Earnings Call October 21, 2021 Third Quarter 2021 Financial Review

2 Forward-Looking Statements This press release contains “forward-looking statements” within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934, including statements regarding the proposed clean-up merger (the "Merger"), the Class A Repurchase Program and the Company’s ability to obtain shareholder approval for the Merger, as well as statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those as to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2020, in our quarterly report on Form 10-Q for the quarter ended June 30, 2021 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including as of and for the three and nine month periods ended September 30, 2021 and 2020, may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2021, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non- GAAP financial measures, such as "pre-provision net revenue (PPNR)", “Core pre-provision net revenue (Core PPNR)”, “core net income (loss)”, “core net income (loss) per share (basic and diluted)”, “core return on assets (ROA)”, “core return on equity (ROE)”, and “core efficiency ratio”. This supplemental information is not required by, or are not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and have continued into 2021, including the effect of non-core banking activities such as the sale of loans and securities, and other non-recurring actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. Important Notices and Disclaimers

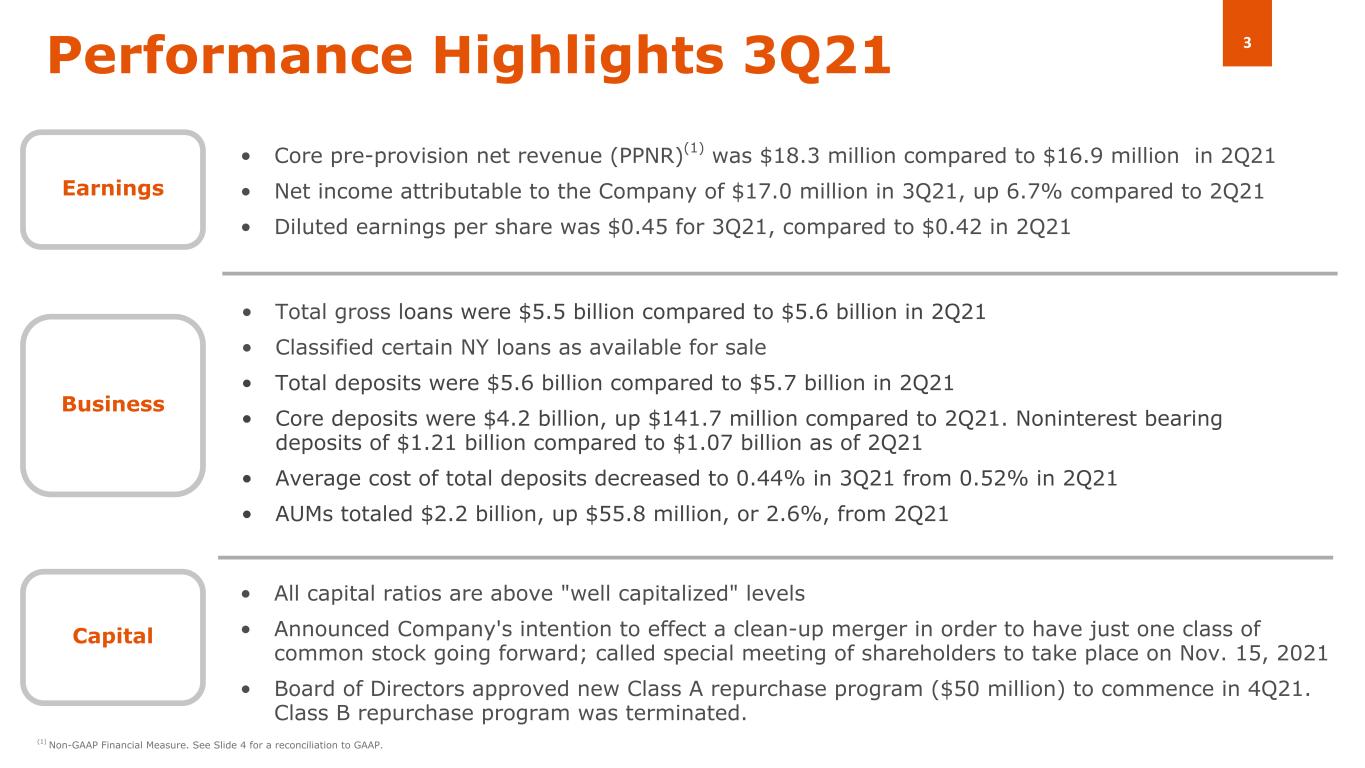

3 • All capital ratios are above "well capitalized" levels • Announced Company's intention to effect a clean-up merger in order to have just one class of common stock going forward; called special meeting of shareholders to take place on Nov. 15, 2021 • Board of Directors approved new Class A repurchase program ($50 million) to commence in 4Q21. Class B repurchase program was terminated. Performance Highlights 3Q21 Capital Business • Core pre-provision net revenue (PPNR)(1) was $18.3 million compared to $16.9 million in 2Q21 • Net income attributable to the Company of $17.0 million in 3Q21, up 6.7% compared to 2Q21 • Diluted earnings per share was $0.45 for 3Q21, compared to $0.42 in 2Q21 • Total gross loans were $5.5 billion compared to $5.6 billion in 2Q21 • Classified certain NY loans as available for sale • Total deposits were $5.6 billion compared to $5.7 billion in 2Q21 • Core deposits were $4.2 billion, up $141.7 million compared to 2Q21. Noninterest bearing deposits of $1.21 billion compared to $1.07 billion as of 2Q21 • Average cost of total deposits decreased to 0.44% in 3Q21 from 0.52% in 2Q21 • AUMs totaled $2.2 billion, up $55.8 million, or 2.6%, from 2Q21 Earnings (1) Non-GAAP Financial Measure. See Slide 4 for a reconciliation to GAAP.

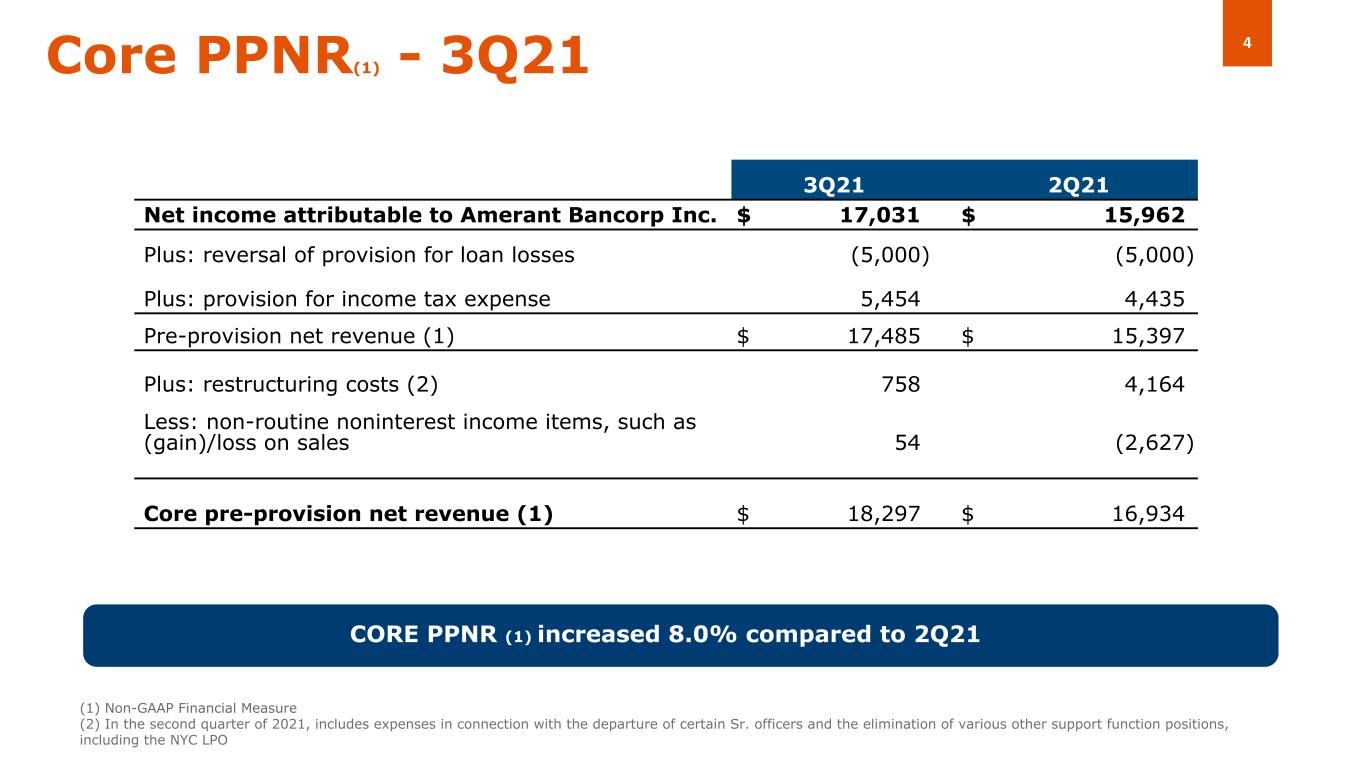

4Core PPNR(1) - 3Q21 CORE PPNR (1) increased 8.0% compared to 2Q21 (1) Non-GAAP Financial Measure (2) In the second quarter of 2021, includes expenses in connection with the departure of certain Sr. officers and the elimination of various other support function positions, including the NYC LPO (( 3Q21 2Q21 Net income attributable to Amerant Bancorp Inc. $ 17,031 $ 15,962 Plus: reversal of provision for loan losses (5,000) (5,000) Plus: provision for income tax expense 5,454 4,435 Pre-provision net revenue (1) $ 17,485 $ 15,397 Plus: restructuring costs (2) 758 4,164 Less: non-routine noninterest income items, such as (gain)/loss on sales 54 (2,627) Core pre-provision net revenue (1) $ 18,297 $ 16,934

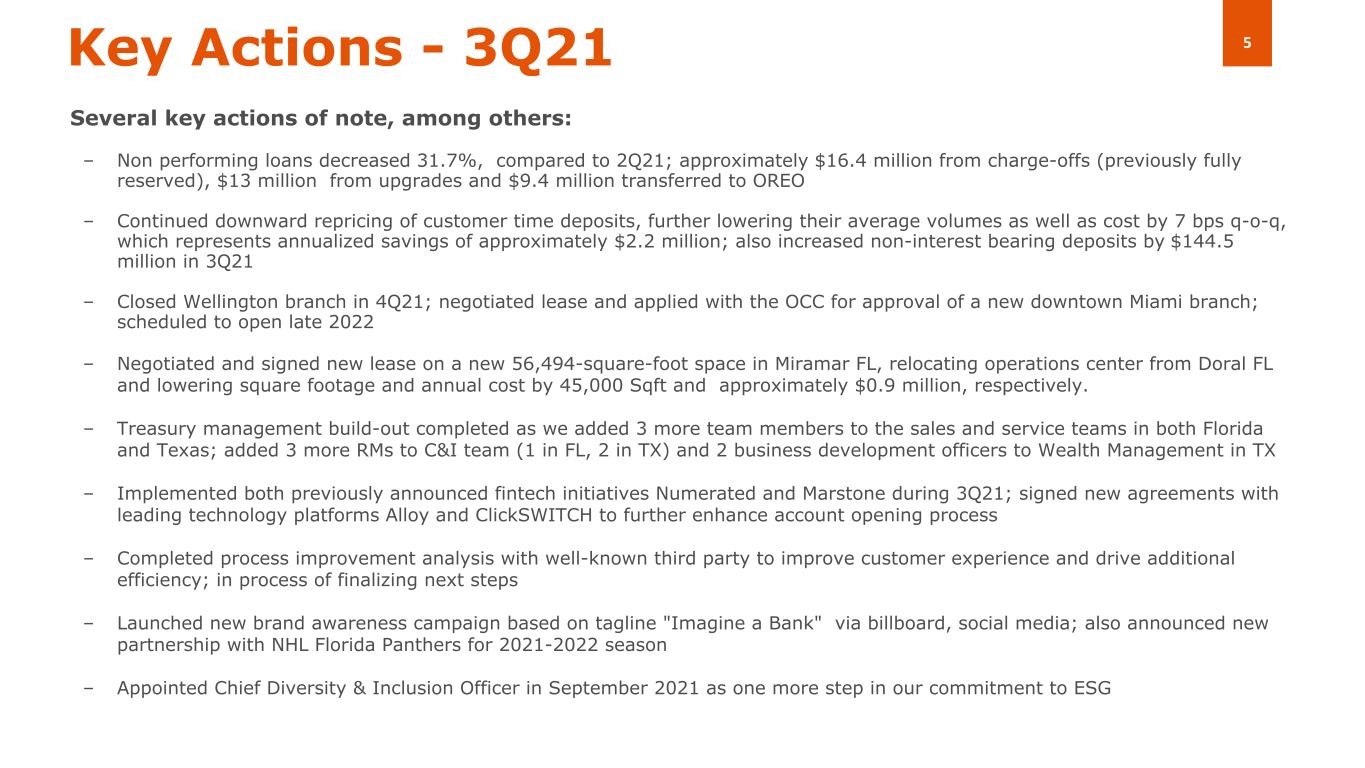

5Key Actions - 3Q21 Several key actions of note, among others: – Non performing loans decreased 31.7%, compared to 2Q21; approximately $16.4 million from charge-offs (previously fully reserved), $13 million from upgrades and $9.4 million transferred to OREO – Continued downward repricing of customer time deposits, further lowering their average volumes as well as cost by 7 bps q-o-q, which represents annualized savings of approximately $2.2 million; also increased non-interest bearing deposits by $144.5 million in 3Q21 – Closed Wellington branch in 4Q21; negotiated lease and applied with the OCC for approval of a new downtown Miami branch; scheduled to open late 2022 – Negotiated and signed new lease on a new 56,494-square-foot space in Miramar FL, relocating operations center from Doral FL and lowering square footage and annual cost by 45,000 Sqft and approximately $0.9 million, respectively. – Treasury management build-out completed as we added 3 more team members to the sales and service teams in both Florida and Texas; added 3 more RMs to C&I team (1 in FL, 2 in TX) and 2 business development officers to Wealth Management in TX – Implemented both previously announced fintech initiatives Numerated and Marstone during 3Q21; signed new agreements with leading technology platforms Alloy and ClickSWITCH to further enhance account opening process – Completed process improvement analysis with well-known third party to improve customer experience and drive additional efficiency; in process of finalizing next steps – Launched new brand awareness campaign based on tagline "Imagine a Bank" via billboard, social media; also announced new partnership with NHL Florida Panthers for 2021-2022 season – Appointed Chief Diversity & Inclusion Officer in September 2021 as one more step in our commitment to ESG

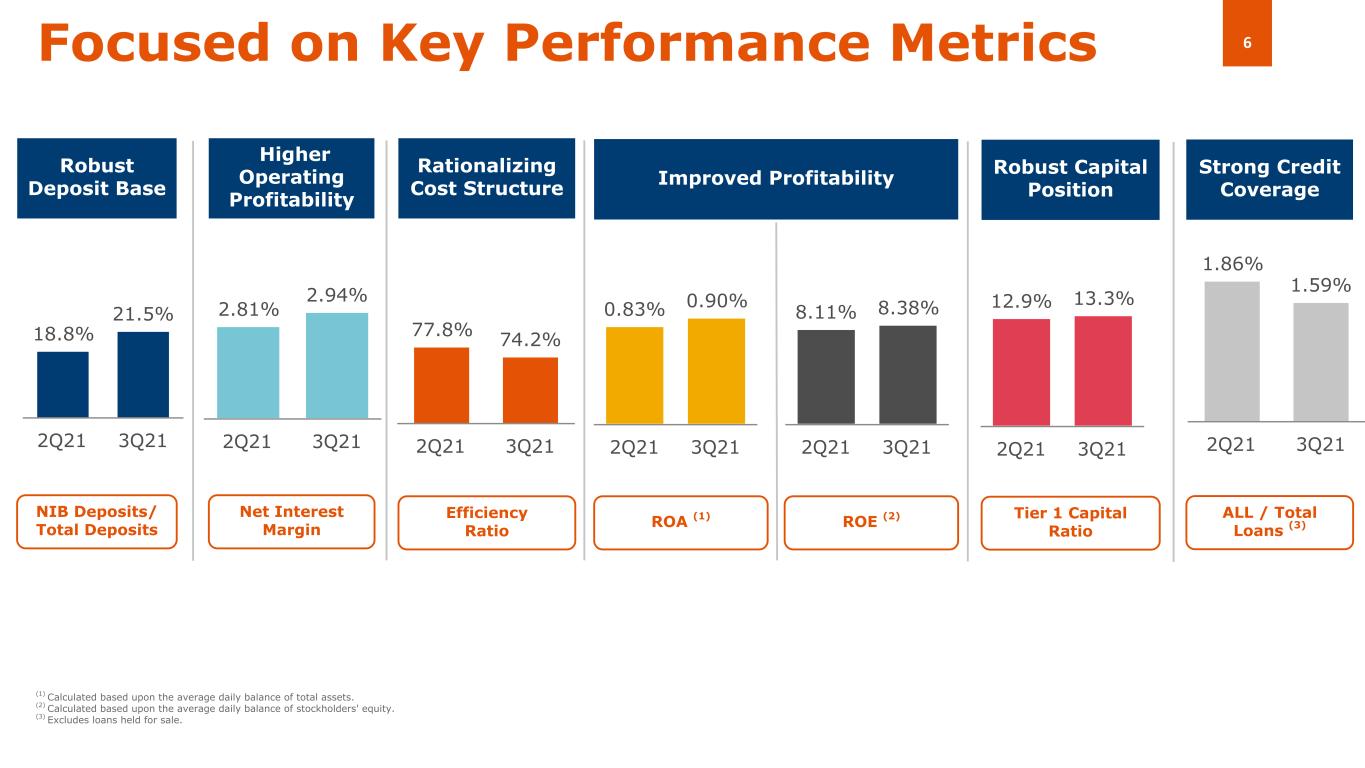

6 77.8% 74.2% 2Q21 3Q21 18.8% 21.5% 2Q21 3Q21 12.9% 13.3% 2Q21 3Q21 2.81% 2.94% 2Q21 3Q21 Focused on Key Performance Metrics Robust Deposit Base Robust Capital Position Higher Operating Profitability Rationalizing Cost Structure (1) Calculated based upon the average daily balance of total assets. (2) Calculated based upon the average daily balance of stockholders' equity. (3) Excludes loans held for sale. 1.86% 1.59% 2Q21 3Q21 Strong Credit Coverage 0.83% 0.90% 2Q21 3Q21 Improved Profitability 8.11% 8.38% 2Q21 3Q21 NIB Deposits/ Total Deposits Tier 1 Capital Ratio Net Interest Margin Efficiency Ratio ALL / Total Loans (3)ROA (1) ROE (2)

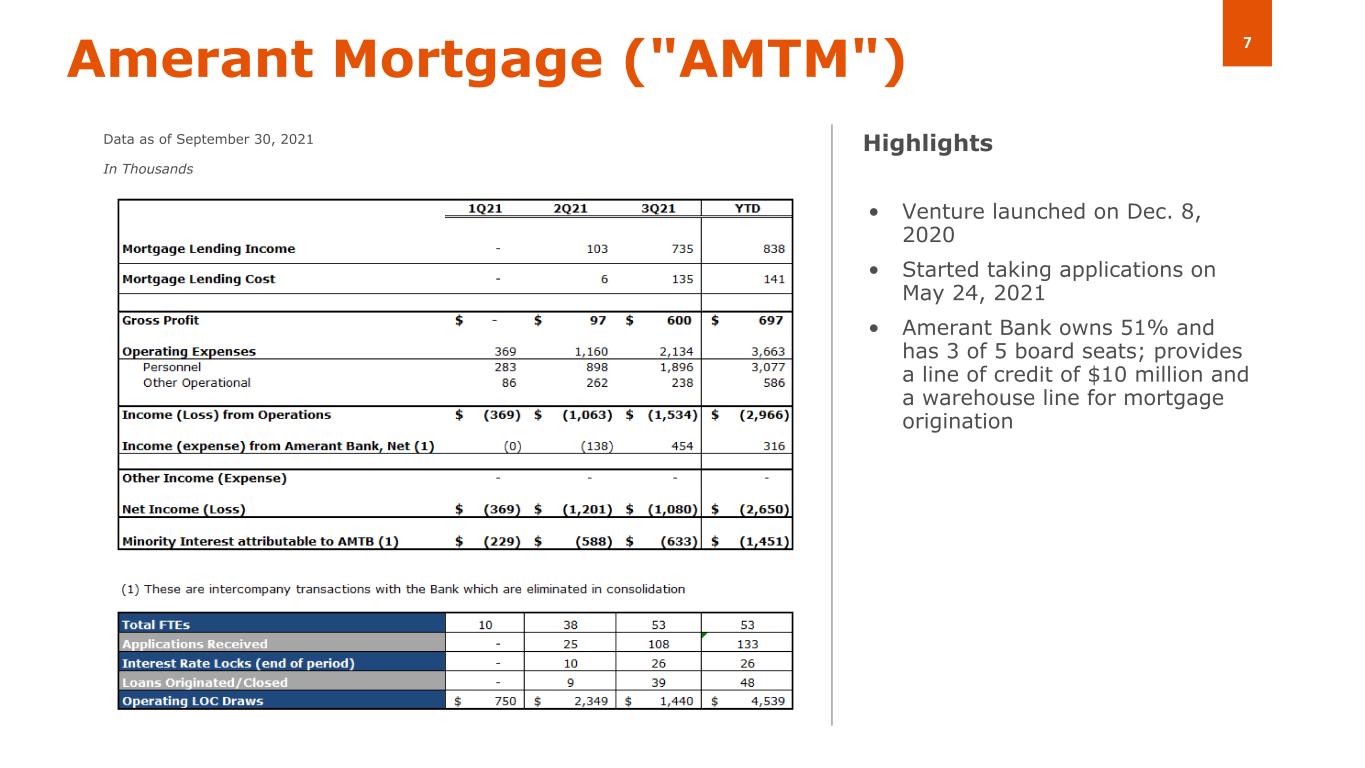

7Amerant Mortgage ("AMTM") • Venture launched on Dec. 8, 2020 • Started taking applications on May 24, 2021 • Amerant Bank owns 51% and has 3 of 5 board seats; provides a line of credit of $10 million and a warehouse line for mortgage origination Data as of September 30, 2021 In Thousands Highlights

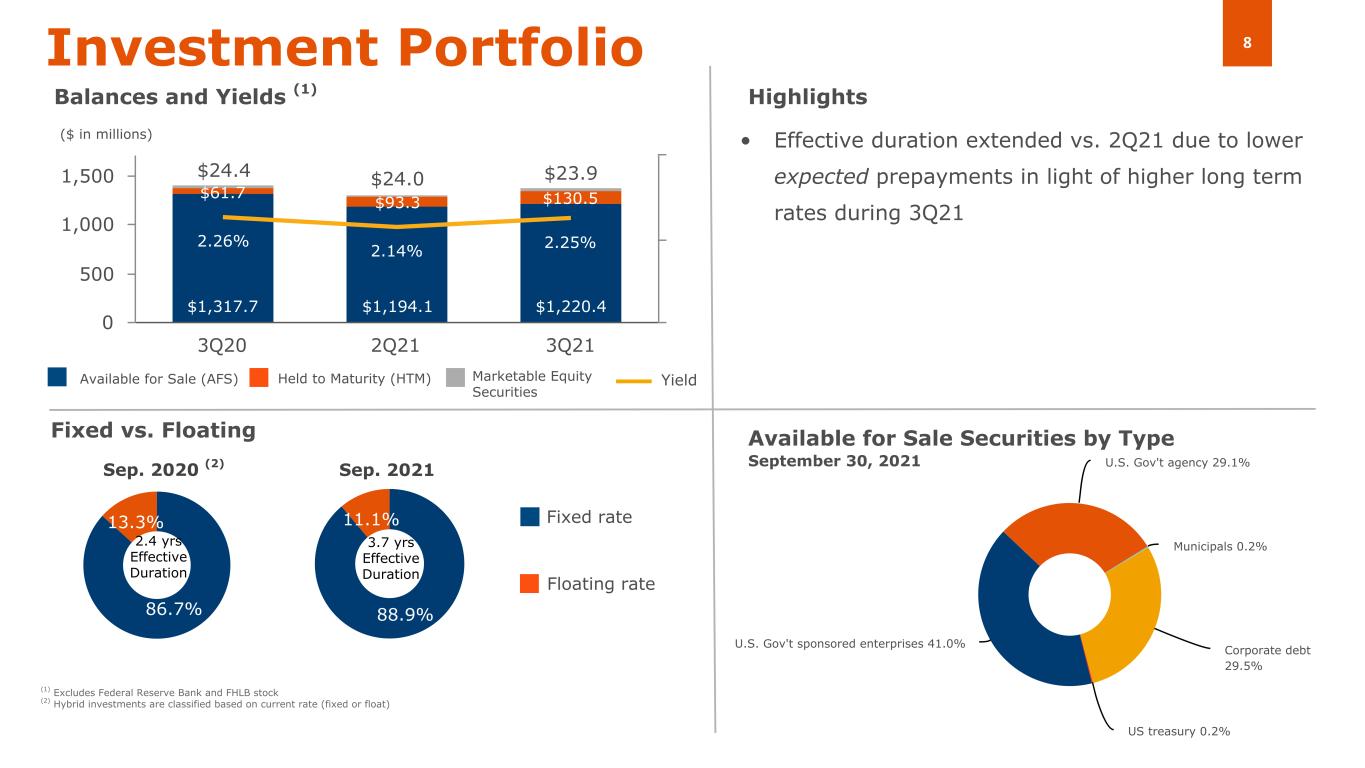

8 88.9% 11.1% U.S. Gov't sponsored enterprises 41.0% U.S. Gov't agency 29.1% Municipals 0.2% Corporate debt 29.5% US treasury 0.2% $1,317.7 $1,194.1 $1,220.4 $61.7 $93.3 $130.5 $24.4 $24.0 $23.9 2.26% 2.14% 2.25% 3Q20 2Q21 3Q21 0 500 1,000 1,500 86.7% 13.3% • Effective duration extended vs. 2Q21 due to lower expected prepayments in light of higher long term rates during 3Q21 Investment Portfolio Balances and Yields (1) Available for Sale (AFS) Held to Maturity (HTM) Highlights Fixed vs. Floating Sep. 2020 (2) Sep. 2021 Floating rate Fixed rate Available for Sale Securities by Type September 30, 2021 2.4 yrs Effective Duration ($ in millions) Marketable Equity Securities (1) Excludes Federal Reserve Bank and FHLB stock (2) Hybrid investments are classified based on current rate (fixed or float) Yield 3.7 yrs Effective Duration

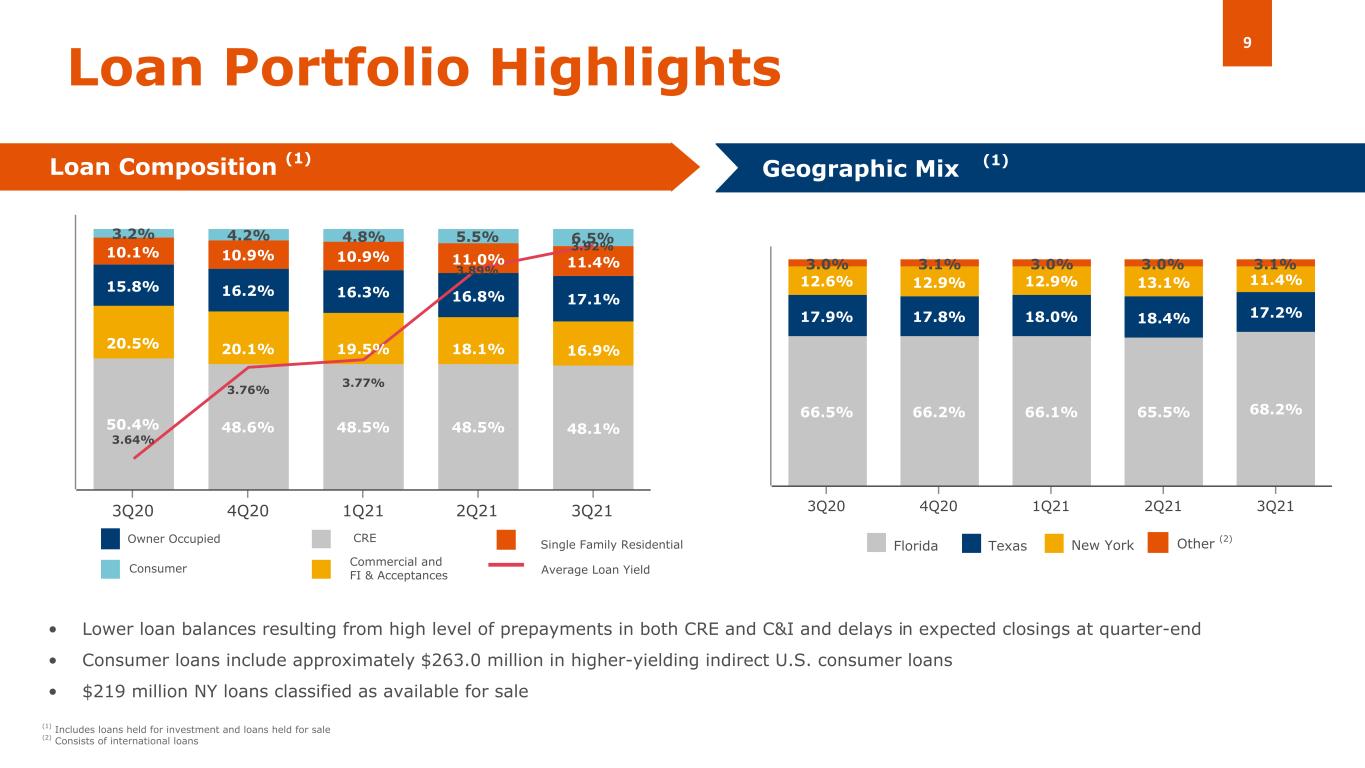

9 50.4% 48.6% 48.5% 48.5% 48.1% 20.5% 20.1% 19.5% 18.1% 16.9% 15.8% 16.2% 16.3% 16.8% 17.1% 10.1% 10.9% 10.9% 11.0% 11.4% 3.2% 4.2% 4.8% 5.5% 6.5% 3.64% 3.76% 3.77% 3.89% 3.92% 3Q20 4Q20 1Q21 2Q21 3Q21 66.5% 66.2% 66.1% 65.5% 68.2% 17.9% 17.8% 18.0% 18.4% 17.2% 12.6% 12.9% 12.9% 13.1% 11.4% 3.0% 3.1% 3.0% 3.0% 3.1% 3Q20 4Q20 1Q21 2Q21 3Q21 Consumer CRE Commercial and FI & Acceptances Owner Occupied Single Family Residential Loan Portfolio Highlights Loan Composition (1) Geographic Mix (Domestic) • Lower loan balances resulting from high level of prepayments in both CRE and C&I and delays in expected closings at quarter-end • Consumer loans include approximately $263.0 million in higher-yielding indirect U.S. consumer loans • $219 million NY loans classified as available for sale (1) Florida Texas New York Average Loan Yield Other (2) (1) Includes loans held for investment and loans held for sale (2) Consists of international loans

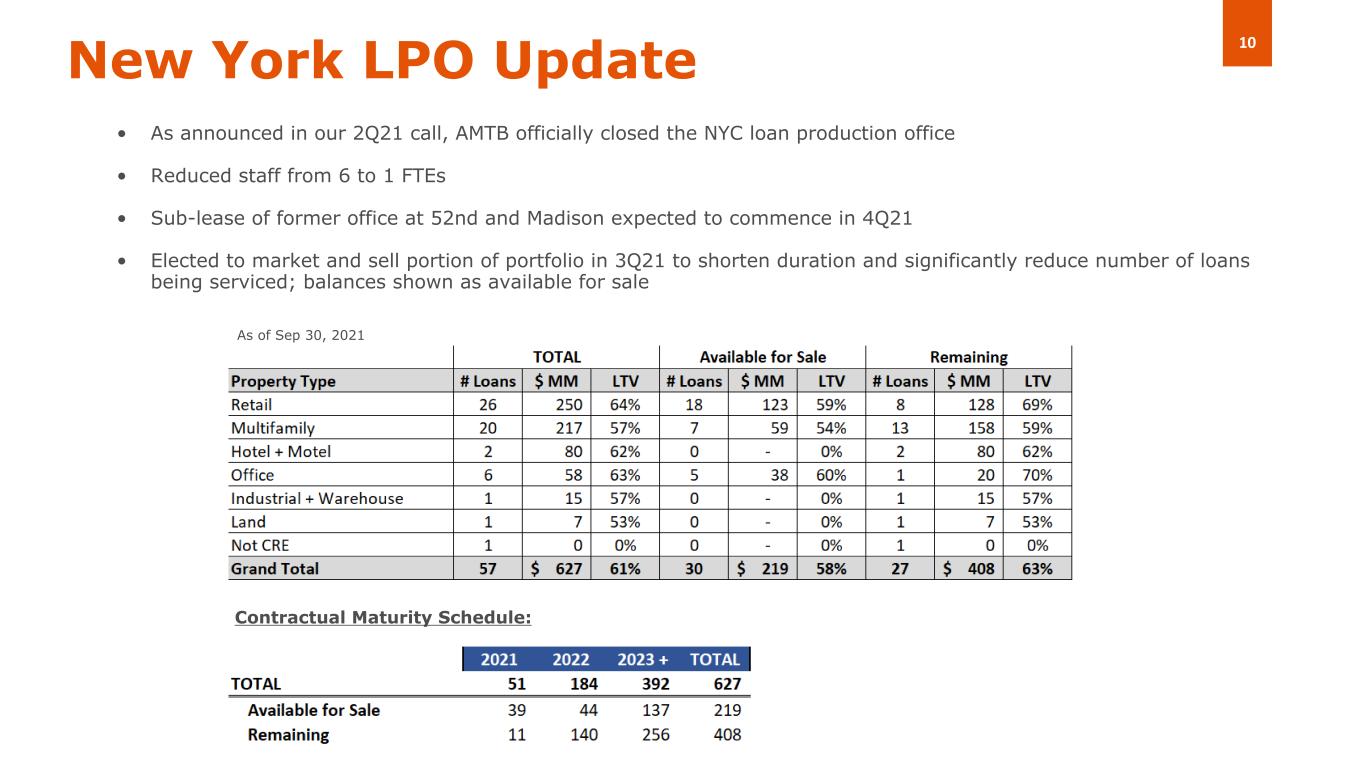

10New York LPO Update • As announced in our 2Q21 call, AMTB officially closed the NYC loan production office • Reduced staff from 6 to 1 FTEs • Sub-lease of former office at 52nd and Madison expected to commence in 4Q21 • Elected to market and sell portion of portfolio in 3Q21 to shorten duration and significantly reduce number of loans being serviced; balances shown as available for sale Contractual Maturity Schedule: As of Sep 30, 2021

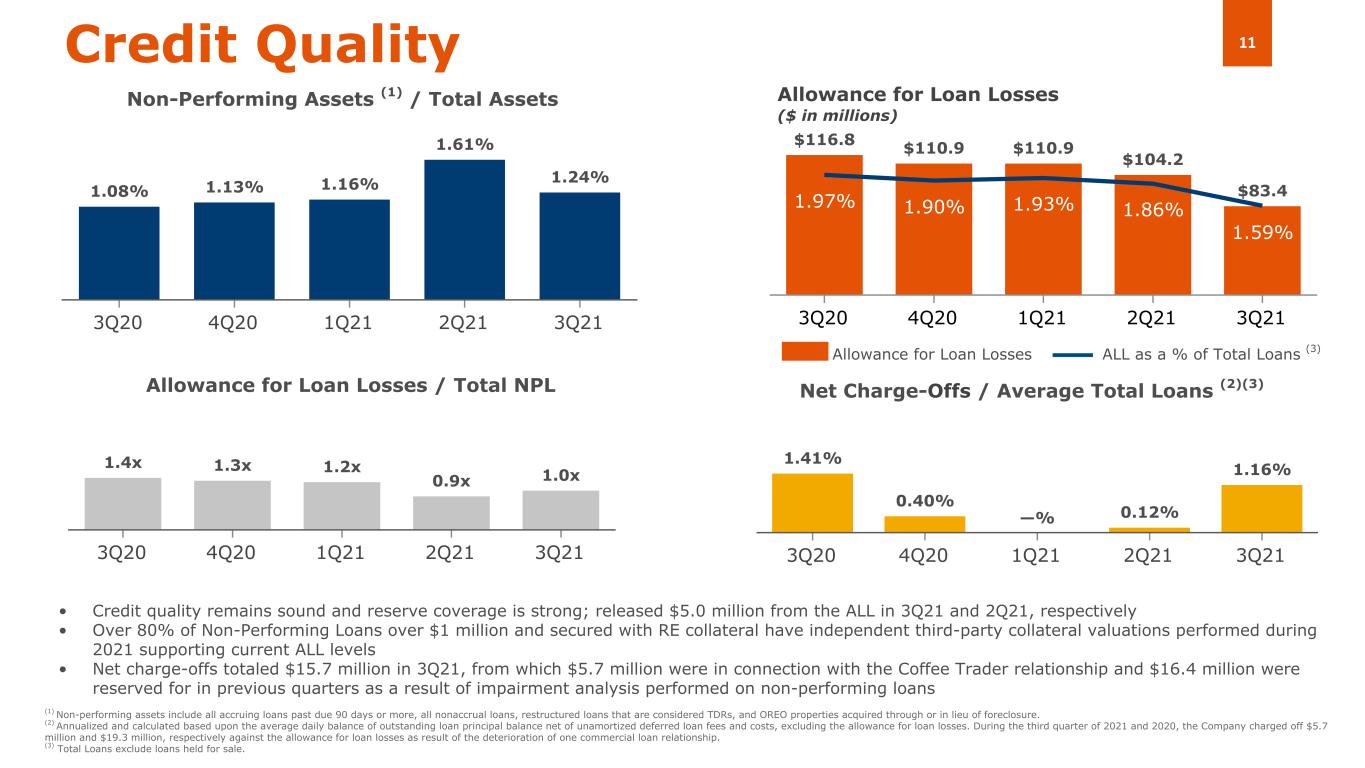

11 $116.8 $110.9 $110.9 $104.2 $83.41.97% 1.90% 1.93% 1.86% 1.59% 3Q20 4Q20 1Q21 2Q21 3Q21 1.41% 0.40% —% 0.12% 1.16% 3Q20 4Q20 1Q21 2Q21 3Q21 • Credit quality remains sound and reserve coverage is strong; released $5.0 million from the ALL in 3Q21 and 2Q21, respectively • Over 80% of Non-Performing Loans over $1 million and secured with RE collateral have independent third-party collateral valuations performed during 2021 supporting current ALL levels • Net charge-offs totaled $15.7 million in 3Q21, from which $5.7 million were in connection with the Coffee Trader relationship and $16.4 million were reserved for in previous quarters as a result of impairment analysis performed on non-performing loans Net Charge-Offs / Average Total Loans (2)(3) Credit Quality Allowance for Loan Losses ($ in millions) Non-Performing Assets (1) / Total Assets Allowance for Loan Losses / Total NPL Allowance for Loan Losses ALL as a % of Total Loans (3) (1) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered TDRs, and OREO properties acquired through or in lieu of foreclosure. (2) Annualized and calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan fees and costs, excluding the allowance for loan losses. During the third quarter of 2021 and 2020, the Company charged off $5.7 million and $19.3 million, respectively against the allowance for loan losses as result of the deterioration of one commercial loan relationship. (3) Total Loans exclude loans held for sale. 1.08% 1.13% 1.16% 1.61% 1.24% 3Q20 4Q20 1Q21 2Q21 3Q21 1.4x 1.3x 1.2x 0.9x 1.0x 3Q20 4Q20 1Q21 2Q21 3Q21

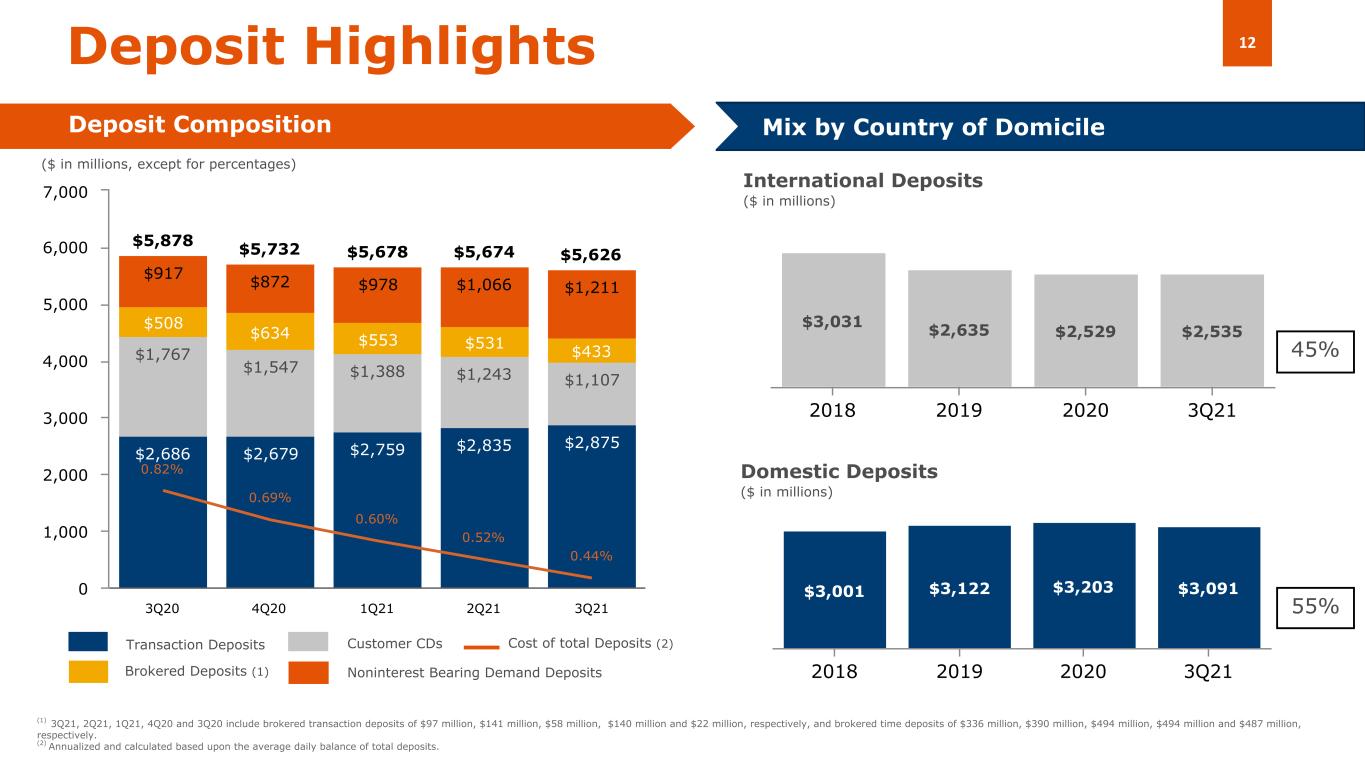

12 $5,878 $5,732 $5,678 $5,674 $5,626 $2,686 $2,679 $2,759 $2,835 $2,875 $1,767 $1,547 $1,388 $1,243 $1,107 $508 $634 $553 $531 $433 $917 $872 $978 $1,066 $1,211 0.82% 0.69% 0.60% 0.52% 0.44% 3Q20 4Q20 1Q21 2Q21 3Q21 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 $3,031 $2,635 $2,529 $2,535 2018 2019 2020 3Q21 $3,001 $3,122 $3,203 $3,091 2018 2019 2020 3Q21 Domestic Deposits ($ in millions) Deposit Highlights Deposit Composition 55% International Deposits ($ in millions) Mix by Country of Domicile Transaction Deposits Customer CDs Brokered Deposits (1) Cost of total Deposits (2) ($ in millions, except for percentages) 45% (1) 3Q21, 2Q21, 1Q21, 4Q20 and 3Q20 include brokered transaction deposits of $97 million, $141 million, $58 million, $140 million and $22 million, respectively, and brokered time deposits of $336 million, $390 million, $494 million, $494 million and $487 million, respectively. (2) Annualized and calculated based upon the average daily balance of total deposits. Noninterest Bearing Demand Deposits

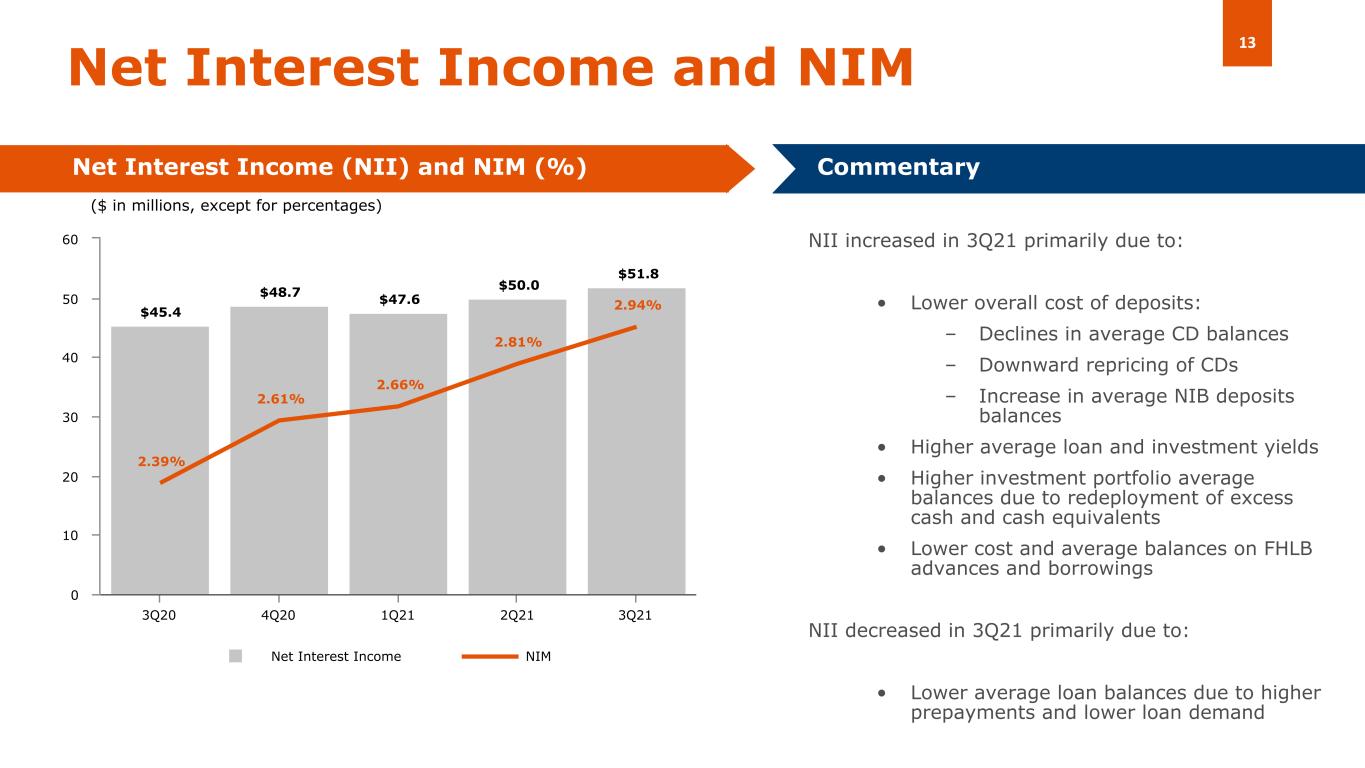

13 $45.4 $48.7 $47.6 $50.0 $51.8 2.39% 2.61% 2.66% 2.81% 2.94% Net Interest Income NIM 3Q20 4Q20 1Q21 2Q21 3Q21 0 10 20 30 40 50 60 NII increased in 3Q21 primarily due to: • Lower overall cost of deposits: – Declines in average CD balances – Downward repricing of CDs – Increase in average NIB deposits balances • Higher average loan and investment yields • Higher investment portfolio average balances due to redeployment of excess cash and cash equivalents • Lower cost and average balances on FHLB advances and borrowings NII decreased in 3Q21 primarily due to: • Lower average loan balances due to higher prepayments and lower loan demand Net Interest Income and NIM Net Interest Income (NII) and NIM (%) Commentary ($ in millions, except for percentages)

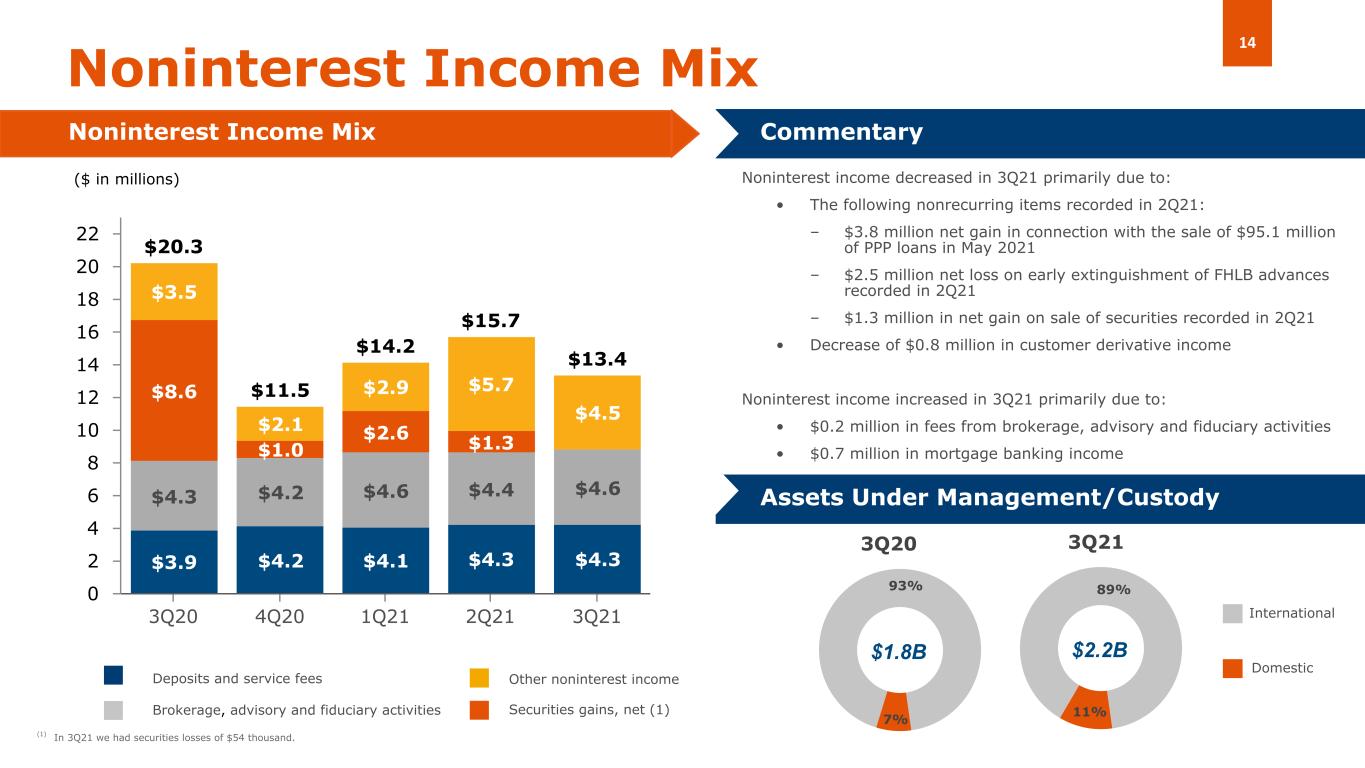

14 $20.3 $11.5 $14.2 $15.7 $13.4 $3.9 $4.2 $4.1 $4.3 $4.3 $4.3 $4.2 $4.6 $4.4 $4.6 $8.6 $1.0 $2.6 $1.3 $3.5 $2.1 $2.9 $5.7 $4.5 3Q20 4Q20 1Q21 2Q21 3Q21 0 2 4 6 8 10 12 14 16 18 20 22 7% 93% 11% 89% Noninterest Income Mix Noninterest Income Mix Commentary Noninterest income decreased in 3Q21 primarily due to: • The following nonrecurring items recorded in 2Q21: – $3.8 million net gain in connection with the sale of $95.1 million of PPP loans in May 2021 – $2.5 million net loss on early extinguishment of FHLB advances recorded in 2Q21 – $1.3 million in net gain on sale of securities recorded in 2Q21 • Decrease of $0.8 million in customer derivative income Noninterest income increased in 3Q21 primarily due to: • $0.2 million in fees from brokerage, advisory and fiduciary activities • $0.7 million in mortgage banking income Assets Under Management/Custody Deposits and service fees Brokerage, advisory and fiduciary activities Other noninterest income $2.2B Domestic International 3Q213Q20 $1.8B ($ in millions) Securities gains, net (1) (1) In 3Q21 we had securities losses of $54 thousand.

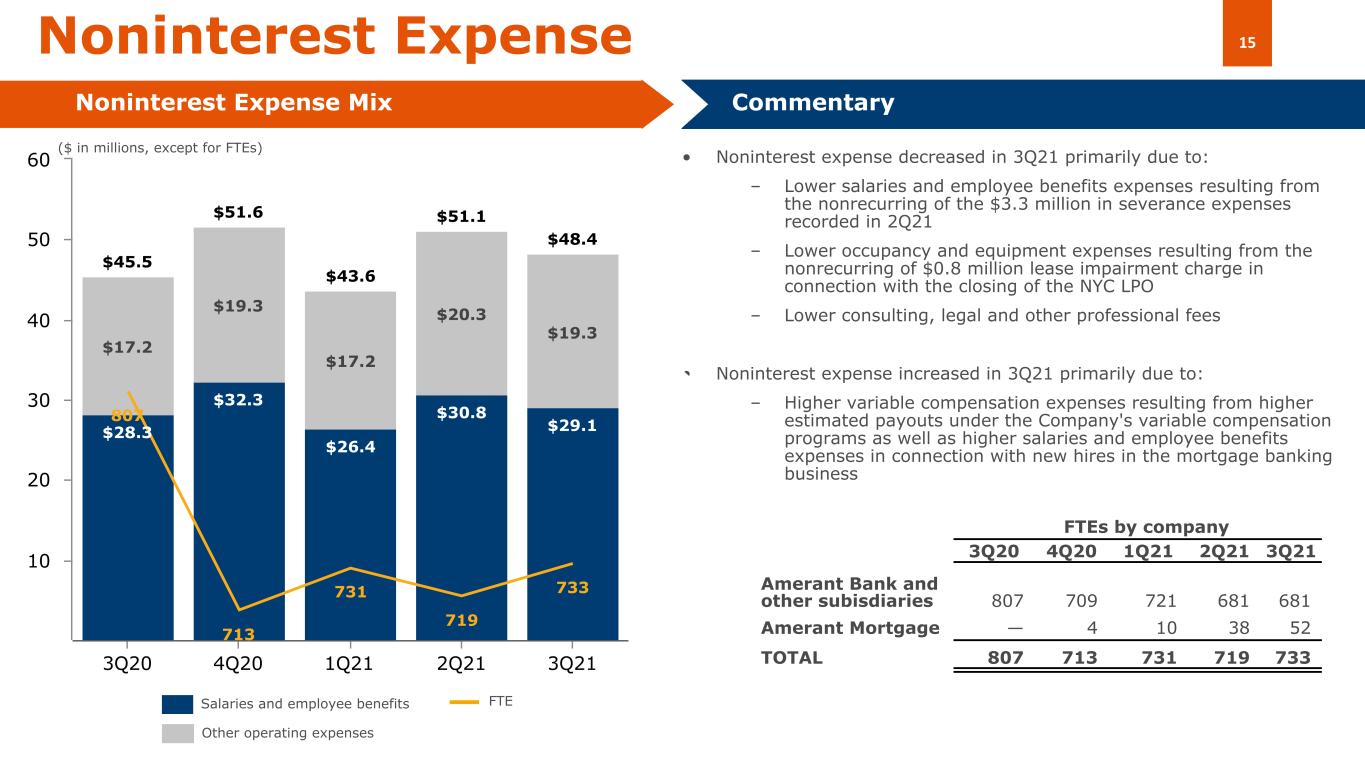

15 • Noninterest expense decreased in 3Q21 primarily due to: – Lower salaries and employee benefits expenses resulting from the nonrecurring of the $3.3 million in severance expenses recorded in 2Q21 – Lower occupancy and equipment expenses resulting from the nonrecurring of $0.8 million lease impairment charge in connection with the closing of the NYC LPO – Lower consulting, legal and other professional fees • Noninterest expense increased in 3Q21 primarily due to: – Higher variable compensation expenses resulting from higher estimated payouts under the Company's variable compensation programs as well as higher salaries and employee benefits expenses in connection with new hires in the mortgage banking business $45.5 $51.6 $43.6 $51.1 $48.4 $28.3 $32.3 $26.4 $30.8 $29.1 $17.2 $19.3 $17.2 $20.3 $19.3 807 713 731 719 733 3Q20 4Q20 1Q21 2Q21 3Q21 10 20 30 40 50 60 Noninterest Expense Noninterest Expense Mix Commentary Other operating expenses Salaries and employee benefits FTE ($ in millions, except for FTEs) FTEs by company 3Q20 4Q20 1Q21 2Q21 3Q21 Amerant Bank and other subisdiaries 807 709 721 681 681 Amerant Mortgage — 4 10 38 52 TOTAL 807 713 731 719 733

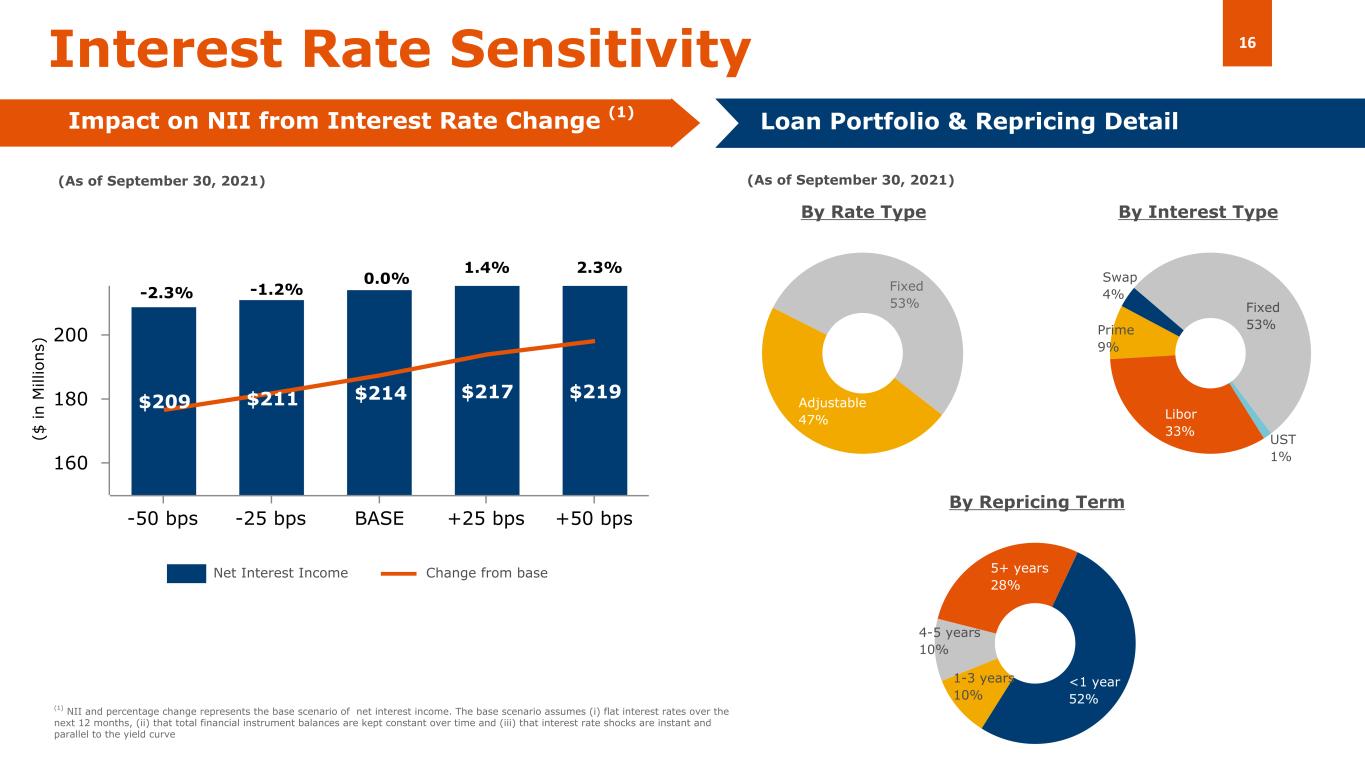

16 $209 $211 $214 $217 $219 -50 bps -25 bps BASE +25 bps +50 bps 160 180 200 (As of September 30, 2021) Fixed 53% Adjustable 47% Interest Rate Sensitivity By Interest TypeBy Rate Type By Repricing Term (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve Loan Portfolio & Repricing Detail Impact on NII from Interest Rate Change (1) Net Interest Income Change from base <1 year 52% 1-3 years 10% 4-5 years 10% 5+ years 28% -2.3% -1.2% 0.0% 2.3%1.4% ($ in M ill io ns ) (As of September 30, 2021) Swap 4% Fixed 53% UST 1% Libor 33% Prime 9%

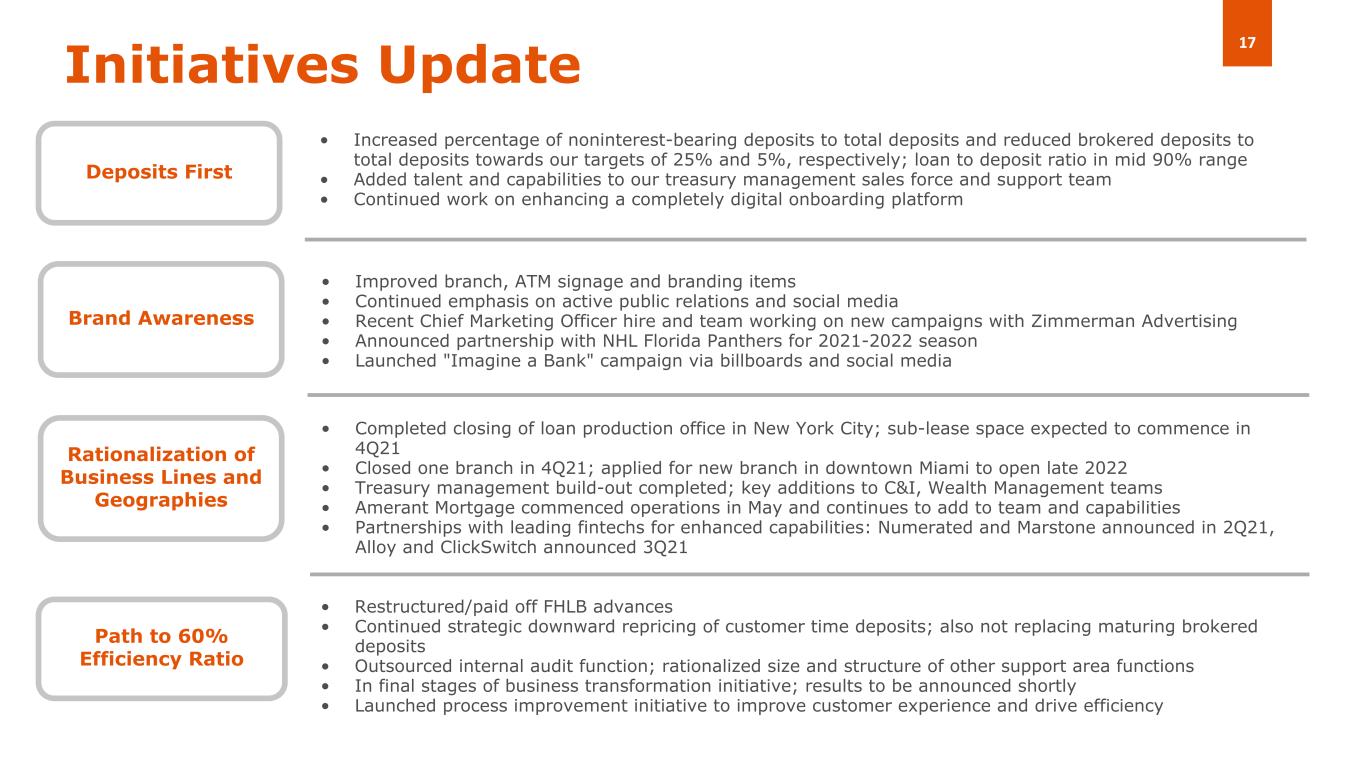

17Initiatives Update • Increased percentage of noninterest-bearing deposits to total deposits and reduced brokered deposits to total deposits towards our targets of 25% and 5%, respectively; loan to deposit ratio in mid 90% range • Added talent and capabilities to our treasury management sales force and support team • Continued work on enhancing a completely digital onboarding platform Deposits First • Improved branch, ATM signage and branding items • Continued emphasis on active public relations and social media • Recent Chief Marketing Officer hire and team working on new campaigns with Zimmerman Advertising • Announced partnership with NHL Florida Panthers for 2021-2022 season • Launched "Imagine a Bank" campaign via billboards and social media Brand Awareness • Completed closing of loan production office in New York City; sub-lease space expected to commence in 4Q21 • Closed one branch in 4Q21; applied for new branch in downtown Miami to open late 2022 • Treasury management build-out completed; key additions to C&I, Wealth Management teams • Amerant Mortgage commenced operations in May and continues to add to team and capabilities • Partnerships with leading fintechs for enhanced capabilities: Numerated and Marstone announced in 2Q21, Alloy and ClickSwitch announced 3Q21 Rationalization of Business Lines and Geographies • Restructured/paid off FHLB advances • Continued strategic downward repricing of customer time deposits; also not replacing maturing brokered deposits • Outsourced internal audit function; rationalized size and structure of other support area functions • In final stages of business transformation initiative; results to be announced shortly • Launched process improvement initiative to improve customer experience and drive efficiency Path to 60% Efficiency Ratio

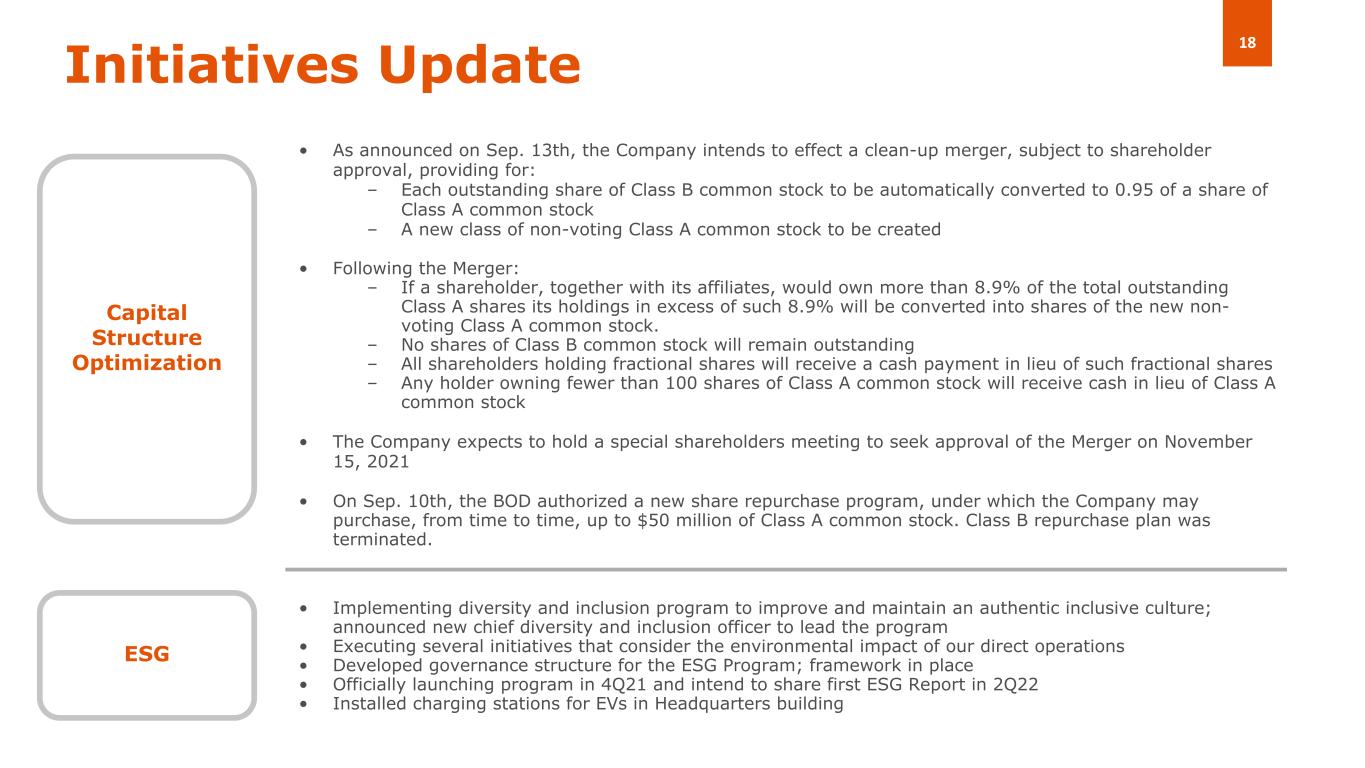

18Initiatives Update Focused on increasing profitability and shareholder value • As announced on Sep. 13th, the Company intends to effect a clean-up merger, subject to shareholder approval, providing for: – Each outstanding share of Class B common stock to be automatically converted to 0.95 of a share of Class A common stock – A new class of non-voting Class A common stock to be created • Following the Merger: – If a shareholder, together with its affiliates, would own more than 8.9% of the total outstanding Class A shares its holdings in excess of such 8.9% will be converted into shares of the new non- voting Class A common stock. – No shares of Class B common stock will remain outstanding – All shareholders holding fractional shares will receive a cash payment in lieu of such fractional shares – Any holder owning fewer than 100 shares of Class A common stock will receive cash in lieu of Class A common stock • The Company expects to hold a special shareholders meeting to seek approval of the Merger on November 15, 2021 • On Sep. 10th, the BOD authorized a new share repurchase program, under which the Company may purchase, from time to time, up to $50 million of Class A common stock. Class B repurchase plan was terminated. Capital Structure Optimization • Implementing diversity and inclusion program to improve and maintain an authentic inclusive culture; announced new chief diversity and inclusion officer to lead the program • Executing several initiatives that consider the environmental impact of our direct operations • Developed governance structure for the ESG Program; framework in place • Officially launching program in 4Q21 and intend to share first ESG Report in 2Q22 • Installed charging stations for EVs in Headquarters building ESG

Supplemental Loan Portfolio Information

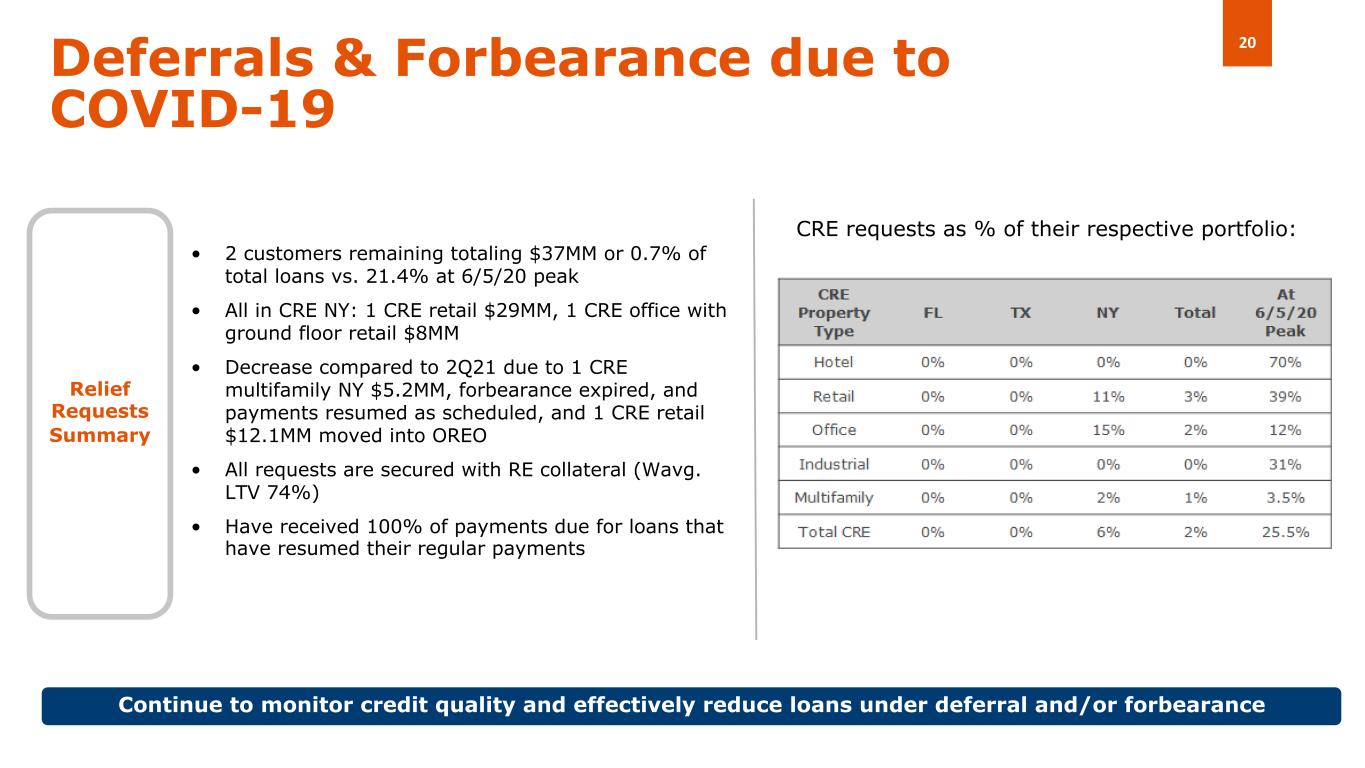

20Deferrals & Forbearance due to COVID-19 • 2 customers remaining totaling $37MM or 0.7% of total loans vs. 21.4% at 6/5/20 peak • All in CRE NY: 1 CRE retail $29MM, 1 CRE office with ground floor retail $8MM • Decrease compared to 2Q21 due to 1 CRE multifamily NY $5.2MM, forbearance expired, and payments resumed as scheduled, and 1 CRE retail $12.1MM moved into OREO • All requests are secured with RE collateral (Wavg. LTV 74%) • Have received 100% of payments due for loans that have resumed their regular payments Relief Requests Summary Continue to monitor credit quality and effectively reduce loans under deferral and/or forbearance CRE requests as % of their respective portfolio:

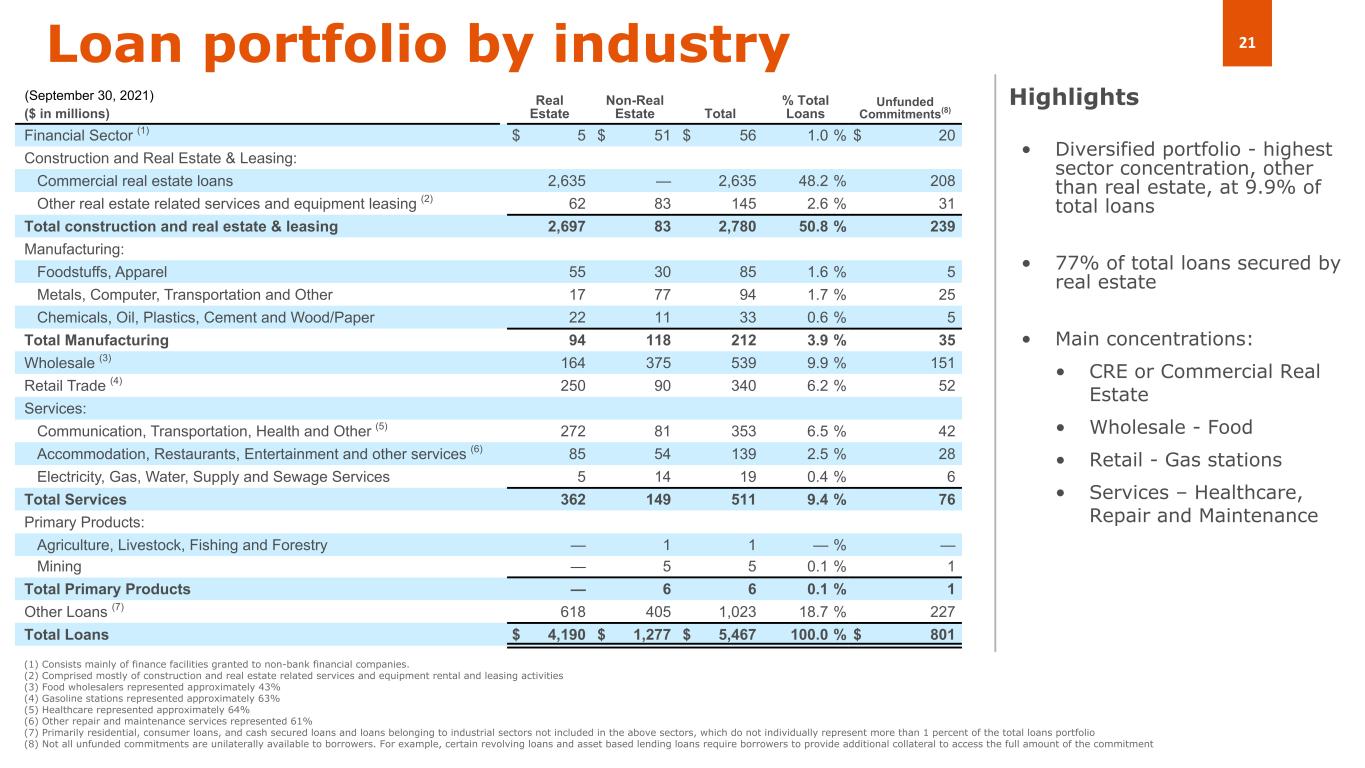

21Loan portfolio by industry • Diversified portfolio - highest sector concentration, other than real estate, at 9.9% of total loans • 77% of total loans secured by real estate • Main concentrations: • CRE or Commercial Real Estate • Wholesale - Food • Retail - Gas stations • Services – Healthcare, Repair and Maintenance Highlights (1) Consists mainly of finance facilities granted to non-bank financial companies. (2) Comprised mostly of construction and real estate related services and equipment rental and leasing activities (3) Food wholesalers represented approximately 43% (4) Gasoline stations represented approximately 63% (5) Healthcare represented approximately 64% (6) Other repair and maintenance services represented 61% (7) Primarily residential, consumer loans, and cash secured loans and loans belonging to industrial sectors not included in the above sectors, which do not individually represent more than 1 percent of the total loans portfolio (8) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers to provide additional collateral to access the full amount of the commitment ($ in millions) Real Estate Non-Real Estate Total % Total Loans Unfunded Commitments(8) Financial Sector (1) $ 5 $ 51 $ 56 1.0 % $ 20 Construction and Real Estate & Leasing: Commercial real estate loans 2,635 — 2,635 48.2 % 208 Other real estate related services and equipment leasing (2) 62 83 145 2.6 % 31 Total construction and real estate & leasing 2,697 83 2,780 50.8 % 239 Manufacturing: Foodstuffs, Apparel 55 30 85 1.6 % 5 Metals, Computer, Transportation and Other 17 77 94 1.7 % 25 Chemicals, Oil, Plastics, Cement and Wood/Paper 22 11 33 0.6 % 5 Total Manufacturing 94 118 212 3.9 % 35 Wholesale (3) 164 375 539 9.9 % 151 Retail Trade (4) 250 90 340 6.2 % 52 Services: Communication, Transportation, Health and Other (5) 272 81 353 6.5 % 42 Accommodation, Restaurants, Entertainment and other services (6) 85 54 139 2.5 % 28 Electricity, Gas, Water, Supply and Sewage Services 5 14 19 0.4 % 6 Total Services 362 149 511 9.4 % 76 Primary Products: Agriculture, Livestock, Fishing and Forestry — 1 1 — % — Mining — 5 5 0.1 % 1 Total Primary Products — 6 6 0.1 % 1 Other Loans (7) 618 405 1,023 18.7 % 227 Total Loans $ 4,190 $ 1,277 $ 5,467 100.0 % $ 801 (September 30, 2021)

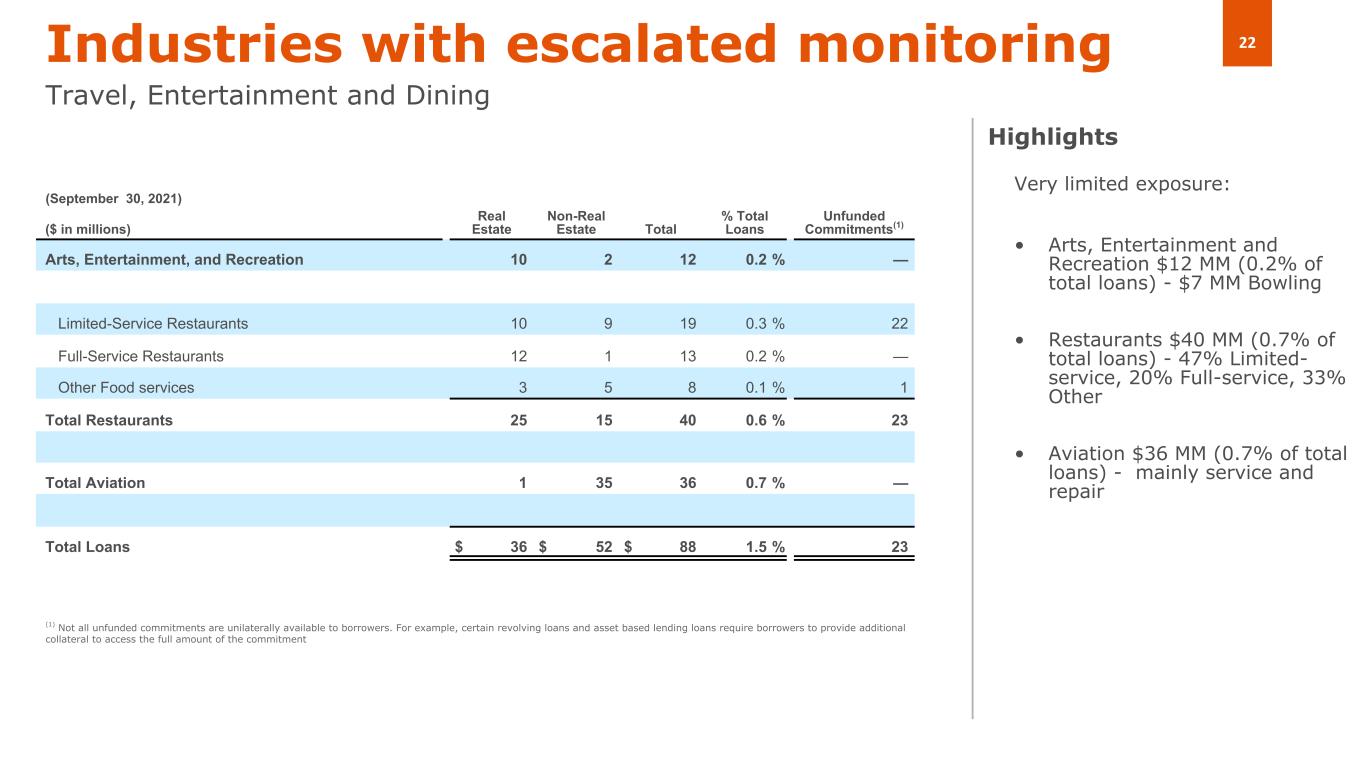

22Industries with escalated monitoring Travel, Entertainment and Dining Very limited exposure: • Arts, Entertainment and Recreation $12 MM (0.2% of total loans) - $7 MM Bowling • Restaurants $40 MM (0.7% of total loans) - 47% Limited- service, 20% Full-service, 33% Other • Aviation $36 MM (0.7% of total loans) - mainly service and repair Highlights (1) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers to provide additional collateral to access the full amount of the commitment ($ in millions) Real Estate Non-Real Estate Total % Total Loans Unfunded Commitments(1) Arts, Entertainment, and Recreation 10 2 12 0.2 % — Limited-Service Restaurants 10 9 19 0.3 % 22 Full-Service Restaurants 12 1 13 0.2 % — Other Food services 3 5 8 0.1 % 1 Total Restaurants 25 15 40 0.6 % 23 Total Aviation 1 35 36 0.7 % — Total Loans $ 36 $ 52 $ 88 1.5 % 23 (September 30, 2021)

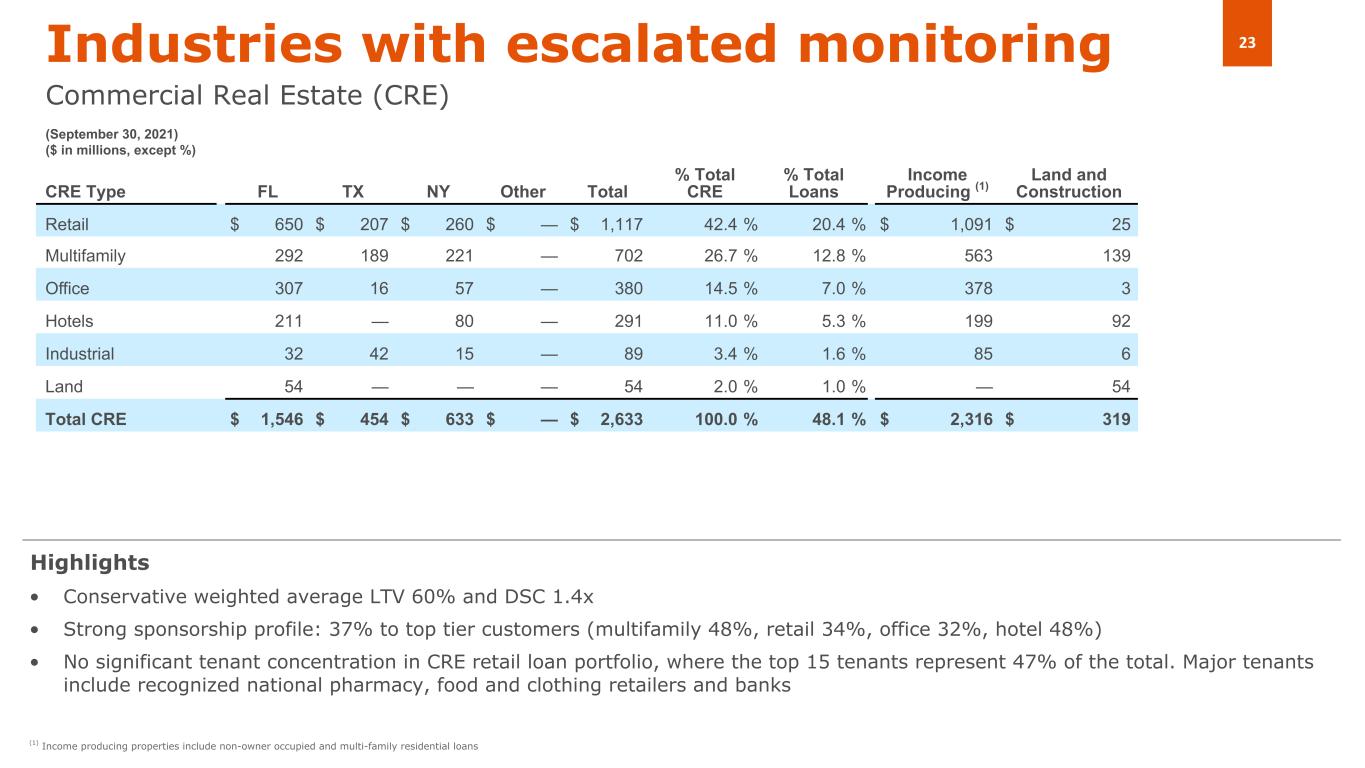

23Industries with escalated monitoring Commercial Real Estate (CRE) CRE Type FL TX NY Other Total % Total CRE % Total Loans Income Producing (1) Land and Construction Retail $ 650 $ 207 $ 260 $ — $ 1,117 42.4 % 20.4 % $ 1,091 $ 25 Multifamily 292 189 221 — 702 26.7 % 12.8 % 563 139 Office 307 16 57 — 380 14.5 % 7.0 % 378 3 Hotels 211 — 80 — 291 11.0 % 5.3 % 199 92 Industrial 32 42 15 — 89 3.4 % 1.6 % 85 6 Land 54 — — — 54 2.0 % 1.0 % — 54 Total CRE $ 1,546 $ 454 $ 633 $ — $ 2,633 100.0 % 48.1 % $ 2,316 $ 319 • Conservative weighted average LTV 60% and DSC 1.4x • Strong sponsorship profile: 37% to top tier customers (multifamily 48%, retail 34%, office 32%, hotel 48%) • No significant tenant concentration in CRE retail loan portfolio, where the top 15 tenants represent 47% of the total. Major tenants include recognized national pharmacy, food and clothing retailers and banks (1) Income producing properties include non-owner occupied and multi-family residential loans Highlights (September 30, 2021) ($ in millions, except %)

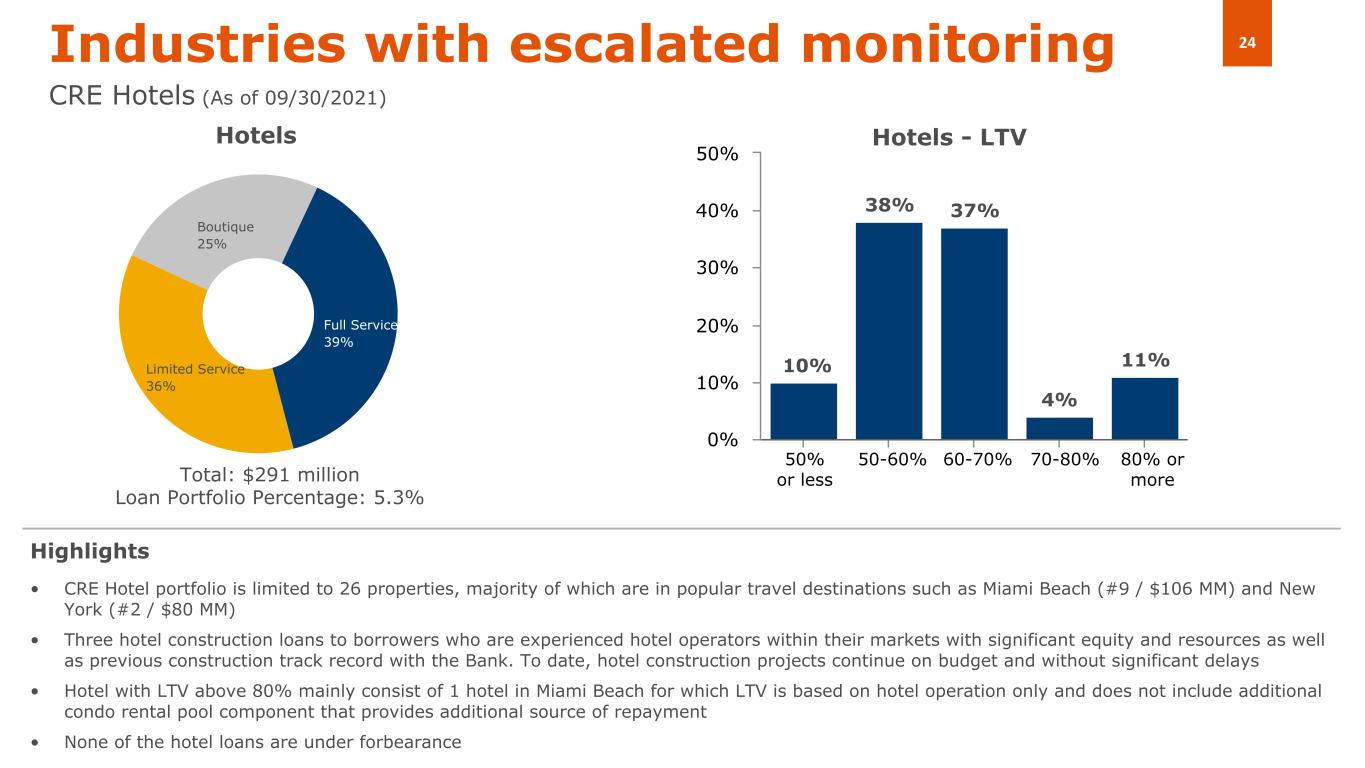

24Industries with escalated monitoring CRE Hotels (As of 09/30/2021) • CRE Hotel portfolio is limited to 26 properties, majority of which are in popular travel destinations such as Miami Beach (#9 / $106 MM) and New York (#2 / $80 MM) • Three hotel construction loans to borrowers who are experienced hotel operators within their markets with significant equity and resources as well as previous construction track record with the Bank. To date, hotel construction projects continue on budget and without significant delays • Hotel with LTV above 80% mainly consist of 1 hotel in Miami Beach for which LTV is based on hotel operation only and does not include additional condo rental pool component that provides additional source of repayment • None of the hotel loans are under forbearance Highlights Full Service 39% Limited Service 36% Boutique 25% Hotels 10% 38% 37% 4% 11% 0% 10% 20% 30% 40% 50% 50% or less 50-60% 60-70% 70-80% 80% or more Hotels - LTV Total: $291 million Loan Portfolio Percentage: 5.3%

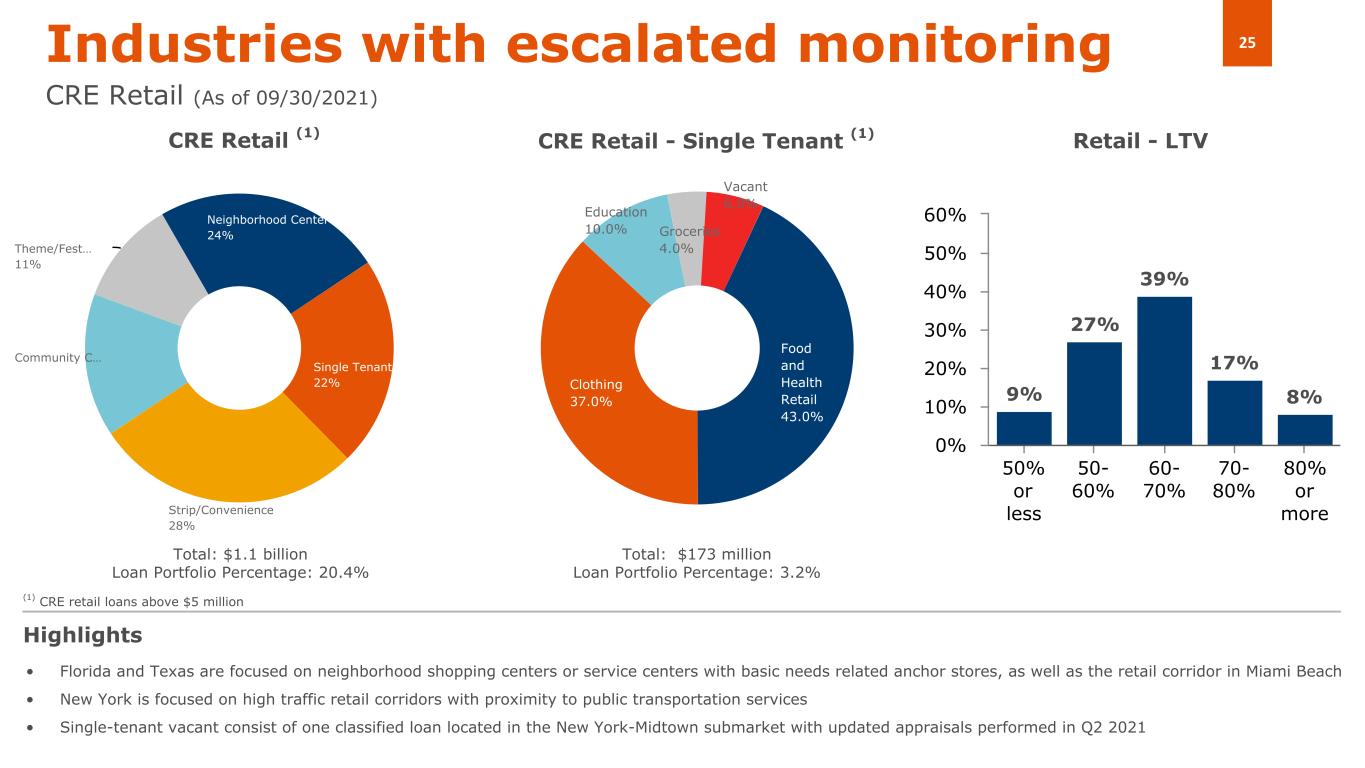

25 9% 27% 39% 17% 8% 50% or less 50- 60% 60- 70% 70- 80% 80% or more 0% 10% 20% 30% 40% 50% 60% Industries with escalated monitoring CRE Retail (As of 09/30/2021) • Florida and Texas are focused on neighborhood shopping centers or service centers with basic needs related anchor stores, as well as the retail corridor in Miami Beach • New York is focused on high traffic retail corridors with proximity to public transportation services • Single-tenant vacant consist of one classified loan located in the New York-Midtown submarket with updated appraisals performed in Q2 2021 Highlights CRE Retail (1) Retail - LTV Food and Health Retail 43.0% Clothing 37.0% Education 10.0% Groceries 4.0% Vacant 6.0% CRE Retail - Single Tenant (1) (1) CRE retail loans above $5 million Total: $1.1 billion Loan Portfolio Percentage: 20.4% Total: $173 million Loan Portfolio Percentage: 3.2% Neighborhood Center 24% Single Tenant 22% Strip/Convenience 28% Community C… Theme/Fest… 11%

Appendices

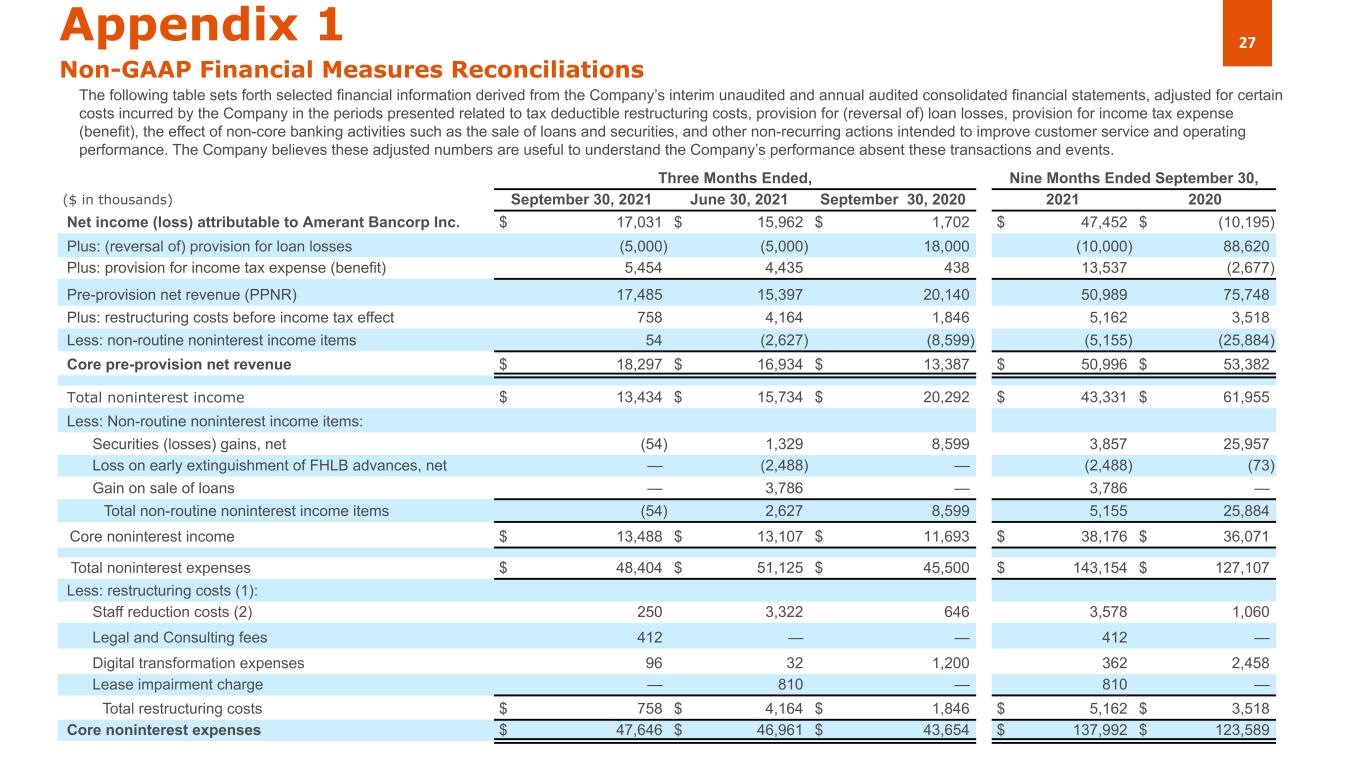

27Appendix 1 Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related to tax deductible restructuring costs, provision for (reversal of) loan losses, provision for income tax expense (benefit), the effect of non-core banking activities such as the sale of loans and securities, and other non-recurring actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events. Three Months Ended, Nine Months Ended September 30, ($ in thousands) September 30, 2021 June 30, 2021 September 30, 2020 2021 2020 Net income (loss) attributable to Amerant Bancorp Inc. $ 17,031 $ 15,962 $ 1,702 $ 47,452 $ (10,195) Plus: (reversal of) provision for loan losses (5,000) (5,000) 18,000 (10,000) 88,620 Plus: provision for income tax expense (benefit) 5,454 4,435 438 13,537 (2,677) Pre-provision net revenue (PPNR) 17,485 15,397 20,140 50,989 75,748 Plus: restructuring costs before income tax effect 758 4,164 1,846 5,162 3,518 Less: non-routine noninterest income items 54 (2,627) (8,599) (5,155) (25,884) Core pre-provision net revenue $ 18,297 $ 16,934 $ 13,387 $ 50,996 $ 53,382 Total noninterest income $ 13,434 $ 15,734 $ 20,292 $ 43,331 $ 61,955 Less: Non-routine noninterest income items: Securities (losses) gains, net (54) 1,329 8,599 3,857 25,957 Loss on early extinguishment of FHLB advances, net — (2,488) — (2,488) (73) Gain on sale of loans — 3,786 — 3,786 — Total non-routine noninterest income items (54) 2,627 8,599 5,155 25,884 Core noninterest income $ 13,488 $ 13,107 $ 11,693 $ 38,176 $ 36,071 Total noninterest expenses $ 48,404 $ 51,125 $ 45,500 $ 143,154 $ 127,107 Less: restructuring costs (1): Staff reduction costs (2) 250 3,322 646 3,578 1,060 Legal and Consulting fees 412 — — 412 — Digital transformation expenses 96 32 1,200 362 2,458 Lease impairment charge — 810 — 810 — Total restructuring costs $ 758 $ 4,164 $ 1,846 $ 5,162 $ 3,518 Core noninterest expenses $ 47,646 $ 46,961 $ 43,654 $ 137,992 $ 123,589

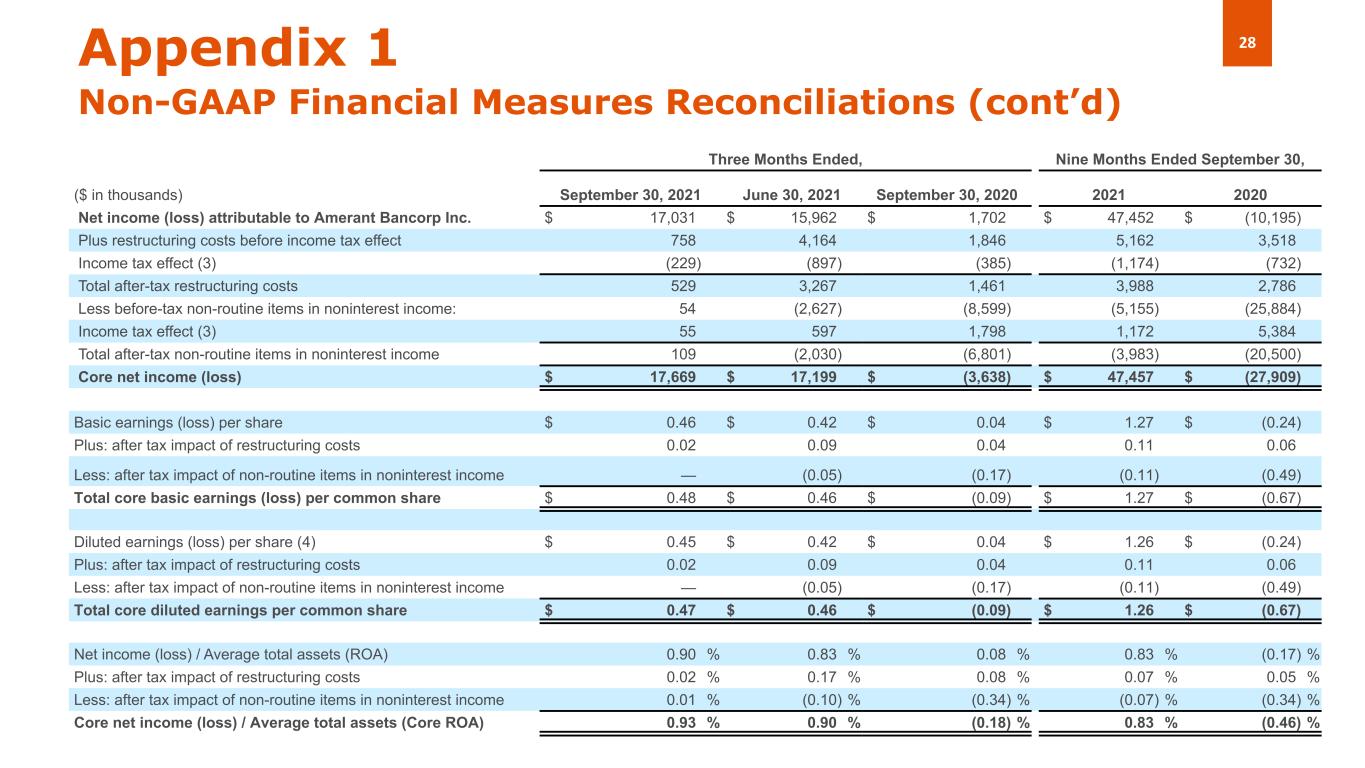

28Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Nine Months Ended September 30, ($ in thousands) September 30, 2021 June 30, 2021 September 30, 2020 2021 2020 Net income (loss) attributable to Amerant Bancorp Inc. $ 17,031 $ 15,962 $ 1,702 $ 47,452 $ (10,195) Plus restructuring costs before income tax effect 758 4,164 1,846 5,162 3,518 Income tax effect (3) (229) (897) (385) (1,174) (732) Total after-tax restructuring costs 529 3,267 1,461 3,988 2,786 Less before-tax non-routine items in noninterest income: 54 (2,627) (8,599) (5,155) (25,884) Income tax effect (3) 55 597 1,798 1,172 5,384 Total after-tax non-routine items in noninterest income 109 (2,030) (6,801) (3,983) (20,500) Core net income (loss) $ 17,669 $ 17,199 $ (3,638) $ 47,457 $ (27,909) Basic earnings (loss) per share $ 0.46 $ 0.42 $ 0.04 $ 1.27 $ (0.24) Plus: after tax impact of restructuring costs 0.02 0.09 0.04 0.11 0.06 Less: after tax impact of non-routine items in noninterest income — (0.05) (0.17) (0.11) (0.49) Total core basic earnings (loss) per common share $ 0.48 $ 0.46 $ (0.09) $ 1.27 $ (0.67) Diluted earnings (loss) per share (4) $ 0.45 $ 0.42 $ 0.04 $ 1.26 $ (0.24) Plus: after tax impact of restructuring costs 0.02 0.09 0.04 0.11 0.06 Less: after tax impact of non-routine items in noninterest income — (0.05) (0.17) (0.11) (0.49) Total core diluted earnings per common share $ 0.47 $ 0.46 $ (0.09) $ 1.26 $ (0.67) Net income (loss) / Average total assets (ROA) 0.90 % 0.83 % 0.08 % 0.83 % (0.17) % Plus: after tax impact of restructuring costs 0.02 % 0.17 % 0.08 % 0.07 % 0.05 % Less: after tax impact of non-routine items in noninterest income 0.01 % (0.10) % (0.34) % (0.07) % (0.34) % Core net income (loss) / Average total assets (Core ROA) 0.93 % 0.90 % (0.18) % 0.83 % (0.46) %

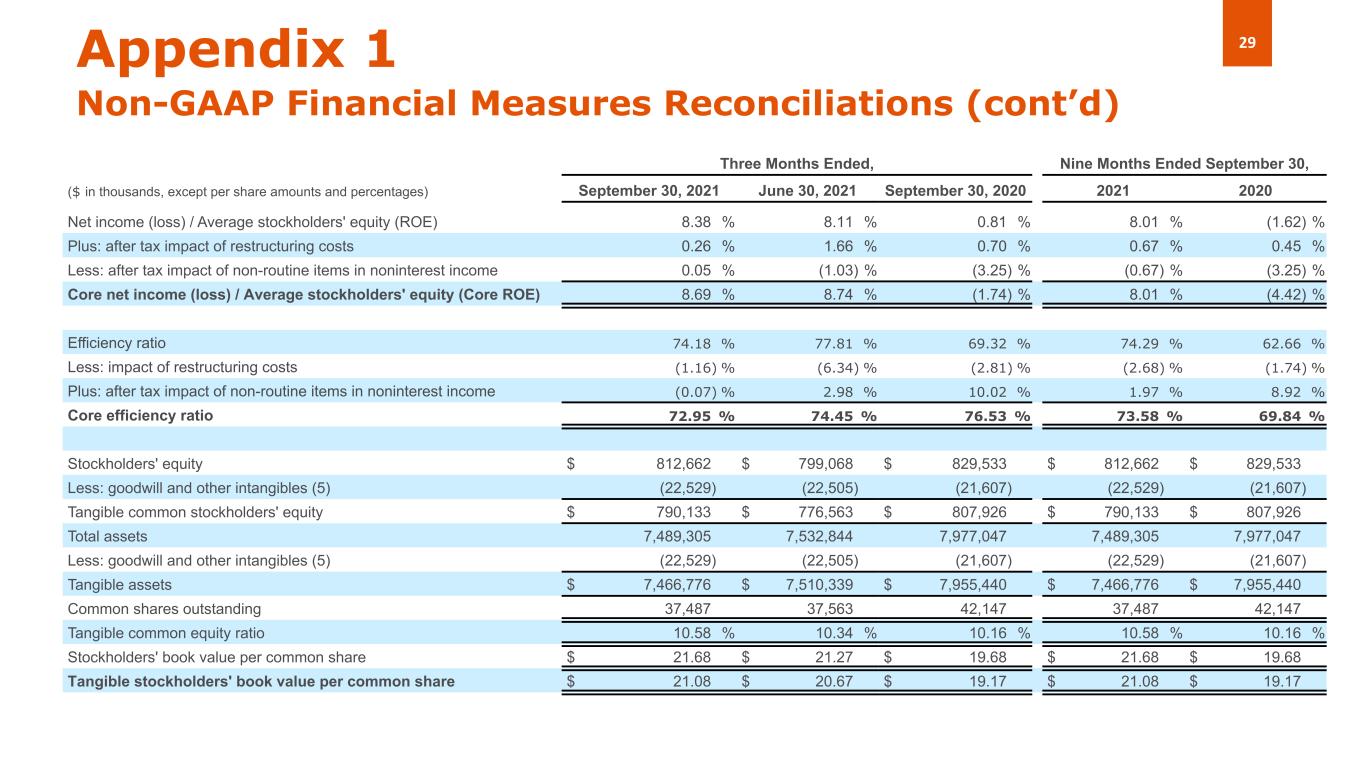

29Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Nine Months Ended September 30, ($ in thousands, except per share amounts and percentages) September 30, 2021 June 30, 2021 September 30, 2020 2021 2020 Net income (loss) / Average stockholders' equity (ROE) 8.38 % 8.11 % 0.81 % 8.01 % (1.62) % Plus: after tax impact of restructuring costs 0.26 % 1.66 % 0.70 % 0.67 % 0.45 % Less: after tax impact of non-routine items in noninterest income 0.05 % (1.03) % (3.25) % (0.67) % (3.25) % Core net income (loss) / Average stockholders' equity (Core ROE) 8.69 % 8.74 % (1.74) % 8.01 % (4.42) % Efficiency ratio 74.18 % 77.81 % 69.32 % 74.29 % 62.66 % Less: impact of restructuring costs (1.16) % (6.34) % (2.81) % (2.68) % (1.74) % Plus: after tax impact of non-routine items in noninterest income (0.07) % 2.98 % 10.02 % 1.97 % 8.92 % Core efficiency ratio 72.95 % 74.45 % 76.53 % 73.58 % 69.84 % Stockholders' equity $ 812,662 $ 799,068 $ 829,533 $ 812,662 $ 829,533 Less: goodwill and other intangibles (5) (22,529) (22,505) (21,607) (22,529) (21,607) Tangible common stockholders' equity $ 790,133 $ 776,563 $ 807,926 $ 790,133 $ 807,926 Total assets 7,489,305 7,532,844 7,977,047 7,489,305 7,977,047 Less: goodwill and other intangibles (5) (22,529) (22,505) (21,607) (22,529) (21,607) Tangible assets $ 7,466,776 $ 7,510,339 $ 7,955,440 $ 7,466,776 $ 7,955,440 Common shares outstanding 37,487 37,563 42,147 37,487 42,147 Tangible common equity ratio 10.58 % 10.34 % 10.16 % 10.58 % 10.16 % Stockholders' book value per common share $ 21.68 $ 21.27 $ 19.68 $ 21.68 $ 19.68 Tangible stockholders' book value per common share $ 21.08 $ 20.67 $ 19.17 $ 21.08 $ 19.17

30Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) (1) Expenses incurred for actions designed to implement the Company’s strategy as a new independent company. These actions include, but are not limited to reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (2) In the second quarter of 2021, includes expenses in connection with the departure of the Company’s Chief Operating Officer and the elimination of various other support function positions, including the NYC LPO. (3) In the nine months ended September 30, 2021 and 2020, amounts were calculated based upon the effective tax rate for the periods of 22.74% and 20.80%, respectively. For all of the other periods shown, amounts represent the difference between the prior and current period year-to-date tax effect. (4) In the three months ended September 30, 2021 and June 30, 2021 and in the nine months ended September 30, 2021, potential dilutive instruments consisted of unvested shares of restricted stock, restricted stock units and performance share units (restricted stock and restricted stock units for all of the other periods shown). For the nine month periods ended September 30, 2020, potential dilutive instruments were not included in the diluted earnings per share computation because the Company reported a net loss and their inclusion would have an antidilutive effect. For all other periods presented, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in those periods, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in those periods, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings. (5) Other intangible assets consist of, among other things, mortgage servicing rights and are included in other assets in the Company's consolidated balance sheets.

Thank you Investor Relations InvestorRelations@amerantbank.com