Fourth Quarter 2025 Earnings Presentation January 23, 2026

2 Important Notices and Disclaimers Forward-Looking Statements This presentation contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. Examples of forward-looking statements include but are not limited to: our future operating or financial performance, including revenues, expenses, expense savings, income or loss and earnings or loss per share, and other financial items; statements regarding expectations, plans or objectives for future operations, products or services, and our expectations on loan recoveries or reaching positive resolutions on problem loans. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlook,” “modeled,” “dedicated,” “create,”and other similar words and expressions of the future. Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2024 filed on March 5, 2025, and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov. Interim Financial Information Unaudited financial information as of and for interim periods, including the three month periods ended September 30, 2025, June 30, 2025, March 31, 2025, and the three and twelve month periods ended December 31, 2025, may not reflect our results of operations for our fiscal year ended, or financial condition as of December 31, 2025, or any other period of time or date. Non-GAAP Financial Measures The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “pre-provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expense”, “core net income”, “core earnings per share (basic and diluted)”, “core return on assets(Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, "tangible common equity ratio", and “tangible stockholders’ equity (book value) per common share" . This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures”. We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our business. Management believes that these supplementary non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies. Appendix 1 reconciles these non-GAAP financial measures to reported results.

3 Amerant's Strategic Direction Remains Clear: Board of Directors approved the updated 3-year Strategic Plan; a plan built on a disciplined, phased roadmap to stabilize, optimize and create a path to sustainable growth Our People are at the Center of Our Success: We believe Human Capital is the key enabler of our strategic plan; ensuring that our workforce remains stable, supported, aligned, and empowered to contribute to our long-term success Our immediate focus is centered on: • Credit Transformation: emphasis on reducing criticized assets and making consistent, disciplined decisions aligned with our risk appetite • Operational Efficiency: expense reduction initiatives, simplifying business lines to improve synergies and risk management and digitizing processes to improve productivity, reduce cost, and enhance the client experience Opening Remarks

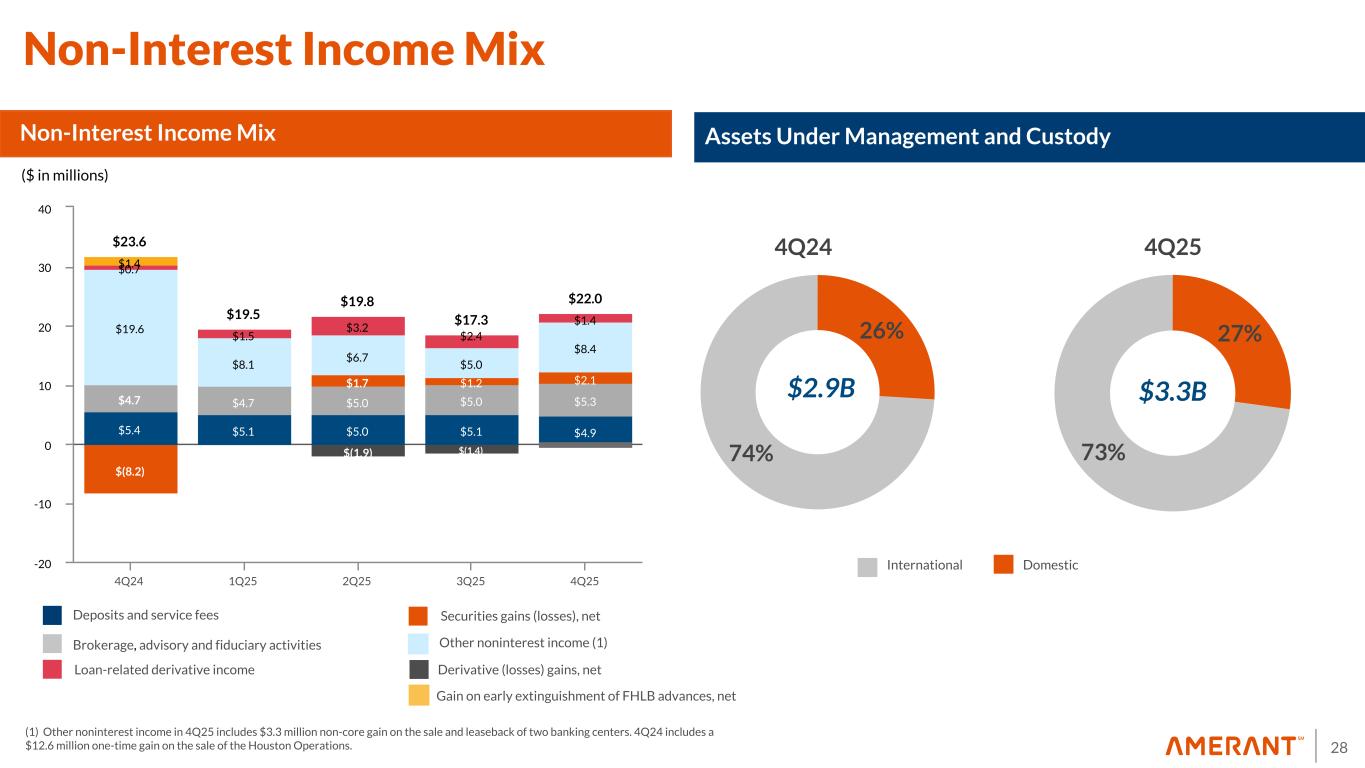

4 Key Financial Metrics (4Q25 vs 3Q25) Assets • Total assets were $9.8 billion, compared to $10.4 billion • Cash and cash and equivalents were $470.2 million, compared to $630.9 million • Total investments were at $2.1 billion, compared to $2.3 billion • Total gross loans were $6.7 billion, compared to $6.9 billion Liabilities • Total deposits were $7.8 billion, compared to $8.3 billion • Core deposits were $5.8 billion, compared to $6.2 billion • Brokered deposits were $435.7 million, compared to $550.2 million • FHLB advances were $712.0 million, compared to $831.7 million Off-Balance Sheet • Assets Under Management and custody (“AUM”) totaled $3.3 billion, compared to $3.2 billion

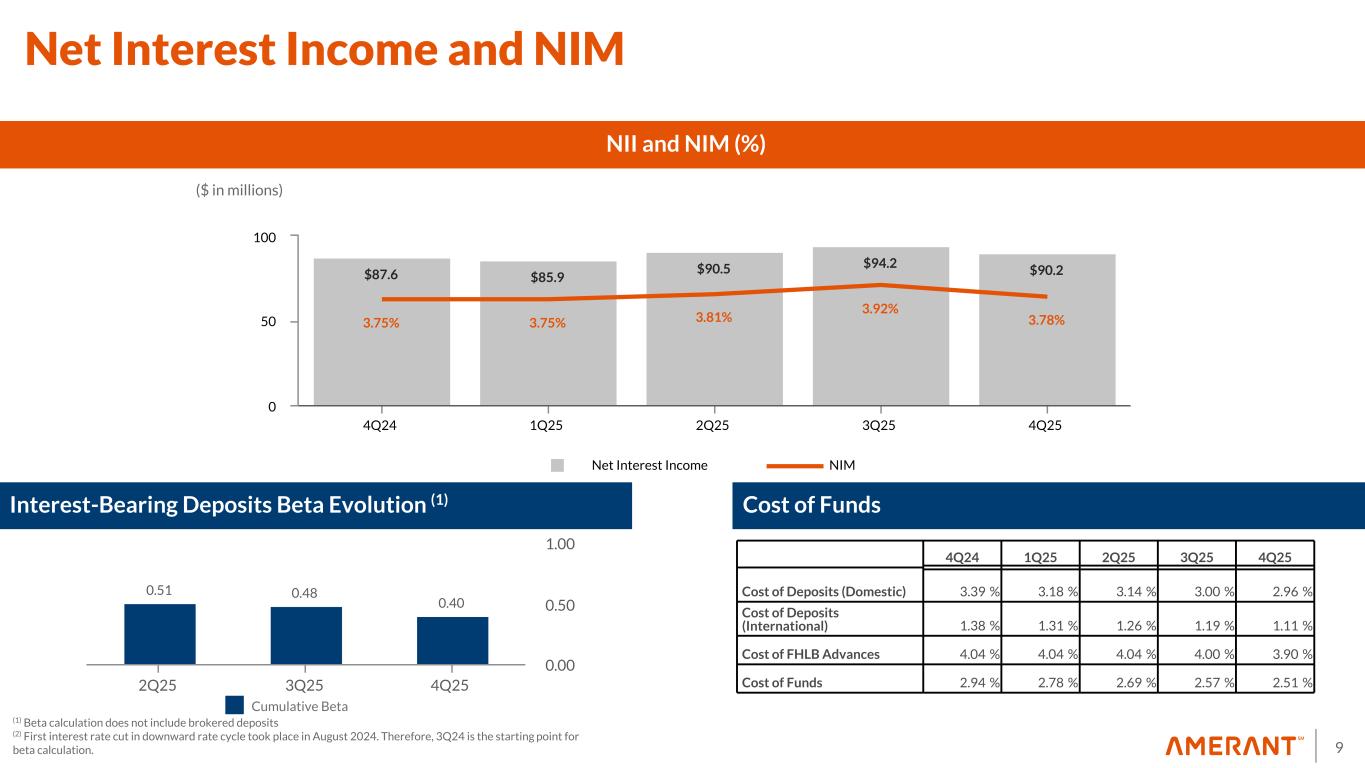

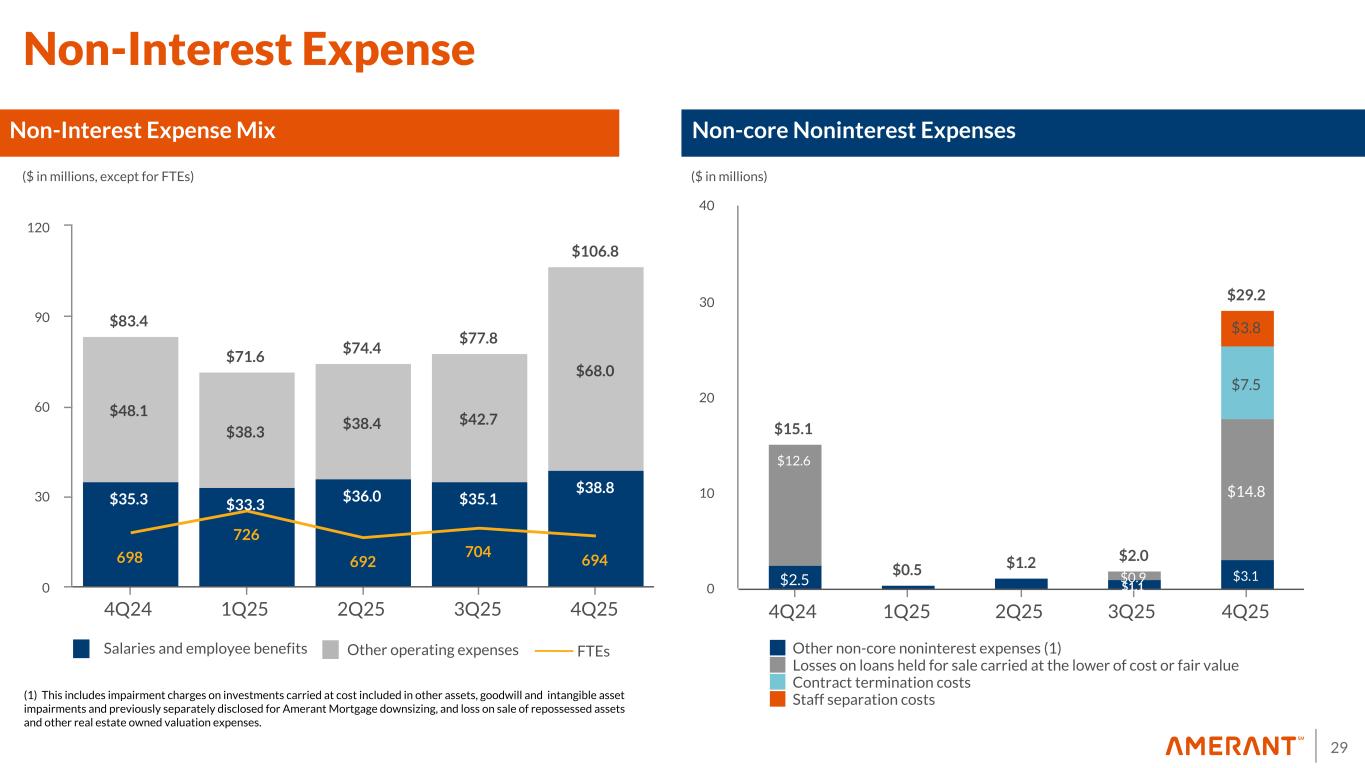

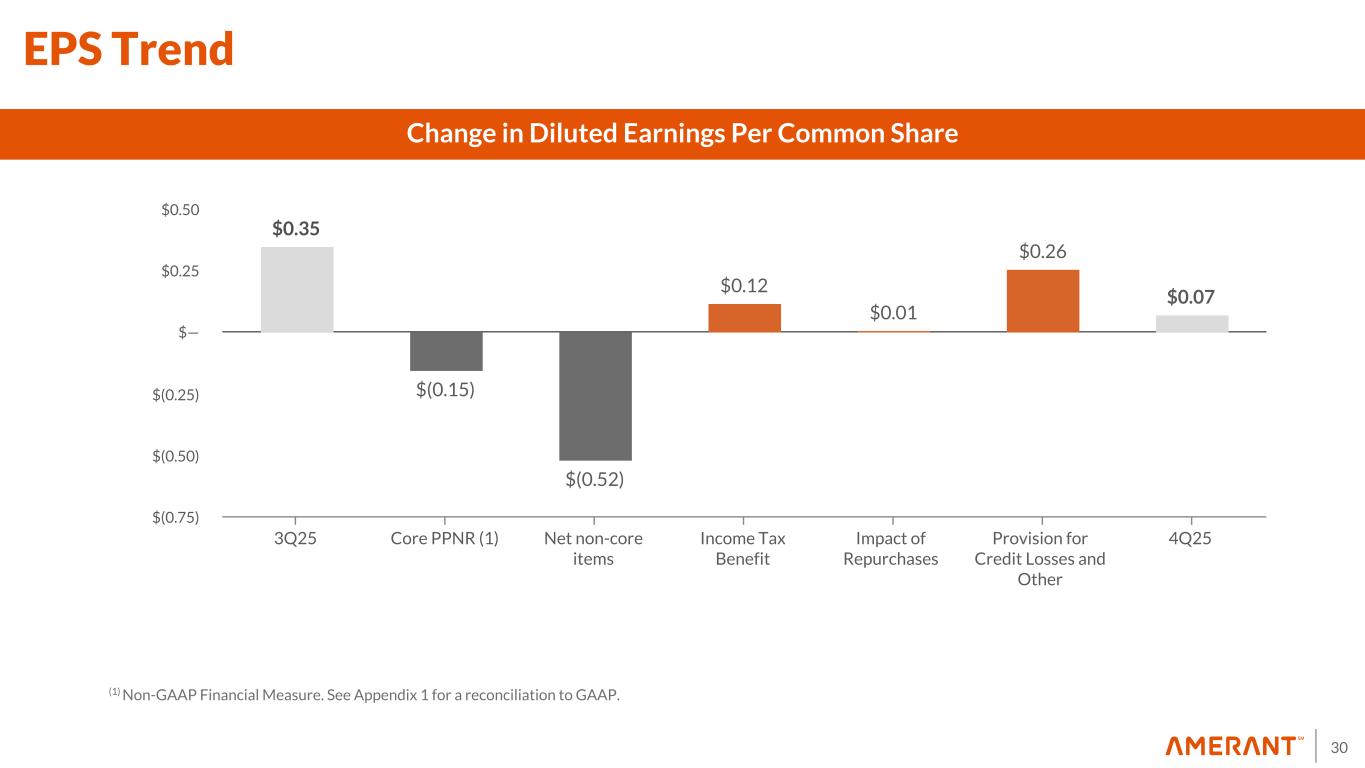

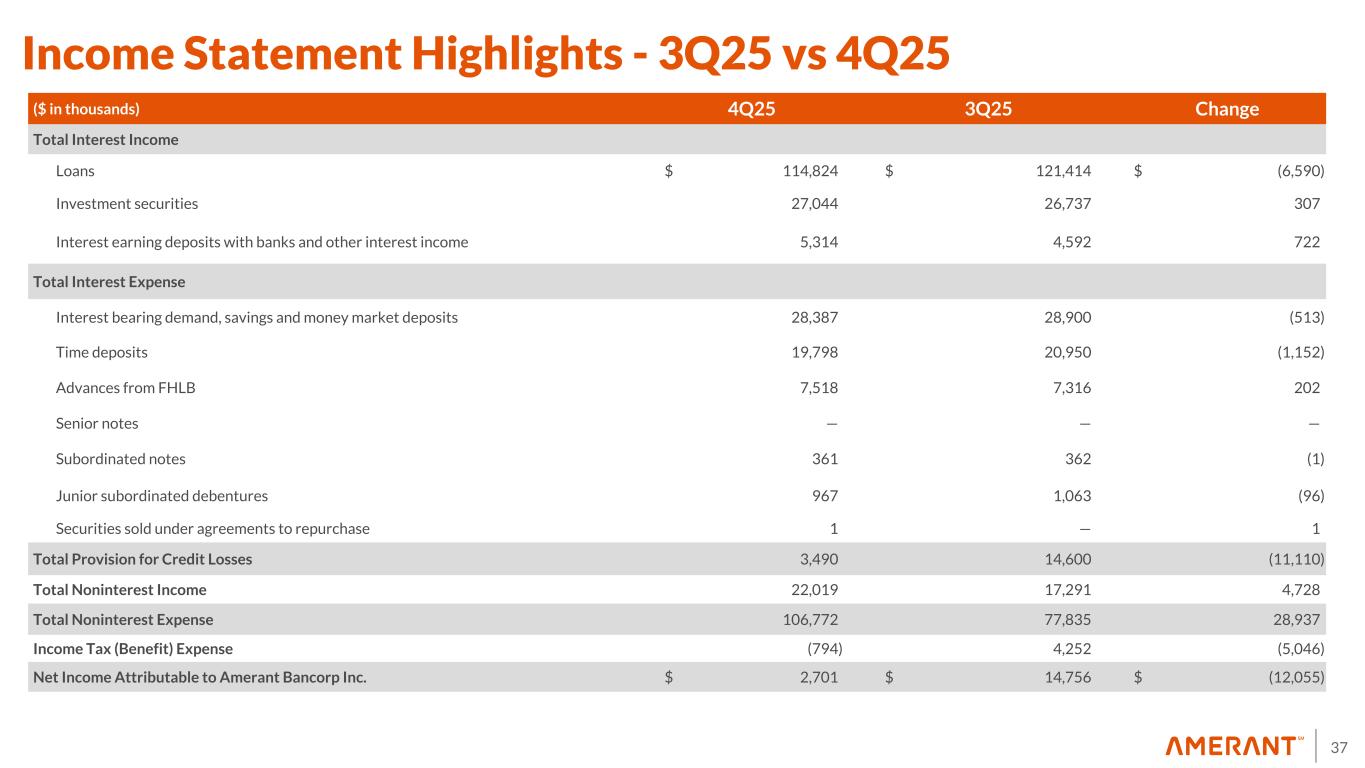

5 Key Financial Metrics (4Q25 vs 3Q25) Income Statement • Net Interest Income (“NII”) was $90.2 million, compared to $94.2 million • Provision for credit losses was $3.5 million, compared to $14.6 million • Noninterest income was $22.0 million, compared to $17.3 million • Noninterest expense was $106.8 million, compared to $77.8 million • Net income attributable to the Company was $2.7 million, compared to net income of $14.8 million Relative Performance Metrics • Net Interest Margin ("NIM") was 3.78%, compared to 3.92% • Diluted earnings per share was $0.07, compared to diluted earnings per share of $0.35 • Efficiency ratio was 95.19%, compared to 69.84% • Return on Assets ("ROA") was 0.10%, compared to 0.57% • Return on Equity ("ROE") was 1.12%, compared to 6.21%

6 Key Financial Metrics (4Q25 vs 3Q25) Non-GAAP Metrics (1) • Core noninterest income was $16.7 million, compared to $17.5 million • Core noninterest expense was $77.6 million, compared to $75.9 million • Pre-provision net revenue ("PPNR") was $5.4 million, compared to $33.6 million • Core PPNR was $29.3 million, compared to $35.8 million • Core Efficiency Ratio was 72.58% compared to 67.96% • Core ROA was 0.84% compared to 0.64% • Core ROE was 8.98% compared to 6.91% Non-Core Items • Noninterest expense was $29.2 million, compared to $2.0 million • Noninterest income was $5.3 million, compared to negative $0.2 million (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP.

7 Key Financial Metrics (4Q25 vs 3Q25) (1) Non-GAAP Financial Measures. See Appendix 1 for a reconciliation to GAAP. (2) TCE Ratio: 4Q25 includes $0.9 million accumulated unrealized losses net of taxes., compared to $6.9 million in 3Q25 Capital • Total Capital Ratio was 14.10%, compared to 13.90% • Common Equity Tier 1 was 11.80%, compared to 11.54% • Tangible Common Equity Ratio (1) (2) was 9.39%, compared to 8.87% Capital Management Actions • Paid quarterly cash dividend of $0.09 per common share on November 28, 2025 • Repurchased 737,334 shares for $13.0 million at a weighted average price of $17.63 per share, or 0.78x of Tangible Book Value ("TBV") per share • Tangible book value per share was $22.56, compared to $22.32

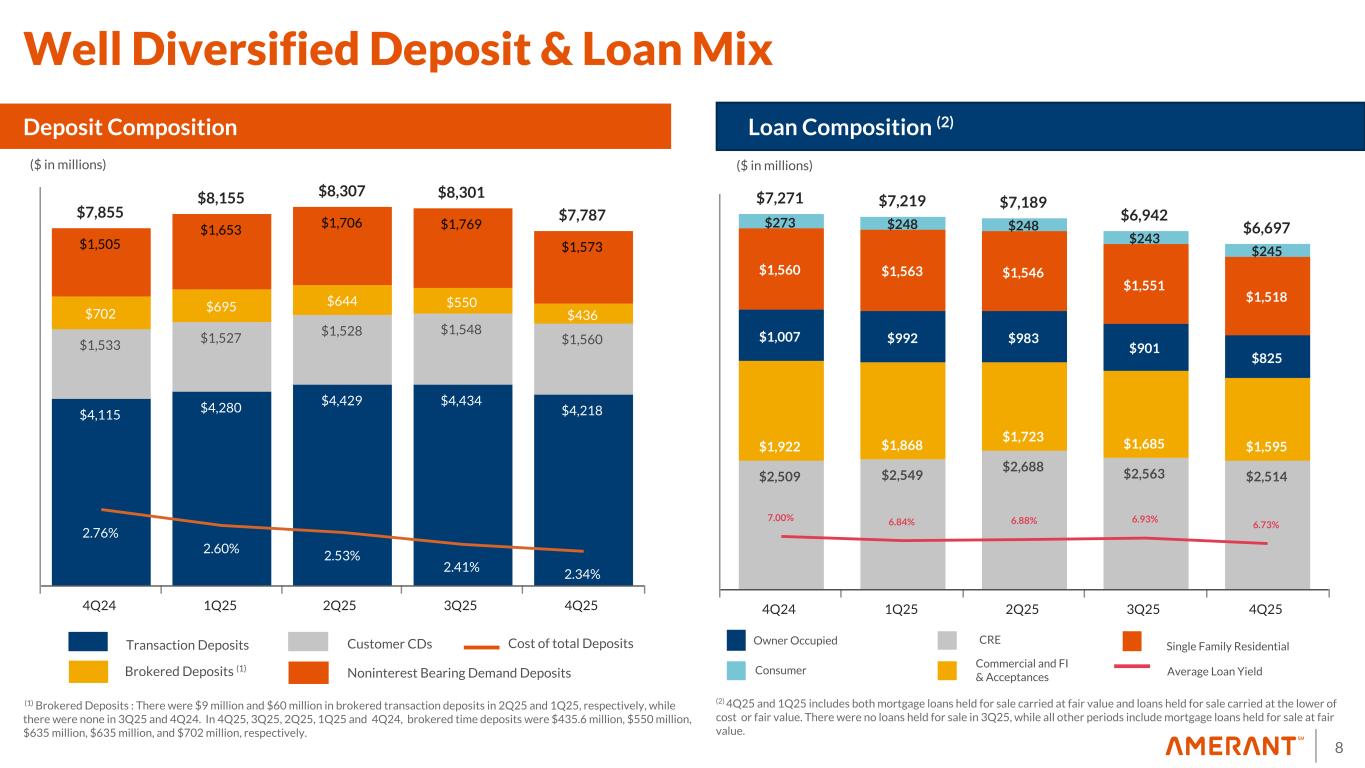

8 $7,855 $8,155 $8,307 $8,301 $7,787 $4,115 $4,280 $4,429 $4,434 $4,218 $1,533 $1,527 $1,528 $1,548 $1,560 $702 $695 $644 $550 $436 $1,505 $1,653 $1,706 $1,769 $1,573 2.76% 2.60% 2.53% 2.41% 2.34% 4Q24 1Q25 2Q25 3Q25 4Q25 Deposit Composition Loan Composition (2) Transaction Deposits Customer CDs Brokered Deposits (1) Cost of total Deposits ($ in millions) Noninterest Bearing Demand Deposits Well Diversified Deposit & Loan Mix (1) Brokered Deposits : There were $9 million and $60 million in brokered transaction deposits in 2Q25 and 1Q25, respectively, while there were none in 3Q25 and 4Q24. In 4Q25, 3Q25, 2Q25, 1Q25 and 4Q24, brokered time deposits were $435.6 million, $550 million, $635 million, $635 million, and $702 million, respectively. $7,271 $7,219 $7,189 $6,942 $6,697 $2,509 $2,549 $2,688 $2,563 $2,514 $1,922 $1,868 $1,723 $1,685 $1,595 $1,007 $992 $983 $901 $825 $1,560 $1,563 $1,546 $1,551 $1,518 $273 $248 $248 $243 $245 7.00% 6.84% 6.88% 6.93% 6.73% 4Q24 1Q25 2Q25 3Q25 4Q25 Consumer CRE Commercial and FI & Acceptances Owner Occupied Single Family Residential Average Loan Yield ($ in millions) (2) 4Q25 and 1Q25 includes both mortgage loans held for sale carried at fair value and loans held for sale carried at the lower of cost or fair value. There were no loans held for sale in 3Q25, while all other periods include mortgage loans held for sale at fair value.

9 $87.6 $85.9 $90.5 $94.2 $90.2 3.75% 3.75% 3.81% 3.92% 3.78% Net Interest Income NIM 4Q24 1Q25 2Q25 3Q25 4Q25 0 50 100 NII and NIM (%) 9 ($ in millions) 4Q24 1Q25 2Q25 3Q25 4Q25 Cost of Deposits (Domestic) 3.39 % 3.18 % 3.14 % 3.00 % 2.96 % Cost of Deposits (International) 1.38 % 1.31 % 1.26 % 1.19 % 1.11 % Cost of FHLB Advances 4.04 % 4.04 % 4.04 % 4.00 % 3.90 % Cost of Funds 2.94 % 2.78 % 2.69 % 2.57 % 2.51 % 0.51 0.48 0.40 2Q25 3Q25 4Q25 0.00 0.50 1.00 Cumulative Beta Net Interest Income and NIM Interest-Bearing Deposits Beta Evolution (1) Cost of Funds (1) Beta calculation does not include brokered deposits (2) First interest rate cut in downward rate cycle took place in August 2024. Therefore, 3Q24 is the starting point for beta calculation.

10 Asset Quality

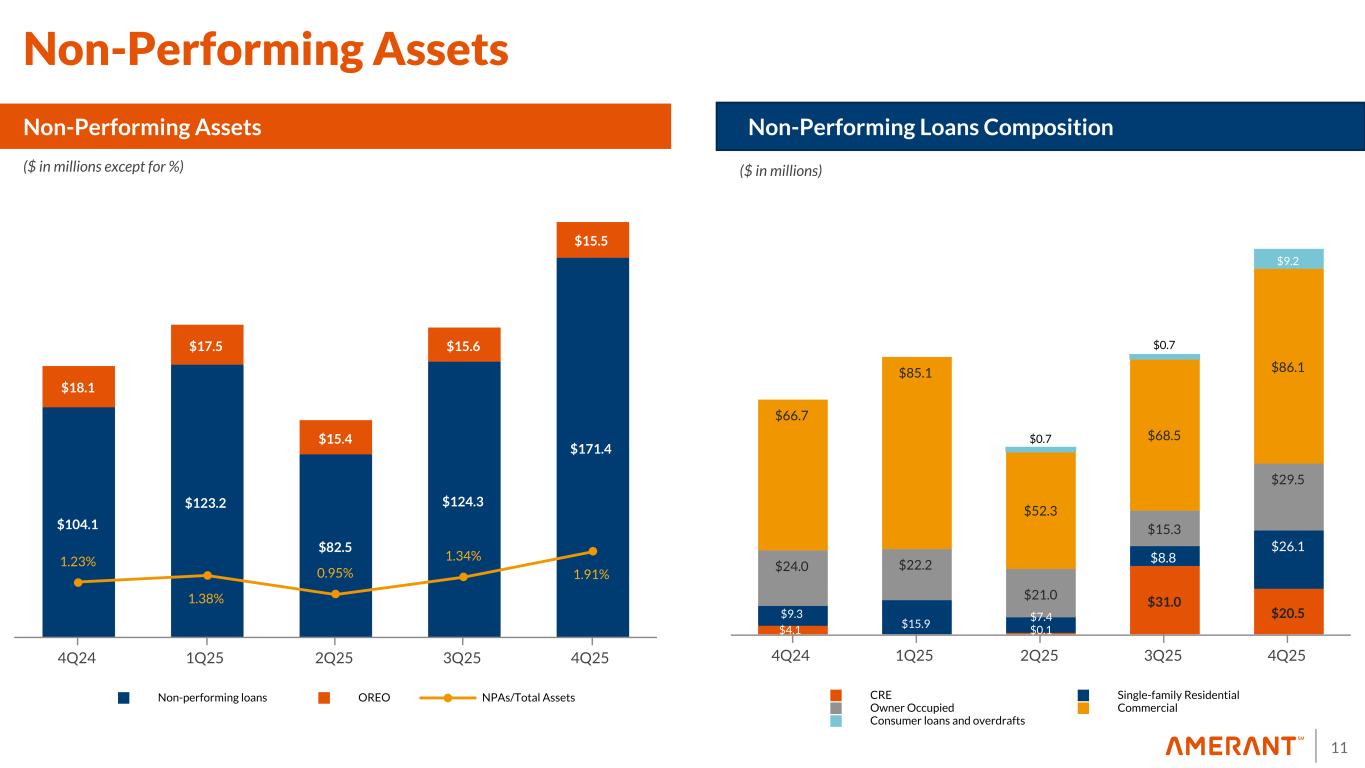

11 Non-Performing Assets $104.1 $123.2 $82.5 $124.3 $171.4 $18.1 $17.5 $15.4 $15.6 $15.5 1.23% 1.38% 0.95% 1.34% 1.91% Non-performing loans OREO NPAs/Total Assets 4Q24 1Q25 2Q25 3Q25 4Q25 ($ in millions except for %) $31.0 $20.5$9.3 $15.9 $8.8 $26.1 $24.0 $22.2 $21.0 $15.3 $29.5 $66.7 $85.1 $52.3 $68.5 $86.1 $0.7 $0.7 $9.2 CRE Single-family Residential Owner Occupied Commercial Consumer loans and overdrafts 4Q24 1Q25 2Q25 3Q25 4Q25 $4.1 Non-Performing Assets Non-Performing Loans Composition ($ in millions) $0.1$4.1 $7.4

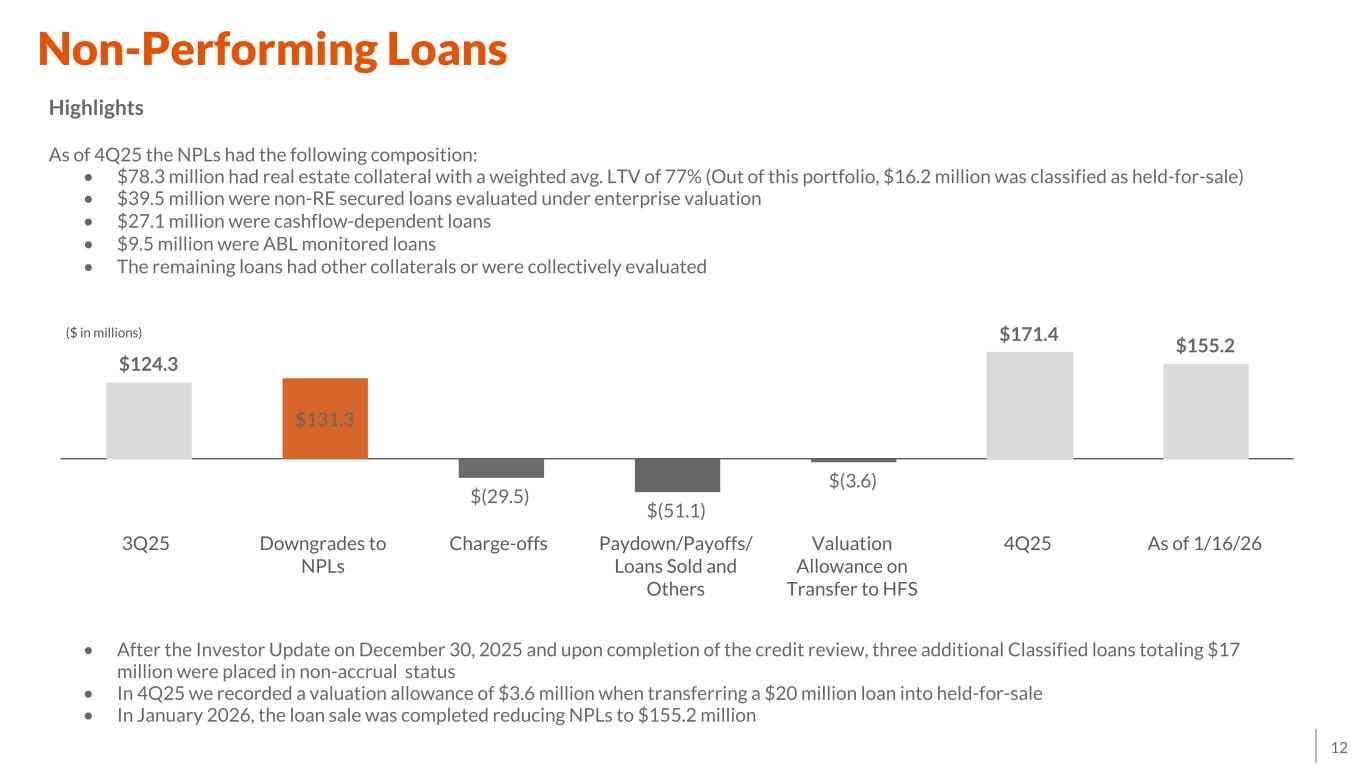

12 Non-Performing Loans • After the Investor Update on December 30, 2025 and upon completion of the credit review, three additional Classified loans totaling $17 million were placed in non-accrual status • In 4Q25 we recorded a valuation allowance of $3.6 million when transferring a $20 million loan into held-for-sale • In January 2026, the loan sale was completed reducing NPLs to $155.2 million ($ in millions) $124.3 $131.3 $(29.5) $(51.1) $(3.6) $171.4 $155.2 3Q25 Downgrades to NPLs Charge-offs Paydown/Payoffs/ Loans Sold and Others Valuation Allowance on Transfer to HFS 4Q25 As of 1/16/26 Highlights As of 4Q25 the NPLs had the following composition: • $78.3 million had real estate collateral with a weighted avg. LTV of 77% (Out of this portfolio, $16.2 million was classified as held-for-sale) • $39.5 million were non-RE secured loans evaluated under enterprise valuation • $27.1 million were cashflow-dependent loans • $9.5 million were ABL monitored loans • The remaining loans had other collaterals or were collectively evaluated

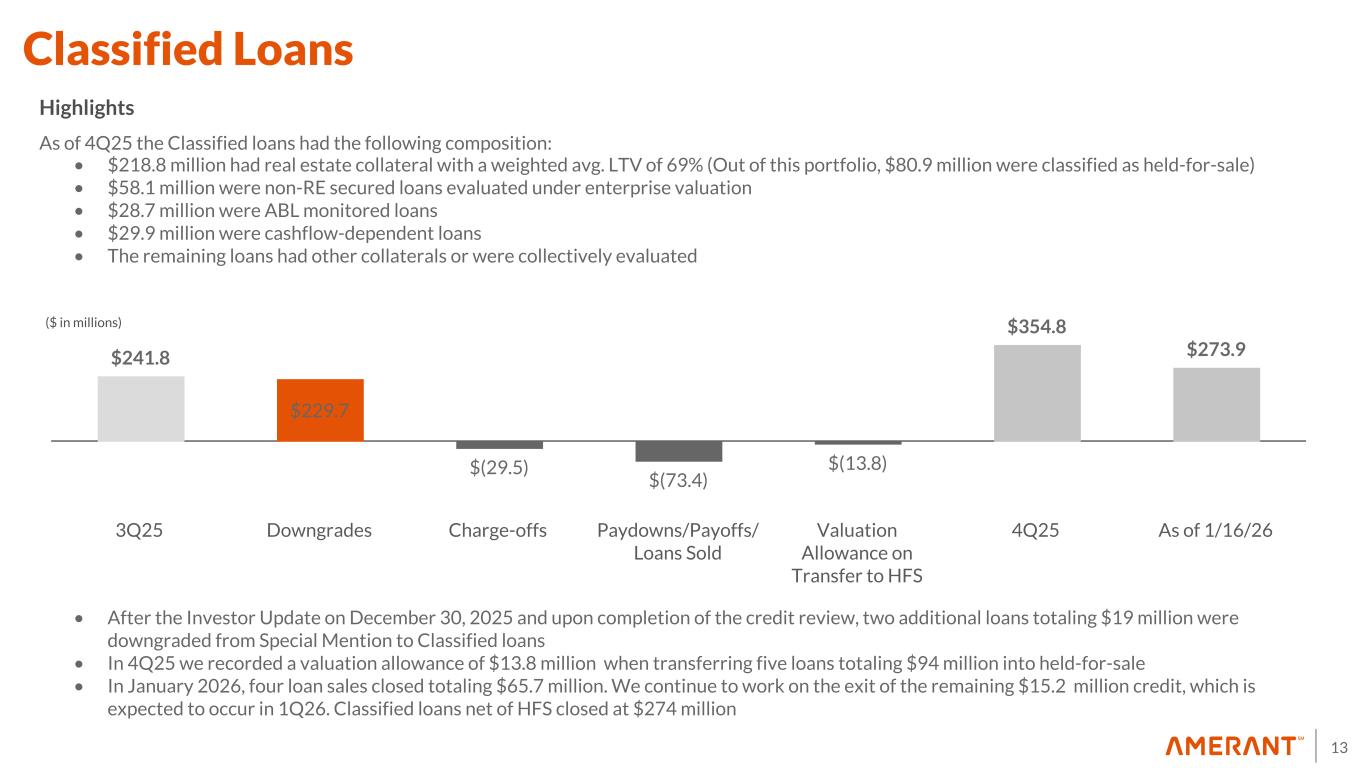

13 Classified Loans $241.8 $229.7 $(29.5) $(73.4) $(13.8) $354.8 $273.9 3Q25 Downgrades Charge-offs Paydowns/Payoffs/ Loans Sold Valuation Allowance on Transfer to HFS 4Q25 As of 1/16/26 ($ in millions) Highlights As of 4Q25 the Classified loans had the following composition: • $218.8 million had real estate collateral with a weighted avg. LTV of 69% (Out of this portfolio, $80.9 million were classified as held-for-sale) • $58.1 million were non-RE secured loans evaluated under enterprise valuation • $28.7 million were ABL monitored loans • $29.9 million were cashflow-dependent loans • The remaining loans had other collaterals or were collectively evaluated • After the Investor Update on December 30, 2025 and upon completion of the credit review, two additional loans totaling $19 million were downgraded from Special Mention to Classified loans • In 4Q25 we recorded a valuation allowance of $13.8 million when transferring five loans totaling $94 million into held-for-sale • In January 2026, four loan sales closed totaling $65.7 million. We continue to work on the exit of the remaining $15.2 million credit, which is expected to occur in 1Q26. Classified loans net of HFS closed at $274 million

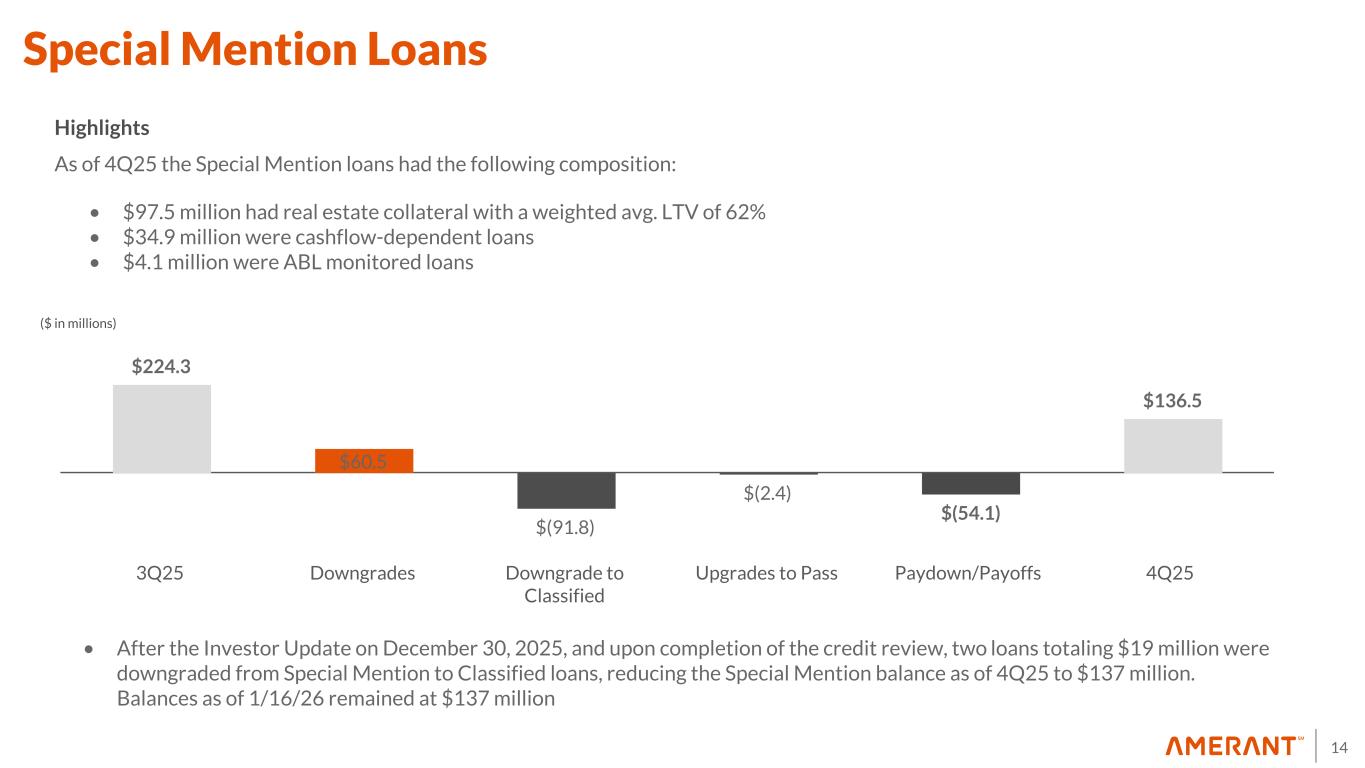

14 Special Mention Loans $224.3 $60.5 $(91.8) $(2.4) $(54.1) $136.5 3Q25 Downgrades Downgrade to Classified Upgrades to Pass Paydown/Payoffs 4Q25 ($ in millions) • After the Investor Update on December 30, 2025, and upon completion of the credit review, two loans totaling $19 million were downgraded from Special Mention to Classified loans, reducing the Special Mention balance as of 4Q25 to $137 million. Balances as of 1/16/26 remained at $137 million Highlights As of 4Q25 the Special Mention loans had the following composition: • $97.5 million had real estate collateral with a weighted avg. LTV of 62% • $34.9 million were cashflow-dependent loans • $4.1 million were ABL monitored loans

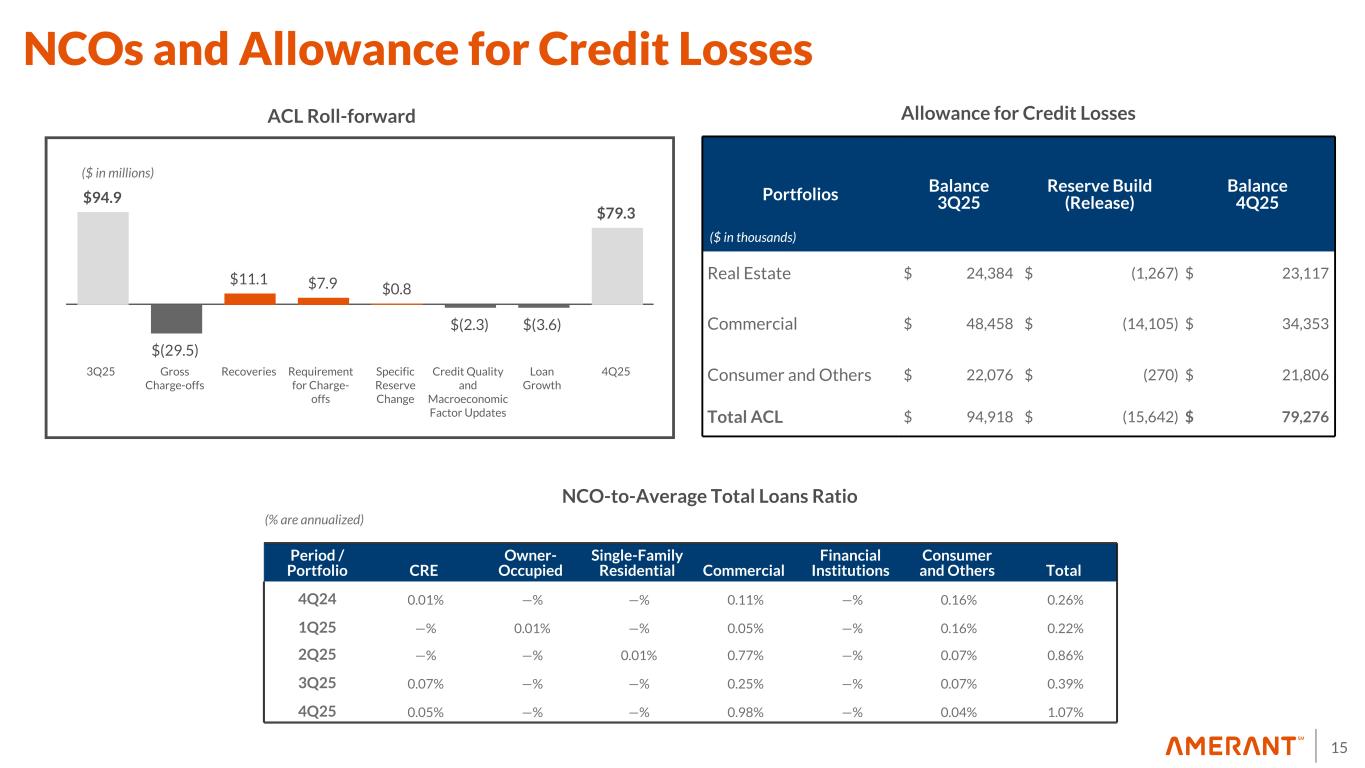

15 NCOs and Allowance for Credit Losses $94.9 $(29.5) $11.1 $7.9 $0.8 $(2.3) $(3.6) $79.3 3Q25 Gross Charge-offs Recoveries Requirement for Charge- offs Specific Reserve Change Credit Quality and Macroeconomic Factor Updates Loan Growth 4Q25 Portfolios Balance 3Q25 Reserve Build (Release) Balance 4Q25 Real Estate $ 24,384 $ (1,267) $ 23,117 Commercial $ 48,458 $ (14,105) $ 34,353 Consumer and Others $ 22,076 $ (270) $ 21,806 Total ACL $ 94,918 $ (15,642) $ 79,276 ACL Roll-forward Allowance for Credit Losses NCO-to-Average Total Loans Ratio ($ in millions) Period / Portfolio CRE Owner- Occupied Single-Family Residential Commercial Financial Institutions Consumer and Others Total 4Q24 0.01% —% —% 0.11% —% 0.16% 0.26% 1Q25 —% 0.01% —% 0.05% —% 0.16% 0.22% 2Q25 —% —% 0.01% 0.77% —% 0.07% 0.86% 3Q25 0.07% —% —% 0.25% —% 0.07% 0.39% 4Q25 0.05% —% —% 0.98% —% 0.04% 1.07% ($ in thousands) (% are annualized)

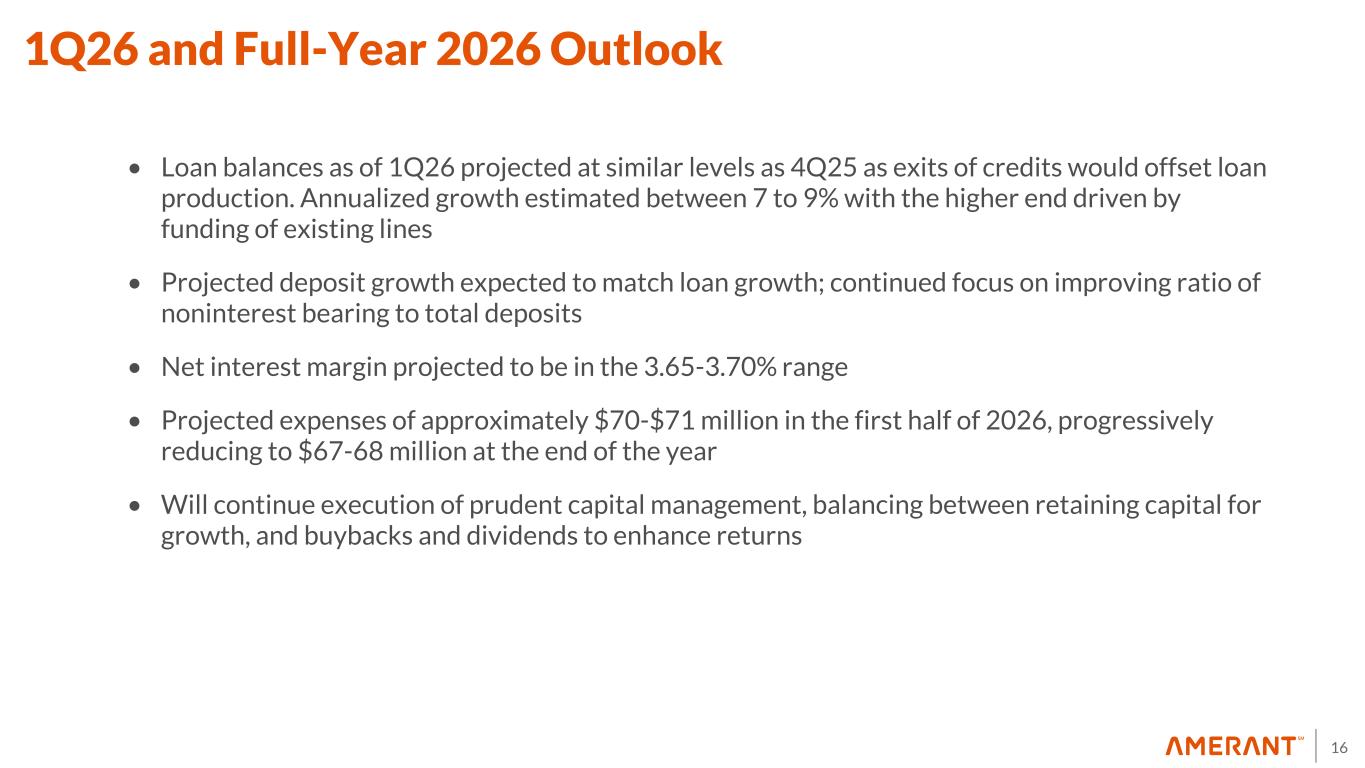

16 • Loan balances as of 1Q26 projected at similar levels as 4Q25 as exits of credits would offset loan production. Annualized growth estimated between 7 to 9% with the higher end driven by funding of existing lines • Projected deposit growth expected to match loan growth; continued focus on improving ratio of noninterest bearing to total deposits • Net interest margin projected to be in the 3.65-3.70% range • Projected expenses of approximately $70-$71 million in the first half of 2026, progressively reducing to $67-68 million at the end of the year • Will continue execution of prudent capital management, balancing between retaining capital for growth, and buybacks and dividends to enhance returns 1Q26 and Full-Year 2026 Outlook

17 Looking ahead, our operating focus is firmly aligned with the following priorities: • Advancing a high-quality loan pipeline supported by disciplined underwriting • Strengthening asset quality through a disciplined, relationship-driven credit culture and strong monitoring processes • Executing cost-efficiency initiatives designed to deliver ongoing, recurring savings • Deepening core deposit relationships to increase share of wallet and reduce reliance on higher-cost funding • Maintaining strong capital and shareholder returns, including our dividend and authorized share repurchases Closing Remarks

Supplemental Information

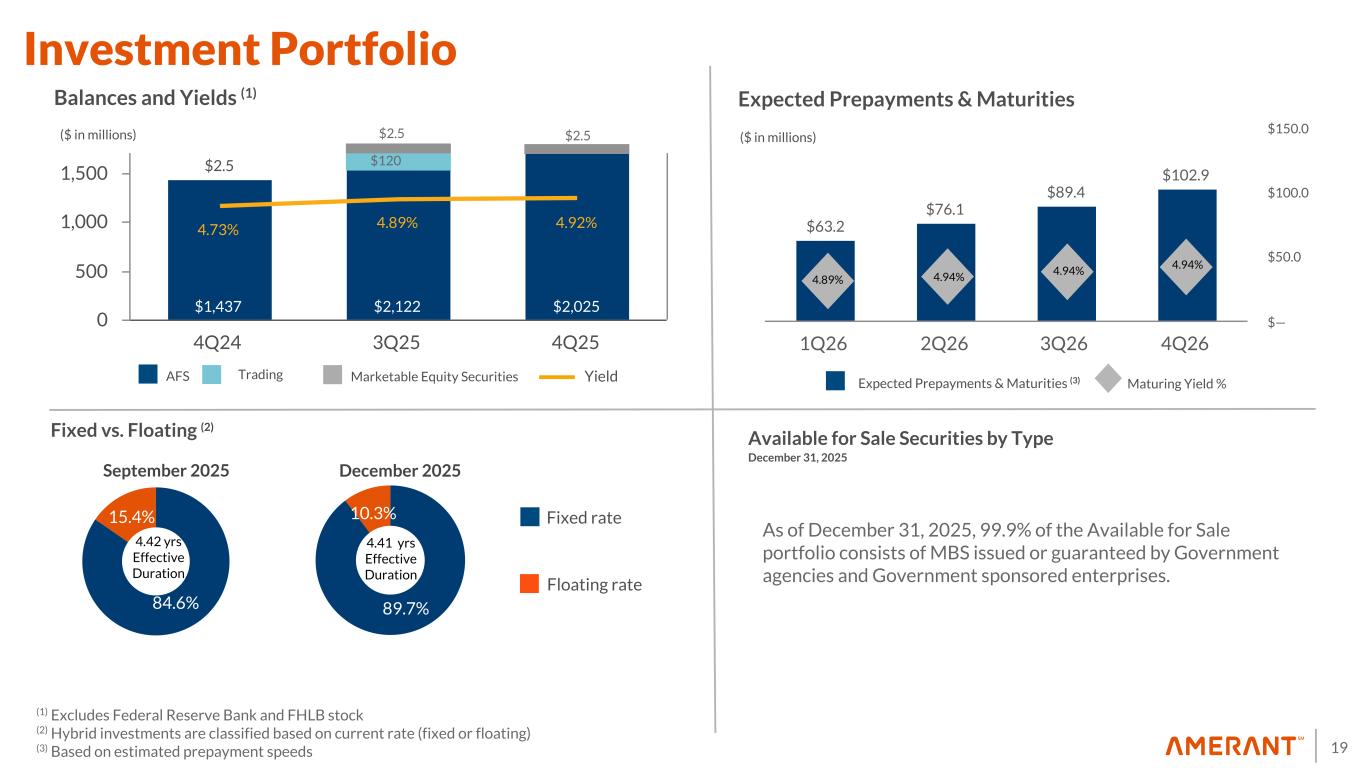

19 89.7% 10.3% $1,437 $2,122 $2,025 $2.5 4.73% 4.89% 4.92% 4Q24 3Q25 4Q25 0 500 1,000 1,500 84.6% 15.4% Balances and Yields (1) AFS Trading Fixed vs. Floating (2) September 2025 December 2025 Floating rate Fixed rate Available for Sale Securities by Type December 31, 2025 4.42 yrs Effective Duration ($ in millions) Marketable Equity Securities (1) Excludes Federal Reserve Bank and FHLB stock (2) Hybrid investments are classified based on current rate (fixed or floating) (3) Based on estimated prepayment speeds Yield 4.41 yrs Effective Duration $63.2 $76.1 $89.4 $102.9 1Q26 2Q26 3Q26 4Q26 $— $50.0 $100.0 $150.0 ($ in millions) Expected Prepayments & Maturities Expected Prepayments & Maturities (3) Maturing Yield % Investment Portfolio 4.89% 4.94% 4.94% 4.94% As of December 31, 2025, 99.9% of the Available for Sale portfolio consists of MBS issued or guaranteed by Government agencies and Government sponsored enterprises. $2.5 $120 $2.5

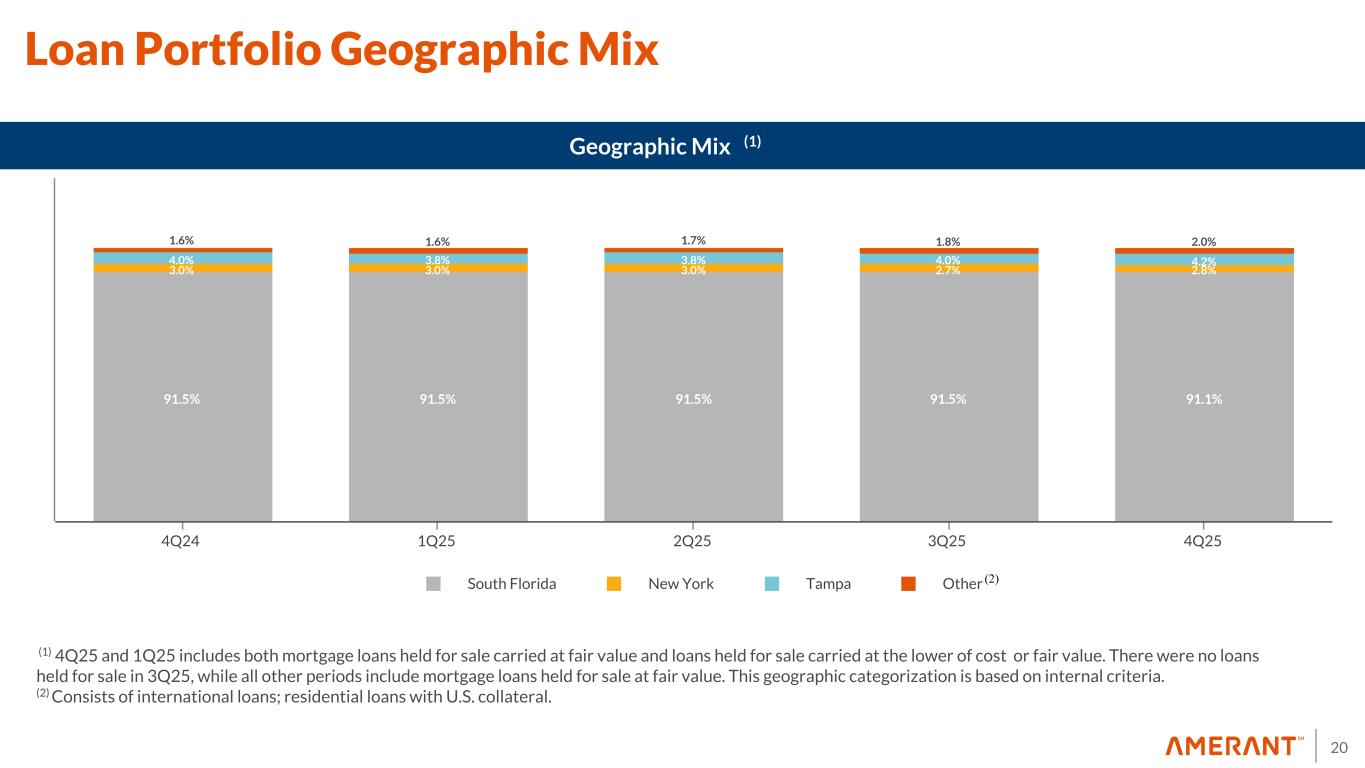

20 91.5% 91.5% 91.5% 91.5% 91.1% 3.0% 3.0% 3.0% 2.7% 2.8% 4.0% 3.8% 3.8% 4.0% 4.2% 1.6% 1.6% 1.7% 1.8% 2.0% South Florida New York Tampa Other 4Q24 1Q25 2Q25 3Q25 4Q25 Geographic Mix (Domestic) Geographic Mix (1) Loan Portfolio Geographic Mix (1) 4Q25 and 1Q25 includes both mortgage loans held for sale carried at fair value and loans held for sale carried at the lower of cost or fair value. There were no loans held for sale in 3Q25, while all other periods include mortgage loans held for sale at fair value. This geographic categorization is based on internal criteria. (2) Consists of international loans; residential loans with U.S. collateral. (2)

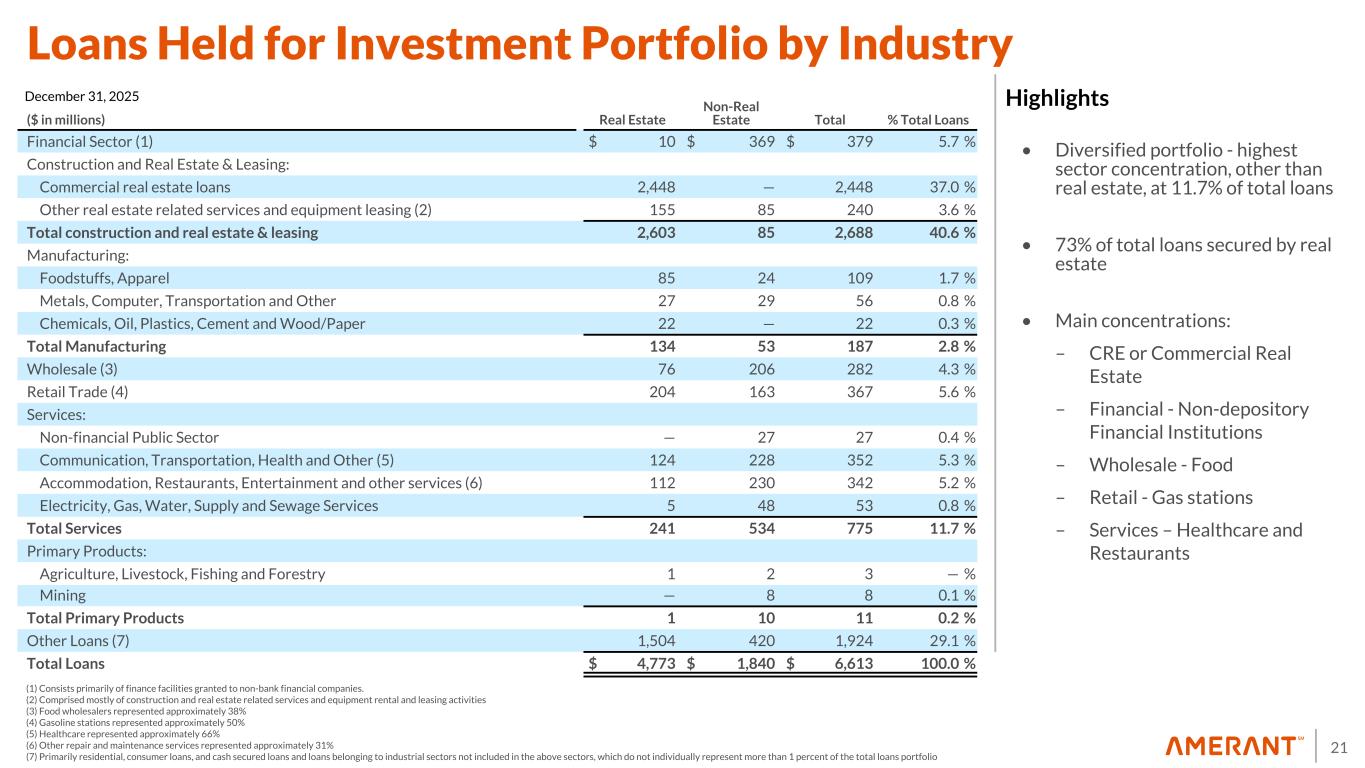

21 Loans Held for Investment Portfolio by Industry • Diversified portfolio - highest sector concentration, other than real estate, at 11.7% of total loans • 73% of total loans secured by real estate • Main concentrations: – CRE or Commercial Real Estate – Financial - Non-depository Financial Institutions – Wholesale - Food – Retail - Gas stations – Services – Healthcare and Restaurants Highlights (1) Consists primarily of finance facilities granted to non-bank financial companies. (2) Comprised mostly of construction and real estate related services and equipment rental and leasing activities (3) Food wholesalers represented approximately 38% (4) Gasoline stations represented approximately 50% (5) Healthcare represented approximately 66% (6) Other repair and maintenance services represented approximately 31% (7) Primarily residential, consumer loans, and cash secured loans and loans belonging to industrial sectors not included in the above sectors, which do not individually represent more than 1 percent of the total loans portfolio ($ in millions) Real Estate Non-Real Estate Total % Total Loans Financial Sector (1) $ 10 $ 369 $ 379 5.7 % Construction and Real Estate & Leasing: Commercial real estate loans 2,448 — 2,448 37.0 % Other real estate related services and equipment leasing (2) 155 85 240 3.6 % Total construction and real estate & leasing 2,603 85 2,688 40.6 % Manufacturing: Foodstuffs, Apparel 85 24 109 1.7 % Metals, Computer, Transportation and Other 27 29 56 0.8 % Chemicals, Oil, Plastics, Cement and Wood/Paper 22 — 22 0.3 % Total Manufacturing 134 53 187 2.8 % Wholesale (3) 76 206 282 4.3 % Retail Trade (4) 204 163 367 5.6 % Services: Non-financial Public Sector — 27 27 0.4 % Communication, Transportation, Health and Other (5) 124 228 352 5.3 % Accommodation, Restaurants, Entertainment and other services (6) 112 230 342 5.2 % Electricity, Gas, Water, Supply and Sewage Services 5 48 53 0.8 % Total Services 241 534 775 11.7 % Primary Products: Agriculture, Livestock, Fishing and Forestry 1 2 3 — % Mining — 8 8 0.1 % Total Primary Products 1 10 11 0.2 % Other Loans (7) 1,504 420 1,924 29.1 % Total Loans $ 4,773 $ 1,840 $ 6,613 100.0 % December 31, 2025

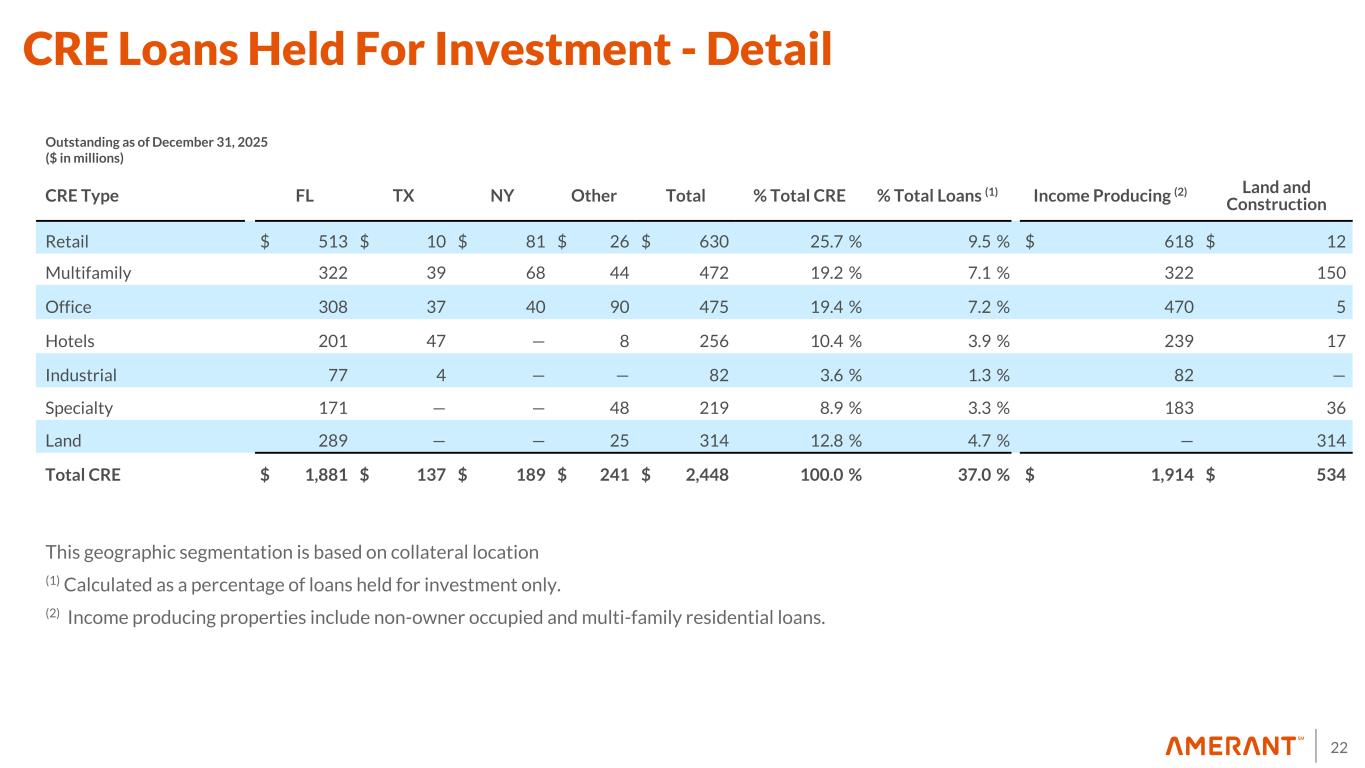

22 CRE Type FL TX NY Other Total % Total CRE % Total Loans (1) Income Producing (2) Land and Construction Retail $ 513 $ 10 $ 81 $ 26 $ 630 25.7 % 9.5 % $ 618 $ 12 Multifamily 322 39 68 44 472 19.2 % 7.1 % 322 150 Office 308 37 40 90 475 19.4 % 7.2 % 470 5 Hotels 201 47 — 8 256 10.4 % 3.9 % 239 17 Industrial 77 4 — — 82 3.6 % 1.3 % 82 — Specialty 171 — — 48 219 8.9 % 3.3 % 183 36 Land 289 — — 25 314 12.8 % 4.7 % — 314 Total CRE $ 1,881 $ 137 $ 189 $ 241 $ 2,448 100.0 % 37.0 % $ 1,914 $ 534 Outstanding as of December 31, 2025 ($ in millions) CRE Loans Held For Investment - Detail This geographic segmentation is based on collateral location (1) Calculated as a percentage of loans held for investment only. (2) Income producing properties include non-owner occupied and multi-family residential loans.

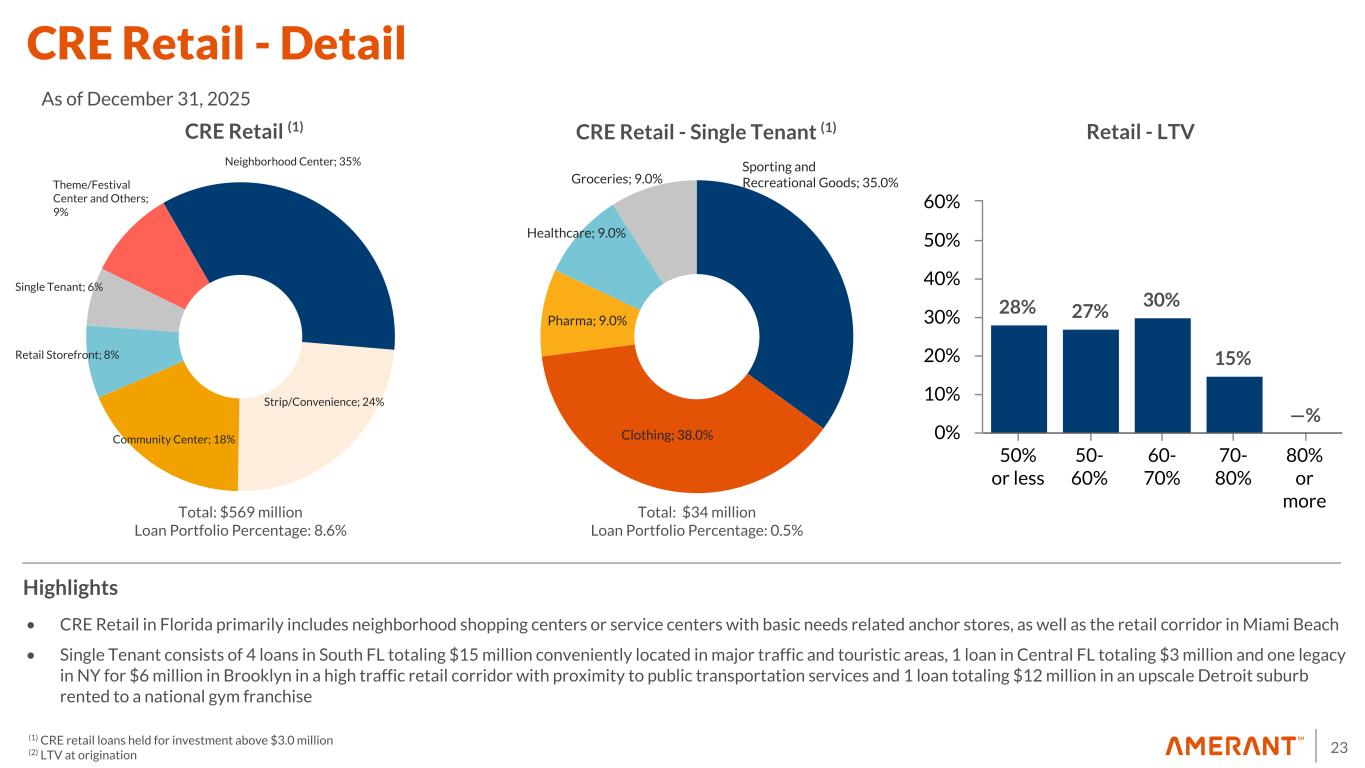

23 28% 27% 30% 15% —% 50% or less 50- 60% 60- 70% 70- 80% 80% or more 0% 10% 20% 30% 40% 50% 60% • CRE Retail in Florida primarily includes neighborhood shopping centers or service centers with basic needs related anchor stores, as well as the retail corridor in Miami Beach • Single Tenant consists of 4 loans in South FL totaling $15 million conveniently located in major traffic and touristic areas, 1 loan in Central FL totaling $3 million and one legacy in NY for $6 million in Brooklyn in a high traffic retail corridor with proximity to public transportation services and 1 loan totaling $12 million in an upscale Detroit suburb rented to a national gym franchise Highlights CRE Retail (1) Retail - LTV Sporting and Recreational Goods; 35.0% Clothing; 38.0% Pharma; 9.0% Healthcare; 9.0% Groceries; 9.0% CRE Retail - Single Tenant (1) Total: $569 million Loan Portfolio Percentage: 8.6% Total: $34 million Loan Portfolio Percentage: 0.5% Neighborhood Center; 35% Strip/Convenience; 24% Community Center; 18% Retail Storefront; 8% Single Tenant; 6% Theme/Festival Center and Others; 9% CRE Retail - Detail As of December 31, 2025 (1) CRE retail loans held for investment above $3.0 million (2) LTV at origination

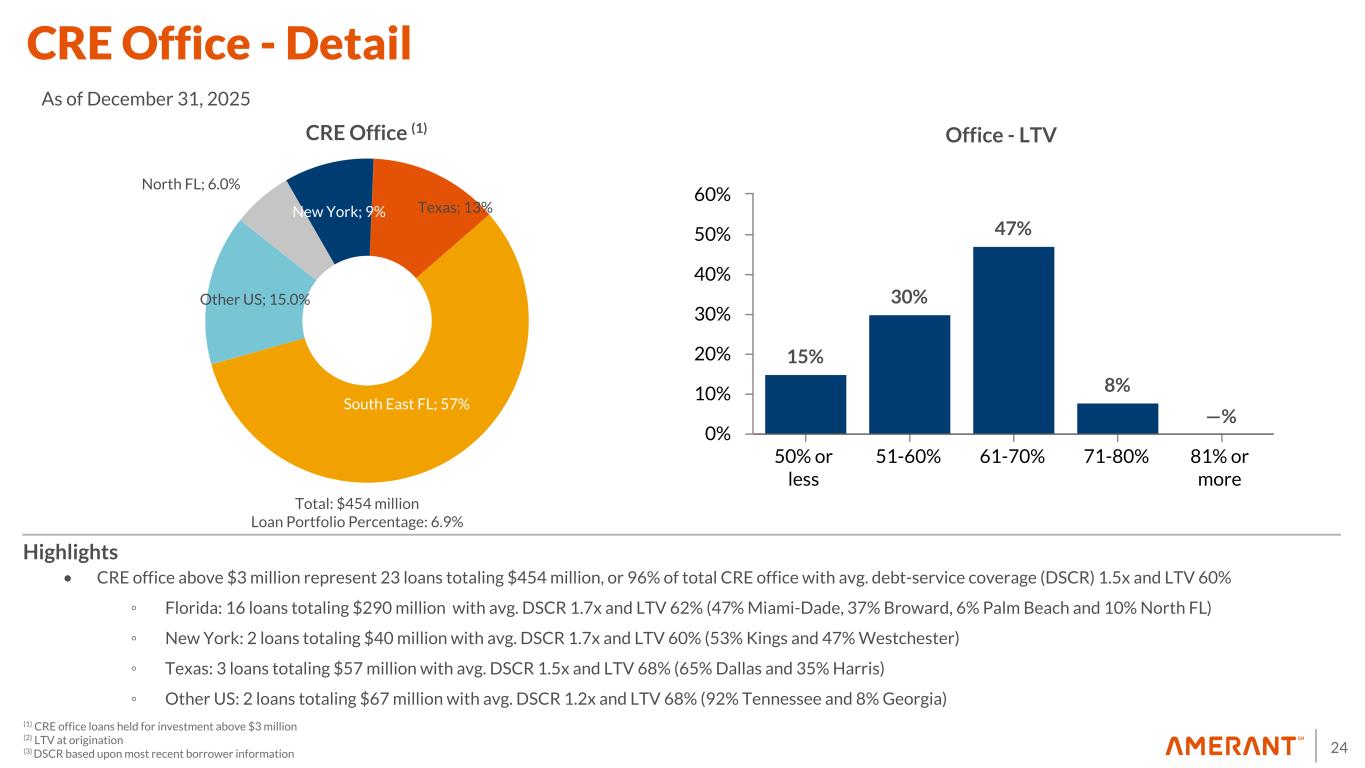

24 New York; 9% Texas; 13% South East FL; 57% Other US; 15.0% North FL; 6.0% 15% 30% 47% 8% —% 50% or less 51-60% 61-70% 71-80% 81% or more 0% 10% 20% 30% 40% 50% 60% • CRE office above $3 million represent 23 loans totaling $454 million, or 96% of total CRE office with avg. debt-service coverage (DSCR) 1.5x and LTV 60% ◦ Florida: 16 loans totaling $290 million with avg. DSCR 1.7x and LTV 62% (47% Miami-Dade, 37% Broward, 6% Palm Beach and 10% North FL) ◦ New York: 2 loans totaling $40 million with avg. DSCR 1.7x and LTV 60% (53% Kings and 47% Westchester) ◦ Texas: 3 loans totaling $57 million with avg. DSCR 1.5x and LTV 68% (65% Dallas and 35% Harris) ◦ Other US: 2 loans totaling $67 million with avg. DSCR 1.2x and LTV 68% (92% Tennessee and 8% Georgia) Highlights CRE Office (1) Office - LTV Total: $454 million Loan Portfolio Percentage: 6.9% CRE Office - Detail As of December 31, 2025 (1) CRE office loans held for investment above $3 million (2) LTV at origination (3) DSCR based upon most recent borrower information

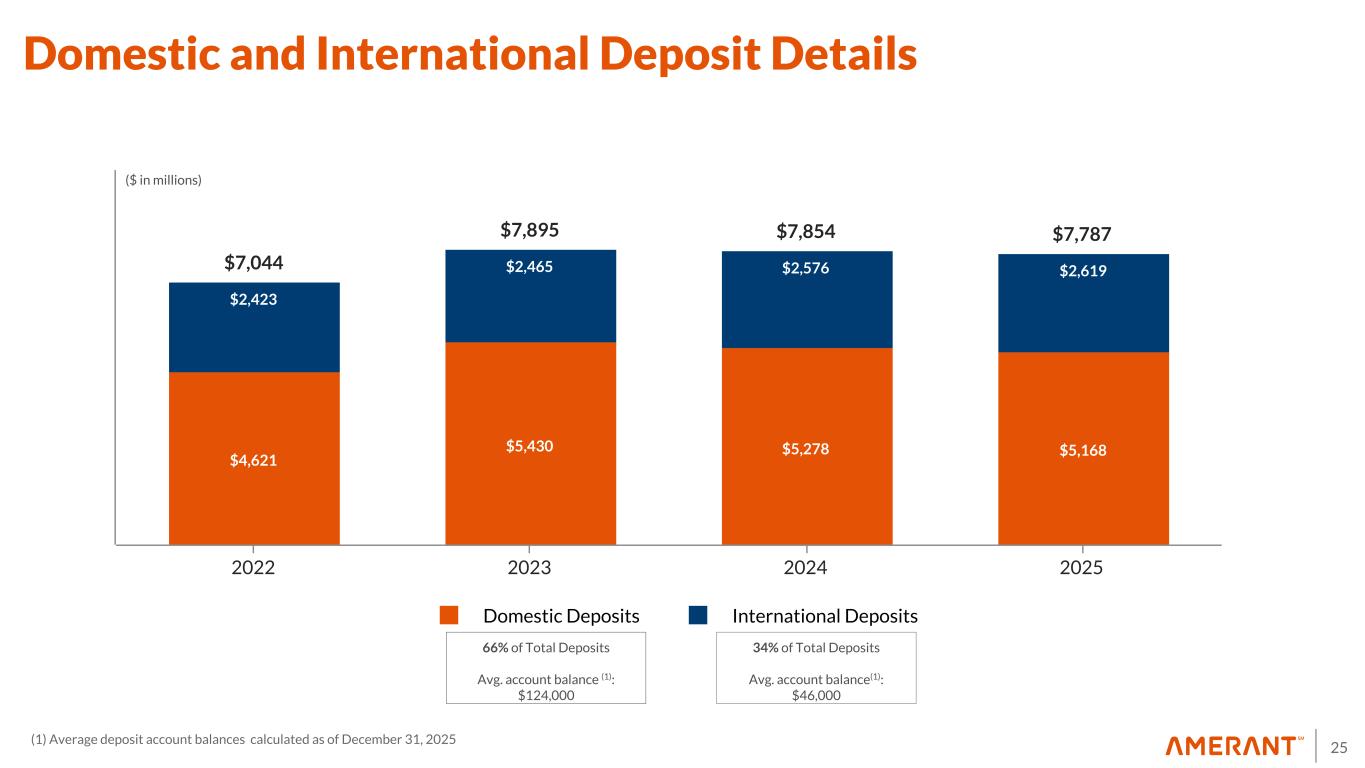

25 $7,044 $7,895 $7,854 $7,787 $4,621 $5,430 $5,278 $5,168 $2,423 $2,465 $2,576 $2,619 Domestic Deposits International Deposits 2022 2023 2024 2025 ($ in millions) 34% of Total Deposits Avg. account balance(1): $46,000 66% of Total Deposits Avg. account balance (1): $124,000 Domestic and International Deposit Details (1) Average deposit account balances calculated as of December 31, 2025

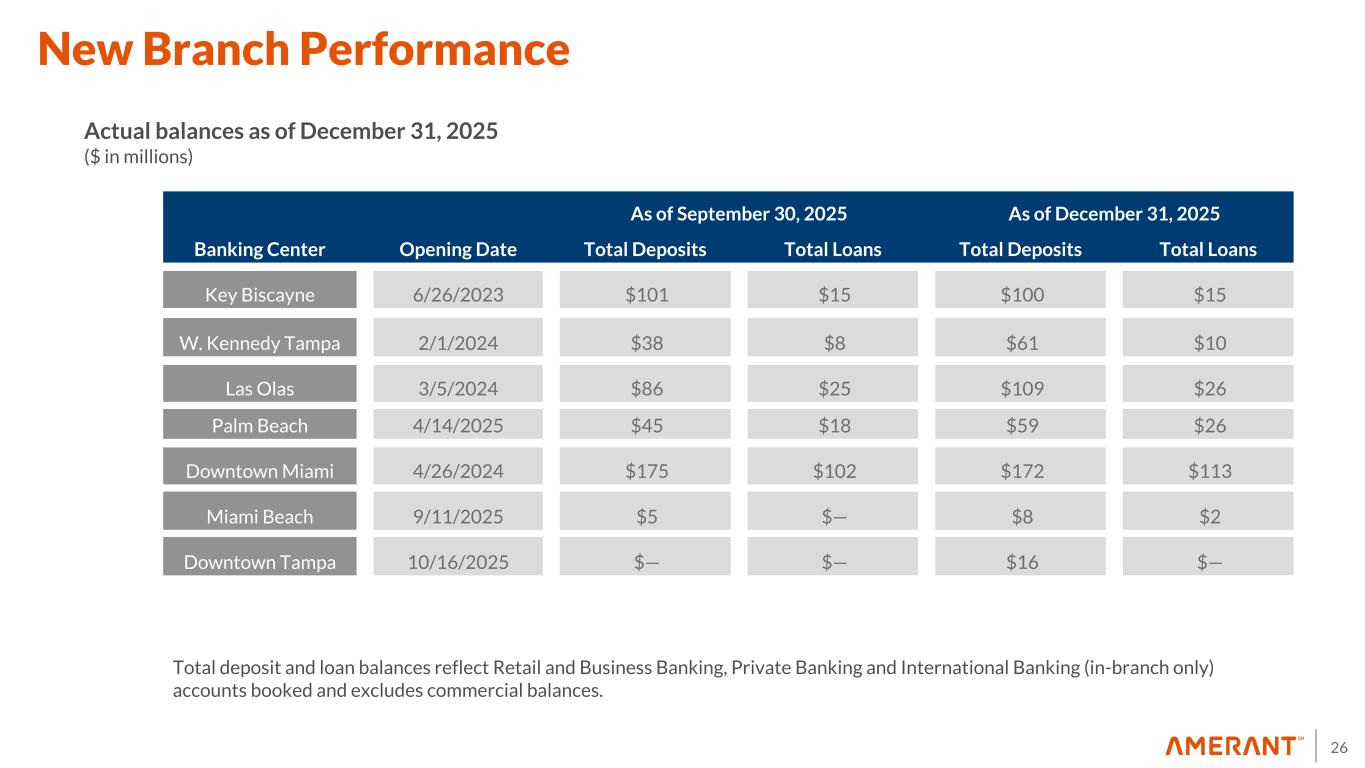

26 New Branch Performance Actual balances as of December 31, 2025 ($ in millions) Total deposit and loan balances reflect Retail and Business Banking, Private Banking and International Banking (in-branch only) accounts booked and excludes commercial balances. As of September 30, 2025 As of December 31, 2025 Banking Center Opening Date Total Deposits Total Loans Total Deposits Total Loans Key Biscayne 6/26/2023 $101 $15 $100 $15 W. Kennedy Tampa 2/1/2024 $38 $8 $61 $10 Las Olas 3/5/2024 $86 $25 $109 $26 Palm Beach 4/14/2025 $45 $18 $59 $26 Downtown Miami 4/26/2024 $175 $102 $172 $113 Miami Beach 9/11/2025 $5 $— $8 $2 Downtown Tampa 10/16/2025 $— $— $16 $—

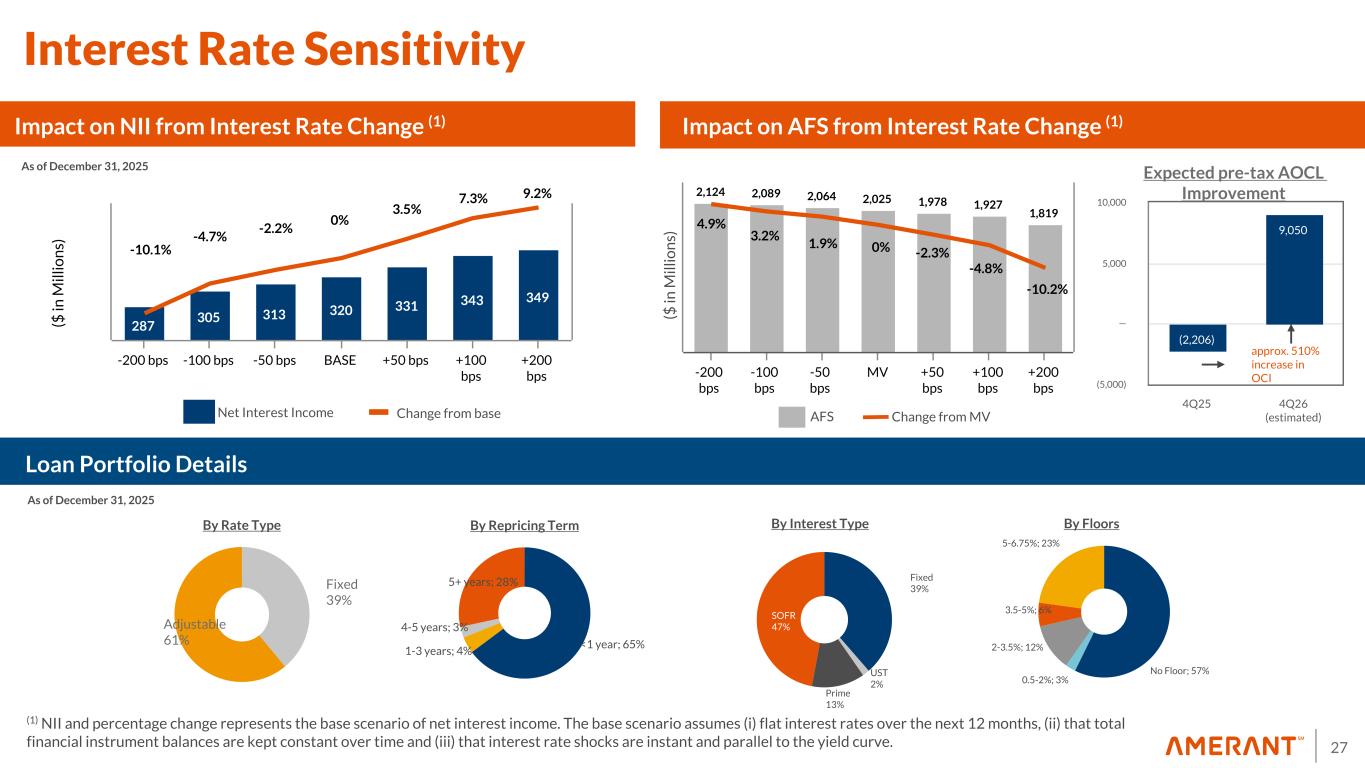

27 <1 year; 65% 1-3 years; 4% 4-5 years; 3% 5+ years; 28% 287 305 313 320 331 343 349 -200 bps -100 bps -50 bps BASE +50 bps +100 bps +200 bps As of December 31, 2025 Fixed 39% Adjustable 61% 27 By Interest TypeBy Rate Type By Repricing Term (1) NII and percentage change represents the base scenario of net interest income. The base scenario assumes (i) flat interest rates over the next 12 months, (ii) that total financial instrument balances are kept constant over time and (iii) that interest rate shocks are instant and parallel to the yield curve. Loan Portfolio Details Impact on NII from Interest Rate Change (1) AFSChange from base ($ in M ill io n s) Fixed 39% UST 2% Prime 13% SOFR 47% As of December 31, 2025 Impact on AFS from Interest Rate Change (1) -10.1% -4.7% 0% 7.3% 3.5% -2.2% 9.2% No Floor; 57% 0.5-2%; 3% 2-3.5%; 12% 3.5-5%; 6% 5-6.75%; 23% By Floors 2,124 2,089 2,064 2,025 1,978 1,927 1,819 -200 bps -100 bps -50 bps MV +50 bps +100 bps +200 bps ($ in M ill io n s) 4.9% 3.2% 1.9% 0% -2.3% -4.8% -10.2% Expected pre-tax AOCL Improvement Change from MVNet Interest Income (2,206) 9,050 4Q25 4Q26 (estimated) (5,000) — 5,000 10,000 approx. 510% increase in OCI Interest Rate Sensitivity

28 $23.6 $19.5 $19.8 $17.3 $22.0 $5.4 $5.1 $5.0 $5.1 $4.9 $4.7 $4.7 $5.0 $5.0 $5.3 $(8.2) $1.7 $1.2 $2.1 $19.6 $8.1 $6.7 $5.0 $8.4 $0.7 $1.5 $3.2 $2.4 $1.4 $(1.9) $(1.4) $1.4 4Q24 1Q25 2Q25 3Q25 4Q25 -20 -10 0 10 20 30 40 26% 74% 27% 73% Non-Interest Income Mix Deposits and service fees Brokerage, advisory and fiduciary activities Other noninterest income (1) DomesticInternational 4Q24 $3.3B ($ in millions) Securities gains (losses), net Loan-related derivative income Derivative (losses) gains, net Gain on early extinguishment of FHLB advances, net Non-Interest Income Mix $2.9B Assets Under Management and Custody 4Q25 (1) Other noninterest income in 4Q25 includes $3.3 million non-core gain on the sale and leaseback of two banking centers. 4Q24 includes a $12.6 million one-time gain on the sale of the Houston Operations. $(0.1)

29 $83.4 $71.6 $74.4 $77.8 $106.8 $35.3 $33.3 $36.0 $35.1 $38.8 $48.1 $38.3 $38.4 $42.7 $68.0 698 726 692 704 694 4Q24 1Q25 2Q25 3Q25 4Q25 0 30 60 90 120 Non-Interest Expense Mix ($ in millions, except for FTEs) Non-core Noninterest Expenses $15.1 $0.5 $1.2 $2.0 $29.2 $2.5 $1.1 $3.1 $12.6 $0.9 $14.8 $7.5 $3.8 Other non-core noninterest expenses (1) Losses on loans held for sale carried at the lower of cost or fair value Contract termination costs Staff separation costs 4Q24 1Q25 2Q25 3Q25 4Q25 0 10 20 30 40 ($ in millions) Non-Interest Expense Salaries and employee benefits Other operating expenses FTEs (1) This includes impairment charges on investments carried at cost included in other assets, goodwill and intangible asset impairments and previously separately disclosed for Amerant Mortgage downsizing, and loss on sale of repossessed assets and other real estate owned valuation expenses.

30 Change in Diluted Earnings Per Common Share $0.35 $(0.15) $(0.52) $0.12 $0.01 $0.26 $0.07 3Q25 Core PPNR (1) Net non-core items Income Tax Benefit Impact of Repurchases Provision for Credit Losses and Other 4Q25 $(0.75) $(0.50) $(0.25) $— $0.25 $0.50 EPS Trend (1) Non-GAAP Financial Measure. See Appendix 1 for a reconciliation to GAAP.

Appendices

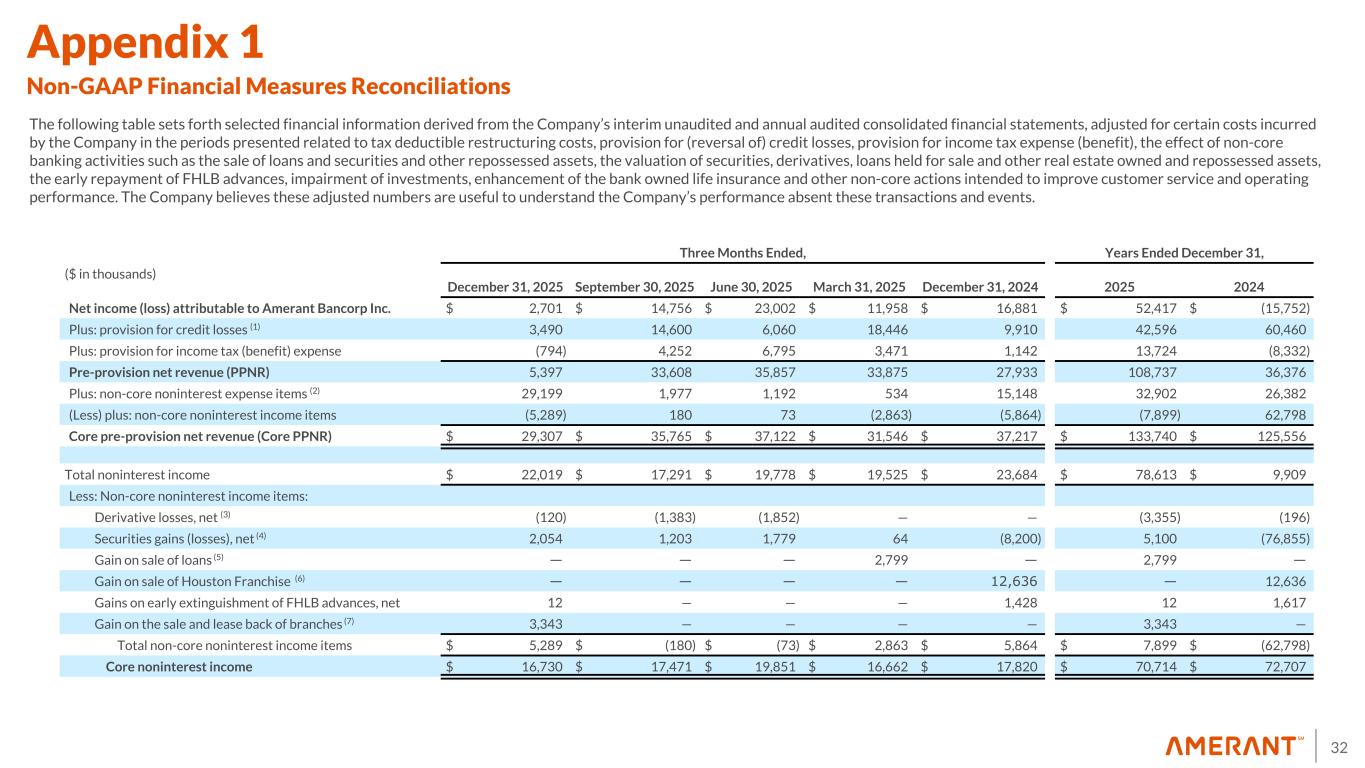

32 Appendix 1 Non-GAAP Financial Measures Reconciliations The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related to tax deductible restructuring costs, provision for (reversal of) credit losses, provision for income tax expense (benefit), the effect of non-core banking activities such as the sale of loans and securities and other repossessed assets, the valuation of securities, derivatives, loans held for sale and other real estate owned and repossessed assets, the early repayment of FHLB advances, impairment of investments, enhancement of the bank owned life insurance and other non-core actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events. Three Months Ended, Years Ended December 31, ($ in thousands) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 2025 2024 Net income (loss) attributable to Amerant Bancorp Inc. $ 2,701 $ 14,756 $ 23,002 $ 11,958 $ 16,881 $ 52,417 $ (15,752) Plus: provision for credit losses (1) 3,490 14,600 6,060 18,446 9,910 42,596 60,460 Plus: provision for income tax (benefit) expense (794) 4,252 6,795 3,471 1,142 13,724 (8,332) Pre-provision net revenue (PPNR) 5,397 33,608 35,857 33,875 27,933 108,737 36,376 Plus: non-core noninterest expense items (2) 29,199 1,977 1,192 534 15,148 32,902 26,382 (Less) plus: non-core noninterest income items (5,289) 180 73 (2,863) (5,864) (7,899) 62,798 Core pre-provision net revenue (Core PPNR) $ 29,307 $ 35,765 $ 37,122 $ 31,546 $ 37,217 $ 133,740 $ 125,556 Total noninterest income $ 22,019 $ 17,291 $ 19,778 $ 19,525 $ 23,684 $ 78,613 $ 9,909 Less: Non-core noninterest income items: Derivative losses, net (3) (120) (1,383) (1,852) — — (3,355) (196) Securities gains (losses), net (4) 2,054 1,203 1,779 64 (8,200) 5,100 (76,855) Gain on sale of loans (5) — — — 2,799 — 2,799 — Gain on sale of Houston Franchise (6) — — — — 12,636 — 12,636 Gains on early extinguishment of FHLB advances, net 12 — — — 1,428 12 1,617 Gain on the sale and lease back of branches (7) 3,343 — — — — 3,343 — Total non-core noninterest income items $ 5,289 $ (180) $ (73) $ 2,863 $ 5,864 $ 7,899 $ (62,798) Core noninterest income $ 16,730 $ 17,471 $ 19,851 $ 16,662 $ 17,820 $ 70,714 $ 72,707

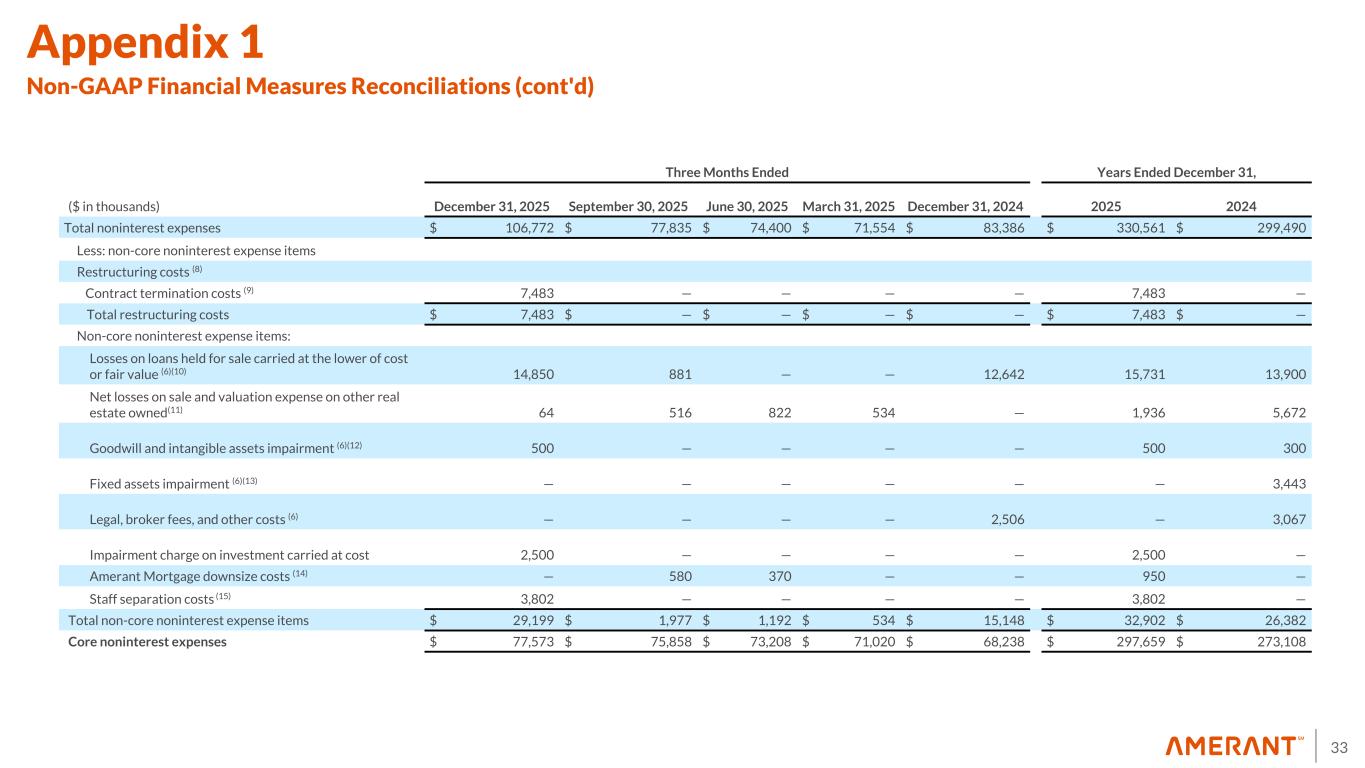

33 Three Months Ended Years Ended December 31, ($ in thousands) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 2025 2024 Total noninterest expenses $ 106,772 $ 77,835 $ 74,400 $ 71,554 $ 83,386 $ 330,561 $ 299,490 Less: non-core noninterest expense items Restructuring costs (8) Contract termination costs (9) 7,483 — — — — 7,483 — Total restructuring costs $ 7,483 $ — $ — $ — $ — $ 7,483 $ — Non-core noninterest expense items: Losses on loans held for sale carried at the lower of cost or fair value (6)(10) 14,850 881 — — 12,642 15,731 13,900 Net losses on sale and valuation expense on other real estate owned(11) 64 516 822 534 — 1,936 5,672 Goodwill and intangible assets impairment (6)(12) 500 — — — — 500 300 Fixed assets impairment (6)(13) — — — — — — 3,443 Legal, broker fees, and other costs (6) — — — — 2,506 — 3,067 Impairment charge on investment carried at cost 2,500 — — — — 2,500 — Amerant Mortgage downsize costs (14) — 580 370 — — 950 — Staff separation costs (15) 3,802 — — — — 3,802 — Total non-core noninterest expense items $ 29,199 $ 1,977 $ 1,192 $ 534 $ 15,148 $ 32,902 $ 26,382 Core noninterest expenses $ 77,573 $ 75,858 $ 73,208 $ 71,020 $ 68,238 $ 297,659 $ 273,108 Appendix 1 Non-GAAP Financial Measures Reconciliations (cont'd)

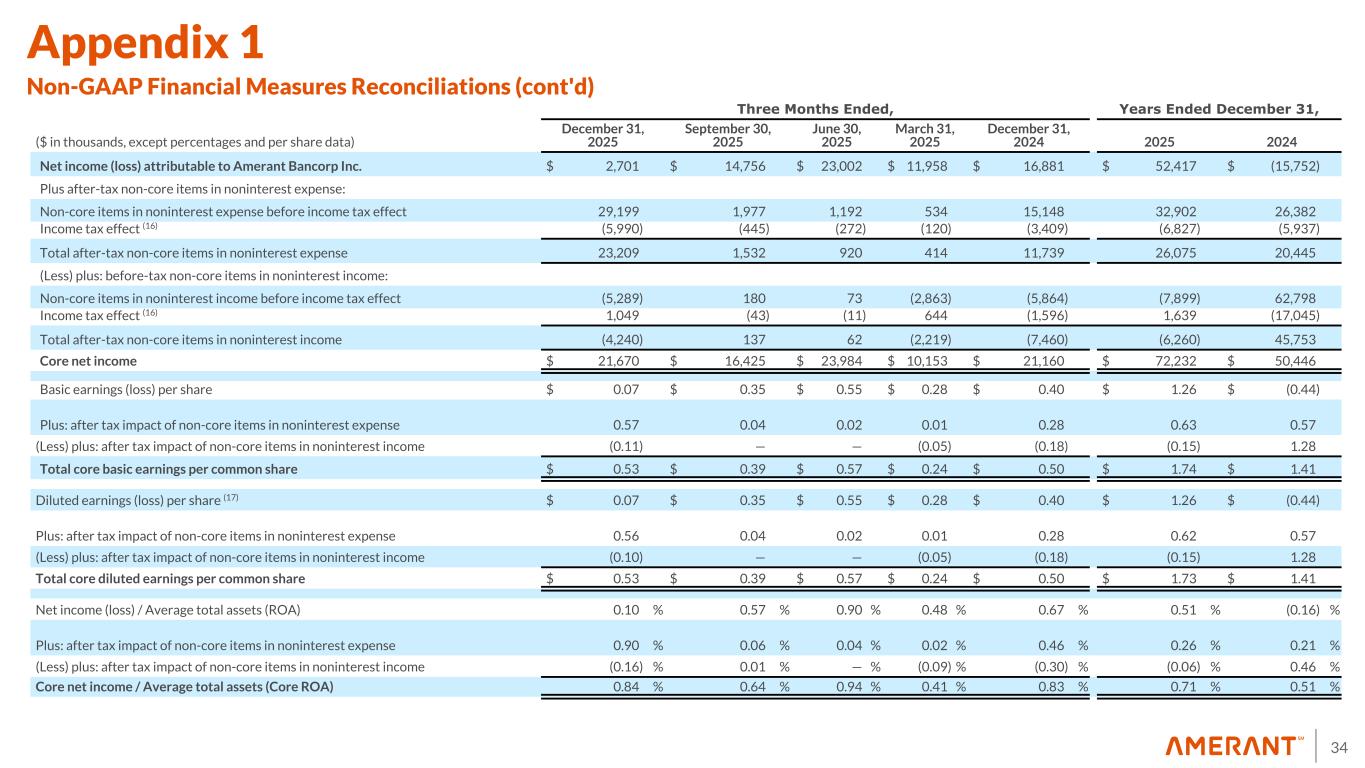

34 Three Months Ended, Years Ended December 31, ($ in thousands, except percentages and per share data) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 2025 2024 Net income (loss) attributable to Amerant Bancorp Inc. $ 2,701 $ 14,756 $ 23,002 $ 11,958 $ 16,881 $ 52,417 $ (15,752) Plus after-tax non-core items in noninterest expense: Non-core items in noninterest expense before income tax effect 29,199 1,977 1,192 534 15,148 32,902 26,382 Income tax effect (16) (5,990) (445) (272) (120) (3,409) (6,827) (5,937) Total after-tax non-core items in noninterest expense 23,209 1,532 920 414 11,739 26,075 20,445 (Less) plus: before-tax non-core items in noninterest income: Non-core items in noninterest income before income tax effect (5,289) 180 73 (2,863) (5,864) (7,899) 62,798 Income tax effect (16) 1,049 (43) (11) 644 (1,596) 1,639 (17,045) Total after-tax non-core items in noninterest income (4,240) 137 62 (2,219) (7,460) (6,260) 45,753 Core net income $ 21,670 $ 16,425 $ 23,984 $ 10,153 $ 21,160 $ 72,232 $ 50,446 Basic earnings (loss) per share $ 0.07 $ 0.35 $ 0.55 $ 0.28 $ 0.40 $ 1.26 $ (0.44) Plus: after tax impact of non-core items in noninterest expense 0.57 0.04 0.02 0.01 0.28 0.63 0.57 (Less) plus: after tax impact of non-core items in noninterest income (0.11) — — (0.05) (0.18) (0.15) 1.28 Total core basic earnings per common share $ 0.53 $ 0.39 $ 0.57 $ 0.24 $ 0.50 $ 1.74 $ 1.41 Diluted earnings (loss) per share (17) $ 0.07 $ 0.35 $ 0.55 $ 0.28 $ 0.40 $ 1.26 $ (0.44) Plus: after tax impact of non-core items in noninterest expense 0.56 0.04 0.02 0.01 0.28 0.62 0.57 (Less) plus: after tax impact of non-core items in noninterest income (0.10) — — (0.05) (0.18) (0.15) 1.28 Total core diluted earnings per common share $ 0.53 $ 0.39 $ 0.57 $ 0.24 $ 0.50 $ 1.73 $ 1.41 Net income (loss) / Average total assets (ROA) 0.10 % 0.57 % 0.90 % 0.48 % 0.67 % 0.51 % (0.16) % Plus: after tax impact of non-core items in noninterest expense 0.90 % 0.06 % 0.04 % 0.02 % 0.46 % 0.26 % 0.21 % (Less) plus: after tax impact of non-core items in noninterest income (0.16) % 0.01 % — % (0.09) % (0.30) % (0.06) % 0.46 % Core net income / Average total assets (Core ROA) 0.84 % 0.64 % 0.94 % 0.41 % 0.83 % 0.71 % 0.51 % Appendix 1 Non-GAAP Financial Measures Reconciliations (cont'd)

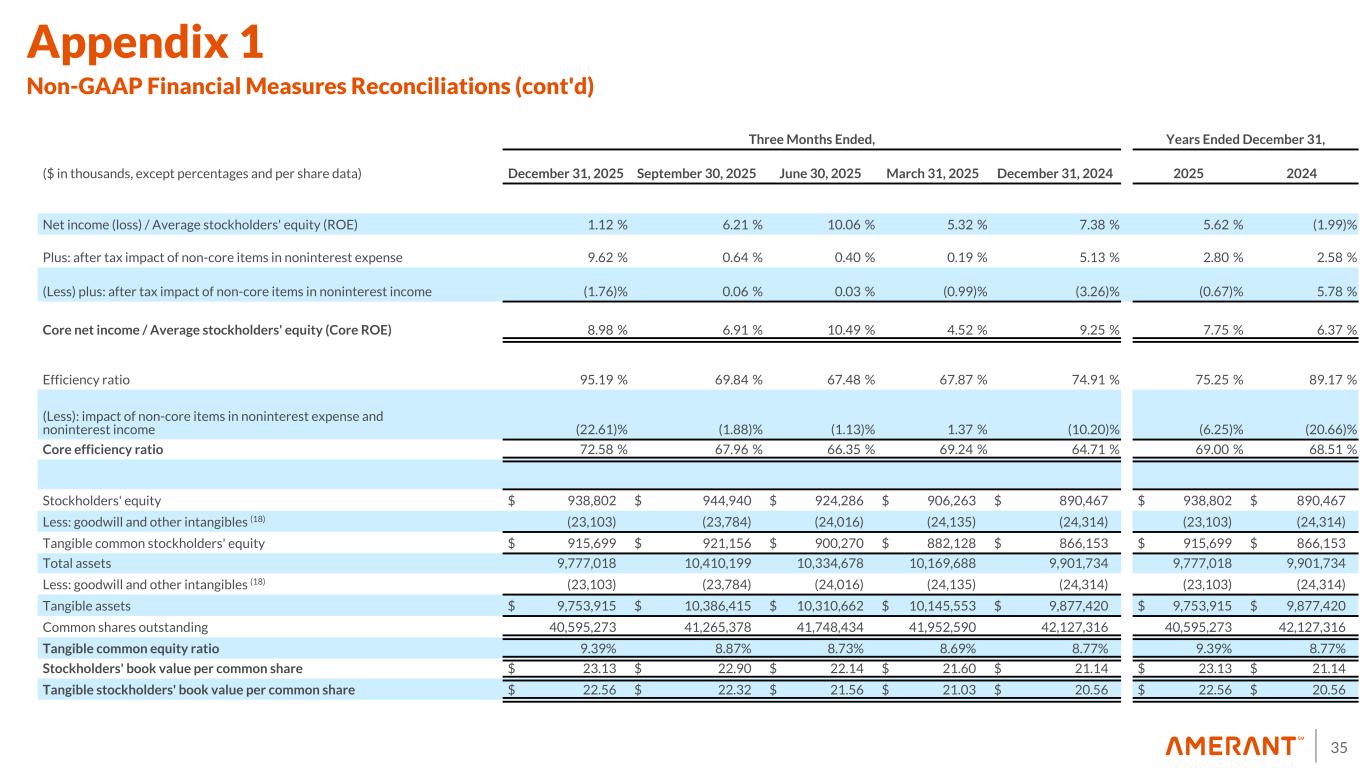

35 Three Months Ended, Years Ended December 31, ($ in thousands, except percentages and per share data) December 31, 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 2025 2024 Net income (loss) / Average stockholders' equity (ROE) 1.12 % 6.21 % 10.06 % 5.32 % 7.38 % 5.62 % (1.99) % Plus: after tax impact of non-core items in noninterest expense 9.62 % 0.64 % 0.40 % 0.19 % 5.13 % 2.80 % 2.58 % (Less) plus: after tax impact of non-core items in noninterest income (1.76) % 0.06 % 0.03 % (0.99) % (3.26) % (0.67) % 5.78 % Core net income / Average stockholders' equity (Core ROE) 8.98 % 6.91 % 10.49 % 4.52 % 9.25 % 7.75 % 6.37 % Efficiency ratio 95.19 % 69.84 % 67.48 % 67.87 % 74.91 % 75.25 % 89.17 % (Less): impact of non-core items in noninterest expense and noninterest income (22.61) % (1.88) % (1.13) % 1.37 % (10.20) % (6.25) % (20.66) % Core efficiency ratio 72.58 % 67.96 % 66.35 % 69.24 % 64.71 % 69.00 % 68.51 % Stockholders' equity $ 938,802 $ 944,940 $ 924,286 $ 906,263 $ 890,467 $ 938,802 $ 890,467 Less: goodwill and other intangibles (18) (23,103) (23,784) (24,016) (24,135) (24,314) (23,103) (24,314) Tangible common stockholders' equity $ 915,699 $ 921,156 $ 900,270 $ 882,128 $ 866,153 $ 915,699 $ 866,153 Total assets 9,777,018 10,410,199 10,334,678 10,169,688 9,901,734 9,777,018 9,901,734 Less: goodwill and other intangibles (18) (23,103) (23,784) (24,016) (24,135) (24,314) (23,103) (24,314) Tangible assets $ 9,753,915 $ 10,386,415 $ 10,310,662 $ 10,145,553 $ 9,877,420 $ 9,753,915 $ 9,877,420 Common shares outstanding 40,595,273 41,265,378 41,748,434 41,952,590 42,127,316 40,595,273 42,127,316 Tangible common equity ratio 9.39 % 8.87 % 8.73 % 8.69 % 8.77 % 9.39 % 8.77 % Stockholders' book value per common share $ 23.13 $ 22.90 $ 22.14 $ 21.60 $ 21.14 $ 23.13 $ 21.14 Tangible stockholders' book value per common share $ 22.56 $ 22.32 $ 21.56 $ 21.03 $ 20.56 $ 22.56 $ 20.56 Appendix 1 Non-GAAP Financial Measures Reconciliations (cont'd)

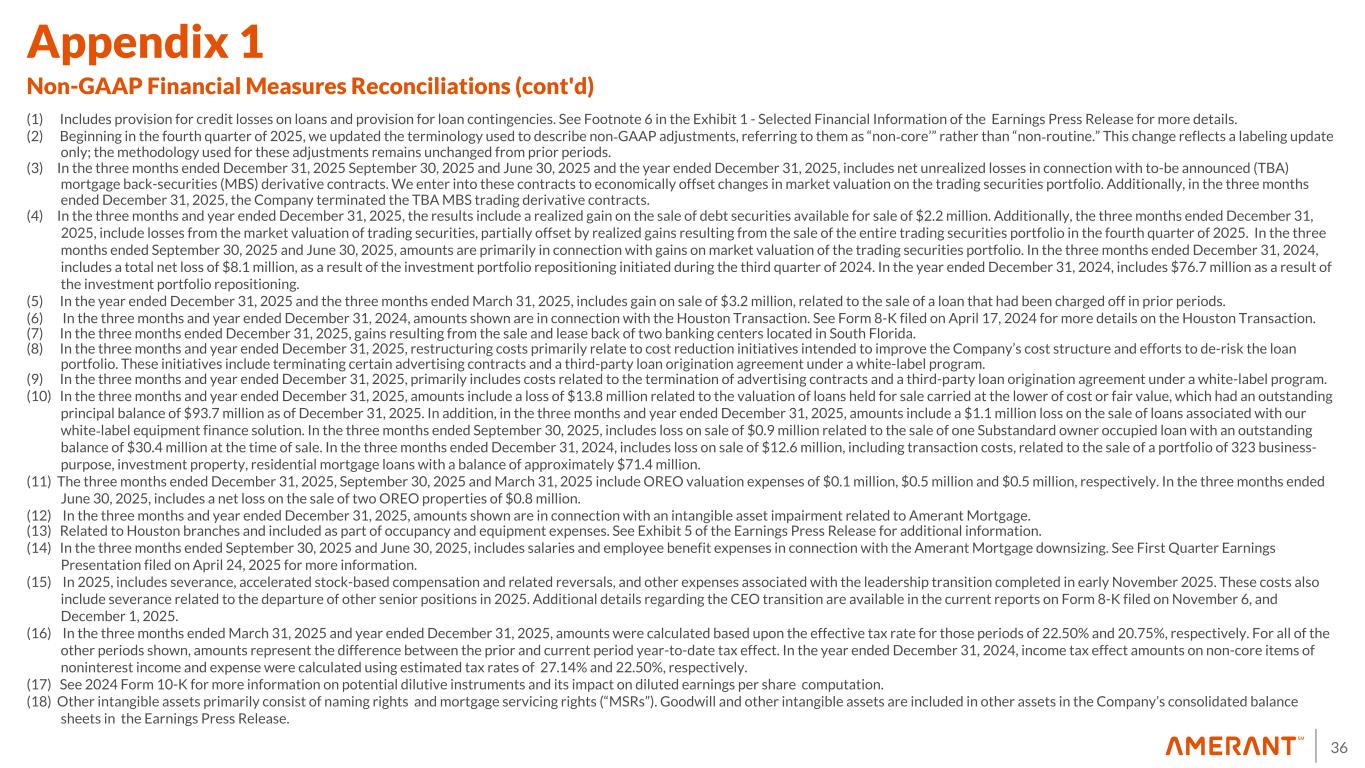

36 Appendix 1 Non-GAAP Financial Measures Reconciliations (cont'd) (1) Includes provision for credit losses on loans and provision for loan contingencies. See Footnote 6 in the Exhibit 1 - Selected Financial Information of the Earnings Press Release for more details. (2) Beginning in the fourth quarter of 2025, we updated the terminology used to describe non-GAAP adjustments, referring to them as “non-core’” rather than “non-routine.” This change reflects a labeling update only; the methodology used for these adjustments remains unchanged from prior periods. (3) In the three months ended December 31, 2025 September 30, 2025 and June 30, 2025 and the year ended December 31, 2025, includes net unrealized losses in connection with to-be announced (TBA) mortgage back-securities (MBS) derivative contracts. We enter into these contracts to economically offset changes in market valuation on the trading securities portfolio. Additionally, in the three months ended December 31, 2025, the Company terminated the TBA MBS trading derivative contracts. (4) In the three months and year ended December 31, 2025, the results include a realized gain on the sale of debt securities available for sale of $2.2 million. Additionally, the three months ended December 31, 2025, include losses from the market valuation of trading securities, partially offset by realized gains resulting from the sale of the entire trading securities portfolio in the fourth quarter of 2025. In the three months ended September 30, 2025 and June 30, 2025, amounts are primarily in connection with gains on market valuation of the trading securities portfolio. In the three months ended December 31, 2024, includes a total net loss of $8.1 million, as a result of the investment portfolio repositioning initiated during the third quarter of 2024. In the year ended December 31, 2024, includes $76.7 million as a result of the investment portfolio repositioning. (5) In the year ended December 31, 2025 and the three months ended March 31, 2025, includes gain on sale of $3.2 million, related to the sale of a loan that had been charged off in prior periods. (6) In the three months and year ended December 31, 2024, amounts shown are in connection with the Houston Transaction. See Form 8-K filed on April 17, 2024 for more details on the Houston Transaction. (7) In the three months ended December 31, 2025, gains resulting from the sale and lease back of two banking centers located in South Florida. (8) In the three months and year ended December 31, 2025, restructuring costs primarily relate to cost reduction initiatives intended to improve the Company’s cost structure and efforts to de-risk the loan portfolio. These initiatives include terminating certain advertising contracts and a third-party loan origination agreement under a white-label program. (9) In the three months and year ended December 31, 2025, primarily includes costs related to the termination of advertising contracts and a third-party loan origination agreement under a white-label program. (10) In the three months and year ended December 31, 2025, amounts include a loss of $13.8 million related to the valuation of loans held for sale carried at the lower of cost or fair value, which had an outstanding principal balance of $93.7 million as of December 31, 2025. In addition, in the three months and year ended December 31, 2025, amounts include a $1.1 million loss on the sale of loans associated with our white-label equipment finance solution. In the three months ended September 30, 2025, includes loss on sale of $0.9 million related to the sale of one Substandard owner occupied loan with an outstanding balance of $30.4 million at the time of sale. In the three months ended December 31, 2024, includes loss on sale of $12.6 million, including transaction costs, related to the sale of a portfolio of 323 business- purpose, investment property, residential mortgage loans with a balance of approximately $71.4 million. (11) The three months ended December 31, 2025, September 30, 2025 and March 31, 2025 include OREO valuation expenses of $0.1 million, $0.5 million and $0.5 million, respectively. In the three months ended June 30, 2025, includes a net loss on the sale of two OREO properties of $0.8 million. (12) In the three months and year ended December 31, 2025, amounts shown are in connection with an intangible asset impairment related to Amerant Mortgage. (13) Related to Houston branches and included as part of occupancy and equipment expenses. See Exhibit 5 of the Earnings Press Release for additional information. (14) In the three months ended September 30, 2025 and June 30, 2025, includes salaries and employee benefit expenses in connection with the Amerant Mortgage downsizing. See First Quarter Earnings Presentation filed on April 24, 2025 for more information. (15) In 2025, includes severance, accelerated stock-based compensation and related reversals, and other expenses associated with the leadership transition completed in early November 2025. These costs also include severance related to the departure of other senior positions in 2025. Additional details regarding the CEO transition are available in the current reports on Form 8-K filed on November 6, and December 1, 2025. (16) In the three months ended March 31, 2025 and year ended December 31, 2025, amounts were calculated based upon the effective tax rate for those periods of 22.50% and 20.75%, respectively. For all of the other periods shown, amounts represent the difference between the prior and current period year-to-date tax effect. In the year ended December 31, 2024, income tax effect amounts on non-core items of noninterest income and expense were calculated using estimated tax rates of 27.14% and 22.50%, respectively. (17) See 2024 Form 10-K for more information on potential dilutive instruments and its impact on diluted earnings per share computation. (18) Other intangible assets primarily consist of naming rights and mortgage servicing rights (“MSRs”). Goodwill and other intangible assets are included in other assets in the Company’s consolidated balance sheets in the Earnings Press Release.

37 Income Statement Highlights - 3Q25 vs 4Q25 ($ in thousands) 4Q25 3Q25 Change Total Interest Income Loans $ 114,824 $ 121,414 $ (6,590) Investment securities 27,044 26,737 307 Interest earning deposits with banks and other interest income 5,314 4,592 722 Total Interest Expense Interest bearing demand, savings and money market deposits 28,387 28,900 (513) Time deposits 19,798 20,950 (1,152) Advances from FHLB 7,518 7,316 202 Senior notes — — — Subordinated notes 361 362 (1) Junior subordinated debentures 967 1,063 (96) Securities sold under agreements to repurchase 1 — 1 Total Provision for Credit Losses 3,490 14,600 (11,110) Total Noninterest Income 22,019 17,291 4,728 Total Noninterest Expense 106,772 77,835 28,937 Income Tax (Benefit) Expense (794) 4,252 (5,046) Net Income Attributable to Amerant Bancorp Inc. $ 2,701 $ 14,756 $ (12,055)

38 • ACL - Allowance for Credit Losses • AFS - Available for Sale • AOCL - Accumulated Other Comprehensive Loss • AUM - Assets Under Management • CET 1 - Common Equity Tier 1 capital ratio • CRE - Commercial Real Estate • Customer CDs - Customer certificate of deposits • EPS – Earnings per Share • FHLB - Federal Home Loan Bank • FTE - Full Time Equivalent • MV - Market Value • NCO - Net Charge-Offs • NPL - Non-Performing Loans • NPA - Non-Performing Assets • NII - Net Interest Income • NIM – Net Interest Margin • ROA - Return on Assets • ROE - Return on Equity • TCE ratio – Tangible Common Equity ratio Glossary

39Glossary (cont'd) • Assets under management and custody: consists of assets held for clients in an agency or fiduciary capacity which are not assets of the Company and therefore are not included in the consolidated financial statements. • Core deposits: consist of total deposits excluding all time deposits • Total gross loans : include loans held for investment net of unamortized deferred loan origination fees and costs, as well as loans held for sale. • Cost of Total Deposits: calculated based upon the average balance of total noninterest bearing and interest bearing deposits, which includes time deposits. • ROA: calculated based upon the average daily balance of total assets • ROE: calculated based upon the average daily balance of stockholders' equity • Loans Held for Investment: excludes loans held for sale carried at fair value and loans held for sale carried at the lower of cost or fair value • Non-performing loans include accruing loans past due by 90 days or more and all nonaccrual loans. Non-performing assets include accruing loans past due by 90 days or more, all nonaccrual loans, other real estate owned ("OREO") properties acquired through or in lieu of foreclosure and other repossessed assets. • Net Charge Offs/Average Total Loans Held for Investment: – Annualized and calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan fees and costs, excluding the allowance for credit losses – Total loans exclude loans held for sale • Cost of Deposits: calculated based upon the average balance of total noninterest bearing and interest bearing deposits, which includes time deposits. • Cost of Funds: calculated based upon the average balance of total financial liabilities which include total interest bearing liabilities and noninterest bearing demand deposits • Quarterly beta (as shown in NII & NIM Slide): calculated based upon the change of the cost of deposit over the change of Federal funds rate (if any) during the quarter. • Net Charge-Offs -charge-offs net of recoveries • Totals may not sum due to rounding of line items.

.