Third Quarter Earnings Presentation October 28, 2025

2 Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. Examples of forward- looking statements include but are not limited to: our future operating or financial performance, including revenues, expenses, expense savings, income or loss and earnings or loss per share, and other financial items; statements regarding expectations, plans or objectives for future operations, products or services, and our expectations on our investment portfolio repositioning and loan recoveries or reaching positive resolutions on problem loans. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlook,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2024 filed on March 5, 2025, and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including the three and nine month periods ended September 30, 2025 and 2024, and the three months ended June 30, 2025, March 31, 2025, and December 31, 2024 may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2025, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “pre- provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expense”, “core net income”, “core earnings per share (basic and diluted)”, “core return on assets (Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, and “tangible stockholders’ equity (book value) per common share" . This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures”. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our business. Management believes that these supplementary non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. Appendix 1 reconciles these non-GAAP financial measures to reported results.

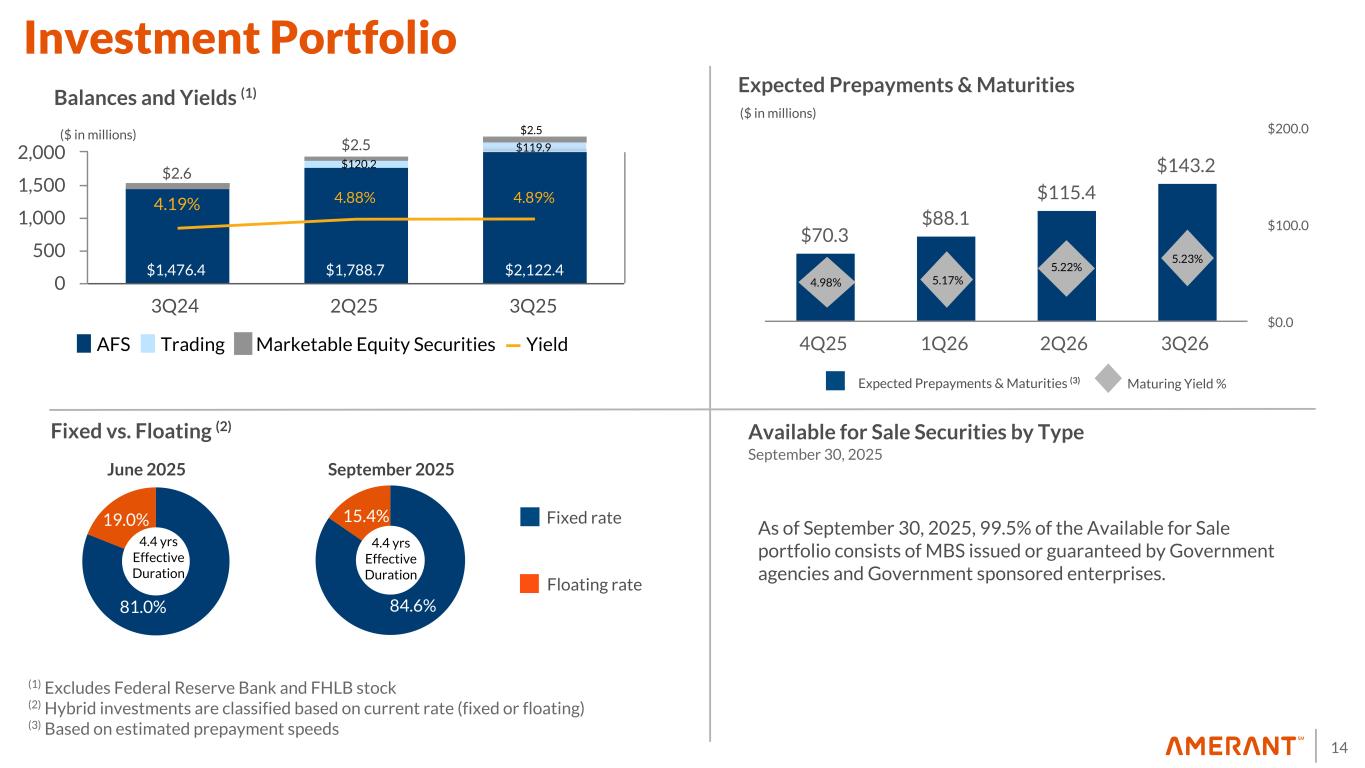

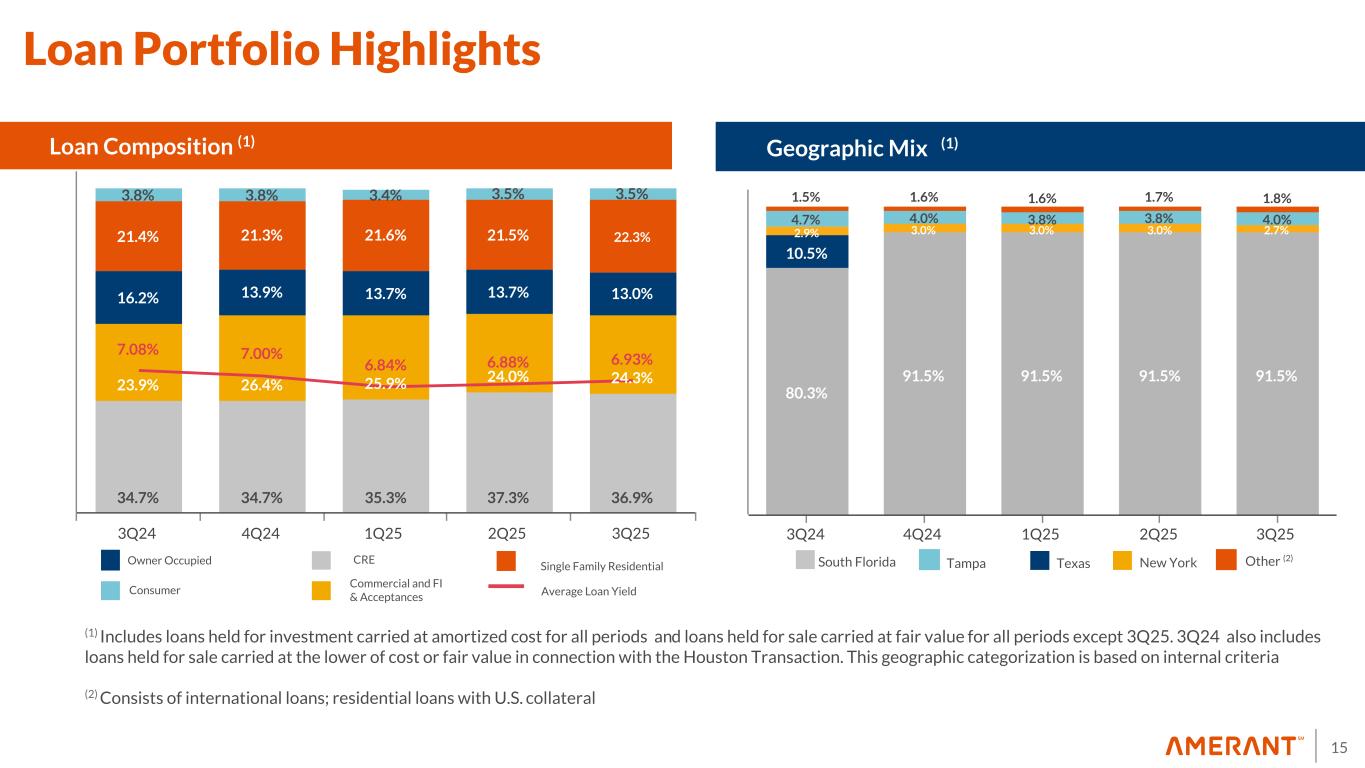

3 3Q25 vs. 2Q25 Highlights Balance Sheet • Total assets were $10.4 billion, compared to $10.3 billion • Cash and cash equivalents were $630.9 million, compared to $636.8 million • Total investment securities were $2.3 billion, compared to $2.0 billion • Total gross loans were $6.9 billion, compared to $7.2 billion • Total deposits were $8.3 billion, compared to $8.3 billion • Core deposits were $6.2 billion, compared to $6.1 billion • Brokered deposits were $550.2 million , compared to $644.0 million • FHLB advances were $831.7 million, compared to $765.0 million Also of note: • Assets Under Management and custody (“AUM”) totaled $3.17 billion, up by $104.5 million, 3.4% from $3.07 billion

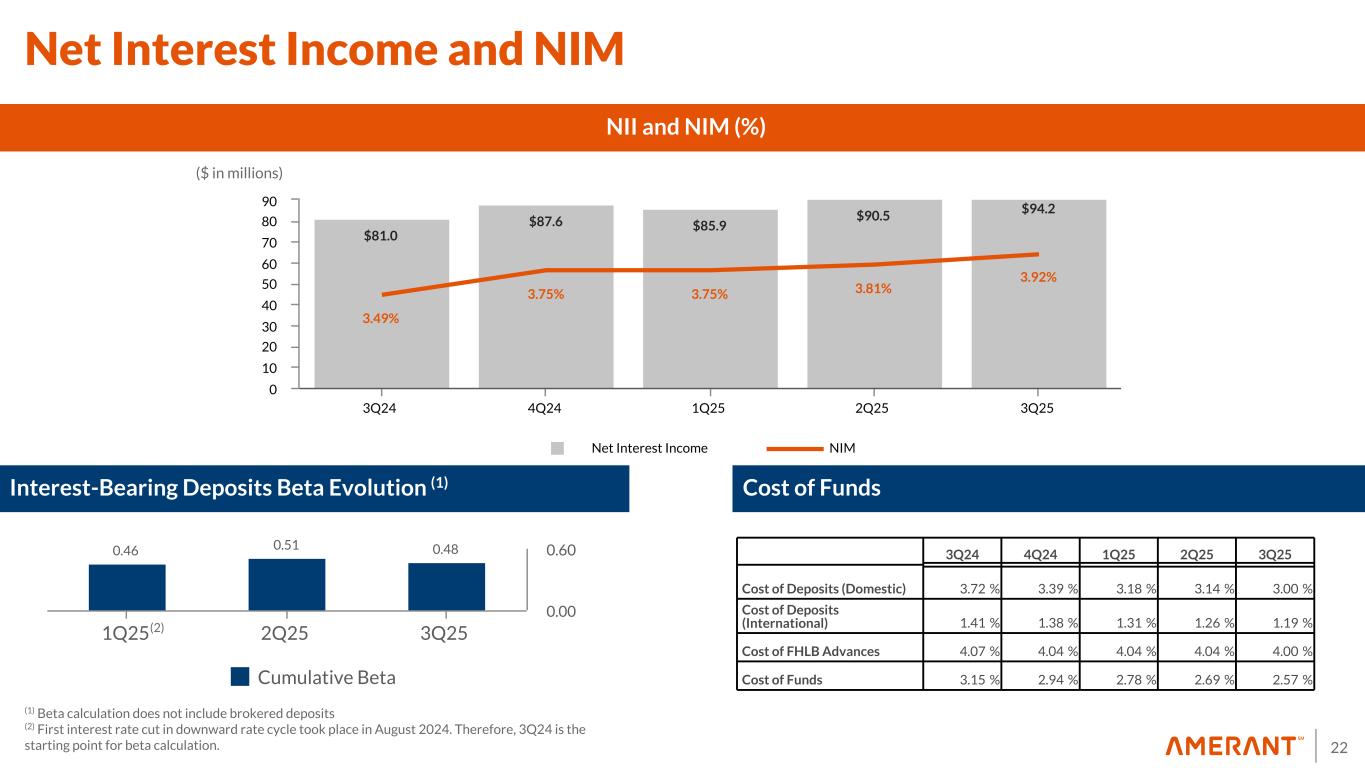

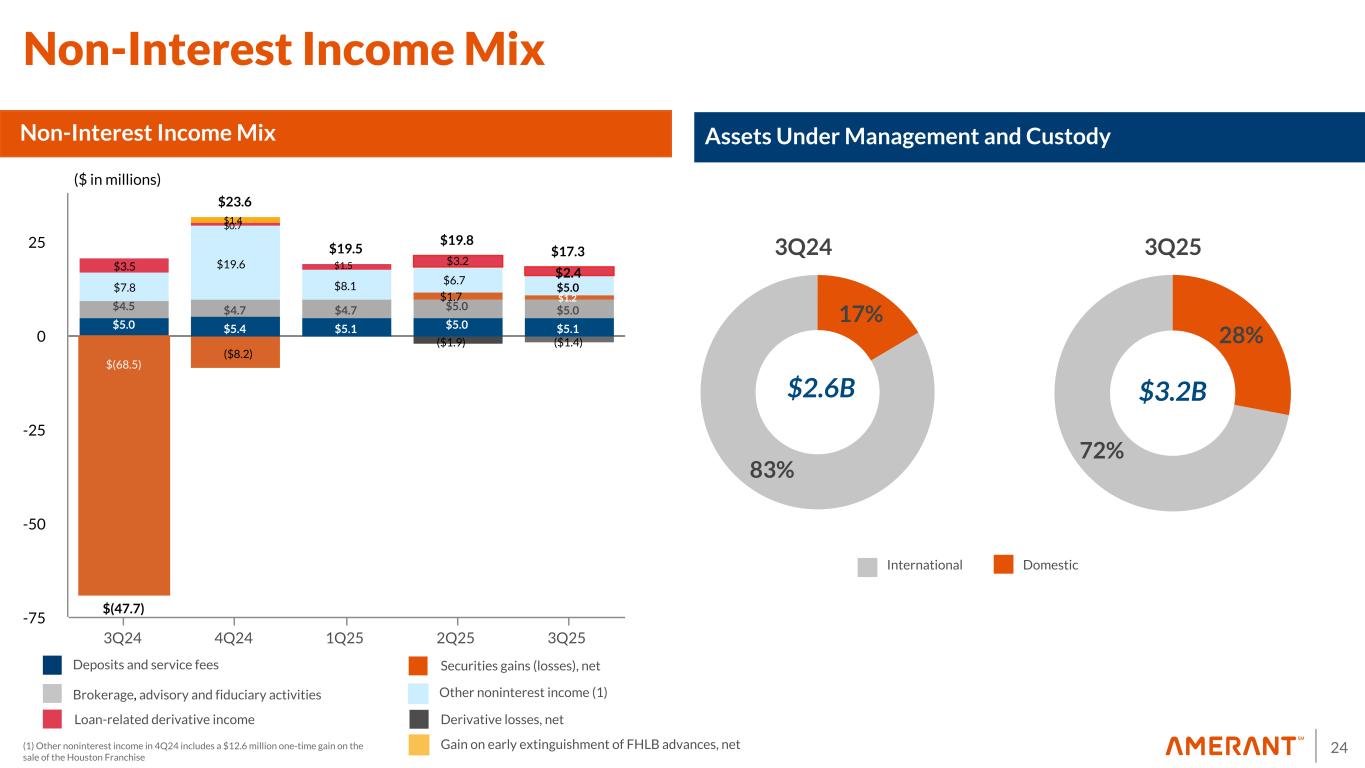

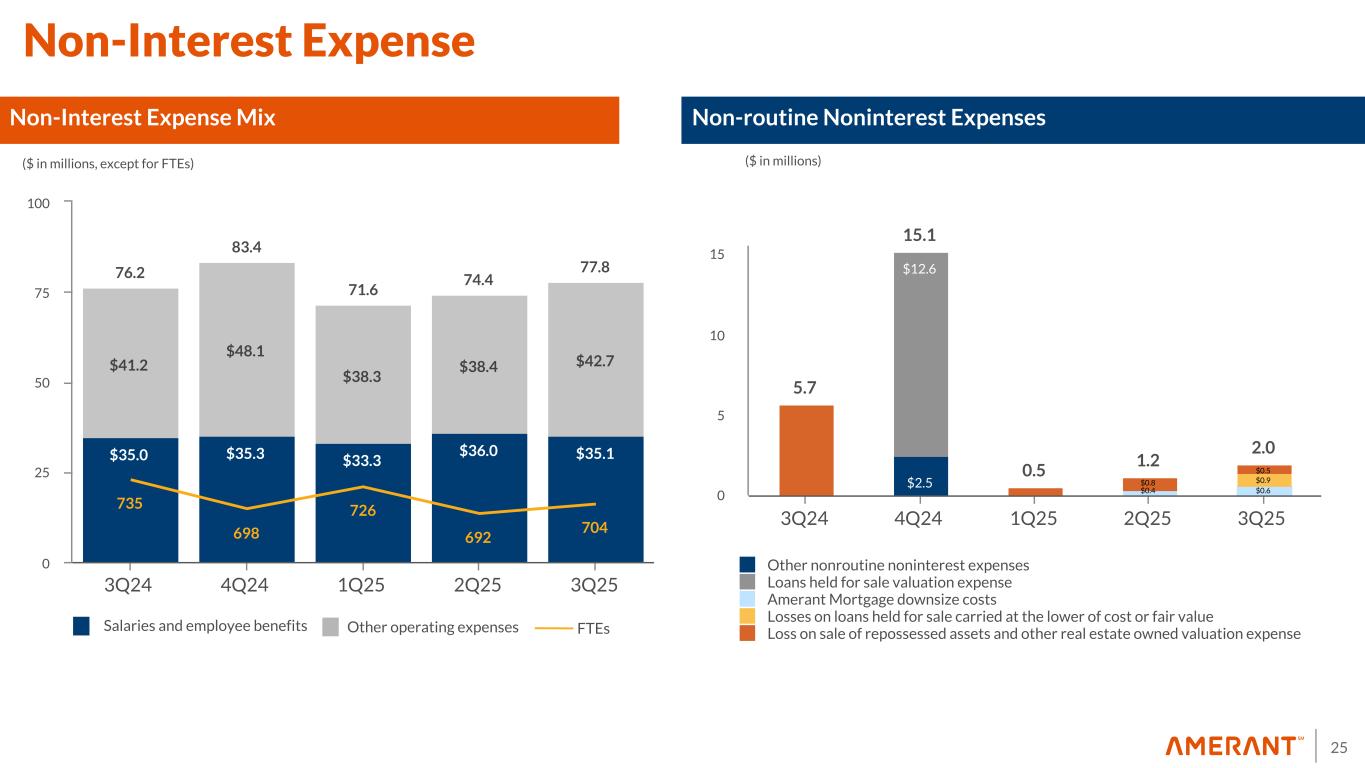

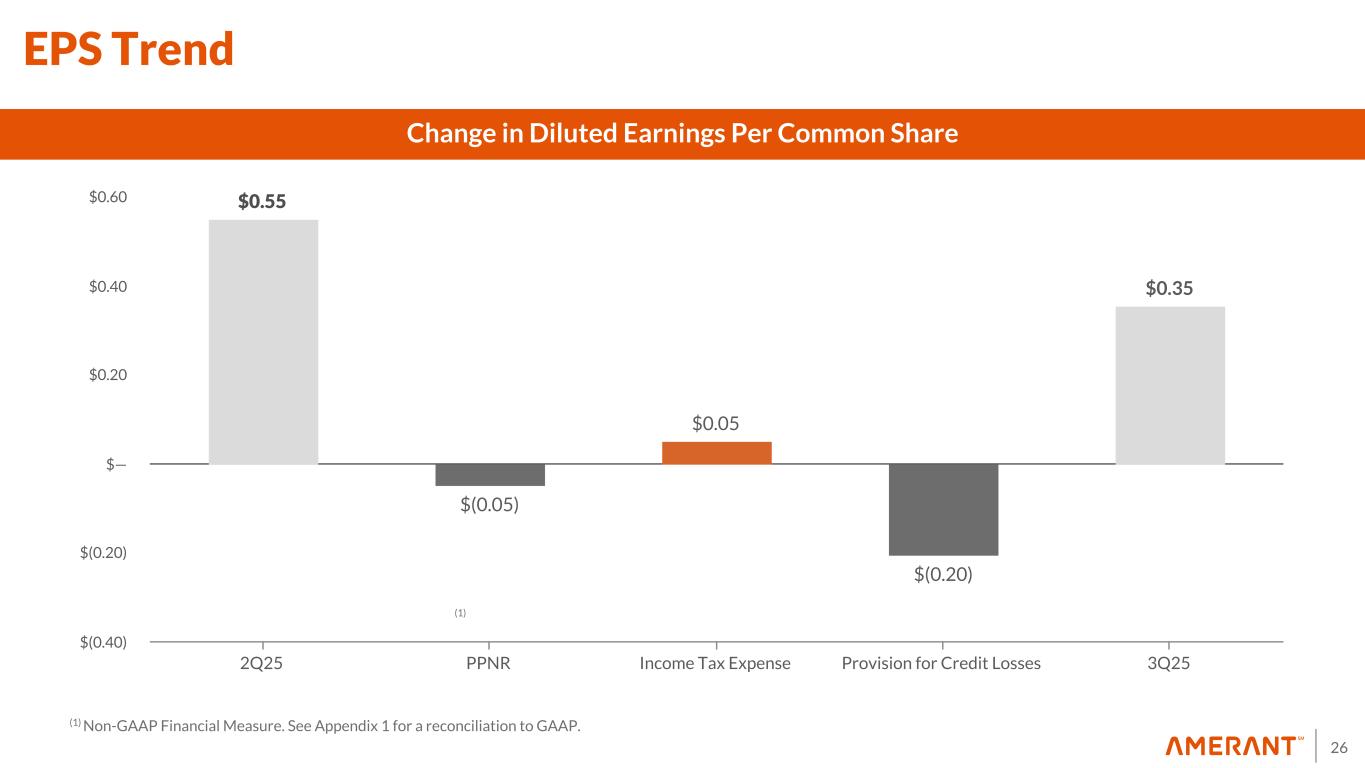

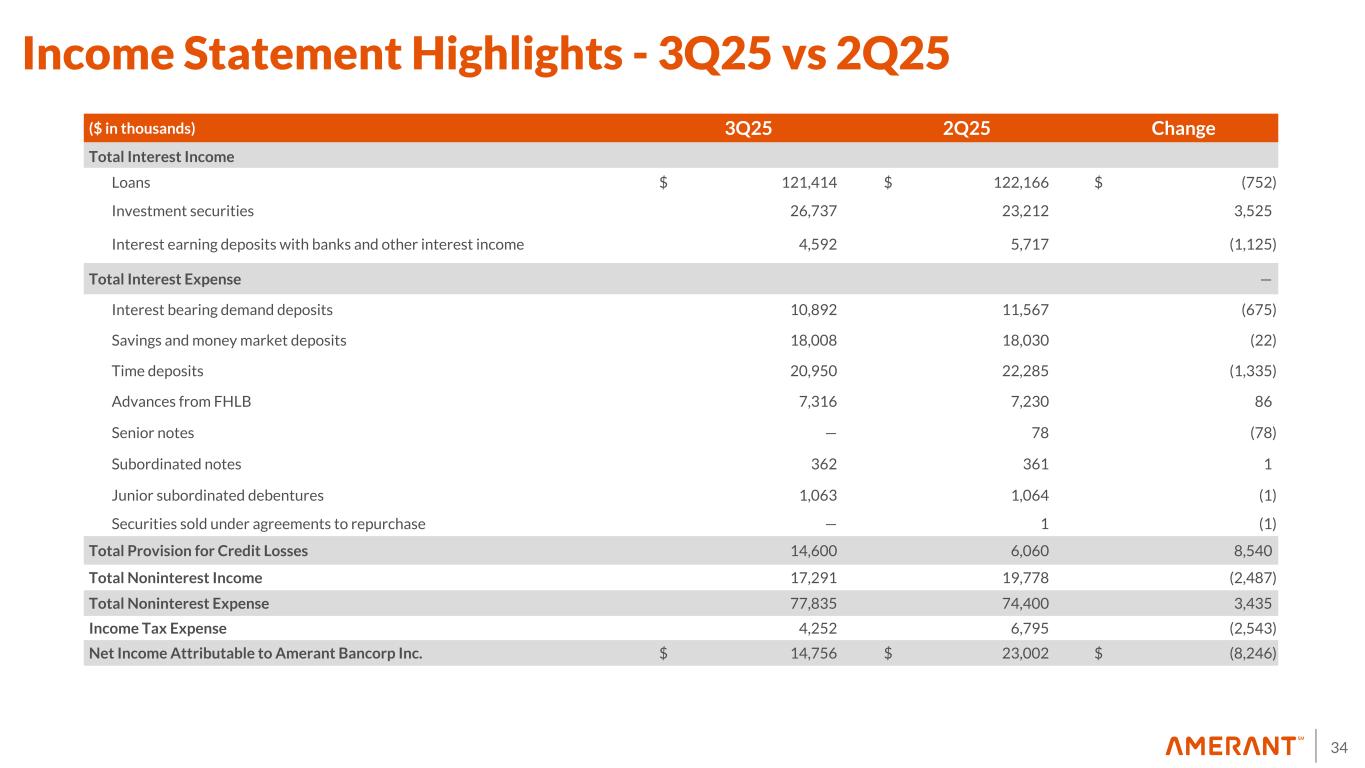

4 3Q25 vs. 2Q25 Highlights Income Statement • Net income attributable to the Company was $14.8 million, compared to $23.0 million • Diluted earnings per share was $0.35, compared to $0.55 • Net Interest Margin ("NIM") was 3.92%, compared to 3.81% • Net Interest Income (“NII”) was $94.2 million, compared to $90.5 million • Non-interest Income was $17.3 million, compared to $19.8 million • Provision for credit losses was $14.6 million, compared to $6.1 million • Non-interest Expense was $77.8 million, compared to $74.4 million • Core non-interest expense (1) was $75.9 million, compared to $73.2 million • Pre-provision net revenue (“PPNR”) (1) was $33.6 million, compared to $35.9 million • Core PPNR (1) was $35.8 million , compared to $37.1 million (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP.

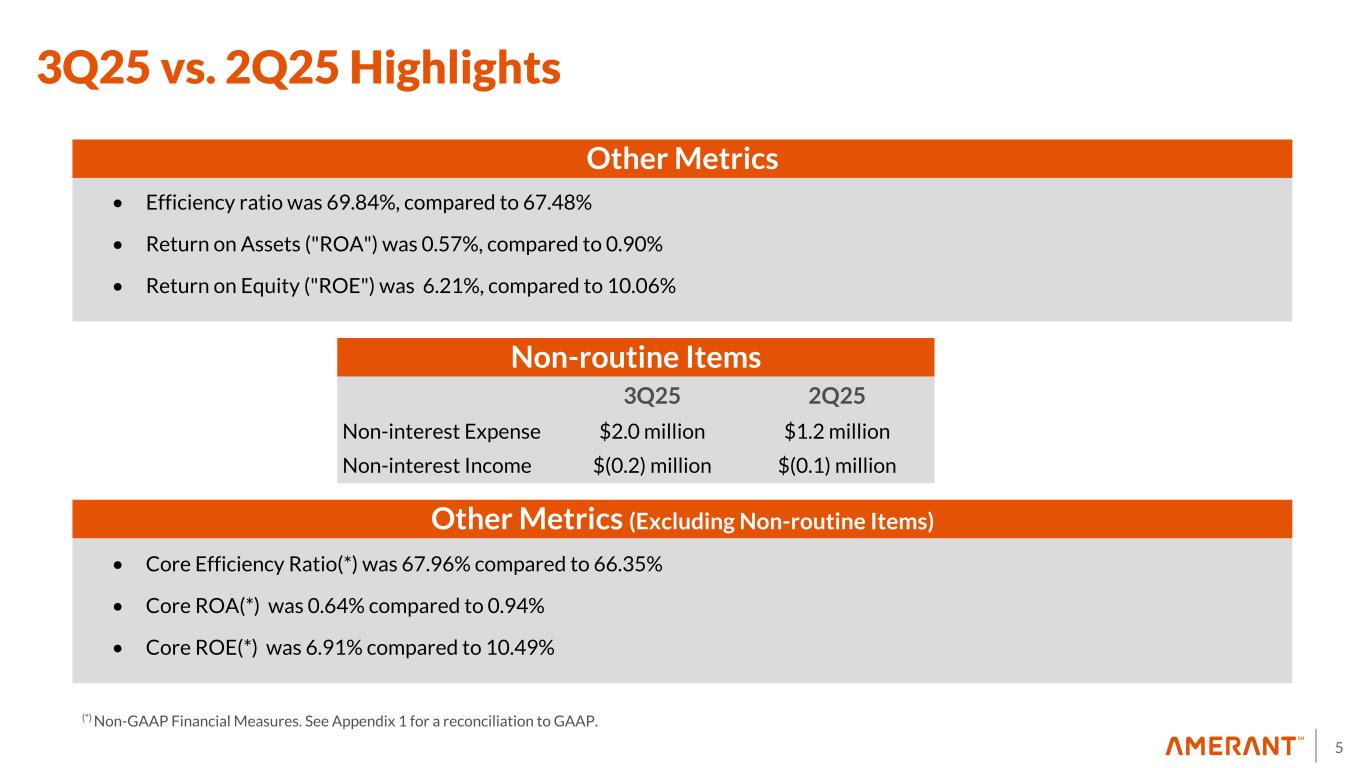

5 3Q25 vs. 2Q25 Highlights Other Metrics • Efficiency ratio was 69.84%, compared to 67.48% • Return on Assets ("ROA") was 0.57%, compared to 0.90% • Return on Equity ("ROE") was 6.21%, compared to 10.06% (*) Non-GAAP Financial Measures. See Appendix 1 for a reconciliation to GAAP. Non-routine Items 3Q25 2Q25 Non-interest Expense $2.0 million $1.2 million Non-interest Income $(0.2) million $(0.1) million Other Metrics (Excluding Non-routine Items) • Core Efficiency Ratio(*) was 67.96% compared to 66.35% • Core ROA(*) was 0.64% compared to 0.94% • Core ROE(*) was 6.91% compared to 10.49%

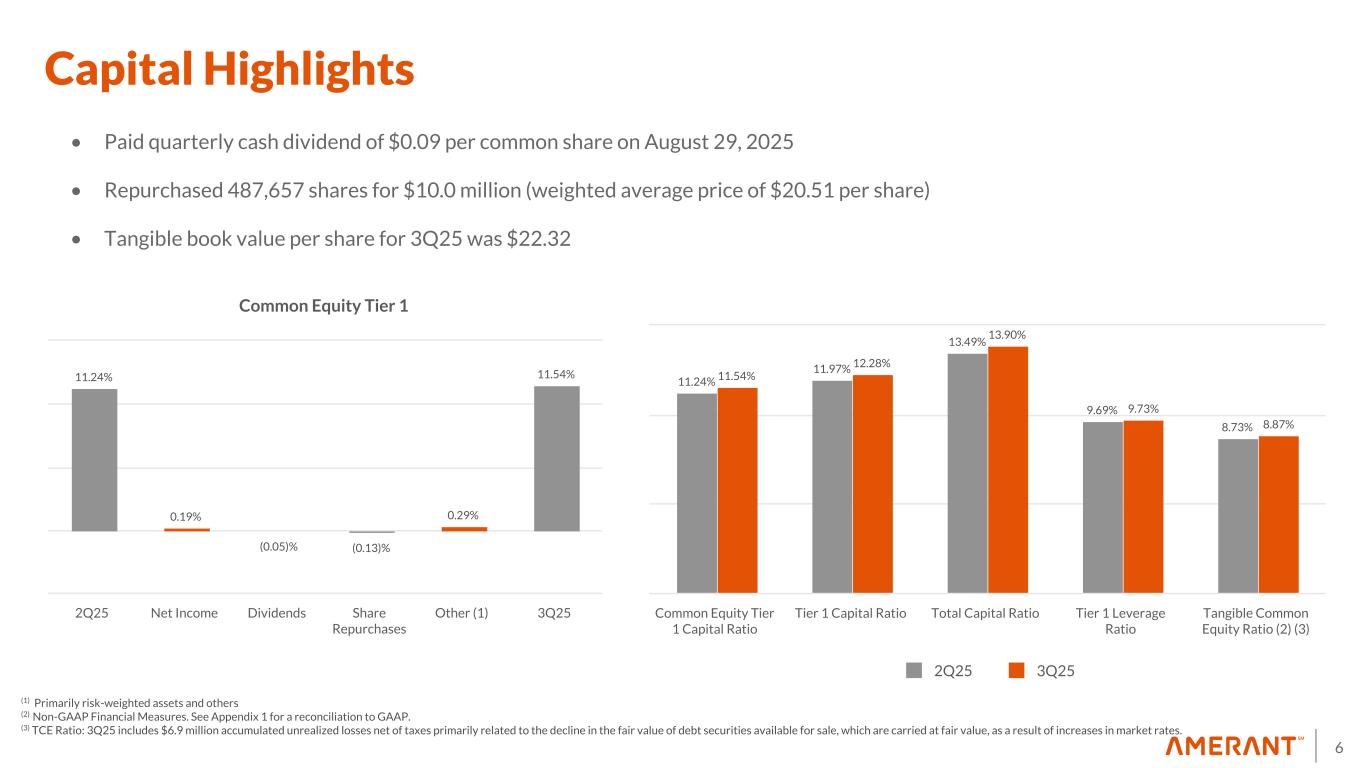

6 Capital Highlights • Paid quarterly cash dividend of $0.09 per common share on August 29, 2025 • Repurchased 487,657 shares for $10.0 million (weighted average price of $20.51 per share) • Tangible book value per share for 3Q25 was $22.32 11.24% 11.97% 13.49% 9.69% 8.73% 11.54% 12.28% 13.90% 9.73% 8.87% 2Q25 3Q25 Common Equity Tier 1 Capital Ratio Tier 1 Capital Ratio Total Capital Ratio Tier 1 Leverage Ratio Tangible Common Equity Ratio (2) (3) (1) Primarily risk-weighted assets and others (2) Non-GAAP Financial Measures. See Appendix 1 for a reconciliation to GAAP. (3) TCE Ratio: 3Q25 includes $6.9 million accumulated unrealized losses net of taxes primarily related to the decline in the fair value of debt securities available for sale, which are carried at fair value, as a result of increases in market rates. Common Equity Tier 1 11.24% 0.19% (0.05)% (0.13)% 0.29% 11.54% 2Q25 Net Income Dividends Share Repurchases Other (1) 3Q25

Asset Quality

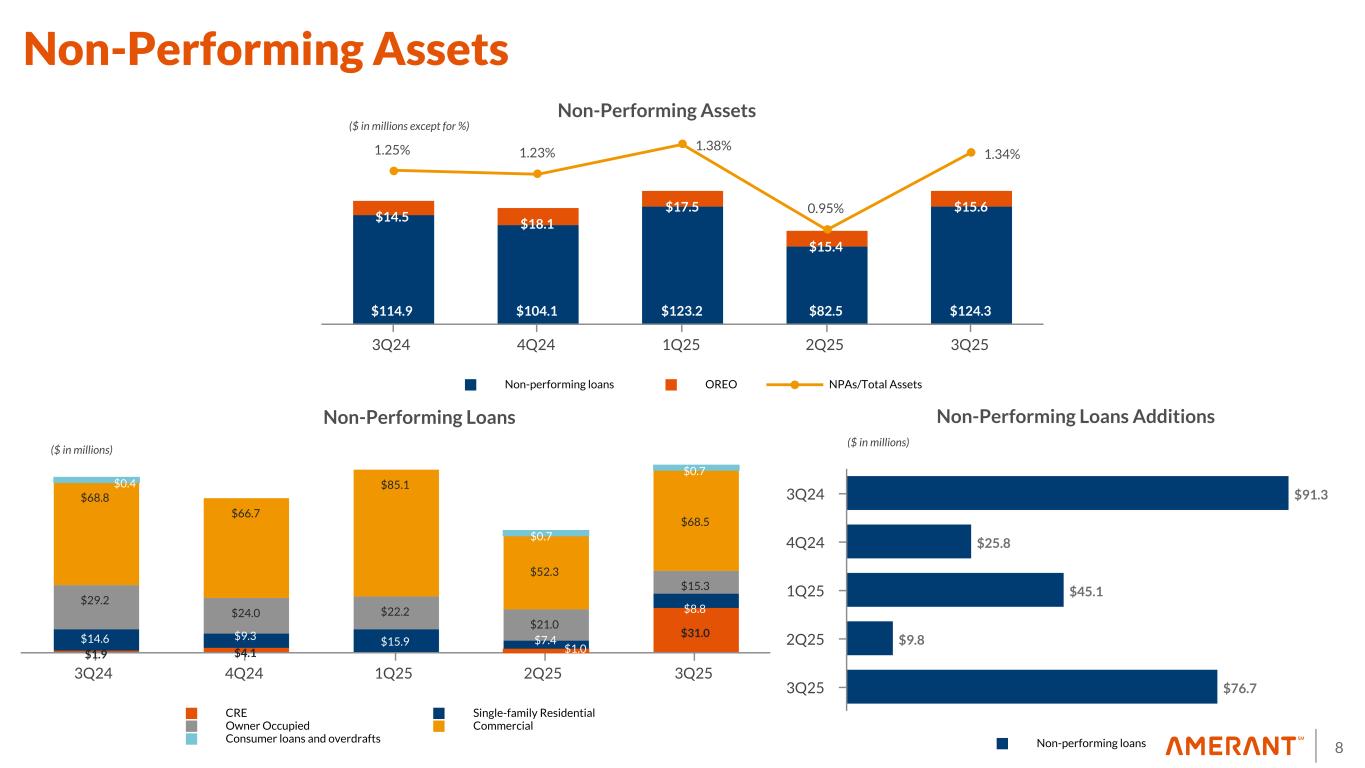

8 Non-Performing Assets $114.9 $104.1 $123.2 $82.5 $124.3 $14.5 $18.1 $17.5 $15.4 $15.6 1.25% 1.23% 1.38% 0.95% 1.34% Non-performing loans OREO NPAs/Total Assets 3Q24 4Q24 1Q25 2Q25 3Q25 Non-Performing Assets Non-Performing Loans Additions ($ in millions except for %) Non-Performing Loans $91.3 $25.8 $45.1 $9.8 $76.7 Non-performing loans 3Q24 4Q24 1Q25 2Q25 3Q25 $1.9 $4.1 $31.0$14.6 $9.3 $15.9 $7.4 $8.8 $29.2 $24.0 $22.2 $21.0 $15.3 $68.8 $66.7 $85.1 $52.3 $68.5 CRE Single-family Residential Owner Occupied Commercial Consumer loans and overdrafts 3Q24 4Q24 1Q25 2Q25 3Q25 ($ in millions) ($ in millions) $1.0 $0.7 $0.7 $0.4

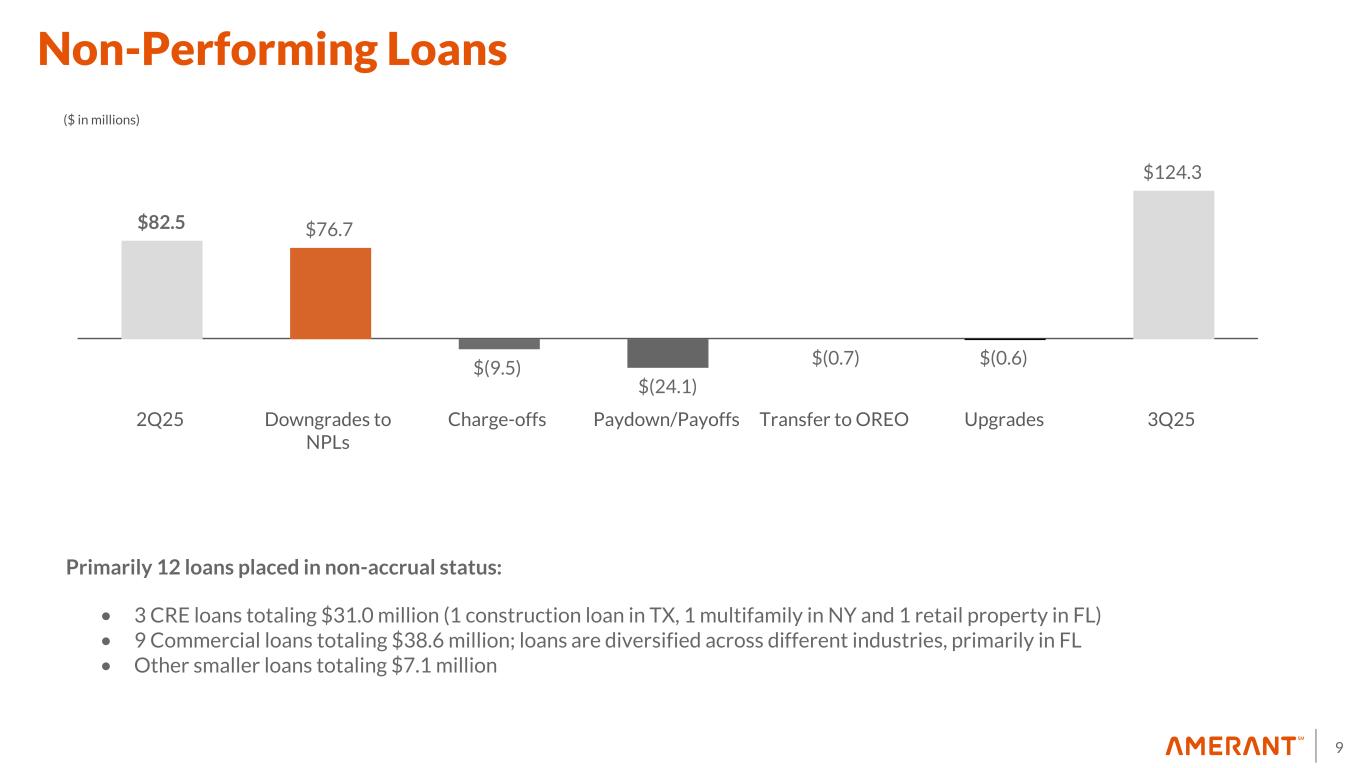

9 Non-Performing Loans Primarily 12 loans placed in non-accrual status: • 3 CRE loans totaling $31.0 million (1 construction loan in TX, 1 multifamily in NY and 1 retail property in FL) • 9 Commercial loans totaling $38.6 million; loans are diversified across different industries, primarily in FL • Other smaller loans totaling $7.1 million ($ in millions) $82.5 $76.7 $(9.5) $(24.1) $(0.7) $(0.6) $124.3 2Q25 Downgrades to NPLs Charge-offs Paydown/Payoffs Transfer to OREO Upgrades 3Q25

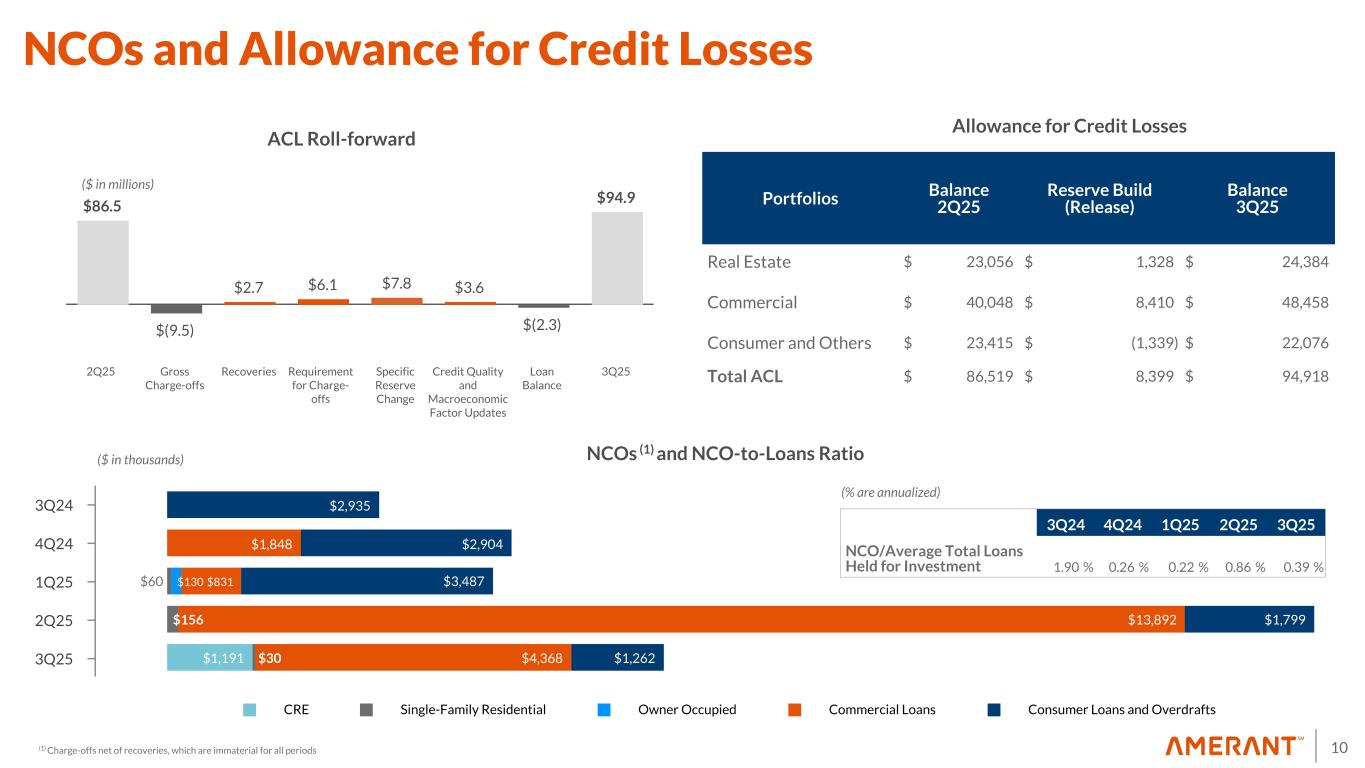

10 NCOs and Allowance for Credit Losses $86.5 $(9.5) $2.7 $6.1 $7.8 $3.6 $(2.3) $94.9 2Q25 Gross Charge-offs Recoveries Requirement for Charge- offs Specific Reserve Change Credit Quality and Macroeconomic Factor Updates Loan Balance 3Q25 Portfolios Balance 2Q25 Reserve Build (Release) Balance 3Q25 Real Estate $ 23,056 $ 1,328 $ 24,384 Commercial $ 40,048 $ 8,410 $ 48,458 Consumer and Others $ 23,415 $ (1,339) $ 22,076 Total ACL $ 86,519 $ 8,399 $ 94,918 ACL Roll-forward Allowance for Credit Losses $1,191 $60 $156 $30 $130 $1,848 $831 $13,892 $4,368 $2,935 $2,904 $3,487 $1,799 $1,262 CRE Single-Family Residential Owner Occupied Commercial Loans Consumer Loans and Overdrafts 3Q24 4Q24 1Q25 2Q25 3Q25 NCOs (1) and NCO-to-Loans Ratio ($ in millions) 3Q24 4Q24 1Q25 2Q25 3Q25 NCO/Average Total Loans Held for Investment 1.90 % 0.26 % 0.22 % 0.86 % 0.39 % (1) Charge-offs net of recoveries, which are immaterial for all periods ($ in thousands) (% are annualized)

11 4Q25 Outlook • Projected loan growth of approximately 2.5% from 3Q25, or $175 million, including a portion via syndicated loans • Projected organic deposit growth consistent with loan growth • Net interest margin projected to be approximately 3.75% • Projected non-interest income between $17.5 and $18.0 million • Core expenses projected to decrease to $74 - $75 million • Core ROA projected between mid 0.80% and low 0.90% by the end of 2025 (*) Non-GAAP Financial Measures. See Appendix 1 for a reconciliation to GAAP.

12 Other Updates before Q&A • Expense reduction initiatives • Commercial Banking leadership • Heightened emphasis on reducing non-performing assets, including additional resources dedicated to expedite resolution • Buyback update

Supplemental Information

14 84.6% 15.4% $1,476.4 $1,788.7 $2,122.4 $2.6 $2.5 4.19% 4.88% 4.89% AFS Trading Marketable Equity Securities Yield 3Q24 2Q25 3Q25 0 500 1,000 1,500 2,000 81.0% 19.0% Balances and Yields (1) Fixed vs. Floating (2) September 2025 Floating rate Fixed rate Available for Sale Securities by Type September 30, 2025 4.4 yrs Effective Duration ($ in millions) (1) Excludes Federal Reserve Bank and FHLB stock (2) Hybrid investments are classified based on current rate (fixed or floating) (3) Based on estimated prepayment speeds 4.4 yrs Effective Duration $70.3 $88.1 $115.4 $143.2 4Q25 1Q26 2Q26 3Q26 $0.0 $100.0 $200.0 ($ in millions) Expected Prepayments & Maturities Expected Prepayments & Maturities (3) Maturing Yield % Investment Portfolio 4.98% 5.17% 5.22% 5.23% June 2025 As of September 30, 2025, 99.5% of the Available for Sale portfolio consists of MBS issued or guaranteed by Government agencies and Government sponsored enterprises. $120.2 $119.9 $2.5

15 34.7% 34.7% 35.3% 37.3% 36.9% 23.9% 26.4% 25.9% 24.0% 24.3% 16.2% 13.9% 13.7% 13.7% 13.0% 21.4% 21.3% 21.6% 21.5% 22.3% 3.8% 3.8% 3.4% 3.5% 3.5% 7.08% 7.00% 6.84% 6.88% 6.93% 3Q24 4Q24 1Q25 2Q25 3Q25 80.3% 91.5% 91.5% 91.5% 91.5% 10.5% 2.9% 3.0% 3.0% 3.0% 2.7% 4.7% 4.0% 3.8% 3.8% 4.0% 1.5% 1.6% 1.6% 1.7% 1.8% 3Q24 4Q24 1Q25 2Q25 3Q25 Consumer CRE Commercial and FI & Acceptances Owner Occupied Single Family Residential Loan Composition (1) Geographic Mix (Domestic) Geographic ix (1) South Florida Texas New York Average Loan Yield Other (2) (1) Includes loans held for investment carried at amortized cost for all periods and loans held for sale carried at fair value for all periods except 3Q25. 3Q24 also includes loans held for sale carried at the lower of cost or fair value in connection with the Houston Transaction. This geographic categorization is based on internal criteria (2) Consists of international loans; residential loans with U.S. collateral Tampa Loan Portfolio Highlights

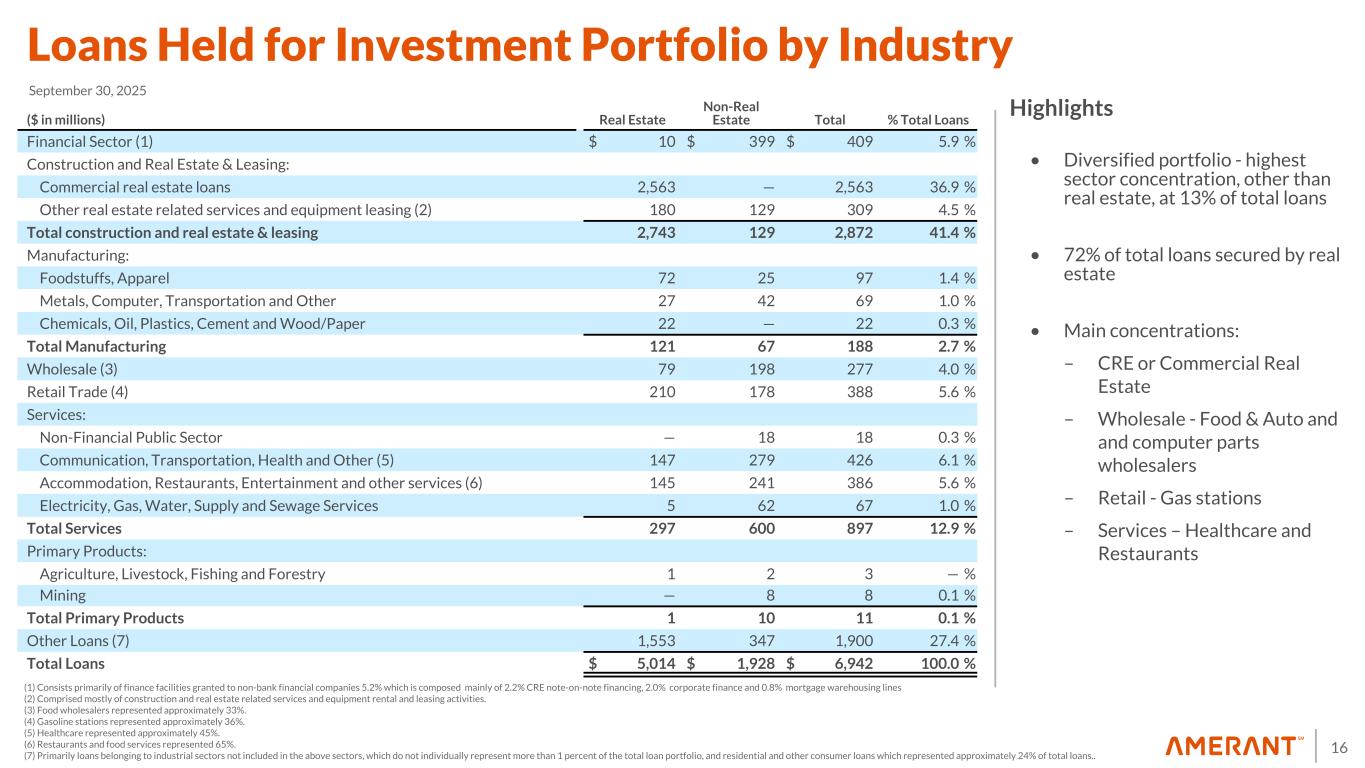

16 Loans Held for Investment Portfolio by Industry • Diversified portfolio - highest sector concentration, other than real estate, at 13% of total loans • 72% of total loans secured by real estate • Main concentrations: – CRE or Commercial Real Estate – Wholesale - Food & Auto and and computer parts wholesalers – Retail - Gas stations – Services – Healthcare and Restaurants Highlights (1) Consists primarily of finance facilities granted to non-bank financial companies 5.2% which is composed mainly of 2.2% CRE note-on-note financing, 2.0% corporate finance and 0.8% mortgage warehousing lines (2) Comprised mostly of construction and real estate related services and equipment rental and leasing activities. (3) Food wholesalers represented approximately 33%. (4) Gasoline stations represented approximately 36%. (5) Healthcare represented approximately 45%. (6) Restaurants and food services represented 65%. (7) Primarily loans belonging to industrial sectors not included in the above sectors, which do not individually represent more than 1 percent of the total loan portfolio, and residential and other consumer loans which represented approximately 24% of total loans.. ($ in millions) Real Estate Non-Real Estate Total % Total Loans Financial Sector (1) $ 10 $ 399 $ 409 5.9 % Construction and Real Estate & Leasing: Commercial real estate loans 2,563 — 2,563 36.9 % Other real estate related services and equipment leasing (2) 180 129 309 4.5 % Total construction and real estate & leasing 2,743 129 2,872 41.4 % Manufacturing: Foodstuffs, Apparel 72 25 97 1.4 % Metals, Computer, Transportation and Other 27 42 69 1.0 % Chemicals, Oil, Plastics, Cement and Wood/Paper 22 — 22 0.3 % Total Manufacturing 121 67 188 2.7 % Wholesale (3) 79 198 277 4.0 % Retail Trade (4) 210 178 388 5.6 % Services: Non-Financial Public Sector — 18 18 0.3 % Communication, Transportation, Health and Other (5) 147 279 426 6.1 % Accommodation, Restaurants, Entertainment and other services (6) 145 241 386 5.6 % Electricity, Gas, Water, Supply and Sewage Services 5 62 67 1.0 % Total Services 297 600 897 12.9 % Primary Products: Agriculture, Livestock, Fishing and Forestry 1 2 3 — % Mining — 8 8 0.1 % Total Primary Products 1 10 11 0.1 % Other Loans (7) 1,553 347 1,900 27.4 % Total Loans $ 5,014 $ 1,928 $ 6,942 100.0 % September 30, 2025

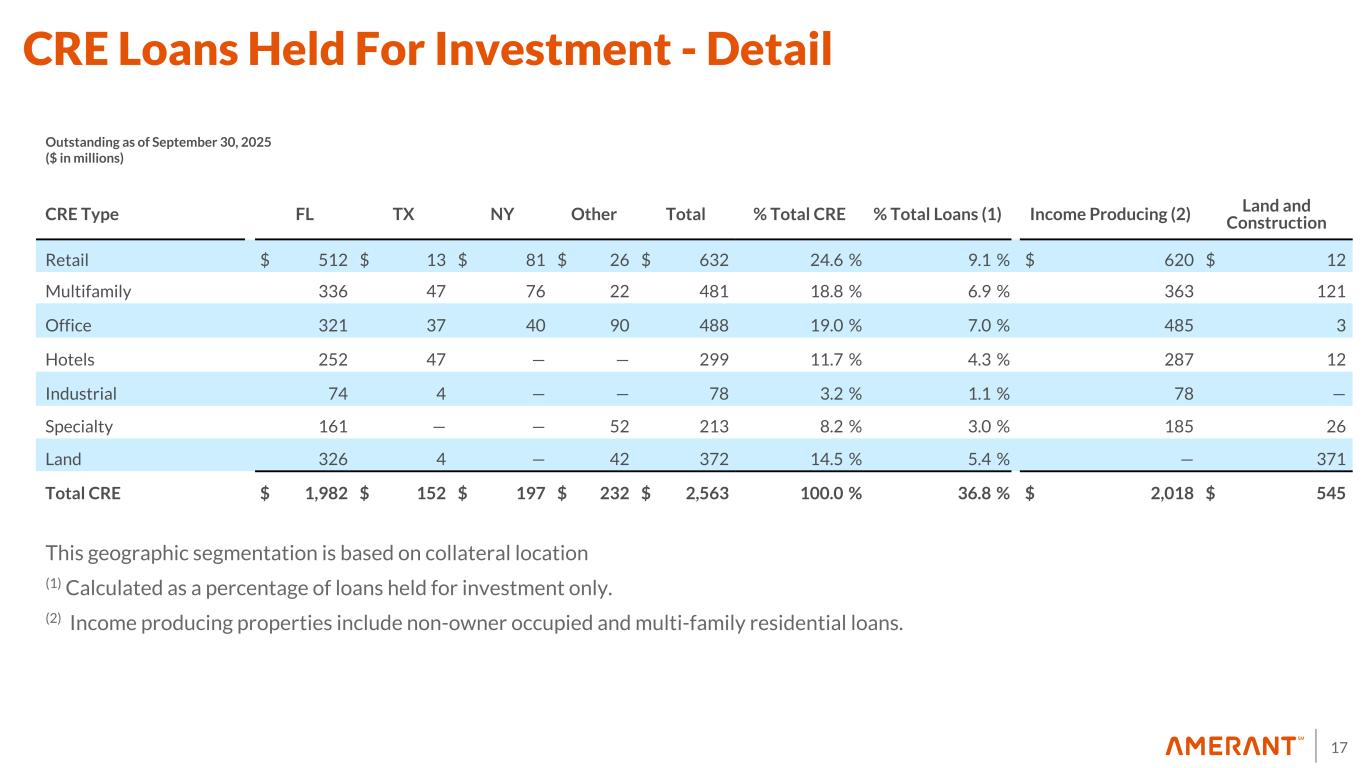

17 CRE Type FL TX NY Other Total % Total CRE % Total Loans (1) Income Producing (2) Land and Construction Retail $ 512 $ 13 $ 81 $ 26 $ 632 24.6 % 9.1 % $ 620 $ 12 Multifamily 336 47 76 22 481 18.8 % 6.9 % 363 121 Office 321 37 40 90 488 19.0 % 7.0 % 485 3 Hotels 252 47 — — 299 11.7 % 4.3 % 287 12 Industrial 74 4 — — 78 3.2 % 1.1 % 78 — Specialty 161 — — 52 213 8.2 % 3.0 % 185 26 Land 326 4 — 42 372 14.5 % 5.4 % — 371 Total CRE $ 1,982 $ 152 $ 197 $ 232 $ 2,563 100.0 % 36.8 % $ 2,018 $ 545 Outstanding as of September 30, 2025 ($ in millions) This geographic segmentation is based on collateral location (1) Calculated as a percentage of loans held for investment only. (2) Income producing properties include non-owner occupied and multi-family residential loans. CRE Loans Held For Investment - Detail

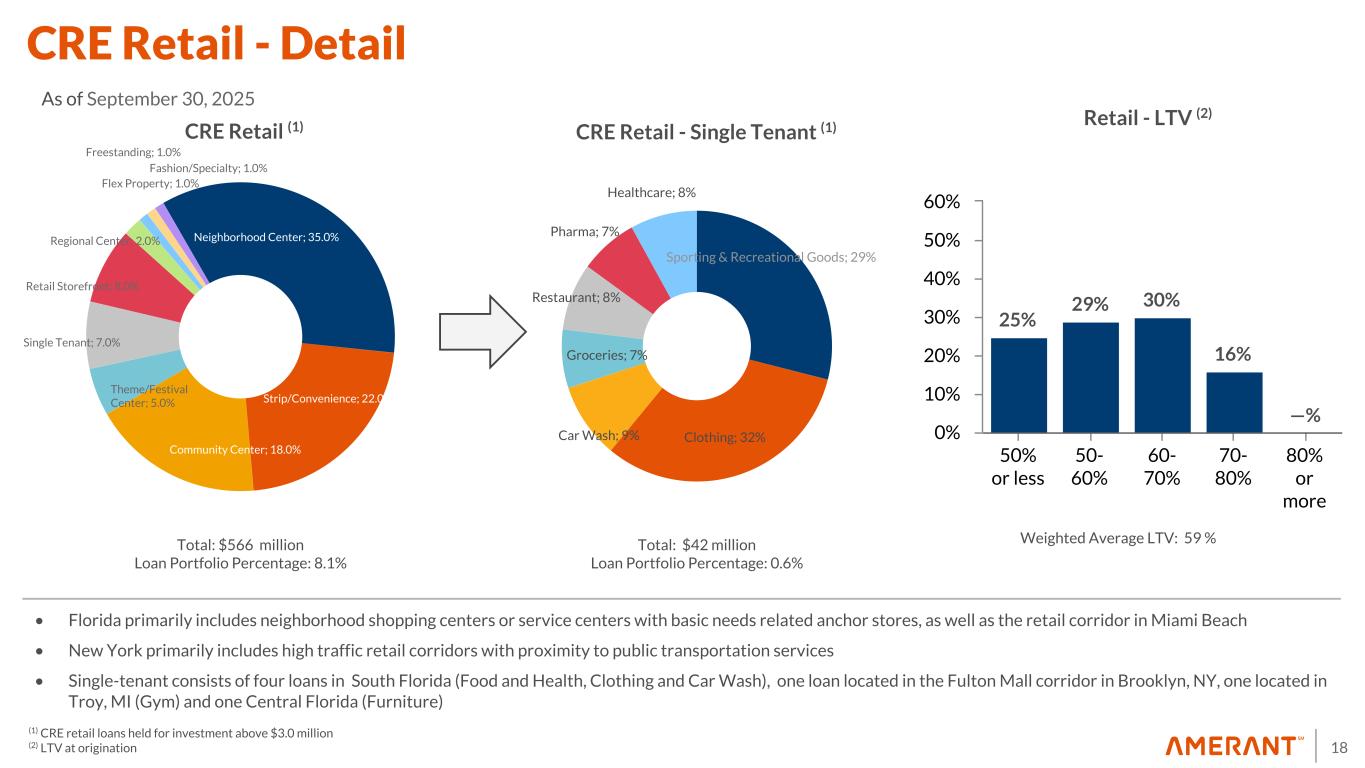

18 25% 29% 30% 16% —% 50% or less 50- 60% 60- 70% 70- 80% 80% or more 0% 10% 20% 30% 40% 50% 60% • Florida primarily includes neighborhood shopping centers or service centers with basic needs related anchor stores, as well as the retail corridor in Miami Beach • New York primarily includes high traffic retail corridors with proximity to public transportation services • Single-tenant consists of four loans in South Florida (Food and Health, Clothing and Car Wash), one loan located in the Fulton Mall corridor in Brooklyn, NY, one located in Troy, MI (Gym) and one Central Florida (Furniture) CRE Retail (1) Retail - LTV (2) Sporting & Recreational Goods; 29% Clothing; 32%Car Wash; 9% Groceries; 7% Restaurant; 8% Pharma; 7% Healthcare; 8% CRE Retail - Single Tenant (1) (1) CRE retail loans held for investment above $3.0 million (2) LTV at origination Total: $566 million Loan Portfolio Percentage: 8.1% Total: $42 million Loan Portfolio Percentage: 0.6% Neighborhood Center; 35.0% Strip/Convenience; 22.0% Community Center; 18.0% Theme/Festival Center; 5.0% Single Tenant; 7.0% Retail Storefront; 8.0% Regional Center; 2.0% Flex Property; 1.0% Fashion/Specialty; 1.0% Freestanding; 1.0% CRE Retail - Detail As of September 30, 2025 Weighted Average LTV: 59 %

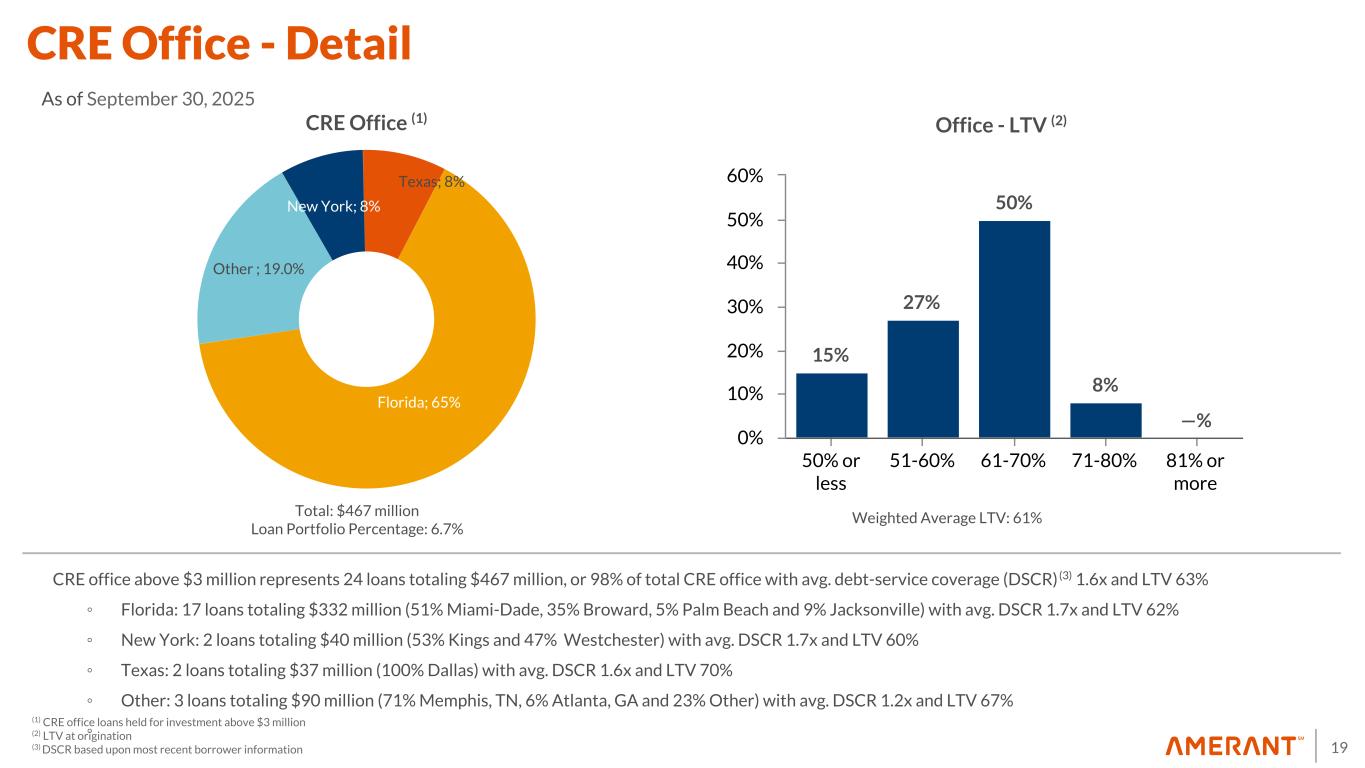

19 New York; 8% Texas; 8% Florida; 65% Other ; 19.0% 15% 27% 50% 8% —% 50% or less 51-60% 61-70% 71-80% 81% or more 0% 10% 20% 30% 40% 50% 60% CRE office above $3 million represents 24 loans totaling $467 million, or 98% of total CRE office with avg. debt-service coverage (DSCR) (3) 1.6x and LTV 63% ◦ Florida: 17 loans totaling $332 million (51% Miami-Dade, 35% Broward, 5% Palm Beach and 9% Jacksonville) with avg. DSCR 1.7x and LTV 62% ◦ New York: 2 loans totaling $40 million (53% Kings and 47% Westchester) with avg. DSCR 1.7x and LTV 60% ◦ Texas: 2 loans totaling $37 million (100% Dallas) with avg. DSCR 1.6x and LTV 70% ◦ Other: 3 loans totaling $90 million (71% Memphis, TN, 6% Atlanta, GA and 23% Other) with avg. DSCR 1.2x and LTV 67% ◦ CRE Office (1) Office - LTV (2) (1) CRE office loans held for investment above $3 million (2) LTV at origination (3) DSCR based upon most recent borrower information Total: $467 million Loan Portfolio Percentage: 6.7% CRE Office - Detail As of September 30, 2025 Weighted Average LTV: 61%

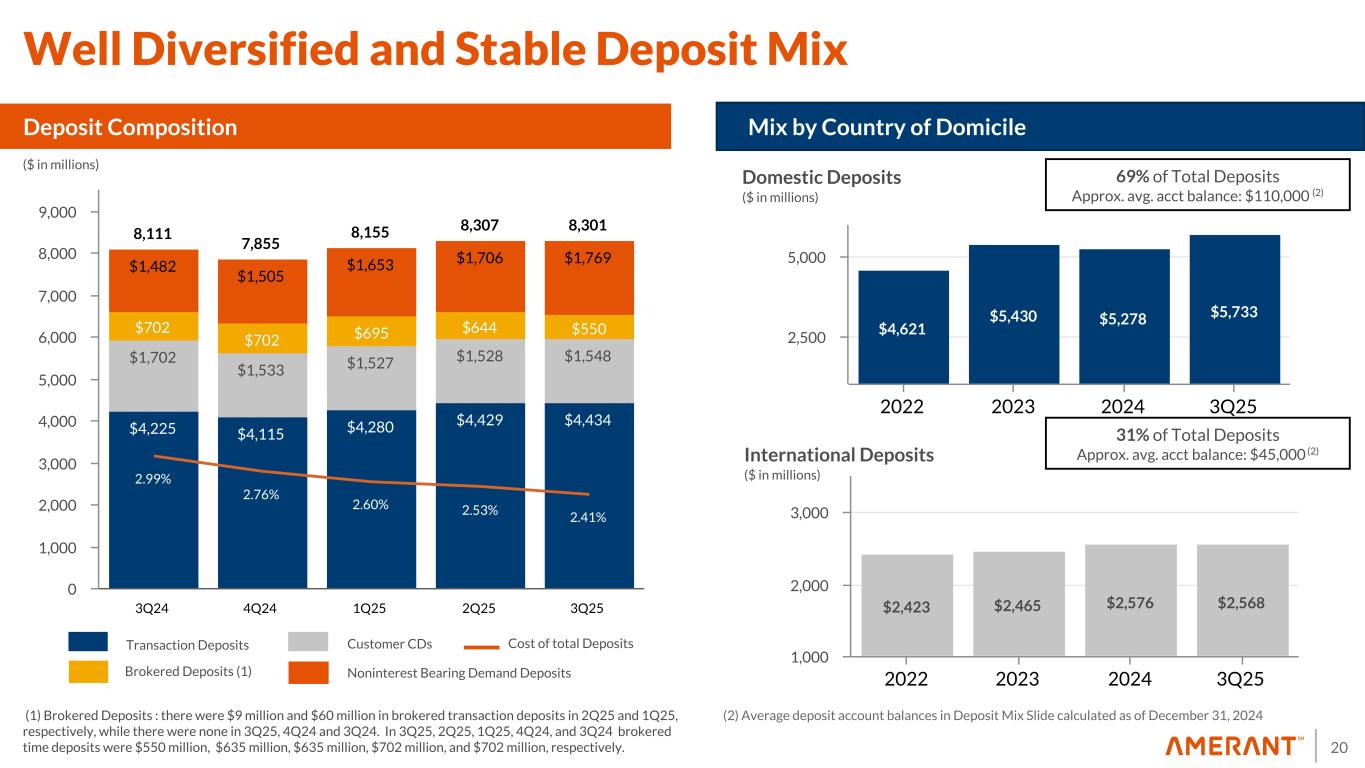

20 8,111 7,855 8,155 8,307 8,301 $4,225 $4,115 $4,280 $4,429 $4,434 $1,702 $1,533 $1,527 $1,528 $1,548 $702 $702 $695 $644 $550 $1,482 $1,505 $1,653 $1,706 $1,769 2.99% 2.76% 2.60% 2.53% 2.41% 3Q24 4Q24 1Q25 2Q25 3Q25 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 9,000 $2,423 $2,465 $2,576 $2,568 2022 2023 2024 3Q25 1,000 2,000 3,000 $4,621 $5,430 $5,278 $5,733 2022 2023 2024 3Q25 2,500 5,000 Domestic Deposits ($ in millions) Deposit Composition International Deposits ($ in millions) Mix by Country of Domicile Transaction Deposits Customer CDs Brokered Deposits (1) Cost of total Deposits ($ in millions) Noninterest Bearing Demand Deposits 31% of Total Deposits Approx. avg. acct balance: $45,000 (2) 69% of Total Deposits Approx. avg. acct balance: $110,000 (2) Well Diversified and Stable Deposit Mix (2) Average deposit account balances in Deposit Mix Slide calculated as of December 31, 2024 (1) Brokered Deposits : there were $9 million and $60 million in brokered transaction deposits in 2Q25 and 1Q25, respectively, while there were none in 3Q25, 4Q24 and 3Q24. In 3Q25, 2Q25, 1Q25, 4Q24, and 3Q24 brokered time deposits were $550 million, $635 million, $635 million, $702 million, and $702 million, respectively.

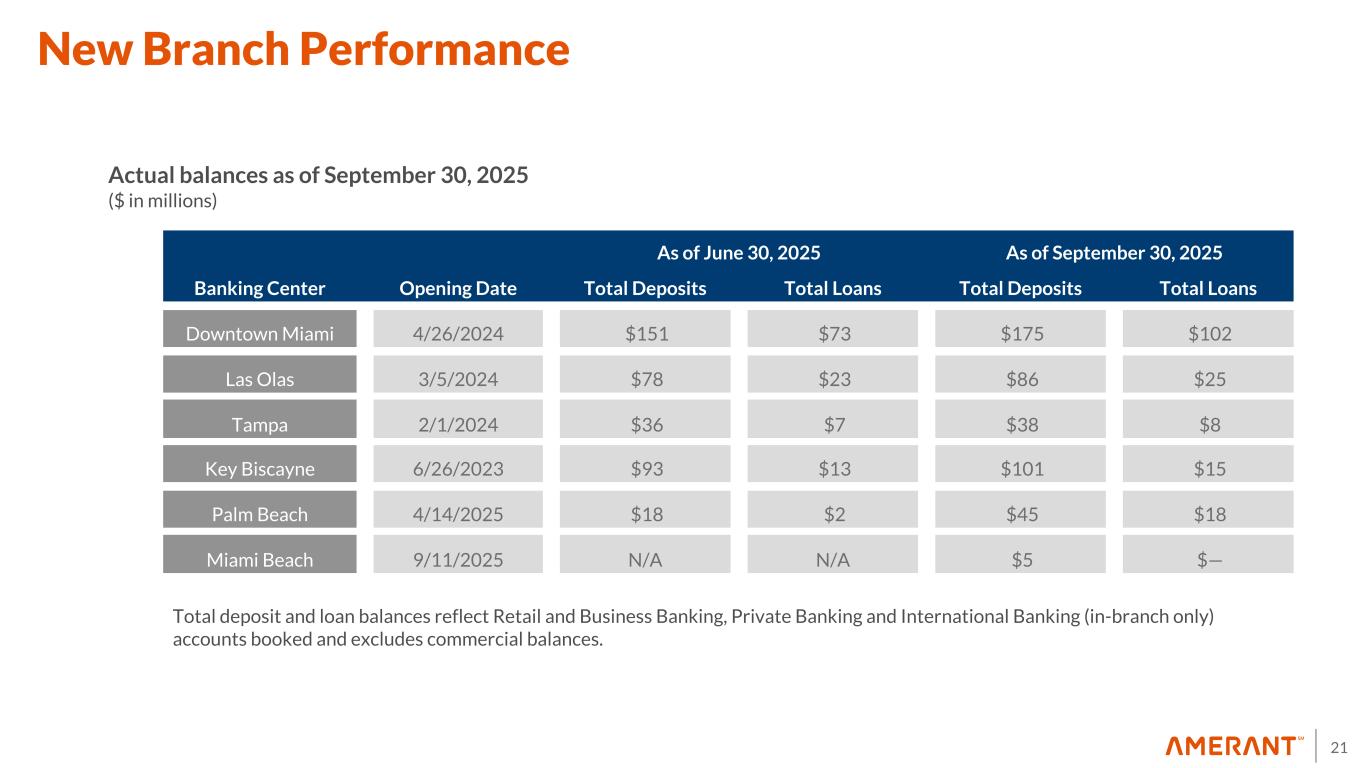

21 New Branch Performance Actual balances as of September 30, 2025 ($ in millions) Total deposit and loan balances reflect Retail and Business Banking, Private Banking and International Banking (in-branch only) accounts booked and excludes commercial balances. As of June 30, 2025 As of September 30, 2025 Banking Center Opening Date Total Deposits Total Loans Total Deposits Total Loans Downtown Miami 4/26/2024 $151 $73 $175 $102 Las Olas 3/5/2024 $78 $23 $86 $25 Tampa 2/1/2024 $36 $7 $38 $8 Key Biscayne 6/26/2023 $93 $13 $101 $15 Palm Beach 4/14/2025 $18 $2 $45 $18 Miami Beach 9/11/2025 N/A N/A $5 $—

22 $81.0 $87.6 $85.9 $90.5 $94.2 3.49% 3.75% 3.75% 3.81% 3.92% Net Interest Income NIM 3Q24 4Q24 1Q25 2Q25 3Q25 0 10 20 30 40 50 60 70 80 90 NII and NIM (%) 22 ($ in millions) 3Q24 4Q24 1Q25 2Q25 3Q25 Cost of Deposits (Domestic) 3.72 % 3.39 % 3.18 % 3.14 % 3.00 % Cost of Deposits (International) 1.41 % 1.38 % 1.31 % 1.26 % 1.19 % Cost of FHLB Advances 4.07 % 4.04 % 4.04 % 4.04 % 4.00 % Cost of Funds 3.15 % 2.94 % 2.78 % 2.69 % 2.57 % 0.46 0.51 0.48 Cumulative Beta 1Q25 2Q25 3Q25 0.00 0.60 Net Interest Income and NIM Interest-Bearing Deposits Beta Evolution (1) Cost of Funds (1) Beta calculation does not include brokered deposits (2) First interest rate cut in downward rate cycle took place in August 2024. Therefore, 3Q24 is the starting point for beta calculation. (2)

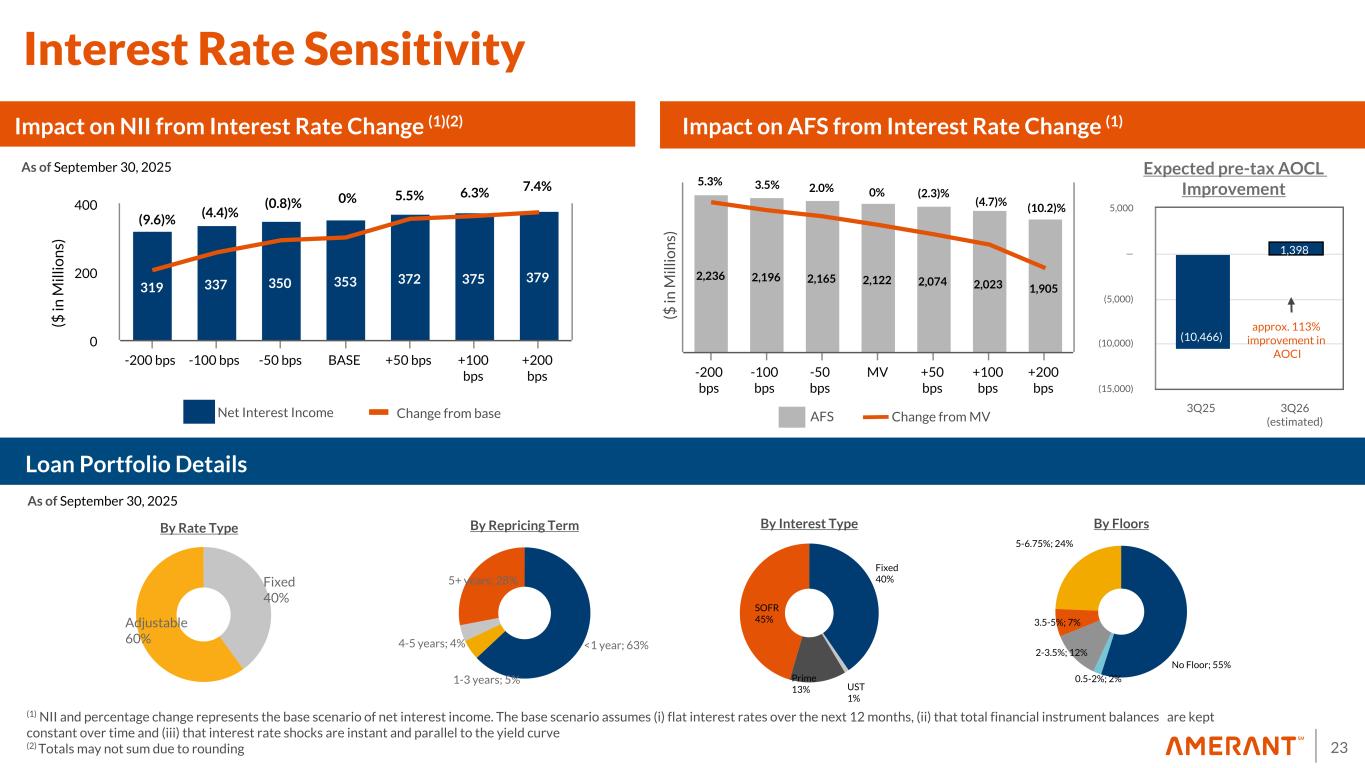

23 <1 year; 63% 1-3 years; 5% 4-5 years; 4% 5+ years; 28% 319 337 350 353 372 375 379 -200 bps -100 bps -50 bps BASE +50 bps +100 bps +200 bps 0 200 400 As of September 30, 2025 Fixed 40% Adjustable 60% 23 By Interest TypeBy Rate Type By Repricing Term (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve (2) Totals may not sum due to rounding Loan Portfolio Details Impact on NII from Interest Rate Change (1)(2) AFSChange from base ($ in M ill io n s) Fixed 40% UST 1% Prime 13% SOFR 45% As of September 30, 2025 Impact on AFS from Interest Rate Change (1) (9.6)% (4.4)% 0% 6.3%5.5% (0.8)% 7.4% No Floor; 55% 0.5-2%; 2% 2-3.5%; 12% 3.5-5%; 7% 5-6.75%; 24% By Floors 2,236 2,196 2,165 2,122 2,074 2,023 1,905 -200 bps -100 bps -50 bps MV +50 bps +100 bps +200 bps ($ in M ill io n s) 5.3% 3.5% 2.0% 0% (2.3)% (4.7)% (10.2)% Expected pre-tax AOCL Improvement Change from MVNet Interest Income (10,466) 1,398 3Q25 3Q26 (estimated) (15,000) (10,000) (5,000) — 5,000 approx. 113% improvement in AOCI Interest Rate Sensitivity

24 $23.6 $19.5 $19.8 $17.3 $(47.7) $5.0 $5.4 $5.1 $5.0 $5.1 $4.5 $4.7 $4.7 $5.0 $5.0 $1.2 $5.0 $2.4 3Q24 4Q24 1Q25 2Q25 3Q25 -75 -50 -25 0 25 17% 83% 28% 72% Non-Interest Income Mix Deposits and service fees Brokerage, advisory and fiduciary activities Other noninterest income (1) DomesticInternational 3Q24 $3.2B ($ in millions) Securities gains (losses), net Loan-related derivative income Derivative losses, net Gain on early extinguishment of FHLB advances, net Non-Interest Income Mix $2.6B Assets Under Management and Custody 3Q25 $(0.2) (1) Other noninterest income in 4Q24 includes a $12.6 million one-time gain on the sale of the Houston Franchise $(68.5) ($1.9) $1.7 $6.7 $3.2 $8.1 $1.5 $0.7 $19.6 $(68.5) $7.8 $3.5 ($1.4) ($8.2) $1.4

25 76.2 83.4 71.6 74.4 77.8 $35.0 $35.3 $33.3 $36.0 $35.1 $41.2 $48.1 $38.3 $38.4 $42.7 735 698 726 692 704 3Q24 4Q24 1Q25 2Q25 3Q25 0 25 50 75 100 Non-Interest Expense Mix ($ in millions, except for FTEs) Non-routine Noninterest Expenses 5.7 15.1 0.5 1.2 2.0 $2.5 $12.6 Other nonroutine noninterest expenses Loans held for sale valuation expense Amerant Mortgage downsize costs Losses on loans held for sale carried at the lower of cost or fair value Loss on sale of repossessed assets and other real estate owned valuation expense 3Q24 4Q24 1Q25 2Q25 3Q25 0 5 10 15 ($ in millions) Non-Interest Expense Salaries and employee benefits Other operating expenses FTEs $0.4 $0.8 $0.5 $0.9 $0.6

26 Change in Diluted Earnings Per Common Share $0.55 $(0.05) $0.05 $(0.20) $0.35 2Q25 PPNR Income Tax Expense Provision for Credit Losses 3Q25 $(0.40) $(0.20) $— $0.20 $0.40 $0.60 EPS Trend (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. (1)

27 New Branch Opening Schedule 4Q 2025: – Bay Harbor Islands – Key Biscayne Space Expansion 2Q 2026: – Central Ave St. Petersburg

Appendices

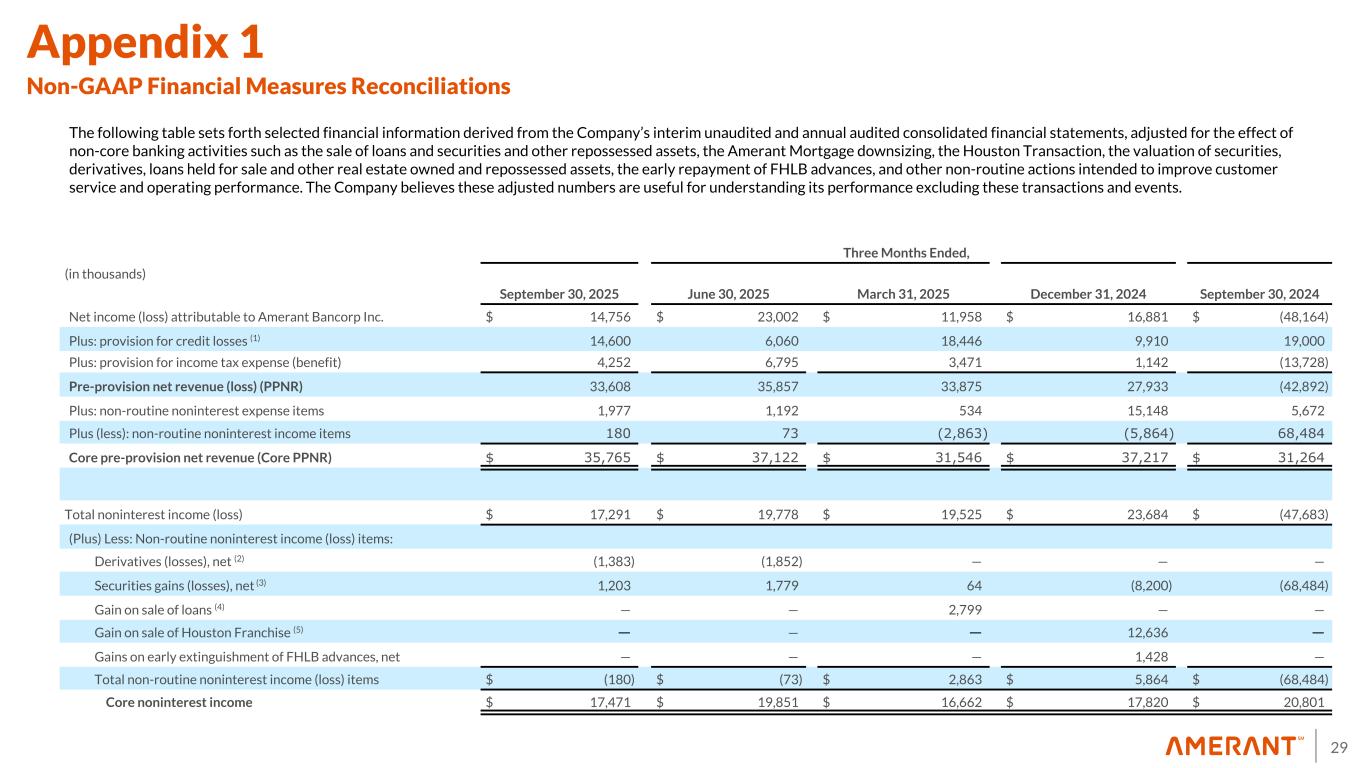

29 Appendix 1 Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for the effect of non-core banking activities such as the sale of loans and securities and other repossessed assets, the Amerant Mortgage downsizing, the Houston Transaction, the valuation of securities, derivatives, loans held for sale and other real estate owned and repossessed assets, the early repayment of FHLB advances, and other non-routine actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful for understanding its performance excluding these transactions and events. Three Months Ended, (in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net income (loss) attributable to Amerant Bancorp Inc. $ 14,756 $ 23,002 $ 11,958 $ 16,881 $ (48,164) Plus: provision for credit losses (1) 14,600 6,060 18,446 9,910 19,000 Plus: provision for income tax expense (benefit) 4,252 6,795 3,471 1,142 (13,728) Pre-provision net revenue (loss) (PPNR) 33,608 35,857 33,875 27,933 (42,892) Plus: non-routine noninterest expense items 1,977 1,192 534 15,148 5,672 Plus (less): non-routine noninterest income items 180 73 (2,863) (5,864) 68,484 Core pre-provision net revenue (Core PPNR) $ 35,765 $ 37,122 $ 31,546 $ 37,217 $ 31,264 Total noninterest income (loss) $ 17,291 $ 19,778 $ 19,525 $ 23,684 $ (47,683) (Plus) Less: Non-routine noninterest income (loss) items: Derivatives (losses), net (2) (1,383) (1,852) — — — Securities gains (losses), net (3) 1,203 1,779 64 (8,200) (68,484) Gain on sale of loans (4) — — 2,799 — — Gain on sale of Houston Franchise (5) — — — 12,636 — Gains on early extinguishment of FHLB advances, net — — — 1,428 — Total non-routine noninterest income (loss) items $ (180) $ (73) $ 2,863 $ 5,864 $ (68,484) Core noninterest income $ 17,471 $ 19,851 $ 16,662 $ 17,820 $ 20,801

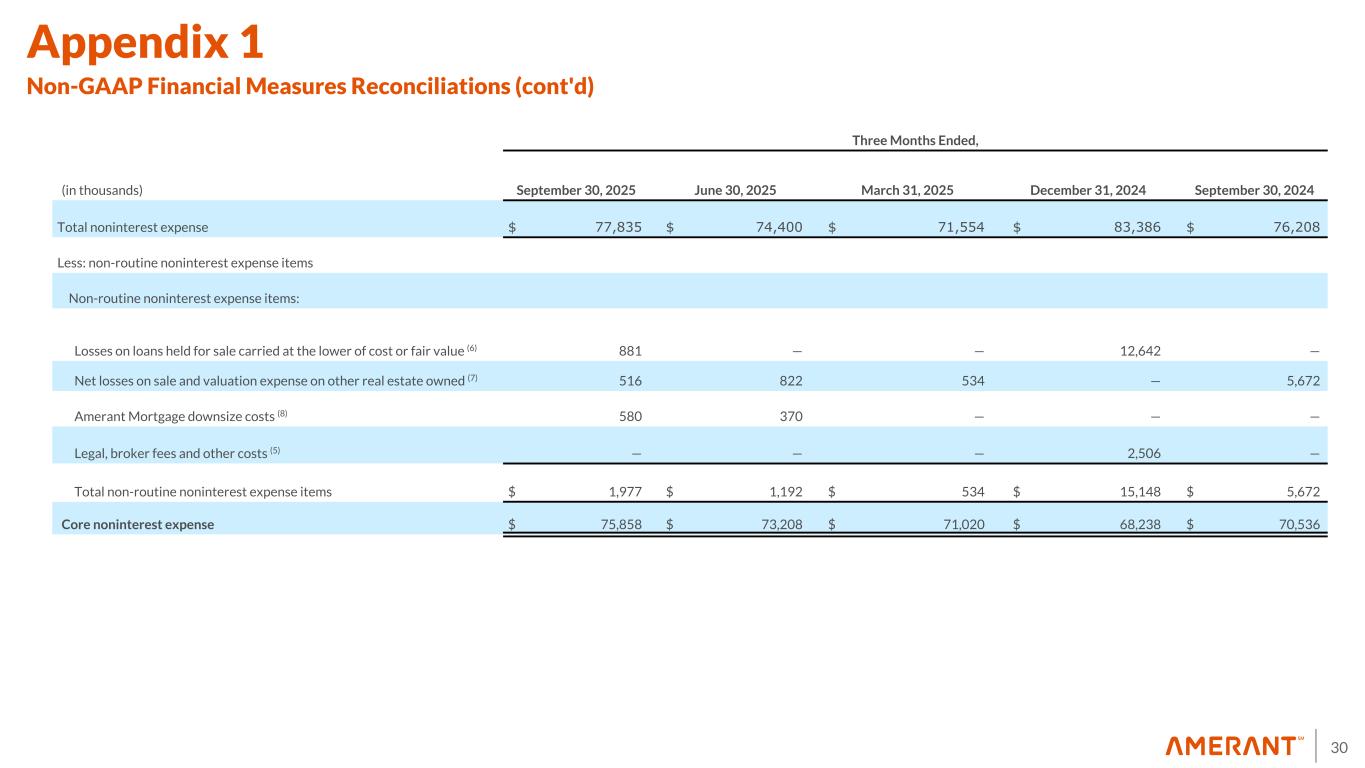

30 Three Months Ended, (in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Total noninterest expense $ 77,835 $ 74,400 $ 71,554 $ 83,386 $ 76,208 Less: non-routine noninterest expense items Non-routine noninterest expense items: Losses on loans held for sale carried at the lower of cost or fair value (6) 881 — — 12,642 — Net losses on sale and valuation expense on other real estate owned (7) 516 822 534 — 5,672 Amerant Mortgage downsize costs (8) 580 370 — — — Legal, broker fees and other costs (5) — — — 2,506 — Total non-routine noninterest expense items $ 1,977 $ 1,192 $ 534 $ 15,148 $ 5,672 Core noninterest expense $ 75,858 $ 73,208 $ 71,020 $ 68,238 $ 70,536 Appendix 1 Non-GAAP Financial Measures Reconciliations (cont'd)

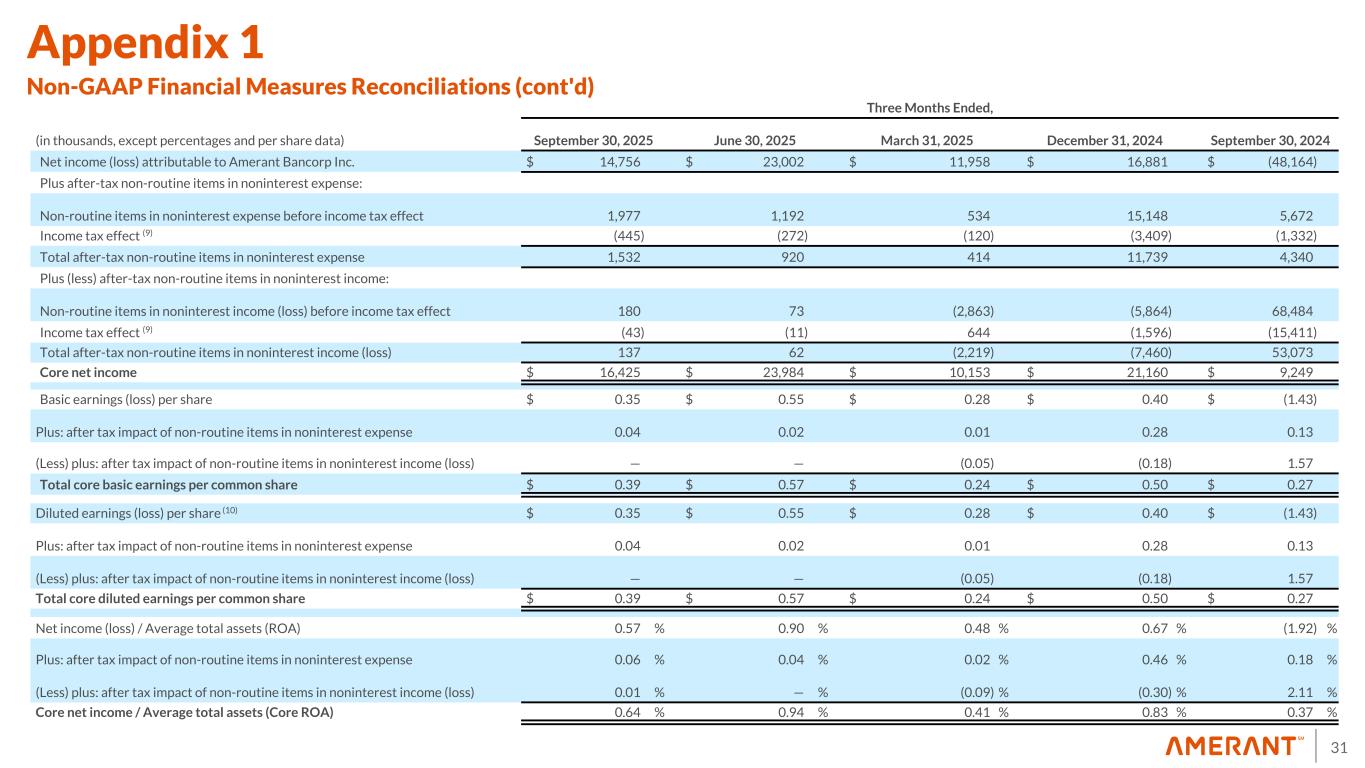

31 Three Months Ended, (in thousands, except percentages and per share data) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net income (loss) attributable to Amerant Bancorp Inc. $ 14,756 $ 23,002 $ 11,958 $ 16,881 $ (48,164) Plus after-tax non-routine items in noninterest expense: Non-routine items in noninterest expense before income tax effect 1,977 1,192 534 15,148 5,672 Income tax effect (9) (445) (272) (120) (3,409) (1,332) Total after-tax non-routine items in noninterest expense 1,532 920 414 11,739 4,340 Plus (less) after-tax non-routine items in noninterest income: Non-routine items in noninterest income (loss) before income tax effect 180 73 (2,863) (5,864) 68,484 Income tax effect (9) (43) (11) 644 (1,596) (15,411) Total after-tax non-routine items in noninterest income (loss) 137 62 (2,219) (7,460) 53,073 Core net income $ 16,425 $ 23,984 $ 10,153 $ 21,160 $ 9,249 Basic earnings (loss) per share $ 0.35 $ 0.55 $ 0.28 $ 0.40 $ (1.43) Plus: after tax impact of non-routine items in noninterest expense 0.04 0.02 0.01 0.28 0.13 (Less) plus: after tax impact of non-routine items in noninterest income (loss) — — (0.05) (0.18) 1.57 Total core basic earnings per common share $ 0.39 $ 0.57 $ 0.24 $ 0.50 $ 0.27 Diluted earnings (loss) per share (10) $ 0.35 $ 0.55 $ 0.28 $ 0.40 $ (1.43) Plus: after tax impact of non-routine items in noninterest expense 0.04 0.02 0.01 0.28 0.13 (Less) plus: after tax impact of non-routine items in noninterest income (loss) — — (0.05) (0.18) 1.57 Total core diluted earnings per common share $ 0.39 $ 0.57 $ 0.24 $ 0.50 $ 0.27 Net income (loss) / Average total assets (ROA) 0.57 % 0.90 % 0.48 % 0.67 % (1.92) % Plus: after tax impact of non-routine items in noninterest expense 0.06 % 0.04 % 0.02 % 0.46 % 0.18 % (Less) plus: after tax impact of non-routine items in noninterest income (loss) 0.01 % — % (0.09) % (0.30) % 2.11 % Core net income / Average total assets (Core ROA) 0.64 % 0.94 % 0.41 % 0.83 % 0.37 % Appendix 1 Non-GAAP Financial Measures Reconciliations (cont'd)

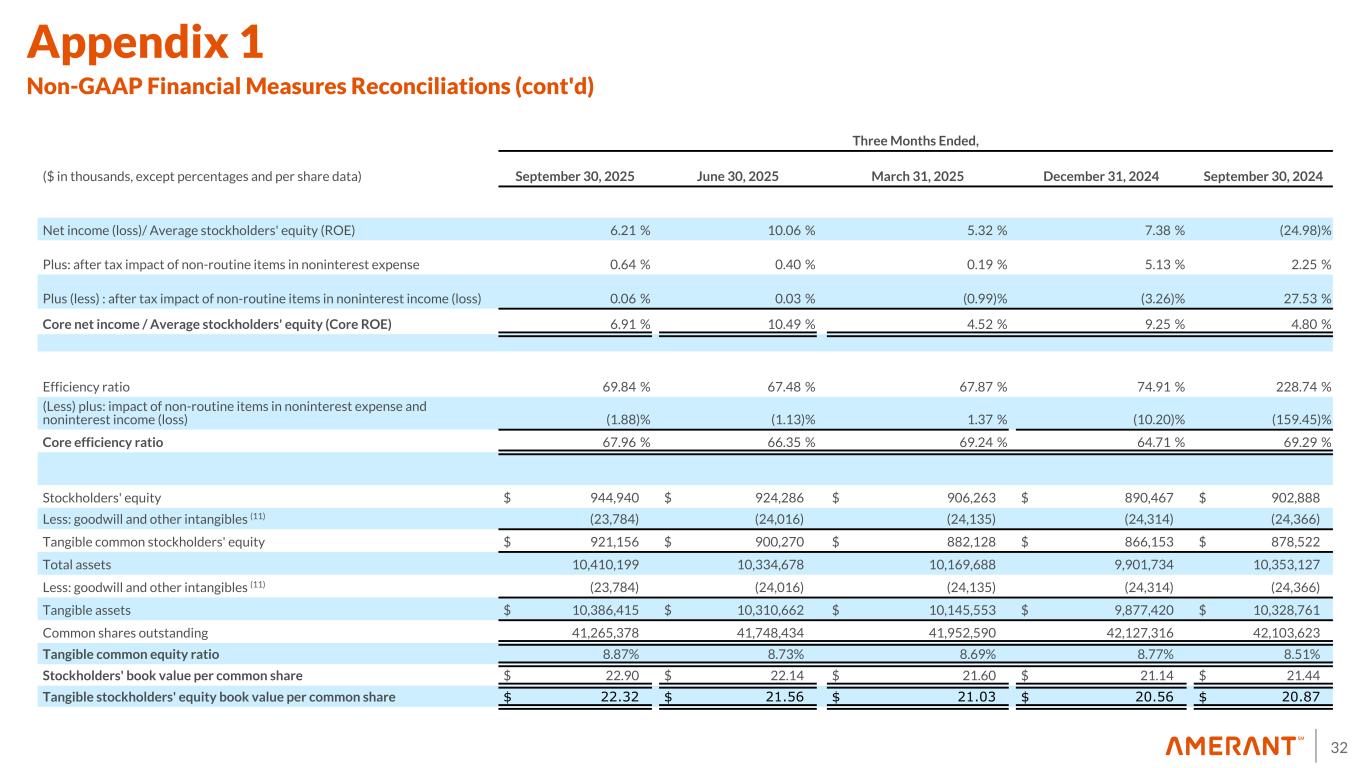

32 Three Months Ended, ($ in thousands, except percentages and per share data) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net income (loss)/ Average stockholders' equity (ROE) 6.21 % 10.06 % 5.32 % 7.38 % (24.98) % Plus: after tax impact of non-routine items in noninterest expense 0.64 % 0.40 % 0.19 % 5.13 % 2.25 % Plus (less) : after tax impact of non-routine items in noninterest income (loss) 0.06 % 0.03 % (0.99) % (3.26) % 27.53 % Core net income / Average stockholders' equity (Core ROE) 6.91 % 10.49 % 4.52 % 9.25 % 4.80 % Efficiency ratio 69.84 % 67.48 % 67.87 % 74.91 % 228.74 % (Less) plus: impact of non-routine items in noninterest expense and noninterest income (loss) (1.88) % (1.13) % 1.37 % (10.20) % (159.45) % Core efficiency ratio 67.96 % 66.35 % 69.24 % 64.71 % 69.29 % Stockholders' equity $ 944,940 $ 924,286 $ 906,263 $ 890,467 $ 902,888 Less: goodwill and other intangibles (11) (23,784) (24,016) (24,135) (24,314) (24,366) Tangible common stockholders' equity $ 921,156 $ 900,270 $ 882,128 $ 866,153 $ 878,522 Total assets 10,410,199 10,334,678 10,169,688 9,901,734 10,353,127 Less: goodwill and other intangibles (11) (23,784) (24,016) (24,135) (24,314) (24,366) Tangible assets $ 10,386,415 $ 10,310,662 $ 10,145,553 $ 9,877,420 $ 10,328,761 Common shares outstanding 41,265,378 41,748,434 41,952,590 42,127,316 42,103,623 Tangible common equity ratio 8.87 % 8.73 % 8.69 % 8.77 % 8.51 % Stockholders' book value per common share $ 22.90 $ 22.14 $ 21.60 $ 21.14 $ 21.44 Tangible stockholders' equity book value per common share $ 22.32 $ 21.56 $ 21.03 $ 20.56 $ 20.87 Appendix 1 Non-GAAP Financial Measures Reconciliations (cont'd)

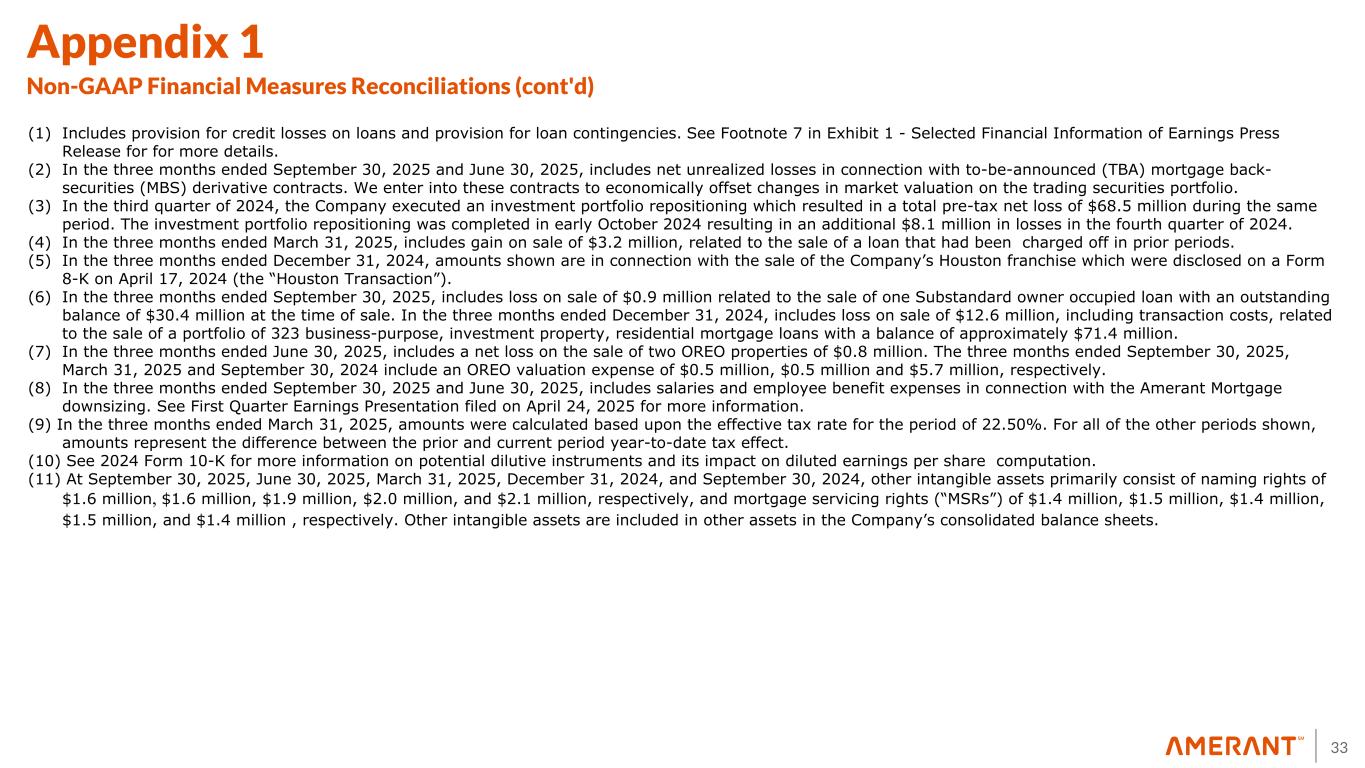

33 Appendix 1 Non-GAAP Financial Measures Reconciliations (cont'd) (1) Includes provision for credit losses on loans and provision for loan contingencies. See Footnote 7 in Exhibit 1 - Selected Financial Information of Earnings Press Release for for more details. (2) In the three months ended September 30, 2025 and June 30, 2025, includes net unrealized losses in connection with to-be-announced (TBA) mortgage back- securities (MBS) derivative contracts. We enter into these contracts to economically offset changes in market valuation on the trading securities portfolio. (3) In the third quarter of 2024, the Company executed an investment portfolio repositioning which resulted in a total pre-tax net loss of $68.5 million during the same period. The investment portfolio repositioning was completed in early October 2024 resulting in an additional $8.1 million in losses in the fourth quarter of 2024. (4) In the three months ended March 31, 2025, includes gain on sale of $3.2 million, related to the sale of a loan that had been charged off in prior periods. (5) In the three months ended December 31, 2024, amounts shown are in connection with the sale of the Company’s Houston franchise which were disclosed on a Form 8-K on April 17, 2024 (the “Houston Transaction”). (6) In the three months ended September 30, 2025, includes loss on sale of $0.9 million related to the sale of one Substandard owner occupied loan with an outstanding balance of $30.4 million at the time of sale. In the three months ended December 31, 2024, includes loss on sale of $12.6 million, including transaction costs, related to the sale of a portfolio of 323 business-purpose, investment property, residential mortgage loans with a balance of approximately $71.4 million. (7) In the three months ended June 30, 2025, includes a net loss on the sale of two OREO properties of $0.8 million. The three months ended September 30, 2025, March 31, 2025 and September 30, 2024 include an OREO valuation expense of $0.5 million, $0.5 million and $5.7 million, respectively. (8) In the three months ended September 30, 2025 and June 30, 2025, includes salaries and employee benefit expenses in connection with the Amerant Mortgage downsizing. See First Quarter Earnings Presentation filed on April 24, 2025 for more information. (9) In the three months ended March 31, 2025, amounts were calculated based upon the effective tax rate for the period of 22.50%. For all of the other periods shown, amounts represent the difference between the prior and current period year-to-date tax effect. (10) See 2024 Form 10-K for more information on potential dilutive instruments and its impact on diluted earnings per share computation. (11) At September 30, 2025, June 30, 2025, March 31, 2025, December 31, 2024, and September 30, 2024, other intangible assets primarily consist of naming rights of $1.6 million, $1.6 million, $1.9 million, $2.0 million, and $2.1 million, respectively, and mortgage servicing rights (“MSRs”) of $1.4 million, $1.5 million, $1.4 million, $1.5 million, and $1.4 million , respectively. Other intangible assets are included in other assets in the Company’s consolidated balance sheets.

34 Income Statement Highlights - 3Q25 vs 2Q25 ($ in thousands) 3Q25 2Q25 Change Total Interest Income Loans $ 121,414 $ 122,166 $ (752) Investment securities 26,737 23,212 3,525 Interest earning deposits with banks and other interest income 4,592 5,717 (1,125) Total Interest Expense — Interest bearing demand deposits 10,892 11,567 (675) Savings and money market deposits 18,008 18,030 (22) Time deposits 20,950 22,285 (1,335) Advances from FHLB 7,316 7,230 86 Senior notes — 78 (78) Subordinated notes 362 361 1 Junior subordinated debentures 1,063 1,064 (1) Securities sold under agreements to repurchase — 1 (1) Total Provision for Credit Losses 14,600 6,060 8,540 Total Noninterest Income 17,291 19,778 (2,487) Total Noninterest Expense 77,835 74,400 3,435 Income Tax Expense 4,252 6,795 (2,543) Net Income Attributable to Amerant Bancorp Inc. $ 14,756 $ 23,002 $ (8,246)

35 • ACL - Allowance for Credit Losses • AFS - Available for Sale • AOCL - Accumulated Other Comprehensive Loss • AUM - Assets Under Management • CET 1 - Common Equity Tier 1 capital ratio • CRE - Commercial Real Estate • Customer CDs - Customer certificate of deposits • EPS – Earnings per Share • FHLB - Federal Home Loan Bank • FTE - Full Time Equivalent • MV - Market Value • NCO - Net Charge-Offs • NPL - Non-Performing Loans • NPA - Non-Performing Assets • NII - Net Interest Income • NIM – Net Interest Margin • ROA - Return on Assets • ROE - Return on Equity • SOFR - Secured Overnight Financing Rate • TCE ratio – Tangible Common Equity ratio Glossary

36Glossary (cont'd) • Assets under management and custody: consists of assets held for clients in an agency or fiduciary capacity which are not assets of the Company and therefore are not included in the consolidated financial statements. • Core deposits: consist of total deposits excluding all time deposits • Total gross loans : include loans held for investment net of unamortized deferred loan origination fees and costs, as well as loans held for sale. • Cost of Total Deposits: calculated based upon the average balance of total noninterest bearing and interest bearing deposits, which includes time deposits. • ROA: calculated based upon the average daily balance of total assets • ROE: calculated based upon the average daily balance of stockholders' equity • Loans Held for Investment: excludes loans held for sale carried at fair value and loans held for sale carried at the lower of cost or fair value • Non-performing loans include accruing loans past due by 90 days or more and all nonaccrual loans. Non-performing assets include accruing loans past due by 90 days or more, all nonaccrual loans, other real estate owned ("OREO") properties acquired through or in lieu of foreclosure and other repossessed assets. • Net Charge Offs/Average Total Loans Held for Investment: – Annualized and calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan fees and costs, excluding the allowance for credit losses – Total loans exclude loans held for sale • Cost of Deposits: calculated based upon the average balance of total noninterest bearing and interest bearing deposits, which includes time deposits. • Cost of Funds: calculated based upon the average balance of total financial liabilities which include total interest bearing liabilities and noninterest bearing demand deposits • Quarterly beta (as shown in NII & NIM Slide): calculated based upon the change of the cost of deposit over the change of Federal funds rate (if any) during the quarter. • Net Charge-Offs -charge-offs net of recoveries • Totals may not sum due to rounding of line items.

.