Investor Update November 10, 2025 NYSE: AMTB amerantbank.com

Being the bank of choice in the markets we serve. Table of Contents 1 2 3 About Us Company Updates Performance Updates Investor Update | 2

Important Notices and Disclosures Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. Examples of forward-looking statements include but are not limited to: our future operating or financial performance, including revenues, expenses, expense savings, income or loss and earnings or loss per share, and other financial items; statements regarding expectations, plans or objectives for future operations, products or services, and our expectations on our investment portfolio repositioning and loan recoveries or reaching positive resolutions on problem loans. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlook,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2024 filed on March 5, 2025, and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including the three and nine month periods ended September 30, 2025 and 2024, and the three months ended June 30, 2025, March 31, 2025, and December 31, 2024 may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2025, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “preprovision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expense”, “core net income”, “core earnings per share (basic and diluted)”, “core return on assets (Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, and “tangible stockholders’ equity (book value) per common share” . This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures”. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our business. Management believes that these supplementary non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. Appendix 1 reconciles these non-GAAP financial measures to reported results. Investor Update | 3

About Us

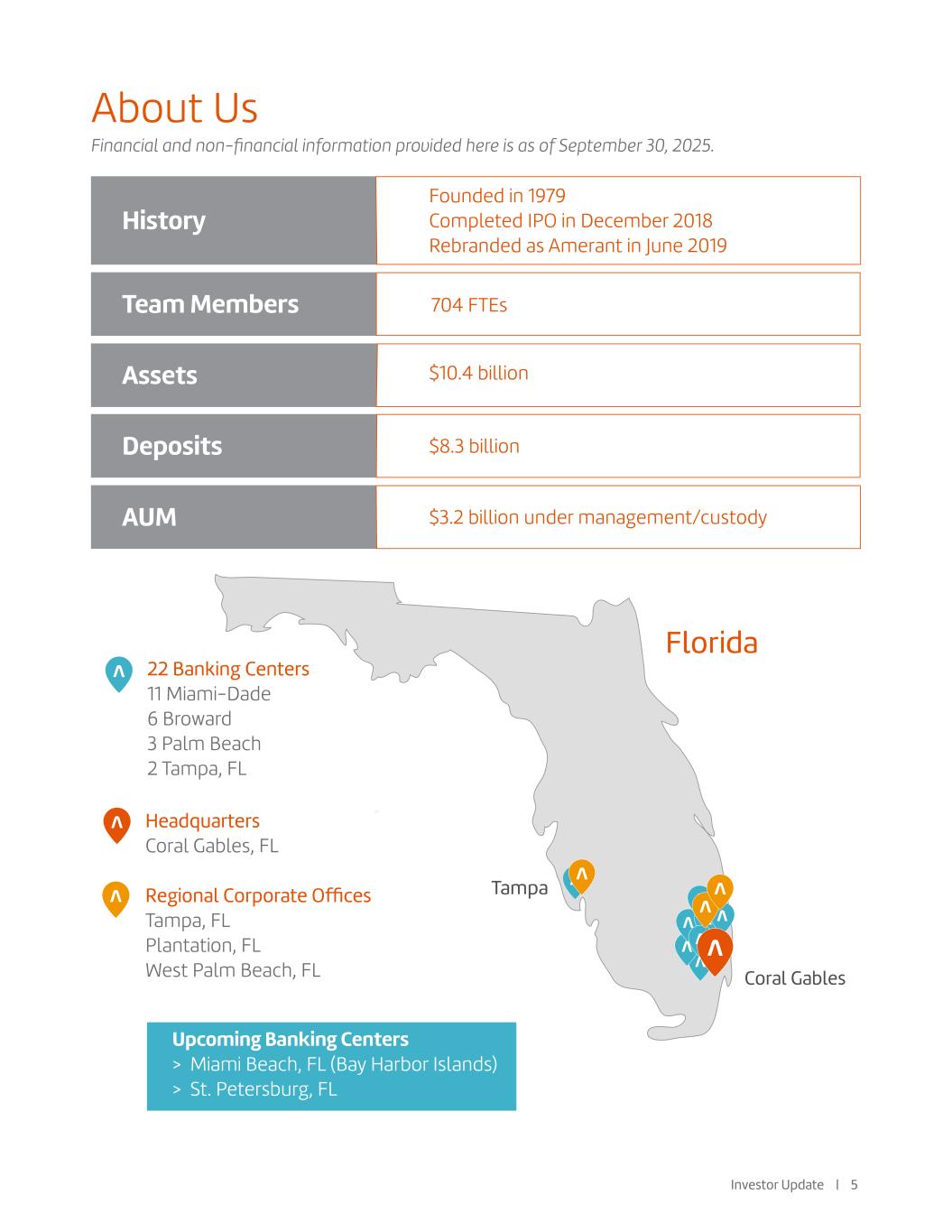

22 Banking Centers 11 Miami-Dade 6 Broward 3 Palm Beach 2 Tampa, FL Headquarters Coral Gables, FL Regional Corporate Offices Tampa, FL Plantation, FL West Palm Beach, FL About Us History Team Members Assets Deposits AUM Founded in 1979 Completed IPO in December 2018 Rebranded as Amerant in June 2019 704 FTEs $10.4 billion $8.3 billion $3.2 billion under management/custody Investor Update | 5 Financial and non-financial information provided here is as of September 30, 2025. Upcoming Banking Centers > Miami Beach, FL (Bay Harbor Islands) > St. Petersburg, FL

Established franchise with high scarcity value; presence in attractive, high-growth markets of South Florida, Tampa and Central Florida. Strong and diverse deposit base; organic, relationship-first focus. Company focus is on the execution of strategic plan to unlock sustainable and profitable growth Our Investment Proposition Investor Update | 6 We have the strong foundation to enable us to become a consistent top-quartile performer as Florida’s bank of choice. Completed core conversion; now operating with a new, fully integrated, state-of- the-art core tech system, enabling us to better serve our customers and team members Completed sale of Houston franchise; focusing on organic growth in Florida Continue to selectively invest in both business development and risk management personnel to drive incremental growth Branch network in place to support future growth in Florida Digital transformation efforts well underway

Being leaders in innovation, quality, efficiency, and customer satisfaction Our Mission, Vision, and Precepts Mission Vision Precepts To provide our customers with the products, services and advice they need to achieve financial success, through our diverse, inclusive and motivated team that is personally involved with the communities we serve, all of which result in increased shareholder value. To be the bank of choice in the markets we serve. Consitently exceeding expectations (going above and beyond) Promoting a diverse and inclusive work environment where every person is given the encouragement, support, and opportunity to be successful Holding ourselves and each other accountable and always doing what is right Treating everyone as we expect to be treated Being the bank of choice in the markets we serve Providing the customer with the right products, services, and advice to meet their needs Investor Update | 7

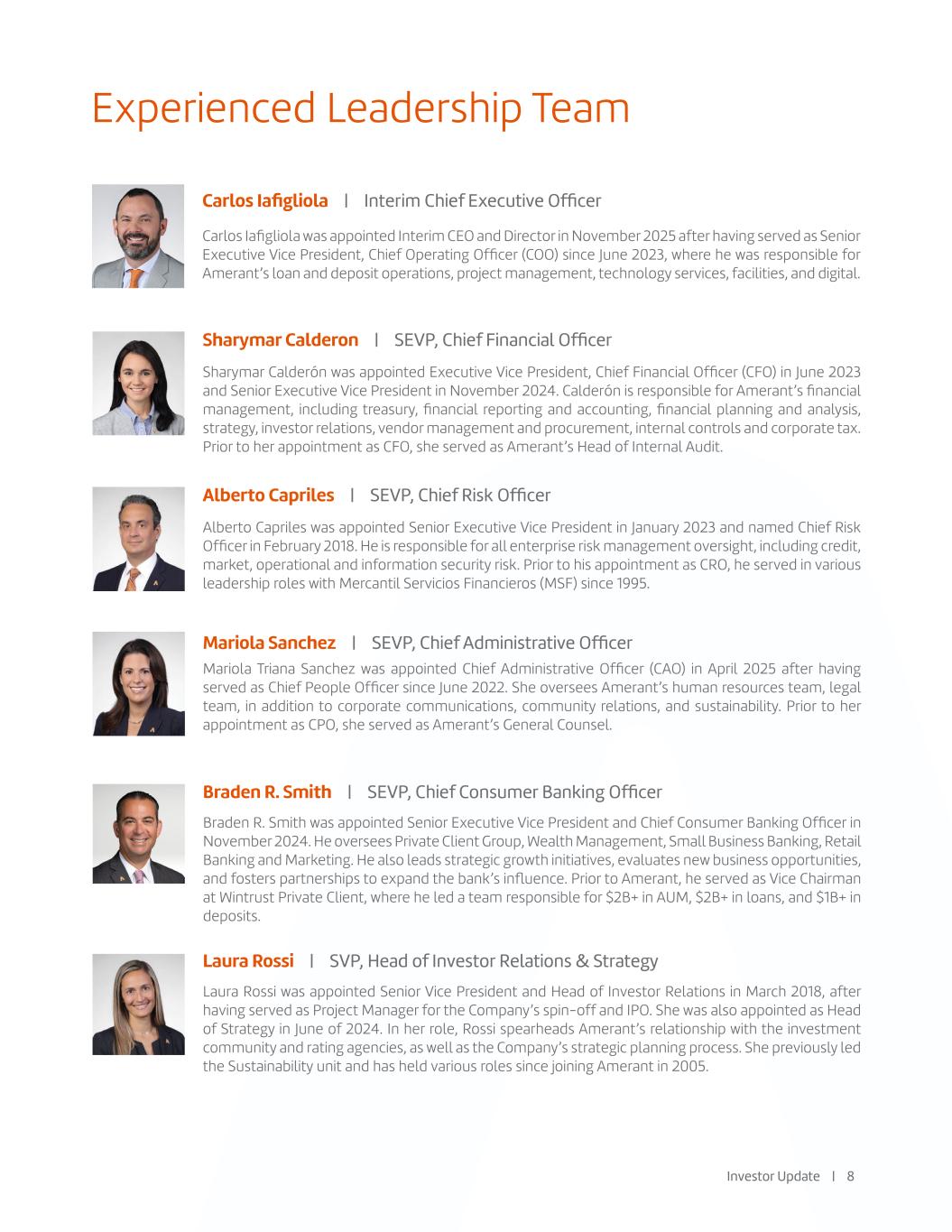

Experienced Leadership Team Sharymar Calderon | SEVP, Chief Financial Officer Sharymar Calderón was appointed Executive Vice President, Chief Financial Officer (CFO) in June 2023 and Senior Executive Vice President in November 2024. Calderón is responsible for Amerant’s financial management, including treasury, financial reporting and accounting, financial planning and analysis, strategy, investor relations, vendor management and procurement, internal controls and corporate tax. Prior to her appointment as CFO, she served as Amerant’s Head of Internal Audit. Alberto Capriles | SEVP, Chief Risk Officer Alberto Capriles was appointed Senior Executive Vice President in January 2023 and named Chief Risk Officer in February 2018. He is responsible for all enterprise risk management oversight, including credit, market, operational and information security risk. Prior to his appointment as CRO, he served in various leadership roles with Mercantil Servicios Financieros (MSF) since 1995. Mariola Sanchez | SEVP, Chief Administrative Officer Mariola Triana Sanchez was appointed Chief Administrative Officer (CAO) in April 2025 after having served as Chief People Officer since June 2022. She oversees Amerant’s human resources team, legal team, in addition to corporate communications, community relations, and sustainability. Prior to her appointment as CPO, she served as Amerant’s General Counsel. Laura Rossi | SVP, Head of Investor Relations & Strategy Laura Rossi was appointed Senior Vice President and Head of Investor Relations in March 2018, after having served as Project Manager for the Company’s spin-off and IPO. She was also appointed as Head of Strategy in June of 2024. In her role, Rossi spearheads Amerant’s relationship with the investment community and rating agencies, as well as the Company’s strategic planning process. She previously led the Sustainability unit and has held various roles since joining Amerant in 2005. Investor Update | 8 Braden R. Smith | SEVP, Chief Consumer Banking Officer Braden R. Smith was appointed Senior Executive Vice President and Chief Consumer Banking Officer in November 2024. He oversees Private Client Group, Wealth Management, Small Business Banking, Retail Banking and Marketing. He also leads strategic growth initiatives, evaluates new business opportunities, and fosters partnerships to expand the bank’s influence. Prior to Amerant, he served as Vice Chairman at Wintrust Private Client, where he led a team responsible for $2B+ in AUM, $2B+ in loans, and $1B+ in deposits. Carlos Iafigliola | Interim Chief Executive Officer Carlos Iafigliola was appointed Interim CEO and Director in November 2025 after having served as Senior Executive Vice President, Chief Operating Officer (COO) since June 2023, where he was responsible for Amerant’s loan and deposit operations, project management, technology services, facilities, and digital.

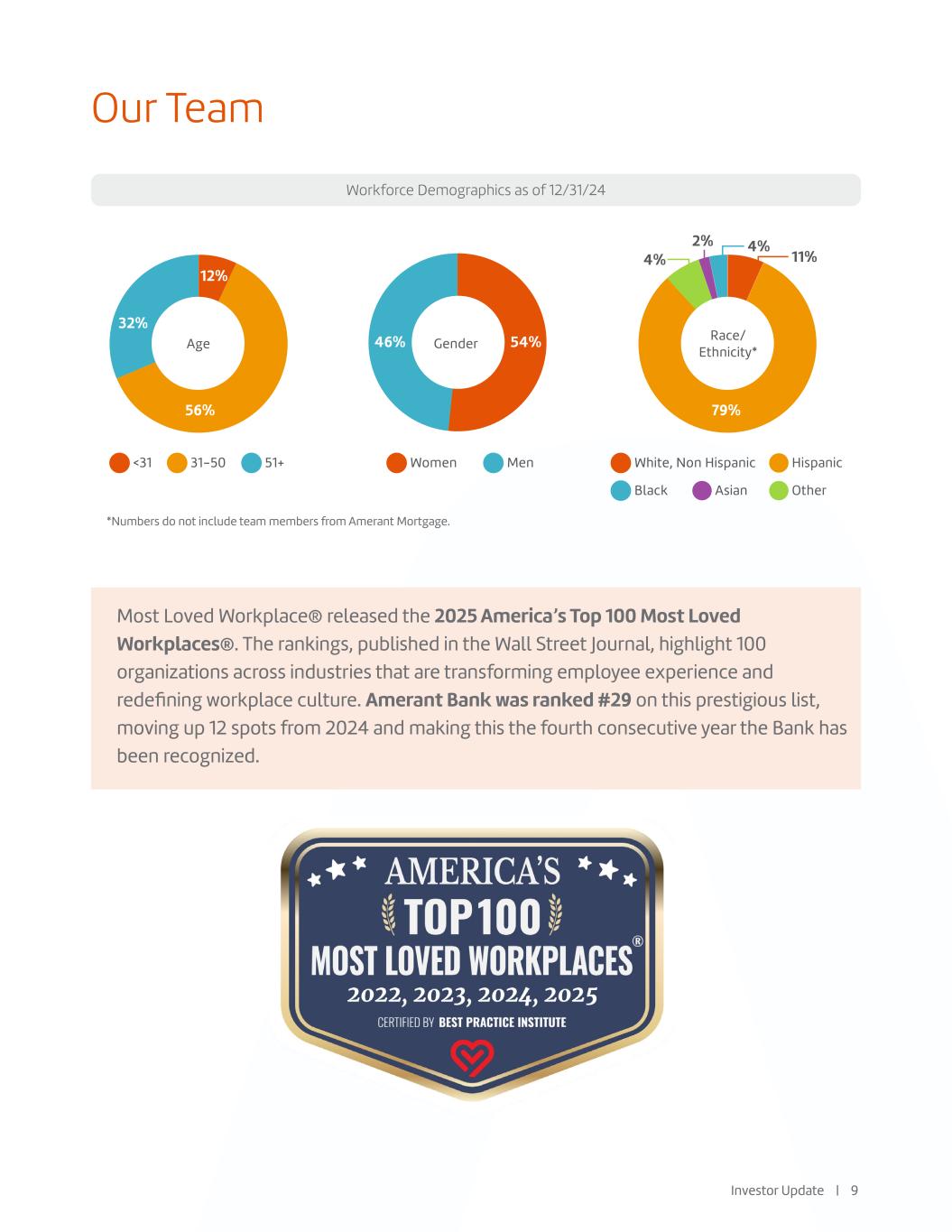

Our Team Workforce Demographics as of 12/31/24 Most Loved Workplace® released the 2025 America’s Top 100 Most Loved Workplaces®. The rankings, published in the Wall Street Journal, highlight 100 organizations across industries that are transforming employee experience and redefining workplace culture. Amerant Bank was ranked #29 on this prestigious list, moving up 12 spots from 2024 and making this the fourth consecutive year the Bank has been recognized. *Numbers do not include team members from Amerant Mortgage. White, Non Hispanic Hispanic Black OtherAsian Women Men<31 31-50 51+ 46% 79% 11% 4% 4% 2% 54% 56% 12% 32% Age Gender Investor Update | 9 Race/ Ethnicity*

Company Updates

Mid-Quarter Updates Accelerating progress against our strategy under new leadership Carlos Iafigliola was named Interim CEO and Director, after serving as SEVP and COO. Carlos has 20 years of experience at Amerant, including having served as EVP and CFO. He has over three decades of experience in the financial services industry, in diverse markets In connection with the transition, Odilon Almeida Jr., former Lead Independent Director, appointed Board Chairman Board and management are fully aligned with and committed to the strategy - focusing on execution particularly on improving credit quality and enhancing our cost structure, supported by robust risk management Priorities continue to be strengthening asset quality, improving efficiencies through controlled expenses, deepening deposit relationships, reigniting loan growth, maintaining strong capital, and achieving stated profitability goals and shareholder returns Commercial Banking Mike Nursey has been named Interim Head of Commercial Banking. He is a seasoned leader with over 35 years of banking experience and is well known and respected in the Florida marketplace. Adding senior local market leaders in greater Miami-Dade County to bolster our in- market leadership and business development efforts in greater Miami-Dade County. Leadership Updates Executive Transition Investor Update | 11

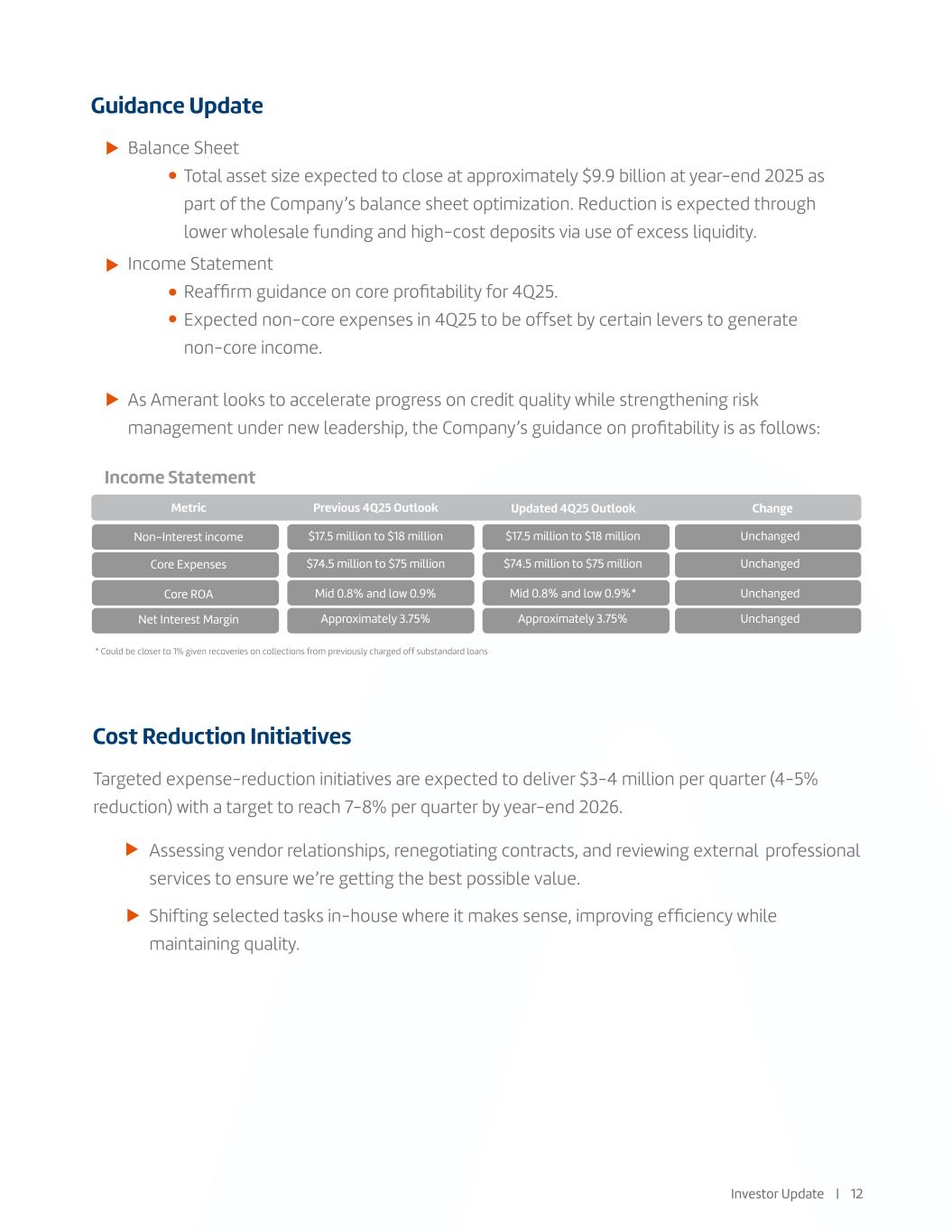

Guidance Update As Amerant looks to accelerate progress on credit quality while strengthening risk management under new leadership, the Company’s guidance on profitability is as follows: Cost Reduction Initiatives Targeted expense-reduction initiatives are expected to deliver $3-4 million per quarter (4-5% reduction) with a target to reach 7-8% per quarter by year-end 2026. Assessing vendor relationships, renegotiating contracts, and reviewing external professional services to ensure we’re getting the best possible value. Shifting selected tasks in-house where it makes sense, improving efficiency while maintaining quality. Non-Interest income Core Expenses Core ROA Net Interest Margin Metric Previous 4Q25 Outlook Updated 4Q25 Outlook Change $17.5 million to $18 million $74.5 million to $75 million Mid 0.8% and low 0.9% Approximately 3.75% $17.5 million to $18 million $74.5 million to $75 million Mid 0.8% and low 0.9%* Approximately 3.75% Unchanged Unchanged Unchanged Unchanged Investor Update | 12 Balance Sheet Total asset size expected to close at approximately $9.9 billion at year-end 2025 as part of the Company’s balance sheet optimization. Reduction is expected through lower wholesale funding and high-cost deposits via use of excess liquidity. Income Statement Reaffirm guidance on core profitability for 4Q25. Expected non-core expenses in 4Q25 to be offset by certain levers to generate non-core income. * Could be closer to 1% given recoveries on collections from previously charged off substandard loans Income Statement

Heightened emphasis on reducing non-performing assets, including additional resources dedicated to expedite resolution Share Buyback Program Focused on the resolution of our special mention as well as non-performing and classified loans. Working on collections from previously charged-off substandard loans and realizing the recoveries. Approximately 75% of the loan portfolio has already been assessed, resulting in a comprehensive coverage of our loan portfolio - only $1.5 billion in loans remain to be reviewed in 4Q25. Aligned necessary personnel to proactively address upcoming covenant testing and financial statement updates as well as driving prudent and expeditious resolution. Complemented our in-house team with a well-known third part to expedite the risk rating testing in 3Q and to assess a significant portion of the portfolio for any signs of potential concern. We expect to continue to invest in these reviews in the fourth quarter to ensure timely completion of the reviews scheduled for 4Q. Launched an extended multi-hour, all-hands-leadership weekly meeting to address special assets as a working group to monitor and drive progress. In 3Q, we utilized a 10b5-1 Plan to purchase 487,657 shares or $10.0 million dollars in the quarter as previously noted, and intend to utilize such plan to execute under this program in 4Q. We will continue to take a prudent approach carefully balancing the need between retaining capital to support growth objectives compared with buybacks and dividends to enhance returns. We intend to utilize the $13 million remaining in our current authorized buyback program this quarter when the stock trades under tangible book value. Investor Update | 13

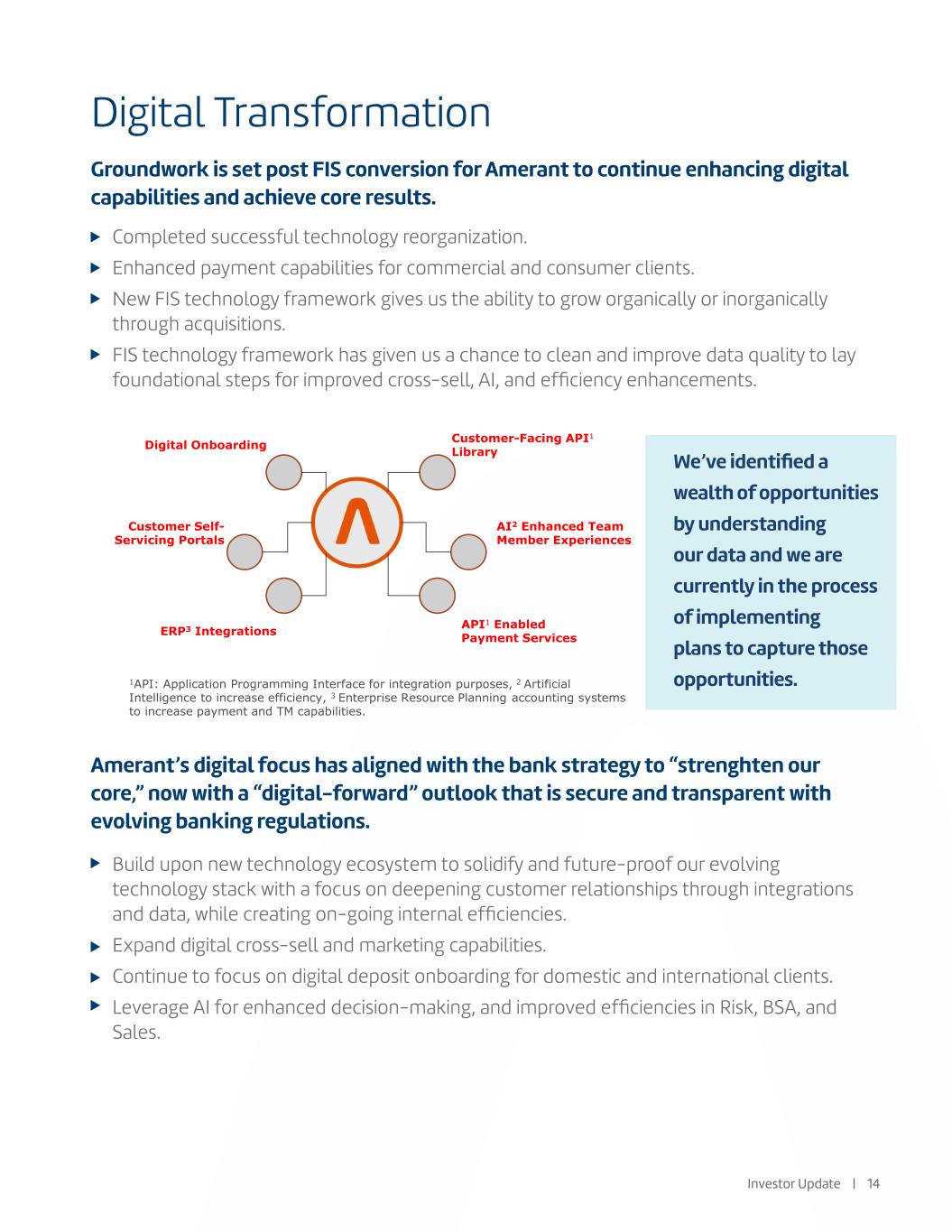

Digital Transformation Groundwork is set post FIS conversion for Amerant to continue enhancing digital capabilities and achieve core results. Amerant’s digital focus has aligned with the bank strategy to “strenghten our core,” now with a “digital-forward” outlook that is secure and transparent with evolving banking regulations. Digital Onboarding Customer-Facing API1 Library Customer Self- Servicing Portals AI2 Enhanced Team Member Experiences ERP3 Integrations API1 Enabled Payment Services 1API: Application Programming Interface for integration purposes, 2 Artificial Intelligence to increase efficiency, 3 Enterprise Resource Planning accounting systems to increase payment and TM capabilities. We’ve identified a wealth of opportunities by understanding our data and we are currently in the process of implementing plans to capture those opportunities. Completed successful technology reorganization. Enhanced payment capabilities for commercial and consumer clients. New FIS technology framework gives us the ability to grow organically or inorganically through acquisitions. FIS technology framework has given us a chance to clean and improve data quality to lay foundational steps for improved cross-sell, AI, and efficiency enhancements. Build upon new technology ecosystem to solidify and future-proof our evolving technology stack with a focus on deepening customer relationships through integrations and data, while creating on-going internal efficiencies. Expand digital cross-sell and marketing capabilities. Continue to focus on digital deposit onboarding for domestic and international clients. Leverage AI for enhanced decision-making, and improved efficiencies in Risk, BSA, and Sales. Investor Update | 14

Maximizing impact Unlocking the full potential of Sports Partnerships. Amerant Bank x Miami Heat: A Game-Changing Partnership Amerant Bank x Florida Panthers: A Championship Partnership Investor Update | 15 Amerant Bank x Tampa Bay Rays: Expanding Our Presence in Tampa Amerant Bank x Miami Dolphins: A Touchdown on any field. Amerant Bank x Miami Marlins: A Home Run Partnership.

New Banking Center & Regional Office Updates Investor Update | 16 West Palm Beach Banking Center and Regional Corporate Office West Palm Beach opened doors in September 2025 Miami Beach Two banking centers - 41st Street opened doors in September 2025; Bay Harbor is targeted for the second half of 2025 > Miami Beach (Bay Harbor area) - 2nd banking center in high profile, deposit-rich area Tampa Downtown Tampa banking center opened doors in October 2025 > St. Petersburg planned for 2026 West Palm Beach Miami Beach New Banking Center Performance Update Total deposit and loan balances reflect Retail and Business Banking, Private Banking and International Banking (in- branch only) accounts booked and excludes commercial balances. Downtown Miami Las Olas Tampa Key Biscayne Total LoansBanking Center 4/26/24 3/5/24 2/1/24 6/26/23 $151 $78 $36 $93 $73 $23 $7 $13 Opening Date Total Deposits Balances as of September 30, 2025 Downtown Tampa (figures in millions) Palm Beach 4/14/25 $18 $2 Miami Beach 9/11/25 N/A N/A $175 $86 $38 $101 $102 $25 $8 $15 $45 $18 $5 - Total LoansTotal Deposits As of June 30, 2025 As of September 30, 2025

Performance Updates

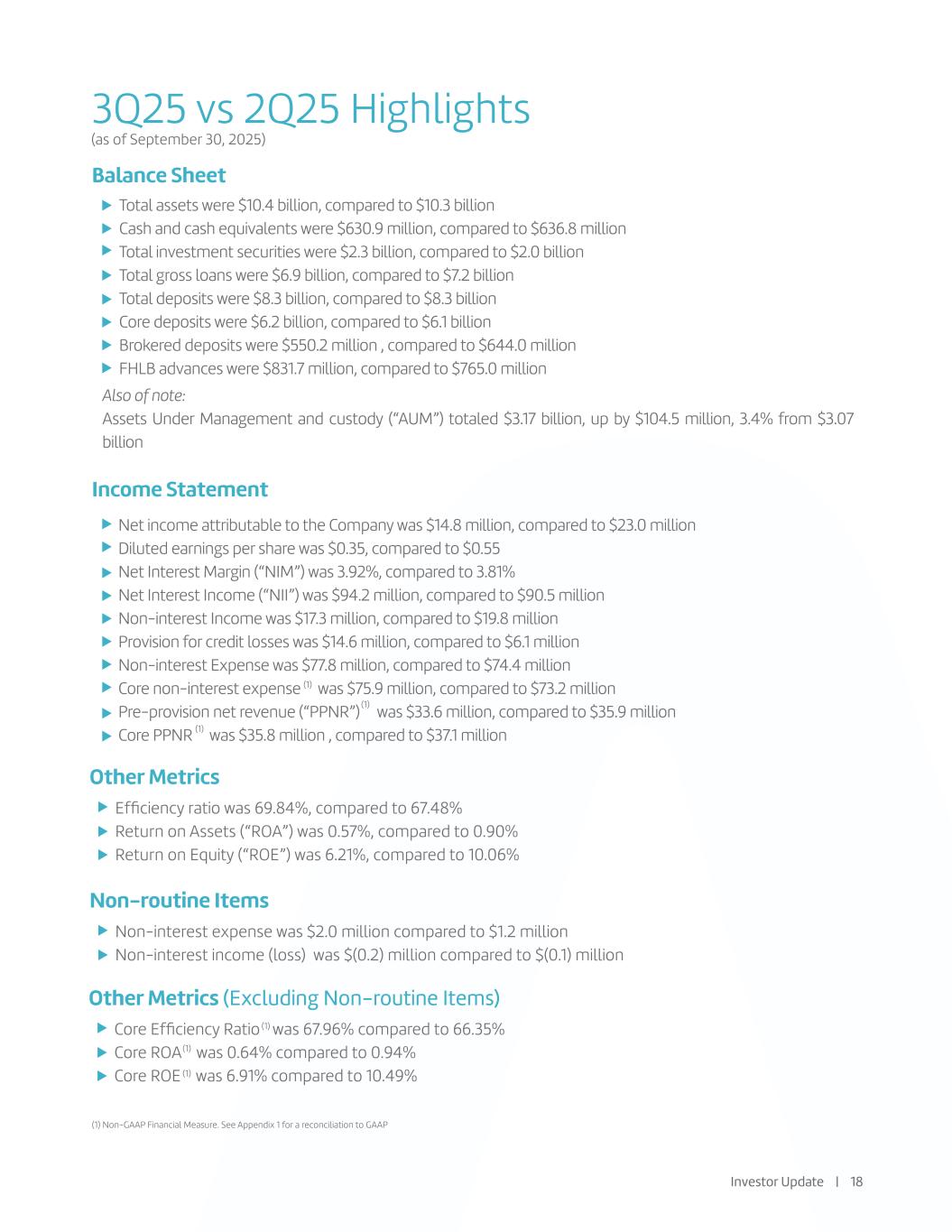

3Q25 vs 2Q25 Highlights Investor Update | 18 Total assets were $10.4 billion, compared to $10.3 billion Cash and cash equivalents were $630.9 million, compared to $636.8 million Total investment securities were $2.3 billion, compared to $2.0 billion Total gross loans were $6.9 billion, compared to $7.2 billion Total deposits were $8.3 billion, compared to $8.3 billion Core deposits were $6.2 billion, compared to $6.1 billion Brokered deposits were $550.2 million , compared to $644.0 million FHLB advances were $831.7 million, compared to $765.0 million Balance Sheet Income Statement (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP (as of September 30, 2025) Net income attributable to the Company was $14.8 million, compared to $23.0 million Diluted earnings per share was $0.35, compared to $0.55 Net Interest Margin (“NIM”) was 3.92%, compared to 3.81% Net Interest Income (“NII”) was $94.2 million, compared to $90.5 million Non-interest Income was $17.3 million, compared to $19.8 million Provision for credit losses was $14.6 million, compared to $6.1 million Non-interest Expense was $77.8 million, compared to $74.4 million Core non-interest expense was $75.9 million, compared to $73.2 million Pre-provision net revenue (“PPNR”) was $33.6 million, compared to $35.9 million Core PPNR was $35.8 million , compared to $37.1 million (1) (1) (1) Also of note: Assets Under Management and custody (“AUM”) totaled $3.17 billion, up by $104.5 million, 3.4% from $3.07 billion Other Metrics Efficiency ratio was 69.84%, compared to 67.48% Return on Assets (“ROA”) was 0.57%, compared to 0.90% Return on Equity (“ROE”) was 6.21%, compared to 10.06% Non-routine Items Non-interest expense was $2.0 million compared to $1.2 million Non-interest income (loss) was $(0.2) million compared to $(0.1) million Other Metrics (Excluding Non-routine Items) Core Efficiency Ratio was 67.96% compared to 66.35% Core ROA was 0.64% compared to 0.94% Core ROE was 6.91% compared to 10.49% (1) (1) (1)

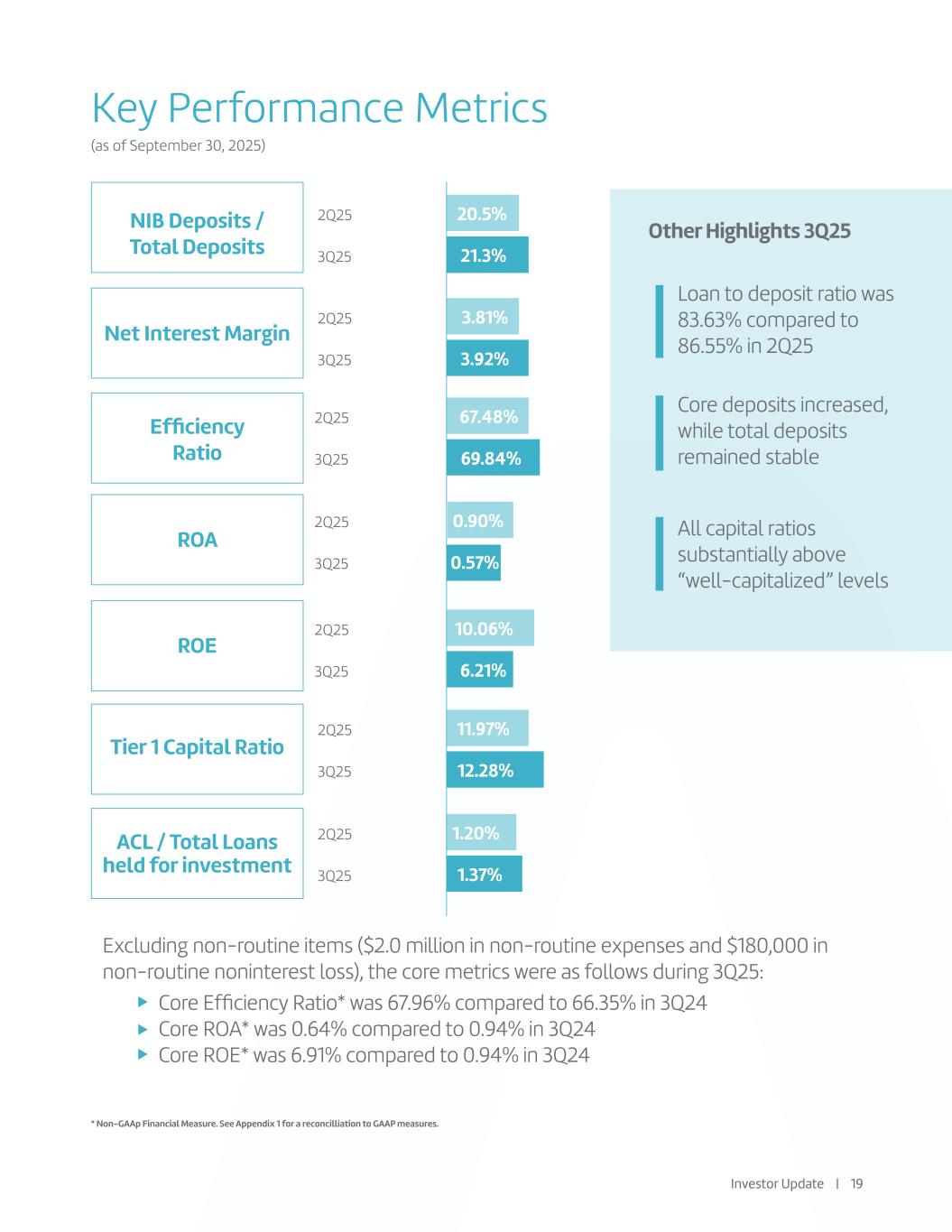

Key Performance Metrics NIB Deposits / Total Deposits Efficiency Ratio ROA ROE Tier 1 Capital Ratio Loan to deposit ratio was 83.63% compared to 86.55% in 2Q25 2Q25 20.5% 2Q25 67.48% 2Q25 10.06% 2Q25 11.97% 3Q25 21.3% 3Q25 69.84% 3Q25 0.57% 3Q25 6.21% 3Q25 1. 12.28% Core deposits increased, while total deposits remained stable Other Highlights 3Q25 All capital ratios substantially above “well-capitalized” levels Investor Update | 19 * Non-GAAp Financial Measure. See Appendix 1 for a reconcilliation to GAAP measures. Excluding non-routine items ($2.0 million in non-routine expenses and $180,000 in non-routine noninterest loss), the core metrics were as follows during 3Q25: Core Efficiency Ratio* was 67.96% compared to 66.35% in 3Q24 Core ROA* was 0.64% compared to 0.94% in 3Q24 Core ROE* was 6.91% compared to 0.94% in 3Q24 (as of September 30, 2025) Net Interest Margin 2Q25 3.81% 3Q25 3.92% ACL / Total Loans held for investment 2Q25 1.20% 3Q25 1. 1.37% 2Q25 0.90%

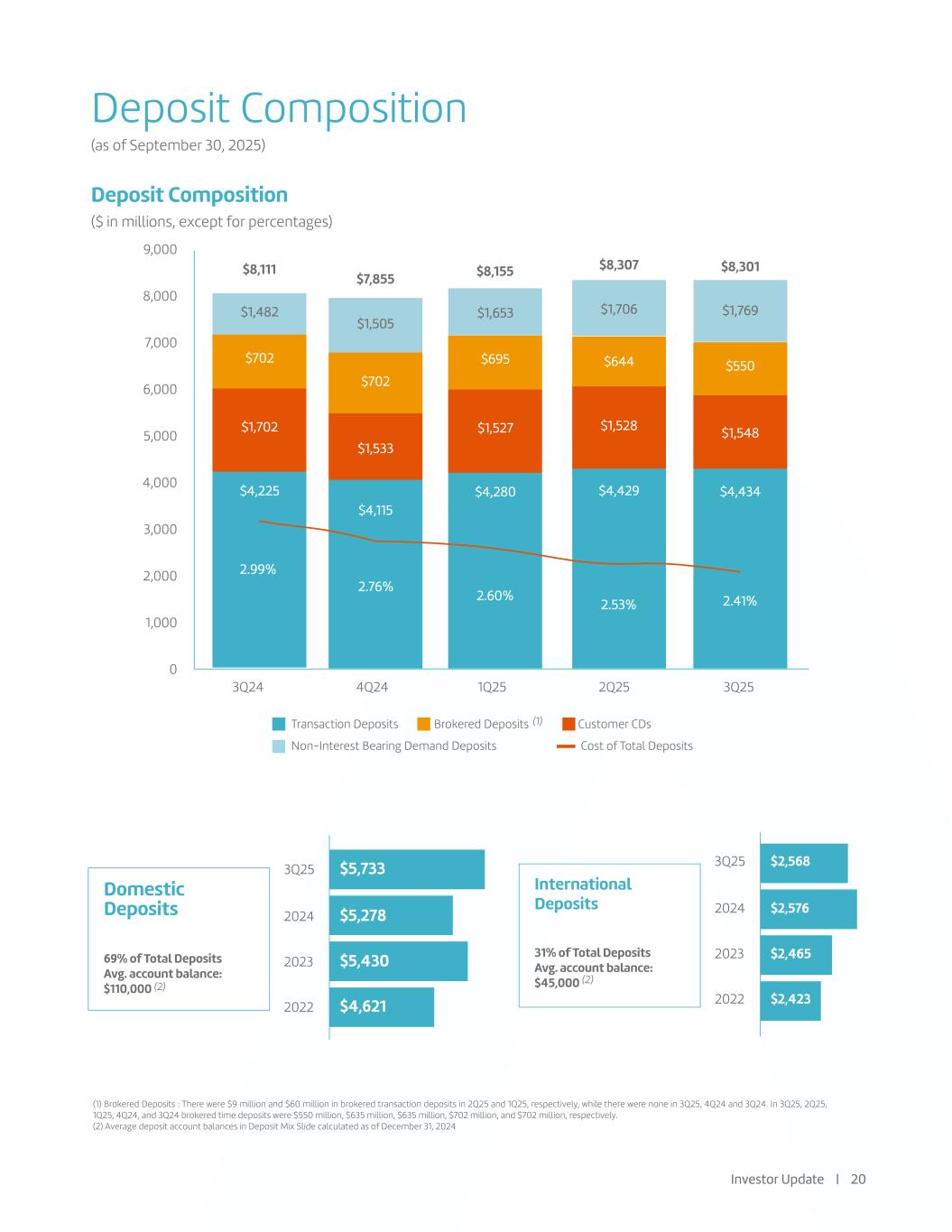

Deposit Composition Deposit Composition ($ in millions, except for percentages) Transaction Deposits Brokered Deposits Customer CDs Non-Interest Bearing Demand Deposits Cost of Total Deposits International Deposits 31% of Total Deposits Avg. account balance: $45,000 2024 $2,5762024 $5,278 2023 $2,4652023 $5,430 2022 $2,4232022 $4,621 3Q24 4Q24 1Q25 2Q25 3Q25 9,000 8,000 7,000 6,000 5,000 4,000 3,000 2,000 1,000 0 3Q25 $2,5683Q25 $5,733 Domestic Deposits 69% of Total Deposits Avg. account balance: $110,000 Investor Update | 20 $1,653 $8,155 2.60% $695 $1,527 $4,280 $1,706 $1,769 $8,307 $8,301 2.53% 2.41% $644 $1,528 $4,429 $550 $1,548 $4,434 (as of September 30, 2025) $1,482 $8,111 2.99% $702 $1,702 $4,225 $1,505 $7,855 2.76% $702 $1,533 $4,115 (1) Brokered Deposits : There were $9 million and $60 million in brokered transaction deposits in 2Q25 and 1Q25, respectively, while there were none in 3Q25, 4Q24 and 3Q24. In 3Q25, 2Q25, 1Q25, 4Q24, and 3Q24 brokered time deposits were $550 million, $635 million, $635 million, $702 million, and $702 million, respectively. (2) Average deposit account balances in Deposit Mix Slide calculated as of December 31, 2024 (2) (2) (1)

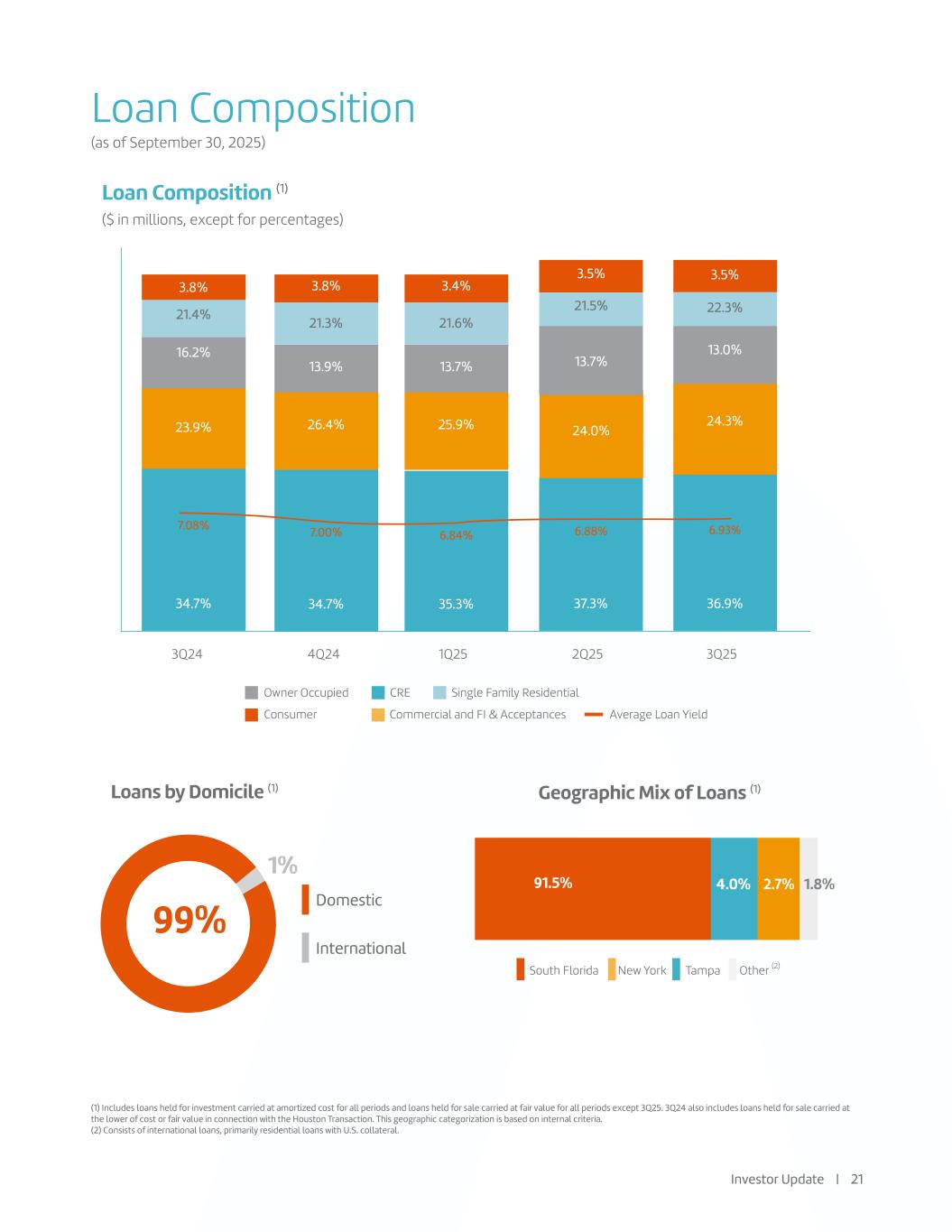

Loan Composition Loan Composition (1) ($ in millions, except for percentages) (1) Includes loans held for investment carried at amortized cost for all periods and loans held for sale carried at fair value for all periods except 3Q25. 3Q24 also includes loans held for sale carried at the lower of cost or fair value in connection with the Houston Transaction. This geographic categorization is based on internal criteria. (2) Consists of international loans, primarily residential loans with U.S. collateral. South Florida New York Tampa Other (2) Owner Occupied CRE Single Family Residential Consumer Commercial and FI & Acceptances Average Loan Yield Loans by Domicile (1) Geographic Mix of Loans (1) 3Q24 4Q24 1Q25 2Q25 3Q25 Domestic International 99% 91.5% 4.0% 1.8% Investor Update | 21 3.4% 21.6% 13.7% 25.9% 35.3% 6.84% 37.3% 36.9% 3.5% 21.5% 13.7% 24.0% 6.88% 6.93% 3.5% 22.3% 13.0% 24.3% (as of September 30, 2025) 34.7% 7.08% 3.8% 21.4% 16.2% 23.9% 3.8% 21.3% 13.9% 26.4% 34.7% 7.00% 1% 2.7%

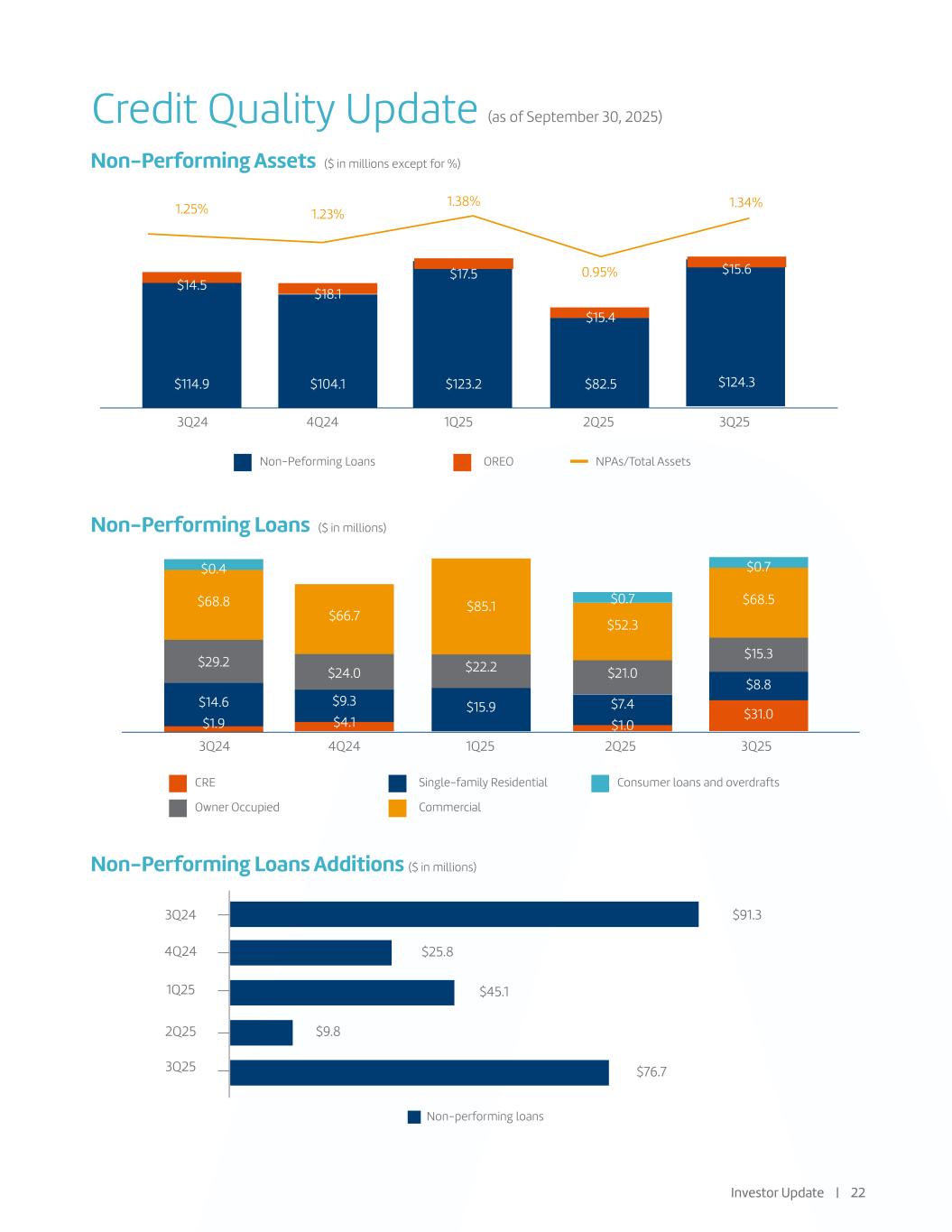

Credit Quality Update Non-Performing Assets ($ in millions except for %) (as of September 30, 2025) Non-Performing Loans ($ in millions) Non-Performing Loans Additions ($ in millions) Non-Peforming Loans OREO NPAs/Total Assets 3Q24 4Q24 1Q25 $114.9 $104.1 $123.2 1.25% 1.23% 1.38% $82.5 0.95% $124.3 1.34% 2Q25 3Q25 $14.5 $17.5 $18.1 $15.4 $15.6 CRE Single-family Residential 3Q24 4Q24 1Q25 2Q25 3Q25 Owner Occupied Commercial Consumer loans and overdrafts $14.6 $29.2 $68.8 $0.4 $1.9 $9.3 $24.0 $66.7 $4.1 $15.9 $22.2 $85.1 $7.4 $21.0 $52.3 $1.0 $8.8 $15.3 $68.5 $0.7 $31.0 $0.7 Non-performing loans 3Q24 4Q24 1Q25 $45.1 $91.3 $25.8 $9.8 $76.7 2Q25 3Q25 Investor Update | 22

($ in millions) Primarily 12 loans placed in non-accrual status: 3 CRE loans totaling $31.0 million (1 construction loan in TX, 1 multifamily in NY and 1 retail property in FL) 9 Commercial loans totaling $38.6 million; loans are diversified across different industries, primarily in FL Other smaller loans totaling $7.1 million Non-Performing Loans NCOs and Allowance for Credit Losses $(24.1) $(9.5) Paydown/ Payoffs 2Q25 Charge-offs $82.5 3Q25 $(0.7) Transfer to OREO $124.3 Downgrade to NPLs $76.7 $(0.6) Upgrades $6.1$2.7 Requirement for Charge- offs 2Q25 Recoveries $86.5 3Q25 $7.8 Specific Reserve Change $94.9 $3.6 Credit Quality and Macroeconomics Factor updates $(2.3) Loan Balance ACL Roll-forward ($ in millions) $(9.5) Gross Charge-offs Investor Update | 23 On October 24, 2025, the Company collected $11.8 million on a commercial loan that had been previously charged off. The collection of this loan resulted in a loan recovery of $8.7 million and interest income recovery of $0.3 million in the fourth quarter of 2025.

Allowance for Credit Losses Composition ($ in thousands) NCOs and NCO-to-Loans Ratio ($ in thousands) Portfolios Balance 2Q25 Reserve Build (Release) Balance 3Q25 $23,056 $40,048 $23,415 $86,519 Real Estate Commercial Consumer and Others Total ACL $1,328 $8,410 $(1,339) $8,399 $24,384 $48,458 $22,076 $94,918 3Q24 4Q24 1Q25 2Q25 3Q25 $3,487 $2,935 $2,904$1,848 CRE n Single-family Residential Commercial LoansOwner Occupied $60 Consumer Loans and Overdrafts $831$130 $1,799$13,892$156 $1,262$4,368$1,191 $30 3Q24 4Q24 1Q25 2Q25 3Q25 NCO/Average Total Loans Held for Investment 1.90% 0.26% 0.22% 0.86% 0.39% (% are annualized) (1) (1) Charge-offs net of recoveries, which are immaterial for all periods Investor Update | 24

Credit Quality Update (78.1) 145.8 Paydown/ Payoffs 2Q25 Downgrades Charge-offs $241.8 3Q25 (29.5) Loans Sold (31.2) 2Q25 Downgrades to Classified 132.8 3Q25 (29.9) Payoffs/Paydowns 215.4 Downgrades to Special Mention composed primarily of 5 commercial loans ($100.6MM), 2 CRE loans totaling ($25.3MM), 3 owner-occupied loan totaling ($26.1 MM) and 1 single-residential loan ($0.7MM) Downgrades from Special mention to Classified composed of 1 CRE Loans ($19.6MM), 2 commercial loans ($10.1MM) and 1 related owner-occupied loan ($1.5 million) Paydowns/Payoffs primarily composed of payoff of 3 CRE loans ($19.1MM) and 3 commercial loans ($9.0MM) Remarks (9.5) Charge-offs totaled $9.5 million composed mainly of 2 commercial loans ($4.1MM), 1 CRE Loan ($1.3MM), small business commercial loans ($1.8MM) and consumer loans ($1.8MM) Paydowns/Payoffs totaled mainly composed of 3 CRE loans ($43.4MM), 2 owner occupied loans ($17.9MM) and 2 commercial loan (13.4MM) Loan sold composed of 1 owner occupied loan ($29.5MM) Remarks Special Mention Loans ($ in millions) Classified Loans ($ in millions) Investor Update | 25 (as of September 30, 2025) 224.3 (0.9) Loss on Sale (0.7) Transfer to OREO Downgrade to SM 152.7 (0.6) Upgrades

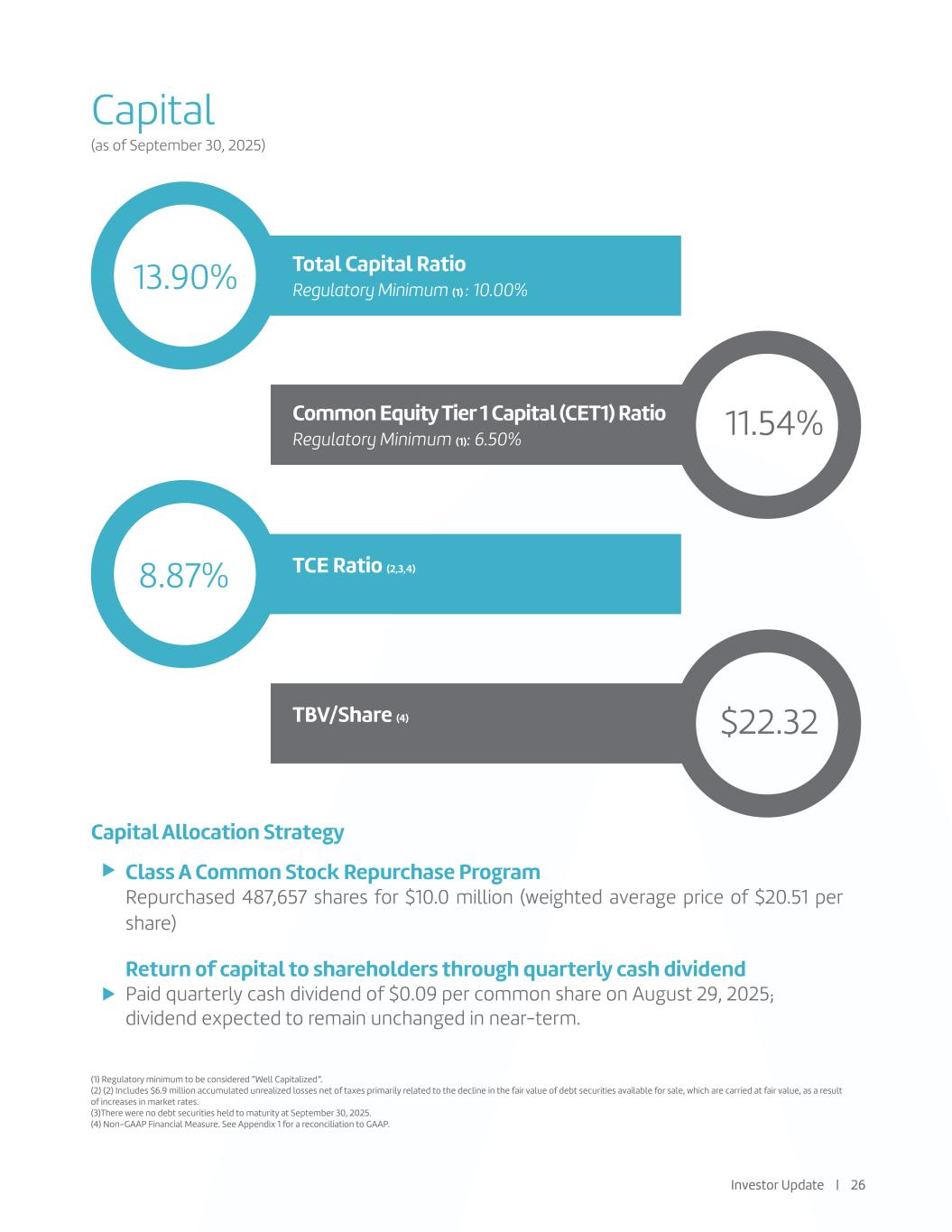

Capital 13.90% 8.87% 11.54% $22.32 Total Capital Ratio Regulatory Minimum (1) : 10.00% Common Equity Tier 1 Capital (CET1) Ratio Regulatory Minimum (1): 6.50% TCE Ratio (2,3,4) TBV/Share (4) Capital Allocation Strategy Class A Common Stock Repurchase Program Repurchased 487,657 shares for $10.0 million (weighted average price of $20.51 per share) Return of capital to shareholders through quarterly cash dividend Investor Update | 26 (as of September 30, 2025) Paid quarterly cash dividend of $0.09 per common share on August 29, 2025; dividend expected to remain unchanged in near-term. (1) Regulatory minimum to be considered “Well Capitalized”. (2) (2) Includes $6.9 million accumulated unrealized losses net of taxes primarily related to the decline in the fair value of debt securities available for sale, which are carried at fair value, as a result of increases in market rates. (3)There were no debt securities held to maturity at September 30, 2025. (4) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP.

Liquidity Semi-annual regular testing of lines of credit; satisfactory results have been obtained as of June 30, 2025. Daily monitoring of Federal Reserve Bank account balances as well as large fund providers. Daily analysis of lending pipeline and deposit gathering opportunities and their impact on cash flow projections. Threshold associated with liquidity stress test scenarios. Threshold for deposit concentration. Limits on liquidity ratios. Active collateral management of both loan and investment portfolios with lending facilities at FHLB and FRB. 99% of the total securities portfolio has government guarantee, while the remainder is rated investment grade. Total advances with the FHLB were $832 million. Borrowing capacity with the FED and FHLB is approximately $3.1 billion, including both securities and loans as collateral. Strong level of cash on hand: $571 million as of 3Q25 at the Federal Reserve Bank (“FRB”) account. Continued efforts to improve ratio of uninsured deposits to total deposits by offering FDIC insurance through Insured Cash Sweep (“ICS”). Our standard liquidity management practices include: Available line of credit with the FED & FHLB as of 3Q25: Additional actions that strenghten liquidity position: Investor Update | 27 (as of September 30, 2025)

Supplemental Information

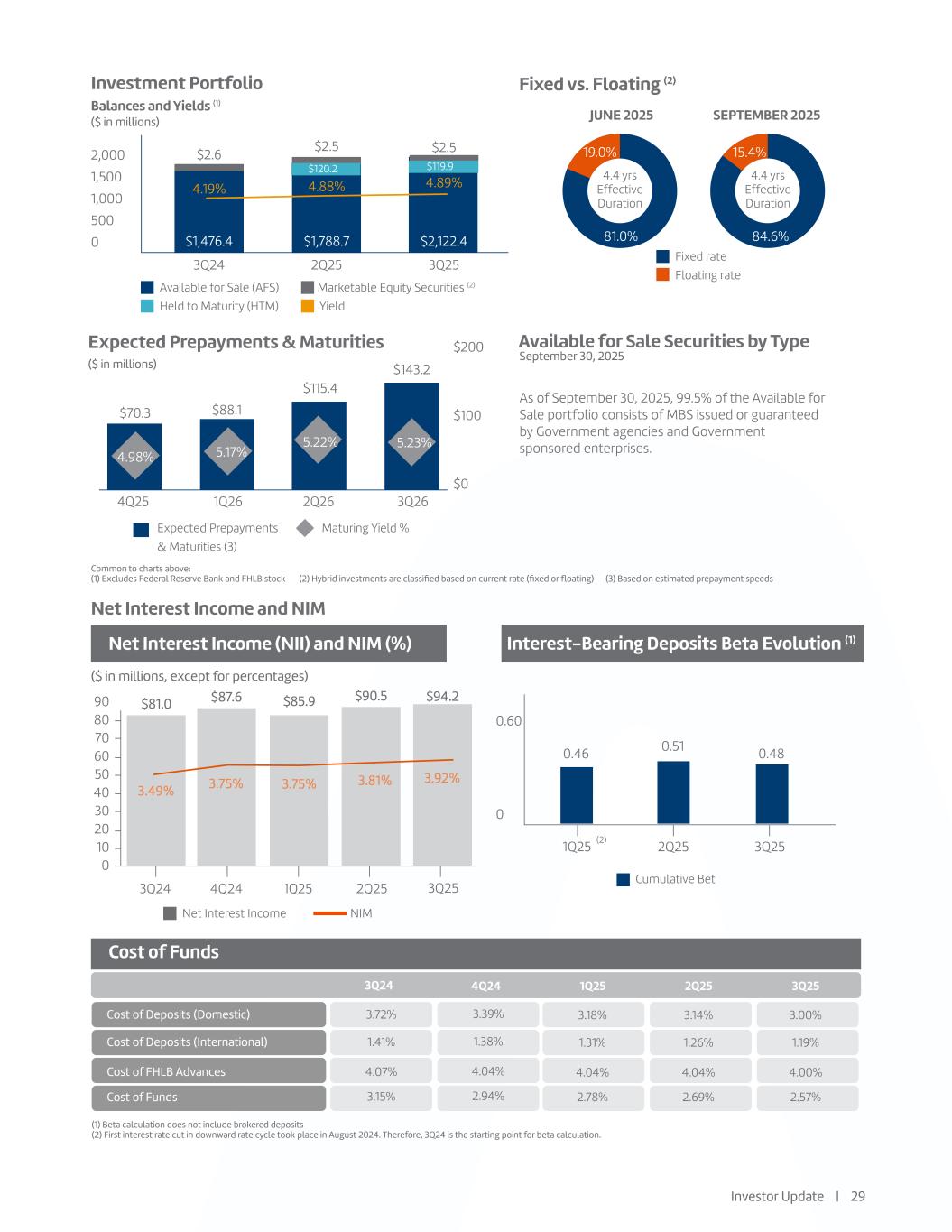

3.75% $85.9 Net Interest Income and NIM ($ in millions, except for percentages) Net Interest Income (NII) and NIM (%) Interest-Bearing Deposits Beta Evolution (1) Cost of Funds Cumulative Bet Net Interest Income NIM 90 80 70 60 50 40 30 20 10 0 0.60 0 2Q25 $87.6 3.75%3.49% $81.0 1Q25 3Q24 2Q25 4Q24 3Q25 1Q25 Cost of Deposits (Domestic) Cost of Deposits (International) Cost of FHLB Advances Cost of Funds 3Q24 4Q24 Investment Portfolio Balances and Yields (1) ($ in millions) Available for Sale (AFS) Marketable Equity Securities (2) Held to Maturity (HTM) Yield 2,000 1,500 1,000 500 0 $2.6 $2.5 3Q24 2Q25 3Q25 $1,476.4 $1,788.7 $2,122.4 4.19% 4.88% 4.89% $2.5 Fixed vs. Floating (2) JUNE 2025 4.4 yrs Effective Duration Fixed rate Floating rate 19.0% 81.0% Available for Sale Securities by Type September 30, 2025 As of September 30, 2025, 99.5% of the Available for Sale portfolio consists of MBS issued or guaranteed by Government agencies and Government sponsored enterprises. Common to charts above: (1) Excludes Federal Reserve Bank and FHLB stock (2) Hybrid investments are classified based on current rate (fixed or floating) (3) Based on estimated prepayment speeds Investor Update | 29 3.18% 1.31% 4.04% 2.78% Expected Prepayments & Maturities ($ in millions) 3.14% 1.26% 4.04% 2.69% 3.00% 1.19% 4.00% 2.57% 3.81% $90.5 SEPTEMBER 2025 4.4 yrs Effective Duration 15.4% 84.6% 4Q25 1Q26 2Q26 3Q26 4.98% 5.17% 5.22% 5.23% $70.3 $88.1 $115.4 $143.2 Expected Prepayments & Maturities (3) Maturing Yield % $200 $100 $0 3Q25 3.92% $94.2 0.48 $120.2 $119.9 0.510.46 (1) Beta calculation does not include brokered deposits (2) First interest rate cut in downward rate cycle took place in August 2024. Therefore, 3Q24 is the starting point for beta calculation. 3.72% 1.41% 4.07% 3.15% 3.39% 1.38% 4.04% 2.94% 1Q25 2Q25 3Q25 (2)

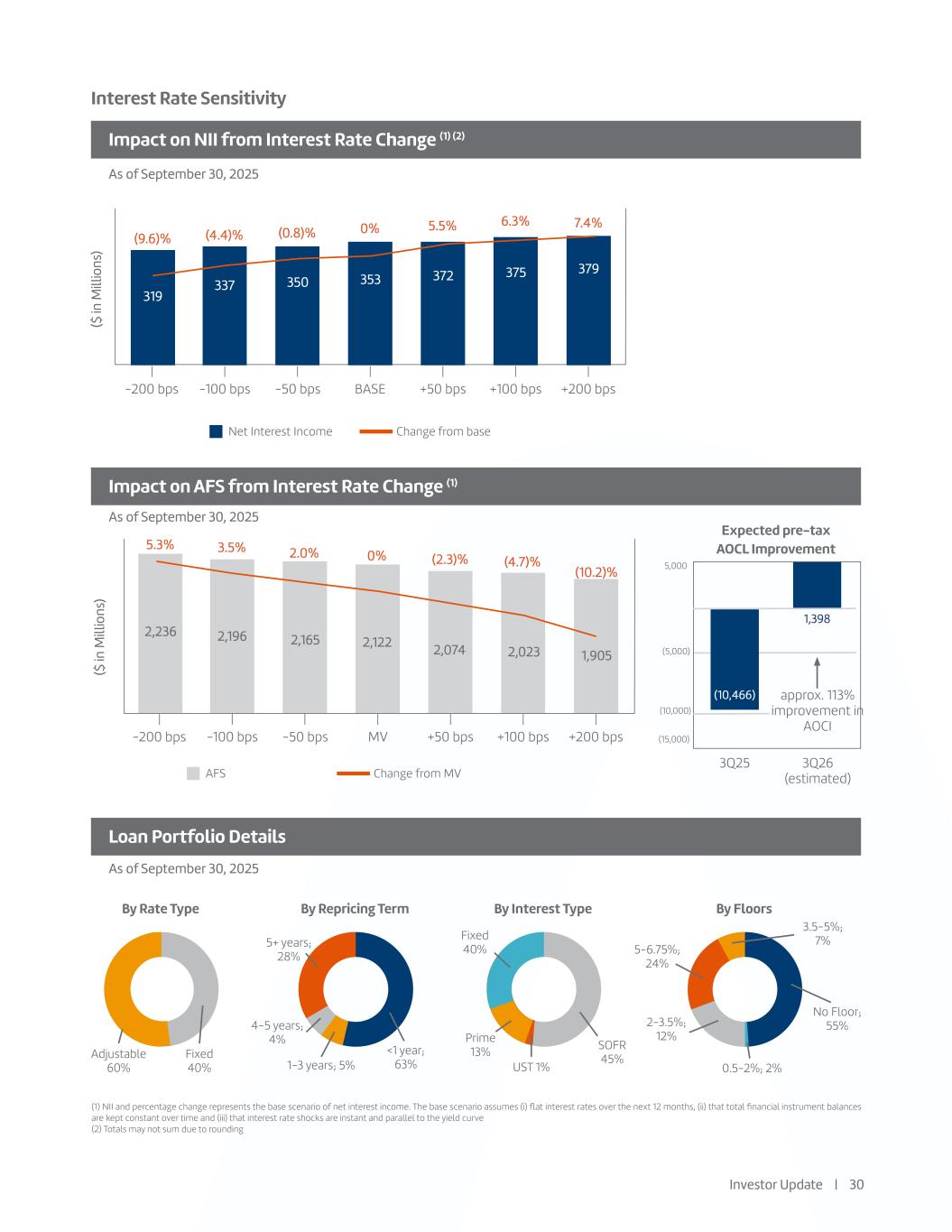

Interest Rate Sensitivity Impact on NII from Interest Rate Change (1) (2) Impact on AFS from Interest Rate Change (1) Loan Portfolio Details As of September 30, 2025 As of September 30, 2025 ($ in M ill io ns ) ($ in M ill io ns ) Net Interest Income Change from base AFS Change from MV (9.6)% 5.3% 319 337 350 353 372 (10,466) 1,398 375 379 (4.4)% 3.5% (0.8)% 2.0% 0% 0% 5.5% (2.3)% 6.3% (4.7)% 7.4% (10.2)% -200 bps 5,000 3Q25 3Q26 (estimated) approx. 113% improvement in AOCI (5,000) -200 bps -100 bps -100 bps -50 bps -50 bps BASE MV +50 bps +50 bps +100 bps +100 bps +200 bps +200 bps (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve (2) Totals may not sum due to rounding Expected pre-tax AOCL Improvement By Rate Type By Repricing Term By Interest Type By Floors Adjustable 60% Fixed 40% 5+ years; 28% <1 year; 63% Fixed 40% UST 1% Prime 13% 4-5 years; 4% 1-3 years; 5% SOFR 45% 5-6.75%; 24% 3.5-5%; 7% 2-3.5%; 12% 0.5-2%; 2% No Floor; 55% Investor Update | 30 As of September 30, 2025 (10,000) 2,236 2,196 2,165 2,122 2,074 2,023 1,905 (15,000)

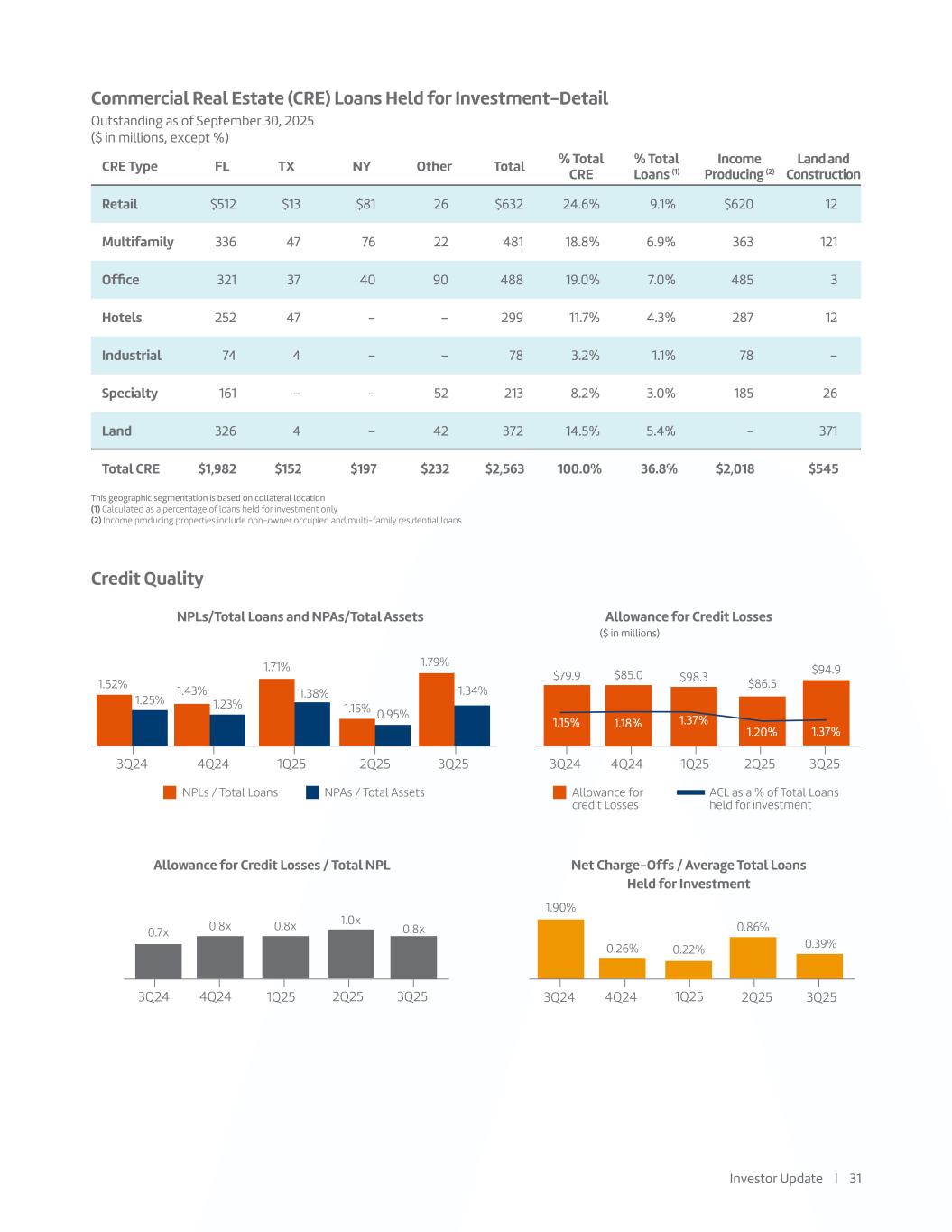

Commercial Real Estate (CRE) Loans Held for Investment-Detail Credit Quality Outstanding as of September 30, 2025 ($ in millions, except %) This geographic segmentation is based on collateral location (1) Calculated as a percentage of loans held for investment only (2) Income producing properties include non-owner occupied and multi-family residential loans CRE Type Retail Multifamily Office Industrial Hotels Specialty Total CRE Land FL TX NY Other Total % Total CRE % Total Loans (1) Income Producing (2) Land and Construction $512 $13 $81 26 $632 24.6% 9.1% $620 12 336 47 76 22 481 18.8% 6.9% 363 121 321 37 40 90 488 19.0% 7.0% 485 3 252 47 – – 299 11.7% 4.3% 287 12 74 4 – – 78 3.2% 1.1% 78 – 161 – – 52 213 8.2% 3.0% 185 26 326 4 – 42 372 14.5% 5.4% - 371 $1,982 $152 $197 $232 $2,563 100.0% 36.8% $2,018 $545 1Q25 4Q24 4Q24 4Q24 1.43%1.52% 1.25% $85.0 0.8x 0.26% $79.9 0.7x 1.90% 1.23% 2Q25 1Q25 1Q25 1Q25 3Q25 2Q25 2Q25 2Q25 3Q24 3Q25 3Q25 3Q25 4Q24 3Q24 3Q24 3Q24 ($ in millions) NPLs/Total Loans and NPAs/Total Assets Allowance for Credit Losses / Total NPL Allowance for Credit Losses Net Charge-Offs / Average Total Loans Held for Investment NPLs / Total Loans NPAs / Total Assets Allowance for credit Losses ACL as a % of Total Loans held for investment 1.18%1.15% Investor Update | 31 1.71% 1.38% $98.3 1.37% 0.8x 0.22% 0.95%1.15% $86.5 1.20% 1.0x 0.86% 1.34% $94.9 1.37% 0.8x 0.39% 1.79%

Investor Update | 32 $0.35 Change in Diluted Earnings Per Common Share EPS Trend Income Tax Expense2Q25 PPNR (1) 3Q25 $0.60 $0.40 $0.20 $- $(0.20) $(0.40) (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP. Provision for Credit Losses $0.05 $(0.20) $0.55 $(0.05) Net Interest Margin Securities2Q25 Loans Cost of FundsOther Earning Asset Mix 0.15% (0.05)%(0.03)% 3.92% NIM Bridge 3.81% 0.04% 3Q25

Glossary Investor Update | 33 • Assets under management and custody: consists of assets held for clients in an agency or fiduciary capacity which are not assets of the Company and therefore are not included in the consolidated financial statements. • Core deposits: consist of total deposits excluding all time deposits • Total gross loans : include loans held for investment net of unamortized deferred loan origination fees and costs, as well as loans held for sale. • Cost of Total Deposits: calculated based upon the average balance of total noninterest bearing and interest bearing deposits, which includes time deposits. • ROA: calculated based upon the average daily balance of total assets • ROE: calculated based upon the average daily balance of stockholders’ equity • Loans Held for Investment: excludes loans held for sale carried at fair value and loans held for sale carried at the lower of cost or fair value • Non-performing loans include accruing loans past due by 90 days or more and all nonaccrual loans. Non-performing assets include accruing loans past due by 90 days or more, all nonaccrual loans, other real estate owned (“OREO”) properties acquired through or in lieu of foreclosure and other repossessed assets. • Net Charge Offs/Average Total Loans Held for Investment: – Annualized and calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan fees and costs, excluding the allowance for credit losses – Total loans exclude loans held for sale • Cost of Deposits: calculated based upon the average balance of total noninterest bearing and interest bearing deposits, which includes time deposits. • Cost of Funds: calculated based upon the average balance of total financial liabilities which include total interest bearing liabilities and noninterest bearing demand deposits • Quarterly beta (as shown in NII & NIM Slide): calculated based upon the change of the cost of deposit over the change of Federal funds rate (if any) during the quarter. • Net Charge-Offs -charge-offs net of recoveries • Totals may not sum due to rounding of line items. • ACL - Allowance for Credit Losses • AFS - Available for Sale • AOCL - Accumulated Other Comprehensive Loss • AUM - Assets Under Management • CET 1 - Common Equity Tier 1 capital ratio • CRE - Commercial Real Estate • Customer CDs - Customer certificate of deposits • EPS – Earnings per Share • FHLB - Federal Home Loan Bank • FTE - Full Time Equivalent • MV - Market Value • NCO - Net Charge-Offs • NPL - Non-Performing Loans • NPA - Non-Performing Assets • NII - Net Interest Income • NIM – Net Interest Margin • ROA - Return on Assets • ROE - Return on Equity • SOFR - Secured Overnight Financing Rate • TCE ratio – Tangible Common Equity ratio

Appendix

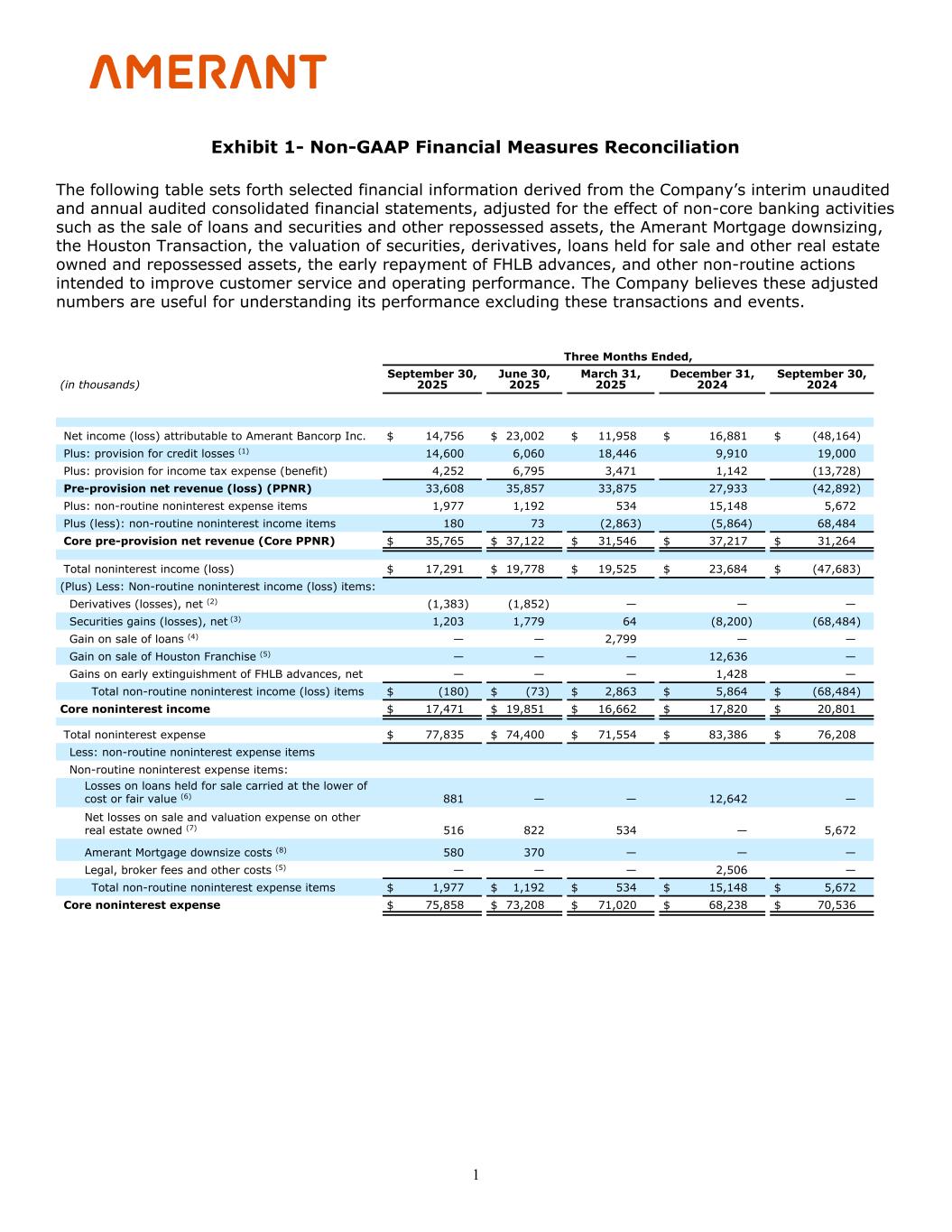

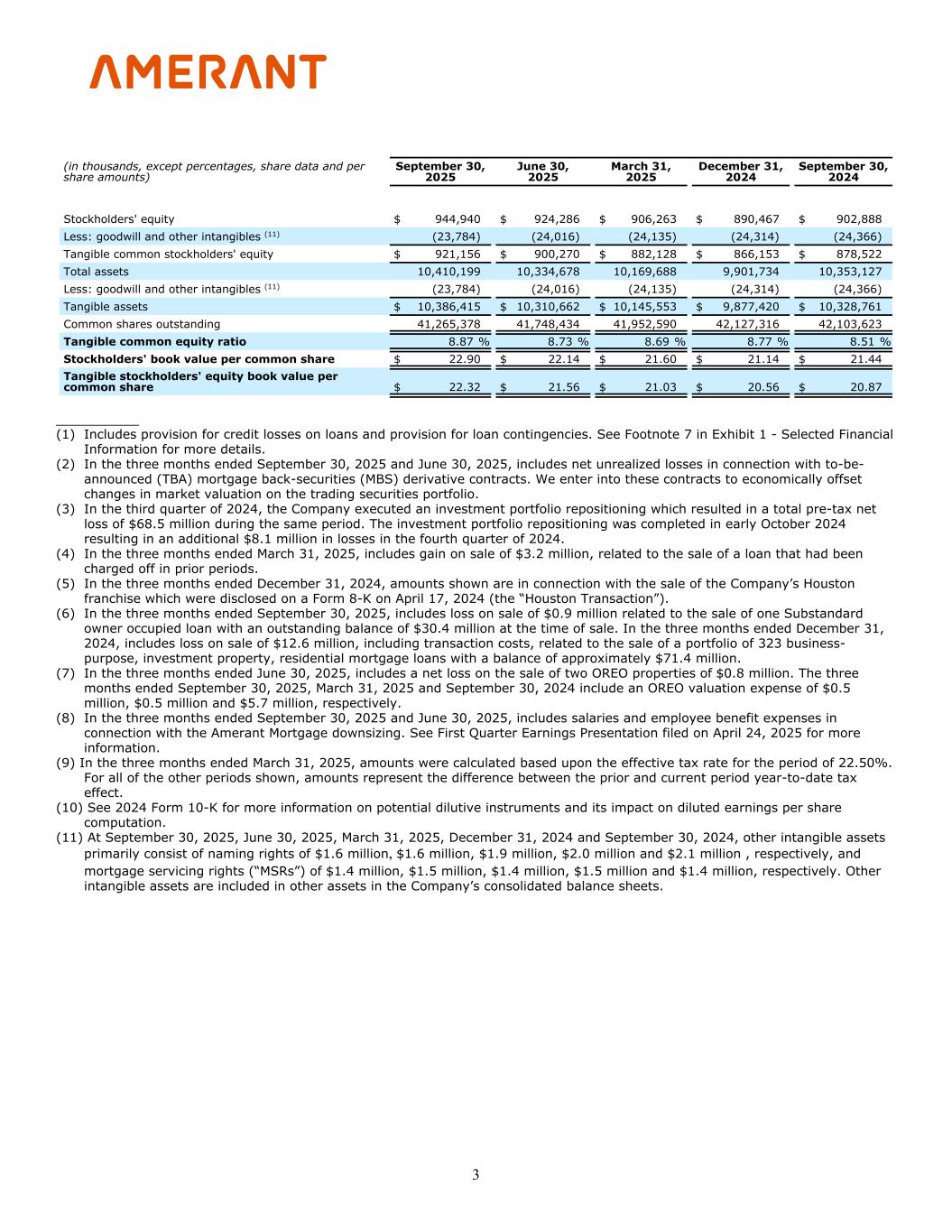

Exhibit 1- Non-GAAP Financial Measures Reconciliation The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for the effect of non-core banking activities such as the sale of loans and securities and other repossessed assets, the Amerant Mortgage downsizing, the Houston Transaction, the valuation of securities, derivatives, loans held for sale and other real estate owned and repossessed assets, the early repayment of FHLB advances, and other non-routine actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful for understanding its performance excluding these transactions and events. (in thousands) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net income (loss) attributable to Amerant Bancorp Inc. $ 14,756 $ 23,002 $ 11,958 $ 16,881 $ (48,164) Plus: provision for credit losses (1) 14,600 6,060 18,446 9,910 19,000 Plus: provision for income tax expense (benefit) 4,252 6,795 3,471 1,142 (13,728) Pre-provision net revenue (loss) (PPNR) 33,608 35,857 33,875 27,933 (42,892) Plus: non-routine noninterest expense items 1,977 1,192 534 15,148 5,672 Plus (less): non-routine noninterest income items 180 73 (2,863) (5,864) 68,484 Core pre-provision net revenue (Core PPNR) $ 35,765 $ 37,122 $ 31,546 $ 37,217 $ 31,264 Total noninterest income (loss) $ 17,291 $ 19,778 $ 19,525 $ 23,684 $ (47,683) (Plus) Less: Non-routine noninterest income (loss) items: Derivatives (losses), net (2) (1,383) (1,852) — — — Securities gains (losses), net (3) 1,203 1,779 64 (8,200) (68,484) Gain on sale of loans (4) — — 2,799 — — Gain on sale of Houston Franchise (5) — — — 12,636 — Gains on early extinguishment of FHLB advances, net — — — 1,428 — Total non-routine noninterest income (loss) items $ (180) $ (73) $ 2,863 $ 5,864 $ (68,484) Core noninterest income $ 17,471 $ 19,851 $ 16,662 $ 17,820 $ 20,801 Total noninterest expense $ 77,835 $ 74,400 $ 71,554 $ 83,386 $ 76,208 Less: non-routine noninterest expense items Non-routine noninterest expense items: Losses on loans held for sale carried at the lower of cost or fair value (6) 881 — — 12,642 — Net losses on sale and valuation expense on other real estate owned (7) 516 822 534 — 5,672 Amerant Mortgage downsize costs (8) 580 370 — — — Legal, broker fees and other costs (5) — — — 2,506 — Total non-routine noninterest expense items $ 1,977 $ 1,192 $ 534 $ 15,148 $ 5,672 Core noninterest expense $ 75,858 $ 73,208 $ 71,020 $ 68,238 $ 70,536 Three Months Ended, 1

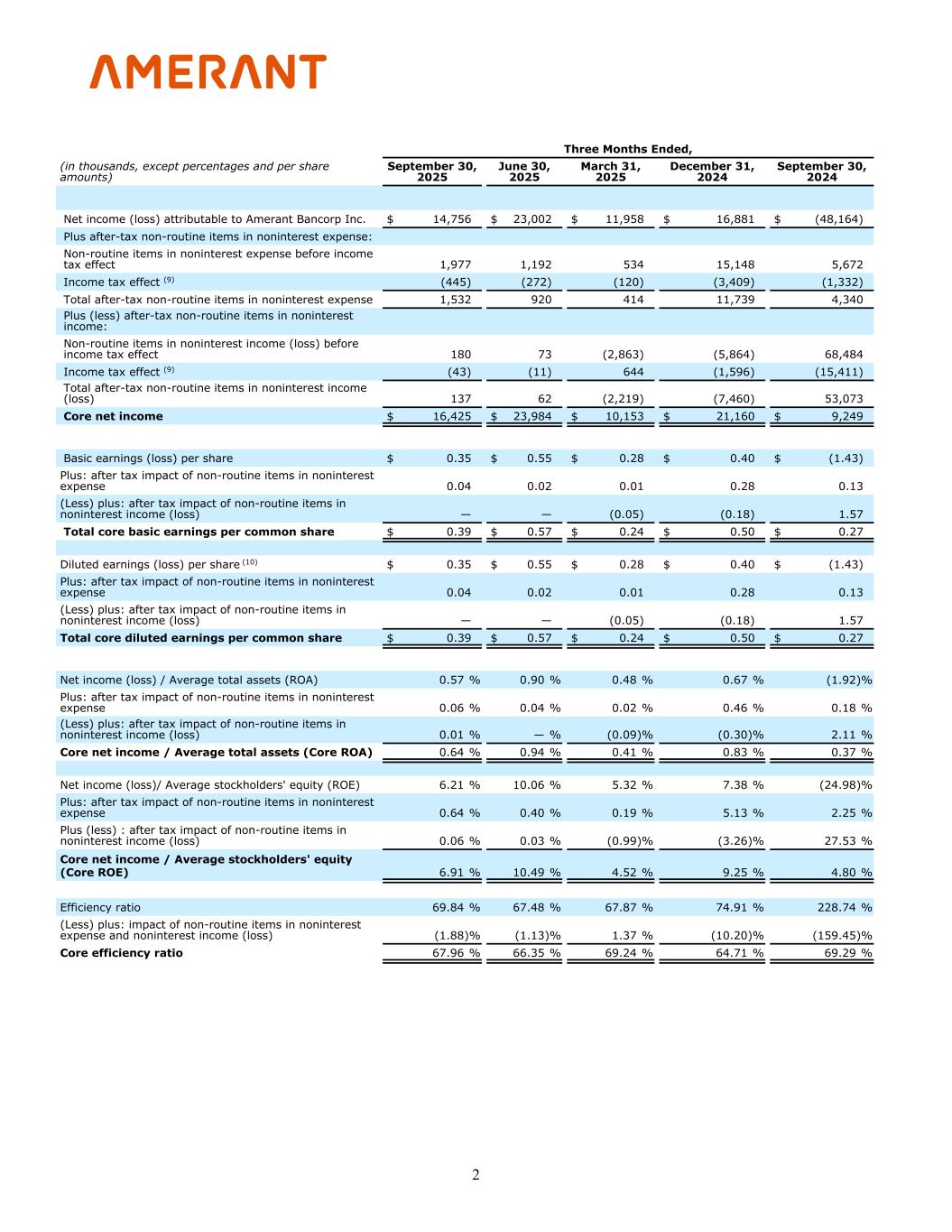

(in thousands, except percentages and per share amounts) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Net income (loss) attributable to Amerant Bancorp Inc. $ 14,756 $ 23,002 $ 11,958 $ 16,881 $ (48,164) Plus after-tax non-routine items in noninterest expense: Non-routine items in noninterest expense before income tax effect 1,977 1,192 534 15,148 5,672 Income tax effect (9) (445) (272) (120) (3,409) (1,332) Total after-tax non-routine items in noninterest expense 1,532 920 414 11,739 4,340 Plus (less) after-tax non-routine items in noninterest income: Non-routine items in noninterest income (loss) before income tax effect 180 73 (2,863) (5,864) 68,484 Income tax effect (9) (43) (11) 644 (1,596) (15,411) Total after-tax non-routine items in noninterest income (loss) 137 62 (2,219) (7,460) 53,073 Core net income $ 16,425 $ 23,984 $ 10,153 $ 21,160 $ 9,249 Basic earnings (loss) per share $ 0.35 $ 0.55 $ 0.28 $ 0.40 $ (1.43) Plus: after tax impact of non-routine items in noninterest expense 0.04 0.02 0.01 0.28 0.13 (Less) plus: after tax impact of non-routine items in noninterest income (loss) — — (0.05) (0.18) 1.57 Total core basic earnings per common share $ 0.39 $ 0.57 $ 0.24 $ 0.50 $ 0.27 Diluted earnings (loss) per share (10) $ 0.35 $ 0.55 $ 0.28 $ 0.40 $ (1.43) Plus: after tax impact of non-routine items in noninterest expense 0.04 0.02 0.01 0.28 0.13 (Less) plus: after tax impact of non-routine items in noninterest income (loss) — — (0.05) (0.18) 1.57 Total core diluted earnings per common share $ 0.39 $ 0.57 $ 0.24 $ 0.50 $ 0.27 Net income (loss) / Average total assets (ROA) 0.57 % 0.90 % 0.48 % 0.67 % (1.92) % Plus: after tax impact of non-routine items in noninterest expense 0.06 % 0.04 % 0.02 % 0.46 % 0.18 % (Less) plus: after tax impact of non-routine items in noninterest income (loss) 0.01 % — % (0.09) % (0.30) % 2.11 % Core net income / Average total assets (Core ROA) 0.64 % 0.94 % 0.41 % 0.83 % 0.37 % Net income (loss)/ Average stockholders' equity (ROE) 6.21 % 10.06 % 5.32 % 7.38 % (24.98) % Plus: after tax impact of non-routine items in noninterest expense 0.64 % 0.40 % 0.19 % 5.13 % 2.25 % Plus (less) : after tax impact of non-routine items in noninterest income (loss) 0.06 % 0.03 % (0.99) % (3.26) % 27.53 % Core net income / Average stockholders' equity (Core ROE) 6.91 % 10.49 % 4.52 % 9.25 % 4.80 % Efficiency ratio 69.84 % 67.48 % 67.87 % 74.91 % 228.74 % (Less) plus: impact of non-routine items in noninterest expense and noninterest income (loss) (1.88) % (1.13) % 1.37 % (10.20) % (159.45) % Core efficiency ratio 67.96 % 66.35 % 69.24 % 64.71 % 69.29 % Three Months Ended, 2

(in thousands, except percentages, share data and per share amounts) September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 Stockholders' equity $ 944,940 $ 924,286 $ 906,263 $ 890,467 $ 902,888 Less: goodwill and other intangibles (11) (23,784) (24,016) (24,135) (24,314) (24,366) Tangible common stockholders' equity $ 921,156 $ 900,270 $ 882,128 $ 866,153 $ 878,522 Total assets 10,410,199 10,334,678 10,169,688 9,901,734 10,353,127 Less: goodwill and other intangibles (11) (23,784) (24,016) (24,135) (24,314) (24,366) Tangible assets $ 10,386,415 $ 10,310,662 $ 10,145,553 $ 9,877,420 $ 10,328,761 Common shares outstanding 41,265,378 41,748,434 41,952,590 42,127,316 42,103,623 Tangible common equity ratio 8.87 % 8.73 % 8.69 % 8.77 % 8.51 % Stockholders' book value per common share $ 22.90 $ 22.14 $ 21.60 $ 21.14 $ 21.44 Tangible stockholders' equity book value per common share $ 22.32 $ 21.56 $ 21.03 $ 20.56 $ 20.87 ____________ (1) Includes provision for credit losses on loans and provision for loan contingencies. See Footnote 7 in Exhibit 1 - Selected Financial Information for more details. (2) In the three months ended September 30, 2025 and June 30, 2025, includes net unrealized losses in connection with to-be- announced (TBA) mortgage back-securities (MBS) derivative contracts. We enter into these contracts to economically offset changes in market valuation on the trading securities portfolio. (3) In the third quarter of 2024, the Company executed an investment portfolio repositioning which resulted in a total pre-tax net loss of $68.5 million during the same period. The investment portfolio repositioning was completed in early October 2024 resulting in an additional $8.1 million in losses in the fourth quarter of 2024. (4) In the three months ended March 31, 2025, includes gain on sale of $3.2 million, related to the sale of a loan that had been charged off in prior periods. (5) In the three months ended December 31, 2024, amounts shown are in connection with the sale of the Company’s Houston franchise which were disclosed on a Form 8-K on April 17, 2024 (the “Houston Transaction”). (6) In the three months ended September 30, 2025, includes loss on sale of $0.9 million related to the sale of one Substandard owner occupied loan with an outstanding balance of $30.4 million at the time of sale. In the three months ended December 31, 2024, includes loss on sale of $12.6 million, including transaction costs, related to the sale of a portfolio of 323 business- purpose, investment property, residential mortgage loans with a balance of approximately $71.4 million. (7) In the three months ended June 30, 2025, includes a net loss on the sale of two OREO properties of $0.8 million. The three months ended September 30, 2025, March 31, 2025 and September 30, 2024 include an OREO valuation expense of $0.5 million, $0.5 million and $5.7 million, respectively. (8) In the three months ended September 30, 2025 and June 30, 2025, includes salaries and employee benefit expenses in connection with the Amerant Mortgage downsizing. See First Quarter Earnings Presentation filed on April 24, 2025 for more information. (9) In the three months ended March 31, 2025, amounts were calculated based upon the effective tax rate for the period of 22.50%. For all of the other periods shown, amounts represent the difference between the prior and current period year-to-date tax effect. (10) See 2024 Form 10-K for more information on potential dilutive instruments and its impact on diluted earnings per share computation. (11) At September 30, 2025, June 30, 2025, March 31, 2025, December 31, 2024 and September 30, 2024, other intangible assets primarily consist of naming rights of $1.6 million, $1.6 million, $1.9 million, $2.0 million and $2.1 million , respectively, and mortgage servicing rights (“MSRs”) of $1.4 million, $1.5 million, $1.4 million, $1.5 million and $1.4 million, respectively. Other intangible assets are included in other assets in the Company’s consolidated balance sheets. 3

Thank You NYSE: AMTB amerantbank.com