amerantbank.com 4Q 24 Updates January 2, 2025

2 Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. Examples of forward-looking statements include but are not limited to: our future operating or financial performance, including revenues, expenses, expense savings, income or loss and earnings or loss per share, and other financial items; statements regarding expectations, plans or objectives for future operations, products or services, and our expectations on our securities repositioning and loan recoveries, reaching effective resolutions on problem loans, or significantly reducing special mention and/or non-performing loans. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2023 filed on March 7, 2024, in our quarterly report on Form 10-Q for the fiscal quarter ended March 31, 2024 filed on May 3, 2024, in our quarterly report on Form 10-Q for the fiscal quarter ended September 30, 2024 filed on November 4, 2024, and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov.

3 4Q24 Updates • On December 27, 2024, sold a portfolio of 323 business-purpose, investment property, residential mortgage loans with an outstanding balance of approximately $71.4 million at the time of sale; loss on sale of $12.6 million including estimated transaction costs. The loans were originated under an Uncommitted Credit and Guarantee Agreement (i.e., an uncommitted loan program). • Average interest rate of the portfolio was 7.13%; additional details will be provided on the Company’s upcoming fourth quarter 2024 earnings call Loan Sale • Balance Sheet size - expected to be approximately $9.9 billion as of December 31, 2024 • Excluding the Houston franchise sale and loan sale (above), expected net deposit growth of approximately $318 million and net loan growth of approximately $310 million during the fourth quarter of 2024 • Crossing the $10 billion threshold is expected in January 2025 given strong deposit and loan pipelines • Reduction in balance sheet size is primarily driven by the Houston franchise sale and early repayment of a net $170 million in FHLB advances, partially offset by deposit production in the quarter Balance Sheet Management Amerant Bancorp Inc. and its subsidiaries (“Amerant” or the “Company”) is providing the following updates regarding transactions in the fourth quarter of 2024: Previously- Announced Non-Routine Items(1) • Houston Franchise Sale completed on November 8, 2024 with deposit premium of $12.5 million and transaction costs of approximately $2.7 million • Securities Portfolio repositioning completed in early October 2024 with $8.1 million in losses in 4Q24 • Gain on early repayment of FHLB Advances of $1.4 million. Net reduction of $170 million expected since 3Q24 (1) Previously disclosed as part of the Investor Update presentation furnished as an Exhibit to the Form 8-K filed with the SEC on November 12, 2024.

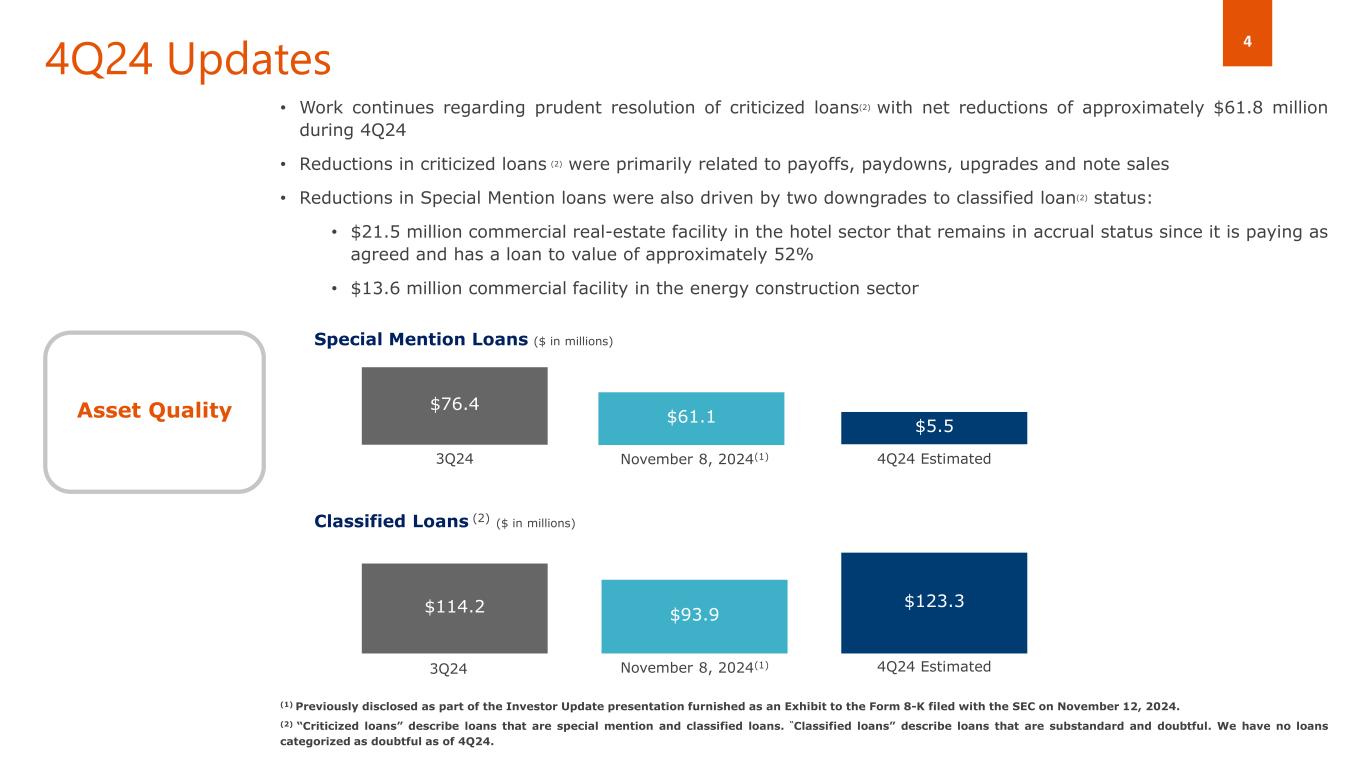

4 4Q24 Updates Asset Quality • Work continues regarding prudent resolution of criticized loans(2) with net reductions of approximately $61.8 million during 4Q24 • Reductions in criticized loans (2) were primarily related to payoffs, paydowns, upgrades and note sales • Reductions in Special Mention loans were also driven by two downgrades to classified loan(2) status: • $21.5 million commercial real-estate facility in the hotel sector that remains in accrual status since it is paying as agreed and has a loan to value of approximately 52% • $13.6 million commercial facility in the energy construction sector Special Mention Loans ($ in millions) Classified Loans (2) ($ in millions) 3Q24 $123.3 $5.5 $76.4 November 8, 2024(1) $114.2 4Q24 Estimated3Q24 (1) Previously disclosed as part of the Investor Update presentation furnished as an Exhibit to the Form 8-K filed with the SEC on November 12, 2024. (2) “Criticized loans” describe loans that are special mention and classified loans. “Classified loans” describe loans that are substandard and doubtful. We have no loans categorized as doubtful as of 4Q24. $61.1 4Q24 Estimated $93.9 November 8, 2024(1)