1 amerantbank.com Investor Update June 14, 2023

2 amerantbank.com Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements, which forward looking statements include information in this presentation regarding the Company’s estimates for certain financial/operational measures through May 31, 2023 and the Company’s outlook for certain financial/operational measures for the second quarter of 2023, including, without limitation, estimates and outlook for provision for loan losses and net interest margin. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward- looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2022, our quarterly report on Form 10-Q for the quarter ended March 31, 2023, and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim and Annual Financial Information The financial/operational information included in this presentation as of May 31, 2023 is based on information available as of such date and management's initial review of operations for the second quarter of 2023 through May 31, 2023. Such information remains subject to change based on the completion of the second quarter 2023 and the Company's customary closing and review procedures. Further, the Company's independent auditor has not reviewed or performed any procedures on such financial/operational information. Such financial/operational information may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2023, or any other period of time or date. Unaudited financial information as of and for interim periods, including the three months periods ended December 31, 2022 and March 31, 2023 and audited financial information for the twelve-month period ended December 31, 2022, may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2023, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non- GAAP financial measures, such as “core noninterest income”, and “core operating expenses”. This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued in 2022, including the effect of non-core banking activities such as the sale of loans and securities, the valuation of securities, derivatives, loans held for sale and other real estate owned, the sale of our corporate headquarters in the fourth quarter of 2021, and other non-routine actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. Appendix I reconciles these non-GAAP financial measures to reported results.

3 amerantbank.com Executive Summary (as of May 31, 2023) The purpose of this presentation is to provide investors and analysts with key updates regarding the Company’s current performance and outlook for the second quarter of 2023. Areas covered include: • Deposits - results to date show continued organic growth, further reduction in uninsured deposits and a significant reduction in institutional deposits • Branch optimization – new consolidation in 4Q 2023 to coincide with upcoming opening in Downtown Miami, and new office in Houston to support the build out of private banking • Stock repurchase program – the Company resumed prudent, low volume daily repurchases in May • Actions taken by management regarding one time/non-recurring items, including staffing optimization to reduce expense run rate in upcoming quarters • Credit update, with a focus on CRE performance, indirect consumer lending and on factors impacting provision for 2Q 2023 • Updated outlook on projected 2Q 2023 results, driven by market factors, credit and management actions

4 amerantbank.com 2023 Investor Update (as of May 31, 2023) Loans: • Growth YTD of $243 million and QTD of $47 million • Increase primarily in commercial loans, partially offset by continued reduction in indirect consumer loans outstanding given termination of program last year Deposits: • Growth YTD of $447 million and QTD of $204 million • Loan to Deposit ratio is now 95.6% compared to 97.6% for 1Q 2023 and 98.2% for 4Q 2022 • June month to date continues to show strong organic deposit growth; focused on improving deposit mix Banking Center Rationalization continues: • Additions: Key Biscayne, FL on track to open by June 30, 2023 Downtown Miami, Tampa and Ft. Lauderdale, FL locations expected in 4Q 2023 New in 2Q23 - San Felipe/River Oaks location in Houston, TX under letter of intent; application filed with OCC • Consolidations: FM 1960 location in Houston, TX – completed on June 2, 2023. Merged with Champions banking center. New in 2Q23 – Edgewater, FL location – expected in 4Q 2023 to coincide with Downtown Miami opening

5 amerantbank.com 2023 Investor Update – Continued (as of May 31, 2023) Stock Repurchase - $25 million Class A common stock share repurchase program in place • Previously repurchased in 1Q 2023 22,403 shares for $0.6 million (pre mid-March) • Repurchased 73,720 shares for $1.3 million in 2Q 2023 (average price of $17.19 per share or 0.8X Price to Book Value) (During May 2023) People – Finalized executive team moves and further optimized structure • New Head of Commercial Banking and Houston market president onboarded in April and May 2023, respectively • New Chief Financial Officer announced in May 2023 and started in role June 1, 2023. This completes executive level changes as former CFO has now assumed new COO role • Merged retail and business banking into one unit to gain synergies between the two lines of business under one leader • Rationalized organization in several other support areas; will result in future period efficiency and personnel expense savings, improved ratio of customer facing vs. support positions • Continuing to selectively add key business development personnel in all three markets we serve, including the hire of the private banking leader in Houston, TX who starts in 3Q 2023

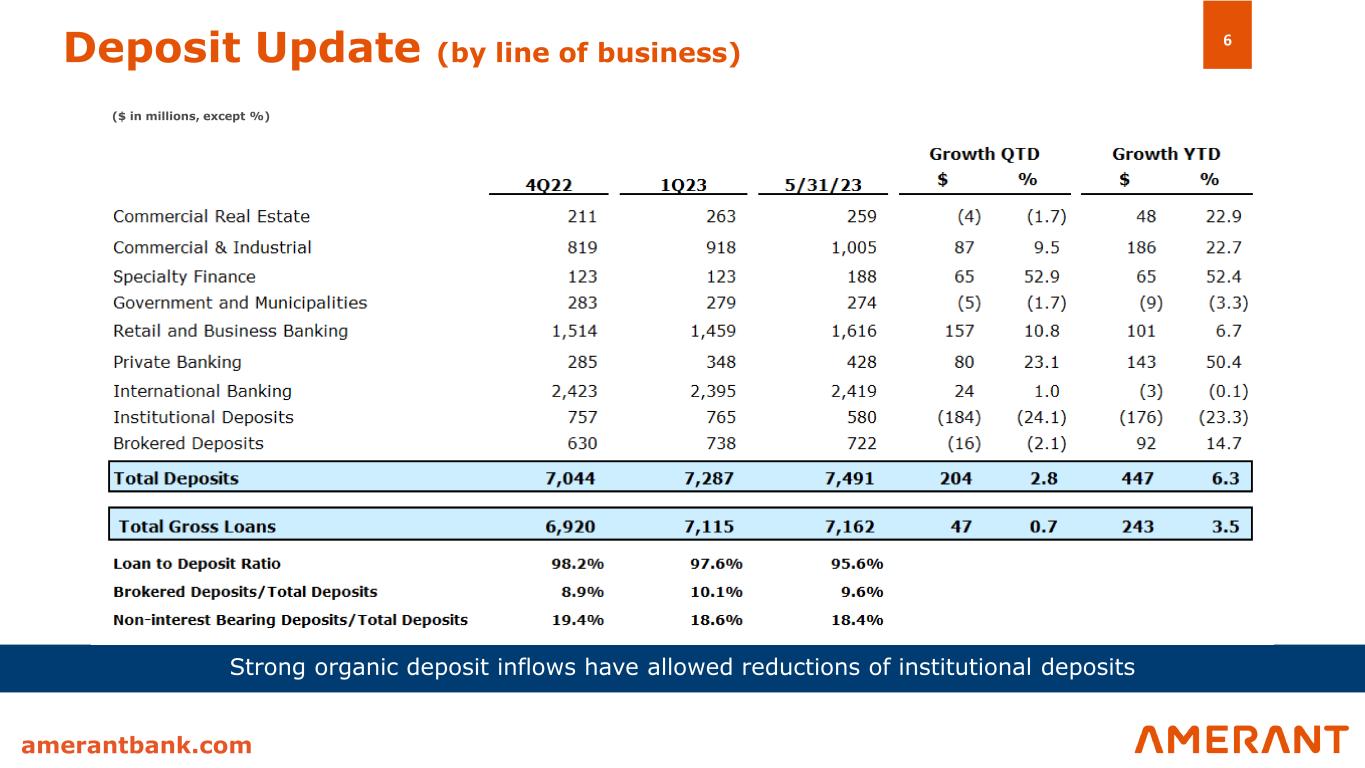

6 amerantbank.com Deposit Update (by line of business) Strong organic deposit inflows have allowed reductions of institutional deposits ($ in millions, except %)

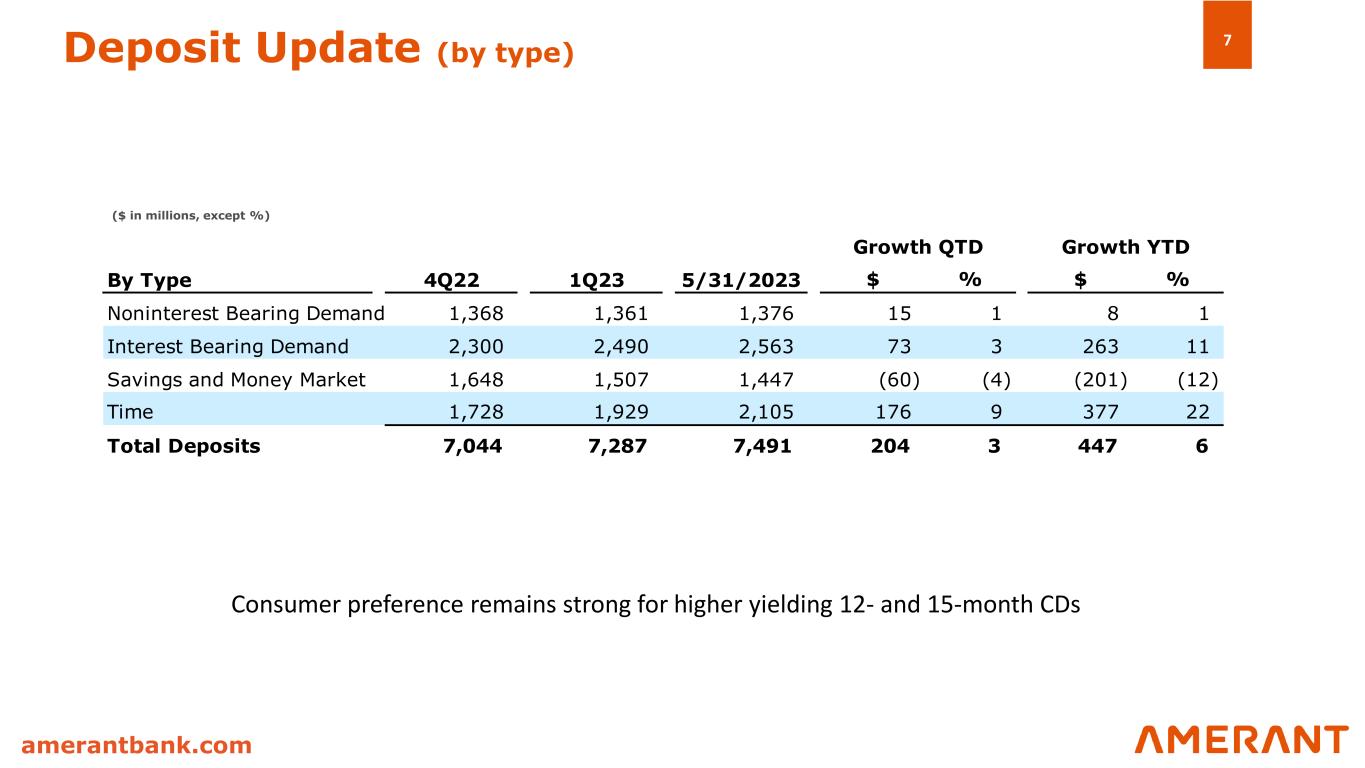

7 amerantbank.com Deposit Update (by type) ($ in millions, except %) $ % $ % Noninterest Bearing Demand 1,368 1,361 1,376 15 1 8 1 Interest Bearing Demand 2,300 2,490 2,563 73 3 263 11 Savings and Money Market 1,648 1,507 1,447 (60) (4) (201) (12) Time 1,728 1,929 2,105 176 9 377 22 Total Deposits 7,044 7,287 7,491 204 3 447 6 Growth YTD By Type 5/31/20231Q234Q22 Growth QTD Consumer preference remains strong for higher yielding 12- and 15-month CDs

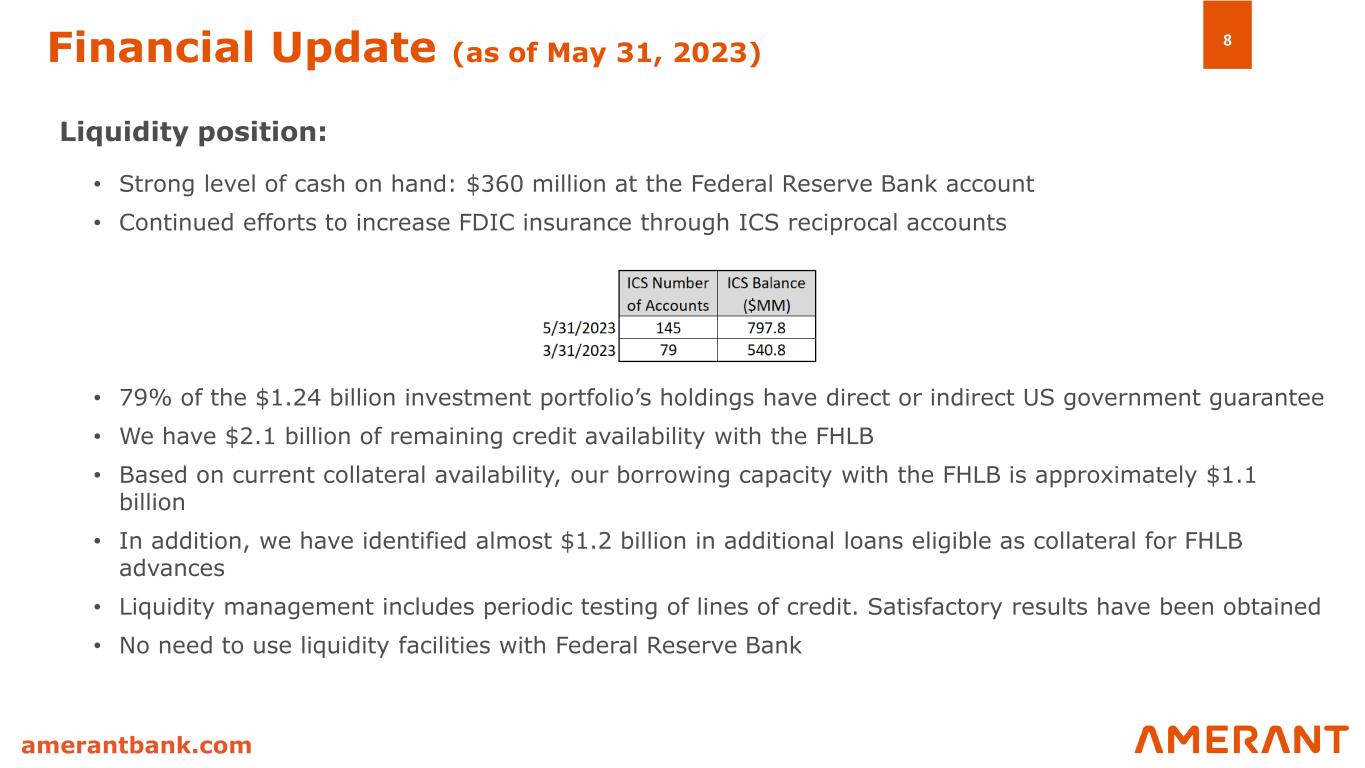

8 amerantbank.com Financial Update (as of May 31, 2023) Liquidity position: • Strong level of cash on hand: $360 million at the Federal Reserve Bank account • Continued efforts to increase FDIC insurance through ICS reciprocal accounts • 79% of the $1.24 billion investment portfolio’s holdings have direct or indirect US government guarantee • We have $2.1 billion of remaining credit availability with the FHLB • Based on current collateral availability, our borrowing capacity with the FHLB is approximately $1.1 billion • In addition, we have identified almost $1.2 billion in additional loans eligible as collateral for FHLB advances • Liquidity management includes periodic testing of lines of credit. Satisfactory results have been obtained • No need to use liquidity facilities with Federal Reserve Bank

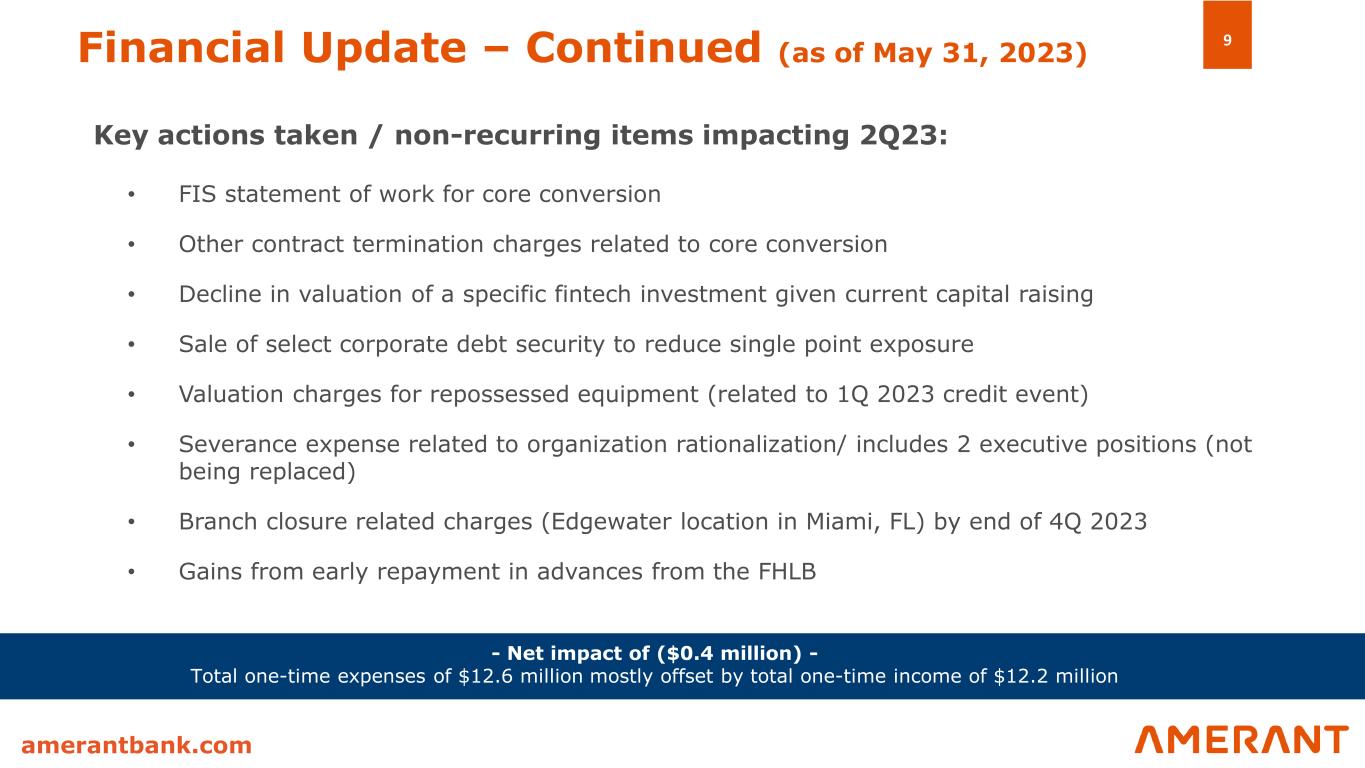

9 amerantbank.com Financial Update – Continued (as of May 31, 2023) Key actions taken / non-recurring items impacting 2Q23: • FIS statement of work for core conversion • Other contract termination charges related to core conversion • Decline in valuation of a specific fintech investment given current capital raising • Sale of select corporate debt security to reduce single point exposure • Valuation charges for repossessed equipment (related to 1Q 2023 credit event) • Severance expense related to organization rationalization/ includes 2 executive positions (not being replaced) • Branch closure related charges (Edgewater location in Miami, FL) by end of 4Q 2023 • Gains from early repayment in advances from the FHLB - Net impact of ($0.4 million) - Total one-time expenses of $12.6 million mostly offset by total one-time income of $12.2 million

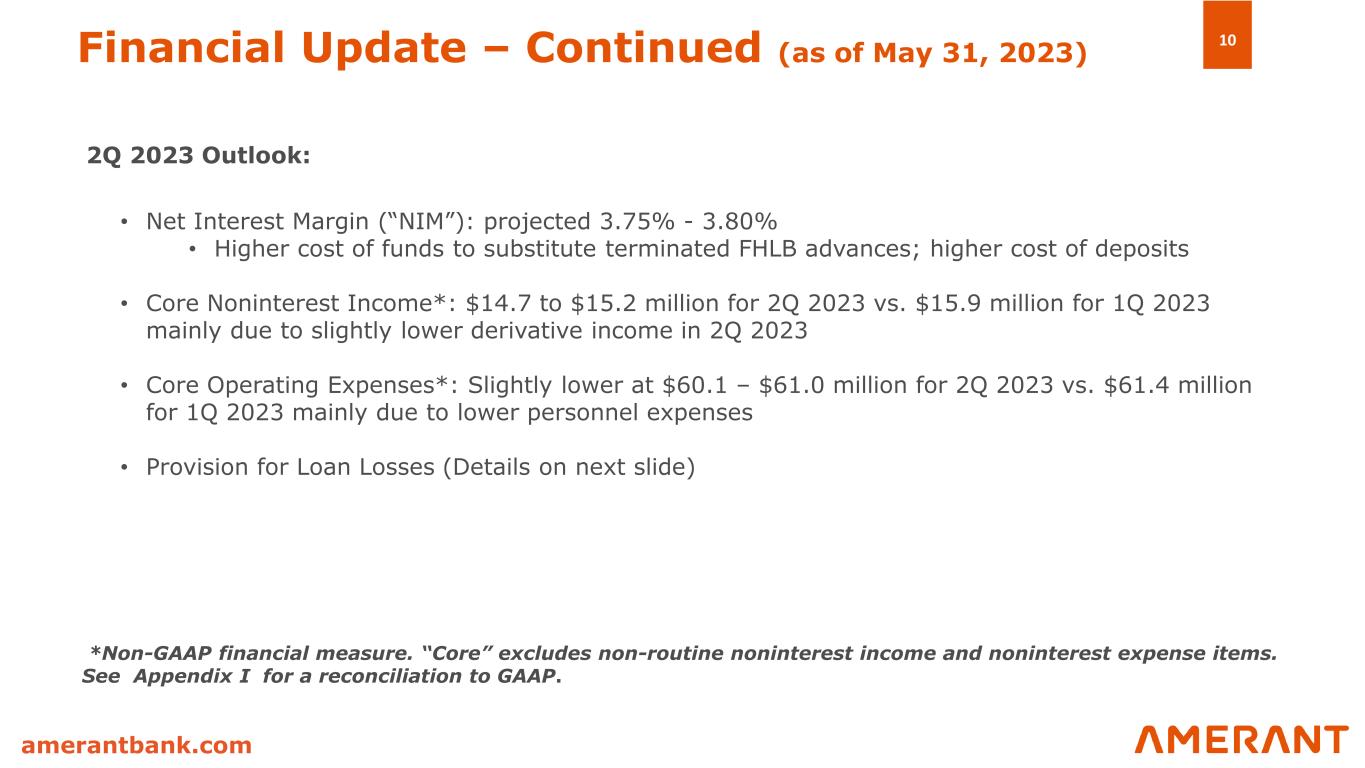

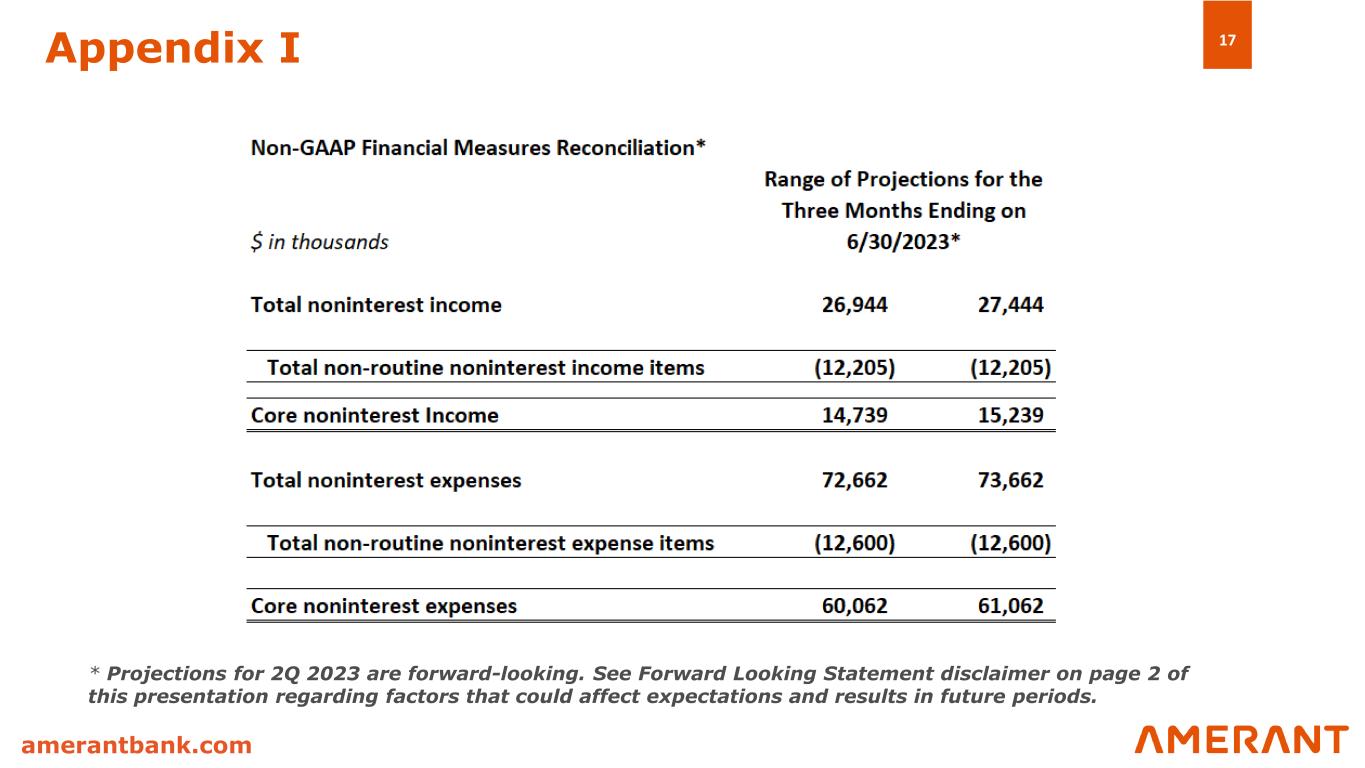

10 amerantbank.com Financial Update – Continued (as of May 31, 2023) 2Q 2023 Outlook: • Net Interest Margin (“NIM”): projected 3.75% - 3.80% • Higher cost of funds to substitute terminated FHLB advances; higher cost of deposits • Core Noninterest Income*: $14.7 to $15.2 million for 2Q 2023 vs. $15.9 million for 1Q 2023 mainly due to slightly lower derivative income in 2Q 2023 • Core Operating Expenses*: Slightly lower at $60.1 – $61.0 million for 2Q 2023 vs. $61.4 million for 1Q 2023 mainly due to lower personnel expenses • Provision for Loan Losses (Details on next slide) *Non-GAAP financial measure. “Core” excludes non-routine noninterest income and noninterest expense items. See Appendix I for a reconciliation to GAAP.

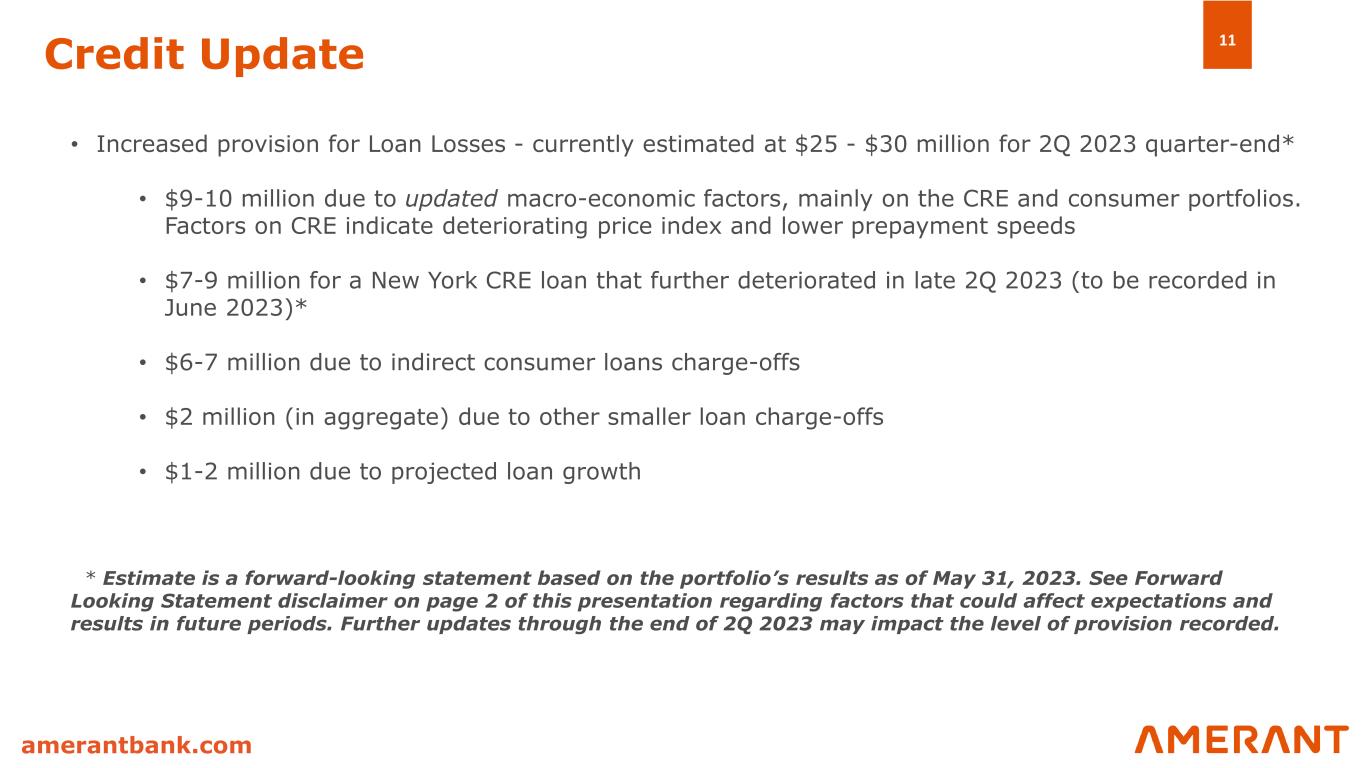

11 amerantbank.com Credit Update • Increased provision for Loan Losses - currently estimated at $25 - $30 million for 2Q 2023 quarter-end* • $9-10 million due to updated macro-economic factors, mainly on the CRE and consumer portfolios. Factors on CRE indicate deteriorating price index and lower prepayment speeds • $7-9 million for a New York CRE loan that further deteriorated in late 2Q 2023 (to be recorded in June 2023)* • $6-7 million due to indirect consumer loans charge-offs • $2 million (in aggregate) due to other smaller loan charge-offs • $1-2 million due to projected loan growth * Estimate is a forward-looking statement based on the portfolio’s results as of May 31, 2023. See Forward Looking Statement disclaimer on page 2 of this presentation regarding factors that could affect expectations and results in future periods. Further updates through the end of 2Q 2023 may impact the level of provision recorded.

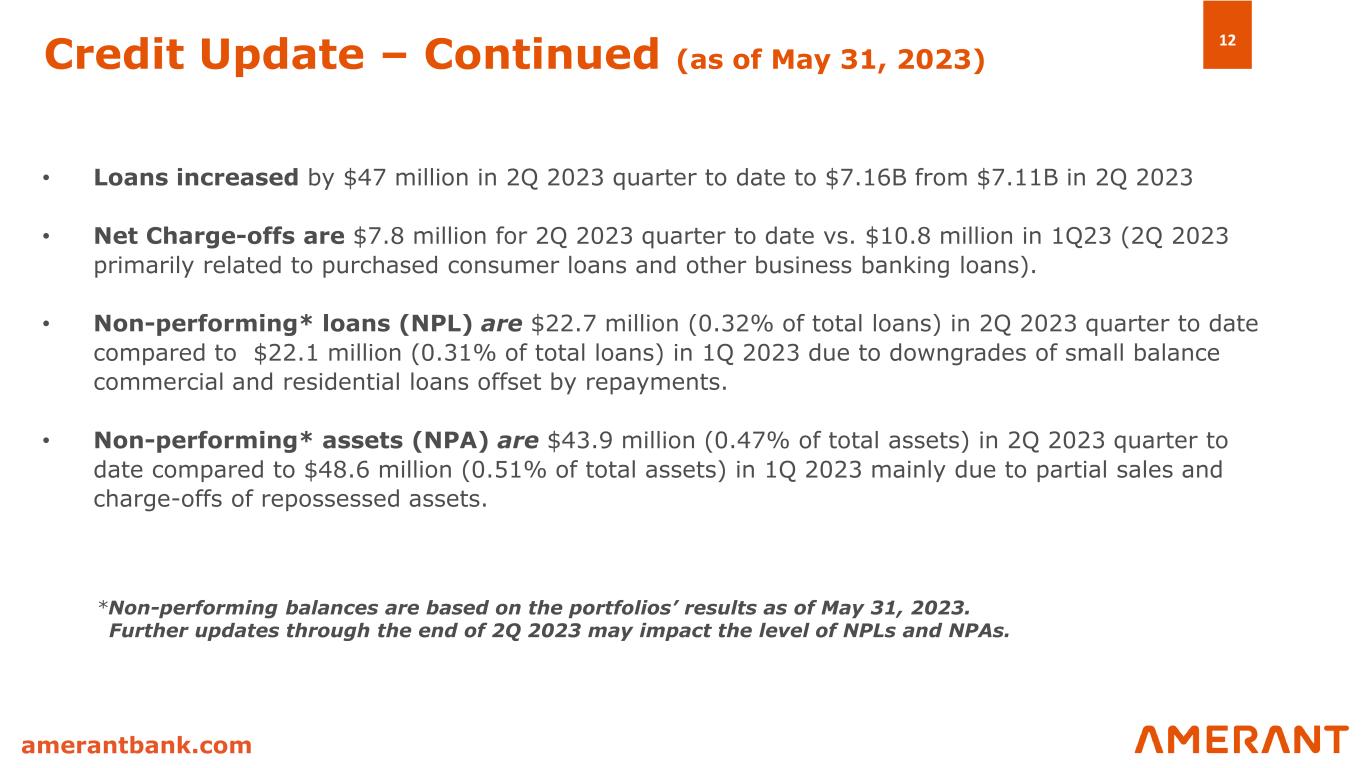

12 amerantbank.com Credit Update – Continued (as of May 31, 2023) • Loans increased by $47 million in 2Q 2023 quarter to date to $7.16B from $7.11B in 2Q 2023 • Net Charge-offs are $7.8 million for 2Q 2023 quarter to date vs. $10.8 million in 1Q23 (2Q 2023 primarily related to purchased consumer loans and other business banking loans). • Non-performing* loans (NPL) are $22.7 million (0.32% of total loans) in 2Q 2023 quarter to date compared to $22.1 million (0.31% of total loans) in 1Q 2023 due to downgrades of small balance commercial and residential loans offset by repayments. • Non-performing* assets (NPA) are $43.9 million (0.47% of total assets) in 2Q 2023 quarter to date compared to $48.6 million (0.51% of total assets) in 1Q 2023 mainly due to partial sales and charge-offs of repossessed assets. *Non-performing balances are based on the portfolios’ results as of May 31, 2023. Further updates through the end of 2Q 2023 may impact the level of NPLs and NPAs.

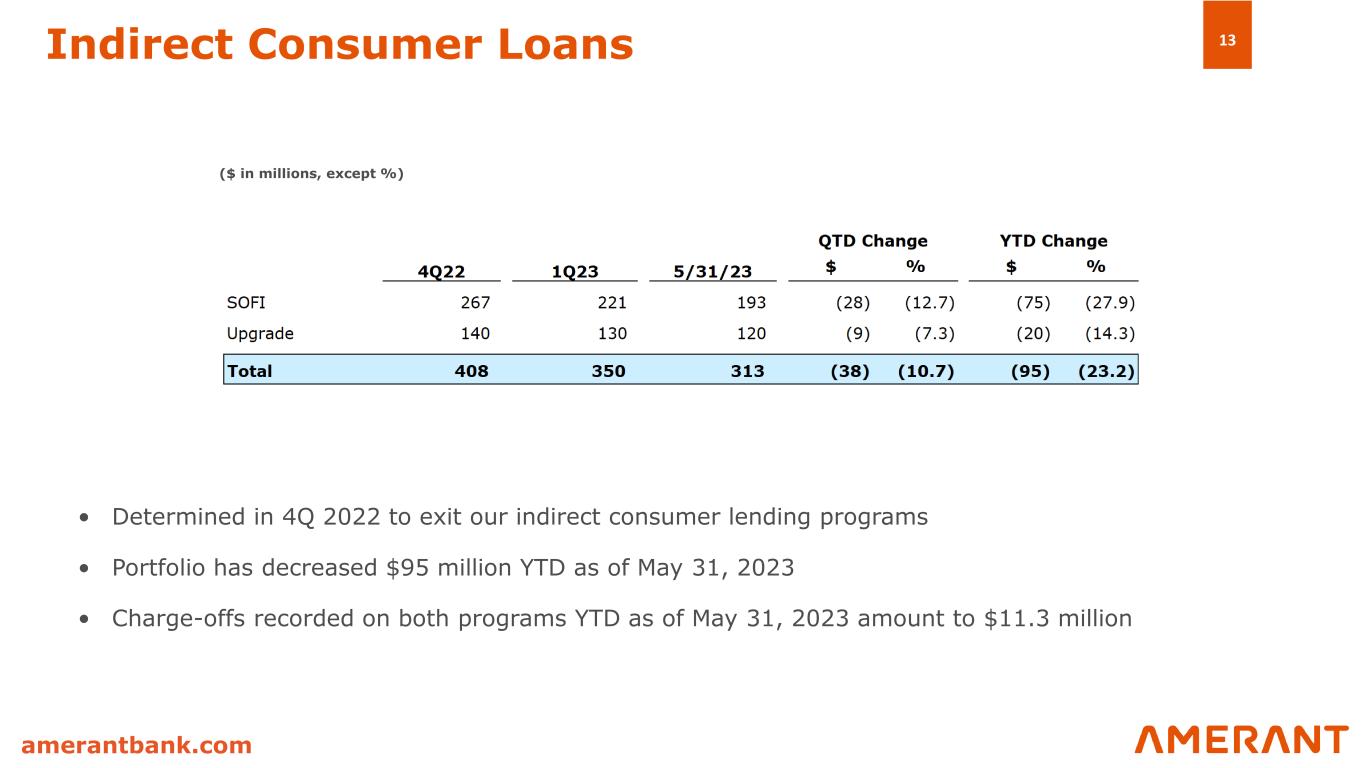

13 amerantbank.com Indirect Consumer Loans ($ in millions, except %) • Determined in 4Q 2022 to exit our indirect consumer lending programs • Portfolio has decreased $95 million YTD as of May 31, 2023 • Charge-offs recorded on both programs YTD as of May 31, 2023 amount to $11.3 million

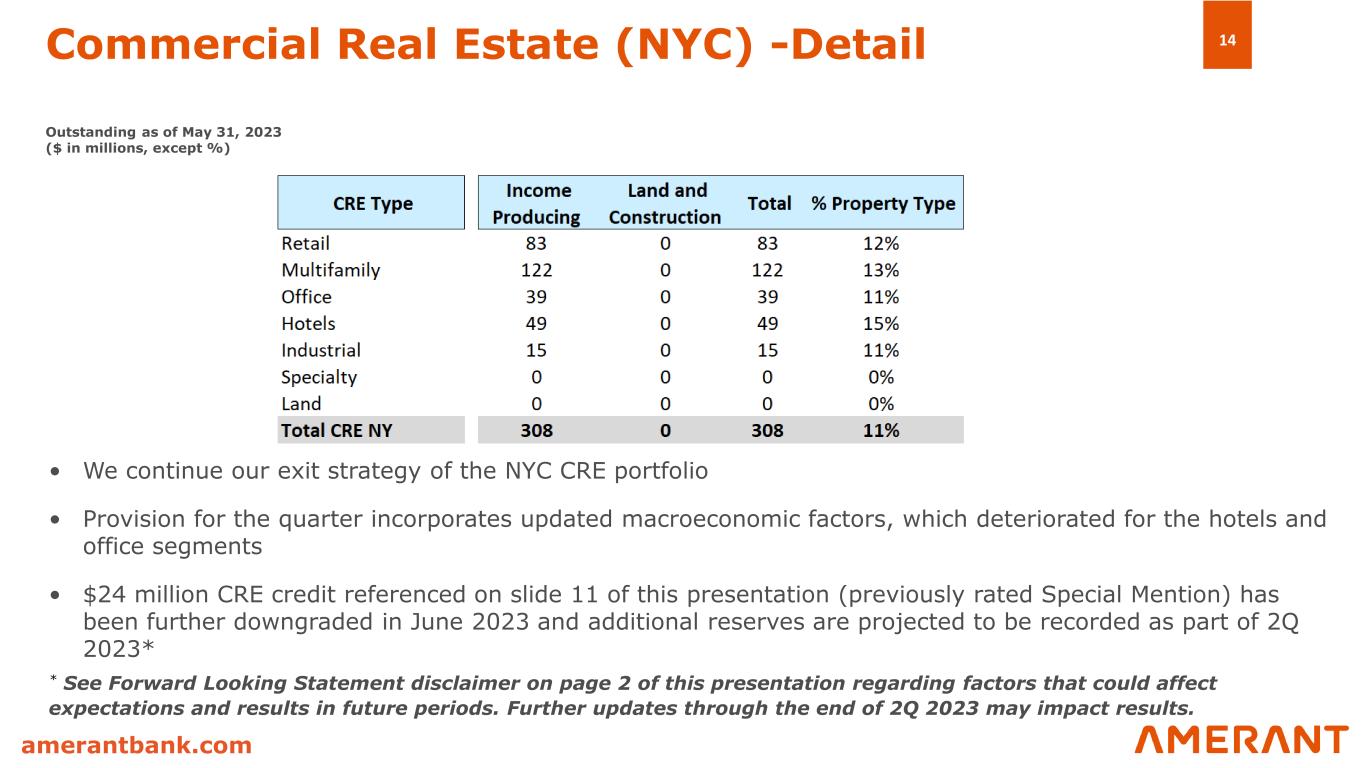

14 amerantbank.com Commercial Real Estate (NYC) -Detail Outstanding as of May 31, 2023 ($ in millions, except %) • We continue our exit strategy of the NYC CRE portfolio • Provision for the quarter incorporates updated macroeconomic factors, which deteriorated for the hotels and office segments • $24 million CRE credit referenced on slide 11 of this presentation (previously rated Special Mention) has been further downgraded in June 2023 and additional reserves are projected to be recorded as part of 2Q 2023* * See Forward Looking Statement disclaimer on page 2 of this presentation regarding factors that could affect expectations and results in future periods. Further updates through the end of 2Q 2023 may impact results.

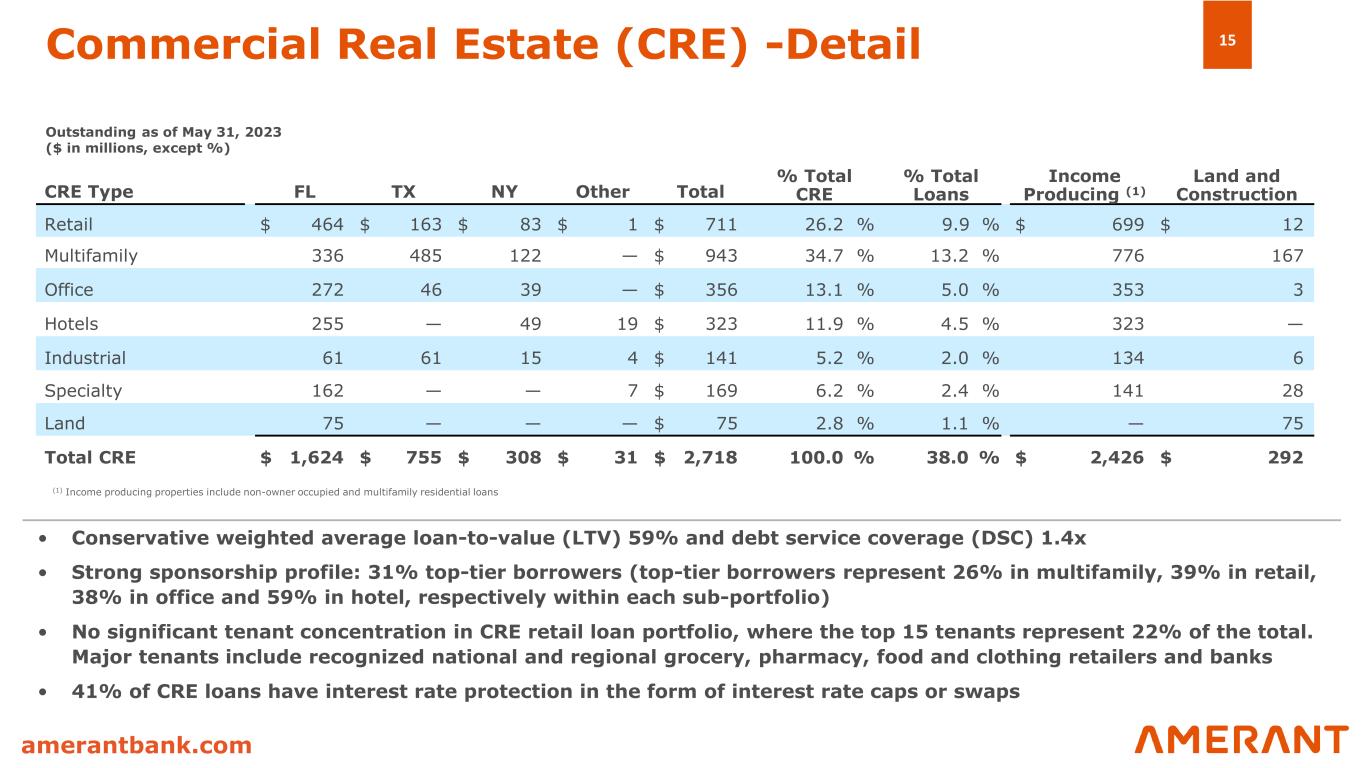

15 amerantbank.com Commercial Real Estate (CRE) -Detail CRE Type FL TX NY Other Total % Total CRE % Total Loans Income Producing (1) Land and Construction Retail $ 464 $ 163 $ 83 $ 1 $ 711 26.2 % 9.9 % $ 699 $ 12 Multifamily 336 485 122 — $ 943 34.7 % 13.2 % 776 167 Office 272 46 39 — $ 356 13.1 % 5.0 % 353 3 Hotels 255 — 49 19 $ 323 11.9 % 4.5 % 323 — Industrial 61 61 15 4 $ 141 5.2 % 2.0 % 134 6 Specialty 162 — — 7 $ 169 6.2 % 2.4 % 141 28 Land 75 — — — $ 75 2.8 % 1.1 % — 75 Total CRE $ 1,624 $ 755 $ 308 $ 31 $ 2,718 100.0 % 38.0 % $ 2,426 $ 292 • Conservative weighted average loan-to-value (LTV) 59% and debt service coverage (DSC) 1.4x • Strong sponsorship profile: 31% top-tier borrowers (top-tier borrowers represent 26% in multifamily, 39% in retail, 38% in office and 59% in hotel, respectively within each sub-portfolio) • No significant tenant concentration in CRE retail loan portfolio, where the top 15 tenants represent 22% of the total. Major tenants include recognized national and regional grocery, pharmacy, food and clothing retailers and banks • 41% of CRE loans have interest rate protection in the form of interest rate caps or swaps Outstanding as of May 31, 2023 ($ in millions, except %) (1) Income producing properties include non-owner occupied and multifamily residential loans

16 amerantbank.com Concluding Comments • Deposits First – intend to remain focused on progressive organic growth and continued reduction in uninsured deposits via ICS program. Focused also on further improving type of deposits and expanding international growth • Executive team is now in place. Staffing optimization that occurred in 2Q will reduce personnel run rate expense in upcoming quarters. However, will continue to look to selectively add business development team members, such as for the Houston private banking team • Credit will continue to be a primary focus given current market conditions. Going forward, similar to deposits, moving towards only organic, full relationship lending in the three markets we serve • Management focused on eliminating one time / non-recurring items “noise” in future quarters to the extent possible • Results show continued progress in our transformation to be “the bank of choice in the markets we serve”

17 amerantbank.com Appendix I * Projections for 2Q 2023 are forward-looking. See Forward Looking Statement disclaimer on page 2 of this presentation regarding factors that could affect expectations and results in future periods.

18 amerantbank.com Thank you Investor Relations InvestorRelations@amerantbank.com