Investor Credit Update December 30, 2025 NYSE: AMTB amerantbank.com

Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. Examples of forward-looking statements include but are not limited to: our future operating or financial performance, including revenues, expenses, expense savings, income or loss and earnings or loss per share, and other financial items; statements regarding expectations, plans or objectives for future operations, products or services, and our expectations on our securities repositioning and loan recoveries, reaching effective resolutions on problem loans, or significantly reducing special mention and/or non-performing loans. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2024 filed on March 5, 2025, and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov.

Focus on updating credit risk migration, reducing non-performing assets, and allocating additional resources to accelerate resolution Credit Administration and business lines proactively addressed covenant testing and financial statement updates across the loan portfolio. Additional resources were deployed to expedite these reviews, and resulting risk rating updates were incorporated as part of this process. Weekly all-hands leadership meetings were launched to focus on special assets through a dedicated working group, ensuring continuos oversight, streamlined coordination, and progress tracking. Credit Review expanded portfolio coverage by engaging a well-recognized third-party firm to accelerate risk rating testing and validation efforts during 3Q and 4Q. The Special Assets group actively pursued resolutions of criticized credits, including loan sales, while also increasing focus on collections from previously charged-off loans and recovery Investor Credit Update | 2 Credit Quality remains a core priority for Amerant, and this Credit Update underscores our commitment to providing investors with timely insight into our risk profile ahead of year-end. During 4Q25, we intensified efforts to reinforce credit discipline. The actions detailed below reflect close collaboration between our Credit and Business teams to accelerate portfolio reviews and address non-performing assets. These initiatives demonstrate our dedication to strengthening credit risk management and establishing a solid foundation that we expect will result in sustainable, healthy growth. Loan Portfolio Coverage Analysis – Results During 2025, Credit Administration and Credit Review (in-house and third-party) assessed the adequacy of risk ratings for a significant portion of the loan portfolio, achieving a combined review coverage of approximately 85% of commercial and Commercial Real Estate (CRE) loans. Credit Administration reviewed approximately $4.5 billion or 73% of the commercial and CRE loan portfolio commitments through financial statement reviews and covenant testing during 4Q25. Credit Review completed reviews covering $5.3 billion or 85% of the commercial and CRE loan portfolio commitments. The remaining $1.1 billion, representing 18% of total commercial and CRE loans are broken down as follows: Criticized Portfolio Management – Results The Company transferred approximately $94 million from loans held for investment to loans held for sale. This transfer resulted in a non-routine loss of approximately $16 million, inclusive of estimated transaction costs. The Company expects to enter into agreements for the sale of these loans and to close the transactions in January 2026, which will result in a $94 million reduction of classified loans. - $540 million (896 loans) are below $3 million and are being monitored through payment performance. - $351 million (133 loans) were originated during 2025. - $239 million (18 loans) are above $3 million. $70 million are cash or securities secured and $131 million are secured by Real Estate. (1) (1) “Classified loans” describe loans that are substandard and doubtful. We have no loans categorized as doubtful as of the date of this update.

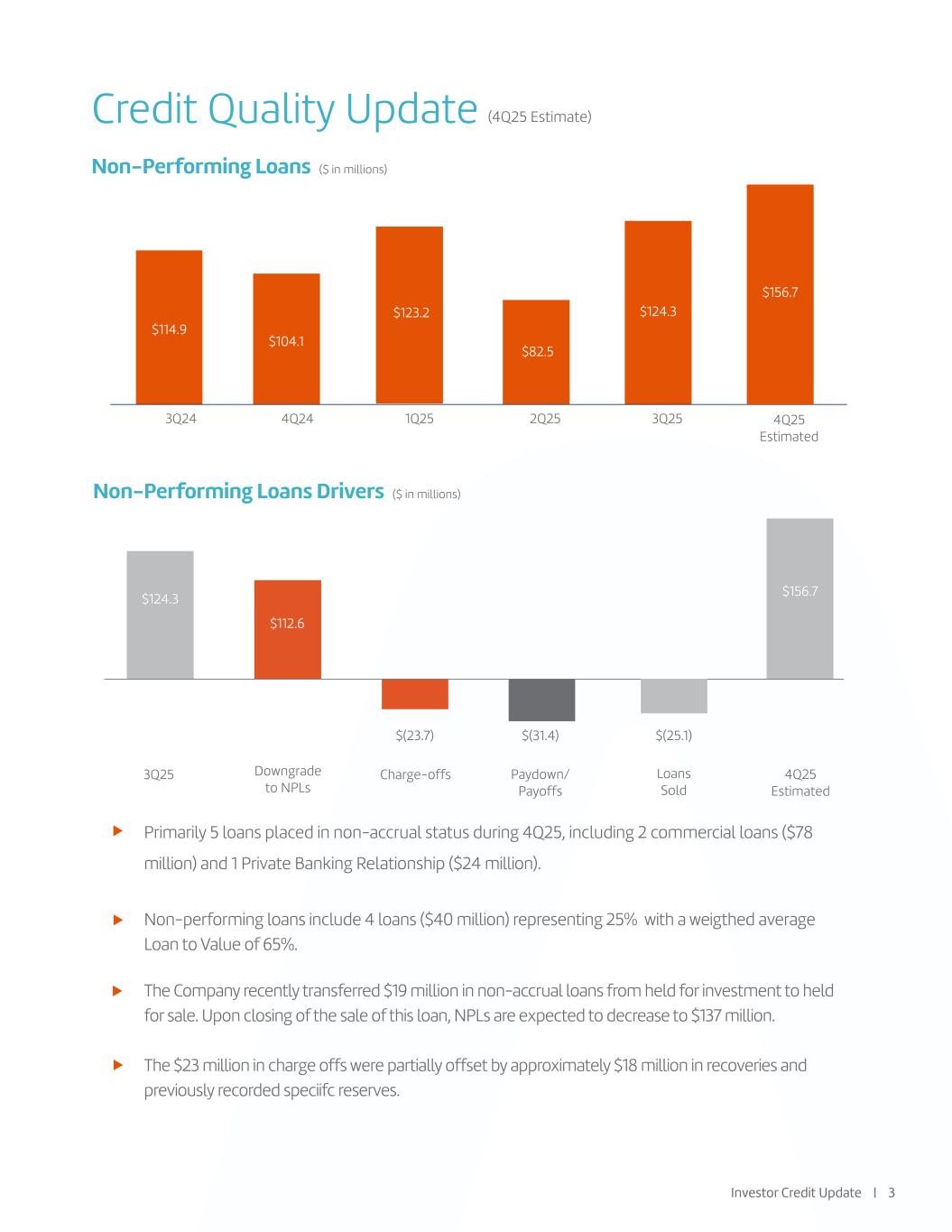

Credit Quality Update (4Q25 Estimate) Non-Performing Loans ($ in millions) 3Q24 4Q24 1Q25 2Q25 3Q25 $114.9 $123.2 $124.3 Investor Credit Update | 3 4Q25 Estimated $156.7 $104.1 $82.5 Primarily 5 loans placed in non-accrual status during 4Q25, including 2 commercial loans ($78 million) and 1 Private Banking Relationship ($24 million). Non-performing loans include 4 loans ($40 million) representing 25% with a weigthed average Loan to Value of 65%. The Company recently transferred $19 million in non-accrual loans from held for investment to held for sale. Upon closing of the sale of this loan, NPLs are expected to decrease to $137 million. The $23 million in charge offs were partially offset by approximately $18 million in recoveries and previously recorded speciifc reserves. $(31.4)$(23.7) Paydown/ Payoffs 3Q25 Charge-offs $124.3 Downgrade to NPLs $112.6 4Q25 Estimated $156.7 Non-Performing Loans Drivers ($ in millions) $(25.1) Loans Sold

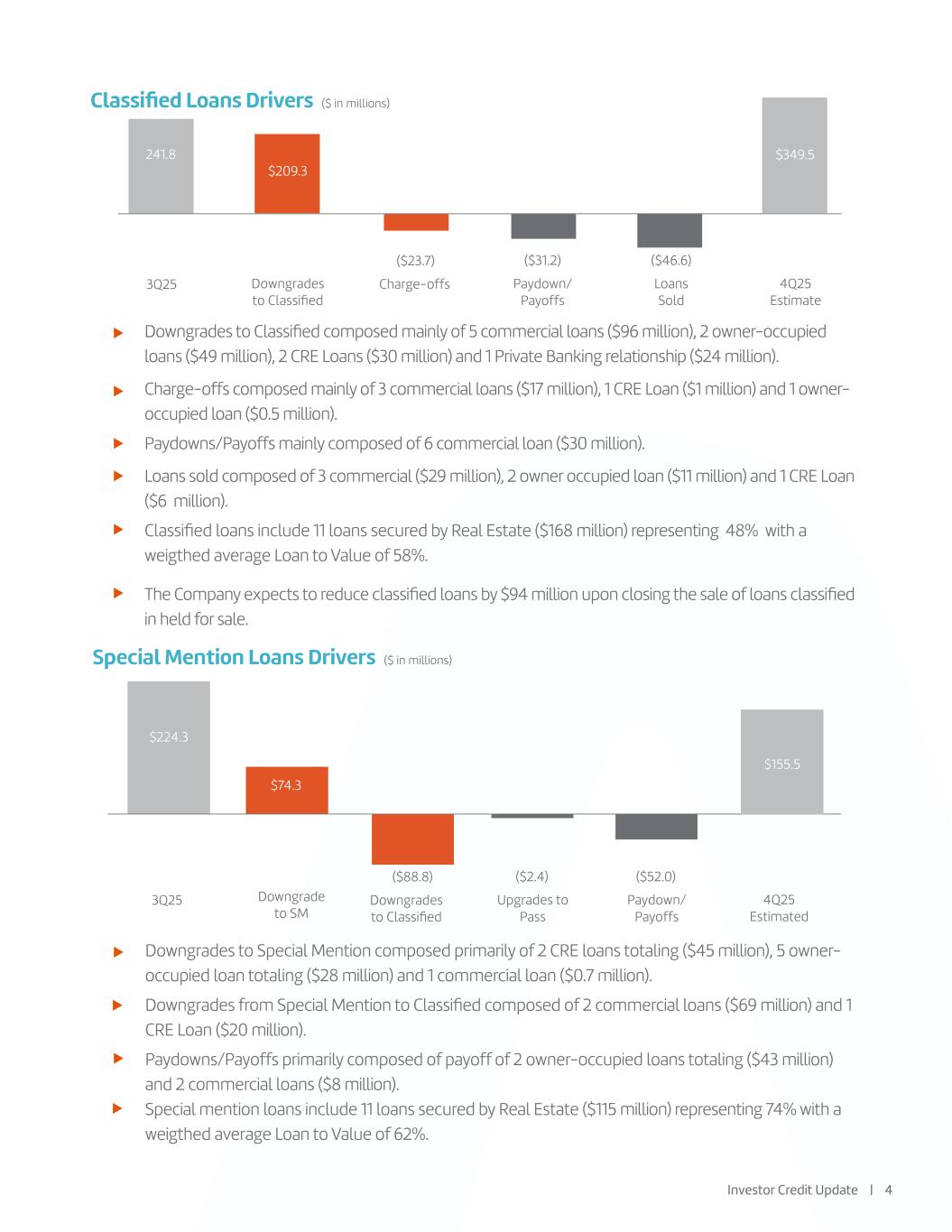

($88.8) 3Q25 Downgrades to Classified $224.3 4Q25 Estimated ($2.4) Upgrades to Pass Downgrades to Special Mention composed primarily of 2 CRE loans totaling ($45 million), 5 owner- occupied loan totaling ($28 million) and 1 commercial loan ($0.7 million). Downgrades from Special Mention to Classified composed of 2 commercial loans ($69 million) and 1 CRE Loan ($20 million). Paydowns/Payoffs primarily composed of payoff of 2 owner-occupied loans totaling ($43 million) and 2 commercial loans ($8 million). Special mention loans include 11 loans secured by Real Estate ($115 million) representing 74% with a weigthed average Loan to Value of 62%. Special Mention Loans Drivers ($ in millions) $155.5 Downgrade to SM $74.3 ($52.0) Paydown/ Payoffs Investor Credit Update | 4 ($31.2) $209.3 Paydown/ Payoffs 3Q25 Downgrades to Classified Charge-offs $349.5 4Q25 Estimate ($46.6) Loans Sold 241.8 ($23.7) Downgrades to Classified composed mainly of 5 commercial loans ($96 million), 2 owner-occupied loans ($49 million), 2 CRE Loans ($30 million) and 1 Private Banking relationship ($24 million). Charge-offs composed mainly of 3 commercial loans ($17 million), 1 CRE Loan ($1 million) and 1 owner- occupied loan ($0.5 million). Paydowns/Payoffs mainly composed of 6 commercial loan ($30 million). Loans sold composed of 3 commercial ($29 million), 2 owner occupied loan ($11 million) and 1 CRE Loan ($6 million). Classified loans include 11 loans secured by Real Estate ($168 million) representing 48% with a weigthed average Loan to Value of 58%. The Company expects to reduce classified loans by $94 million upon closing the sale of loans classified in held for sale. Classified Loans Drivers ($ in millions)

Thank You NYSE: AMTB amerantbank.com