Earnings Call January 29, 2021 Fourth Quarter 2020 Financial Review

Forward-Looking Statements This presentation contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, including statements with respect to our objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” and other similar words and expressions of the future. Forward-looking statements, including those as to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10- K for the fiscal year ended December 31, 2019, in our quarterly report on Form 10-Q for the fiscal quarter ended June 30, 2020 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including the three and twelve month periods ended December 31, 2020 and the three month period ended December 31, 2019, may not reflect our results of operations for our fiscal year ended, or financial condition as of December 31, 2020, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “adjusted noninterest income”, “adjusted noninterest expense”, “adjusted net income (loss)”, “operating income”, “adjusted net income (loss) per share (basic and diluted)”, “adjusted return on assets (ROA)”, “adjusted return on equity (ROE)”, and other ratios. This supplemental information is not required by, or is not presented in accordance with, U.S. generally accepted accounting principles (“GAAP”). The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued into 2020, the one-time loss on sale of the Beacon operations center in the fourth quarter of 2020, the one-time gain on sale of the vacant Beacon land in the fourth quarter of 2019, the Company’s increases of its allowance for loan losses and net gains on sales of securities in the first, second and third quarters of 2020. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. See Appendix 1 “Non-GAAP Financial Measures Reconciliations” of the earnings presentation for a reconciliation of these non-GAAP financial measures to their GAAP counterparts. Important Notices and Disclaimers

Opening Remarks 4Q20 and Full Year

• No provision for loan losses recorded in 4Q20 on lower-than-initially-estimated credit deterioration and improved economic conditions • Assigned additional $5.8 million specific reserve related to the Miami-based U.S. coffee trader ('the Coffee Trader") • ALL coverage ratio for 4Q20 strong at 1.90%, down from 1.97% in 3Q20 • Allowance to non-performing loans(1) ratio decreased to 1.3x in 4Q20, down from 1.4x in 3Q20 Performance Highlights 4Q20 Credit Quality Balance Sheet • Net income of $8.5 million in 4Q20, up 397.8% compared to a net income of $1.7 million in 3Q20; Diluted earnings per share was $0.20 for 4Q20, compared to $0.04 in 3Q20 • Net Interest Income ("NII") of $48.7 million in 4Q20, up 7.3% from $45.3 million in 3Q20 mainly due to lower overall deposit costs and higher yield on loan portfolio, partially offset by lower average balances on AFS securities • Net Interest Margin ("NIM") for 4Q20 was 2.61%, up 22 basis points from 2.39% in 3Q20 • Noninterest income decreased 43.3% from 3Q20 driven mainly by lower net gains of sale of securities and a one-time loss on the sale of the Beacon operations center • Noninterest expense increased 13.5% over 3Q20 largely driven by higher severance expenses (voluntary early retirement plan and involuntary severance plan) • Total loans were $5.8 billion, down 1.4% from 3Q20. Continued to purchase higher-yield consumer loans, and consumer and residential loan portfolios increased, both quarter-over-quarter • Total deposits were $5.7 billion, down 2.5% from 3Q20, mainly driven by a reduction of high-cost customer CDs • Total cash and cash equivalents were $214.4 million as of December 31, 2020, relatively flat from 3Q20 • The Company has $1.2 billion in investment securities that could be used as collateral for borrowings and $1.3 billion in additional borrowing capacity with the FHLB Profitability (1) Non-performing loans include all accruing loans 90 days or more past due, all nonaccrual loans and restructured loans that are considered TDRs. Non-performing loans were $87.7 million, as of December 31, 2020, and includes $19.6 million for the Coffee Trader loan relationship

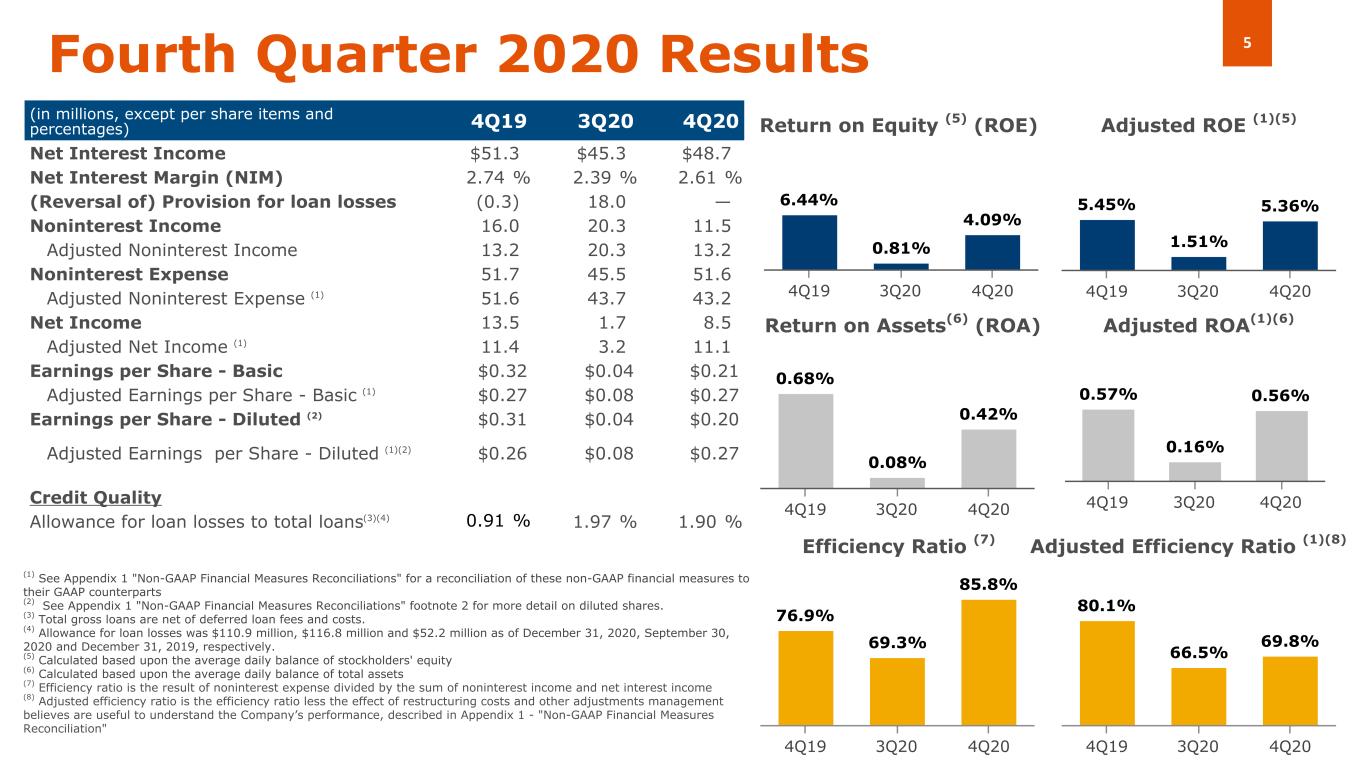

0.57% 0.16% 0.56% 4Q19 3Q20 4Q20 80.1% 66.5% 69.8% 4Q19 3Q20 4Q20 0.68% 0.08% 0.42% 4Q19 3Q20 4Q20 76.9% 69.3% 85.8% 4Q19 3Q20 4Q20 Return on Assets(6) (ROA) Fourth Quarter 2020 Results Return on Equity (5) (ROE) Adjusted ROE (1)(5) Efficiency Ratio (7) Adjusted ROA(1)(6) Adjusted Efficiency Ratio (1)(8) (1) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP counterparts (2) See Appendix 1 "Non-GAAP Financial Measures Reconciliations" footnote 2 for more detail on diluted shares. (3) Total gross loans are net of deferred loan fees and costs. (4) Allowance for loan losses was $110.9 million, $116.8 million and $52.2 million as of December 31, 2020, September 30, 2020 and December 31, 2019, respectively. (5) Calculated based upon the average daily balance of stockholders' equity (6) Calculated based upon the average daily balance of total assets (7) Efficiency ratio is the result of noninterest expense divided by the sum of noninterest income and net interest income (8) Adjusted efficiency ratio is the efficiency ratio less the effect of restructuring costs and other adjustments management believes are useful to understand the Company’s performance, described in Appendix 1 - "Non-GAAP Financial Measures Reconciliation" 6.44% 0.81% 4.09% 4Q19 3Q20 4Q20 5.45% 1.51% 5.36% 4Q19 3Q20 4Q20 (in millions, except per share items and percentages) 4Q19 3Q20 4Q20 Net Interest Income $51.3 $45.3 $48.7 Net Interest Margin (NIM) 2.74 % 2.39 % 2.61 % (Reversal of) Provision for loan losses (0.3) 18.0 — Noninterest Income 16.0 20.3 11.5 Adjusted Noninterest Income 13.2 20.3 13.2 Noninterest Expense 51.7 45.5 51.6 Adjusted Noninterest Expense (1) 51.6 43.7 43.2 Net Income 13.5 1.7 8.5 Adjusted Net Income (1) 11.4 3.2 11.1 Earnings per Share - Basic $0.32 $0.04 $0.21 Adjusted Earnings per Share - Basic (1) $0.27 $0.08 $0.27 Earnings per Share - Diluted (2) $0.31 $0.04 $0.20 Adjusted Earnings per Share - Diluted (1)(2) $0.26 $0.08 $0.27 Credit Quality Allowance for loan losses to total loans(3)(4) 0.91 % 1.97 % 1.90 %

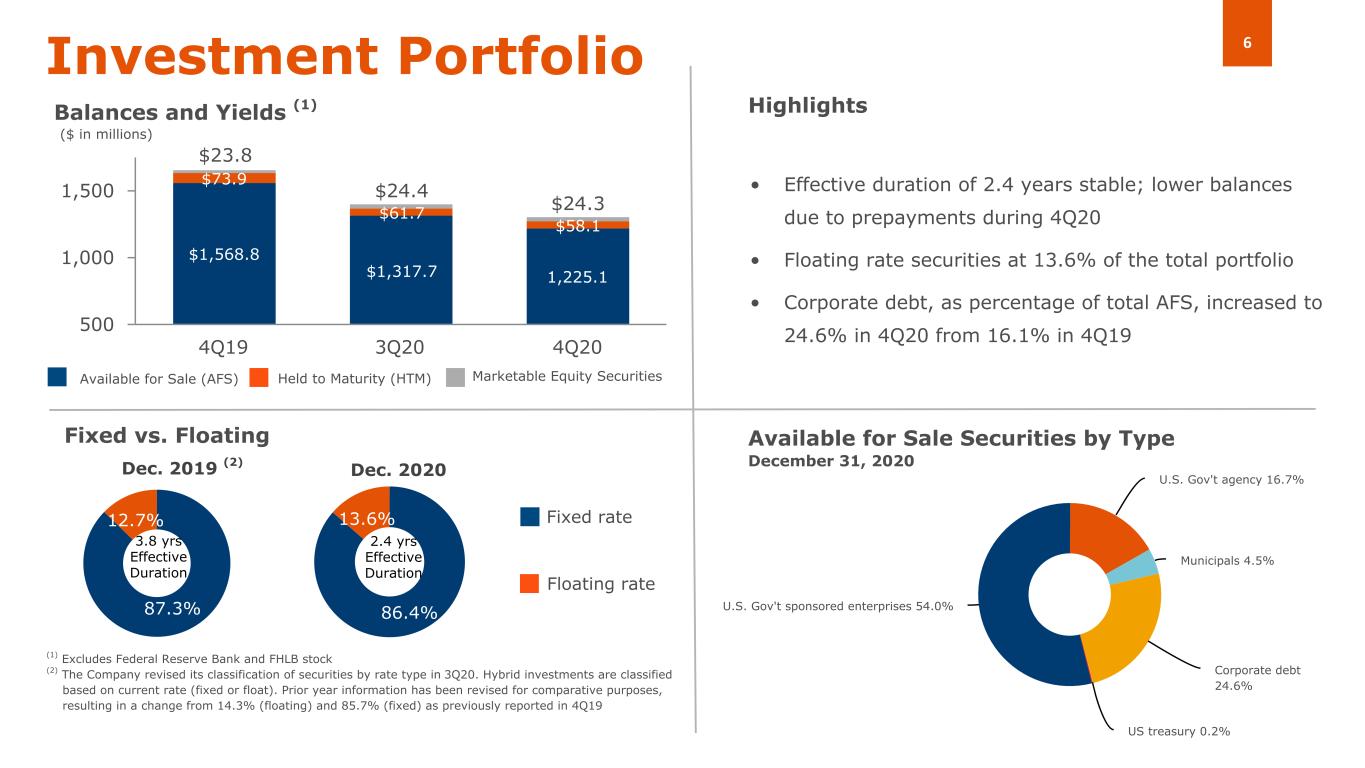

86.4% 13.6% U.S. Gov't sponsored enterprises 54.0% U.S. Gov't agency 16.7% Municipals 4.5% Corporate debt 24.6% US treasury 0.2% $1,568.8 $1,317.7 1,225.1 $73.9 $61.7 $58.1 $23.8 $24.4 $24.3 4Q19 3Q20 4Q20 500 1,000 1,500 87.3% 12.7% • Effective duration of 2.4 years stable; lower balances due to prepayments during 4Q20 • Floating rate securities at 13.6% of the total portfolio • Corporate debt, as percentage of total AFS, increased to 24.6% in 4Q20 from 16.1% in 4Q19 Investment Portfolio Balances and Yields (1) Available for Sale (AFS) Held to Maturity (HTM) Highlights Fixed vs. Floating Dec. 2019 (2) Dec. 2020 Floating rate Fixed rate Available for Sale Securities by Type December 31, 2020 3.8 yrs Effective Duration ($ in millions) Marketable Equity Securities (1) Excludes Federal Reserve Bank and FHLB stock (2) The Company revised its classification of securities by rate type in 3Q20. Hybrid investments are classified based on current rate (fixed or float). Prior year information has been revised for comparative purposes, resulting in a change from 14.3% (floating) and 85.7% (fixed) as previously reported in 4Q19 2.4 yrs Effective Duration

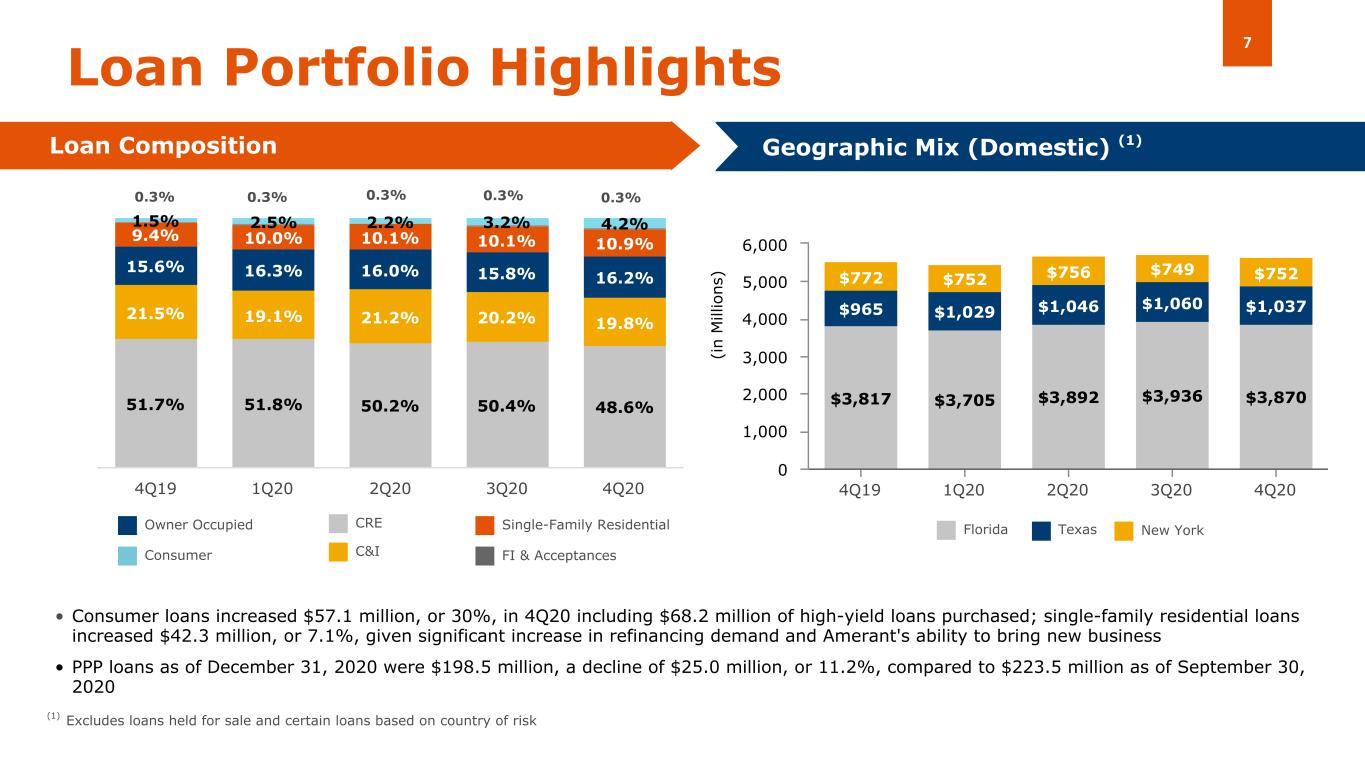

Consumer FI & Acceptances CRE C&I Owner Occupied Single-Family Residential Loan Portfolio Highlights Loan Composition Geographic Mix (Domestic) • Consumer loans increased $57.1 million, or 30%, in 4Q20 including $68.2 million of high-yield loans purchased; single-family residential loans increased $42.3 million, or 7.1%, given significant increase in refinancing demand and Amerant's ability to bring new business • PPP loans as of December 31, 2020 were $198.5 million, a decline of $25.0 million, or 11.2%, compared to $223.5 million as of September 30, 2020 (1) Florida Texas New York 0.3% 0.3% 0.3% 0.3% (in M ill io n s) 0.3% $3,817 $3,705 $3,892 $3,936 $3,870 $965 $1,029 $1,046 $1,060 $1,037 $772 $752 $756 $749 $752 4Q19 1Q20 2Q20 3Q20 4Q20 0 1,000 2,000 3,000 4,000 5,000 6,000 51.7% 51.8% 50.2% 50.4% 48.6% 21.5% 19.1% 21.2% 20.2% 19.8% 15.6% 16.3% 16.0% 15.8% 16.2% 9.4% 10.0% 10.1% 10.1% 10.9% 1.5% 2.5% 2.2% 3.2% 4.2% 4Q19 1Q20 2Q20 3Q20 4Q20 (1) Excludes loans held for sale and certain loans based on country of risk

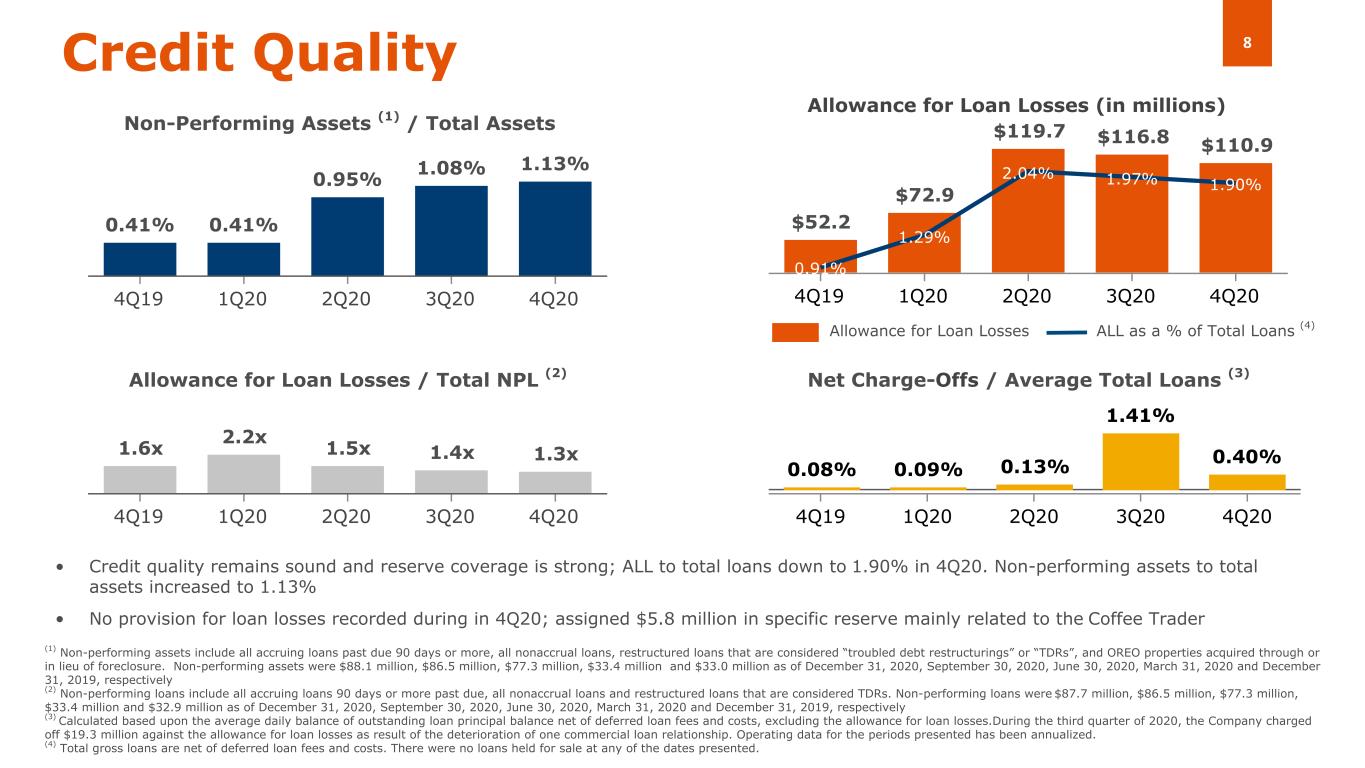

0.41% 0.41% 0.95% 1.08% 1.13% 4Q19 1Q20 2Q20 3Q20 4Q20 $52.2 $72.9 $119.7 $116.8 $110.9 0.91% 1.29% 2.04% 1.97% 1.90% 4Q19 1Q20 2Q20 3Q20 4Q20 Net Charge-Offs / Average Total Loans (3) Credit Quality Allowance for Loan Losses (in millions) Non-Performing Assets (1) / Total Assets Allowance for Loan Losses / Total NPL (2) Allowance for Loan Losses ALL as a % of Total Loans (4) 1.6x 2.2x 1.5x 1.4x 1.3x 4Q19 1Q20 2Q20 3Q20 4Q20 • Credit quality remains sound and reserve coverage is strong; ALL to total loans down to 1.90% in 4Q20. Non-performing assets to total assets increased to 1.13% • No provision for loan losses recorded during in 4Q20; assigned $5.8 million in specific reserve mainly related to the Coffee Trader 0.08% 0.09% 0.13% 1.41% 0.40% 4Q19 1Q20 2Q20 3Q20 4Q20 (1) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of foreclosure. Non-performing assets were $88.1 million, $86.5 million, $77.3 million, $33.4 million and $33.0 million as of December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020 and December 31, 2019, respectively (2) Non-performing loans include all accruing loans 90 days or more past due, all nonaccrual loans and restructured loans that are considered TDRs. Non-performing loans were $87.7 million, $86.5 million, $77.3 million, $33.4 million and $32.9 million as of December 31, 2020, September 30, 2020, June 30, 2020, March 31, 2020 and December 31, 2019, respectively (3) Calculated based upon the average daily balance of outstanding loan principal balance net of deferred loan fees and costs, excluding the allowance for loan losses.During the third quarter of 2020, the Company charged off $19.3 million against the allowance for loan losses as result of the deterioration of one commercial loan relationship. Operating data for the periods presented has been annualized. (4) Total gross loans are net of deferred loan fees and costs. There were no loans held for sale at any of the dates presented.

$5,744 $5,668 $5,872 $5,925 $5,842 $1,739 $1,770 $1,675 $1,469 $1,373 4.47% 4.31% 3.77% 3.64% 3.76% 2.66% 2.59% 2.50% 2.32% 2.29% 4Q19 1Q20 2Q20 3Q20 4Q20 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 Interest-Earning Assets (1) • Loan yield increased 12 basis points versus previous quarter, primarily driven by higher yields resulting from floor strategy on C&I portfolio, prepayment penalties collected and higher average balances on indirect lending • Despite low rate environment, investment yield remained virtually flat partially mitigated by reinvestment in higher-yield securities in line with risk appetite (1) Balances represent period-end outstanding amounts Investments (1)Loans(1) Loan Yield Investment Yield (in millions, except for percentages)

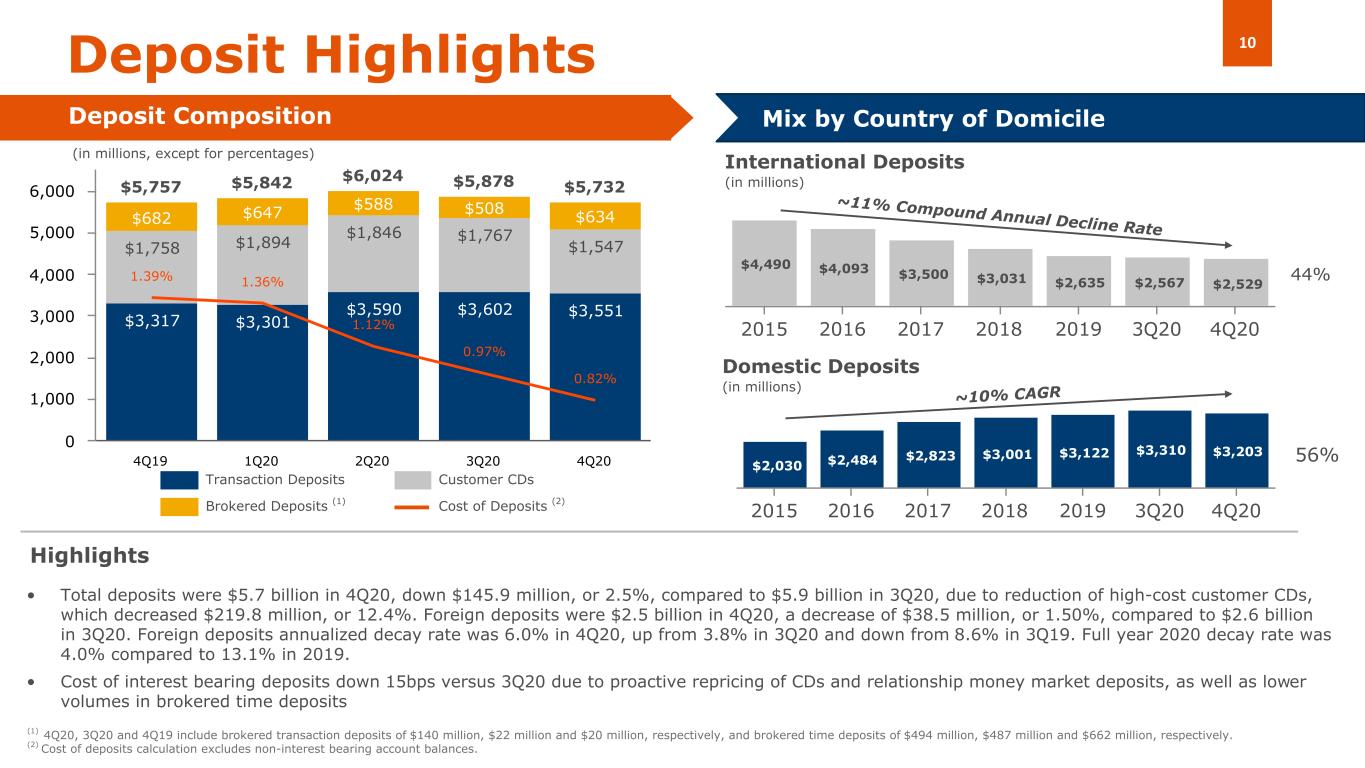

$2,030 $2,484 $2,823 $3,001 $3,122 $3,310 $3,203 2015 2016 2017 2018 2019 3Q20 4Q20 $4,490 $4,093 $3,500 $3,031 $2,635 $2,567 $2,529 2015 2016 2017 2018 2019 3Q20 4Q20 $5,757 $5,842 $6,024 $5,878 $5,732 $3,317 $3,301 $3,590 $3,602 $3,551 $1,758 $1,894 $1,846 $1,767 $1,547 $682 $647 $588 $508 $634 1.39% 1.36% 1.12% 0.97% 0.82% 4Q19 1Q20 2Q20 3Q20 4Q20 0 1,000 2,000 3,000 4,000 5,000 6,000 ~10% CAGR Domestic Deposits (in millions) ~11% Compound Annual Decline Rate Deposit Highlights Deposit Composition • Total deposits were $5.7 billion in 4Q20, down $145.9 million, or 2.5%, compared to $5.9 billion in 3Q20, due to reduction of high-cost customer CDs, which decreased $219.8 million, or 12.4%. Foreign deposits were $2.5 billion in 4Q20, a decrease of $38.5 million, or 1.50%, compared to $2.6 billion in 3Q20. Foreign deposits annualized decay rate was 6.0% in 4Q20, up from 3.8% in 3Q20 and down from 8.6% in 3Q19. Full year 2020 decay rate was 4.0% compared to 13.1% in 2019. • Cost of interest bearing deposits down 15bps versus 3Q20 due to proactive repricing of CDs and relationship money market deposits, as well as lower volumes in brokered time deposits 56% International Deposits (in millions) Mix by Country of Domicile Transaction Deposits Customer CDs Brokered Deposits (1) Cost of Deposits (2) 44% Highlights (in millions, except for percentages) (1) 4Q20, 3Q20 and 4Q19 include brokered transaction deposits of $140 million, $22 million and $20 million, respectively, and brokered time deposits of $494 million, $487 million and $662 million, respectively. (2) Cost of deposits calculation excludes non-interest bearing account balances.

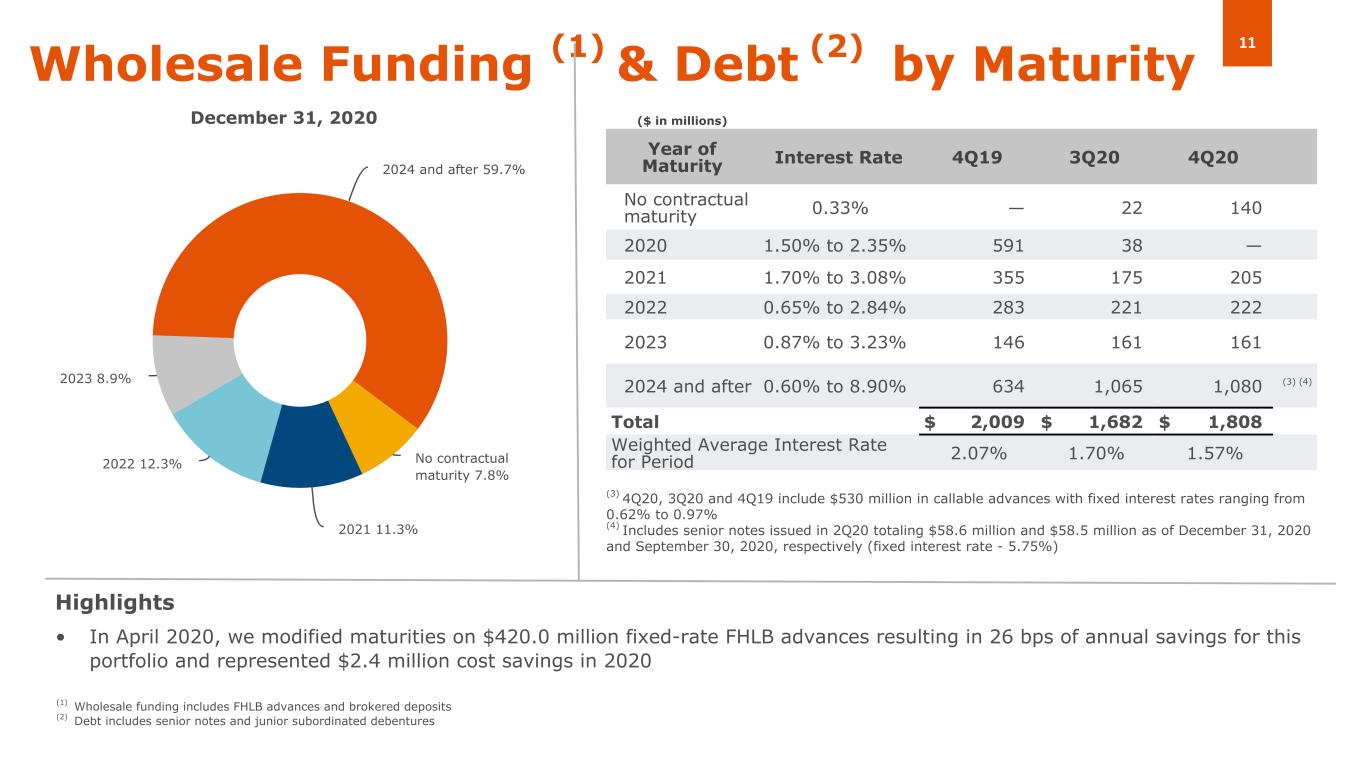

2021 11.3% 2022 12.3% 2023 8.9% 2024 and after 59.7% No contractual maturity 7.8% Wholesale Funding (1) & Debt (2) by Maturity ($ in millions) Year of Maturity Interest Rate 4Q19 3Q20 4Q20 No contractual maturity 0.33% — 22 140 2020 1.50% to 2.35% 591 38 — 2021 1.70% to 3.08% 355 175 205 2022 0.65% to 2.84% 283 221 222 2023 0.87% to 3.23% 146 161 161 2024 and after 0.60% to 8.90% 634 1,065 1,080 (3) (4) Total $ 2,009 $ 1,682 $ 1,808 Weighted Average Interest Rate for Period 2.07% 1.70% 1.57% • In April 2020, we modified maturities on $420.0 million fixed-rate FHLB advances resulting in 26 bps of annual savings for this portfolio and represented $2.4 million cost savings in 2020 Highlights (3) 4Q20, 3Q20 and 4Q19 include $530 million in callable advances with fixed interest rates ranging from 0.62% to 0.97% (4) Includes senior notes issued in 2Q20 totaling $58.6 million and $58.5 million as of December 31, 2020 and September 30, 2020, respectively (fixed interest rate - 5.75%) December 31, 2020 (1) Wholesale funding includes FHLB advances and brokered deposits (2) Debt includes senior notes and junior subordinated debentures

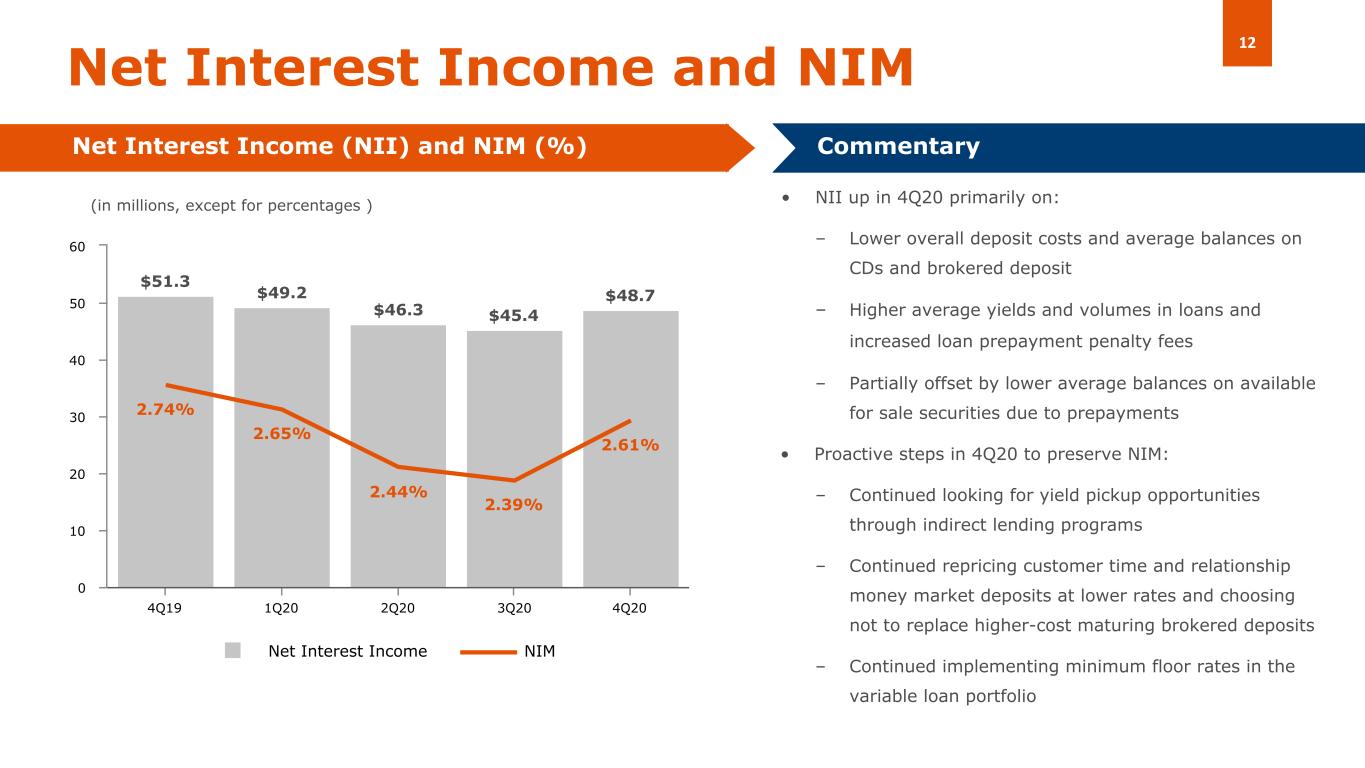

$51.3 $49.2 $46.3 $45.4 $48.7 2.74% 2.65% 2.44% 2.39% 2.61% Net Interest Income NIM 4Q19 1Q20 2Q20 3Q20 4Q20 0 10 20 30 40 50 60 • NII up in 4Q20 primarily on: – Lower overall deposit costs and average balances on CDs and brokered deposit – Higher average yields and volumes in loans and increased loan prepayment penalty fees – Partially offset by lower average balances on available for sale securities due to prepayments • Proactive steps in 4Q20 to preserve NIM: – Continued looking for yield pickup opportunities through indirect lending programs – Continued repricing customer time and relationship money market deposits at lower rates and choosing not to replace higher-cost maturing brokered deposits – Continued implementing minimum floor rates in the variable loan portfolio Net Interest Income and NIM Net Interest Income (NII) and NIM (%) Commentary (in millions, except for percentages )

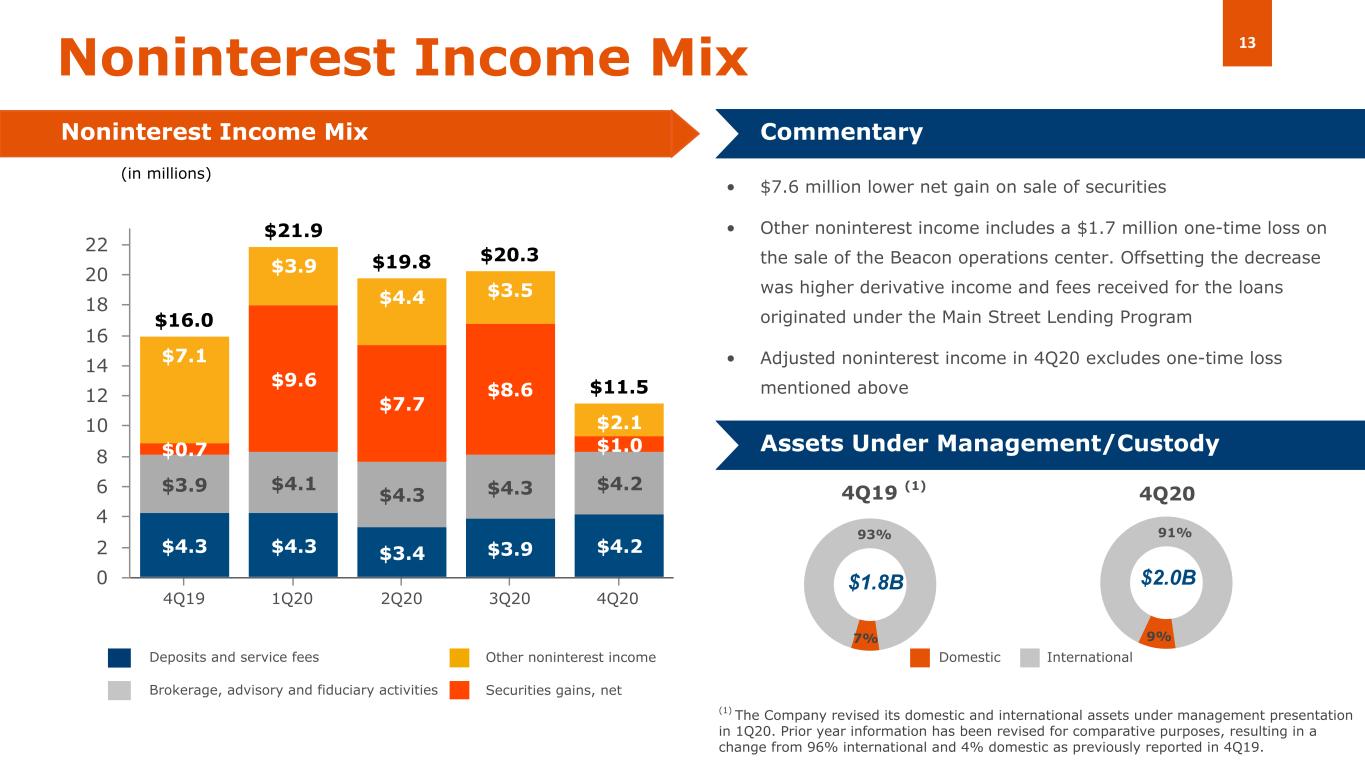

7% 93% 9% 91% $16.0 $21.9 $19.8 $20.3 $11.5 $4.3 $4.3 $3.4 $3.9 $4.2 $3.9 $4.1 $4.3 $4.3 $4.2 $0.7 $9.6 $7.7 $8.6 $1.0 $7.1 $3.9 $4.4 $3.5 $2.1 4Q19 1Q20 2Q20 3Q20 4Q20 0 2 4 6 8 10 12 14 16 18 20 22 Noninterest Income Mix Commentary • $7.6 million lower net gain on sale of securities • Other noninterest income includes a $1.7 million one-time loss on the sale of the Beacon operations center. Offsetting the decrease was higher derivative income and fees received for the loans originated under the Main Street Lending Program • Adjusted noninterest income in 4Q20 excludes one-time loss mentioned above Assets Under Management/Custody Deposits and service fees Brokerage, advisory and fiduciary activities Other noninterest income $2.0B Domestic International 4Q20 $1.8B 4Q19 (1) (in millions) (1) The Company revised its domestic and international assets under management presentation in 1Q20. Prior year information has been revised for comparative purposes, resulting in a change from 96% international and 4% domestic as previously reported in 4Q19. Securities gains, net Noninterest Income Mix

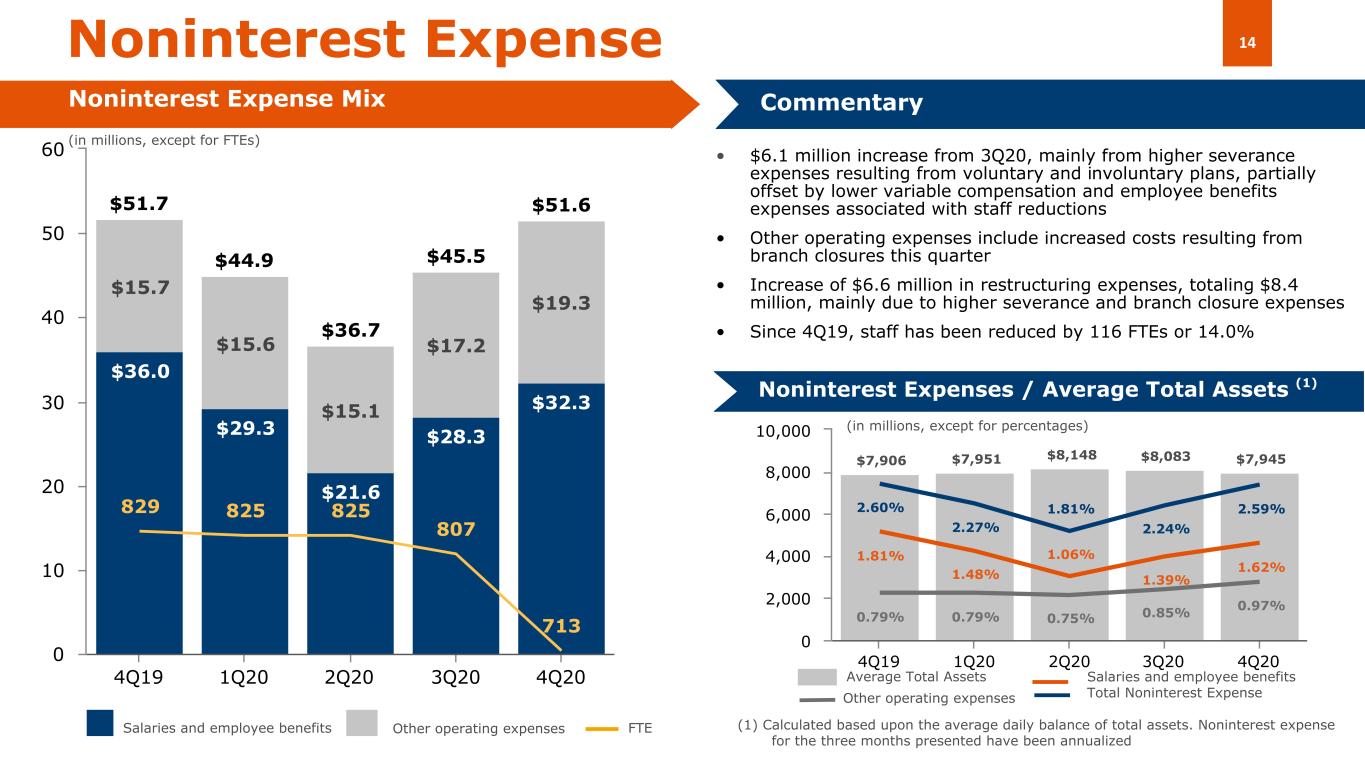

$7,906 $7,951 $8,148 $8,083 $7,945 1.81% 1.48% 1.06% 1.39% 1.62% 0.79% 0.79% 0.75% 0.85% 0.97% 2.60% 2.27% 1.81% 2.24% 2.59% 4Q19 1Q20 2Q20 3Q20 4Q20 0 2,000 4,000 6,000 8,000 10,000 $51.7 $44.9 $36.7 $45.5 $51.6 $36.0 $29.3 $21.6 $28.3 $32.3 $15.7 $15.6 $15.1 $17.2 $19.3 829 825 825 807 713 4Q19 1Q20 2Q20 3Q20 4Q20 0 10 20 30 40 50 60 Noninterest Expense Noninterest Expense Mix Commentary Noninterest Expenses / Average Total Assets (1) Other operating expensesSalaries and employee benefits FTE Average Total Assets Salaries and employee benefits Other operating expenses Total Noninterest Expense (in millions, except for FTEs) (in millions, except for percentages) (1) Calculated based upon the average daily balance of total assets. Noninterest expense for the three months presented have been annualized • $6.1 million increase from 3Q20, mainly from higher severance expenses resulting from voluntary and involuntary plans, partially offset by lower variable compensation and employee benefits expenses associated with staff reductions • Other operating expenses include increased costs resulting from branch closures this quarter • Increase of $6.6 million in restructuring expenses, totaling $8.4 million, mainly due to higher severance and branch closure expenses • Since 4Q19, staff has been reduced by 116 FTEs or 14.0%

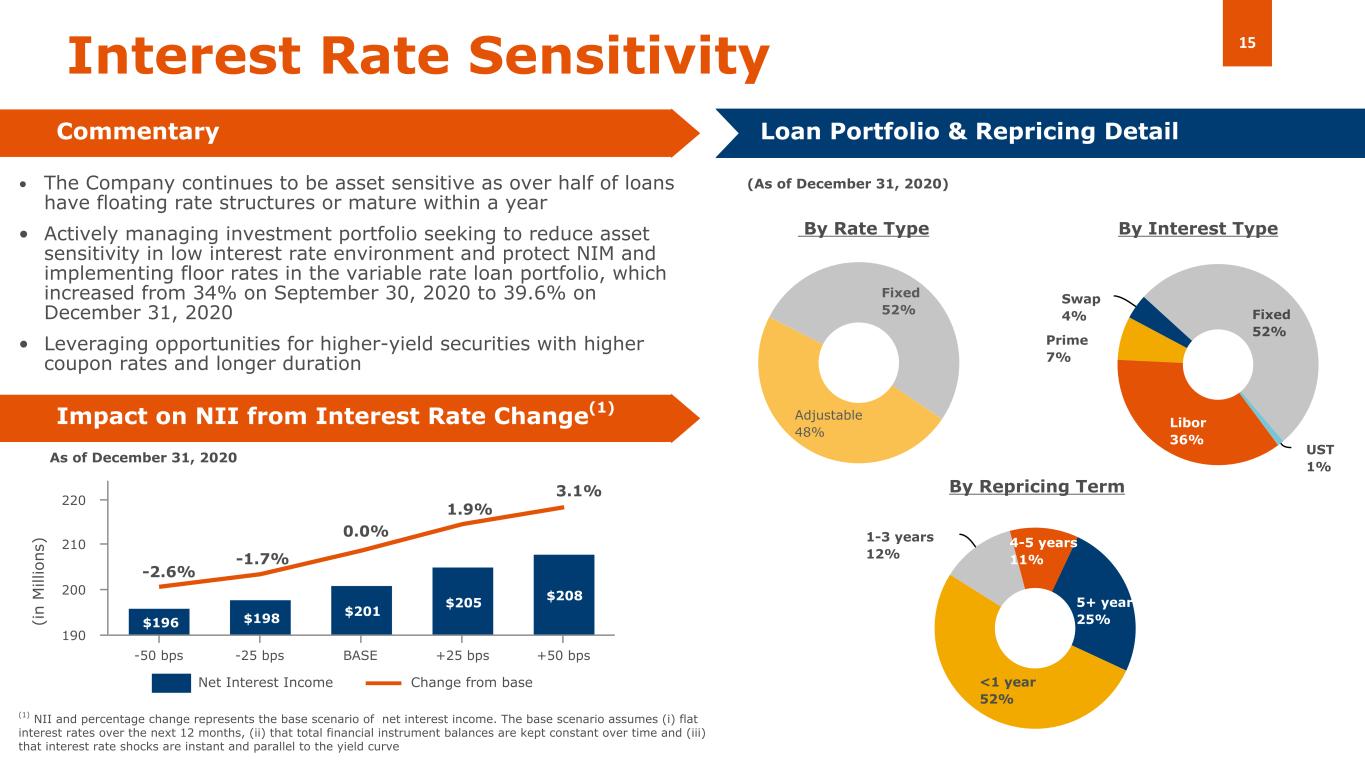

$196 $198 $201 $205 $208 -50 bps -25 bps BASE +25 bps +50 bps 190 200 210 220 5+ years 25% <1 year 52% 1-3 years 12% 4-5 years 11% Swap 4% Fixed 52% UST 1% Libor 36% Prime 7% Fixed 52% Adjustable 48% Interest Rate Sensitivity • The Company continues to be asset sensitive as over half of loans have floating rate structures or mature within a year • Actively managing investment portfolio seeking to reduce asset sensitivity in low interest rate environment and protect NIM and implementing floor rates in the variable rate loan portfolio, which increased from 34% on September 30, 2020 to 39.6% on December 31, 2020 • Leveraging opportunities for higher-yield securities with higher coupon rates and longer duration By Interest Type By Rate Type By Repricing Term (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve Commentary Loan Portfolio & Repricing Detail Impact on NII from Interest Rate Change(1) Net Interest Income Change from base -2.6% -1.7% 0.0% 3.1% 1.9% (i n M ill io n s) As of December 31, 2020 (As of December 31, 2020)

2021 Goals Net Interest Income Noninterest Income Loans Noninterest Expenses Deposits Capital Management Credit Quality • Enhance loan portfolio yield while proactively reducing funding costs to improve NIM • Preserve asset quality • Optimize monitoring of loan portfolio • Proactive assessment of ALL • Continue expansion of wealth management via client acquisition and fee income initiatives • Continue simplification of operations and moving forward with new technologies and approaches to drive expense reduction initiatives • Continue alignment of operating structure and resources with our business activities • Continue to focus on customer- centric and multiproduct relationship strategies in personal and commercial portfolios • Increase domestic deposits and share of wallet from higher net worth international customers • Dynamic capital management Committed to driving shareholder value • Continue growth of domestic loans by targeting selected customers and verticals/niches for loans • Continue diversification between C&I and CRE throughout our markets

Supplemental Loan Portfolio Information As of December 31, 2020

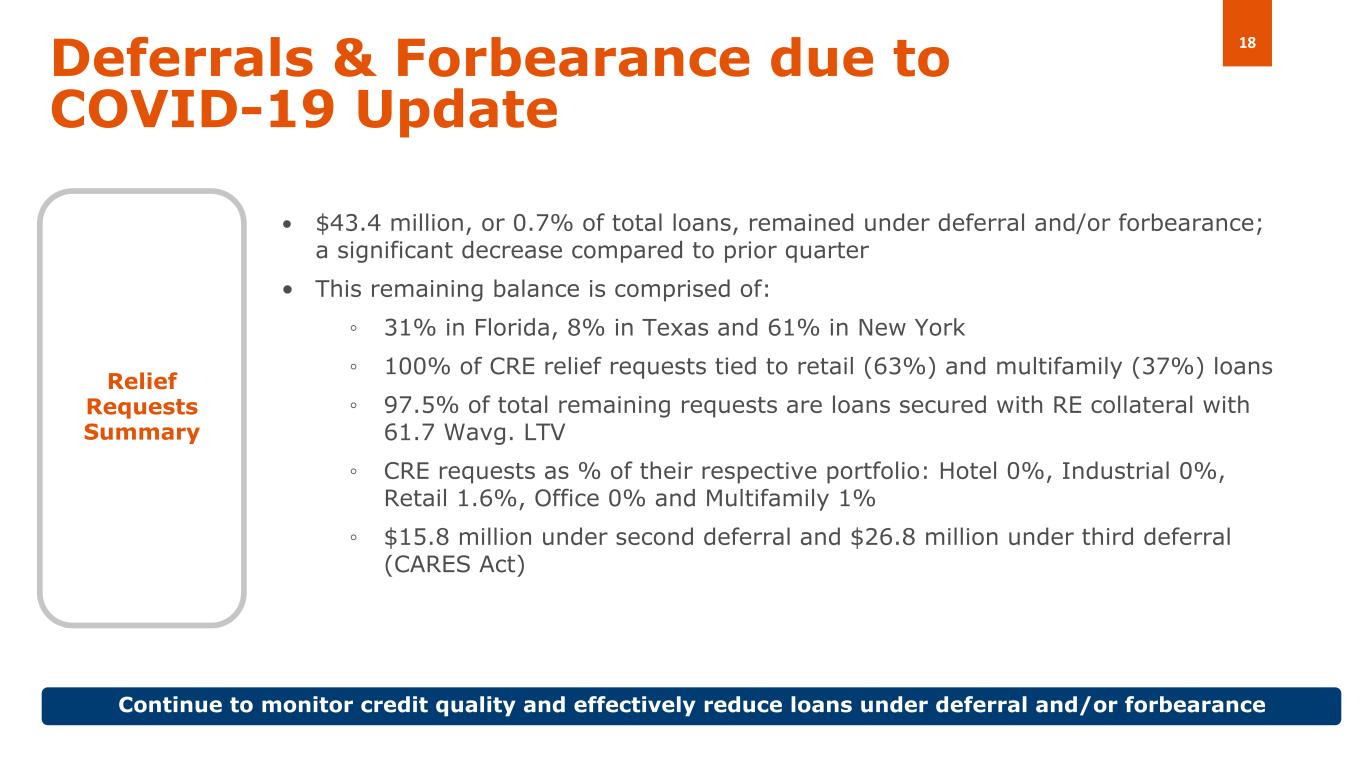

Deferrals & Forbearance due to COVID-19 Update • $43.4 million, or 0.7% of total loans, remained under deferral and/or forbearance; a significant decrease compared to prior quarter • This remaining balance is comprised of: ◦ 31% in Florida, 8% in Texas and 61% in New York ◦ 100% of CRE relief requests tied to retail (63%) and multifamily (37%) loans ◦ 97.5% of total remaining requests are loans secured with RE collateral with 61.7 Wavg. LTV ◦ CRE requests as % of their respective portfolio: Hotel 0%, Industrial 0%, Retail 1.6%, Office 0% and Multifamily 1% ◦ $15.8 million under second deferral and $26.8 million under third deferral (CARES Act) Relief Requests Summary Continue to monitor credit quality and effectively reduce loans under deferral and/or forbearance

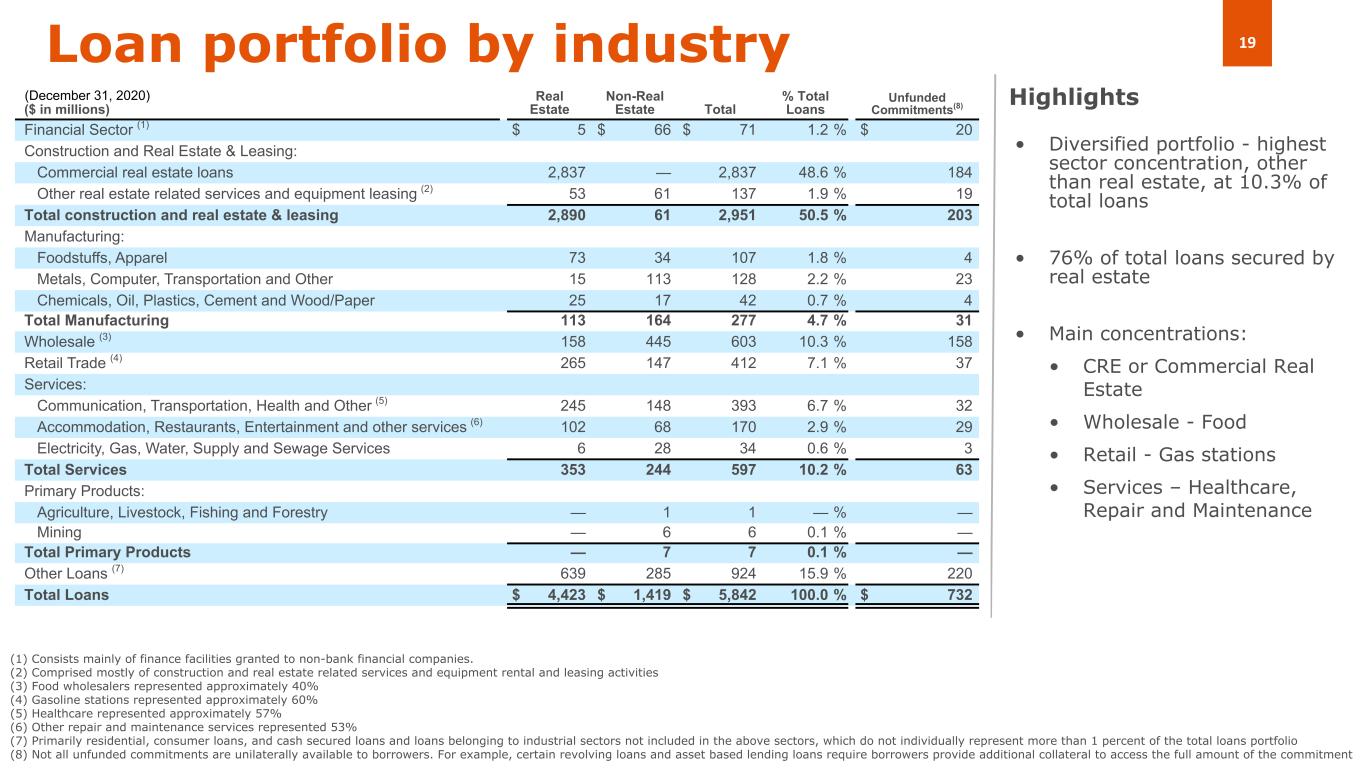

Loan portfolio by industry • Diversified portfolio - highest sector concentration, other than real estate, at 10.3% of total loans • 76% of total loans secured by real estate • Main concentrations: • CRE or Commercial Real Estate • Wholesale - Food • Retail - Gas stations • Services – Healthcare, Repair and Maintenance Highlights (1) Consists mainly of finance facilities granted to non-bank financial companies. (2) Comprised mostly of construction and real estate related services and equipment rental and leasing activities (3) Food wholesalers represented approximately 40% (4) Gasoline stations represented approximately 60% (5) Healthcare represented approximately 57% (6) Other repair and maintenance services represented 53% (7) Primarily residential, consumer loans, and cash secured loans and loans belonging to industrial sectors not included in the above sectors, which do not individually represent more than 1 percent of the total loans portfolio (8) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers provide additional collateral to access the full amount of the commitment ($ in millions) Real Estate Non-Real Estate Total % Total Loans Unfunded Commitments(8) Financial Sector (1) $ 5 $ 66 $ 71 1.2 % $ 20 Construction and Real Estate & Leasing: Commercial real estate loans 2,837 — 2,837 48.6 % 184 Other real estate related services and equipment leasing (2) 53 61 137 1.9 % 19 Total construction and real estate & leasing 2,890 61 2,951 50.5 % 203 Manufacturing: Foodstuffs, Apparel 73 34 107 1.8 % 4 Metals, Computer, Transportation and Other 15 113 128 2.2 % 23 Chemicals, Oil, Plastics, Cement and Wood/Paper 25 17 42 0.7 % 4 Total Manufacturing 113 164 277 4.7 % 31 Wholesale (3) 158 445 603 10.3 % 158 Retail Trade (4) 265 147 412 7.1 % 37 Services: Communication, Transportation, Health and Other (5) 245 148 393 6.7 % 32 Accommodation, Restaurants, Entertainment and other services (6) 102 68 170 2.9 % 29 Electricity, Gas, Water, Supply and Sewage Services 6 28 34 0.6 % 3 Total Services 353 244 597 10.2 % 63 Primary Products: Agriculture, Livestock, Fishing and Forestry — 1 1 — % — Mining — 6 6 0.1 % — Total Primary Products — 7 7 0.1 % — Other Loans (7) 639 285 924 15.9 % 220 Total Loans $ 4,423 $ 1,419 $ 5,842 100.0 % $ 732 (December 31, 2020)

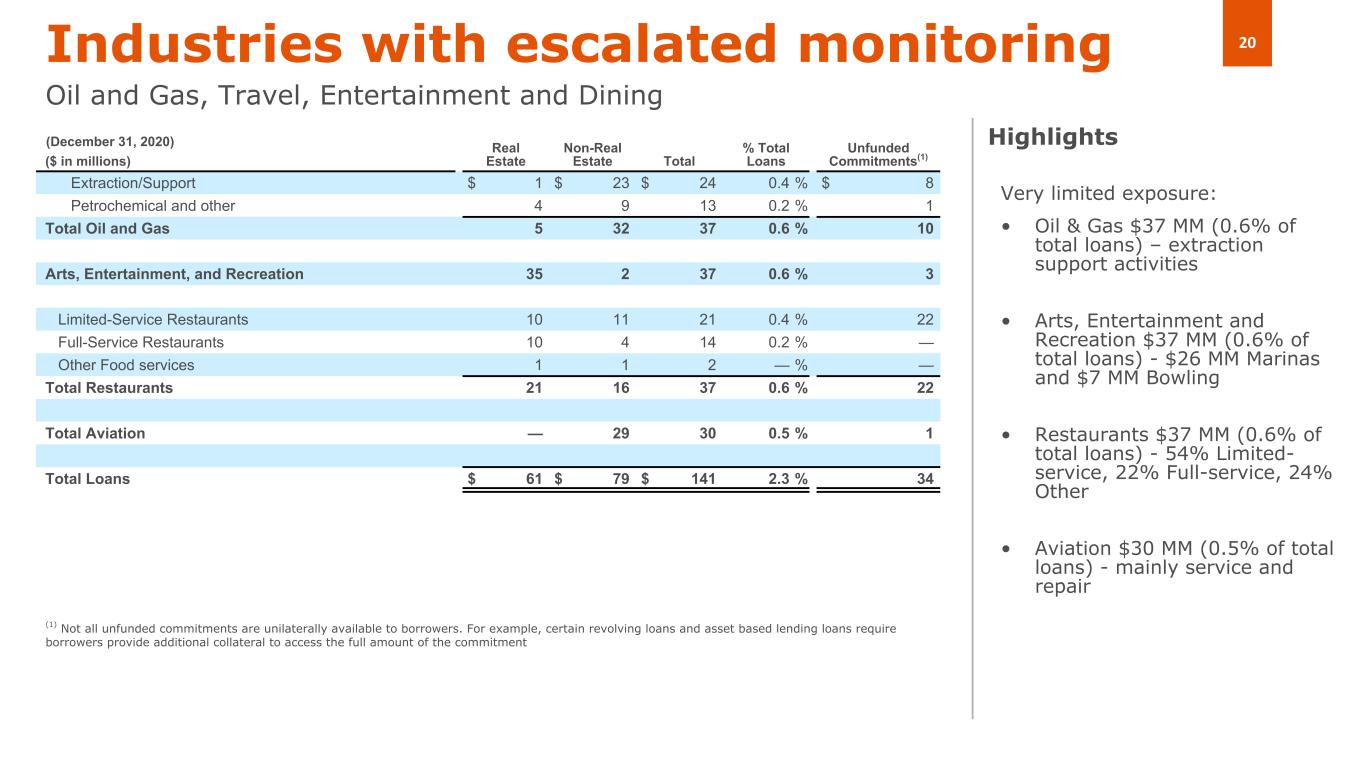

Industries with escalated monitoring Oil and Gas, Travel, Entertainment and Dining Very limited exposure: • Oil & Gas $37 MM (0.6% of total loans) – extraction support activities • Arts, Entertainment and Recreation $37 MM (0.6% of total loans) - $26 MM Marinas and $7 MM Bowling • Restaurants $37 MM (0.6% of total loans) - 54% Limited- service, 22% Full-service, 24% Other • Aviation $30 MM (0.5% of total loans) - mainly service and repair Highlights (1) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers provide additional collateral to access the full amount of the commitment ($ in millions) Real Estate Non-Real Estate Total % Total Loans Unfunded Commitments(1) Extraction/Support $ 1 $ 23 $ 24 0.4 % $ 8 Petrochemical and other 4 9 13 0.2 % 1 Total Oil and Gas 5 32 37 0.6 % 10 Arts, Entertainment, and Recreation 35 2 37 0.6 % 3 Limited-Service Restaurants 10 11 21 0.4 % 22 Full-Service Restaurants 10 4 14 0.2 % — Other Food services 1 1 2 — % — Total Restaurants 21 16 37 0.6 % 22 Total Aviation — 29 30 0.5 % 1 Total Loans $ 61 $ 79 $ 141 2.3 % 34 (December 31, 2020)

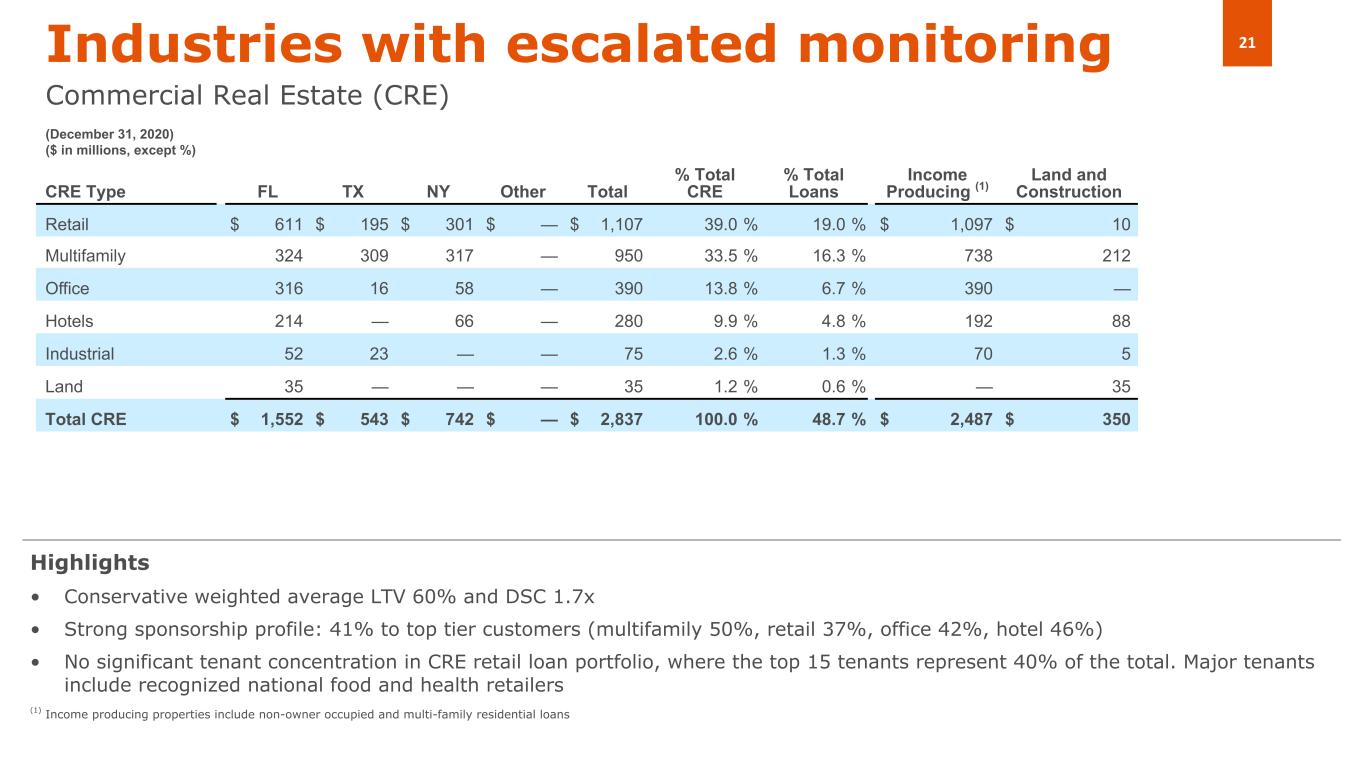

Industries with escalated monitoring Commercial Real Estate (CRE) CRE Type FL TX NY Other Total % Total CRE % Total Loans Income Producing (1) Land and Construction Retail $ 611 $ 195 $ 301 $ — $ 1,107 39.0 % 19.0 % $ 1,097 $ 10 Multifamily 324 309 317 — 950 33.5 % 16.3 % 738 212 Office 316 16 58 — 390 13.8 % 6.7 % 390 — Hotels 214 — 66 — 280 9.9 % 4.8 % 192 88 Industrial 52 23 — — 75 2.6 % 1.3 % 70 5 Land 35 — — — 35 1.2 % 0.6 % — 35 Total CRE $ 1,552 $ 543 $ 742 $ — $ 2,837 100.0 % 48.7 % $ 2,487 $ 350 • Conservative weighted average LTV 60% and DSC 1.7x • Strong sponsorship profile: 41% to top tier customers (multifamily 50%, retail 37%, office 42%, hotel 46%) • No significant tenant concentration in CRE retail loan portfolio, where the top 15 tenants represent 40% of the total. Major tenants include recognized national food and health retailers (1) Income producing properties include non-owner occupied and multi-family residential loans Highlights (December 31, 2020) ($ in millions, except %)

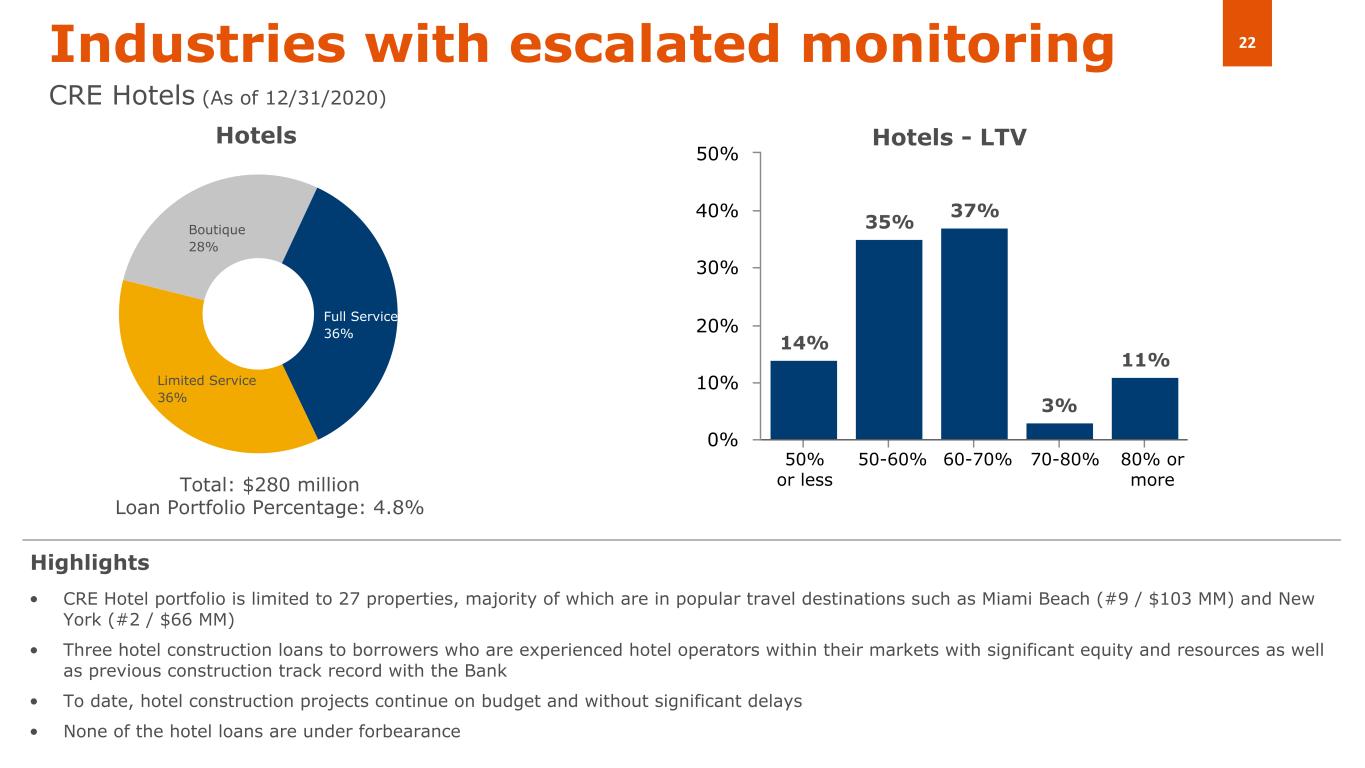

Industries with escalated monitoring CRE Hotels (As of 12/31/2020) • CRE Hotel portfolio is limited to 27 properties, majority of which are in popular travel destinations such as Miami Beach (#9 / $103 MM) and New York (#2 / $66 MM) • Three hotel construction loans to borrowers who are experienced hotel operators within their markets with significant equity and resources as well as previous construction track record with the Bank • To date, hotel construction projects continue on budget and without significant delays • None of the hotel loans are under forbearance Highlights Full Service 36% Limited Service 36% Boutique 28% Hotels 14% 35% 37% 3% 11% 0% 10% 20% 30% 40% 50% 50% or less 50-60% 60-70% 70-80% 80% or more Hotels - LTV Total: $280 million Loan Portfolio Percentage: 4.8%

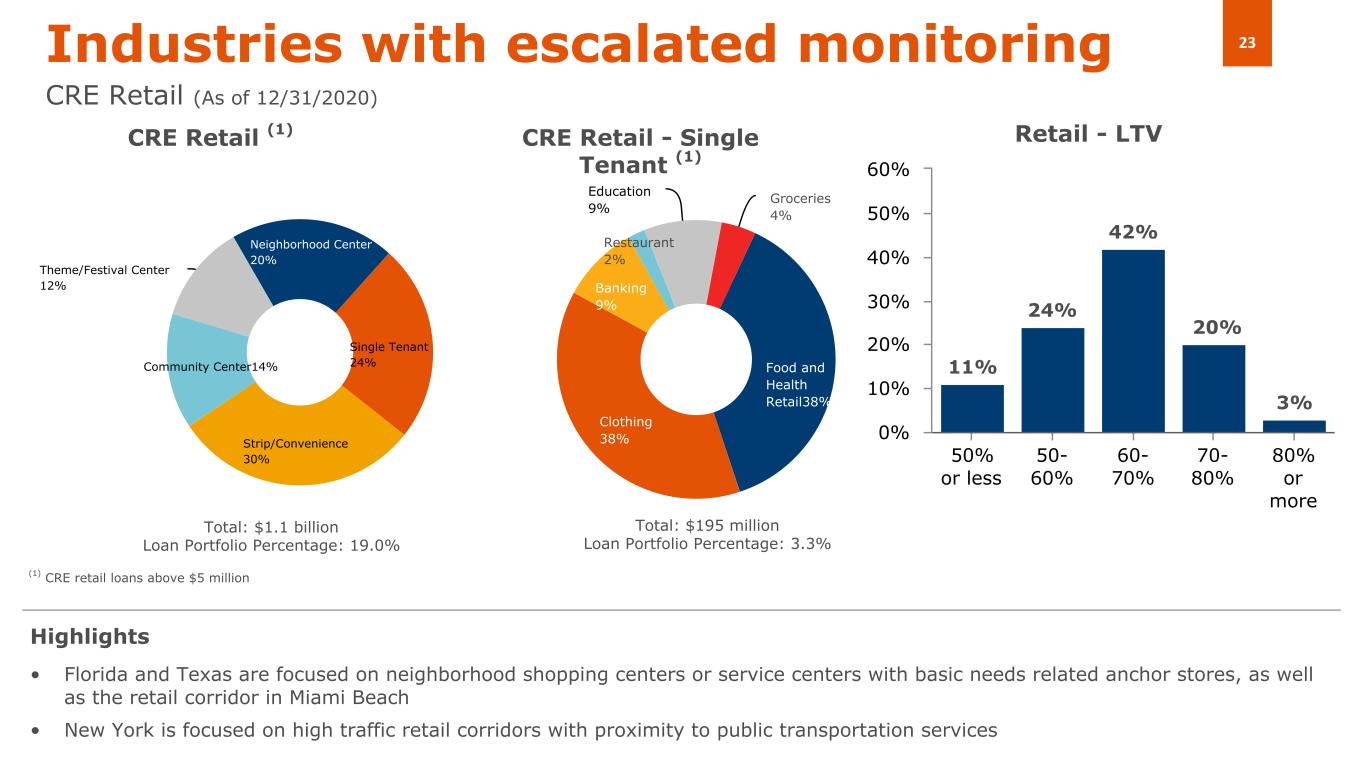

11% 24% 42% 20% 3% 50% or less 50- 60% 60- 70% 70- 80% 80% or more 0% 10% 20% 30% 40% 50% 60% Industries with escalated monitoring CRE Retail (As of 12/31/2020) • Florida and Texas are focused on neighborhood shopping centers or service centers with basic needs related anchor stores, as well as the retail corridor in Miami Beach • New York is focused on high traffic retail corridors with proximity to public transportation services Highlights CRE Retail (1) Retail - LTV Food and Health Retail38% Clothing 38% Banking 9% Restaurant 2% Education 9% Groceries 4% CRE Retail - Single Tenant (1) (1) CRE retail loans above $5 million Total: $1.1 billion Loan Portfolio Percentage: 19.0% Total: $195 million Loan Portfolio Percentage: 3.3% Neighborhood Center 20% Single Tenant 24% Strip/Convenience 30% Community Center14% Theme/Festival Center 12%

Appendices

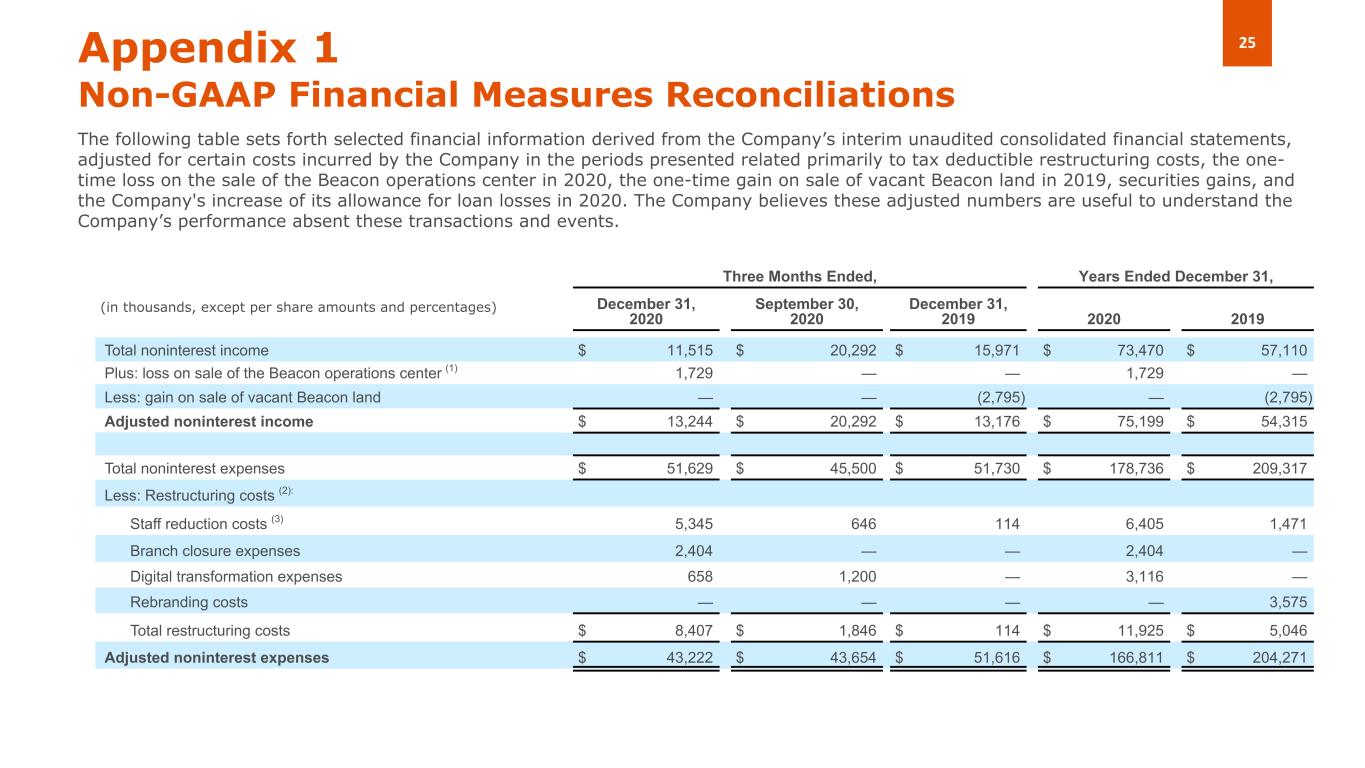

The following table sets forth selected financial information derived from the Company’s interim unaudited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related primarily to tax deductible restructuring costs, the one- time loss on the sale of the Beacon operations center in 2020, the one-time gain on sale of vacant Beacon land in 2019, securities gains, and the Company's increase of its allowance for loan losses in 2020. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events. Appendix 1 Non-GAAP Financial Measures Reconciliations Three Months Ended, Years Ended December 31, (in thousands, except per share amounts and percentages) December 31, 2020 September 30, 2020 December 31, 2019 2020 2019 Total noninterest income $ 11,515 $ 20,292 $ 15,971 $ 73,470 $ 57,110 Plus: loss on sale of the Beacon operations center (1) 1,729 — — 1,729 — Less: gain on sale of vacant Beacon land — — (2,795) — (2,795) Adjusted noninterest income $ 13,244 $ 20,292 $ 13,176 $ 75,199 $ 54,315 Total noninterest expenses $ 51,629 $ 45,500 $ 51,730 $ 178,736 $ 209,317 Less: Restructuring costs (2): Staff reduction costs (3) 5,345 646 114 6,405 1,471 Branch closure expenses 2,404 — — 2,404 — Digital transformation expenses 658 1,200 — 3,116 — Rebranding costs — — — — 3,575 Total restructuring costs $ 8,407 $ 1,846 $ 114 $ 11,925 $ 5,046 Adjusted noninterest expenses $ 43,222 $ 43,654 $ 51,616 $ 166,811 $ 204,271

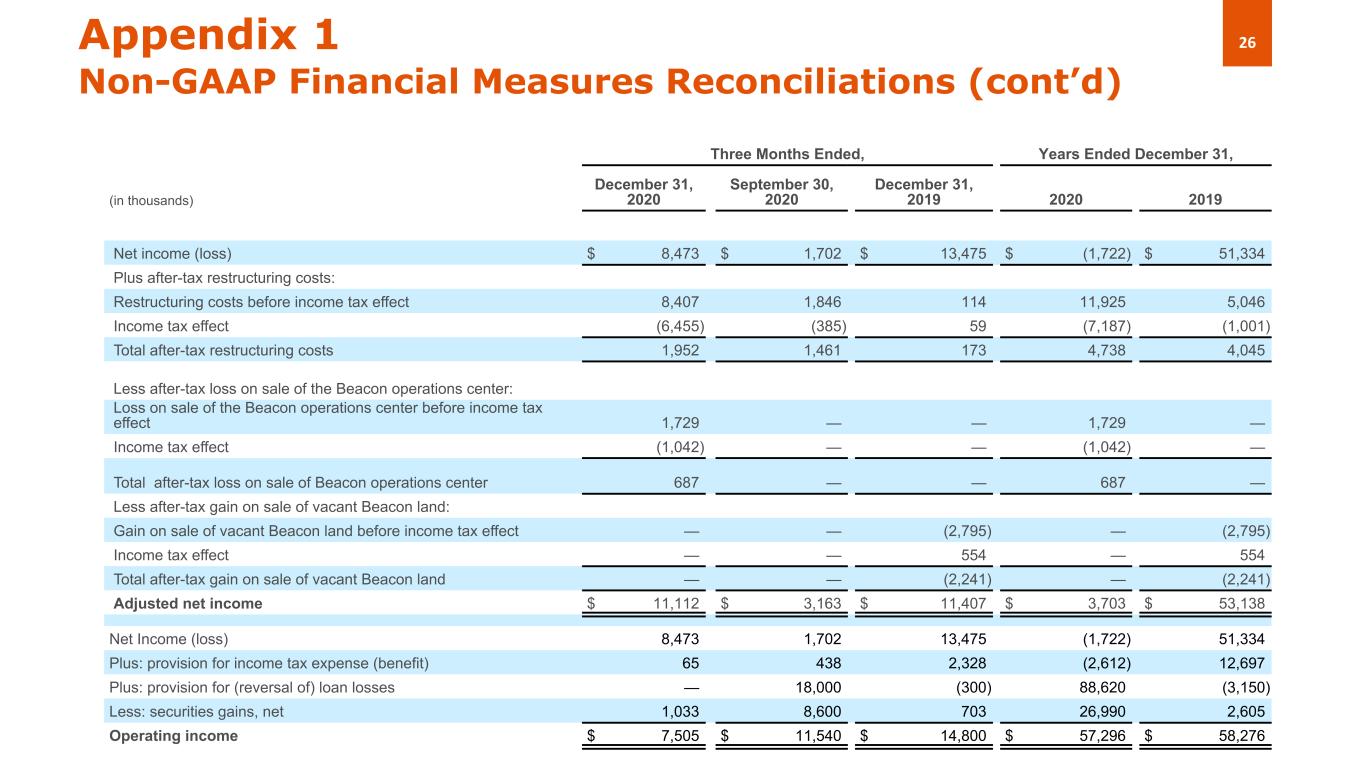

Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Years Ended December 31, (in thousands) December 31, 2020 September 30, 2020 December 31, 2019 2020 2019 Net income (loss) $ 8,473 $ 1,702 $ 13,475 $ (1,722) $ 51,334 Plus after-tax restructuring costs: Restructuring costs before income tax effect 8,407 1,846 114 11,925 5,046 Income tax effect (6,455) (385) 59 (7,187) (1,001) Total after-tax restructuring costs 1,952 1,461 173 4,738 4,045 Less after-tax loss on sale of the Beacon operations center: Loss on sale of the Beacon operations center before income tax effect 1,729 — — 1,729 — Income tax effect (1,042) — — (1,042) — Total after-tax loss on sale of Beacon operations center 687 — — 687 — Less after-tax gain on sale of vacant Beacon land: Gain on sale of vacant Beacon land before income tax effect — — (2,795) — (2,795) Income tax effect — — 554 — 554 Total after-tax gain on sale of vacant Beacon land — — (2,241) — (2,241) Adjusted net income $ 11,112 $ 3,163 $ 11,407 $ 3,703 $ 53,138 Net Income (loss) 8,473 1,702 13,475 (1,722) 51,334 Plus: provision for income tax expense (benefit) 65 438 2,328 (2,612) 12,697 Plus: provision for (reversal of) loan losses — 18,000 (300) 88,620 (3,150) Less: securities gains, net 1,033 8,600 703 26,990 2,605 Operating income $ 7,505 $ 11,540 $ 14,800 $ 57,296 $ 58,276

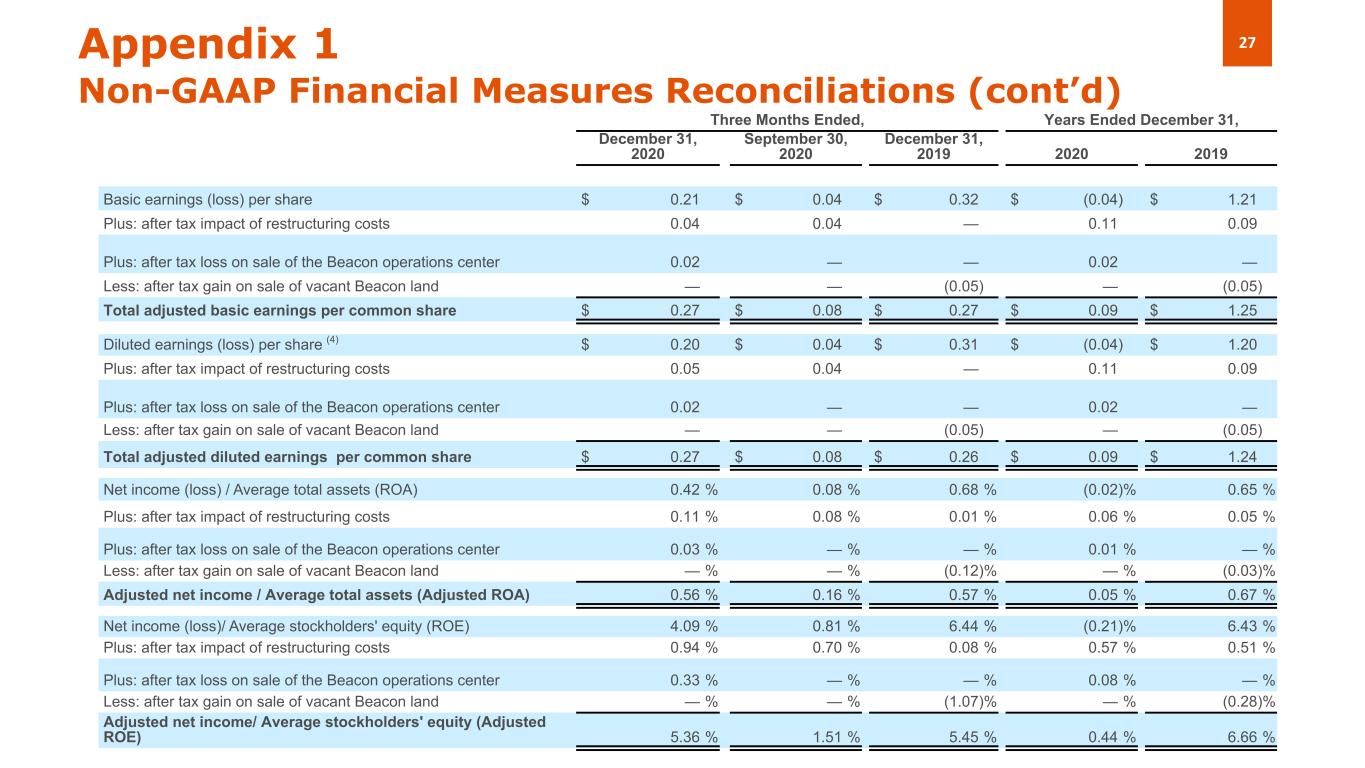

Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Years Ended December 31, December 31, 2020 September 30, 2020 December 31, 2019 2020 2019 Basic earnings (loss) per share $ 0.21 $ 0.04 $ 0.32 $ (0.04) $ 1.21 Plus: after tax impact of restructuring costs 0.04 0.04 — 0.11 0.09 Plus: after tax loss on sale of the Beacon operations center 0.02 — — 0.02 — Less: after tax gain on sale of vacant Beacon land — — (0.05) — (0.05) Total adjusted basic earnings per common share $ 0.27 $ 0.08 $ 0.27 $ 0.09 $ 1.25 Diluted earnings (loss) per share (4) $ 0.20 $ 0.04 $ 0.31 $ (0.04) $ 1.20 Plus: after tax impact of restructuring costs 0.05 0.04 — 0.11 0.09 Plus: after tax loss on sale of the Beacon operations center 0.02 — — 0.02 — Less: after tax gain on sale of vacant Beacon land — — (0.05) — (0.05) Total adjusted diluted earnings per common share $ 0.27 $ 0.08 $ 0.26 $ 0.09 $ 1.24 Net income (loss) / Average total assets (ROA) 0.42 % 0.08 % 0.68 % (0.02) % 0.65 % Plus: after tax impact of restructuring costs 0.11 % 0.08 % 0.01 % 0.06 % 0.05 % Plus: after tax loss on sale of the Beacon operations center 0.03 % — % — % 0.01 % — % Less: after tax gain on sale of vacant Beacon land — % — % (0.12) % — % (0.03) % Adjusted net income / Average total assets (Adjusted ROA) 0.56 % 0.16 % 0.57 % 0.05 % 0.67 % Net income (loss)/ Average stockholders' equity (ROE) 4.09 % 0.81 % 6.44 % (0.21) % 6.43 % Plus: after tax impact of restructuring costs 0.94 % 0.70 % 0.08 % 0.57 % 0.51 % Plus: after tax loss on sale of the Beacon operations center 0.33 % — % — % 0.08 % — % Less: after tax gain on sale of vacant Beacon land — % — % (1.07) % — % (0.28) % Adjusted net income/ Average stockholders' equity (Adjusted ROE) 5.36 % 1.51 % 5.45 % 0.44 % 6.66 %

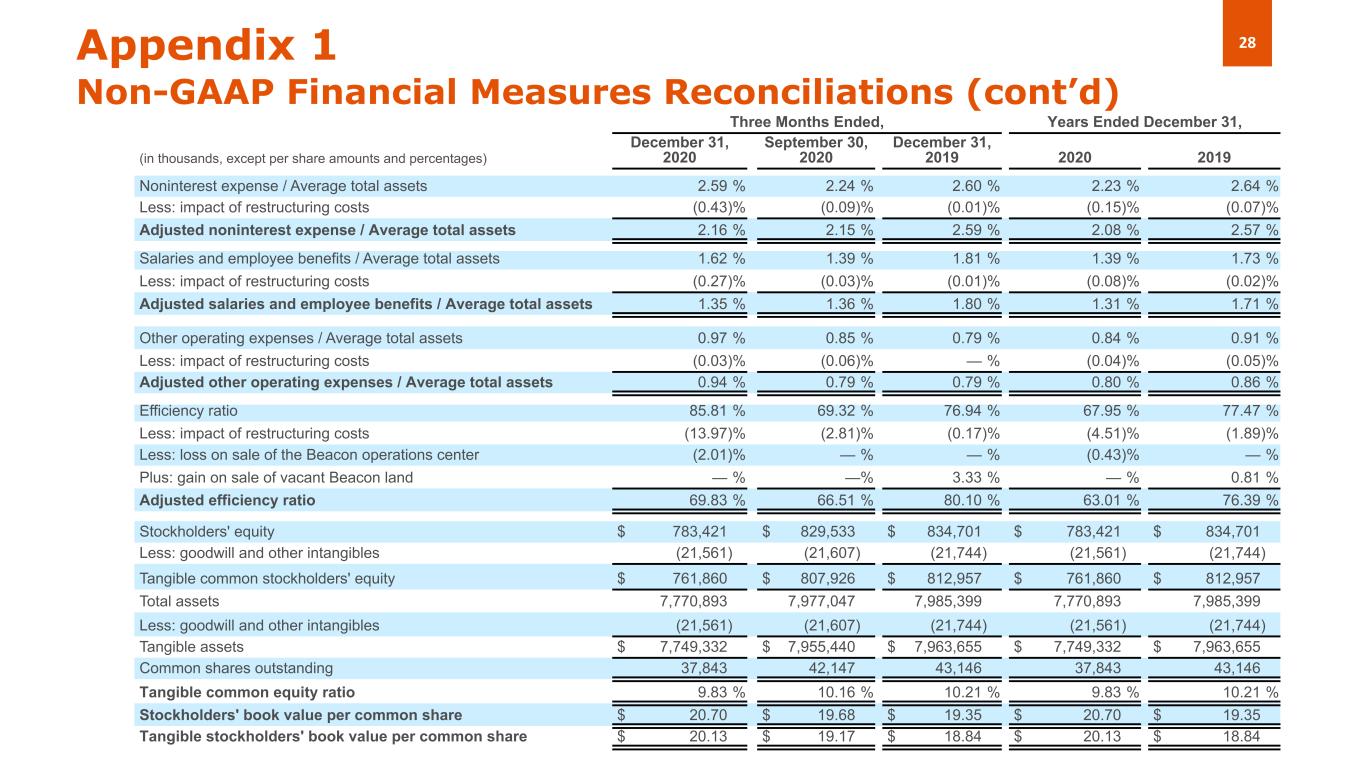

Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Years Ended December 31, (in thousands, except per share amounts and percentages) December 31, 2020 September 30, 2020 December 31, 2019 2020 2019 Noninterest expense / Average total assets 2.59 % 2.24 % 2.60 % 2.23 % 2.64 % Less: impact of restructuring costs (0.43) % (0.09) % (0.01) % (0.15) % (0.07) % Adjusted noninterest expense / Average total assets 2.16 % 2.15 % 2.59 % 2.08 % 2.57 % Salaries and employee benefits / Average total assets 1.62 % 1.39 % 1.81 % 1.39 % 1.73 % Less: impact of restructuring costs (0.27) % (0.03) % (0.01) % (0.08) % (0.02) % Adjusted salaries and employee benefits / Average total assets 1.35 % 1.36 % 1.80 % 1.31 % 1.71 % Other operating expenses / Average total assets 0.97 % 0.85 % 0.79 % 0.84 % 0.91 % Less: impact of restructuring costs (0.03) % (0.06) % — % (0.04) % (0.05) % Adjusted other operating expenses / Average total assets 0.94 % 0.79 % 0.79 % 0.80 % 0.86 % Efficiency ratio 85.81 % 69.32 % 76.94 % 67.95 % 77.47 % Less: impact of restructuring costs (13.97) % (2.81) % (0.17) % (4.51) % (1.89) % Less: loss on sale of the Beacon operations center (2.01) % — % — % (0.43) % — % Plus: gain on sale of vacant Beacon land — % —% 3.33 % — % 0.81 % Adjusted efficiency ratio 69.83 % 66.51 % 80.10 % 63.01 % 76.39 % Stockholders' equity $ 783,421 $ 829,533 $ 834,701 $ 783,421 $ 834,701 Less: goodwill and other intangibles (21,561) (21,607) (21,744) (21,561) (21,744) Tangible common stockholders' equity $ 761,860 $ 807,926 $ 812,957 $ 761,860 $ 812,957 Total assets 7,770,893 7,977,047 7,985,399 7,770,893 7,985,399 Less: goodwill and other intangibles (21,561) (21,607) (21,744) (21,561) (21,744) Tangible assets $ 7,749,332 $ 7,955,440 $ 7,963,655 $ 7,749,332 $ 7,963,655 Common shares outstanding 37,843 42,147 43,146 37,843 43,146 Tangible common equity ratio 9.83 % 10.16 % 10.21 % 9.83 % 10.21 % Stockholders' book value per common share $ 20.70 $ 19.68 $ 19.35 $ 20.70 $ 19.35 Tangible stockholders' book value per common share $ 20.13 $ 19.17 $ 18.84 $ 20.13 $ 18.84

(1) The Company leased-back the property for a 2-year term. (2) Expenses incurred for actions designed to implement the Company’s strategy as a new independent company. These actions include, but are not limited to reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (3) On October 9, 2020, the Board of Directors of the Company adopted a voluntary early retirement plan for certain eligible long-term employees and an involuntary severance plan for certain other positions consistent with the Company’s effort to streamline operations and better align its operating structure with its business activities. 31 employees elected to participate in the voluntary plan, all of whom retired on or before December 31, 2020. The involuntary plan impacted 31 employees most of whom no longer worked for the Company and/or its subsidiaries by December 31, 2020. On December 28, 2020, the Company determined the termination costs and annual savings related to the voluntary and involuntary plans. The Company incurred approximately $3.5 million and $1.8 million in one-time termination costs in the fourth quarter of 2020 in connection with the voluntary and involuntary plans, respectively, the majority of which will be paid over time in the form of installment payments until December 2021. The Company estimates that the voluntary and involuntary plans will yield estimated annual savings of approximately $4.2 million and $5.5 million, respectively, for combined estimated annual savings of approximately $9.7 million beginning in 2021. (4) As of December 31, 2020, September 30, 2020, and December 31, 2019 potential dilutive instruments consisted of unvested shares of restricted stock and restricted stock units mainly related to the Company’s IPO in 2018, totaling 248,750, 478,587 and 530,620, respectively. For the year ended December 31, 2020, potential dilutive instruments were not included in the dilutive earnings per share computation because the Company reported a net loss and their inclusion would have an antidilutive effect. For all other periods presented, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in those periods, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in those periods, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings. Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d)

Thank you Investor Relations InvestorRelations@amerantbank.com