September 2022 Investor Update

2 amerantbank.com Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2021, our quarterly reports on Form 10-Q for the quarters ended March 31, and June 30, 2022 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including the three and six month periods ended June 30, 2022 and 2021, may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2022, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “pre-provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, ”core noninterest income”, ”core noninterest expenses”, ”core net income (loss)”, ”core earnings (loss) per share (basic and diluted)”, ”core return on assets (Core ROA)”, ”core return on equity (Core ROE)”, ”core efficiency ratio”, and ”tangible stockholders’ equity (book value) per common share”. This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as ”non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued in 2022, including the effect of non-core banking activities such as the sale of loans and securities, the valuation of securities, derivatives, loans held for sale and other real estate owned, the sale of our corporate headquarters in the fourth quarter of 2021, and other non-routine actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non- GAAP financial measures may differ from similar measures presented by other companies. Appendix 2 reconciles these non-GAAP financial measures to reported results.

3 amerantbank.com Investment Opportunity Highlights – Established franchise with high scarcity value; presence in attractive, high-growth markets of Miami, Tampa and Houston – Strong and diverse deposit base; deposits first focus – Strong reserve coverage and disciplined credit culture – Net interest income continues to grow with balance sheet growth and recent interest rate hikes – Significant fee income opportunities from wealth and mortgage banking – Executing on digital transformation; fintech driven strategy – Well capitalized; committed to enhance shareholder returns via dynamic capital management – Executing on recently developed ESG program; focused on making ESG part of Company's DNA

4 amerantbank.com 98% 2% 60% 40% Domestic • Largest community bank headquartered in Florida About Us • 24 branches throughout South Florida and Houston • $6.20 billion • $8.2 billion • Coral Gables, FL • 680 FTEs (AMTB: 613 / AMTM: 67) • $1.87 billion under management/ custody • Founded in 1979 • Completed IPO in Dec. 2018 • Rebranded as Amerant in June 2019 Footprint Assets Headquarters Employees Loans by country of risk Deposits Geographic Mix Financial Highlights AUM (1) See Appendix 2 ”Non-GAAP Financial Measures Reconciliations" for a reconciliation of these non-GAAP financial measures to their GAAP counterparts. (2) Excludes minority interest in Amerant Mortgage LLC. in the six the six months ended June 30, 2022 and in 2021. The minority interest share changed from 49% to 42.6% in the first quarter of 2022 and then from 42.6% to 20% in the second quarter of 2022. In connection with the change in minority interest share in the second quarter of 2022, the Company reduced its additional paid-in capital for a total of $1.9 million with a corresponding increase to the equity attributable to noncontrolling interests. (3) Efficiency ratio is the result of noninterest expense, respectively divided by the sum of noninterest income and net interest income (4) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of foreclosure (5) Calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan origination fees and costs, excluding the allowance for loan losses Market Share History Deposits June 30, 2022 (in millions, except per share data and percentages) Six Months Ended June 30, 2022 2021 2020 2019 Balance Sheet Assets $ 8,151 $ 7,638 $ 7,771 $ 7,985 Loans $ 5,847 $ 5,568 $ 5,842 $ 5,744 Deposits $ 6,203 $ 5,631 $ 5,732 $ 5,757 Tangible Common Equity (1) $ 689 $ 809 $ 762 $ 813 Income Statement Net Income (Loss) attributable to the Company (2) $ 23.6 $ 112.9 $ (1.7) $ 51.3 Core Net Income (Loss) (1) $ 37.6 $ 66.8 $ (7.0) $ 51.8 Core Pre-provision net revenue (1) $ 37.3 $ 69.9 $ 71.0 $ 61.4 Net Income (Loss) per Share - Basic $ 0.69 $ 3.04 $ (0.04) $ 1.21 Core Net Income (Loss) per Share - Basic (1) $ 1.10 $ 1.80 $ (0.17) $ 1.22 ROA 0.61 % 1.50 % (0.02) % 0.65 % Core ROA (1) 0.97 % 0.89 % (0.09) % 0.65 % ROE 6.18 % 14.19 % (0.21) % 6.43 % Core ROE (1) 9.83 % 8.39 % (0.83) % 6.49 % Efficiency Ratio (3) 86.9 % 60.9 % 68.0 % 77.5 % Core Efficiency Ratio (1)(3) 75.0 % 74.0 % 70.1 % 76.9 % Capital Common Equity Tier 1 Capital Ratio 11.1 % 12.5 % 11.7 % 12.6 % Tangible Common Equity Ratio 8.5 % 10.6 % 9.8 % 10.2 % Stockholders' Book Value per Common Share $ 21.07 $ 23.18 $ 20.70 $ 19.35 Tangible Book Value per Common Share (1) $ 20.40 $ 22.55 $ 20.13 $ 18.84 Asset Quality Non-performing Assets (4) / Assets 0.39 % 0.78 % 1.13 % 0.41 % Net charge offs / Average Total Loans Held for Investment(5) 0.29 % 0.44 % 0.52 % 0.11 % International

5 amerantbank.com 4.0% 6.0% 3.2% Miami Houston U.S. Te xa s 10.7% 18.7% 6.8% Miami Houston U.S. June 30, 2021 Growing and Attractive Markets (1) The Company closed its Wellington branch on October 15, 2021 and announced the closing of a banking center to occur in early 4Q22. (2) Deposit Market Share data and number of branches is as of June 30, 2021. For the current number of branches see Branch Footprint (3) Includes brokered deposits of $531 million as of June 30, 2021 (4) Includes the Katy, TX branch. The city of Katy is in Harris, Fort Bend, and Waller Counties and the new facility serves nearby areas of these counties (5) Our Sugar Land, TX branch also serves Fort Bend County and our Katy, TX branch lies adjacent to this market (6) Community banks include those with less than $10 billion in assets Sources: Deposit data from FDIC as of June 30, 2021 (Bank-level). Market demographics, and county data and market share from S&P Global. Market Intelligence as of June 30, 2021 Amerant is the largest community bank in the Miami-Dade MSA (6) Deposit Market Share (2) Market Demographics Market Deposits ($mm) % of AMTB Market Share % Miami-Dade, FL (3) 4,686 82.1 2.6 Broward, FL $326 5.7 0.5 Palm Beach, FL $115 1.7 0.2 Florida $ 5,127 90 % 1.9 % Market Deposits ($mm) % of AMTB Market Share % Harris, TX (4)(5) $584 0.1 0.8 Texas $ 584 10 % 0.8% Branch Footprint (1) Fl or id a 2012 – 2022 Population Change 2022 – 2027 Est. Population Change 7 banking centers 17 banking centers June 2022

6 amerantbank.com Performance Highlights 2Q22 Business • Net income attributable to the Company of $7.7 million in 2Q22 compared to $16.0 million in 1Q22 • Core pre-provision net revenue (Core PPNR)(1) was $19.4 million in 2Q22 compared to $17.9 million in 1Q22 • Diluted earnings per share (EPS) was $0.23 in 2Q22 compared to $0.45 in 1Q22 • Core diluted EPS(1) was $0.45 for 2Q22 compared to $0.63 for 1Q22 • Net Interest Margin (“NIM”) increased to 3.28% in 2Q22 compared to 3.18% in 1Q22 • Total assets increased to $8.2 billion compared to $7.8 billion as of the close of 1Q22 • Total gross loans increased $126.2 million, or 2.2%, to $5.85 billion compared to $5.72 billion in 1Q22, while average yield on loans increased to 4.38% in 2Q22 compared to 4.16% in 1Q22 • The New York loan portfolio declined slightly to $354.0 million as of 2Q22, compared to $373.0 million as of 1Q22 • Total deposits as of 2Q22 were $6.20 billion, up $511.2 million compared to $5.69 billion in 1Q22 • Core deposits were $4.95 billion, up $505.0 million, or 11.4%, compared to $4.44 billion as of 1Q22, as the Company added new sources of deposits during the second quarter. Core deposits include: – Interest bearing demand deposits of $2.02 billion as of 2Q22 compared to $1.54 billion as of 1Q22 – Noninterest bearing deposits of $1.30 billion in 2Q22 compared to $1.32 billion as of 1Q22 – Savings and money market deposits of $1.63 billion in 2Q22 compared to $1.58 billion in 1Q22 • Average cost of total deposits increased to 0.48% in 2Q22 compared to 0.38% in 1Q22, while the loan to deposit ratio improved to 94.27% compared to 100.52% in 1Q22 • Brokered deposits slightly increased to $365.8 million in 2Q22 from $347.3 million in 1Q22. Brokered deposits to total deposits were 5.9% and 6.1% in 2Q22 and 1Q22, respectively • FHLB advances declined by $150 million, the result of repaying $350.0 million in callable advances and borrowing $200.0 million in long-term fixed advances to extend duration and lock-in fixed interest rates • AUM totaled $1.87 billion, down $261.4 million, or 12.3%, from 1Q22, reflective of market declines in value Earnings (1) Non-GAAP Financial Measure. See Core PPNR slide and Appendix 1 for a reconciliation to GAAP.

7 amerantbank.com Select Updates 3Q22 • Cash dividend of $0.09 per share of Amerant common stock paid out on August 31, 2022 • Banking center updates: – Opened new Hialeah, FL location – Received OCC approval to open a new branch in Key Biscayne, FL – Opening in University Place in Houston in 4Q22 – closing South Shepherd location and transferring customers over – Downtown Miami location scheduled to open in 1Q23 • Have added key business development personnel in Tampa (C&I and Equipment Finance) and South Florida (Treasury Management, Private Banking, Commercial Banking and Retail Banking) • Loan pipeline in all three markets continues to be robust • All named executive officers participate in the Company’s new Employee Stock Purchase Plan. In addition, several executives purchased shares post the release of 2Q22 earnings as the blackout period ended

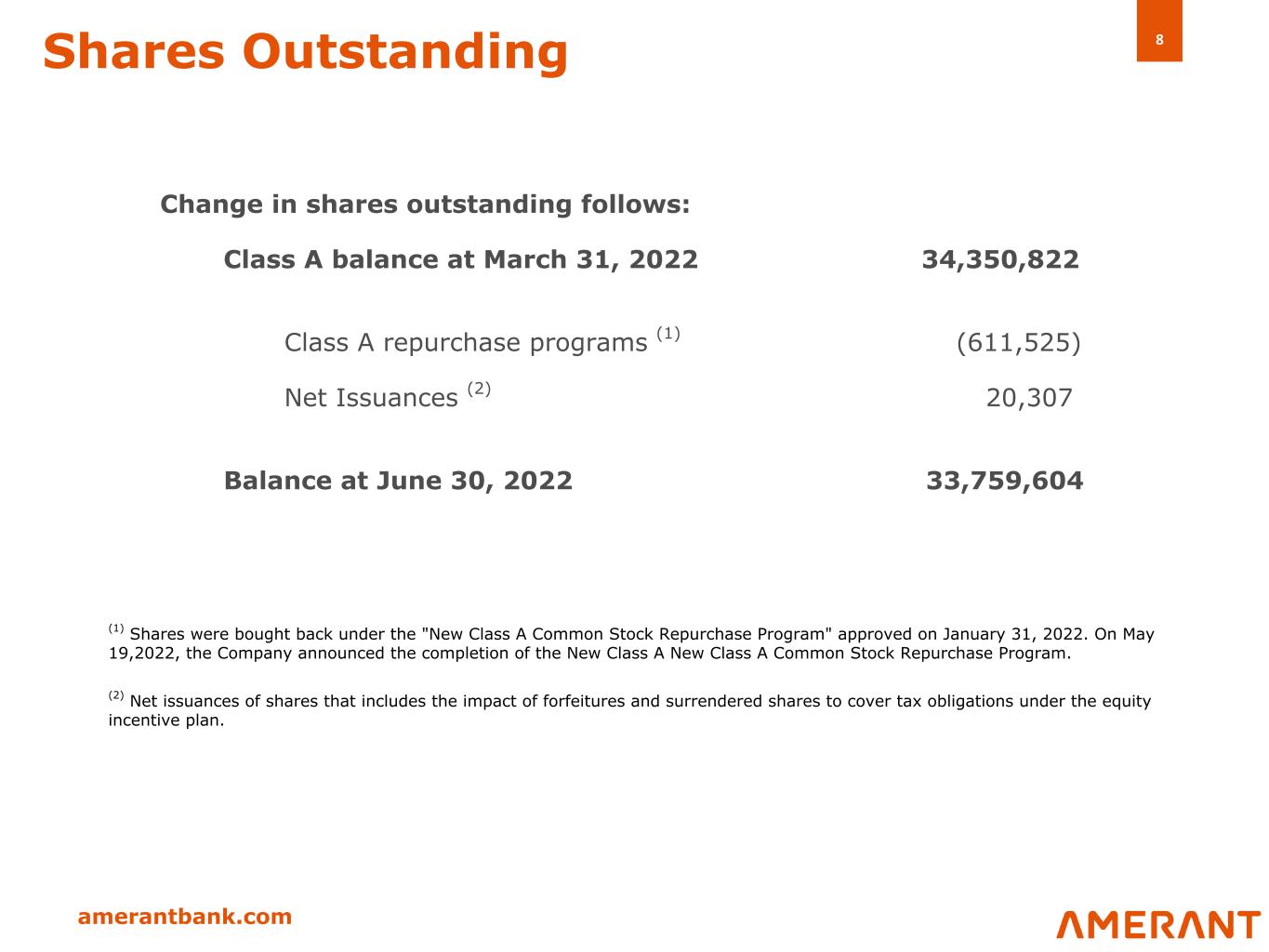

8 amerantbank.com Shares Outstanding (1) Shares were bought back under the "New Class A Common Stock Repurchase Program" approved on January 31, 2022. On May 19,2022, the Company announced the completion of the New Class A New Class A Common Stock Repurchase Program. (2) Net issuances of shares that includes the impact of forfeitures and surrendered shares to cover tax obligations under the equity incentive plan. Change in shares outstanding follows: Class A balance at March 31, 2022 34,350,822 Class A repurchase programs (1) (611,525) Net Issuances (2) 20,307 Balance at June 30, 2022 33,759,604

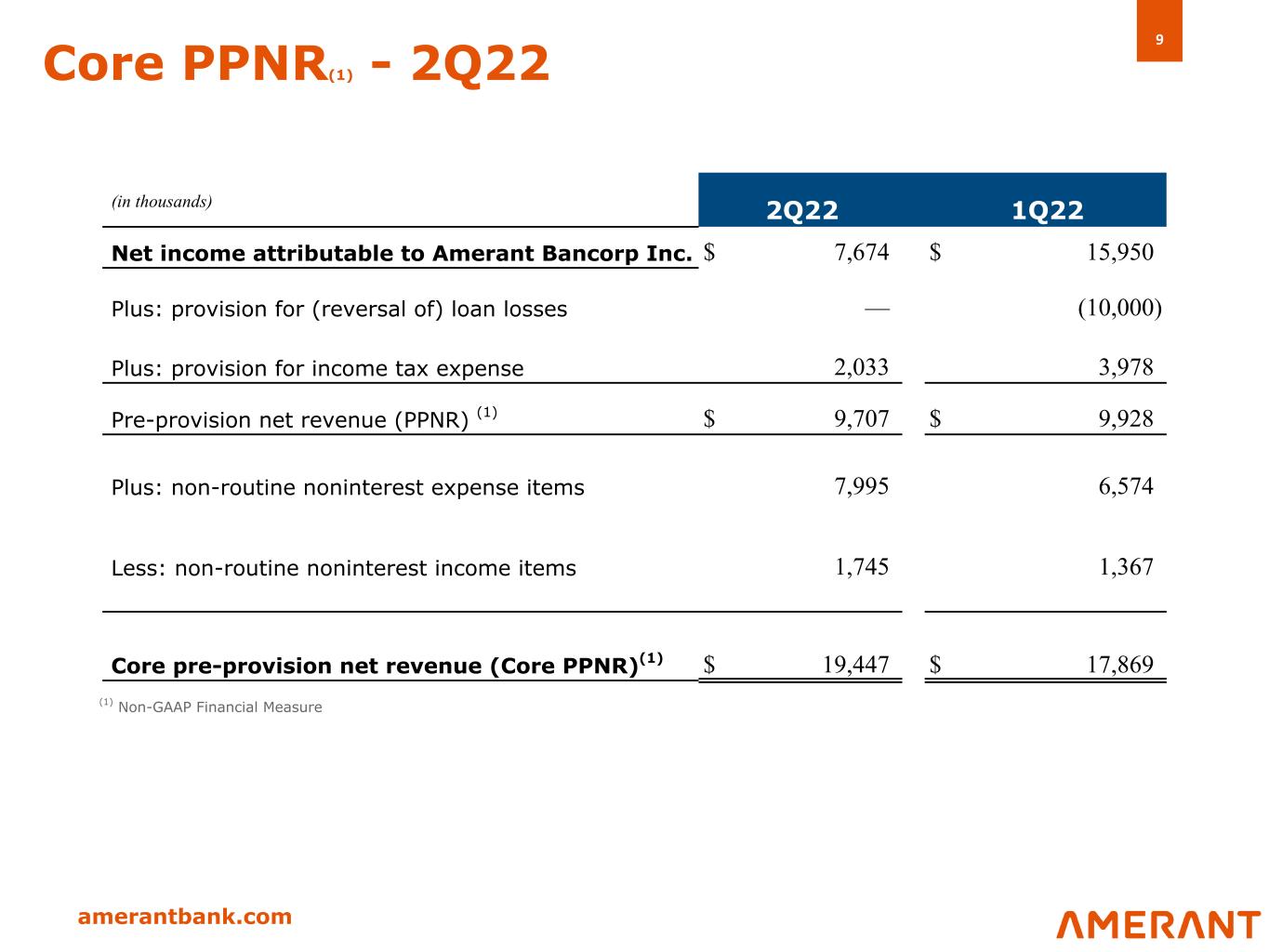

9 amerantbank.com Core PPNR(1) - 2Q22 (1) Non-GAAP Financial Measure ( 2Q22 1Q22 Net income attributable to Amerant Bancorp Inc. $ 7,674 $ 15,950 Plus: provision for (reversal of) loan losses — (10,000) Plus: provision for income tax expense 2,033 3,978 Pre-provision net revenue (PPNR) (1) $ 9,707 $ 9,928 Plus: non-routine noninterest expense items 7,995 6,574 Less: non-routine noninterest income items 1,745 1,367 Core pre-provision net revenue (Core PPNR)(1) $ 19,447 $ 17,869 (in thousands)

10 amerantbank.com Key Actions 2Q22 • Reduced non-performing loans (“NPL”) to $25.2 million as of 2Q22 compared to $47.0 million as of 1Q22. • As part of the NPL reduction, the Company received a $5.5 million payment and charged off the remaining $3.6 million on the previously disclosed Coffee Trader relationship. All future receipts, if any, will be recorded as recoveries. • Amerant Mortgage reported improved results; FTEs decreased from 79 in 1Q22 to 67 as of 2Q22; reached breakeven on a stand-alone basis in 2Q22 despite challenges related to the interest rate environment. • Successfully completed the Company’s second $50 million Class A Common Stock repurchase program. The Company has now completed two consecutive $50 million stock repurchase programs and repurchased an aggregate 3,148,399 Class A Common Stock since mid-November 2021, when the Company announced the successful conversion to one class of common stock. • Launched new white label equipment finance solution and started originations during 2Q22 • Announced the closing of a banking center to occur in early 4Q22; $1.1 million in expected annual savings; recorded non-routine closure charges of $1.6 million in 2Q22. • Recorded remaining $2.8 million in estimated contract termination costs in 2Q22 in connection with the conversion to FIS. • Incurred $3.6 million in other non-routine charges, including $3.2 million in Other Real Estate Owned valuation ("OREO") and $0.7 million in severance charges, partially offset by improved valuation of $0.3 million in loans held for sale. • Continued executing on building brand awareness by entering into a new multi-year agreement to become the official Bank of the NBA's Miami Heat; also entered into a new multi-year agreement as a proud partner of the NHL's Florida Panthers. • Announced four senior executive appointments to complete build out of senior management team, including new head of consumer banking, new chief digital officer, new chief legal and administrative officer and new chief people officer. • Increased Tampa loan production office to 10 FTEs, with most of the team focused on commercial and industrial business origination.

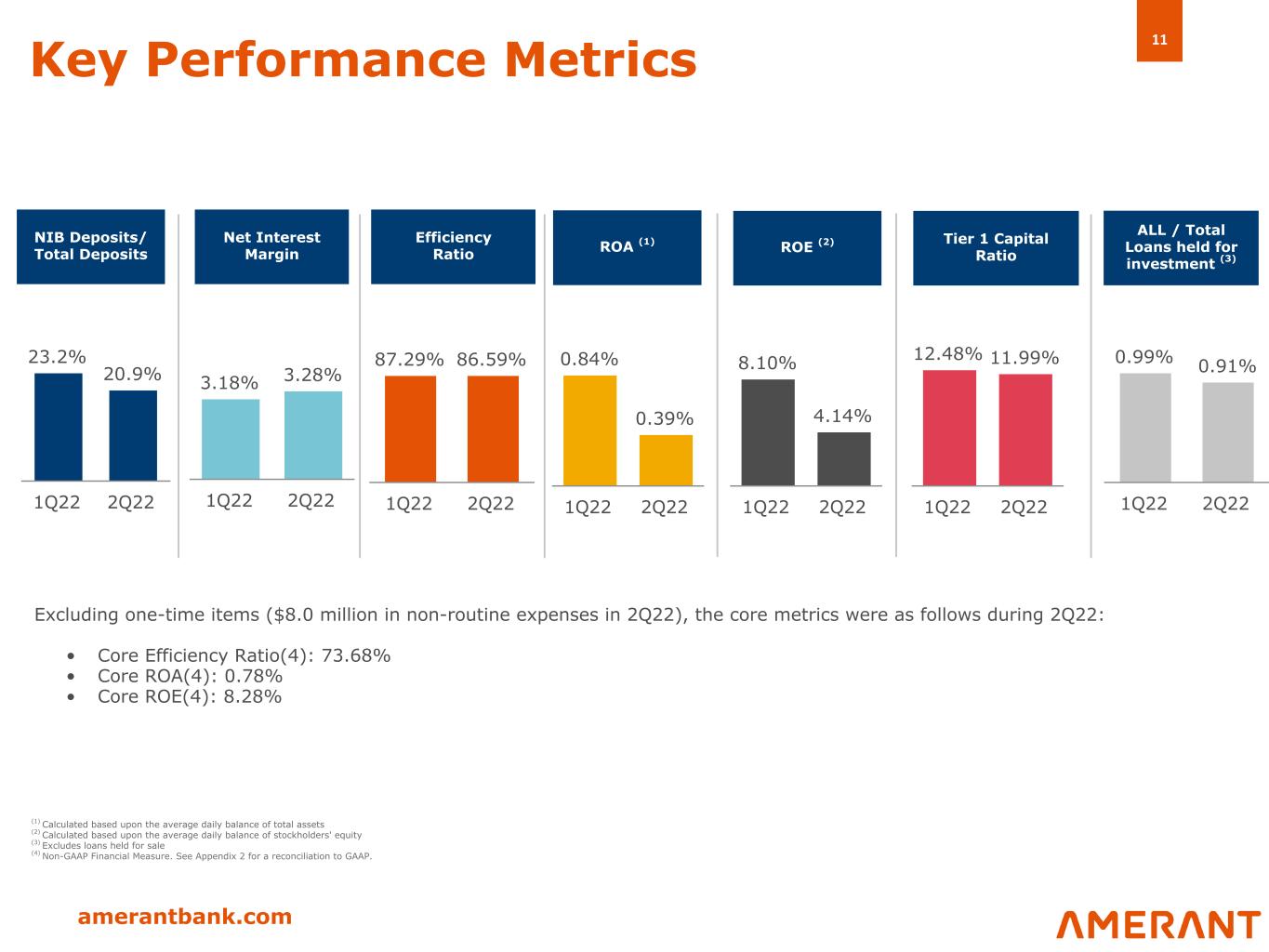

11 amerantbank.com 87.29% 86.59% 1Q22 2Q22 23.2% 20.9% 1Q22 2Q22 12.48% 11.99% 1Q22 2Q22 3.18% 3.28% 1Q22 2Q22 Key Performance Metrics NIB Deposits/ Total Deposits Tier 1 Capital Ratio Net Interest Margin Efficiency Ratio (1) Calculated based upon the average daily balance of total assets (2) Calculated based upon the average daily balance of stockholders' equity (3) Excludes loans held for sale (4) Non-GAAP Financial Measure. See Appendix 2 for a reconciliation to GAAP. 0.99% 0.91% 1Q22 2Q22 ALL / Total Loans held for investment (3) 0.84% 0.39% 1Q22 2Q22 ROA (1) 8.10% 4.14% 1Q22 2Q22 Excluding one-time items ($8.0 million in non-routine expenses in 2Q22), the core metrics were as follows during 2Q22: • Core Efficiency Ratio(4): 73.68% • Core ROA(4): 0.78% • Core ROE(4): 8.28% ROE (2)

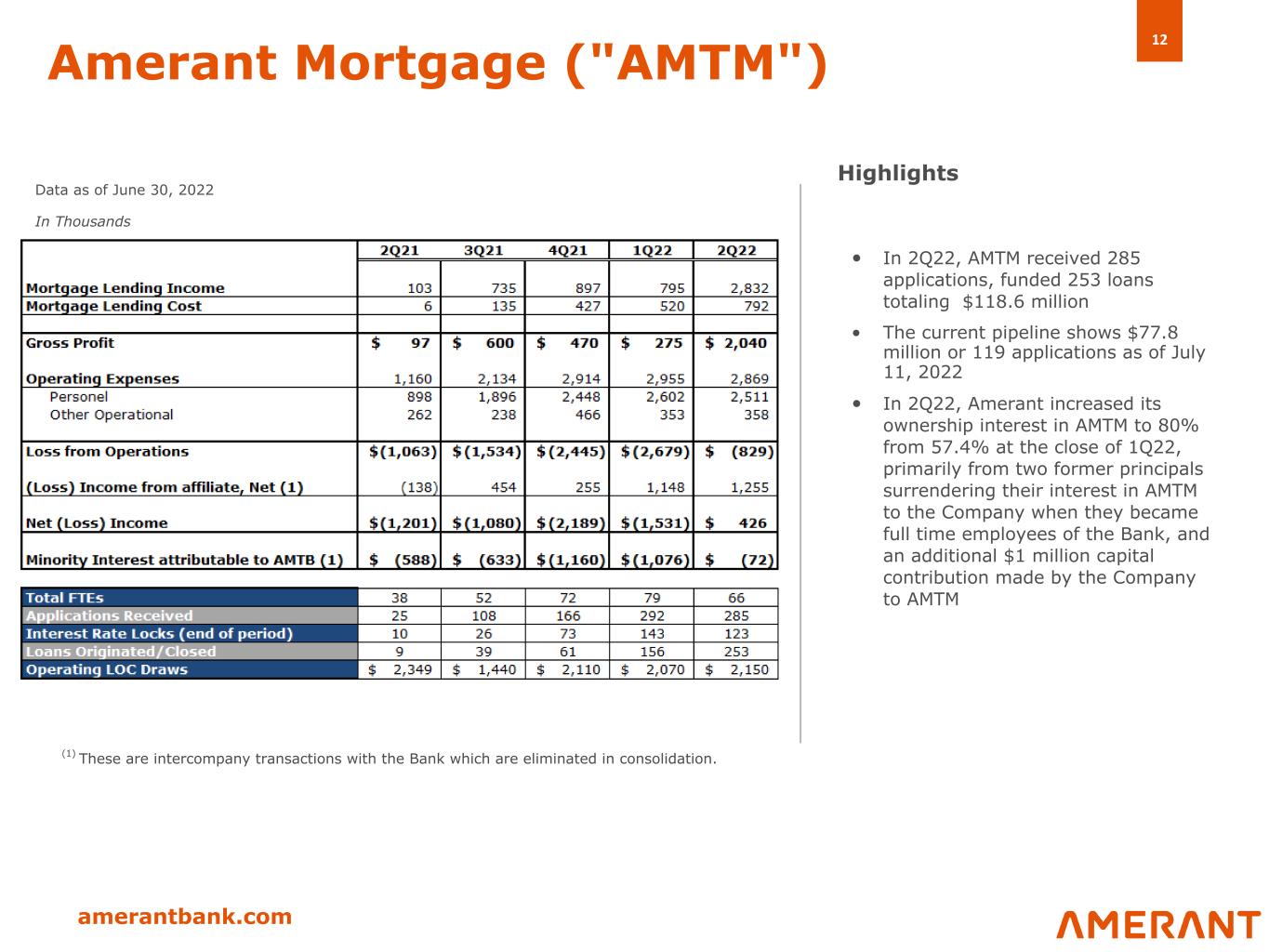

12 amerantbank.com Amerant Mortgage ("AMTM") • In 2Q22, AMTM received 285 applications, funded 253 loans totaling $118.6 million • The current pipeline shows $77.8 million or 119 applications as of July 11, 2022 • In 2Q22, Amerant increased its ownership interest in AMTM to 80% from 57.4% at the close of 1Q22, primarily from two former principals surrendering their interest in AMTM to the Company when they became full time employees of the Bank, and an additional $1 million capital contribution made by the Company to AMTM Data as of June 30, 2022 In Thousands Highlights (1) These are intercompany transactions with the Bank which are eliminated in consolidation.

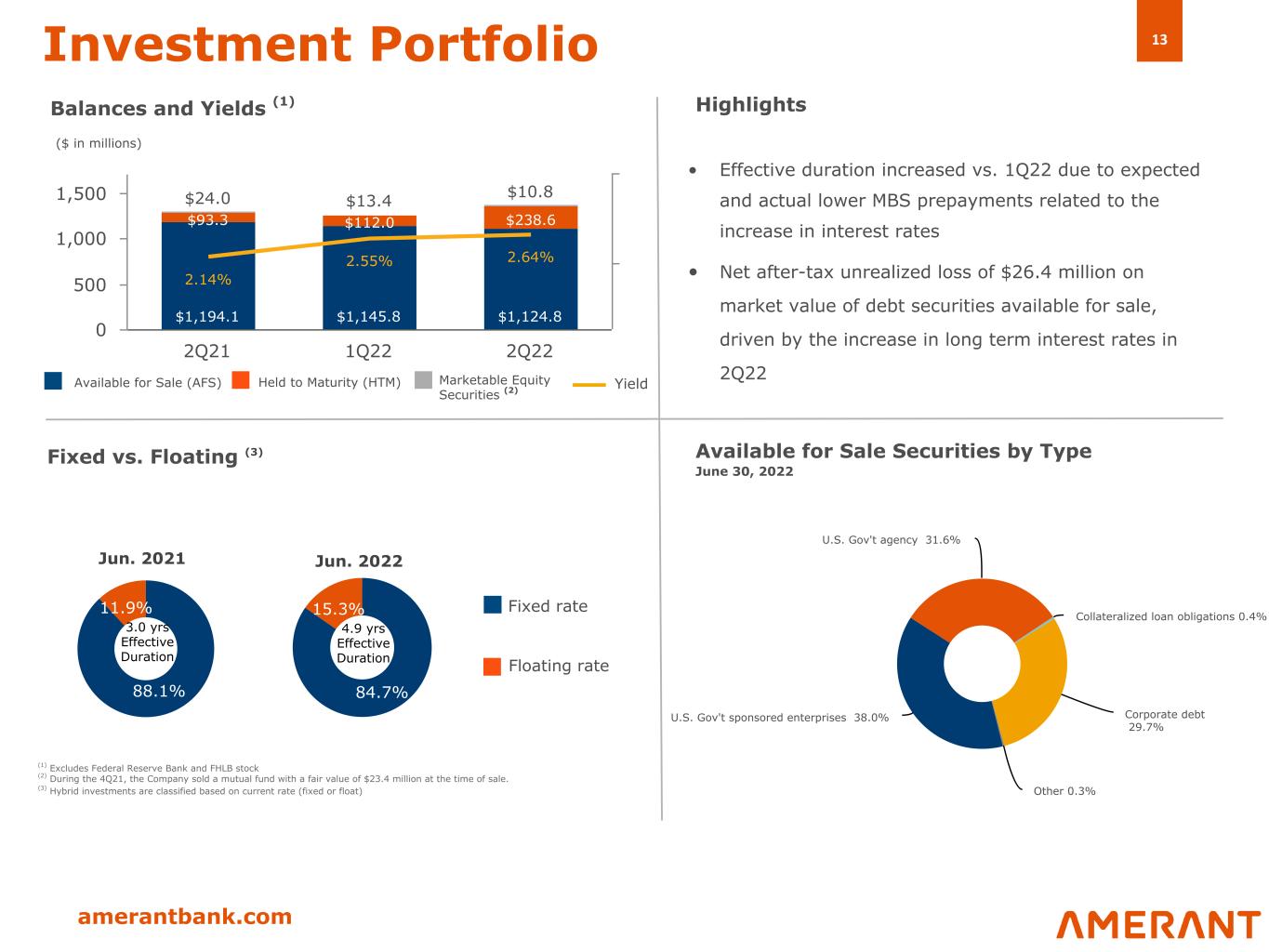

13 amerantbank.com 84.7% 15.3% U.S. Gov't sponsored enterprises 38.0% U.S. Gov't agency 31.6% Collateralized loan obligations 0.4% Corporate debt 29.7% Other 0.3% $1,194.1 $1,145.8 $1,124.8 $93.3 $112.0 $238.6 $24.0 $13.4 $10.8 2.14% 2.55% 2.64% 2Q21 1Q22 2Q22 0 500 1,000 1,500 88.1% 11.9% • Effective duration increased vs. 1Q22 due to expected and actual lower MBS prepayments related to the increase in interest rates • Net after-tax unrealized loss of $26.4 million on market value of debt securities available for sale, driven by the increase in long term interest rates in 2Q22 Investment Portfolio Balances and Yields (1) Available for Sale (AFS) Held to Maturity (HTM) Highlights Fixed vs. Floating (3) Jun. 2021 Jun. 2022 Floating rate Fixed rate Available for Sale Securities by Type June 30, 2022 3.0 yrs Effective Duration ($ in millions) Marketable Equity Securities (2) (1) Excludes Federal Reserve Bank and FHLB stock (2) During the 4Q21, the Company sold a mutual fund with a fair value of $23.4 million at the time of sale. (3) Hybrid investments are classified based on current rate (fixed or float) Yield 4.9 yrs Effective Duration

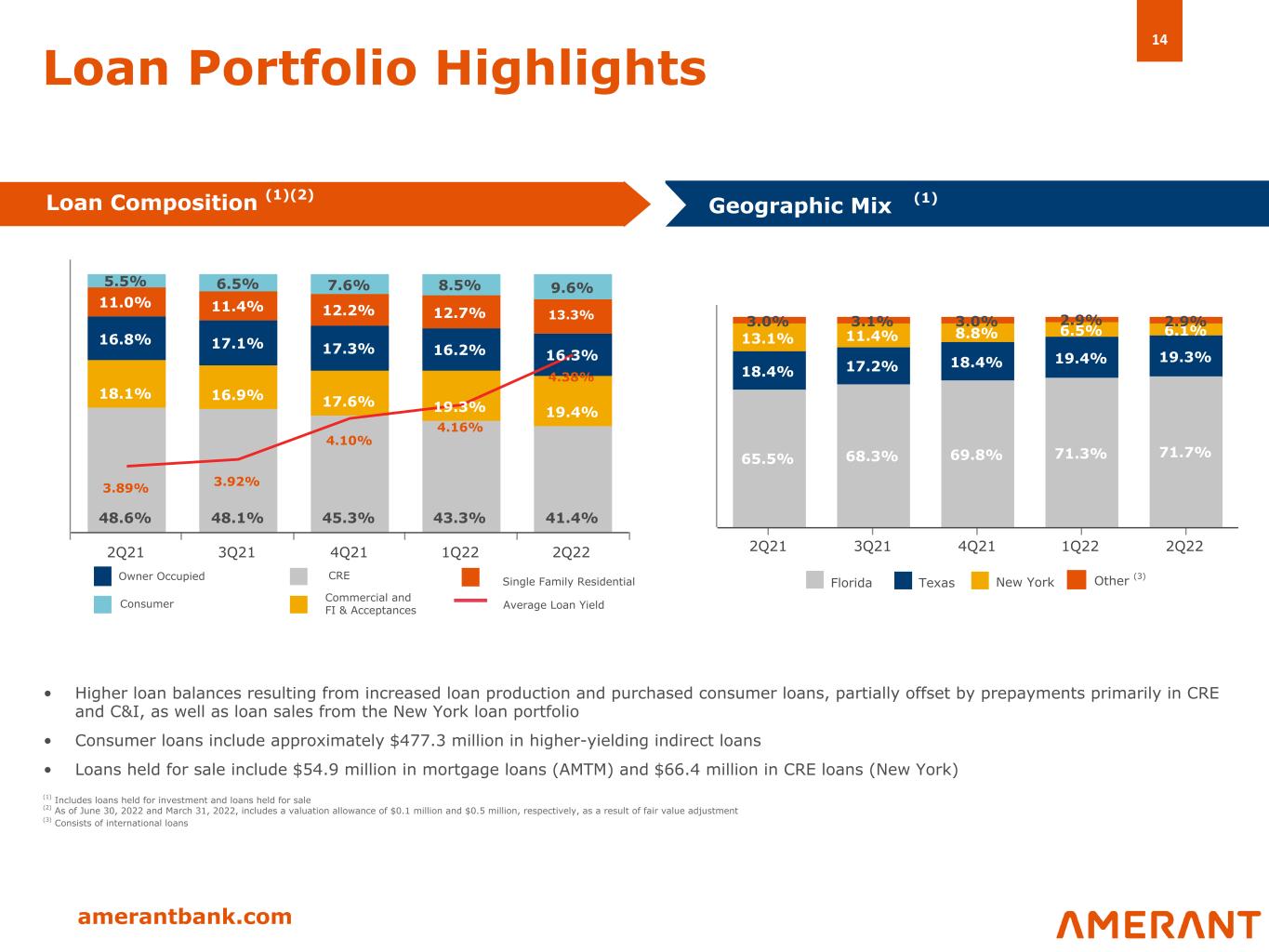

14 amerantbank.com 48.6% 48.1% 45.3% 43.3% 41.4% 18.1% 16.9% 17.6% 19.3% 19.4% 16.8% 17.1% 17.3% 16.2% 16.3% 11.0% 11.4% 12.2% 12.7% 13.3% 5.5% 6.5% 7.6% 8.5% 9.6% 3.89% 3.92% 4.10% 4.16% 4.38% 2Q21 3Q21 4Q21 1Q22 2Q22 65.5% 68.3% 69.8% 71.3% 71.7% 18.4% 17.2% 18.4% 19.4% 19.3% 13.1% 11.4% 8.8% 6.5% 6.1%3.0% 3.1% 3.0% 2.9% 2.9% 2Q21 3Q21 4Q21 1Q22 2Q22 Consumer CRE Commercial and FI & Acceptances Owner Occupied Single Family Residential Loan Portfolio Highlights Loan Composition (1)(2) Geographic Mix (Domestic) • Higher loan balances resulting from increased loan production and purchased consumer loans, partially offset by prepayments primarily in CRE and C&I, as well as loan sales from the New York loan portfolio • Consumer loans include approximately $477.3 million in higher-yielding indirect loans • Loans held for sale include $54.9 million in mortgage loans (AMTM) and $66.4 million in CRE loans (New York) Geographic Mix (1) Florida Texas New York Average Loan Yield Other (3) (1) Includes loans held for investment and loans held for sale (2) As of June 30, 2022 and March 31, 2022, includes a valuation allowance of $0.1 million and $0.5 million, respectively, as a result of fair value adjustment (3) Consists of international loans

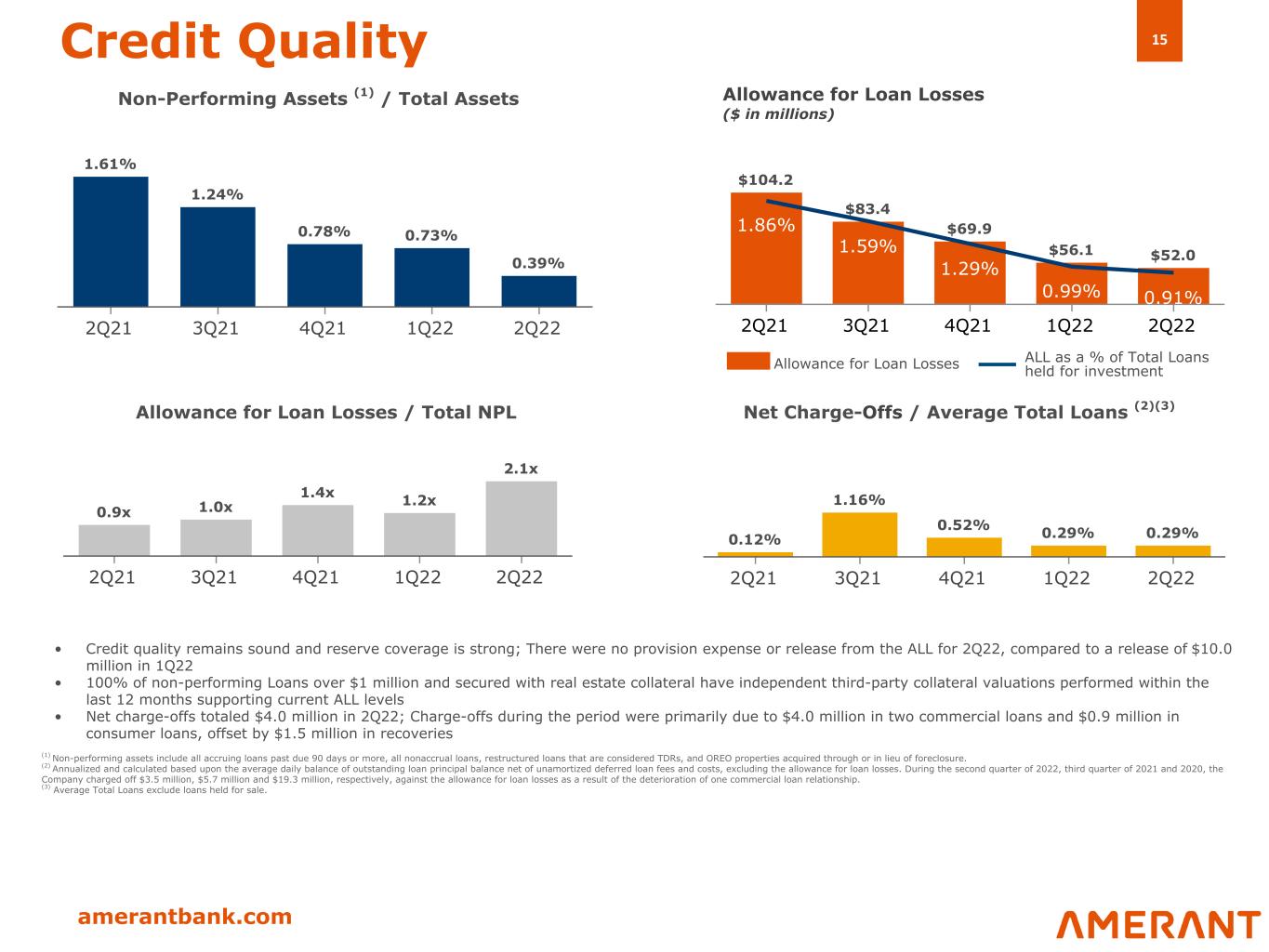

15 amerantbank.com $104.2 $83.4 $69.9 $56.1 $52.0 1.86% 1.59% 1.29% 0.99% 0.91% 2Q21 3Q21 4Q21 1Q22 2Q22 0.12% 1.16% 0.52% 0.29% 0.29% 2Q21 3Q21 4Q21 1Q22 2Q22 • Credit quality remains sound and reserve coverage is strong; There were no provision expense or release from the ALL for 2Q22, compared to a release of $10.0 million in 1Q22 • 100% of non-performing Loans over $1 million and secured with real estate collateral have independent third-party collateral valuations performed within the last 12 months supporting current ALL levels • Net charge-offs totaled $4.0 million in 2Q22; Charge-offs during the period were primarily due to $4.0 million in two commercial loans and $0.9 million in consumer loans, offset by $1.5 million in recoveries Net Charge-Offs / Average Total Loans (2)(3) Credit Quality Allowance for Loan Losses ($ in millions) Non-Performing Assets (1) / Total Assets Allowance for Loan Losses / Total NPL Allowance for Loan Losses ALL as a % of Total Loans held for investment (1) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered TDRs, and OREO properties acquired through or in lieu of foreclosure. (2) Annualized and calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan fees and costs, excluding the allowance for loan losses. During the second quarter of 2022, third quarter of 2021 and 2020, the Company charged off $3.5 million, $5.7 million and $19.3 million, respectively, against the allowance for loan losses as a result of the deterioration of one commercial loan relationship. (3) Average Total Loans exclude loans held for sale. 1.61% 1.24% 0.78% 0.73% 0.39% 2Q21 3Q21 4Q21 1Q22 2Q22 0.9x 1.0x 1.4x 1.2x 2.1x 2Q21 3Q21 4Q21 1Q22 2Q22

16 amerantbank.com $5,675 $5,626 $5,631 $5,692 $6,203 $2,835 $2,875 $3,013 $3,076 $3,601 $1,243 $1,107 $1,048 $951 $937$531 $433 $387 $347 $366 $1,066 $1,211 $1,183 $1,318 $1,299 0.52% 0.44% 0.41% 0.38% 0.48% 2Q21 3Q21 4Q21 1Q22 2Q22 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 $2,635 $2,529 $2,494 $2,480 2019 2020 2021 2Q22 $3,122 $3,203 $3,137 $3,723 2019 2020 2021 2Q22 Domestic Deposits ($ in millions) Deposit Highlights Deposit Composition 60% International Deposits ($ in millions) Mix by Country of Domicile Transaction Deposits Customer CDs Brokered Deposits (1) Cost of total Deposits (2) ($ in millions, except for percentages) 40% (1) 2Q22, 1Q22, 4Q21, 3Q21, and 2Q21 include brokered transaction deposits of $48 million, $50 million, $98 million, $97 million and $141 million respectively, and brokered time deposits of $318 million, $297 million, $290 million, $336 million and $390 million respectively. (2) Annualized and calculated based upon the average daily balance of total deposits. Noninterest Bearing Demand Deposits

17 amerantbank.com NII increase in 2Q22 was driven by: • higher average yields on loans, debt securities available for sale and placements • higher average balance of commercial and consumer loans • higher average balances of debt securities held to maturity, and • lower average balances of FHLB and customer time deposits Net Interest Income and NIM Net Interest Income (NII) and NIM (%) Commentary ($ in millions, except for percentages) $50.0 $51.8 $55.8 $55.6 $58.9 2.81% 2.94% 3.17% 3.18% 3.28% Net Interest Income NIM 2Q21 3Q21 4Q21 1Q22 2Q22 0 10 20 30 40 50 60

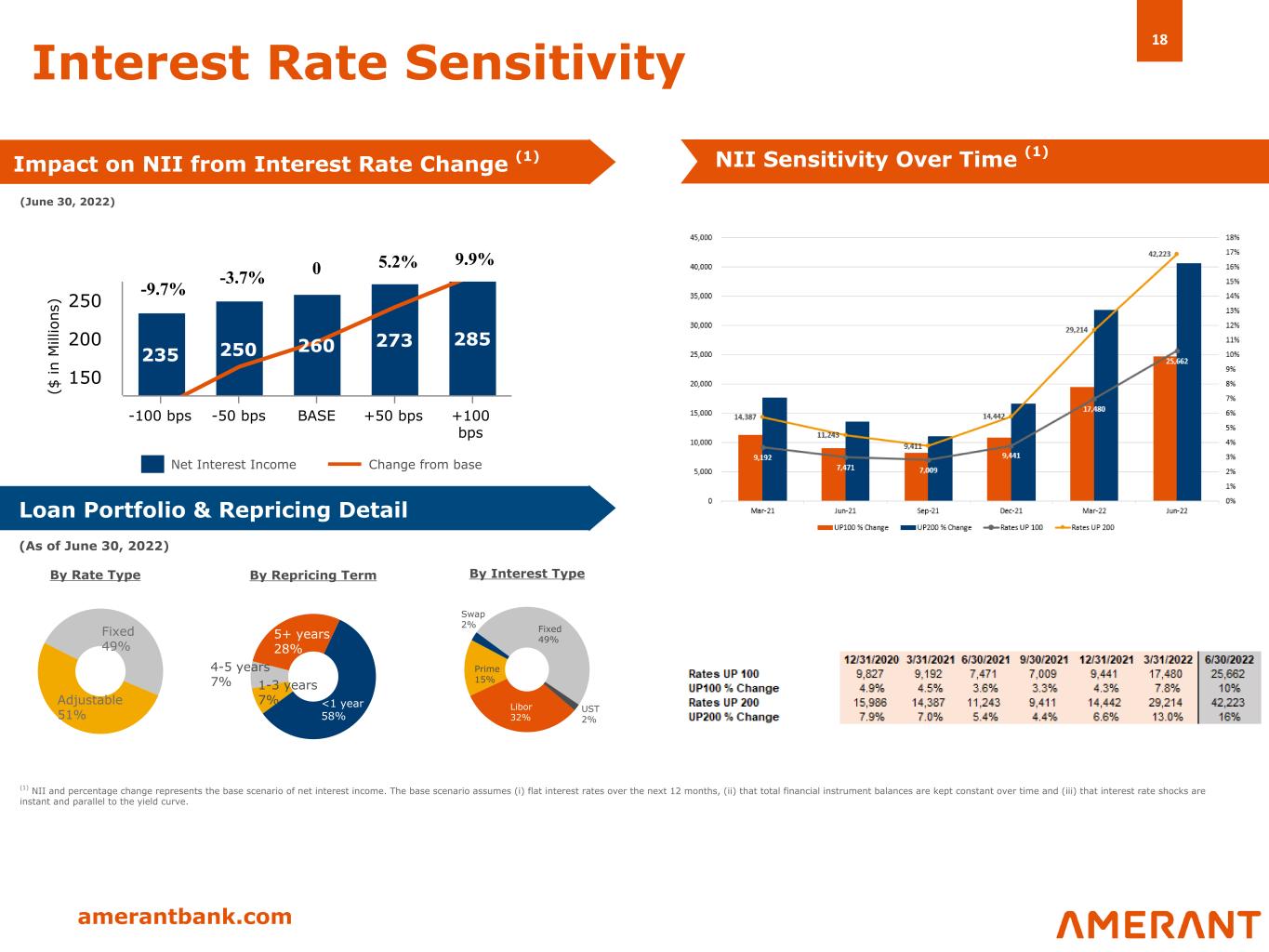

18 amerantbank.com 235 250 260 273 285 -100 bps -50 bps BASE +50 bps +100 bps 150 200 250 (June 30, 2022) Fixed 49% Adjustable 51% Interest Rate Sensitivity By Interest TypeBy Rate Type By Repricing Term (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve. Loan Portfolio & Repricing Detail Impact on NII from Interest Rate Change (1) Net Interest Income Change from base <1 year 58% 1-3 years 7% 4-5 years 7% 5+ years 28% ($ in M ill io ns ) (As of June 30, 2022) Swap 2% Fixed 49% UST 2% Libor 32% Prime 15% NII Sensitivity Over Time (1) -9.7% -3.7% 0 5.2% 9.9%

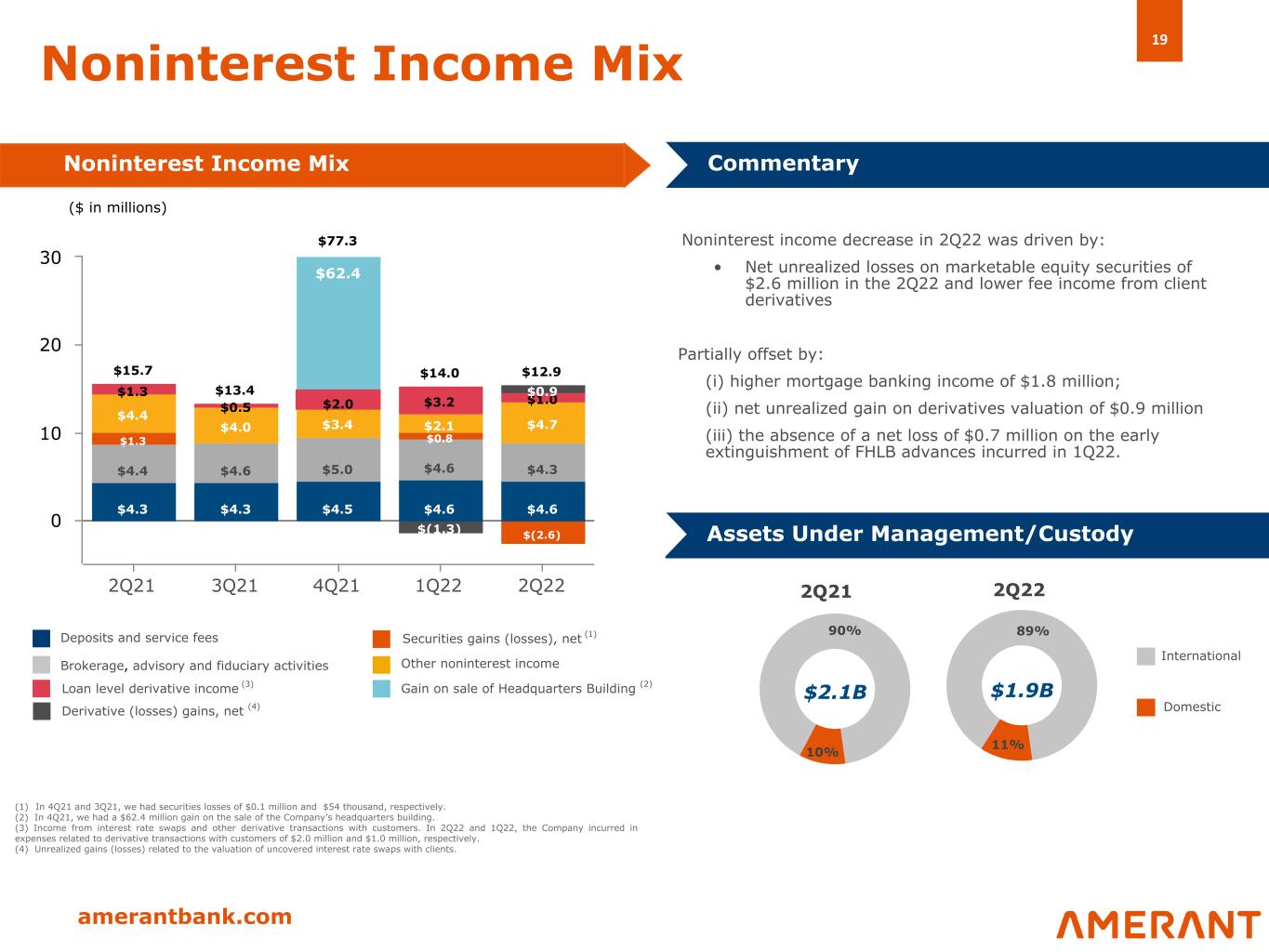

19 amerantbank.com $14.0$15.7 $13.4 $12.9 $4.3 $4.3 $4.5 $4.6 $4.6 $4.4 $4.6 $5.0 $4.6 $4.3 $1.3 $0.8 $(2.6) $4.4 $4.0 $3.4 $2.1 $4.7 $62.4 $1.3 $0.5 $3.2 $1.0 $(1.3) $0.9 2Q21 3Q21 4Q21 1Q22 2Q22 0 10 20 30 10% 90% 11% 89% Noninterest Income Mix Noninterest Income Mix Commentary Noninterest income decrease in 2Q22 was driven by: • Net unrealized losses on marketable equity securities of $2.6 million in the 2Q22 and lower fee income from client derivatives Partially offset by: (i) higher mortgage banking income of $1.8 million; (ii) net unrealized gain on derivatives valuation of $0.9 million (iii) the absence of a net loss of $0.7 million on the early extinguishment of FHLB advances incurred in 1Q22. Assets Under Management/Custody Deposits and service fees Brokerage, advisory and fiduciary activities Other noninterest income $1.9B Domestic International 2Q222Q21 $2.1B ($ in millions) Securities gains (losses), net (1) (1) In 4Q21 and 3Q21, we had securities losses of $0.1 million and $54 thousand, respectively. (2) In 4Q21, we had a $62.4 million gain on the sale of the Company’s headquarters building. (3) Income from interest rate swaps and other derivative transactions with customers. In 2Q22 and 1Q22, the Company incurred in expenses related to derivative transactions with customers of $2.0 million and $1.0 million, respectively. (4) Unrealized gains (losses) related to the valuation of uncovered interest rate swaps with clients. Gain on sale of Headquarters Building (2)Loan level derivative income (3) Derivative (losses) gains, net (4) $77.3 $2.0

20 amerantbank.com • Noninterest expense increased in 2Q22 primarily due to: – a non-routine expense of $3.2 million related to the market valuation adjustment of an OREO property in New York – a lease impairment charge of $1.6 million related to the closing of a banking center – higher other professional fees primarily in connection with customer derivative transactions – incremental variable compensation expenses – higher advertising expenses • Core noninterest expense(1), excluding $8.0 million in non-routine items, was $54.2 million in 2Q22 • 680 total FTEs as of 2Q22, of which 57% of total FTEs are in business development roles compared to 43% in support functions $51.1 $48.4 $55.1 $60.8 $62.2 $30.8 $29.1 $31.3 $30.4 $30.2 $20.3 $19.3 $23.8 $30.4 $32.0 719 733 763 677 680 2Q21 3Q21 4Q21 1Q22 2Q22 10 20 30 40 50 60 70 Noninterest Expense Noninterest Expense Mix Commentary Other operating expenses Salaries and employee benefits FTE ($ in millions, except for FTEs) FTEs by company 2Q21 3Q21 4Q21 1Q22 2Q22 Amerant Bank and other subisdiaries 681 681 691 598 613 Amerant Mortgage 38 52 72 79 67 TOTAL 719 733 763 677 680 Effective January 1, 2022, 80 employees were transferred to FIS (1) Non-GAAP Financial Measure. See Appendix 2 for a reconciliation to GAAP.

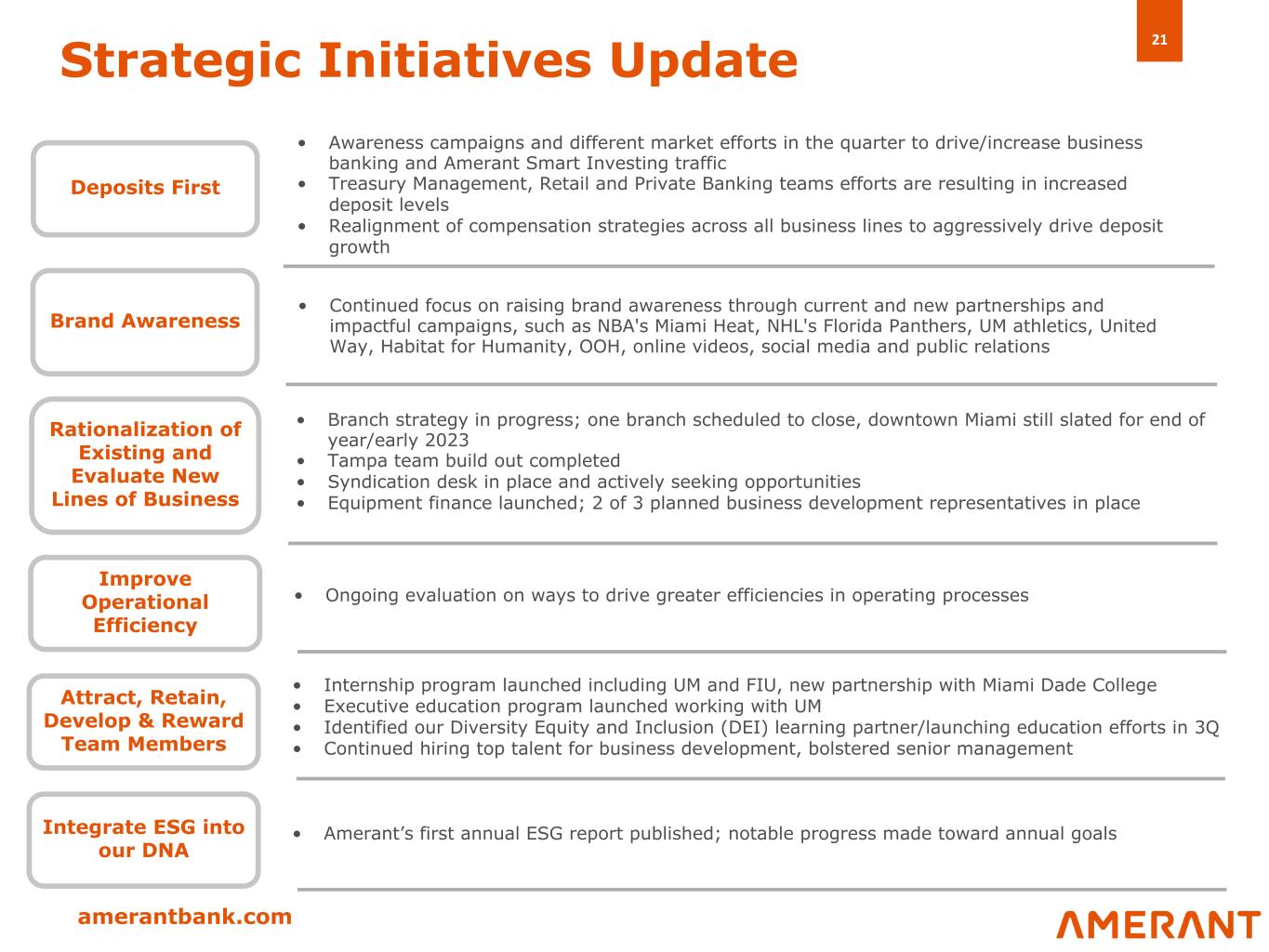

21 amerantbank.com Strategic Initiatives Update • Awareness campaigns and different market efforts in the quarter to drive/increase business banking and Amerant Smart Investing traffic • Treasury Management, Retail and Private Banking teams efforts are resulting in increased deposit levels • Realignment of compensation strategies across all business lines to aggressively drive deposit growth Deposits First • Continued focus on raising brand awareness through current and new partnerships and impactful campaigns, such as NBA's Miami Heat, NHL's Florida Panthers, UM athletics, United Way, Habitat for Humanity, OOH, online videos, social media and public relations Brand Awareness • Branch strategy in progress; one branch scheduled to close, downtown Miami still slated for end of year/early 2023 • Tampa team build out completed • Syndication desk in place and actively seeking opportunities • Equipment finance launched; 2 of 3 planned business development representatives in place Rationalization of Existing and Evaluate New Lines of Business • Ongoing evaluation on ways to drive greater efficiencies in operating processes Improve Operational Efficiency Attract, Retain, Develop & Reward Team Members • Internship program launched including UM and FIU, new partnership with Miami Dade College • Executive education program launched working with UM • Identified our Diversity Equity and Inclusion (DEI) learning partner/launching education efforts in 3Q • Continued hiring top talent for business development, bolstered senior management Integrate ESG into our DNA • Amerant’s first annual ESG report published; notable progress made toward annual goals

22 amerantbank.com ESG Framework To visit our ESG Page and see our 2021 Sustainability Report, please follow this link: https://www.amerantbank.com/esg

23 amerantbank.com Partnerships Each is a multi-year partnership which supports and aligns with businesses and organizations well known and deeply rooted in South Florida

amerantbank.com Appendices

25 amerantbank.com Appendix 1 Summary Financial Statements (1) Includes debt securities available for sale, held to maturity, equity securities with readily determinable fair value not held for trading and trading securities. FHLB and FRB stock are included in "Other Assets" (2) Loans held for sale in connection with Amerant Mortgage ongoing business. (3) New York loans transferred from held for investment to loans held for sale in 2021. (4) Includes the effect of the sale and lease-back of the Company's headquarters building in the fourth quarter of 2021. (5) Includes the effect of adopting ASU 2016-02 (Leases) in 1Q21. As of June 30, 2022 and December 31, 2021, other assets include operating lease right-of-use assets of $139.4 million and $141.1 million, respectively. As of June 30, 2022 and December 31, 2021, other liabilities include total operating lease liability of $143.5 million and $143.0 million, respectively. (6) The balances of Senior and Subordinated Notes are presented net of direct issuance costs which are deferred and amortized over 5 years and 10 years, respectively. On March 9, 2022, the Company completed a $30.0 million offering of subordinated notes with a 4.25% fixed-to-floating rate and due March 15, 2032 (the “Subordinated Notes”). The Subordinated Notes will initially bear interest at a fixed rate of 4.25% per annum, from and including March 9, 2022, to but excluding March 15, 2027, with interest payable semi-annually in arrears. From and including March 15, 2027, to but excluding the stated maturity date or early redemption date, the interest rate will reset quarterly to an annual floating rate equal to the then-current benchmark rate, which will initially be the three-month Secured Overnight Financing Rate (“SOFR”) plus 251 basis points, with interest during such period payable quarterly in arrears. If three-month SOFR cannot be determined during the applicable floating rate period, a different index will be determined and used in accordance with the terms of the Notes. The Subordinated Notes have been structured to qualify as Tier 2 capital of the Company for regulatory capital purposes, and rank equally in right of payment to all of our existing and future subordinated indebtedness. (7) The Company records net loss attributable to non-controlling interest in its consolidated statement of operations equal to the percentage of the economic or ownership interest retained in the interest of Amerant Mortgage, and presents non-controlling interest as a component of stockholders' equity on the consolidated balance sheets. As of June 30, As of December 31, (in millions) 2022 2021 2020 2019 Assets Cash and cash equivalents $354.1 $274.2 $214.4 $121.3 Total Securities (1) 1,374.3 1,293.7 1,307.6 1,666.5 Mortgage Loans Held for Sale, at fair value (2) 54.9 14.9 — — Loans held for sale, at lower of cost or fair value (3) 66.4 143.2 — — Loans held for investment, Gross 5,726.1 5,409.4 5,842.3 5,744.3 Allowance for Loan Losses 52.0 69.9 110.9 52.2 Loans held for invesment, net 5,674.1 5,339.5 5,731.4 5,692.1 Premises & Equipment, net (4) 39.1 37.9 110.0 128.8 Goodwill 19.5 19.5 19.5 19.5 Bank Owned Life Insurance 225.7 223.0 217.5 211.9 Other Assets (4) (5) 343.1 292.5 170.5 145.3 Total Assets $8,151.2 $7,638.4 $7,770.9 $7,985.4 Liabilities Total Deposits $6,202.9 $5,630.9 $5,731.6 $5,757.1 Advances from the Federal Home Loan Bank and Other Borrowings $830.5 $809.6 1,050.0 1,235.0 Senior notes (6) 59.1 58.9 58.6 — Subordinated notes (6) 29.2 — — — Junior Subordinated Debentures Held by Trust Subsidiaries 64.2 64.2 64.2 92.2 Accounts Payable, Accrued Liabilities and Other Liabilities (5) 253.9 242.9 83.1 66.3 Total Liabilities $7,439.8 $6,806.5 $6,987.5 $7,150.7 Stockholders' Equity Total Stockholders' Equity before noncontrolling interest 713.3 834.5 783.4 834.7 Noncontrolling interest (7) (1.9) (2.6) — — Total Stockholders' Equity 711.4 831.9 783.4 834.7 Total Liabilities and Stockholders' Equity $8,151.2 $7,638.4 $7,770.9 $7,985.4

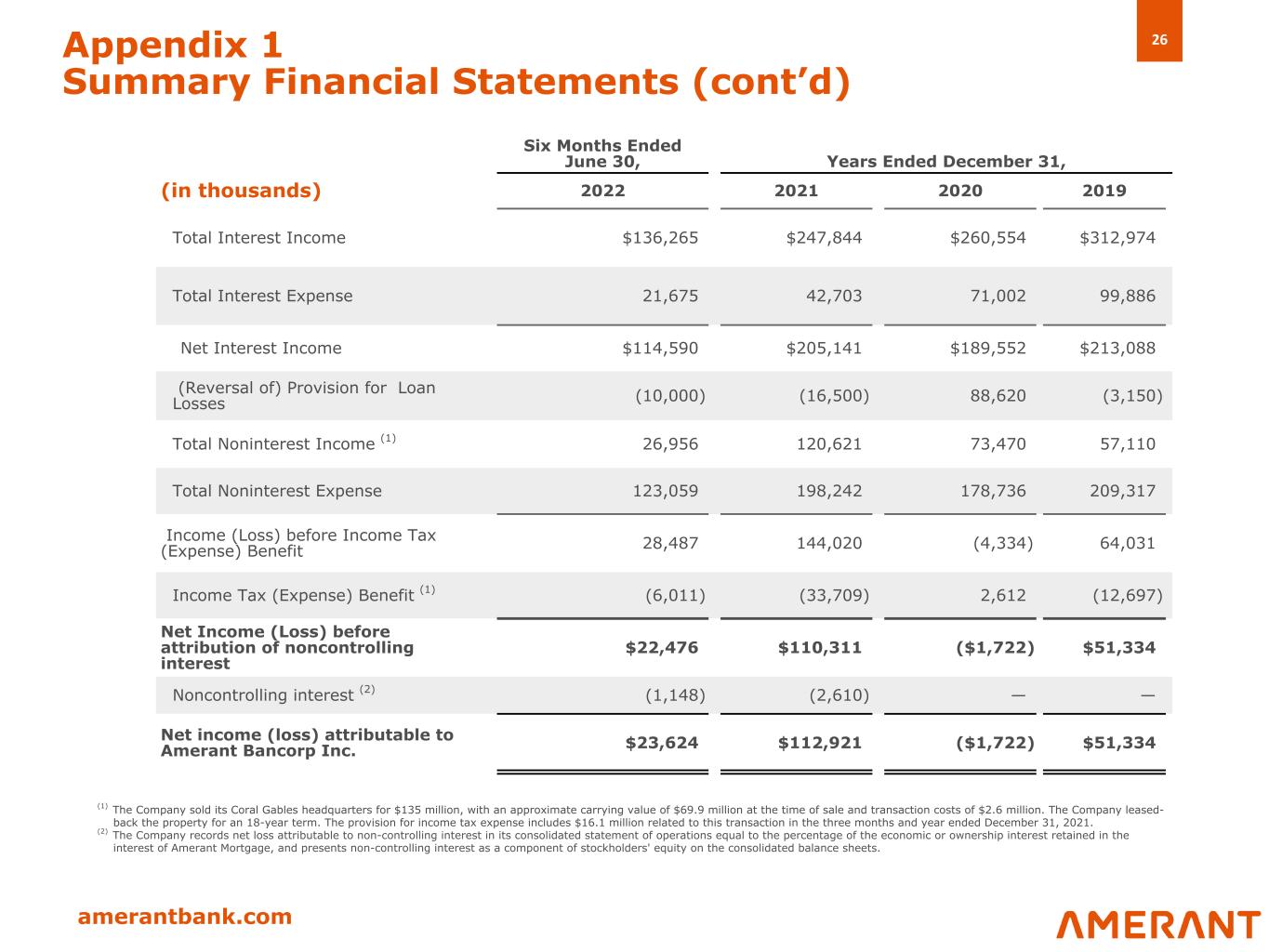

26 amerantbank.com Appendix 1 Summary Financial Statements (cont’d) Six Months Ended June 30, Years Ended December 31, (in thousands) 2022 2021 2020 2019 Total Interest Income $136,265 $247,844 $260,554 $312,974 Total Interest Expense 21,675 42,703 71,002 99,886 Net Interest Income $114,590 $205,141 $189,552 $213,088 (Reversal of) Provision for Loan Losses (10,000) (16,500) 88,620 (3,150) Total Noninterest Income (1) 26,956 120,621 73,470 57,110 Total Noninterest Expense 123,059 198,242 178,736 209,317 Income (Loss) before Income Tax (Expense) Benefit 28,487 144,020 (4,334) 64,031 Income Tax (Expense) Benefit (1) (6,011) (33,709) 2,612 (12,697) Net Income (Loss) before attribution of noncontrolling interest $22,476 $110,311 ($1,722) $51,334 Noncontrolling interest (2) (1,148) (2,610) — — Net income (loss) attributable to Amerant Bancorp Inc. $23,624 $112,921 ($1,722) $51,334 (1) The Company sold its Coral Gables headquarters for $135 million, with an approximate carrying value of $69.9 million at the time of sale and transaction costs of $2.6 million. The Company leased- back the property for an 18-year term. The provision for income tax expense includes $16.1 million related to this transaction in the three months and year ended December 31, 2021. (2) The Company records net loss attributable to non-controlling interest in its consolidated statement of operations equal to the percentage of the economic or ownership interest retained in the interest of Amerant Mortgage, and presents non-controlling interest as a component of stockholders' equity on the consolidated balance sheets.

27 amerantbank.com Explanation of Certain Non-GAAP Financial Measures This presentation contains certain adjusted financial information or non-GAAP financial measures, including “pre-provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core net income (loss)”, “core net income (loss) per share (basic and diluted)”, “core return on assets (Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, and “tangible stockholders’ equity (book value) per common share”. See below detailed information on adjustments included in this presentation: • the $1.7 million loss on the sale of the Beacon operations center during the fourth quarter of 2020 • the $2.8 million net gain on the sale of vacant Beacon land during the fourth quarter of 2019, • the $5.0 million, $11.9 million, $7.1 million and $11.2 million in restructuring expenses in 2019, 2020, 2021, and the first half of 2022, respectively, related to staff reduction costs, legal and consulting fees, rebranding costs, digital transformation costs, branch closure expenses, contract termination costs and a lease impairment charge • the effect of non-core banking activities such as the sale of loans and securities, the valuation of securities, derivatives, loans held for sale and other real estate owned and other non-recurring actions intended to improve customer service and operating performance • the $62.4 million gain on the sale of the Company's headquarters building in 2021 The Company uses certain non-GAAP financial measures, within the meaning of SEC Regulation G, which are included in this Presentation to explain our results and which are used in our internal evaluation and management of the Company’s businesses. The Company’s management believes these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view the Company’s performance using the same tools that management uses to evaluate the Company’s past performance and prospects for future performance. The Company believes these are especially useful in light of the effects of restructuring expenses, as well as the sale of the Company's headquarters building in the fourth quarter of 2021, the sale of the Beacon operations center in the fourth quarter of 2020, the sale of the vacant Beacon land in the fourth quarter of 2019 and the effect of non-core banking activities such as the sale of loans and securities, the valuation of securities, derivatives, loans held for sale and other real estate owned and other non-recurring actions intended to improve customer service and operating performance. These as-adjusted measures are not in accordance with generally accepted accounting principles (“GAAP”). This Appendix 2 reconciles these adjustments to reported results. Appendix 2 Non-GAAP Financial Measures Reconciliations

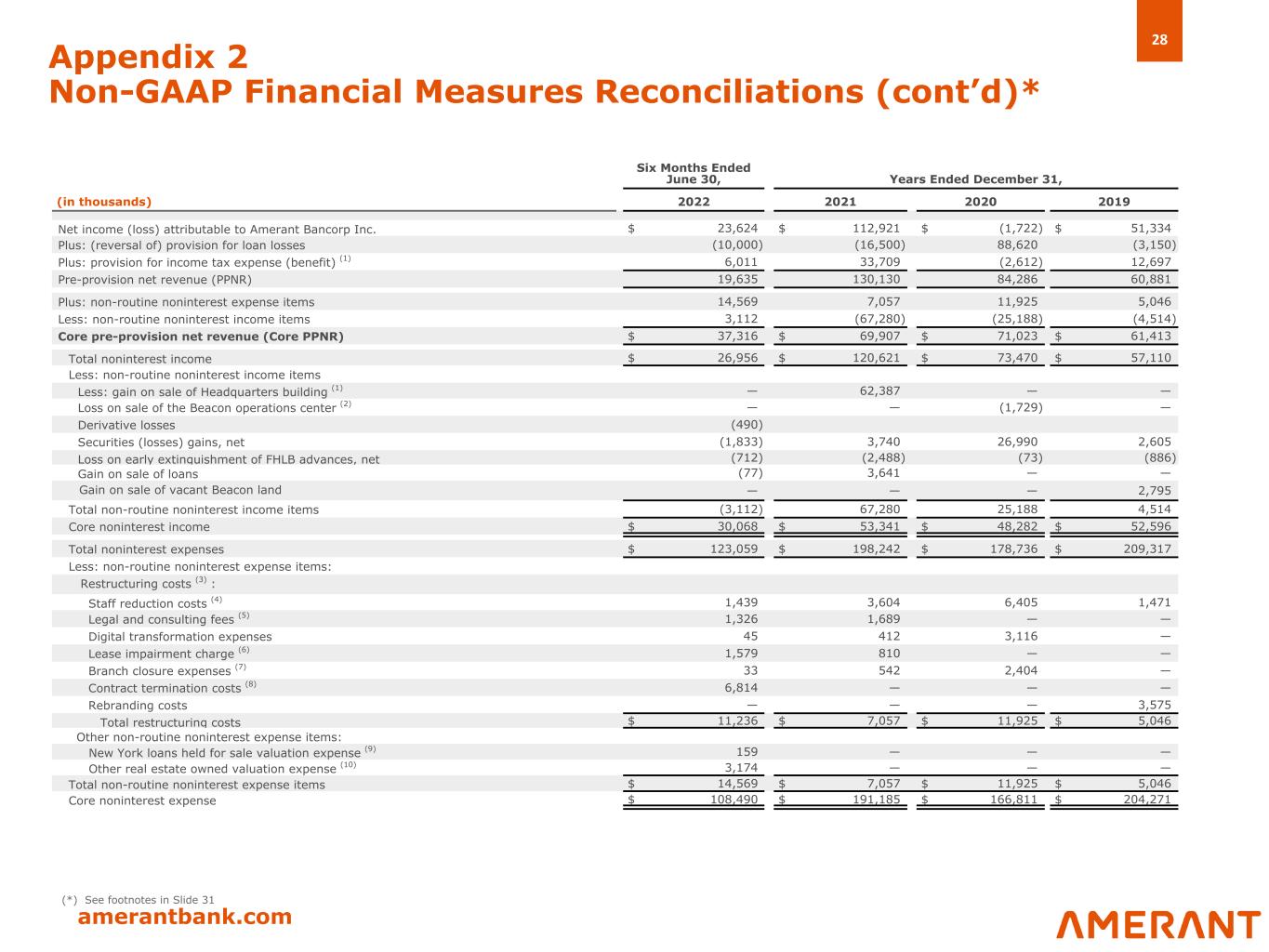

28 amerantbank.com Six Months Ended June 30, Years Ended December 31, (in thousands) 2022 2021 2020 2019 Net income (loss) attributable to Amerant Bancorp Inc. $ 23,624 $ 112,921 $ (1,722) $ 51,334 Plus: (reversal of) provision for loan losses (10,000) (16,500) 88,620 (3,150) Plus: provision for income tax expense (benefit) (1) 6,011 33,709 (2,612) 12,697 Pre-provision net revenue (PPNR) 19,635 130,130 84,286 60,881 Plus: non-routine noninterest expense items 14,569 7,057 11,925 5,046 Less: non-routine noninterest income items 3,112 (67,280) (25,188) (4,514) Core pre-provision net revenue (Core PPNR) $ 37,316 $ 69,907 $ 71,023 $ 61,413 Total noninterest income $ 26,956 $ 120,621 $ 73,470 $ 57,110 Less: non-routine noninterest income items Less: gain on sale of Headquarters building (1) — 62,387 — — Loss on sale of the Beacon operations center (2) — — (1,729) — Derivative losses (490) Securities (losses) gains, net (1,833) 3,740 26,990 2,605 Loss on early extinguishment of FHLB advances, net (712) (2,488) (73) (886) Gain on sale of loans (77) 3,641 — — Gain on sale of vacant Beacon land — — — 2,795 Total non-routine noninterest income items (3,112) 67,280 25,188 4,514 Core noninterest income $ 30,068 $ 53,341 $ 48,282 $ 52,596 Total noninterest expenses $ 123,059 $ 198,242 $ 178,736 $ 209,317 Less: non-routine noninterest expense items: Restructuring costs (3) : Staff reduction costs (4) 1,439 3,604 6,405 1,471 Legal and consulting fees (5) 1,326 1,689 — — Digital transformation expenses 45 412 3,116 — Lease impairment charge (6) 1,579 810 — — Branch closure expenses (7) 33 542 2,404 — Contract termination costs (8) 6,814 — — — Rebranding costs — — — 3,575 Total restructuring costs $ 11,236 $ 7,057 $ 11,925 $ 5,046 Other non-routine noninterest expense items: New York loans held for sale valuation expense (9) 159 — — — Other real estate owned valuation expense (10) 3,174 — — — Total non-routine noninterest expense items $ 14,569 $ 7,057 $ 11,925 $ 5,046 Core noninterest expense $ 108,490 $ 191,185 $ 166,811 $ 204,271 Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d)* (*) See footnotes in Slide 31

29 amerantbank.com Six Months Ended June 30, Years Ended December 31, (in thousands) 2022 2021 2020 2019 Net income (loss) attributable to Amerant Bancorp Inc. $ 23,624 $ 112,921 $ (1,722) $ 51,334 Plus after-tax non-routine items in noninterest expense: Non-routine items in noninterest expenses before income tax effect 14,569 7,057 11,925 5,046 Income tax effect (11) (3,074) (1,652) (7,187) (1,001) Total after-tax non-routine items in noninterest expense 11,495 5,405 4,738 4,045 Plus (less) after-tax non-routine items in noninterest income: Non-routine items in noninterest income before income tax effect 3,112 (67,280) (25,188) (4,514) Income tax effect (11) (657) 15,750 15,181 895 Total after-tax non-routine items in noninterest income 2,455 (51,530) (10,007) (3,619) Core net income (loss) $ 37,574 $ 66,796 $ (6,991) $ 51,760 Basic earnings (loss) per share $ 0.69 $ 3.04 $ (0.04) $ 1.21 Plus: after tax impact of non-routine items in noninterest expense 0.34 0.15 0.11 0.09 Plus (less): after tax impact of non-routine items in noninterest income 0.07 (1.39) (0.24) (0.08) Total core basic earnings (loss) per common share $ 1.10 $ 1.80 $ (0.17) $ 1.22 Diluted earnings (loss) per share (12) 0.68 $ 3.01 $ (0.04) $ 1.20 Plus: after tax impact of non-routine items in noninterest expense 0.34 0.14 0.11 0.09 Plus (less): after tax impact of non-routine items in noninterest income 0.07 (1.37) (0.24) (0.08) Total core diluted earnings (loss) per common share $ 1.09 $ 1.78 $ (0.17) $ 1.21 Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d)* (*) See footnotes in Slide 31

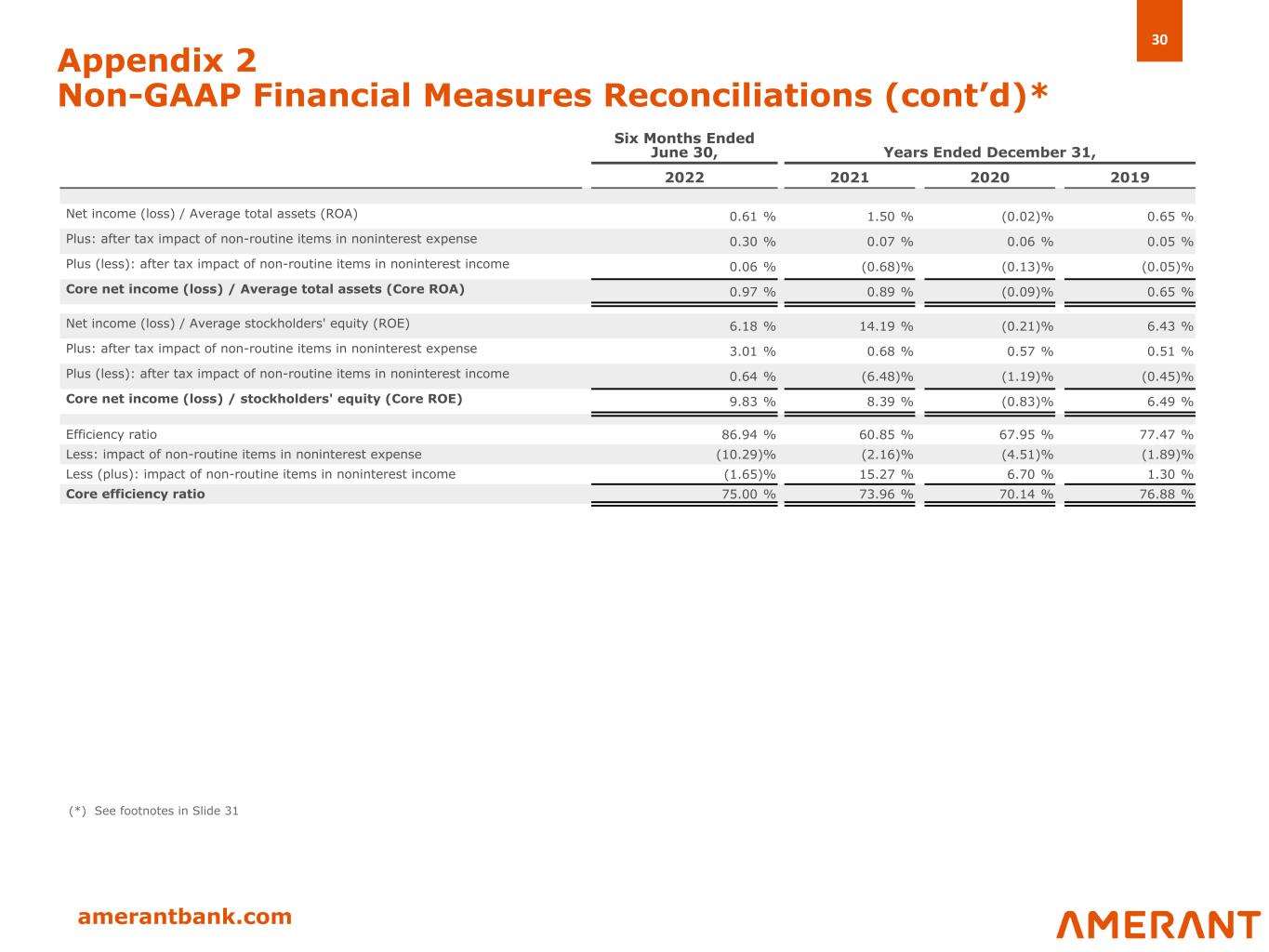

30 amerantbank.com Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d)* Six Months Ended June 30, Years Ended December 31, 2022 2021 2020 2019 Net income (loss) / Average total assets (ROA) 0.61 % 1.50 % (0.02) % 0.65 % Plus: after tax impact of non-routine items in noninterest expense 0.30 % 0.07 % 0.06 % 0.05 % Plus (less): after tax impact of non-routine items in noninterest income 0.06 % (0.68) % (0.13) % (0.05) % Core net income (loss) / Average total assets (Core ROA) 0.97 % 0.89 % (0.09) % 0.65 % Net income (loss) / Average stockholders' equity (ROE) 6.18 % 14.19 % (0.21) % 6.43 % Plus: after tax impact of non-routine items in noninterest expense 3.01 % 0.68 % 0.57 % 0.51 % Plus (less): after tax impact of non-routine items in noninterest income 0.64 % (6.48) % (1.19) % (0.45) % Core net income (loss) / stockholders' equity (Core ROE) 9.83 % 8.39 % (0.83) % 6.49 % Efficiency ratio 86.94 % 60.85 % 67.95 % 77.47 % Less: impact of non-routine items in noninterest expense (10.29) % (2.16) % (4.51) % (1.89) % Less (plus): impact of non-routine items in noninterest income (1.65) % 15.27 % 6.70 % 1.30 % Core efficiency ratio 75.00 % 73.96 % 70.14 % 76.88 % (*) See footnotes in Slide 31

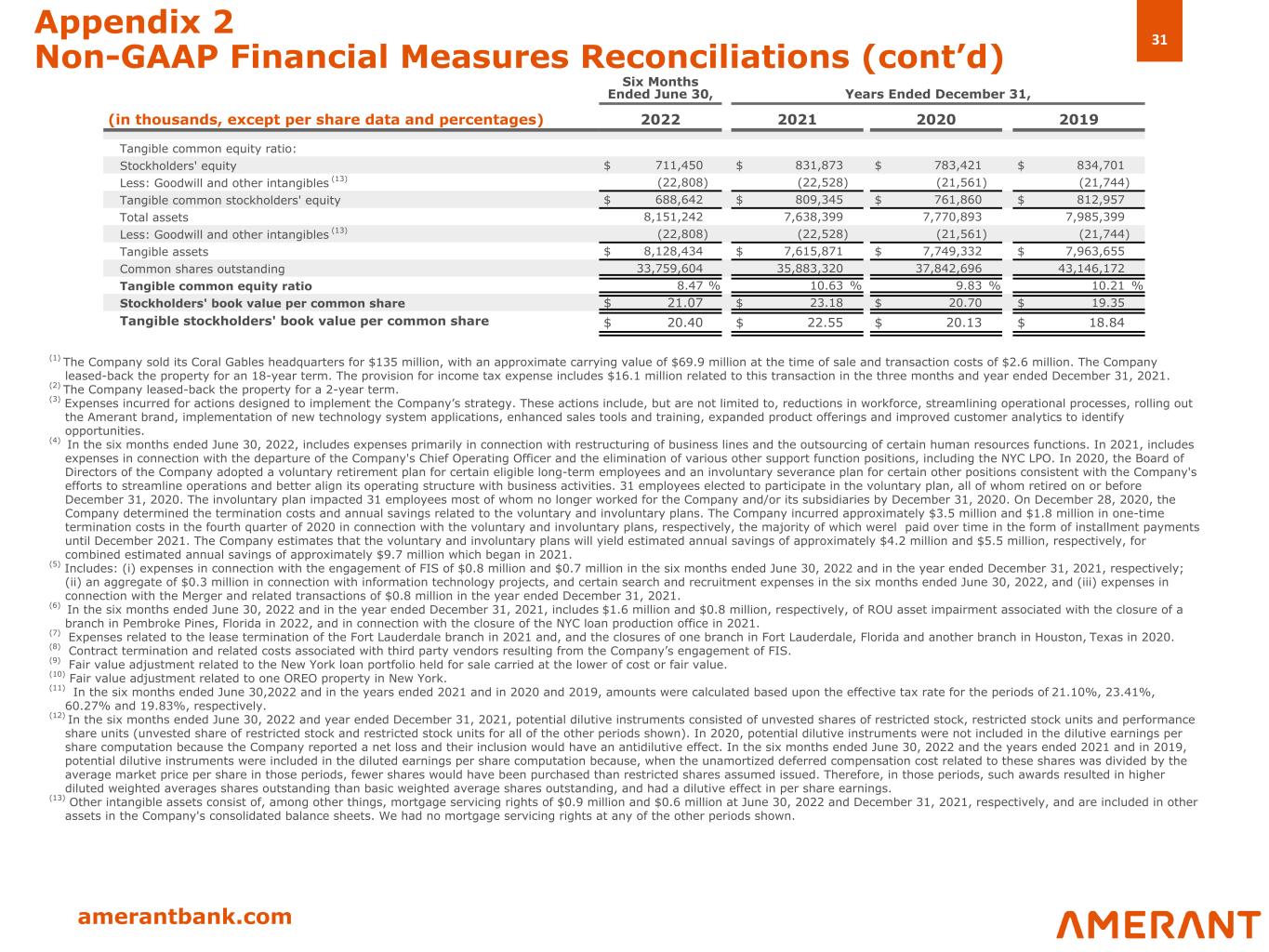

31 amerantbank.com Appendix 2 Non-GAAP Financial Measures Reconciliations (cont’d) Six Months Ended June 30, Years Ended December 31, (in thousands, except per share data and percentages) 2022 2021 2020 2019 Tangible common equity ratio: Stockholders' equity $ 711,450 $ 831,873 $ 783,421 $ 834,701 Less: Goodwill and other intangibles (13) (22,808) (22,528) (21,561) (21,744) Tangible common stockholders' equity $ 688,642 $ 809,345 $ 761,860 $ 812,957 Total assets 8,151,242 7,638,399 7,770,893 7,985,399 Less: Goodwill and other intangibles (13) (22,808) (22,528) (21,561) (21,744) Tangible assets $ 8,128,434 $ 7,615,871 $ 7,749,332 $ 7,963,655 Common shares outstanding 33,759,604 35,883,320 37,842,696 43,146,172 Tangible common equity ratio 8.47 % 10.63 % 9.83 % 10.21 % Stockholders' book value per common share $ 21.07 $ 23.18 $ 20.70 $ 19.35 Tangible stockholders' book value per common share $ 20.40 $ 22.55 $ 20.13 $ 18.84 (1) The Company sold its Coral Gables headquarters for $135 million, with an approximate carrying value of $69.9 million at the time of sale and transaction costs of $2.6 million. The Company leased-back the property for an 18-year term. The provision for income tax expense includes $16.1 million related to this transaction in the three months and year ended December 31, 2021. (2) The Company leased-back the property for a 2-year term. (3) Expenses incurred for actions designed to implement the Company’s strategy. These actions include, but are not limited to, reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (4) In the six months ended June 30, 2022, includes expenses primarily in connection with restructuring of business lines and the outsourcing of certain human resources functions. In 2021, includes expenses in connection with the departure of the Company's Chief Operating Officer and the elimination of various other support function positions, including the NYC LPO. In 2020, the Board of Directors of the Company adopted a voluntary retirement plan for certain eligible long-term employees and an involuntary severance plan for certain other positions consistent with the Company's efforts to streamline operations and better align its operating structure with business activities. 31 employees elected to participate in the voluntary plan, all of whom retired on or before December 31, 2020. The involuntary plan impacted 31 employees most of whom no longer worked for the Company and/or its subsidiaries by December 31, 2020. On December 28, 2020, the Company determined the termination costs and annual savings related to the voluntary and involuntary plans. The Company incurred approximately $3.5 million and $1.8 million in one-time termination costs in the fourth quarter of 2020 in connection with the voluntary and involuntary plans, respectively, the majority of which werel paid over time in the form of installment payments until December 2021. The Company estimates that the voluntary and involuntary plans will yield estimated annual savings of approximately $4.2 million and $5.5 million, respectively, for combined estimated annual savings of approximately $9.7 million which began in 2021. (5) Includes: (i) expenses in connection with the engagement of FIS of $0.8 million and $0.7 million in the six months ended June 30, 2022 and in the year ended December 31, 2021, respectively; (ii) an aggregate of $0.3 million in connection with information technology projects, and certain search and recruitment expenses in the six months ended June 30, 2022, and (iii) expenses in connection with the Merger and related transactions of $0.8 million in the year ended December 31, 2021. (6) In the six months ended June 30, 2022 and in the year ended December 31, 2021, includes $1.6 million and $0.8 million, respectively, of ROU asset impairment associated with the closure of a branch in Pembroke Pines, Florida in 2022, and in connection with the closure of the NYC loan production office in 2021. (7) Expenses related to the lease termination of the Fort Lauderdale branch in 2021 and, and the closures of one branch in Fort Lauderdale, Florida and another branch in Houston, Texas in 2020. (8) Contract termination and related costs associated with third party vendors resulting from the Company’s engagement of FIS. (9) Fair value adjustment related to the New York loan portfolio held for sale carried at the lower of cost or fair value. (10) Fair value adjustment related to one OREO property in New York. (11) In the six months ended June 30,2022 and in the years ended 2021 and in 2020 and 2019, amounts were calculated based upon the effective tax rate for the periods of 21.10%, 23.41%, 60.27% and 19.83%, respectively. (12) In the six months ended June 30, 2022 and year ended December 31, 2021, potential dilutive instruments consisted of unvested shares of restricted stock, restricted stock units and performance share units (unvested share of restricted stock and restricted stock units for all of the other periods shown). In 2020, potential dilutive instruments were not included in the dilutive earnings per share computation because the Company reported a net loss and their inclusion would have an antidilutive effect. In the six months ended June 30, 2022 and the years ended 2021 and in 2019, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in those periods, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in those periods, such awards resulted in higher diluted weighted averages shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings. (13) Other intangible assets consist of, among other things, mortgage servicing rights of $0.9 million and $0.6 million at June 30, 2022 and December 31, 2021, respectively, and are included in other assets in the Company's consolidated balance sheets. We had no mortgage servicing rights at any of the other periods shown.

Thank you Investor Relations InvestorRelations@amerantbank.com