Investor Update November 12, 2024 NYSE: AMTB amerantbank.com

Being the bank of choice in the markets we serve. Table of Contents 1 2 3 4 About Us Company Updates Performance Updates Community Updates Investor Update | 2

Important Notices and Disclosures Updated Information As outlined in the Form 10-Q for the quarterly period ended September 30, 2024 (the “3Q24 Form 10-Q”) which was filed on November 4, 2024, the Company’s interim consolidated financial statements were finalized and certain line items and financial data included in the 3Q24 Form 10-Q differ from and supersede certain line items and financial data that were included in the press release and slide presentation attached as Exhibit 99.1 (the “Earnings Release”) and Exhibit 99.2 (the “Earnings Presentation”), respectively, of a current report on Form 8-K of the Company dated October 23, 2024. These corrections had no effect on the consolidated statements of operations or earnings per share for the third quarter of 2024. Appendix 2 reconciles the line items and financial data that were reported in the 3Q24 Form 10-Q with the same line items and financial data that were included in the Earnings Release and Earnings Presentation. Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. Examples of forward-looking statements include but are not limited to: our future operating or financial performance, including revenues, expenses, expense savings, income or loss and earnings or loss per share, and other financial items; statements regarding expectations, plans or objectives for future operations, products or services, and our expectations on our securities repositioning and loan recoveries, reaching effective resolutions on problem loans, or significantly reducing special mention and/or non-performing loans. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2023 filed on March 7, 2024, in our quarterly report on Form 10-Q for the fiscal quarter ended March 31, 2024 filed on May 3, 2024, in our 3Q24 Form 10-Q and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “pre-provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expenses”, “core net income”, “core earnings per share (basic and diluted)”, “core net income/average total assets (Core ROA)”, “core net income/average stockholders’ equity (Core ROE)”, “core efficiency ratio”, “tangible stockholders’ equity (book value) per common share”, “tangible common equity ratio, adjusted for net unrealized accumulated losses on debt securities held to maturity”, and “tangible stockholders’ equity (book value) per common share, adjusted for net unrealized accumulated losses on debt securities held to maturity”. This supplemental information is not required by or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued in 2024, including the effect of non-core banking activities such as the sale of loans and securities (including the investment portfolio repositioning initiated in the third quarter of 2024) and other repossessed assets, certain non-routine items recorded in 2024 in connection with the Houston Sale Transaction, the valuation of securities, derivatives, loans held for sale and other real estate owned and repossessed assets, the early repayment of FHLB advances, impairment of investments, Bank owned life insurance restructure, and other non-routine actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non- GAAP financial measures may differ from similar measures presented by other companies. Appendix 1 reconciles these non-GAAP financial measures to reported results. Investor Update | 3

About Us

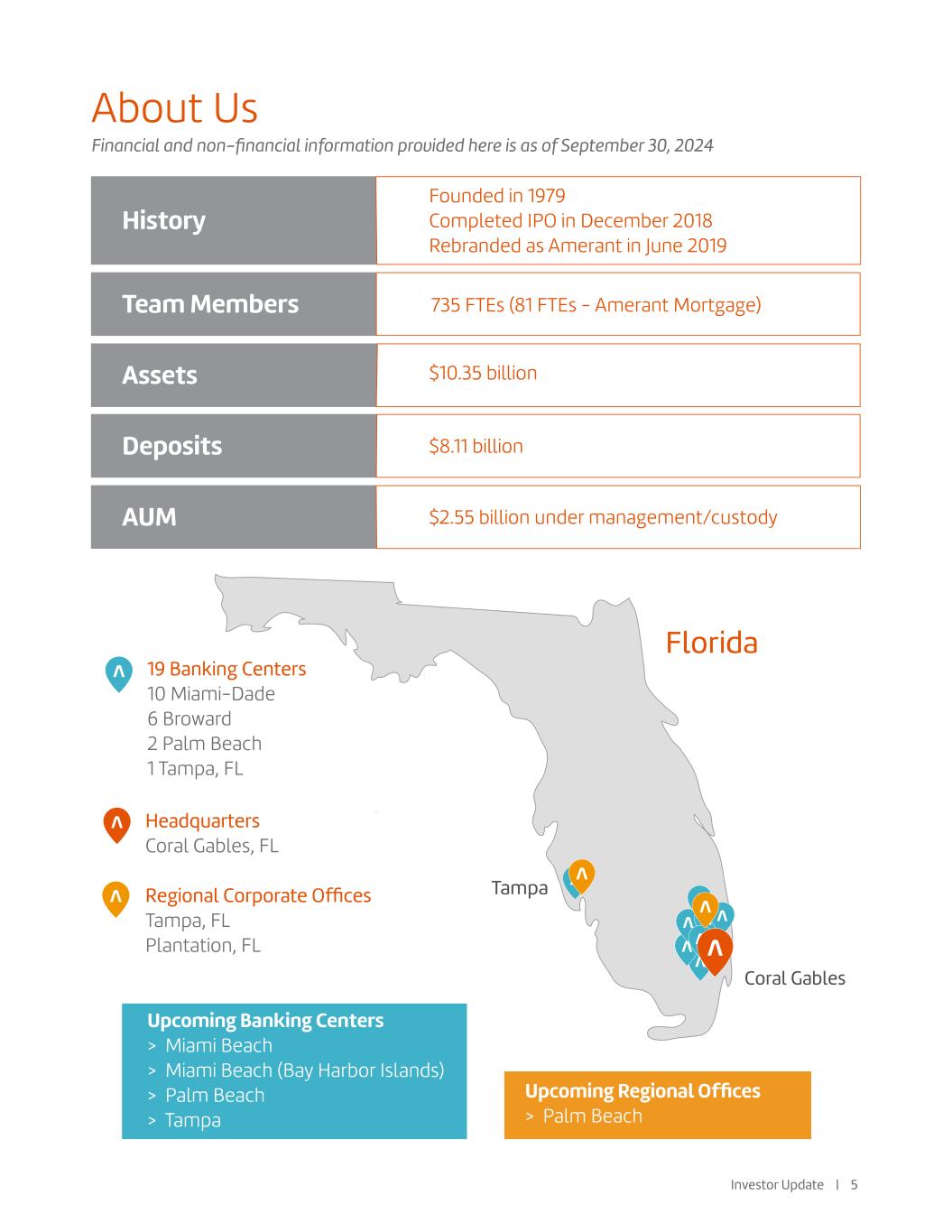

19 Banking Centers 10 Miami-Dade 6 Broward 2 Palm Beach 1 Tampa, FL Headquarters Coral Gables, FL Regional Corporate Offices Tampa, FL Plantation, FL About Us History Team Members Assets Deposits AUM Founded in 1979 Completed IPO in December 2018 Rebranded as Amerant in June 2019 735 FTEs (81 FTEs - Amerant Mortgage) $10.35 billion $8.11 billion $2.55 billion under management/custody Investor Update | 5 Financial and non-financial information provided here is as of September 30, 2024 Upcoming Banking Centers > Miami Beach > Miami Beach (Bay Harbor Islands) > Palm Beach > Tampa Upcoming Regional Offices > Palm Beach

Our Investment Proposition Established franchise with high scarcity value; presence in attractive, high- growth markets of South Florida, Tampa and Central Florida. Strong and diverse deposit base; organic, deposits-first focus. Well capitalized; solid credit reserve coverage. Completed multiyear transformation; focus is now on execution and profitable growth Investor Update | 6 Executive leadership focused on executing strategic plan Completed core conversion; now operating with a new, fully integrated, state- of-the-art core tech system, enabling us to better serve our customers and team members Completed sale of Houston franchise; focusing on organic growth in Florida New locations and infrastructure changes ongoing as growth continues Accelerating digital transformation efforts We have the strong foundation to enable us to become a consistent top-quartile performer as Florida’s bank of choice.

Being leaders in innovation, quality, efficiency, and customer satisfaction Our Mission, Vision, and Precepts Mission Vision Precepts To provide our customers with the products, services and advice they need to achieve financial success, through our diverse, inclusive and motivated team that is personally involved with the communities we serve, all of which result in increased shareholder value. To be the bank of choice in the markets we serve. Consitently exceeding expectations (going above and beyond) Promoting a diverse and inclusive work environment where every person is given the encouragement, support, and opportunity to be successful Holding ourselves and each other accountable and always doing what is right Treating everyone as we expect to be treated Being the bank of choice in the markets we serve Providing the customer with the right products, services, and advice to meet their needs Investor Update | 7

Experienced Leadership Team Jerry Plush | Chairman and CEO Mr. Plush serves as the Company’s Chairman, President, and CEO since June 8, 2022, having served previously as Vice-Chairman & CEO since March 20, 2021, and as Vice Chairman since February 15, 2021. Mr. Plush is a highly respected financial services industry professional with over 35 years of senior executive leadership experience. Sharymar Calderon | EVP, Chief Financial Officer Sharymar Calderón was appointed Executive Vice President, Chief Financial Officer (CFO) in June 2023. Calderón is responsible for Amerant’s financial management, including treasury, financial reporting and accounting, financial analysis, strategy, investor relations, internal controls and corporate tax. Alberto Capriles | SEVP, Chief Risk Officer Alberto Capriles was appointed Senior Executive Vice President in January 2023 and named Chief Risk Officer in February 2018. He is responsible for all enterprise risk management oversight, including credit, market, operational and information security risk. Juan Esterripa | SEVP, Chief Commercial Banking Officer Juan Esterripa serves as Amerant Bank’s SEVP, Head of Commercial Banking since April 2023. He is a seasoned banking professional with significant experience in corporate and commercial banking. In his role, Esterripa oversees multiple business sectors, including commercial banking, commercial real estate, syndications, specialty finance, and treasury management. Carlos Iafigliola | SEVP, Chief Operating Officer Carlos Iafigliola was appointed Senior Executive Vice President, Chief Operating Officer (COO) in June 2023. He is responsible for Amerant’s loan and deposit operations, project management, technology services, procurement, facilities, and digital. Prior to his appointment as COO, Iafigliola served as CFO. Howard Levine | SEVP, Chief Consumer Banking Officer Howard Levine was appointed Senior Executive Vice President in January 2023. He has served as Head of Consumer Banking since joining Amerant in June 2022. Levine oversees the Private Client Group, Wealth Management, Small Business Banking, Retail Banking, and Amerant Mortgage. Most recently, he served as EVP and Chief Revenue Officer at Amerant Mortgage. Mariola Sanchez | SEVP, Chief People Officer Mariola Triana Sanchez was appointed Chief People Officer (CPO) in June 2022. She oversees Amerant’s human resources team, in addition to corporate communications, community relations, sustainability, and marketing. Prior to her appointment as CPO, she served as Amerant’s General Counsel. Laura Rossi | SVP, Head of Investor Relations & Strategy Laura Rossi was appointed Senior Vice President and Head of Investor Relations in March 2018 and has also served as Head of Strategy since June 2024, having previously led the Sustainability unit since August 2022. In her role, Rossi spearheads Amerant’s relationship with the investment community and rating agencies, as well as the Company’s strategic planning process. Investor Update | 8

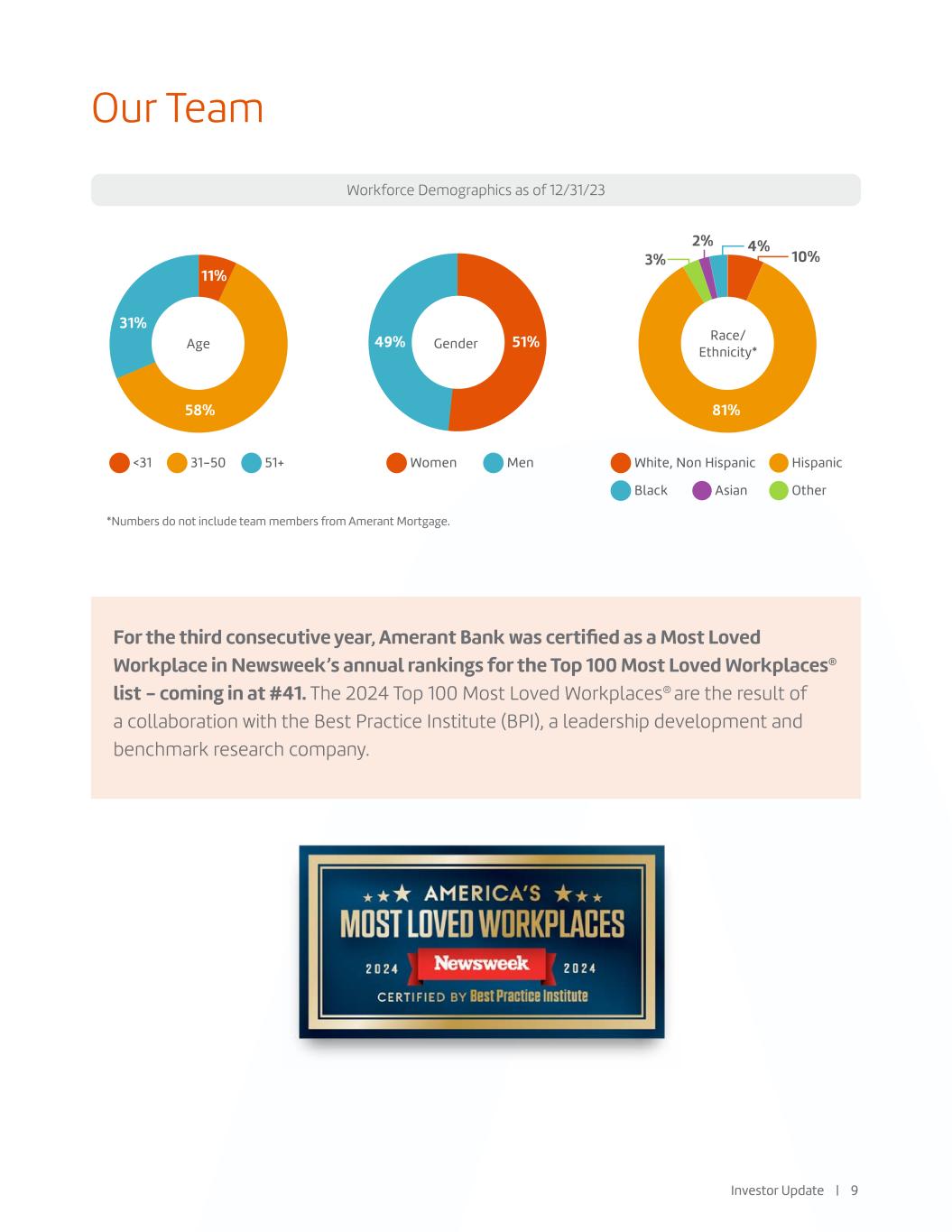

Our Team Workforce Demographics as of 12/31/23 For the third consecutive year, Amerant Bank was certified as a Most Loved Workplace in Newsweek’s annual rankings for the Top 100 Most Loved Workplaces® list - coming in at #41. The 2024 Top 100 Most Loved Workplaces® are the result of a collaboration with the Best Practice Institute (BPI), a leadership development and benchmark research company. *Numbers do not include team members from Amerant Mortgage. White, Non Hispanic Hispanic Black OtherAsian Women Men<31 31-50 51+ 49% 81% 10% 4% 3% 2% 51% 58% 11% 31% Age Gender Race/ Ethnicity* Investor Update | 9

Company Updates

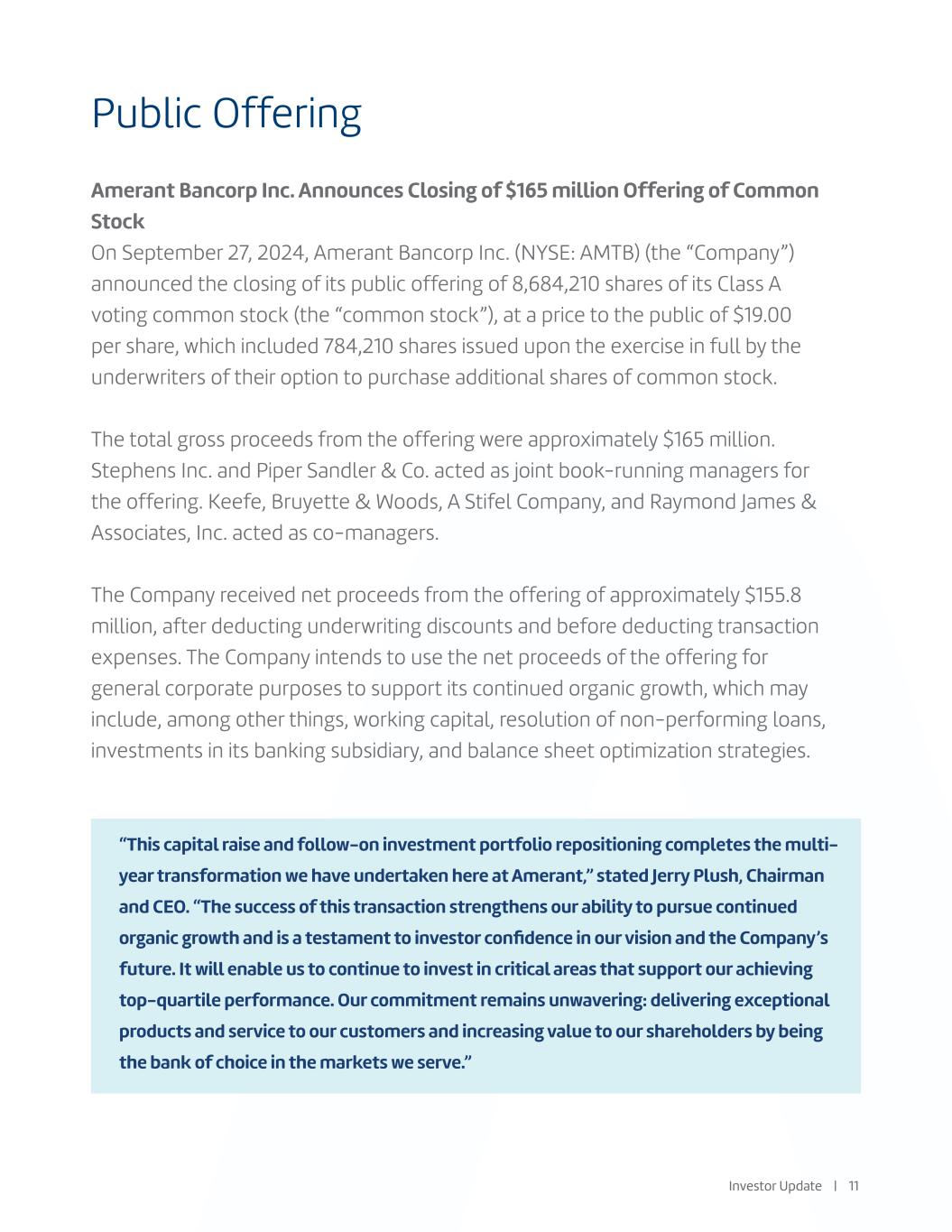

Public Offering Amerant Bancorp Inc. Announces Closing of $165 million Offering of Common Stock On September 27, 2024, Amerant Bancorp Inc. (NYSE: AMTB) (the “Company”) announced the closing of its public offering of 8,684,210 shares of its Class A voting common stock (the “common stock”), at a price to the public of $19.00 per share, which included 784,210 shares issued upon the exercise in full by the underwriters of their option to purchase additional shares of common stock. The total gross proceeds from the offering were approximately $165 million. Stephens Inc. and Piper Sandler & Co. acted as joint book-running managers for the offering. Keefe, Bruyette & Woods, A Stifel Company, and Raymond James & Associates, Inc. acted as co-managers. The Company received net proceeds from the offering of approximately $155.8 million, after deducting underwriting discounts and before deducting transaction expenses. The Company intends to use the net proceeds of the offering for general corporate purposes to support its continued organic growth, which may include, among other things, working capital, resolution of non-performing loans, investments in its banking subsidiary, and balance sheet optimization strategies. “This capital raise and follow-on investment portfolio repositioning completes the multi- year transformation we have undertaken here at Amerant,” stated Jerry Plush, Chairman and CEO. “The success of this transaction strengthens our ability to pursue continued organic growth and is a testament to investor confidence in our vision and the Company’s future. It will enable us to continue to invest in critical areas that support our achieving top-quartile performance. Our commitment remains unwavering: delivering exceptional products and service to our customers and increasing value to our shareholders by being the bank of choice in the markets we serve.” Investor Update | 11

Houston Franchise Update Completed Sale to MidFirst Bank on November 8, 2024 $479M Total Loans Divested $574M Total Deposits Divested 83% Loan/Deposit Ratio on Divested Franchise 6 Branches $12.5M Net Deposit Premium 5.4% Core Deposit Premium ~70 bps CET1 Enhancement 215% Regulatory CRE Concentration Ratio ~1% | +$0.19 TBV per share accretion Investor Update | 12 Lease Obligations Assumed by MidFirst on all other HOU properties Loans and deposit balances as of November 5, 2024 (Other metrics as of September 30, 2024, adjusted by the Houston transaction)

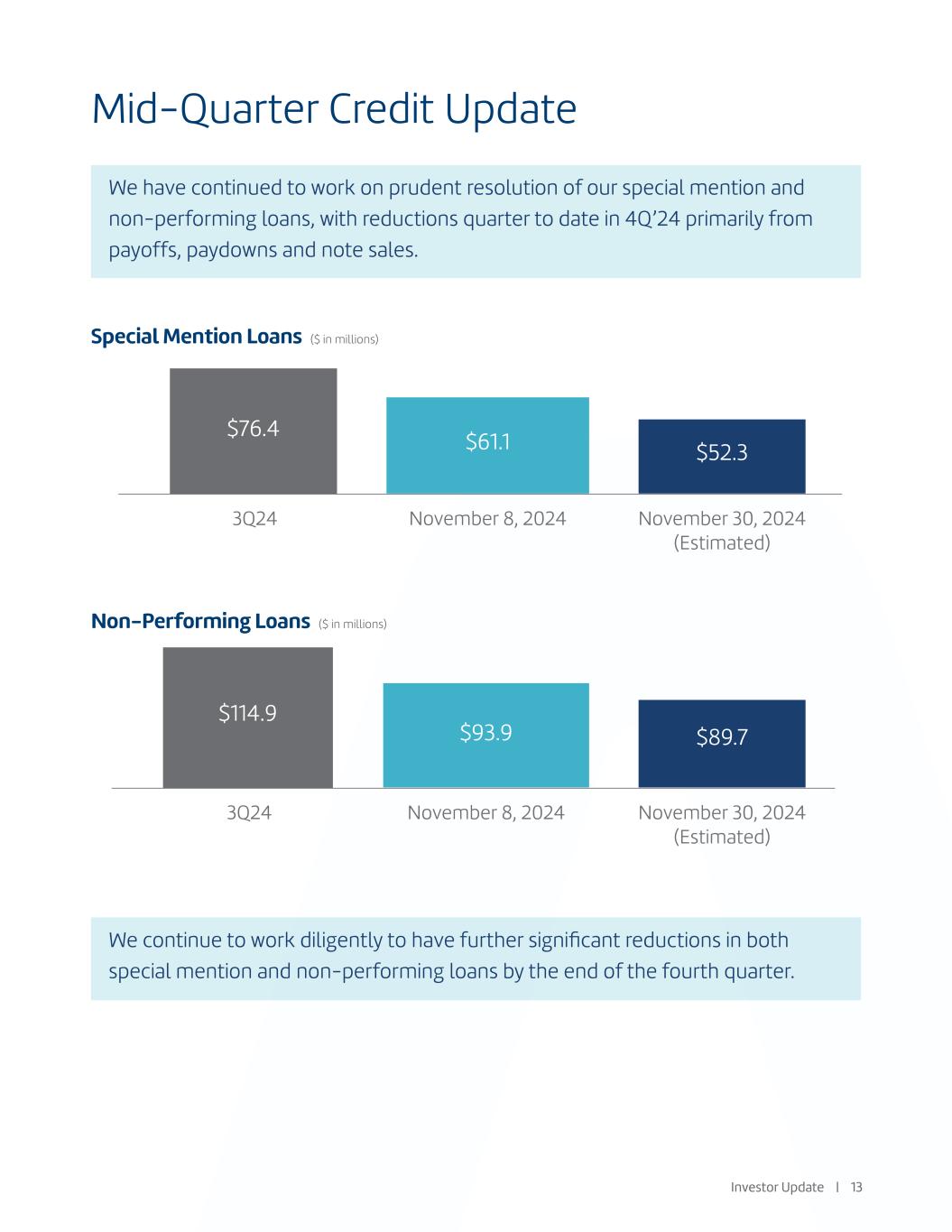

We have continued to work on prudent resolution of our special mention and non-performing loans, with reductions quarter to date in 4Q’24 primarily from payoffs, paydowns and note sales. Mid-Quarter Credit Update 3Q24 $61.1 November 8, 2024 Special Mention Loans ($ in millions) Non-Performing Loans ($ in millions) $76.4 3Q24 $93.9 November 8, 2024 $114.9 Investor Update | 13 $52.3 November 30, 2024 (Estimated) $89.7 We continue to work diligently to have further significant reductions in both special mention and non-performing loans by the end of the fourth quarter. November 30, 2024 (Estimated)

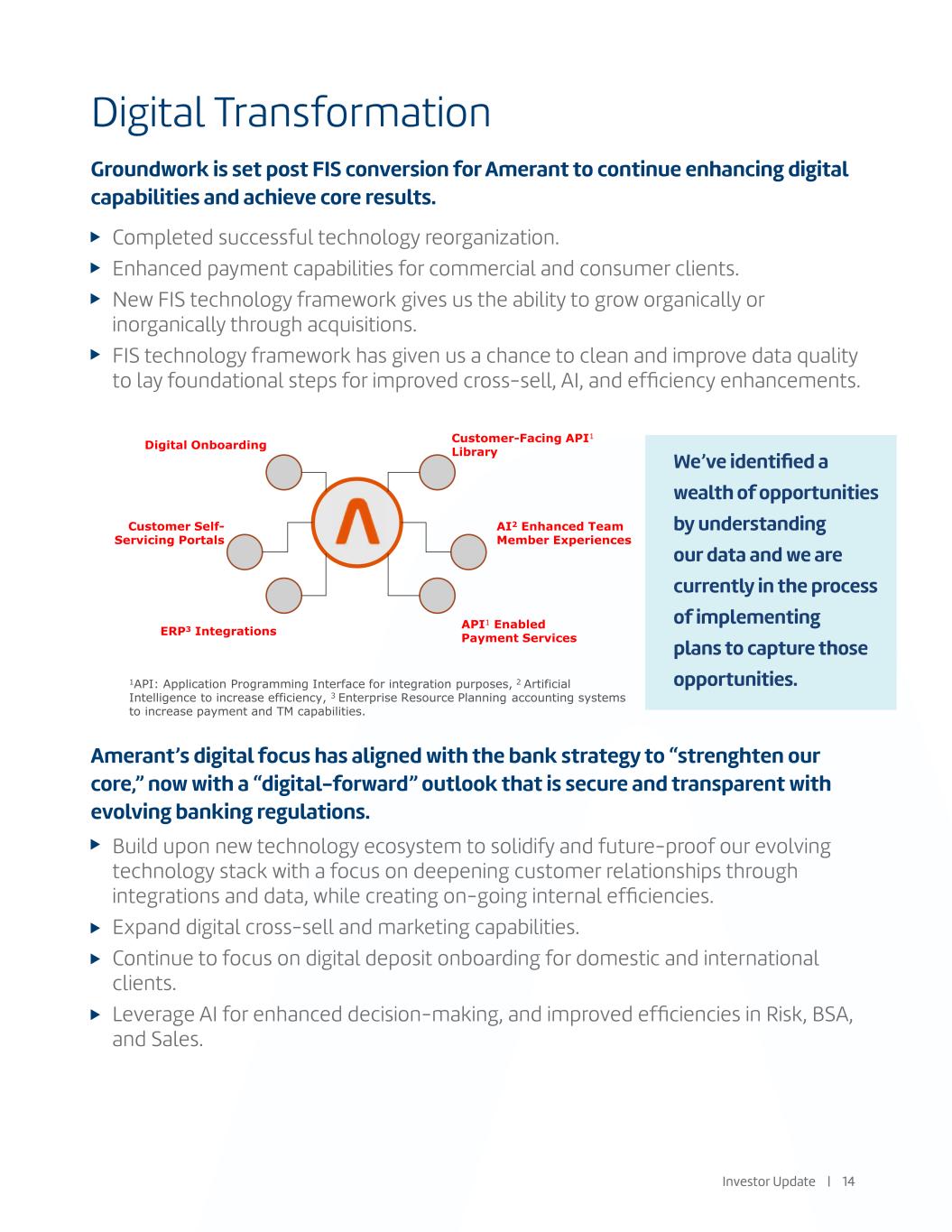

Digital Transformation Groundwork is set post FIS conversion for Amerant to continue enhancing digital capabilities and achieve core results. Amerant’s digital focus has aligned with the bank strategy to “strenghten our core,” now with a “digital-forward” outlook that is secure and transparent with evolving banking regulations. Digital Onboarding Customer-Facing API1 Library Customer Self- Servicing Portals AI2 Enhanced Team Member Experiences ERP3 Integrations API1 Enabled Payment Services 1API: Application Programming Interface for integration purposes, 2 Artificial Intelligence to increase efficiency, 3 Enterprise Resource Planning accounting systems to increase payment and TM capabilities. We’ve identified a wealth of opportunities by understanding our data and we are currently in the process of implementing plans to capture those opportunities. Completed successful technology reorganization. Enhanced payment capabilities for commercial and consumer clients. New FIS technology framework gives us the ability to grow organically or inorganically through acquisitions. FIS technology framework has given us a chance to clean and improve data quality to lay foundational steps for improved cross-sell, AI, and efficiency enhancements. Build upon new technology ecosystem to solidify and future-proof our evolving technology stack with a focus on deepening customer relationships through integrations and data, while creating on-going internal efficiencies. Expand digital cross-sell and marketing capabilities. Continue to focus on digital deposit onboarding for domestic and international clients. Leverage AI for enhanced decision-making, and improved efficiencies in Risk, BSA, and Sales. Investor Update | 14

The Amerant Brand Evolution 2024 Imagine Tomorrow Campaign Our Imagine Campaign is aligned with the underlying reasons our customers choose Amerant for their banking needs. Shifting from a functional to an emotive approach, our brand is continuosly evolving. Obtaining a business loan now signifies the realization of your entrepreneurial dreams and starting a savings fund for your wedding translates to a joyous “happily ever after” with your partner. Investor Update | 15 Life. You can mark it as an endless parade of choices being made. There’s a few that’ll stay with us for a lifetime, like a name. And a whole lot that’ll seem insignificant, like chocolate or vanilla, coleslaw or fries. And then, there are the big ones. The life-changing ones. The ones that’ll wake us in the middle of the night just to remind us of the enormous weight in every single one. These are the choices all our dreams and plans are built on. So choose wisely today, and imagine what can be tomorrow.

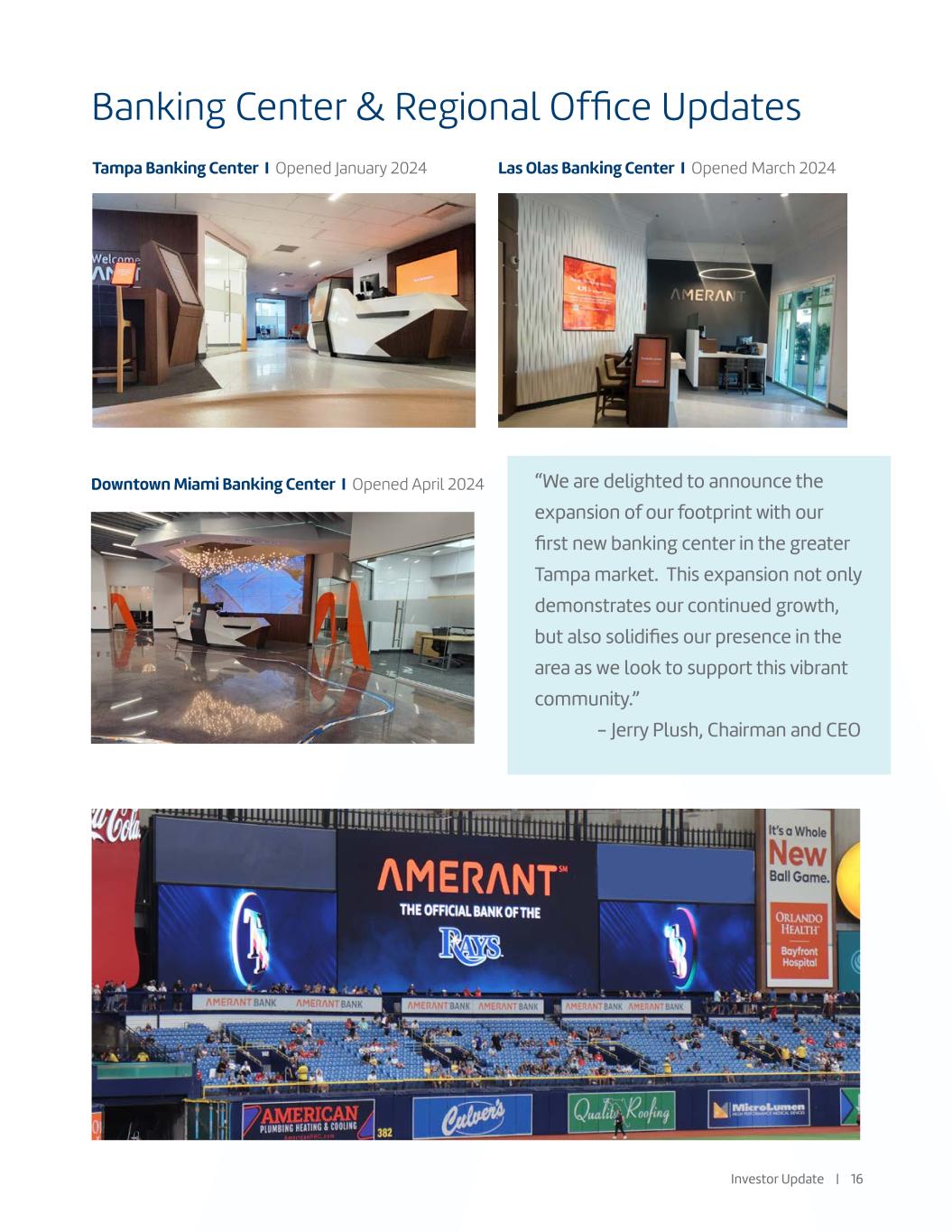

Banking Center & Regional Office Updates Tampa Banking Center I Opened January 2024 Investor Update | 16 “We are delighted to announce the expansion of our footprint with our first new banking center in the greater Tampa market. This expansion not only demonstrates our continued growth, but also solidifies our presence in the area as we look to support this vibrant community.” - Jerry Plush, Chairman and CEO Las Olas Banking Center I Opened March 2024 Downtown Miami Banking Center I Opened April 2024

Banking Center & Regional Office Updates Broward County/Plantation Regional Corporate Office Located within the Cornerstone One Building at 1200 South Pine Island Road, Plantation, Florida, Amerant occupies 5,500 square feet, with an expansion of an additional 7,000 square feet sometime in early 2025. Our expanded offices will be home for key lines of business. Tampa Regional Corporate Office Opened February 2024, located at 4830 West Kennedy Blvd., in the vibrant Westshore Business District, this office embodies our commitment to expanding our presence and better serving our clients in the greater Tampa market. Investor Update | 17 Palm Beach One banking center targeted for first half of 2025 > Downtown Palm Beach Miami Beach Two banking centers targeted for first half of 2025 > Miami Beach > Miami Beach (Bay Harbor area) Tampa One banking center targeted for first half of 2025 > Downtown Tampa Palm Beach Regional Corporate Office Targeted for First Half of 2025 Downtown Palm Beach: 525 Okeechobee Blvd., Suite 100, West Palm Beach, FL Palm Beach Miami Beach

Performance Updates

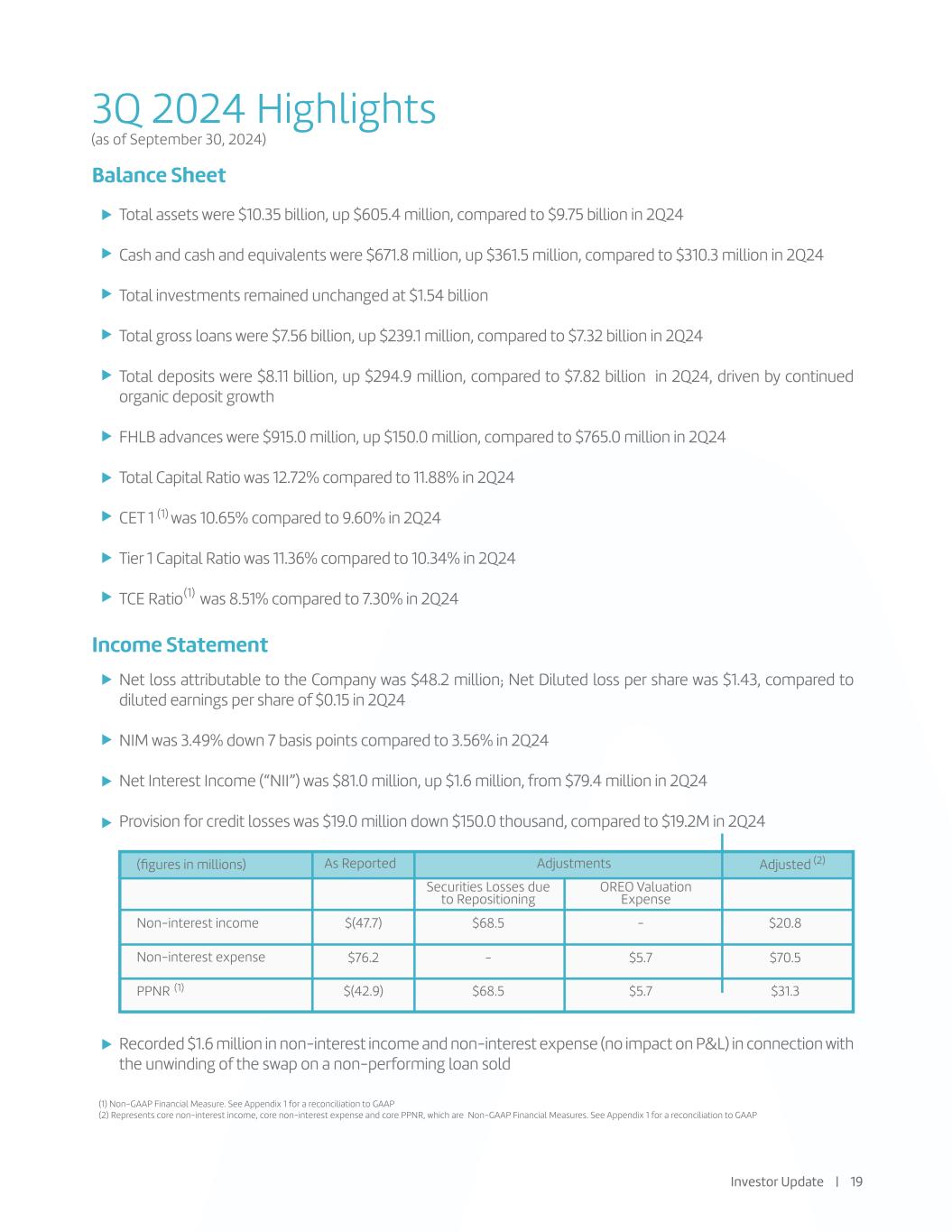

3Q 2024 Highlights Investor Update | 19 Total assets were $10.35 billion, up $605.4 million, compared to $9.75 billion in 2Q24 Cash and cash and equivalents were $671.8 million, up $361.5 million, compared to $310.3 million in 2Q24 Total investments remained unchanged at $1.54 billion Total gross loans were $7.56 billion, up $239.1 million, compared to $7.32 billion in 2Q24 Total deposits were $8.11 billion, up $294.9 million, compared to $7.82 billion in 2Q24, driven by continued organic deposit growth FHLB advances were $915.0 million, up $150.0 million, compared to $765.0 million in 2Q24 Total Capital Ratio was 12.72% compared to 11.88% in 2Q24 CET 1 was 10.65% compared to 9.60% in 2Q24 Tier 1 Capital Ratio was 11.36% compared to 10.34% in 2Q24 TCE Ratio was 8.51% compared to 7.30% in 2Q24 Net loss attributable to the Company was $48.2 million; Net Diluted loss per share was $1.43, compared to diluted earnings per share of $0.15 in 2Q24 NIM was 3.49% down 7 basis points compared to 3.56% in 2Q24 Net Interest Income (“NII”) was $81.0 million, up $1.6 million, from $79.4 million in 2Q24 Provision for credit losses was $19.0 million down $150.0 thousand, compared to $19.2M in 2Q24 Recorded $1.6 million in non-interest income and non-interest expense (no impact on P&L) in connection with the unwinding of the swap on a non-performing loan sold Balance Sheet Income Statement As Reported Adjustments Adjusted Securities Losses due to Repositioning OREO Valuation Expense Non-interest income Non-interest expense PPNR $(47.7) $76.2 $(42.9) $68.5 - $68.5 - $5.7 $5.7 $20.8 $70.5 $31.3 (2) (1) (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP (2) Represents core non-interest income, core non-interest expense and core PPNR, which are Non-GAAP Financial Measures. See Appendix 1 for a reconciliation to GAAP (figures in millions) (as of September 30, 2024) (1) (1)

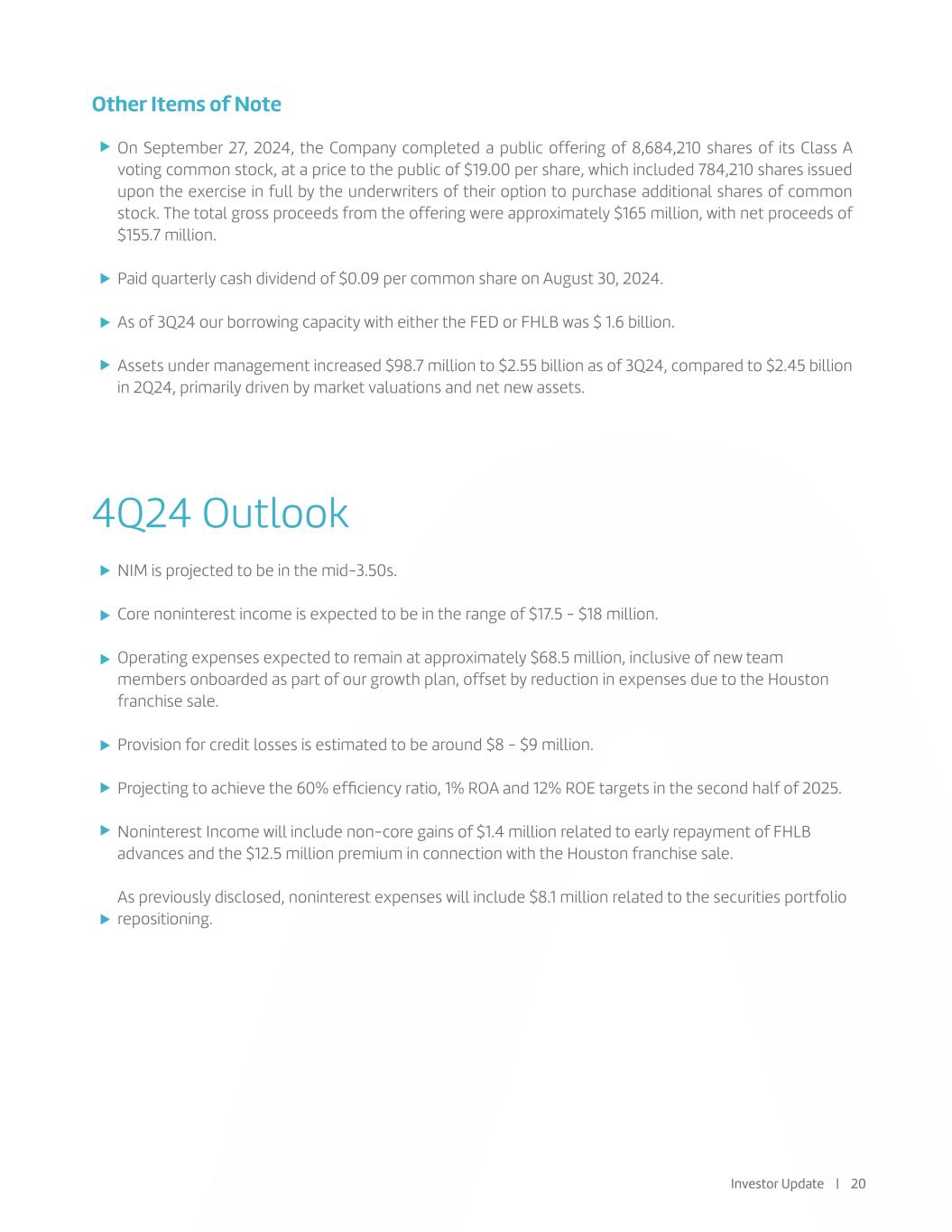

4Q24 Outlook NIM is projected to be in the mid-3.50s. Core noninterest income is expected to be in the range of $17.5 - $18 million. Operating expenses expected to remain at approximately $68.5 million, inclusive of new team members onboarded as part of our growth plan, offset by reduction in expenses due to the Houston franchise sale. Provision for credit losses is estimated to be around $8 - $9 million. Projecting to achieve the 60% efficiency ratio, 1% ROA and 12% ROE targets in the second half of 2025. Noninterest Income will include non-core gains of $1.4 million related to early repayment of FHLB advances and the $12.5 million premium in connection with the Houston franchise sale. As previously disclosed, noninterest expenses will include $8.1 million related to the securities portfolio repositioning. Other Items of Note On September 27, 2024, the Company completed a public offering of 8,684,210 shares of its Class A voting common stock, at a price to the public of $19.00 per share, which included 784,210 shares issued upon the exercise in full by the underwriters of their option to purchase additional shares of common stock. The total gross proceeds from the offering were approximately $165 million, with net proceeds of $155.7 million. Paid quarterly cash dividend of $0.09 per common share on August 30, 2024. As of 3Q24 our borrowing capacity with either the FED or FHLB was $ 1.6 billion. Assets under management increased $98.7 million to $2.55 billion as of 3Q24, compared to $2.45 billion in 2Q24, primarily driven by market valuations and net new assets. Investor Update | 20

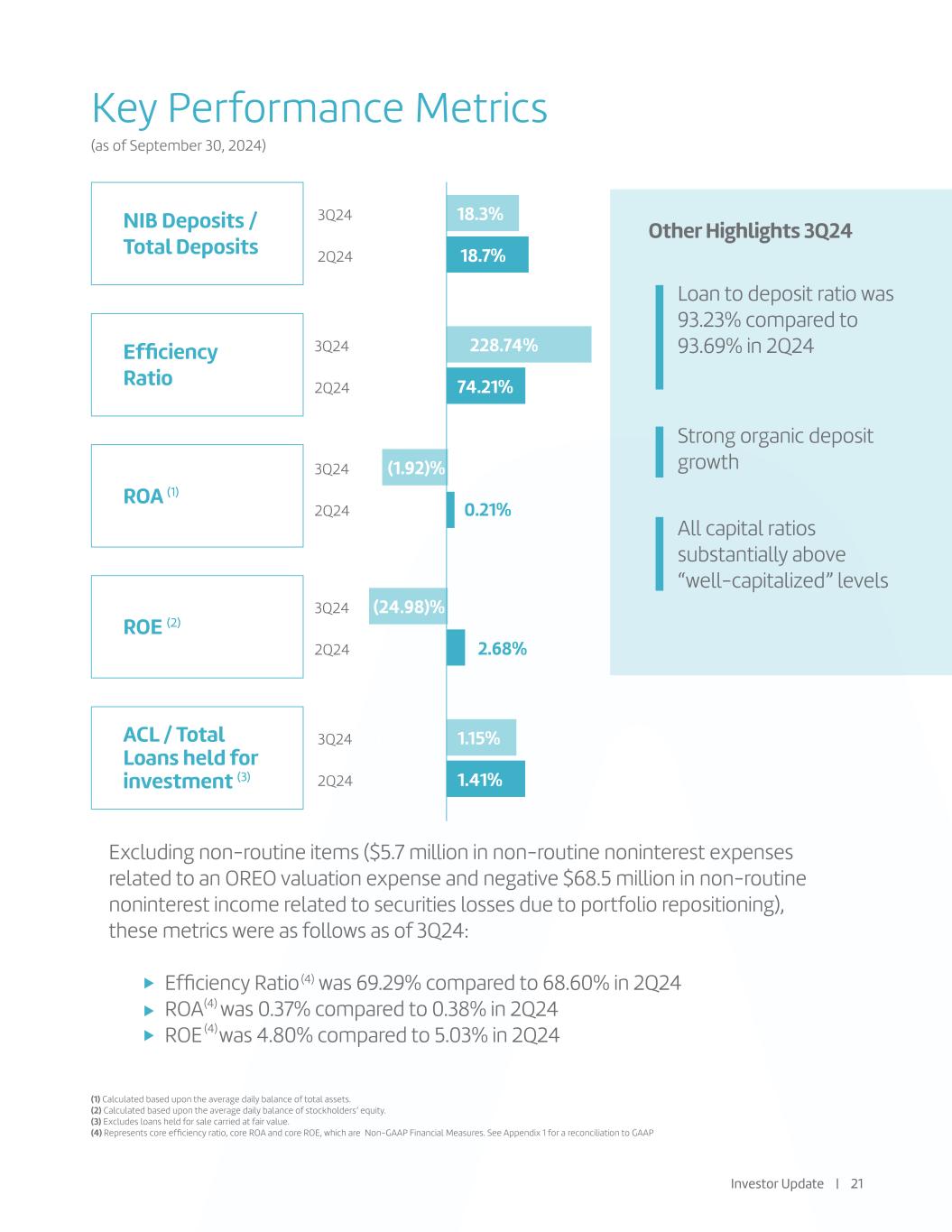

Key Performance Metrics NIB Deposits / Total Deposits Efficiency Ratio ROA (1) ROE (2) ACL / Total Loans held for investment (3) Loan to deposit ratio was 93.23% compared to 93.69% in 2Q24 3Q24 18.3% 3Q24 228.74% 3Q24 (1.92)% 3Q24 (24.98)% 3Q24 1 1.15% 2Q24 18.7% 2Q24 74.21% 2Q24 0.21% 2Q24 2.68% 2Q24 1. 1.41% Strong organic deposit growth Other Highlights 3Q24 All capital ratios substantially above “well-capitalized” levels Investor Update | 21 (1) Calculated based upon the average daily balance of total assets. (2) Calculated based upon the average daily balance of stockholders’ equity. (3) Excludes loans held for sale carried at fair value. (4) Represents core efficiency ratio, core ROA and core ROE, which are Non-GAAP Financial Measures. See Appendix 1 for a reconciliation to GAAP Excluding non-routine items ($5.7 million in non-routine noninterest expenses related to an OREO valuation expense and negative $68.5 million in non-routine noninterest income related to securities losses due to portfolio repositioning), these metrics were as follows as of 3Q24: Efficiency Ratio was 69.29% compared to 68.60% in 2Q24 ROA was 0.37% compared to 0.38% in 2Q24 ROE was 4.80% compared to 5.03% in 2Q24 (4) (4) (4) (as of September 30, 2024)

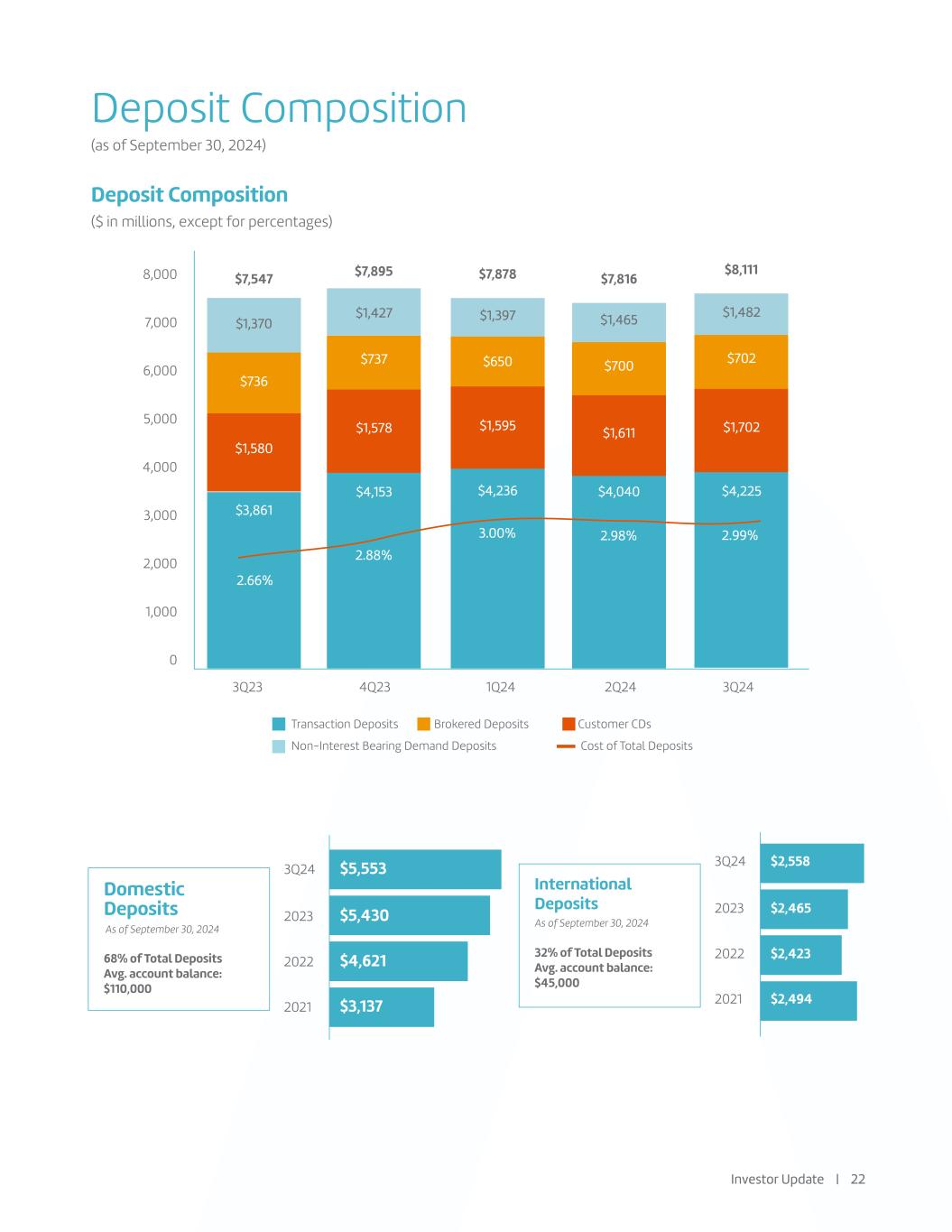

Deposit Composition Deposit Composition ($ in millions, except for percentages) Transaction Deposits Brokered Deposits Customer CDs Non-Interest Bearing Demand Deposits Cost of Total Deposits International Deposits 32% of Total Deposits Avg. account balance: $45,000 2023 $2,4652023 $5,430 2022 $2,4232022 $4,621 2021 $2,4942021 $3,137 3Q23 4Q23 1Q24 2Q24 3Q24 $1,482 $8,1118,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 3Q24 $2,5583Q24 $5,553 Domestic Deposits 68% of Total Deposits Avg. account balance: $110,000 2.99% $702 $1,702 $4,225 $1,370 $7,547 2.66% $736 $1,580 $3,861 Investor Update | 22 $1,427 $7,895 2.88% $737 $1,578 $4,153 As of September 30, 2024 As of September 30, 2024 $1,397 $1,465 $7,878 $7,816 3.00% 2.98% $650 $1,595 $4,236 $700 $1,611 $4,040 (as of September 30, 2024)

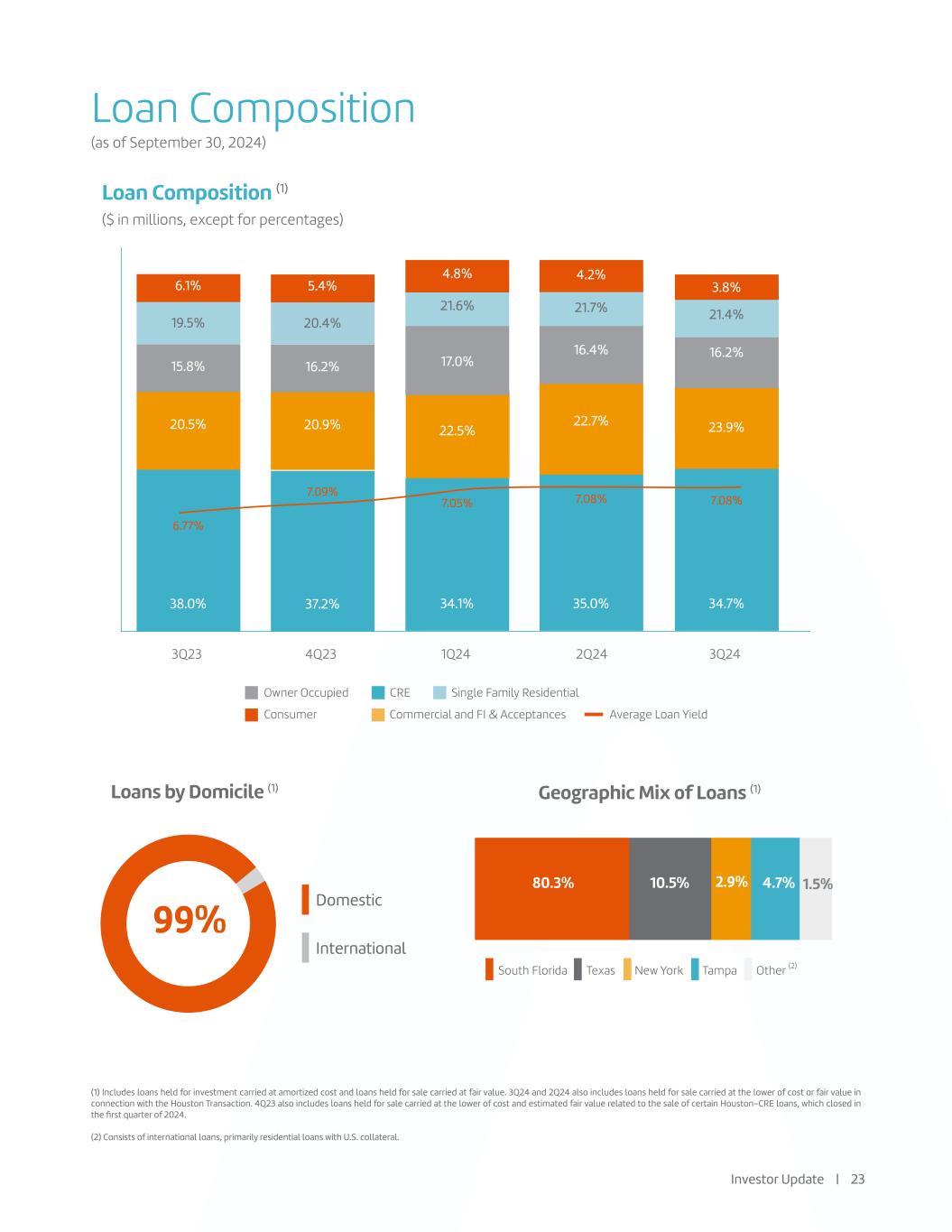

Loan Composition Loan Composition (1) ($ in millions, except for percentages) (1) Includes loans held for investment carried at amortized cost and loans held for sale carried at fair value. 3Q24 and 2Q24 also includes loans held for sale carried at the lower of cost or fair value in connection with the Houston Transaction. 4Q23 also includes loans held for sale carried at the lower of cost and estimated fair value related to the sale of certain Houston-CRE loans, which closed in the first quarter of 2024. (2) Consists of international loans, primarily residential loans with U.S. collateral. South Florida Texas New York Tampa Other (2) Owner Occupied CRE Single Family Residential Consumer Commercial and FI & Acceptances Average Loan Yield Loans by Domicile (1) Geographic Mix of Loans (1) 3Q23 4Q23 1Q24 2Q24 3Q24 Domestic International 99% 80.3% 10.5% 2.9% 4.7% 34.7% 7.08% 3.8% 21.4% 16.2% 23.9% 6.1% 19.5% 15.8% 20.5% 38.0% 6.77% 1.5% Investor Update | 23 5.4% 20.4% 16.2% 20.9% 37.2% 7.09% 34.1% 35.0% 4.8% 21.6% 17.0% 22.5% 7.05% 7.08% 4.2% 21.7% 16.4% 22.7% (as of September 30, 2024)

Credit Quality Update $2.3 $14.7 $(35.6) $3.2 Loan Growth2Q24 Requirements for Charge-offs Gross Charge-offs Recoveries $94.4 $(33.6) $86.3 Sold2Q24 Downgrades to Substandard Charge-offs $114.9 3Q24 Credit Quality & Macroeconomic Changes $(4.4) Release from TX Portfolio HFS 3Q24 $75.5 $(3.2) Payoffs/Paydowns $(18.2) $5.5 $(2.9) Downgrades to Substandard 2Q24 Downgrades to Special Mention Upgrades to Pass $95.3 $76.4 3Q24 $(3.3) Payoffs/ Paydowns $101.0 Gross charge-offs includes $17.3 million that was provisioned in the previous period. Remarks $0.9 The downgrade to Special Mention is one relationship with four owner-occupied loans totaling $5.5 million. The downgrades to Substandard consisted mainly of three owner-occupied loans and one commercial loan. Remarks $(35.6) The downgrades to substandard are composed mainly of six commercial/owner-occupied loans and two CRE loan, in addition to downgrades to special mention described in section above. The downgrades were not concentrated in a specific industry or geography. Note sales included one owner-occupied loan totaling $28 million and two small real estate secured loans. All notes were sold at par. Remarks Allowance for Credit Losses ($ in millions) Special Mention Loans ($ in millions) Non-Performing Loans ($ in millions) Investor Update | 24 (as of September 30, 2024)

Capital 12.72% 8.51% 10.65% $20.87 Total Capital Ratio Regulatory Minimum (1) : 10.00% Common Equity Tier 1 Capital (CET1) Ratio Regulatory Minimum: 6.50% TCE Ratio (2,3,4) TBV/Share (4) Capital Allocation Strategy 2023 Class A Common Stock Repurchase Program up to $20 million As of September 30, 2024, the Company has repurchased an aggregate of 344,326 shares for $7.5 million. Return of capital to shareholders through quarterly cash dividend 1.68%(5) annualized dividend yield and dividend expected to remain unchanged in near-term. (1) Regulatory minimum to be considered “Well Capitalized” (2) Includes $13.0 million accumulated unrealized losses net of taxes primarily related to the decline in the fair value of debt securities available for sale, which are carried at fair value, as a result of increases in market rates. (3) There were no debt securities held to maturity at September 30, 2024 (4) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. (5) Based on share price at the close of market on September 30, 2024 Investor Update | 25 (as of September 30, 2024)

Liquidity Regular testing of lines of credit; satisfactory results have been obtained as of September 30, 2024 Daily monitoring of Federal Reserve Bank account balances as well as large fund providers Daily analysis of lending pipeline and deposit gathering opportunities and their impact on cash flow projections Targets associated with liquidity stress test scenarios Targets for deposit concentration Limits on liquidity ratios Active collateral management of both loan and investment portfolios with lending facilities at FHLB and FRB 90.5% of the total portfolio has government guarantee, while the remainder is rated investment grade Total advances were $915 million An additional $1.9 billion of remaining credit availability with the FHLB Borrowing capacity with the FHLB is approximately $1.6 billion, including both securities and loans As of October 21, 2024, after the transfer of loan collateral, our borrowing capacity has increased to $2.6 billion. Strong level of cash on hand: $613 million as of 3Q24 at the Federal Reserve Bank (“FRB”) account Continued efforts to increase FDIC insurance through Insured Cash Sweep (“ICS”) Instituted deposit covenants with minimum balance requirements for any new credit relationship Prudently utilizing our $20 million share repurchase program with a focus on liquidity management and capital preservation Our standard liquidity management practices include: Available line of credit with FHLB as of 3Q24: Additional actions that strenghten liquidity position: Investor Update | 26 (as of September 30, 2024)

Supplemental Information

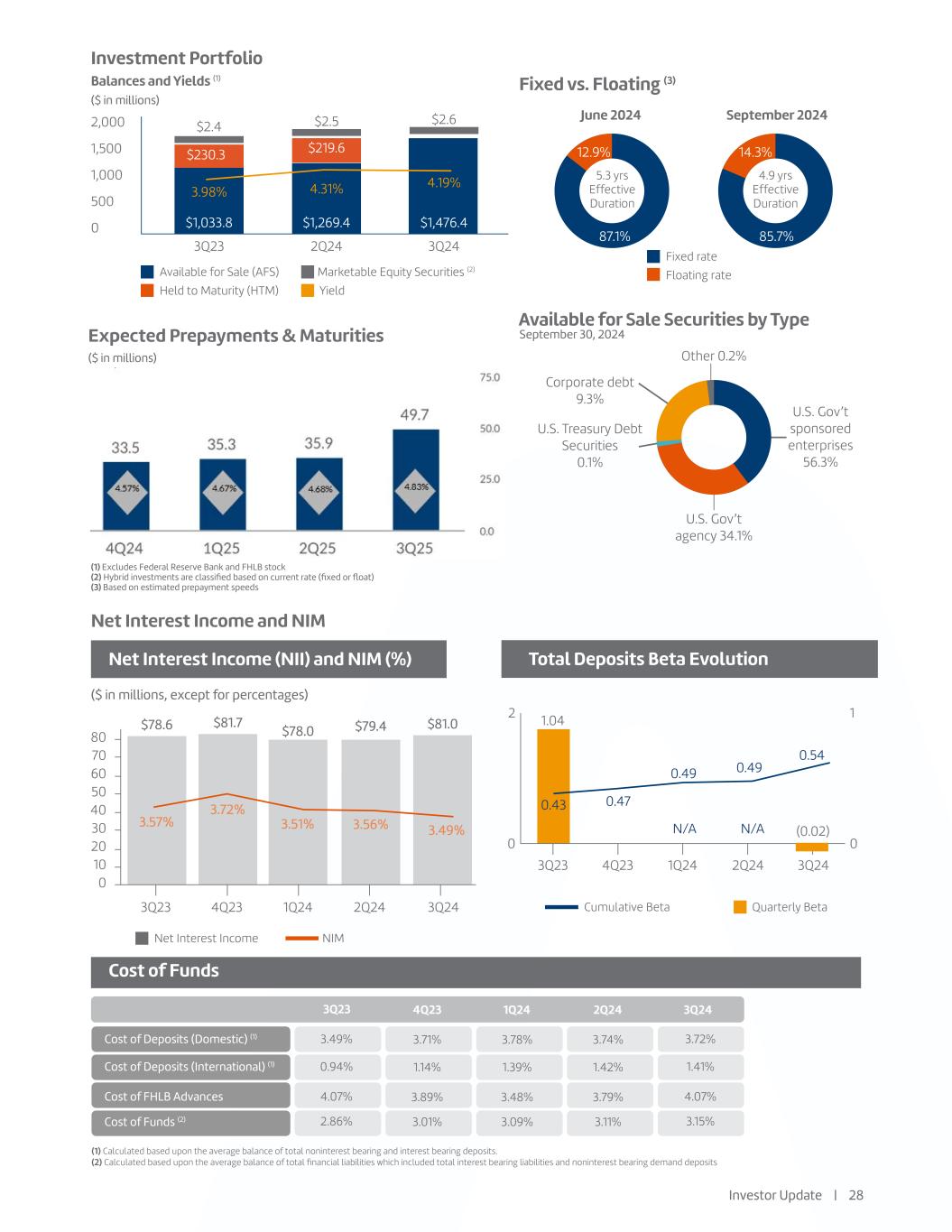

3.56% $79.4 Net Interest Income and NIM ($ in millions, except for percentages) Net Interest Income (NII) and NIM (%) Total Deposits Beta Evolution Cost of Funds (1) Calculated based upon the average balance of total noninterest bearing and interest bearing deposits. (2) Calculated based upon the average balance of total financial liabilities which included total interest bearing liabilities and noninterest bearing demand deposits Cumulative Beta Quarterly Beta Net Interest Income NIM 2 0 80 70 60 50 40 30 20 10 0 1 0 3Q23 3Q24 $78.0 3.51%3.57% 3.72% $78.6 $81.7 4Q23 3Q23 1Q24 4Q23 1.04 2Q24 1Q24 3Q24 2Q24 3.72% 1.41% 4.07% 3.15% 3.49% 0.94% 4.07% 2.86% Cost of Deposits (Domestic) (1) Cost of Deposits (International) (1) Cost of FHLB Advances Cost of Funds (2) 3Q243Q23 0.43 0.47 0.49 0.49 Investment Portfolio Balances and Yields (1) ($ in millions) Available for Sale (AFS) Marketable Equity Securities (2) Held to Maturity (HTM) Yield 2,000 1,500 1,000 500 0 $2.4 $2.6 3Q23 2Q24 3Q24 $230.3 $219.6 $1,033.8 $1,269.4 $1,476.4 3.98% 4.31% 4.19% $2.5 Fixed vs. Floating (3) June 2024 September 2024 5.3 yrs Effective Duration 4.9 yrs Effective Duration Fixed rate Floating rate 12.9% 87.1% 14.3% 85.7% Available for Sale Securities by Type September 30, 2024 Corporate debt 9.3% U.S. Treasury Debt Securities 0.1% U.S. Gov’t agency 34.1% U.S. Gov’t sponsored enterprises 56.3% Other 0.2% (1) Excludes Federal Reserve Bank and FHLB stock (2) Hybrid investments are classified based on current rate (fixed or float) (3) Based on estimated prepayment speeds Investor Update | 28 0.54 4Q23 3.71% 1.14% 3.89% 3.01% Expected Prepayments & Maturities ($ in millions) N/A N/A 3.78% 1.39% 3.48% 3.09% 3.74% 1.42% 3.79% 3.11% 1Q24 2Q24 3.49% $81.0 (0.02)

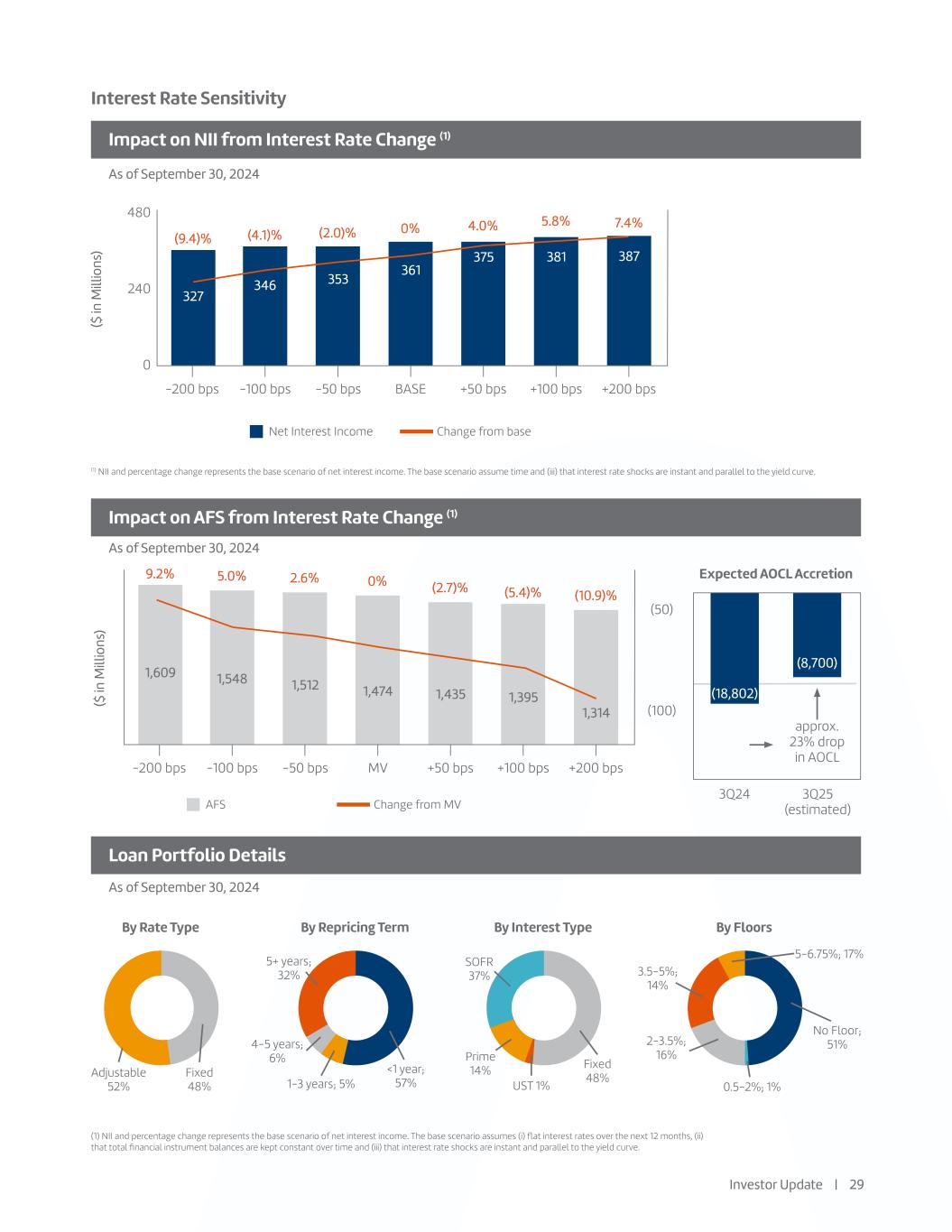

Interest Rate Sensitivity Impact on NII from Interest Rate Change (1) Impact on AFS from Interest Rate Change (1) Loan Portfolio Details As of September 30, 2024 As of September 30, 2024 ($ in M ill io ns ) ($ in M ill io ns ) Net Interest Income Change from base AFS Change from MV 480 240 0 (9.4)% 9.2% 327 1,609 346 1,548 353 1,512 361 1,474 375 (18,802) (8,700) 1,435 381 1,395 387 1,314 (4.1)% 5.0% (2.0)% 2.6% 0% 0% 4.0% (2.7)% 5.8% (5.4)% 7.4% (10.9)% -200 bps (50) 3Q24 3Q25 (estimated) approx. 23% drop in AOCL (100) -200 bps -100 bps -100 bps -50 bps -50 bps BASE MV +50 bps +50 bps +100 bps +100 bps +200 bps +200 bps (1) NII and percentage change represents the base scenario of net interest income. The base scenario assume time and (iii) that interest rate shocks are instant and parallel to the yield curve. (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve. Expected AOCL Accretion By Rate Type By Repricing Term By Interest Type By Floors Adjustable 52% Fixed 48% 5+ years; 32% <1 year; 57% Fixed 48% UST 1% Prime 14% 4-5 years; 6% 1-3 years; 5% SOFR 37% 5-6.75%; 17% 3.5-5%; 14% 2-3.5%; 16% 0.5-2%; 1% No Floor; 51% Investor Update | 29 As of September 30, 2024

Commercial Real Estate (CRE) Held for Investment-Detail Credit Quality Outstanding as of September 30, 2024 ($ in millions, except %) (1) Calculated as a percentage of loans held for investment only (2) Income producing properties include non-owner occupied and multi-family residential loans CRE Type Retail Multifamily Office Industrial Hotels Specialty Total CRE Land FL TX NY Other Total % Total CRE % Total Loans (1) Income Producing (2) Land and Construction $635 $23 $84 - $742 30.2% 10.7% $739 4 297 76 84 - 457 18.6% 6.6% 352 105 344 42 40 5 432 17.5% 6.2% 432 - 248 28 – 19 295 12.0% 4.2% 287 8 57 – 15 – 72 2.9% 1.0% 72 – 180 – – 16 196 8.0% 2.9% 159 38 247 6 – 14 267 10.8% 3.8% - 266 $2,009 $175 $223 $54 $2,461 100.0% 35.3% $2,040 $421 2Q24 1Q24 1Q24 1Q24 0.43%0.46% 0.57% 0.47% 0.56% $96.1 3.2x 0.69% $98.8 3.0x 0.82% $95.5 2.8x 0.85% 0.51% 3Q24 2Q24 2Q24 2Q24 3Q23 3Q24 3Q24 3Q24 4Q23 3Q23 3Q23 3Q23 1Q24 4Q23 4Q23 4Q23 ($ in millions) NPLs and NPAs / Total Assets Allowance for Credit Losses / Total NPL Allowance for Credit Losses Net Charge-Offs / Average Total Loans Held for Investment NPLs / Total Loans NPAs / Total Assets Allowance for credit Losses ACL as a % of Total Loans held for investment 1.38%1.40% 1.39% Investor Update | 30 1.38% 1.24% $94.4 1.41% 0.9x 1.13% 1.25% 1.52% $79.9 1.15% 0.7x 1.90%

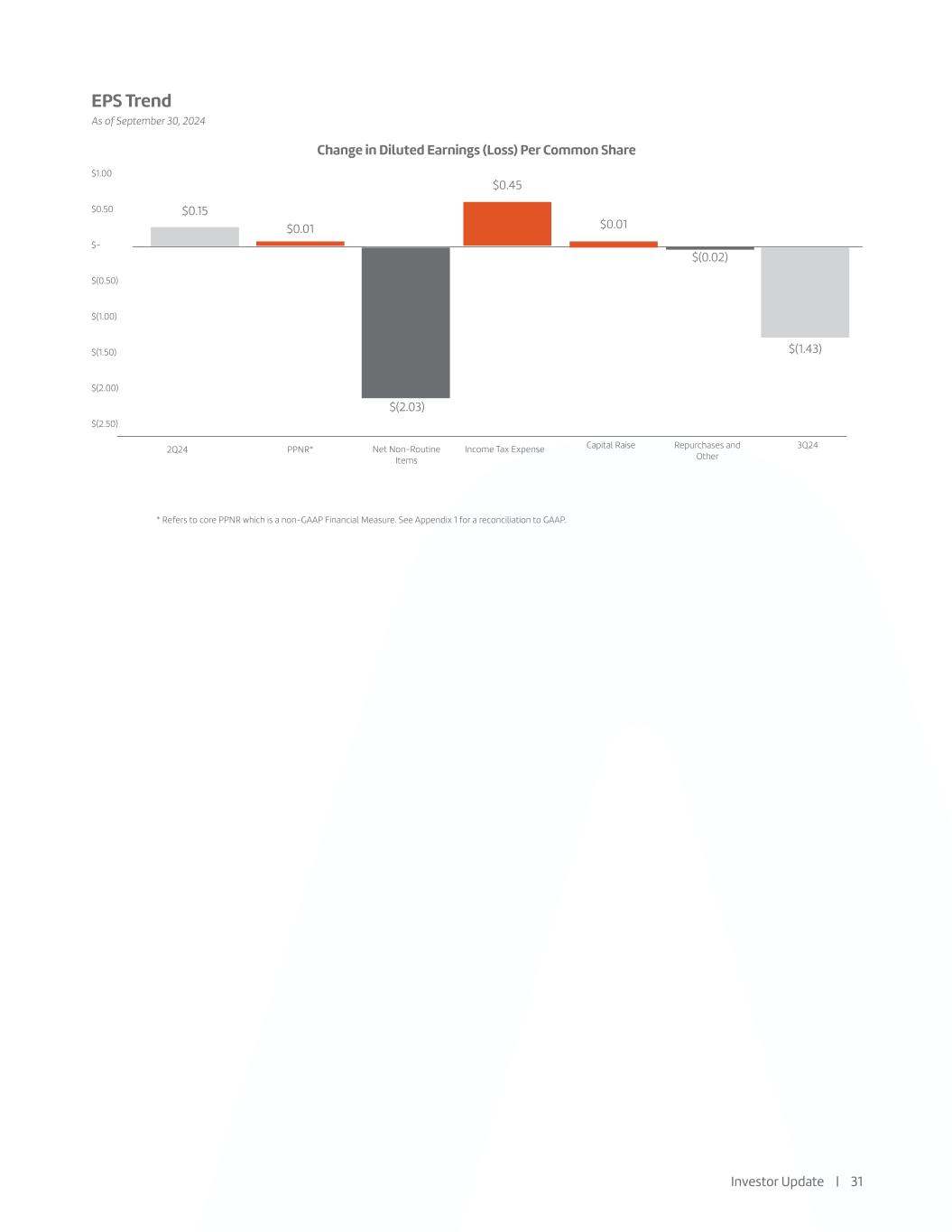

Investor Update | 31 $(2.03) Change in Diluted Earnings (Loss) Per Common Share EPS Trend Income Tax Expense Capital Raise2Q24 PPNR* Net Non-Routine Items 3Q24 $0.01 $1.00 $0.50 $- $(0.50) $(1.00) $(1.50) $(2.00) $(2.50) * Refers to core PPNR which is a non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. $0.01 Repurchases and Other $0.45 $0.15 $(0.02) $(1.43) As of September 30, 2024

Glossary Investor Update | 32 • TCE Ratio: 3Q24 includes $13.0 million accumulated unrealized losses net of taxes primarily related to the decline in the fair value of debt securities available for sale, which are carried at fair value, as a result of increases in market rates. • Total gross loans: includes loans held for investment carried at amortized cost, loans held for sale carried at fair value, and loans held for sale carried at the lower of estimated fair value or cost. • Brokered Deposits : there were no brokered transaction deposits in 3Q24, 2Q24 and 1Q24, while 4Q23 and 3Q23 include brokered transaction deposits of $17 million and $13 million, respectively. 3Q24, 2Q24, 1Q24, 4Q23 and 3Q23 brokered time deposits were $702 million, $700 million, $650 million, $720 million and $723 million, respectively. • Cost of Total Deposits: annualized and calculated based upon the average daily balance of total deposits. • Average deposit account balances in Deposit Mix Slide calculated as of December 31, 2023. • ROA: calculated based upon the average daily balance of total assets. • ROE: calculated based upon the average daily balance of stockholders’ equity. • Loans Held for Investment: excludes loans held for sale carried at fair value and loans held for sale carried at the lower of cost or fair value. • Non-performing loans include accruing loans past due by 90 days or more and all nonaccrual loans. Non-performing assets include accruing loans past due by 90 days or more, all nonaccrual loans, other real estate owned (“OREO”) properties acquired through or in lieu of foreclosure and other repossessed assets. • Net Charge Offs/Average Total Loans Held for Investment: • Annualized and calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan fees and costs, excluding the allowance for credit losses. • Total loans exclude loans held for sale. • Cost of Deposits: calculated based upon the average balance of total noninterest bearing and interest bearing deposits, which includes time deposits. • Cost of Funds: calculated based upon the average balance of total financial liabilities which include total interest bearing liabilities and noninterest bearing demand deposits. • Quarterly beta (as shown in NII & NIM Slide): calculated based upon the change of the cost of deposit over the change of Federal funds rate (if any) during the quarter.

Appendix

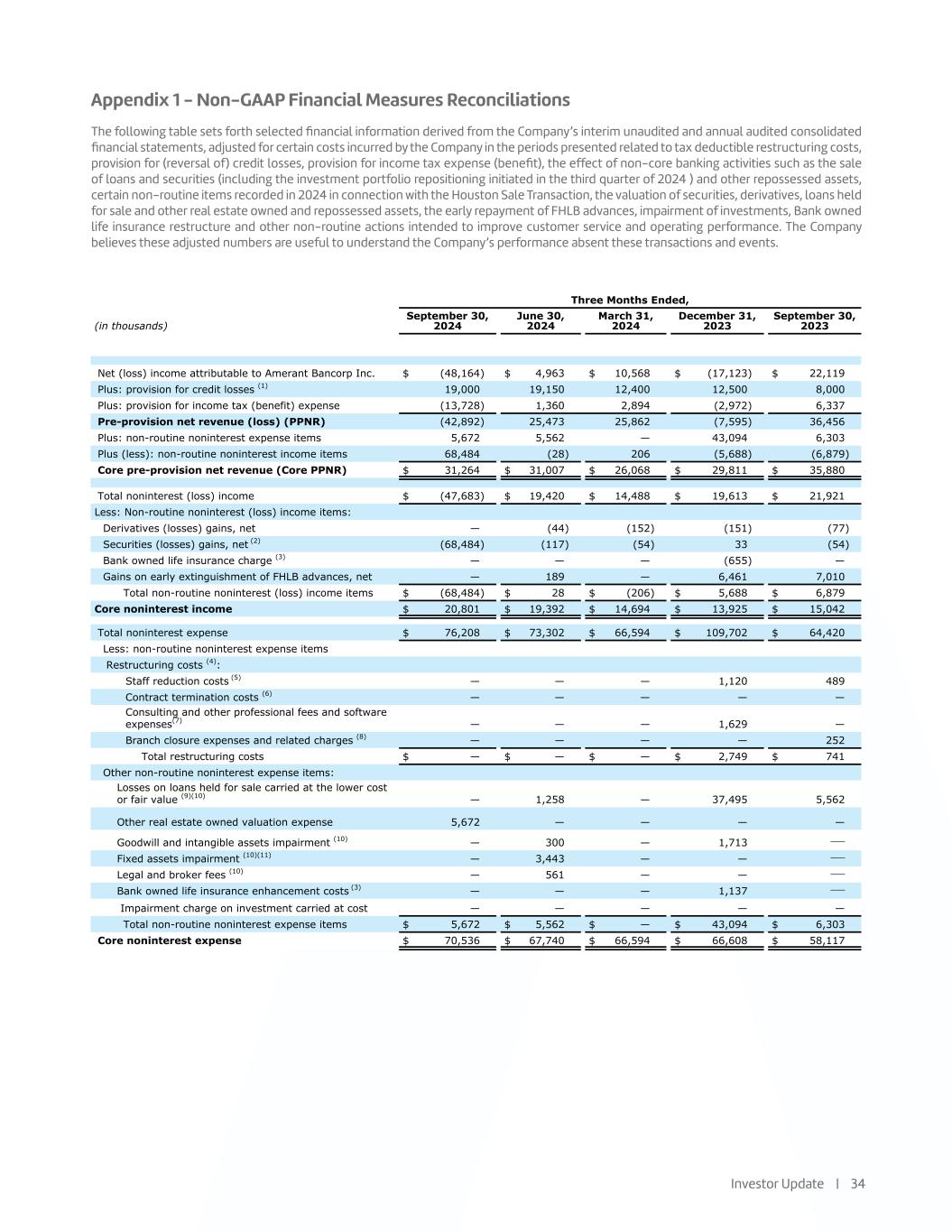

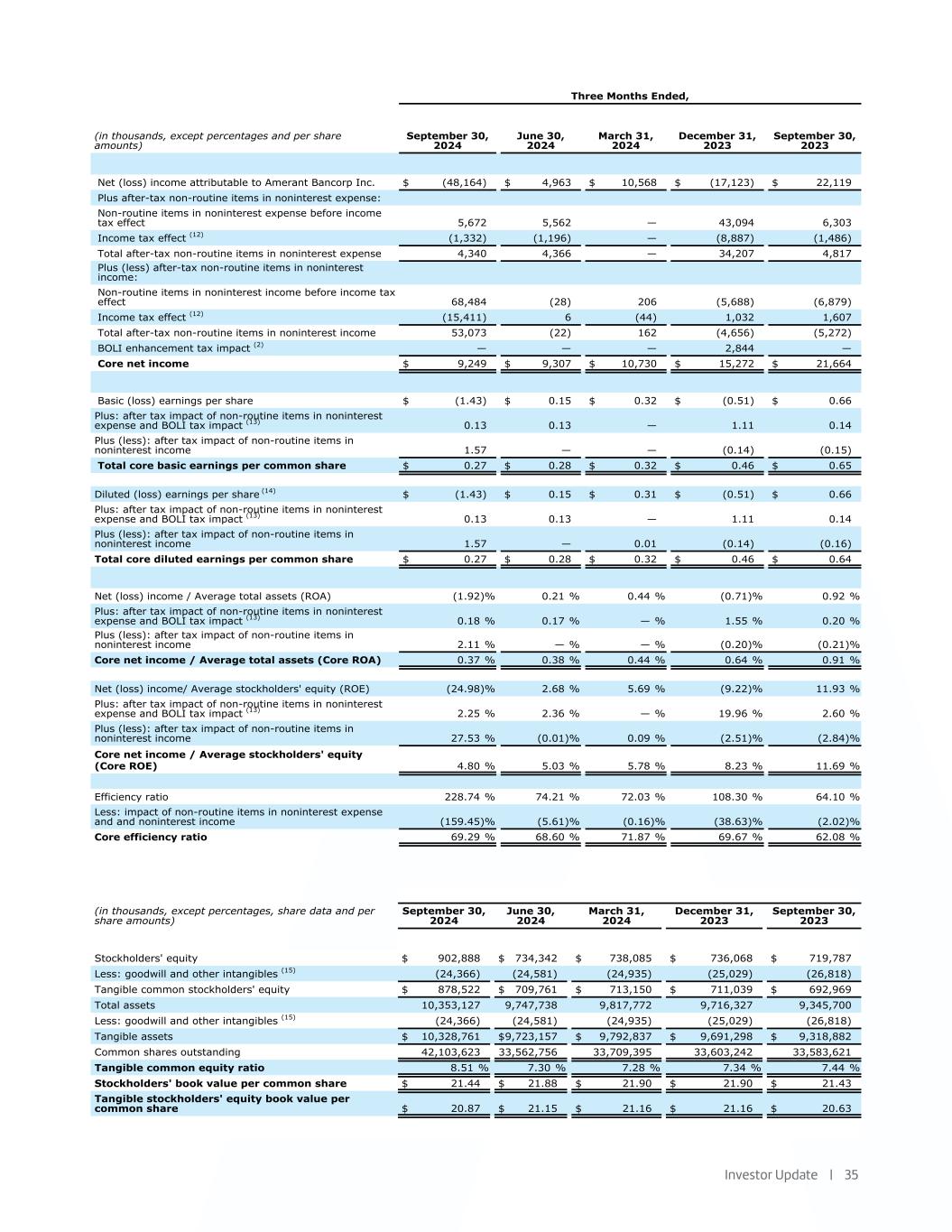

Appendix 1 - Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related to tax deductible restructuring costs, provision for (reversal of) credit losses, provision for income tax expense (benefit), the effect of non-core banking activities such as the sale of loans and securities (including the investment portfolio repositioning initiated in the third quarter of 2024 ) and other repossessed assets, certain non-routine items recorded in 2024 in connection with the Houston Sale Transaction, the valuation of securities, derivatives, loans held for sale and other real estate owned and repossessed assets, the early repayment of FHLB advances, impairment of investments, Bank owned life insurance restructure and other non-routine actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events. Investor Update | 34

Investor Update | 35

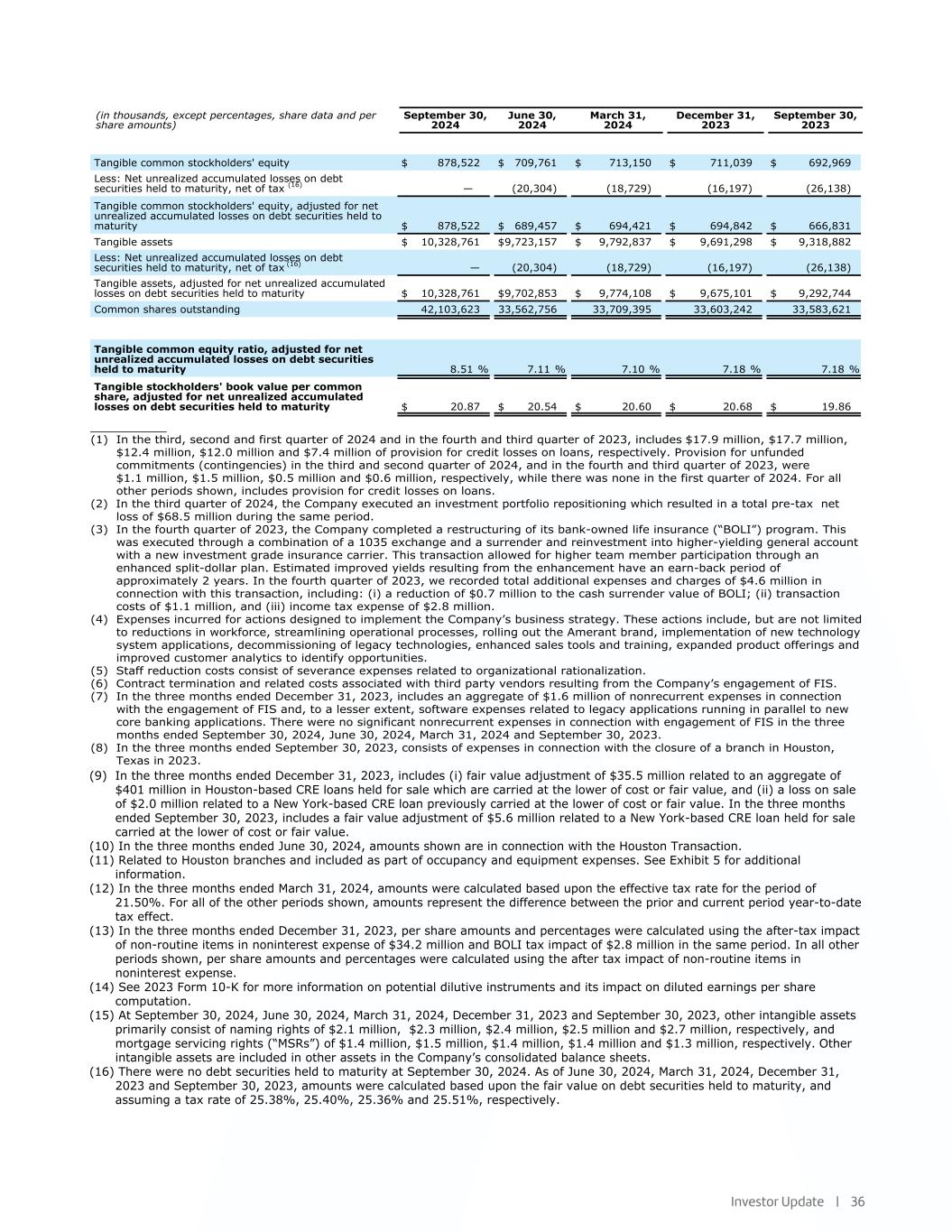

Investor Update | 36

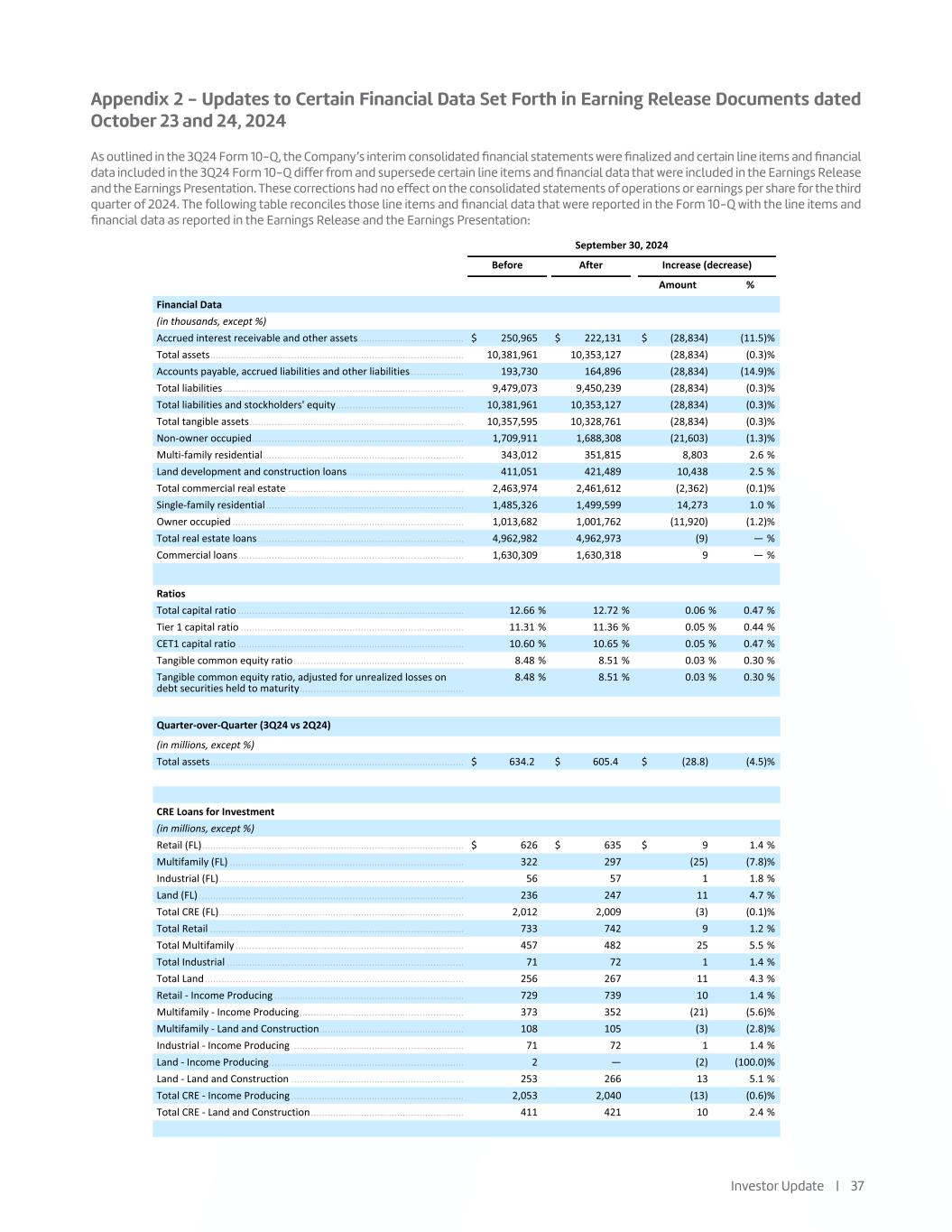

Appendix 2 - Updates to Certain Financial Data Set Forth in Earning Release Documents dated October 23 and 24, 2024 Investor Update | 37 As outlined in the 3Q24 Form 10-Q, the Company’s interim consolidated financial statements were finalized and certain line items and financial data included in the 3Q24 Form 10-Q differ from and supersede certain line items and financial data that were included in the Earnings Release and the Earnings Presentation. These corrections had no effect on the consolidated statements of operations or earnings per share for the third quarter of 2024. The following table reconciles those line items and financial data that were reported in the Form 10-Q with the line items and financial data as reported in the Earnings Release and the Earnings Presentation:

Thank You NYSE: AMTB amerantbank.com