Earnings Call January 20, 2023 Fourth Quarter 2022

2Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward- looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2021, our quarterly reports on Form 10-Q for the quarter ended March 31, 2022, June 30, 2022, and September 30, 2022 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including the three and twelve month periods ended December 31, 2022 and the three month period ended December 31, 2021, may not reflect our results of operations for our fiscal year ended, or financial condition as of December 31, 2022, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non- GAAP financial measures, such as “pre-provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expenses”, “core net income”, “core earnings per share (basic and diluted)”, “core return on assets (Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, and “tangible stockholders’ equity book value per common share”. This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued in 2022, including the effect of non-core banking activities such as the sale of loans and securities, the valuation of securities, derivatives, loans held for sale and other real estate owned, the sale of our corporate headquarters in the fourth quarter of 2021, and other non-routine actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. Appendix 1 reconciles these non-GAAP financial measures to reported results.

3 • All capital ratios are above "well capitalized" levels • Cash dividend of $0.09 per share of Amerant common stock paid out on November 30, 2022 Performance Highlights 4Q22 Capital Business • Net income attributable to the Company of $18.8 million(1) in 4Q22 compared to $20.9 million in 3Q22 • Core pre-provision net revenue (PPNR)(2) was $37.8 million in 4Q22 compared to $30.3 million in 3Q22 • Diluted earnings per share (EPS) was $0.55(1) in 4Q22 compared to $0.62 in 3Q22 • Core diluted EPS(2) was $0.40 in 4Q22 compared to $0.63 in 3Q22 • Net Interest Margin ("NIM") was 3.96% in 4Q22 compared to 3.61% in 3Q22 Earnings (1) Net income attributable to the Company results in $22.0 million, or $0.65 per diluted share, in the fourth quarter of 2022, excluding the CECL retroactive effect corresponding to the first, second and third quarters of 2022. The provision for credit losses attributable to the fourth quarter of 2022 is $16.9 million, excluding the CECL retroactive effect corresponding to the first, second and third quarters of 2022. In the fourth quarter of 2022, the Company adopted CECL and recorded the related impact on its ACL in 2022 through a provision for credit losses of $11.1 million. (2) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. • Total assets increased $387.8 million, or 4.44%, to $9.1 billion compared to $8.7 billion as of 3Q22 • Total gross loans increased $416.3 million, or 6.40%, to $6.9 billion compared to $6.5 billion in 3Q22 • Average yield on loans increased to 5.85% in 4Q22 compared to 5.06% in 3Q22 • Total deposits were $7.0 billion, up $456.1 million, or 6.92% compared to $6.6 billion in 3Q22 • Average cost of total deposits increased to 1.38% in 4Q22 compared to 0.83% in 3Q22 • Core deposits were $5.3 billion, up $114.3 million, or 2.20%, compared to $5.2 billion as of 3Q22 • Loan to deposit ratio decreased to 98.23% in 4Q22 compared to 98.71% in 3Q22 • AUM totaled $2.0 billion, up $184.4 million, or 10.2%, from $1.8 billion in 3Q22

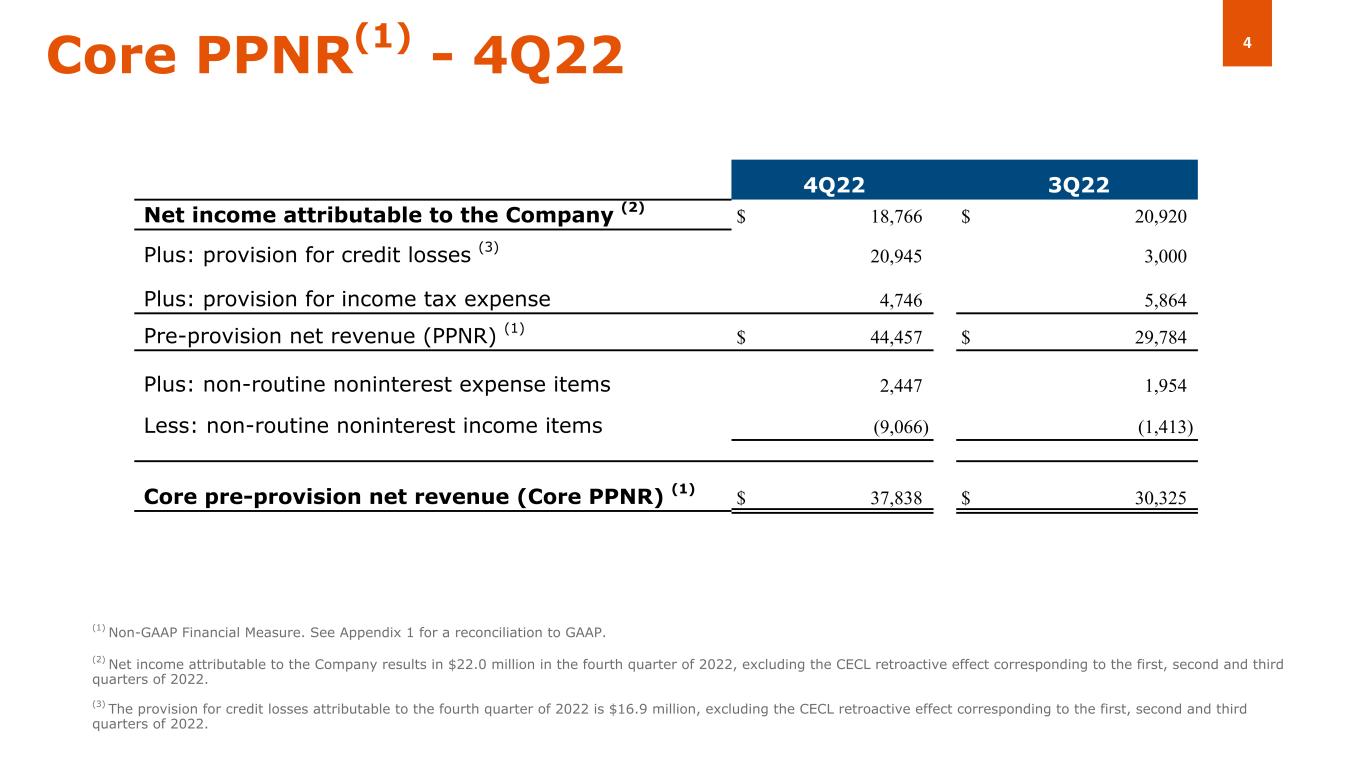

4Core PPNR(1) - 4Q22 (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. (2) Net income attributable to the Company results in $22.0 million in the fourth quarter of 2022, excluding the CECL retroactive effect corresponding to the first, second and third quarters of 2022. (3) The provision for credit losses attributable to the fourth quarter of 2022 is $16.9 million, excluding the CECL retroactive effect corresponding to the first, second and third quarters of 2022. (( 4Q22 3Q22 Net income attributable to the Company (2) $ 18,766 $ 20,920 Plus: provision for credit losses (3) 20,945 3,000 Plus: provision for income tax expense 4,746 5,864 Pre-provision net revenue (PPNR) (1) $ 44,457 $ 29,784 Plus: non-routine noninterest expense items 2,447 1,954 Less: non-routine noninterest income items (9,066) (1,413) Core pre-provision net revenue (Core PPNR) (1) $ 37,838 $ 30,325

5Key Actions - 4Q22 – Closed on OREO property at no additional loss on October 14, 2022 – Banking center updates: ◦ Closed Pembroke Pines, FL location on 10/17/22, as previously announced ◦ Opened in University Place in Houston on 10/31/22 – closed South Shepherd banking center ◦ Downtown Miami location now expected to open during 3Q23 ◦ Received OCC approval to open two new full-service banking centers, one in Key Biscayne, FL – Estimated opening in 2Q23, and another in Ft. Lauderdale, FL in 3Q23 – Continued to add key business development personnel in domestic retail, private and commercial banking, as well as wealth management – Announced an expanded multi-year partnership with Florida Panthers, making Amerant the Official Bank of the Florida Panthers and FLA Live Arena – Appointed Ms. Erin Dolan Knight as a member of the Board of Directors, effective December 15, 2022 – Board of Directors authorized a new share repurchase program for up to $25 million of its shares of Class A common stock – Became a large accelerated filer, exited emergency growth company status and adopted the Current Expected Credit Loss (“CECL”) accounting standard

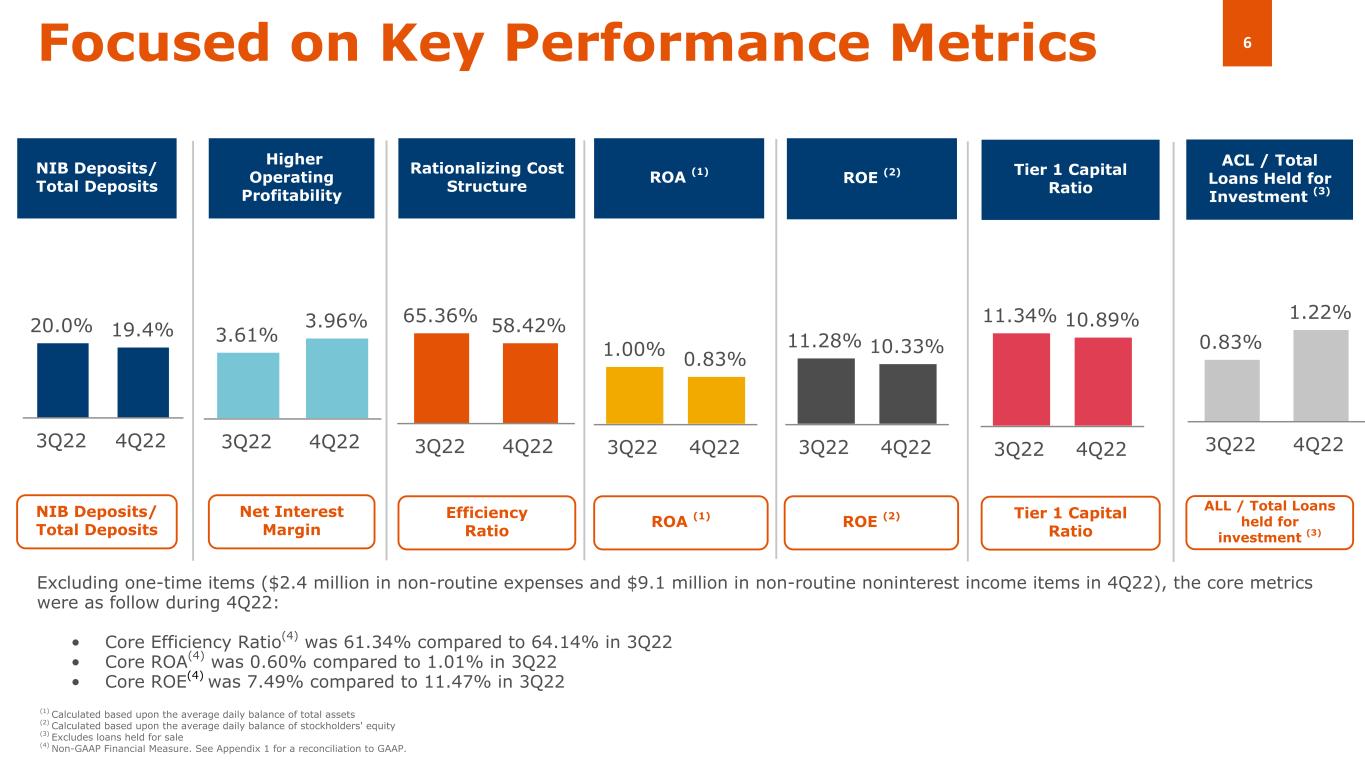

6 65.36% 58.42% 3Q22 4Q22 20.0% 19.4% 3Q22 4Q22 11.34% 10.89% 3Q22 4Q22 3.61% 3.96% 3Q22 4Q22 Focused on Key Performance Metrics NIB Deposits/ Total Deposits Tier 1 Capital Ratio Higher Operating Profitability Rationalizing Cost Structure (1) Calculated based upon the average daily balance of total assets (2) Calculated based upon the average daily balance of stockholders' equity (3) Excludes loans held for sale (4) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. 0.83% 1.22% 3Q22 4Q22 ACL / Total Loans Held for Investment (3) 1.00% 0.83% 3Q22 4Q22 ROA (1) 11.28% 10.33% 3Q22 4Q22 NIB Deposits/ Total Deposits Tier 1 Capital Ratio Net Interest Margin Efficiency Ratio ALL / Total Loans held for investment (3) ROA (1) ROE (2) Excluding one-time items ($2.4 million in non-routine expenses and $9.1 million in non-routine noninterest income items in 4Q22), the core metrics were as follow during 4Q22: • Core Efficiency Ratio(4) was 61.34% compared to 64.14% in 3Q22 • Core ROA(4) was 0.60% compared to 1.01% in 3Q22 • Core ROE(4) was 7.49% compared to 11.47% in 3Q22 ROE (2)

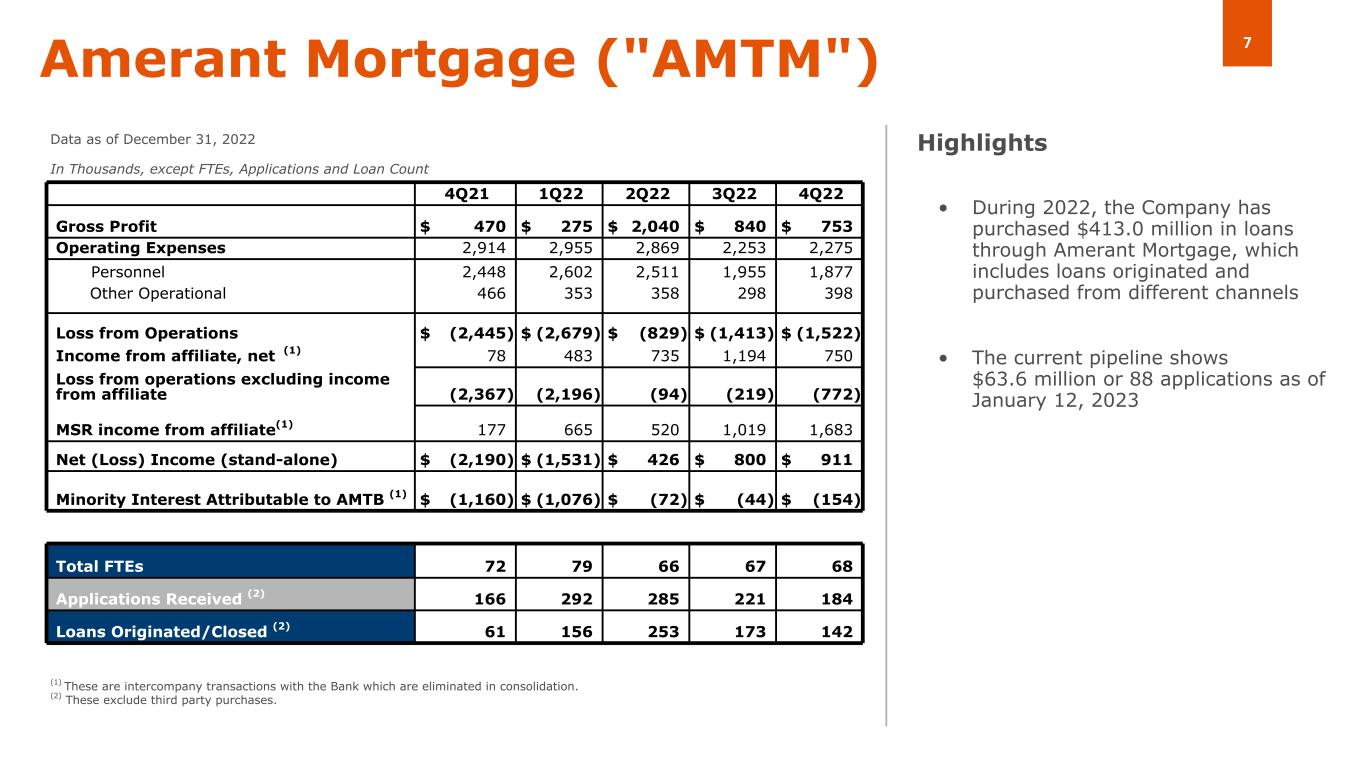

7Amerant Mortgage ("AMTM") • During 2022, the Company has purchased $413.0 million in loans through Amerant Mortgage, which includes loans originated and purchased from different channels • The current pipeline shows $63.6 million or 88 applications as of January 12, 2023 Data as of December 31, 2022 In Thousands, except FTEs, Applications and Loan Count Highlights (1) These are intercompany transactions with the Bank which are eliminated in consolidation. (2) These exclude third party purchases. ( 4Q21 1Q22 2Q22 3Q22 4Q22 Gross Profit $ 470 $ 275 $ 2,040 $ 840 $ 753 Operating Expenses 2,914 2,955 2,869 2,253 2,275 Personnel 2,448 2,602 2,511 1,955 1,877 Other Operational 466 353 358 298 398 Loss from Operations $ (2,445) $ (2,679) $ (829) $ (1,413) $ (1,522) Income from affiliate, net (1) 78 483 735 1,194 750 Loss from operations excluding income from affiliate (2,367) (2,196) (94) (219) (772) MSR income from affiliate(1) 177 665 520 1,019 1,683 Net (Loss) Income (stand-alone) $ (2,190) $ (1,531) $ 426 $ 800 $ 911 Minority Interest Attributable to AMTB (1) $ (1,160) $ (1,076) $ (72) $ (44) $ (154) Total FTEs 72 79 66 67 68 Applications Received (2) 166 292 285 221 184 Loans Originated/Closed (2) 61 156 253 173 142

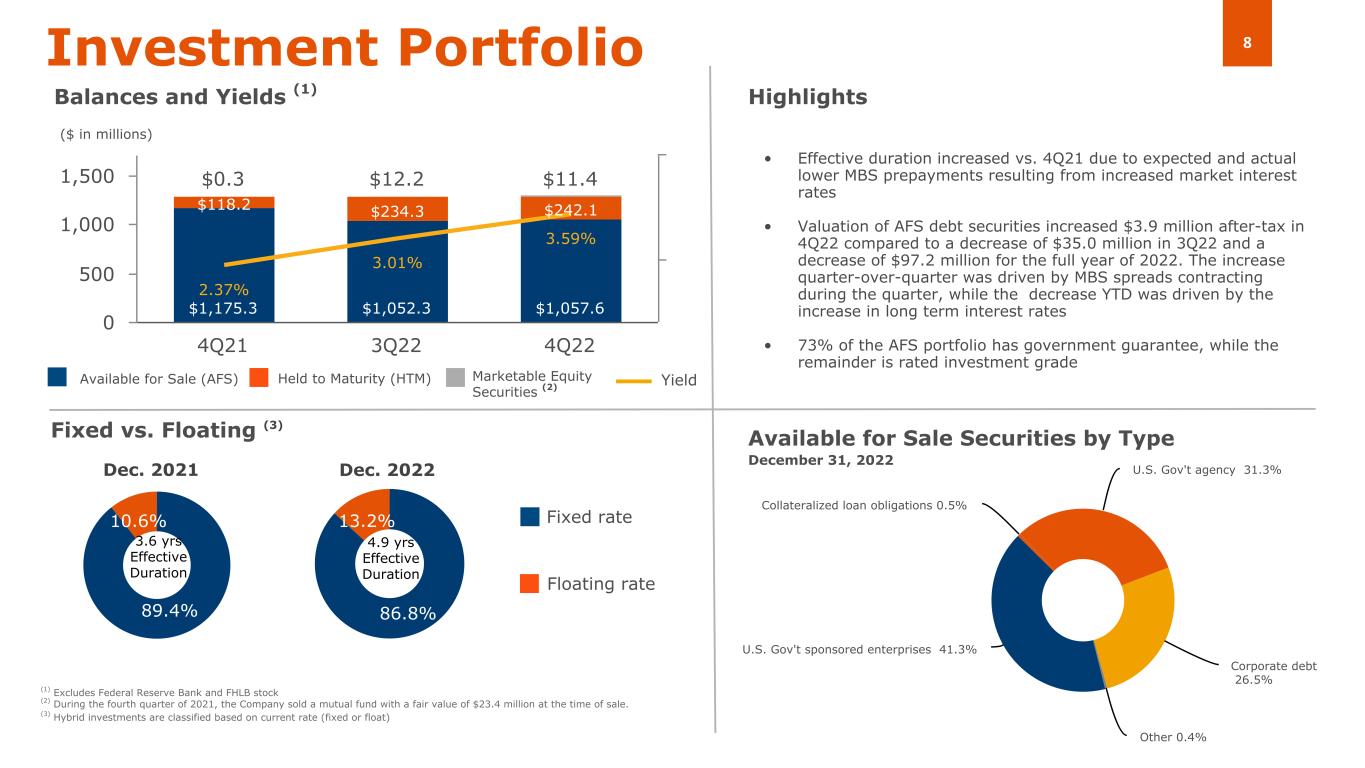

8 86.8% 13.2% U.S. Gov't sponsored enterprises 41.3% Collateralized loan obligations 0.5% U.S. Gov't agency 31.3% Corporate debt 26.5% Other 0.4% $1,175.3 $1,052.3 $1,057.6 $118.2 $234.3 $242.1 $0.3 $12.2 $11.4 2.37% 3.01% 3.59% 4Q21 3Q22 4Q22 0 500 1,000 1,500 89.4% 10.6% Investment Portfolio Balances and Yields (1) Available for Sale (AFS) Held to Maturity (HTM) Highlights Fixed vs. Floating (3) Dec. 2021 Dec. 2022 Floating rate Fixed rate Available for Sale Securities by Type December 31, 2022 3.6 yrs Effective Duration ($ in millions) Marketable Equity Securities (2) (1) Excludes Federal Reserve Bank and FHLB stock (2) During the fourth quarter of 2021, the Company sold a mutual fund with a fair value of $23.4 million at the time of sale. (3) Hybrid investments are classified based on current rate (fixed or float) Yield 4.9 yrs Effective Duration • Effective duration increased vs. 4Q21 due to expected and actual lower MBS prepayments resulting from increased market interest rates • Valuation of AFS debt securities increased $3.9 million after-tax in 4Q22 compared to a decrease of $35.0 million in 3Q22 and a decrease of $97.2 million for the full year of 2022. The increase quarter-over-quarter was driven by MBS spreads contracting during the quarter, while the decrease YTD was driven by the increase in long term interest rates • 73% of the AFS portfolio has government guarantee, while the remainder is rated investment grade

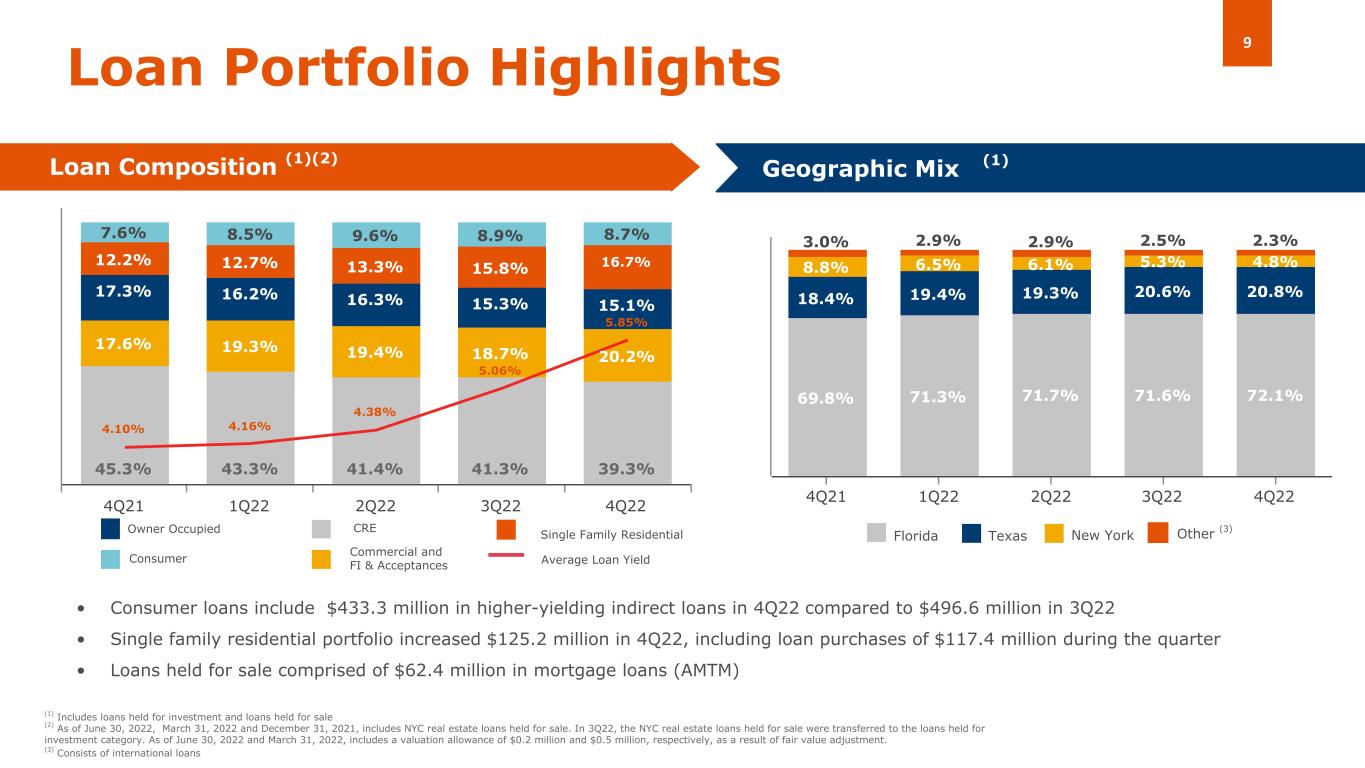

9 45.3% 43.3% 41.4% 41.3% 39.3% 17.6% 19.3% 19.4% 18.7% 20.2% 17.3% 16.2% 16.3% 15.3% 15.1% 12.2% 12.7% 13.3% 15.8% 16.7% 7.6% 8.5% 9.6% 8.9% 8.7% 4.10% 4.16% 4.38% 5.06% 5.85% 4Q21 1Q22 2Q22 3Q22 4Q22 69.8% 71.3% 71.7% 71.6% 72.1% 18.4% 19.4% 19.3% 20.6% 20.8% 8.8% 6.5% 6.1% 5.3% 4.8% 3.0% 2.9% 2.9% 2.5% 2.3% 4Q21 1Q22 2Q22 3Q22 4Q22 Consumer CRE Commercial and FI & Acceptances Owner Occupied Single Family Residential Loan Portfolio Highlights Loan Composition (1)(2) Geographic Mix (Domestic) • Consumer loans include $433.3 million in higher-yielding indirect loans in 4Q22 compared to $496.6 million in 3Q22 • Single family residential portfolio increased $125.2 million in 4Q22, including loan purchases of $117.4 million during the quarter • Loans held for sale comprised of $62.4 million in mortgage loans (AMTM) (1) Florida Texas New York Average Loan Yield Other (3) (1) Includes loans held for investment and loans held for sale (2) As of June 30, 2022, March 31, 2022 and December 31, 2021, includes NYC real estate loans held for sale. In 3Q22, the NYC real estate loans held for sale were transferred to the loans held for investment category. As of June 30, 2022 and March 31, 2022, includes a valuation allowance of $0.2 million and $0.5 million, respectively, as a result of fair value adjustment. (3) Consists of international loans

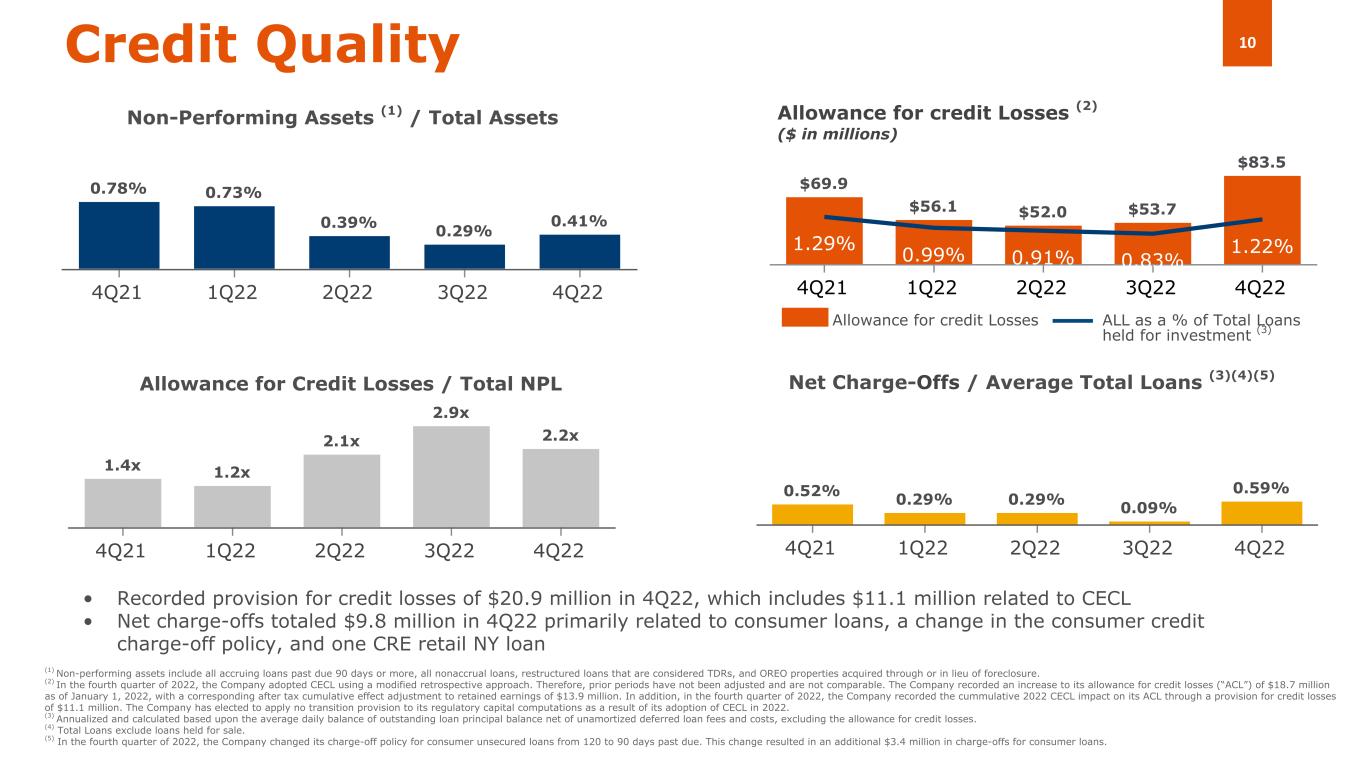

10 1.4x 1.2x 2.1x 2.9x 2.2x 4Q21 1Q22 2Q22 3Q22 4Q22 $69.9 $56.1 $52.0 $53.7 $83.5 1.29% 0.99% 0.91% 0.83% 1.22% 4Q21 1Q22 2Q22 3Q22 4Q22 0.52% 0.29% 0.29% 0.09% 0.59% 4Q21 1Q22 2Q22 3Q22 4Q22 Net Charge-Offs / Average Total Loans (3)(4)(5) Credit Quality Allowance for credit Losses (2) ($ in millions) Non-Performing Assets (1) / Total Assets Allowance for Credit Losses / Total NPL Allowance for credit Losses ALL as a % of Total Loans held for investment (3) (1) Non-performing assets include all accruing loans past due 90 days or more, all nonaccrual loans, restructured loans that are considered TDRs, and OREO properties acquired through or in lieu of foreclosure. (2) In the fourth quarter of 2022, the Company adopted CECL using a modified retrospective approach. Therefore, prior periods have not been adjusted and are not comparable. The Company recorded an increase to its allowance for credit losses (“ACL”) of $18.7 million as of January 1, 2022, with a corresponding after tax cumulative effect adjustment to retained earnings of $13.9 million. In addition, in the fourth quarter of 2022, the Company recorded the cummulative 2022 CECL impact on its ACL through a provision for credit losses of $11.1 million. The Company has elected to apply no transition provision to its regulatory capital computations as a result of its adoption of CECL in 2022. (3) Annualized and calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan fees and costs, excluding the allowance for credit losses. (4) Total Loans exclude loans held for sale. (5) In the fourth quarter of 2022, the Company changed its charge-off policy for consumer unsecured loans from 120 to 90 days past due. This change resulted in an additional $3.4 million in charge-offs for consumer loans. 0.78% 0.73% 0.39% 0.29% 0.41% 4Q21 1Q22 2Q22 3Q22 4Q22 • Recorded provision for credit losses of $20.9 million in 4Q22, which includes $11.1 million related to CECL • Net charge-offs totaled $9.8 million in 4Q22 primarily related to consumer loans, a change in the consumer credit charge-off policy, and one CRE retail NY loan

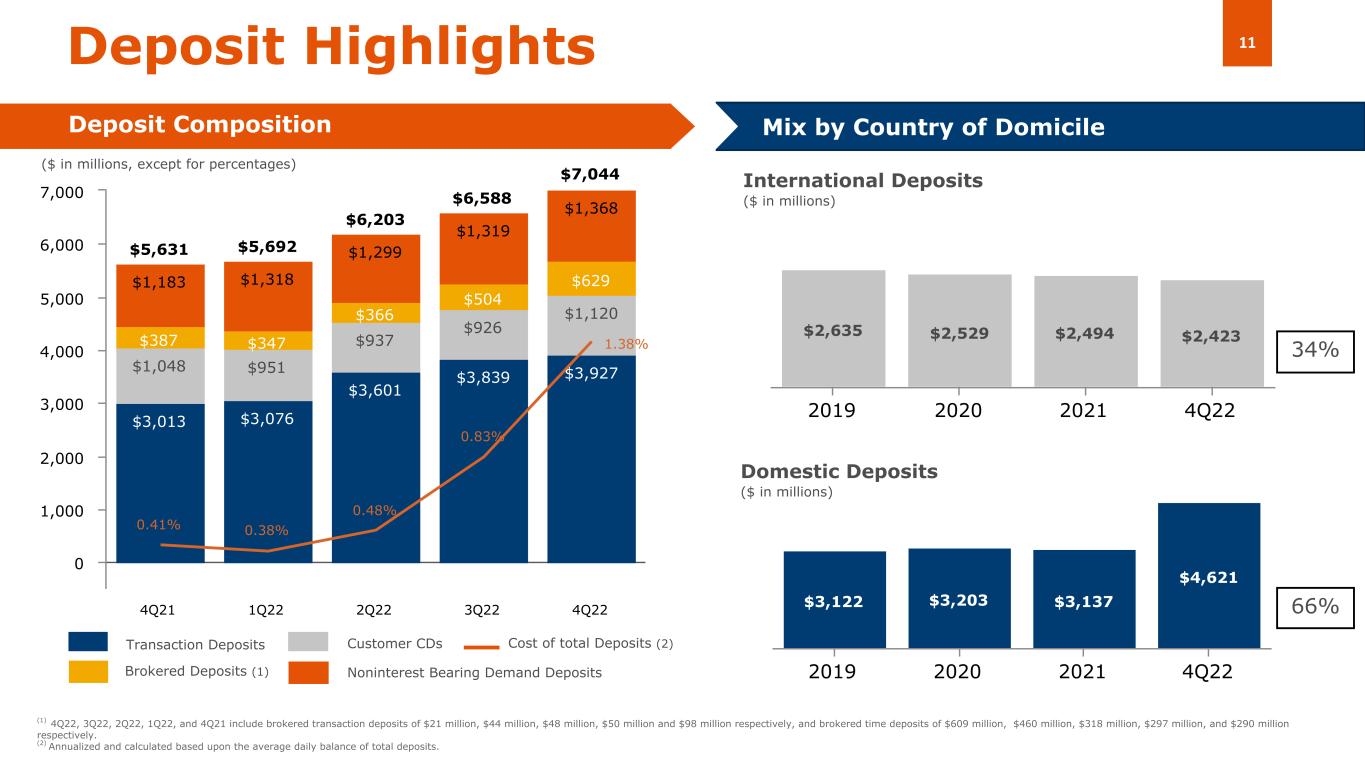

11 $5,631 $5,692 $6,203 $6,588 $7,044 $3,013 $3,076 $3,601 $3,839 $3,927$1,048 $951 $937 $926 $1,120 $387 $347 $366 $504 $629$1,183 $1,318 $1,299 $1,319 $1,368 0.41% 0.38% 0.48% 0.83% 1.38% 4Q21 1Q22 2Q22 3Q22 4Q22 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 $2,635 $2,529 $2,494 $2,423 2019 2020 2021 4Q22 $3,122 $3,203 $3,137 $4,621 2019 2020 2021 4Q22 Domestic Deposits ($ in millions) Deposit Highlights Deposit Composition 66% International Deposits ($ in millions) Mix by Country of Domicile Transaction Deposits Customer CDs Brokered Deposits (1) Cost of total Deposits (2) ($ in millions, except for percentages) 34% (1) 4Q22, 3Q22, 2Q22, 1Q22, and 4Q21 include brokered transaction deposits of $21 million, $44 million, $48 million, $50 million and $98 million respectively, and brokered time deposits of $609 million, $460 million, $318 million, $297 million, and $290 million respectively. (2) Annualized and calculated based upon the average daily balance of total deposits. Noninterest Bearing Demand Deposits

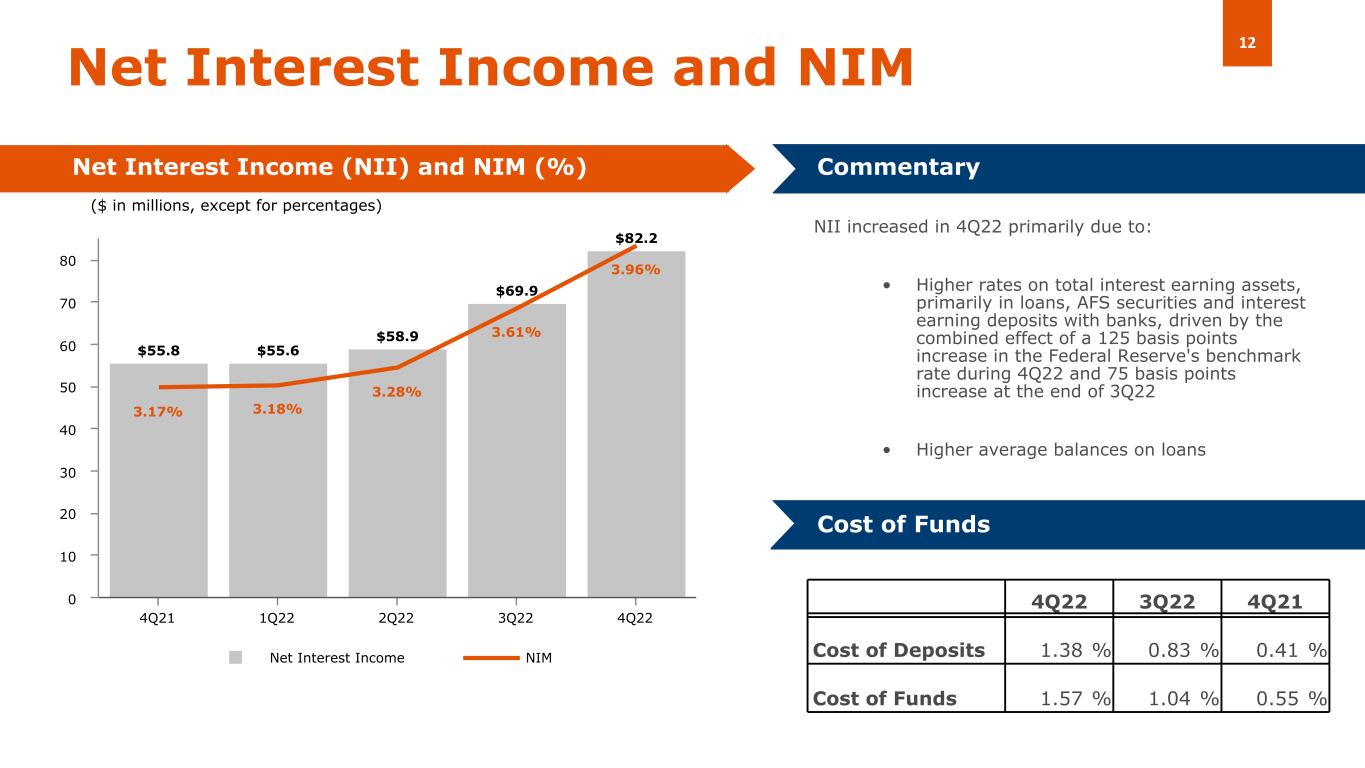

12 $55.8 $55.6 $58.9 $69.9 $82.2 3.17% 3.18% 3.28% 3.61% 3.96% Net Interest Income NIM 4Q21 1Q22 2Q22 3Q22 4Q22 0 10 20 30 40 50 60 70 80 NII increased in 4Q22 primarily due to: • Higher rates on total interest earning assets, primarily in loans, AFS securities and interest earning deposits with banks, driven by the combined effect of a 125 basis points increase in the Federal Reserve's benchmark rate during 4Q22 and 75 basis points increase at the end of 3Q22 • Higher average balances on loans Net Interest Income and NIM Net Interest Income (NII) and NIM (%) Commentary ($ in millions, except for percentages) 4Q22 3Q22 4Q21 Cost of Deposits 1.38 % 0.83 % 0.41 % Cost of Funds 1.57 % 1.04 % 0.55 % Cost of Funds

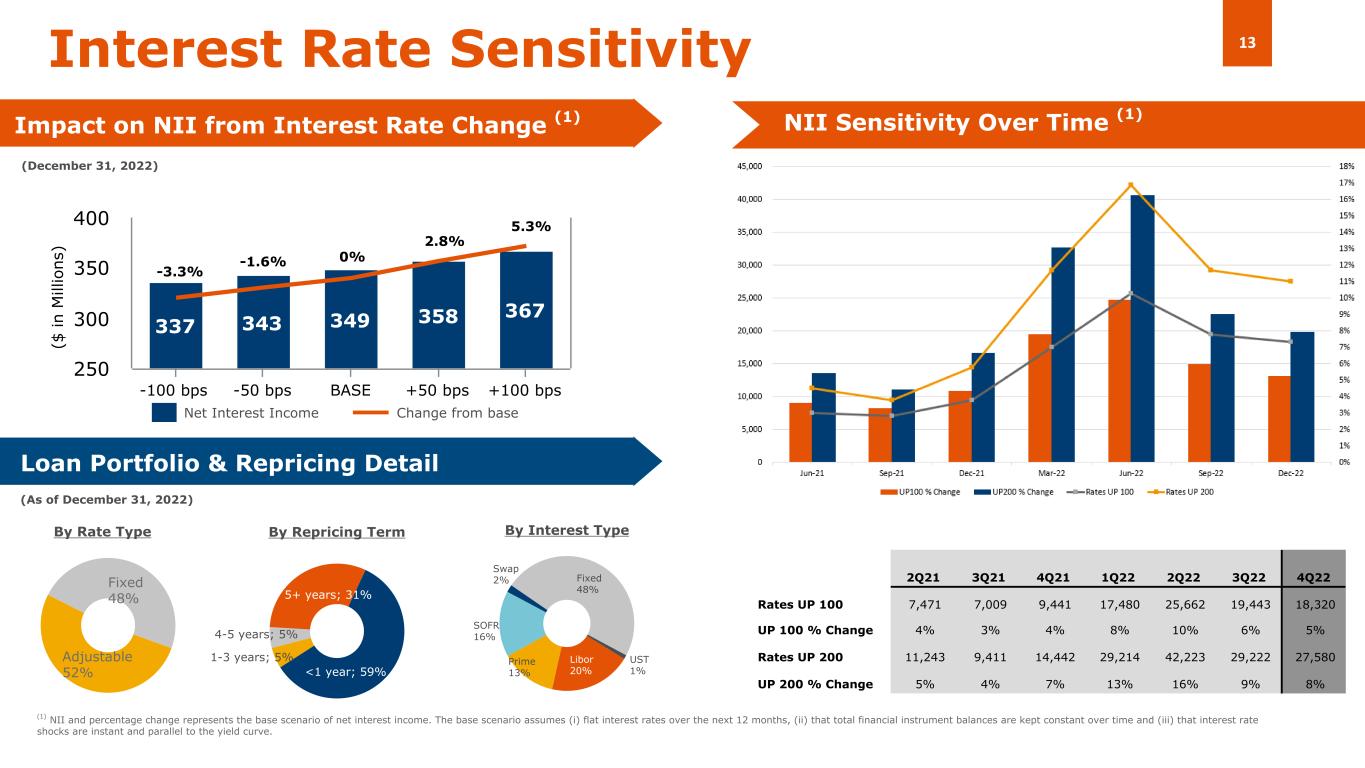

13 Swap 2% Fixed 48% UST 1% Libor 20% Prime 13% SOFR 16% <1 year; 59% 1-3 years; 5% 4-5 years; 5% 5+ years; 31% 337 343 349 358 367 -100 bps -50 bps BASE +50 bps +100 bps 250 300 350 400 (December 31, 2022) Fixed 48% Adjustable 52% Interest Rate Sensitivity By Interest TypeBy Rate Type By Repricing Term (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve. Loan Portfolio & Repricing Detail Impact on NII from Interest Rate Change (1) Net Interest Income Change from base ($ in M ill io ns ) (As of December 31, 2022) NII Sensitivity Over Time (1) -3.3% -1.6% 0% 5.3% 2.8% 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 Rates UP 100 7,471 7,009 9,441 17,480 25,662 19,443 18,320 UP 100 % Change 4% 3% 4% 8% 10% 6% 5% Rates UP 200 11,243 9,411 14,442 29,214 42,223 29,222 27,580 UP 200 % Change 5% 4% 7% 13% 16% 9% 8%

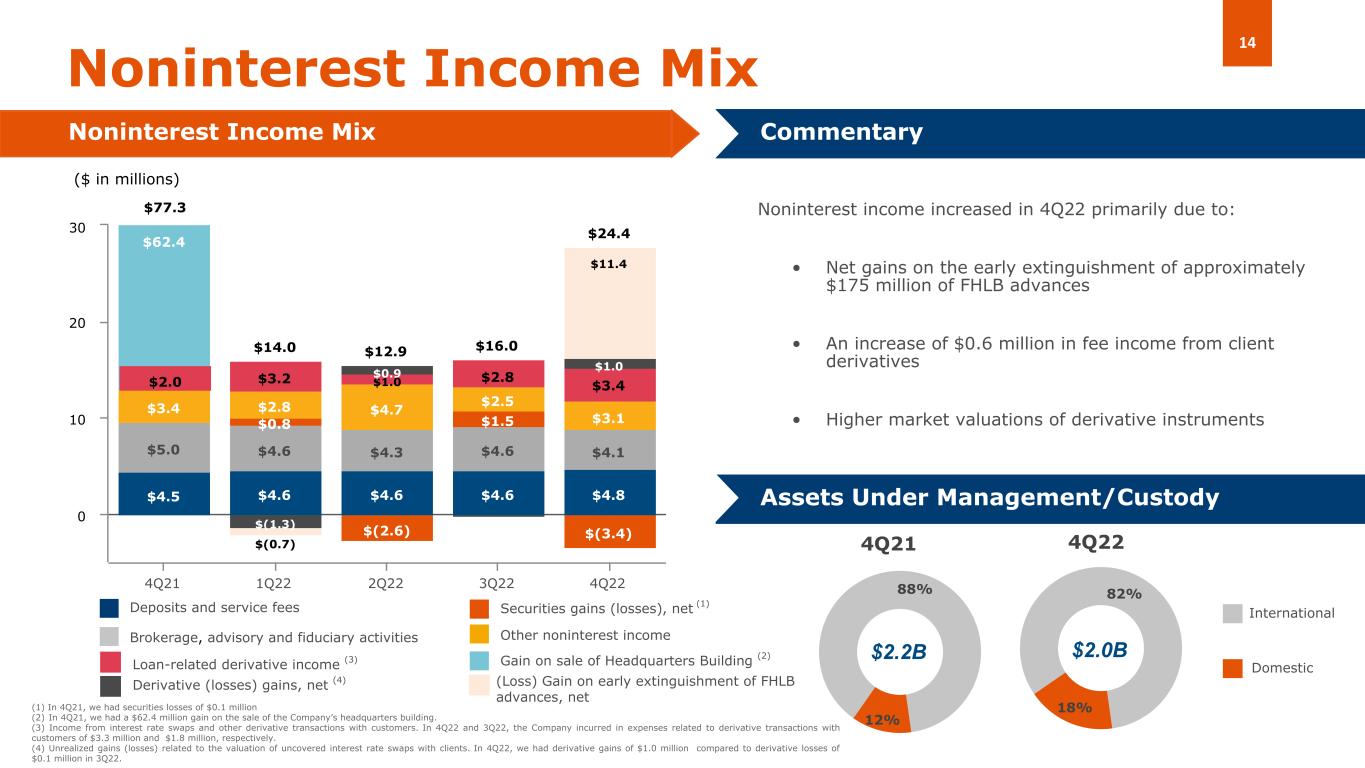

14 $14.0 $12.9 $16.0 $24.4 $4.5 $4.6 $4.6 $4.6 $4.8 $5.0 $4.6 $4.3 $4.6 $4.1 $0.8 $(2.6) $1.5 $(3.4) $3.4 $2.8 $4.7 $2.5 $3.1 $62.4 $3.2 $1.0 $2.8 $3.4 $(1.3) $0.9 $1.0 $(0.7) $11.4 4Q21 1Q22 2Q22 3Q22 4Q22 0 10 20 30 12% 88% 18% 82% Noninterest Income Mix Noninterest Income Mix Commentary Noninterest income increased in 4Q22 primarily due to: • Net gains on the early extinguishment of approximately $175 million of FHLB advances • An increase of $0.6 million in fee income from client derivatives • Higher market valuations of derivative instruments Assets Under Management/Custody Deposits and service fees Brokerage, advisory and fiduciary activities Other noninterest income $2.0B Domestic International 4Q224Q21 $2.2B ($ in millions) Securities gains (losses), net (1) $77.3 Gain on sale of Headquarters Building (2) Loan-related derivative income (3) Derivative (losses) gains, net (4) (1) In 4Q21, we had securities losses of $0.1 million (2) In 4Q21, we had a $62.4 million gain on the sale of the Company’s headquarters building. (3) Income from interest rate swaps and other derivative transactions with customers. In 4Q22 and 3Q22, the Company incurred in expenses related to derivative transactions with customers of $3.3 million and $1.8 million, respectively. (4) Unrealized gains (losses) related to the valuation of uncovered interest rate swaps with clients. In 4Q22, we had derivative gains of $1.0 million compared to derivative losses of $0.1 million in 3Q22. $2.0 (Loss) Gain on early extinguishment of FHLB advances, net

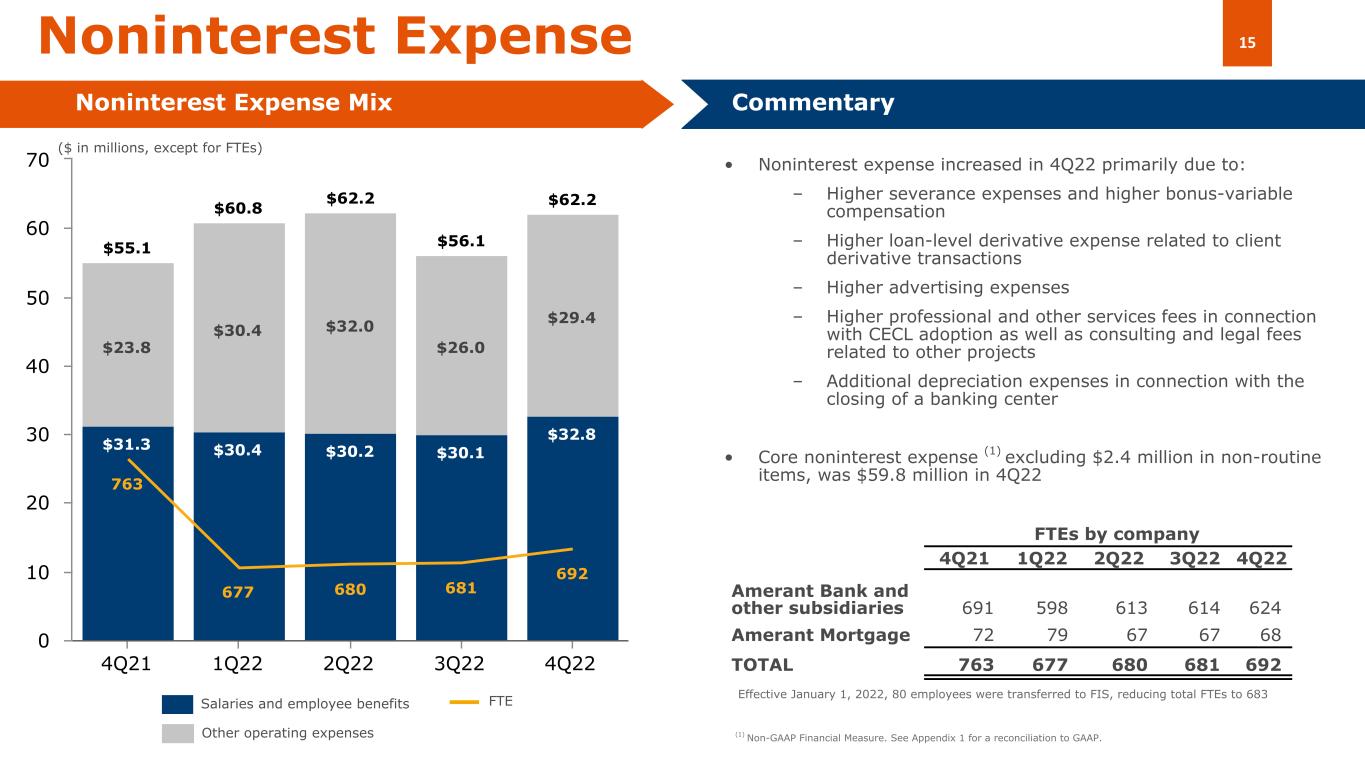

15 • Noninterest expense increased in 4Q22 primarily due to: – Higher severance expenses and higher bonus-variable compensation – Higher loan-level derivative expense related to client derivative transactions – Higher advertising expenses – Higher professional and other services fees in connection with CECL adoption as well as consulting and legal fees related to other projects – Additional depreciation expenses in connection with the closing of a banking center • Core noninterest expense (1) excluding $2.4 million in non-routine items, was $59.8 million in 4Q22 $55.1 $60.8 $62.2 $56.1 $62.2 $31.3 $30.4 $30.2 $30.1 $32.8 $23.8 $30.4 $32.0 $26.0 $29.4 763 677 680 681 692 4Q21 1Q22 2Q22 3Q22 4Q22 0 10 20 30 40 50 60 70 Noninterest Expense Noninterest Expense Mix Commentary Other operating expenses Salaries and employee benefits FTE ($ in millions, except for FTEs) FTEs by company 4Q21 1Q22 2Q22 3Q22 4Q22 Amerant Bank and other subsidiaries 691 598 613 614 624 Amerant Mortgage 72 79 67 67 68 TOTAL 763 677 680 681 692 Effective January 1, 2022, 80 employees were transferred to FIS, reducing total FTEs to 683 (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP.

Closing Remarks

Supplemental Loan Portfolio Information

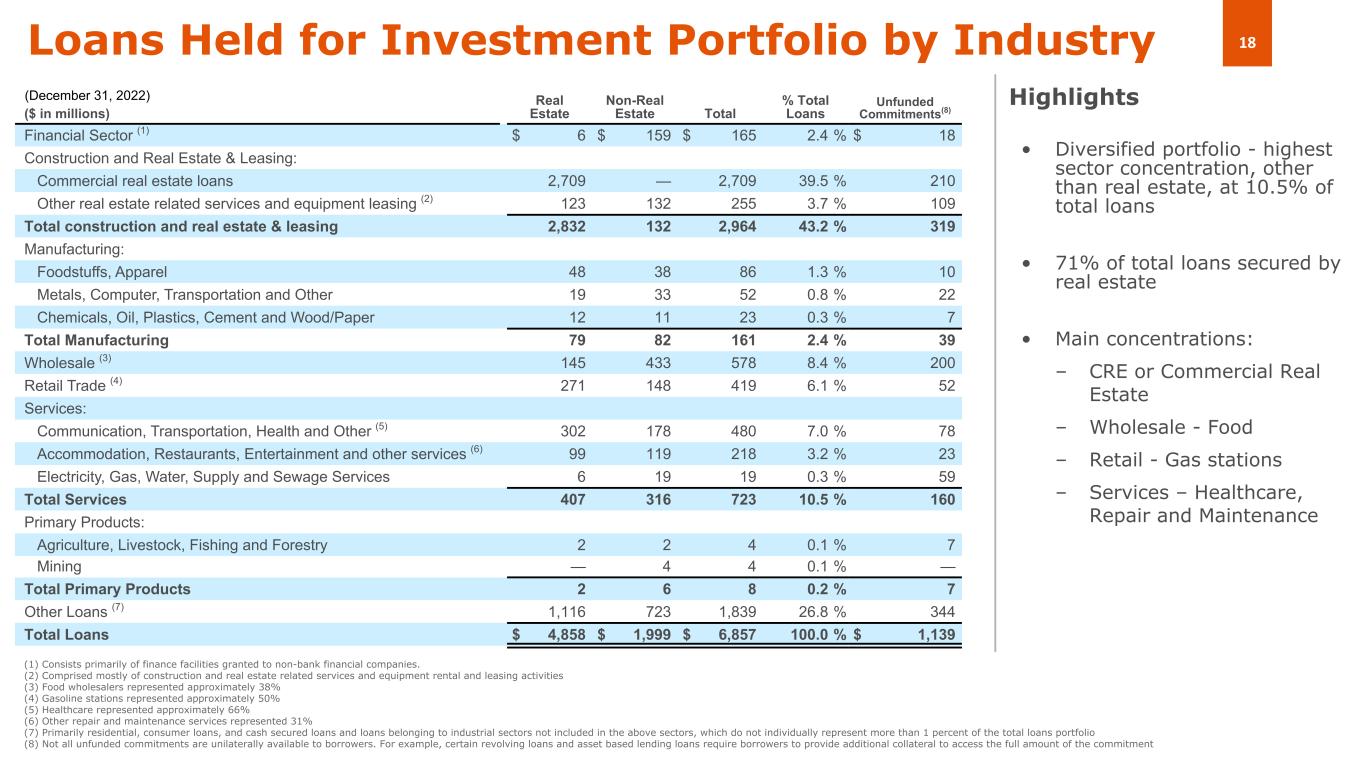

18Loans Held for Investment Portfolio by Industry • Diversified portfolio - highest sector concentration, other than real estate, at 10.5% of total loans • 71% of total loans secured by real estate • Main concentrations: – CRE or Commercial Real Estate – Wholesale - Food – Retail - Gas stations – Services – Healthcare, Repair and Maintenance Highlights (1) Consists primarily of finance facilities granted to non-bank financial companies. (2) Comprised mostly of construction and real estate related services and equipment rental and leasing activities (3) Food wholesalers represented approximately 38% (4) Gasoline stations represented approximately 50% (5) Healthcare represented approximately 66% (6) Other repair and maintenance services represented 31% (7) Primarily residential, consumer loans, and cash secured loans and loans belonging to industrial sectors not included in the above sectors, which do not individually represent more than 1 percent of the total loans portfolio (8) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers to provide additional collateral to access the full amount of the commitment ($ in millions) Real Estate Non-Real Estate Total % Total Loans Unfunded Commitments(8) Financial Sector (1) $ 6 $ 159 $ 165 2.4 % $ 18 Construction and Real Estate & Leasing: Commercial real estate loans 2,709 — 2,709 39.5 % 210 Other real estate related services and equipment leasing (2) 123 132 255 3.7 % 109 Total construction and real estate & leasing 2,832 132 2,964 43.2 % 319 Manufacturing: Foodstuffs, Apparel 48 38 86 1.3 % 10 Metals, Computer, Transportation and Other 19 33 52 0.8 % 22 Chemicals, Oil, Plastics, Cement and Wood/Paper 12 11 23 0.3 % 7 Total Manufacturing 79 82 161 2.4 % 39 Wholesale (3) 145 433 578 8.4 % 200 Retail Trade (4) 271 148 419 6.1 % 52 Services: Communication, Transportation, Health and Other (5) 302 178 480 7.0 % 78 Accommodation, Restaurants, Entertainment and other services (6) 99 119 218 3.2 % 23 Electricity, Gas, Water, Supply and Sewage Services 6 19 19 0.3 % 59 Total Services 407 316 723 10.5 % 160 Primary Products: Agriculture, Livestock, Fishing and Forestry 2 2 4 0.1 % 7 Mining — 4 4 0.1 % — Total Primary Products 2 6 8 0.2 % 7 Other Loans (7) 1,116 723 1,839 26.8 % 344 Total Loans $ 4,858 $ 1,999 $ 6,857 100.0 % $ 1,139 (December 31, 2022)

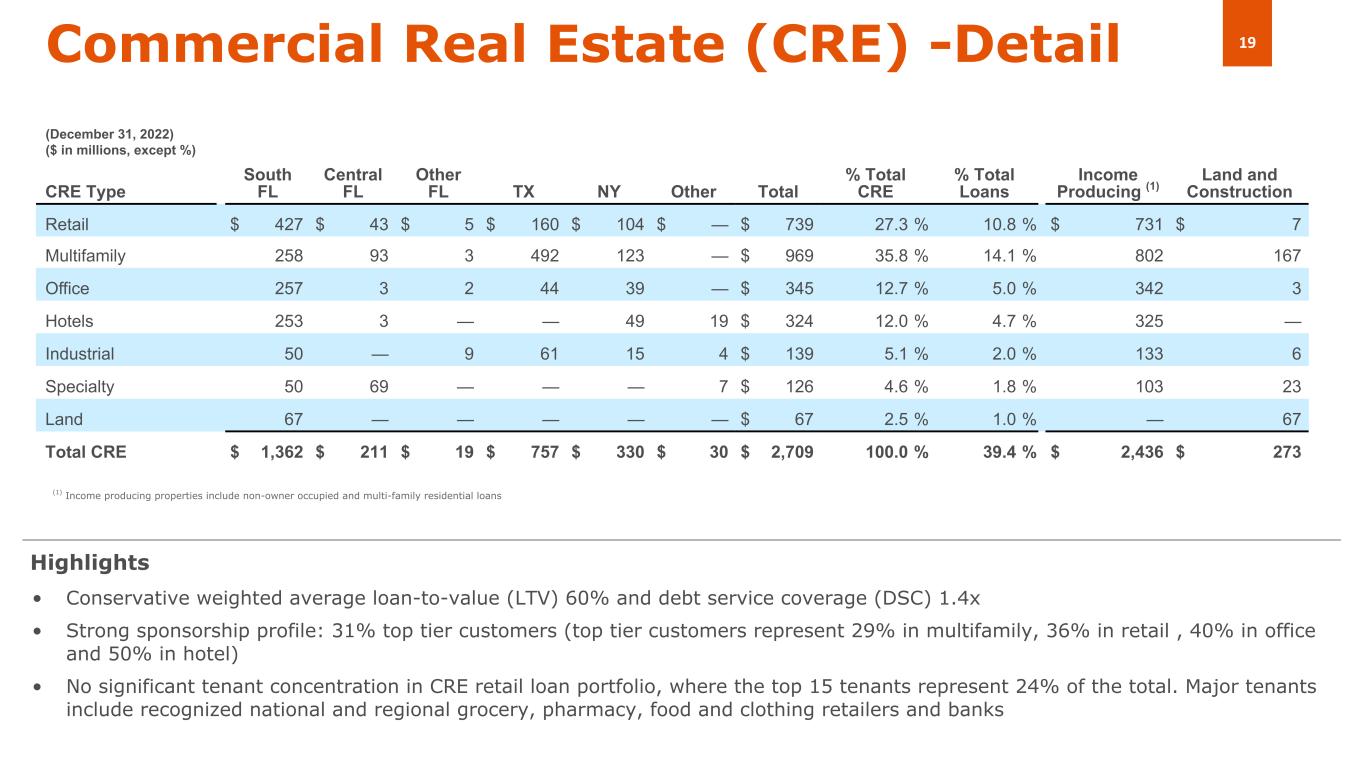

19Commercial Real Estate (CRE) -Detail CRE Type South FL Central FL Other FL TX NY Other Total % Total CRE % Total Loans Income Producing (1) Land and Construction Retail $ 427 $ 43 $ 5 $ 160 $ 104 $ — $ 739 27.3 % 10.8 % $ 731 $ 7 Multifamily 258 93 3 492 123 — $ 969 35.8 % 14.1 % 802 167 Office 257 3 2 44 39 — $ 345 12.7 % 5.0 % 342 3 Hotels 253 3 — — 49 19 $ 324 12.0 % 4.7 % 325 — Industrial 50 — 9 61 15 4 $ 139 5.1 % 2.0 % 133 6 Specialty 50 69 — — — 7 $ 126 4.6 % 1.8 % 103 23 Land 67 — — — — — $ 67 2.5 % 1.0 % — 67 Total CRE $ 1,362 $ 211 $ 19 $ 757 $ 330 $ 30 $ 2,709 100.0 % 39.4 % $ 2,436 $ 273 • Conservative weighted average loan-to-value (LTV) 60% and debt service coverage (DSC) 1.4x • Strong sponsorship profile: 31% top tier customers (top tier customers represent 29% in multifamily, 36% in retail , 40% in office and 50% in hotel) • No significant tenant concentration in CRE retail loan portfolio, where the top 15 tenants represent 24% of the total. Major tenants include recognized national and regional grocery, pharmacy, food and clothing retailers and banks Highlights (December 31, 2022) ($ in millions, except %) (1) Income producing properties include non-owner occupied and multi-family residential loans

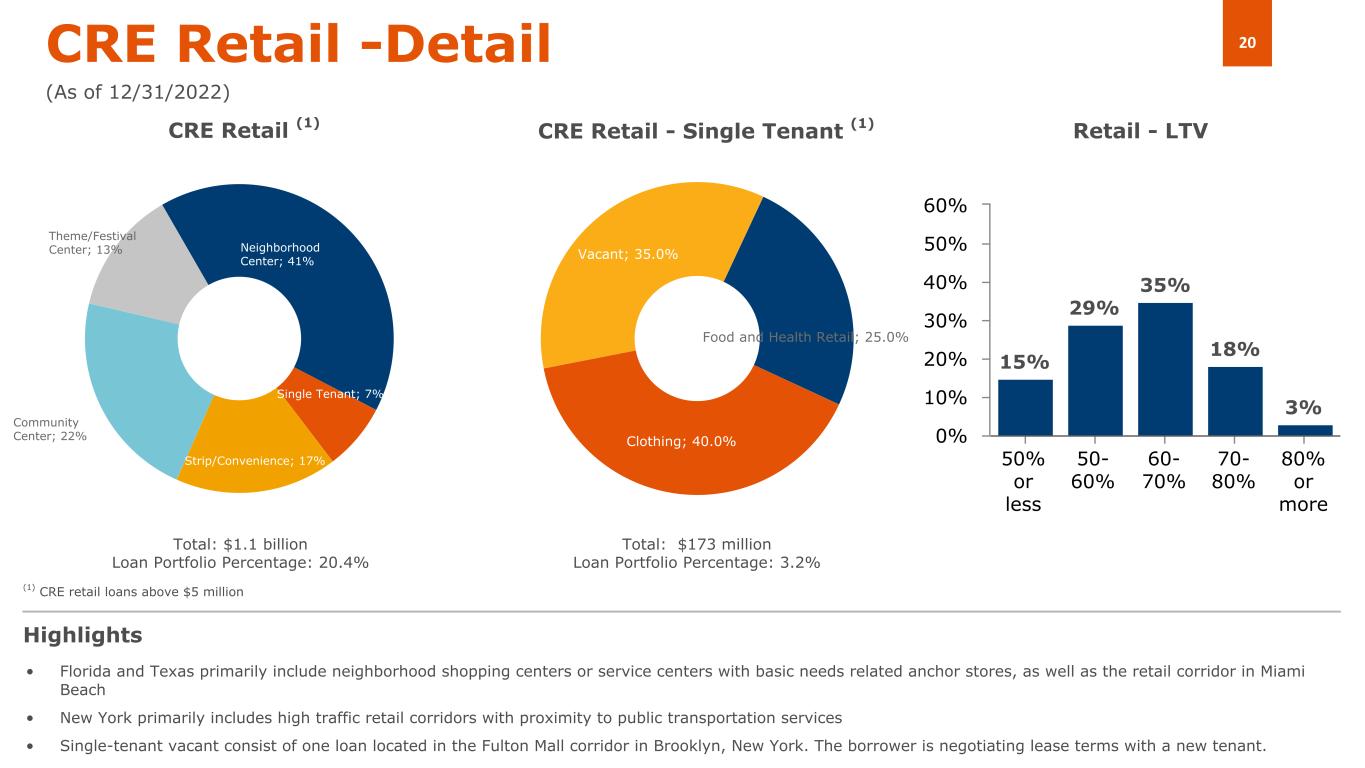

20 15% 29% 35% 18% 3% 50% or less 50- 60% 60- 70% 70- 80% 80% or more 0% 10% 20% 30% 40% 50% 60% CRE Retail -Detail (As of 12/31/2022) • Florida and Texas primarily include neighborhood shopping centers or service centers with basic needs related anchor stores, as well as the retail corridor in Miami Beach • New York primarily includes high traffic retail corridors with proximity to public transportation services • Single-tenant vacant consist of one loan located in the Fulton Mall corridor in Brooklyn, New York. The borrower is negotiating lease terms with a new tenant. Highlights CRE Retail (1) Retail - LTV Food and Health Retail; 25.0% Clothing; 40.0% Vacant; 35.0% CRE Retail - Single Tenant (1) (1) CRE retail loans above $5 million Total: $1.1 billion Loan Portfolio Percentage: 20.4% Total: $173 million Loan Portfolio Percentage: 3.2% Neighborhood Center; 41% Single Tenant; 7% Strip/Convenience; 17% Community Center; 22% Theme/Festival Center; 13%

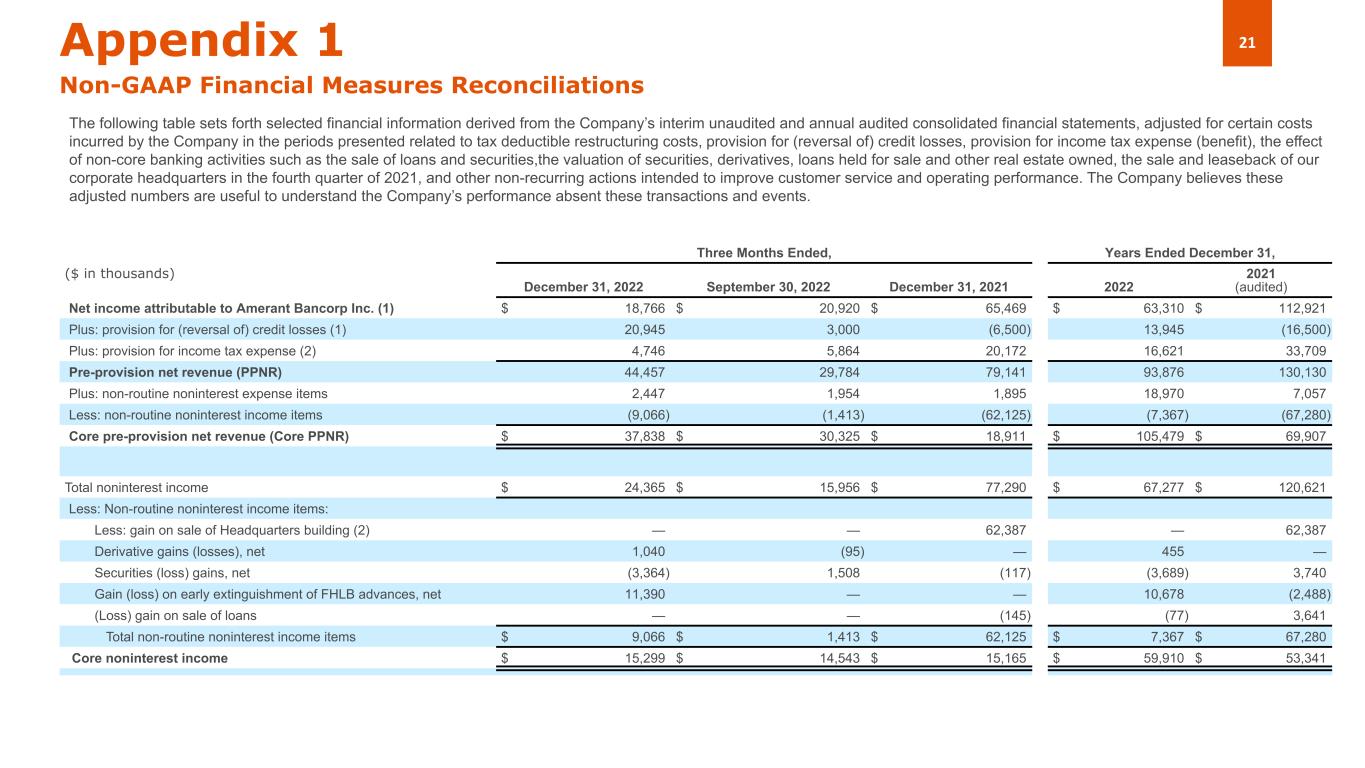

21Appendix 1 Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related to tax deductible restructuring costs, provision for (reversal of) credit losses, provision for income tax expense (benefit), the effect of non-core banking activities such as the sale of loans and securities,the valuation of securities, derivatives, loans held for sale and other real estate owned, the sale and leaseback of our corporate headquarters in the fourth quarter of 2021, and other non-recurring actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events. Three Months Ended, Years Ended December 31, ($ in thousands) December 31, 2022 September 30, 2022 December 31, 2021 2022 2021 (audited) Net income attributable to Amerant Bancorp Inc. (1) $ 18,766 $ 20,920 $ 65,469 $ 63,310 $ 112,921 Plus: provision for (reversal of) credit losses (1) 20,945 3,000 (6,500) 13,945 (16,500) Plus: provision for income tax expense (2) 4,746 5,864 20,172 16,621 33,709 Pre-provision net revenue (PPNR) 44,457 29,784 79,141 93,876 130,130 Plus: non-routine noninterest expense items 2,447 1,954 1,895 18,970 7,057 Less: non-routine noninterest income items (9,066) (1,413) (62,125) (7,367) (67,280) Core pre-provision net revenue (Core PPNR) $ 37,838 $ 30,325 $ 18,911 $ 105,479 $ 69,907 Total noninterest income $ 24,365 $ 15,956 $ 77,290 $ 67,277 $ 120,621 Less: Non-routine noninterest income items: Less: gain on sale of Headquarters building (2) — — 62,387 — 62,387 Derivative gains (losses), net 1,040 (95) — 455 — Securities (loss) gains, net (3,364) 1,508 (117) (3,689) 3,740 Gain (loss) on early extinguishment of FHLB advances, net 11,390 — — 10,678 (2,488) (Loss) gain on sale of loans — — (145) (77) 3,641 Total non-routine noninterest income items $ 9,066 $ 1,413 $ 62,125 $ 7,367 $ 67,280 Core noninterest income $ 15,299 $ 14,543 $ 15,165 $ 59,910 $ 53,341

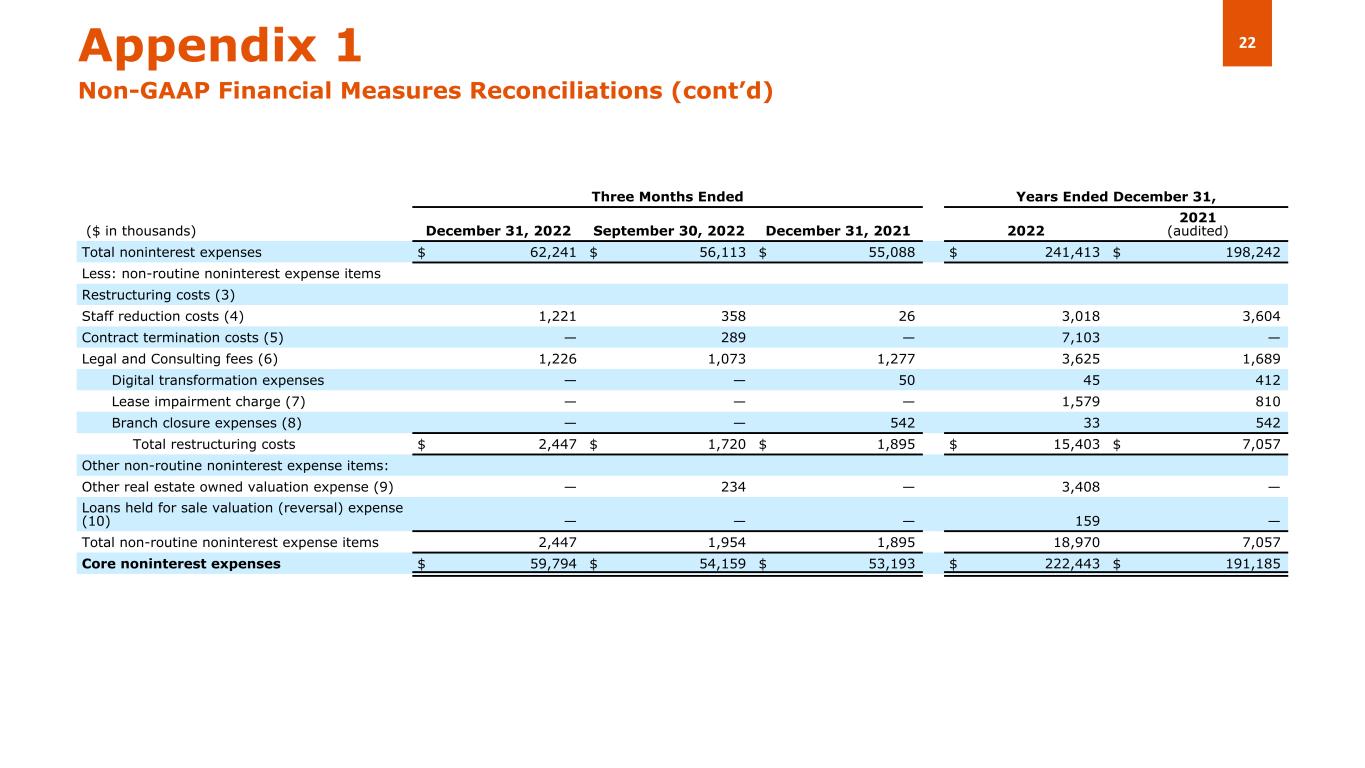

22 Three Months Ended Years Ended December 31, ($ in thousands) December 31, 2022 September 30, 2022 December 31, 2021 2022 2021 (audited) Total noninterest expenses $ 62,241 $ 56,113 $ 55,088 $ 241,413 $ 198,242 Less: non-routine noninterest expense items Restructuring costs (3) Staff reduction costs (4) 1,221 358 26 3,018 3,604 Contract termination costs (5) — 289 — 7,103 — Legal and Consulting fees (6) 1,226 1,073 1,277 3,625 1,689 Digital transformation expenses — — 50 45 412 Lease impairment charge (7) — — — 1,579 810 Branch closure expenses (8) — — 542 33 542 Total restructuring costs $ 2,447 $ 1,720 $ 1,895 $ 15,403 $ 7,057 Other non-routine noninterest expense items: Other real estate owned valuation expense (9) — 234 — 3,408 — Loans held for sale valuation (reversal) expense (10) — — — 159 — Total non-routine noninterest expense items 2,447 1,954 1,895 18,970 7,057 Core noninterest expenses $ 59,794 $ 54,159 $ 53,193 $ 222,443 $ 191,185 Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d)

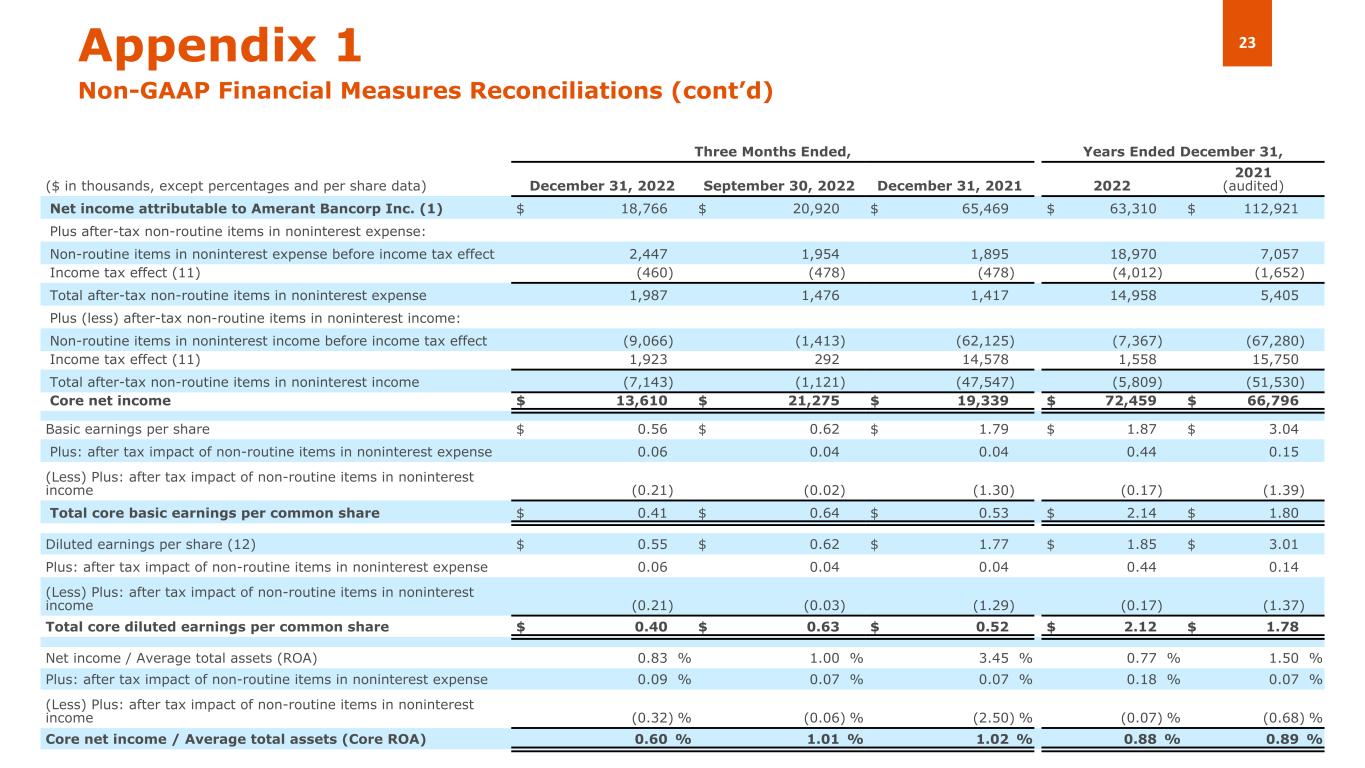

23Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, Years Ended December 31, ($ in thousands, except percentages and per share data) December 31, 2022 September 30, 2022 December 31, 2021 2022 2021 (audited) Net income attributable to Amerant Bancorp Inc. (1) $ 18,766 $ 20,920 $ 65,469 $ 63,310 $ 112,921 Plus after-tax non-routine items in noninterest expense: Non-routine items in noninterest expense before income tax effect 2,447 1,954 1,895 18,970 7,057 Income tax effect (11) (460) (478) (478) (4,012) (1,652) Total after-tax non-routine items in noninterest expense 1,987 1,476 1,417 14,958 5,405 Plus (less) after-tax non-routine items in noninterest income: Non-routine items in noninterest income before income tax effect (9,066) (1,413) (62,125) (7,367) (67,280) Income tax effect (11) 1,923 292 14,578 1,558 15,750 Total after-tax non-routine items in noninterest income (7,143) (1,121) (47,547) (5,809) (51,530) Core net income $ 13,610 $ 21,275 $ 19,339 $ 72,459 $ 66,796 Basic earnings per share $ 0.56 $ 0.62 $ 1.79 $ 1.87 $ 3.04 Plus: after tax impact of non-routine items in noninterest expense 0.06 0.04 0.04 0.44 0.15 (Less) Plus: after tax impact of non-routine items in noninterest income (0.21) (0.02) (1.30) (0.17) (1.39) Total core basic earnings per common share $ 0.41 $ 0.64 $ 0.53 $ 2.14 $ 1.80 Diluted earnings per share (12) $ 0.55 $ 0.62 $ 1.77 $ 1.85 $ 3.01 Plus: after tax impact of non-routine items in noninterest expense 0.06 0.04 0.04 0.44 0.14 (Less) Plus: after tax impact of non-routine items in noninterest income (0.21) (0.03) (1.29) (0.17) (1.37) Total core diluted earnings per common share $ 0.40 $ 0.63 $ 0.52 $ 2.12 $ 1.78 Net income / Average total assets (ROA) 0.83 % 1.00 % 3.45 % 0.77 % 1.50 % Plus: after tax impact of non-routine items in noninterest expense 0.09 % 0.07 % 0.07 % 0.18 % 0.07 % (Less) Plus: after tax impact of non-routine items in noninterest income (0.32) % (0.06) % (2.50) % (0.07) % (0.68) % Core net income / Average total assets (Core ROA) 0.60 % 1.01 % 1.02 % 0.88 % 0.89 %

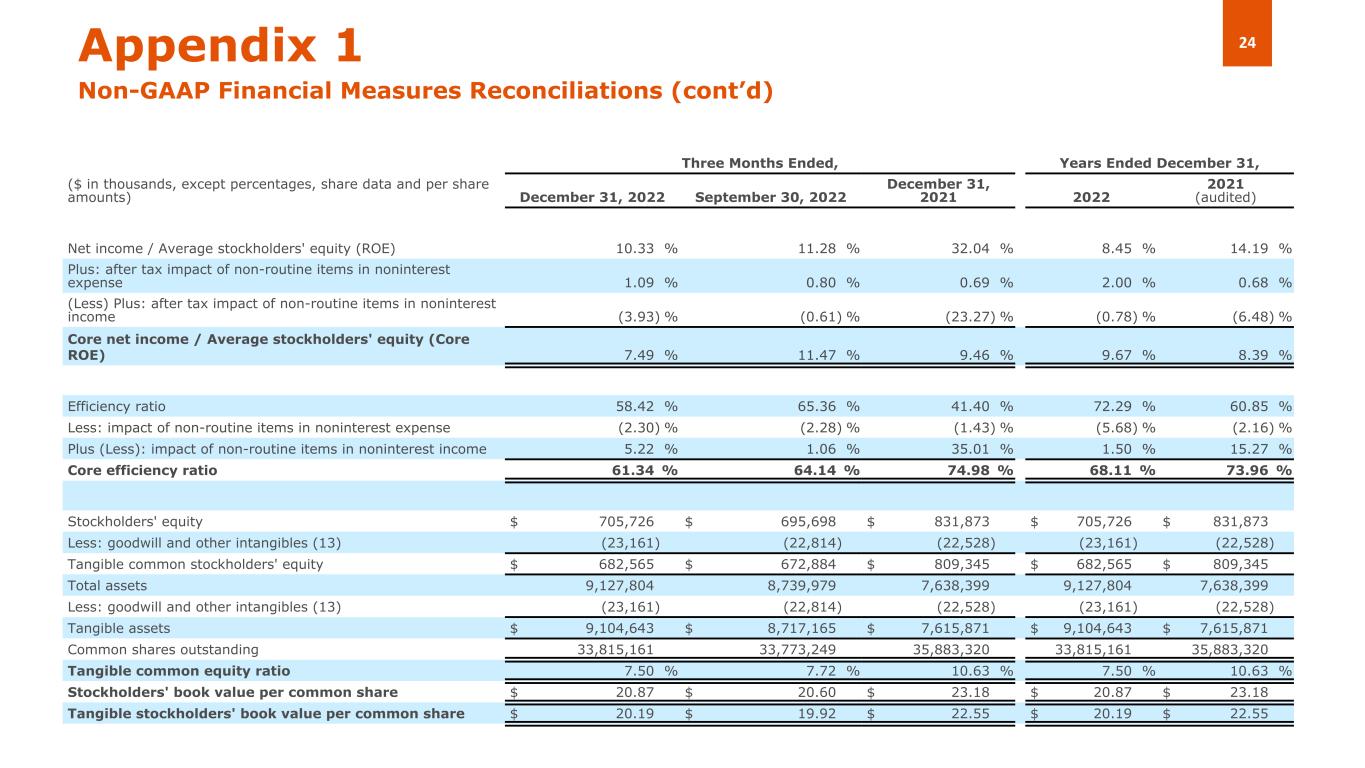

24 Three Months Ended, Years Ended December 31, ($ in thousands, except percentages, share data and per share amounts) December 31, 2022 September 30, 2022 December 31, 2021 2022 2021 (audited) Net income / Average stockholders' equity (ROE) 10.33 % 11.28 % 32.04 % 8.45 % 14.19 % Plus: after tax impact of non-routine items in noninterest expense 1.09 % 0.80 % 0.69 % 2.00 % 0.68 % (Less) Plus: after tax impact of non-routine items in noninterest income (3.93) % (0.61) % (23.27) % (0.78) % (6.48) % Core net income / Average stockholders' equity (Core ROE) 7.49 % 11.47 % 9.46 % 9.67 % 8.39 % Efficiency ratio 58.42 % 65.36 % 41.40 % 72.29 % 60.85 % Less: impact of non-routine items in noninterest expense (2.30) % (2.28) % (1.43) % (5.68) % (2.16) % Plus (Less): impact of non-routine items in noninterest income 5.22 % 1.06 % 35.01 % 1.50 % 15.27 % Core efficiency ratio 61.34 % 64.14 % 74.98 % 68.11 % 73.96 % Stockholders' equity $ 705,726 $ 695,698 $ 831,873 $ 705,726 $ 831,873 Less: goodwill and other intangibles (13) (23,161) (22,814) (22,528) (23,161) (22,528) Tangible common stockholders' equity $ 682,565 $ 672,884 $ 809,345 $ 682,565 $ 809,345 Total assets 9,127,804 8,739,979 7,638,399 9,127,804 7,638,399 Less: goodwill and other intangibles (13) (23,161) (22,814) (22,528) (23,161) (22,528) Tangible assets $ 9,104,643 $ 8,717,165 $ 7,615,871 $ 9,104,643 $ 7,615,871 Common shares outstanding 33,815,161 33,773,249 35,883,320 33,815,161 35,883,320 Tangible common equity ratio 7.50 % 7.72 % 10.63 % 7.50 % 10.63 % Stockholders' book value per common share $ 20.87 $ 20.60 $ 23.18 $ 20.87 $ 23.18 Tangible stockholders' book value per common share $ 20.19 $ 19.92 $ 22.55 $ 20.19 $ 22.55 Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d)

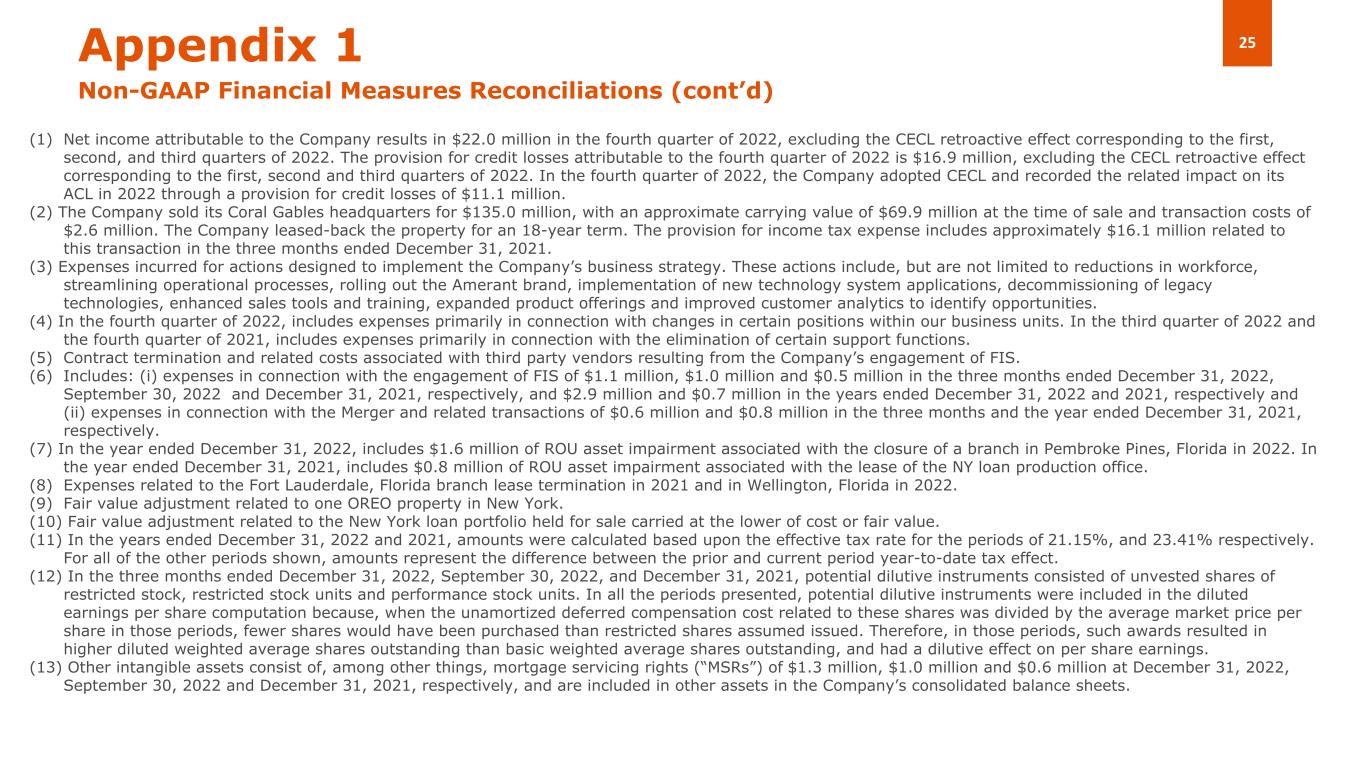

25 (1) Net income attributable to the Company results in $22.0 million in the fourth quarter of 2022, excluding the CECL retroactive effect corresponding to the first, second, and third quarters of 2022. The provision for credit losses attributable to the fourth quarter of 2022 is $16.9 million, excluding the CECL retroactive effect corresponding to the first, second and third quarters of 2022. In the fourth quarter of 2022, the Company adopted CECL and recorded the related impact on its ACL in 2022 through a provision for credit losses of $11.1 million. (2) The Company sold its Coral Gables headquarters for $135.0 million, with an approximate carrying value of $69.9 million at the time of sale and transaction costs of $2.6 million. The Company leased-back the property for an 18-year term. The provision for income tax expense includes approximately $16.1 million related to this transaction in the three months ended December 31, 2021. (3) Expenses incurred for actions designed to implement the Company’s business strategy. These actions include, but are not limited to reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, decommissioning of legacy technologies, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (4) In the fourth quarter of 2022, includes expenses primarily in connection with changes in certain positions within our business units. In the third quarter of 2022 and the fourth quarter of 2021, includes expenses primarily in connection with the elimination of certain support functions. (5) Contract termination and related costs associated with third party vendors resulting from the Company’s engagement of FIS. (6) Includes: (i) expenses in connection with the engagement of FIS of $1.1 million, $1.0 million and $0.5 million in the three months ended December 31, 2022, September 30, 2022 and December 31, 2021, respectively, and $2.9 million and $0.7 million in the years ended December 31, 2022 and 2021, respectively and (ii) expenses in connection with the Merger and related transactions of $0.6 million and $0.8 million in the three months and the year ended December 31, 2021, respectively. (7) In the year ended December 31, 2022, includes $1.6 million of ROU asset impairment associated with the closure of a branch in Pembroke Pines, Florida in 2022. In the year ended December 31, 2021, includes $0.8 million of ROU asset impairment associated with the lease of the NY loan production office. (8) Expenses related to the Fort Lauderdale, Florida branch lease termination in 2021 and in Wellington, Florida in 2022. (9) Fair value adjustment related to one OREO property in New York. (10) Fair value adjustment related to the New York loan portfolio held for sale carried at the lower of cost or fair value. (11) In the years ended December 31, 2022 and 2021, amounts were calculated based upon the effective tax rate for the periods of 21.15%, and 23.41% respectively. For all of the other periods shown, amounts represent the difference between the prior and current period year-to-date tax effect. (12) In the three months ended December 31, 2022, September 30, 2022, and December 31, 2021, potential dilutive instruments consisted of unvested shares of restricted stock, restricted stock units and performance stock units. In all the periods presented, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in those periods, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in those periods, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect on per share earnings. (13) Other intangible assets consist of, among other things, mortgage servicing rights (“MSRs”) of $1.3 million, $1.0 million and $0.6 million at December 31, 2022, September 30, 2022 and December 31, 2021, respectively, and are included in other assets in the Company’s consolidated balance sheets. Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d)

Thank you Investor Relations InvestorRelations@amerantbank.com