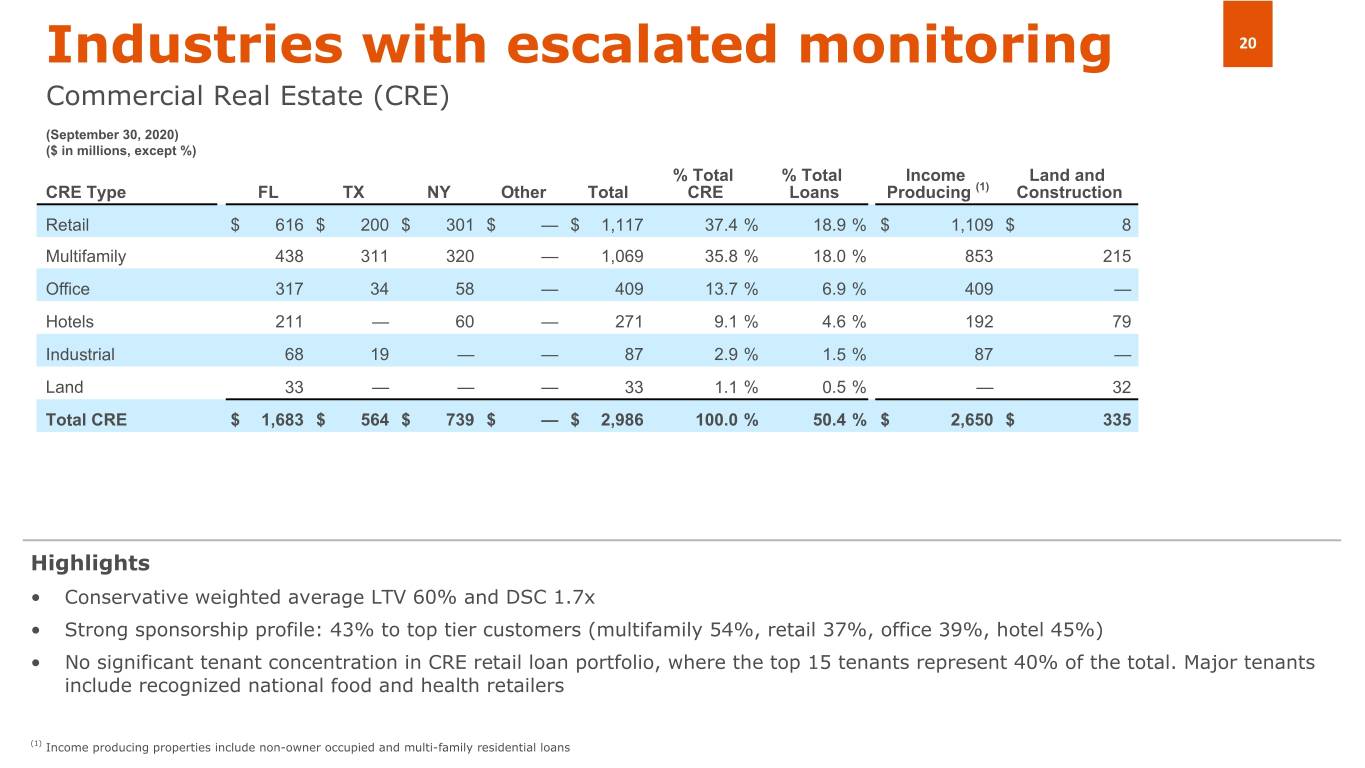

Industries with escalated monitoring 20 Commercial Real Estate (CRE) (September 30, 2020) ($ in millions, except %) % Total % Total Income Land and CRE Type FL TX NY Other Total CRE Loans Producing (1) Construction Retail $ 616 $ 200 $ 301 $ — $ 1,117 37.4 % 18.9 % $ 1,109 $ 8 Multifamily 438 311 320 — 1,069 35.8 % 18.0 % 853 215 Office 317 34 58 — 409 13.7 % 6.9 % 409 — Hotels 211 — 60 — 271 9.1 % 4.6 % 192 79 Industrial 68 19 — — 87 2.9 % 1.5 % 87 — Land 33 — — — 33 1.1 % 0.5 % — 32 Total CRE $ 1,683 $ 564 $ 739 $ — $ 2,986 100.0 % 50.4 % $ 2,650 $ 335 Highlights • Conservative weighted average LTV 60% and DSC 1.7x • Strong sponsorship profile: 43% to top tier customers (multifamily 54%, retail 37%, office 39%, hotel 45%) • No significant tenant concentration in CRE retail loan portfolio, where the top 15 tenants represent 40% of the total. Major tenants include recognized national food and health retailers (1) Income producing properties include non-owner occupied and multi-family residential loans

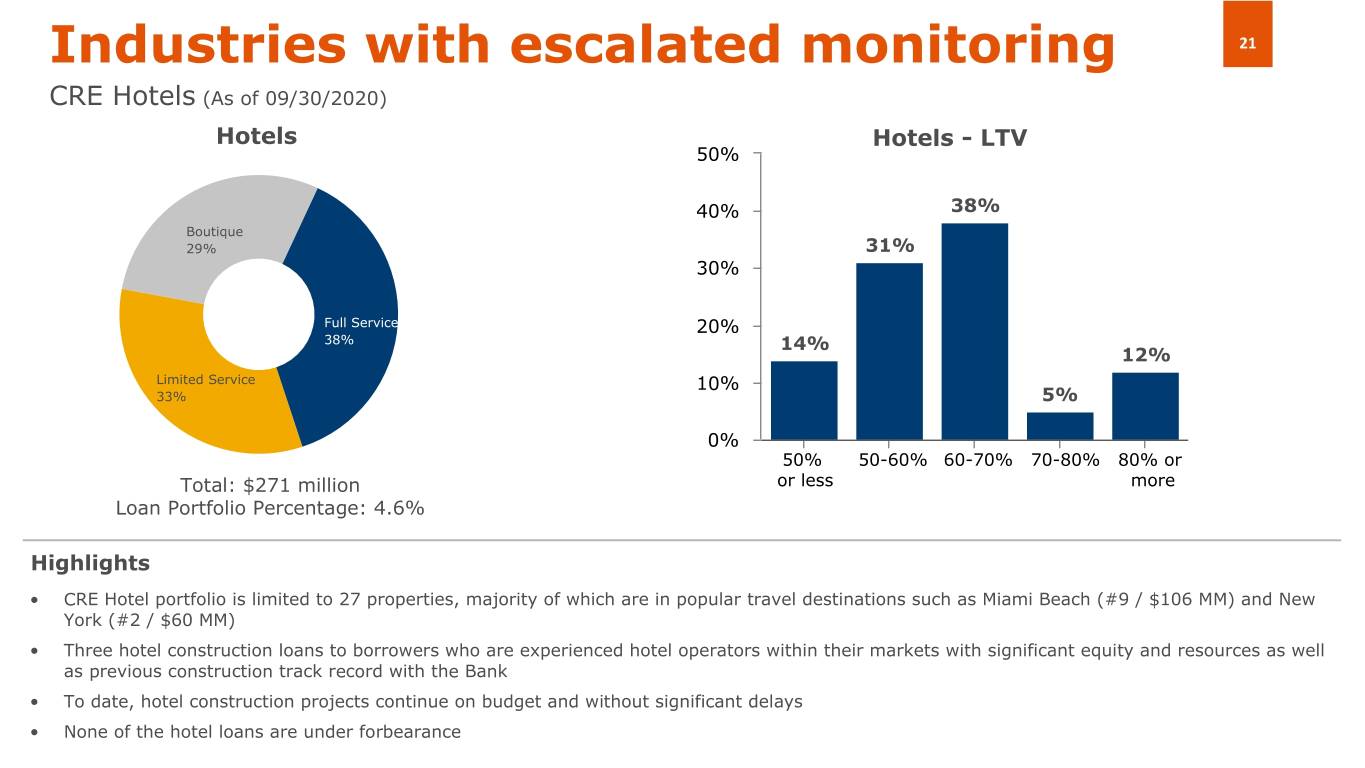

Industries with escalated monitoring 21 CRE Hotels (As of 09/30/2020) Hotels Hotels - LTV 50% 40% 38% Boutique 29% 31% 30% Full Service 20% 38% 14% 12% Limited Service 10% 33% 5% 0% 50% 50-60% 60-70% 70-80% 80% or Total: $271 million or less more Loan Portfolio Percentage: 4.6% Highlights • CRE Hotel portfolio is limited to 27 properties, majority of which are in popular travel destinations such as Miami Beach (#9 / $106 MM) and New York (#2 / $60 MM) • Three hotel construction loans to borrowers who are experienced hotel operators within their markets with significant equity and resources as well as previous construction track record with the Bank • To date, hotel construction projects continue on budget and without significant delays • None of the hotel loans are under forbearance

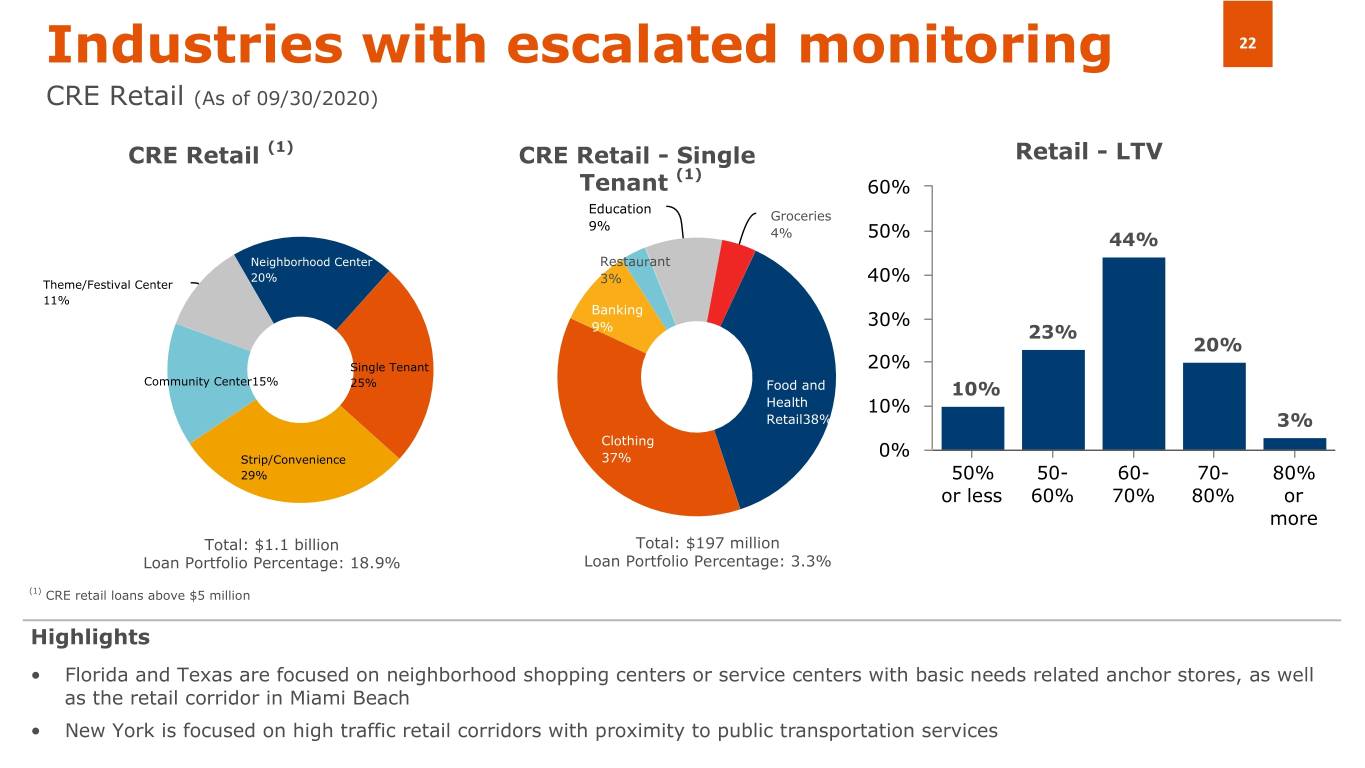

Industries with escalated monitoring 22 CRE Retail (As of 09/30/2020) CRE Retail (1) CRE Retail - Single Retail - LTV (1) Tenant 60% Education Groceries 9% 4% 50% 44% Neighborhood Center Restaurant 20% Theme/Festival Center 3% 40% 11% Banking 30% 9% 23% 20% Single Tenant 20% Community Center15% 25% Food and 10% Health 10% Retail38% 3% Clothing Strip/Convenience 37% 0% 29% 50% 50- 60- 70- 80% or less 60% 70% 80% or more Total: $1.1 billion Total: $197 million Loan Portfolio Percentage: 18.9% Loan Portfolio Percentage: 3.3% (1) CRE retail loans above $5 million Highlights • Florida and Texas are focused on neighborhood shopping centers or service centers with basic needs related anchor stores, as well as the retail corridor in Miami Beach • New York is focused on high traffic retail corridors with proximity to public transportation services

Appendices

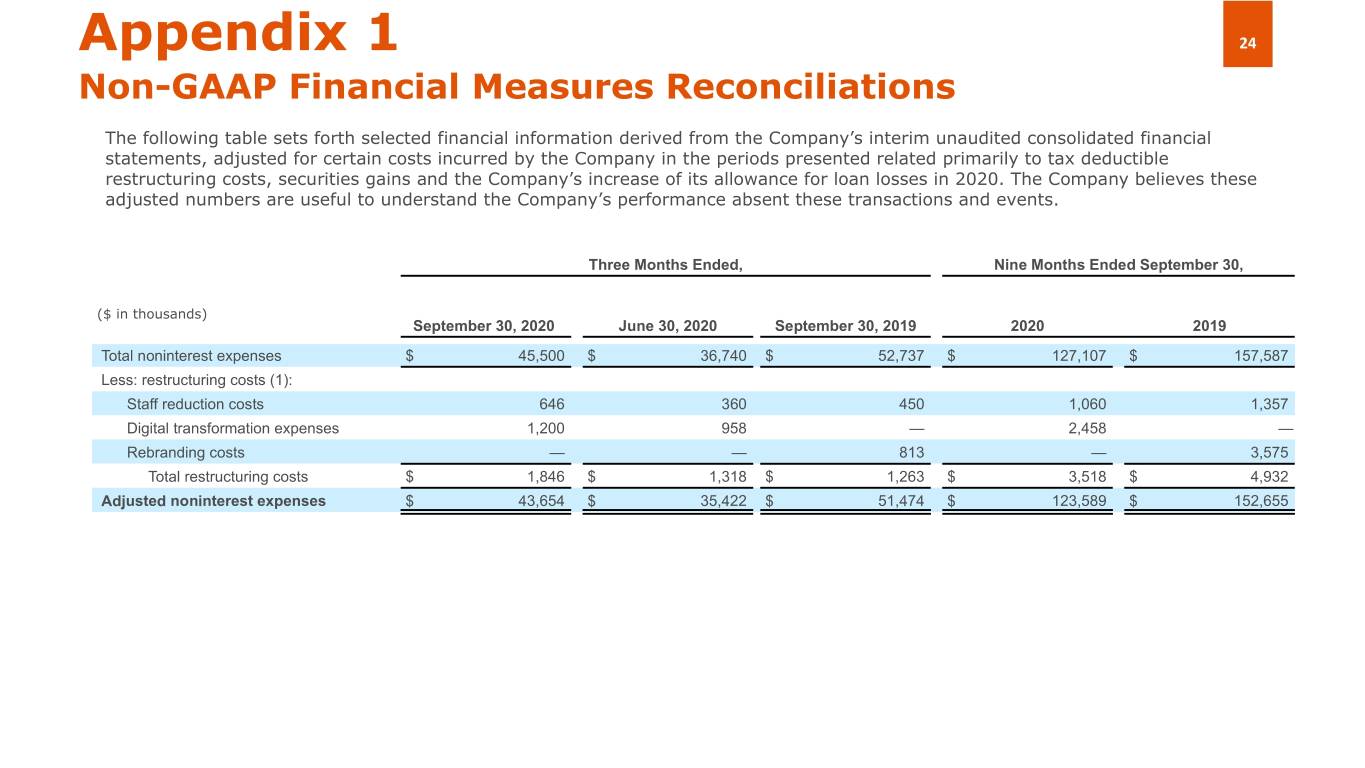

Appendix 1 24 Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related primarily to tax deductible restructuring costs, securities gains and the Company’s increase of its allowance for loan losses in 2020. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events. Three Months Ended, Nine Months Ended September 30, ($ in thousands) September 30, 2020 June 30, 2020 September 30, 2019 2020 2019 Total noninterest expenses $ 45,500 $ 36,740 $ 52,737 $ 127,107 $ 157,587 Less: restructuring costs (1): Staff reduction costs 646 360 450 1,060 1,357 Digital transformation expenses 1,200 958 — 2,458 — Rebranding costs — — 813 — 3,575 Total restructuring costs $ 1,846 $ 1,318 $ 1,263 $ 3,518 $ 4,932 Adjusted noninterest expenses $ 43,654 $ 35,422 $ 51,474 $ 123,589 $ 152,655

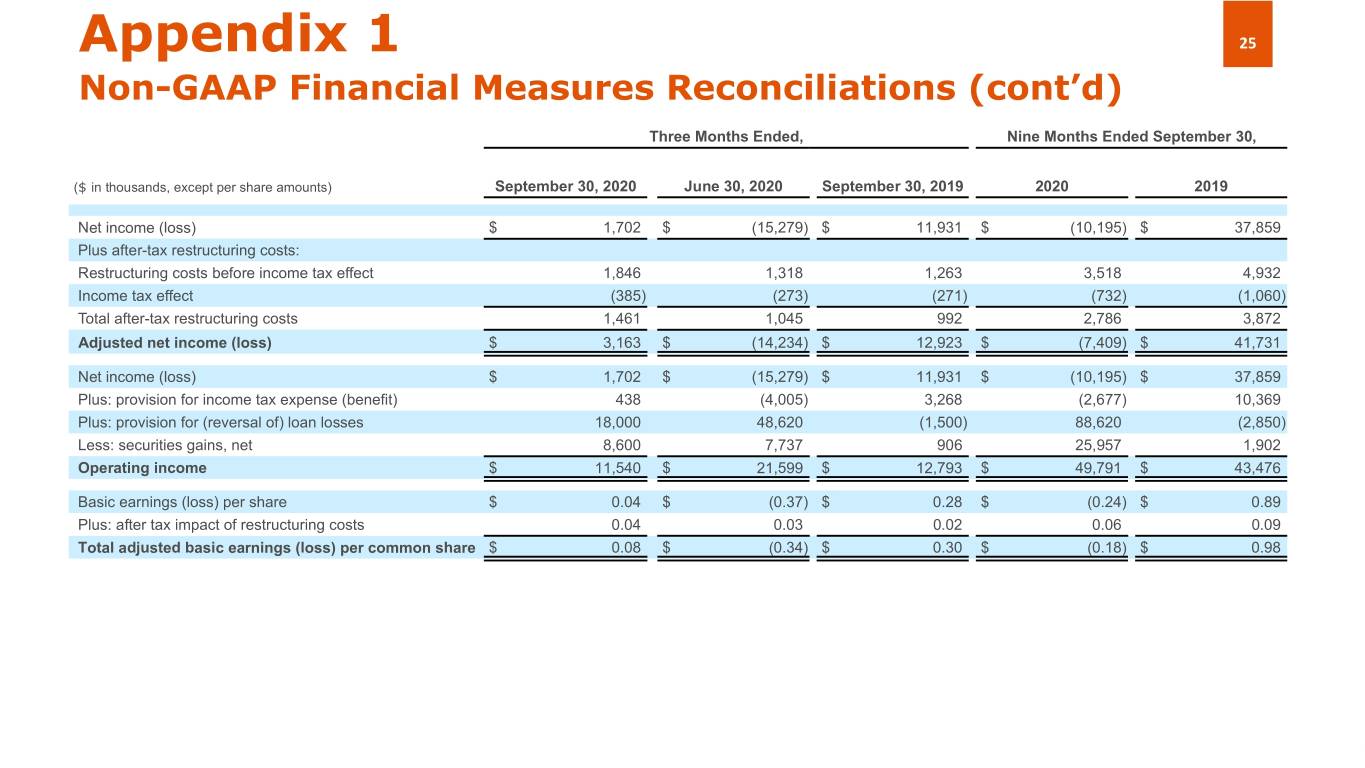

Appendix 1 25 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Nine Months Ended September 30, ($ in thousands, except per share amounts) September 30, 2020 June 30, 2020 September 30, 2019 2020 2019 Net income (loss) $ 1,702 $ (15,279) $ 11,931 $ (10,195) $ 37,859 Plus after-tax restructuring costs: Restructuring costs before income tax effect 1,846 1,318 1,263 3,518 4,932 Income tax effect (385) (273) (271) (732) (1,060) Total after-tax restructuring costs 1,461 1,045 992 2,786 3,872 Adjusted net income (loss) $ 3,163 $ (14,234) $ 12,923 $ (7,409) $ 41,731 Net income (loss) $ 1,702 $ (15,279) $ 11,931 $ (10,195) $ 37,859 Plus: provision for income tax expense (benefit) 438 (4,005) 3,268 (2,677) 10,369 Plus: provision for (reversal of) loan losses 18,000 48,620 (1,500) 88,620 (2,850) Less: securities gains, net 8,600 7,737 906 25,957 1,902 Operating income $ 11,540 $ 21,599 $ 12,793 $ 49,791 $ 43,476 Basic earnings (loss) per share $ 0.04 $ (0.37) $ 0.28 $ (0.24) $ 0.89 Plus: after tax impact of restructuring costs 0.04 0.03 0.02 0.06 0.09 Total adjusted basic earnings (loss) per common share $ 0.08 $ (0.34) $ 0.30 $ (0.18) $ 0.98

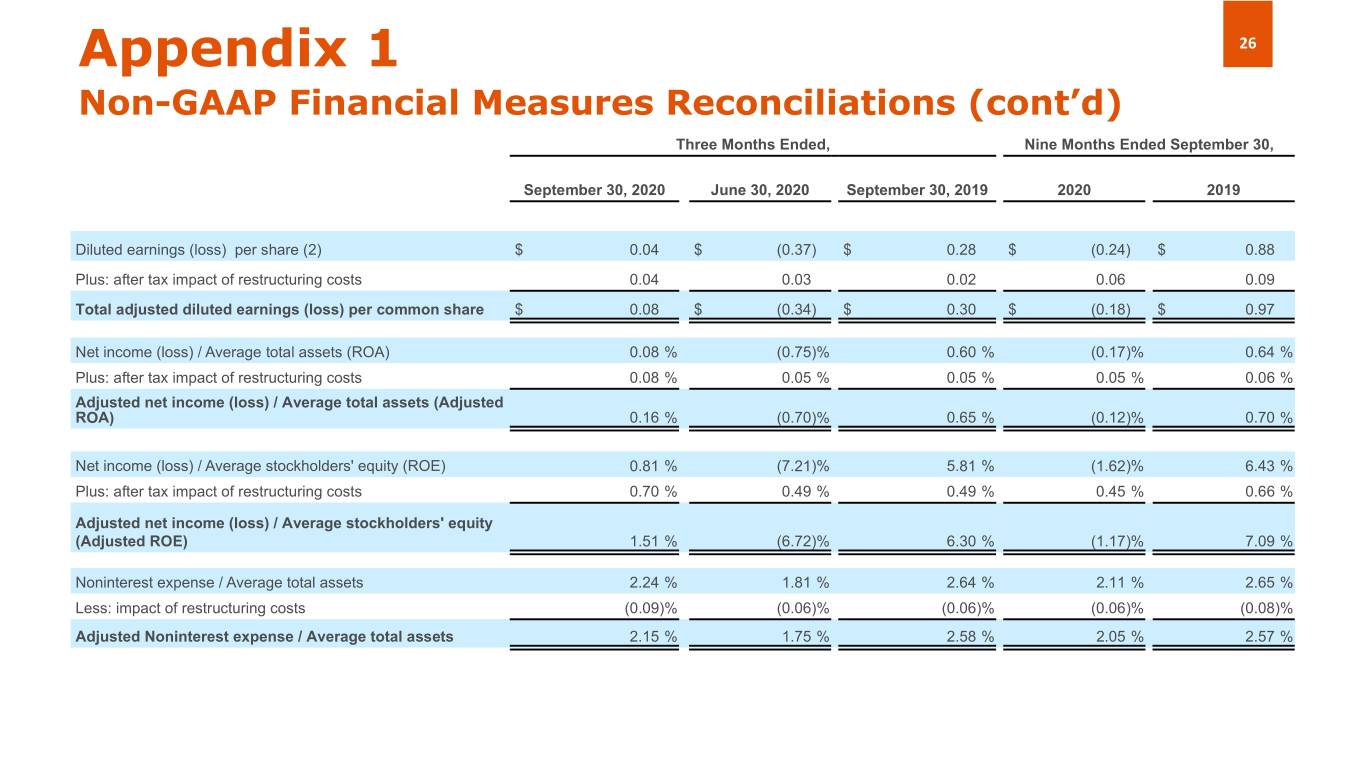

Appendix 1 26 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Nine Months Ended September 30, September 30, 2020 June 30, 2020 September 30, 2019 2020 2019 Diluted earnings (loss) per share (2) $ 0.04 $ (0.37) $ 0.28 $ (0.24) $ 0.88 Plus: after tax impact of restructuring costs 0.04 0.03 0.02 0.06 0.09 Total adjusted diluted earnings (loss) per common share $ 0.08 $ (0.34) $ 0.30 $ (0.18) $ 0.97 Net income (loss) / Average total assets (ROA) 0.08 % (0.75) % 0.60 % (0.17) % 0.64 % Plus: after tax impact of restructuring costs 0.08 % 0.05 % 0.05 % 0.05 % 0.06 % Adjusted net income (loss) / Average total assets (Adjusted ROA) 0.16 % (0.70) % 0.65 % (0.12) % 0.70 % Net income (loss) / Average stockholders' equity (ROE) 0.81 % (7.21) % 5.81 % (1.62) % 6.43 % Plus: after tax impact of restructuring costs 0.70 % 0.49 % 0.49 % 0.45 % 0.66 % Adjusted net income (loss) / Average stockholders' equity (Adjusted ROE) 1.51 % (6.72) % 6.30 % (1.17) % 7.09 % Noninterest expense / Average total assets 2.24 % 1.81 % 2.64 % 2.11 % 2.65 % Less: impact of restructuring costs (0.09) % (0.06) % (0.06) % (0.06) % (0.08) % Adjusted Noninterest expense / Average total assets 2.15 % 1.75 % 2.58 % 2.05 % 2.57 %

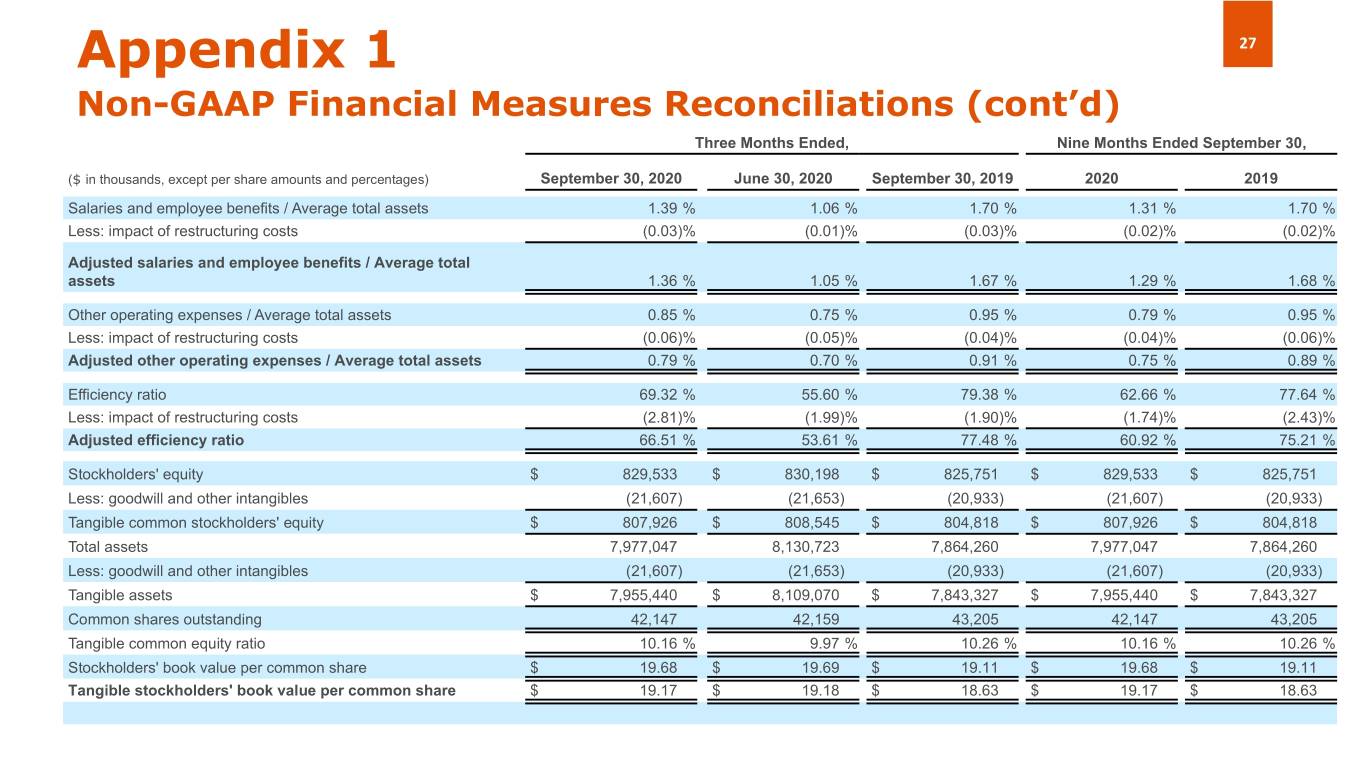

Appendix 1 27 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Nine Months Ended September 30, ($ in thousands, except per share amounts and percentages) September 30, 2020 June 30, 2020 September 30, 2019 2020 2019 Salaries and employee benefits / Average total assets 1.39 % 1.06 % 1.70 % 1.31 % 1.70 % Less: impact of restructuring costs (0.03) % (0.01) % (0.03) % (0.02) % (0.02) % Adjusted salaries and employee benefits / Average total assets 1.36 % 1.05 % 1.67 % 1.29 % 1.68 % Other operating expenses / Average total assets 0.85 % 0.75 % 0.95 % 0.79 % 0.95 % Less: impact of restructuring costs (0.06) % (0.05) % (0.04) % (0.04) % (0.06) % Adjusted other operating expenses / Average total assets 0.79 % 0.70 % 0.91 % 0.75 % 0.89 % Efficiency ratio 69.32 % 55.60 % 79.38 % 62.66 % 77.64 % Less: impact of restructuring costs (2.81) % (1.99) % (1.90) % (1.74) % (2.43) % Adjusted efficiency ratio 66.51 % 53.61 % 77.48 % 60.92 % 75.21 % Stockholders' equity $ 829,533 $ 830,198 $ 825,751 $ 829,533 $ 825,751 Less: goodwill and other intangibles (21,607) (21,653) (20,933) (21,607) (20,933) Tangible common stockholders' equity $ 807,926 $ 808,545 $ 804,818 $ 807,926 $ 804,818 Total assets 7,977,047 8,130,723 7,864,260 7,977,047 7,864,260 Less: goodwill and other intangibles (21,607) (21,653) (20,933) (21,607) (20,933) Tangible assets $ 7,955,440 $ 8,109,070 $ 7,843,327 $ 7,955,440 $ 7,843,327 Common shares outstanding 42,147 42,159 43,205 42,147 43,205 Tangible common equity ratio 10.16 % 9.97 % 10.26 % 10.16 % 10.26 % Stockholders' book value per common share $ 19.68 $ 19.69 $ 19.11 $ 19.68 $ 19.11 Tangible stockholders' book value per common share $ 19.17 $ 19.18 $ 18.63 $ 19.17 $ 18.63

Appendix 1 28 Non-GAAP Financial Measures Reconciliations (cont’d) (1) Expenses incurred for actions designed to implement the Company’s strategy as a new independent company. These actions include, but are not limited to reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (2) As of September 30, 2020,June 30, 2020 and September 30, 2019 potential dilutive instruments consisted of unvested shares of restricted stock and restricted stock units mainly related to the Company’s IPO in 2018, totaling 478,587, 491,360 and 789,652, respectively. For the three months ended June 30, 2020 and the nine months ended September 30, 2020, potential dilutive instruments were not included in the dilutive earnings per share computation because the Company reported a net loss and their inclusion would have an antidilutive effect. For all other periods presented, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in those periods, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in those periods, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings.

Thank you Investor Relations InvestorRelations@amerantbank.com