Earnings Call April 21, 2023 First Quarter 2023

2 Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2022 filed on March 1, 2023 (the "Form 10-K"), and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including the three month periods ended March 31, 2023, December 31, 2022 and March, 31 2022, may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2023, or any other period of time or date. As previously disclosed in the Form 10-K, the Company adopted the new guidance on accounting for current expected credit losses on financial instruments (“CECL”) effective as of January 1, 2022. Quarterly amounts previously reported on our quarterly reports on Form 10-Q for the periods ended March 31, 2022, June 30, 2022 and September 30, 2022 do not reflect the adoption of CECL. In the fourth quarter of 2022, the Company recorded a provision for credit losses totaling $20.9 million, including $11.1 million related to the retroactive effect of adopting CECL for all previous quarterly periods in the year ended December 31, 2022, including loan growth and changes to macro-economic conditions during the period. Recast amounts included in the earnings release and accompanying presentation reflect the impacts of the adoption of CECL on each interim period of 2022. See the Form 10-K for more details on the adoption of CECL and related effects to quarterly results for each quarter in the year ended December 31, 2022. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “pre-provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expenses”, “core net income”, “core earnings per share (basic and diluted)”, “core return on assets (Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, “tangible stockholders’ equity book value per common share”, “tangible common equity ratio, adjusted for unrealized losses on debt securities held to maturity”, and “tangible stockholders' book value per common share, adjusted for unrealized losses on debt securities held to maturity”, and "tangible stockholders' book value per common share, adjusted for unrealized losses on securities held to maturity". This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued in 2023, including the effect of non-core banking activities such as the sale of loans and securities, the valuation of securities, derivatives, loans held for sale and other real estate owned, early repayment of FHLB advances, and other non-recurring actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. Exhibit 2 reconciles these non-GAAP financial measures to reported results. Important Notices and Disclaimers

3Performance Highlights 1Q23 Business • Net income attributable to the Company was $20.2 million in 1Q23 compared to $22.0 million in 4Q22(1) • Core pre-provision net revenue (Core PPNR)(2) was $37.1 million in 1Q23 compared to $37.8 million in 4Q22 • Diluted earnings per share (EPS) was $0.60 in 1Q23 compared to $0.65 in 4Q22(1) • Core diluted EPS(2) was $0.59 for 1Q23 compared to $0.50 for 4Q22(1) • Net Interest Margin (“NIM”) was 3.90% in 1Q23 compared to 3.96% in 4Q22 • Total assets increased $367.5 million, or 4.03%, to $9.5 billion compared to $9.1 billion as of the close of 4Q22 • Total gross loans increased $195.4 million, or 2.8%, to $7.12 billion compared to $6.92 billion in 4Q22 • Average yield on loans increased to 6.38% in 1Q23 compared to 5.85% in 4Q22 • Total deposits as of 1Q23 were $7.29 billion, up $242.5 million, or 3.4% compared to $7.04 billion in 4Q22 • Average cost of total deposits increased to 1.91% in 1Q23 compared to 1.38% in 4Q22 • Core deposits were $5.36 billion, up $41.4 million, or 0.8%, compared to $5.32 billion as of 4Q22 • Loan to deposit ratio improved to 97.64% compared to 98.23% in 4Q22 • AUM totaled $2.11 billion, up $111.9 million, or 5.6%, compared to $2.00 billion in 4Q22 Earnings Capital • All capital ratios continue to be substantially above "well-capitalized" levels • Quarterly cash dividend of $0.09 per share of Amerant common stock paid out on February 28, 2023 (1) As previously disclosed, the Company adopted CECL in the fourth quarter of 2022, effective as of January 1, 2022. See Form 10-K for more details on the CECL adoption and related effects to quarterly results for each quarter in the year ended December 31, 2022. (2) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP.

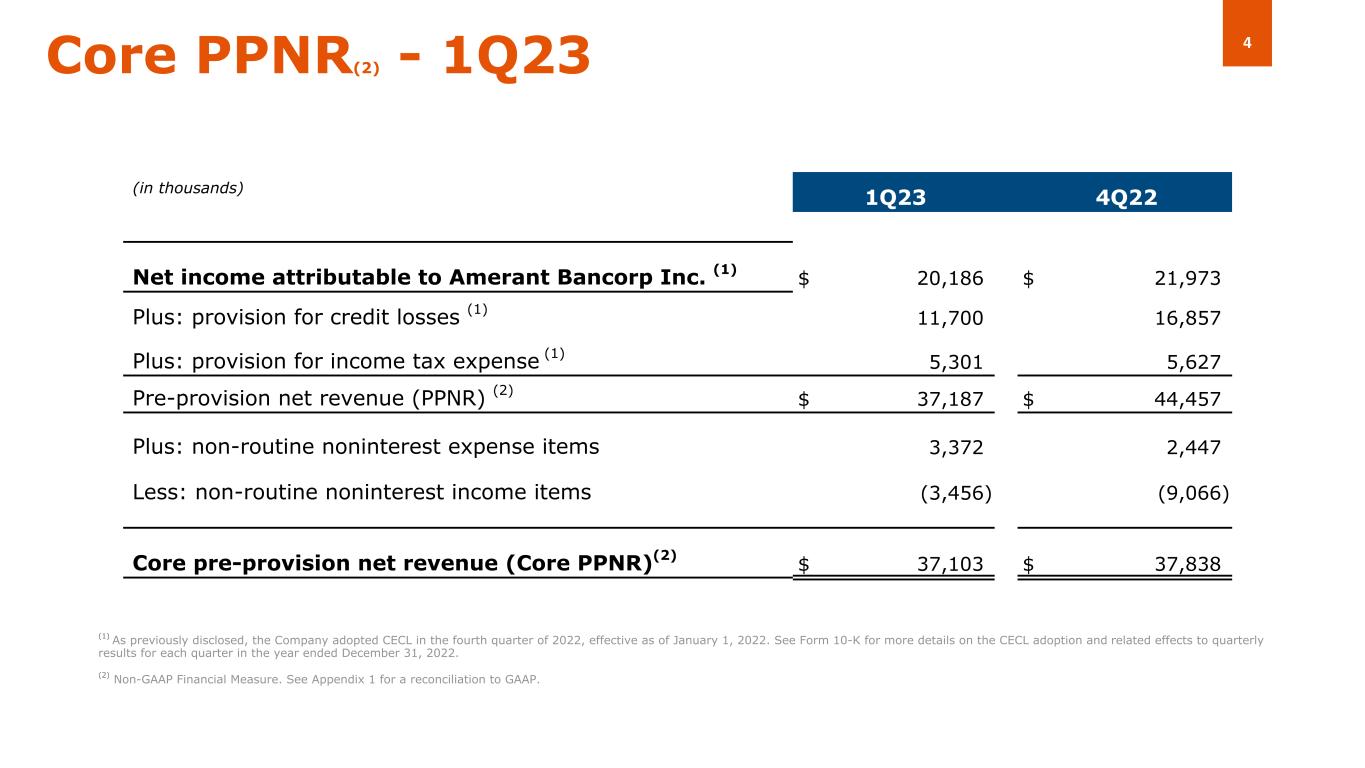

4Core PPNR(2) - 1Q23 (1) As previously disclosed, the Company adopted CECL in the fourth quarter of 2022, effective as of January 1, 2022. See Form 10-K for more details on the CECL adoption and related effects to quarterly results for each quarter in the year ended December 31, 2022. (2) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. (in 1Q23 4Q22 Net income attributable to Amerant Bancorp Inc. (1) $ 20,186 $ 21,973 Plus: provision for credit losses (1) 11,700 16,857 Plus: provision for income tax expense (1) 5,301 5,627 Pre-provision net revenue (PPNR) (2) $ 37,187 $ 44,457 Plus: non-routine noninterest expense items 3,372 2,447 Less: non-routine noninterest income items (3,456) (9,066) Core pre-provision net revenue (Core PPNR)(2) $ 37,103 $ 37,838 (in thousands)

5Key Actions of Note in 1Q23 • Continued to add key business development personnel in both Amerant Mortgage and Amerant Bank • Hired two senior executives for open positions: – New Head of Commercial Banking – New Houston market president • Amerant Mortgage grew its national footprint with the addition of a Midwest hub focused on Fannie Mae and Freddie Mac conforming loan production • Consolidated international banking units (retail, private banking and commercial) under one executive solely focused on driving international deposit growth • Completed relocation to a new highly efficient operations center in Miramar, FL • Closing FM 1960 Rd. Houston, TX in 2Q23 • Launched new Amerant website in February 2023 • Repurchased 22,403 shares of Class A common stock during 1Q23 under $25 million share repurchase program, prior to recent events impacting liquidity in the sector • FIS conversion date moved from mid-May to mid-July to provide greater digital experience for consumers • Appointed new board member, Ashaki Rucker, who officially joined the Board effective April 17, 2023

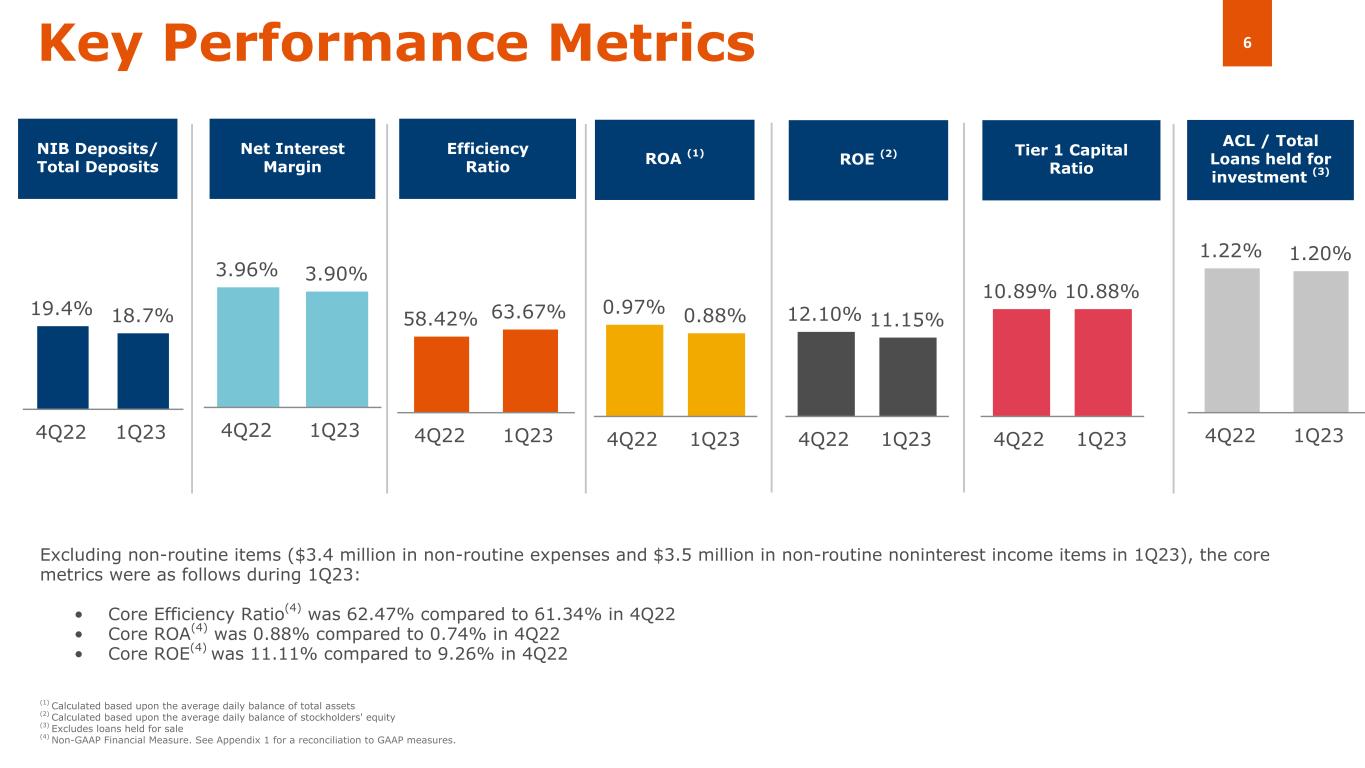

6 58.42% 63.67% 4Q22 1Q23 19.4% 18.7% 4Q22 1Q23 10.89% 10.88% 4Q22 1Q23 3.96% 3.90% 4Q22 1Q23 Key Performance Metrics NIB Deposits/ Total Deposits Tier 1 Capital Ratio Net Interest Margin Efficiency Ratio (1) Calculated based upon the average daily balance of total assets (2) Calculated based upon the average daily balance of stockholders' equity (3) Excludes loans held for sale (4) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP measures. 1.22% 1.20% 4Q22 1Q23 ACL / Total Loans held for investment (3) 0.97% 0.88% 4Q22 1Q23 ROA (1) 12.10% 11.15% 4Q22 1Q23 Excluding non-routine items ($3.4 million in non-routine expenses and $3.5 million in non-routine noninterest income items in 1Q23), the core metrics were as follows during 1Q23: • Core Efficiency Ratio(4) was 62.47% compared to 61.34% in 4Q22 • Core ROA(4) was 0.88% compared to 0.74% in 4Q22 • Core ROE(4) was 11.11% compared to 9.26% in 4Q22 ROE (2)

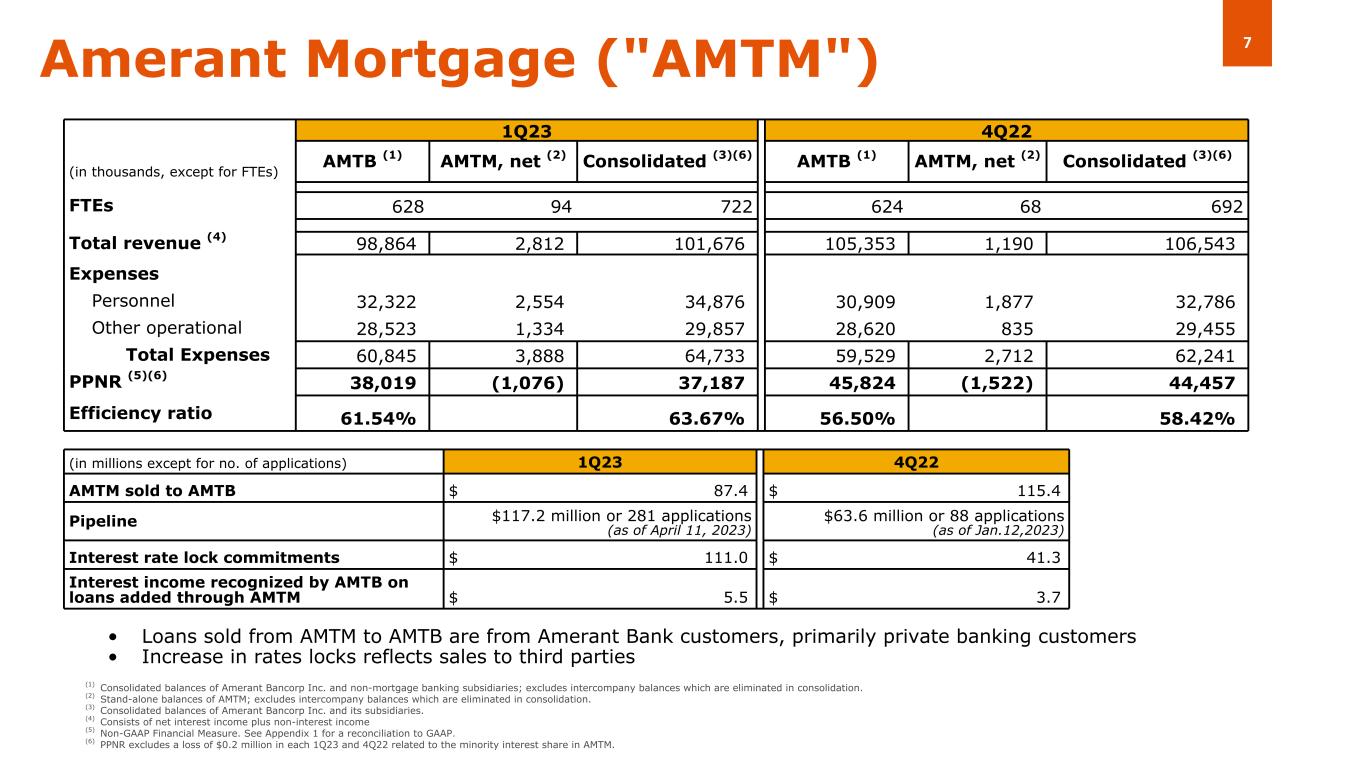

7Amerant Mortgage ("AMTM") 1Q23 4Q22 (in thousands, except for FTEs) AMTB (1) AMTM, net (2) Consolidated (3)(6) AMTB (1) AMTM, net (2) Consolidated (3)(6) FTEs 628 94 722 624 68 692 Total revenue (4) 98,864 2,812 101,676 105,353 1,190 106,543 Expenses Personnel 32,322 2,554 34,876 30,909 1,877 32,786 Other operational 28,523 1,334 29,857 28,620 835 29,455 Total Expenses 60,845 3,888 64,733 59,529 2,712 62,241 PPNR (5)(6) 38,019 (1,076) 37,187 45,824 (1,522) 44,457 Efficiency ratio 61.54 % 63.67 % 56.50 % 58.42 % (1) Consolidated balances of Amerant Bancorp Inc. and non-mortgage banking subsidiaries; excludes intercompany balances which are eliminated in consolidation. (2) Stand-alone balances of AMTM; excludes intercompany balances which are eliminated in consolidation. (3) Consolidated balances of Amerant Bancorp Inc. and its subsidiaries. (4) Consists of net interest income plus non-interest income (5) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. (6) PPNR excludes a loss of $0.2 million in each 1Q23 and 4Q22 related to the minority interest share in AMTM. (in millions except for no. of applications) 1Q23 4Q22 AMTM sold to AMTB $ 87.4 $ 115.4 Pipeline $117.2 million or 281 applications (as of April 11, 2023) $63.6 million or 88 applications (as of Jan.12,2023) Interest rate lock commitments $ 111.0 $ 41.3 Interest income recognized by AMTB on loans added through AMTM $ 5.5 $ 3.7 • Loans sold from AMTM to AMTB are from Amerant Bank customers, primarily private banking customers • Increase in rates locks reflects sales to third parties

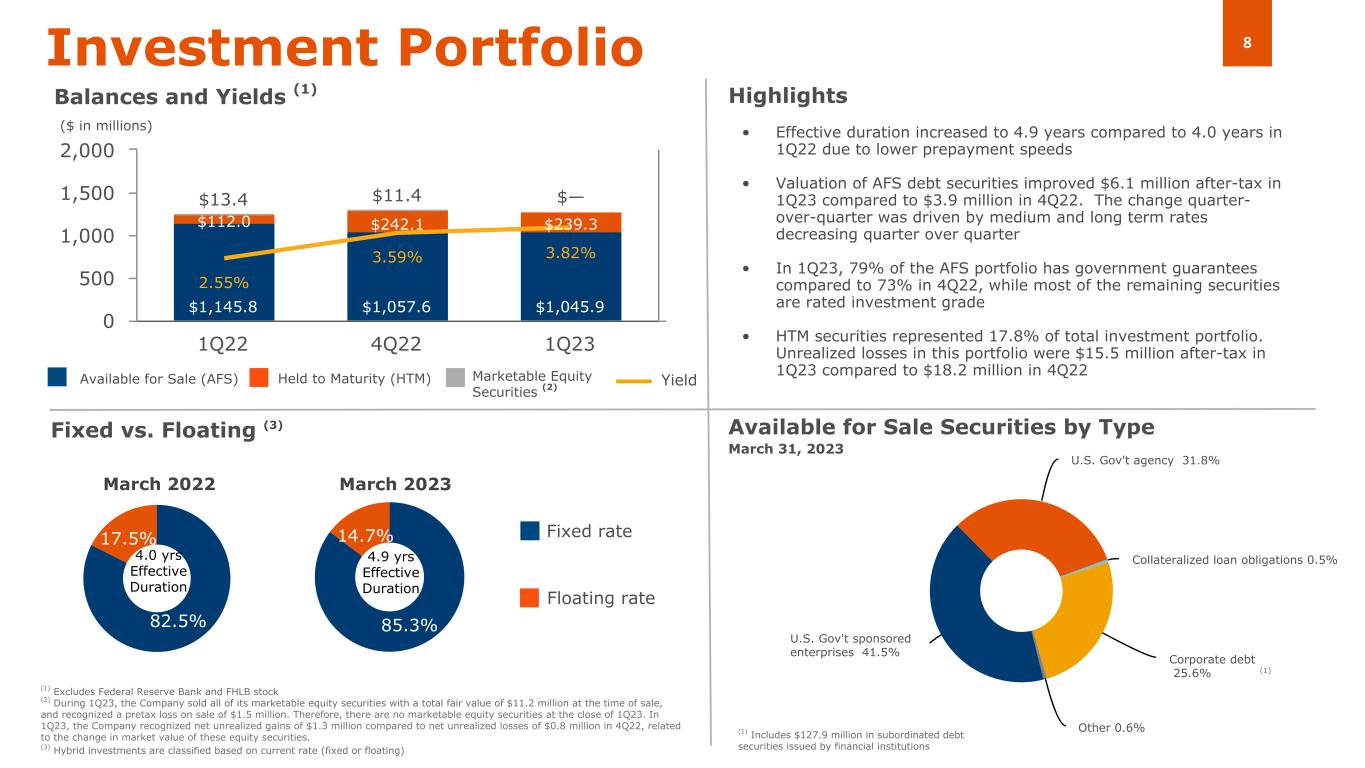

8 85.3% 14.7% U.S. Gov't sponsored enterprises 41.5% U.S. Gov't agency 31.8% Collateralized loan obligations 0.5% Corporate debt 25.6% Other 0.6% $1,145.8 $1,057.6 $1,045.9 $112.0 $242.1 $239.3 $13.4 $11.4 $— 2.55% 3.59% 3.82% 1Q22 4Q22 1Q23 0 500 1,000 1,500 2,000 82.5% 17.5% Investment Portfolio Balances and Yields (1) Available for Sale (AFS) Held to Maturity (HTM) Highlights Fixed vs. Floating (3) March 2022 March 2023 Floating rate Fixed rate Available for Sale Securities by Type March 31, 2023 4.0 yrs Effective Duration ($ in millions) Marketable Equity Securities (2) (1) Excludes Federal Reserve Bank and FHLB stock (2) During 1Q23, the Company sold all of its marketable equity securities with a total fair value of $11.2 million at the time of sale, and recognized a pretax loss on sale of $1.5 million. Therefore, there are no marketable equity securities at the close of 1Q23. In 1Q23, the Company recognized net unrealized gains of $1.3 million compared to net unrealized losses of $0.8 million in 4Q22, related to the change in market value of these equity securities. (3) Hybrid investments are classified based on current rate (fixed or floating) Yield 4.9 yrs Effective Duration • Effective duration increased to 4.9 years compared to 4.0 years in 1Q22 due to lower prepayment speeds • Valuation of AFS debt securities improved $6.1 million after-tax in 1Q23 compared to $3.9 million in 4Q22. The change quarter- over-quarter was driven by medium and long term rates decreasing quarter over quarter • In 1Q23, 79% of the AFS portfolio has government guarantees compared to 73% in 4Q22, while most of the remaining securities are rated investment grade • HTM securities represented 17.8% of total investment portfolio. Unrealized losses in this portfolio were $15.5 million after-tax in 1Q23 compared to $18.2 million in 4Q22 (1) Includes $127.9 million in subordinated debt securities issued by financial institutions (1)

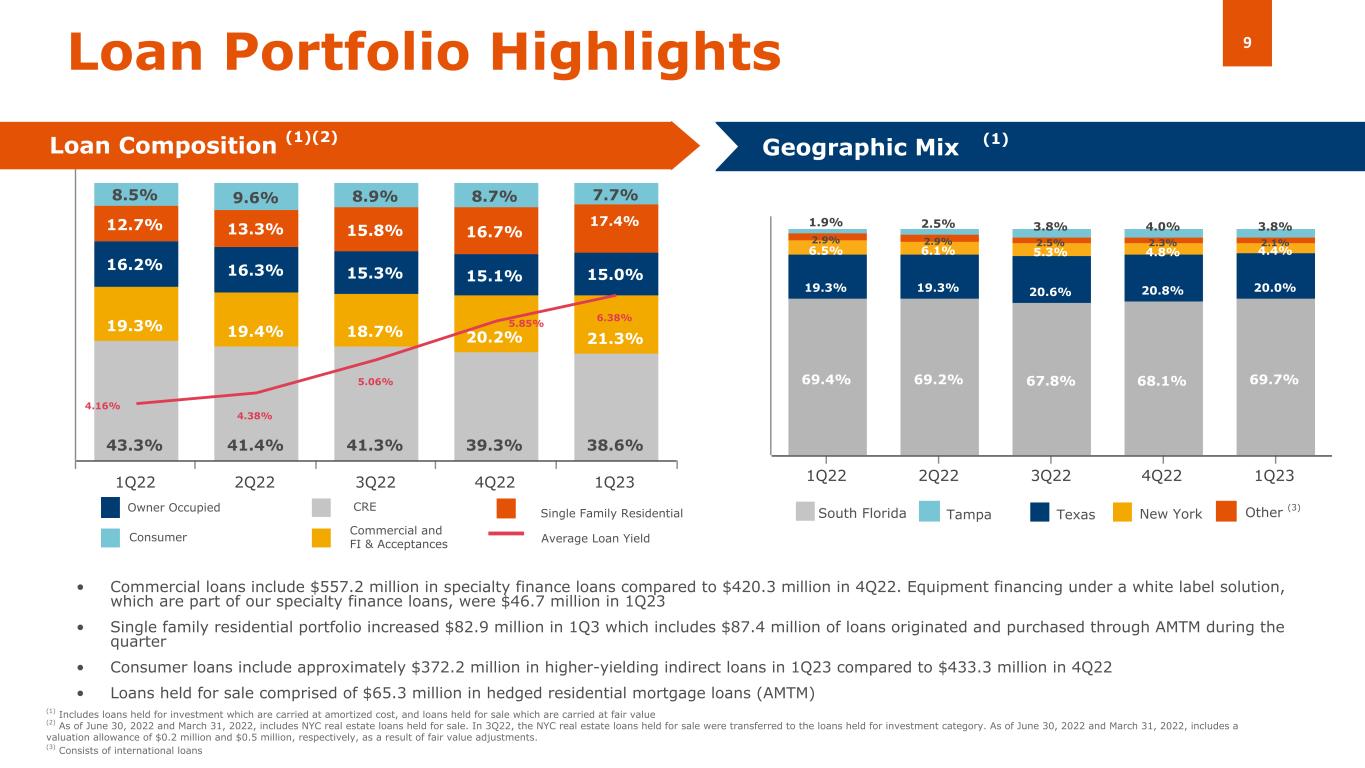

9 43.3% 41.4% 41.3% 39.3% 38.6% 19.3% 19.4% 18.7% 20.2% 21.3% 16.2% 16.3% 15.3% 15.1% 15.0% 12.7% 13.3% 15.8% 16.7% 17.4% 8.5% 9.6% 8.9% 8.7% 7.7% 4.16% 4.38% 5.06% 5.85% 6.38% 1Q22 2Q22 3Q22 4Q22 1Q23 69.4% 69.2% 67.8% 68.1% 69.7% 19.3% 19.3% 20.6% 20.8% 20.0% 6.5% 6.1% 5.3% 4.8% 4.4% 2.9% 2.9% 2.5% 2.3% 2.1% 1.9% 2.5% 3.8% 4.0% 3.8% 1Q22 2Q22 3Q22 4Q22 1Q23 Consumer CRE Commercial and FI & Acceptances Owner Occupied Single Family Residential Loan Portfolio Highlights Loan Composition (1)(2) Geographic Mix (Domestic) • Commercial loans include $557.2 million in specialty finance loans compared to $420.3 million in 4Q22. Equipment financing under a white label solution, which are part of our specialty finance loans, were $46.7 million in 1Q23 • Single family residential portfolio increased $82.9 million in 1Q3 which includes $87.4 million of loans originated and purchased through AMTM during the quarter • Consumer loans include approximately $372.2 million in higher-yielding indirect loans in 1Q23 compared to $433.3 million in 4Q22 • Loans held for sale comprised of $65.3 million in hedged residential mortgage loans (AMTM) (1) South Florida Texas New York Average Loan Yield Other (3) (1) Includes loans held for investment which are carried at amortized cost, and loans held for sale which are carried at fair value (2) As of June 30, 2022 and March 31, 2022, includes NYC real estate loans held for sale. In 3Q22, the NYC real estate loans held for sale were transferred to the loans held for investment category. As of June 30, 2022 and March 31, 2022, includes a valuation allowance of $0.2 million and $0.5 million, respectively, as a result of fair value adjustments. (3) Consists of international loans Tampa

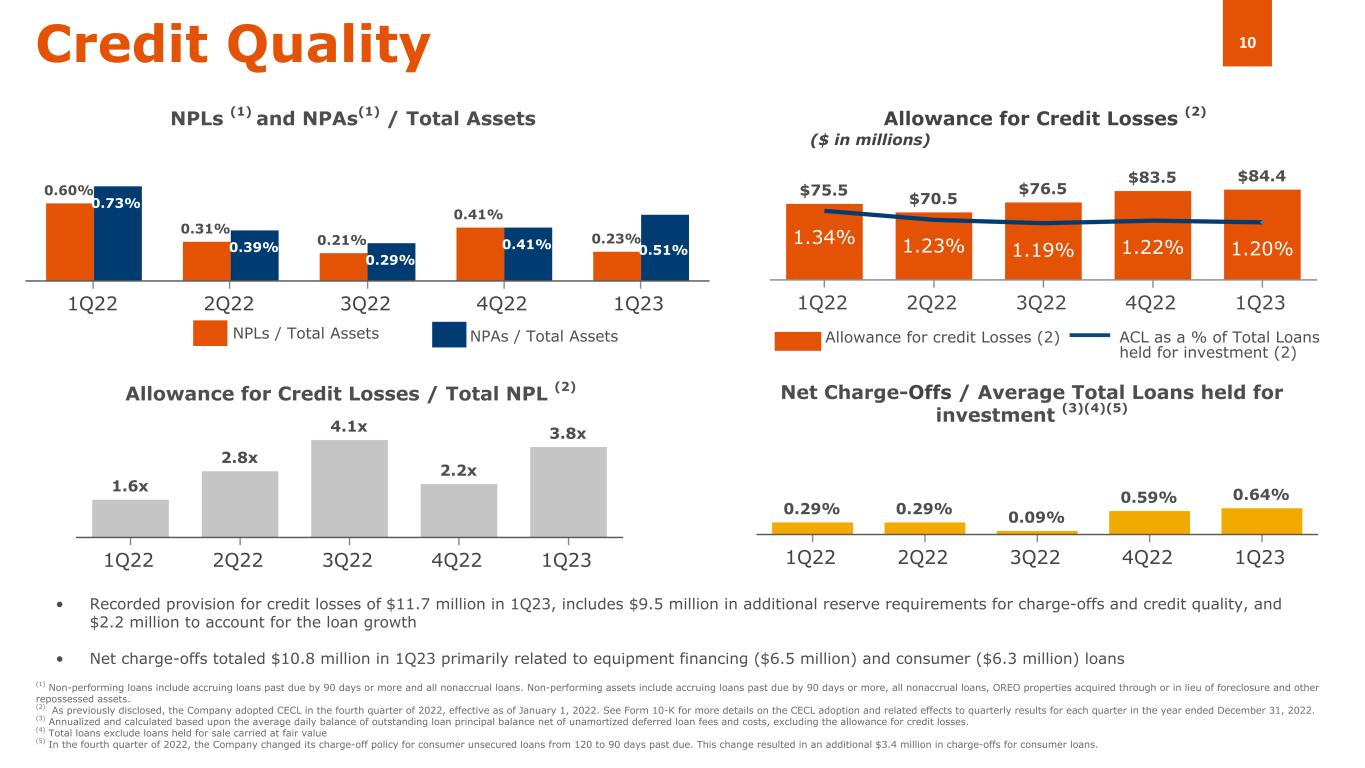

10 0.60% 0.31% 0.21% 0.41% 0.23% 0.73% 0.39% 0.29% 0.41% 0.51% 1Q22 2Q22 3Q22 4Q22 1Q23 1.6x 2.8x 4.1x 2.2x 3.8x 1Q22 2Q22 3Q22 4Q22 1Q23 $75.5 $70.5 $76.5 $83.5 $84.4 1.34% 1.23% 1.19% 1.22% 1.20% 1Q22 2Q22 3Q22 4Q22 1Q23 0.29% 0.29% 0.09% 0.59% 0.64% 1Q22 2Q22 3Q22 4Q22 1Q23 • Recorded provision for credit losses of $11.7 million in 1Q23, includes $9.5 million in additional reserve requirements for charge-offs and credit quality, and $2.2 million to account for the loan growth • Net charge-offs totaled $10.8 million in 1Q23 primarily related to equipment financing ($6.5 million) and consumer ($6.3 million) loans Net Charge-Offs / Average Total Loans held for investment (3)(4)(5) Credit Quality Allowance for Credit Losses (2) ($ in millions) NPLs (1) and NPAs(1) / Total Assets Allowance for Credit Losses / Total NPL (2) Allowance for credit Losses (2) ACL as a % of Total Loans held for investment (2) (1) Non-performing loans include accruing loans past due by 90 days or more and all nonaccrual loans. Non-performing assets include accruing loans past due by 90 days or more, all nonaccrual loans, OREO properties acquired through or in lieu of foreclosure and other repossessed assets. (2) As previously disclosed, the Company adopted CECL in the fourth quarter of 2022, effective as of January 1, 2022. See Form 10-K for more details on the CECL adoption and related effects to quarterly results for each quarter in the year ended December 31, 2022. (3) Annualized and calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan fees and costs, excluding the allowance for credit losses. (4) Total loans exclude loans held for sale carried at fair value (5) In the fourth quarter of 2022, the Company changed its charge-off policy for consumer unsecured loans from 120 to 90 days past due. This change resulted in an additional $3.4 million in charge-offs for consumer loans. NPLs / Total Assets NPAs / Total Assets

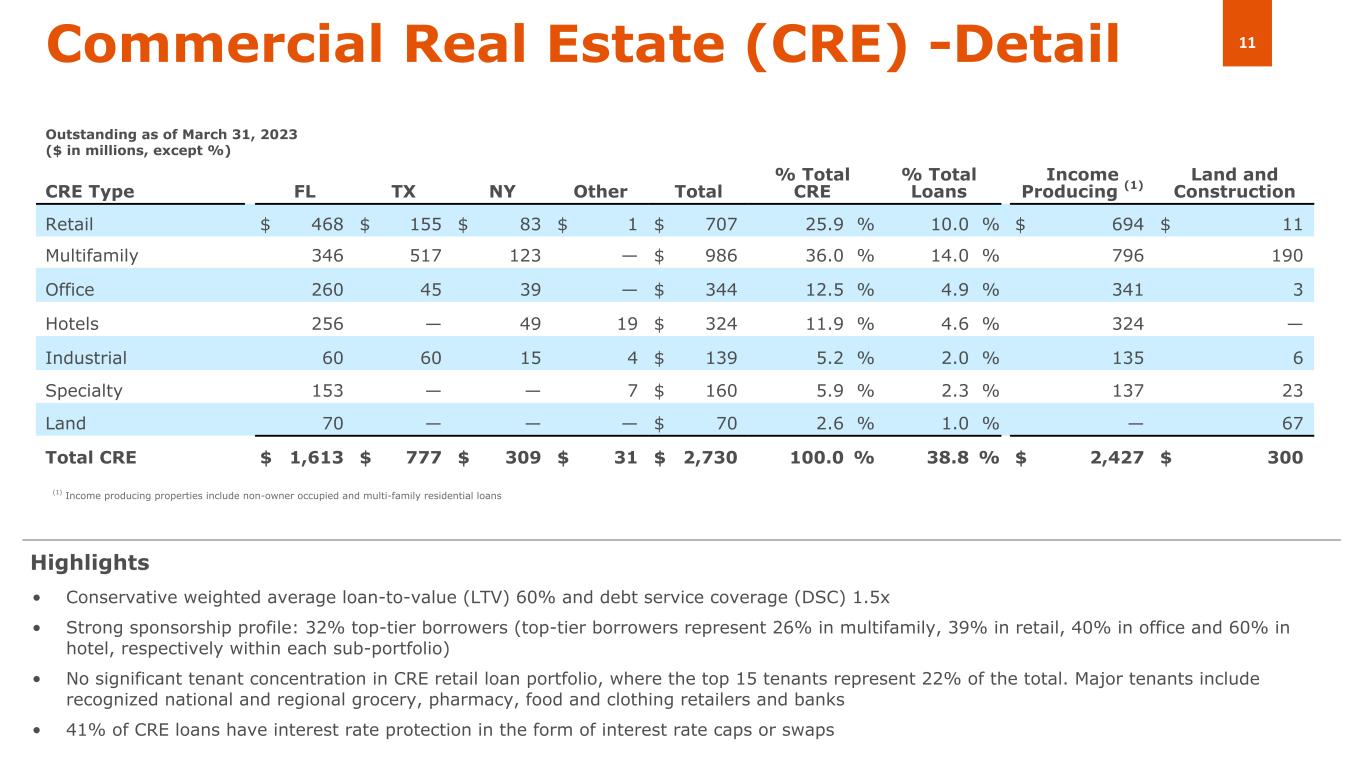

11Commercial Real Estate (CRE) -Detail CRE Type FL TX NY Other Total % Total CRE % Total Loans Income Producing (1) Land and Construction Retail $ 468 $ 155 $ 83 $ 1 $ 707 25.9 % 10.0 % $ 694 $ 11 Multifamily 346 517 123 — $ 986 36.0 % 14.0 % 796 190 Office 260 45 39 — $ 344 12.5 % 4.9 % 341 3 Hotels 256 — 49 19 $ 324 11.9 % 4.6 % 324 — Industrial 60 60 15 4 $ 139 5.2 % 2.0 % 135 6 Specialty 153 — — 7 $ 160 5.9 % 2.3 % 137 23 Land 70 — — — $ 70 2.6 % 1.0 % — 67 Total CRE $ 1,613 $ 777 $ 309 $ 31 $ 2,730 100.0 % 38.8 % $ 2,427 $ 300 • Conservative weighted average loan-to-value (LTV) 60% and debt service coverage (DSC) 1.5x • Strong sponsorship profile: 32% top-tier borrowers (top-tier borrowers represent 26% in multifamily, 39% in retail, 40% in office and 60% in hotel, respectively within each sub-portfolio) • No significant tenant concentration in CRE retail loan portfolio, where the top 15 tenants represent 22% of the total. Major tenants include recognized national and regional grocery, pharmacy, food and clothing retailers and banks • 41% of CRE loans have interest rate protection in the form of interest rate caps or swaps Highlights Outstanding as of March 31, 2023 ($ in millions, except %) (1) Income producing properties include non-owner occupied and multi-family residential loans

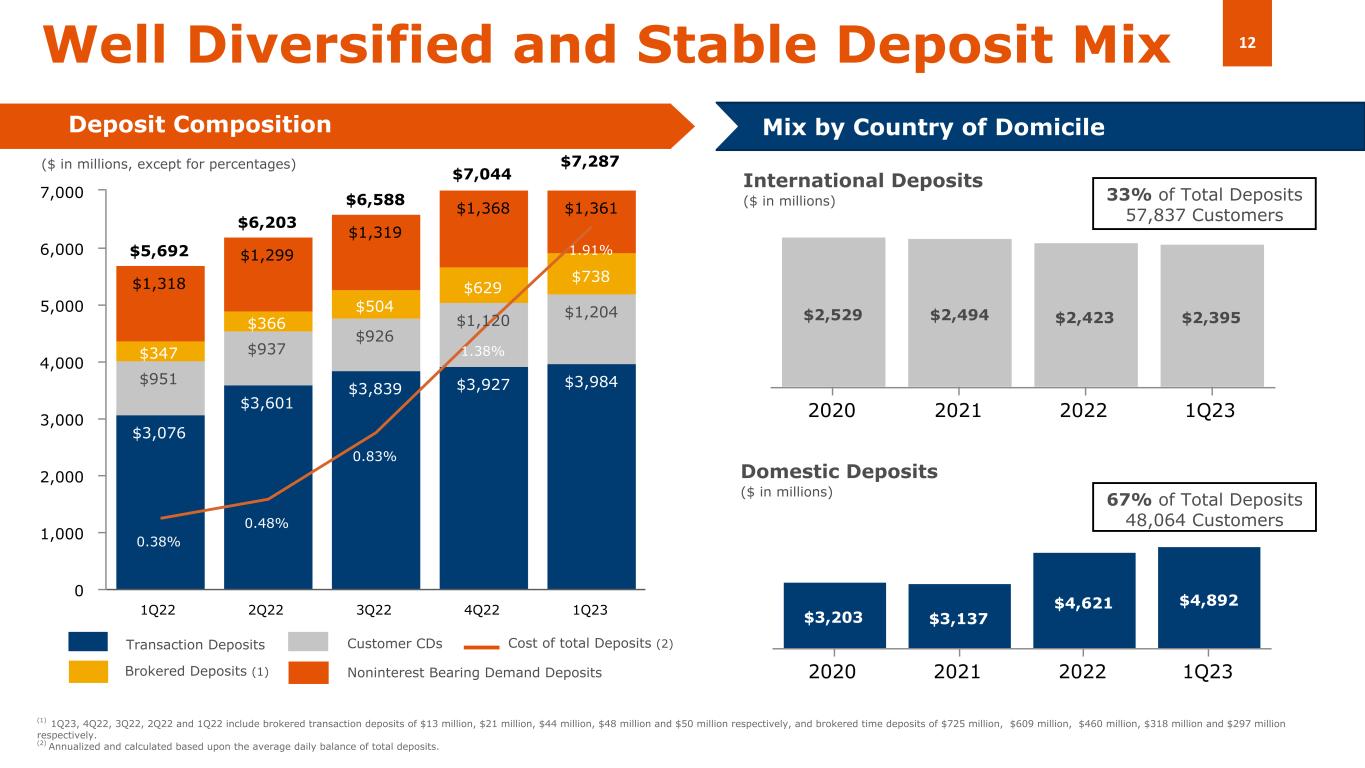

12 $5,692 $6,203 $6,588 $7,044 $7,287 $3,076 $3,601 $3,839 $3,927 $3,984$951 $937 $926 $1,120 $1,204 $347 $366 $504 $629 $738$1,318 $1,299 $1,319 $1,368 $1,361 0.38% 0.48% 0.83% 1.38% 1.91% 1Q22 2Q22 3Q22 4Q22 1Q23 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 $2,529 $2,494 $2,423 $2,395 2020 2021 2022 1Q23 $3,203 $3,137 $4,621 $4,892 2020 2021 2022 1Q23 Domestic Deposits ($ in millions) Well Diversified and Stable Deposit Mix Deposit Composition International Deposits ($ in millions) Mix by Country of Domicile Transaction Deposits Customer CDs Brokered Deposits (1) Cost of total Deposits (2) ($ in millions, except for percentages) (1) 1Q23, 4Q22, 3Q22, 2Q22 and 1Q22 include brokered transaction deposits of $13 million, $21 million, $44 million, $48 million and $50 million respectively, and brokered time deposits of $725 million, $609 million, $460 million, $318 million and $297 million respectively. (2) Annualized and calculated based upon the average daily balance of total deposits. Noninterest Bearing Demand Deposits 33% of Total Deposits 57,837 Customers 67% of Total Deposits 48,064 Customers

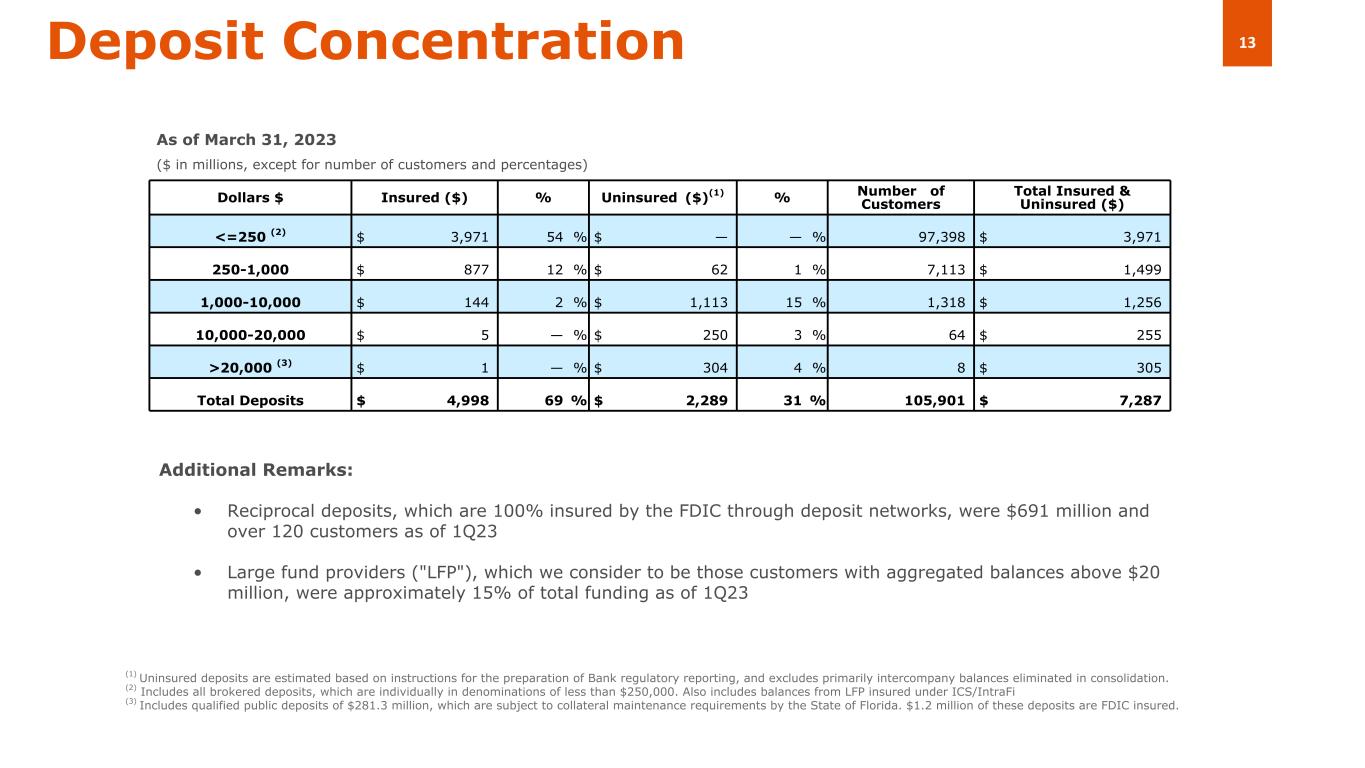

13Deposit Concentration Dollars $ Insured ($) % Uninsured ($)(1) % Number of Customers Total Insured & Uninsured ($) <=250 (2) $ 3,971 54 % $ — — % 97,398 $ 3,971 250-1,000 $ 877 12 % $ 62 1 % 7,113 $ 1,499 1,000-10,000 $ 144 2 % $ 1,113 15 % 1,318 $ 1,256 10,000-20,000 $ 5 — % $ 250 3 % 64 $ 255 >20,000 (3) $ 1 — % $ 304 4 % 8 $ 305 Total Deposits $ 4,998 69 % $ 2,289 31 % 105,901 $ 7,287 As of March 31, 2023 (1) Uninsured deposits are estimated based on instructions for the preparation of Bank regulatory reporting, and excludes primarily intercompany balances eliminated in consolidation. (2) Includes all brokered deposits, which are individually in denominations of less than $250,000. Also includes balances from LFP insured under ICS/IntraFi (3) Includes qualified public deposits of $281.3 million, which are subject to collateral maintenance requirements by the State of Florida. $1.2 million of these deposits are FDIC insured. Additional Remarks: • Reciprocal deposits, which are 100% insured by the FDIC through deposit networks, were $691 million and over 120 customers as of 1Q23 • Large fund providers ("LFP"), which we consider to be those customers with aggregated balances above $20 million, were approximately 15% of total funding as of 1Q23 ($ in millions, except for number of customers and percentages)

14Liquidity Risk Management Our standard liquidity management practices include: • Regular testing of lines of credit • Daily monitoring of Federal Reserve Bank account balances as well as large fund providers • Daily analysis of lending pipeline and deposit gathering opportunities and their impact on cash flow projections • Targets associated with liquidity stress test scenarios • Targets for deposit concentration • Limits on liquidity ratios • Active collateral management of both loan and investment portfolios with lending facilities at FHLB and FRB Available line of credit with FHLB as of 1Q23: • Total advances were $1.05 billion (11% of assets pledged) • An additional $1.7 billion remained available with the FHLB Additional actions that strengthen liquidity position: • Increased cash at FED account by $200 million on borrowings from FHLB. Held over $485 million in cash and cash equivalents as of 1Q23 • Increased visibility of Insured Cash Sweep (ICS) to offer 100% FDIC insurance to large deposit accounts • Issuance of new brokered CDs to anticipate upcoming maturities and increase cash position at the FRB • Instituted deposit covenants with minimum balance requirements for any new credit relationship • Prudently paused our $25 million share repurchase program and focused on liquidity management and preservation

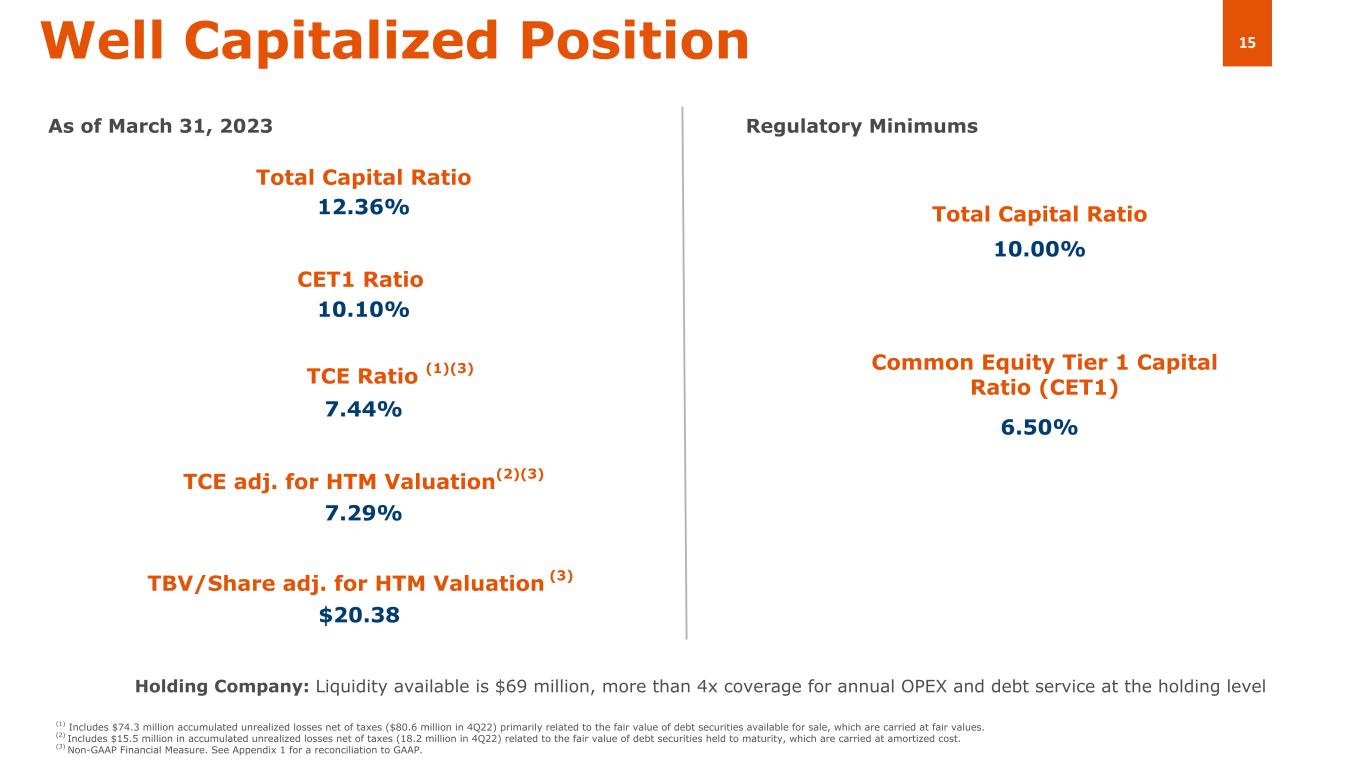

15Well Capitalized Position Holding Company: Liquidity available is $69 million, more than 4x coverage for annual OPEX and debt service at the holding level (1) Includes $74.3 million accumulated unrealized losses net of taxes ($80.6 million in 4Q22) primarily related to the fair value of debt securities available for sale, which are carried at fair values. (2) Includes $15.5 million in accumulated unrealized losses net of taxes (18.2 million in 4Q22) related to the fair value of debt securities held to maturity, which are carried at amortized cost. (3) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. As of March 31, 2023 Total Capital Ratio 12.36% TCE Ratio (1)(3) TCE adj. for HTM Valuation(2)(3) TBV/Share adj. for HTM Valuation (3) CET1 Ratio 7.44% 10.10% 7.29% $20.38 Regulatory Minimums Total Capital Ratio 10.00% Common Equity Tier 1 Capital Ratio (CET1) 6.50%

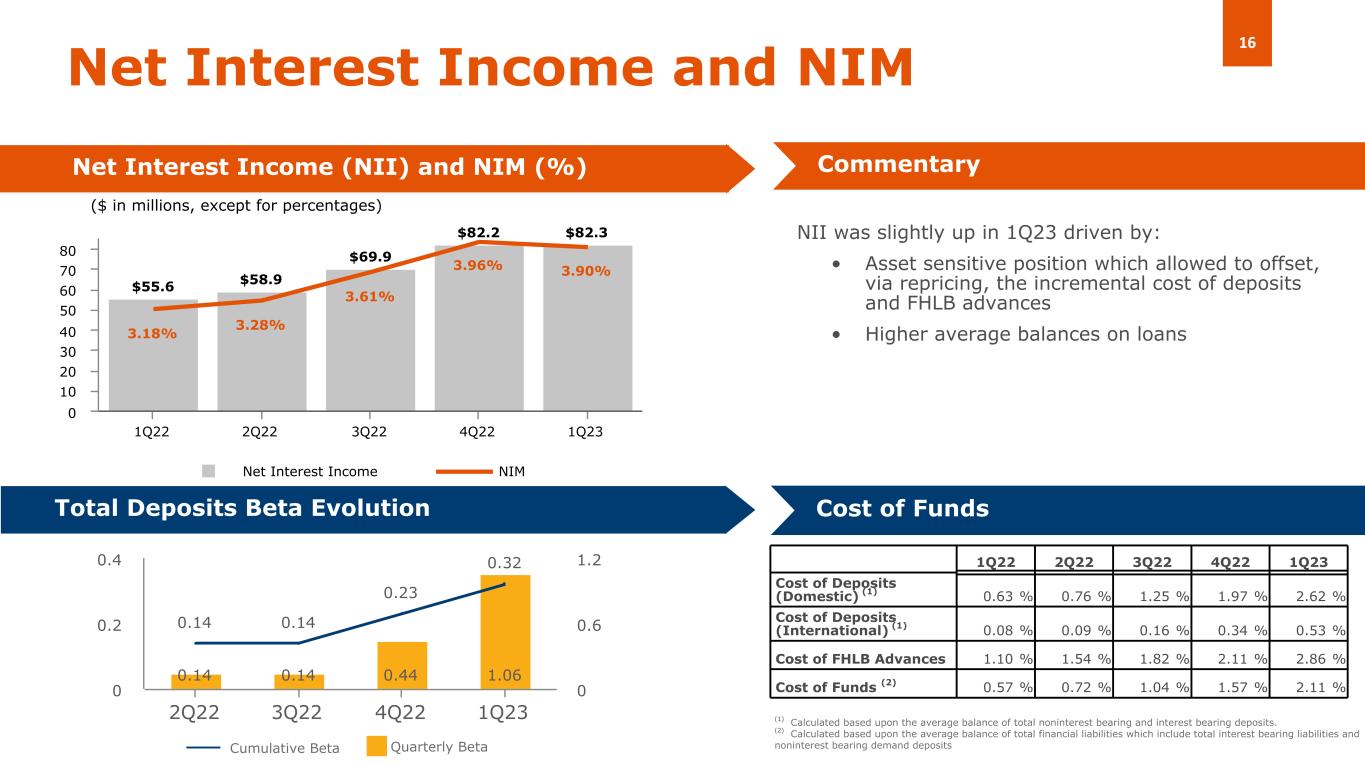

16 $55.6 $58.9 $69.9 $82.2 $82.3 3.18% 3.28% 3.61% 3.96% 3.90% Net Interest Income NIM 1Q22 2Q22 3Q22 4Q22 1Q23 0 10 20 30 40 50 60 70 80 NII was slightly up in 1Q23 driven by: • Asset sensitive position which allowed to offset, via repricing, the incremental cost of deposits and FHLB advances • Higher average balances on loans Net Interest Income and NIM Net Interest Income (NII) and NIM (%) Total Deposits Beta Evolution ($ in millions, except for percentages) Commentary 1Q22 2Q22 3Q22 4Q22 1Q23 Cost of Deposits (Domestic) (1) 0.63 % 0.76 % 1.25 % 1.97 % 2.62 % Cost of Deposits (International) (1) 0.08 % 0.09 % 0.16 % 0.34 % 0.53 % Cost of FHLB Advances 1.10 % 1.54 % 1.82 % 2.11 % 2.86 % Cost of Funds (2) 0.57 % 0.72 % 1.04 % 1.57 % 2.11 % Cost of Funds 0.14 0.14 0.44 1.06 0.14 0.14 0.23 0.32 2Q22 3Q22 4Q22 1Q23 0 0.2 0.4 0 0.6 1.2 (1) Calculated based upon the average balance of total noninterest bearing and interest bearing deposits. (2) Calculated based upon the average balance of total financial liabilities which include total interest bearing liabilities and noninterest bearing demand depositsQuarterly BetaCumulative Beta

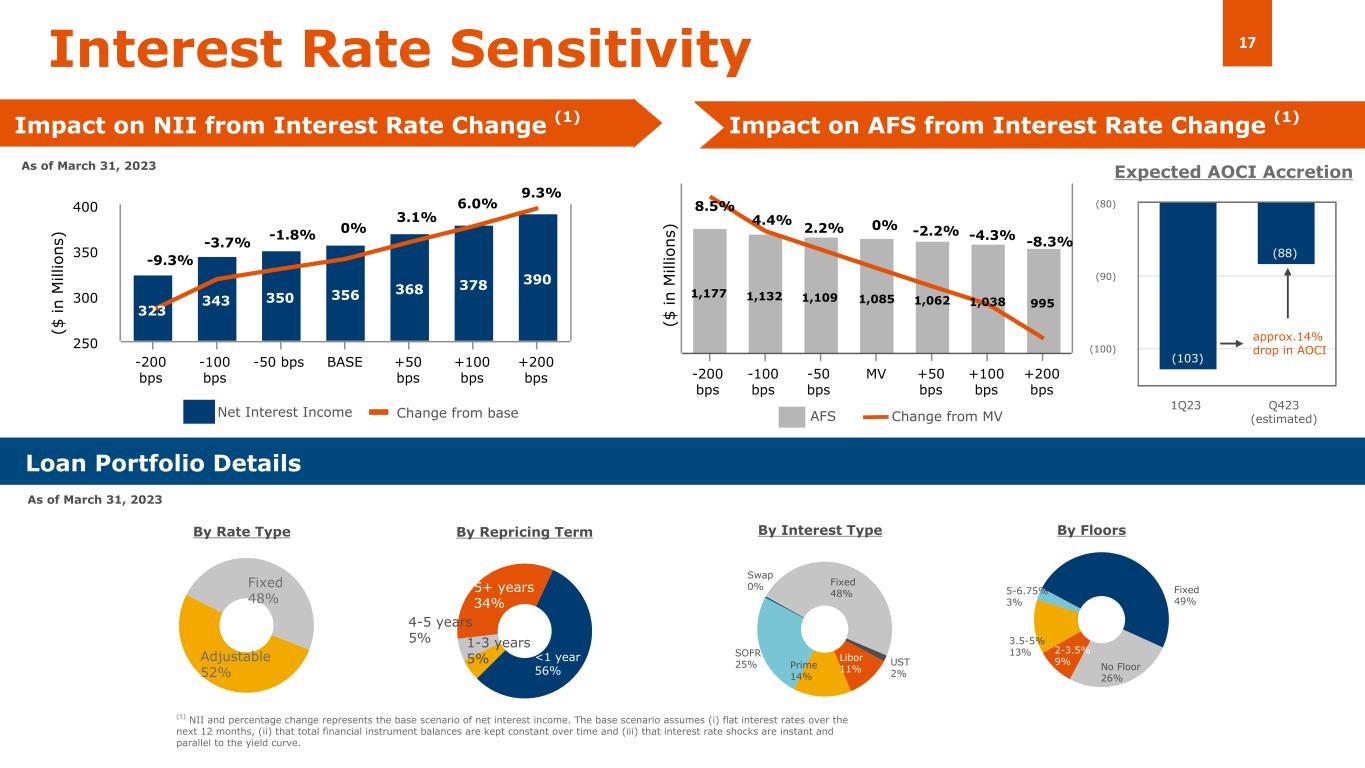

17 323 343 350 356 368 378 390 -200 bps -100 bps -50 bps BASE +50 bps +100 bps +200 bps 250 300 350 400 As of March 31, 2023 Fixed 48% Adjustable 52% Interest Rate Sensitivity By Interest TypeBy Rate Type By Repricing Term (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve. Loan Portfolio Details Impact on NII from Interest Rate Change (1) AFSChange from base <1 year 56% 1-3 years 5% 4-5 years 5% 5+ years 34% ($ in M ill io ns ) As of March 31, 2023 Swap 0% Fixed 48% UST 2% Libor 11%Prime 14% SOFR 25% Impact on AFS from Interest Rate Change (1) -9.3% -3.7% 0% 6.0% 3.1% -1.8% 9.3% Fixed 49% No Floor 26% 2-3.5% 9% 3.5-5% 13% 5-6.75% 3% By Floors 1,177 1,132 1,109 1,085 1,062 1,038 995 -200 bps -100 bps -50 bps MV +50 bps +100 bps +200 bps ($ in M ill io ns ) 8.5% 4.4% 2.2% 0% -2.2% -4.3% -8.3% Expected AOCI Accretion Change from MVNet Interest Income (103) (88) 1Q23 Q423 (estimated) (100) (90) (80) approx.14% drop in AOCI

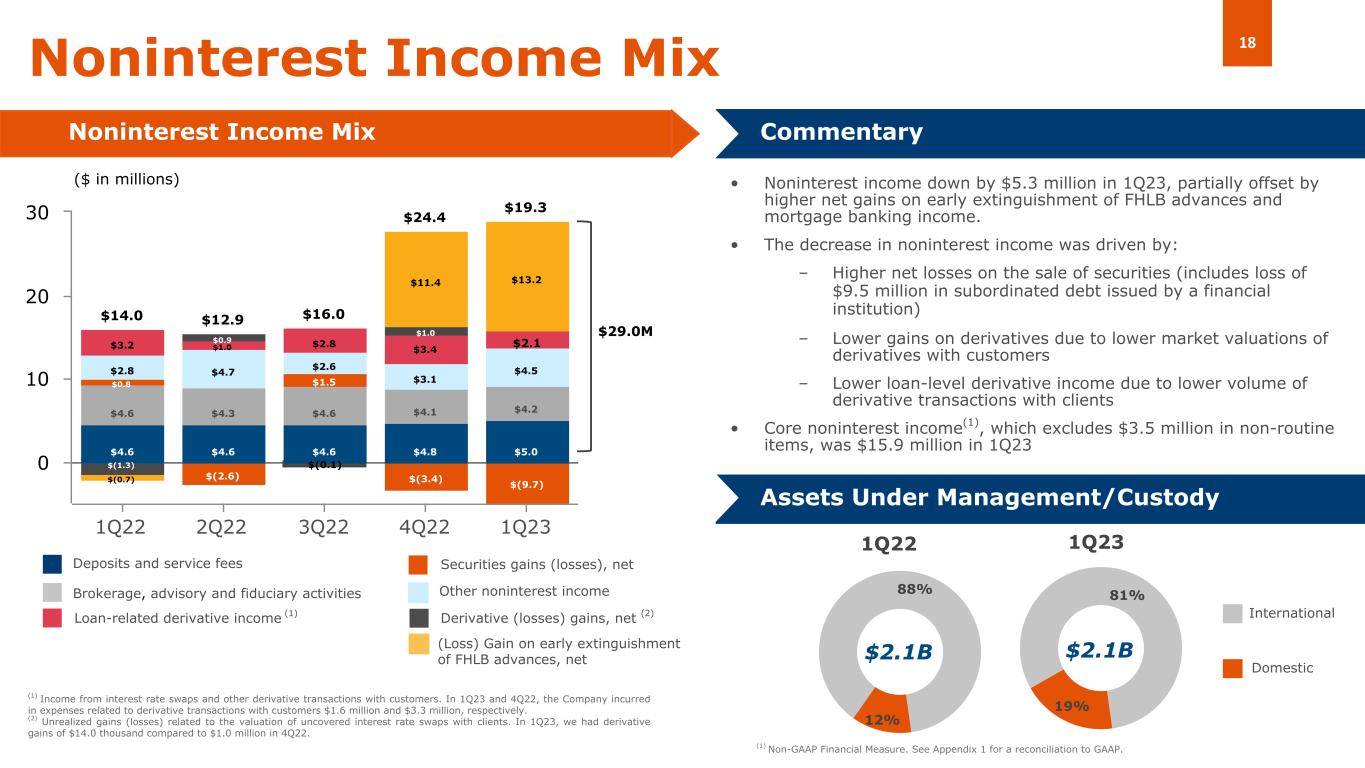

18 $14.0 $12.9 $16.0 $24.4 $19.3 $4.6 $4.6 $4.6 $4.8 $5.0 $4.6 $4.3 $4.6 $4.1 $4.2 $0.8 $(2.6) $1.5 $(3.4) $(9.7) $2.8 $4.7 $2.6 $3.1 $4.5 $3.2 $1.0 $2.8 $3.4 $2.1 $(1.3) $0.9 $(0.1) $1.0 $(0.7) $11.4 $13.2 1Q22 2Q22 3Q22 4Q22 1Q23 0 10 20 30 12% 88% 19% 81% Noninterest Income Mix Noninterest Income Mix Commentary Assets Under Management/Custody Deposits and service fees Brokerage, advisory and fiduciary activities Other noninterest income $2.1B Domestic International 1Q231Q22 $2.1B ($ in millions) Securities gains (losses), net (1) Income from interest rate swaps and other derivative transactions with customers. In 1Q23 and 4Q22, the Company incurred in expenses related to derivative transactions with customers $1.6 million and $3.3 million, respectively. (2) Unrealized gains (losses) related to the valuation of uncovered interest rate swaps with clients. In 1Q23, we had derivative gains of $14.0 thousand compared to $1.0 million in 4Q22. Loan-related derivative income (1) Derivative (losses) gains, net (2) $62.4 (Loss) Gain on early extinguishment of FHLB advances, net $29.0M • Noninterest income down by $5.3 million in 1Q23, partially offset by higher net gains on early extinguishment of FHLB advances and mortgage banking income. • The decrease in noninterest income was driven by: – Higher net losses on the sale of securities (includes loss of $9.5 million in subordinated debt issued by a financial institution) – Lower gains on derivatives due to lower market valuations of derivatives with customers – Lower loan-level derivative income due to lower volume of derivative transactions with clients • Core noninterest income(1), which excludes $3.5 million in non-routine items, was $15.9 million in 1Q23 (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP.

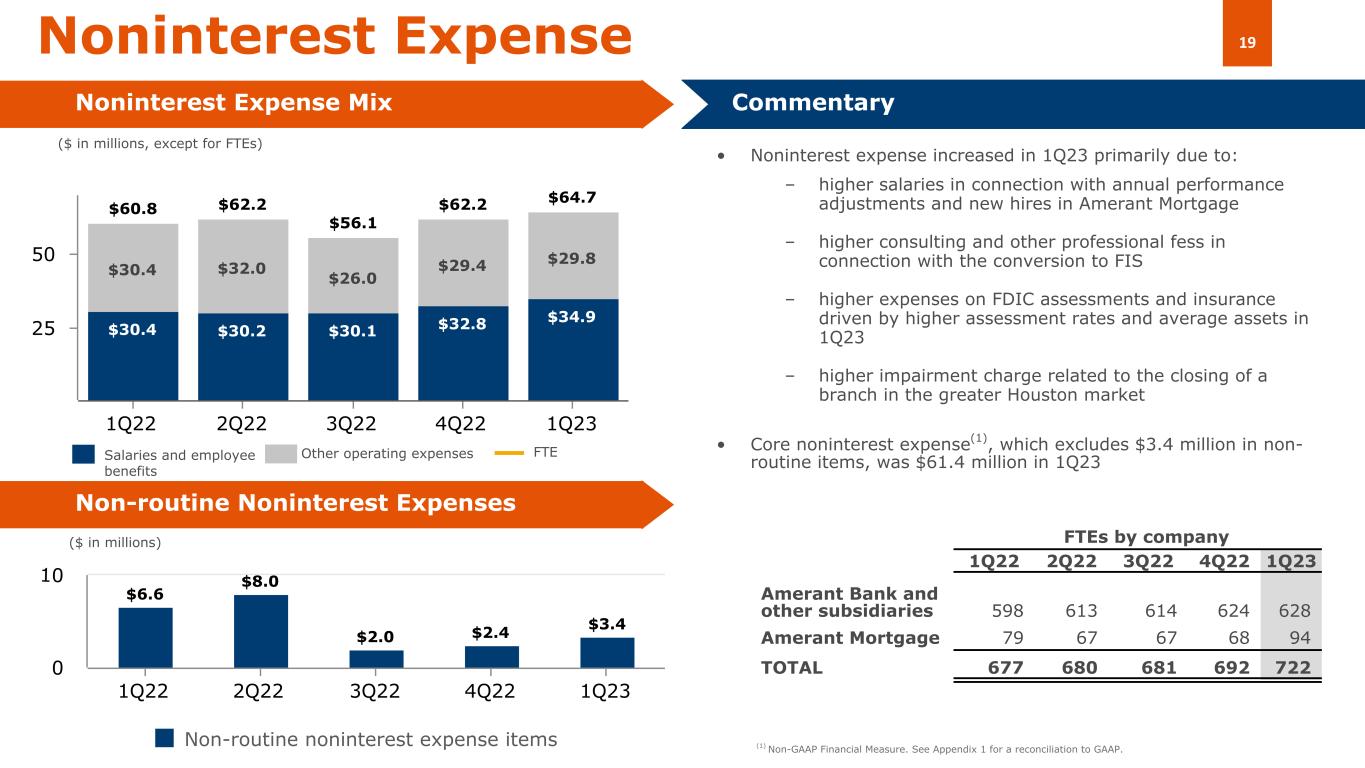

19 • Noninterest expense increased in 1Q23 primarily due to: – higher salaries in connection with annual performance adjustments and new hires in Amerant Mortgage – higher consulting and other professional fess in connection with the conversion to FIS – higher expenses on FDIC assessments and insurance driven by higher assessment rates and average assets in 1Q23 – higher impairment charge related to the closing of a branch in the greater Houston market • Core noninterest expense(1), which excludes $3.4 million in non- routine items, was $61.4 million in 1Q23 $60.8 $62.2 $56.1 $62.2 $64.7 $30.4 $30.2 $30.1 $32.8 $34.9 $30.4 $32.0 $26.0 $29.4 $29.8 1Q22 2Q22 3Q22 4Q22 1Q23 25 50 Noninterest Expense Noninterest Expense Mix Commentary Other operating expensesSalaries and employee benefits FTE ($ in millions, except for FTEs) FTEs by company 1Q22 2Q22 3Q22 4Q22 1Q23 Amerant Bank and other subsidiaries 598 613 614 624 628 Amerant Mortgage 79 67 67 68 94 TOTAL 677 680 681 692 722 (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. Non-routine Noninterest Expenses $6.6 $8.0 $2.0 $2.4 $3.4 Non-routine noninterest expense items 1Q22 2Q22 3Q22 4Q22 1Q23 0 10 ($ in millions)

Closing Remarks

Supplemental Loan Portfolio Information

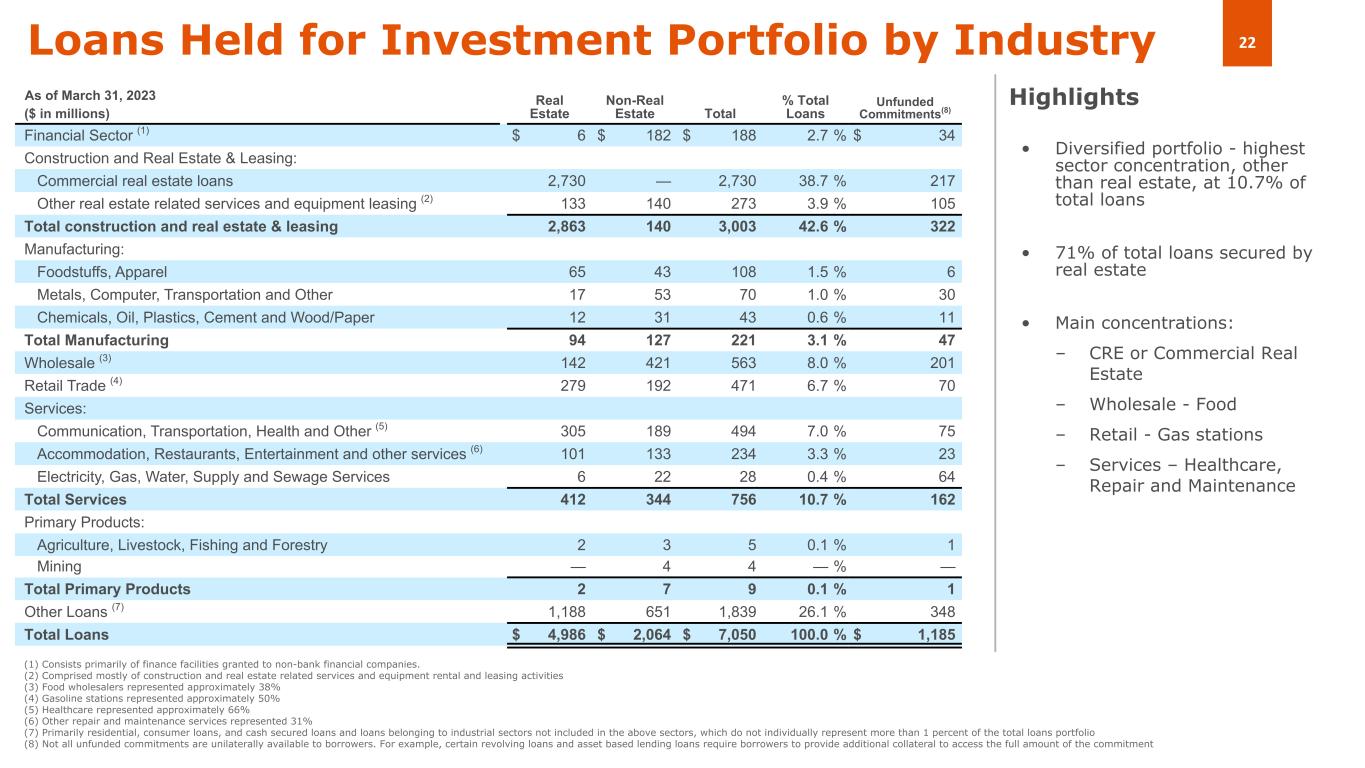

22Loans Held for Investment Portfolio by Industry • Diversified portfolio - highest sector concentration, other than real estate, at 10.7% of total loans • 71% of total loans secured by real estate • Main concentrations: – CRE or Commercial Real Estate – Wholesale - Food – Retail - Gas stations – Services – Healthcare, Repair and Maintenance Highlights (1) Consists primarily of finance facilities granted to non-bank financial companies. (2) Comprised mostly of construction and real estate related services and equipment rental and leasing activities (3) Food wholesalers represented approximately 38% (4) Gasoline stations represented approximately 50% (5) Healthcare represented approximately 66% (6) Other repair and maintenance services represented 31% (7) Primarily residential, consumer loans, and cash secured loans and loans belonging to industrial sectors not included in the above sectors, which do not individually represent more than 1 percent of the total loans portfolio (8) Not all unfunded commitments are unilaterally available to borrowers. For example, certain revolving loans and asset based lending loans require borrowers to provide additional collateral to access the full amount of the commitment ($ in millions) Real Estate Non-Real Estate Total % Total Loans Unfunded Commitments(8) Financial Sector (1) $ 6 $ 182 $ 188 2.7 % $ 34 Construction and Real Estate & Leasing: Commercial real estate loans 2,730 — 2,730 38.7 % 217 Other real estate related services and equipment leasing (2) 133 140 273 3.9 % 105 Total construction and real estate & leasing 2,863 140 3,003 42.6 % 322 Manufacturing: Foodstuffs, Apparel 65 43 108 1.5 % 6 Metals, Computer, Transportation and Other 17 53 70 1.0 % 30 Chemicals, Oil, Plastics, Cement and Wood/Paper 12 31 43 0.6 % 11 Total Manufacturing 94 127 221 3.1 % 47 Wholesale (3) 142 421 563 8.0 % 201 Retail Trade (4) 279 192 471 6.7 % 70 Services: Communication, Transportation, Health and Other (5) 305 189 494 7.0 % 75 Accommodation, Restaurants, Entertainment and other services (6) 101 133 234 3.3 % 23 Electricity, Gas, Water, Supply and Sewage Services 6 22 28 0.4 % 64 Total Services 412 344 756 10.7 % 162 Primary Products: Agriculture, Livestock, Fishing and Forestry 2 3 5 0.1 % 1 Mining — 4 4 — % — Total Primary Products 2 7 9 0.1 % 1 Other Loans (7) 1,188 651 1,839 26.1 % 348 Total Loans $ 4,986 $ 2,064 $ 7,050 100.0 % $ 1,185 As of March 31, 2023

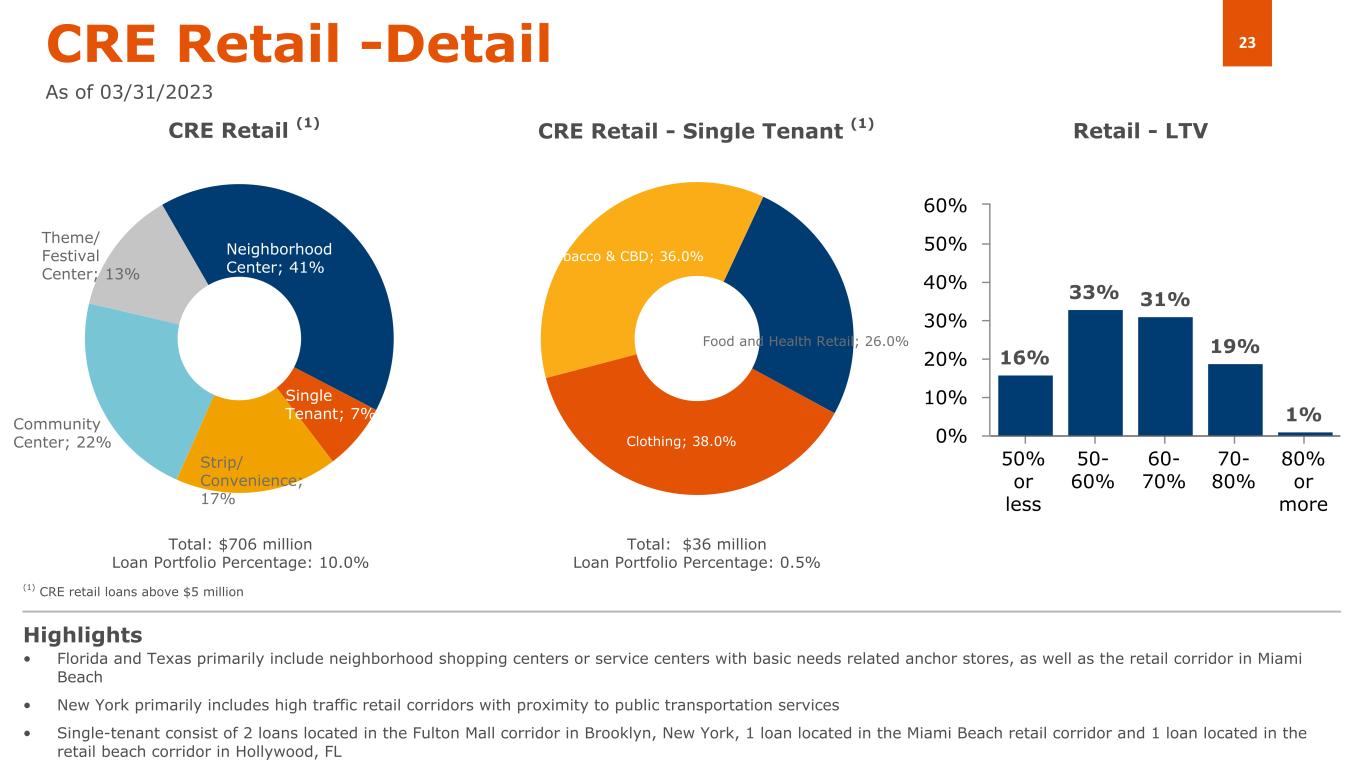

23 16% 33% 31% 19% 1% 50% or less 50- 60% 60- 70% 70- 80% 80% or more 0% 10% 20% 30% 40% 50% 60% CRE Retail -Detail As of 03/31/2023 • Florida and Texas primarily include neighborhood shopping centers or service centers with basic needs related anchor stores, as well as the retail corridor in Miami Beach • New York primarily includes high traffic retail corridors with proximity to public transportation services • Single-tenant consist of 2 loans located in the Fulton Mall corridor in Brooklyn, New York, 1 loan located in the Miami Beach retail corridor and 1 loan located in the retail beach corridor in Hollywood, FL Highlights CRE Retail (1) Retail - LTV Food and Health Retail; 26.0% Clothing; 38.0% Tobacco & CBD; 36.0% CRE Retail - Single Tenant (1) (1) CRE retail loans above $5 million Total: $706 million Loan Portfolio Percentage: 10.0% Total: $36 million Loan Portfolio Percentage: 0.5% Neighborhood Center; 41% Single Tenant; 7% Strip/ Convenience; 17% Community Center; 22% Theme/ Festival Center; 13%

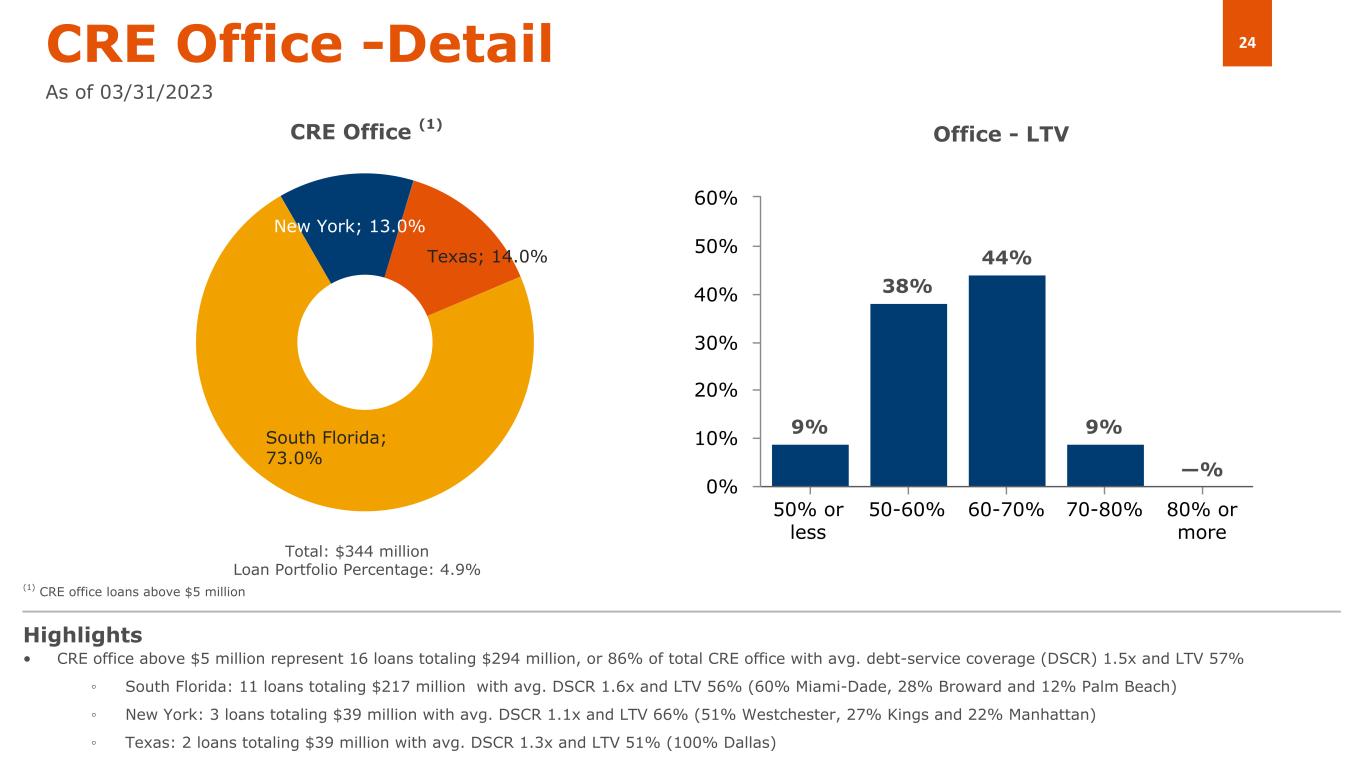

24 New York; 13.0% Texas; 14.0% South Florida; 73.0% 9% 38% 44% 9% —% 50% or less 50-60% 60-70% 70-80% 80% or more 0% 10% 20% 30% 40% 50% 60% CRE Office -Detail As of 03/31/2023 • CRE office above $5 million represent 16 loans totaling $294 million, or 86% of total CRE office with avg. debt-service coverage (DSCR) 1.5x and LTV 57% ◦ South Florida: 11 loans totaling $217 million with avg. DSCR 1.6x and LTV 56% (60% Miami-Dade, 28% Broward and 12% Palm Beach) ◦ New York: 3 loans totaling $39 million with avg. DSCR 1.1x and LTV 66% (51% Westchester, 27% Kings and 22% Manhattan) ◦ Texas: 2 loans totaling $39 million with avg. DSCR 1.3x and LTV 51% (100% Dallas) Highlights CRE Office (1) Office - LTV (1) CRE office loans above $5 million Total: $344 million Loan Portfolio Percentage: 4.9%

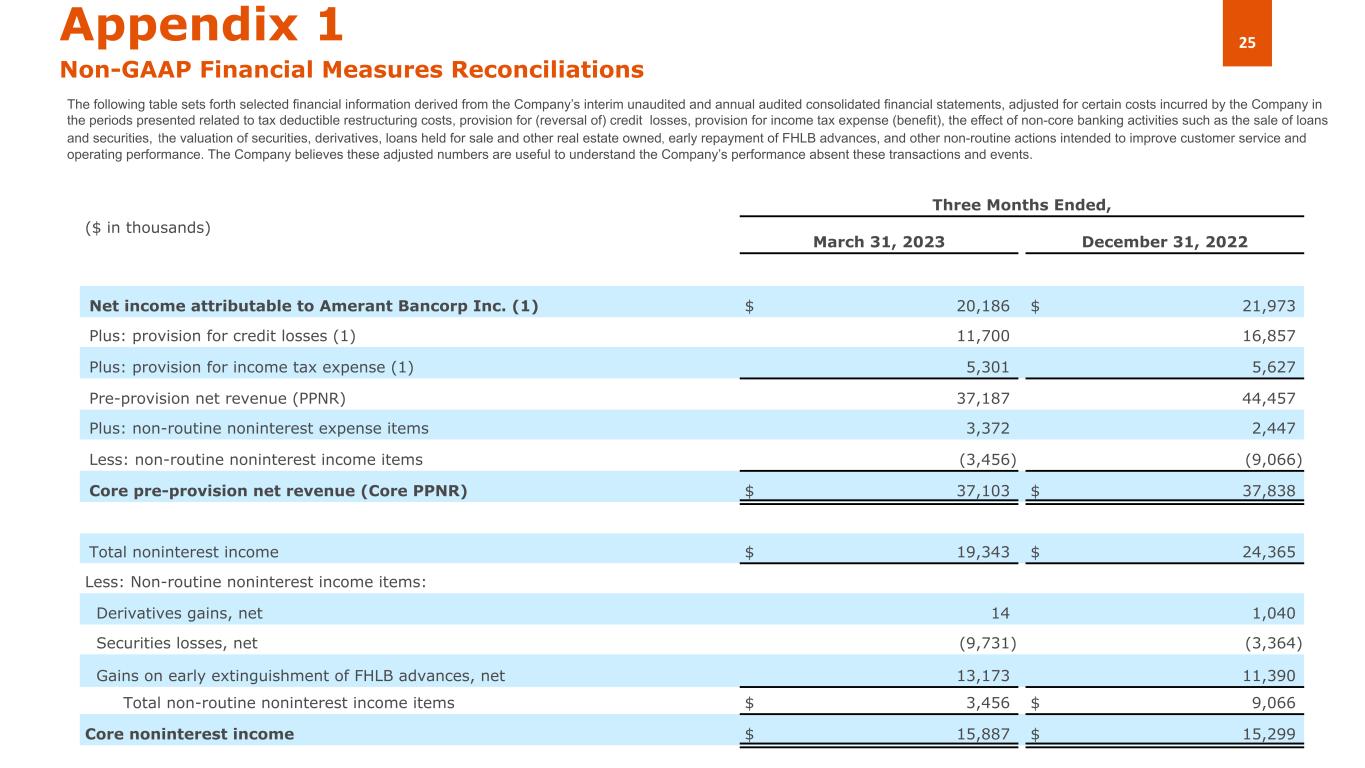

25Appendix 1 Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related to tax deductible restructuring costs, provision for (reversal of) credit losses, provision for income tax expense (benefit), the effect of non-core banking activities such as the sale of loans and securities, the valuation of securities, derivatives, loans held for sale and other real estate owned, early repayment of FHLB advances, and other non-routine actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events. Three Months Ended, ($ in thousands) March 31, 2023 December 31, 2022 Net income attributable to Amerant Bancorp Inc. (1) $ 20,186 $ 21,973 Plus: provision for credit losses (1) 11,700 16,857 Plus: provision for income tax expense (1) 5,301 5,627 Pre-provision net revenue (PPNR) 37,187 44,457 Plus: non-routine noninterest expense items 3,372 2,447 Less: non-routine noninterest income items (3,456) (9,066) Core pre-provision net revenue (Core PPNR) $ 37,103 $ 37,838 Total noninterest income $ 19,343 $ 24,365 Less: Non-routine noninterest income items: Derivatives gains, net 14 1,040 Securities losses, net (9,731) (3,364) Gains on early extinguishment of FHLB advances, net 13,173 11,390 Total non-routine noninterest income items $ 3,456 $ 9,066 Core noninterest income $ 15,887 $ 15,299

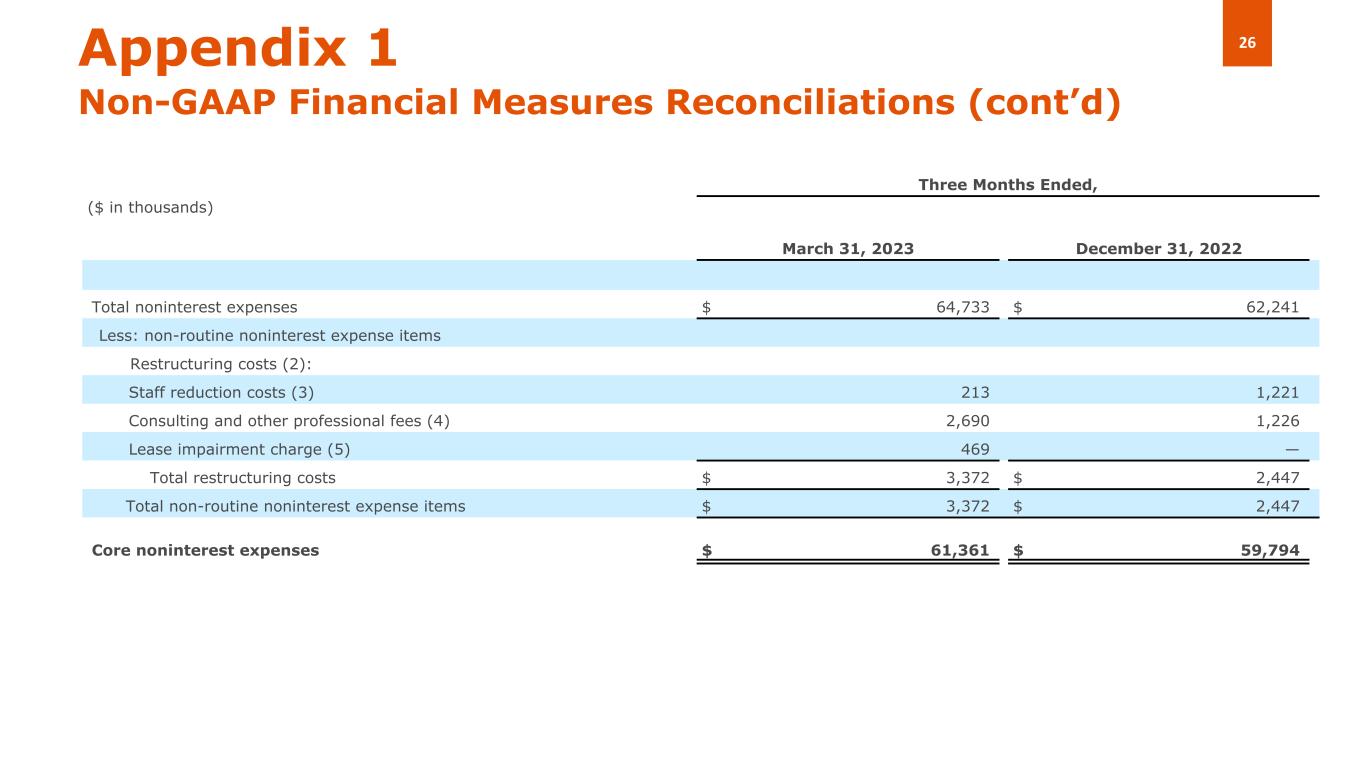

26 Three Months Ended, ($ in thousands) March 31, 2023 December 31, 2022 Total noninterest expenses $ 64,733 $ 62,241 Less: non-routine noninterest expense items Restructuring costs (2): Staff reduction costs (3) 213 1,221 Consulting and other professional fees (4) 2,690 1,226 Lease impairment charge (5) 469 — Total restructuring costs $ 3,372 $ 2,447 Total non-routine noninterest expense items $ 3,372 $ 2,447 Core noninterest expenses $ 61,361 $ 59,794 Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d)

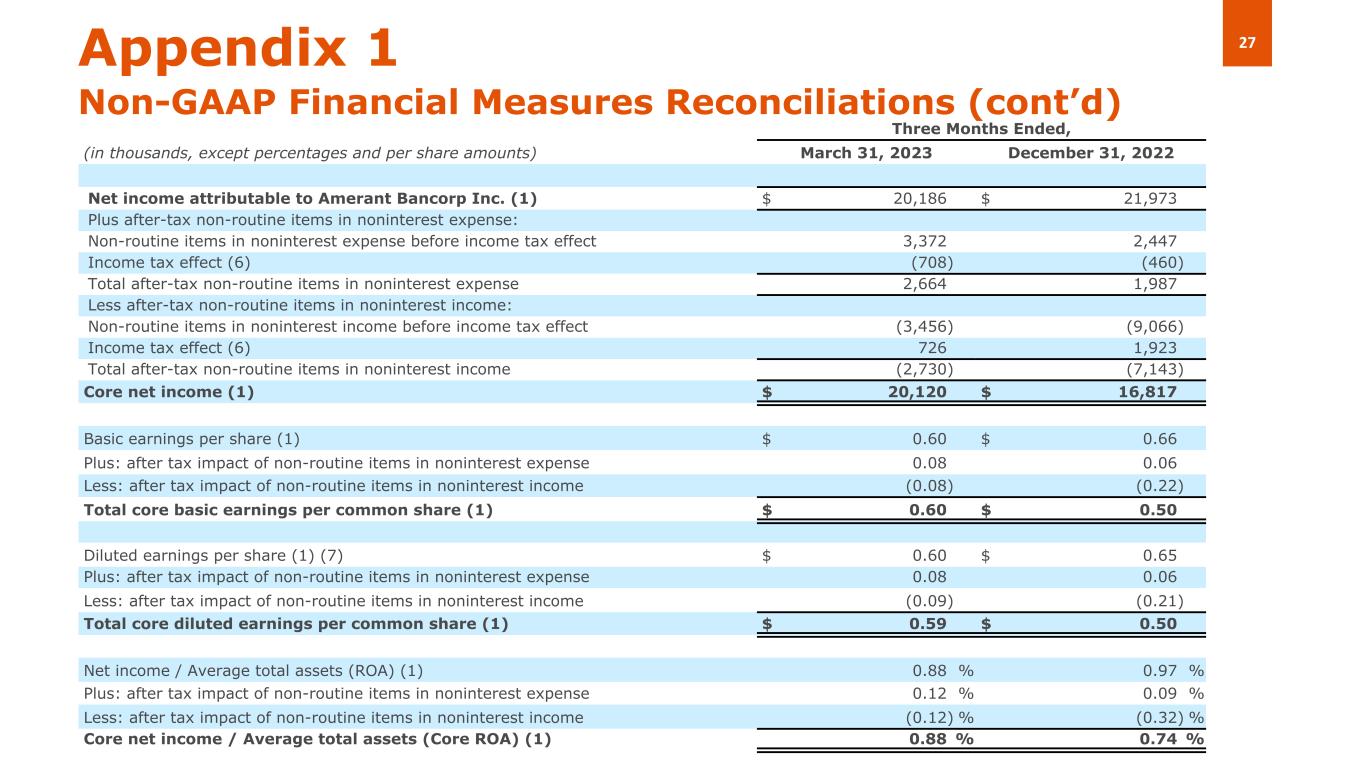

27Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, (in thousands, except percentages and per share amounts) March 31, 2023 December 31, 2022 Net income attributable to Amerant Bancorp Inc. (1) $ 20,186 $ 21,973 Plus after-tax non-routine items in noninterest expense: Non-routine items in noninterest expense before income tax effect 3,372 2,447 Income tax effect (6) (708) (460) Total after-tax non-routine items in noninterest expense 2,664 1,987 Less after-tax non-routine items in noninterest income: Non-routine items in noninterest income before income tax effect (3,456) (9,066) Income tax effect (6) 726 1,923 Total after-tax non-routine items in noninterest income (2,730) (7,143) Core net income (1) $ 20,120 $ 16,817 Basic earnings per share (1) $ 0.60 $ 0.66 Plus: after tax impact of non-routine items in noninterest expense 0.08 0.06 Less: after tax impact of non-routine items in noninterest income (0.08) (0.22) Total core basic earnings per common share (1) $ 0.60 $ 0.50 Diluted earnings per share (1) (7) $ 0.60 $ 0.65 Plus: after tax impact of non-routine items in noninterest expense 0.08 0.06 Less: after tax impact of non-routine items in noninterest income (0.09) (0.21) Total core diluted earnings per common share (1) $ 0.59 $ 0.50 Net income / Average total assets (ROA) (1) 0.88 % 0.97 % Plus: after tax impact of non-routine items in noninterest expense 0.12 % 0.09 % Less: after tax impact of non-routine items in noninterest income (0.12) % (0.32) % Core net income / Average total assets (Core ROA) (1) 0.88 % 0.74 %

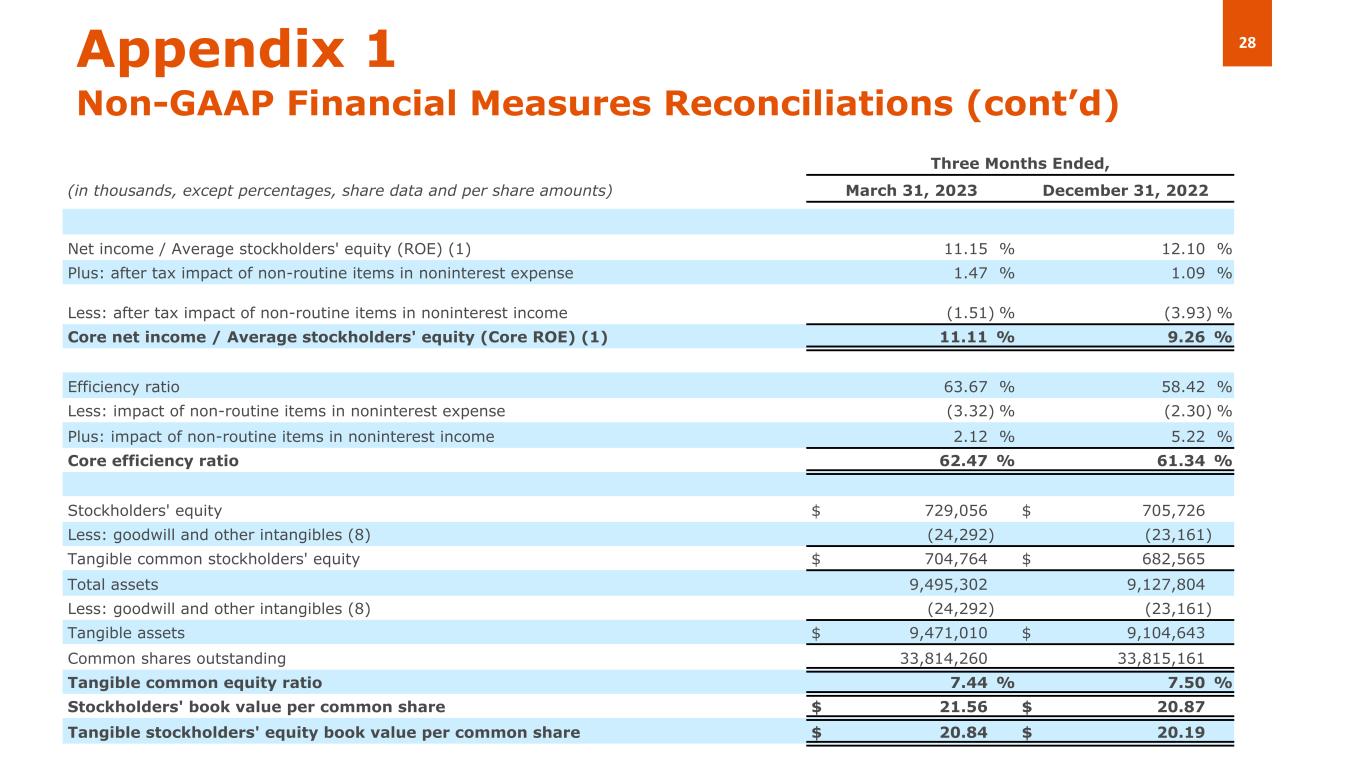

28Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, (in thousands, except percentages, share data and per share amounts) March 31, 2023 December 31, 2022 Net income / Average stockholders' equity (ROE) (1) 11.15 % 12.10 % Plus: after tax impact of non-routine items in noninterest expense 1.47 % 1.09 % Less: after tax impact of non-routine items in noninterest income (1.51) % (3.93) % Core net income / Average stockholders' equity (Core ROE) (1) 11.11 % 9.26 % Efficiency ratio 63.67 % 58.42 % Less: impact of non-routine items in noninterest expense (3.32) % (2.30) % Plus: impact of non-routine items in noninterest income 2.12 % 5.22 % Core efficiency ratio 62.47 % 61.34 % Stockholders' equity $ 729,056 $ 705,726 Less: goodwill and other intangibles (8) (24,292) (23,161) Tangible common stockholders' equity $ 704,764 $ 682,565 Total assets 9,495,302 9,127,804 Less: goodwill and other intangibles (8) (24,292) (23,161) Tangible assets $ 9,471,010 $ 9,104,643 Common shares outstanding 33,814,260 33,815,161 Tangible common equity ratio 7.44 % 7.50 % Stockholders' book value per common share $ 21.56 $ 20.87 Tangible stockholders' equity book value per common share $ 20.84 $ 20.19

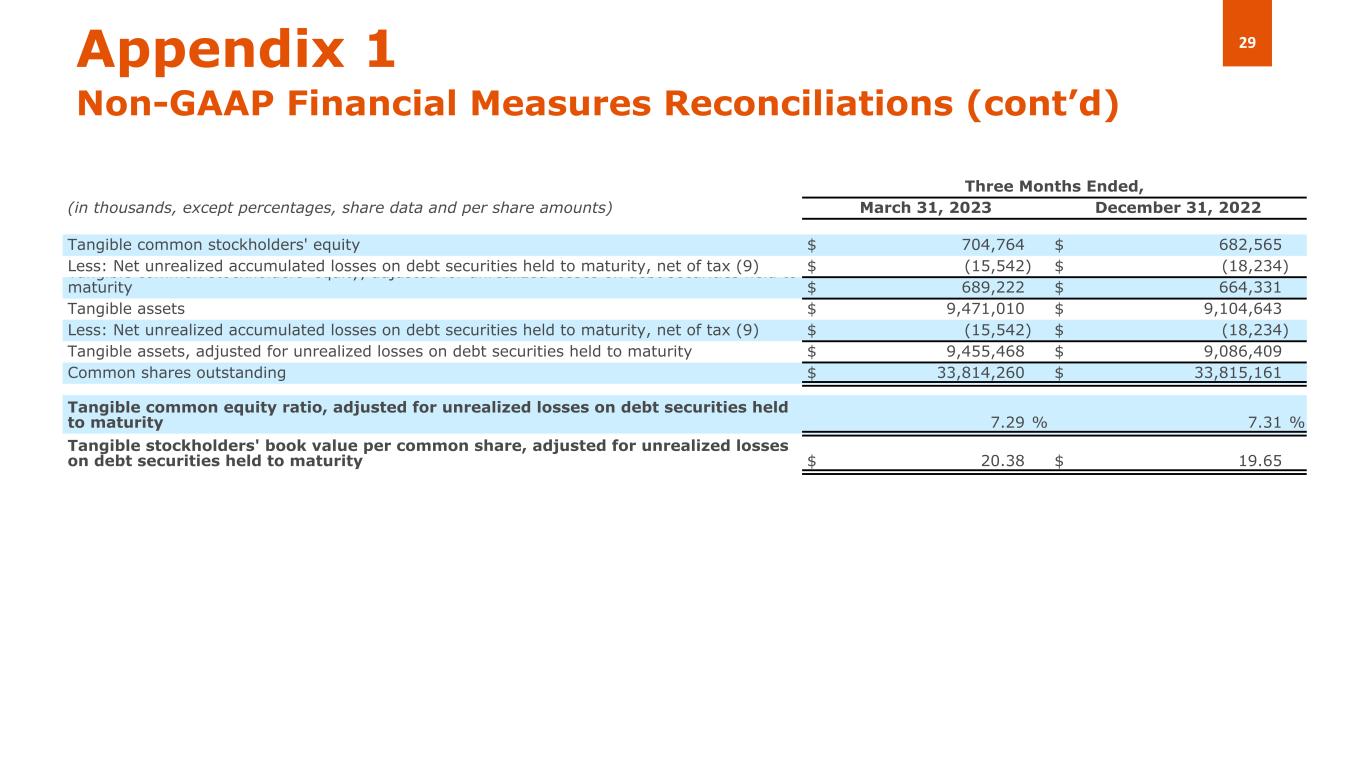

29Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) Three Months Ended, (in thousands, except percentages, share data and per share amounts) March 31, 2023 December 31, 2022 Tangible common stockholders' equity $ 704,764 $ 682,565 Less: Net unrealized accumulated losses on debt securities held to maturity, net of tax (9) $ (15,542) $ (18,234) Tangible common stockholders' equity, adjusted for unrealized losses on debt securities held to maturity $ 689,222 $ 664,331 Tangible assets $ 9,471,010 $ 9,104,643 Less: Net unrealized accumulated losses on debt securities held to maturity, net of tax (9) $ (15,542) $ (18,234) Tangible assets, adjusted for unrealized losses on debt securities held to maturity $ 9,455,468 $ 9,086,409 Common shares outstanding $ 33,814,260 $ 33,815,161 Tangible common equity ratio, adjusted for unrealized losses on debt securities held to maturity 7.29 % 7.31 % Tangible stockholders' book value per common share, adjusted for unrealized losses on debt securities held to maturity $ 20.38 $ 19.65

30Appendix 1 Non-GAAP Financial Measures Reconciliations (cont’d) (1) As previously disclosed, the Company adopted CECL in the fourth quarter of 2022, effective as of January 1, 2022. See Form 10-K for more details on the CECL adoption and related effects to quarterly results for each quarter in the year ended December 31, 2022. (2) Expenses incurred for actions designed to implement the Company’s business strategy. These actions include, but are not limited to reductions in workforce, streamlining operational processes, rolling out the Amerant brand, implementation of new technology system applications, decommissioning of legacy technologies, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (3) Staff reduction costs in the three months ended March 31, 2023 and December 31, 2022, are mainly related to severance expenses in connection with employment terminations and changes in certain positions. (4) Includes expenses in connection with the engagement of FIS of $2.6 million and $1.1 million in the three months ended March 31, 2023 and December 31, 2022, respectively. (5) In the three months ended March 31, 2023, includes $0.5 million of right-of-use asset, or ROU, impairment associated with the closure of a branch in Texas in 2023. (6) In the three months ended March 31, 2023, amounts were calculated based upon the effective tax rate for the period of 21.00%. For the three months ended December 31, 2022, amount represents the difference between the prior and current period year-to-date tax effect. (7) In the three months ended March 31, 2023 and December 31, 2022, potential dilutive instruments consisted of unvested shares of restricted stock, restricted stock units and performance stock units. In all the periods presented, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in those periods, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in those periods, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect on per share earnings. (8) Other intangible assets consist of, among other items, mortgage servicing rights (“MSRs”) of $1.4 million and $1.3 million at March 31, 2023 and December 31, 2022, respectively, and are included in other assets in the Company’s consolidated balance sheets. (9) In the three months ended March 31, 2023 and December 31, 2022, amounts were calculated based upon the fair value on debt securities held to maturity, and assuming a tax rate of 25.53% and 25.55%, respectively.

Thank you Investor Relations InvestorRelations@amerantbank.com