Investor Update February 13, 2024 NYSE: AMTB amerantbank.com

Being the bank of choice in the markets we serve. Table of Contents 1 2 3 4 About Us Company Updates Performance Updates Community Updates Investor Update | 2

Important Notices and Disclosures Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2022 filed on March 1, 2023 (the “Form 10-K”), our quarterly report on Form 10-Q for the quarter ended March 31, 2023 filed on May 2, 2023, and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “pre-provision net revenue (PPNR)”, “core pre- provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expenses”, “core net income”, “core earnings per share (basic and diluted)”, “core return on assets (Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, “tangible stockholders’ equity (book value) per common share”, “tangible common equity ratio, adjusted for unrealized losses on debt securities held to maturity”, and “tangible stockholders’ equity (book value) per common share, adjusted for unrealized losses on debt securities held to maturity”, and “tangible stockholders’ book value per common share, adjusted for unrealized losses on securities held to maturity”. This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued in 2023, including the effect of non-routine items such as the sale of loans and securities and other repossessed assets, the valuation of securities, derivatives, loans held for sale and other real estate owned, impairment of investments, early repayment of FHLB advances, Bank owned life insurance restructure, and other non-recurring actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. Appendix 1 reconciles these non-GAAP financial measures to reported GAAP results. Interim Financial Information Unaudited financial information as of and for interim periods, including the three month periods ended September 30, 2023, June 30, 2023, March 31, 2023, and the three and twelve month periods ended December 31, 2023, may not reflect our results of operations for our fiscal year ended, or financial condition as of December 31, 2023, or any other period of time or date. As previously disclosed in the Form 10-K, the Company adopted the new guidance on accounting for current expected credit losses on financial instruments (“CECL”) effective as of January 1, 2022. Quarterly amounts previously reported on our quarterly reports on Form 10-Q for the periods ended March 31, 2022, June 30, 2022 and September 30, 2022 do not reflect the adoption of CECL. In the fourth quarter of 2022, the Company recorded a provision for credit losses totaling $20.9 million, including $11.1 million related to the retroactive effect of adopting CECL for all previous quarterly periods in the year ended December 31, 2022, including loan growth and changes to macro-economic conditions during the period. Recast amounts included in the earnings release and accompanying presentation reflect the impacts of the adoption of CECL on each interim period of 2022. See the Form 10-K for more details on the adoption of CECL and related effects to quarterly results for each quarter in the year ended December 31, 2022. Investor Update | 3

About Us

About Us History Team Members Assets Deposits AUM Founded in 1979 Completed IPO in December 2018 Rebranded as Amerant in June 2019 682 FTEs (67 FTEs - Amerant Mortgage) $9.7 billion Largest community bank headquartered in Florida $7.9 billion $2.3 billion under management/custody 23 Banking Centers 10 Miami-Dade 4 Broward 2 Palm Beach 1 Tampa, FL 6 Houston, TX Headquarters Coral Gables, FL Regional Corporate Offices Houston, TX Tampa, FL (upcoming) Plantation, FL (upcoming) 1 (1) Community banks include those with less than $10 billion in assets Investor Update | 5 Financial and non-financial information provided here is as of December 31, 2023

Our Investment Proposition Established franchise with high scarcity value; presence in attractive, high-growth markets of Miami/South Florida, Tampa and Houston. Strong and diverse deposit base; organic, deposits-first focus. Strong reserve coverage and disciplined credit culture. Well capitalized; committed to enhancing shareholder returns via dynamic capital management. Transition from multiyear transformation phase over to excution and profitable growth Investor Update | 6 Executive leadership team in place Completed core conversion; now operating with a new, fully integrated, state-of-the-art core tech system to better serve our customers and team members New locations and infrastructure changes nearing completion Accelerating digital transformation efforts We have the strong foundation to enable us to become a consistent top-quartile performer.

Being leaders in innovation, quality, efficiency, and customer satisfaction Our Mission, Vision, and Precepts Mission Vision Precepts To provide our customers with the products, services and advice they need to achieve financial success, through our diverse, inclusive and motivated team that is personally involved with the communities we serve, all of which result in increased shareholder value. To be the bank of choice in the markets we serve. Consitently exceeding expectations (going above and beyond) Promoting a diverse and inclusive work environment where every person is given the encouragement, support, and opportunity to be successful Holding ourselves and each other accountable and always doing what is right Treating everyone as we expect to be treated Being the bank of choice in the markets we serve Providing the customer with the right products, services, and advice to meet their needs Investor Update | 7

Experienced Leadership Team Jerry Plush | Chairman and CEO Mr. Plush serves as the Company’s Chairman, President, and CEO since June 8, 2022, having served previously as Vice-Chairman & CEO since March 20, 2021, and as Vice Chairman since February 15, 2021. Mr. Plush is a highly respected financial services industry professional with over 35 years of senior executive leadership experience. Sharymar Calderon | EVP, Chief Financial Officer Sharymar Calderón Yépez was appointed Executive Vice President, Chief Financial Officer (CFO) in June 2023. Calderón is responsible for Amerant’s financial management, including treasury, financial reporting and accounting, financial analysis, investor relations & sustainability, internal controls and corporate tax. Alberto Capriles | SEVP, Chief Risk Officer Alberto Capriles was appointed Senior Executive Vice President in January 2023 and named Chief Risk Officer in February 2018. He is responsible for all enterprise risk management oversight, including credit, market, operational and information security risk. Juan Esterripa | SEVP, Head of Commercial Banking Juan Esterripa serves as Amerant Bank’s SEVP, Head of Commercial Banking since April 2023. He is a seasoned banking professional with significant experience in corporate and commercial banking. In his role, Esterripa oversees multiple business sectors, including commercial banking, commercial real estate, syndications, specialty finance, and treasury management. Carlos Iafigliola | SEVP, Chief Operating Officer Carlos Iafigliola was appointed Senior Executive Vice President, Chief Operating Officer (COO) in June 2023. He is responsible for Amerant’s loan and deposit operations, project management, technology services, procurement, facilities, strategy and digital. Prior to his appointment as COO, Iafigliola served as CFO since May 2020. Howard Levine | SEVP, Head of Consumer Banking Howard Levine was appointed Senior Executive Vice President in January 2023. He has served as Head of Consumer Banking since joining Amerant in June 2022. Levine oversees the Private Client Group, Wealth Management, Small Business Banking, Retail Banking, and Amerant Mortgage. Most recently, he served as EVP and Chief Revenue Officer at Amerant Mortgage. Mariola Sanchez | SEVP, Chief People Officer Mariola Triana Sanchez leads Amerant Bank’s approach to people and organizational culture as the bank’s Chief People Officer. Previously serving as Amerant’s General Counsel, Mariola was appointed to her position in June 2022. Laura Rossi | SVP, Head of Investor Relations & Sustainability Laura Rossi was appointed Senior Vice President and Head of Investor Relations & Sustainability in August 2022, having served previously as SVP, Head of Investor Relations since March 2018. In her role, Rossi spearheads Amerant’s relationship with the investment community and rating agencies, as well as the Company’s ESG program execution and strategy. Investor Update | 8

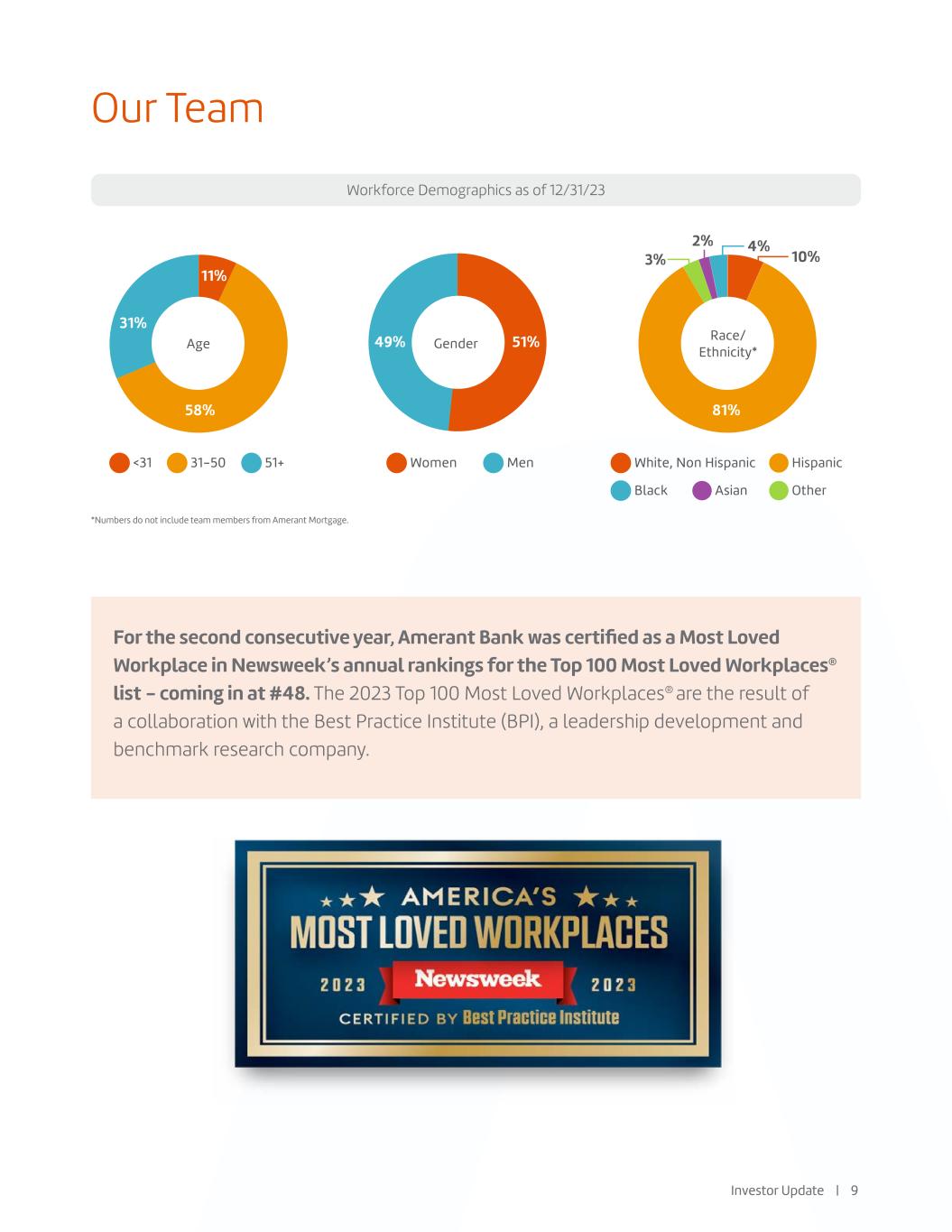

Our Team Workforce Demographics as of 12/31/23 For the second consecutive year, Amerant Bank was certified as a Most Loved Workplace in Newsweek’s annual rankings for the Top 100 Most Loved Workplaces® list - coming in at #48. The 2023 Top 100 Most Loved Workplaces® are the result of a collaboration with the Best Practice Institute (BPI), a leadership development and benchmark research company. *Numbers do not include team members from Amerant Mortgage. White, Non Hispanic Hispanic Black OtherAsian Women Men<31 31-50 51+ 49% 81% 10% 4% 3% 2% 51% 58% 11% 31% Age Gender Race/ Ethnicity* Investor Update | 9

Company Updates

4Q 2023 in Review Investor Update | 11 Total deposits increased $326 million, while total loans grew by $132 million Reclassified $401 million of our Houston-based multifamily loans as held-for-sale; recorded non- cash charge of $30.0 million before taxes in 4Q23; sale completed on January 25, 2024 Completed previously-announced NYC CRE loan sale Restructured FHLB advances resulting in a reduced cost of funds from wholesale funding for 2024 Acquired remaining ownership interest in Amerant Mortgage, which is now a wholly-owned subsidiary; rightsized staffing given current rate environment Approved plan for dissolution of Elant Bank & Trust, our Cayman-based subsidiary Further organizational rationalization resulting in reduction in FTEs and operational efficiencies Completed FIS core conversion; digital transformation efforts accelerated post conversion Restructured Bank-Owned Life Insurance (“BOLI”); benefits to be recorded in future periods Mid-1Q 2024 Update Reduction in institutional deposits of $262 million (as of February 8, 2024) As of January 31, 2024, loan balance reduction resulting from the Houston multifamily loan sale was partially offset by $159 million in loan production; continue to expect strong loan and deposit pipelines and project earning assets and deposits to end flat in 1Q24 compared to 4Q23 2024 Outlook Projected annual loan growth of approximately 15% Projected annual deposit growth to match loan growth Focus on improving the ratio of noninterest-bearing to total deposits Loan-to-deposit target is expected to remain at 95% Net interest margin is expected to be stable compared to the normalized 4Q ‘23 results at the $3.50 to $3.60 level in the first half of 2024 and to improve over the second half of the year Given investment in continued expansion, higher expenses are expected in the first half of 2024 projecting to achieve 60% efficiency in the second half of 2024 as we grow Continue executing prudent capital management, balancing between retaining capital for growth and buybacks and dividends to enhance returns

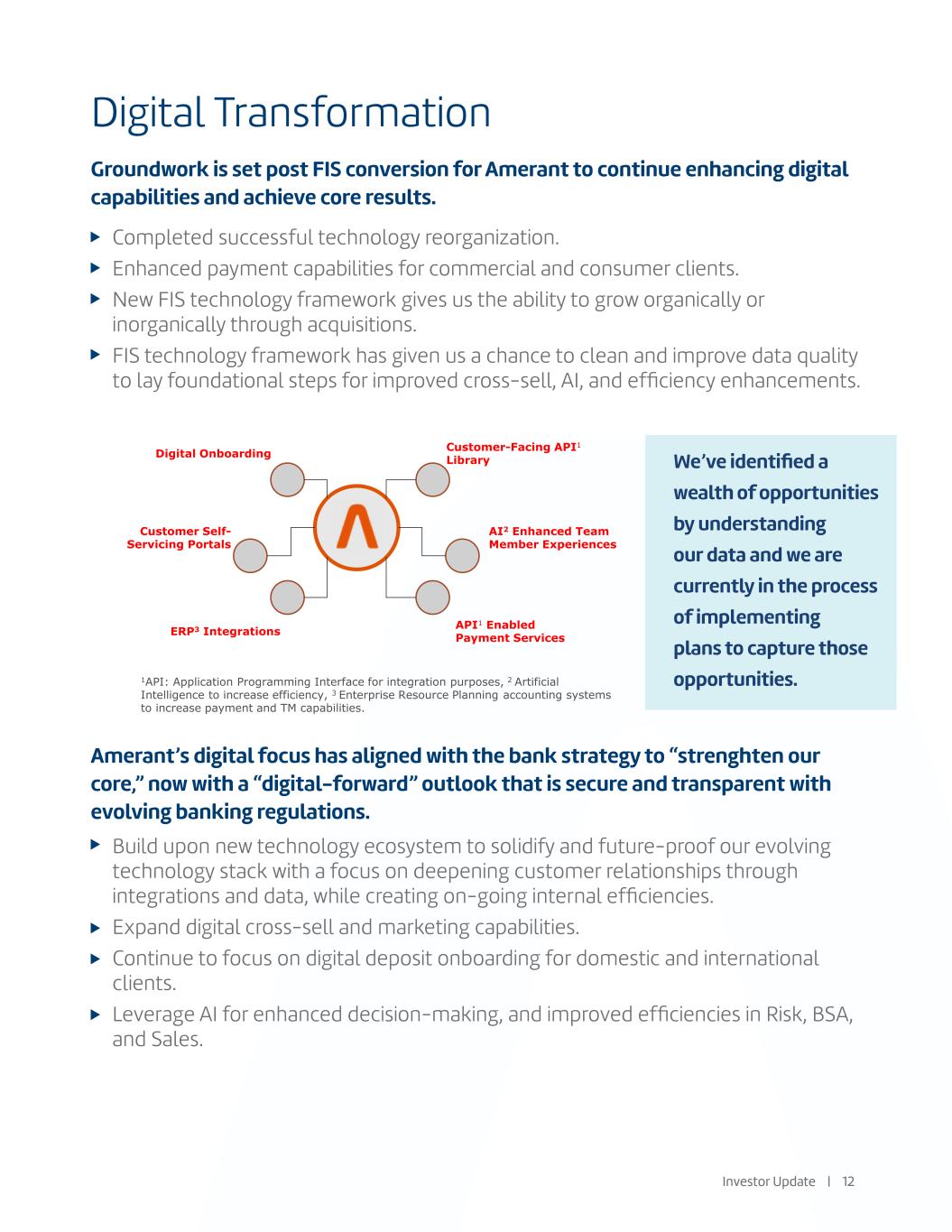

Digital Transformation Groundwork is set post FIS conversion for Amerant to continue enhancing digital capabilities and achieve core results. Amerant’s digital focus has aligned with the bank strategy to “strenghten our core,” now with a “digital-forward” outlook that is secure and transparent with evolving banking regulations. Digital Onboarding Customer-Facing API1 Library Customer Self- Servicing Portals AI2 Enhanced Team Member Experiences ERP3 Integrations API1 Enabled Payment Services 1API: Application Programming Interface for integration purposes, 2 Artificial Intelligence to increase efficiency, 3 Enterprise Resource Planning accounting systems to increase payment and TM capabilities. We’ve identified a wealth of opportunities by understanding our data and we are currently in the process of implementing plans to capture those opportunities. Completed successful technology reorganization. Enhanced payment capabilities for commercial and consumer clients. New FIS technology framework gives us the ability to grow organically or inorganically through acquisitions. FIS technology framework has given us a chance to clean and improve data quality to lay foundational steps for improved cross-sell, AI, and efficiency enhancements. Build upon new technology ecosystem to solidify and future-proof our evolving technology stack with a focus on deepening customer relationships through integrations and data, while creating on-going internal efficiencies. Expand digital cross-sell and marketing capabilities. Continue to focus on digital deposit onboarding for domestic and international clients. Leverage AI for enhanced decision-making, and improved efficiencies in Risk, BSA, and Sales. Investor Update | 12

The Amerant Brand Evolution 2024 Imagine Tomorrow Campaign We have identified an opportunity to enhance our 2021 Imagine Campaign by aligning it with the underlying reasons our customers should choose Amerant for their banking needs. Shifting from a functional to an emotive approach. Obtaining a business loan now signifies the realization of your entrepreneurial dreams and starting a savings fund for your wedding translates to a joyous “happily ever after” with your partner. Life. You can mark it as an endless parade of choices being made. There’s a few that’ll stay with us for a lifetime, like a name. And a whole lot that’ll seem insignificant, like chocolate or vanilla, coleslaw or fries. And then, there are the big ones. The life-changing ones. The ones that’ll wake us in the middle of the night just to remind us of the enormous weight in every single one. These are the choices all our dreams and plans are built on. So choose wisely today, and imagine what can be tomorrow. Investor Update | 13

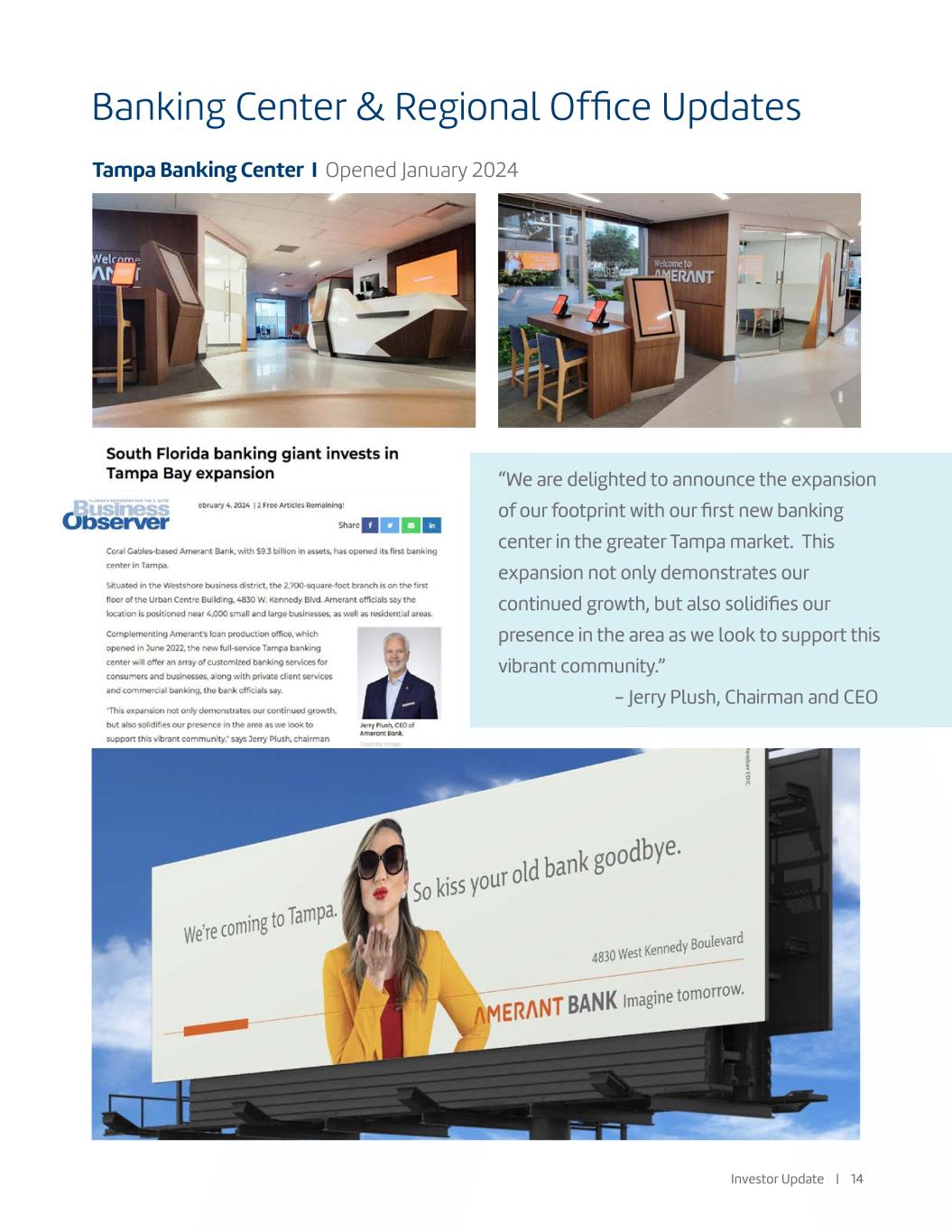

Banking Center & Regional Office Updates Tampa Banking Center I Opened January 2024 Investor Update | 14 “We are delighted to announce the expansion of our footprint with our first new banking center in the greater Tampa market. This expansion not only demonstrates our continued growth, but also solidifies our presence in the area as we look to support this vibrant community.” - Jerry Plush, Chairman and CEO

Banking Center & Regional Office Updates Broward County Regional Corporate Office Our vision is to be the bank of choice in the markets we serve, and the establishment of a formal regional corporate office in Broward County is essential toward achieving that vision. Located within the Cornerstone One Building at 1200 South Pine Island Road, Plantation, Florida, Amerant will immediately occupy 5,500 square feet, with an expansion of an additional 7,000 square feet sometime in late 1Q 2024. Our new office will be home for key lines of business. Tampa Regional Corporate Office Targeted for 1Q 2024. Investor Update | 15 Downtown Miami Banking Center Targeted for 1Q 2024 Las Olas, Ft. Lauderdale Banking Center Targeted for 1Q 2024

Performance Updates

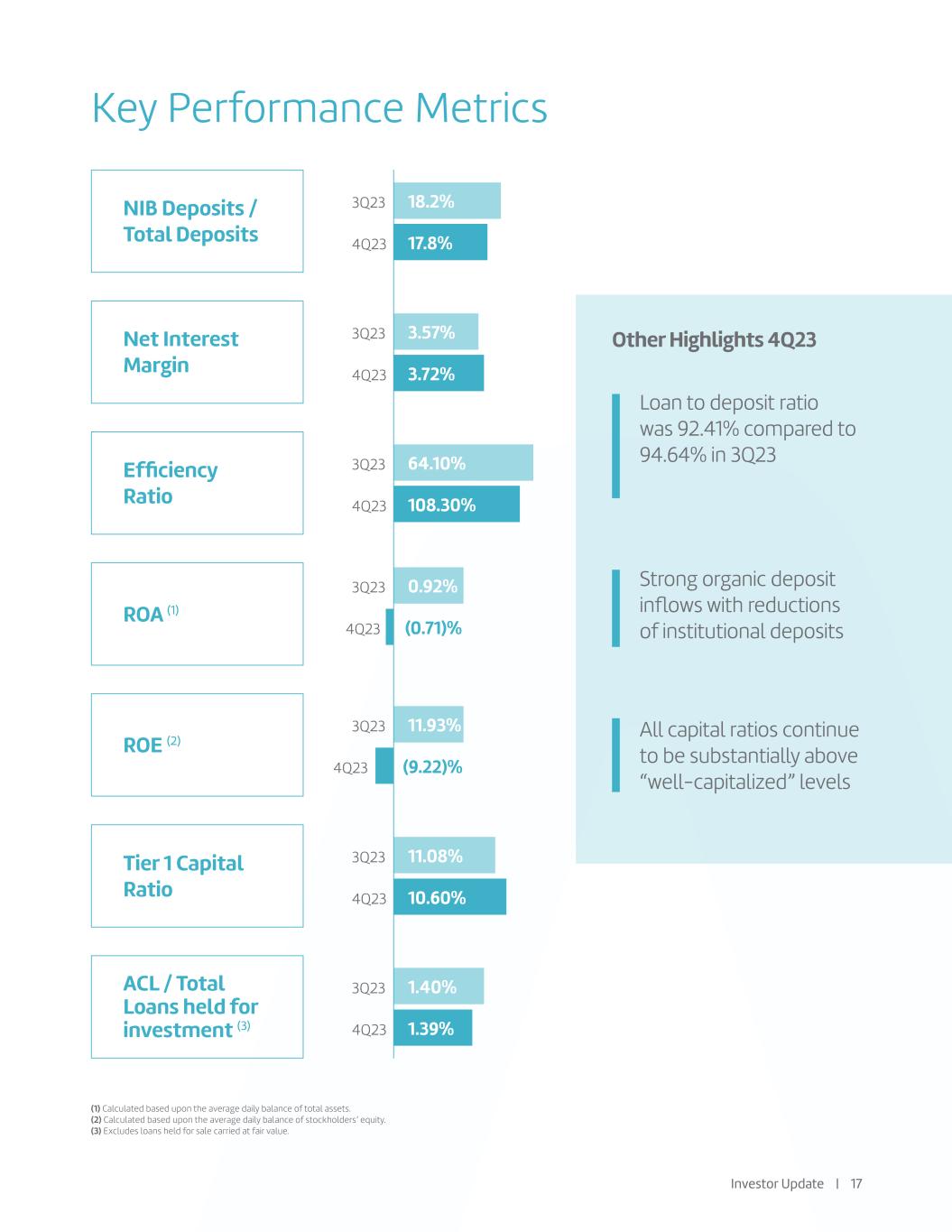

Key Performance Metrics NIB Deposits / Total Deposits Net Interest Margin Efficiency Ratio ROA (1) ROE (2) Tier 1 Capital Ratio ACL / Total Loans held for investment (3) Loan to deposit ratio was 92.41% compared to 94.64% in 3Q23 3Q23 18.2% 3Q23 3.57% 3Q23 64.10% 3Q23 0.92% 3Q23 11.93% 3Q23 11.08% 3Q23 1.40% 4Q23 17.8% 4Q23 3.72% 4Q23 108.30% 4Q23 (0.71)% 4Q23 (9.22)% 4Q23 10.60% 4Q23 1.39% Strong organic deposit inflows with reductions of institutional deposits Other Highlights 4Q23 All capital ratios continue to be substantially above “well-capitalized” levels Investor Update | 17 (1) Calculated based upon the average daily balance of total assets. (2) Calculated based upon the average daily balance of stockholders’ equity. (3) Excludes loans held for sale carried at fair value.

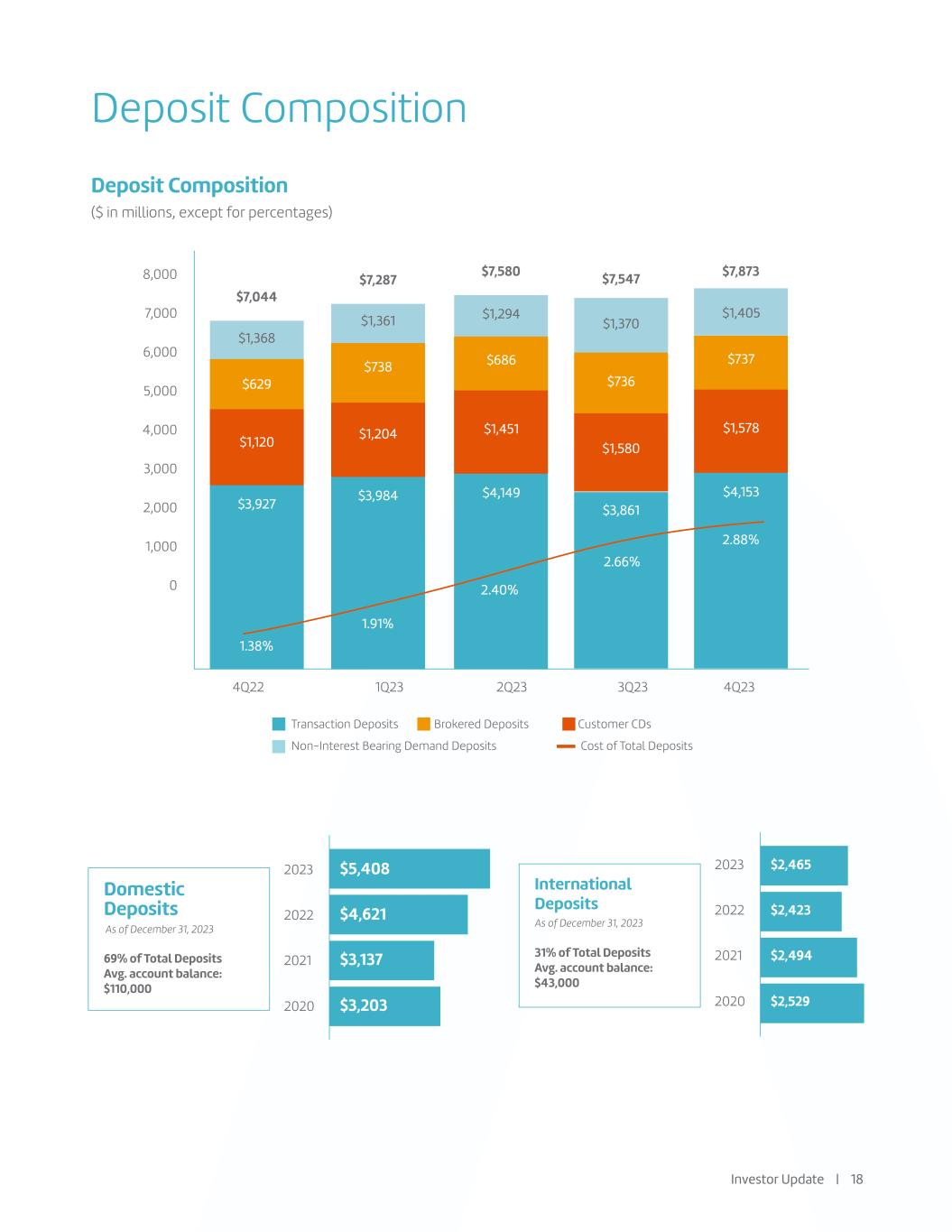

Deposit Composition Deposit Composition ($ in millions, except for percentages) Transaction Deposits Brokered Deposits Customer CDs Non-Interest Bearing Demand Deposits Cost of Total Deposits International Deposits 31% of Total Deposits Avg. account balance: $43,000 2023 $2,4652023 $5,408 2022 $2,4232022 $4,621 2021 $2,4942021 $3,137 4Q22 1Q23 2Q23 3Q23 4Q23 $1,368 $1,361 $1,294 $7,044 $7,287 $7,5808,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 2020 $2,5292020 $3,203 Domestic Deposits 69% of Total Deposits Avg. account balance: $110,000 1.38% 1.91% 2.40% $629 $1,120 $3,927 $738 $1,204 $3,984 $686 $1,451 $4,149 $1,370 $7,547 2.66% $736 $1,580 $3,861 Investor Update | 18 $1,405 $7,873 2.88% $737 $1,578 $4,153 As of December 31, 2023 As of December 31, 2023

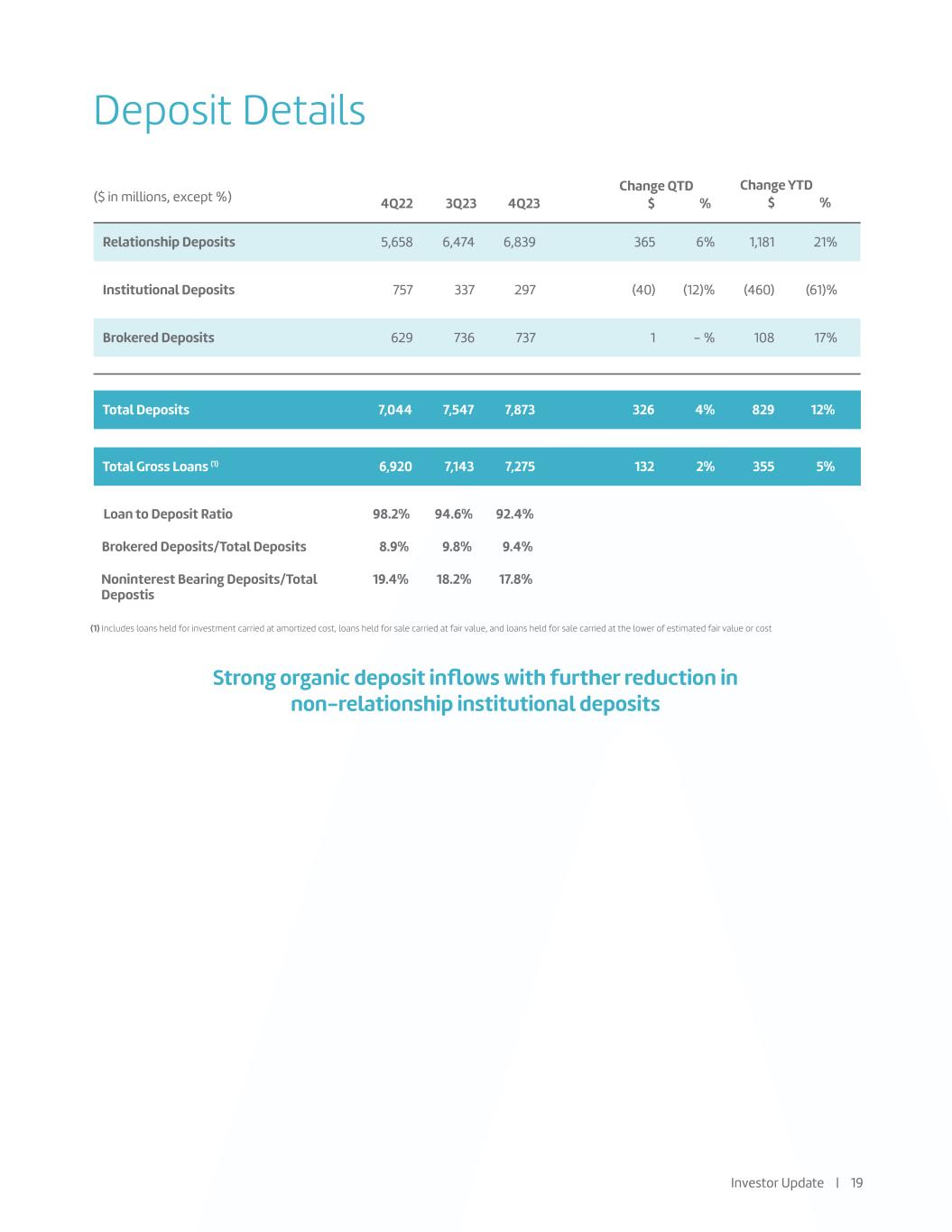

Deposit Details Strong organic deposit inflows with further reduction in non-relationship institutional deposits Relationship Deposits Institutional Deposits Brokered Deposits 4Q22 3Q23 4Q23 Change QTD 5,658 6,474 6,839 365 6% 1,181 21% 757 337 297 (40) (12)% (460) (61)% 629 736 737 1 - % 108 17% (1) Includes loans held for investment carried at amortized cost, loans held for sale carried at fair value, and loans held for sale carried at the lower of estimated fair value or cost Total Deposits 7,044 7,547 7,873 326 4% Total Gross Loans (1) 6,920 7,143 7,275 132 2% Loan to Deposit Ratio 98.2% 94.6% 92.4% Brokered Deposits/Total Deposits 8.9% 9.8% 9.4% Noninterest Bearing Deposits/Total Depostis 19.4% 18.2% 17.8% $ % Change YTD $ % 829 12% 355 5% ($ in millions, except %) Investor Update | 19

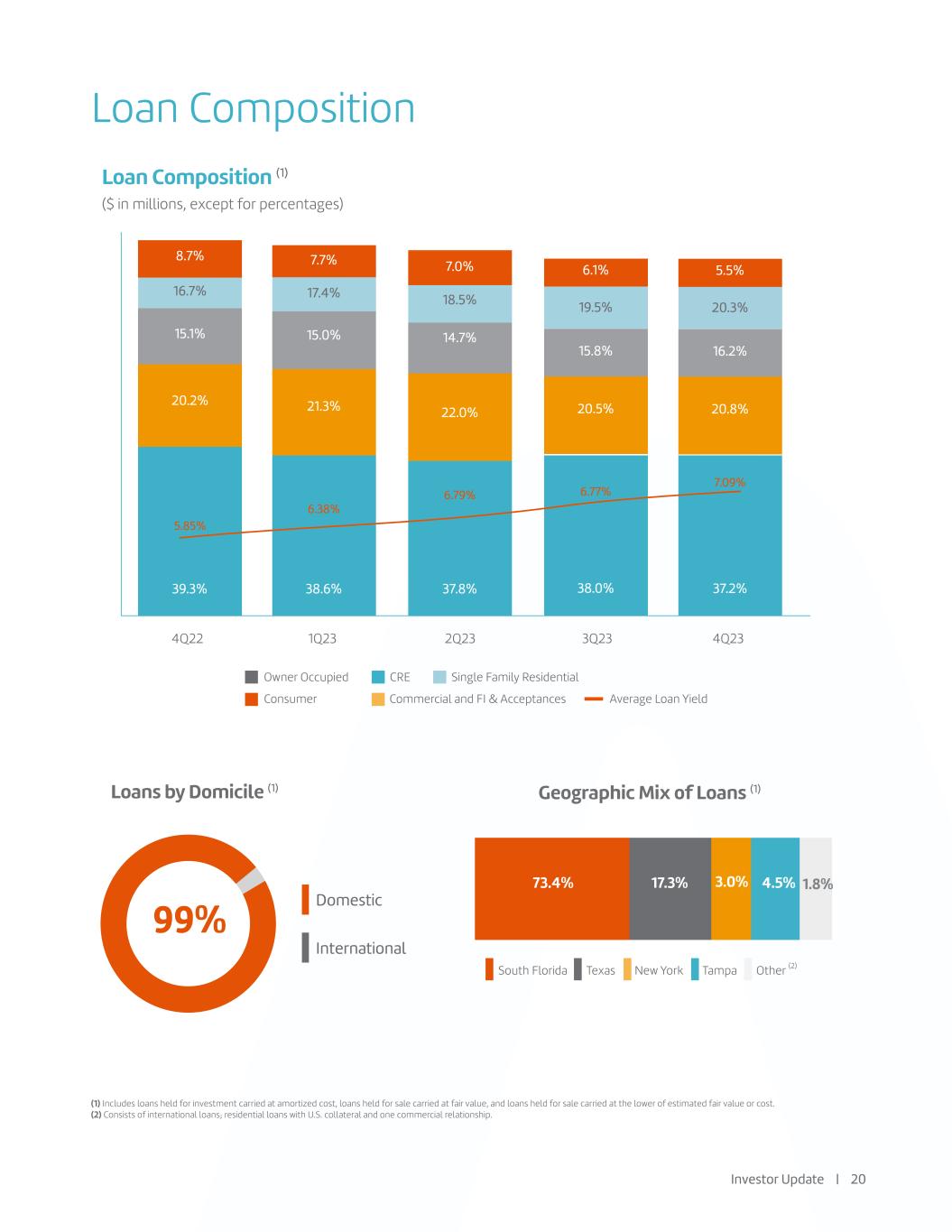

Loan Composition Loan Composition (1) ($ in millions, except for percentages) (1) Includes loans held for investment carried at amortized cost, loans held for sale carried at fair value, and loans held for sale carried at the lower of estimated fair value or cost. (2) Consists of international loans; residential loans with U.S. collateral and one commercial relationship. South Florida Texas New York Tampa Other (2) Owner Occupied CRE Single Family Residential Consumer Commercial and FI & Acceptances Average Loan Yield Loans by Domicile (1) Geographic Mix of Loans (1) 4Q22 1Q23 2Q23 3Q23 4Q23 Domestic International 99% 73.4% 17.3% 3.0% 4.5% 39.3% 38.6% 37.8% 8.7% 16.7% 15.1% 20.2% 5.85% 6.38% 6.79% 7.7% 17.4% 15.0% 21.3% 7.0% 18.5% 14.7% 22.0% 6.1% 19.5% 15.8% 20.5% 38.0% 6.77% 1.8% Investor Update | 20 5.5% 20.3% 16.2% 20.8% 37.2% 7.09%

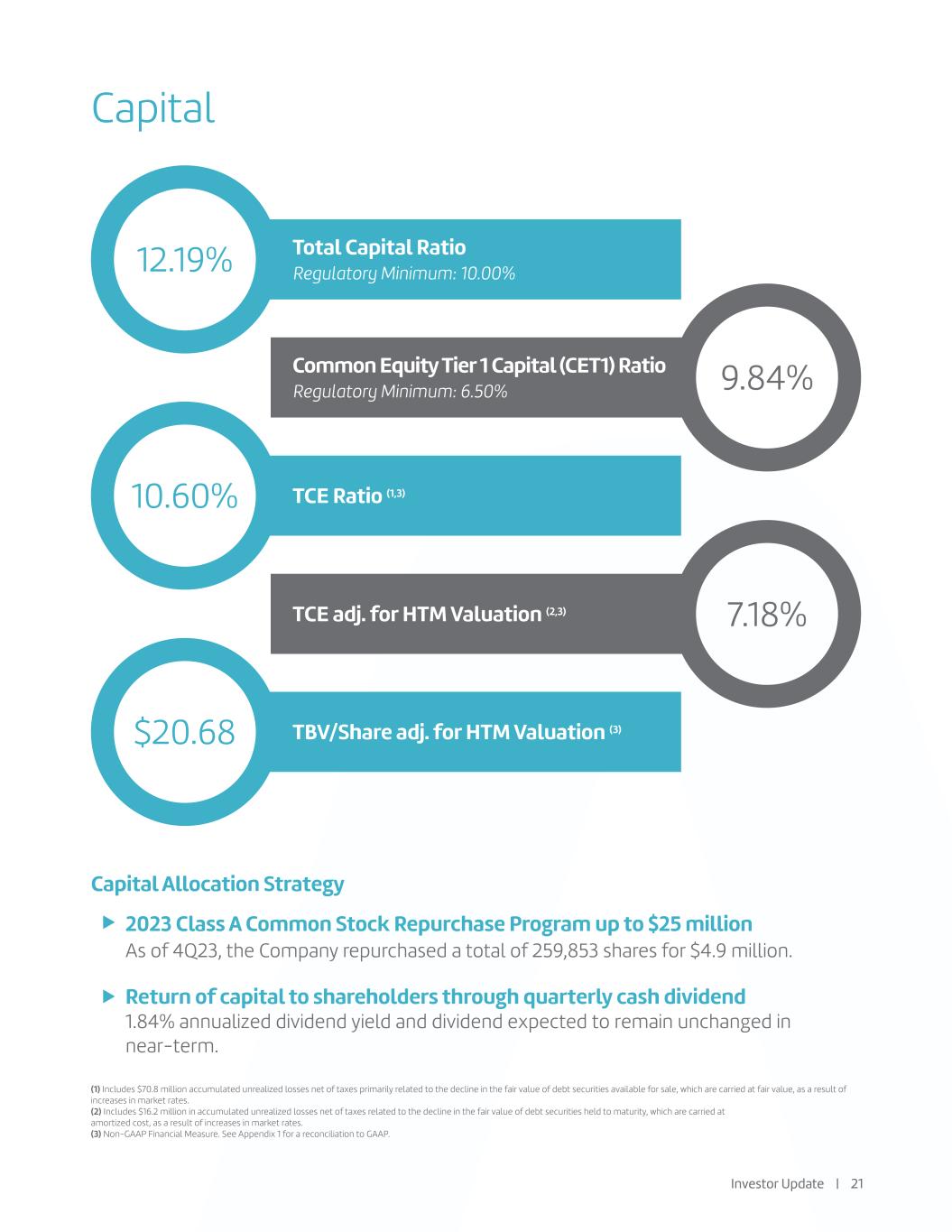

Capital 12.19% 10.60% 9.84% 7.18% $20.68 Total Capital Ratio Regulatory Minimum: 10.00% Common Equity Tier 1 Capital (CET1) Ratio Regulatory Minimum: 6.50% TCE Ratio (1,3) TCE adj. for HTM Valuation (2,3) TBV/Share adj. for HTM Valuation (3) Capital Allocation Strategy 2023 Class A Common Stock Repurchase Program up to $25 million As of 4Q23, the Company repurchased a total of 259,853 shares for $4.9 million. Return of capital to shareholders through quarterly cash dividend 1.84% annualized dividend yield and dividend expected to remain unchanged in near-term. (1) Includes $70.8 million accumulated unrealized losses net of taxes primarily related to the decline in the fair value of debt securities available for sale, which are carried at fair value, as a result of increases in market rates. (2) Includes $16.2 million in accumulated unrealized losses net of taxes related to the decline in the fair value of debt securities held to maturity, which are carried at amortized cost, as a result of increases in market rates. (3) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. Investor Update | 21

Liquidity Regular testing of lines of credit; satisfactory results have been obtained as of December 31, 2023 Daily monitoring of Federal Reserve Bank account balances as well as large fund providers Daily analysis of lending pipeline and deposit gathering opportunities and their impact on cash flow projections Targets associated with liquidity stress test scenarios Targets for deposit concentration Limits on liquidity ratios Active collateral management of both loan and investment portfolios with lending facilities at FHLB and FRB 82% of the total portfolio has government guarantee, while the remainder is rated investment grade Total advances were $645 million An additional $2.2 billion of remaining credit availability with the FHLB Borrowing capacity with the FHLB is approximately $1.92 billion, including both securities and loans Strong level of cash on hand: $249 million as of 4Q23 at the Federal Reserve Bank (“FRB”) account Continued efforts to increase FDIC insurance through Insured Cash Sweep (“ICS”) Instituted deposit covenants with minimum balance requirements for any new credit relationship Prudently utilizing our $20 million share repurchase program with a focus on liquidity management and capital preservation Our standard liquidity management practices include: Available line of credit with FHLB as of 4Q23: Additional actions that strenghten liquidity position: Investor Update | 22

Supplemental Information

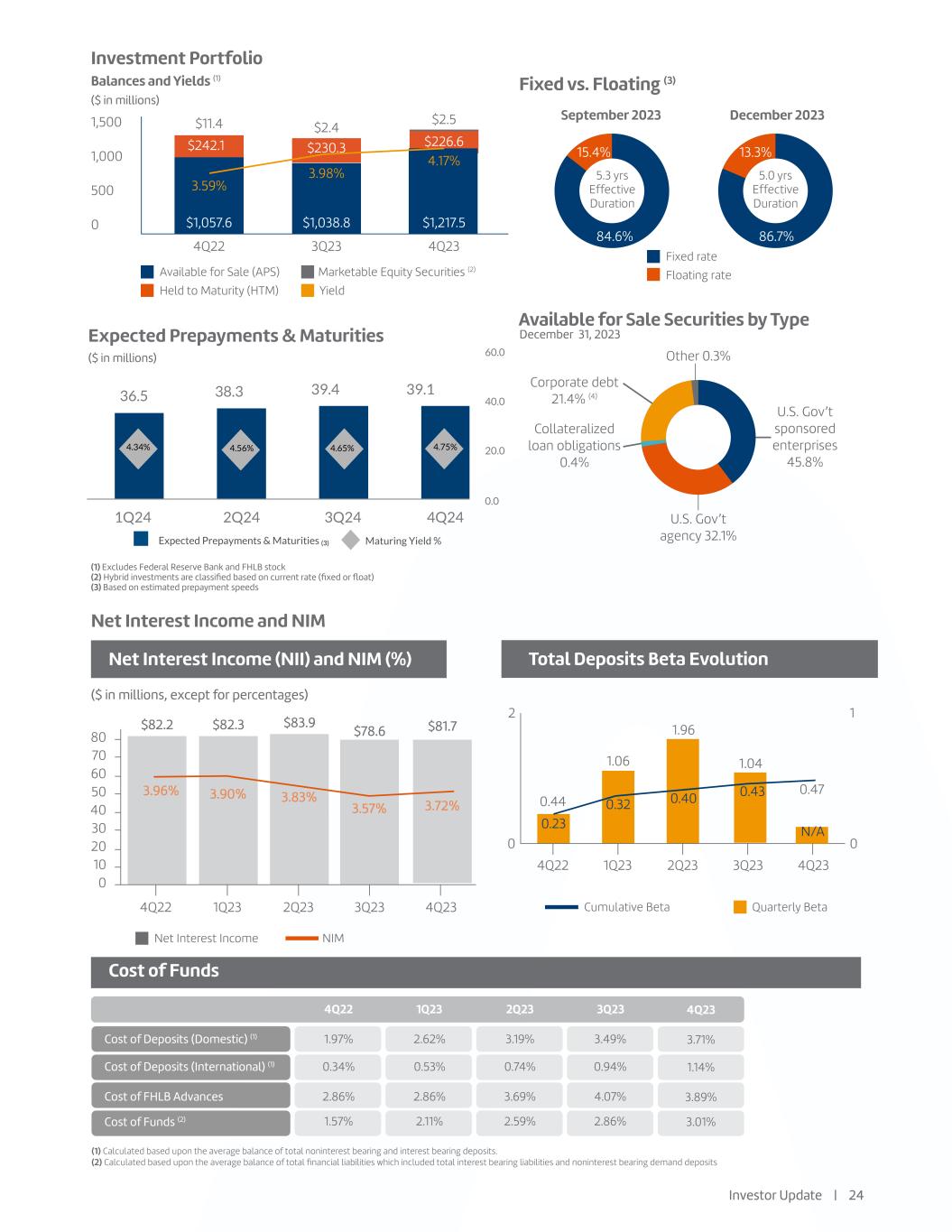

3.72% $81.7 Net Interest Income and NIM ($ in millions, except for percentages) Net Interest Income (NII) and NIM (%) Total Deposits Beta Evolution Cost of Funds (1) Calculated based upon the average balance of total noninterest bearing and interest bearing deposits. (2) Calculated based upon the average balance of total financial liabilities which included total interest bearing liabilities and noninterest bearing demand deposits Cumulative Beta Quarterly Beta Net Interest Income NIM 2 0 80 70 60 50 40 30 20 10 0 1 0 4Q22 4Q22 $78.6 3.57% 3.96% 3.90% 3.83% $82.2 $82.3 $83.9 1Q23 1Q23 1.04 2Q23 2Q23 0.44 3Q23 3Q23 1.06 4Q23 4Q23 1.96 1.97% 0.34% 2.86% 1.57% 2.62% 0.53% 2.86% 2.11% 3.19% 0.74% 3.69% 2.59% 3.49% 0.94% 4.07% 2.86% Cost of Deposits (Domestic) (1) Cost of Deposits (International) (1) Cost of FHLB Advances Cost of Funds (2) 4Q22 1Q23 2Q23 3Q23 0.23 0.32 0.40 0.43 Investment Portfolio Balances and Yields (1) ($ in millions) Available for Sale (APS) Marketable Equity Securities (2) Held to Maturity (HTM) Yield 1,500 1,000 500 0 $11.4 $2.5 4Q22 3Q23 4Q23 $242.1 $230.3 $226.6 $1,057.6 $1,038.8 $1,217.5 3.59% 3.98% 4.17% $2.4 Fixed vs. Floating (3) September 2023 December 2023 5.3 yrs Effective Duration 5.0 yrs Effective Duration Fixed rate Floating rate 15.4% 84.6% 13.3% 86.7% Available for Sale Securities by Type December 31, 2023 Corporate debt 21.4% (4) Collateralized loan obligations 0.4% U.S. Gov’t agency 32.1% U.S. Gov’t sponsored enterprises 45.8% Other 0.3% (1) Excludes Federal Reserve Bank and FHLB stock (2) Hybrid investments are classified based on current rate (fixed or float) (3) Based on estimated prepayment speeds Investor Update | 24 0.47 N/A 4Q23 3.71% 1.14% 3.89% 3.01% Expected Prepayments & Maturities ($ in millions) 36.5 38.3 39.4 39.1 1Q24 2Q24 3Q24 4Q24 0.0 20.0 40.0 60.0

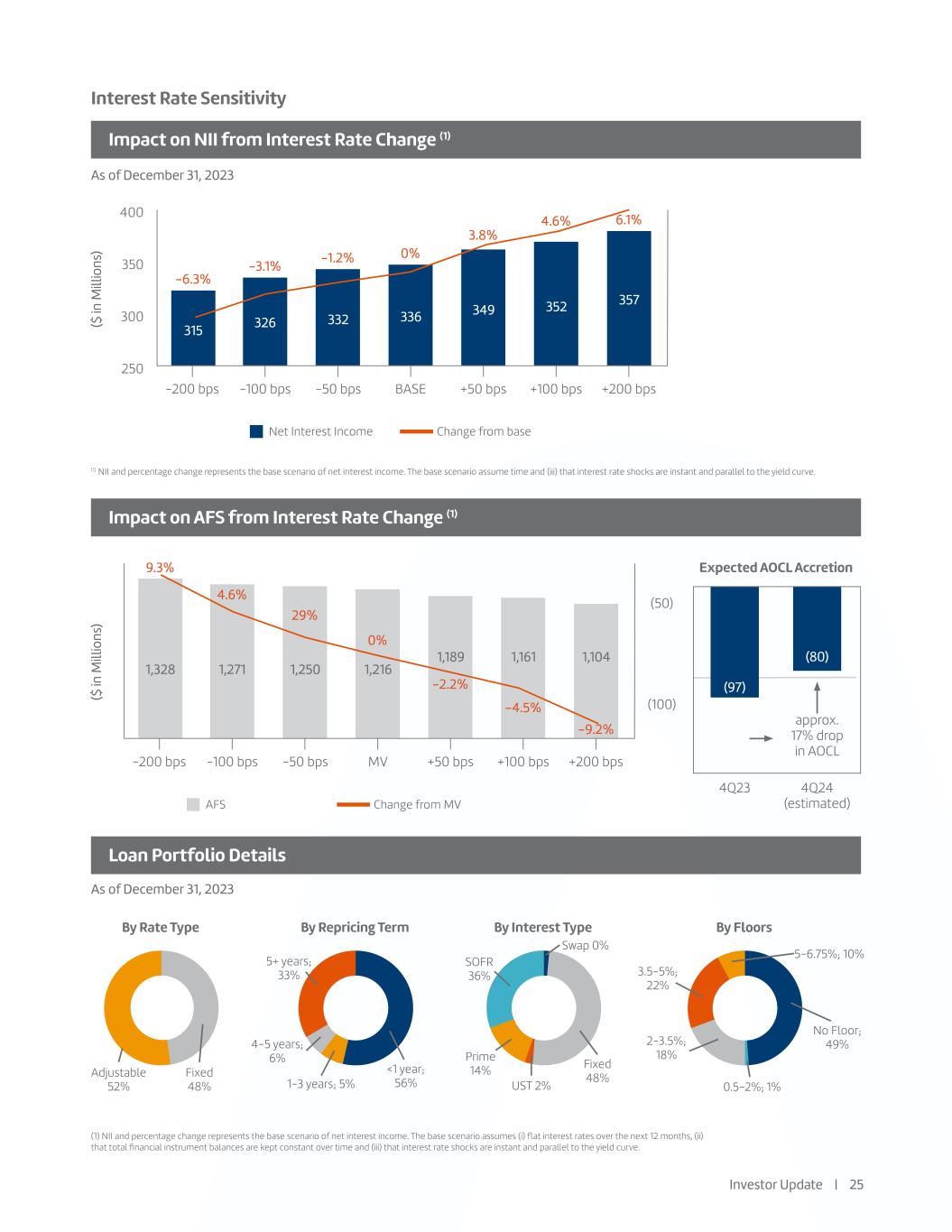

Interest Rate Sensitivity Impact on NII from Interest Rate Change (1) Impact on AFS from Interest Rate Change (1) Loan Portfolio Details As of December 31, 2023 As of December 31, 2023 ($ in M ill io ns ) ($ in M ill io ns ) Net Interest Income Change from base AFS Change from MV 400 350 300 250 -6.3% 9.3% 315 1,328 326 1,271 332 1,250 336 1,216 349 (97) (80)1,189 352 1,161 357 1,104 -3.1% 4.6% -1.2% 29% 0% 0% 3.8% -2.2% 4.6% -4.5% 6.1% -9.2% -200 bps (50) 4Q23 4Q24 (estimated) approx. 17% drop in AOCL (100) -200 bps -100 bps -100 bps -50 bps -50 bps BASE MV +50 bps +50 bps +100 bps +100 bps +200 bps +200 bps (1) NII and percentage change represents the base scenario of net interest income. The base scenario assume time and (iii) that interest rate shocks are instant and parallel to the yield curve. (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve. Expected AOCL Accretion By Rate Type By Repricing Term By Interest Type By Floors Adjustable 52% Fixed 48% 5+ years; 33% <1 year; 56% Swap 0% Fixed 48% UST 2% Prime 14% 4-5 years; 6% 1-3 years; 5% SOFR 36% 5-6.75%; 10% 3.5-5%; 22% 2-3.5%; 18% 0.5-2%; 1% No Floor; 49% Investor Update | 25

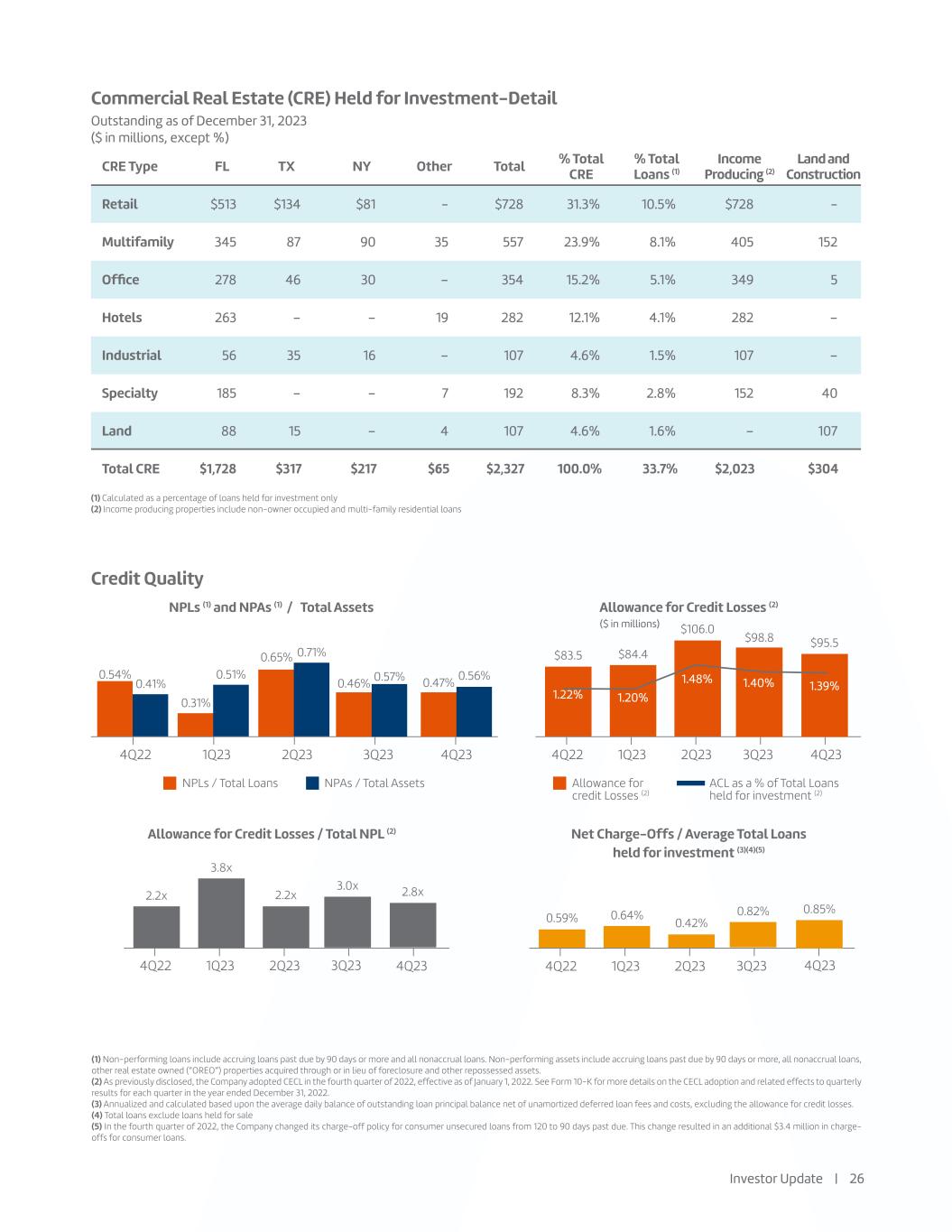

Commercial Real Estate (CRE) Held for Investment-Detail Credit Quality Outstanding as of December 31, 2023 ($ in millions, except %) (1) Calculated as a percentage of loans held for investment only (2) Income producing properties include non-owner occupied and multi-family residential loans CRE Type Retail Multifamily Office Industrial Hotels Specialty Total CRE Land FL TX NY Other Total % Total CRE % Total Loans (1) Income Producing (2) Land and Construction $513 $134 $81 - $728 31.3% 10.5% $728 - 345 87 90 35 557 23.9% 8.1% 405 152 278 46 30 – 354 15.2% 5.1% 349 5 263 – – 19 282 12.1% 4.1% 282 – 56 35 16 – 107 4.6% 1.5% 107 – 185 – – 7 192 8.3% 2.8% 152 40 88 15 – 4 107 4.6% 1.6% – 107 $1,728 $317 $217 $65 $2,327 100.0% 33.7% $2,023 $304 (1) Non-performing loans include accruing loans past due by 90 days or more and all nonaccrual loans. Non-performing assets include accruing loans past due by 90 days or more, all nonaccrual loans, other real estate owned (“OREO”) properties acquired through or in lieu of foreclosure and other repossessed assets. (2) As previously disclosed, the Company adopted CECL in the fourth quarter of 2022, effective as of January 1, 2022. See Form 10-K for more details on the CECL adoption and related effects to quarterly results for each quarter in the year ended December 31, 2022. (3) Annualized and calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan fees and costs, excluding the allowance for credit losses. (4) Total loans exclude loans held for sale (5) In the fourth quarter of 2022, the Company changed its charge-off policy for consumer unsecured loans from 120 to 90 days past due. This change resulted in an additional $3.4 million in charge- offs for consumer loans. 4Q23 3Q23 3Q23 3Q23 0.46% 0.31% 0.51% 0.65% 0.71% $98.8 3.0x 0.82% $83.5 2.2x 0.59% $84.4 3.8x 0.64% $106.0 2.2x 0.42% 0.41% 0.54% 0.57% 4Q22 4Q23 4Q23 4Q23 1Q23 4Q22 4Q22 4Q22 2Q23 1Q23 1Q23 1Q23 3Q23 2Q23 2Q23 2Q23 ($ in millions) NPLs (1) and NPAs (1) / Total Assets Allowance for Credit Losses / Total NPL (2) Allowance for Credit Losses (2) Net Charge-Offs / Average Total Loans held for investment (3)(4)(5) NPLs / Total Loans NPAs / Total Assets Allowance for credit Losses (2) ACL as a % of Total Loans held for investment (2) 1.40% 1.22% 1.20% 1.48% Investor Update | 26 0.47% 0.56% $95.5 1.39% 2.8x 0.85%

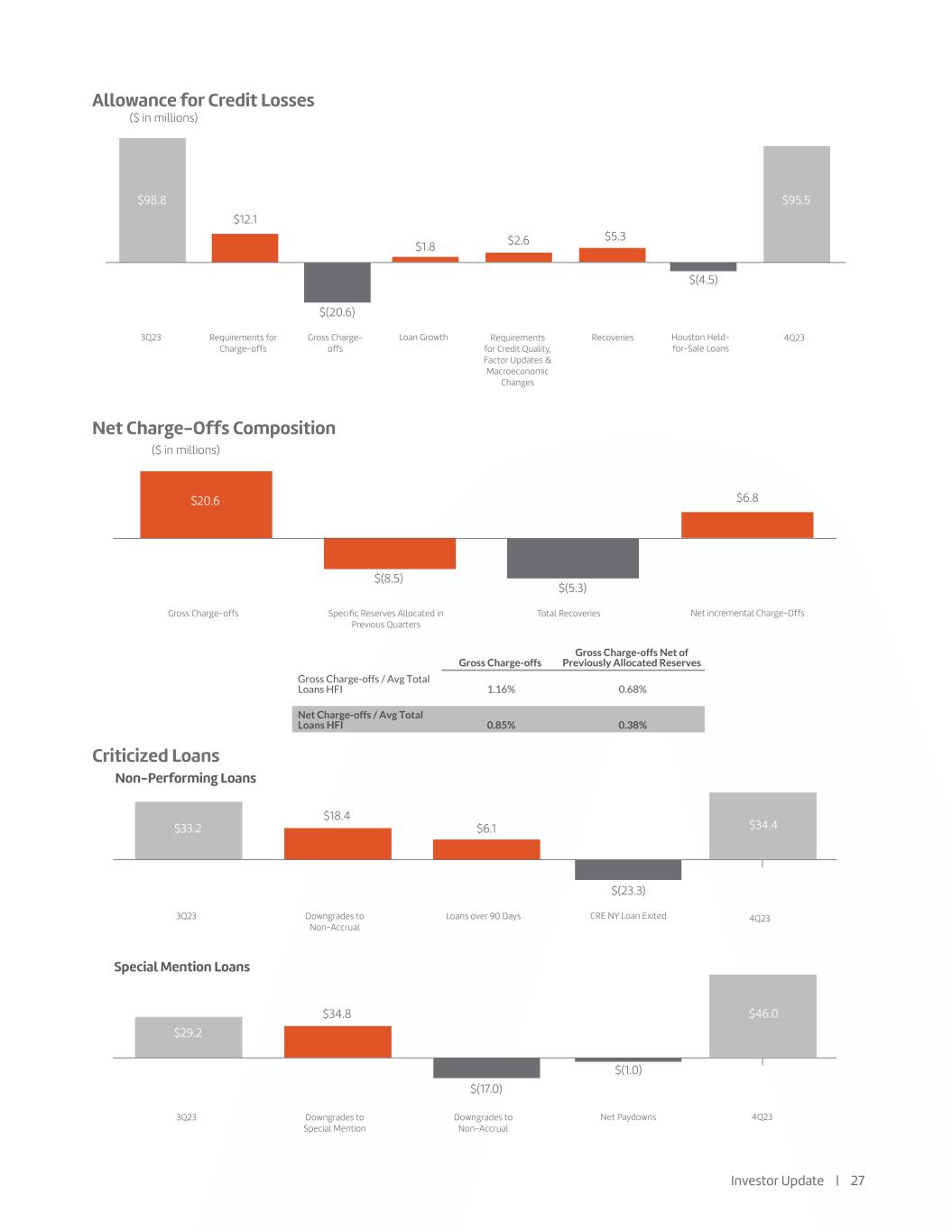

$1.8 ($ in millions) $12.1 $(20.6) $2.6 $(4.5) $5.3 Allowance for Credit Losses Net Charge-Offs Composition Investor Update | 27 Loan Growth Requirements for Credit Quality, Factor Updates & Macroeconomic Changes 3Q23 Requirements for Charge-offs Gross Charge- offs Houston Held- for-Sale Loans 4Q23Recoveries $98.8 $95.5 $6.8 $(8.5) $(5.3) Net incremental Charge-OffsGross Charge-offs Specific Reserves Allocated in Previous Quarters Total Recoveries $20.6 ($ in millions) Criticized Loans $(23.3) $18.4 $6.1 CRE NY Loan Exited3Q23 Downgrades to Non-Accrual Loans over 90 Days $33.2 Non-Performing Loans $34.4 $(1.0) $34.8 $(17.0) Net Paydowns3Q23 Downgrades to Special Mention Downgrades to Non-Accrual $29.2 Special Mention Loans $46.0 4Q23 4Q23 0.85% 0.38%

Investor Update | 28 0.16% Margin Bridge 0.15% 0.16% 0.03% (0.02)% Net Interest Margin Securities Other Earning Asset Mix 3Q23 Loans Loan Recovery Cost of Funds 4Q23Funding Mix 3.57% 3.72% (0.01)% $(1.14) Change in Diluted Earnings (Loss) Per Common Share $(0.18) $(0.13) $(0.51) EPS Trend Provision for Credit Losses Income Tax Benefit3Q23 Core PPNR Net Non-Routine Items 4Q23 $0.66 $0.28 1 0.5 0 -0.5 -1 -1.5 Diluted Earnings Loss in 4Q23 reflects the impact of $37.4 million of net non-routine items ($5.7 million in non-routine noninterest income and $43.1 million in non- routine noninterest expenses). Excluding non-routine items, core diluted EPS was $0.46 during 4Q23

Glossary Investor Update | 29

Appendix

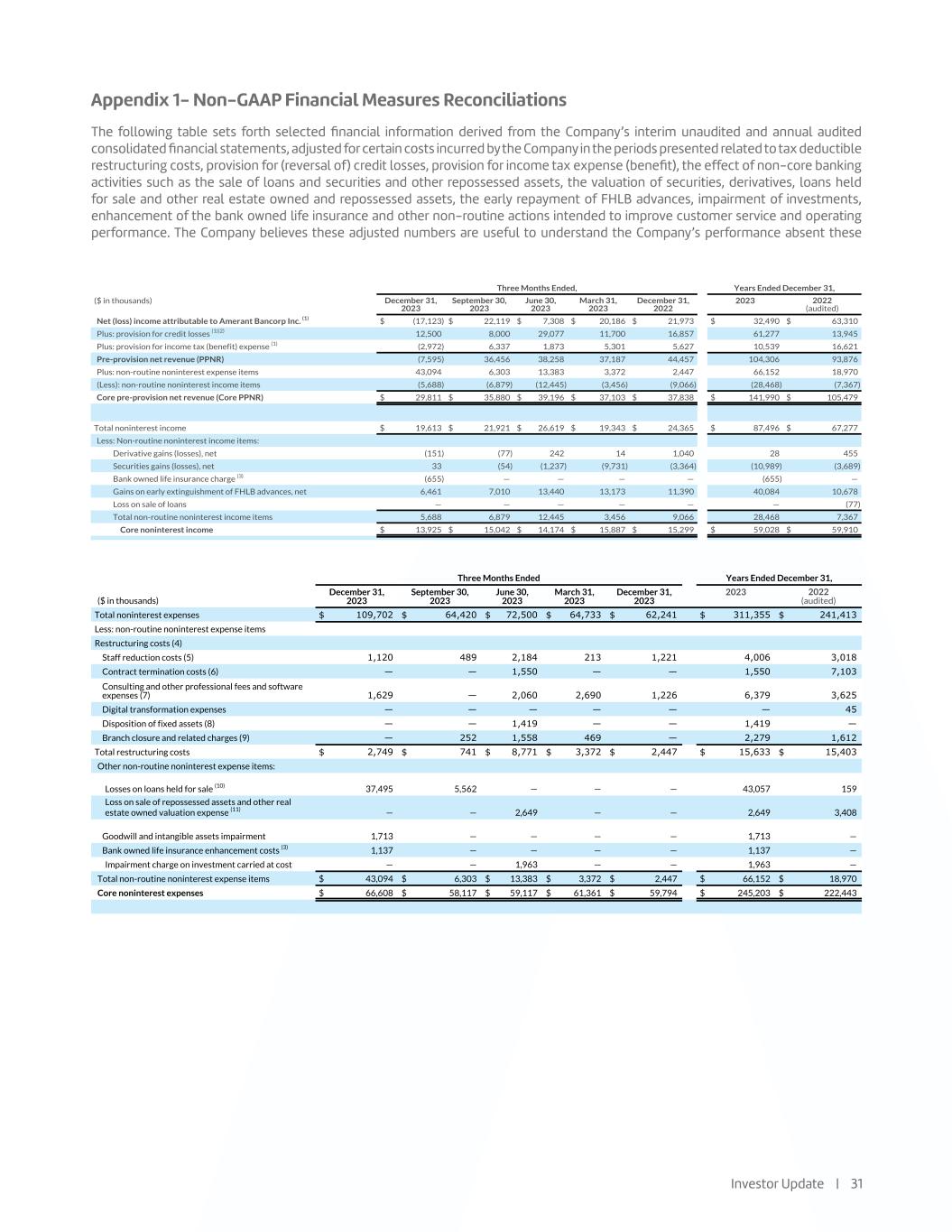

Appendix 1- Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related to tax deductible restructuring costs, provision for (reversal of) credit losses, provision for income tax expense (benefit), the effect of non-core banking activities such as the sale of loans and securities and other repossessed assets, the valuation of securities, derivatives, loans held for sale and other real estate owned and repossessed assets, the early repayment of FHLB advances, impairment of investments, enhancement of the bank owned life insurance and other non-routine actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these Investor Update | 31

Investor Update | 32

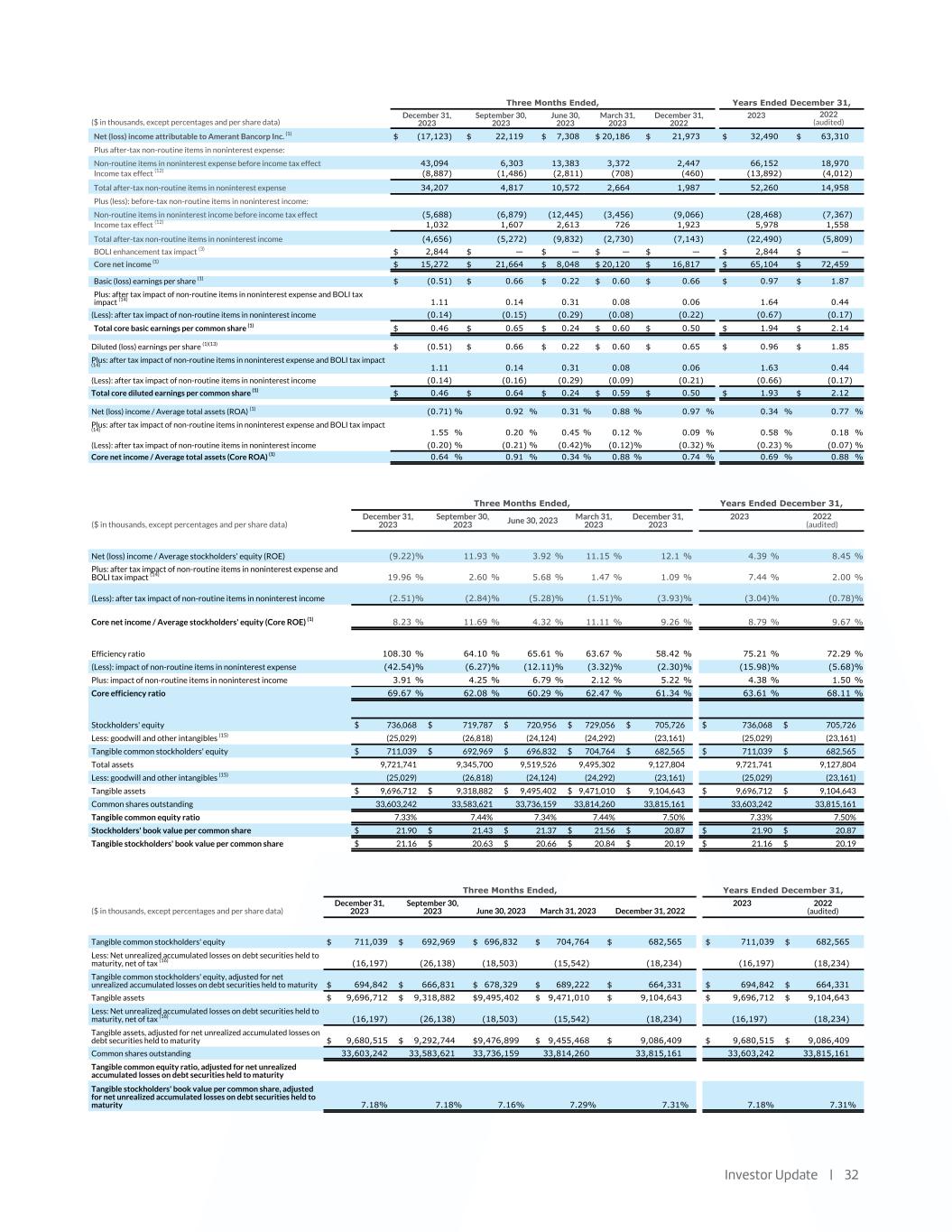

Investor Update | 33 (1) As previously disclosed, the Company adopted CECL in the fourth quarter of 2022, effective as of January 1, 2022. See Form 10-K for more details of the CECL adoption and related effects to quarterly results for each quarter in the year ended December 31, 2022. (2) In the fourth and third quarter of 2023, includes provision for credit losses on loans of $12.0 million and $7.4 million, respectively, and unfunded commitments (contingencies) of $0.5 million and $0.6 million, respectively. For all other periods shown, includes provision for credit losses on loans. There was no provision for credit losses on unfunded commitments in the second quarter of 2023 and the fourth quarter of 2022. In the first quarter of 2023, the provision for credit losses on unfunded commitments was $0.3 million. (3) In the fourth quarter of 2023, the Company completed a restructuring of its bank-owned life insurance (“BOLI”) program. This was executed through a combination of a 1035 exchange and a surrender and reinvestment into higher-yielding general account with a new investment grade insurance carrier. This transaction allowed for higher team member participation through an enhanced split-dollar plan. Estimated improved yields resulting from the enhancement have an earn-back period of approximately 2 years. In the fourth quarter of 2023, we recorded total additional expenses and charges of $4.6 million in connection with this transaction, including: (i) a reduction of $0.7 million to the cash surrender value of BOLI; (ii) transaction costs of $1.1 million, and (iii) income tax expense of $2.8 million. (4) Expenses incurred for actions designed to implement the Company’s business strategy. These actions include, but are not limited to reductions in workforce, streamlining operational processes, promoting the Amerant brand, implementation of new technology system applications, decommissioning of legacy technologies, enhanced sales tools and training, expanded product offerings and improved customer analytics to identify opportunities. (5) Staff reduction costs consist of severance expenses related to organizational rationalization. (6) Contract termination and related costs associated with third party vendors resulting from the Company’s engagement of FIS. (7) In the three months and year ended December 31, 2023, includes an aggregate of $1.6 million and $6.4 million, respectively, of nonrecurrent expenses in connection with the engagement of FIS and, to a lesser extent, software expenses related to legacy applications running in parallel to new core banking applications. There were no significant nonrecurrent expenses in connection with engagement of FIS in the three months ended September 30, 2023. In the three months ended June 30, 2023, March 31, 2023 and December 31, 2022, and the year ended December 31, 2022, include expenses of $2.0 million, $2.6 million, $1.1 million and $2.9 million, respectively, in connection with engagement of FIS. In addition, includes $0.2 million in connection with certain search and recruitment expenses and $0.1 million of costs associated with the subleasing of the New York office space in the year ended December 31, 2022. (8) Include expenses in connection with the disposition of fixed assets due to the write-off of in-development software in each of the three months ended June 30, 2023 and year ended December 31, 2023. (9) In each of the three months ended September 30, 2023 and year ended December 31, 2023, include expenses of $0.3 million in connection with the closure of a branch in Houston, Texas in 2023. In addition, in each of the three months ended June 30, 2023 and year ended December 31, 2023, include $0.9 million of accelerated amortization of leasehold improvements and $0.6 million of right-of-use, or ROU asset impairment, associated with the closure of a branch in Miami, Florida in 2023. Also, in each of the three months ended March 31, 2023 and year ended December 31, 2023, include $0.5 million of ROU asset impairment associated with the closure of a branch in Houston, Texas in 2023. In the year ended December 31, 2022, includes $1.6 million of ROU asset impairment associated with the closure of a branch in Pembroke Pines, Florida in 2022. (10) In each of the three months and year ended December 31, 2023, includes: (i) a fair value adjustment of $35.5 million related to an aggregate of $401 million in Houston-based CRE loans held for sale which are carried at the lower of fair value or cost, and (ii) a loss on sale of $2.0 million related to a New York-based CRE loan previously carried at the lower of fair value or cost. In each of the three months ended September 30, 2023 and the year ended December 31, 2023, includes a fair value adjustment of $5.6 million related to a New York-based CRE loan held for sale carried at the lower of fair value or cost. In the year ended December 31, 2022, amount represents the fair value adjustment related to the New York loan portfolio held for sale carried at the lower of cost or fair value. (11) In each of the three months ended June 30, 2023 and year ended December 31, 2023, amount represents the loss on sale of repossessed assets in connection with our equipment-financing activities. In the year ended December 31, 2022, amount represents the fair value adjustment related to one OREO property in New York. (12) In the year ended December 31, 2023, amounts were calculated using an estimated tax rate of 21.00%. In the year ended December 31, 2022 and the three months ended March 31, 2023, amounts were calculated based upon the effective tax rate for the periods of 21.15% and 21.00%, respectively. For all of the other periods shown, amounts represent the difference between the prior and current period year-to-date tax effect. (13) Potential dilutive instruments consisted of unvested shares of restricted stock, restricted stock units and performance stock units. In all the periods presented, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in those periods, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in those periods, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect on per share earnings. (14) In the three months and year ended December 31, 2023, per share amounts and percentages were calculated using the after-tax impact of non- routine items in noninterest expense of $34.2 million and $52.3 million, respectively, and BOLI tax impact of $2.8 million in each period. In all other periods shown, per share amounts and percentages were calculated using the after tax impact of non-routine items in noninterest expense. (15) At December 31, 2023 and September 30, 2023, other intangible assets primarily consist of naming rights of $2.5 million and $2.7 million, respectively, and mortgage servicing rights (“MSRs”)of $1.4 million and $1.3 million, respectively. At June 30, 2023, March 31, 2023 and December 31, 2022, other intangible assets primarily consist of MSRs of $1.3 million, $1.4 million and $1.3 million, respectively. Other intangible assets are included in other assets in the Company’s consolidated balance sheets. (16) As of December 31, 2023, September 30, 2023, June 30, 2023, March 31, 2023 and December 31, 2022, amounts were calculated based upon the fair value on debt securities held to maturity, and assuming a tax rate of 25.36%, 25.51%, 25.46%, 25.53% and 25.55%, respectively.

Thank You NYSE: AMTB amerantbank.com